37

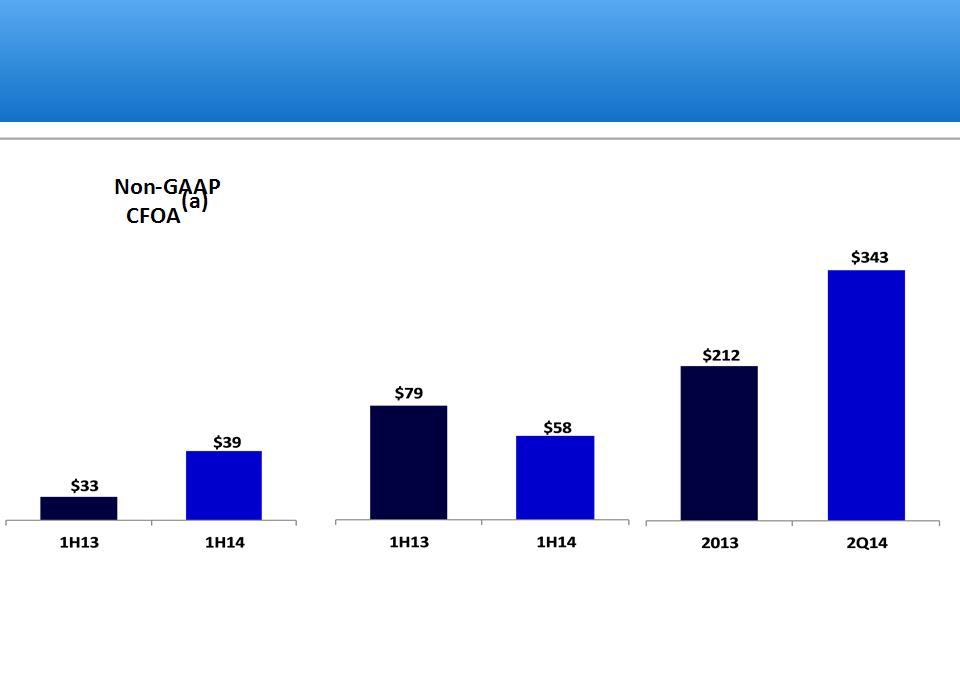

Non-GAAP Reconciliations - 2013 Notes

(a) To eliminate

• a $1.1 million adjustment in the first quarter of 2013 to the amount of gain recognized on a 2010 business acquisition in Mexico as a result of a

favorable adjustment to the purchase price received in the first quarter of 2013.

• $1.7 million of adjustments in the third and fourth quarters of 2013 primarily related to the January 2013 acquisition of Rede Trel in Brazil.

• $3.1 million in adjustments in the fourth quarter of 2013 related to the increase in a loss contingency assumed in the 2010 Mexico acquisition and

the impairment of an intangible asset acquired in the 2009 India acquisition.

• a $2.6 million tax adjustment related to the Belgium disposition.

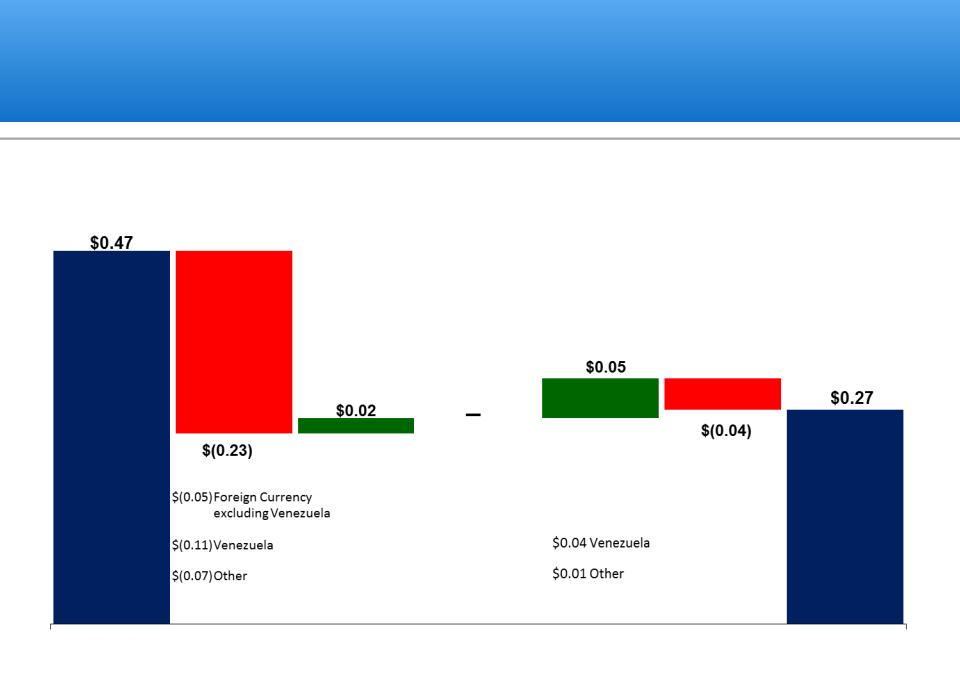

(b) To eliminate the effects of the February 2013 currency devaluation in Venezuela in which the official exchange rate in Venezuela declined 16% from 5.3

to 6.3 bolivars to the U.S. dollar. Expenses eliminated from non-GAAP results include first quarter currency exchange losses totaling $13.4 million related

to remeasured net monetary assets as well as expenses related to nonmonetary assets ($0.5 million in the first quarter, $0.2 million in the second

quarter, $0.2 million in the third quarter and $0.3 million in the fourth quarter). Nonmonetary assets were not remeasured to a lower basis when the

currency devalued. Instead, under highly inflationary accounting rules, these assets retained their higher historical bases, which excess is recognized in

earnings as the asset is consumed.

(c) To eliminate employee benefit settlement losses in Mexico.

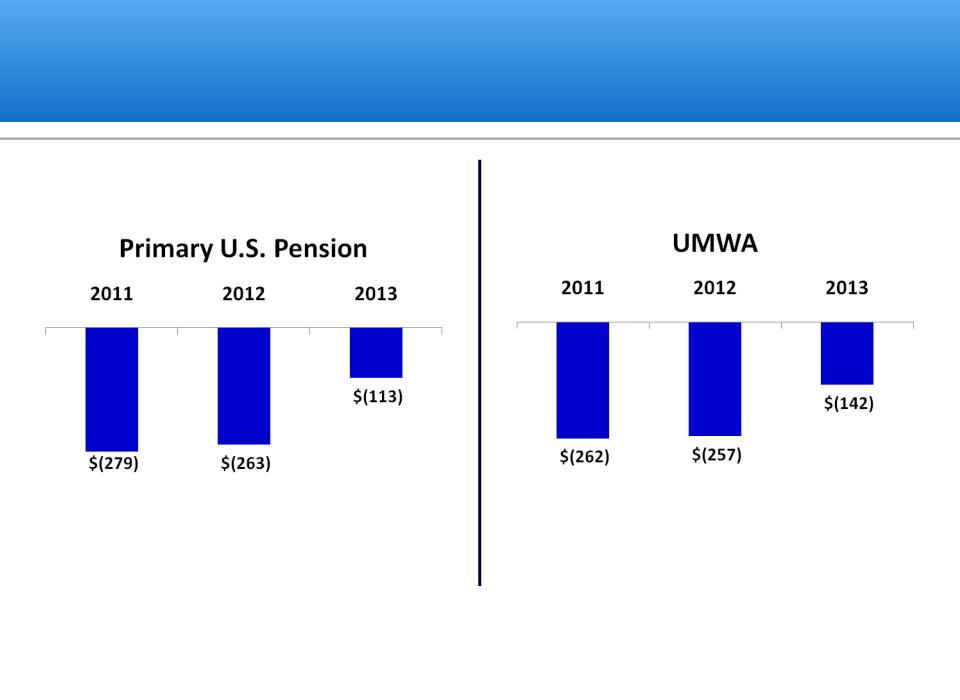

(d) To eliminate expenses related to U.S. retirement plans.

(e) To adjust effective income tax rate in the interim period to be equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP

effective tax rate for 2013 is 33.1%.

(f) Effective March 24, 2014, Brink’s began remeasuring its Venezuelan operating results using currency exchange rates reported under a newly established

currency exchange process in Venezuela (the “SICAD II process”). This adjustment reflects a hypothetical remeasurement of Brink’s Venezuela’s 2013

revenue and operating results using a rate of 50 bolivars to the U.S. dollar, which approximates the rate observed in the new SICAD II currency exchange

process in March 2014. Losses that would have been recognized in 2013 had Brink’s used a rate of 50 bolivars to the U.S. dollar to remeasure its net

monetary assets have been excluded from this adjustment and the Adjusted Non-GAAP results.

(g) Non-GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar.