Exhibit 99.3

September 4, 2014 2:00 pm EST

Forward Looking Statements This presentation contains “forward-looking statements”—that is, statements related to future, not past events. In this context, forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” Forward-looking statements by their nature address matters that are, to different degrees, uncertain. For us, particular uncertainties arise from changes in the demand for our coal by the domestic electric generation industry; from legislation and regulations relating to the Clean Air Act and other environmental initiatives; from operational, geological, permit, labor and weather-related factors; from fluctuations in the amount of cash we generate from operations; and from numerous other matters of national, regional and global scale, including those of political, economic, business, competitive or regulatory nature. These uncertainties may cause our actual results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. 2

Participants Victor Stabio, Hallador Energy, Chairman of the Board Brent Bilsland, Hallador Energy, President & CEO Andy Bishop, Hallador Energy, Chief Financial Officer & Treasurer Larry Martin, Sunrise Coal, Chief Financial Officer 3

Agenda Vectren Acquisition Closing Update Financing Acquisition Benefits Sunrise Coal Assets 230 MM Ton Complex Created Thick Reserves Sales/Cost Structure Familiar Customer Base Integration Timeline Q & A 4

Closing Update Closing occurred Friday, August 29, 2014 Closing price was $320 million Balance sheet adjustment true up to occur within 90 days of closing (coal inventory, parts inventory) New employee orientation occurred prior to closing. – Coal production commenced September 2, 2014. 5

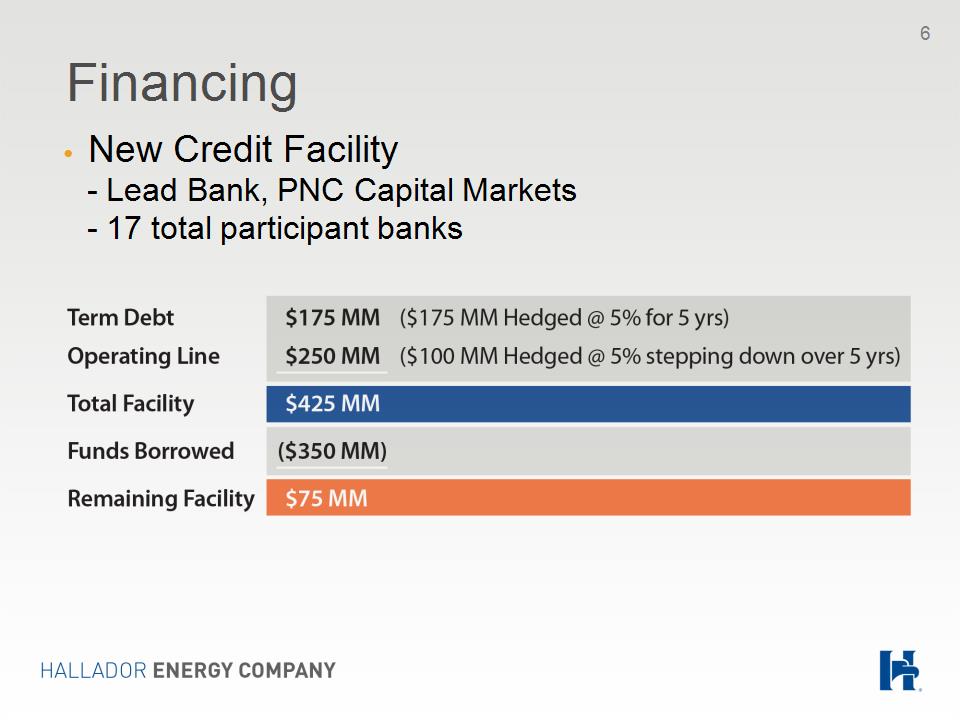

Financing New Credit Facility – Lead Bank, PNC Capital Markets – 17 total participant banks 6

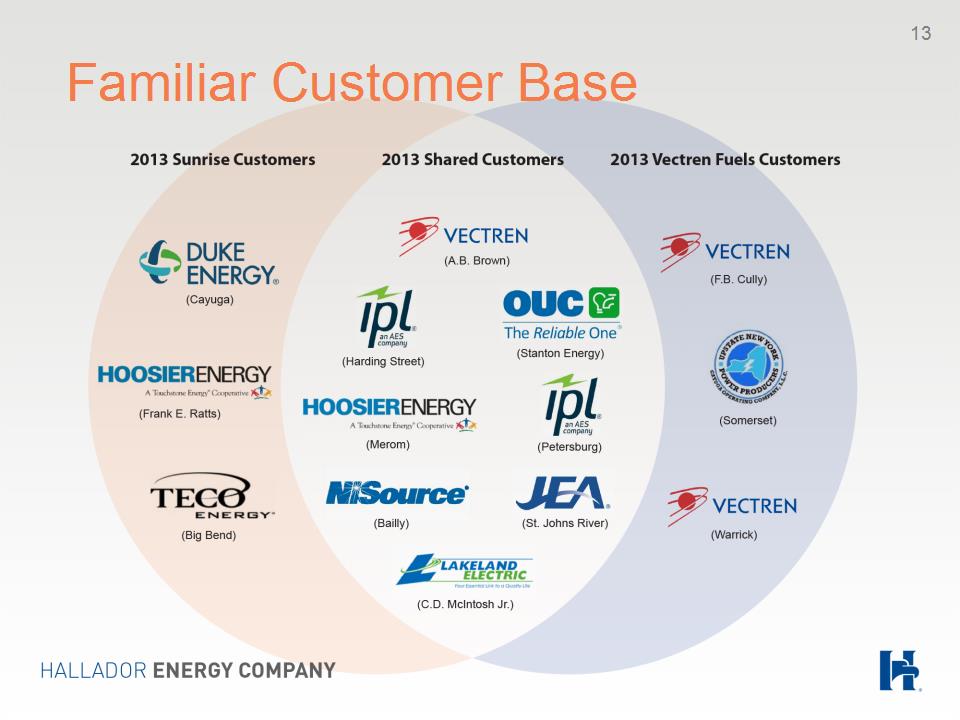

Acquisition Benefits Reduces operational risk and diversifies mine production Creates a 230 million ton contiguous reserve position Increases quality customer base (100% Investment Grade, 100% scrubbed, 100% “base load” plants) Enhances strong contract position through 2023 Expands market share to 2nd largest Indiana producer 7

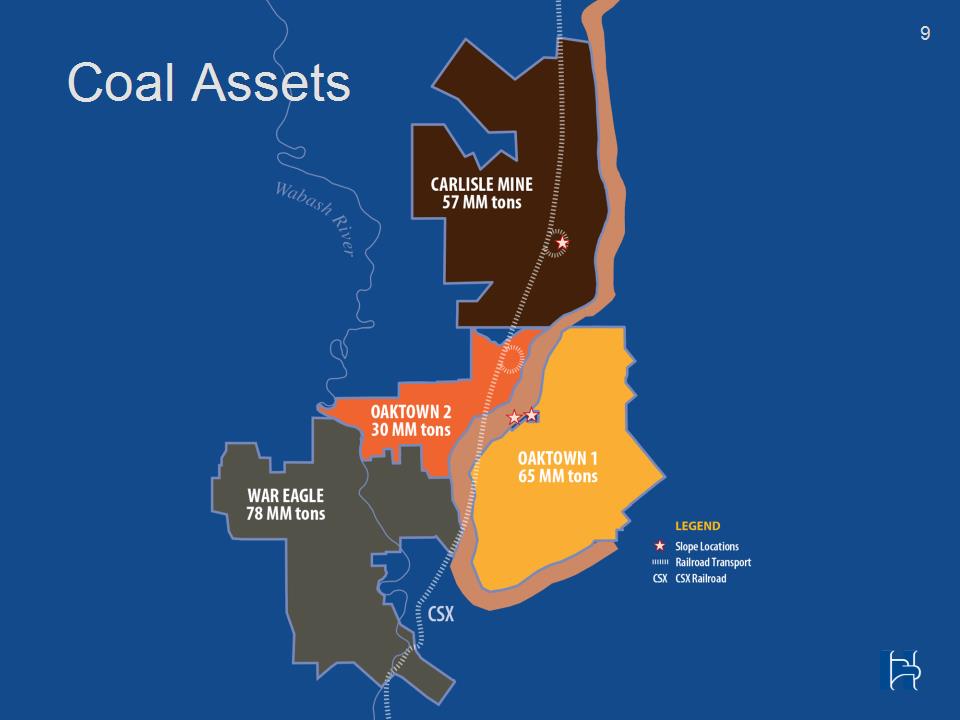

Sunrise Coal Assets Sunrise is a wholly owned subsidiary of Hallador Energy Bulldog permit in 2015 War Eagle will now be mined through Oaktown 2 portal Setting the stage for 230 MM underground complex 8

Coal Assets 9

230 MM ton Complex Created 10

Thick Reserves = Low Cost 11

Sales / Cost Structure Carlisle’s historical cost structure has been less than $30/ton cash cost 12

Familiar Customer Base 13

Integration Timeline 14

Question & Answer 15