|

Exhibit 99.1

|

Microsoft linkedin

on today’s call

Satya Nadella Jefff weiner amy hood Brad smith

Forward-Looking Statements

This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the proposed transaction and business combination between Microsoft and LinkedIn, including statements regarding the benefits of the transaction, the anticipated timing of the transaction and the products and markets of each company. These forward-looking statements generally are identified by the words _believe,“ “project,“ “expect,“ “anticipate,“ “estimate,“ “intend,“ “strategy,“ “future,“ “opportunity,“ “plan,“ “may,“ “should,“ “will,“ “would,“ “will be,“ “will continue,“ “will likely result,_ and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this presentation, including but not limited to: (i) the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect LinkedIn s business and the price of the common stock of LinkedIn, (ii) the failure to satisfy the conditions to the consummation of the transaction, including the adoption of the merger agreement by the stockholders of LinkedIn and the receipt of certain governmental and regulatory approvals, (iii) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, (iv) the effect of the announcement or pendency of the transaction on LinkedIn s business relationships, operating results and business generally, (v) risks that the proposed transaction disrupts current plans and operations of LinkedIn or Microsoft and potential difficulties in LinkedIn employee retention as a result of the transaction, (vi) risks related to diverting management s attention from LinkedIn s ongoing business operations, (vii) the outcome of any legal proceedings that may be instituted against us or against LinkedIn related to the merger agreement or the transaction, (viii) the ability of Microsoft to successfully integrate LinkedIn s operations, product lines, and technology and (ix) the ability of Microsoft to implement its plans, forecasts, and other expectations with respect to LinkedIn s business after the completion of the proposed merger and realize additional opportunities for growth and innovation. In addition, please refer to the documents that Microsoft and LinkedIn file with the SEC on Forms 10-K, 10-Q and 8-K. These filings identify and address other important risks and uncertainties that could cause events and results to differ materially from those contained in the forward-looking statements set forth in this presentation. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Microsoft and LinkedIn assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise.

Additional Information and Where to Find It

Nothing in this presentation shall constitute a solicitation to buy or subscribe for or an offer to sell any securities of LinkedIn or Microsoft or a solicitation of any vote or approval. In connection with the transaction, LinkedIn will file relevant materials with the Securities and Exchange Commission (the _SEC_), including a proxy statement on Schedule 14A. This filing does not constitute a solicitation of any vote or approval. Promptly after filing its definitive proxy statement with the SEC, LinkedIn will mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the transaction. INVESTORS AND STOCKHOLDERSOF LINKEDIN ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTION THAT LINKEDIN WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT LINKEDIN AND THE TRANSACTION. The definitive proxy statement, the preliminary proxy statement and other relevant materials in connection with the transaction (when they become available), and any other documents filed by

LinkedIn with the SEC, may be obtained free of charge at the SEC s website (http://www.sec.gov) or at LinkedIn s website (http://investors.linkedin.com) or by writing to LinkedIn Corporation, Investor Relations, 2029 StierlinCourt, Mountain View, California 94043.

LinkedIn and its directors and executive officers may be deemed _participants_ in the solicitation of proxies from LinkedIn s stockholders with respect to the transaction. Information about LinkedIn s directors and executive officers and their ownership of LinkedIn s common stock is set forth in LinkedIn s proxy statement on Schedule 14A filed with the SEC on April 22, 2016 and will be set forth in the proxy statement and other materials to be filed with SEC in connection with the transaction.

June 13, 2016

World s World s Leading Leading Professional Professional Network Cloud +

Microsoft s and LinkedIn s vision for the opportunity ahead

5

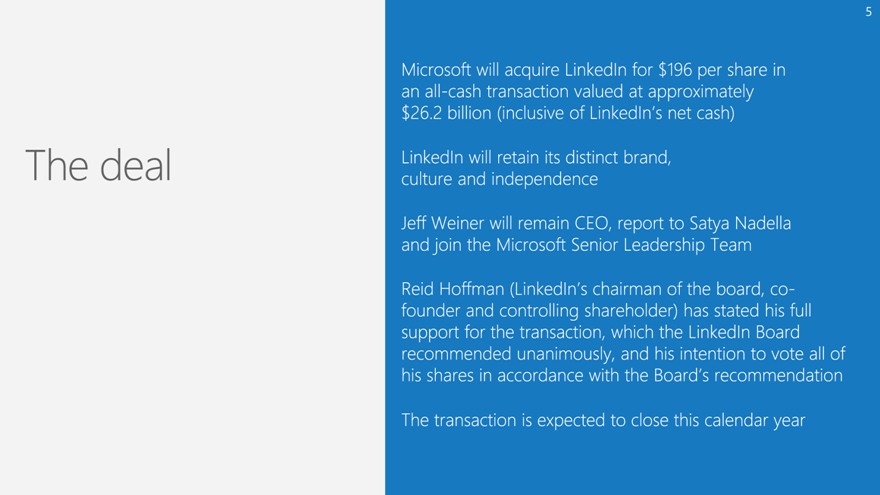

The deal

Microsoft will acquire Linkedin for $196 per share in an all-cash transaction valued at approximately $26.2 billion (inclusive of Linkedln’s net cash)

Linkedln will retain its distinct brand,

culture and independence

Jeff Weiner will remain CEO, report to Satya Nadella

and join the Microsoft Senior Leadership Team

Reid Hoffman (Linkedln’s chairman of the board, cofounder and controlling shareholder) has stated his full support for the transaction, which the Linkedln Board recommended unanimously, and his intention to vote all of his shares in accordance with the Board’s recommendation

The transaction is expected to close this calendar year

6

A common mission

Microsoft and Linkedin share a

common mission centered on

empowering people and organizations

Empower

people and organizations

Microsoft Linkedin

Empower every person and Connect the woMd’s

every organization on the professionals to make them

planet to achieve more more productive and successful

7

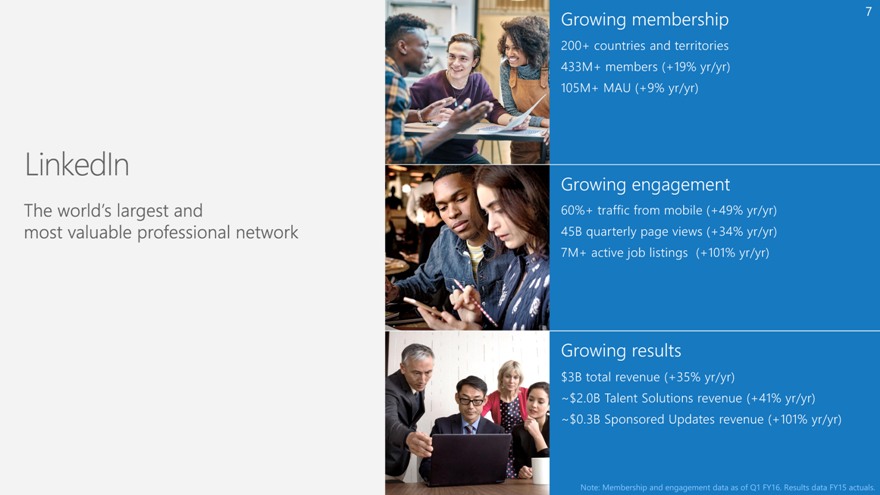

Linkedin

The world’s largest and

most valuable professional network

Growing membership

200+ countries and territories 433M+ members (+19% yr/yr)

105M+ MAU (+9% yr/yr)

Growing engagement

60%+ traffic from mobiie (+49% yr/yr)

45B quarteriy page views (+34% yr/yr)

7M+ active job iistings (+101% yr/yr)

Growing results

$3B total revenue (+35% yr/yr)

-$2.OB Taient Soiutions revenue (+41% yr/yr)

-$0.3B Sponsored Updates revenue (+101% yr/yr)

Note: Membership and engagement data as of Qi FY16. Results data FY15 actuals.

8

Opportunity ahead

Realize a,common mission by bringing together

the worlds leading professional cloud and network

Drive increased engagement across Linked In

as well as Office 365 and Dynamics

Accelerate monetization through individual and

organization subscriptions and targeted advertising

9

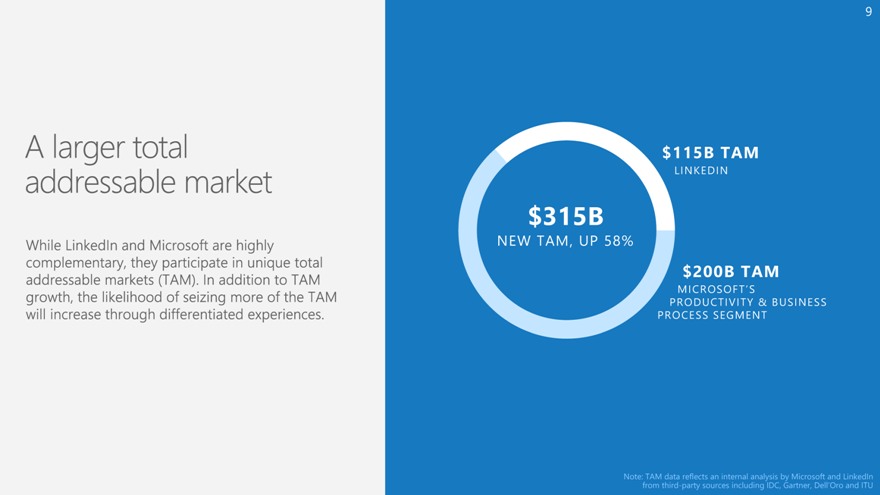

A larger total addressable market

While Linked In and Microsoft are highly complementary, they participate in unique total addressable markets (TAM). In addition to TAM growth, the likelihood of seizing more of the TAM will increase through differentiated experiences.

$315B

NEW TAM, UP 58%

$115B TAM LINKEDIN

$200B TAM

MICROSOFT’S

PRODUCTIVITY & BUSINESS PROCESS SEGMENT

Note: TAM data reflects an internal analysis by Microsoft and Linkedln from third-party sources including DC, Gartner, Dell’Oro and ITU

10

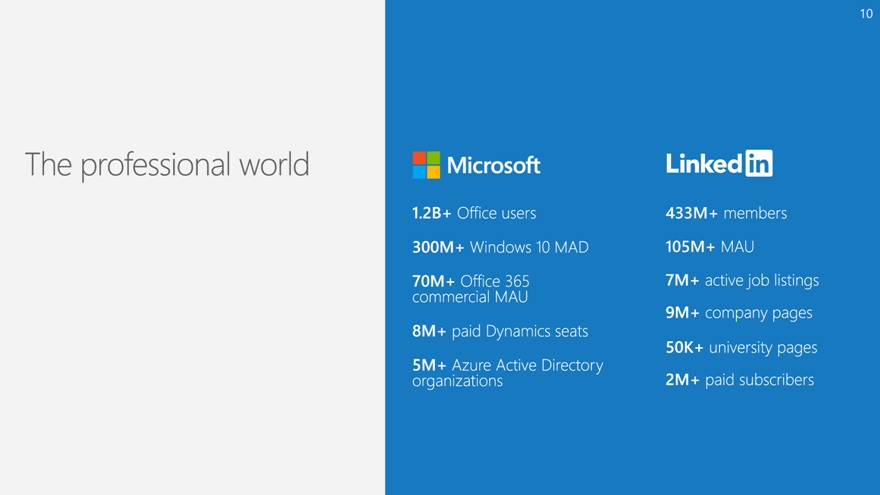

The professional world

Microsoft

1..2B÷ Office users

300M+ Windows 10 MAD

70M+ Office 365

commercial MAU

8M+ paid Dynamics seats

5M + Azure Active Directory organizations

Linked in

433M+ members

105M+ MAU

7M+ active job listings

9M+ company pages

50K+ university pages

2M+ paid subscribers

11

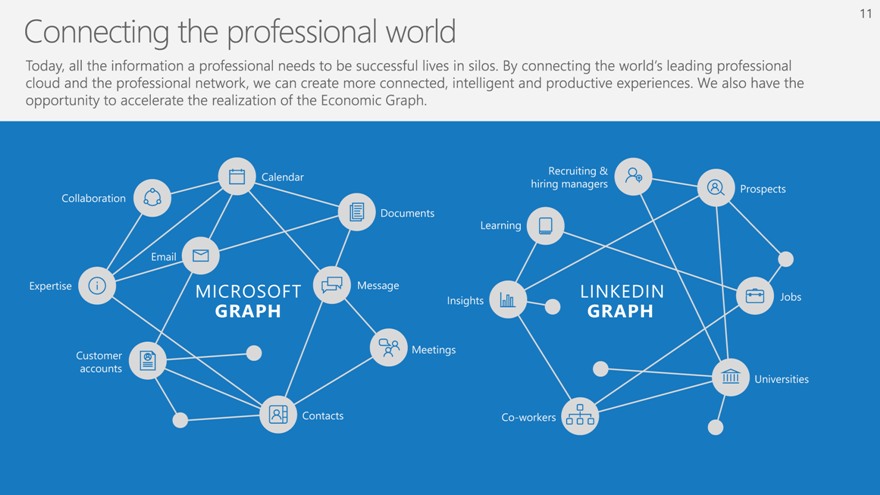

Connecting the professional world

Today, all the information a professional needs to be successful lives in silos. By connecting the world’s leading professional cloud and the professional network, we can create more connected, intelligent and productive experiences. We also have the opportunity to accelerate the realization of the Economic Graph.

2 Calendar

Collaboration

Expertise

Documents

MICROSOFT GRAPH

Message

Customer

accounts

Meetings

Contacts

7

Learning

Recruiting &

hiring managers

Insights

Meetings

N

LINKEDIN

GRAPH

K Jobs

Co-workers

Universities

12

Illustrations

How Microsoft and LinkedIn can reinvent ways to make professionals more productive

13

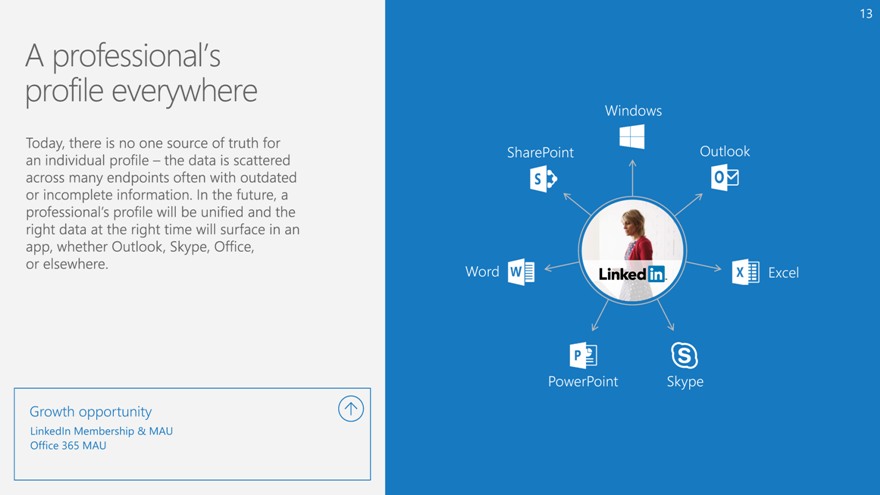

A professional’s profile everywhere

Today, there is no one source of truth for an individual profile — the data is scattered across many endpoints often with outdated or incomplete information. In the future, a professional’s profile will be unified and the right data at the right time will surface in an app, whether Outlook, Skype, Office, or elsewhere.

Growth opportunity

Linkedin Membership & MAU Office 365 MAU

Windows

Share Point

Word

Outlook

Excel

PowerPoint Skype

14

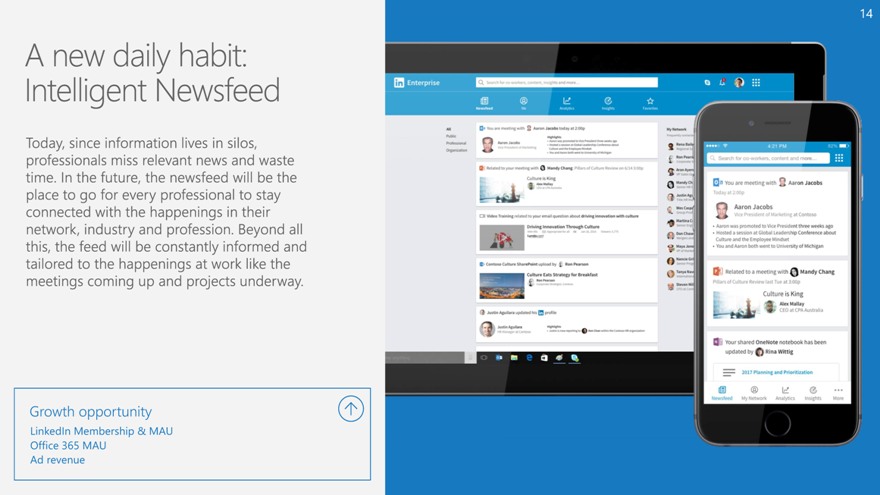

A new daily habit:

Intelligent Newsfeed

Today, since information lives in silos, professionals miss relevant news and waste time. In the future, the newsfeed will be the place to go for every professional to stay connected with the happenings in their network, industry and profession. Beyond all this, the feed will be constantly informed and tailored to the happenings at work like the meetings coming up and projects underway.

Growth opportunity

Linkedln Membership & MAU Office 365 MAU

Ad revenue

Growth opportunity

LinkedIn Membership & MAU

Office 365 MAU

Ad revenue

15

A digital assistant that’s predictive

Today Cortana knows about you, your organization and about the world. In the future, Cortana will also know your entire professional network to connect dots on your behalf so you stay one step ahead.

Growth opportunity

Member MAU

Office 365 MAU

Ad revenue

Hi Jen, you are meeting with Sam next. You and Sam both went to the University of Washington and you both know Cindy Smith. Good news, the Huskies won last night s game. Do you want to look at Sam s profile?

Do you want to see your meeting history with Cindy and Sam? Also, ok if I share the presentation for today with Sam?

Growth opportunity

Member MAU Office 365 MAU Ad revenue

16

Illustrations

How Microsoft and LinkedIn can reinvent selling, marketing and talent management business processes

17

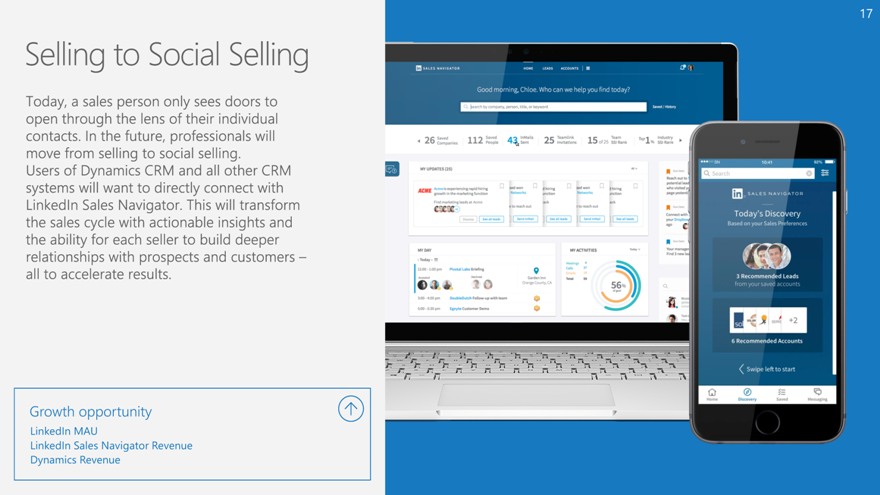

Selling to Social Selling

Today, a sales person only sees doors to open through the lens of their individual contacts. In the future, professionals will move from selling to social selling. Users of Dynamics CRM and all other CRM systems will want to directly connect with Linked In Sales Navigator. This will transform the sales cycle with actionable insights and the ability for each seller to build deeper relationships with prospects and customers — all to accelerate results.

Growth opportunity

LinkedIn MAU

LinkedIn Sales Navigator Revenue Dynamics Revenue

18

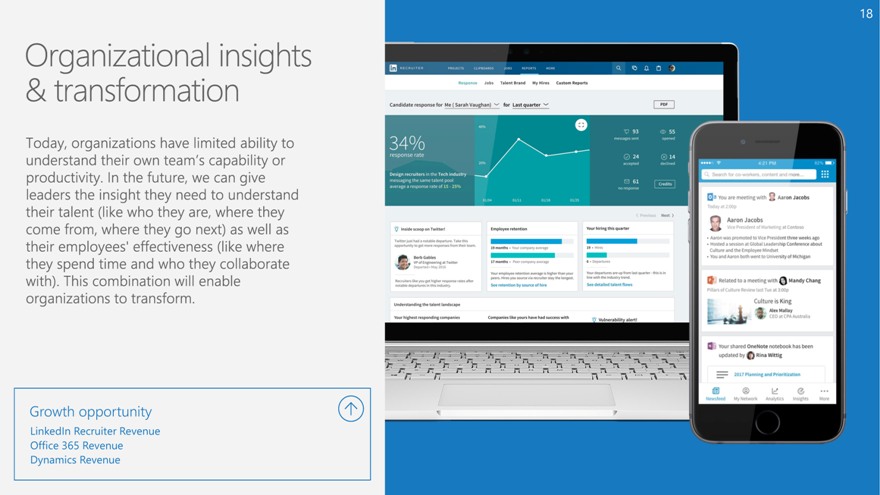

Organizational insights & transformation

Today, organizations have limited ability to understand their own team’s capability or productivity. In the future, we can give leaders the insight they need to understand their talent (like who they are, where they come from, where they go next) as well as their employees’ effectiveness (like where they spend time and who they collaborate with). This combination will enable organizations to transform.

Growth opportunity

LinkedIn Recruiter Revenue Office 365 Revenue Dynamics Revenue

19

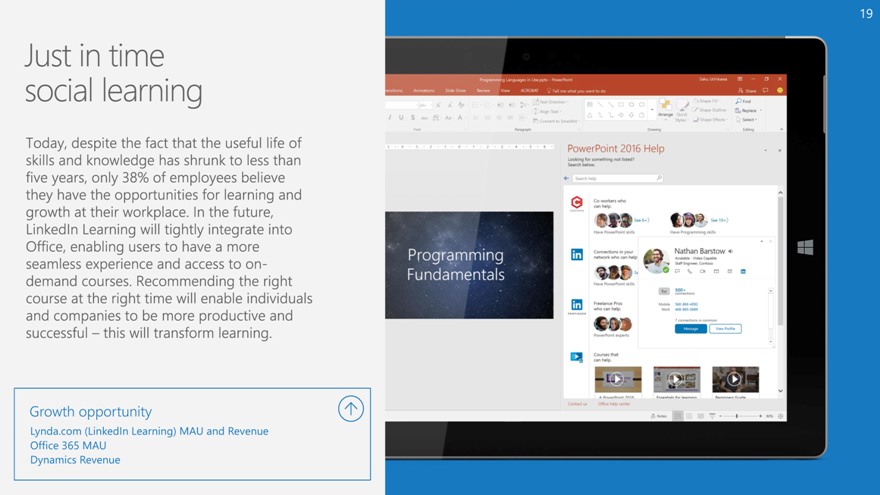

Just in time social learning

Today, despite the fact that the useful life of skills and knowledge has shrunk to less than five years, only 38% of employees believe they have the opportunities for learning and growth at their workplace. In the future, Linkedln Learning will tightly integrate into Office, enabling users to have a more seamless experience and access to on- demand courses. Recommending the right course at the right time will enable individuals and companies to be more productive and successful — this will transform learning.

Growth opportunity

Lynda.com (LinkedIn Learning) MAU and Revenue Office 365 MAU

Dynamics Revenue

20

Value beyond

these scenarios

Linkedin can utilize Microsoft’s field and distribution

channels to reach new audiences and more customers

Access to Microsoft’s scaled cloud infrastructure

and technology stack

Increased Bing engagement with the

best professional search

Linkedln feed with Windows notifications

Empower developers in new ways with rich APIs

and new training opportunity

21

Summary of Approach

22

Regulatory approach

We plan to obtain regulatory approval in the

United States, the European Union, Canada

and Brazil before closing the transaction

We are confident about our prospects for obtaining

regulatory approval by the end of this calendar year

We believe the merger is highly complementary and will

benefit consumer and enterprise users who will achieve

more through our joint innovation and new scenarios

23

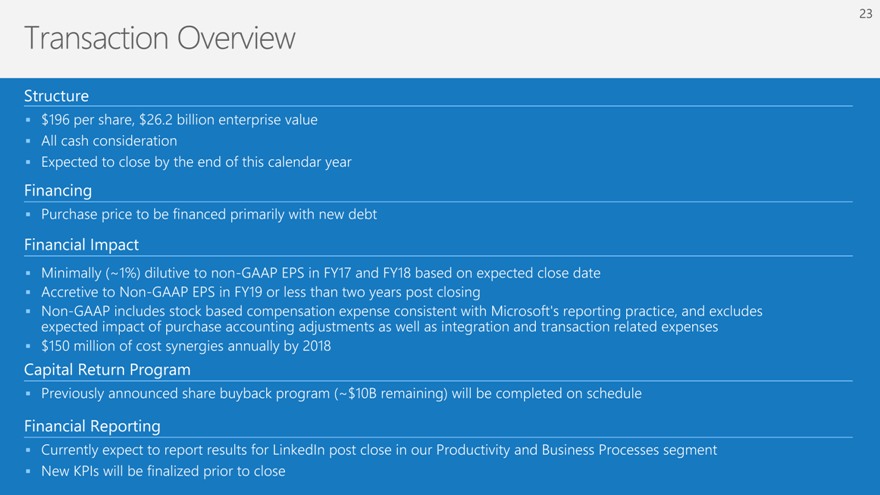

Transaction Overview

Structure

$196 per share, $26.2 billion enterprise value

All cash consideration

Expected to close by the end of this calendar year

Financing

Purchase price to be financed primarily with new debt

Financial Impact

Minimally (~1%) dilutive to non-GAAP EPS in FY17 and FY18 based on expected close date

Accretive to Non-GAAP EPS in FY19 or less than two years post closing

Non-GAAP includes stock based compensation expense consistent with Microsoft’s reporting practice, and excludes

expected impact of purchase accounting adjustments as well as integration and transaction related expenses

$150 million of cost synergies annually by 2018

Capital ReturnProgram

Previously announced share buyback program (~$10B remaining) will be completed on schedule

FinancialReporting

Currently expect to report results for LinkedIn post close in our Productivity and Business Processes segment

New KPIs will be finalized prior to close

24

World s World s Leading Leading Professional Professional Network Cloud +