A CLEAR MISSION A Look Ahead Management Presentation January 2016

2 | © 2016 Spectranetics All Rights Reserved. Safe Harbor Statement This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. You can identify these statements because they do not relate strictly to historical or current facts. Such statements may include words such as "anticipate," "will," "estimate," "expect," "look forward," "strive," "project," "intend," "should," "plan," "believe," "hope," "enable," "potential," and other words and terms of similar meaning in connection with any discussion of, among other things, future operating or financial performance, strategic initiatives and business strategies, clinical trials, regulatory or competitive environments, our intellectual property and product development. These forward-looking statements include, but are not limited to, statements regarding our competitive position, product development and commercialization schedule, expectation of continued growth and the reasons for that growth, growth rates, strength, integration and product launches, and 2015 and 2016 outlook and projected results including projected revenue and expenses, net loss and gross margin. Such statements are based on current assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. You are cautioned not to place undue reliance on these forward- looking statements and to note they speak only as of the date of this presentation. These risks and uncertainties may include financial results differing from guidance, inability to successfully integrate AngioScore and Stellarex into our business, market acceptance of excimer laser atherectomy technology and our vascular intervention and lead management products, lack of cash necessary to satisfy our cash obligations under our outstanding 2.625% Convertible Senior Notes due 2034, our debt adversely affecting our financial health and prevent us from fulfilling our debt service and other obligations, increasing price and product competition, increased pressure on expense levels resulting from expanded sales, marketing, product development and clinical activities, uncertain success of our strategic direction, dependence on new product development, loss of key personnel, uncertain success of or delays in our clinical trials, costs of and adverse results in any ongoing legal proceeding, or any legal proceeding in which we may become involved, adverse impact to our business of the health care reform and related legislation or regulations, including changes in reimbursements, continued or worsening adverse conditions in the general domestic and global economic markets and continued volatility and disruption of the credit markets, which affects the ability of hospitals and other health care systems to obtain credit and may impede our access to capital, intellectual property claims of third parties, availability of inventory from suppliers, adverse outcome of FDA inspections, the receipt of FDA clearance and other regulatory approvals to market new products or applications and the timeliness of any clearance and approvals, market acceptance of new products or applications, product defects, ability to manufacture sufficient volumes to fulfill customer demand, availability of vendor-sourced components at reasonable prices, unexpected delays or costs associated with any planned improvements to our manufacturing processes, and share price volatility due to the initiation or cessation of coverage, or changes in ratings, by securities analysts. For a further list and description of such risks and uncertainties that could cause our actual results, performance or achievements to materially differ from any anticipated results, performance or achievements, please see our previously filed SEC reports, including those risks set forth in our 2014 Annual Report on Form 10-K and 2015 quarterly reports on Form 10-Q. We disclaim any intention or obligation to update or revise any financial or other projections or other forward-looking statements, whether because of new information, future events or otherwise.

3 | © 2016 Spectranetics All Rights Reserved. SPECTRANETICS Growth Driven Company • Founded 1984, HQ in Colorado • Listed on NASDAQ in 1992: SPNC • Growth story • Large, growing markets; gaining share • Compelling product portfolio & clinical studies pipeline • ~900 Global teammates, >65 countries

4 | © 2016 Spectranetics All Rights Reserved. Serving Two Markets SPNC MARKET OPPORTUNITY ~$6B ~$0.7B LEAD MANAGEMENT~$5.3B VASCULAR INTERVENTION

5 | © 2016 Spectranetics All Rights Reserved. 1.5M procedures/year 25M in the EU & U.S. alone >200M afflicted globally 1.7M procedures/year $190B healthcare costs >500M EU & U.S. with ≥1 CVD major risk factor PAD: Underpenetrated & Growing CAD: Large Established Market 1.1M 600K • Diagnosis and treatment standards needed • Strong healthcare economics • Up to 65% of PCIs are Complex Cases • 9 SPNC Indications • 2015 atherectomy reimbursement PAD PTA, Stents Bypass Amputation Atherectomy CAD PCI Complex Cases Single Vessel, Single Stent VASCULAR MARKETS

6 | © 2016 Spectranetics All Rights Reserved. PERIPHERAL ARTERY DISEASE 6 34M OPPORTUNITY: Diagnosis and treatment standards needed Strong healthcare economics 875,000 PTA, Stents 250,000 Bypass 250,000 Amputation 125,000 Atherectomy >200M People Living with PAD Globally 25M EU & US alone* $1.7B Market ~8% Growth 1.5M* Procedures/Year *All EU & US A Global Pandemic

7 | © 2016 Spectranetics All Rights Reserved. Market Characteristics Large, growing, underpenetrated market Patients are implanted younger and living longer = more device replacements Sicker patients, aging devices = 320% increase in infection rate over a 7-year period Lead management = central issue in CRM LEAD MANAGEMENT Developing the Market WW Potential Market 2014 = >$700MM* $100M served market in 2014 Class I penetrated 25% Class II penetrated 9% Class II $525MM Class I $175MM *Based on analysis of external data.

8 | © 2016 Spectranetics All Rights Reserved. LIFE & LIMB SAVING PORTFOLIOSolving Complex Challenges Lead Management – Laser & Mechanical Tools Vascular Intervention – Cross - Prep - Treat * * Not approved for use in the U.S. *

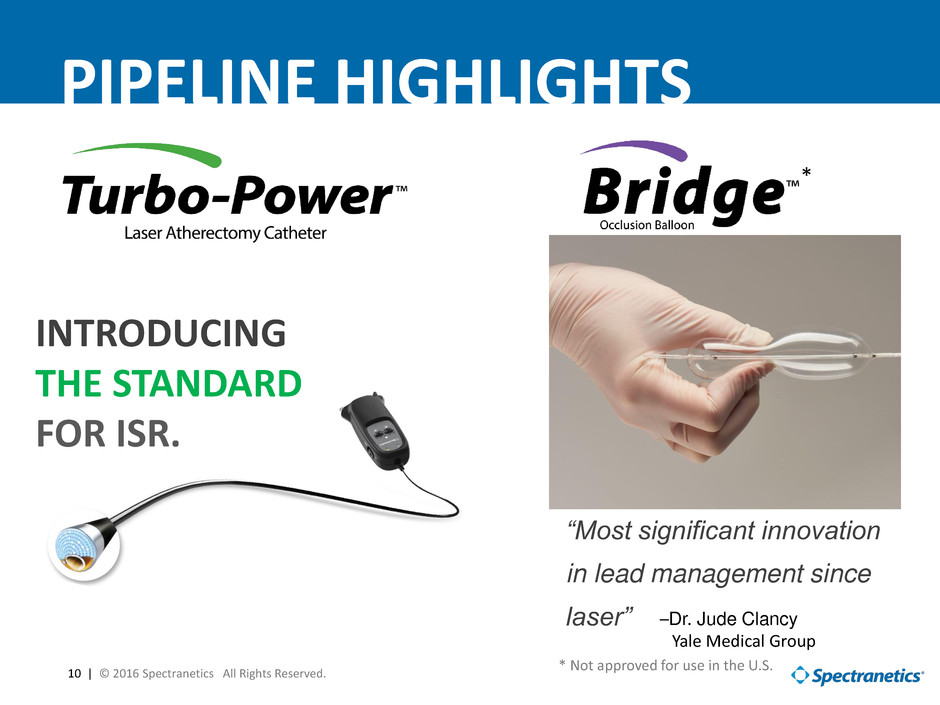

9 | © 2016 Spectranetics All Rights Reserved. THE ROAD AHEADRobust Pipeline 2015 • EU Stellarex ATK • Turbo Power • AngioSculpt 7mm & 8mm 2016 • Bridge to Surgery • Initiate 10,000 patient clinical studies… • EU DCBs – Stellarex BTK & AngioSculptX 2017 • US Stellarex ATK • Nexcimer – Next Gen Laser • Japan Peripheral Atherectomy 2018 & Beyond • DCBs – ISR, Next Gen Products • Calcium Solutions • Next Gen LM tools

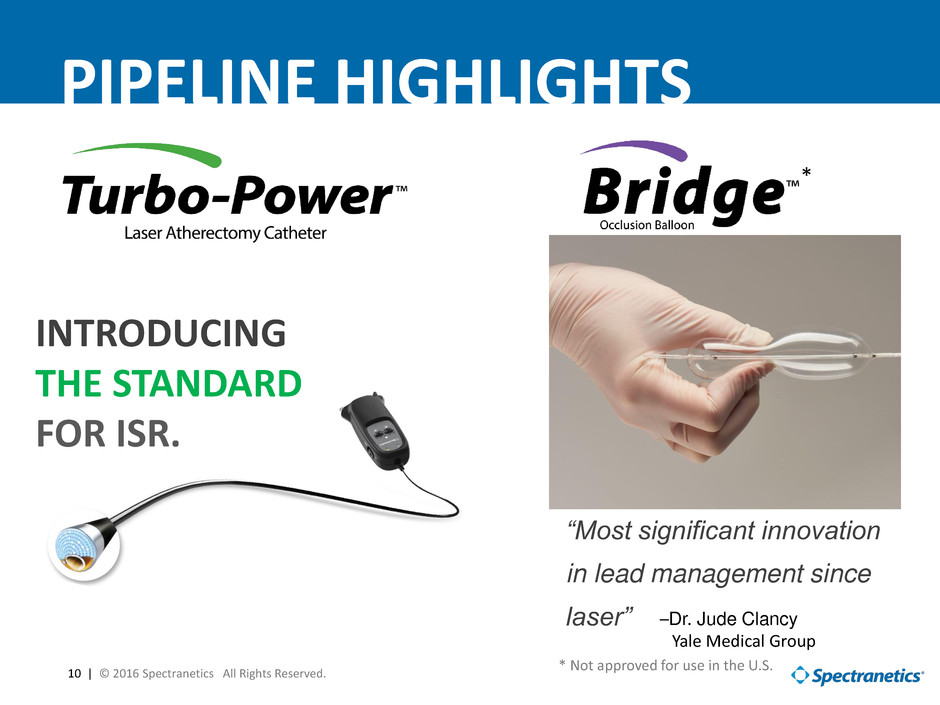

10 | © 2016 Spectranetics All Rights Reserved. INTRODUCING THE STANDARD FOR ISR. PIPELINE HIGHLIGHTS “Most significant innovation in lead management since laser” –Dr. Jude Clancy Yale Medical Group * Not approved for use in the U.S. *

11 | © 2016 Spectranetics All Rights Reserved. DCB PROGRAM • Top tier first-in-human clinical data and performance • Completed enrollment of ILLUMENATE program – Five clinical trials enrolling over 1100 pts – 12-month data to be presented in 2016 • EU launch progressing nicely • Stellarex US launch targeted in 2017 • AngioSculptX Coronary CE mark anticipated in 2016 Opportunity to become a market leader * Not approved for use in the U.S. * *

12 | © 2016 Spectranetics All Rights Reserved. DCB PROGRAM * Not approved for use in the U.S. * “… ILLUMENATE FIH study indicates Stellarex as a distinguished second generation DCB technology able to combine low drug dose with amongst best reported clinical outcomes up to 2 years” - Dr. Thomas Zeller

13 | © 2016 Spectranetics All Rights Reserved. ILLUMENATE DATA RELEASE Next 12 months April 2016 ILLUMENATE Global 12 month interim data September 2016 ILLUMENATE EU RCT 12 month data October 2016 ILLUMENATE US Pivotal 12 month data January 2017 ILLUMENATE Global Registry 12 month data January 2016 Encore FIH 24 month data May 2016 Encore interim Global 12 month data Nov 2016 Encore EU RCT and US Pivotal data Major Data Releases Significant podium presence in 2016. * * Current anticipated data release schedule. Subject to change based on trial and/or regulatory related events.

14 | © 2016 Spectranetics All Rights Reserved. 25 50 75 100 125 150 175 200 225 250 275 2011 2012 2013 2014 2015 Outlook Demonstrated track record of growth Large, growing markets, taking share Compelling clinical data Attractive innovation pipeline Expanding global footprint LOOKING BACK (i n m ill ion s ) 5-year CAGR: ~15% Track record of Growth * * 2015 Outlook based on 10/22/15 guidance.

15 | © 2016 Spectranetics All Rights Reserved. LOOKING AHEAD

17 | © 2016 Spectranetics All Rights Reserved. DIFFERENTIATED PORTFOLIO Solving Complex Challenges Cross Prep •Quick-Cross •Quick-Cross Select •Quick-Cross Extreme •Quick-Cross Capture •Turbo-Elite •Quick-Access •Turbo-Elite •Turbo-Power •ELCA •AngioSculpt PTA •AngioSculpt PTCA •Quick-Cat •Stellarex DCB – SFA •Stellarex DCB – BTK •AngioSculptX – Coronary Treat Highly differentiated and clinically driven portfolio

18 | © 2016 Spectranetics All Rights Reserved. COMPREHENSIVE TOOLKIT Addressing Physician Needs Laser • Broadened portfolio in mid-2015 • Gaining share • Continued expansion in 2016 • LLD locks onto inner length of lead • First choice before using powered sheath • Superior procedural success vs. competitive mechanical tools • Bridge to Surgery • Buys precious time in the event of complication • Targeted at building confidence, unlocking market PipelineAccessoriesMechanical Broad portfolio to address complex clinical needs

19 | © 2016 Spectranetics All Rights Reserved. India Russia China Brazil Germany Japan GLOBAL GROWTHAccelerating the Market Opportunity • Separate LM/VI salesforces • Take share with mechanical tools • Stellarex® launch • AngioSculpt performing well • Submit Peripheral atherectomy Shonin 2016 Launch laser in Brazil, China and India EU Japan BRIC

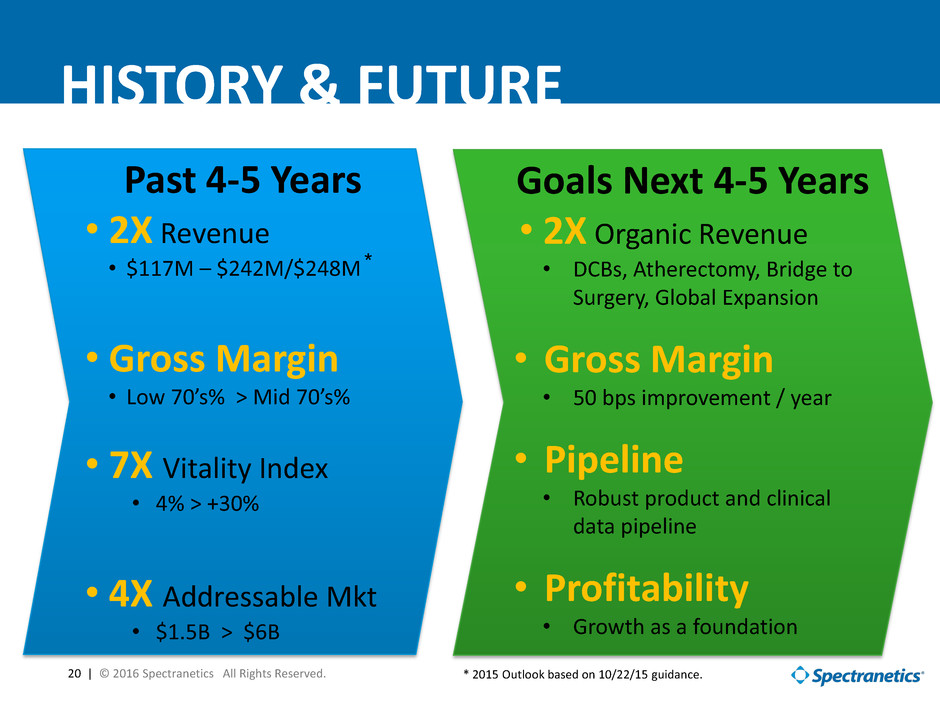

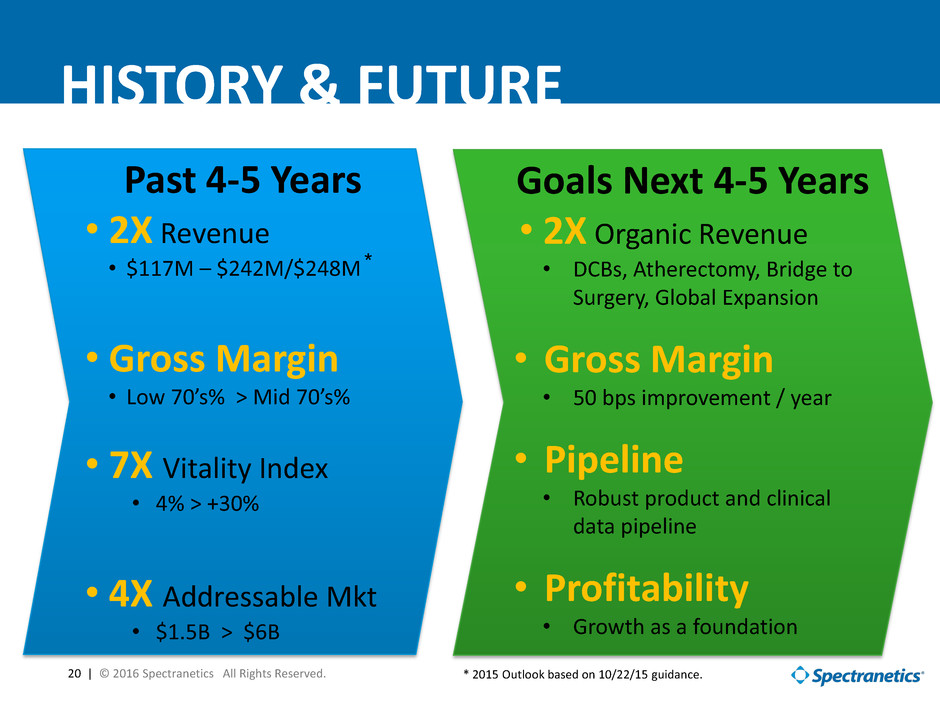

20 | © 2016 Spectranetics All Rights Reserved. HISTORY & FUTURE Goals Next 4-5 Years • 2X Organic Revenue • DCBs, Atherectomy, Bridge to Surgery, Global Expansion • Gross Margin • 50 bps improvement / year • Pipeline • Robust product and clinical data pipeline • Profitability • Growth as a foundation Past 4-5 Years • 2X Revenue • $117M – $242M/$248M • Gross Margin • Low 70’s% > Mid 70’s% • 7X Vitality Index • 4% > +30% • 4X Addressable Mkt • $1.5B > $6B * * 2015 Outlook based on 10/22/15 guidance.