UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04581

CORNERCAP GROUP OF FUNDS

(Exact name of registrant as specified in charter)

The Peachtree, Suite 1700, 1355 Peachtree Street NE, Atlanta, Georgia 30309

(Address of principal executive offices) (Zip code)

Paul F. Leone, Esq.

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: (404) 870-0700

Date of fiscal year end: March 31

Date of reporting period: April 1, 2013 – March 31, 2014

Item 1. Reports to Stockholders.

| | |

| Manager’s Report to Shareholders (Unaudited) | | |

| | March 31, 2014 |

Dear Shareholders:

CornerCap Investment Counsel recently celebrated our 25th year in business, following our departure from RJR Nabisco in March 1989. Over that period, we have grown the firm through reputation, returns and retention of clients.

A little bit of history … With modest assets under management, in September 1992 we decided to enter the mutual fund business. Managing, administering and serving mutual funds are exceptionally expensive. We also decided to only manage pure no-load funds. In other words, there would be no monies coming from fund shareholders to compensate anyone selling our funds, i.e. growth would be slow. We knew that CornerCap would be absorbing most of the mutual fund expenses for a number of years, and we did.

To finish the firm-fund-bio, to save costs we found and “acquired” one of the worst performing funds in the marketplace, the Sunshine Growth Trust (SGT) in California. The SGT evolved to become our CornerCap Small Cap Value fund. Since September 1992, this previously failed fund has realized a 10.13% before tax annualized return after all costs. It is interesting that of the 1,166 small cap value/blend mutual funds that are currently in the Morningstar Universe, we are one of only 45 funds with investment results over this 21.5 year period. Please see page 5 for the complete standardized performance.

As noted earlier, we grow by reputation and returns. Over the last fiscal year, the assets in our three mutual funds grew 47%, from $64 million to $94 million. Our investment advisory firm has over $900 million in client assets. We appreciate you and our other loyal clients for helping to make that happen.

And the results were … Over that last fiscal year, all three of our mutual funds have realized much higher than normal absolute returns and have also outpaced their benchmarks. Our two all-equity funds, the Large/Mid Value and the Small Cap Value, have returned 28.42% and 33.09% while their benchmark returns were 21.86% for the S&P 500® Index and 22.65% for the Russell 2000® Value Index, respectively. Our more conservative Balanced fund realized a return of 16.76% versus 12.70% for the Combined 60% S&P 500® Index/40% Barclays Capital U.S. Government/Corporate Bond Index benchmark.

As noted above, this fiscal year reflected a significant outperformance of each funds’ benchmark return. The market is on a five year rebound following the extreme 2007-2009 market crash. However even as the market was recovering during the initial years, investors were fearfully tiptoeing through an imagined minefield. The biggest stock winners ignored valuations and simply reflected safety: Higher yield, low beta* (more market-like), low volatility and mega-cap stocks. However, earnings and cash flows did not support these investor preferences and the market has reversed – safety materially underperformed during this fiscal year.

We are confident that valuation wins over time. Everyone knows that price is important whether you’re in the stock market or the supermarket. The confusion comes with the opportunity for sellers to create much more excitement and fear with stocks than with groceries. Our disciplined, valuation-focused research has created average annual returns over the last five years of 21.98% for the Large/Mid Cap, 27.29% for the Small Cap, and 14.74% for the Balanced funds, all exceeding their benchmarks. Please see pages 3, 5 and 7 for complete standardized performance.

| | |

| | |

Annual Report | March 31, 2014 | | 1 |

| | |

Manager’s Report to Shareholders (Unaudited) | | |

| | March 31, 2014 |

And the problem was … For our taxable shareholders, the unfortunate byproduct of exceptional returns is higher taxes. For those who have read the most recent commentary on our website, 2013 represented “The Perfect Storm” for taxes. And, the conditions still exist for the continuation of that storm. For higher income taxpayers, in 2013 we had:

| | • | | High investment returns |

| | • | | The long term capital gains tax rate went up almost 60%, from 15% to 23.8% |

| | • | | The elimination of some tax deductions |

| | • | | Most tax loss carry forwards from the 2007-2009 market crash have been depleted |

At CornerCap, while we put investments first, we pay close attention to taxes. If we have a large gain in a security that needs to be trimmed or eliminated, we check the long term capital gain threshold (one year) and make a calculated decision about selling now or delaying the sale until it becomes long term. Throughout the taxable year we review holdings for any significant tax harvesting opportunities, potentially buying more of the underweighted holding and then selling the lots with tax losses after the wash sell rule is achieved (30 days). And of course, we only sell a holding when the fundamentals do not support retention or when the security’s weighting exceeds the fund’s portfolio management guidelines. We pay attention to taxes but eventually taxes have to be paid.

Thank you for being a shareholder in our CornerCap Group of Funds and please let us know if we can be of service to any of your family or friends.

CornerCap Investment Counsel

May 31, 2014

| *Beta | – A measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. |

The Letter to Shareholders seeks to describe some of CornerCap Investment Counsel’s current opinions and views of the financial markets. Although CornerCap Investment Counsel believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed.

Diversification does not eliminate the risk of experiencing investment loss.

| | |

Manager’s Report to Shareholders (Unaudited) | | |

| | March 31, 2014 |

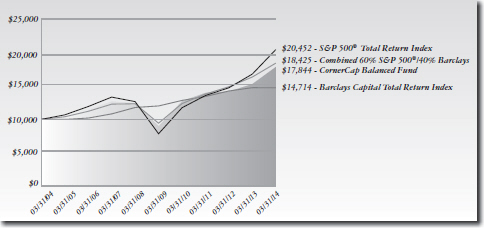

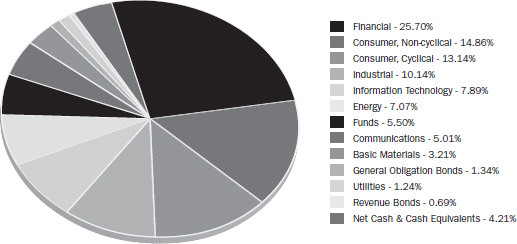

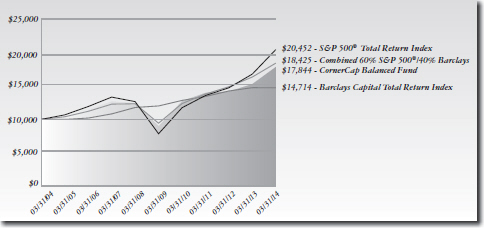

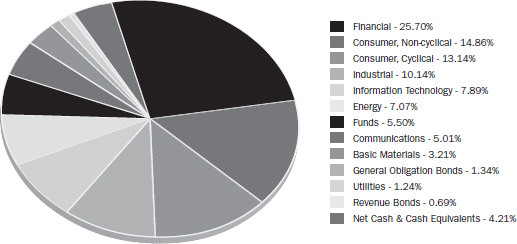

CORNERCAP BALANCED FUND

Investment Performance through March 31, 2014 (In Thousands)

Total Return

for the period ended March 31, 2014

| | | | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception(b) | | Gross

Expense

Ratio | | Net Expense

Ratio(c) |

CornerCap Balanced Fund(a) | | 16.76% | | 14.74% | | 5.96% | | 5.97% | | 1.32% | | 1.12% |

Combined 60% S&P 500® Index/40% Barclays Capital

U.S. Government/ Corporate Bond Index(d) | | 12.70% | | 14.36% | | 6.30% | | 6.53% | | | | |

S&P 500® Index(e) | | 21.86% | | 21.16% | | 7.42% | | 6.75% | | | | |

Barclays Capital U.S. Government/Corporate Bond Index(f) | | (0.13%) | | 4.18% | | 3.94% | | 5.32% | | | | |

Past performance does not guarantee future results. The performance data quoted does not reflect the deduction of the 1% redemption fee imposed if shares are redeemed or exchanged within sixty days of purchase or the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Data quoted represents past performance.

Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Mutual fund performance changes over time and currently may be significantly lower than stated above. Performance is updated and published monthly. Visit the Fund’s website at www.cornercapfunds.com or call 888-813-8637 for month-end performance figures.

| | |

| | |

Annual Report | March 31, 2014 | | 3 |

| | |

Manager’s Report to Shareholders (Unaudited) | | |

| | March 31, 2014 |

| (a) | The Fund’s total returns include the reinvestment of dividend and capital gain distributions but have not been adjusted for any income taxes payable by shareholders on these distributions. |

| (b) | The Balanced Fund began operations May 24, 1997. |

| (c) | CornerCap Investment Counsel, Inc. (the “Adviser”) has entered into a contractual agreement with the Balanced Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Balanced Fund, if necessary, in an amount that limits “Total Annual Fund Operating Expenses” (exclusive of interest, taxes, brokerage fees and commissions, Acquired Fund Fees and Expenses, and extraordinary expenses) to not more than 1.10%. To the extent the Balanced Fund incurs excluded expenses, the expense ratio will increase. The current contractual agreement cannot be terminated prior to August 1, 2014 without the Board of Trustees’ approval. |

| (d) | Effective August 17, 2006, the Balanced Fund has elected to use the comparative index 60% S&P 500® Index and 40% Barclays Capital U.S. Government/Corporate Bond Index. |

| (e) | The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding) with each stock’s weight in the Index proportionate to its market value. |

| (f) | The Barclays Capital U.S. Government/Corporate Bond Index measures the general performance of fixed-income securities by tracking publicly issued U.S. Treasury and debt obligations (excluding mortgage-backed securities), fixed-rate, non-convertible, investment-grade corporate debt securities, and U.S. dollar-denominated, SEC-registered non-convertible debt issued by foreign governmental entities or international agencies. |

The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

Sector Allocation as a Percentage of Total Investments at March 31, 2014*

| * | These allocations may not reflect the current or future position of the portfolio. |

| | |

Manager’s Report to Shareholders (Unaudited) | | |

| | March 31, 2014 |

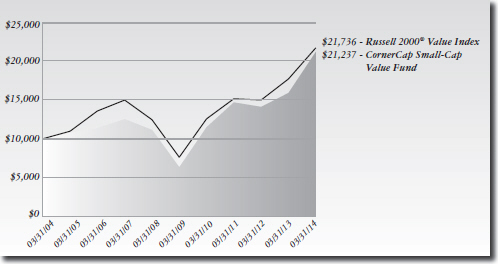

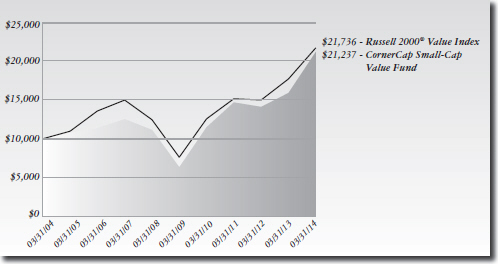

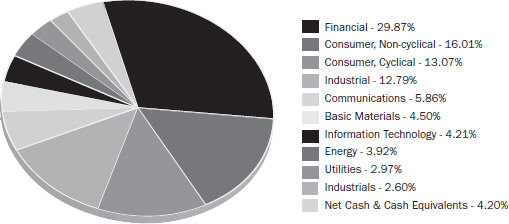

CORNERCAP SMALL-CAP VALUE FUND

Investment Performance through March 31, 2014 (In Thousands)

Total Return

for the period ended March 31, 2014

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | 5 Year | | 10 Year | | Since

Inception(b) | | Gross Expense Ratio | | Expense Ratio(c) |

CornerCap Small-Cap Value Fund(a) | | | | 33.09 | % | | | | 27.29 | % | | | | 7.82 | % | | | | 10.13 | % | | | | 1.51 | % | | | | 1.31 | % |

Russell 2000® Value Index(d) | | | | 22.65 | % | | | | 23.33 | % | | | | 8.07 | % | | | | 11.69 | % | | | | | | | | | | |

Russell 2000® Index(e) | | | | 24.90 | % | | | | 24.31 | % | | | | 8.53 | % | | | | 10.24 | % | | | | | | | | | | |

Past performance does not guarantee future results. The performance data quoted does not reflect the deduction of the 1% redemption fee imposed if shares are redeemed or exchanged within sixty days of purchase or the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Data quoted represents past performance.

Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Mutual fund performance changes over time and currently may be significantly lower than stated above. Performance is updated and published monthly. Visit the Fund’s website at www.cornercapfunds.com or call 888-813-8637 for month-end performance figures.

| | |

| | |

Annual Report | March 31, 2014 | | 5 |

| | |

Manager’s Report to Shareholders (Unaudited) | | |

| | March 31, 2014 |

| (a) | The Fund’s total returns include the reinvestment of dividend and capital gain distributions, but have not been adjusted for any income taxes payable by shareholders on these distributions. |

| (b) | The Small-Cap Value Fund began operations on September 30, 1992. |

| (c) | CornerCap Investment Counsel, Inc. (the “Adviser”) has entered into a contractual agreement with the Small-Cap Value Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Small-Cap Value Fund, if necessary, in an amount that limits “Total Annual Fund Operating Expenses” (exclusive of interest, taxes, brokerage fees and commissions, Acquired Fund Fees and Expenses, and extraordinary expenses) to not more than 1.30%. To the extent the Small-Cap Value Fund incurs excluded expenses, the expense ratio will increase. The current contractual agreement cannot be terminated prior to August 1, 2014 without the Board of Trustees’ approval. |

| (d) | The Russell 2000® Value Index measures the 2,000 smallest of the 3,000 largest U.S. Companies (based on total market capitalization) that have lower price-to-book ratios and lower forecasted growth values. Index returns include dividends and/or interest income and, unlike Fund returns, do not reflect fees or expenses. |

| (e) | The Russell 2000® Index is an index that measures the performance of the 2,000 smallest companies in the Russell 3000® Index. |

The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

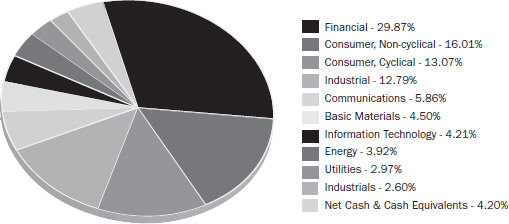

Sector Allocation

as a Percentage of Total Investments at March 31, 2014*

| * | These allocations may not reflect the current or future position of the portfolio. |

| | |

Manager’s Report to Shareholders (Unaudited) | | |

| | March 31, 2014 |

| |

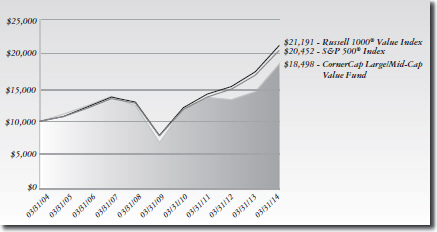

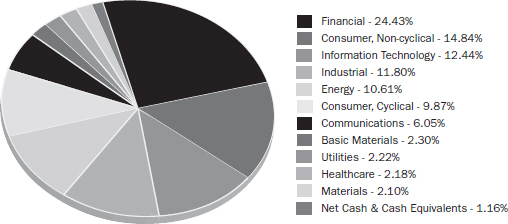

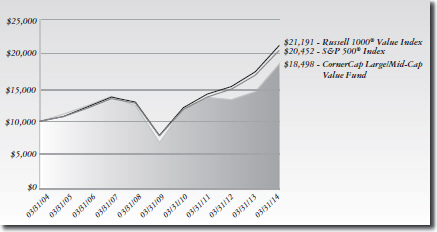

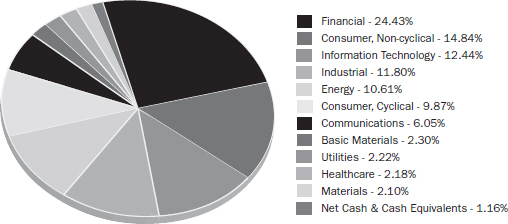

| CORNERCAP LARGE/MID-CAP VALUE FUND | | |

Investment Performance through March 31, 2014 (In Thousands)

Total Return

for the period ended March 31, 2014

| | | | | | | | | | | | |

| | 1 Year | | 5 Year | | 10 Year | | Since Inception(b) | | Gross Expense

Ratio | | Net Expense

Ratio(c) |

CornerCap Large/Mid-Cap Value Fund(a) | | 28.42% | | 21.98% | | 6.34% | | 2.80% | | 1.51% | | 1.21% |

S&P 500® Index(d) | | 21.86 | | 21.16% | | 7.42% | | 3.98% | | | | |

Russell 1000® Value Index(e) | | 21.57% | | 21.75% | | 7.58% | | 6.77% | | | | |

Past performance does not guarantee future results. The performance data quoted does not reflect the deduction of the 1% redemption fee imposed if shares are redeemed or exchanged within sixty days of purchase or the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Data quoted represents past performance.

Investment return and share price will fluctuate with market conditions, and investors may have a gain or loss when shares are sold. Mutual fund performance changes over time and currently may be significantly lower than stated above. Performance is updated and published monthly. Visit the Fund’s website at www.cornercapfunds.com or call 888-813-8637 for month-end performance figures.

| (a) | The Fund’s total returns include the reinvestment of dividend and capital gain distribution, but have not been adjusted for any income taxes payable by shareholders on these distributions. |

| (b) | Effective July 29, 2010, the CornerCap Contrarian Fund changed its name to the CornerCap Large/Mid-Cap Value Fund. The CornerCap Large/Mid-Cap Value Fund maintains the same |

| | |

| | |

Annual Report | March 31, 2014 | | 7 |

| | |

Manager’s Report to Shareholders (Unaudited) | | |

| | March 31, 2014 |

| | investment objective as the CornerCap Contrarian Fund: long-term capital appreciation. Prior to October 11, 2004, the CornerCap Contrarian Fund was known as the CornerCap Micro-Cap Fund. The performance figures include figures for the Cornerstone Micro-Cap Fund, L.P., which was a private, unregistered fund managed by CornerCap Investment Counsel, Inc. (the “Adviser”) that began operations in August 31, 1996 and transferred all its assets to the Micro-Cap Fund on July 27, 2000. The Cornerstone Micro-Cap Fund was managed by the same Adviser as the Micro-Cap Fund. It pursued the same objectives and employed the same strategies as the Micro-Cap Fund. As of December 11, 2004, the Fund’s strategy was changed to multi-cap contrarian. |

| (c) | The Adviser has entered into a contractual agreement with the Large/Mid-Cap Fund under which it has agreed to waive or reduce its fees and to assume other expenses of the Large/Mid- Cap Fund, if necessary, in an amount that limits “Total Annual Fund Operating Expenses” (exclusive of interest, taxes, brokerage fees and commissions, Acquired Fund Fees and Expenses, and extraordinary expenses) to not more than 1.20%. To the extent the Large/Mid- Cap Value Fund incurs excluded expenses, the expense ratio will increase. The contractual agreement cannot be terminated prior to August 1, 2014 without the Board of Trustees’ approval. |

| (d) | The S&P 500® Index is an unmanaged index of 500 common stocks chosen for market size, liquidity, and industry group representation. It is a market-value weighted index (stock price times number of shares outstanding) with each stock’s weight in the Index proportionate to its market value. |

| (e) | The Russell 1000® Value Index measures the performance of those companies out of the 1,000 largest U.S. companies (based on total market capitalization) that have lower price-to-book ratios and lower forecasted growth values. |

The index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

Sector Allocation

as a Percentage of Total Investments at March 31, 2014*

| * | These allocations may not reflect the current or future position of the portfolio. |

| | |

Fund Expenses (Unaudited) | | |

| | |

As a shareholder of a Fund, you incur two types of costs: transaction costs, such as wire fees, redemption fees, and low balance fees, and ongoing costs, including management fees, and other fund operating expenses. This example is intended to help you understand your indirect costs, also referred to as “ongoing costs” (in dollars), of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

This example is based on an investment of $1,000 invested at the beginning of the period and held for the entire six-month period of October 1, 2013 through March 31, 2014.

Actual Expenses The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested at the beginning of the period, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes The second line of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transaction costs, such as wire fees, redemption fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| | | | | | | | | | | | | | | |

| | | Beginning

Account Value

10/01/2013 | | Ending

Account Value

3/31/2014 | | Expense

Paid During

Period(a) |

CornerCap Balanced Fund | | | | | | | | | | | | | | | |

Actual Fund Return | | | $ | 1,000.00 | | | | $ | 1,100.20 | | | | $ | 5.76 | |

Hypothetical Fund Return (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,019.45 | | | | $ | 5.54 | |

CornerCap Small-Cap Value Fund | | | | | | | | | | | | | | | |

Actual Fund Return | | | $ | 1,000.00 | | | | $ | 1,122.60 | | | | $ | 6.88 | |

Hypothetical Fund Return (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,018.45 | | | | $ | 6.54 | |

CornerCap Large/Mid-Cap Value Fund | | | | | | | | | | | | | | | |

Actual Fund Return | | | $ | 1,000.00 | | | | $ | 1,151.90 | | | | $ | 6.44 | |

Hypothetical Fund Return (5% return before expenses) | | | $ | 1,000.00 | | | | $ | 1,018.95 | | | | $ | 6.04 | |

| | |

| | |

Annual Report | March 31, 2014 | | 9 |

| | |

Fund Expenses (Unaudited) | | |

| | |

| (a) | These calculations are based on the expenses incurred in the most recent fiscal half-year. The period’s annualized six-month expense ratio is 1.10% for Balanced Fund; 1.30% for Small-Cap Value Fund and 1.20% for Large/Mid-Cap Value Fund, respectively. The dollar amounts shown as “Expenses Paid During Period” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent half-year (182), then divided by 365. |

The expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect any transactional costs, account maintenance fees or charges by processing organizations. The Fund does not charge any account maintenance fee or sales load, but does charge a 1.00% redemption fee that is applicable to all redemptions (sales or exchanges) made within sixty (60) days of an initial purchase of shares; provided, however, that the redemption fee will not apply if the shares to be redeemed are held in a retirement account subject to the Employee Retirement Income Security Act.

| | |

| | |

10 | | www.cornercapfunds.com |

| | |

Schedule of Investments | | |

CornerCap Balanced Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| |

COMMON STOCKS (61.5%) | | | | | | | | |

Aerospace & Defense (1.4%) | | | | | | | | |

General Dynamics Corp. | | | 3,050 | | | $ | 332,206 | |

| | | | | | | | |

| | |

Agriculture (1.2%) | | | | | | | | |

Altria Group, Inc. | | | 7,770 | | | | 290,831 | |

| | | | | | | | |

| | |

Auto Manufacturers (1.2%) | | | | | | | | |

General Motors Co. | | | 8,290 | | | | 285,342 | |

| | | | | | | | |

| | |

Banks (10.5%) | | | | | | | | |

The Bank of New York Mellon Corp. | | | 8,155 | | | | 287,790 | |

BB&T Corp. | | | 8,120 | | | | 326,180 | |

Capital One Financial Corp. | | | 4,580 | | | | 353,393 | |

Citigroup, Inc. | | | 5,920 | | | | 281,792 | |

The Goldman Sachs Group, Inc. | | | 1,755 | | | | 287,557 | |

JPMorgan Chase & Co. | | | 5,110 | | | | 310,228 | |

The PNC Financial Services Group, Inc. | | | 3,495 | | | | 304,065 | |

Wells Fargo & Co. | | | 6,585 | | | | 327,538 | |

| | | | | | | | |

| | | | | | | 2,478,543 | |

| | | | | | | | |

| | |

Chemicals (1.3%) | | | | | | | | |

Eastman Chemical Co. | | | 3,530 | | | | 304,321 | |

| | | | | | | | |

| | |

Commercial Services (1.3%) | | | | | | | | |

The Western Union Co. | | | 18,180 | | | | 297,425 | |

| | | | | | | | |

| | |

Computers (3.9%) | | | | | | | | |

EMC Corp. | | | 10,670 | | | | 292,465 | |

Hewlett-Packard Co. | | | 10,160 | | | | 328,777 | |

Western Digital Corp. | | | 3,155 | | | | 289,692 | |

| | | | | | | | |

| | | | | | | 910,934 | |

| | | | | | | | |

| | |

Electric (1.2%) | | | | | | | | |

Pinnacle West Capital Corp. | | | 5,335 | | | | 291,611 | |

| | | | | | | | |

| | |

Electrical Components & Equipment (2.6%) | | | | | | | | |

Emerson Electric Co. | | | 4,360 | | | | 291,248 | |

Energizer Holdings, Inc. | | | 3,060 | | | | 308,264 | |

| | | | | | | | |

| | | | | | | 599,512 | |

| | | | | | | | |

| | |

Food (2.6%) | | | | | | | | |

ConAgra Foods, Inc. | | | 9,990 | | | | 309,990 | |

The Kroger Co. | | | 6,990 | | | | 305,113 | |

| | | | | | | | |

| | | | | | | 615,103 | |

| | | | | | | | |

| | |

Healthcare Products (1.2%) | | | | | | | | |

Medtronic, Inc. | | | 4,550 | | | | 280,007 | |

| | | | | | | | |

| | |

| | |

Annual Report | March 31, 2014 | | 11 |

| | |

Schedule of Investments | | |

CornerCap Balanced Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| |

Healthcare Services (2.6%) | | | | | | | | |

Laboratory Corp. of America Holdings(a) | | | 2,955 | | | $ | 290,211 | |

UnitedHealth Group, Inc. | | | 3,860 | | | | 316,481 | |

| | | | | | | | |

| | | | | | | 606,692 | |

| | | | | | | | |

| | |

Insurance (5.0%) | | | | | | | | |

The Allstate Corp. | | | 4,945 | | | | 279,788 | |

Everest Re Group Ltd. | | | 1,870 | | | | 286,203 | |

Lincoln National Corp. | | | 6,080 | | | | 308,074 | |

Reinsurance Group of America, Inc. | | | 3,675 | | | | 292,640 | |

| | | | | | | | |

| | | | | | | 1,166,705 | |

| | | | | | | | |

| | |

Machinery-Diversified (1.2%) | | | | | | | | |

Deere & Co. | | | 3,220 | | | | 292,376 | |

| | | | | | | | |

| | |

Media (1.2%) | | | | | | | | |

DIRECTV(a) | | | 3,645 | | | | 278,551 | |

| | | | | | | | |

| | |

Miscellaneous Manufacturing (1.2%) | | | | | | | | |

Dover Corp. | | | 3,565 | | | | 291,439 | |

| | | | | | | | |

| | |

Oil & Gas (5.0%) | | | | | | | | |

ConocoPhillips | | | 4,415 | | | | 310,595 | |

Devon Energy Corp. | | | 4,405 | | | | 294,827 | |

Ensco PLC, Class A | | | 5,405 | | | | 285,276 | |

Occidental Petroleum Corp. | | | 3,055 | | | | 291,111 | |

| | | | | | | | |

| | | | | | | 1,181,809 | |

| | | | | | | | |

| | |

Oil & Gas Services (1.3%) | | | | | | | | |

National Oilwell Varco, Inc. | | | 3,915 | | | | 304,861 | |

| | | | | | | | |

| | |

Packaging & Containers (1.2%) | | | | | | | | |

Rock-Tenn Co., Class A | | | 2,750 | | | | 290,318 | |

| | | | | | | | |

| | |

Pharmaceuticals (1.3%) | | | | | | | | |

Teva Pharmaceutical Industries Ltd., Sponsored ADR | | | 5,905 | | | | 312,020 | |

| | | | | | | | |

| | |

Retail (5.0%) | | | | | | | | |

Bed Bath & Beyond, Inc.(a) | | | 4,195 | | | | 288,616 | |

Coach, Inc. | | | 5,995 | | | | 297,712 | |

Kohl’s Corp. | | | 5,355 | | | | 304,164 | |

Nordstrom, Inc. | | | 4,405 | | | | 275,092 | |

| | | | | | | | |

| | | | | | | 1,165,584 | |

| | | | | | | | |

| | |

Semiconductors (1.3%) | | | | | | | | |

Intel Corp. | | | 11,800 | | | | 304,558 | |

| | | | | | | | |

| | |

Software (2.7%) | | | | | | | | |

Microsoft Corp. | | | 7,445 | | | | 305,171 | |

| | |

| | |

12 | | www.cornercapfunds.com |

| | |

| Schedule of Investments | | |

CornerCap Balanced Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

Software (2.7%) (continued) | | | | | | | | |

Oracle Corp. | | | 8,220 | | | $ | 336,280 | |

| | | | | | | | |

| | | | | | | 641,451 | |

| | | | | | | | |

| | |

Telecommunications (2.7%) | | | | | | | | |

AT&T, Inc. | | | 9,010 | | | | 315,981 | |

CenturyLink, Inc. | | | 9,450 | | | | 310,338 | |

| | | | | | | | |

| | | | | | | 626,319 | |

| | | | | | | | |

| | |

Transportation (1.4%) | | | | | | | | |

Union Pacific Corp. | | | 1,735 | | | | 325,590 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (COST $11,614,369) | | | | | | | 14,474,108 | |

| | | | | | | | |

| | |

EXCHANGE TRADED FUNDS (3.7%) | | | | | | | | |

Guggenheim BulletShares® 2014 High Yield Corporate Bond ETF | | | 16,300 | | | | 432,863 | |

Guggenheim BulletShares® 2015 High Yield Corporate Bond ETF | | | 16,470 | | | | 445,184 | |

| | | | | | | | |

| | |

TOTAL EXCHANGE TRADED FUNDS (COST $879,509) | | | | | | | 878,047 | |

| | | | | | | | |

| | |

OPEN-END FUNDS (1.8%) | | | | | | | | |

Performance Trust Strategic Bond Fund | | | 18,485 | | | | 416,651 | |

| | | | | | | | |

| | |

TOTAL OPEN-END FUNDS (COST $412,855) | | | | | | | 416,651 | |

| | | | | | | | |

| | |

CLOSED-END FUNDS (3.0%) | | | | | | | | |

Nuveen Mortgage Opportunity Term Fund | | | 29,634 | | | | 695,510 | |

| | | | | | | | |

| | |

TOTAL CLOSED-END FUNDS (COST $767,495) | | | | | | | 695,510 | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Fair Value | |

CORPORATE BONDS (23.8%) | | | | | | | | |

Agriculture (1.0%) | | | | | | | | |

Reynolds American, Inc.,

6.750%, 06/15/2017 | | $ | 200,000 | | | | 230,620 | |

| | | | | | | | |

| | |

Auto Manufacturers (1.5%) | | | | | | | | |

Ford Motor Co.,

9.215%, 09/15/2021 | | | 275,000 | | | | 359,499 | |

| | | | | | | | |

| | |

| | |

Annual Report | March 31, 2014 | | 13 |

| | |

Schedule of Investments | | |

CornerCap Balanced Fund | | March 31, 2014 |

| | | | | | | | |

| | | Principal

Amount | | | Fair Value | |

Banks (1.9%) | | | | | | | | |

Citigroup, Inc.,

5.000%, 09/15/2014 | | $ | 150,000 | | | $ | 152,907 | |

The Goldman Sachs Group, Inc.,

4.000%, 03/18/2029(b) | | | 300,000 | | | | 295,651 | |

| | | | | | | | |

| | | | | | | 448,558 | |

| | | | | | | | |

| | |

Chemicals (1.9%) | | | | | | | | |

CF Industries, Inc.,

7.125%, 05/01/2020 | | | 250,000 | | | | 297,338 | |

The Dow Chemical Co.,

2.500%, 02/15/2016 | | | 150,000 | | | | 154,499 | |

| | | | | | | | |

| | | | | | | 451,837 | |

| | | | | | | | |

| | |

Cosmetics & Personal Care (1.6%) | | | | | | | | |

The Estee Lauder Co., Inc.,

5.550%, 05/15/2017 | | | 150,000 | | | | 168,070 | |

The Procter & Gamble Co.,

4.950%, 08/15/2014 | | | 200,000 | | | | 203,385 | |

| | | | | | | | |

| | | | | | | 371,455 | |

| | | | | | | | |

| | |

Diversified Financial Services (2.2%) | | | | | | | | |

Credit Suisse USA, Inc.,

5.375%, 03/02/2016 | | | 250,000 | | | | 270,949 | |

General Electric Capital Corp.,

4.750%, 09/15/2014 | | | 240,000 | | | | 244,789 | |

| | | | | | | | |

| | | | | | | 515,738 | |

| | | | | | | | |

| | |

Food (0.9%) | | | | | | | | |

Safeway, Inc.,

3.950%, 08/15/2020 | | | 200,000 | | | | 202,523 | |

| | | | | | | | |

| | |

Healthcare Services (1.2%) | | | | | | | | |

Humana, Inc.,

6.300%, 08/01/2018 | | | 250,000 | | | | 289,007 | |

| | | | | | | | |

| | |

Home Furnishings (0.7%) | | | | | | | | |

Whirlpool Corp.,

6.500%, 06/15/2016 | | | 150,000 | | | | 167,012 | |

| | | | | | | | |

| | |

Insurance (3.1%) | | | | | | | | |

Principal Life Income Funding Trusts, | | | | | | | | |

5.100%, 04/15/2014 | | | 150,000 | | | | 150,233 | |

The Travelers Cos., Inc., | | | | | | | | |

5.900%, 06/02/2019 | | | 150,000 | | | | 175,549 | |

| | |

| | |

14 | | www.cornercapfunds.com |

| | |

Schedule of Investments | | |

CornerCap Balanced Fund | | March 31, 2014 |

| | | | | | | | |

| | | Principal Amount | | | Fair Value | |

Insurance (3.1%) (continued) | | | | | | | | |

W.R. Berkley Corp., | | | | | | | | |

5.600%, 05/15/2015 | | $ | 150,000 | | | $ | 157,166 | |

5.375%, 09/15/2020 | | | 230,000 | | | | 252,961 | |

| | | | | | | | |

| | | | | | | 735,909 | |

| | | | | | | | |

| | |

Lodging (1.2%) | | | | | | | | |

Starwood Hotels & Resorts Worldwide, Inc., | | | | | | | | |

7.375%, 11/15/2015 | | | 250,000 | | | | 273,764 | |

| | | | | | | | |

| | |

Media (1.2%) | | | | | | | | |

DIRECTV Holdings LLC / DIRECTV Financing Co., Inc, | | | | | | | | |

5.000%, 03/01/2021 | | | 255,000 | | | | 274,199 | |

| | | | | | | | |

| | |

Metal Fabricate & Hardware (1.1%) | | | | | | | | |

The Timken Co., | | | | | | | | |

6.000%, 09/15/2014 | | | 250,000 | | | | 255,544 | |

| | | | | | | | |

| | |

Oil & Gas (0.7%) | | | | | | | | |

Statoil ASA, | | | | | | | | |

6.700%, 01/15/2018 | | | 150,000 | | | | 176,952 | |

| | | | | | | | |

| | |

Retail (3.6%) | | | | | | | | |

AutoZone, Inc., | | | | | | | | |

5.500%, 11/15/2015 | | | 150,000 | | | | 161,234 | |

Best Buy Co., Inc., | | | | | | | | |

3.750%, 03/15/2016 | | | 200,000 | | | | 206,000 | |

Dillard’s, Inc., | | | | | | | | |

6.625%, 01/15/2018 | | | 275,000 | | | | 309,375 | |

Foot Locker, Inc., | | | | | | | | |

8.500%, 01/15/2022 | | | 135,000 | | | | 160,650 | |

| | | | | | | | |

| | | | | | | 837,259 | |

| | | | | | | | |

| | |

TOTAL CORPORATE BONDS (COST $5,449,365) | | | | | | | 5,589,876 | |

| | | | | | | | |

| | |

MUNICIPAL BONDS (2.0%) | | | | | | | | |

Kansas (0.6%) | | | | | | | | |

Johnson County KS, Build America General | | | | | | | | |

Obligation Bonds, Unified School District No. | | | | | | | | |

232, 4.950%, 09/01/2019 | | | 150,000 | | | | 154,545 | |

| | | | | | | | |

| | |

North Dakota (0.7%) | | | | | | | | |

Grand Forks ND, Build America Revenue Bonds, | | | | | | | | |

Series A, 4.500%, 09/01/2019 | | | 150,000 | | | | 163,296 | |

| | | | | | | | |

| | |

| | |

Annual Report | March 31, 2014 | | 15 |

| | |

Schedule of Investments | | |

CornerCap Balanced Fund | | March 31, 2014 |

| | | | | | | | |

| | | Principal Amount | | | Fair Value | |

Texas (0.7%) | | | | | | | | |

County of Galveston TX, Build America General | | | | | | | | |

Obligation Bonds, Series B, 4.200%, | | | | | | | | |

02/01/2017 | | $ | 150,000 | | | $ | 160,179 | |

| | | | | | | | |

| | |

TOTAL MUNICIPAL BONDS (COST $453,451) | | | | | | | 478,020 | |

| | | | | | | | |

| | |

CERTIFICATES OF DEPOSIT (1.0%) | | | | | | | | |

Goldman Sachs Bank USA, Medium-Term | | | | | | | | |

Certificate of Deposit, 0.800%, 08/06/2015 | | | 250,000 | | | | 250,266 | |

| | | | | | | | |

| | |

TOTAL CERTIFICATES OF DEPOSIT (COST $250,000) | | | | | | | 250,266 | |

| | | | | | | | |

| | |

| | | Shares | | | Fair Value | |

SHORT TERM INVESTMENTS (2.9%) | | | | | | | | |

Federated Treasury Obligation Money Market | | | | | | | | |

Fund, 7 Day Yield 0.010% | | | 674,259 | | | | 674,259 | |

| | | | | | | | |

| | |

TOTAL SHORT TERM INVESTMENTS (COST $674,259) | | | | | | | 674,259 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS (COST $20,501,303) | | | 99.7% | | | | 23,456,737 | |

| | | | | | | | |

| | |

TOTAL ASSETS IN EXCESS OF OTHER LIABILITIES | | | 0.3% | | | | 63,765 | |

| | | | | | | | |

| | |

NET ASSETS | | | 100.0% | | | $ | 23,520,502 | |

| | | | | | | | |

| (a) | Non-Income Producing Security. |

| (b) | Represents a step bond. Rate disclosed is as of March 31, 2014. |

Common Abbreviations:

ADR - American Depositary Receipt.

ASA - Allmennaksjeselskap is the Norwegian term for a public limited company.

ETF - Exchange Traded Fund.

LLC - Limited Liability Company.

Ltd. - Limited.

PLC - Public Limited Company.

The accompanying notes to the financial statements are an integral part of these financial statements.

| | |

| | |

16 | | www.cornercapfunds.com |

| | |

Schedule of Investments | | |

CornerCap Small-Cap Value Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| |

COMMON STOCKS (95.8%) | | | | | | | | |

Aerospace & Defense (1.7%) | | | | | | | | |

AAR Corp. | | | 12,240 | | | $ | 317,628 | |

Kaman Corp. | | | 9,035 | | | | 367,544 | |

National Presto Industries, Inc. | | | 4,270 | | | | 333,231 | |

| | | | | | | | |

| | | | | | | 1,018,403 | |

| | | | | | | | |

Agriculture (0.6%) | | | | | | | | |

The Andersons, Inc. | | | 6,415 | | | | 380,025 | |

| | | | | | | | |

| | |

Apparel (0.6%) | | | | | | | | |

Steven Madden Ltd.(a) | | | 10,060 | | | | 361,959 | |

| | | | | | | | |

| | |

Auto Parts & Equipment (2.2%) | | | | | | | | |

Cooper Tire & Rubber Co. | | | 14,270 | | | | 346,761 | |

Standard Motor Products, Inc. | | | 10,750 | | | | 384,528 | |

Strattec Security Corp. | | | 7,715 | | | | 557,254 | |

| | | | | | | | |

| | | | | | | 1,288,543 | |

| | | | | | | | |

Banks (17.6%) | | | | | | | | |

Arrow Financial Corp. | | | 13,805 | | | | 365,004 | |

Bank of Kentucky Financial Corp. | | | 11,520 | | | | 432,461 | |

Community Trust Bancorp, Inc. | | | 6,760 | | | | 280,405 | |

Enterprise Financial Services Corp. | | | 17,685 | | | | 354,938 | |

Financial Institutions, Inc. | | | 15,535 | | | | 357,616 | |

First Business Financial Services, Inc. | | | 9,130 | | | | 430,753 | |

First Community Bancshares, Inc. | | | 22,725 | | | | 371,781 | |

First Interstate Bancsystem, Inc. | | | 11,520 | | | | 325,094 | |

First Merchants Corp. | | | 19,010 | | | | 411,376 | |

FirstMerit Corp. | | | 16,530 | | | | 344,320 | |

German American Bancorp, Inc. | | | 13,350 | | | | 385,681 | |

Great Southern Bancorp, Inc. | | | 12,220 | | | | 366,967 | |

Horizon Bancorp | | | 14,725 | | | | 328,073 | |

Lakeland Bancorp, Inc. | | | 30,935 | | | | 348,019 | |

Lakeland Financial Corp. | | | 8,685 | | | | 349,311 | |

MainSource Financial Group, Inc. | | | 23,020 | | | | 393,642 | |

Merchants Bancshares, Inc. | | | 10,035 | | | | 327,241 | |

Monarch Financial Holdings, Inc. | | | 23,195 | | | | 284,371 | |

NBT Bancorp, Inc. | | | 11,820 | | | | 289,117 | |

Old National Bancorp | | | 24,235 | | | | 361,344 | |

Peoples Bancorp, Inc. | | | 15,185 | | | | 375,525 | |

PrivateBancorp, Inc. | | | 15,095 | | | | 460,548 | |

S&T Bancorp, Inc. | | | 14,120 | | | | 334,644 | |

S.Y. Bancorp, Inc. | | | 10,325 | | | | 326,683 | |

Southside Bancshares, Inc. | | | 11,760 | | | | 369,029 | |

Tompkins Financial Corp. | | | 7,405 | | | | 362,549 | |

Trico Bancshares | | | 15,360 | | | | 398,285 | |

Walker & Dunlop, Inc.(a) | | | 26,625 | | | | 435,319 | |

| | |

| | |

Annual Report | March 31, 2014 | | 17 |

| | |

Schedule of Investments | | |

CornerCap Small-Cap Value Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| |

Banks (17.6%) (continued) | | | | | | | | |

WesBanco, Inc. | | | 10,540 | | | $ | 335,488 | |

| | | | | | | | |

| | | | | | | 10,505,584 | |

| | | | | | | | |

Building Materials (0.5%) | | | | | | | | |

Universal Forest Products, Inc. | | | 5,905 | | | | 326,783 | |

| | | | | | | | |

| | |

Chemicals (2.0%) | | | | | | | | |

A. Schulman, Inc. | | | 10,055 | | | | 364,594 | |

Aceto Corp. | | | 21,575 | | | | 433,442 | |

OMNOVA Solutions, Inc.(a) | | | 37,035 | | | | 384,423 | |

| | | | | | | | |

| | | | | | | 1,182,459 | |

| | | | | | | | |

Commercial Services (8.3%) | | | | | | | | |

ABM Industries, Inc. | | | 12,085 | | | | 347,323 | |

American Public Education, Inc.(a) | | | 7,915 | | | | 277,658 | |

The Brink’s Co. | | | 11,685 | | | | 333,607 | |

FTI Consulting, Inc.(a) | | | 11,740 | | | | 391,412 | |

Global Cash Access Holdings, Inc.(a) | | | 44,245 | | | | 303,521 | |

ICF International, Inc.(a) | | | 7,780 | | | | 309,722 | |

Korn/Ferry International(a) | | | 16,715 | | | | 497,605 | |

Matthews International Corp., Class A | | | 8,910 | | | | 363,617 | |

Medifast, Inc.(a) | | | 9,850 | | | | 286,536 | |

Navigant Consulting, Inc.(a) | | | 21,545 | | | | 402,030 | |

The Providence Service Corp.(a) | | | 11,815 | | | | 334,128 | |

RPX Corp.(a) | | | 22,245 | | | | 362,149 | |

Steiner Leisure Ltd.(a) | | | 7,570 | | | | 350,112 | |

TrueBlue, Inc.(a) | | | 12,910 | | | | 377,747 | |

| | | | | | | | |

| | | | | | | 4,937,167 | |

| | | | | | | | |

Computers (2.4%) | | | | | | | | |

Datalink Corp.(a) | | | 26,185 | | | | 364,757 | |

Insight Enterprises, Inc.(a) | | | 16,715 | | | | 419,714 | |

Mentor Graphics Corp. | | | 15,990 | | | | 352,100 | |

Sykes Enterprises, Inc.(a) | | | 16,265 | | | | 323,185 | |

| | | | | | | | |

| | | | | | | 1,459,756 | |

| | | | | | | | |

Diversified Financial Services (2.8%) | | | | | | | | |

Gain Capital Holdings, Inc. | | | 26,825 | | | | 289,978 | |

Higher One Holdings, Inc.(a) | | | 42,420 | | | | 306,697 | |

Investment Technology Group, Inc.(a) | | | 20,290 | | | | 409,858 | |

Regional Management Corp.(a) | | | 14,490 | | | | 357,323 | |

Walter Investment Management Corp.(a) | | | 11,130 | | | | 332,008 | |

| | | | | | | | |

| | | | | | | 1,695,864 | |

| | | | | | | | |

Electric (2.4%) | | | | | | | | |

Avista Corp. | | | 13,090 | | | | 401,208 | |

El Paso Electric Co. | | | 8,045 | | | | 287,448 | |

The Empire District Electric Co. | | | 14,575 | | | | 354,464 | |

UIL Holdings Corp. | | | 10,195 | | | | 375,278 | |

| | | | | | | | |

| | | | | | | 1,418,398 | |

| | | | | | | | |

| | |

| | |

18 | | www.cornercapfunds.com |

| | |

Schedule of Investments | | |

CornerCap Small-Cap Value Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| |

Electronics (1.6%) | | | | | | | | |

Plexus Corp.(a) | | | 8,985 | | | $ | 360,029 | |

Sanmina Corp.(a) | | | 17,825 | | | | 311,046 | |

Stoneridge, Inc.(a) | | | 27,130 | | | | 304,670 | |

| | | | | | | | |

| | | | | | | 975,745 | |

| | | | | | | | |

Energy-Alternate Sources (0.7%) | | | | | | | | |

FutureFuel Corp. | | | 19,480 | | | | 395,444 | |

| | | | | | | | |

| | |

Engineering & Construction (1.1%) | | | | | | | | |

AECOM Technology Corp.(a) | | | 11,415 | | | | 367,220 | |

MYR Group, Inc.(a) | | | 12,590 | | | | 318,779 | |

| | | | | | | | |

| | | | | | | 685,999 | |

| | | | | | | | |

Environmental Control (0.6%) | | | | | | | | |

Darling International, Inc.(a) | | | 17,145 | | | | 343,243 | |

| | | | | | | | |

| | |

Food (1.9%) | | | | | | | | |

Cal-Maine Foods, Inc. | | | 6,490 | | | | 407,442 | |

Ingles Markets, Inc., Class A | | | 14,755 | | | | 351,464 | |

Spartan Stores, Inc. | | | 15,462 | | | | 358,873 | |

| | | | | | | | |

| | | | | | | 1,117,779 | |

| | | | | | | | |

Forest Products & Paper (1.9%) | | | | | | | | |

Neenah Paper, Inc. | | | 8,285 | | | | 428,500 | |

Orchids Paper Products Co. | | | 12,780 | | | | 391,068 | |

Schweitzer-Mauduit International, Inc. | | | 8,055 | | | | 343,063 | |

| | | | | | | | |

| | | | | | | 1,162,631 | |

| | | | | | | | |

Gas (0.6%) | | | | | | | | |

Southwest Gas Corp. | | | 6,650 | | | | 355,443 | |

| | | | | | | | |

| | |

Healthcare Products (0.6%) | | | | | | | | |

Hanger, Inc.(a) | | | 10,395 | | | | 350,104 | |

| | | | | | | | |

| | |

Healthcare Services (3.1%) | | | | | | | | |

Amsurg Corp.(a) | | | 7,970 | | | | 375,228 | |

The Ensign Group, Inc. | | | 8,550 | | | | 373,122 | |

LHC Group, Inc.(a) | | | 14,140 | | | | 311,928 | |

Magellan Health Services, Inc.(a) | | | 5,650 | | | | 335,327 | |

Select Medical Holdings Corp. | | | 36,790 | | | | 458,036 | |

| | | | | | | | |

| | | | | | | 1,853,641 | |

| | | | | | | | |

Home Builders (0.5%) | | | | | | | | |

Meritage Homes Corp.(a) | | | 7,610 | | | | 318,707 | |

| | | | | | | | |

| | |

Home Furnishings (1.2%) | | | | | | | | |

Daktronics, Inc. | | | 25,265 | | | | 363,563 | |

VOXX International Corp.(a) | | | 25,300 | | | | 346,104 | |

| | | | | | | | |

| | | | | | | 709,667 | |

| | | | | | | | |

| | |

| | |

Annual Report | March 31, 2014 | | 19 |

| | |

Schedule of Investments | | |

CornerCap Small-Cap Value Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| |

Household Products (0.6%) | | | | | | | | |

Ennis, Inc. | | | 21,450 | | | $ | 355,426 | |

| | | | | | | | |

| | |

Housewares (0.6%) | | | | | | | | |

Lifetime Brands, Inc. | | | 19,665 | | | | 351,217 | |

| | | | | | | | |

| | |

Insurance (7.4%) | | | | | | | | |

AmTrust Financial Services, Inc. | | | 9,640 | | | | 362,560 | |

Crawford & Co., Class B | | | 42,055 | | | | 458,820 | |

EMC Insurance Group, Inc. | | | 9,775 | | | | 347,306 | |

Greenlight Capital Re Ltd., Class A(a) | | | 10,295 | | | | 337,676 | |

Horace Mann Educators Corp. | | | 10,540 | | | | 305,660 | |

Maiden Holdings Ltd. | | | 30,475 | | | | 380,328 | |

Montpelier Re Holdings Ltd. | | | 10,830 | | | | 322,301 | |

Primerica, Inc. | | | 6,930 | | | | 326,472 | |

Protective Life Corp. | | | 6,045 | | | | 317,907 | |

Selective Insurance Group, Inc. | | | 15,585 | | | | 363,442 | |

Symetra Financial Corp. | | | 16,960 | | | | 336,147 | |

United Insurance Holdings Corp. | | | 37,065 | | | | 541,520 | |

| | | | | | | | |

| | | | | | | 4,400,139 | |

| | | | | | | | |

Internet (1.7%) | | | | | | | | |

Conversant, Inc.(a) | | | 12,350 | | | | 347,653 | |

Dice Holdings, Inc.(a) | | | 39,705 | | | | 296,199 | |

ePlus, Inc.(a) | | | 6,270 | | | | 349,615 | |

| | | | | | | | |

| | | | | | | 993,467 | |

| | | | | | | | |

Iron & Steel (0.6%) | | | | | | | | |

Shiloh Industries, Inc.(a) | | | 19,425 | | | | 344,599 | |

| | | | | | | | |

| | |

Lodging (1.2%) | | | | | | | | |

The Marcus Corp. | | | 22,775 | | | | 380,343 | |

Monarch Casino & Resort, Inc.(a) | | | 18,840 | | | | 349,105 | |

| | | | | | | | |

| | | | | | | 729,448 | |

| | | | | | | | |

Machinery-Diversified (0.6%) | | | | | | | | |

Kadant, Inc. | | | 9,340 | | | | 340,630 | |

| | | | | | | | |

| | |

Media (1.8%) | | | | | | | | |

Courier Corp. | | | 19,220 | | | | 295,988 | |

Journal Communications, Inc., Class A(a) | | | 40,355 | | | | 357,545 | |

Starz, Class A(a) | | | 13,125 | | | | 423,675 | |

| | | | | | | | |

| | | | | | | 1,077,208 | |

| | | | | | | | |

Metal Fabricate & Hardware (1.2%) | | | | | | | | |

LB Foster Co., Class A | | | 7,720 | | | | 361,682 | |

Worthington Industries, Inc. | | | 8,935 | | | | 341,764 | |

| | | | | | | | |

| | | | | | | 703,446 | |

| | | | | | | | |

Miscellaneous Manufacturing (3.7%) | | | | | | | | |

Chase Corp. | | | 11,700 | | | | 368,901 | |

| | |

| | |

20 | | www.cornercapfunds.com |

| | |

Schedule of Investments | | |

CornerCap Small-Cap Value Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| |

Miscellaneous Manufacturing (3.7%) (continued) | | | | | | | | |

Federal Signal Corp. | | | 24,100 | | | $ | 359,090 | |

Koppers Holdings, Inc. | | | 7,780 | | | | 320,769 | |

Myers Industries, Inc. | | | 16,890 | | | | 336,449 | |

Park-Ohio Holdings Corp.(a) | | | 8,680 | | | | 487,382 | |

Standex International Corp. | | | 5,905 | | | | 316,390 | |

| | | | | | | | |

| | | | | | | 2,188,981 | |

| | | | | | | | |

Office Furnishings (0.6%) | | | | | | | | |

HNI Corp. | | | 10,235 | | | | 374,192 | |

| | | | | | | | |

| | |

Oil & Gas (2.0%) | | | | | | | | |

Panhandle Oil and Gas, Inc., Class A | | | 8,875 | | | | 387,039 | |

Stone Energy Corp.(a) | | | 11,240 | | | | 471,743 | |

Unit Corp.(a) | | | 5,580 | | | | 364,820 | |

| | | | | | | | |

| | | | | | | 1,223,602 | |

| | | | | | | | |

Oil & Gas Services (1.2%) | | | | | | | | |

Newpark Resources, Inc.(a) | | | 30,120 | | | | 344,874 | |

Tesco Corp.(a) | | | 20,570 | | | | 380,545 | |

| | | | | | | | |

| | | | | | | 725,419 | |

| | | | | | | | |

Packaging & Containers (1.1%) | | | | | | | | |

Silgan Holdings, Inc. | | | 7,115 | | | | 352,335 | |

UFP Technologies, Inc.(a) | | | 13,640 | | | | 332,270 | |

| | | | | | | | |

| | | | | | | 684,605 | |

| | | | | | | | |

Pharmaceuticals (2.4%) | | | | | | | | |

Nature’s Sunshine Products, Inc. | | | 19,805 | | | | 272,913 | |

Nutraceutical International Corp.(a) | | | 13,885 | | | | 360,871 | |

Omega Protein Corp.(a) | | | 33,855 | | | | 408,630 | |

PharMerica Corp.(a) | | | 13,490 | | | | 377,450 | |

| | | | | | | | |

| | | | | | | 1,419,864 | |

| | | | | | | | |

Retail (3.8%) | | | | | | | | |

Big 5 Sporting Goods Corp. | | | 20,755 | | | | 333,118 | |

The Cato Corp., Class A | | | 11,085 | | | | 299,738 | |

Destination Maternity Corp. | | | 11,100 | | | | 304,140 | |

Einstein Noah Restaurant Group, Inc. | | | 22,645 | | | | 372,737 | |

Express, Inc.(a) | | | 19,385 | | | | 307,834 | |

The Finish Line, Inc., Class A | | | 10,490 | | | | 284,174 | |

Genesco, Inc.(a) | | | 4,665 | | | | 347,869 | |

| | | | | | | | |

| | | | | | | 2,249,610 | |

| | | | | | | | |

Savings & Loans (2.1%) | | | | | | | | |

Berkshire Hills Bancorp, Inc. | | | 11,250 | | | | 291,150 | |

Dime Community Bancshares, Inc. | | | 15,570 | | | | 264,378 | |

First Defiance Financial Corp. | | | 12,015 | | | | 325,847 | |

WSFS Financial Corp. | | | 5,165 | | | | 368,936 | |

| | | | | | | | |

| | | | | | | 1,250,311 | |

| | | | | | | | |

| | |

| | |

Annual Report | March 31, 2014 | | 21 |

| | |

Schedule of Investments | | |

CornerCap Small-Cap Value Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| |

Semiconductors (0.6%) | | | | | | | | |

Ultra Clean Holdings, Inc.(a) | | | 28,540 | | | $ | 375,301 | |

| | | | | | | | |

| | |

Software (1.1%) | | | | | | | | |

CSG Systems International, Inc. | | | 13,050 | | | | 339,822 | |

PDF Solutions, Inc.(a) | | | 18,635 | | | | 338,598 | |

| | | | | | | | |

| | | | | | | 678,420 | |

| | | | | | | | |

Telecommunications (2.4%) | | | | | | | | |

Black Box Corp. | | | 15,480 | | | | 376,783 | |

Comverse, Inc.(a) | | | 9,865 | | | | 341,132 | |

Ixia(a) | | | 27,875 | | | | 348,437 | |

NETGEAR, Inc.(a) | | | 10,870 | | | | 366,645 | |

| | | | | | | | |

| | | | | | | 1,432,997 | |

| | | | | | | | |

Textiles (1.1%) | | | | | | | | |

Culp, Inc. | | | 16,215 | | | | 320,084 | |

UniFirst Corp. | | | 3,175 | | | | 349,060 | |

| | | | | | | | |

| | | | | | | 669,144 | |

| | | | | | | | |

Transportation (1.8%) | | | | | | | | |

Arkansas Best Corp. | | | 10,615 | | | | 392,224 | |

Matson, Inc. | | | 11,925 | | | | 294,428 | |

Universal Truckload Services, Inc. | | | 13,790 | | | | 398,531 | |

| | | | | | | | |

| | | | | | | 1,085,183 | |

| | | | | | | | |

Wholesale Distributors (1.3%) | | | | | | | | |

ScanSource, Inc.(a) | | | 9,585 | | | | 390,780 | |

United Stationers, Inc. | | | 8,885 | | | | 364,907 | |

| | | | | | | | |

| | | | | | | 755,687 | |

| | | | | | | | |

TOTAL COMMON STOCKS (COST $48,806,420) | | | | | | | 57,252,240 | |

| | | | | | | | |

| | |

SHORT TERM INVESTMENTS (4.1%) | | | | | | | | |

Federated Treasury Obligation Money Market Fund, 7 Day Yield 0.010% | | | 2,455,311 | | | | 2,455,311 | |

| | | | | | | | |

| | |

TOTAL SHORT TERM INVESTMENTS (COST $2,455,311) | | | | | | | 2,455,311 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS (COST $51,261,731) | | | 99.9% | | | | 59,707,551 | |

| | | | | | | | |

| | |

TOTAL ASSETS IN EXCESS OF OTHER LIABILITIES | | | 0.1% | | | | 52,193 | |

| | | | | | | | |

| | |

NET ASSETS | | | 100.0% | | | $ | 59,759,744 | |

| | | | | | | | |

| (a) | Non-Income Producing Security. |

Common Abbreviations:

Ltd. - Limited.

The accompanying notes to the financial statements are an integral part of these financial statements.

| | |

| | |

22 | | www.cornercapfunds.com |

| | |

Schedule of Investments | | |

CornerCap Large/Mid-Cap Value Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| |

COMMON STOCKS (98.8%) | | | | | | | | |

Aerospace & Defense (1.9%) | | | | | | | | |

General Dynamics Corp. | | | 1,875 | | | $ | 204,225 | |

| | | | | | | | |

| | |

Agriculture (2.0%) | | | | | | | | |

Altria Group, Inc. | | | 5,795 | | | | 216,907 | |

| | | | | | | | |

| | |

Auto Manufacturers (1.9%) | | | | | | | | |

General Motors Co. | | | 6,095 | | | | 209,790 | |

| | | | | | | | |

| | |

Banks (16.1%) | | | | | | | | |

The Bank of New York Mellon Corp. | | | 6,485 | | | | 228,856 | |

BB&T Corp. | | | 5,815 | | | | 233,588 | |

Capital One Financial Corp. | | | 2,760 | | | | 212,962 | |

Citigroup, Inc. | | | 4,360 | | | | 207,536 | |

The Goldman Sachs Group, Inc. | | | 1,210 | | | | 198,258 | |

JPMorgan Chase & Co. | | | 3,660 | | | | 222,199 | |

The PNC Financial Services Group, Inc. | | | 2,570 | | | | 223,590 | |

Wells Fargo & Co. | | | 4,460 | | | | 221,840 | |

| | | | | | | | |

| | | | | | | 1,748,829 | |

| | | | | | | | |

Chemicals (2.3%) | | | | | | | | |

Eastman Chemical Co. | | | 2,890 | | | | 249,147 | |

| | | | | | | | |

| | |

Commercial Services (2.1%) | | | | | | | | |

The Western Union Co. | | | 14,020 | | | | 229,367 | |

| | | | | | | | |

| | |

Computers (6.4%) | | | | | | | | |

EMC Corp. | | | 8,465 | | | | 232,026 | |

Hewlett-Packard Co. | | | 7,415 | | | | 239,949 | |

Western Digital Corp. | | | 2,433 | | | | 223,398 | |

| | | | | | | | |

| | | | | | | 695,373 | |

| | | | | | | | |

Electric (2.2%) | | | | | | | | |

Pinnacle West Capital Corp. | | | 4,405 | | | | 240,777 | |

| | | | | | | | |

| | |

Electrical Components & Equipment (4.0%) | | | | | | | | |

Emerson Electric Co. | | | 3,200 | | | | 213,760 | |

Energizer Holdings, Inc. | | | 2,240 | | | | 225,658 | |

| | | | | | | | |

| | | | | | | 439,418 | |

| | | | | | | | |

Food (4.0%) | | | | | | | | |

ConAgra Foods, Inc. | | | 7,180 | | | | 222,796 | |

The Kroger Co. | | | 4,885 | | | | 213,230 | |

| | | | | | | | |

| | | | | | | 436,026 | |

| | | | | | | | |

Healthcare Products (2.2%) | | | | | | | | |

Medtronic, Inc. | | | 3,850 | | | | 236,929 | |

| | | | | | | | |

| | |

| | |

Annual Report | March 31, 2014 | | 23 |

| | |

Schedule of Investments | | |

CornerCap Large/Mid-Cap Value Fund | | March 31, 2014 |

| | | | | | | | |

| | | Shares | | | Fair Value | |

| |

Healthcare Services (4.5%) | | | | | | | | |

Laboratory Corp. of America Holdings(a) | | | 2,515 | | | $ | 246,998 | |

UnitedHealth Group, Inc. | | | 2,880 | | | | 236,131 | |

| | | | | | | | |

| | | | | | | 483,129 | |

| | | | | | | | |

Insurance (8.3%) | | | | | | | | |

The Allstate Corp. | | | 4,220 | | | | 238,768 | |

Everest Re Group Ltd. | | | 1,410 | | | | 215,800 | |

Lincoln National Corp. | | | 4,440 | | | | 224,975 | |

Reinsurance Group of America, Inc. | | | 2,810 | | | | 223,760 | |

| | | | | | | | |

| | | | | | | 903,303 | |

| | | | | | | | |

Machinery-Diversified (2.1%) | | | | | | | | |

Deere & Co. | | | 2,500 | | | | 227,000 | |

| | | | | | | | |

| | |

Media (1.9%) | | | | | | | | |

DIRECTV(a) | | | 2,680 | | | | 204,806 | |

| | | | | | | | |

| | |

Miscellaneous Manufacturing (1.7%) | | | | | | | | |

Dover Corp. | | | 2,270 | | | | 185,573 | |

| | | | | | | | |

| | |

Oil & Gas (8.5%) | | | | | | | | |

ConocoPhillips | | | 3,455 | | | | 243,059 | |

Devon Energy Corp. | | | 3,755 | | | | 251,322 | |

Ensco PLC, Class A | | | 4,290 | | | | 226,426 | |

Occidental Petroleum Corp. | | | 2,170 | | | | 206,780 | |

| | | | | | | | |

| | | | | | | 927,587 | |

| | | | | | | | |

Oil & Gas Services (2.1%) | | | | | | | | |

National Oilwell Varco, Inc. | | | 2,875 | | | | 223,876 | |

| | | | | | | | |

| | |

Packaging & Containers (2.1%) | | | | | | | | |

Rock-Tenn Co., Class A | | | 2,160 | | | | 228,031 | |

| | | | | | | | |

| | |

Pharmaceuticals (2.3%) | | | | | | | | |

Teva Pharmaceutical Industries Ltd., Sponsored ADR | | | 4,630 | | | | 244,649 | |

| | | | | | | | |

| | |

Retail (7.9%) | | | | | | | | |

Bed Bath & Beyond, Inc.(a) | | | 3,075 | | | | 211,560 | |

Coach, Inc. | | | 3,930 | | | | 195,164 | |

Kohl’s Corp. | | | 4,250 | | | | 241,400 | |

Nordstrom, Inc. | | | 3,405 | | | | 212,642 | |

| | | | | | | | |

| | | | | | | 860,766 | |

| | | | | | | | |

Semiconductors (1.9%) | | | | | | | | |

Intel Corp. | | | 8,065 | | | | 208,158 | |

| | | | | | | | |

| | |

Software (4.1%) | | | | | | | | |

Microsoft Corp. | | | 5,300 | | | | 217,247 | |

| | |

| | |

24 | | www.cornercapfunds.com |

| | |

Schedule of Investments | | |

CornerCap Large/Mid-Cap Value Fund | | March 31, 2014 |

| | | | | | | | |

| �� | | Shares | | | Fair Value | |

Software (4.1%) (continued) | | | | | | | | |

Oracle Corp. | | | 5,595 | | | $ | 228,891 | |

| | | | | | | | |

| | | | | | | 446,138 | |

| | | | | | | | |

Telecommunications (4.2%) | | | | | | | | |

AT&T, Inc. | | | 6,510 | | | | 228,306 | |

CenturyLink, Inc. | | | 6,810 | | | | 223,640 | |

| | | | | | | | |

| | | | | | | 451,946 | |

| | | | | | | | |

Transportation (2.1%) | | | | | | | | |

Union Pacific Corp. | | | 1,195 | | | | 224,254 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (COST $8,754,101) | | | | | | | 10,726,004 | |

| | | | | | | | |

| | |

SHORT TERM INVESTMENTS (1.2%) | | | | | | | | |

Federated Treasury Obligation Money Market Fund, 7 Day Yield 0.010% | | | 125,984 | | | | 125,984 | |

| | | | | | | | |

| | |

TOTAL SHORT TERM INVESTMENTS (COST $125,984) | | | | | | | 125,984 | |

| | | | | | | | |

| | |

TOTAL INVESTMENTS (COST $8,880,085) | | | 100.0% | | | | 10,851,988 | |

| | | | | | | | |

| | |

TOTAL ASSETS IN EXCESS OF OTHER LIABILITIES | | | 0.0%(b) | | | | 68 | |

| | | | | | | | |

| | |

NET ASSETS | | | 100.0% | | | $ | 10,852,056 | |

| | | | | | | | |

| (a) | Non-Income Producing Security. |

Common Abbreviations:

ADR - American Depositary Receipt.

Ltd. - Limited.

PLC - Public Limited Company.

The accompanying notes to the financial statements are an integral part of these financial statements.

| | |

| | |

Annual Report | March 31, 2014 | | 25 |

| | |

Statements of Assets and Liabilities | | |

| | | | |

| | | CornerCap

Balanced

Fund | |

ASSETS: | | | | |

Investments, at value (Cost - see below) | | $ | 23,456,737 | |

Receivable for investments sold | | | 0 | |

Receivable for fund shares subscribed | | | 4,815 | |

Dividends and interest receivable | | | 80,396 | |

| |

Total assets | | | 23,541,948 | |

| |

| |

LIABILITIES: | | | | |

Payable for investments purchased | | | 0 | |

Payable for fund shares redeemed | | | 0 | |

Advisory fee payable | | | 15,597 | |

Operating services fee payable | | | 5,849 | |

| |

Total liabilities | | | 21,446 | |

| |

Net assets | | $ | 23,520,502 | |

| |

| |

PRICING OF SHARES (NOTE 2): | | | | |

Net Assets | | $ | 23,520,502 | |

Shares Outstanding | | | 1,516,112 | |

| |

Net asset value, offering and redemption price per share | | $ | 15.51 | |

| |

| |

NET ASSETS CONSISTS OF: | | | | |

Paid-in capital | | $ | 19,177,460 | |

Accumulated net investment income | | | 100,016 | |

Accumulated net realized gain on investments | | | 1,287,592 | |

Net unrealized appreciation in value of investments | | | 2,955,434 | |

| |

Net assets | | $ | 23,520,502 | |

| |

| |

Cost of Investments | | $ | 20,501,303 | |

The accompanying notes to the financial statements are an integral part of these financial statements.

| | |

| | |

26 | | www.cornercapfunds.com |

| | | | | | |

CornerCap Small-Cap Value Fund | | | CornerCap Large/Mid-Cap Value Fund | |

| | | | | | | |

| $ | 59,707,551 | | | $ | 10,851,988 | |

| | 1,696,111 | | | | 0 | |

| | 45,289 | | | | 0 | |

| | 37,058 | | | | 10,829 | |

| | 61,486,009 | | | | 10,862,817 | |

| |

| | | | | | | |

| | 1,565,901 | | | | 0 | |

| | 95,660 | | | | 0 | |

| | 39,818 | | | | 6,277 | |

| | 24,886 | | | | 4,484 | |

| | 1,726,265 | | | | 10,761 | |

| $ | 59,759,744 | | | $ | 10,852,056 | |

| | | |

| |

| | | | | | | |

| $ | 59,759,744 | | | $ | 10,852,056 | |

| | 3,676,526 | | | | 782,620 | |

| $ | 16.25 | | | $ | 13.87 | |

| | | |

| |

| | | | | | | |

| $ | 46,460,887 | | | $ | 8,772,726 | |

| | 0 | | | | 32,661 | |

| | 4,853,037 | | | | 74,766 | |

| | 8,445,820 | | | | 1,971,903 | |

| $ | 59,759,744 | | | $ | 10,852,056 | |

| | | |

| |

| $ | 51,261,731 | | | $ | 8,880,085 | |

| | |

| | |

Annual Report | March 31, 2014 | | 27 |

| | | | |

| | | CornerCap

Balanced

Fund | |

INVESTMENT INCOME: | | | | |

Dividends, (net of foreign withholding taxes of $731, $– and $522) | | $ | 367,119 | |

Interest | | | 180,961 | |

Total investment income | | | 548,080 | |

| |

EXPENSES: | | | | |

Advisory fees | | | 207,389 | |

Operating services fees | | | 62,217 | |

Total expenses | | | 269,606 | |

Less fees waived/reimbursed by investment advisor | | | (41,478) | |

Net expenses | | | 228,128 | |

Net investment income | | | 319,952 | |

| |

REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | | |

Net realized gain on investments | | | 1,938,644 | |

Long-term capital gains distributions from other investment companies | | | 39,075 | |

Change in unrealized appreciation of investments | | | 932,941 | |

Net gain on investments | | | 2,910,660 | |

Net increase in net assets resulting from operations | | $ | 3,230,612 | |

| | | | | |

The accompanying notes to the financial statements are an integral part of these financial statements.

| | |

| | |

28 | | www.cornercapfunds.com |

| | |

| | |

| | For the Year Ended March 31, 2014 |

| | | | | | |

Corner Cap Small-Cap Value Fund | | | CornerCap Large/Mid-Cap Value Fund | |

| | | | | | |

| $ | 676,265 | | | $ | 214,296 | |

| | 0 | | | | 0 | |

| | 676,265 | | | | 214,296 | |

| |

| | | | | | | |

| | 512,056 | | | | 98,111 | |

| | 256,028 | | | | 49,056 | |

| | 768,084 | | | | 147,167 | |

| | (102,411) | | | | (29,433) | |

| | 665,673 | | | | 117,734 | |

| | 10,592 | | | | 96,562 | |

| |

| | | | | | | |

| | 8,729,108 | | | | 1,229,947 | |

| | – | | | | – | |

| | 5,903,304 | | | | 1,129,991 | |

| | 14,632,412 | | | | 2,359,938 | |

| $ | 14,643,004 | | | $ | 2,456,500 | |

| | | |

| | |

| | |

Annual Report | March 31, 2014 | | 29 |

| | |

Statements of Changes in Net Assets | | |

| | |

| | | | | | | | |

| | | Corner Cap Balanced Fund | |

| | | Year Ended

March 31, 2014 | | | Year Ended

March 31, 2013 | |

| | |

OPERATIONS: | | | | | | | | |

Net investment income | | $ | 319,952 | | | $ | 323,619 | |

Net realized gain on investments | | | 1,938,644 | | | | 293,341 | |

Long-term capital gains distributions from other investment companies | | | 39,075 | | | | – | |

Change in unrealized appreciation of investments | | | 932,941 | | | | 737,346 | |

Net increase in net assets resulting from operations | | | 3,230,612 | | | | 1,354,306 | |

| | |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

From net investment income | | | (290,002 | ) | | | (318,111 | ) |

From net realized gain on investments | | | (830,002 | ) | | | (339,062 | ) |

Total distributions | | | (1,120,004 | ) | | | (657,173 | ) |

| | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

Increase in net assets resulting from capital share transactions (see Note 3) | | | 2,117,524 | | | | 55,176 | |

Redemption fees | | | 1,894 | | | | 6 | |

Net increase from capital shares transactions | | | 2,119,418 | | | | 55,182 | |

| | |

Total increase in net assets | | | 4,230,026 | | | | 752,315 | |

| | |

NET ASSETS: | | | | | | | | |

Beginning of year | | | 19,290,476 | | | | 18,538,161 | |

End of year* | | $ | 23,520,502 | | | $ | 19,290,476 | |

| | | | | | | | | |

| | |

*Including accumulated net investment income/(loss) of: | | $ | 100,016 | | | $ | 69,828 | |

The accompanying notes to the financial statements are an integral part of these financial statements.

| | |

| | |

30 | | www.cornercapfunds.com |

| | | | | | | | | | | | | | |

| CornerCap Small-Cap Value Fund | | | CornerCap Large/Mid-Cap Value Fund | |

Year Ended

March 31, 2014 | | | Year Ended

March 31, 2013 | | | Year Ended

March 31, 2014 | | | Year Ended

March 31, 2013 | |

| | | |

| | | | | | | | | | | | | | |

| $ | 10,592 | | | $ | 186,617 | | | $ | 96,562 | | | $ | 77,963 | |

| | 8,729,108 | | | | 3,287,284 | | | | 1,229,947 | | | | 124,696 | |

| | – | | | | – | | | | – | | | | – | |

| | 5,903,304 | | | | 110,675 | | | | 1,129,991 | | | | 590,686 | |

| | 14,643,004 | | | | 3,584,576 | | | | 2,456,500 | | | | 793,345 | |

| | | |

| | | | | | | | | | | | | | |

| | – | | | | (251,823) | | | | (80,252) | | | | (72,572) | |

| | (6,390,497) | | | | (1,311,701) | | | | – | | | | – | |

| | (6,390,497) | | | | (1,563,524) | | | | (80,252) | | | | (72,572) | |

| | | |

| | | | | | | | | | | | | | |

| | 14,905,290 | | | | 11,656,157 | | | | 311,915 | | | | 1,879,890 | |

| | 1,568 | | | | 708 | | | | 1,001 | | | | 2,447 | |

| | 14,906,858 | | | | 11,656,865 | | | | 312,916 | | | | 1,882,337 | |

| | | |

| | 23,159,365 | | | | 13,677,917 | | | | 2,689,164 | | | | 2,603,110 | |

| | | |

| | | | | | | | | | | | | | |

| | 36,600,379 | | | | 22,922,462 | | | | 8,162,892 | | | | 5,559,782 | |

| $ | 59,759,744 | | | $ | 36,600,379 | | | $ | 10,852,056 | | | $ | 8,162,892 | |

| | | | | | | | | | | | | | | |

| | | |

| $ | 0 | | | $ | (7,836) | | | $ | 32,661 | | | $ | 16,351 | |

| | |

| | |

Annual Report | March 31, 2014 | | 31 |

| | |

Financial Highlights | | |

CornerCap Balanced Fund | | |

| | |

| Selected data for each share of beneficial interest outstanding throughout the years indicated: | | Year Ended

March 31, 2014 |

PER SHARE OPERATING PERFORMANCE | | |

Net asset value, beginning of year | | $14.03 |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | |

Net investment income | | 0.23(a) |

Net realized and unrealized gain/(loss) on investments | | 2.09 |

| |

Total Income from Investment Operations | | 2.32 |

| |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | |

Distributions from net investment income | | (0.22) |

Distributions from net realized gain on investments | | (0.62) |

| |

Total Dividends and Distributions to Shareholders | | (0.84) |

| |

Paid-in Capital from Redemption Fees | | 0.00(b) |

| |

Net asset value, end of year | | $15.51 |

| | | |

| |

Total return | | 16.76% |

| |

RATIOS AND SUPPLEMENTAL DATA: | | |

Net assets, end of year (in 000s) | | $23,521 |

| |

RATIOS TO AVERAGE NET ASSETS: | | |

Expenses without fees waived/reimbursed | | 1.30% |

Expenses | | 1.10% |

Net investment income | | 1.54% |

| |

Portfolio turnover rate | | 43% |

| (a) | Calculated using the average shares method. |

| (b) | Less than $0.005 per share. |

| (c) | Effective October 1, 2011, the Adviser agreed to limit expenses at 1.10%. Prior to October 1, 2011, no expense cap was in place. |

The accompanying notes to the financial statements are an integral part of these financial statements.

| | |

| | |

32 | | www.cornercapfunds.com |

| | | | | | |

Year Ended

March 31, 2013 | | Year Ended

March 31, 2012 | | Year Ended

March 31, 2011 | | Year Ended

March 31, 2010 |

| | | |

| $13.51 | | $13.65 | | $12.82 | | $9.26 |

| | | |

| 0.24 | | 0.24 | | 0.26 | | 0.28 |

| 0.78 | | (0.07) | | 0.97 | | 3.57 |

| | | |

| 1.02 | | 0.17 | | 1.23 | | 3.85 |

| | | |

| (0.24) | | (0.31) | | (0.40) | | (0.29) |

| (0.26) | | – | | – | | – |

| | | |

| (0.50) | | (0.31) | | (0.40) | | (0.29) |

| | | |

| 0.00(b) | | 0.00(b) | | 0.00(b) | | 0.00(b) |

| | | |

| $14.03 | | $13.51 | | $13.65 | | $12.82 |

| | | | | | | |

| | | |

| 7.85% | | 1.47% | | 9.78% | | 41.77% |

| | | |

| $19,290 | | $18,538 | | $18,427 | | $15,635 |

| | | |

| 1.30% | | 1.30% | | N/A | | N/A |

| 1.10% | | 1.20%(c) | | 1.30% | | 1.30% |

| 1.82% | | 1.64% | | 2.13% | | 2.45% |

| | | |

| 40% | | 38% | | 31% | | 32% |

| | |

| | |

Annual Report | March 31, 2014 | | 33 |

| | |

Financial Highlights | | |

CornerCap Small-Cap Value Fund | | |

| | |

| Selected data for each share of beneficial interest outstanding throughout the years indicated: | | Year Ended

March 31, 2014 |

PER SHARE OPERATING PERFORMANCE | | |

Net asset value, beginning of year | | $13.74 |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | |

Net investment income/(loss) | | 0.00(a)(b) |

Net realized and unrealized gain/(loss) on investments | | 4.51 |

| |

Total Income/(Loss) from Investment Operations | | 4.51 |

| |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | |

Distributions from net investment income | | – |

Distributions from net realized gain on investments | | (2.00) |

| |

Total Dividends and Distributions to Shareholders | | (2.00) |

| |

Paid-in Capital from Redemption Fees | | 0.00(a) |

| |

Net asset value, end of year | | $16.25 |

| | | |

| |

Total return | | 33.09% |

| |

RATIOS AND SUPPLEMENTAL DATA: | | |

Net assets, end of year (in 000s) | | $59,760 |

| |

RATIOS TO AVERAGE NET ASSETS: | | |

Expenses without fees waived/reimbursed | | 1.50% |

Expenses | | 1.30% |

Net investment income/(loss) | | 0.02% |

| |

Portfolio turnover rate | | 109% |

| (a) | Less than $0.005 per share. |

| (b) | Calculated using the average shares method. |

| (c) | Effective October 1, 2011, the Adviser agreed to limit expenses at 1.30%. Prior to October 1, 2011, no expense cap was in place. |

The accompanying notes to the financial statements are an integral part of these financial statements.

| | |

| | |

34 | | www.cornercapfunds.com |

| | | | | | |

Year Ended

March 31, 2013 | | Year Ended

March 31, 2012 | | Year Ended

March 31, 2011 | | Year Ended

March 31, 2010 |

| | | | | | |

| $12.98 | | $13.51 | | $10.57 | | $5.83 |

| | | | | | |

| 0.10 | | 0.03 | | (0.07) | | (0.07) |

| 1.46 | | (0.56) | | 3.01 | | 4.81 |

| | | |

| 1.56 | | (0.53) | | 2.94 | | 4.74 |

| | | |

| | | | | | |

| (0.13) | | – | | – | | – |

| (0.67) | | – | | – | | – |

| | | |

| (0.80) | | – | | – | | – |

| | | |

| 0.00(a) | | 0.00(a) | | 0.00(a) | | 0.00(a) |

| | | |

| $13.74 | | $12.98 | | $13.51 | | $10.57 |

| | | | | | | |

| | | |

| 12.70% | | (3.92)% | | 27.81% | | 81.30% |

| | | |

| | | | | | |

| $36,600 | | $22,922 | | $22,872 | | $16,448 |

| | | |

| | | | | | |

| 1.50% | | 1.50% | | N/A | | N/A |

| 1.30% | | 1.40%(c) | | 1.50% | | 1.50% |

| 0.74% | | 0.30% | | (0.62)% | | (0.75)% |

| | | |

| 131% | | 56% | | 61% | | 52% |

| | |

| | |

Annual Report | March 31, 2014 | | 35 |

| | |

Financial Highlights | | |

CornerCap Large/Mid-Cap Value Fund | | |

| | | | | |

| Selected data for each share of beneficial interest outstanding throughout the years indicated: | | Year Ended

March 31, 2014 |

PER SHARE OPERATING PERFORMANCE | | |

Net asset value, beginning of year | | $10.88 |

INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | |

Net investment income/(loss) | | 0.12(b) |

Net realized and unrealized gain/(loss) on investments | | 2.97 |

| |

Total Income/(Loss) from Investment Operations | | 3.09 |

| |

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | |

Distributions from net investment income | | (0.10) |

Distributions from net realized gain on investments | | – |

| |

Total Dividends and Distributions to Shareholders | | (0.10) |

| |

Paid-in Capital from Redemption Fees | | 0.00(d) |

| |

Net asset value, end of year | | $13.87 |

| | | | |

| |

Total return | | 28.42% |

| |

RATIOS AND SUPPLEMENTAL DATA: | | |

Net assets, end of year (in 000s) | | $10,852 |

| |

RATIOS TO AVERAGE NET ASSETS: | | |

Expenses without fees waived/reimbursed | | 1.50% |

Expenses | | 1.20% |

Net investment income/(loss) | | 0.98% |

| |

Portfolio turnover rate | | 60% |

| (a) | Prior to July 29, 2010, the CornerCap Large/Mid-Cap Value Fund was known as the CornerCap Contrarian Fund. |

| (b) | Calculated using the average shares method. |

| (c) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value for the year, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the year. |

| (d) | Less than $0.005 per share. |

| (e) | Effective October 1, 2011, the Adviser agreed to limit expenses at 1.20%. Prior to October 1, 2011, the expense cap in place was 1.30 %. |

The accompanying notes to the financial statements are an integral part of these financial statements.