United States

Securities and Exchange Commission

Washington, D.C. 20549

Form N-CSR

Certified Shareholder Report of Registered Management Investment Companies

811-4577

(Investment Company Act File Number)

Federated Hermes Income Securities Trust

_______________________________________________________________

(Exact Name of Registrant as Specified in Charter)

Federated Hermes Funds

4000 Ericsson Drive

Warrendale, Pennsylvania 15086-7561

(Address of Principal Executive Offices)

(412) 288-1900

(Registrant's Telephone Number)

Peter J. Germain, Esquire

1001 Liberty Avenue

Pittsburgh, Pennsylvania 15222-3779

(Name and Address of Agent for Service)

(Notices should be sent to the Agent for Service)

Date of Fiscal Year End: 10/31/20

Date of Reporting Period: 10/31/20

| Item 1. | Reports to Stockholders |

Annual Shareholder Report

October 31, 2020

Federated Hermes Muni and Stock Advantage Fund(formerly, Federated Muni and Stock Advantage Fund)

Fund Established 2003

A Portfolio of Federated Hermes Income Securities Trust(formerly, Federated Income Securities Trust)

IMPORTANT NOTICE REGARDING REPORT DELIVERY

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by contacting your financial intermediary (such as a broker-dealer or bank); other shareholders may call the Fund at 1-800-341-7400, Option 4.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by contacting your financial intermediary (such as a broker-dealer or bank); other shareholders may call the Fund at 1-800-341-7400, Option 4. Your election to receive reports in paper will apply to all funds held with the Fund complex or your financial intermediary.

Not FDIC Insured ▪ May Lose Value ▪ No Bank Guarantee

J. Christopher

Donahue

President

Federated Hermes Muni and Stock Advantage Fund

Letter from the President

Dear Valued Shareholder,

I am pleased to present the Annual Shareholder Report for your fund covering the period from November 1, 2019 through October 31, 2020.

The Fund’s primary investment objective is to provide tax-advantaged income with a secondary objective of capital appreciation.

As we all confront the unprecedented effects of the coronavirus and the challenges it presents to our families, communities, businesses and the financial markets, I want you to know that everyone at Federated Hermes is dedicated to helping you successfully navigate the markets ahead. You can count on us for the insights, investment management knowledge and client service that you have come to expect. Please refer to our website, FederatedInvestors.com, for timely updates on this and other economic and market matters.

Thank you for investing with us. I hope you find this information useful and look forward to keeping you informed.

Sincerely,

J. Christopher Donahue, President

Management’s Discussion of Fund Performance (unaudited)

The total return of Federated Hermes Muni and Stock Advantage Fund (the “Fund”), based on net asset value for the 12-month reporting period ended October 31, 2020, was 2.73% for Class A Shares, 1.95% for Class B Shares, 1.96% for Class C Shares, 2.73% for Class F Shares and 2.99% for Institutional Shares. The 2.99% total return for the Institutional Shares for the reporting period consisted of 0.31% in appreciation of net asset value of the Fund’s shares and 2.68% in reinvested dividends. The total return of the Fund’s custom blended index (60% S&P Municipal Bond Index (S&P Muni Index) and 40% Russell 1000® Value Index (R1000V))1 (“Blended Index”) was -0.38% for the same period. The total return of the Morningstar Allocation Funds Average–30% to 50% Equity (M30-50),2 a peer group average for the Fund, was 2.76% during the same period. The Fund’s and the M30-50’s total returns for the most recently completed fiscal year reflected actual cash flows, transaction costs and other expenses, which were not reflected in the total return of the R1000V or S&P Muni Index.

During the reporting period, the Fund’s investment strategy focused on income earning investments, specifically high-quality, qualified dividend income stocks3 and intermediate- and long-term, tax-exempt securities4 to achieve the Fund’s primary tax-advantaged income objective and secondary capital appreciation objective. The most significant factors that affected the Fund’s performance during the reporting period were: (a) the Fund’s allocation between stocks and tax-exempt securities; (b) the selection of equity securities of similar issuers (referred to as sectors) and the selection of individual equity securities; (c) the selection of tax-exempt municipal securities with different maturities (expressed by a yield curve showing the relative yield of similar securities with different maturities), different credit characteristics or different structural attributes; and (d) the effective duration5 of the Fund’s tax-exempt securities portfolio.

The following discussion will focus on the performance of the Fund’s Institutional Shares relative to the Blended Index.

Annual Shareholder Report

MARKET OVERVIEW

After a strong end to 2019, the outbreak and spread of the Covid-19 virus in the first quarter 2020 significantly disrupted an otherwise healthy U.S. economy, resulting in significant market volatility. Fear and uncertainty in the early days of the outbreak drove investor sentiment to the relative safety of larger, high quality companies. For the reporting period, stocks of larger companies and growth companies fared better than value stocks, with modest gains for broad U.S. equity indices like the S&P 500 Index (S&P 500)6 and declines for the R1000V. The stock market underwent a significant selloff during the first quarter of 2020 due to the coronavirus pandemic, and value stocks were hit particularly hard. The Federal Reserve (the “Fed”) lowered interest rates and provided stimulus packages that helped cushion the downturn on businesses and individuals. The R1000V produced positive performance in the second and third quarters but considerably lagged that of the broad equity market and other asset classes, including large growth, as both fiscal and monetary stimulus poured into the economy and signs of the economy reopening emerged.

The S&P 500 returned 9.71%, and the R1000V returned -7.57% for the reporting period. In general, larger market capitalization stocks outperformed smaller market capitalization stocks, and growth stocks outperformed value stocks. Strong performance in Information Technology, Consumer Discretionary and Communications Services dominated relatively weaker performance in Energy, Financials,and Real Estate across the S&P 500 sectors during the reporting period.

U.S. Treasury yields declined sharply as the Coronavirus pandemic and efforts to contain the contagious disease produced a record decline in global economic activity during the second quarter of calendar year 2020. The Fed rapidly reduced its target short-term interest rates to near zero and instituted large-scale purchases of U.S. Treasures in order to support market functioning and counter the economic shock as unemployment spiked to the highest level since the Great Depression and inflation declined. Treasury yields hit record lows, with the U.S. 10-year yield at 0.51% in August 2020, before rising somewhat as economic growth staged a strong partial recovery later in the period. Overall, yields on 2-year, 10-year and 30-year U.S. Treasury securities declined 137 basis points (bp), 82 bp and 52 bp, respectively, over the reporting period.

Annual Shareholder Report

The onset of the global pandemic prompted a wide-spread flight to cash and safety, resulting in record-sized redemptions from municipal funds and heavy selling of municipal bonds as credit fears surged. Municipal market yields spiked in late March 2020, with the 10-year “AAA” muni yield rising about 200 basis points from March 9 to March 23, and credit spreads within the municipal market surged higher. Bold monetary and market actions from the Fed and fiscal policy actions from the U.S. government helped to stabilize strained financial markets, prompting municipal yields to rapidly decline and the widening of municipal credit spreads to partially reverse. By period-end, high-quality municipal yields had more than reversed all of the surge seen in the second quarter of 2020, with 2-year, 10-year and 30-year Municipal Market Data (MMD) “AAA” tax exempt yields declining 90 bp, 56 bp and 35 bp, respectively, over the period. The S&P Muni Index returned 3.55% for the reporting period.

PORTFOLIO ALLOCATION

During the reporting period, the Fund’s portfolio was allocated between qualified dividend income stocks and tax-exempt securities to reflect the Fund’s primary investment objective of tax-advantaged income8 and its secondary objective of capital appreciation. The factors used in the allocation decision during the reporting period were: (1) maintenance of at least 50% exposure to tax-exempt municipal securities in order to comply with Internal Revenue Service rules governing the payment of tax-exempt dividends from the tax-exempt securities portion of the Fund’s portfolio; (2) the Fund’s ability to pay and maintain an attractive level of dividends; and (3) the expected relative total return of tax-exempt securities and stocks. The allocation at the end of the reporting period was 57.9% tax-exempt municipal bonds, 41% stocks and 1.1% tax-exempt cash equivalents. During the reporting period, the Fund used various types of derivative instruments9, including equity futures, to protect the Fund from volatile market conditions. Equity futures detracted -0.03% from and equity options added 0.02% to the Fund’s performance for the reporting period. The Fund’s overweight to equities relative to the R1000V benchmark weight detracted from Fund performance during the reporting period.

SECTOR AND SECURITY SELECTION–EQUITY STOCKS

The return of the equity component of the Fund’s portfolio outperformed the R1000V during the reporting period. Stock selection in Information Technology and Consumer Discretionary were the main drivers of the outperformance. Within Information Technology, the Fund’s stock selection within Hardware and Equipment was the largest contributor to performance. Within Consumer Discretionary, security selection within Retailing was the largest contributor during the reporting period.

Annual Shareholder Report

Overall, during the reporting period, both sector allocation and stock selection contributed to the Fund’s outperformance relative to the R1000V. An overweight position in the Information Technology sector and an underweight position in the Financials sector contributed to the Fund’s performance during the reporting period. In addition, a structural sector underweight in the Real Estate sector as dividends were not qualified, was a positive contributor to performance. As noted above, the Fund had positive stock selection in the Information Technology and Consumer Discretionary sectors and negative stock selection in the Materials and Industrials sectors.

SECURITY SELECTION–TAX-EXEMPT MUNICIPAL BONDS

During the reporting period, the bond portfolio manager’s strategies were to: (1) invest in tax-exempt municipal bonds whose interest is not subject to (or not a specific preference item for purposes of) the federal alternative minimum tax for individuals; (2) maintain exposure to intermediate and long-term tax-exempt municipal bonds to capture the income advantages of such securities relative to tax-exempt municipal bonds with shorter maturities; (3) maintain a significant weighting in low investment-grade and noninvestment-grade bonds10 (or equivalents), given their income advantages; and (4) adjust portfolio duration (or sensitivity to interest rates) and yield curve exposures in an effort to enhance bond portfolio total return as market interest rates fluctuate11.

The Fund’s tax-exempt municipal bond portfolio underperformed the return of the S&P Muni Index. The bond portfolio’s allocation across the credit spectrum, with an overweight to mid- and low-quality and underweight to high-quality securities, detracted from relative performance, as did the allocation of holdings across municipal sectors. Security selection hurt relative muni performance. In contrast, duration management contributed favorably to relative performance.

DURATION–TAX-EXEMPT MUNICIPAL BONDS

During the reporting period, the duration of the Fund’s tax-exempt municipal bond portfolio averaged about 5.1 years, which was longer than the duration of the S&P Muni Index, which averaged about 4.7 years. This longer duration reflected the Fund’s focus on intermediate and long-term securities and Fund management’s tactical extension of duration after the rapid increase in municipal yields during the second quarter of 2020.

1

Please see the footnotes to the line graphs below for definitions of, and further information about, the S&P Muni Index and R1000V. The total return for the 12-month reporting period for the Fund’s current broad-based securities market indices, the S&P Muni Index and the R1000V, were 3.55% and -7.57%, respectively.

2

Please see the footnotes to the line graphs below for definitions of, and further information about, the M30-50.

3

There are no guarantees that dividend paying stocks will continue to pay dividends.

Annual Shareholder Report

4

The Fund is not entirely a “tax-exempt” or “municipal” fund. Although a portion of the dividends paid by the Fund will consist of exempt-interest dividends that are exempt from regular federal income tax, some distributions will be subject to federal income tax. Additionally, most distributions will be subject to applicable state and local personal income tax.

5

Duration is a measure of a security’s price sensitivity to changes in interest rates. Securities with longer durations are more sensitive to changes in interest rates than securities with shorter durations.

6

The S&P 500 is an unmanaged, capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The index is unmanaged, and it is not possible to invest directly in an index.

7

MMD is a market data provider that produces daily generic yield curve of investment-grade municipal bonds based on a survey of municipal securities dealers and observed trades. The MMD AAA yield curve is a widely used reference for top credit quality municipal bonds in the marketplace. Investment-grade municipal bonds are rated at least “BBB” by Standard & Poor’s or another nationally recognized statistical ratings organization (or are comparable unrated municipal bonds).

8

Fund income may be subject to state and local taxes. Although this Fund pursues tax-advantaged income and seeks to invest primarily in securities whose interest is not subject to the federal alternative minimum tax, there are no assurances that it will achieve these goals.

9

The Fund’s use of derivative instruments involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other traditional instruments.

10

Investment-grade securities and noninvestment-grade securities may either be: (a) rated by a nationally recognized statistical ratings organization or rating agency; or (b) unrated securities that the Fund’s Adviser believes are of comparable quality. The rating agencies that provided the ratings for rated securities include Standard & Poor’s, Moody’s Investor Services, Inc. and Fitch Rating Service. When ratings vary, the highest rating is used. Credit ratings of “AA” or better are considered to be high credit quality; credit ratings of “A” are considered high or medium/good quality; and credit ratings of “BBB” are considered to be medium/good credit quality, and the lowest category of investment-grade securities; credit ratings of “BB” and below are lower-rated, noninvestment-grade securities or junk bonds; and credit ratings of “CCC” or below are noninvestment-grade securities that have high default risk. Credit ratings are an indication of the risk that a security will default. They do not protect a security from credit risk. Lower rated bonds typically offer higher yields to help compensate investors for the increased risk associated with them. Among these risks are lower creditworthiness, greater price volatility, more risk to principal and income than with higher rated securities and increased possibilities of default.

11

Bond prices are sensitive to changes in interest rates and interest rate spreads between bonds of varying credit quality. A rise in interest rates or interest rate spreads can cause a decline in their prices.

Annual Shareholder Report

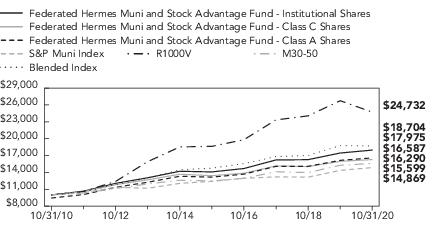

FUND PERFORMANCE AND GROWTH OF A $10,000 INVESTMENT

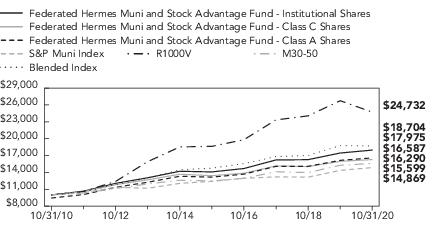

The graph below illustrates the hypothetical investment of $10,0001 in the Federated Hermes Muni and Stock Advantage Fund2 from October 31, 2010 to October 31, 2020, compared to the S&P Municipal Bond Index (S&P Muni Index),3 the Russell 1000® Value Index (R1000V),4 the custom blend of indexes comprised of 60% S&P Muni Index/ 40% R1000V (“Blended Index”) and the Morningstar Allocation Funds Average–30% to 50% Equity (M30-50).5 The Average Annual Total Return Table below shows returns for each class averaged over the stated periods.

Growth of a $10,000 Investment

Growth of $10,000 as of October 31, 2020

■ Total returns shown for Class A Shares include the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450).

■ Total returns shown for the Class C Shares include the maximum contingent deferred sales charge of 1.00% as applicable.

The Fund offers multiple share classes whose performance may be greater than or less than its other share class(es) due to differences in sales charges and expenses. See the Average Annual Return table below for the returns of additional classes not shown in the line graphs above.

Annual Shareholder Report

Average Annual Total Returns for the Period Ended 10/31/2020

(returns reflect all applicable sales charges and contingent deferred sales charges as specified below in footnote #1)

Performance data quoted represents past performance which is no guarantee of future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Mutual fund performance changes over time and current performance may be lower or higher than what is stated. For current to the most recent month-end performance and after-tax returns, visit FederatedInvestors.com or call 1-800-341-7400. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Mutual funds are not obligations of or guaranteed by any bank and are not federally insured.

1

Represents a hypothetical investment of $10,000 in the Fund after deducting applicable sales charges: for Class A Shares, the maximum sales charge of 5.50% ($10,000 investment minus $550 sales charge = $9,450); for Class B Shares, the maximum contingent deferred sales charge is 5.50% on any redemption less than one year from the purchase date; for Class C Shares, the maximum contingent deferred sales charge is 1.00% on any redemption less than one year from the purchase date; for Class F Shares, the maximum sales charge of 1.00% ($10,000 investment minus $100 sales charge = $9,900), and the contingent deferred sales charge is 1.00% on any redemption less than four years from the purchase date. The Fund’s performance assumes the reinvestment of all dividends and distributions. The S&P Muni Index, R1000V, Blended Index and the M30-50 have been adjusted to reflect reinvestment of dividends on securities in the indices and average.

2

As indicated in its name, Federated Hermes Muni and Stock Advantage Fund invests in both municipal (muni) securities and equity securities (stock) as described in the Fund’s prospectus. Thus the Fund is not entirely a “tax-exempt” or “municipal” fund, and a portion of the income derived from the Fund’s portfolio (or dividend distributions) will be subject to federal income tax and state and local personal income tax.

3

The S&P Muni Index is a broad, market value-weighted index that seeks to measure the performance of the U.S. municipal bond market. It tracks fixed-rate tax-free bonds and bonds subject to the alternative minimum tax (AMT). The index includes bonds of all quality—from “AAA” to non-rated, including defaulted bonds—from all sectors of the municipal bond market. The index is not adjusted to reflect sales charges, expenses and other fees that the Securities and Exchange Commission (SEC) requires to be reflected in the Fund’s performance. The index is unmanaged, and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

Annual Shareholder Report

4

The R1000V measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 Index companies with lower price-to-book ratios and lower expected growth values. The R1000V is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment and is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. The index is not adjusted to reflect sales charges, expenses and other fees that the SEC requires to be reflected in the Fund’s performance. The index is unmanaged, and, unlike the Fund, is not affected by cash flows. It is not possible to invest directly in an index.

5

Morningstar figures represent the average of the total returns reported by all the funds designated by Morningstar as falling into the respective category indicated. They do not reflect sales charges. The Morningstar figures in the Growth of $10,000 line graph are based on historical return information published by Morningstar and reflect the return of the funds comprising the category in the year of publication. Because the funds designated by Morningstar as falling into the category can change over time, the Morningstar figures in the line graph may not match the Morningstar figures in the Average Annual Total Returns table, which reflect the return of the funds that currently comprise the category.

6

The Fund’s Institutional Shares commenced operations on December 29, 2010. For the period prior to the commencement of operations of the Institutional Shares, the performance information shown for the Fund’s Institutional Shares is for the Fund’s Class A Shares. The performance of the Class A Shares has not been adjusted to reflect the expenses of the Institutional Shares, since the Institutional Shares have a lower expense ratio than the expense ratio of Class A Shares during those periods. The performance of Class A Shares has been adjusted to reflect the absence of sales charges and to remove any voluntary waiver of fund expenses related to Class A Shares during the period prior to commencement of the Institutional Shares.

Annual Shareholder Report

Portfolio of Investments Summary Tables (unaudited)

At October 31, 2020, the Fund’s portfolio composition1 was as follows:

| Percentage of

Total Net Assets |

Tax-Exempt, Fixed-Income Securities | |

| |

| |

| |

Other Assets and Liabilities—Net5 | |

| |

At October 31, 2020, the Fund’s sector composition6 for its equity securities was as follows:

| Percentage of

Equity Securities |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Annual Shareholder Report

At October 31, 2020, the Fund’s sector composition7 for its tax-exempt securities was as follows:

| Percentage of

Tax-Exempt

Securities |

| |

| |

| |

| |

| |

| |

| |

General Obligation—State Appropriation | |

| |

| |

| |

| |

1

See the Fund’s Prospectus and Statement of Additional Information for a description of the types of securities in which the Fund invests.

2

Cash equivalents include any investments in tax-exempt, variable rate instruments.

3

Based upon net unrealized appreciation (depreciation) or value of the derivative contracts as applicable. Derivative contracts may consist of futures, forwards, options and swaps. The impact of a derivative contract on the Fund’s performance may be larger than its unrealized appreciation (depreciation) or value may indicate. In many cases, the notional value or amount of a derivative contract may provide a better indication of the contract’s significance to the portfolio. More complete information regarding the Fund’s direct investments in derivative contracts, including unrealized appreciation (depreciation), value and notional values or amounts of such contracts, can be found in the table at the end of the Portfolio of Investments included in this Report.

4

Represents less than 0.1%.

5

Assets, other than investments in securities and derivative contracts, less liabilities. See Statement of Assets and Liabilities.

6

Sector classifications are based upon, and individual portfolio securities are assigned to, the classifications of the Global Industry Classification Standard (GICS) except that the Adviser assigns a classification to securities not classified by the GICS and to securities for which the Adviser does not have access to the classification made by the GICS.

7

Sector classifications and the assignment of holdings to such sectors, are based upon the economic sector and/or revenue source of the underlying obligor, as determined by the Fund’s Adviser. For securities that have been enhanced by a third-party guarantor, such as bond insurers and banks, sector classifications are based upon the economic sector and/or revenue source of the underlying obligor, as determined by the Fund’s Adviser. Refunded securities are those whose debt service is paid from escrowed assets, usually U.S. government securities.

8

For purposes of this table, sector classifications constitute 72.9% of the Fund’s total investments in tax-exempt securities. Remaining tax-exempt security sectors have been aggregated under the designation “Other.”

Annual Shareholder Report

Portfolio of Investments

October 31, 2020

| | | |

| | | |

| | | |

| | Black Belt Energy Gas District, AL, Gas Prepay Revenue Bonds Project No. 5 (Series 2020A-1) TOBs, (Morgan Stanley GTD), 4.000%, Mandatory Tender 10/1/2026 | |

| | Selma, AL IDB (International Paper Co.), Revenue Bonds (Series 2011A), 5.375%, 12/1/2035 | |

| | | |

| | | |

| | Arizona State IDA (Equitable School Revolving Fund), Senior National Charter School Revenue Bonds (Series 2020A), 4.000%, 11/1/2050 | |

| | Arizona State Industrial Development Authority Education Revenue (Basis Schools, Inc. Obligated Group), Education Revenue Bonds (Series 2017F), (School District Credit Program GTD), 5.000%, 7/1/2052 | |

| | Maricopa County, AZ, IDA (GreatHearts Academies), Education Revenue Bonds (GreatHearts Arizona Projects) (Series 2017C), (Arizona Public School Credit Enhancement Program GTD), 5.000%, 7/1/2048 | |

| | Maricopa County, AZ, IDA (Paradise Schools), Revenue Refunding Bonds, 5.000%, 7/1/2036 | |

| | Phoenix, AZ Civic Improvement Corp.—Airport System, Junior Line Airport Revenue Bonds (Series 2019A), 4.000%, 7/1/2044 | |

| | Phoenix, AZ Civic Improvement Corp.—Airport System, Junior Line Airport Revenue Bonds (Series 2019A), 5.000%, 7/1/2044 | |

| | Phoenix, AZ IDA (GreatHearts Academies), Education Facility Revenue Bonds (Series 2014A), 5.000%, 7/1/2034 | |

| | | |

| | | |

| | California Health Facilities Financing Authority (Providence St. Joseph Health), Revenue Bonds (Series 2014B), 5.000%, 10/1/2044 | |

| | California Health Facilities Financing Authority (Stanford Health Care), Revenue Refunding Bonds (Series 2017A), 4.000%, 11/15/2040 | |

| | California School Finance Authority (KIPP LA), School Facility Revenue Bonds (Series 2014A), 5.000%, 7/1/2034 | |

| | California School Finance Authority (KIPP LA), School Facility Revenue Bonds (Series 2014A), 5.125%, 7/1/2044 | |

| | California School Finance Authority (KIPP LA), School Facility Revenue Bonds (Series 2015A), 5.000%, 7/1/2045 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | California State University (The Trustees of), Systemwide Revenue Bonds (Series 2014A), 5.000%, 11/1/2039 | |

| | California State University (The Trustees of), Systemwide Revenue Bonds (Series 2015A), 5.000%, 11/1/2030 | |

| | California State, School Facilities UT GO Bonds, 5.000%, 11/1/2031 | |

| | California State, Various Purpose Refunding GO Bonds, 5.000%, 2/1/2038 | |

| | California Statewide Communities Development Authority (899 Charleston LLC), Revenue Refunding Bonds (Series 2014A), 5.250%, 11/1/2044 | |

| | California Statewide Communities Development Authority (Sutter Health), Refunding Revenue Bonds (Series 2011D), 5.250%, 8/15/2031 | |

| | Chula Vista, CA Municipal Finance Authority, Special Tax Revenue Refunding Bonds (Series 2013), 5.500%, 9/1/2028 | |

| | Corona-Norco USD Community Facilities District No. 98-1, CA, 2013 Special Tax Refunding Bonds, 5.000%, 9/1/2032 | |

| | Foothill/Eastern Transportation Corridor Agency, CA, Toll Road Refunding Revenue Bonds (Series 2013A), (Original Issue Yield: 6.050%), 5.750%, 1/15/2046 | |

| | Golden State Tobacco Securitization Corp., CA (California State), Enhanced Tobacco Settlement Asset-Backed Bonds (Series 2015A), 5.000%, 6/1/2040 | |

| | Los Angeles Department of Water & Power (Los Angeles, CA Department of Water & Power (Electric/Power System)), Power System Revenue Bonds (Series 2019C), 5.000%, 7/1/2038 | |

| | M-S-R Energy Authority, CA, Gas Revenue Bonds (Series 2009A), (Original Issue Yield: 6.375%), (Citigroup, Inc. GTD), 6.125%, 11/1/2029 | |

| | M-S-R Energy Authority, CA, Gas Revenue Bonds (Series 2009C), (Original Issue Yield: 6.700%), (Citigroup, Inc. GTD), 6.500%, 11/1/2039 | |

| | San Jose, CA Airport, Airport Revenue Bonds (Series 2011A-2), (Original Issue Yield: 5.050%), 5.000%, 3/1/2031 | |

| | Transbay Joint Powers Authority, CA, Senior Tax Allocation Bonds Green Bonds (Series 2020A), 5.000%, 10/1/2049 | |

| | University of California (The Regents of), General Revenue Bonds (Series 2013AI), 5.000%, 5/15/2032 | |

| | University of California (The Regents of), Limited Project Revenue Bonds (Series 2012G), (United States Treasury PRF 5/15/2022@100), 5.000%, 5/15/2031 | |

| | University of California (The Regents of), Limited Project Revenue Bonds (Series 2012G), 5.000%, 5/15/2031 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | University of California (The Regents of), Limited Project Revenue Bonds (Series 2017M), 5.000%, 5/15/2036 | |

| | | |

| | | |

| | Arista, CO Metropolitan District, Special Revenue Refunding and Improvement Bonds (Series 2018A), 5.125%, 12/1/2048 | |

| | Clear Creek Station Metropolitan District No. 2, LT GO Refunding Bonds (Series 2017A), 5.000%, 12/1/2047 | |

| | Colorado Educational & Cultural Facilities Authority (University Lab School), Charter School Refunding & Improvement Revenue Bonds (Series 2015), 5.000%, 12/15/2035 | |

| | Colorado Health Facilities Authority (Christian Living Communities), Revenue Refunding Bonds (Series 2016), 5.000%, 1/1/2037 | |

| | Colorado Health Facilities Authority (Sisters of Charity of Leavenworth Health System), Revenue Bonds (Series 2013A), (Original Issue Yield: 5.120%), 5.000%, 1/1/2044 | |

| | Colorado Health Facilities Authority (Total Long-term Care National Obligated Group), Revenue Bonds (Series 2010A), (United States Treasury PRF 11/15/2020@100), 6.000%, 11/15/2030 | |

| | Colorado Springs, CO Utility System, Utilities System Revenue Bonds (Series 2014A-1), 5.000%, 11/15/2044 | |

| | Colorado State Health Facilities Authority Revenue (CommonSpirit Health), Revenue Bonds (Series 2019A-1), 4.000%, 8/1/2037 | |

| | Denver (City & County), CO (Denver, CO City & County Airport Authority), Airport System Revenue Bonds (Series 2013B), (Original Issue Yield: 5.050%), 5.000%, 11/15/2043 | |

| | STC Metropolitan District No. 2, CO, LT GO and Special Revenue Refunding and Improvement Bonds (Series2019A), 5.000%, 12/1/2049 | |

| | University of Colorado (The Regents of), University Enterprise Revenue Bonds (Series 2013A), (United States Treasury PRF 6/1/2023@100), 5.000%, 6/1/2032 | |

| | | |

| | | |

| | Connecticut State Special Transportation Fund, Special Tax Obligation Bonds Transportation Infrastructure Purpose (Series 2018B), 5.000%, 10/1/2032 | |

| | Connecticut State, UT GO Bonds (Series 2020C), 4.000%, 6/1/2036 | |

| | | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Delaware Economic Development Authority (ACTS Retirement Life Communities, Inc.), Retirement Communities Revenue Bonds (Series 2018B), 5.000%, 11/15/2048 | |

| | District of Columbia—0.9% | |

| | District of Columbia (KIPP DC), Revenue Bonds (Series 2013A), (United States Treasury PRF 7/1/2023@100), 6.000%, 7/1/2048 | |

| | District of Columbia Revenue (District of Columbia International School), Revenue Bonds (Series 2019), 5.000%, 7/1/2054 | |

| | District of Columbia Revenue (Friendship Public Charter School, Inc.), Revenue Bonds (Series 2016A), 5.000%, 6/1/2041 | |

| | District of Columbia Revenue (Ingleside at Rock Creek), Project Revenue Bonds (Series 2017A), (Original Issue Yield: 5.125%), 5.000%, 7/1/2042 | |

| | District of Columbia Revenue (Ingleside at Rock Creek), Project Revenue Bonds (Series 2017A), 5.000%, 7/1/2037 | |

| | District of Columbia, UT GO Bonds (Series 2019A), 5.000%, 10/15/2029 | |

| | Metropolitan Washington, DC Airports Authority (Dulles Metrorail and Capital Improvement Project), Dulles Toll Road Subordinate Lien Revenue Refunding Bonds (Series 2019B), (Assured Guaranty Municipal Corp. INS), 4.000%, 10/1/2053 | |

| | | |

| | | |

| | Collier County, FL IDA (Arlington of Naples), Continuing Care Community Revenue Bonds (Series 2013A), (Original Issue Yield: 8.250%), 8.125%, 5/15/2044 | |

| | Florida State Board of Education (Florida State), General Obligation Refunding Bonds (Series 2016C), 5.000%, 6/1/2025 | |

| | Miami-Dade County, FL (Miami-Dade County, FL Seaport), Seaport Revenue Bonds (Series 2013A), 5.750%, 10/1/2030 | |

| | Miami-Dade County, FL (Miami-Dade County, FL Seaport), Seaport Revenue Bonds (Series 2013A), 5.750%, 10/1/2032 | |

| | Miami-Dade County, FL Expressway Authority, Toll System Refunding Revenue Bonds (Series 2013A), 5.000%, 7/1/2027 | |

| | Miami-Dade County, FL Expressway Authority, Toll System Refunding Revenue Bonds (Series 2013A), 5.000%, 7/1/2028 | |

| | Miami-Dade County, FL Water & Sewer, Water & Sewer System Revenue Refunding Bonds (Series 2015), 5.000%, 10/1/2023 | |

| | Orlando, FL Utilities Commission, Utility System Revenue Bonds (Series 2018A), 5.000%, 10/1/2037 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Palm Beach County, FL Health Facilities Authority (Sinai Residences of Boca Raton), Revenue Bonds (Series 2014A), 7.250%, 6/1/2034 | |

| | | |

| | | |

| | Atlanta, GA Water & Wastewater, Revenue Refunding Bonds (Series 2015), 5.000%, 11/1/2040 | |

| | Atlanta, GA Water & Wastewater, Revenue Refunding Bonds (Series 2018C), 5.000%, 11/1/2032 | |

| | Fulton County, GA Development Authority (Piedmont Healthcare, Inc.), Revenue Bonds (Series 2014A), 5.000%, 7/1/2044 | |

| | Fulton County, GA Residential Care Facilities (Lenbrook Square Foundation, Inc.), Retirement Facility Refunding Revenue Bonds (Series 2016), 5.000%, 7/1/2036 | |

| | | |

| | | |

| | Idaho Health Facilities Authority (Terraces of Boise), Revenue Bonds (Series 2013A), (Original Issue Yield: 7.875%), 7.750%, 10/1/2034 | |

| | Idaho Health Facilities Authority (Terraces of Boise), Revenue Bonds (Series 2013A), (Original Issue Yield: 8.250%), 8.125%, 10/1/2049 | |

| | | |

| | | |

| | Chicago, IL Board of Education, UT GO Dedicated Refunding Bonds (Series 2018D), (Original Issue Yield: 5.210%), 5.000%, 12/1/2046 | |

| | Chicago, IL Midway Airport, Second Lien Revenue & Refunding Bonds (Series 2014B), 5.000%, 1/1/2036 | |

| | Chicago, IL Midway Airport, Second Lien Revenue Refunding Bonds (Series 2014B), 5.000%, 1/1/2035 | |

| | Chicago, IL O’Hare International Airport, General Airport Senior Lien Revenue Refunding Bonds (Series 2016B), 5.000%, 1/1/2041 | |

| | Chicago, IL O’Hare International Airport, General Airport Senior Lien Revenue Refunding Bonds (Series 2018B), 5.000%, 1/1/2048 | |

| | Chicago, IL O’Hare International Airport, General Airport Third Lien Revenue Bonds (Series 2011A), (Original Issue Yield: 5.940%), (United States Treasury PRF 1/1/2021@100), 5.750%, 1/1/2039 | |

| | Chicago, IL O’Hare International Airport, General Airport Third Lien Revenue Bonds (Series 2011A), (Original Issue Yield: 5.940%), (United States Treasury PRF 1/1/2021@100), 5.750%, 1/1/2039 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Chicago, IL Sales Tax, Revenue Refunding Bonds (Series 2002), (United States Treasury PRF 1/1/2025@100), 5.000%, 1/1/2027 | |

| | Chicago, IL Water Revenue, Second Lien Water Revenue Refunding Bonds (Series 2004), 5.000%, 11/1/2023 | |

| | Chicago, IL Water Revenue, Second Lien Water Revenue Refunding Bonds (Series 2004), 5.000%, 11/1/2024 | |

| | Cook County, IL Sales Tax, Revenue Refunding Bonds (Series 2017), 5.000%, 11/15/2037 | |

| | DuPage County, IL (Naperville Campus LLC), Special Tax Bonds (Series 2006), 5.625%, 3/1/2036 | |

| | Illinois Finance Authority (Admiral at the Lake), Revenue Refunding Bonds (Series 2017), (Original Issue Yield: 5.500%), 5.250%, 5/15/2054 | |

| | Illinois Finance Authority (DePaul University), Revenue Bonds (Series 2016), 5.000%, 10/1/2041 | |

| | Illinois State Toll Highway Authority, Toll Highway Senior Revenue Bonds (Series 2014B), 5.000%, 1/1/2039 | |

| | Illinois State, GO Bonds (Series 2017D), 5.000%, 11/1/2028 | |

| | Illinois State, UT GO Bonds (Series 2013A), 5.000%, 4/1/2035 | |

| | Illinois State, UT GO Bonds (Series 2017D), 5.000%, 11/1/2026 | |

| | Illinois State, UT GO Bonds (Series 2018A), 5.000%, 5/1/2042 | |

| | Illinois State, UT GO Bonds (Series June 2013), (Original Issue Yield: 5.650%), 5.500%, 7/1/2038 | |

| | Illinois State, UT GO Refunding Bonds (Series 2018A), 5.000%, 10/1/2026 | |

| | Illinois State, UT GO Refunding Bonds (Series 2018A), 5.000%, 10/1/2028 | |

| | Illinois State, UT GO Refunding Bonds (Series February 2010), 5.000%, 1/1/2024 | |

| | Illinois State, UT GO Refunding Bonds (Series May 2012), 5.000%, 8/1/2024 | |

| | Metropolitan Pier & Exposition Authority, IL, McCormick Place Expansion Project Bonds (Series 2015A), (Original Issue Yield: 5.060%), 5.000%, 6/15/2053 | |

| | Railsplitter Tobacco Settlement Authority, IL, Tobacco Settlement Revenue Bonds (Series 2010), (Original Issue Yield: 6.100%), (United States Treasury PRF 6/1/2021@100), 6.000%, 6/1/2028 | |

| | Sales Tax Securitization Corp., IL, Sales Tax Securitization Bonds (Series 2018A), 5.000%, 1/1/2048 | |

| | | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Indiana Municipal Power Agency, Power Supply System Revenue Bonds (Series 2013A), (United States Treasury PRF 7/1/2023@100), 5.250%, 1/1/2034 | |

| | Indiana Municipal Power Agency, Revenue Refunding Bonds (Series 2017A), 5.000%, 1/1/2042 | |

| | Indiana State Finance Authority Hospital Revenue (Indiana University Health Obligated Group), Hospital Revenue Refunding Bonds (Series 2014A), 5.000%, 12/1/2029 | |

| | Indiana State Finance Authority Wastewater Utilities (CWA Authority), First Lien Wastewater Utility Revenue Bonds (Series 2012A), 5.000%, 10/1/2029 | |

| | Indiana State Finance Authority Wastewater Utilities (CWA Authority), First Lien Wastewater Utility Revenue Bonds (Series 2014A), 5.000%, 10/1/2039 | |

| | Whiting, IN Environmental Facilities (BP PLC), Revenue Bonds (Series 2009), 5.250%, 1/1/2021 | |

| | | |

| | | |

| | Iowa Finance Authority (Deerfield Retirement Community, Inc.), Lifespace GTD Senior Living Facility Revenue Refunding Bonds (Series 2014A), 5.400%, 11/15/2046 | |

| | Iowa Finance Authority (Deerfield Retirement Community, Inc.), Senior Living Facility Revenue Refunding Bonds (Series 2014B), 4.253%, 5/15/2056 | |

| | Iowa Finance Authority (Iowa Fertilizer Co. LLC), Midwestern Disaster Area Revenue Bonds (Series 2013) Exchange Bonds (Series B) TOBs, 5.250%, Mandatory Tender 12/1/2037 | |

| | Iowa Finance Authority (Iowa Fertilizer Co. LLC), Midwestern Disaster Area Revenue Bonds (Series 2013), 5.875%, 12/1/2027 | |

| | Tobacco Settlement Financing Corp., IA, Tobacco Settlement Asset-Backed Bonds (Series 2005C), (Original Issue Yield: 5.700%), 5.375%, 6/1/2038 | |

| | Tobacco Settlement Financing Corp., IA, Tobacco Settlement Asset-Backed Bonds (Series 2005C), (Original Issue Yield: 5.780%), 5.500%, 6/1/2042 | |

| | | |

| | | |

| | Wyandotte County, KS Unified Government Utility System, Improvement & Refunding Revenue Bonds (Series 2014-A), 5.000%, 9/1/2044 | |

| | | |

| | Kentucky Economic Development Finance Authority (Miralea), Revenue Bonds (Series 2016A), 5.000%, 5/15/2051 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Kentucky Public Transportation Infrastructure Authority, First Tier Toll Revenue Bonds (Series 2013), (Original Issue Yield: 6.125%), 6.000%, 7/1/2053 | |

| | Louisville & Jefferson County, KY Metropolitan Government (Catholic Health Initiatives), Revenue Bonds (Series 2012A), (United States Treasury PRF 6/1/2022@100), 5.000%, 12/1/2035 | |

| | Louisville & Jefferson County, KY Metropolitan Government (Catholic Health Initiatives), Revenue Bonds (Series 2012A), (United States Treasury PRF 6/1/2022@100), 5.000%, 12/1/2035 | |

| | | |

| | | |

| | Louisiana State Citizens Property Insurance Corp., Refunding Revenue Bonds (Series 2012), (United States Treasury PRF 6/1/2022@100), 5.000%, 6/1/2024 | |

| | St. Charles Parish, LA Gulf Opportunity Zone (Valero Energy Corp.), Revenue Bonds (Series 2010) TOBs, 4.000%, Mandatory Tender 6/1/2022 | |

| | St. James Parish, LA (NuStar Logistics LP), Revenue Bonds (Series 2011) TOBs, 5.850%, Mandatory Tender 6/1/2025 | |

| | | |

| | | |

| | Maine Health & Higher Educational Facilities Authority (MaineGeneral Medical Center), Revenue Bonds (Series 2011), (Original Issue Yield: 7.000%), 6.750%, 7/1/2041 | |

| | | |

| | Anne Arundel County, MD, LT GO Bonds (Series 2018), 5.000%, 10/1/2032 | |

| | Maryland State Economic Development Corp. (Ports America Chesapeake, Inc. ), Transportation Facilities Revenue Refunding Bonds (Series 2017A), 5.000%, 6/1/2031 | |

| | Maryland State Economic Development Corp. (Ports America Chesapeake, Inc. ), Transportation Facilities Revenue Refunding Bonds (Series 2017A), 5.000%, 6/1/2035 | |

| | Westminster, MD (Lutheran Village at Miller’s Grant, Inc.), Revenue Bonds (Series 2014A), 6.000%, 7/1/2034 | |

| | | |

| | | |

| | Massachusetts Development Finance Agency (Harvard University), Revenue Refunding Bonds (Series 2016A), 5.000%, 7/15/2040 | |

| | Massachusetts Development Finance Agency (Mass General Brigham), Revenue Bonds (Series 2016Q), 5.000%, 7/1/2041 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Massachusetts Development Finance Agency (Wellforce Obligated Group), Revenue Bonds (Series 2020C), (Assured Guaranty Municipal Corp. INS), 4.000%, 10/1/2045 | |

| | Massachusetts School Building Authority, Senior Dedicated Sales Tax Revenue Refunding Bonds (Series 2015C), 5.000%, 8/15/2037 | |

| | Massachusetts Water Resources Authority, General Revenue Refunding Bonds (Series 2017C), 5.000%, 8/1/2030 | |

| | | |

| | | |

| | Detroit, MI, UT GO Bonds (Series 2020), 5.500%, 4/1/2050 | |

| | Michigan State Finance Authority Revenue (Great Lakes, MI Water Authority Sewage Disposal System), Local Government Loan Program Revenue Bonds (Series 2015C-1), 5.000%, 7/1/2035 | |

| | Michigan State Finance Authority Revenue (Great Lakes, MI Water Authority Water Supply System), Senior Lien Revenue Bonds (Series 2014 D-1), (Assured Guaranty Municipal Corp. INS), 5.000%, 7/1/2037 | |

| | Michigan State Finance Authority Revenue (Public Lighting Authority ), Local Government Loan Program Revenue Bonds (Series 2014B), 5.000%, 7/1/2039 | |

| | Michigan Strategic Fund (Michigan State), LT Obligation Revenue Bonds (Series 2011), 5.250%, 10/15/2026 | |

| | Wayne County, MI Airport Authority, Revenue Bonds (Series 2012A), 5.000%, 12/1/2037 | |

| | | |

| | | |

| | Forest Lake, MN (Lakes International Language Academy), Charter School Lease Revenue Bonds (Series 2018A), 5.375%, 8/1/2050 | |

| | Minnesota State, Various Purpose Refunding UT GO Bonds (Series 2016D), 5.000%, 8/1/2025 | |

| | Western Minnesota Municipal Power Agency, MN, Power Supply Revenue Bonds (Series 2014A), (United States Treasury PRF 1/1/2024@100), 5.000%, 1/1/2040 | |

| | | |

| | | |

| | Lowndes County, MS Solid Waste Disposal (International Paper Co.), PCR Refunding Bonds (Project A) Weyerhaeuser/ International Paper, 6.800%, 4/1/2022 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Kansas City, MO Redevelopment Authority (Kansas City Convention Center Headquarters Hotel CID), Revenue Bonds (Series 2018B), (Original Issue Yield: 5.079%), 5.000%, 2/1/2050 | |

| | Missouri State HEFA (BJC Health System, MO), Health Facilities Revenue Bonds, 5.000%, 1/1/2044 | |

| | St. Louis, MO Airport Revenue (St. Louis Lambert International Airport), Airport Revenue Refunding and Airport Revenue Bonds (Series 2017C), (Assured Guaranty Municipal Corp. INS), 5.000%, 7/1/2042 | |

| | | |

| | | |

| | Central Plains Energy Project, NE, Gas Project Revenue Bonds (Project No. 3) (Series 2012), (Goldman Sachs Group, Inc. GTD), 5.000%, 9/1/2032 | |

| | Central Plains Energy Project, NE, Gas Project Revenue Bonds (Project No. 3) (Series 2012), (Original Issue Yield: 5.050%), (Goldman Sachs Group, Inc. GTD), 5.000%, 9/1/2042 | |

| | Central Plains Energy Project, NE, Gas Project Revenue Bonds (Project No. 3) (Series 2017A), (Goldman Sachs Group, Inc. GTD), 5.000%, 9/1/2042 | |

| | Nebraska Public Power District, General Revenue Bonds (Series 20014A), 5.000%, 1/1/2037 | |

| | Nebraska Public Power District, General Revenue Bonds (Series 20014A), 5.000%, 1/1/2038 | |

| | | |

| | | |

| | New Hampshire Health and Education Facilities Authority (Hillside Village), Revenue Bonds (Series 2017A), 6.125%, 7/1/2037 | |

| | | |

| | New Jersey EDA (New Jersey State), School Facilities Construction Bonds (Series 2015 WW), (United States Treasury PRF 6/15/2025@100), 5.250%, 6/15/2040 | |

| | New Jersey EDA (New Jersey State), School Facilities Construction Bonds (Series 2015 WW), 5.250%, 6/15/2040 | |

| | New Jersey EDA (New Jersey State), School Facilities Construction Refunding Bonds (Series 2017 DDD), 5.000%, 6/15/2033 | |

| | New Jersey EDA (New Jersey State), School Facilities Construction Refunding Bonds (Series 2018EEE), 5.000%, 6/15/2043 | |

| | New Jersey State Transportation Trust Fund Authority (New Jersey State), Federal Highway Reimbursement Revenue Refunding Notes (Series 2018A), 5.000%, 6/15/2031 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | New Jersey State Transportation Trust Fund Authority (New Jersey State), Transportation System Bonds (Series 2010D), 5.000%, 12/15/2023 | |

| | New Jersey State Transportation Trust Fund Authority (New Jersey State), Transportation System Bonds (Series 2011A), (United States Treasury PRF 6/15/2021@100), 6.000%, 6/15/2035 | |

| | New Jersey State Transportation Trust Fund Authority (New Jersey State), Transportation System Bonds (Series 2011B), (Original Issue Yield: 5.050%), (United States Treasury PRF 6/15/2021@100), 5.000%, 6/15/2042 | |

| | New Jersey State Transportation Trust Fund Authority (New Jersey State), Transportation System Bonds (Series 2018A), 5.000%, 12/15/2034 | |

| | New Jersey Turnpike Authority, Turnpike Revenue Bonds (Series 2015E), 5.000%, 1/1/2034 | |

| | New Jersey Turnpike Authority, Turnpike Revenue Bonds (Series 2017G), 4.000%, 1/1/2043 | |

| | South Jersey Transportation Authority, Transportation System Revenue Bonds (Series 2020A), 4.000%, 11/1/2050 | |

| | Tobacco Settlement Financing Corp., NJ, Tobacco Settlement Asset-Backed Refunding Bonds (Series 2018A), 5.000%, 6/1/2036 | |

| | Tobacco Settlement Financing Corp., NJ, Tobacco Settlement Asset-Backed Refunding Bonds (Series 2018A), 5.250%, 6/1/2046 | |

| | Tobacco Settlement Financing Corp., NJ, Tobacco Settlement Asset-Backed Subordinate Refunding Bonds (Series 2018B), 5.000%, 6/1/2046 | |

| | | |

| | | |

| | New Mexico State Hospital Equipment Loan Council (Presbyterian Healthcare Services), Hospital System Revenue Bonds (Series 2017A), 5.000%, 8/1/2046 | |

| | | |

| | Glen Cove, NY Local Economic Assistance Corp. (Garvies Point Public Improvement Project), Revenue Bonds (Series 2016A), (Original Issue Yield: 5.080%), 5.000%, 1/1/2056 | |

| | Hudson Yards Infrastructure Corp. NY, Hudson Yards Senior Revenue Bonds (Series 2012A), (United States Treasury PRF 2/15/2021@100), 5.750%, 2/15/2047 | |

| | Hudson Yards Infrastructure Corp. NY, Hudson Yards Senior Revenue Bonds (Series 2012A), 5.750%, 2/15/2047 | |

| | Metropolitan Transportation Authority, NY (MTA Transportation Revenue), Revenue Bonds (Series 2013C), 5.000%, 11/15/2042 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Metropolitan Transportation Authority, NY (MTA Transportation Revenue), Transportation Revenue Bonds (Series 2014B), 5.250%, 11/15/2039 | |

| | Metropolitan Transportation Authority, NY (MTA Transportation Revenue), Transportation Revenue Green Bonds (Series 2020C-1), 5.000%, 11/15/2050 | |

| | Metropolitan Transportation Authority, NY (MTA Transportation Revenue), Transportation Revenue Refunding Bonds (Series 2017B), 5.000%, 11/15/2024 | |

| | New York City, NY IDA (Yankee Stadium LLC), CPI PILOT Revenue Bonds (Series 2006) FRNs, (FGIC INS), 2.140% (US CPI Urban Consumers YoY NSA +0.820%), 3/1/2021 | |

| | New York City, NY Municipal Water Finance Authority, Water & Sewer System Second General Resolution Revenue Bonds (Fiscal 2015 Series EE), 5.000%, 6/15/2036 | |

| | New York City, NY Transitional Finance Authority, Future Tax Secured Subordinate Revenue Bonds (Series 2014A-1)), 5.000%, 8/1/2036 | |

| | New York City, NY, UT GO Bonds (Series 2018B-1), 5.000%, 10/1/2039 | |

| | New York Liberty Development Corporation (3 World Trade Center), Revenue Bonds (Series 2014 Class 1), 5.000%, 11/15/2044 | |

| | New York Liberty Development Corporation (4 World Trade Center), Liberty Revenue Bonds (Series 2011), 5.750%, 11/15/2051 | |

| | New York State Dormitory Authority (Columbia University), Revenue Bonds (Series 2018A), 5.000%, 10/1/2048 | |

| | New York State Dormitory Authority State Personal Income Tax Revenue (New York State Personal Income Tax Revenue Bond Fund), General Purpose Revenue Refunding Bonds (Series 2012A), 5.000%, 12/15/2028 | |

| | New York State Power Authority, Revenue Bonds (Series 2020A), 4.000%, 11/15/2050 | |

| | New York State Power Authority, Revenue Bonds (Series 2020A), 4.000%, 11/15/2055 | |

| | New York State Thruway Authority (New York State Thruway Authority—General Revenue), General Revenue Bonds (Series 2012I), (United States Treasury PRF 1/1/2022@100), 5.000%, 1/1/2037 | |

| | New York State Thruway Authority (New York State Thruway Authority—General Revenue), General Revenue Junior Indebtedness Obligations (Series 2019B), 4.000%, 1/1/2050 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | New York State Urban Development Corp. (New York State Personal Income Tax Revenue Bond Fund), State Personal Income Tax Revenue Bonds (Series 2017A), 5.000%, 3/15/2027 | |

| | Port Authority of New York and New Jersey, Revenue Bonds (194th Series ), 5.000%, 10/15/2041 | |

| | TFA State/School Building Aid (New York City, NY Transitional Finance Authority), Building Aid Revenue Bonds (Series 2019S-3A), 5.000%, 7/15/2032 | |

| | TSASC, Inc. NY, Tobacco Settlement Asset Backed Senior Refunding Bonds (Series 2017A), 5.000%, 6/1/2024 | |

| | | |

| | | |

| | Charlotte, NC (Charlotte, NC Douglas International Airport), Airport Revenue Bonds (Series 2017A), 5.000%, 7/1/2042 | |

| | Charlotte-Mecklenburg Hospital Authority, NC (Atrium Health (previously Carolinas HealthCare) System), Health Care Revenue & Refunding Revenue Bonds (Series 2012A), 5.000%, 1/15/2043 | |

| | North Carolina Municipal Power Agency No. 1, Refunding Revenue Bonds (Series 2015A), 5.000%, 1/1/2031 | |

| | North Carolina State Turnpike Authority, Triangle Expressway System Appropriation Revenue Refunding Bonds (Series 2018A), 4.000%, 1/1/2034 | |

| | | |

| | | |

| | Allen County, OH (Bon Secours Mercy Health), Hospital Facilities Revenue Bonds (Series 2020A), 4.000%, 12/1/2040 | |

| | Buckeye Tobacco Settlement Financing Authority, OH, Tobacco Settlement Asset-Backed Refunding Bonds (Series 2020B-2 Class 2), 5.000%, 6/1/2055 | |

| | Cuyahoga County, OH Hospital Authority (MetroHealth System), Hospital Revenue Bonds (Series 2017), (Original Issue Yield: 5.030%), 5.000%, 2/15/2057 | |

| | Hamilton County, OH (Life Enriching Communities), Healthcare Improvement and Refunding Revenue Bonds (Series 2016), 5.000%, 1/1/2051 | |

| | Lucas County, OH (ProMedica Healthcare Obligated Group), Revenue Bonds (Series 2011A), (Original Issue Yield: 6.220%), (United States Treasury PRF 11/15/2021@100), 6.000%, 11/15/2041 | |

| | Muskingum County, OH (Genesis Healthcare Corp.), Hospital Facilities Revenue Bonds (Series 2013), 5.000%, 2/15/2027 | |

| | Ohio State Higher Educational Facility Commission (Cleveland Clinic), Hospital Revenue Refunding Bonds (Series 2017A), 5.000%, 1/1/2033 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Ohio State Hospital Revenue (University Hospitals Health System, Inc.), Hospital Revenue Bonds (Series 2016A), 5.000%, 1/15/2041 | |

| | Ohio State Hospital Revenue (University Hospitals Health System, Inc.), Hospital Revenue Bonds (Series 2016A), 5.000%, 1/15/2046 | |

| | Ohio State Turnpike & Infrastructure Commission, Turnpike Junior Lien Revenue Bonds (Series 2013A-1), (Original Issue Yield: 5.050%), (United States Treasury PRF 2/15/2023@100), 5.000%, 2/15/2048 | |

| | Ohio State Turnpike & Infrastructure Commission, Turnpike Junior Lien Revenue Bonds (Series 2013A-1), 5.250%, 2/15/2030 | |

| | Ohio State, Capital Facilities Lease-Appropriation Bonds (Series 2016A), 5.000%, 2/1/2028 | |

| | Toledo-Lucas County, OH Port Authority (CSX Corp.), Revenue Bonds, 6.450%, 12/15/2021 | |

| | University of Cincinnati, OH, General Receipts Bonds (Series 2013C), (United States Treasury PRF 12/1/2023@100), 5.000%, 6/1/2039 | |

| | | |

| | | |

| | Oklahoma Development Finance Authority (OU Medicine), Hospital Revenue Bonds (Series 2018B), 5.500%, 8/15/2052 | |

| | Oklahoma Development Finance Authority (OU Medicine), Hospital Revenue Bonds (Series 2018B), 5.500%, 8/15/2057 | |

| | Tulsa, OK Industrial Authority (Montereau, Inc.), Senior Living Community Revenue Refunding Bonds (Series 2017), 5.250%, 11/15/2037 | |

| | | |

| | | |

| | Oregon State, UT GO State Project Bonds (Series 2017C), 5.000%, 6/1/2034 | |

| | | |

| | Allentown, PA Neighborhood Improvement Zone Development Authority, Tax Revenue Bonds (Series 2012A), 5.000%, 5/1/2042 | |

| | Commonwealth Financing Authority of PA (Commonwealth of Pennsylvania), Tobacco Master Settlement Payment Revenue Bonds (Series 2018), 5.000%, 6/1/2033 | |

| | Cumberland County, PA Municipal Authority (Diakon Lutheran Social Ministries), Revenue Bonds (Series 2015), 5.000%, 1/1/2038 | |

| | Cumberland County, PA Municipal Authority (Dickinson College), Revenue Bonds (Series 2016), 5.000%, 5/1/2029 | |

| | Delaware River Joint Toll Bridge Commission, Revenue Bonds (Series 2017), 5.000%, 7/1/2047 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Geisinger Authority, PA Health System, Health System Revenue Bonds (Series 2020A), 4.000%, 4/1/2050 | |

| | Lancaster County, PA Hospital Authority (University of Pennsylvania Health System), Revenue Refunding Bonds (Series 2016), 5.000%, 8/15/2042 | |

| | Northampton County, PA General Purpose Authority (St. Luke's University Health Network), Hospital Revenue Bonds (Series 2018A), (Original Issue Yield: 4.090%), 4.000%, 8/15/2048 | |

| | Pennsylvania State Higher Education Facilities Authority (Thomas Jefferson University), Fixed Rate Revenue Bonds (Series 2015A), 5.000%, 9/1/2045 | |

| | Pennsylvania State Higher Education Facilities Authority (University of Pennsylvania Health System), Revenue Bonds (Series 2017A), 5.000%, 8/15/2047 | |

| | Pennsylvania State Turnpike Commission, Oil Franchise Tax Senior Revenue Refunding Bonds (Series 2016A), 5.000%, 12/1/2031 | |

| | Pennsylvania State Turnpike Commission, Turnpike Revenue Bonds (Series 2015B), 5.000%, 12/1/2045 | |

| | Philadelphia, PA Authority for Industrial Development (PresbyHomes Germantown/Morrisville), Senior Living Revenue Bonds (Series 2005A), 5.625%, 7/1/2035 | |

| | | |

| | | |

| | Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Bonds (Series 2019A), (Original Issue Yield: 5.154%), 5.000%, 7/1/2058 | |

| | Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Bonds (Series 2019A-1), 4.750%, 7/1/2053 | |

| | Puerto Rico Sales Tax Financing Corp., Restructured Sales Tax Bonds (Series 2019A-2), 4.784%, 7/1/2058 | |

| | | |

| | | |

| | Tobacco Settlement Financing Corp., RI, Tobacco Settlement Asset-Backed Bonds (Series 2015B), 5.000%, 6/1/2050 | |

| | | |

| | South Carolina Jobs-EDA (Prisma Health Obligated Group), Hospital Revenue Bonds (Series 2018A), 5.000%, 5/1/2048 | |

| | South Carolina Public Service Company (Santee Cooper), Revenue Refunding and Improvement Bonds (Series 2020A), 4.000%, 12/1/2040 | |

| | | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Educational Enhancement Funding Corp., SD, Tobacco Settlement Revenue Bonds (Series 2013B), 5.000%, 6/1/2023 | |

| | | |

| | Greenville, TN Health and Educational Facilities Board (Ballad Health), Hospital Revenue Bonds (Series 2018A), 4.000%, 7/1/2040 | |

| | Metropolitan Government Nashville & Davidson County, TN, GO Improvement Bonds (Series 2018), 5.000%, 7/1/2031 | |

| | Metropolitan Nashville Tennessee Airport Authority, Subordinate Airport Revenue Bonds (Series 2019A), 5.000%, 7/1/2054 | |

| | Rutherford County, TN Health and Educational Facilities Board (Ascension Health Alliance Senior Credit Group), Revenue Bonds (Series 2012C), (United States Treasury PRF 11/15/2021@100), 5.000%, 11/15/2047 | |

| | Tennessee Energy Acquisition Corp., Gas Revenue Bonds (Series 2006A), (Goldman Sachs Group, Inc. GTD), 5.250%, 9/1/2023 | |

| | Tennessee State School Board Authority, Higher Educational Facilities Second Program Bonds (Series 2013A), 5.000%, 11/1/2029 | |

| | | |

| | | |

| | Central Texas Regional Mobility Authority, Senior Lien Revenue Bonds (Series 2011), (Original Issue Yield: 6.300%), (United States Treasury PRF 1/1/2021@100), 6.250%, 1/1/2046 | |

| | Clifton Higher Education Finance Corporation, TX (Idea Public Schools ), 6.000%, 8/15/2033 | |

| | Clifton Higher Education Finance Corporation, TX (Idea Public Schools ), Education Revenue Bonds (Series 2012), 5.000%, 8/15/2042 | |

| | Clifton Higher Education Finance Corporation, TX (Uplift Education), Revenue Bonds (Series 2015A), 5.000%, 12/1/2035 | |

| | Corpus Christi, TX Utility System, Junior Lien Revenue Improvement Bonds (Series 2015A), 5.000%, 7/15/2040 | |

| | Dallas, TX Waterworks & Sewer System, Revenue Refunding Bonds (Series 2013), (United States Treasury PRF 10/1/2023@100), 5.000%, 10/1/2031 | |

| | Dallas-Fort Worth, TX International Airport, Joint Revenue Refunding Bonds (Series 2012B), 5.000%, 11/1/2035 | |

| | Decatur, TX Hospital Authority (Wise Regional Health System), Hospital Revenue Bonds (Series 2014A), (Original Issue Yield: 5.300%), 5.250%, 9/1/2044 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Grand Parkway Transportation Corp., TX, Subordinate Tier Toll Revenue Bonds (Series 2013B TELA Supported), (United States Treasury PRF 10/1/2023@100), 5.250%, 10/1/2051 | |

| | Harris County, TX Education Facilities Finance Corp. (Brazos Presbyterian Homes, Inc.), First Mortgage Revenue Bonds (Series 2016), 5.000%, 1/1/2048 | |

| | Houston, TX Combined Utility System, First Lien Revenue & Refunding Bonds (Series 2014D), 5.000%, 11/15/2044 | |

| | Houston, TX Higher Education Finance Corp. (Cosmos Foundation, Inc. ), Education Revenue Bonds (Series 2011A), (United States Treasury PRF 5/15/2021@100), 6.875%, 5/15/2041 | |

| | Leander, TX Independent School District, UT GO Refunding Bonds (Series 2013A), (Texas Permanent School Fund Guarantee Program GTD), 5.000%, 8/15/2031 | |

| | Leander, TX Independent School District, UT GO Refunding Bonds (Series 2013A), (United States Treasury PRF 8/15/2023@100), 5.000%, 8/15/2031 | |

| | Lower Colorado River Authority, TX (LCRA Transmission Services Corp.), Transmission Contract Refunding Revenue Bonds (Series 2020A), 5.000%, 5/15/2050 | |

| | New Hope Cultural Education Facilities Finance Corporation (MRC Crestview), Retirement Facility Revenue Bonds (Series 2016), 5.000%, 11/15/2036 | |

| | New Hope Cultural Education Facilities Finance Corporation (MRC Crestview), Retirement Facility Revenue Bonds (Series 2016), 5.000%, 11/15/2046 | |

| | New Hope Cultural Education Facilities Finance Corporation (MRC Langford), Retirement Facility Revenue Bonds (Series 2016A), 5.500%, 11/15/2046 | |

| | North Texas Tollway Authority, First Tier Revenue Refunding Bonds (Series 2011B), (Original Issue Yield: 5.120%), (United States Treasury PRF 1/1/2021@100), 5.000%, 1/1/2038 | |

| | North Texas Tollway Authority, First Tier Revenue Refunding Bonds (Series 2015B), 5.000%, 1/1/2045 | |

| | North Texas Tollway Authority, Second Tier Revenue Refunding Bonds (Series 2014B), 5.000%, 1/1/2031 | |

| | Red River, TX HFDC (MRC The Crossings), Retirement Facility Revenue Bonds (Series 2014A), (Original Issue Yield: 7.550%), 7.500%, 11/15/2034 | |

| | San Antonio, TX Electric & Gas System, Revenue Bonds (New Series 2015), 5.000%, 2/1/2032 | |

| | San Antonio, TX Electric & Gas System, Revenue Refunding Bonds (New Series 2015), 5.000%, 2/1/2027 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Spring, TX Independent School District, Unlimited Tax School Building Bonds (Series 2019), (Texas Permanent School Fund Guarantee Program GTD), 4.000%, 8/15/2043 | |

| | Tarrant County, TX Cultural Education Facilities Finance Corp. (Buckingham Senior Living Community), Retirement Facility Revenue Bonds (Series 2015A Fixed Rate Bonds), 5.500%, 11/15/2045 | |

| | Tarrant County, TX Cultural Education Facilities Finance Corp. (Buckner Senior Living-Ventana Project), Tax-Exempt Mandatory Paydown Securities 80 (Series 2017B-1), 5.625%, 11/15/2024 | |

| | Texas Municipal Gas Acquisition & Supply Corp. I, Gas Supply Senior Lien Revenue Bonds (Series 2006A), (Bank of America Corp. GTD), 5.250%, 12/15/2026 | |

| | Texas Private Activity Bonds Surface Transportation Corporation (LBJ Infrastructure Group LLC), Senior Lien Revenue Refunding Bonds I-635 Managed Lanes Project (Series 2020A), 4.000%, 12/31/2039 | |

| | Texas State Transportation Commission (Central Texas Turnpike System), First Tier Revenue Refunding Bonds (Series 2012-A), (United States Treasury PRF 8/15/2022@100), 5.000%, 8/15/2041 | |

| | Texas State Transportation Commission (State Highway 249 System), First Tier Toll Revenue Bonds (Series 2019A), 5.000%, 8/1/2057 | |

| | Texas Water Development Board (Texas State Water Implementation Revenue Fund), Revenue Bonds (Series 2017A), 4.000%, 10/15/2036 | |

| | | |

| | | |

| | Virginia College Building Authority, Revenue Bonds (Series 2018A), 5.000%, 9/1/2031 | |

| | Virginia Commonwealth Transportation Board (Virginia State), Transportation Capital Projects Revenue Refunding Bonds (Series 2017), 5.000%, 5/15/2026 | |

| | Virginia Small Business Financing Authority (Bon Secours Mercy Health), Hospital Facilities Revenue Bonds (Series 2020A), 4.000%, 12/1/2049 | |

| | | |

| | | |

| | Central Puget Sound, WA Regional Transit Authority, Sales Tax Improvement & Refunding Bonds (Series 2015S-1) (Green Bonds), 5.000%, 11/1/2029 | |

| | Energy Northwest, WA, Columbia Generating Station Electric Revenue Refunding Bonds (Series 2020A), 5.000%, 7/1/2039 | |

Annual Shareholder Report

| | | |

| | MUNICIPAL BONDS—continued | |

| | | |

| | Seattle, WA Municipal Light & Power, Improvement and Refunding Revenue Bonds (Series 2017C), 4.000%, 9/1/2040 | |

| | Seattle, WA Municipal Light & Power, Improvement Revenue Bonds (Series 2018A), 4.000%, 1/1/2031 | |

| | Tobacco Settlement Authority, WA, Tobacco Settlement Revenue Refunding Bonds (Series 2013), 5.250%, 6/1/2031 | |

| | Washington State Health Care Facilities Authority (CommonSpirit Health), Revenue Refunding Bonds (Series 2019A-1), 4.000%, 8/1/2044 | |

| | Washington State Housing Finance Commission (Presbyterian Retirement Communities Northwest), Revenue Bonds (Series 2016), 5.000%, 1/1/2031 | |

| | Washington State Housing Finance Commission (Rockwood Retirement Communities), Nonprofit Housing Revenue & Refunding Revenue Bonds (Series 2014A), (Original Issue Yield: 7.400%), 7.375%, 1/1/2044 | |

| | Washington State, UT GO Bonds (Series 2018C), 5.000%, 2/1/2036 | |

| | Washington State, UT GO Motor Vehicle Fuel Tax Bonds (Series 2019B), 5.000%, 6/1/2039 | |

| | | |

| | | |

| | Wisconsin Health & Educational Facilities Authority (Hospital Sisters Services, Inc.), Revenue Refunding Bonds (Series 2014A), 5.000%, 11/15/2029 | |

| | Wisconsin State, UT GO Bonds (Series 2018A), 4.000%, 5/1/2034 | |

| | | |

| | | |

| | Laramie County, WY (Cheyenne Regional Medical Center), Hospital Revenue Bonds (Series 2012), 5.000%, 5/1/2037 | |

| | TOTAL MUNICIPAL BONDS

(IDENTIFIED COST $765,806,206) | |

| | | |

| | Communication Services—3.5% | |

| | | |

| | | |

| | | |

| | | |

| | Verizon Communications, Inc. | |

| | | |

| | | |

Annual Shareholder Report

| | | |

| | | |

| | Consumer Discretionary—5.4% | |

| | | |

| | American Eagle Outfitters, Inc. | |

| | | |

| | | |

| | Dick’s Sporting Goods, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Wyndham Destinations, Inc. | |

| | | |

| | | |

| | Constellation Brands, Inc., Class A | |

| | | |

| | Mondelez International, Inc. | |

| | Philip Morris International, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Capital One Financial Corp. | |

| | Citizens Financial Group, Inc. | |

| | | |

| | Goldman Sachs Group, Inc. | |

| | | |

| | LPL Investment Holdings, Inc. | |

| | Reinsurance Group of America | |

Annual Shareholder Report

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Thermo Fisher Scientific, Inc. | |

| | | |

| | Zimmer Biomet Holdings, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | Honeywell International, Inc. | |

| | | |

| | Jacobs Engineering Group, Inc. | |

| | | |

| | Stanley Black & Decker, Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Information Technology—6.9% | |

| | Akamai Technologies, Inc. | |

| | | |

| | | |

| | | |

| | Fidelity National Information Services, Inc. | |

| | | |

Annual Shareholder Report

| | | |

| | | |

| | Information Technology—continued | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | American Electric Power Co., Inc. | |

| | American Water Works Co., Inc. | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | TOTAL COMMON STOCKS

(IDENTIFIED COST $492,818,826) | |

| | SHORT-TERM MUNICIPALS—0.2% | |

| | | |

| | Columbia, AL IDB PCRB (Alabama Power Co.), (Series C) Daily VRDNs, 0.160%, 11/2/2020 | |

| | Wilsonville, AL IDB (Alabama Power Co.), (Series D) (Gaston Plant) Daily VRDNs, 0.120%, 11/2/2020 | |

| | | |

| | | |

| | Allen County, OH (Bon Secours Mercy Health), (Series 2010C) Daily VRDNs, (BMO Harris Bank, N.A. LOC), 0.110%, 11/2/2020 | |

Annual Shareholder Report

| | | |

| | SHORT-TERM MUNICIPALS—continued | |

| | | |

| | Ohio State Higher Educational Facility Commission (Cleveland Clinic), (Series 2013B-2) Daily VRDNs, (Bank of New York Mellon, N.A. LIQ), 0.110%, 11/2/2020 | |

| | | |

| | | |

| | Philadelphia, PA Hospitals & Higher Education Facilities Authority (Children’s Hospital of Philadelphia), (Series 2002-B) Daily VRDNs, (Wells Fargo Bank, N.A. LIQ), 0.110%, 11/2/2020 | |

| | TOTAL SHORT-TERM MUNICIPALS

(IDENTIFIED COST $3,600,000) | |

| | TOTAL INVESTMENT IN SECURITIES—99.2%

(IDENTIFIED COST $1,262,225,032)5 | |

| | OTHER ASSETS AND LIABILITIES - NET—0.8%6 | |

| | | |

At October 31, 2020, the Fund had the following outstanding written option contract:

| | | | | |

| |

| | | | | |

(PREMIUMS RECEIVED $176,323) | |

At October 31, 2020, the Fund held no securities that are subject to the federal alternative minimum tax (AMT) (unaudited).

1

Denotes a restricted security that either: (a) cannot be offered for public sale without first being registered, or availing of an exemption from registration, under the Securities Act of 1933; or (b) is subject to a contractual restriction on public sales. At October 31, 2020, these restricted securities amounted to $19,843,736, which represented 1.4% of total net assets.

2

Non-income-producing security.

4

Current rate and current maturity or next reset date shown for floating rate notes and variable rate notes/demand instruments. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above.

5

The cost of investments for federal tax purposes amounts to $1,272,271,873.

6

Assets, other than investments in securities, less liabilities. See Statement of Assets and Liabilities.

Note: The categories of investments are shown as a percentage of total net assets at October 31, 2020.

Annual Shareholder Report

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

Level 1—quoted prices in active markets for identical securities.

Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.). Also includes securities valued at amortized cost.

Level 3—significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used, as of October 31, 2020, in valuing the Fund’s assets carried at fair value:

| | | | |

| | Level 2—

Other

Significant

Observable

Inputs | Level 3—

Significant

Unobservable

Inputs | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Other Financial Instrument: | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

TOTAL OTHER FINANCIAL INSTRUMENT | | | | |

Annual Shareholder Report

The following acronym(s) are used throughout this portfolio:

| |

| —Economic Development Authority |

| —Financial Guaranty Insurance Company |

| |

| |

| |

| —Health and Education Facilities Authority |

| —Health Facility Development Corporation |

| —Industrial Development Authority |

| —Industrial Development Bond |

| |

| |

| |

| |

| —Pollution Control Revenue |

| —Pollution Control Revenue Bonds |

| —Payment in Lieu of Taxes |

| |

| —Toll Equity Loan Agreement |

| —Transitional Finance Authority |

| |

| |

| |

| —Variable Rate Demand Notes |

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class A Shares

(For a Share Outstanding Throughout Each Period)

| | | | | |

Net Asset Value, Beginning of Period | | | | | |

Income From Investment Operations: | | | | | |

| | | | | |

Net realized and unrealized gain (loss) | | | | | |

TOTAL FROM INVESTMENT OPERATIONS | | | | | |

| | | | | |

Distributions from net investment income | | | | | |

Distributions from net realized gain | | | | | |

| | | | | |

Net Asset Value, End of Period | | | | | |

| | | | | |

Ratios to Average Net Assets: | | | | | |

| | | | | |

| | | | | |

Expense waiver/reimbursement5 | | | | | |

| | | | | |

Net assets, end of period (000 omitted) | | | | | |

| | | | | |

1

Per share number has been calculated using the average shares method.

2

Based on net asset value, which does not reflect the sales charge, redemption fee or contingent deferred sales charge, if applicable.

3

Amount does not reflect net expenses incurred by investment companies in which the Fund may invest.

4

The net expense ratio is calculated without reduction for expense offset arrangements. The net expense ratio is 1.00% for the years ended October 31, 2020, 2019 and 2018, respectively, after taking into account these expense reductions.

5

This expense decrease is reflected in both the net expense and net investment income ratios shown above. Amount does not reflect expense waiver/reimbursement recorded by investment companies in which the Fund may invest.

See Notes which are an integral part of the Financial Statements

Annual Shareholder Report

Financial Highlights–Class B Shares

(For a Share Outstanding Throughout Each Period)

| | | | | |

Net Asset Value, Beginning of Period | | | | | |