Flyers Energy Group, LLC and Subsidiaries

Condensed Consolidated Financial Statements (Unaudited)

For the nine months ended September 30, 2021

Flyers Energy Group, LLC and Subsidiaries

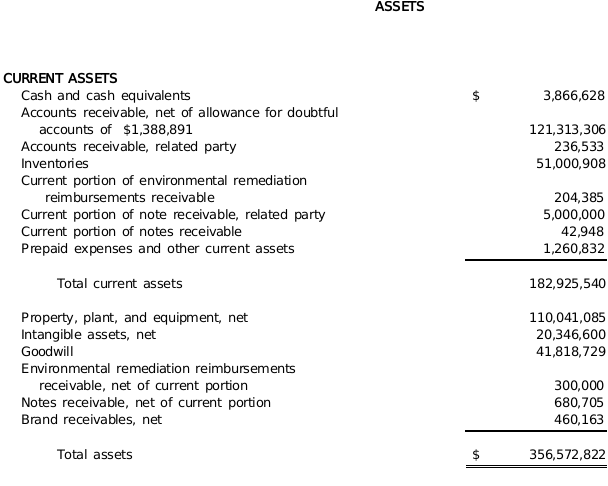

Condensed Consolidated Balance Sheet

September 30, 2021

(Unaudited)

| | |

| The accompanying notes are an integral part of the consolidated financial statements |

2

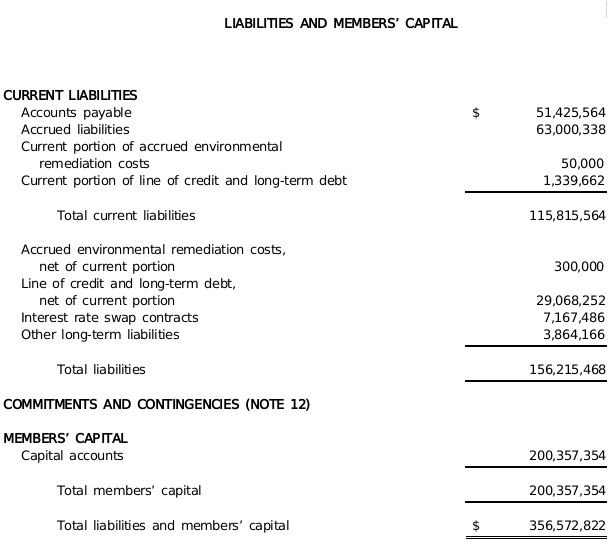

Flyers Energy Group, LLC and Subsidiaries

Condensed Consolidated Balance Sheet

September 30, 2021

(Unaudited)

| | |

| The accompanying notes are an integral part of the unaudited condensed consolidated financial statements |

3

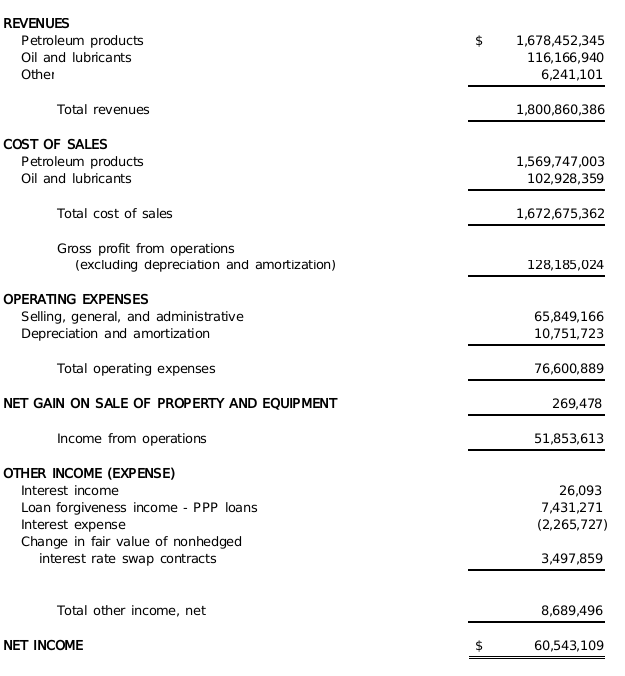

Flyers Energy Group, LLC and Subsidiaries

Condensed Consolidated Income Statement

Nine Months Ended September 30, 2021

(Unaudited)

| | |

| The accompanying notes are an integral part of the unaudited condensed consolidated financial statements |

4

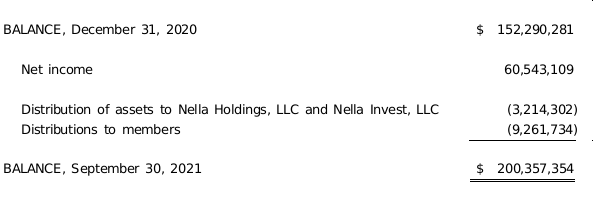

Flyers Energy Group, LLC and Subsidiaries

Condensed Consolidated Statement of Members’ Capital

Nine Months Ended September 30, 2021

(Unaudited)

| | |

| The accompanying notes are an integral part of the unaudited condensed consolidated financial statements |

5

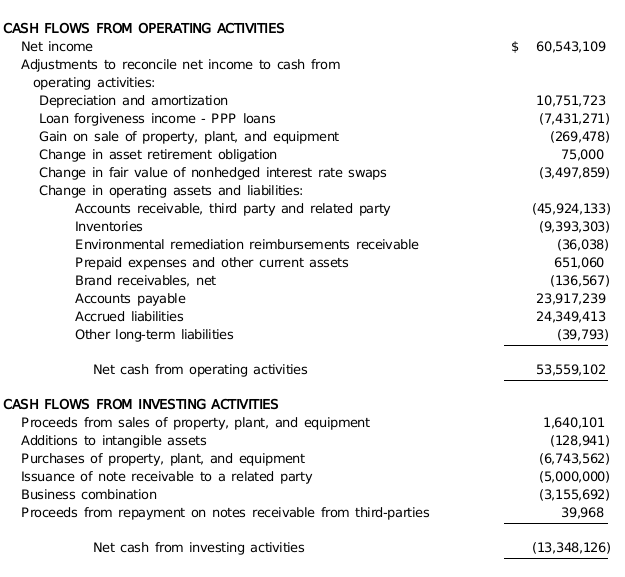

Flyers Energy Group, LLC and Subsidiaries

Condensed Consolidated Statement of Cash Flows

Nine Months Ended September 30, 2021

(Unaudited)

| | |

| The accompanying notes are an integral part of the unaudited condensed consolidated financial statements |

6

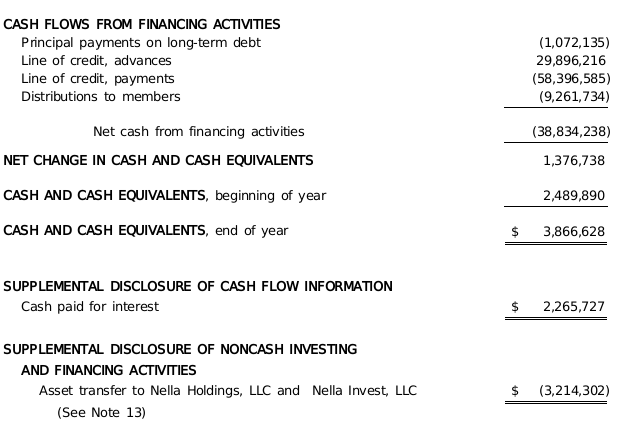

Flyers Energy Group, LLC and Subsidiaries

Condensed Consolidated Statement of Cash Flows

Nine Months Ended September 30, 2021

(Unaudited)

| | |

| The accompanying notes are an integral part of the unaudited condensed consolidated financial statements |

7

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of consolidation – The accompanying condensed consolidated financial statements include Flyers Energy Group, LLC and its wholly-owned subsidiaries (the “Company”) as follows:

•Flyers Energy Group, LLC, including its wholly-owned subsidiaries;

•Nella Properties, LLC;

•Flyers Energy, LLC;

•Flyers Transportation, LLC;

•Western Energetix, LLC;

•Caminol Management, LLC;

•Oly Services, LLC

Flyers Energy Group, LLC is wholly owned by the four members: David Dwelle Family, LP, Eclipse Investments LP, Speedy Investments, LP and TAD Family, LP (collectively referred to as the Members), each having equal ownership interest. The Members are owned by the family trusts of four individuals: David Dwelle, Stephen Dwelle, Walter Dwelle, and Thomas Dwelle (collectively referred to as the Principals).

The consolidation of the above entities is collectively referred to as “Flyers Energy Group, LLC” or the “Company.” Intercompany accounts and transactions have been eliminated in consolidation.

Principles of consolidation and investments - The condensed consolidated financial statements include the accounts of the Company and the accounts of subsidiaries under the Company’s control. All significant intercompany balances and transactions have been eliminated in consolidation. In accordance with ASC 810, the Company has analyzed the other related entities that the Principals are members of and determined that none are required to be consolidated into the Company’s year-end condensed financial statements. The decision of whether or not to consolidate an entity requires consideration of majority voting interests, as well as effective economic or other control over the entity. The consolidated financial statements are prepared in accordance with accounting standards generally accepted in the United States of America(“GAAP”).

Nature of operations – The Company is engaged in the operation of automated fueling stations and cardlock stations in 23 states, and delivery of bulk fuel and lubricants throughout California, Nevada, and Arizona. The Company has dealership agreements with branded gas stations for the supply of fuel and also supplies fuel to other jobbers from their inventory held at terminals. The Company has a transportation division, which hauls most of the fuel for the Company’s stations and dealers, as well as for third-parties.

Basis of presentation – The accompanying condensed consolidated financial statements have been prepared in accordance with GAAP for interim financial information. The unaudited interim condensed consolidated financial statements, which reflect all adjustments (consisting of normal recurring items or items discussed herein) that the Company believes necessary to fairly state results of its interim operations, should be read in conjunction with the notes to the consolidated financial statements included in the Company’s audited consolidated financial statements for the year ended December 31, 2020. Revenues, expenses, assets and liabilities can vary during each quarter of the year. Therefore, the results and trends in these interim financial statements may not be representative of those for the full year. All adjustments necessary for a fair statement of the condensed consolidated financial statements, which are normal and recurring in nature, have been made for the interim periods reported.

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

Cash, cash equivalents, and restricted cash – The Company considers all highly liquid instruments, with an original maturity of three months or less, to be cash equivalents. The Company had no restricted cash as of September 30, 2021.

Concentration of credit risk – Financial instruments that potentially subject the Company to concentration of credit risk consist principally of temporary cash investments. The Company has deposits that at times exceed federally insured amounts.

The Company uses its revolving line of credit to fund operations, as needed. The line of credit is subject to periodic renewal and has historically been renewed.

Accounts receivable and allowance for doubtful accounts – Accounts receivable are recorded at the invoiced amount, less estimated returns, allowances, and discounts. The allowance for doubtful accounts is the Company’s best estimate of the amount of probable credit losses in existing accounts receivable. The Company determines the allowance based on historical write-off experience. The Company reviews the allowance for doubtful accounts monthly and past due balances over 60 days are reviewed individually for collectability. Account balances are charged-off against the allowance when the Company believes it is probable the receivable will not be recovered. Bad debt expense was approximately $432,000 during the nine months ended September 30, 2021.

Brand agreements – Brand agreements represent amounts received by the Company from major oil companies for the branding of customer dealer locations while the Company concurrently enters into an advance and supply agreement with the customer dealer, who receives the benefit of branding their location. Pursuant to the terms of the agreements, the Company initially records a brand receivable from the dealer for advancements and a brand liability to the major oil companies for receipts, representing amounts due or payable under default, which amortize concurrently over the terms of the agreements. On occasion, the Company will provide additional advancements as an incentive to the customer dealer. Since the Company is effectively acting as an agent of the branding amounts between the major oil company and the dealer, they present these agreements on a net basis on the consolidated balance sheets. As of September 30, 2021 brand receivables were $11,803,040 and brand liabilities were $11,342,877.

Inventories – Petroleum inventories are stated at the lower of cost or net realizable value, using the average cost method, which approximates the first-in, first-out method. Net realizable value is based upon the estimated sales value less cost of distribution and selling costs.

Property, plant, and equipment – Property, plant, and equipment purchased by the Company are stated at cost, net of accumulated depreciation and amortization. All costs associated with major improvements are capitalized, and repairs and maintenance costs are expensed as incurred. Depreciation is computed using the straight-line method over the estimated useful lives of the asset, which range from 20 to 40 years for buildings and 5 to 10 years for equipment. Buildings and improvements that are constructed on leased land and property are amortized using the straight-line method over the shorter of the expected lease terms or their estimated useful lives. The cost and accumulated depreciation and amortization of items sold or retired are removed from the account and any resulting gain or loss is reflected in operations for the current year.

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

Definite-lived intangible assets – Definite-lived intangible assets are stated at cost, net of accumulated amortization. Definite-lived intangible assets are amortized, using the straight-line method, over their estimated useful lives ranging up to 20 years. When intangible assets are retired or otherwise disposed of, the cost and related accumulated amortization are removed from the accounts and any resulting gain or loss is reflected in operations for the year.

Long-lived assets – Long-lived assets consist primarily of buildings, equipment, and definite-lived intangible assets, which are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used is measured by comparison of the carrying amount of an asset to the future net undiscounted cash flows expected to be generated by the asset (before interest). If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amounts of the assets exceed the fair value of the assets. Assets to be disposed of are reported at the lower of the carrying amount or fair value less cost to sell. Fair value is based on appraisals or other reasonable methods, such as discounted cash flows, to estimate fair value. Management of the Company believes that no impairment exists for long-lived assets at September 30, 2021.

Goodwill – Goodwill represents the difference between the purchase price of an acquired business and the fair value of the identifiable tangible and intangible net assets acquired. Goodwill is assessed for impairment annually, or sooner if events or circumstances change that would more likely than not reduce the fair value of the reporting unit below its’ carrying amount. The Company has one reporting unit. In testing goodwill for impairment, management has the option first to perform a qualitative assessment to determine whether it is more likely than not that goodwill is impaired. A goodwill impairment loss is recognized to the extent the carrying amount of the Company, including goodwill, exceeds its fair value. Management of the Company believes that no impairment exists for goodwill at September 30, 2021.

Environmental remediation costs and reimbursements – Liabilities are recorded for environmental remediation activities when clean-up is probable and the cost can be reasonably estimated based on information obtained by independent environmental consultants and internal environmental staff. Remediation reserves are recorded on an undiscounted basis, are adjusted periodically based on updated information, and are impacted by a number of factors, including changes in technology, government policy, soil formation, and other items. Accordingly, it is at least reasonably possible that a change in estimate could occur.

The receivable for remediation cost reimbursements represents amounts estimated to be recoverable from a state of California program to fund underground storage tank clean-up costs and are recorded at management’s estimate of the amount to be received on claims filed and to be filed. Such estimates could change based on the state’s review of claims filed or to be filed.

Legal costs – The Company accrues cost of settlement, damages, and, under certain conditions, the costs of defense when such costs are probable and estimable.

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

Asset retirement obligations – The Company records the fair value of a legal liability for an asset retirement obligation (ARO) in the year in which it is incurred. The Company’s legal liabilities include removal of gasoline storage tanks at the Company’s cardlocks, and removal of solar panels installed at certain locations. When a new liability for AROs is recorded, the Company capitalizes the costs of the liability by increasing the carrying amount of the long-lived asset. The Company records AROs on a straight-line basis over the lease term under certain operating leases. The liability is accreted to its present value each period, and the capitalized cost is depreciated over the useful life of the related asset. At retirement, the Company settles the obligation for its recorded amount and may incur a gain or loss. As of September 30, 2021, asset retirement obligations were approximately $3,854,000, primarily included in other long-term liabilities on the condensed consolidated balance sheet.

Greenhouse gas emission program – The Company is required to report emissions and additional data based on volumes of different fuel products sold at terminals to calculate emissions allowance under a Cap-and-Trade program annually to the California Air Resources Board (CARB) under California Assembly Bill 32 (AB 32), whereby the Company is required to annually pay for allowances and offsets a minimum of 30% of the prior year’s applicable emissions over a three-year period. The Company purchases carbon credits at CARB administered auctions or on the open market to cover their calculated obligations under AB 32. The Company records a net asset or liability for the difference between their allowance and obligation at year end. At September 30, 2021, the Company maintained a net liability of $16,133,281 which is included as a component of accrued liabilities. For the nine months ended September 30, 2021, the Company incurred $24,930,657 of costs, which are included in cost of sales in the condensed consolidated income statement. For the nine months ended September 30, 2021, the Company purchased credits totaling $10,806,400.

Low carbon fuel standard program – The Company is required to report quarterly progress reports and annual compliance reports related to the Low Carbon Fuel Standard (LCFS) program to CARB under AB 32. Compliance with the regulation is demonstrated when the Company has possessed and retired a number of credits equal to its annual compliance obligation. The Company’s compliance obligation is determined when it supplies fuels or blend stocks with carbon intensity values above that of the program standard, effectively generating a deficit. These deficits represent the Company’s compliance obligation which must be satisfied with corresponding credits. Credits are generated when the Company supplies fuels or blend stocks with carbon intensity values below that of the program standard. Regulated parties also have the option to purchase credits from other regulated parties through the LCFS Clearance Market. Once banked, credits may be retained indefinitely, retired to meet an AB 32 compliance obligation, or sold to other regulated parties. The Company has the option to carryback credits to meet the compliance of an immediate prior year.

The Company records a net asset or liability for the difference between their credits and deficits at year end. At September 30, 2021, the Company maintained a net liability of $18,632,745 which is included as a component of accrued liabilities. For the nine months ended September 30, 2021, the Company incurred $28,785,300 of costs, which are included in cost of sales in the condensed consolidated income statement. For the nine months ended September 30, 2021, the Company purchased credits totaling $23,645,042.

Excise taxes – Excise taxes assessed by governmental authorities and included as part of purchased inventory are presented on a gross basis. During 2021, the Company incurred approximately $128,000,000 of excise taxes, which are included in revenues and cost of sales in the consolidated income statement.

Sales taxes – Sales taxes are assessed by governmental authorities and excluded as part of purchased inventory. All sales taxes that remained unpaid as of September 30, 2021 are included within accrued liabilities in the consolidated balance sheet.

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

Income taxes – The Company is comprised of limited liability companies, and as such, is not subject to federal and state income taxes. The Members separately account for their pro-rata share of the Company’s items of income, deductions, losses, and credits. Therefore, no provision is made in the accompanying condensed consolidated financial statements for liabilities for federal, state, or local income taxes since such liabilities are the responsibility of the individual Members.

Accounting standards prescribe a recognition threshold and measurement process for accounting for uncertain tax positions and provide guidance on various related matters such as de-recognition, interest, penalties, and disclosures required. The Company does not have any entity level uncertain tax positions as of September 30, 2021.

Derivative instruments – The Company maintains a strategy that incorporates the use of derivative instruments to minimize significant fluctuations in earnings that are caused by interest rate and fuel price volatility. Derivative instruments that are used by the Company include interest rate and gas price swap contracts and fuel futures, forward and option contracts.

The Company hedges certain fuel inventories and future delivery purchase contracts using gas price swap contracts and futures, and forward and option contracts to manage risk from market fluctuations and to reduce price volatility of fuel market prices. During the nine months ended September 30, 2021, the Company did not utilize fuel derivatives and did not have any fuel related derivatives outstanding.

Interest rate swap contracts are reported at fair value. The Company documents its risk management strategy and hedge effectiveness at the inception of and during the term of the hedge. For instruments that are designated and qualify as cash flow hedges, the gains and losses on the effective portion of the hedges are included as a component of other comprehensive income and are subsequently reclassified into earnings when interest on the related debt is paid. At September 30, 2021, the Company did not have any interest rate swaps designated as cash flow hedges. The Company’s interest rate risk management strategy is to stabilize cash flow requirements by maintaining interest rate swap contracts to convert variable-rate debt to a fixed-rate. The change in fair value of interest rate swap contracts that do not qualify as cash flow hedges are recognized in other nonoperating income on the consolidated income statement.

Fair value of financial instruments – The Company applies the fair value measurement accounting standard whenever other accounting pronouncements require or permit fair value measurements. Fair value is defined in the accounting standard as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The fair value hierarchy under current accounting guidance prioritizes the inputs to valuation techniques used to measure fair value into three broad levels (Level 1, Level 2, and Level 3). Level 1 inputs are unadjusted quoted prices in active markets (as defined) for identical assets or liabilities that the Company has the ability to access at the measurement date. Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. Level 3 inputs are unobservable inputs for the asset or liability and reflect the Company’s own assumptions about the assumptions that market participants would use in pricing the asset or liability (including assumptions about risk) in a principal market.

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

The fair value of the interest rate swap contracts is estimated using a discounted cash flow analysis that considers the expected future cash flows of each interest rate swap, taking into account current interest rates and the current creditworthiness of the swap counterparties. The fair value of the interest rate swap contracts was determined using Level 2 inputs. The fair value of fuel futures is generally based on quoted prices using Level 1 inputs.

The carrying amount of cash and cash equivalents, restricted cash, accounts receivable, notes receivable, and accounts payable approximate fair value because of the short maturity or immaterial nature of those instruments. The fair value of the line of credit and long-term debt are estimated based on the current variable rate of debt or borrowing rates for similar issues, which approximates carrying amounts. It is not practical to estimate the fair value of the note receivable with a related party.

Accounting estimates – The preparation of condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of consolidated assets and liabilities and disclosures of contingent assets and liabilities at the date of the condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting years. Actual results could differ from those estimates.

Recent accounting pronouncements (Accounting standards issued but not yet adopted)

Leases (Topic 842) – In February 2016, Accounting Standards Update (ASU) 2016-02 was issued. The primary objective of the new standard, which amends the existing lease guidance and adds additional disclosures, is to increase transparency and comparability among organizations by recognizing all lease assets and lease liabilities on the balance sheet, including operating leases that under the current standard are off-balance sheet.

For non-public business entities, ASU 2016-02 is effective for fiscal years beginning after December 15, 2021 and early adoption is permitted. The Company will adopt ASU 2016-02 in 2022 utilizing the modified retrospective transition method and applying the transition provisions at the effective date. The Company is planning the implementation of the new standard using the package of practical expedients under the transition provision that allows the Company not to reassess whether a contract contains a lease, how the lease is classified and if initial direct costs can be capitalized. The Company does not plan to elect the practical expedient that allows using hindsight when determining the lease term. Also, from a lessee point of view, and for most of the new class of assets defined by the Company, the Company plans to elect an accounting policy that allows aggregation of non-lease components with the related lease components when evaluating accounting treatment. Lastly, the Company is planning to elect the accounting policy that permits to not recognize the lease asset and related lease liability for leases with a lease term of 12 months or leases since commencement date.

The main impact expected as of the effective date is the recognition of the right-of-use asset and the related liability in the financial statements for all those contracts that contain a lease. The Company is still in the process of assessing the lease contracts to determine the inputs that are a key element to measure the right to use asset and related liabilities. Subsequent to adoption, the Company does not anticipate the impact on its results and cash flows to be material.

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

Financial Instruments-Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments. In June 2016, ASU 2016-13 was issued, which replaces the incurred loss impairment model in current GAAP with a model that reflects expected credit losses over the lifetime of the asset and requires consideration of a broader range of reasonable and supportable information to determine credit loss estimates. For non-public business entities, ASU 2016-13 is effective for fiscal years beginning after December 15, 2022 (including interim periods within those fiscal years) and early adoption is permitted. The Company will adopt ASU 2016-13, including the related codification amendments, as of January 1, 2023 utilizing the modified retrospective transition method. The Company is currently evaluating the impacts of this ASU, but it is not expected to have a material impact on the Company’s condensed consolidated financial statements and disclosures.

Revenue recognition – The Company principally generates all revenue from contracts with customers from sales and shipment of petroleum fuel products and oil and lubricants to the Company’s customers. Revenue is recognized at a point in time when the Company satisfies a performance obligation by transferring control of the products to a customer. Transfer of control occurs upon the shipment of goods to a customer, at which point title to inventory passes to the customer. The Company does not have any significant financing components as payment is received at or shortly after the point of sale in accordance with customary payment terms.

The nature of the contracts with customers gives rise to certain types of variable consideration which principally includes returns for the purchase of oil and lubricants and volume discounts, for the supply of petroleum fuel products, of which can decrease the transaction price. However, returns are insignificant and volume discounts principally result in a decreased sales price on future purchases once purchasing commitment thresholds are met, as defined in the contracts. Consequently, volume discounts are appropriately accounted for as a component of the purchase price. Sales return amounts are generally credited to the customer. The Company estimates variable consideration as the most likely amount that the Company is entitled to from the sale.

Sales taxes assessed by a governmental authority that are both imposed on and concurrent with a specific revenue-producing transaction, that are collected by the Company from a customer, are excluded from revenue. However, excise taxes assessed by governmental authorities and imposed during the inventory procurement process are presented on a gross basis and are included in revenues and cost of sales.

Amounts billed to customers related to shipping and handling are classified as revenue, and the costs associated with outbound freight after control of a product has transferred to a customer are accounted for as fulfillment costs and are included in cost of sales.

Subsequent events – Subsequent events are events or transactions that occur after the condensed consolidated balance sheet date, but before condensed consolidated financial statements are available to be issued. The Company recognizes in the condensed consolidated financial statements the effects of all subsequent events that provide additional evidence about conditions that existed at the date of the condensed consolidated balance sheet, including the estimates inherent in the process of preparing the condensed consolidated financial statements. The Company’s condensed consolidated financial statements do not recognize subsequent events that provide evidence about conditions that did not exist at the date of the condensed consolidated balance sheet, but arose after the condensed consolidated balance sheet date and before condensed consolidated financial statements were available to be issued. The Company has evaluated subsequent events through March 18, 2022, which is the date the condensed consolidated financial statements were available to be issued as approved by management (See Note 14).

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

COVID-19 – The ongoing coronavirus (COVID-19) pandemic and efforts to control its spread have resulted in reduced demand for fuel and other related products and services, negatively impacting the Company’s results of operations beginning in 2020, which has improved significantly throughout 2021 and to the present. As of September 30, 2021, the Company’s volume and operating results have improved to near pre Covid levels. The Company is continuing to assess the ongoing effects of the pandemic and its variants on operations, but given the uncertainty about the situation, an estimate of the impact to the condensed consolidated financial statements cannot be made at this time.

NOTE 2 – BUSINESS COMBINATION

Mansfield Energy Corporation (Mansfield) – In February 2021, the Company purchased five cardlock sites in Ohio from Mansfield for $3,155,692, for the purpose of expanding the Company’s operations in the Midwest. The transaction costs were immaterial and were expensed.

This transaction was accounted for under the acquisition method of accounting, whereby the identifiable assets acquired, and liabilities assumed are recorded at fair value and the activities are included in the consolidated operations of the Company as of the acquisition date.

NOTE 3 – INVENTORIES

Inventories consist of the following at September 30, 2021:

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

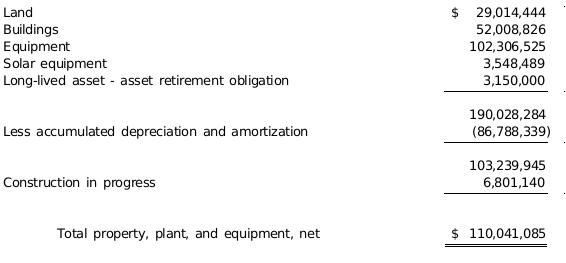

NOTE 4 – PROPERTY, PLANT, AND EQUIPMENT

Property, plant, and equipment consists of the following at September 30, 2021:

Depreciation expense totaled $8,033,750 for the nine months ended September 30, 2021.

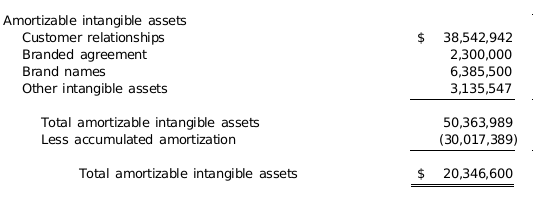

NOTE 5 – INTANGIBLE ASSETS

Intangible assets consist of the following at September 30, 2021:

Amortization expense totaled $2,717,973 for the nine months ended September 30, 2021.

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

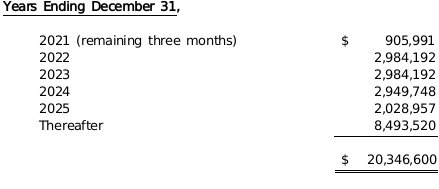

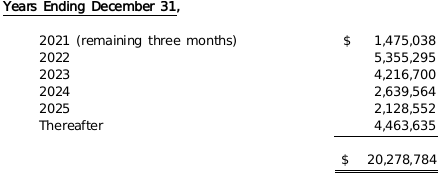

Estimated future amortization expense for intangible assets is as follows:

NOTE 6 – GOODWILL

Goodwill consists of the following at September 30,2021:

NOTE 7 – ENVIRONMENTAL REMEDIATION

The state of California created the Underground Storage Tank Cleanup Fund (USTCF) to reimburse California businesses for clean-up of gasoline contamination of soil and groundwater caused by leaking underground storage tanks. The estimated future clean-up costs for gasoline stations currently owned by the Company was $350,000 at September 30, 2021. These costs have been accrued by the Company as a liability based on management’s best estimate. At September 30, 2021, the related reimbursement receivable from the USTCF is estimated to be $504,385 and has been recorded based on reimbursable clean-up costs previously incurred and estimated future clean-up costs.

The Company expects to complete the remediation efforts and collect applicable reimbursements during 2022. Such estimates could change if actual costs for clean-up are different or if reimbursement is at a different proportion of claims filed and to be filed than the estimated reimbursement rate used by the Company.

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 8 – ACCRUED LIABILITIES

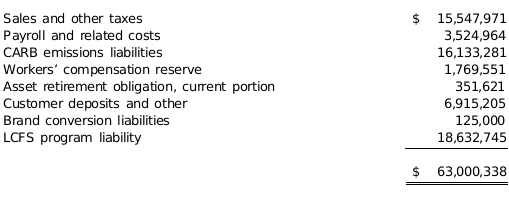

Accrued liabilities consist of the following at September 30:

NOTE 9 – REVOLVING LINE OF CREDIT AND LONG-TERM DEBT

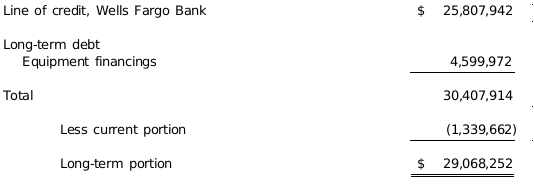

Revolving line of credit and long-term debt consist of the following at September 30:

Wells Fargo credit agreements – The Company maintains a credit agreement, as amended and restated in May 2020, with Wells Fargo Bank (the Wells Fargo Credit Agreement). The Wells Fargo Credit Agreement provides for a revolving line of credit (the Line) of up to $150,000,000.

The Line includes a provision with maximum borrowings being limited to a percentage of eligible accounts receivable and inventory. At September 30, 2021, the amount available on the Line was approximately $124,192,000. The Line bears interest at the daily Libor rate, plus 1.5%. The Company is required to pay a commitment fee of 0.25% on the unused amount of the Line. The Line has a maturity date in May 2024. On January 3, 2022, the line of credit was paid off. (See Note 14).

The line of credit is collateralized by substantially all the Company’s assets and subject to cross-default provisions with all other outstanding debt. There are various restrictive covenants under the agreement, including quarterly calculations of total leverage, fixed charge coverage ratios, and limitations on capital expenditures, distributions, and incurring additional debt. The Company believes it was not in violation of any debt covenants for the period ended September 30, 2021.

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

Paycheck Protection Program loans – During 2020, the Company received SBA Paycheck Protection Program (PPP) loans across multiple entities for a total of $7,431,271. The funds were used to retain workers, maintain payroll, interest payments, lease payments, and utility payments due to current economic uncertainty from the COVID-19 pandemic. As of September 30, 2021, the loans were forgiven in full and the debt forgiveness was recognized as other income.

Equipment financings – The Company’s equipment financings bear interest at rates ranging from 1.42% to 4.67%, with monthly principal payments ranging from $2,011 to $18,333 plus interest and maturing at dates from December 2021 to September 2025. The equipment financings are collateralized by certain equipment, as defined in the agreements, and guaranteed by the Company. In December of 2021, all of the equipment financing debt was paid off. (See Note 14).

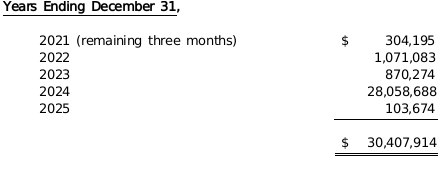

Future maturities of the Line and long-term debt are as follows as of September 30, 2021:

NOTE 10 – INTEREST RATE SWAP CONTRACTS

At September 30, 2021, the Company is party to two interest rate swap contracts with Wells Fargo Bank that involve the exchange of fixed interest rate payments at rates of 2.46% and 2.87% on notional amounts totaling $75,000,000. The notional amounts are reduced periodically in exchange for floating interest rate payments that equal the interest due under the mortgage and equipment loan. The notional amounts on the interest rate swaps are reduced consistent with the amortization of the principal balances for the debt. The net payments or receipts under the agreements are recognized as an adjustment to interest expense. These contracts expire in October 2024 and April 2028, respectively. The interest rate swap contracts liability was $7,167,486 at September 30, 2021.

The Company elected not to apply hedge accounting on the two interest rate swap contracts that expire in October 2024 and April 2028. Accordingly, the unrealized change in fair value of $3,497,859 has been recorded as a component of other income (expense) on the condensed consolidated income statement during 2021. The swap contracts were transferred to a related party in January of 2022. (See Note 14).

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

NOTE 11 – RETIREMENT PLAN

The Company has a profit-sharing retirement plan (the Retirement Plan) established under the provisions of Internal Revenue Service Code Section 401(k). Employees are eligible to make voluntary contributions to the Retirement Plan after qualifying service requirements are satisfied. Only those employees of Flyers Energy, LLC, Flyers Transportation, LLC, and Caminol Management, LLC are included in the Retirement Plan. There are no employees in Flyers Energy Group, LLC, Nella Properties, LLC, Western Energetix Terminals, LLC, and Oly Services, LLC. Matching contributions are at the discretion of the Company. The Company’s matching contributions were $1,319,850 for the nine months ended September 30, 2021.

While the Company expects to continue the Retirement Plan, it has reserved the right to modify, amend, or terminate the Retirement Plan. In the event of termination, the entire trust fund balance must be disbursed to the participants or their beneficiaries.

NOTE 12 – COMMITMENTS AND CONTINGENCIES

Contingencies – The Company is involved in various claims and legal actions arising in the ordinary course of business. In the opinion of management, the ultimate disposition of these matters will not have a material adverse effect on the Company’s consolidated financial position, results of operations, or liquidity.

Leases – The Company has various leases for facilities, which are classified as operating leases. Future minimum lease payments are subject to rent and property tax escalation clauses. The Company records any difference between the straight-line rent amounts payable under the leases as deferred rent, which is classified in other long-term liabilities on the consolidated balance sheets. As of September 30, 2021, deferred rent was $337,122.

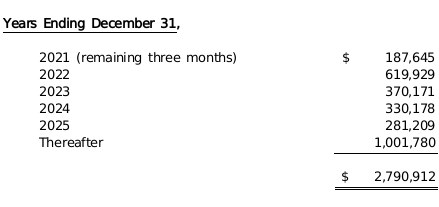

The noncancelable operating lease payments with initial or remaining terms of more than one year are as follows as of September 30, 2021:

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

Subleases – The Company leases and subleases portions of several properties. Future minimum rentals to be received on noncancellable leases and subleases as of September 30, 2021 are as follows:

Rent expense for the nine months ended September 30, 2021 totaled $4,583,867. Rent income from leases and subleases for the nine months ended September 30, 2021 totaled $669,605, which is included in other revenues on the condensed consolidated income statement.

Unbranded fuel purchase agreements – The Company has several contracts with major fuel suppliers to purchase unbranded fuel. The purchase price of the unbranded fuel is determined monthly by the Oil Price Information Service pipeline average. None of the commitments bear financial penalties in case of default by the Company.

Lubricants distributor agreement – The Company has a lubricants distributor agreement (the Distribution Agreement) with ExxonMobil Oil Corporation (ExxonMobil) to service customers within Nevada and California expiring June 30, 2029. Under the Distribution Agreement, the Company manages the distribution of a line of branded products and technical services within an assigned territory. Purchases totaled $100,711,971 for the nine months ended September 30, 2021.

NOTE 13 – RELATED PARTY TRANSACTIONS

Related parties include entities which have common ownership with the Company, including but not limited to Nella Holdings, LLC, Flyers Sustainable Energy, LLC, and Nella Invest, LLC.

The Company has an agreement with several related party entities in which certain advances are made to the related parties. These advances include expenses, dues and subscriptions, payroll and other administrative expenses. During the nine months ended September 30, 2021, the expenses advanced to related parties totaled $432,427. As of September 30, 2021, the Company has a receivable balance from the related parties of $236,533. This amount was paid off in December 2021. (See Note 14)

The Company has an agreement with Nella Invest, LLC whereby the Company makes certain advances in exchange for a note receivable. During the nine months ended September 30, 2021, the Company advanced $5,000,000 to Nella Invest, LLC which is shown on the balance sheet as a current note receivable at September 30, 2021. The note was paid in full in December 2021 (See Note 14).

Flyers Energy Group, LLC and Subsidiaries

Notes to Unaudited Condensed Consolidated Financial Statements

Certain property and equipment totaling $3,214,302 was transferred by the Company to related parties at net book value in the nine months ended September 30,2021. These amounts are recorded as a capital distribution in the condensed consolidated statement of members’ capital.

The Company purchased LCFS credits from related parties totaling $21,365,042 during the nine months ended September 30, 2021.

NOTE 14 – SUBSEQUENT EVENTS

Advances made to Nella Invest, LLC after September 30, 2021 totaled $18,056,530.

On October 28, 2021, the Company entered into an agreement to sell all of the outstanding membership interests in the Company to World Fuels Services, Inc (Buyer). The sale closed on January 3, 2022 for a total estimated consideration of $792.7 million, subject to customary adjustments relating to net working capital, indebtedness and transaction expenses. At closing, $642.7 million, inclusive of $19.7 million for estimated net working capital adjustments, was paid in cash and, at the election of the Buyer, $50 million was paid through the delivery of 1,768,034 shares of the Buyer’s parent company’s common stock at a price of $28.28 per share. The remaining $100 million was held back to satisfy potential indemnification and other obligations of the Company, with one-half to be released on the first and second anniversary of the closing of the sale, in each case subject to reduction in respect to amounts claimed under the purchase agreement.

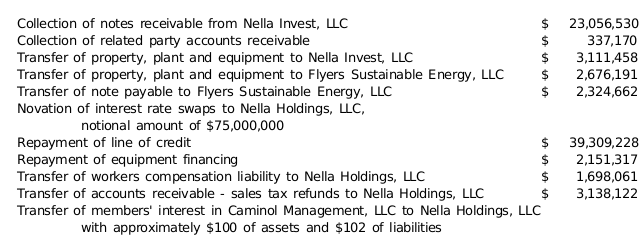

In accordance with the WFS agreement, the following transactions were completed prior to or as a part of the close on January 3, 2022: