UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the registrantx Filed by a party other than the registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Materials Pursuant to Rule 14a-12 |

RICA FOODS, INC.

(Name of Registrant as specified in its Charter)

RICA FOODS, INC.

(Name of Person(s) Filing Proxy Statement)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: Fee paid previously with preliminary materials. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

RICA FOODS, INC.

200 South Biscayne Boulevard, Suite 4530

Miami, FL 33131

January 31, 2005

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of Rica Foods, Inc. that will be held at the offices of Pipasa, S.A., the Company’s wholly owned operating subsidiary, which are located one kilometer west and 350 meters northwest from Intel, La Ribera de Belen, Heredia in Costa Rica. on March 4, 2005 at 12:00 noon EST, 11:00 A.M. local Costa Rican time. I look forward to greeting as many of our shareholders as possible.

Details of the business to be conducted at the annual meeting are given in the attached Notice of Annual Meeting and Proxy Statement.

Whether or not you attend the annual meeting it is important that your shares be represented and voted at the meeting. Therefore, I urge you to sign, date, and promptly return the enclosed proxy card in the enclosed postage-paid envelope. If you decide to attend the annual meeting, you will of course be able to vote in person, even if you have previously submitted your proxy card.

On behalf of the board of directors, I would like to express our appreciation for your continued interest in the affairs of the Company.

|

| Sincerely, |

|

| /s/ VICTOR OCONITRILLO |

| Victor Oconitrillo |

| President and Chairman of the Board |

RICA FOODS, INC.

200 South Biscayne Boulevard, Suite 4530

Miami, FL 33131

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MARCH 4, 2005

To the Shareholders of

Rica Foods, Inc.:

NOTICE IS HEREBY GIVEN that the 2005 Annual Meeting of Shareholders (the “Annual Meeting”) of Rica Foods, Inc., a Nevada corporation (the “Company”), will be held on March 4, 2005, at 12:00 noon EST, 11:00 a.m. local Costa Rican time, at the offices of Pipasa, S.A., the Company’s wholly owned operating subsidiary, which are located one kilometer west and 350 meters northwest from Intel, La Ribera de Belen, Heredia in Costa Rica, for the following purposes:

| | • | | To elect eight members of the Company’s Board of Directors to hold office until the next Annual Meeting of Shareholders or until their successors are duly elected and qualified; |

| | • | | To consider and vote upon a proposal to approve of and ratify the selection of Stonefield Josephson, Inc. as the Company’s independent auditors for the fiscal year ending September 30, 2004; and |

| | • | | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

All shareholders are cordially invited to attend; however, only shareholders of record at the close of business on Wednesday January 26, 2005 are entitled to vote at the Annual Meeting or any adjournments thereof.

|

By Order of the Board of Directors, |

|

| /s/ Alfonso Gutierrez |

| ALFONSO GUTIERREZ |

| SECRETARY |

Miami, Florida

January 31, 2005

THIS IS AN IMPORTANT MEETING AND ALL SHAREHOLDERS ARE INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE COMPLETE, SIGN AND DATE THE ENCLOSED PROXY CARD AND RETURN IT PROMPTLY IN THE ENCLOSED RETURN ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. SHAREHOLDERS WHO EXECUTE A PROXY CARD MAY NEVERTHELESS ATTEND THE MEETING, REVOKE THEIR PROXY AND VOTE THEIR SHARES IN PERSON.

2005 ANNUAL MEETING OF SHAREHOLDERS

OF

RICA FOODS, INC.

PROXY STATEMENT

March 4, 2005, 12:00 noon EST, 11:00 A.M. local Costa Rican time

Offices of Pipasa, S.A.

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Rica Foods, Inc., a Nevada corporation (the “Company”), of proxies from the holders of the Company’s common stock, par value $.001 per share (the “Common Stock”), for use at the 2005 Annual Meeting of Shareholders of the Company to be held at the offices of Pipasa, S.A., the Company’s wholly owned operating subsidiary, which are located one kilometer west and 350 meters northwest from Intel, La Ribera de Belen, Heredia in Costa Rica on March 4, 2005, at 12:00 noon EST, 11:00 A.M. local Costa Rican time or at any adjournment(s) or postponement(s) thereof (the “Annual Meeting”), pursuant to the foregoing Notice of Annual Meeting of Shareholders.

The approximate date that this Proxy Statement and the enclosed form of proxy are first being sent to shareholders is January 31, 2005. Shareholders should review the information provided herein in conjunction with the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2004, which accompanies this Proxy Statement. The complete mailing address, including zip code, of the Company’s principal executive offices is 200 South Biscayne Boulevard, Suite 4530, Miami, FL 33131 and its telephone number is (305) 858-9480.

PURPOSES OF THE MEETING

At the Annual Meeting, the Company’s shareholders will consider and vote upon the following matters:

1. The election of eight members to the Company’s Board of Directors to serve until the next Annual Meeting of Shareholders of the Company’s or until their successors are duly elected and qualified;

2. To consider and vote upon a proposal to approve of and ratify the selection of Stonefield Josephson, Inc. as the Company’s independent auditors for the fiscal year ended September 30, 2004; and

3. Such other business as may properly come before the Annual Meeting, including any adjournments or postponements thereof.

Unless contrary instructions are indicated on the enclosed proxy, all shares represented by valid proxies received pursuant to this solicitation (and which have not been revoked in accordance with the procedures set forth above) will be voted: (1)FORthe election of the eight nominees for director named below; and (2)FORthe approval of and ratification of Stonefield Josephson, Inc. as the Company’s independent auditors for the fiscal year ending September 30, 2004.

In the event a shareholder specifies a different choice by means of the enclosed proxy, his shares will be voted in accordance with the specification so made. The Board does not know of any other matters that may be brought before the Annual Meeting nor does it foresee or have reason to believe that proxy holders will have to vote for substitute or alternate director nominees. In the event that any other matter should come before the Annual Meeting or any director nominee is not available for election, the persons named in the enclosed proxy will have discretionary authority to vote all proxies not marked to the contrary with respect to such matters, in accordance with their best judgment.

GENERAL INFORMATION ABOUT VOTING

Who can vote?

You can vote your shares of Common Stock if the Company’s records show that you owned the shares on January 26, 2005. A total of 12,864,321 shares of Common Stock can vote at the Annual Meeting. You get one vote for each share of Common Stock. The enclosed proxy card shows the number of shares you can vote.

How do I vote by proxy?

Follow the instructions on the enclosed proxy card to vote on each proposal to be considered at the Annual Meeting. Sign and date the proxy card and mail it back to the Company in the enclosed envelope. The proxyholders named on the proxy card will vote your shares as such shareholder instructs. If you sign and return the proxy card but do not vote on a proposal, the proxyholders will vote for you on that proposal. Unless you instruct otherwise, the proxyholders will vote for each of the seven director nominees and in favor of all of the other proposals to be considered at the Annual Meeting.

When was this proxy statement sent to shareholders?

This proxy statement was first mailed on approximately January 31, 2005 to the Company’s shareholders of record as of January 26, 2005, the record date for voting at the Annual Meeting.

What if other matters come up at the Annual Meeting?

The matters described in this proxy statement are the only matters the Company knows will be voted on at the Annual Meeting. If other matters are properly presented at the meeting, the proxyholders will vote your shares as they see fit.

Can I change my vote after I return my proxy card?

Yes. At any time before the vote on a proposal, you can change your vote either by giving the Company’s secretary a written notice revoking your proxy card or by signing, dating, and returning to the Company a new proxy card. The Company will honor the proxy card with the latest date.

Can I vote in person at the Annual Meeting rather than by completing the proxy card?

Although the Company encourages you to complete and return the proxy card to ensure that your vote is counted, you can attend the Annual Meeting and vote your shares in person.

What do I do if my shares are held in “street name”?

If your shares are held in the name of your broker, a bank, or other nominee, that party should give you instructions for voting your shares.

How are votes counted?

The Company will hold the Annual Meeting if holders of one-third of the shares of Common Stock entitled to vote either sign and return their proxy cards or attend the meeting. If you sign and return your proxy card, your shares will be counted to determine whether the Company has a quorum even if you abstain or fail to vote on any of the proposals listed on the proxy card.

2

If your shares are held in the name of a nominee, and you do not tell the nominee by February 18, 2005 how to vote your shares (so-called “broker nonvotes”), the nominee can vote them as it sees fit only on matters that are determined to be routine, and not on any other proposal. Broker nonvotes will be counted as present to determine if a quorum exists but will not be counted as present and entitled to vote on any nonroutine proposal.

Who pays for this proxy solicitation?

The Company does. In addition to sending you these materials, the Company may engage a proxy solicitation firm to contact you directly by telephone, mail or in person. The Company will bear such costs, if any, which are not expected to exceed $5,000.

3

SHAREHOLDER PROPOSALS

Shareholder proposal for inclusion in the Proxy Statement for the Annual Meeting of Shareholders to be held in the year 2006 must be received at the principal executive offices of the Company on or before October 3, 2005. Shareholders interested in submitting a proposal for inclusion in the proxy materials for the Annual Meeting of Shareholders in 2006 may do so by following the procedures prescribed in SEC Rule 14a-8.

After the October 3, 2005 deadline, a Shareholder may present a proposal at our Annual Meeting of Shareholders in 2004 if it is submitted to our Secretary, but we are not obligated to present the matter in our proxy materials. If the proposal is submitted after October 3, 2005, the Company’s proxies will have discretionary authority to vote on such proposal.

In order for a shareholder to nominate a candidate for director, under the Company’s Bylaws timely notice of the nomination must be received by the Company in advance of the meeting. Ordinarily, such notice must be received not less than 90 nor more than 120 days before the first anniversary of the date of the Company’s proxy statement in connection with the last Annual Meeting of Shareholders, i.e., between November 2, 2005 and October 3, 2005 for the 2006 Annual Meeting. The shareholder filing the notice of nomination must include:

| | • | | As to the shareholder and the beneficial owner, if any, on whose behalf the nomination is made: |

| | • | | the name and address of such shareholder, as they appear on the Company’s stock transfer books; |

| | • | | the class and number of shares of capital stock of the Company which are owned beneficially and of record by such stockholder and such beneficial owner; |

| | • | | a representation that such shareholder is a shareholder of record and intends to appear in person or by proxy at such meeting to nominate the person or persons specified in the notice; and |

| | • | | a representation whether the stockholder or the beneficial owner, if any, intends or is part of a group which intends (a) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Company’s outstanding capital stock required to elect the nominee and/or (b) otherwise to solicit proxies from stockholders in support of such nomination. |

| | • | | As to each person whom the shareholder proposes to nominate for election as a director: |

| | • | | the name, age, business address and, if known, residence address of such person; |

| | • | | the principal occupation or employment of such person; |

| | • | | the class and number of shares of stock of the Company that are beneficially owned by such person; |

| | • | | any other information relating to such person that is required to be disclosed in solicitations of proxies for election of directors or is otherwise required by the rules and regulations of the Securities and Exchange Commission promulgated under the Exchange Act; and |

4

| | • | | the written consent of such person to be named in the proxy statement as a nominee and to serve as a director if elected. |

In order for a shareholder to bring other business before a shareholder meeting, timely notice must be received by the Company within the time limits described above. Such notice must include:

| | • | | the information described above with respect to the shareholder proposing such business; |

| | • | | a brief description of the business desired to be brought before the Annual Meeting of Shareholders, including the complete text of any resolutions to be presented at such meeting, and the reasons for conducting such business at the Annual Meeting of Shareholders; and |

| | • | | any material interest in such business of such stockholder and the beneficial owner, if any, on whose behalf the proposal is made. |

These requirements are separate from and in addition to the requirements a shareholder must meet to have a proposal included in the Company’s proxy statement.

In each case the notice must be given by personal delivery or by United States certified mail, postage prepaid, to Mauricio Marenco, the General Counsel of the Company, whose address is 200 South Biscayne Boulevard, Suite 4530, Miami, FL 33131. Any shareholder desiring a copy of the Company’s Bylaws will be furnished one without charge upon written request to the General Counsel. A copy of the Company’s Bylaws is filed as an exhibit to the Company’s Current Report on Form 8-K, as filed with the Commission on December 10, 2004, and is available at the Securities and Exchange Commission Internet website at www.sec.gov.

5

OUTSTANDING VOTING SECURITIES AND VOTING RIGHTS

The Board of Directors has set the close of business on Wednesday, January 26, 2005, as the record date (the “Record Date”) for determining shareholders of the Company entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 12,864,321 shares of Common Stock issued and outstanding, all of which are entitled to be voted at the Annual Meeting. Each share of Common Stock is entitled to one vote on each matter submitted to shareholders for approval at the Annual Meeting. Shareholders do not have the right to cumulate their votes for directors.

The Company’s Bylaws provide that the presence, in person or by proxy, of the holders of record of one-third of the outstanding shares of Common Stock entitled to vote at the Annual Meeting are necessary to constitute a quorum.

Pursuant to the Nevada General Corporation Law, directors (Proposal No. 1) will be elected by a plurality of the votes cast by the shares of Common Stock represented in person or by proxy at the Annual Meeting. Pursuant to the Company’s Bylaws, the affirmative vote of a majority of the outstanding shares of Common Stock represented in person or by proxy at the Annual Meeting is required to approve the ratification of auditors (Proposal No. 2).

Abstentions and broker non-votes are counted as present for purposes of determining the presence of a quorum. Abstentions are not counted as votes cast “for” or “against” the election of any director (Proposal No. 1).However, abstentions are treated as present and entitled to vote and thus have the effect of a vote against the ratification of auditors (proposal No. 2).A broker non-vote on a matter is considered not entitled to vote on that matter and this is not counted in determining whether a matter requiring approval of a majority of the shares present and entitled to vote has been approved or whether a plurality of the shares present and entitled to vote has been voted in favor of a proposal.

If less than one-third of the outstanding shares of Common Stock entitled to vote are represented at the meeting, a majority of the shares so represented may adjourn the meeting to another date, time or place, and notice need not be given for the new date, time or place, if the new date, time or place is announced at the meeting before an adjournment is taken. Prior to the Annual Meeting, the Company will select one or more inspectors of election for the meeting. Such inspectors shall determine the number of shares of Common Stock represented at the meeting, the existence of a quorum and the validity and effect of proxies and shall receive, count and tabulate ballots and votes and determine the results thereof.

A list of shareholders entitled to vote at the Annual Meeting will be available at the Company’s offices, 200 South Biscayne Boulevard, Suite 4530, Miami, FL 33131, for a period of ten days prior to the Annual Meeting and at the Annual Meeting itself, for examination by any shareholder.

CHANGE IN CONTROL

On December 22, 2003, Calixto Chaves (“Mr. Chaves”), Monica Chaves (“Ms. Chaves’), JP Chaves, Comercial Angui and certain other shareholders (the “Selling Shareholders”), sold (the “Stock Sale”) all 9,933,154 shares of the common stock held by the Selling Shareholders (the “Shares”), representing approximately 77.2% of the Company’s issued and outstanding shares of common stock, to Avicola Campesinos, Inc., a Nevada corporation (“Avicola”), for a cash purchase price of approximately U.S.$12.5 million.

The Company has been informed that Avicola is wholly owned by Tenedora G.S., S.A., a Costa Rican corporation (“Tenedora”).

The Company has also been informed that Mavipel, S.A., a Costa Rican corporation (“Mavipel”), Inversiones Harenaz L III, S.A. (“Harenaz”), a Costa Rican corporation, CYS Asesores de Mercadeo y Finanzas, S.A, a Costa Rican corporation (“CYS”), Sarita Trading, S.A., a Panamanian corporation

6

(“Sarita”), Corporacion Adral, S.A., Costa Rican corporation (“Adral”), Corporacion Aspila, S.A., a Costa Rican corporation (“Aspila”), Hoy por Hoy, S.A., a Costa Rican corporation (“Hoy”), Asociacion Solidarista de Empleados Grupo Sama y Afines, a Costa Rican labor entity (“ASEGSA”) and Quirinal, S.A. (“Quirinal”) are the holders of approximately 39.79%, 11.96%, 10.82%, 13.4%, 8.1%, 9.2%, 2.3%, 1.7%, and 2.8%, respectively of the outstanding common stock of Tenedora. Together, Mavipel, Harenaz, CYS, Sarita, Adral, Aspila, Hoy, ASEGSA and Quirinal may be deemed to control Tenedora.

The Company has also been informed that Elsie Roman, the wife of Victor Oconitrillo, is the holder of 100% of the outstanding common stock of Mavipel. Henry Zamora is the holder of 100% of the outstanding common stock of Harenaz. Rolando Cervantes is the holder of 100% of the outstanding common stock of CYS. Edgar Rodriguez is the holder of 100% of the outstanding common stock of Sarita. Oscar Arias is the holder of 100% of the outstanding common stock of Adral. Robert Aspinall is the holder of 100% of the outstanding common stock of Aspila. Oscar Hernandez is the holder of 100% of the outstanding common stock of Hoy. Alfonso Gutierrez is the holder of 100% of the outstanding common stock of Quirinal.

The Stock Sale was conditioned upon the approval of the Board of Directors of the Company, which was granted after the Board considered a number of factors, including the following:

| | • | | Approximately $6.9 million of the proceeds of the Stock Sale were used to satisfy Mr. Chaves’ existing indebtedness to the Company and approximately $1.95 million of the proceeds were used to settle certain litigation. |

| | • | | Mr. Chaves and Mr. Jorge Quesada have, at various times, personally guaranteed the Company’s repayment of various debts. As of the closing of the Stock Sale, Mr. Chaves and Mr. Quesada had outstanding personal guarantees with respect to approximately $27.9 million and $9.2 million of the Company’s indebtedness. The guarantees extended by Mr. Chaves and Mr. Quesada will remain in place notwithstanding the Stock Sale. In addition, Mr. Chaves has entered into an agreement with the Company whereby he has agreed to indemnify the Company from and against any losses or damages caused by his failure within the next year to provide, if requested, his personal guarantee with respect to any loan which he has previously guaranteed and the Company is seeking to defer repayment of. |

| | • | | Mr. Chaves has agreed to indemnify the Company from and against certain damages or losses that could directly or indirectly result from or in connection with the Stock Sale. |

Avicola conditioned the closing of the Stock Sale on the Company’s electing seven affiliates of Avicola to serve on the eight person board of directors of each of the Company’s subsidiaries and elected affiliates of Avicola to serve as the President, Vice President, Secretary, Treasurer and Controller of each subsidiary.

The Company has been informed that, in order to fund the purchase of the Shares, on December 15, 2003 (the “Effective Date”), Avicola entered into a financing agreement (the “Financing Agreement”) with Servicios Bursatiles Internacionales Sociedad Anonima (“SBI”), a Panamanian corporation pursuant to which SBI extended a loan to Avicola in the amount of approximately $12.5 million (the “Purchase Loan”). The entire Purchase Loan was used by Avicola to purchase the Shares.

Under the terms of the Financing Agreement, interest on the Purchase Loan will be payable annually, with the first payment due one year from the Effective Date, at the rate of prime plus four. The outstanding principal amount of the Purchase Loan plus any accrued but unpaid interest will be payable on December 15, 2008. As security for the Purchase Loan, Avicola has pledged the Shares to SBI pursuant to the terms of a stock pledge agreement. In addition, Tenedora has extended a guarantee with respect to the Purchase Loan.

7

ELECTION OF DIRECTORS

(Proposal No. 1)

The Company’s Board of Directors currently consists of eight members. Eight directors are to be elected at the Annual Meeting to hold office until the next Annual Meeting of Shareholders and until their successors are elected and qualified. It is intended that the accompanying proxy will be voted in favor of the following persons to serve as directors unless the shareholder indicates to the contrary on the proxy. Under Nevada law, the eight persons receiving the highest number of votes cast in his or her favor in person or by proxy at the Annual Meeting will be elected as directors of the Company. Management expects that each of the nominees will be available for election, but if any of them is not a candidate at the time the election occurs, it is intended that such proxy will be voted for the election of another nominee to be designated by the Board of Directors to fill any such vacancy. Each of the eight director nominees listed below has been approved by the Governance and Nominating Committee.

DIRECTORS

The directors and executive officers of the Company, their ages and present positions held in the Company, as of the date of this Proxy Statement, are as follows:

| | | | |

Name

| | Age

| | Position

|

| Mr. Victor Oconitrillo | | 46 | | Chairman of the Board, President and Director of the Company and President of the Board of Directors of Pipasa |

| | |

| Mr. Alfonso Gutierrez | | 55 | | Secretary and Director of the Company and Secretary of Pipasa |

| | |

| Mr. Eladio Villalta | | 72 | | Treasurer and Director of the Company and Treasurer of Pipasa |

| | |

| Dr. Carlos Ceciliano | | 70 | | Director of the Company and Supervisor of the Board of Director of Pipasa |

| | |

| Hon. Amb. Luis Lauredo | | 55 | | Director, Chairman of the Audit Committee |

| | |

| Mr. Grant “Jack” Peeples | | 73 | | Director |

| | |

| Mr. Manuel Escobar | | 55 | | Director |

| | |

| Mr. Alfred Smith, IV | | 52 | | Director |

| | |

| Mr. Pedro Dobles | | 52 | | Chief Executive Officer, Vice President of Pipasa |

| | |

| Ms. Gina Sequeira | | 34 | | Chief Financial Officer |

There are no family relationships among the Company’s officers and directors, nor are there any arrangements or understandings between any of the directors or officers of the Company or any other person pursuant to which any officer or director was or is to be selected as an officer or director.

Effective January 27, 2005, the Board of Directors of Rica Foods, Inc. (the “Company”) appointed Pedro Dobles as Chief Executive Officer of the Company following the resignation of Calixto Chaves effective January 26, 2005.

8

Mr. Victor Oconitrillo. Mr. Oconitrillo was appointed President and Chairman of the Board of Directors of the Company in August 2004. and was appointed as President of each of the Company’s Subsidiaries in December 2003. From 1994 until the present, Mr. Oconitrillo has served as the General Manager and as a director of Grupo Consolidado SAMA, S.A. (“SAMA”), a privately held financial advisory corporation, and certain of its privately held affiliated companies, including Inversiones Sama, S.A., Puesto de Bolsa, Sama Internacional (G.S.), S.A. and Sama Valores (G.S.), S.A. Mr. Oconitrillo received his Bachelor’s Degree in Sociology and his Masters in Business Administration with an emphasis in international business from the University of Costa Rica. Since 1982, Mr. Oconitrillo has also been accredited as a stock broker by the Bolsa Nacional de Valores, S.A, the Costa Rican stock exchange.

Mr. Alfonso Gutierrez. Mr. Gutierrez was appointed as a Director and Secretary of the of the Company in August 2004. He had previously been appointed as Secretary of the Company’s Subsidiaries in August 2003. From 1976 until the present, Mr. Gutierrez has worked as an attorney for a private law firm owned by him. Mr. Guiterrez has also served as President of SAMA’s Board of Directors from November 2002 until the present. Mr. Guiterrez received his Licenciatura in Law from the Universidad de Costa Rica and has engaged in post-graduate study in commercial law from the Instituto de Comercial y Comparado Lorenzo Moss.

Mr. Eladio Villalta. Mr. Villalta was appointed as a Director and Treasurer of the Company in August 2004. He had previously been appointed as the Treasurer of the Company’s Subsidiaries in August 2003. From 1988 until June 1993, Mr. Villalta worked as an Independent Accounting Advisor to Conferencia Episcopal. Mr. Villalta retired in June 1993, Mr. Villalta has served as a member of the Board of Directors of SAMA from April 2003 until the present. Mr. Villalta received his Licenciature in Business Administration with an emphasis in accounting from the Universidad de Costa Rica and has engaged in post-graduate study at the University CEARA de Brasil and the University of California in Los Angelas. Mr. Villalta is a Certified Public Accountant.

Mr. Carlos Ceciliano. Mr. Ceciliano was appointed as a member of the Board of Directors of the Company in August 2004. He had previously been appointed as the Supervisor of the Board of Directors of the Company’s Subsidiaries in December 2003. Prior to such appointment, Mr. Ceciliano served as the Vice President of the Board of Directors of the Company’s Subsidiaries from August 2003 until December 2003. From June 2002 until the present, Mr. Ceciliano has served as the President of Ceciliano Consultores, S.A., a business consulting firm which he owns and operates. From June 1974 until May 2002, Mr. Ceciliano was a partner in Ceciliano y Compania, a Costa Rican privately held accounting firm. Mr. Ceciliano has also served as the Supervisor of the Board of Directors of SAMA from 1976 until the present. Mr. Ceciliano received his Bachelor’s Degree in Economics and Social Science with an emphasis in business administration from the University of Costa Rica.

Honorable Ambassador Luis Lauredo. Mr. Lauredo has served as Director and a member of the Audit Committee of the Company since August 2001. In September 2004, Mr. Lauredo was appointed as Chairman of the Audit Committee. Mr. Lauredo also served as a director of the Company from August 1996 until December 1999, at which time he resigned to serve as the United States Ambassador to the Organization of American States. Mr. Lauredo served as Ambassador until June 2001. Mr. Lauredo previously served as the Chairman of the Audit Committee from August 1996 to July 2000. In July 2001, Mr. Lauredo became President of Hunton & Williams International, LLC, a wholly owned subsidiary (the “Subsidiary”) of the international law firm of Hunton & Williams LLP. Mr. Lauredo is and has served as a director of Colonial Bank of South Florida since October 2001. From 1995 to 1999, Mr. Lauredo was President of Greenberg Traurig Consulting, Inc., an affiliate of the international law firm, Greenberg Traurig, Hoffman, Lipoff, Rosen & Quentel. From 1994 to 1995, he was Executive Director of the Summit of the Americas. From 1992 to 1994, he was a Commissioner on the Florida Public Service Commission, as well as

9

Chairman of the International. Relations Committee of the National Association of Regulatory Utility Commissioners. In his career, Mr. Lauredo has held a number of positions in the banking industry, including Senior Vice President of the Export-Import Bank of the United States of America. He has represented the President of the United States as special U.S. Ambassador to the inaugurations of the Presidents of Colombia, Venezuela, Brazil, and Costa Rica. He also served as a founding Director of the Hispanic Council on Foreign Affairs (Washington, D.C.). Mr. Lauredo received his B.A. from Columbia University in New York City and has attended the University of Madrid in Spain and Georgetown University Law Center in Washington, D.C.

Mr. Grant “Jack” Peeples. Mr. Peeples has served as a Director and a member of the Audit Committee since August 2001. He served in the Korean War as an Airborne Infantry Officer and Rifle Company Commander. He was awarded Combat Infantryman Badge, Bronze Star for Valor and Purple Heart. He graduated from the University of Florida College of Law in 1957, joined the law firm of former Governor Leroy Collins in Tallahassee, Florida. Mr. Peeples was appointed as Legislative Counsel to Governor Collins in 1958 and appointed to the Governor’s Cabinet as State Beverage Director in 1959. Mr. Peeples returned to the private practice of law in 1961, specializing in legislative and administrative practice in Tallahassee, Florida; and became the founding partner of Peeples, Earl & Blank in 1970, specializing in environmental law and acting as Senior Trial Counsel in numerous landmark environmental and regulatory cases. Mr. Peeples retired from Peeples, Earl & Blank in 1994 and joined White & Case as Of Counsel. He served as Campaign Chairman and Chairman of the Transition Team for Governor Lawton Chiles as well as the Legislative and Senior Counsel to the Governor. Mr. Peeples has also served as the Vice-Chairman of the Governor’s Commission on Governance, the Vice-Chairman of Governor’s Commission on the Homeless, the Chairman of Florida Aviation Commission, the Co-Chairman of the Dade County Homeless Trust, a Board Member of the Florida Independent College Fund, a Member of the Board of Overseers, a member of the board of the University of Florida Medical School, and representative of the Governor and the Cabinet on the Downtown Development Authority. He has also served as General Counsel and as a member of the Board of Directors of Deltona Corporation, a NYSE company, as a member of the Board of Directors and Chairman of the Audit Committee of United Petroleum Group, a Hunt family company, and as Senior Counsel and a member of the Board of Directors of Senior Networks, Inc.

Mr. Manuel Escobar. Mr. Escobar was appointed as Audit Committee member on December 9, 2004. He has served, from March 2003 until the present, as the Vice President of Finance of Trimpot Electrónicas Ltda, a privately held company specializing in the manufacture of electronic components for the global markets. Prior to serving as the Vice President of Finance, from January 1980 until March 2003, Mr. Escobar served as the Plant Controller of Trimpot. From 1986 until 1996, Mr. Escobar also taught classes in managerial control, accounting and productions management, cost accounting, finance and general management at the Universidad Latina de Costa Rica and the Universidad UACA - Veritas. Mr. Escobar has received a degree in finance from Escuela Nacional de Comercio - El Salvador, a Licentiate Degree in Business Administration from Universidad Nacional - El Salvador, an MBA from National University - San Diego, California and a Licentiate Degree in Public Accounting from Univerisidad Interamericana - San Jose, Costa Rica.

Mr. Alfred E. Smith, IV. Mr. Smith has been a member of the Board of Directors of the Company since June, 1994. Mr. Smith has been the Managing Partner of the Wall Street firm of Bear Wagner since April, 2001 and was the Managing Director of Hunter Specialists, LLC, New York, from January 1997 to April, 2001. From 1979 to 1996, he was with CMJ Partners, a New York Stock Exchange member firm. Mr. Smith is the Chairman of the Government Relations Committee of the New York Stock Exchange, Director and Secretary of the Alfred Emanuel Smith Memorial Foundation, Chairman of the Cardinal’s Committee for the Laity-Wall Street Division since 1985, Founder and Chairman of Hackers for Hope since 1989, Director of the Center for Hope since 1989, a Director at the Catholic Youth Organization until 1997, member of the President’s Council of Memorial Sloan Kettering Hospital since 1986, and a member of the New York City Advisory Board of the Enterprise Foundation. Mr. Smith is also a member of the Board of Trustees of St.

10

Vincent’s Hospital and Medical Center, since 1986, and the Cavalry Hospital since 1998, and was a member of the Board of Trustees of Iona Prep School, Saint Agnes Hospital, and Our Lady of Mercy Medical Center. Mr. Smith is a member of the Association of the Sovereign Military Order of Malta. He has received numerous awards for his charity humanitarian work, including “Wall Street 50” Honoree Humanitarian Award, Terence Cardinal Cooke Center in 1999; Man of the Year Award at Iona Prep in 1986, Club of Champions Gold Medal Award of the Catholic Youth Organization, Ellis Island Medal of Honor, the National Brotherhood Award of the National Conference of Christians and Jews, the Graymoor Community Service Award by the Franciscan Friars of the Atonement, the American Cancer Society’s Gold Sword of Hope Award, and the Terence Cardinal Cooke Humanitarian Award by Our Lady of Mercy Medical Center. Mr. Smith was educated at Villanova University.

Mr. Pedro Dobles. Effective January 27, 2005, Mr. Dobles was appointed as Chief Executive Officer of the Company. Mr. Dobles has been serving as the Vice President of Pipasa, S.A., the Company’s wholly owned operating subsidiary since December 2003. From October 1995 until July 2003, Mr. Dobles served as the General Director of Florida Ice and Farm (Cervecceria Costa Rica), the largest privately held brewery company in Costa Rica. His responsibilities as General Director included overseeing all of the company’s operations. Prior to becoming the General Director of Florida Ice and Farm, from 1976 until July 2003, Mr. Dobles served in a variety of positions with Florida Ice and Farm, including Finance Director, General Controller and Vice-General Director. Mr. Dobles has also served as a member of the Board of Directors of Group SAMA, S.A. from August 2003 until the present. See Item 13 of the Company’s Form 10-K for the year ended September 30, 2004 for a discussion of transactions between the Company and SAMA during the 2004 fiscal year. Mr. Dobles received his Bachelor’s Degree in Industrial Engineering from the University of Houston and his Masters in Business Administration from Instituto Centroamericano de Administracion de Empresas. Mr. Dobles also attended strategic marketing management seminars at Harvard Business School in June 1993 and business strategy seminars at Columbia University in 1991.

Ms. Gina Sequeira. Ms. Sequeira was appointed Chief Financial Officer of the Company on November 2002. She joined the Company in April of 1996 and has served in the financial and accounting divisions of the Company. Ms. Sequeira obtained her degree in accounting from the Universidad Internacional de las Americas in 1994 and has been a member of the Institute of Certified Public Accountants of Costa Rica since 1998. Ms. Sequeira worked in external auditing prior to her employment with the Company.

Controlled Company

Avicola Campesinos, Inc., the Company’s majority shareholder, owns approximately 77.2% of the Company’s common stock and, consequently, holds over 50% of the Company’s voting power. Accordingly, the Company is a “controlled company” under Section 801 of the AMEX Company Guide. Therefore, the Company is not subject to the AMEX rules requiring AMEX listed companies to have a Board of Directors consisting of at least 50% “independent directors”, governing the determination of executive compensation and governing the nomination of directors. The Company has, however, voluntarily complied with AMEX’s executive compensation determination rules and director nomination rules.

Independent Directors

The Board of Directors has affirmatively determined that Messrs. Lauredo, Peeples, Escobar and Smith meet the definition of “independent director” under Section 121A of the AMEX Company Guide.

Committees and Meetings of the Board of Directors

During the fiscal year ended September 30, 2004, the Company’s Board of Directors held ten meetings, and took four actions by unanimous written consent. Alfred Smith, IV attended fewer than 75% of the aggregate of (i) the number of the meetings of the Board which were held during the period that such person served on the Board of Directors and (ii) the number of meetings of committees of the Board of Directors held during the period that such person served on such committee.

11

While members of the Company’s Board of Directors are not required to be present at the Company’s annual meetings, all members of the Company’s Board of Directors are welcome and encouraged to attend. All of the directors were able to attend the 2003 annual meeting.

The Company has three committees: the Audit Committee, the Compensation Committee and the Governance and Nominating Committee.

The Audit Committee is currently composed of three directors: Mr. Luis Lauredo, as Chairman, Mr. Jack Peeples and Mr. Manuel Escobar. The principal functions of the Audit Committee include, but are not limited to, (i) the oversight of the accounting and financial reporting processes of the Company and its internal control over financial reporting; (ii) the oversight of the quality and integrity of the Company’s financial statements and the independent audit thereof; and (iii) the approval, prior to the engagement of, the Company’s independent auditors and, in connection therewith, the review and evaluation of the qualifications, independence and performance of the Company’s independent auditors. The Audit Committee met ten times during the fiscal year ended September 30, 2004 and took four actions by unanimous written consent. The Audit Committee operates under a written Audit Committee Charter adopted by the Company’s Board of Directors, the adequacy of which is regularly assessed by the Board of Directors and the Audit Committee. The Board has determined that each member of the Audit Committee is independent pursuant to Section 121(a) of the AMEX Company Guide and that Mr. Escobar meets the “financial expert” requirements set forth in the rules established pursuant to the Sarbanes-Oxley Act of 2002.

The Compensation Committee is currently comprised of three directors: Mr. Luis Lauredo, as Chairman, Mr. Jack Peeples and Mr. Manuel Escobar. The Compensation Committee’s functions include the establishment and administration of policies for the Company’s compensation programs and the approval of the compensation levels of the executive officers of the Company and its subsidiaries. The Compensation Committee met one time during the fiscal year ended September 30, 2004 and took one action by unanimous written consent. The Compensation Committee operates under a written Compensation Committee Charter adopted by the Company’s Board of Directors, the adequacy of which is regularly assessed by the Board of Directors and the Compensation Committee. The Board has determined that each member of the Compensation Committee is independent pursuant to Section 121(a) of the AMEX Company Guide.

The Governance and Nominating Committee is currently comprised of three directors: Mr. Luis Lauredo, Mr. Jack Peeples and Mr. Alfred Smith, IV. The principal function of the Governance and Nominating Committee is to seek, review and recommend qualified candidates to the Board of Directors for nomination for election to the Board. The Governance and Nominating Committee was established by the Board on September 29, 2004 and, accordingly, did not hold any meetings during the fiscal year ended September 30, 2004. The Governance and Nominating Committee operates under a written Governance and Nominating Committee Charter adopted by the Company’s Board of Directors, the adequacy of which is regularly assessed by the Board of Directors and the Governance and Nominating Committee. A copy of the Governance and Nominating Committee Charter is attached asAppendix A to this Proxy Statement. The Board has determined that each member of the Governance and Nominating is independent pursuant to Section 121(a) of the AMEX Company Guide.

The Governance and Nominating Committee’s Charter provides that the Governance and Nominating Committee will consider director candidates recommended by shareholders. Pursuant to the Governance and Nominating Committee Charter, director candidates nominated by shareholders will be evaluated by the Governance and Nominating Committee using the same guidelines and procedures used in evaluating director candidates nominated by other persons. Shareholders should submit any such recommendations for the Governance and Nominating Committee through the method described under the section entitled “Communications with the Board of Directors” below. In addition, in accordance with the Company’s Bylaws, any shareholder of record entitled to vote for the election of directors at the Annual Meeting may nominate persons for election to the Board of Directors if such shareholder complies with the notice procedures set forth in the Bylaws and summarized in the section entitled “Shareholder Proposals” above.

12

In evaluating director nominees, the Governance and Nominating Committee considers the following factors:

| | • | | the appropriate size and the diversity of the Company’s Board of Directors; |

| | • | | the needs of the Company with respect to the particular talents and experience of its directors; |

| | • | | the knowledge, skills and experience of nominees, including experience in technology, business, finance, administration or public service, in light of prevailing business conditions and the knowledge, skills and experience already possessed by other members of the Board; |

| | • | | familiarity with national and international business matters; |

| | • | | experience in political affairs; |

| | • | | experience with accounting rules and practices; |

| | • | | appreciation of the relationship of the Company’s business to the changing needs of society; and |

| | • | | the desire to balance the considerable benefit of continuity with the periodic injection of the fresh perspective provided by new members. |

The Governance and Nominating Committee’s goal is to assemble a Board of Directors that brings to the Company a variety of perspectives and skills derived from business and professional experience. In doing so the Governance and Nominating Committee also considers candidates with appropriate non-business backgrounds.

Other than the foregoing there are no stated minimum criteria for director nominees, although the Governance and Nominating Committee may also consider such other factors as it may deem are in the best interests of the Company and its shareholders. The Governance and Nominating Committee also believes it appropriate for certain key members of the Company’s management to participate as members of the Board.

The Governance and Nominating Committee identifies nominees by first evaluating the current members of the Board of Directors willing to continue in service. Current members of the Board with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the Governance and Nominating Committee or the Board decides not to re-nominate a member for re-election, the Governance and Nominating Committee identifies the desired skills and experience of a new nominee in light of the criteria above. Current members of the Governance and Nominating Committee and Board of Directors are polled for suggestions as to individuals meeting the criteria of the Governance and Nominating Committee. Research may also be performed to identify qualified individuals. To date, the Company has not engaged third parties to identify or evaluate or assist in identifying potential nominees, although the Company reserves the right in the future to retain a third party search firm, if necessary.

Communications with the Board of Directors

Shareholders can send communications to the Board and, if applicable, to the Governance and Nominating Committee or to specified individual directors in writing c/o Mauricio Marenco, General Counsel, Rica Foods, Inc., Wachovia Financial Center 200 South Biscayne Boulevard, Suite 4530, Miami, FL 33131. The Company does not screen mail and all such letters will be forwarded to the Board of Directors, the Governance and Nominating Committee or any such specified individual directors.

13

Report of the Audit Committee(1)

The Audit Committee is responsible for overseeing the Company’s financial reporting process on behalf of the Board of Directors. In this oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, including the system of internal controls, and of the independent auditors, who, in their report, express an opinion on the conformity of the Company’s annual financial statements to generally accepted accounting principles in the United States.

In fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed with management and the independent auditors the Company’s audited financial statements contained in the Company’s Annual Report on Form 10-K for the year ended September 30, 2004, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as amended. In addition, the Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The Audit Committee has substantively discussed with the independent auditors the auditors’ independence from the Company and its management. The Audit Committee has also considered the compatibilities of non-audit services with the auditors’ independence.

The Audit Committee discussed with the Company’s independent auditors the overall scope and plans for their audit. The Audit Committee met with the Company’s independent auditors, with and without management present, to discuss the results of their examinations, their evaluations of the Company’s internal controls, and the overall quality of the Company’s financial reporting.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2004, for filing with the Securities and Exchange Commission. The Audit Committee and the Board have also recommended, subject to shareholder approval, the selection of Stonefield Josephson, Inc. as the Company’s independent auditor for the year ending September 30, 2005.

|

| The Audit Committee |

|

| |

| Hon. Amb. Luis Lauredo |

| Mr. Grant “Jack” Peeples |

| Mr. Manuel Escobar |

| (1) | The material in this Report of the Audit Committee shall not be deemed to be “soliciting material,” nor to be “filed” with the Securities and Exchange Commission nor subject to Regulation 14A or 14C. This report is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended or the Securities Exchange Act of 1934, as amended. |

14

Legal Proceedings

On August 15, 2003 , the Commission filed a settled civil injunctive action against the Company, Calixto Chaves, the Company’s Chief Executive Officer (the “Former CEO”) at the time of the injunctive action and the Company’s Chief Financial Officer (the “CFO”) for violations of the CEO and CFO certification requirements of the Sarbanes-Oxley Act of 2002. The Company, the Former CEO and the CFO have consented, without admitting or denying the allegations in the Commission’s complaint, to the entry of a Final Judgment of Permanent Injunction and Other Relief (“Final Judgment”). According to the Commission’s complaint, on January 13, 2003, the Company filed a Form 10-K annual report with the Commission containing a purportedly unqualified independent auditor’s report from Deloitte & Touche. The audit report represented that the Company’s consolidated financial statements were presented fairly and in conformity with generally accepted accounting principles. At the time of the filing, however, Deloitte & Touche had not provided the Company with a signed audit report and, according to the Commission’s complaint, the Company’s financial statements contained material classification errors.

The Final Judgment permanently enjoins the Company from violating Sections 13(a), 13(b)(2)(A) and 13(b)(2)(B) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 12b-20 and 13a-1 thereunder, which governs the accuracy of the issuer books and records and financial disclosures. The Final Judgment also permanently enjoins the Former CEO and CFO from violating Section 13(b)(5) of the Exchange Act and Rule 13a-14 thereunder and from aiding and abetting violations of Sections 13(a), 13(b)(2)(A) and 13(b)(2)(B) of the Exchange Act and Rules 12b-20 and 13a-1 thereunder. Pursuant to the Final Judgment, the Former CEO was ordered to pay $25,000 in civil penalties. A penalty was not imposed against the CFO based on the sworn financial statements and other financial information she provided to the Commission.

The Company is not aware of any pending, material legal proceedings to which any director, officer or affiliate of the Company, any owner of record or beneficially of more than five percent of any class of voting securities of the Company, or any associate of any such director, officer, affiliate of the Company, or security holder is a party adverse to the Company or any of its subsidiaries or has a material interest adverse the Company.

Additional Information Concerning Directors

The Company reimburses all members of the Board of Directors for their expenses in connection with their activities as Directors of the Company. Directors of the Company receive additional compensation for their services as Directors at a rate of $200 for each Board meeting that they attend. Members of the Audit Committee receive additional compensation for their services as Audit Committee members at a rate of $600 for each Audit Committee meeting they attend.

On November 29, 2004, the Board of Directors of the Company granted, effective October 15, 2004 (the “Grant Date”), a total of 120,000 options (the “Director Options”) to purchase shares of the Company’s common stock to two of its current directors. In addition, on the same date, as consideration for past services to the Company, the Company granted 10,000 options (collectively with the Director Options, the “Options”) to purchase shares of the Company’s common stock to one of its former directors. The Options vested upon issuance and are exercisable at an exercise price of $4.40 at any time during the period (the “Exercise Period”) commencing on the three month (3rd) anniversary of the Grant Date and terminating on the six month (6th) anniversary of the Grant Date (the “Expiration Date”).

Compliance with Section 16(a) of the Securities Exchange Act 1934

Sec 16(a) of 1934 Act requires the Company’s directors and executive officers, and persons who own more than ten percent (10%) of the Company’s outstanding Common Stock, to file with the Securities and Exchange Commission (the “SEC”) initial report of ownership and report changes in ownership of Common Stock. Such persons are required by SEC regulations to furnish the Company with copies of all such reports they file.

15

To our knowledge, based solely on a review of the copies of reports furnished to us and written or oral representations that no other reports were required for such persons, all Section 16(a) filing requirements applicable to our officers, directors and greater than ten percent (10%) beneficial owners have been complied with respect to the fiscal years ended September 30, 2004, except for the late filing of a Form 3 filed by Jose Vidal, the late filing of one Form 4 by each of Calixto Chaves, Jorge Quesada, Comercial Angui, Inversiones La Ribera and Antonio Echeverria and the late filing of two Form 4s by each of Pedro Dobles and Eladio Villalta.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth, as of the Record Date, the number of shares of Common Stock of the Company which were owned beneficially by (i) each person who is known by the Company to own beneficially more than 5% of its Common Stock, (ii) each director and nominee for director, (iii) certain executive officers of the Company, and (iv) all directors and officers as a group. Unless otherwise indicated, the address of each beneficial owner is Rica Foods, Inc., Wachovia Financial Center 200 South Biscayne Boulevard, Suite 4530 Miami, FL 33131.

| | | | | |

Name and Address of Beneficial Owner

| | Amount and Nature of

Beneficial Ownership (1)(2)

| | | Percentage of

Shares Owned (1)

|

Avicola Campesinos, S.A.(3) | | 9,933,154 | (4) | | 77.2 |

Tenedora G.S., S.A. | | 9,933,154 | (4) | | 77.2 |

Mr. Victor Oconitrillo | | 0 | (4) | | * |

Mr. Pedro Dobles | | 35,500 | | | * |

Mr. Alfonso Gutierrez | | 0 | (4) | | * |

Mr. Eladio Villalta | | 26,500 | | | * |

Mr. Carlos Ceciliano | | 0 | | | * |

Mr. Calixto Chaves | | 0 | | | * |

Mr. Alfred E. Smith IV(5) | | 34,534 | | | * |

Hon. Amb. Luis Lauredo | | 60,000 | (6) | | * |

Mr. Grant “Jack” Peeples | | 60,000 | (7) | | * |

Mr. Manuel Escobar(8) | | 0 | | | * |

Ms. Gina Sequeira | | 0 | | | * |

All directors and executive officers as a group (11 persons) | | 216,534 | | | 1 |

| * | Indicates less than 1% of outstanding shares owned. |

| (1) | A person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days from January 26, 2004 upon exercise of options, warrants and convertible securities. Each beneficial owner’s percentage ownership is determined by assuming that options, warrants and convertible securities that are held by such person (but not those held by any other person) and that are exercisable within 60 days from January 26, 2004 have been exercised. |

| (2) | Unless otherwise noted, the Company believes that all persons named in the table have sole voting and investment power with respect to all shares of Common Stock beneficially owned by them. |

| (3) | Avicola’s principal business address is 6100 Neil Road, Suite 500, Reno, NV 89551. |

| (4) | Includes 9,933,514 shares held of record by Avicola, a corporation wholly owned by Tenedora G.S., S.A. Tenedora’s principal business address is Bufete Chaverri Soto & Asociados, Barrio Escalante, de cine Magaly 400 metros al este, San Jose, Costa Rica. Mavipel, S.A., a Costa Rican corporation (“Mavipel”), Inversiones Harenaz L III, S.A. (“Harenaz”), a Costa Rican corporation, CYS Asesores de Mercadeo y Finanzas, S.A, a Costa Rican corporation (“CYS”), Sarita Trading, S.A., a Panamanian corporation (“Sarita”), Corporacion Adral, S.A., Costa Rican corporation (“Adral”), Corporacion Aspila, S.A., a Costa Rican corporation (“Aspila”), Hoy por Hoy, S.A., a Costa Rican corporation (“Hoy”), Asociacion Solidarista de Empleados Grupo Sama y Afines, a Costa Rican labor |

16

| | entity (“ASEGSA”) and Quirinal, S.A. (“Quirinal”) are the holders of approximately 39.79%, 11.96%, 10.72%, 13.4%, 8.1%, 9.2%, 2.3%, 1.7%, and 2.8%, respectively of the outstanding common stock of Tenedora. Together, Mavipel, Harenaz, CYS, Sarita, Adral, Centro, Hoy, ASEGSA and Quirinal may be deemed to control Tenedora. Elsie Roman, the wife of Victor Oconitrillo, is the holder of 100% of the outstanding common stock of Mavipel. Henry Zamora is the holder of 100% of the outstanding common stock of Harenaz. Rolando Cervantes is the holder of 100% of the outstanding common stock of CYS. Edgar Rodriguez is the holder of 100% of the outstanding common stock of Sarita. Oscar Arias is the holder of 100% of the outstanding common stock of Adral. Robert Aspinall is the holder of 100% of the outstanding common stock of Aspila. Oscar Hernandez is the holder of 100% of the outstanding common stock of Hoy. Alfonso Gutierrez is the holder of 100% of the outstanding common stock of Quirinal. Avicola, Tenedora, Mavipel, Harenaz, CYS, Sarita, Adral, Aspila, Hoy, ASEGSA, Quirinal, Elsie Roman, Henry Zamora, Rolando Cervantes, Edgar Rodriguez, Oscar Arias, Robert Aspinall, Oscar Hernandez and Alfonso Gutierrez are members of a “group” for purposes of Section 13(d) of the Exchange Act. Each of Mavipel, Harenaz, CYS, Sarita, Adral, Aspila, Hoy, ASEGSA, Quirinal, Elsie Roman, Victor Oconitrillo, Henry Zamora, Rolando Cervantes, Edgar Rodriguez, Oscar Arias, Robert Aspinall, Oscar Hernandez and Alfonso Gutierrez disclaims beneficial ownership of these securities and this report shall not be deemed an admission that such Reporting Persons are the beneficial owners of the securities for purposes of Section 16 or for any other purposes. |

| (5) | Mr. Smith’s principal business address is 40 Wall Street, 42nd floor, New York, NY 10005. |

| (6) | Includes 60,000 shares issuable upon the exercise of stock options. Mr. Lauredo’s principal business address is 1111 Brickell Avenue, Suite 2500, Miami, FL 33131. |

| (7) | Includes 60,000 shares issuable upon the exercise of stock options. Mr. Peeples’ principal busines address is Wachovia Financial Center, 200 South Biscayne Blvd. Suite 4530, Miami, FL 33131. |

| (8) | Mr. Escobar’s principal business address is 150 M Oeste del Puente Francisco Orlich, carretera a San Antonio de Belén, Heredia, Costa Rica |

Potential Change in Control

As indicated above, as security for the Purchase Loan, Avicola has pledged the 9,933,154 shares of Common Stock purchased in the Stock Sale to SBI pursuant to the terms of the Stock Pledge Agreement. Pursuant to the Stock Pledge Agreement, Avicola has agreed that it shall not sell, assign or otherwise transfer any of the 9,933,154 shares of Common Stock to any person except to SBI.

The Stock Pledge Agreement contains certain ordinary default provisions. In addition, in the event that, among other things, (i) Avicola or the Company defaults in any payment of principal or interest on any indebtedness, except the Purchase Loan, in excess of $250,000 beyond the grace period, if any or (ii) Avicola or the Company defaults in the observance or performance of any other agreement or condition relating to any indebtedness, except the Purchase Loan, or any other event shall occur, the effect of which default or other event is to cause or permit the holders of such indebtedness to cause such indebtedness to become due prior to its stated maturity, SBI can, among other things, take ownership of or sell any or all of the 9,933,154 shares.

17

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth, for the fiscal years ended September 30, 2004, 2003 and 2002 the aggregate compensation awarded to, earned by or paid to Mr. Chaves, the Company’s former Chief Executive Officer. Mr. Chaves resigned effective January 26, 2005 and Mr. Pedro Dobles was appointed as his replacement. No Executive Officer of the Company or its subsidiaries earned compensation in excess of $100,000 during fiscal year ended September 30, 2004. The Company neither granted any restricted stock awards or stock appreciation rights to nor made any long-term incentive plan payouts to any of the Named Executive Officers during the fiscal years ended September 30, 2004, 2003, and 2002.

| | | | | | | | | | | | | |

Name and Principal Position

| | Fiscal

Year

| | Salary(1)

| | Bonus

| | | All Other

Compensation

| |

Calixto Chaves | | 2004 | | $ | 0 | | $ | 0 | | | $ | 74,273 | (2) |

Former Chief Executive Officer | | 2003 | | $ | 166,546 | | $ | 13,308 | | | $ | 434,868 | |

(Resigned effective January 26, 2005) | | 2002 | | $ | 160,336 | | $ | 3,49 | (1) | | $ | 18,133 | |

| (1) | Salary compensation was paid in Costa Rican colones and in dollars. For the purposes of this presentation, all compensation has been converted to U.S. dollars at the then current exchange rate for Costa Rican colones. |

| (2) | Includes $74,273 for Mr. Chaves’ provision of loan guarantee services. |

Employment Agreements and Change in Control Agreements

The Company has no employment agreements and no change in control agreements with any executive officer.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee are or ever have been officers of the Company. This Committee makes the determinations for stock issuances pursuant to the Company’s compensation plans. Except for payments paid upon the severance or termination of an employee as required by Costa Rican law, the Company has no retirement, pension or profit sharing plans covering its officers and directors, but has contemplated the implementation of such a plan in the future.

Board Compensation Committee Report on Executive Compensation

The Compensation Committee is responsible for establishing and administering the policies for the Company’s compensation programs and for approving the compensation levels of the executives and managers of the Company and its subsidiaries, including its Chief Executive Officer. The Committee also reviews with the Chief Executive Officer guidelines for salaries and bonus awards applicable to the Company’s employees other than its executives and managers.

Statement of Philosophy of Executive Compensation

The executive compensation program of the Company is designed to (i) provide base compensation reasonably comparable to that offered by other leading companies to their executives and managers so as to attract and retain talented personnel, (ii) motivate certain executives and managers to achieve the strategic goals set by the Company, and (iii) further align the interests of the executives and managers with the long-term interests of the Shareholders. To implement this philosophy, the Company offers its executives and managers compensation packages that include a mix of salary, the opportunity to receive discretionary incentive bonus awards, and, at times, stock options.

18

In determining the level and form of executive compensation to be paid or awarded, the Committee relies primarily on the recommendations of the Human Resources Department, which provides the Committee an assessment of the subject executive’s performance and the Company’s performance in light of its strategic objectives. The Committee considered a number of factors in establishing compensation in the fiscal year ended September 30, 2004, none of which was quantified, ranked or assigned relative weight.

| | • | | The Company’s retention of its position as one of the leading producers and distributors of poultry products in Costa Rica. |

| | • | | The further diversification, expansion, and broadening of the Company’s core business and new service offerings. |

| | • | | Individual performance and contributions to the Company. |

| | • | | Individual compensation history. |

Salary

The base salary of executives and managers is determined initially by analyzing and evaluating the responsibilities of the position and comparing the proposed base salary with that of executives and managers in comparable positions in other companies. Adjustments are determined by objective factors such as the Company’s performance and the individual’s contribution to that performance and subjective considerations such as additional responsibilities taken on by the executive or manager. The Committee awarded increases in base salary to certain of the executive officers and managers of the Company.

Incentive Awards

In addition to paying a base salary, the Company offers certain of its executives and managers an opportunity to earn discretionary incentive bonuses as a component of overall compensation based on the performance of the individual and the individual’s business unit. For the fiscal year ended September 30, 2004, the Committee awarded bonuses to certain of the Company’s executives and managers.

CEO Compensation

As of September 2003 and 2002, Mr. Calixto Chaves, the former Chief Executive Officer had accrued approximately $450,000 and $405,000 of severance benefits for serving as Chairman of the Board of the Company’s subsidiaries, Pipasa and As de Oros as a result of his approximate over 30 years of employment with the subsidiaries. During fiscal year 2002, the subsidiaries of the Company authorized Mr. Chaves to apply approximately $275,000 as an advanced payment with respect to his accrued severance benefits. In September 2003, Mr. Chaves resigned as Chairman of the Board of the subsidiaries. In accordance with Costa Rican law, Mr. Chaves was entitled to receive his remaining accrued severance benefits and accordingly was authorized to apply approximately $175,000. Approximately $425,000 of the severance benefits which Mr. Chaves was authorized to receive in 2002 and 2003 were used to satisfy interest expenses on outstanding loans owed to the subsidiaries by Mr. Chaves. The remaining $25,000 was set aside in a reserve account for the payment of Mr. Chaves’ future interest obligations and, as of December 31, 2003, had been used by the Company in its entirety towards interest payments owed on Mr. Chaves’ indebtedness during the first quarter of fiscal 2004. No cash was disbursed or paid to the Chief Executive Officer in these transactions. In light of his receipt of these severance benefits, Mr. Chaves was not paid any salary or bonus during fiscal 2004.

19

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Related Party Guarantees

Since the Company’s inception in 1969 and since 1991, Mr. Chaves and Mr. Jorge Quesada, respectively, have personally guaranteed the repayment of the various notes, loans and credit facilities (the “Credit Arrangements”) of the Company and its various operating subsidiaries. As of September 30, 2004, none of the Company’s Credit Arrangements were personally guaranteed by either Mr. Chaves or Mr. Quesada. The Company agreed to compensate Mr. Chaves for the guarantee services described above in an amount equal to 1% per annum of the aggregate loan amount subject to his personal guarantee (the “Financial Service Fee”). In satisfaction of the Financial Service Fee, the Company will, as of the end of each fiscal quarter, make a quarterly payment to Mr. Chaves in an amount equal to .25% of the daily average aggregate loan balance subject to the personal guarantees (the “Quarterly Payment”). If, as of the end of the fiscal quarter, Mr. Chaves is indebted to the company, Mr. Chaves has the option in his sole discretion to either, (i) direct the Company to use the quarterly payment to off-set the amount he owes the Company or (ii) receive the Quarterly Payment in cash. Mr. Quesada does not receive, nor has he ever received, any compensation for providing the guarantee services described above.

For the fiscal years ended September 30, 2004 and 2003, the Company has incurred a Financial Service Fee to Mr. Chaves in the amount of $74,273 and $262,765, respectively, which amount was used to offset indebtedness owed by Mr. Chaves to the Company. The entire Financial Service Fee incurred by the Company during the fiscal year ended September 30, 2004 was incurred by the Company during the first quarter of fiscal 2004. As discussed below, the Company ceased compensating Mr. Chaves for the Guarantee Services effective December 31, 2003.

On December 22, 2003, Mr. Chaves sold all of his shares of the Company’s common stock to Avicola Campesinos, Inc (the “Stock Sale”). In connection with such Stock Sale, Mr. Chaves entered into an agreement with the Company whereby he has agreed to indemnify the Company from and against any losses or damages caused by his failure within the 2004 calendar year to provide, if requested, his personal guarantee with respect to any loan which he has previously guaranteed and the Company is seeking to defer repayment of. There can be no assurances that Mr. Chaves’ future guarantees will be sought by the Company’s lenders and, if sought, will be procured. Effective December 31, 2003, the Company, with Mr. Chaves agreement, decided to discontinue its practice of compensating Mr. Chaves for the Guarantee Services.

Commencing in September 2003, Tendedora, S.A. (“Tenedora”), the parent company of the Company’s majority shareholder, Avicola Campesinos, Inc., and Grupo SAMA, S.A. (“SAMA”) began providing guarantees (the “Tenedora Guarantees” and the “SAMA Guarantees”, respectively) for certain of the indebtedness that the Company obtained from BICSA. As of September 30, 2003, Tenedora and SAMA had guaranteed approximately $1.7 million and $657,000, respectively, of the Company’s outstanding indebtedness to BICSA. Both Tenedora and SAMA continued to provide guarantee services to the Company throughout the 2004 fiscal year. During 2004 fiscal year, the weighted average amount of the Tenedora Guarantees and the SAMA Guarantees was approximately $6.4 million and $3.6 million, respectively. As of September 30, 2004, the outstanding amount of the Tenedora Guarantees and the SAMA Guarantees was $8.6 million and $6.4 million, respectively. During the 2004 fiscal year, certain of the BICSA indebtedness secured by the Tenedora Guarantees was also secured by the Trust and the SAMA Guarantees and all of the BICSA indebtedness secured by the SAMA Guarantees was also secured by the Trust and the Tendora Guarantees. During the 2004 fiscal year, certain of the indebtedness of BICSA was also guaranteed by the Trust. SAMA ceased providing guarantee services to the Company on September 30, 2004; however, Tenedora has continued to provide guarantee services to the Company during the first quarter of 2005.

20

Loans to Related Parties

| | | | | | | | | | | |

Name

| | September 30,

2004

| | September 30,

2003

| | | September 30,

2002

| |

Calixto Chaves | | $ | — | | $ | 6,876,469 | (1) | | $ | 6,894,658 | (3) |

Maya Tiamx, S.A | | | — | | | 29,861 | (2) | | | 30,626 | (2) |

| (1) | Included $5,570,126, $431,938 and $903,427 owed to the Company by Ribera, Atisbos and O.C.C., Costa Rican companies owned by Mr. Chaves and his wife. The figure provided also includes $213,551 owed to the Company by Avicola Core Etuba, Ltda. (“Core”), a Brazilian company of which the majority of outstanding shares are beneficially owned by Mr. Chaves. |

| (2) | Maya TIAMX, S.A., is a Costa Rican company owned by Mr. Jose Pablo Chaves, the son of Calixto Chaves. |

| (3) | Consisted of $5,495,438, $354,442, $793,707 and $251,072 owed to the Company by Ribera, Atisbos, O.C.C. and Core. |

At various times in the past, Mr. Chaves and companies controlled by him have borrowed money from the Company. Since September 30, 2002, Mr. Chaves’ largest aggregate amount of indebtedness outstanding occurred at September 30, 2001. The loans made to Ribera, Atisbos and O.C.C., all Costa Rican companies owned by Mr. Calixto Chaves and his wife, were evidenced by thirteen promissory notes payable on demand (the “Loans”), nine of which are denominated in U.S. dollars and accrue interest at the rate of 8%, and four of which are denominated in Costa Rican colones and which accrue interest at rates ranging from 16% to 24%.

The amounts outstanding from Core as of September 30, 2003 and 2002 , included a promissory note of $128,628, bearing an interest rate of 11%, and other account receivables that originate mainly from expenses incurred in a due diligence process.

Mr. Chaves had provided collateral for the Loans by the subscription of a guarantee trust contract for the benefit of Pipasa. The guarantee contract contained two assets, two farms, with an aggregate value of approximately $4 million, as estimated by real estate brokers as of May 2002.

On December 22, 2003, Mr. Chaves sold all of his shares of the Company’s common stock to Avicola Campesinos, Inc. Approximately $6.9 million of the proceeds of the stock sale were used to satisfy Mr. Chaves’ existing indebtedness to the Company.

Repurchase of Preferred Stock

On September 29, 2004, the Company’s Board of Directors authorized management to repurchase from companies (the “Controlled Companies”) controlled by Calixto Chaves, the former Chief Executive Officer, an aggregate of 151,400 shares of preferred stock of Pipasa, S.A., a wholly owned subsidiary of the Company (the “Preferred Shares”). In exchange for the Preferred Shares, the Company issued the Controlled Companies promissory notes (the “Notes”) in the aggregate amount of $341,445, which is the US dollar equivalent of the amount the Controlled Companies paid for the Preferred Shares in colones (the “Preferred Share Cost”). The Preferred Shares entitled the Controlled Companies to an annual dividend ranging from 10% to 14% of the Preferred Share Cost, payable in perpetuity. The Notes, denominated in colones, bear interest at the annual rate of 10% and mature five years from the date of issuance.

Investments - Cash Equivalents

As of September 30, 2004, the Company was indirectly holding approximately $1 million of short-term investment products, including certificates of deposit and investment fund investments (collectively, the “SAMA Investments”), that are directly or indirectly offered by Inversiones SAMA, S.A. (Puesto de Bolsa)

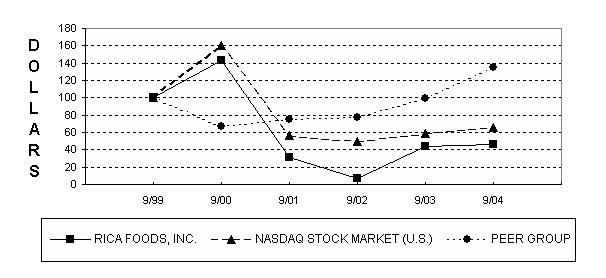

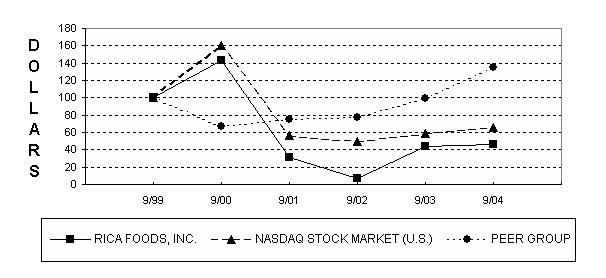

21