Exhibit 99.1

Subsidiary Companies' Business Highlights

NACCO Materials Handling Group (“NMHG”) Business Highlights

Leading Global Lift Truck Manufacturer

| |

| • | Leading market share positions with large installed population base |

| |

| • | Comprehensive global product line with many recently introduced or significantly redesigned products |

| |

| • | Globally integrated operations with significant economies of scale |

Leading Brands and Market Shares

Hyster® and Yale® are among the most recognized brands in the lift truck industry.

| |

| • | Leading market share positions in the Americas and worldwide |

| |

| • | In business for more than 80 years |

Both brands serve the needs of customers across the manufacturing and services spectrum and deliver core competencies in product support and fleet management. Hyster has an additional competency in Big and Jumbo Trucks, serving the needs of ports, steel and rail.

| |

| • | NMHG is one of the top five world leaders in the lift truck industry |

| |

| • | Significant growth potential in Eastern Europe, Asia-Pacific, Latin America and China |

In 2011, NMHG introduced a new range of UTILEV® brand forklift trucks. UTILEV® is a utility lift truck that meets the needs of basic applications.

Comprehensive Product Line

| |

| • | Class 1: Electric counterbalanced rider lift trucks: 1 ton - 6 ton capacity |

| |

| • | Class 2: Electric narrow aisle lift trucks: 1.5 ton - 6 ton capacity |

| |

| • | Class 3: Electric hand lift trucks: 1 ton - 4 ton capacity |

| |

| • | Class 4: Internal combustion engine counterbalanced lift trucks, cushion tire: 1.5 ton - 8 ton capacity |

| |

| • | Class 5: Internal combustion engine counterbalanced lift trucks, pneumatic tire: 1.5 ton - 52 ton capacity |

Global Partnerships

Hyster® and Yale® have developed partnerships to support customer needs in equipment, financing, alternative energy and high quality global product availability.

| |

| • | Exclusive North America joint venture in materials handling with GE Capital Corporation provides a secure and competitive source of equipment and operational financing for customers in the United States. Relationship with GE globally. |

| |

| • | Over 40 year old joint venture in product development and manufacturing in Japan with Sumitomo Heavy Industries |

| |

| • | Product development and supply partnerships with hydrogen fuel cell, telemetry devices and advanced battery manufacturers to ensure customers have access to the latest in energy efficient technologies to increase sustainability, reduce operational costs and improve productivity |

Global Scope of Operations

| |

| • | Map of NMHG global locations |

| |

| • | Product development centers in the United States, Italy, India, The Netherlands, the United Kingdom and Japan |

| |

| • | International purchasing office in China |

Global Economies of Scale

| |

| • | Diagram of NMHG economies of scale strategy |

Large Global Installed Population

| |

| • | Estimated 785,000 Hyster® and Yale® lift trucks in operation worldwide (as of December 31, 2011) |

| |

| • | Large installed base provides barrier to entry and assures ongoing parts revenue |

| |

| • | Majority of total parts for the Hyster® and Yale® installed base are captured by NMHG's exclusive dealers in the Americas market (as of December 31, 2011) |

| |

| • | Over 50,000 customer lift trucks under Hyster® and Yale® fleet management programs |

| |

| • | Comprehensive global proprietary and “all-makes” service parts program |

| |

| • | Service parts can result in recurring, higher-margin revenues |

| |

| ◦ | Aftermarket parts sales represented approximately 13% of NMHG's annual revenues in 2011 |

Experienced Management Team

| |

| • | Strong team of long-term NMHG managers and executives with global experience |

| |

| • | Supported by professionals recruited from leading industrial companies, such as Case, Allied Signal, Brunswick, Komatsu, Ingersoll Rand and Ford |

Highly Professional Dealers

| |

| • | Strong, stable network of independent dealers in key U.S. markets |

| |

| • | Global operations supplying both Hyster® and Yale® dealer networks |

| |

| • | Independently owned and operated dealers with exclusive product and sales territories |

| |

| • | Certain dealers represent both Hyster® and Yale® in defined territories |

| |

| • | Strong global distribution drives market share |

Leading National Accounts Program

| |

| • | Industry-leading, direct-sales National Accounts program |

| |

| • | Over 150 National Accounts in a wide range of industries (as of December 31, 2011) |

| |

| • | Industry penetration in Lumber, Paper, Beverages, Wholesale Foods and Retail, among others |

| |

| • | Growing global account program |

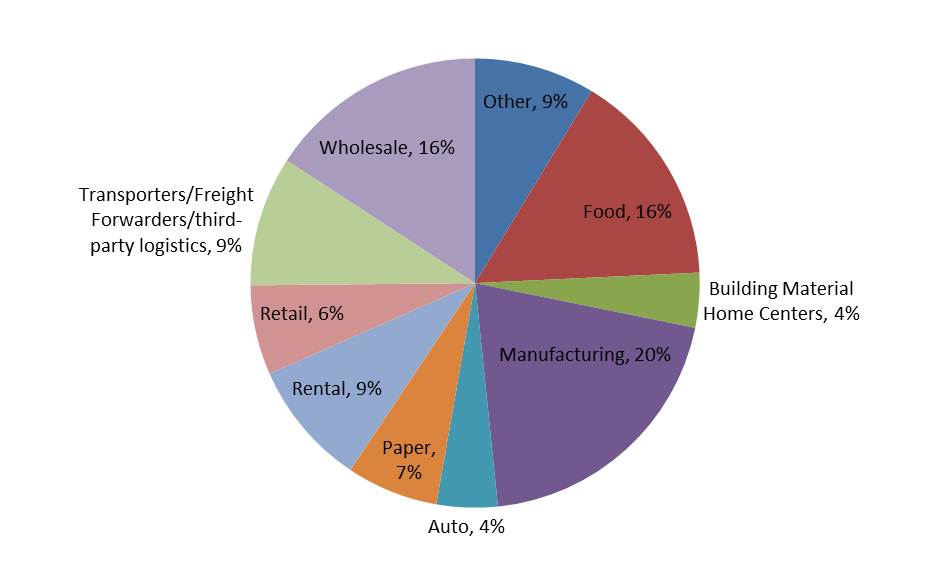

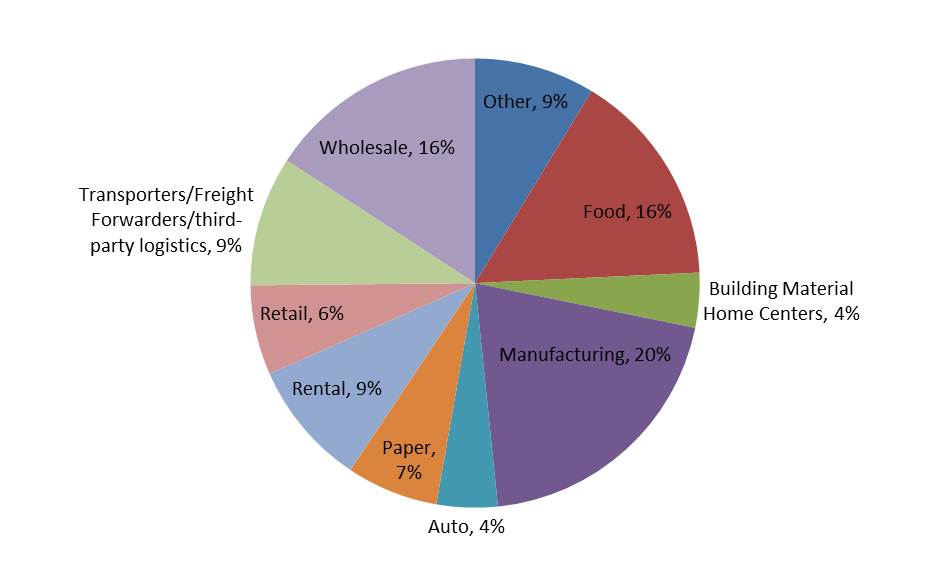

Diversified Customer Base

A diversified customer base reduces exposure to individual customer or industry risk.

| |

| • | Substantial geographic distribution with 62% of 2011 sales in the Americas market, 30% in the European, Middle East and Africa markets and 8% in China and other Asia-Pacific markets |

| |

| • | NMHG markets industrial lift trucks into over 600 different end-user applications in more than 700 industries (as of December 31, 2011) |

| |

| • | Top 10 customers accounted for approximately 31% of 2011 unit sales |

| |

| • | Unit shipments by industry as a percentage of 2011 units sold: |

Hamilton Beach Business Highlights

Leading Brands and Market Shares

| |

| • | One of the leading companies in small kitchen and garment care appliances in North America and growing throughout Latin America |

| |

| • | Hamilton Beach participates in 43 small kitchen appliance categories and holds a significant share in many of the key small appliance categories |

| |

| • | Outside of the kitchen, Hamilton Beach also participates in the home environment and outdoor grill categories |

| |

| • | One of the leading companies in the commercial counter-top equipment category, with significant share positions in commercial blenders and spindle mixers |

| |

| • | Broad complement of key brand names, including the Hamilton Beach® and Proctor Silex® brands, targeted at distinct consumer segments |

| |

| • | The Hamilton Beach® and Proctor Silex® brands have been extended, via strategic licensing partnerships, to related consumer household products categories such as mid-size home appliances and cookware |

Comprehensive Product Line

|

| |

Air Purifiers Automatic Drip Coffee Makers Baby Food Makers Blenders Bread Makers Can Openers Coffee Grinders Coffee Urns Deep Fryers Drink Mixers Electric Knives Espresso/Cappuccino Makers Fifth Burners Food Choppers Food Processors Food Steamers Griddles Hand Blenders Hand Mixers Hot Pots Ice Cream Makers | Ice Shavers Ice Tea Makers Indoor Grills Irons Jar Openers Juice Extractors Juicers Kettles Odor Eliminators Outdoor Grills Panini Makers Percolators Popcorn Makers Rice Cookers Roaster Ovens Sandwich Makers Single Serve Coffee Makers Skillets Slow Cookers Stand Mixers Toasters Toaster Ovens Waffle Bakers |

Strong Retailer Relationships

| |

| • | Approximately 1,300 active accounts (as of December 31, 2011) |

| |

| • | Has category management responsibilities at Wal-Mart (U.S. and Mexico), Target, Kmart, Sears and a number of other food, drug and mass merchandise retailers throughout the United States and Mexico |

| |

| • | Has received Vendor-of-the-Year awards at Wal-Mart, Target, Kmart, Sears and others |

| |

| • | Has received vendor "Innovation" and "Quality" awards from Wal-Mart |

Low Cost Distribution and Procurement

| |

| • | Focused on continuous improvement and leveraging the strengths of all supply chain participants |

| |

| • | Industry-leading working capital management |

Strong Supplier Relationships

| |

| • | Source finished products through approximately 35 suppliers primarily located in China, typically with a lead supplier for each product category |

| |

| • | Working with multiple suppliers allows Hamilton Beach to bring a wide variety of products to market quickly |

Experienced Management Team

| |

| • | Senior management team averages more than 20 years of experience with Hamilton Beach |

| |

| • | Highly professional team with significant tenure at Hamilton Beach, as well as experience from industry-leading consumer companies |

Increasing Number of Innovative Products

Hamilton Beach® BrewStation® Coffee maker

•Breakthrough family of carafeless, one-hand dispensing coffee makers

Hamilton Beach® Wave~Action® Blenders

•Wave-Action® system forces mixture down into the blades for smoother results

Hamilton Beach® Stay or Go™ Slow Cooker

•Clip-tight, lid locks for spill-resistant travel

•Hinged lid stays up for easy buffet serving

Hamilton Beach® The Scoop™ Single-Serve Coffee maker

•Scoop any ground coffee and brew a single serving that's hotter, faster and better tasting

Hamilton Beach® The Scoop™ 2-Way Brewer Coffee maker

•Two ways to brew - full 12-cup pot or scoop any ground coffee to brew a single serving

Hamilton Beach® Revolution® Ice Shaver

•Key product for the restaurant and bar business

•For smoothies, daiquiris, margaritas and more

Hamilton Beach® Toastation® Toaster & Oven

•Compact all-in-one appliance that functions as a toaster and a toaster oven

Hamilton Beach® OpenStation™ Can Opener

•Opens cans, jars, lids and even hard-plastic packaging

Hamilton Beach® Durathon™ Iron

| |

| • | Durathon™ nonstick soleplate is 10 times more durable than traditional nonstick, providing scratch-resistant durability with superior glide performance |

Kitchen Collection Business Highlights

Successful, Proven Format

| |

| • | Proven Kitchen Collection format has helped Kitchen Collection become the leading specialty retailer of kitchen and related products in outlet malls |

| |

| • | Focus on wide variety of specialty kitchenware delivers above-average margins |

| |

| • | In August 2006, Kitchen Collection acquired the assets, including the name, of Le Gourmet Chef, Inc., which expanded Kitchen Collection's presence in outlet and traditional malls |

| |

| • | As of December 31, 2011, Kitchen Collection had a total of 337 stores; 276 Kitchen Collection® stores and 61 Le Gourmet Chef® stores |

Traditional Mall Format

| |

| • | Stores located in traditional malls focus on a wide range of nationally-branded specialty housewares |

| |

| • | 113 traditional mall Kitchen Collection® stores are operating as of January 31, 2012 |

| |

| • | 12 traditional mall Le Gourmet Chef® stores are operating as of January 31, 2012 |

| |

| • | Potential market of over 500 traditional enclosed malls nationwide |

Continuous Improvement

| |

| • | Kitchen Collection has developed specific approaches over time to improve the three main retail performance drivers |

| |

| ◦ | Number of customer visits |

| |

| ◦ | Percentage of visitors who purchase |

| |

| ◦ | Average dollar amount of sales |

| |

| • | Kitchen Collection continually tests and implements new approaches to further improve these key drivers |

Disciplined Overhead Management

| |

| • | Headquarters staff provides merchandising expertise, accounting, information systems and oversight with a focus on maintaining a low cost culture |

| |

| • | Small number of full-time employees at store level |

Leading Brand Names

| |

| • | Top brands sold by Kitchen Collection® and Le Gourmet Chef® include Kitchen Aid, OXO, Cuisinart, Keurig, Wilton, Calphalon, Henckels and Wusthof |

| |

| • | Kitchen Collection sells a wide range of branded housewares including Hamilton Beach® and Proctor Silex® kitchen electrics, including close-out and excess inventory items from Hamilton Beach Brands, as well as Hamilton Beach®- and Proctor Silex®-branded non-electric gadgets, bakeware and cookware |

Efficient Supply Chain

| |

| • | In 2011, to improve distribution operations and increase efficiencies, Kitchen Collection combined its two distribution centers into one larger facility |

| |

| • | Many high-volume products ship directly to store locations from U.S.-based vendors |

North American Coal (“NACoal”) Business Highlights

Coal Production Overview

Coal fuels about 45% of electrical generation in the United States

The U.S.'s abundant recoverable coal reserves of over 261 billion tons help to provide a lower-cost energy source and can contribute to U.S. energy independence.

| |

| • | Coal production in the United States in 2011 was approximately 1.1 billion tons |

| |

| • | Coal is one of the lowest cost fuels for long-term base-load electric power generation and is less expensive than natural gas or oil |

Energy sector shows moderate growth.

| |

| • | Coal will continue to be an important energy source as new technologies, including coal gasification, show promise in cost-effectively capturing carbon dioxide |

Focus on Lignite Coal

NACoal is the nation's largest miner of lignite coal, and the 9th largest coal producer nationwide as of December 31, 2011, delivering 27.9 million tons of coal in 2011.

NACoal has 2.3 billion tons of coal reserves, including Unconsolidated Mining Operations, of which 1.1 billion tons are committed to current customers as of December 31, 2011.

Chart comparing lignite coal to other types of coal

Diverse Mining Locations

Map of NACoal's mine locations

Dependable Financial Performance

| |

| • | Steady operating income and cash flow before financing activities |

Minimal Exposure to Coal Prices

| |

| • | Contracts structured to minimize exposure to fluctuations in coal prices |

| |

| • | Long-term agreements establish mining services that NACoal will perform and the mechanisms for compensation |

Stable Operating Income Streams

Seven Unconsolidated Mining Operations (Louisiana, Mississippi, North Dakota and Texas)

| |

| • | Cost plus an agreed pre-tax profit or management fee per ton |

| |

| • | Modest up front equity investment by NACoal |

| |

| • | Debt financing guaranteed by customer; non-recourse to NACoal |

| |

| • | No coal market price risk |

| |

| • | Long-term contracts (2012-2045) |

| |

| ◦ | Contract expiring in 2012 automatically extends if NACoal's customer's third-party coal supply agreement is extended |

| |

| • | 2011 deliveries of 25.2 million tons |

| |

| • | Four of these mining operations are in the development stage and therefore do not mine or deliver coal |

| |

| ◦ | Demery Resources Company (Permit obtained) |

| |

| ▪ | Approximately 300,000 to 400,000 tons of coal annually for a new customer, with deliveries expected to commence in late 2012 or early 2013 |

| |

| ◦ | Camino Real Fuels (Permitting stage) |

| |

| ▪ | Approximately 2.7 million tons of coal annually for a new customer, with initial deliveries expected to commence in 2014 |

| |

| ◦ | Caddo Creek Resources Company (Permitting stage) |

| |

| ▪ | Approximately 650,000 tons of coal annually for a customer that currently purchases coal from The Sabine Mining Company, with initial deliveries expected to commence in early 2014 |

| |

| ◦ | Liberty Fuels Company (Permit obtained) |

| |

| ▪ | Approximately 4.8 million tons of lignite coal annually for a new customer, with initial deliveries expected to commence in early 2014 |

One Consolidated Mining Operation (Mississippi)

| |

| • | Fixed price with agreed cost and price escalators |

| |

| • | NACoal assumes operating risks; greater initial capital investment and greater profit opportunity |

| |

| • | Financing by NACoal and not the customer |

| |

| • | Contract extends through 2032 |

| |

| • | 2011 deliveries of 2.7 million tons |

Eight limerock dragline mining operations (Florida)

| |

| • | Cost plus an agreed pre-tax profit or fixed fee per cubic yard of limerock removed from quarry |

| |

| • | 2011 deliveries of 13.7 million cubic yards |

Two Unconsolidated Special Projects (North Dakota, India)

| |

| ◦ | Operates the first commercial-scale coal drying facility in the United States for a power plant |

| |

| ◦ | Provides mining services for the Sasan Mine near Pradesh, India |

Other Income Streams

| |

| • | Agreements to provide consulting services based on NACoal's mining expertise |

| |

| • | Mineral royalty streams from NACoal's non-operating properties |

Outstanding Mining Skills

| |

| • | Use of technology to increase efficiency |

| |

| • | Award-winning environmental protection and safety records |

Future Mining Project Potential

| |

| • | Potential for further coal mining projects |

| |

| • | Potential for additional limerock dragline or other natural resources mining projects |

New Project Opportunities

| |

| • | Pursue various projects related to new coal-based energy technologies, including coal-to-liquids conversion, coal gasification, coal drying and other clean coal technologies |

| |

| • | Pursue opportunities to manage coal mining projects worldwide |

| |

| • | Pursue opportunities to enter the export market |