Full Year 2017 Investor Presentation Exhibit 99

Safe Harbor Statement The statements contained in this presentation that are not historical facts are "forward-looking statements" within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934. These forward-looking statements are made subject to certain risks and uncertainties, which could cause actual results to differ materially from those presented in these forward-looking statements. Such risks and uncertainties with respect to each subsidiary's operations are listed in the appendix of this document. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof. Forward-Looking Statements

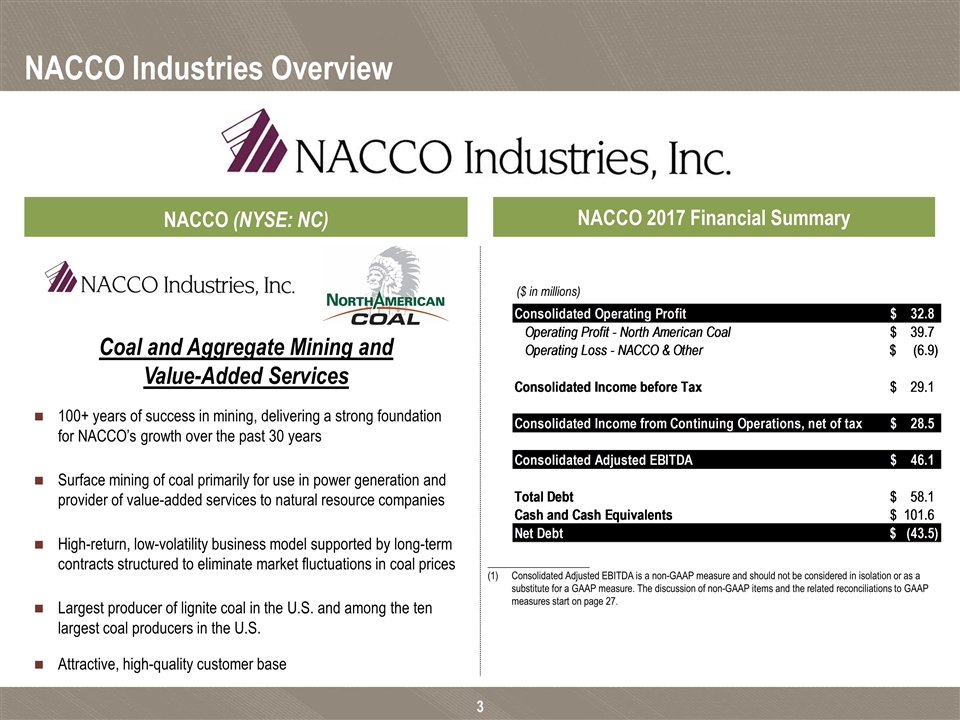

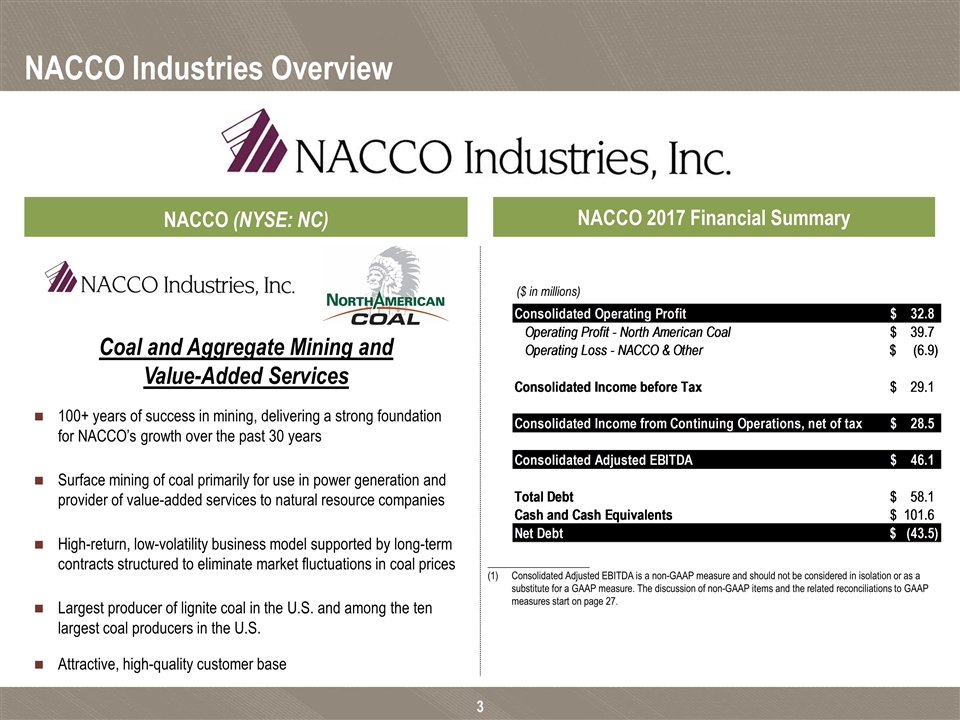

NACCO Industries Overview

Coal and Aggregate Mining and Value-Added Services 100+ years of success in mining, delivering a strong foundation for NACCO’s growth over the past 30 years Surface mining of coal primarily for use in power generation and provider of value-added services to natural resource companies High-return, low-volatility business model supported by long-term contracts structured to eliminate market fluctuations in coal prices Largest producer of lignite coal in the U.S. and among the ten largest coal producers in the U.S. Attractive, high-quality customer base NACCO Industries Overview NACCO (NYSE: NC) NACCO 2017 Financial Summary ($ in millions) _____________________ Consolidated Adjusted EBITDA is a non-GAAP measure and should not be considered in isolation or as a substitute for a GAAP measure. The discussion of non-GAAP items and the related reconciliations to GAAP measures start on page 27. Consolidated Operating Profit $32.799999999999997 Operating Profit - North American Coal $39.700000000000003 Operating Loss - NACCO & Other $-6.9 Consolidated Income before Tax $29.1 Consolidated Income from Continuing Operations, net of tax $28.5 Consolidated Adjusted EBITDA $46.1 Total Debt $58.1 Cash and Cash Equivalents $101.6 Net Debt $-43.499999999999993

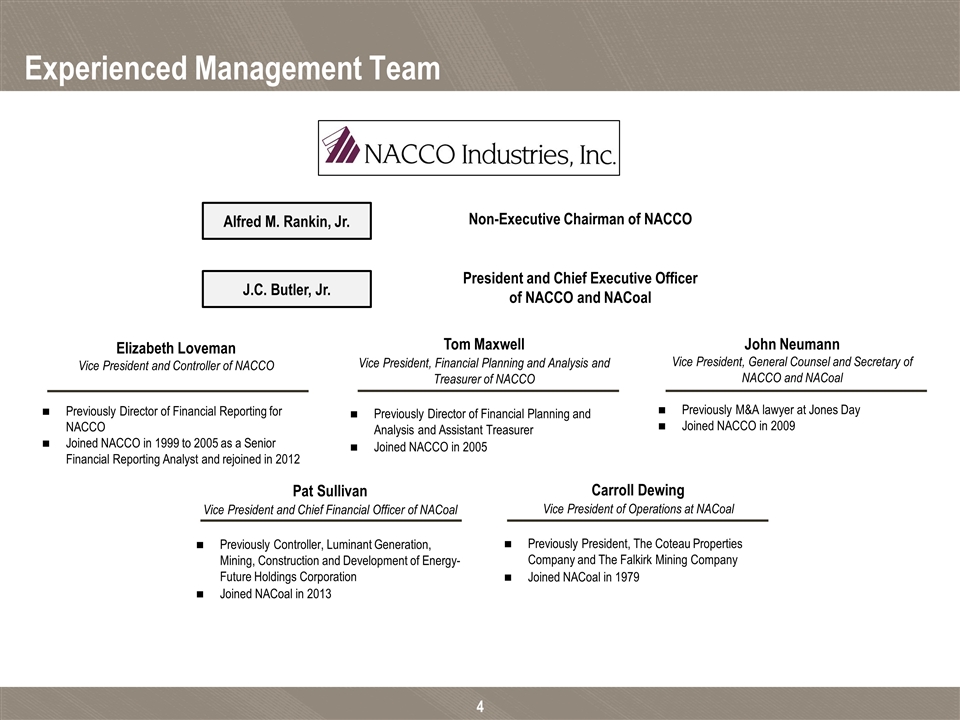

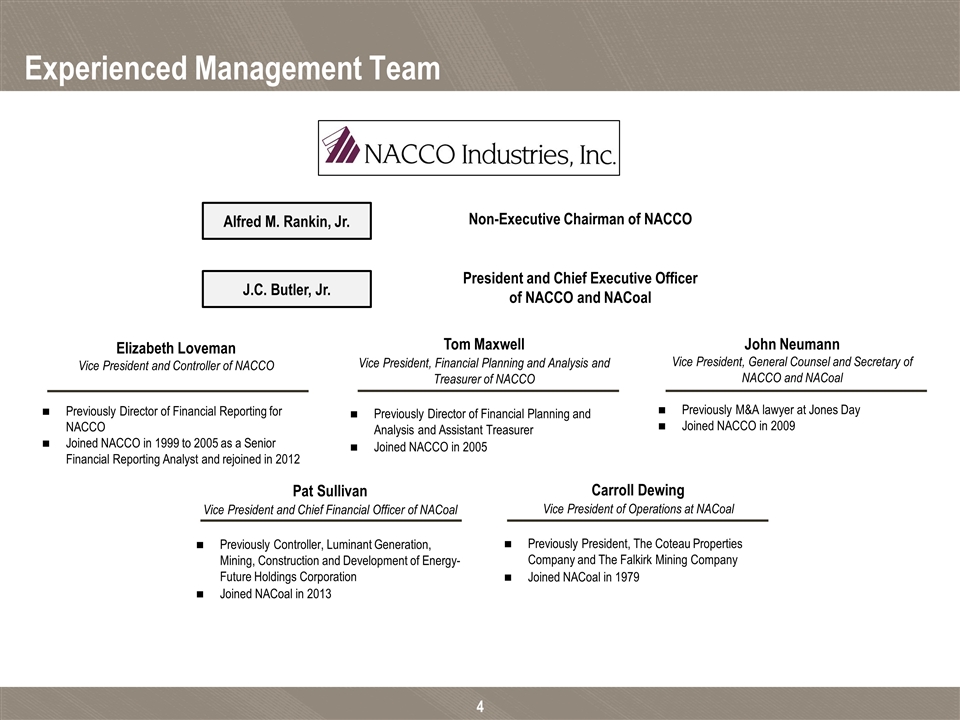

Experienced Management Team Alfred M. Rankin, Jr. J.C. Butler, Jr. Non-Executive Chairman of NACCO President and Chief Executive Officer of NACCO and NACoal John Neumann Vice President, General Counsel and Secretary of NACCO and NACoal Previously M&A lawyer at Jones Day Joined NACCO in 2009 Elizabeth Loveman Vice President and Controller of NACCO Previously Director of Financial Reporting for NACCO Joined NACCO in 1999 to 2005 as a Senior Financial Reporting Analyst and rejoined in 2012 Tom Maxwell Vice President, Financial Planning and Analysis and Treasurer of NACCO Previously Director of Financial Planning and Analysis and Assistant Treasurer Joined NACCO in 2005 Carroll Dewing Vice President of Operations at NACoal Previously President, The Coteau Properties Company and The Falkirk Mining Company Joined NACoal in 1979 Pat Sullivan Vice President and Chief Financial Officer of NACoal Previously Controller, Luminant Generation, Mining, Construction and Development of Energy-Future Holdings Corporation Joined NACoal in 2013

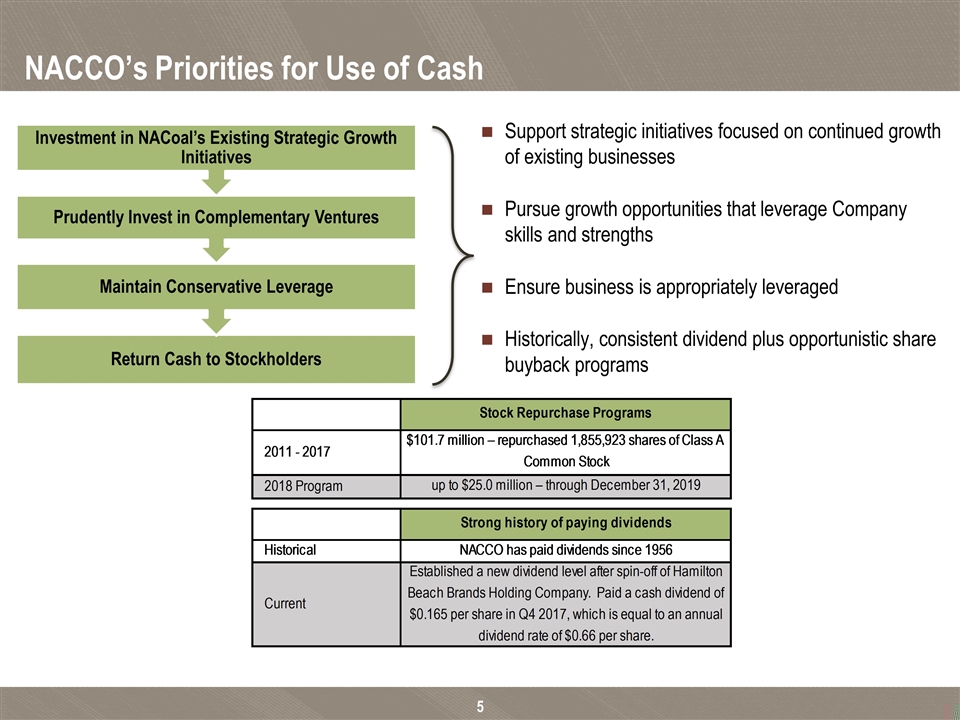

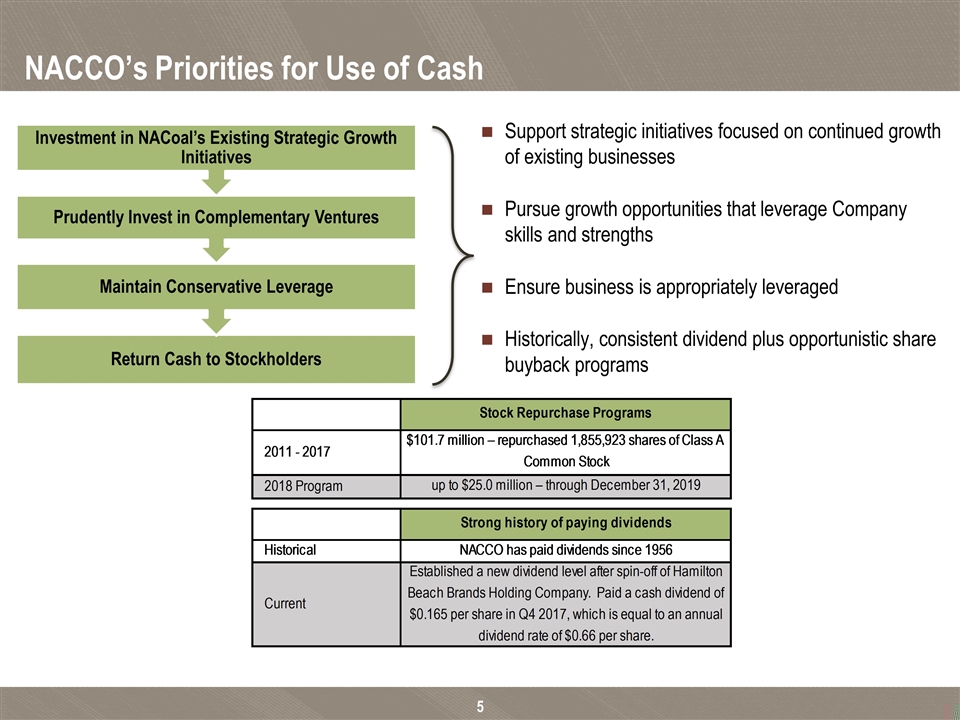

NACCO’s Priorities for Use of Cash Support strategic initiatives focused on continued growth of existing businesses Pursue growth opportunities that leverage Company skills and strengths Ensure business is appropriately leveraged Historically, consistent dividend plus opportunistic share buyback programs Stock Repurchase Programs 2011 - 2017 $101.7 million – repurchased 1,855,923 shares of Class A Common Stock 2018 Program up to $25.0 million – through December 31, 2019 Strong history of paying dividends Historical NACCO has paid dividends since 1956 Current Established a new dividend level after spin-off of Hamilton Beach Brands Holding Company. Paid a cash dividend of $0.165 per share in Q4 2017, which is equal to an annual dividend rate of $0.66 per share. Investment in NACoal’s Existing Strategic Growth Initiatives Return Cash to Stockholders Maintain Conservative Leverage Prudently Invest in Complementary Ventures

North American Coal Overview

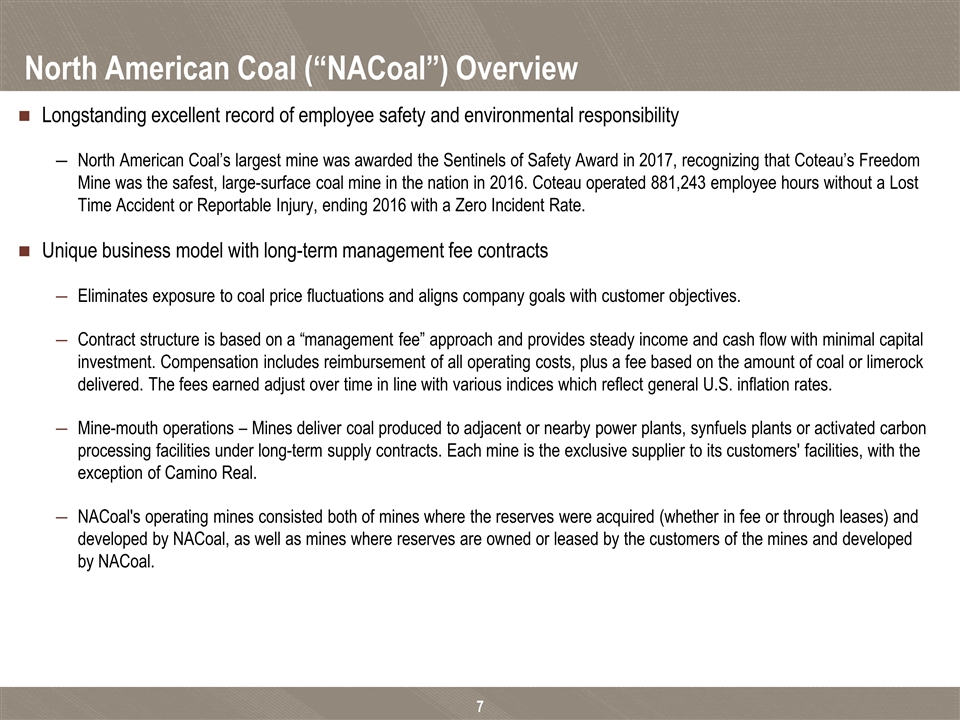

North American Coal (“NACoal”) Overview Longstanding excellent record of employee safety and environmental responsibility North American Coal’s largest mine was awarded the Sentinels of Safety Award in 2017, recognizing that Coteau’s Freedom Mine was the safest, large-surface coal mine in the nation in 2016. Coteau operated 881,243 employee hours without a Lost Time Accident or Reportable Injury, ending 2016 with a Zero Incident Rate. Unique business model with long-term management fee contracts Eliminates exposure to coal price fluctuations and aligns company goals with customer objectives. Contract structure is based on a “management fee” approach and provides steady income and cash flow with minimal capital investment. Compensation includes reimbursement of all operating costs, plus a fee based on the amount of coal or limerock delivered. The fees earned adjust over time in line with various indices which reflect general U.S. inflation rates. Mine-mouth operations – Mines deliver coal produced to adjacent or nearby power plants, synfuels plants or activated carbon processing facilities under long-term supply contracts. Each mine is the exclusive supplier to its customers' facilities, with the exception of Camino Real. NACoal's operating mines consisted both of mines where the reserves were acquired (whether in fee or through leases) and developed by NACoal, as well as mines where reserves are owned or leased by the customers of the mines and developed by NACoal.

North American Coal (“NACoal”) Overview North American Mining North American Mining provides value-added services for independently owned limerock quarries and is reimbursed by its customers based on actual costs plus a management fee per unit of limerock delivered. Significant growth in recent years, leveraging cost-plus business model Since 2015, North American Mining has grown from serving two customers with seven quarries utilizing 10 draglines, to serving five customers with 15 quarries utilizing 23 draglines and an electric rope shovel as of December 31, 2017 Value-added services NoDak Energy Services, LLC operates and maintains a coal drying system that is embedded inside a customer’s power plant Camino Real Fuels operates and maintains a coal handling and train loadout facility for its customer Bisti Fuels operates and maintains a sophisticated coal blending and handling facility for its customer, including an approximately 15-mile rail operation with two locomotives used to transport coal from the mine to the power plant Other mines provide ash handling and ash management services for their customers North American Coal Royalty Company provides surface and mineral acquisition and lease maintenance services for NACoal and on behalf of many of its customers

Attractive Mix of Operations Surface Coal Mining North American Mining Value-Added Services

Excellent Safety Record 2013 – 2017 National Mining Association Top 25 U.S. Coal Producers Ranked by Average Incident Rate ___________________ OSHA (Occupational Safety and Healthy Administration) Incident Rate = Total number of injuries and illnesses multiplied by 200,000 divided by number of hours worked by all employees. The math described can lead to incident rates below one. (1)

Environmental Responsibility Environmental Protection Agency Environmental Excellence Award The Department of Interior Office of Surface Mining Best of the Best Award The Department of Interior Office of Surface Mining Director’s Award The Department of Interior Office of Surface Mining Good Neighbor Award The Texas Parks & Wildlife Department Lone Star Steward Award The Department of Interior Office of Surface Mining Excellence in Surface Coal Mining and Reclamation Award The North Dakota Public Service Commission Excellence in Surface Coal Mining & Reclamation Award North American Coal has received 80 federal and state awards for successful and innovative reclamation projects over the last 30 years

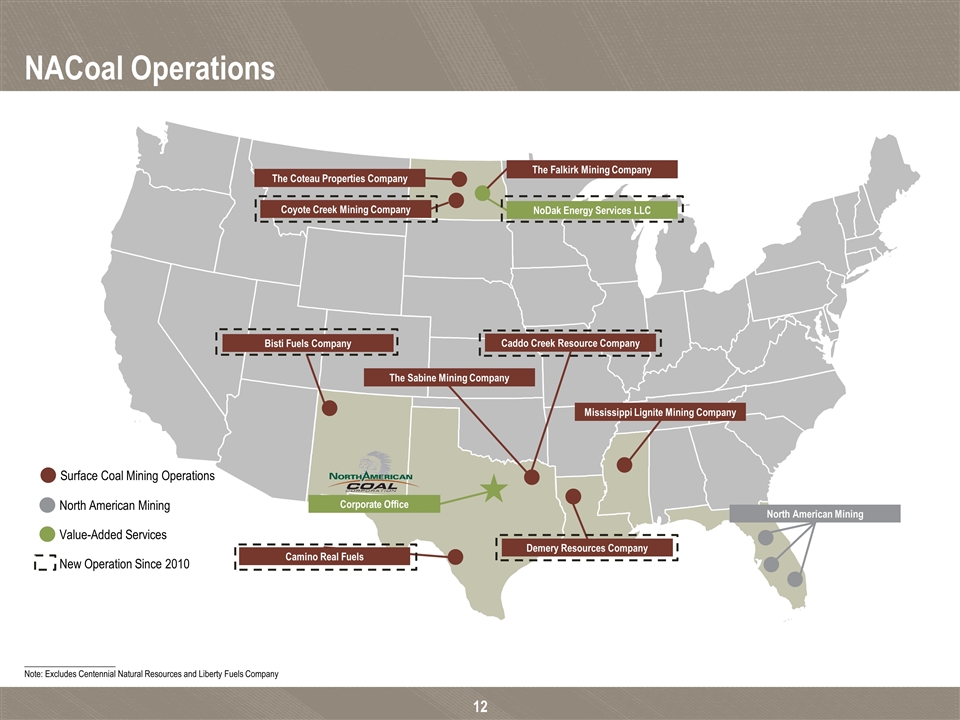

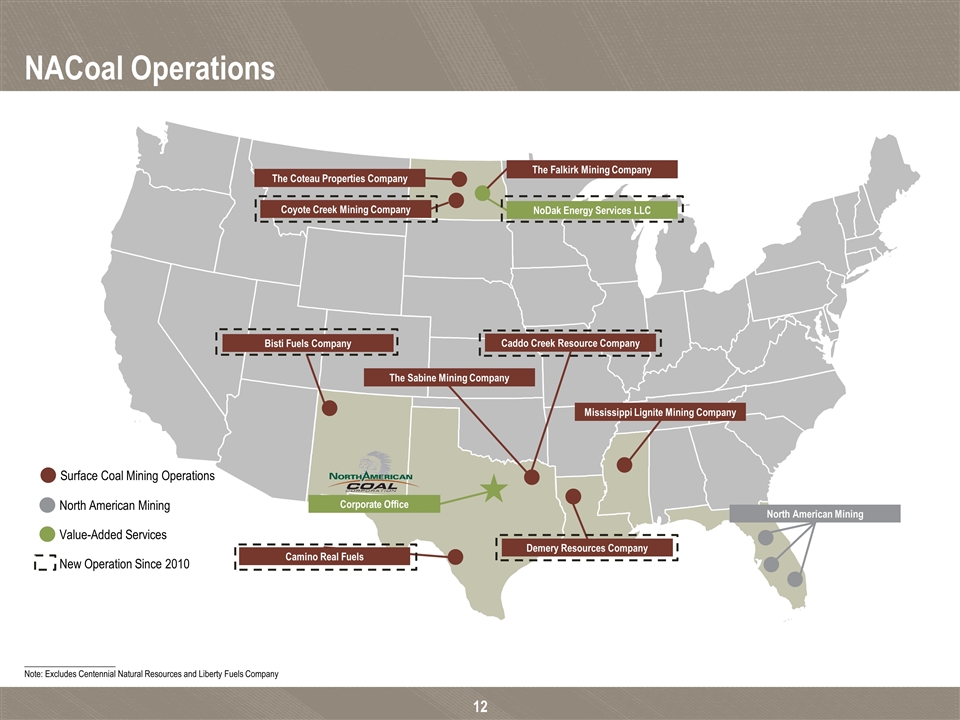

NACoal Operations Mississippi Lignite Mining Company The Coteau Properties Company Coyote Creek Mining Company The Falkirk Mining Company NoDak Energy Services LLC Bisti Fuels Company Camino Real Fuels Caddo Creek Resource Company The Sabine Mining Company Demery Resources Company North American Mining Corporate Office North American Mining Value-Added Services _____________________ Note: Excludes Centennial Natural Resources and Liberty Fuels Company New Operation Since 2010 Surface Coal Mining Operations

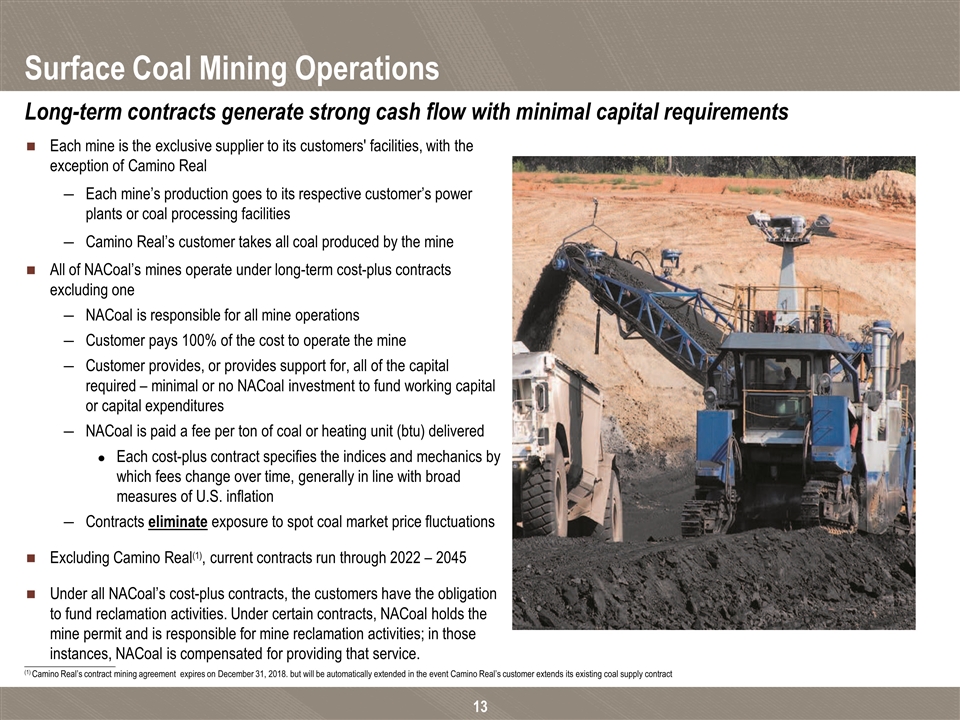

Surface Coal Mining Operations Each mine is the exclusive supplier to its customers' facilities, with the exception of Camino Real Each mine’s production goes to its respective customer’s power plants or coal processing facilities Camino Real’s customer takes all coal produced by the mine All of NACoal’s mines operate under long-term cost-plus contracts excluding one NACoal is responsible for all mine operations Customer pays 100% of the cost to operate the mine Customer provides, or provides support for, all of the capital required – minimal or no NACoal investment to fund working capital or capital expenditures NACoal is paid a fee per ton of coal or heating unit (btu) delivered Each cost-plus contract specifies the indices and mechanics by which fees change over time, generally in line with broad measures of U.S. inflation Contracts eliminate exposure to spot coal market price fluctuations Excluding Camino Real(1), current contracts run through 2022 – 2045 Under all NACoal’s cost-plus contracts, the customers have the obligation to fund reclamation activities. Under certain contracts, NACoal holds the mine permit and is responsible for mine reclamation activities; in those instances, NACoal is compensated for providing that service. Long-term contracts generate strong cash flow with minimal capital requirements _____________________ (1) Camino Real’s contract mining agreement expires on December 31, 2018. but will be automatically extended in the event Camino Real’s customer extends its existing coal supply contract

Surface Coal Mining Operations – Mississippi Lignite Mining Company Mississippi Lignite Mining Company (“MLMC”) delivers coal to a power plant adjacent to the mine under a long-term contract that extends through 2032 MLMC is the exclusive supplier of coal to its customer’s power plant Contractually agreed-upon price adjusts monthly primarily based on changes in the level of established indices, which reflect general U.S. inflation rates, including cost components such as labor and diesel fuel Coal sales price is not subject to spot coal market fluctuations Profitability at MLMC is affected by its customer’s demand for coal, changes in the indices that determine MLMC’s sales price and actual costs incurred Operates pursuant to a more traditional business model in which NACoal pays all operating costs and provides the capital for this mine Periodic significant capital spending requirements to replace major equipment and to secure land and coal for future mining

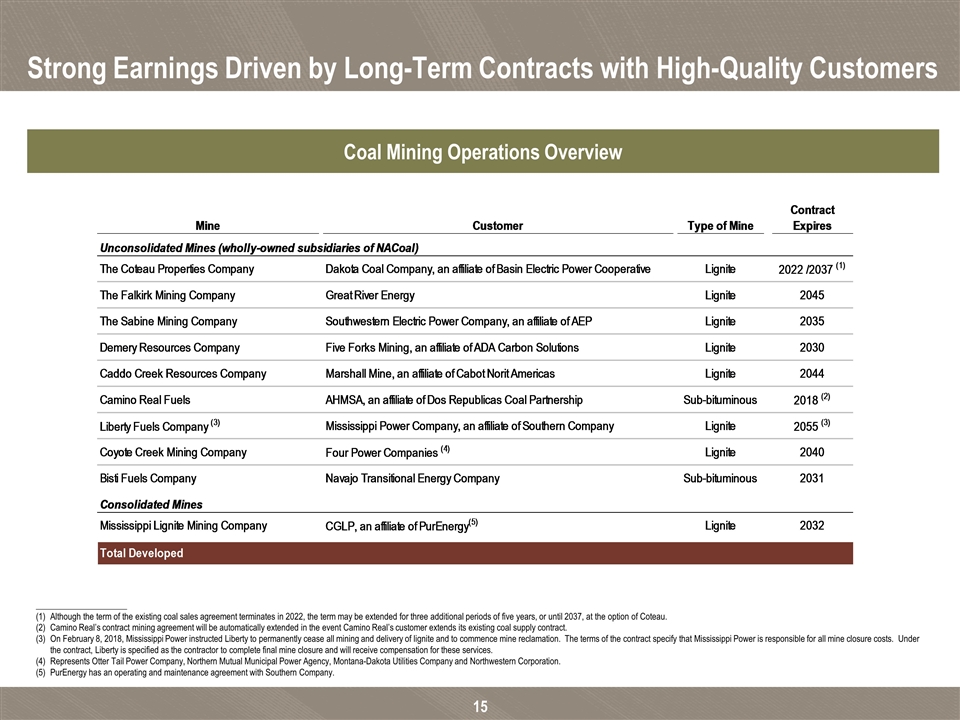

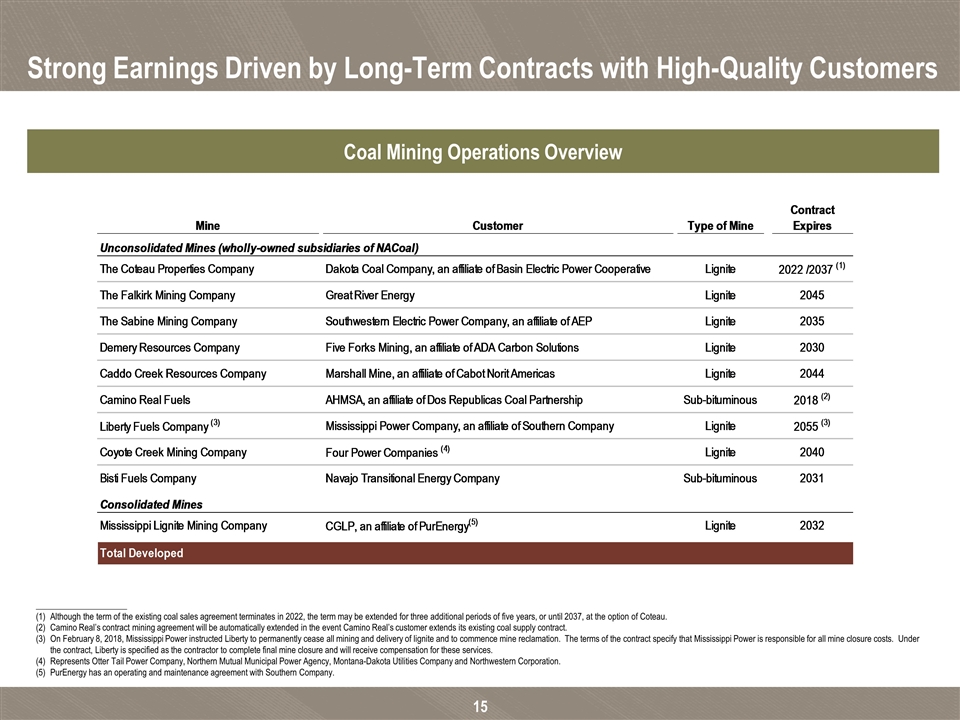

Strong Earnings Driven by Long-Term Contracts with High-Quality Customers Coal Mining Operations Overview _____________________ Although the term of the existing coal sales agreement terminates in 2022, the term may be extended for three additional periods of five years, or until 2037, at the option of Coteau. Camino Real’s contract mining agreement will be automatically extended in the event Camino Real’s customer extends its existing coal supply contract. On February 8, 2018, Mississippi Power instructed Liberty to permanently cease all mining and delivery of lignite and to commence mine reclamation. The terms of the contract specify that Mississippi Power is responsible for all mine closure costs. Under the contract, Liberty is specified as the contractor to complete final mine closure and will receive compensation for these services. Represents Otter Tail Power Company, Northern Mutual Municipal Power Agency, Montana-Dakota Utilities Company and Northwestern Corporation. PurEnergy has an operating and maintenance agreement with Southern Company. Mine Customer Type of Mine Contract Expires Unconsolidated Mines (wholly-owned subsidiaries of NACoal) The Coteau Properties Company Dakota Coal Company, an affiliate of Basin Electric Power Cooperative Lignite 2022 /2037 (1) The Falkirk Mining Company Great River Energy Lignite 2045 The Sabine Mining Company Southwestern Electric Power Company, an affiliate of AEP Lignite 2035 Demery Resources Company Five Forks Mining, an affiliate of ADA Carbon Solutions Lignite 2030 Caddo Creek Resources Company Marshall Mine, an affiliate of Cabot Norit Americas Lignite 2044 Camino Real Fuels AHMSA, an affiliate of Dos Republicas Coal Partnership Sub-bituminous 2018 (2) Liberty Fuels Company (3) Mississippi Power Company, an affiliate of Southern Company Lignite 2055 (3) Coyote Creek Mining Company Four Power Companies (4) Lignite 2040 Bisti Fuels Company Navajo Transitional Energy Company Sub-bituminous 2031 Consolidated Mines Mississippi Lignite Mining Company CGLP, an affiliate of PurEnergy(5) Lignite 2032 Total Developed Coteau Dakota Coal Company, an affiliate of Basin Electric Power Coeperative Falkirk Great River Energy Sabine Southwestern Electric Power Company, an affiliate of AEP Demery Five Forks Mining, an affiliate of ADA Carbon Solutions Caddo Marshall Mine, an affiliate of Cabot Norit Americas Camino AHMSA, an affiliate of Dos Republicas Coal Partnership Liberty Mississippi Power Company, an affiliate of Southern Company Coyote Four Power Companies (1) Bisti Navajo Transitional Energy Company Mississippi CGLP, an affiliate of Pure Energy (2) (1) Otter Tail Power Company, Northern Mutual Municipal Power Agency, Montana-Dakota Utilities Company and Northwestern Corporation (2) Pure Energy has an operating and maintence agreement with Southern Company

North American Mining Operates and maintains draglines for extraction of limerock at customer-owned limerock quarries Customers pay all mining costs plus a fee per cubic yard excavated or limerock yards delivered Operates more draglines than other Florida operators, with 23 draglines and an electric rope shovel for 5 customers at 15 quarries as of December 31, 2017 Operations viewed as growth platform with significant expansion since 2015 Extracts a significant amount of the annual limerock produced in Florida

Value-Added Services and Other Income Sources Cost-plus contract with fee to operate a coal drying facility within a power plant operated by a major coal customer Ash handling and haulage services provided for some customers as part of mining contract or for a separate fee Ongoing royalty income from rights to coal, oil and gas reserves Reserves located in Ohio, Pennsylvania, North Dakota, Texas, Alabama, Mississippi and Louisiana

Increase the profits generated by existing mining operations & achieve income growth from development of new mining and services ventures NACoal Key Strategy Overview Focus on core operations Continuous effort to drive down production costs, benefiting both customers and NACoal Work with customers to maximize efficiency and operating capacity of their facilities, benefiting both customers and NACoal Strategies for growth Leverage strength of proven cost-plus business model though the thoughtful deployment of North American Coal’s core skills, strengths and relationships Expansion of established North American Coal business Build and operate new surface coal mines to serve existing or new customer relationships Five new coal mines built since 2010 Replace legacy miners at existing surface coal mines Bisti Fuels became operator of Navajo Mine on 1/1/17 Expand North American Mining, including into other aggregates and minerals and across new geographies Significant growth since 2015 Leverage core skills to facilitate additional expansion Environmental services Ash hauling, coal drying, processing and handling services Maintain moderate leverage and avoid commodity price exposure

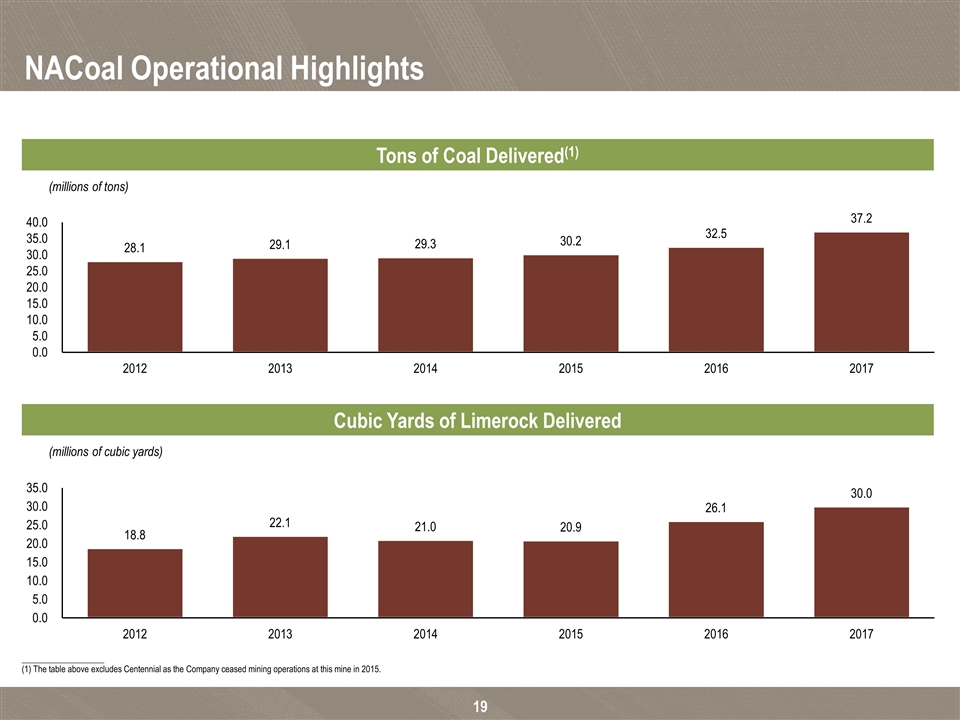

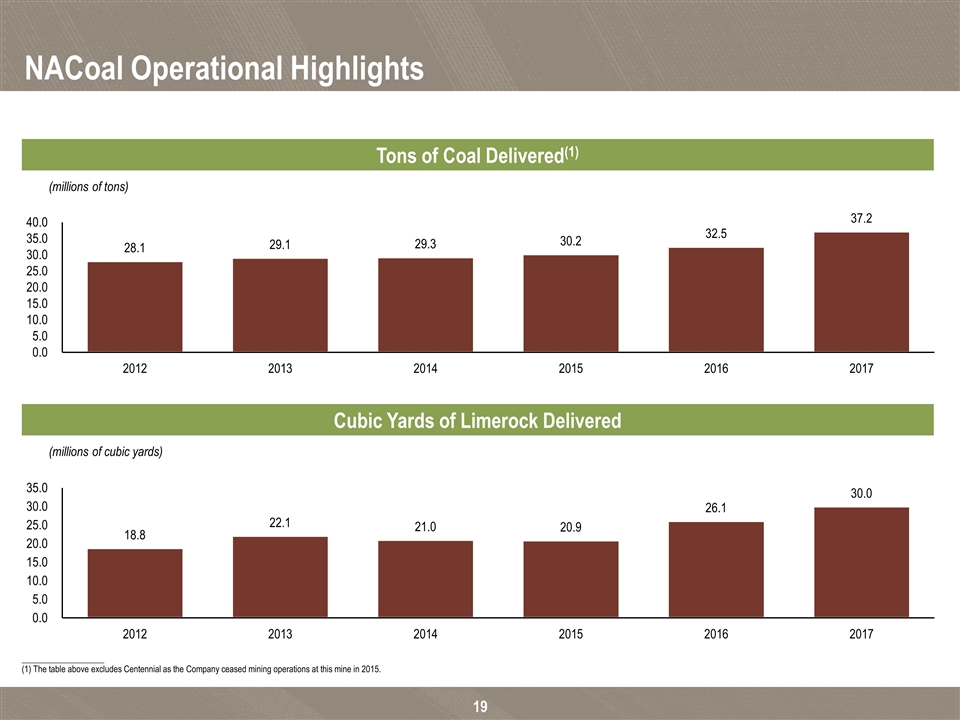

NACoal Operational Highlights (millions of tons) (millions of cubic yards) Tons of Coal Delivered(1) Cubic Yards of Limerock Delivered ___________________ (1) The table above excludes Centennial as the Company ceased mining operations at this mine in 2015.

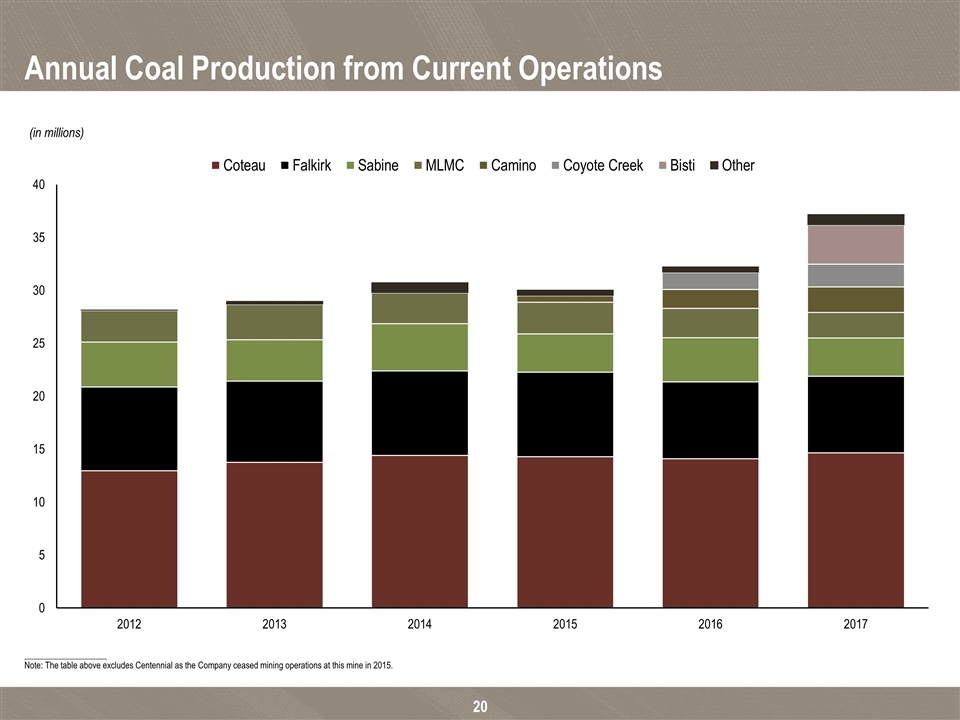

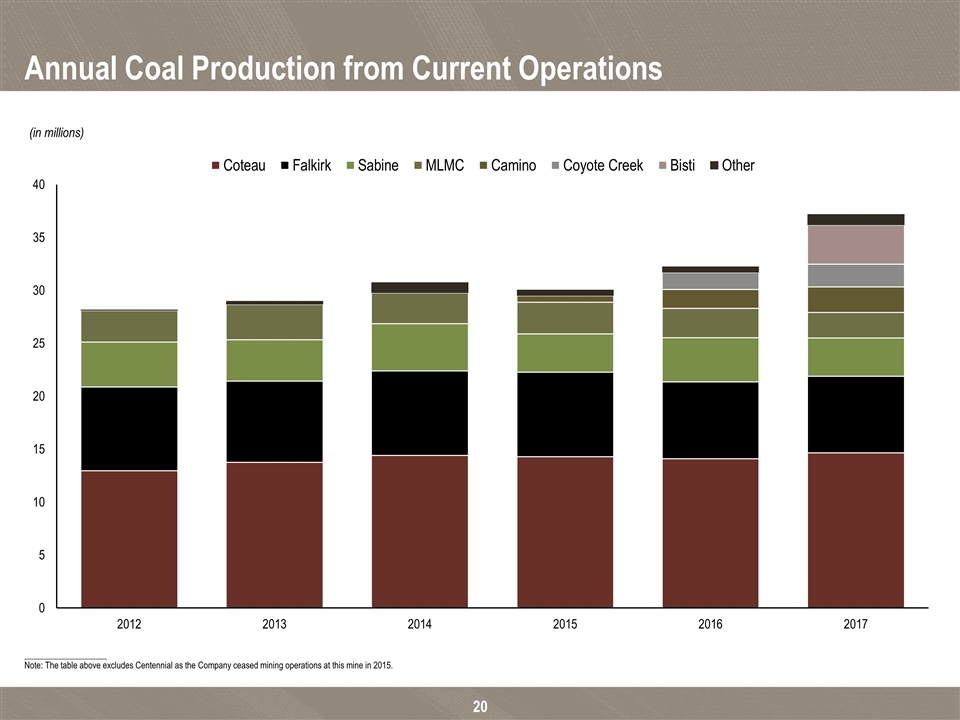

Annual Coal Production from Current Operations ___________________ Note: The table above excludes Centennial as the Company ceased mining operations at this mine in 2015. (in millions)

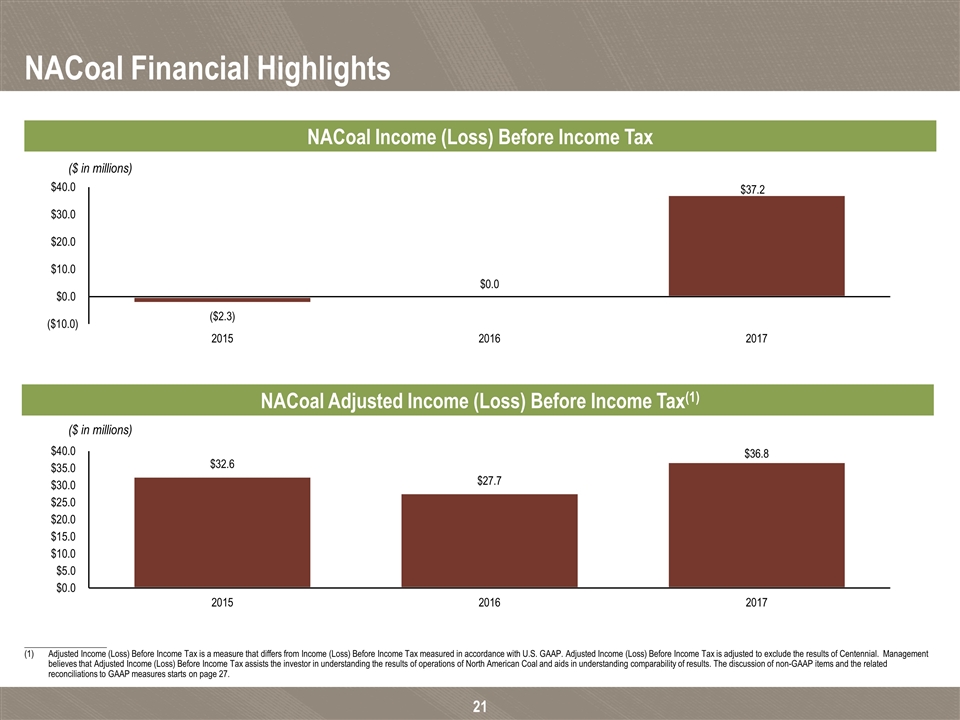

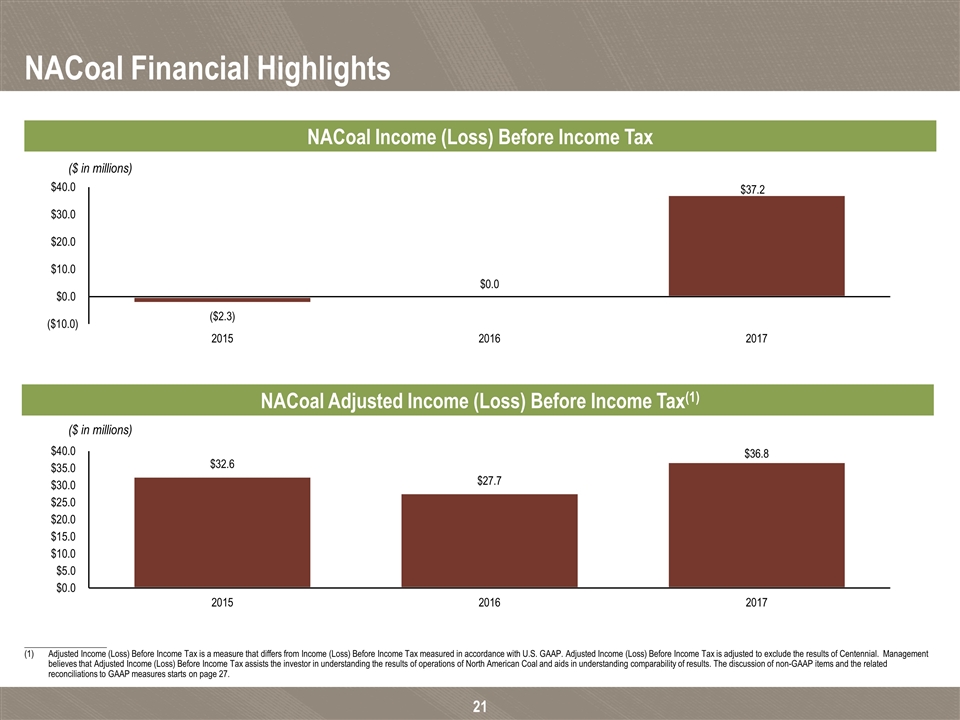

NACoal Financial Highlights ($ in millions) ($ in millions) ___________________ Adjusted Income (Loss) Before Income Tax is a measure that differs from Income (Loss) Before Income Tax measured in accordance with U.S. GAAP. Adjusted Income (Loss) Before Income Tax is adjusted to exclude the results of Centennial. Management believes that Adjusted Income (Loss) Before Income Tax assists the investor in understanding the results of operations of North American Coal and aids in understanding comparability of results. The discussion of non-GAAP items and the related reconciliations to GAAP measures starts on page 27. NACoal Income (Loss) Before Income Tax NACoal Adjusted Income (Loss) Before Income Tax(1)

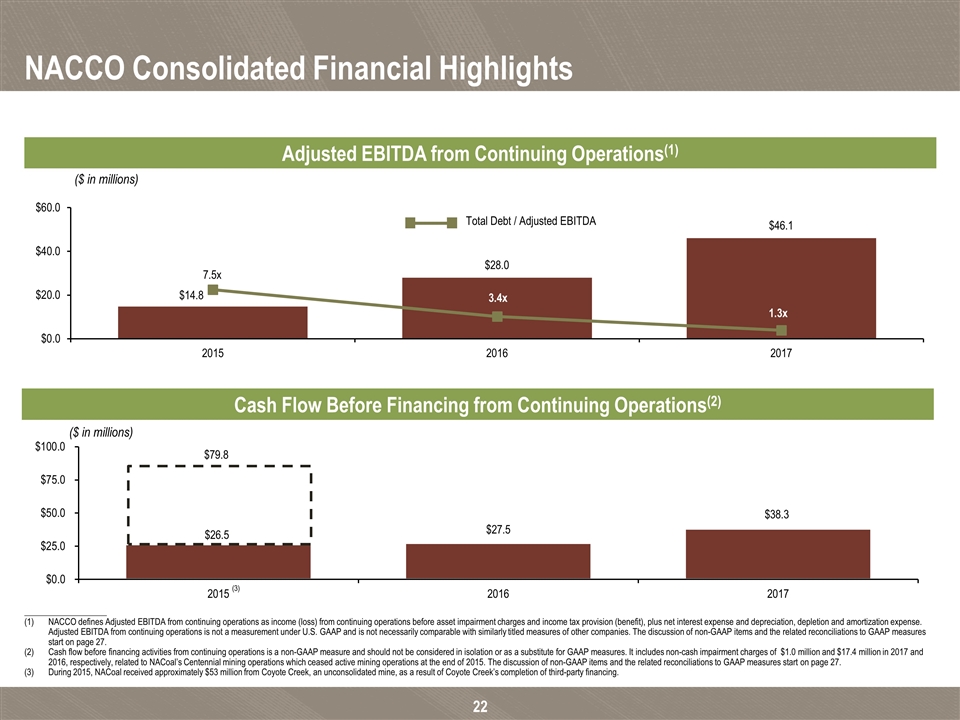

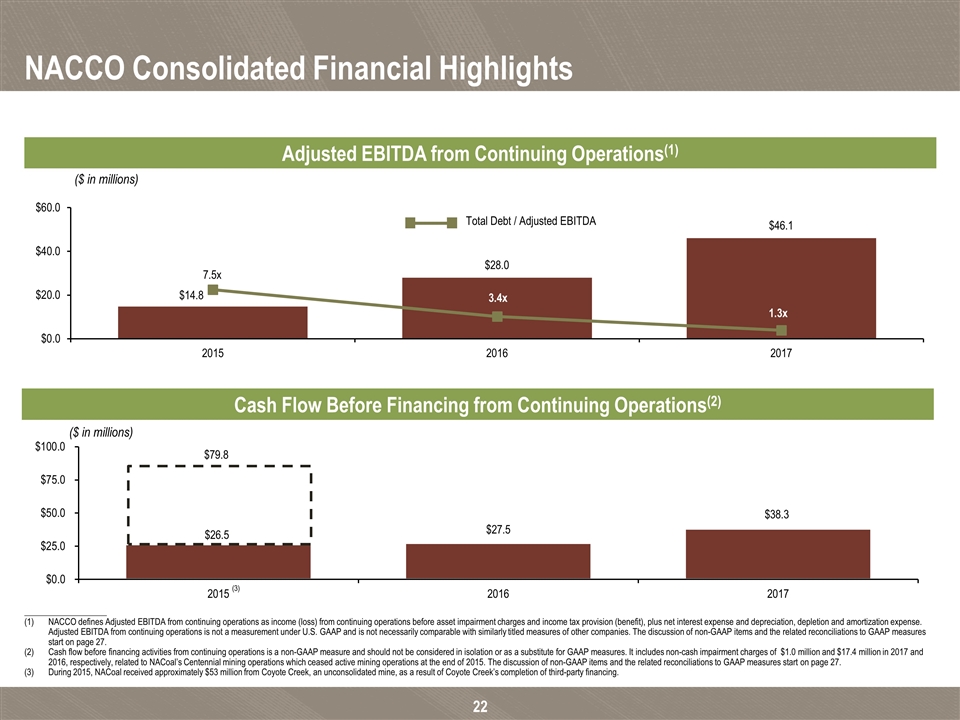

NACCO Consolidated Financial Highlights ___________________ NACCO defines Adjusted EBITDA from continuing operations as income (loss) from continuing operations before asset impairment charges and income tax provision (benefit), plus net interest expense and depreciation, depletion and amortization expense. Adjusted EBITDA from continuing operations is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of other companies. The discussion of non-GAAP items and the related reconciliations to GAAP measures start on page 27. Cash flow before financing activities from continuing operations is a non-GAAP measure and should not be considered in isolation or as a substitute for GAAP measures. It includes non-cash impairment charges of $1.0 million and $17.4 million in 2017 and 2016, respectively, related to NACoal’s Centennial mining operations which ceased active mining operations at the end of 2015. The discussion of non-GAAP items and the related reconciliations to GAAP measures start on page 27. During 2015, NACoal received approximately $53 million from Coyote Creek, an unconsolidated mine, as a result of Coyote Creek’s completion of third-party financing. ($ in millions) Cash Flow Before Financing from Continuing Operations(2) ($ in millions) Adjusted EBITDA from Continuing Operations(1) (3) Total Debt / Adjusted EBITDA

Strong in a Challenging Environment NACoal is well positioned in light of challenges facing the coal mining and electric generation industries Power plants served are younger, larger and more efficient than most that have closed in recent years Power plants served are competitive suppliers of electricity in their respective dispatch areas Customers continue to invest in efficiency and environmental upgrades to their facilities NACoal does not have any direct exposure to coal market price volatility

Why Invest in NACCO? NACoal has over 100 years of success in mining and provided the foundation for the growth of the Company over the past 30 years The completion of the HBBHC spin-off in 2017 provides NACCO stockholders with a more focused investment option NACoal is expected to continue to benefit from its high-return, low-volatility business model supported by long-term contracts Core business model is built upon long-term cost-plus contracts at nearly all of its coal mining, limerock mining and value-added services operations Exclusive supplier for each customer facility except Camino Real Attractive but unusual business model, based largely on long-term management fee contracts, requires minimal capital investment Long-term contracts provide the majority of earnings and strong annuity-like cash flows without cyclical swings Well suited to serve as a contract miner in both coal and non-coal mining operations Opportunities may exist to serve as a contract miner for those who continue to need coal for power generation or other processes using coal or to serve as a contract miner in non-coal mining operations, such as aggregates or other minerals Key objectives: Preserve core long-term contracts with existing customers Expand the North American Mining aggregates business Pursue other opportunities for growth by leveraging the Company’s core skills

Appendix

Risk Factors The statements contained in this presentation that are not historical facts are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are made subject to certain risks and uncertainties, which could cause actual results to differ materially from those presented. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof. Among the factors that could cause plans, actions and results to differ materially from current expectations are, without limitation: (1) changes in tax laws or regulatory requirements, including changes in mining or power plant emission regulations and health, safety or environmental legislation, (2) changes in costs related to geological conditions, repairs and maintenance, new equipment and replacement parts, fuel or other similar items, (3) regulatory actions, changes in mining permit requirements or delays in obtaining mining permits that could affect deliveries to customers, (4) weather conditions, extended power plant outages, liquidity events or other events that would change the level of customers' coal or limerock requirements, (5) weather or equipment problems that could affect deliveries to customers, (6) changes in the power industry that would affect demand for NACoal's reserves, (7) changes in the costs to reclaim NACoal mining areas, (8) costs to pursue and develop new mining and value-added service opportunities, (9) changes to or termination of a long-term mining contract, or a customer default under a contract, (10) delays or reductions in coal deliveries at NACoal's mines, (11) increased competition, including consolidation within the industry, and (12) the possibility that the impact of the U.S. Tax Cuts and Jobs Act could be less favorable than current estimates.

Non-GAAP Disclosure This presentation contains non-GAAP financial measures. Included in this presentation are reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). Adjusted income and Adjusted EBITDA are measures of net income (loss) that differ from financial results measured in accordance with GAAP. The adjusted financial measures are U.S. GAAP financial measures adjusted to exclude Centennial. Adjusted EBITDA, cash flow before financing, and the adjusted financial measures in this presentation are provided solely as supplemental non-GAAP disclosures of operating results. Management believes these non-GAAP financial measures assist investors in understanding the results of operations of NACCO Industries, Inc. and its subsidiaries and aid in understanding comparability of results. In addition, management evaluates results using these non-GAAP financial measures. NACCO defines non-GAAP measures as follows: Adjusted Income (Loss) Before Income Tax is adjusted to exclude the results of Centennial; Adjusted EBITDA from continuing operations is defined as income (loss) from continuing operations before asset impairment charges and income tax expense (benefit) plus net interest expense and depreciation, depletion and amortization expense; Cash flow before financing is defined as net cash from operating activities plus net cash from investing activities. It includes non-cash impairment charges related to NACoal’s Centennial mining operations which ceased active mining operations at the end of 2015. For reconciliations from GAAP measurements to non-GAAP measurements see pages 28 to 30.

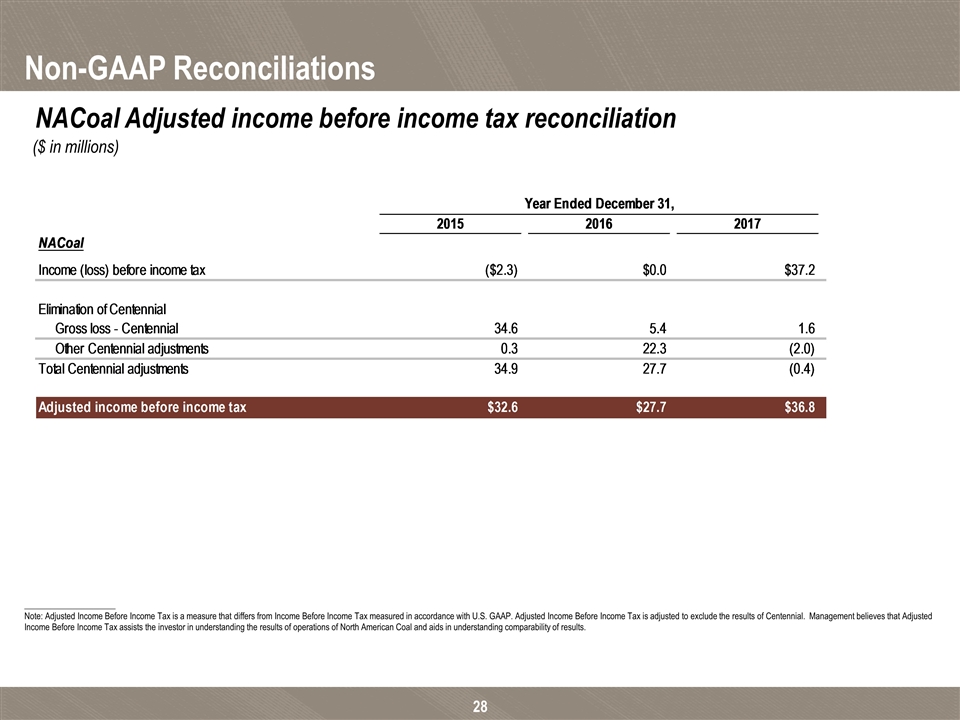

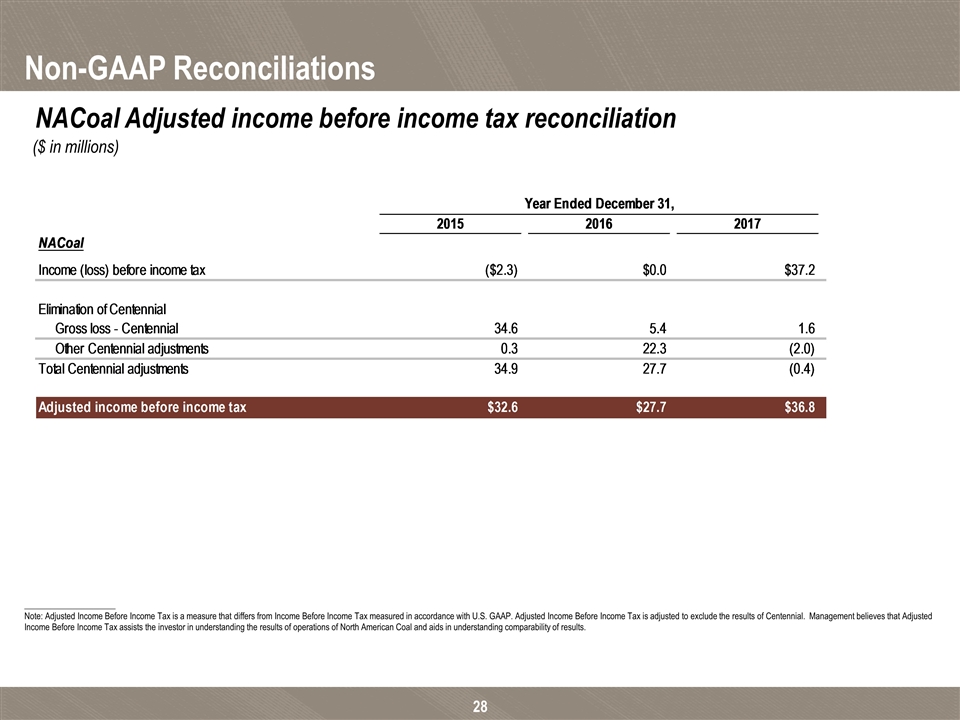

Non-GAAP Reconciliations NACoal Adjusted income before income tax reconciliation ($ in millions) _____________________ Note: Adjusted Income Before Income Tax is a measure that differs from Income Before Income Tax measured in accordance with U.S. GAAP. Adjusted Income Before Income Tax is adjusted to exclude the results of Centennial. Management believes that Adjusted Income Before Income Tax assists the investor in understanding the results of operations of North American Coal and aids in understanding comparability of results. Year Ended December 31, 2015 2016 2017 NACoal Income (loss) before income tax $-2.2999999999999998 $3.2000000000000001E-2 $37.200000000000003 Elimination of Centennial Gross loss - Centennial 34.6 5.4009999999999998 1.6 Other Centennial adjustments 0.3 22.274999999999999 -2 Total Centennial adjustments 34.9 27.675999999999998 -0.39999999999999991 Adjusted income before income tax $32.6 $27.707999999999998 $36.800000000000004

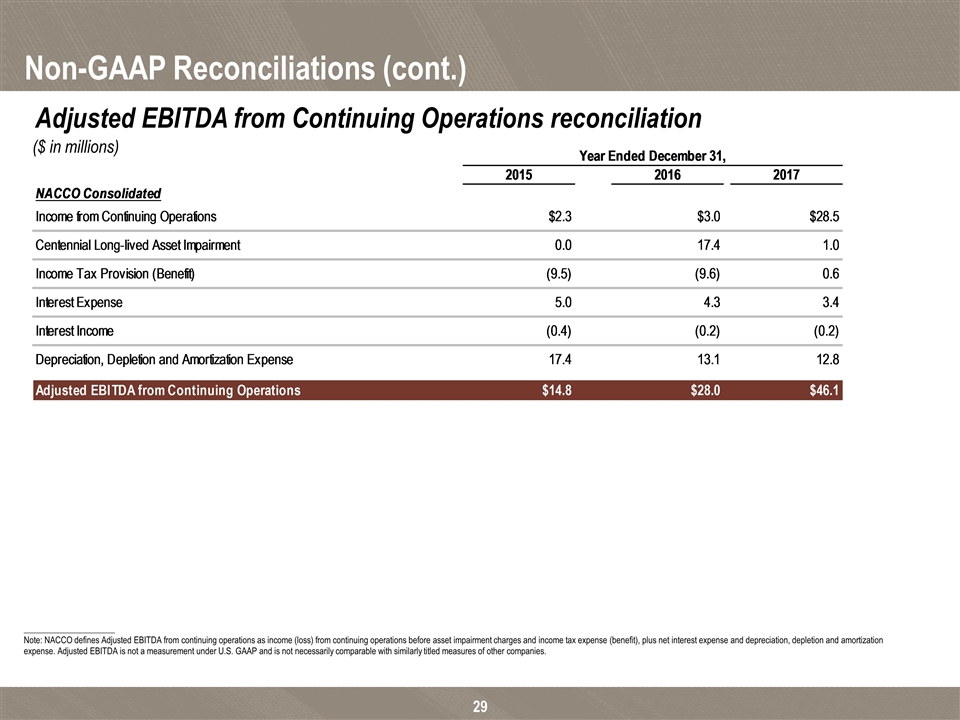

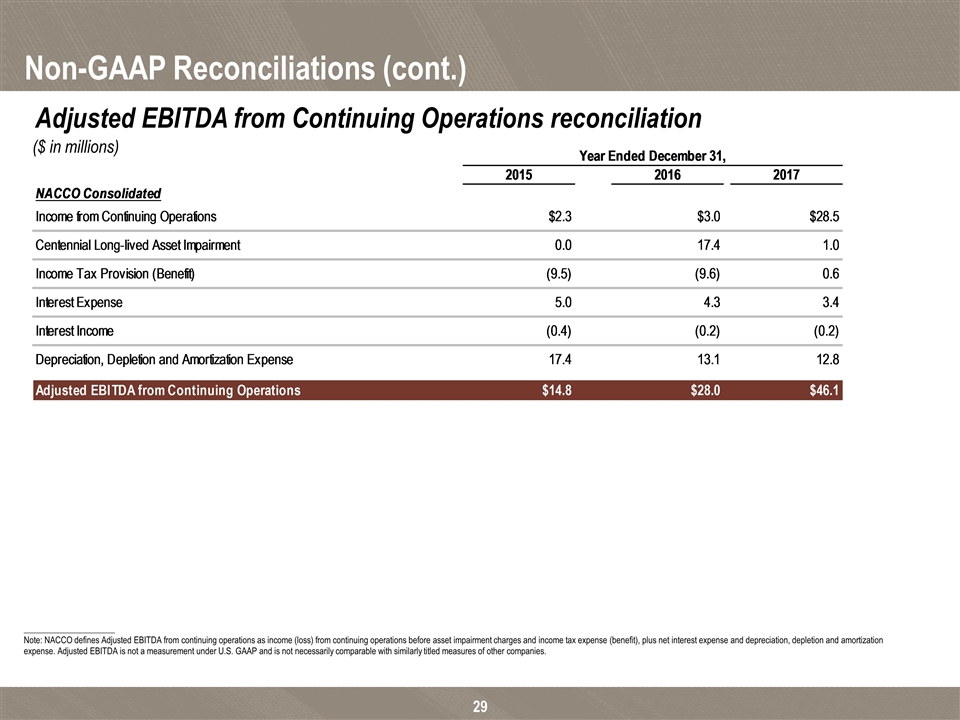

Non-GAAP Reconciliations (cont.) ($ in millions) Adjusted EBITDA from Continuing Operations reconciliation _____________________ Note: NACCO defines Adjusted EBITDA from continuing operations as income (loss) from continuing operations before asset impairment charges and income tax expense (benefit), plus net interest expense and depreciation, depletion and amortization expense. Adjusted EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of other companies. Year Ended December 31, 2015 2016 2017 NACCO Consolidated Income from Continuing Operations $2.2999999999999998 $3 $28.463000000000001 Centennial Long-lived Asset Impairment 0 17.443000000000001 1 Income Tax Provision (Benefit) -9.5 -9.6 0.6 Interest Expense 5 4.3179999999999996 3.4 Interest Income -0.4 -0.19600000000000001 -0.2 Depreciation, Depletion and Amortization Expense 17.399999999999999 13.05 12.8 34.299999999999997 Adjusted EBITDA from Continuing Operations $14.8 $28 $46.063000000000002

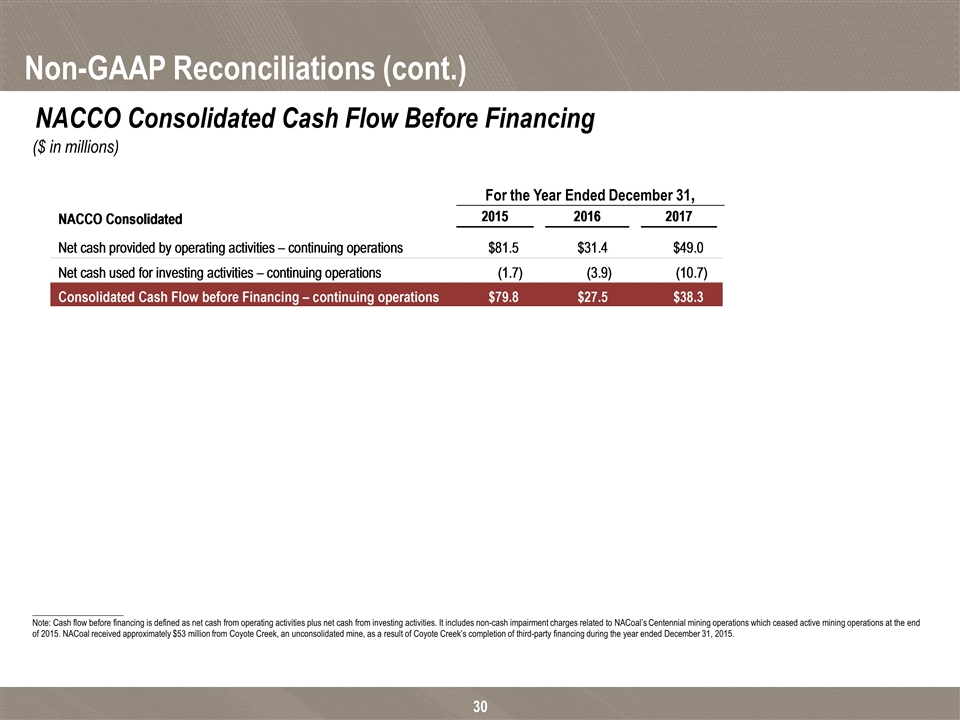

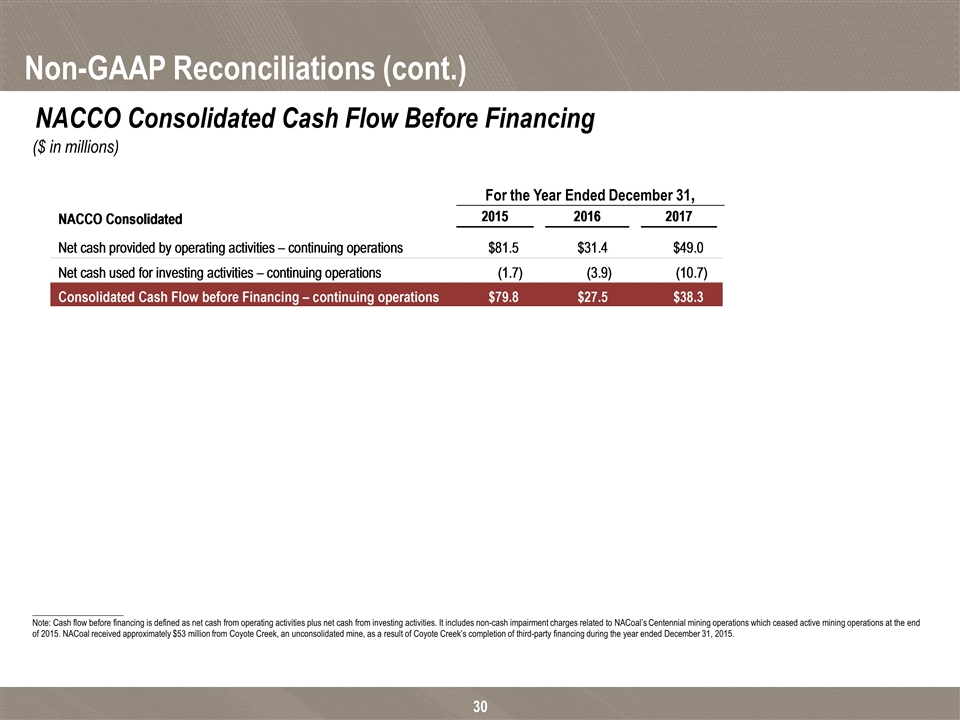

Non-GAAP Reconciliations (cont.) NACCO Consolidated Cash Flow Before Financing ($ in millions) _____________________ Note: Cash flow before financing is defined as net cash from operating activities plus net cash from investing activities. It includes non-cash impairment charges related to NACoal’s Centennial mining operations which ceased active mining operations at the end of 2015. NACoal received approximately $53 million from Coyote Creek, an unconsolidated mine, as a result of Coyote Creek’s completion of third-party financing during the year ended December 31, 2015. For the Year Ended December 31, NACCO Consolidated 201520162017Net cash provided by operating activities – continuing operations$81.5$31.4$49.0Net cash used for investing activities – continuing operations(1.7)(3.9) (10.7)Consolidated Cash Flow before Financing – continuing operations$79.8$27.5$38.3