TRUSTED PARTNERS. INTEGRATED SOLUTIONS. POWERFUL RESULTS. INVESTOR PRESENTATION March 2020 Exhibit 99

Safe Harbor Statement and Disclosure This presentation includes forward-looking comments subject to important risks and uncertainties. It may also contain financial measures that are not in conformance with accounting principles generally accepted in the United States of America (GAAP). Refer to NACCO’s reports filed on Forms 8-K (current), 10-Q (quarterly), and 10-K (annual) for information on factors that could cause actual results to differ materially from information in this presentation. Past performance may not be representative of future results. Information noted in the following slides was effective as of the Company’s most recent earnings release and conference call (March 5, 2020). Nothing in this presentation should be construed as reaffirming or disaffirming the outlook provided as of that date. This presentation is not an offer to sell or a solicitation of offers to buy any of NACCO Industries, Inc.’s securities.

Company Overview

NACCO Industries NACCO Industries, Inc.® is the public holding company for The North American Coal Corporation®. The Company and its affiliates operate in the mining and natural resources industries through three operating segments: Coal Mining Operates surface coal mines under long-term contracts with power generation companies and activated carbon producers pursuant to a service-based business model North American Mining (“NAMining”) Provides value-added contract mining and other services for producers of aggregates, lithium and other minerals Minerals Management Promotes the development of the Company’s oil, gas and coal reserves, generating income primarily from royalty-based lease payments from third parties In addition, the Company has launched a new business providing stream and wetland mitigation solutions, Mitigation Resources of North America NACCO (NYSE: NC)

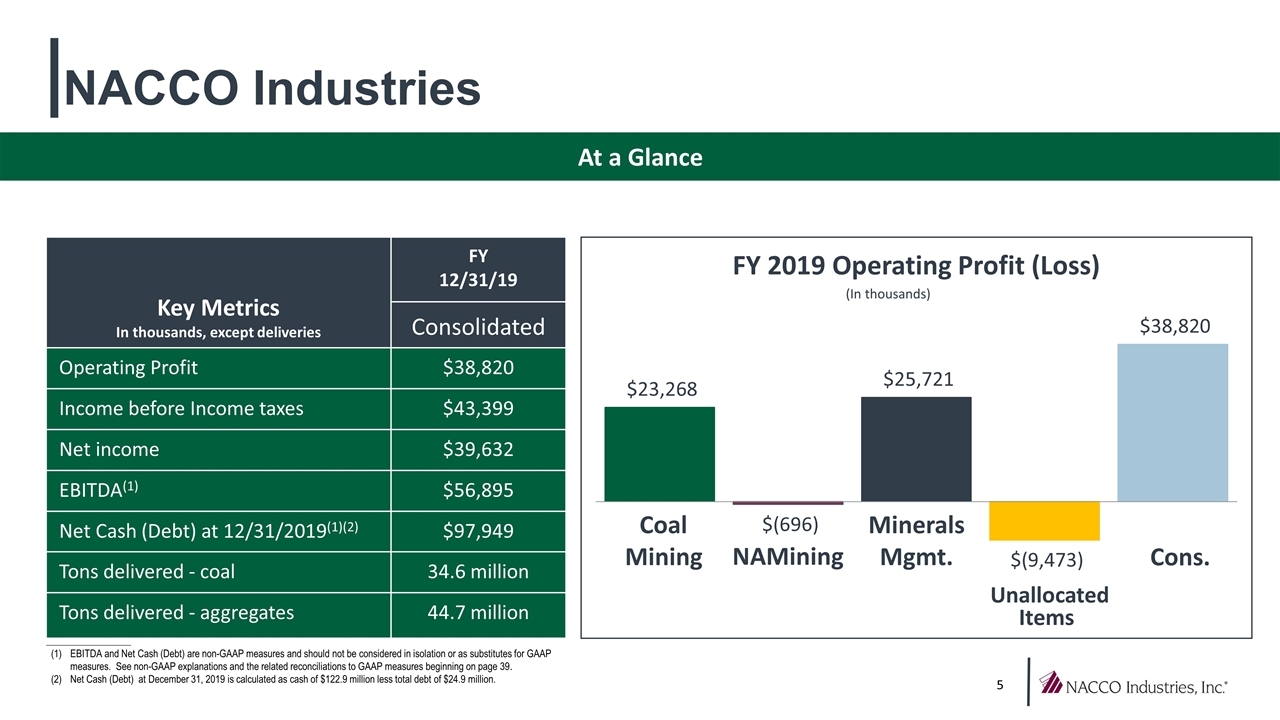

NACCO Industries At a Glance _____________________ EBITDA and Net Cash (Debt) are non-GAAP measures and should not be considered in isolation or as substitutes for GAAP measures. See non-GAAP explanations and the related reconciliations to GAAP measures beginning on page 39. Net Cash (Debt) at December 31, 2019 is calculated as cash of $122.9 million less total debt of $24.9 million. Key Metrics In thousands, except deliveries FY 12/31/19 Consolidated Operating Profit $38,820 Income before Income taxes $43,399 Net income $39,632 EBITDA(1) $56,895 Net Cash (Debt) at 12/31/2019(1)(2) $97,949 Tons delivered - coal 34.6 million Tons delivered - aggregates 44.7 million (In thousands) NAMining Minerals Mgmt. Unallocated Items Cons. At a Glance Coal Mining

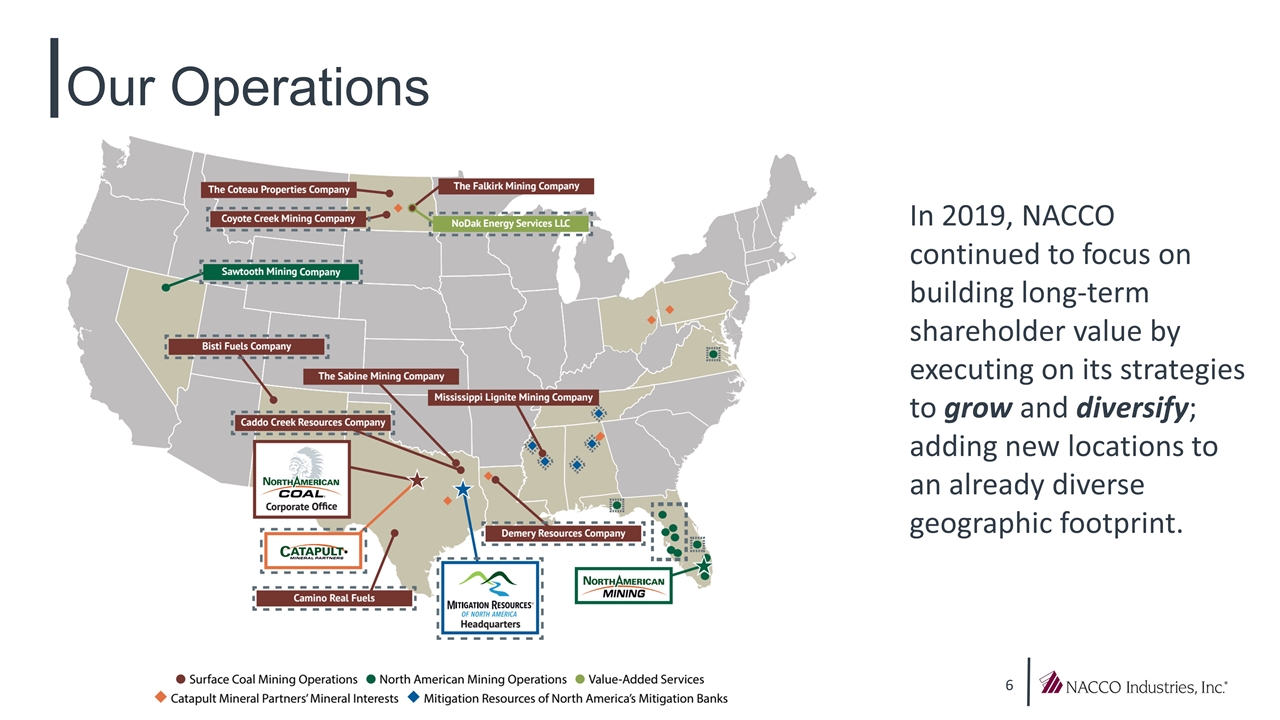

Our Operations In 2019, NACCO continued to focus on building long-term shareholder value by executing on its strategies to grow and diversify; adding new locations to an already diverse geographic footprint.

It’s About People: Trusted Partners While our core competency is mining, our business is about people –our customers, our employees and our communities Our customers: Long-term relationships help us understand our customer’s business objectives and allow us to deliver results that strengthen their businesses Our employees: We are proud of our high level of employee engagement and strong retention rates Training programs ensure bench strength for succession, growth and diversification Shared commitment to operational excellence and safety Received over 100 safety awards at the state and national levels Our communities: Successful and innovative reclamation projects Planted over 8.6 million trees since 1978 as part of reclamation activities

Trusted Partners - Excellent Safety Record 2014 – 2018 National Mining Association Top 25 U.S. Coal Producers Ranked by Average Incident Rate

Trusted Partners - Environmental Stewardship Environmental Protection Agency Environmental Excellence Award The Department of Interior Office of Surface Mining Best of the Best Award The Department of Interior Office of Surface Mining Director’s Award The Department of Interior Office of Surface Mining Good Neighbor Award The Department of Interior Office of Surface Mining Excellence in Surface Coal Mining and Reclamation Award The Texas Parks & Wildlife Department Lone Star Steward Award The Railroad Commission of Texas State Reclamation Award The Interstate Mining Compact Commission’s National Reclamation Award The North Dakota Public Service Commission Excellence in Surface Coal Mining & Reclamation Award Managing and enhancing land is one of the great benefits we offer customers From permit management to agency or tribal coordination, North American Coal is an expert in environmental stewardship and compliance 9 North American Coal has received over 90 federal and state awards for successful and innovative reclamation projects over the last 30 years

Coal Mining

Power Plant Operation & Maintenance Electricity Sales Regulatory Matters Mining Land Acquisition Reserve Acquisition Permitting Mine Planning Load & Haul Coal Handling Reclamation Bond Release The Coal Mining segment provides integrated solutions for power generation companies Customer Operations

Coal Mining 107 year history of mining coal Nine surface coal mines Delivered 34.6 million tons of coal in 2019 Mines deliver coal produced to adjacent or nearby power plants, synfuels plants or activated carbon facilities All but one mine is the exclusive supplier to its customer’s facility Camino Real’s customer takes all coal produced but also purchases from other suppliers

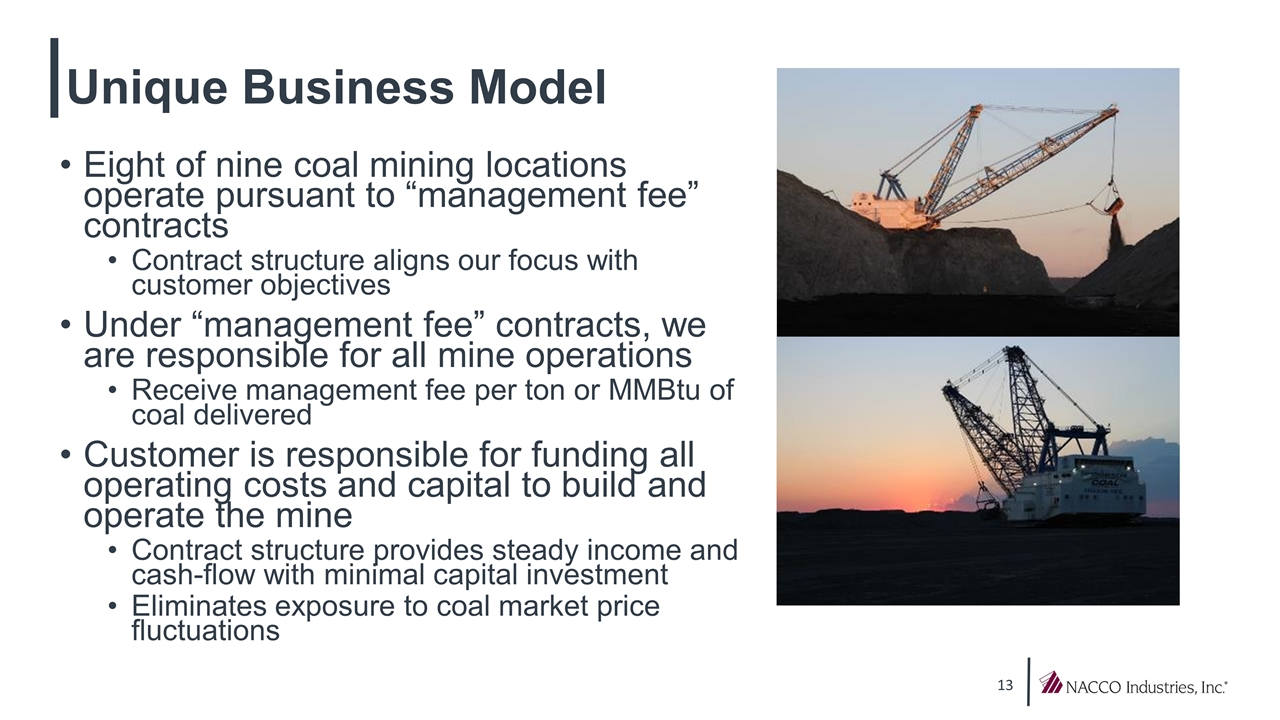

Unique Business Model Eight of nine coal mining locations operate pursuant to “management fee” contracts Contract structure aligns our focus with customer objectives Under “management fee” contracts, we are responsible for all mine operations Receive management fee per ton or MMBtu of coal delivered Customer is responsible for funding all operating costs and capital to build and operate the mine Contract structure provides steady income and cash-flow with minimal capital investment Eliminates exposure to coal market price fluctuations

Mississippi Lignite Mining Company (MLMC) MLMC delivers coal to the adjacent Red Hills power plant under a contract that runs through 2032 The Red Hills Power Plant supplies electricity to TVA under a long-term power purchase agreement. MLMC provides 100% of the fuel for the Red Hills power plant MLMC contract is the only coal contract in which NACoal is responsible for all operating costs, capital requirements and final mine reclamation MLMC will require significant capital spending over the next several years as it moves to a new mine area Contractually agreed-upon coal sales price adjusts monthly primarily based on changes in the level of established indices, which reflect general U.S. inflation rates, including cost components such as labor and diesel fuel Coal sales price is not subject to spot coal market fluctuations Profitability is affected by three key factors: customer demand for coal, changes in the indices that determine coal sales price and actual costs incurred

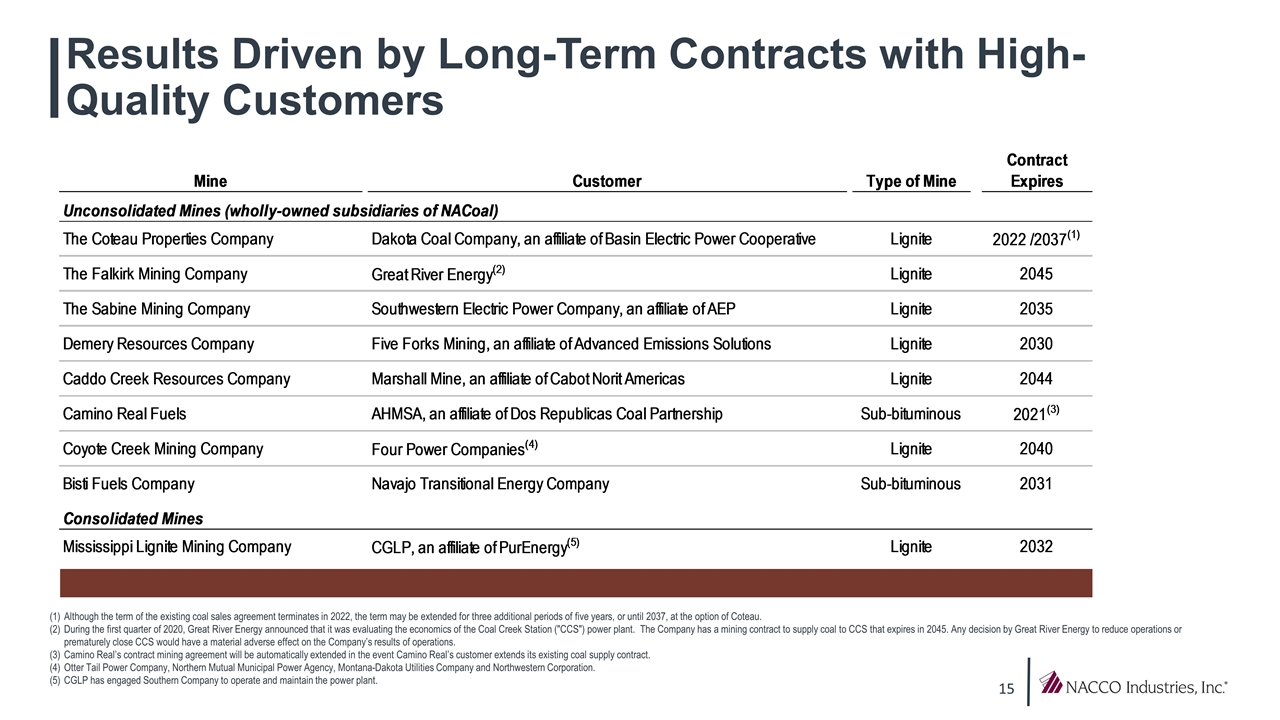

Results Driven by Long-Term Contracts with High-Quality Customers Although the term of the existing coal sales agreement terminates in 2022, the term may be extended for three additional periods of five years, or until 2037, at the option of Coteau. During the first quarter of 2020, Great River Energy announced that it was evaluating the economics of the Coal Creek Station ("CCS") power plant. The Company has a mining contract to supply coal to CCS that expires in 2045. Any decision by Great River Energy to reduce operations or prematurely close CCS would have a material adverse effect on the Company’s results of operations. Camino Real’s contract mining agreement will be automatically extended in the event Camino Real’s customer extends its existing coal supply contract. Otter Tail Power Company, Northern Mutual Municipal Power Agency, Montana-Dakota Utilities Company and Northwestern Corporation. CGLP has engaged Southern Company to operate and maintain the power plant. Mine Customer Type of Mine Contract Expires Unconsolidated Mines (wholly-owned subsidiaries of NACoal) The Coteau Properties Company Dakota Coal Company, an affiliate of Basin Electric Power Cooperative Lignite 2022 /2037(1) The Falkirk Mining Company Great River Energy(2) Lignite 2045 The Sabine Mining Company Southwestern Electric Power Company, an affiliate of AEP Lignite 2035 Demery Resources Company Five Forks Mining, an affiliate of Advanced Emissions Solutions Lignite 2030 Caddo Creek Resources Company Marshall Mine, an affiliate of Cabot Norit Americas Lignite 2044 Camino Real Fuels AHMSA, an affiliate of Dos Republicas Coal Partnership Sub-bituminous 2021(3) Coyote Creek Mining Company Four Power Companies(4) Lignite 2040 Bisti Fuels Company Navajo Transitional Energy Company Sub-bituminous 2031 Consolidated Mines Mississippi Lignite Mining Company CGLP, an affiliate of PurEnergy(5) Lignite 2032 Coteau Dakota Coal Company, an affiliate of Basin Electric Power Coeperative Falkirk Great River Energy Sabine Southwestern Electric Power Company, an affiliate of AEP Demery Five Forks Mining, an affiliate of ADA Carbon Solutions Caddo Marshall Mine, an affiliate of Cabot Norit Americas Camino AHMSA, an affiliate of Dos Republicas Coal Partnership Liberty Mississippi Power Company, an affiliate of Southern Company Coyote Four Power Companies (1) Bisti Navajo Transitional Energy Company Mississippi CGLP, an affiliate of Pure Energy (2) (1) Otter Tail Power Company, Northern Mutual Municipal Power Agency, Montana-Dakota Utilities Company and Northwestern Corporation (2) Pure Energy has an operating and maintence agreement with Southern Company

No direct exposure to coal market price Focus to drive down production costs and maximize efficiency and operating capacity at each mine Benefits both customers and the Company as fuel cost is a major driver for power plant dispatch Power plant dispatch drives demand for coal Customers continue to invest in efficiency and environmental upgrades to facilities Well-Positioned in Light of Challenging Environment

Well-Positioned in Light of Challenging Environment We believe the power plants we supply are generally younger and more efficient, with better environmental controls than most that have closed in recent years During the past 10 years, North American Coal built five new coal mines and assumed operation of an existing mine for a new customer Currently providing other value-added services for existing customers Some mines provide coal blending and handling, ash handling and ash management services Continued pursuit of additional opportunities to assume operation of existing mines Utilizing management fee business model

North American Mining

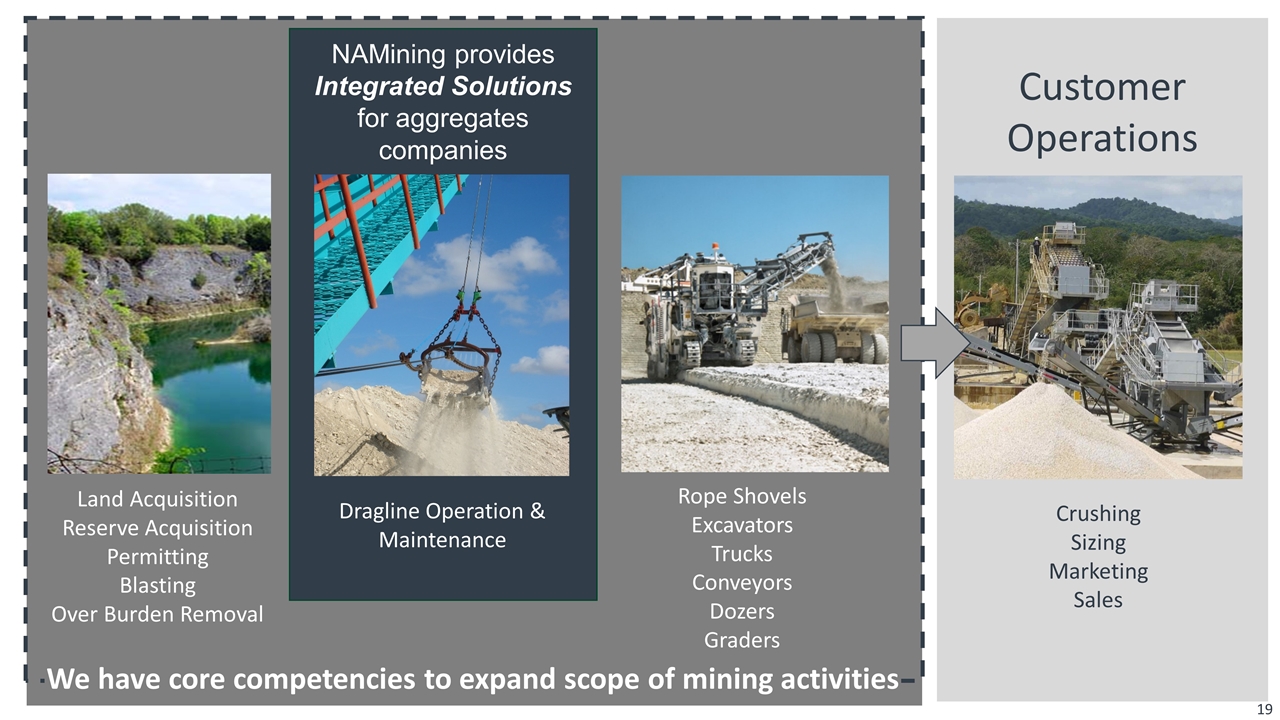

NAMining provides Integrated Solutions for aggregates companies Rope Shovels Excavators Trucks Conveyors Dozers Graders Land Acquisition Reserve Acquisition Permitting Blasting Over Burden Removal Dragline Operation & Maintenance Crushing Sizing Marketing Sales We have core competencies to expand scope of mining activities Customer Operations

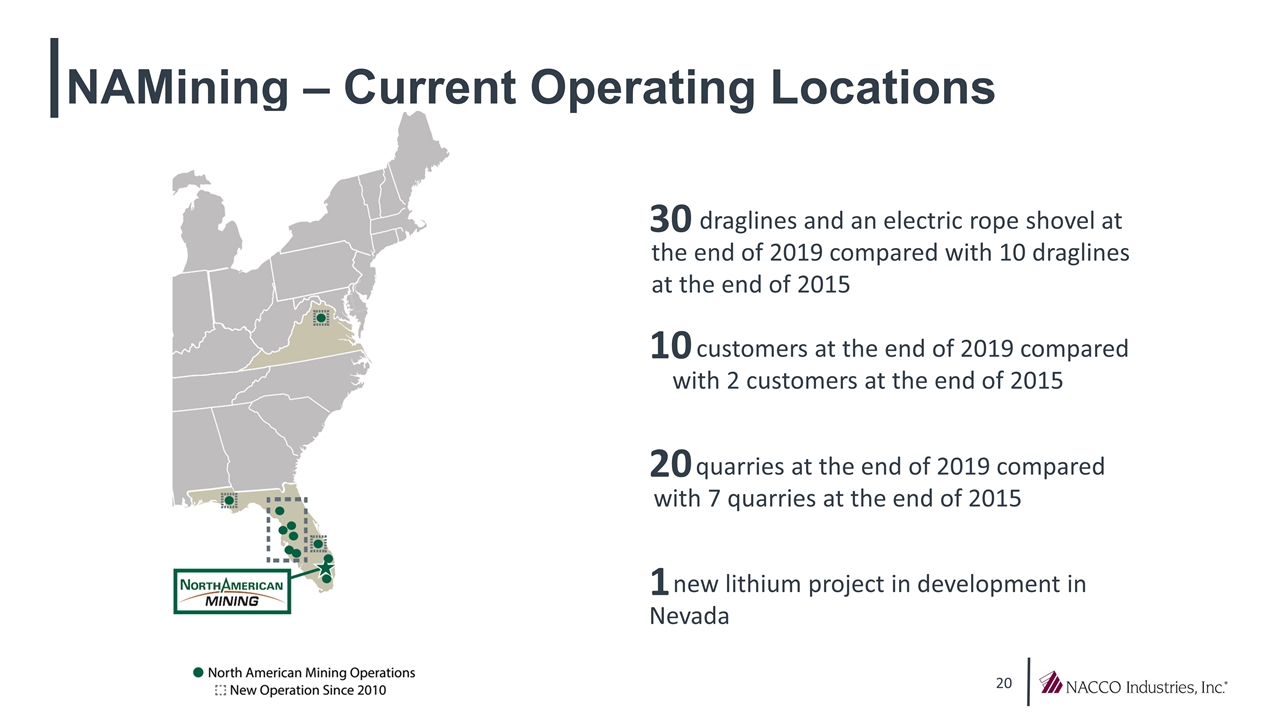

NAMining – Current Operating Locations draglines and an electric rope shovel at the end of 2019 compared with 10 draglines at the end of 2015 customers at the end of 2019 compared with 2 customers at the end of 2015 quarries at the end of 2019 compared with 7 quarries at the end of 2015 30 10 20 new lithium project in development in Nevada 1

NAMining Segment Serviced-based business model to create value Focused on: Mining materials other than coal Primarily limestone as well as sand and in the future, lithium Mining services where our core skills can provide value Long-term customer relationships Entered into a 20-year limestone mining services agreement with a new customer during 2019

Platform for Growth Outside Coal Geography Focus on expanding footprint beyond the southeastern United States Contract mining services provide: Dependable production Optimized quality of delivered material Controlled costs Expand scope of work – ability to offer a full range of comprehensive mining services Well-suited to mine a range of minerals and materials Entered into a contract in 2019 to mine lithium Continued growth can lead to increased profitability Recently established administrative infrastructure to support scalability

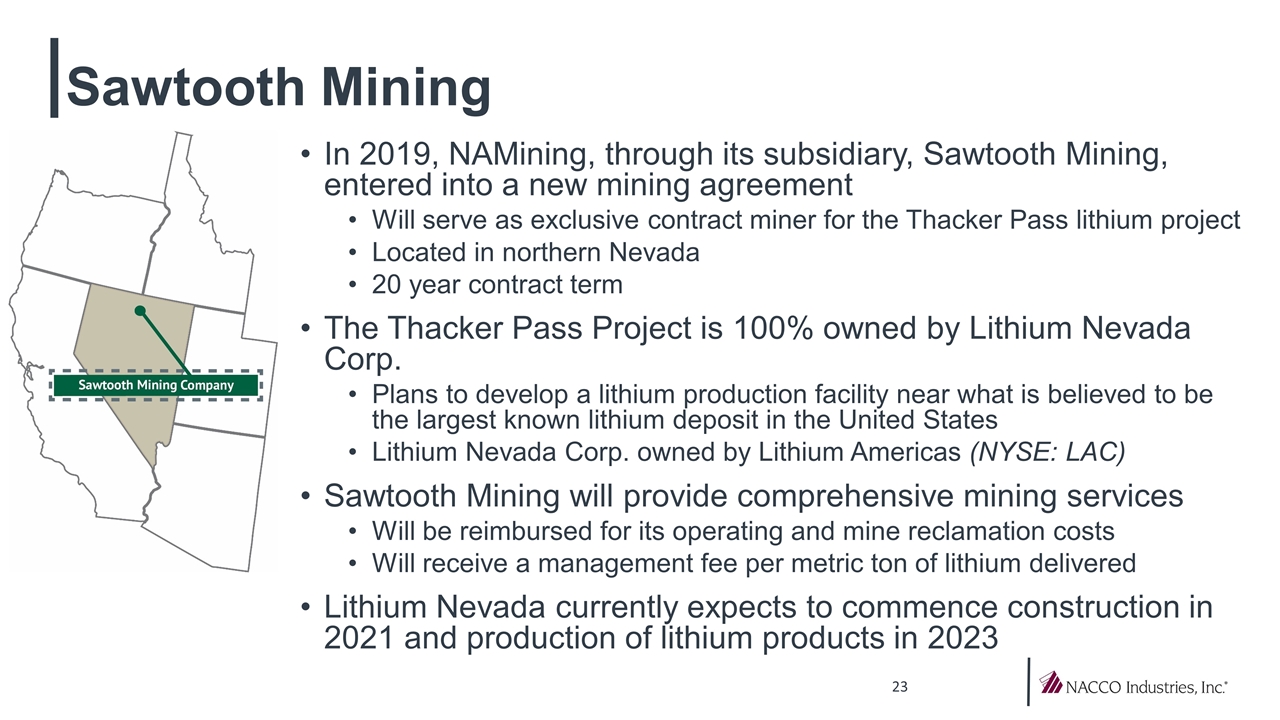

Sawtooth Mining In 2019, NAMining, through its subsidiary, Sawtooth Mining, entered into a new mining agreement Will serve as exclusive contract miner for the Thacker Pass lithium project Located in northern Nevada 20 year contract term The Thacker Pass Project is 100% owned by Lithium Nevada Corp. Plans to develop a lithium production facility near what is believed to be the largest known lithium deposit in the United States Lithium Nevada Corp. owned by Lithium Americas (NYSE: LAC) Sawtooth Mining will provide comprehensive mining services Will be reimbursed for its operating and mine reclamation costs Will receive a management fee per metric ton of lithium delivered Lithium Nevada currently expects to commence construction in 2021 and production of lithium products in 2023

Minerals Management

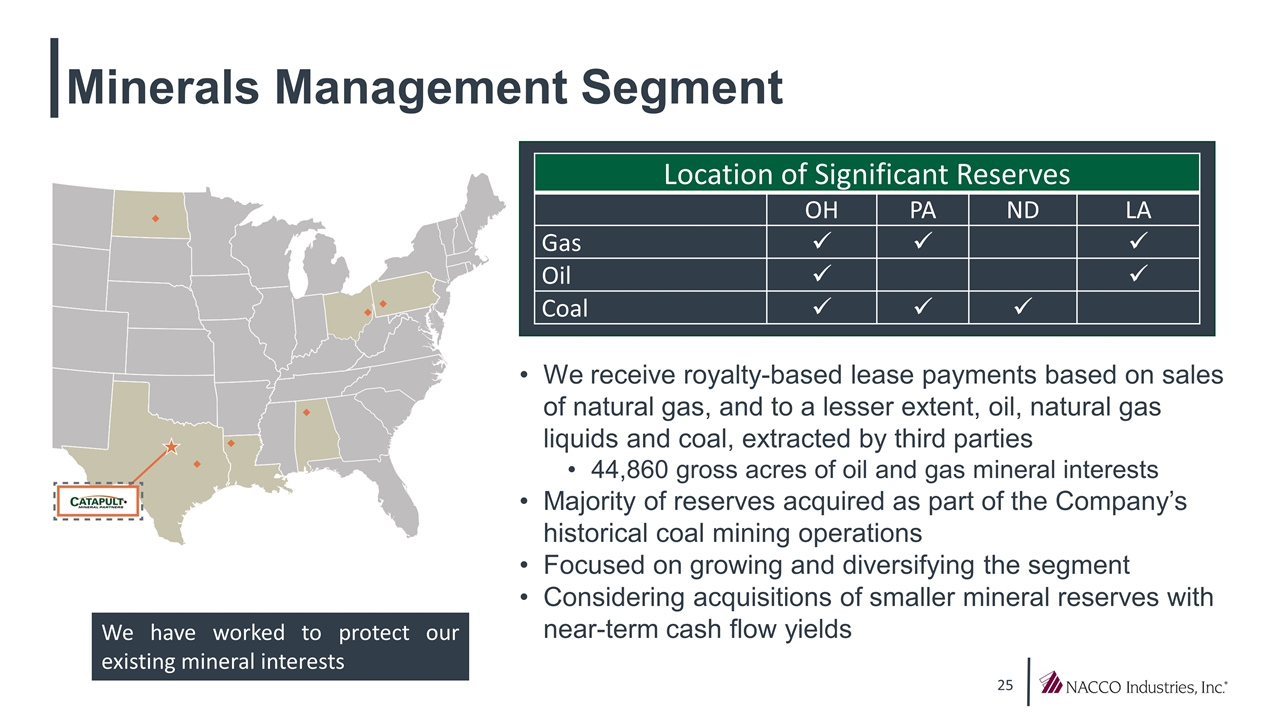

Minerals Management Segment We receive royalty-based lease payments based on sales of natural gas, and to a lesser extent, oil, natural gas liquids and coal, extracted by third parties 44,860 gross acres of oil and gas mineral interests Majority of reserves acquired as part of the Company’s historical coal mining operations Focused on growing and diversifying the segment Considering acquisitions of smaller mineral reserves with near-term cash flow yields Location of Significant Reserves OH PA ND LA Gas ü ü ü Oil ü ü Coal ü ü ü We have worked to protect our existing mineral interests

Minerals Management Segment Minerals Management income grew significantly in 2019 compared with 2018, primarily due to an increase in the number and productivity of gas wells operated by third parties Production from newly developed natural gas wells can decrease quickly due to the natural production decline curve, as a result royalty income in 2020 is expected to be substantially lower than 2019 levels Royalty income can fluctuate due to a number of other factors outside the Company's control, including: The number of wells being operated by third parties Fluctuations in commodity prices (primarily natural gas) and production rates Regulatory issues The Company's lessees' willingness and ability to incur well-development and other operating costs Changes in the availability and continuing development of infrastructure

Other Growth & Diversification

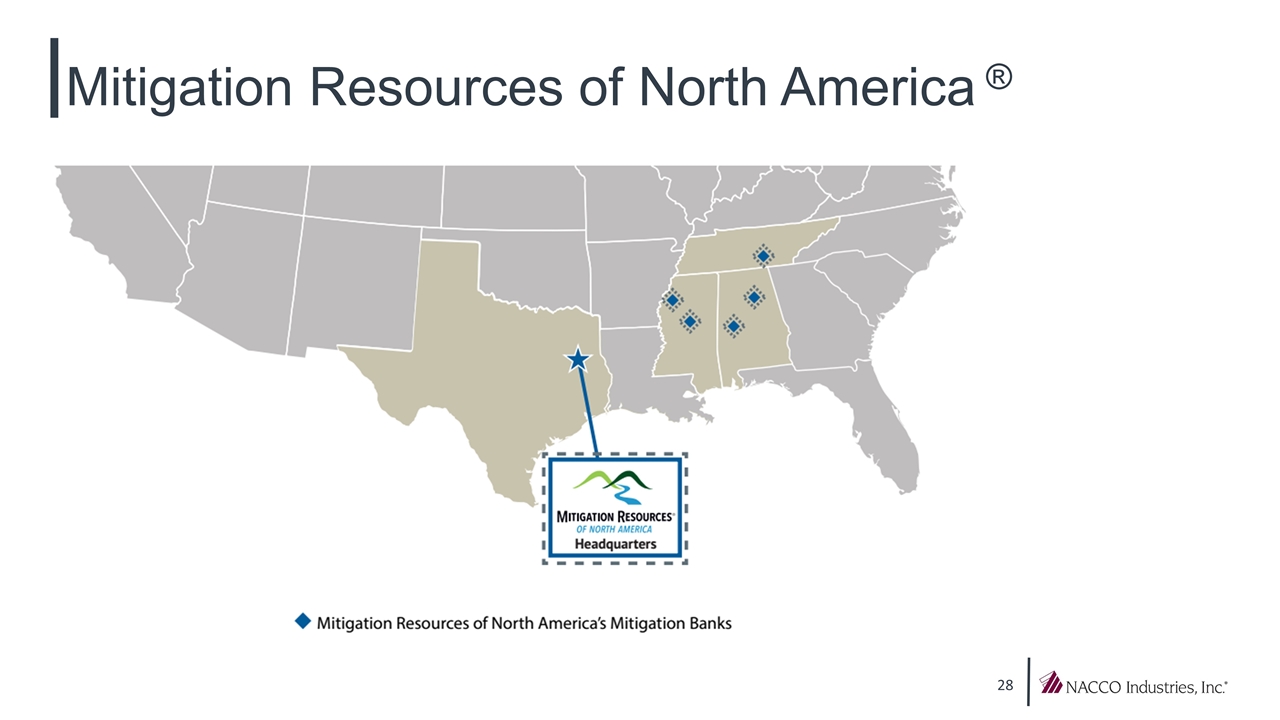

Mitigation Resources of North America ®

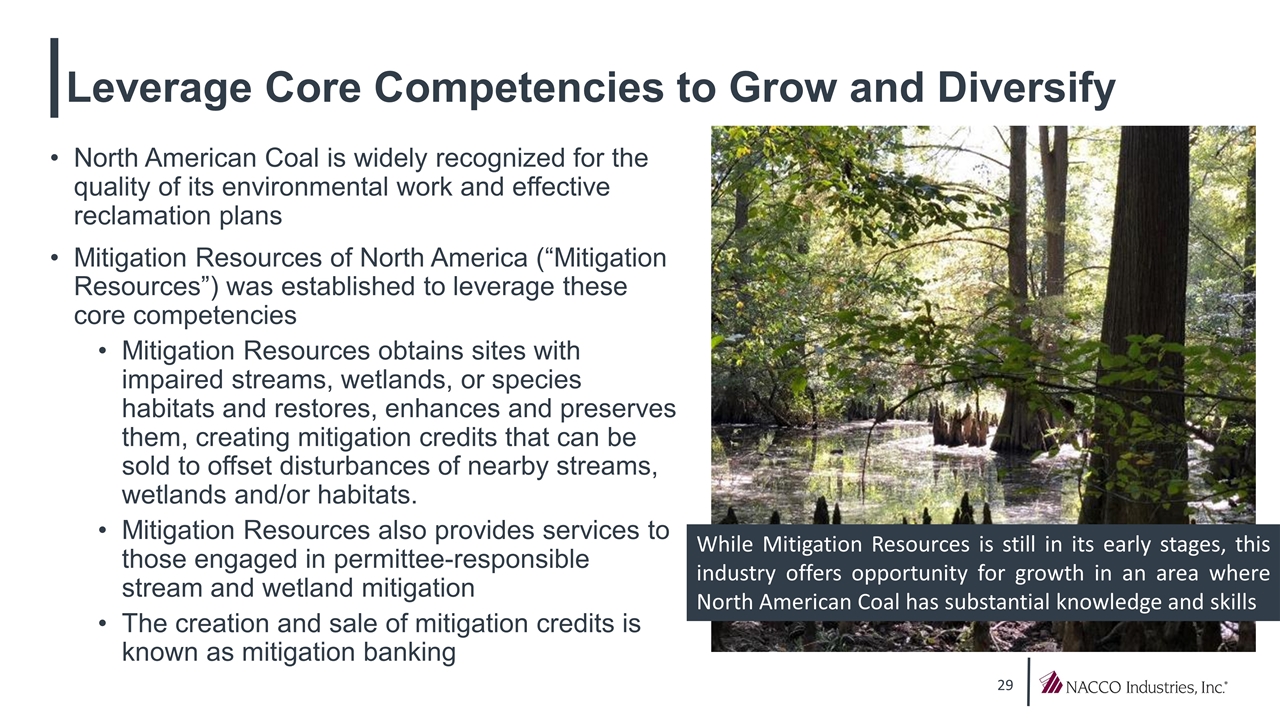

Leverage Core Competencies to Grow and Diversify North American Coal is widely recognized for the quality of its environmental work and effective reclamation plans Mitigation Resources of North America (“Mitigation Resources”) was established to leverage these core competencies Mitigation Resources obtains sites with impaired streams, wetlands, or species habitats and restores, enhances and preserves them, creating mitigation credits that can be sold to offset disturbances of nearby streams, wetlands and/or habitats. Mitigation Resources also provides services to those engaged in permittee-responsible stream and wetland mitigation The creation and sale of mitigation credits is known as mitigation banking While Mitigation Resources is still in its early stages, this industry offers opportunity for growth in an area where North American Coal has substantial knowledge and skills

Summary

Leverage core capabilities to diversify into related businesses High return, low volatility business model supported by long-term contracts Rapidly growing contract miner in aggregates and minerals industry Expand income streams from royalties earned on gas and coal reserves extracted by others Coal Mining Minerals Management Conservative Balance Sheet Strong annuity-like cash flows without cyclical swings Diversification Financial Strength North American Mining

Why Invest in NACCO? 100 years of success in mining provides the foundation for continued growth Well suited to serve as a contract miner in both coal and non-coal mining operations Continue pursuit of non-coal mining opportunities principally through the North American Mining segment Pursue growth opportunities that leverage core competencies, mining expertise and environmental stewardship “Management fee” contract structure eliminates volatility from fluctuations in coal prices Provide customers with Integrated Solutions Focus on developing the Minerals Management segment Highly-Efficient, Cost-Effective Mining Solutions Strong balance sheet and free cash flow generation provides capacity for growth Safety First. Safety Always. 32 Sentinels of Safety Awards received in 2017 and 2019

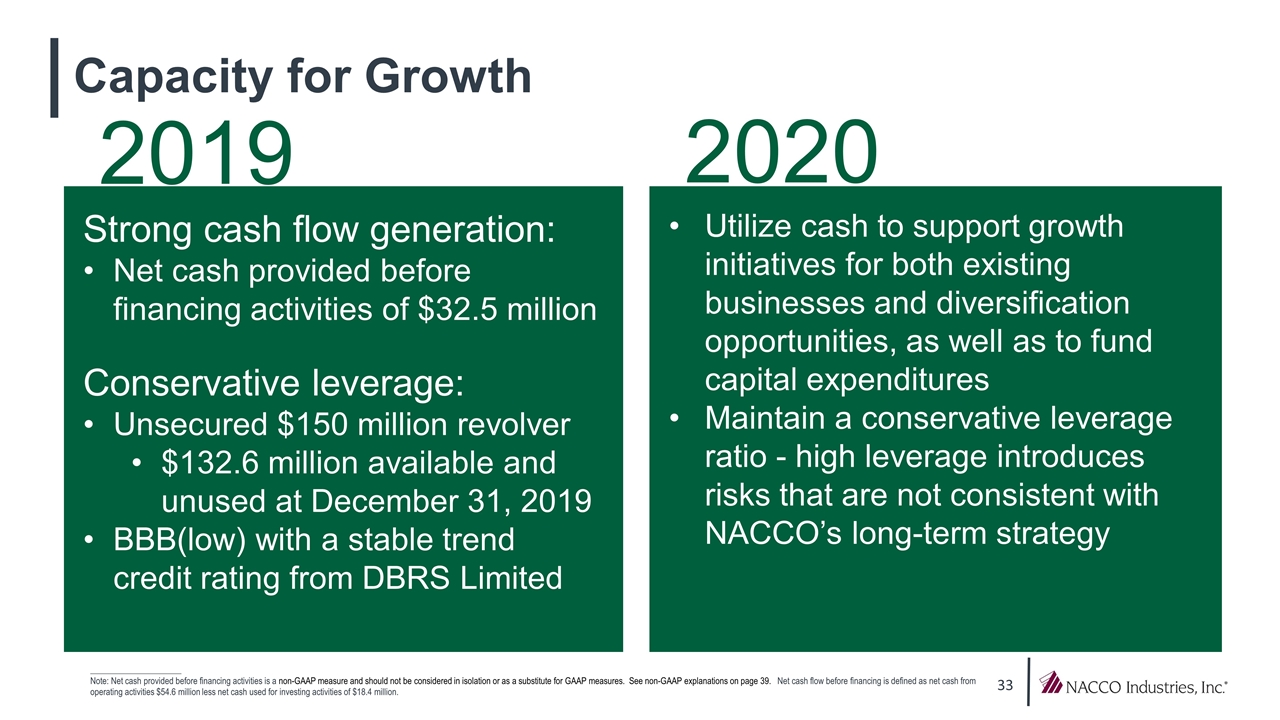

Strong cash flow generation: Net cash provided before financing activities of $32.5 million Conservative leverage: Unsecured $150 million revolver $132.6 million available and unused at December 31, 2019 BBB(low) with a stable trend credit rating from DBRS Limited Utilize cash to support growth initiatives for both existing businesses and diversification opportunities, as well as to fund capital expenditures Maintain a conservative leverage ratio - high leverage introduces risks that are not consistent with NACCO’s long-term strategy Capacity for Growth _____________________ Note: Net cash provided before financing activities is a non-GAAP measure and should not be considered in isolation or as a substitute for GAAP measures. See non-GAAP explanations on page 39. Net cash flow before financing is defined as net cash from operating activities $54.6 million less net cash used for investing activities of $18.4 million. 2019 2020

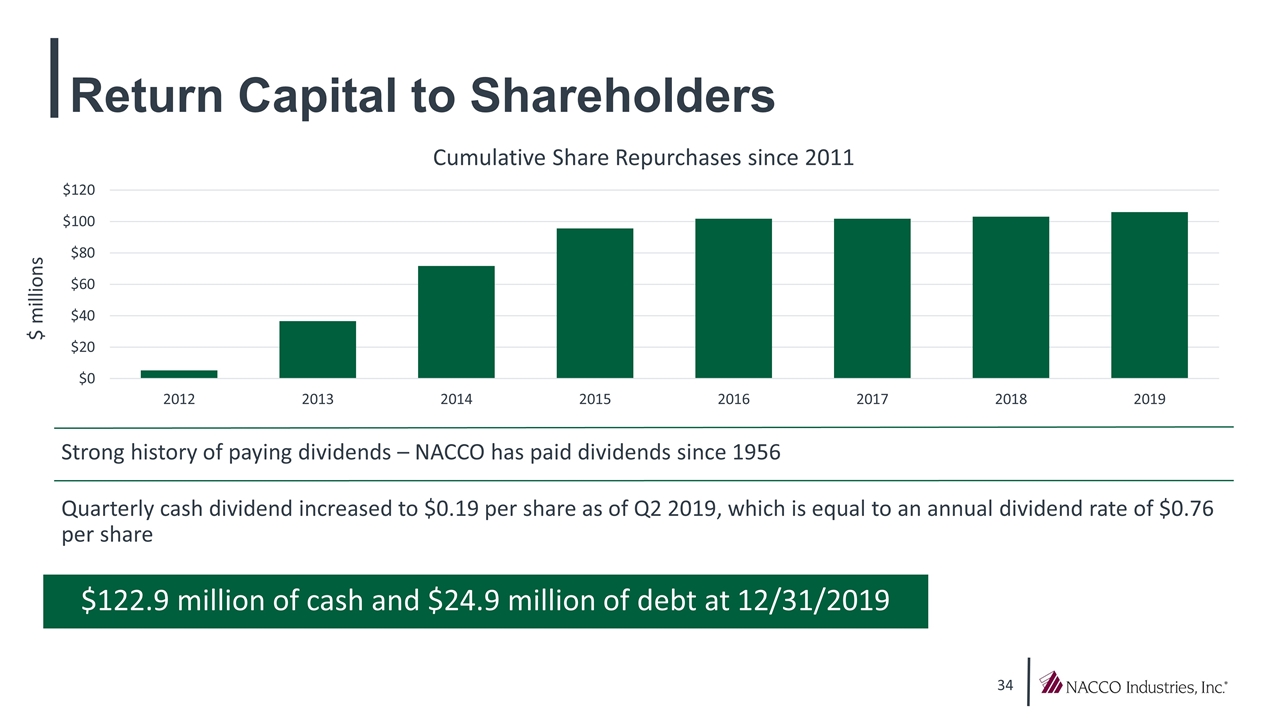

Return Capital to Shareholders Strong history of paying dividends – NACCO has paid dividends since 1956 $122.9 million of cash and $24.9 million of debt at 12/31/2019 Quarterly cash dividend increased to $0.19 per share as of Q2 2019, which is equal to an annual dividend rate of $0.76 per share $ millions

Financial Results

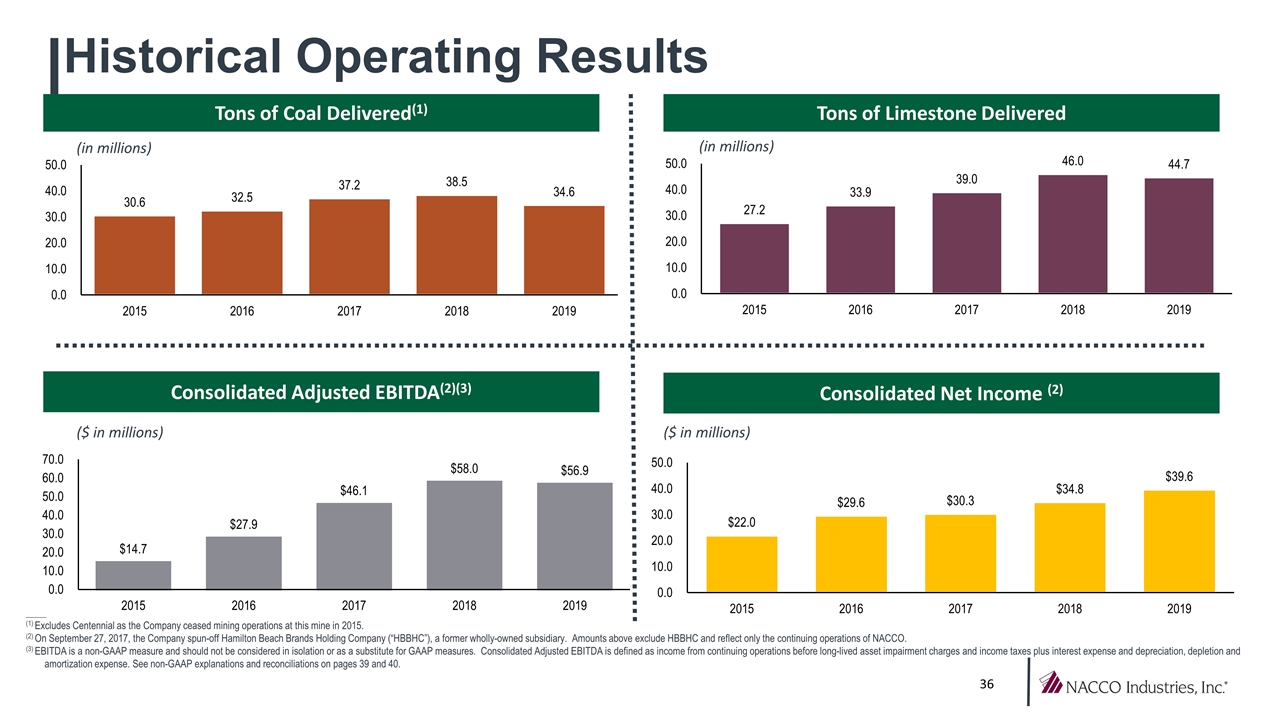

Historical Operating Results Tons of Coal Delivered(1) Tons of Limestone Delivered Consolidated Adjusted EBITDA(2)(3) Consolidated Net Income (2) ($ in millions) ($ in millions) _____ (1) Excludes Centennial as the Company ceased mining operations at this mine in 2015. (2) On September 27, 2017, the Company spun-off Hamilton Beach Brands Holding Company (“HBBHC”), a former wholly-owned subsidiary. Amounts above exclude HBBHC and reflect only the continuing operations of NACCO. (3) EBITDA is a non-GAAP measure and should not be considered in isolation or as a substitute for GAAP measures. Consolidated Adjusted EBITDA is defined as income from continuing operations before long-lived asset impairment charges and income taxes plus interest expense and depreciation, depletion and amortization expense. See non-GAAP explanations and reconciliations on pages 39 and 40. (in millions) (in millions)

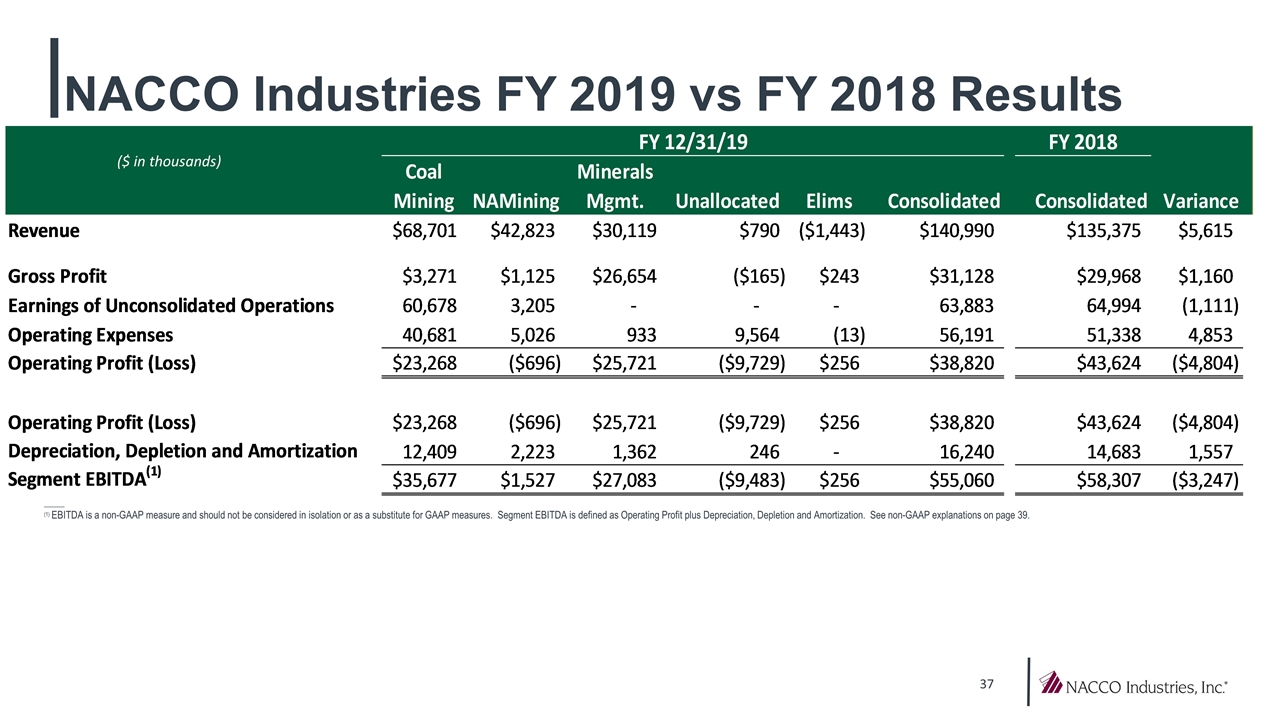

($ in thousands) Results for FY 2018 and Q1 2019 vs. Q1 2018 _____ (1) EBITDA is a non-GAAP measure and should not be considered in isolation or as a substitute for GAAP measures. Segment EBITDA is defined as Operating Profit plus Depreciation, Depletion and Amortization. See non-GAAP explanations on page 39. NACCO Industries FY 2019 vs FY 2018 Results FY 12/31/19 FY 2018 Coal Mining NAMining Minerals Mgmt. Unallocated Elims Consolidated Consolidated Variance Revenue $68,701 $42,823 $30,119 $790 $-1,443 $,140,990 $,135,375 $5,615 Gross Profit $3,271 $1,125 $26,654 $-,165 $243 $31,128 $29,968 $1,160 Earnings of Unconsolidated Operations 60,678 3,205 0 0 0 63,883 64994 -1111 Operating Expenses 40,681 5,026 933 9,564 -13 56,191 51338 4853 Operating Profit (Loss) $23,268 $-,696 $25,721 $-9,729 $256 $38,820 $43,624 $-4,804 Operating Profit (Loss) $23,268 $-,696 $25,721 $-9,729 $256 $38,820 $43,624 $-4,804 Depreciation, Depletion and Amortization 12,409 2,223 1,362 246 0 16,240 14,683 1,557 Segment EBITDA(1) $35,677 $1,527 $27,083 $-9,483 $256 $55,060 $58,307 $-3,247

Appendix

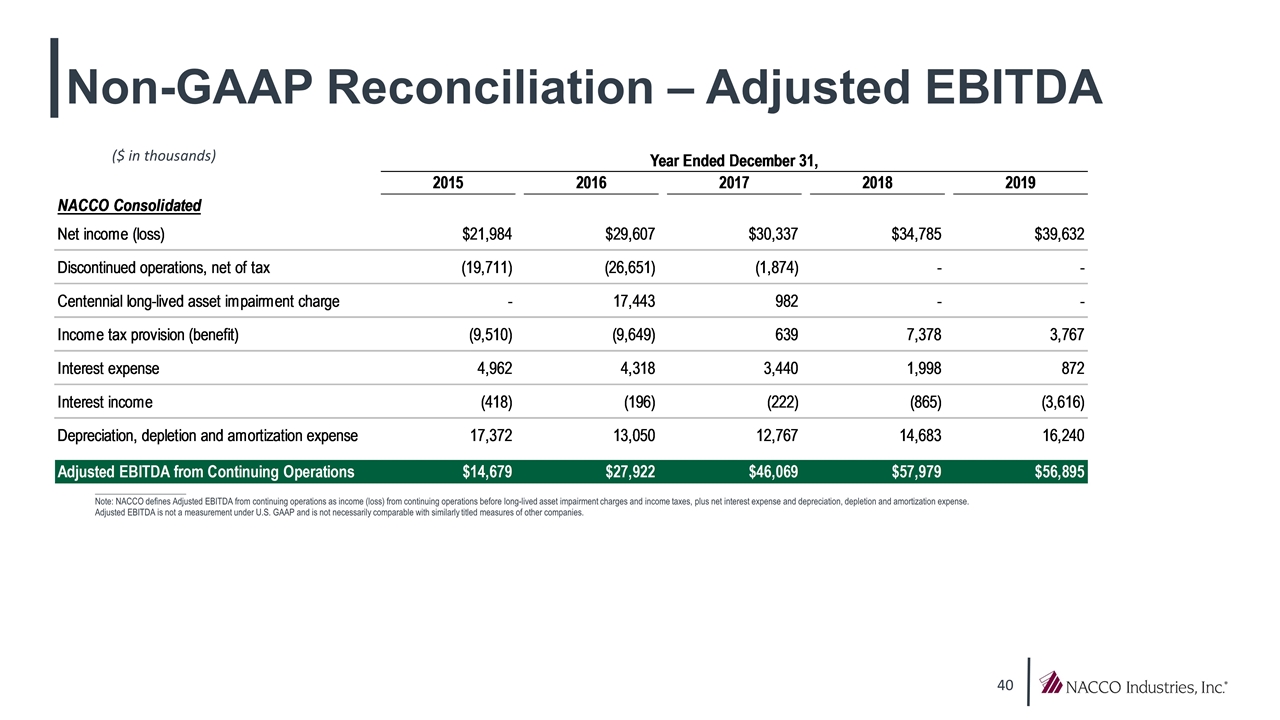

Non-GAAP Disclosure This presentation contains non-GAAP financial measures. Included in this presentation are reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with U.S. generally accepted accounting principles ("GAAP"). Adjusted EBITDA is a measure of net income (loss) that differs from financial results measured in accordance with GAAP. Adjusted EBITDA, cash flow before financing, and net cash (debt) in this presentation are provided solely as supplemental non-GAAP disclosures of operating results. Management believes these non-GAAP financial measures assist investors in understanding the results of operations of NACCO Industries, Inc. and its subsidiaries and aid in understanding comparability of results. In addition, management evaluates results using these non-GAAP financial measures. NACCO defines non-GAAP measures as follows: Adjusted EBITDA from continuing operations is defined as income (loss) from continuing operations before long-lived asset impairment charges and income taxes plus net interest expense and depreciation, depletion and amortization expense; Cash flow before financing is defined as net cash from operating activities plus net cash from investing activities. It includes non-cash impairment charges related to NACoal’s Centennial mining operations, which ceased active mining operations at the end of 2015. Net Cash (Debt) is defined as Cash minus Debt.

Non-GAAP Reconciliation – Adjusted EBITDA _____________________ Note: NACCO defines Adjusted EBITDA from continuing operations as income (loss) from continuing operations before long-lived asset impairment charges and income taxes, plus net interest expense and depreciation, depletion and amortization expense. Adjusted EBITDA is not a measurement under U.S. GAAP and is not necessarily comparable with similarly titled measures of other companies. ($ in thousands) Year Ended December 31, 2015 2016 2017 2018 2019 NACCO Consolidated Net income (loss) $21,984 $29,607 $30,337 $34,785 $39,632 Discontinued operations, net of tax ,-19,711 ,-26,651 -1,874 0 0 Centennial long-lived asset impairment charge 0 17,443 982 0 0 Income tax provision (benefit) -9,510 -9,649 639 7,378 3,767 Interest expense 4,962 4,318 3,440 1,998 872 Interest income -,418 -,196 -,222 -,865 -3,616 Depreciation, depletion and amortization expense 17,372 13,050 12,767 14,683 16,240 34.299999999999997 34.299999999999997 Adjusted EBITDA from Continuing Operations $14,679 $27,922 $46,069 $57,979 $56,895