UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

COMMISSION FILE NUMBER: 001-33929

CHINA SHEN ZHOU MINING & RESOURCES, INC.

(Name of Small Business Issuer Specified in its Charter)

| Nevada | 87-0430816 |

| (State of incorporation) | (IRS Employer Identification Number) |

No. 166 Fushi Road, Zeyang Tower,

Shijingshan District, Beijing, China 100043

(Address of principal executive offices) (Zip Code)

86-010-8890 6927

(Issuer’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act:

| Title of Each Class: | | Name of Each Exchange on Which Registered |

| Common Stock, par value $.001 | | NYSE Amex |

Securities registered under Section 12(g) of the Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act):

Yes o No þ

The aggregate market value of the 4,970,914 shares of voting and non-voting common equity stock held by non-affiliates of the registrant was $ 15,161,288 as of June 30, 2008, the last business day of the registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on such date of $3.05 per share, as reported by NYSE Amex Market (formerly American Stock Exchange).

As of April 14, 2009, there were 22,214,514 shares of common stock of China Shen Zhou Mining & Resources, Inc. outstanding.

TABLE OF CONTENTS

| PART I | |

| | ITEM 1. | BUSINESS | 4 |

| | Corporate History | 4 |

| | Our Industry | 5 |

| | Current Business Operations | 6 |

| | Description of Products | 6 |

| | Sales and Marketing | 7 |

| | Our Major Customers | 7 |

| | Competition | 8 |

| | Business Strategies | 8 |

| | Expansion of Production Capacity to Meet Demand | 8 |

| | Exploration Activities | 9 |

| | Acquire More Mineral Resources | 10 |

| | Competitive Advantages | 10 |

| | Government Regulation | 10 |

| | Employees | 11 |

| | ITEM 1A. | RISK FACTORS | |

| | ITEM 1B. | UNRESOLVED STAFF COMMENTS | |

| | ITEM 2. | PROPERTIES | 24 |

| | General | 24 |

| | Sumochaganaobao Fluorite Mine (Production Stage) | 27 |

| | The Kuru-Tegerek Cu-Au Mine (Under Development) | 31 |

| | Mining Site No. 2 of Qingxing Copper Mine, in production Stage (Qingshan Metal) | 34 |

| | Keyinbulake Cu-Zn Property in development stage (Xingzhen Mining) | 37 |

| | Qianzhen Mining | 39 |

| | ITEM 3. | LEGAL PROCEEDINGS | 40 |

| | ITEM 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS | 40 |

| PART II | |

| | ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 41 |

| | Equity Compensation Plan Information | 41 |

| | ITEM 6. | SELECTED FINANCIAL DATA | 42 |

| | ITEM 7. | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 42 |

| | Expansion of Production Capacity to Meet Demand | 38 |

| | Acquire More Mineral Resources | 40 |

| | | |

| | ITEM 8. | FINANCIAL STATEMENTS | 54 |

| | ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 54 |

| | ITEM 9A. | CONTROLS AND PROCEDURES | 54 |

| | ITEM 9B. | OTHER INFORMATION | 55 |

| PART III | |

| | ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 55 |

| | Involvement in Certain Legal Proceedings | 57 |

| | Compliance with Section 16(a) of the Securities Exchange Act of 1934 | 58 |

| | Code of Ethics | 58 |

| | Director Nominees Recommended by Stockholders | 58 |

| | Board Composition; Audit Committee and Financial Expert | 58 |

| | ITEM 11. | EXECUTIVE COMPENSATION | 59 |

| | Outstanding Equity Awards at Fiscal Year-End | 59 |

| | Director Compensation | 59 |

| | Retirement, Post-Termination and Change in Control | 60 |

| | ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. | 60 |

| | ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 61 |

| | | | |

| | ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 62 |

| PART IV |

| | ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES | 62 |

PART I

Corporate History

Unless otherwise indicated, or unless the context otherwise requires, all references in this Annual Report to the terms “Company,” “CSZM,” “we,” “our,” or “us” mean China Shen Zhou Mining & Resources, Inc., a Nevada corporation.

We are the result of a share exchange/reverse takeover among Earth Products & Technologies, Inc., a Nevada corporation (“EPTI”) with American Federal Mining Group, Inc., an Illinois company (hereinafter “AFMG”), and the shareholders of AFMG. The effective date of the transaction was September 15, 2006. Pursuant to the transaction, EPTI issued a total of 20,000,000 shares of common voting stock to AFMG Shareholders, in exchange for 100% of AFMG’s common stock. The common stock was issued in reliance on the exemption from registration set forth in Section 4(2) of the Securities Act of 1933, as amended. This transaction will be accounted for as a reverse takeover (recapitalization) with AFMG deemed the acquirer for accounting purposes and EPTI the legal acquirer.

As a result of the share exchange/reverse takeover, AFMG became a wholly-owned subsidiary of EPTI, with EPTI, which previously had no material operations, becoming a holding company for the business of AFMG and its subsidiaries. AFMG is a holding company, incorporated in Illinois, whose principal business is the ownership of entities in the People’s Republic of China (“PRC” or “China”) engaged in the acquisition, exploration, extraction and development of mining properties.

The share exchange/reverse takeover resulted in a change in voting control of EPTI. The former shareholders of AFMG now hold a total of 20,000,000 shares of common stock, or approximately 94% of the outstanding common stock of EPTI, and the original EPTI shareholders now hold a total of 1,297,700 shares of common stock, or approximately 6% of the outstanding common stock. At the closing, EPTI’s officers and directors resigned, and Xiao-Jing Yu was appointed as President of EPTI. Effective October 20, 2006, EPTI changed its name to China Shen Zhou Mining & Resources, Inc.

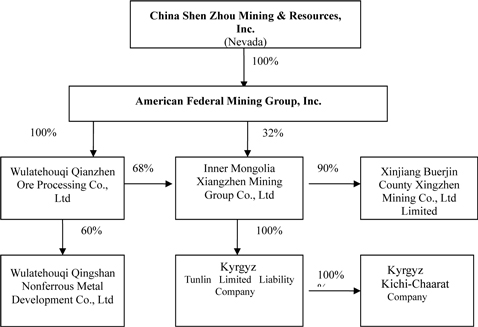

AFMG owns all of the registered capital of Inner Mongolia Wulatehouqi Qianzhen Ore Processing Co., Ltd. (“Qianzhen Mining”), a limited liability company organized in the PRC. Qianzhen Mining holds 68% of the registered capital of Inner Mongolia Xiangzhen Mining Group Co., Ltd., a limited liability company organized in the PRC (“Xiangzhen Mining”), with the remaining 32% of the registered capital of Xiangzhen Mining being held by AFMG, thus effectively making Xiangzhen Mining a wholly-owned subsidiary of AFMG. The percentage of ownership interest in Xiangzhen Mining by AFMG and Qianzhen Mining changed from 67% and 33% in 2006 to 68% and 32% in 2007, respectively, due to additional investment into Xiangzhen Mining by AFMG and Qianzhen Mining. Xiangzhen Mining also holds 100% of the registered capital of Tun-Lin Limited Liability Company (“Tun-Lin”), which is a Kyrgyz Republic registered company, which in turn owns 100% of Kichi Chaarat Closed Stock Company . Qianzhen Mining owns 60% of Wulatehouqi Qingshan Nonferrous Metal Development Co., Ltd. (“Qingshan Metal”). The other 40% of Qingshan Metal is owned by several individual shareholders. Xiangzhen Mining owns 90% of Xinjiang Buerjin County Xingzhen Mining Co., Ltd. (“Xingzhen Mining”). The other 10% is owned by Xinjiang Tianxiang New Technology Development Co., Ltd.

In December 2007, the company disposed one of its subsidiaries, Tianzhen Mining, an exploration stage company located in Wuqia County, Xinjiang Uygur Autonomous Region.

The table below illustrates the corporate structure of the Company:

Our common stock is listed on the NYSE Amex under the symbol “SHZ.”

Our executive offices are located at No. 166 Fushi Road, Zeyang Tower, Suite 1210 Shijingshan District, Beijing, China 100043. Our telephone number is 86-010-88906927.

Our Industry

Our primary business activity is mining, processing and distributing fluorite ores and processed fluorite powder, copper, zinc, lead, and other mineral concentrates. Along with China’s modernization drive, its economy has witnessed significant growth in the past three decades, which brought about a rapid growth in its manufacturing capacity. Moreover, due to its investment environment and cheap labor, China has attracted many manufacturers from developed countries.

Fluorite is mainly used by the steel industry as a melting agent and the fluorite chemical industry to manufacture hydrofluoric acid, a widely used raw material for the chemical industry. China produced 3.0 million metric tons of fluorite ore in 2006, 3.85 million metric tons in 2007 and 4.416 million metric tons in 2008. In 2008, about 87.5% of the annual output was consumed within China and 12.5% was exported, according to the publication of the China Fluorite Conference at Kunming and based on the estimates by China’s Fluorite Industry Association.. In recent years, large exports of fluorite and hydrofluoric acid have depleted fluorite resources in China. In order to protect fluorite reserves, the Chinese government instituted an export quota system in 2001.

Since 2007, the annual production capacity of steel has increased by 5% in China. Due to the increase of steel production, a capacity to produce aluminum fluoride at 500,000 metric tons had been built up by the end of 2008, which requires 0.75 million metric tons of fluorite powders. As of October 2008, the production capacity of hydrofluoric acid has increased to 1.0 million metric tons per year and 345,000 metric tons are under construction, which requires 2.5 million metric tons and 0.86 million metric tons of fluorite powders respectively. Due to the global financial crisis, however, the actual production is estimated at 60% of its capacity, according to the publication of China’s Inorganic Fluoride Industry Association.

In 2008, 1.75 million metric tons of fluorite powders were consumed by the producers of hydrofluoric acid, 3.44 million metric tons by the producers of aluminum, 1.0 million metric tons by the producers of steel, 0.516 million metric tons by the producers of aluminum fluoride and 0.6 million metric tons by the producers of construction materials in China, according to the publication of China’s Inorganic Fluoride Industry Association

Current Business Operations

Our primary business activity is mining, processing and distributing fluorite ore, zinc, copper, lead, and other mineral products. All of our business is conducted through our China-based subsidiaries. We operate mines in the Inner Mongolia Autonomous Region and Xinjiang Uygur Autonomous Region, which are known for their rich minerals of fluorite, copper, lead and zinc. Regional human resources of general labor and specialized professional mining teams are available to us at a low cost. We maintain good relationships with the local governments by providing employment opportunities to the local work force and tax revenues to the government. We have also achieved stable long term cooperative relationships with several large-scale domestic steel, nonferrous refining and chemical enterprises after years of experience and relationships in the mineral markets. Such relationships combined with the large resources available on hand provide the Company with a competitive advantage over others in the same industry.

The following table summarizes the business activities of AFMG’s subsidiaries:

| Subsidiaries | | Current Business Activities |

| Qianzhen Mining | | Engage mainly in the processing of zinc-lead ore |

| Xiangzhen Mining | | Engage in the extraction and processing of fluorite ore |

| Xingzhen Mining | | Engage mainly in exploration and development of zinc-copper mine |

| Qingshan Metal | | Engage mainly in the extraction of copper-zinc ore, some processing |

Tun-Lin Kichi Chaarat | | Holding company of Kichi Chaarat Engage in the development of Kichi Chaarat gold and copper deposit |

Description of Products

Fluorite :

We extract and process fluorite ores or fluorspar in northern Inner Mongolia. In 2008, we extracted a total amount of 122,000 metric tons of fluorite ores. There are two final products from extraction and processing of fluorites: high grade fluorite ores with a purity of above 75% CaF2 and fluorite powder with a purity of greater than 97% CaF2 The high grade fluorite ores, selected directly from the mined ores, are sold to steel making companies to be used as a melting agent in steel making. The fluorite powder is a key upstream material for the manufacture of fluorine compounds by the fluorine chemical industry.

In 2008, we produced approximately 61,000 metric tons of high grade fluorite ores and sold 24,135 metric tons with total sales of approximately US$2.6 million, accounting for approximately 69% of the revenues of our fluorite business.. We also processed 32,087 metric tons of fluorite ores, produced 17,664 metric tons of fluorite powder and sold 15,243 metric tons for approximately US$ 1.1million, which accounts for approximately 31% of the revenues of our fluorite business.

Nonferrous :

We extract and process zinc, copper and lead ores in the central part of Inner Mongolia and northeastern part of Xinjiang Uyur Autonomous Region. Our final products are zinc concentrate, copper concentrate and lead concentrate which are sold to metallurgical companies which in turn refine them into zinc, copper and lead ingots.

In 2008, we produced zinc concentrate, copper concentrates and concentrate sulfur equivalent to 1,850 metric tons of zinc metal, 120 metric tons of copper metal and 20,342 tons of concentrate sulfur and sold zinc and copper concentrates equivalent to 1,850 metric tons of zinc metal, 145 metric tons of copper metal and 18,147 metric tons of concentrate sulfur, accounting for approximately 43%, 29% and 28%, respectively, of the total revenues of our nonferrous business of approximately $7.1 million.

-Sales and Marketing

We do not have any marketing staff. We have maintained long term and good relationships with our customers, who send their orders directly to us. Our in-house sales staff fill these orders based on our actual production ability and deliver the products to our customers through railways or trucks. We expect these relationships with our customer to continue.

Major Suppliers

During the year 2008, We have no concentrated suppliers. We extract and process zinc, copper and fluorite ores from our mines and purchase fuel and very few raw materials.

Our Major Customers

In 2008, our revenues from our fluorite business and nonferrous metals business were $3.7 million and $3.4 million, respectively.

The following table shows our major customers (5% or more) for our nonferrous business as of December 31, 2008:

| Number | | Customer | | Revenue* ($1,000) | | | Percentage (%) | |

| 1 | | RuiPeng Mining Ltd | | | 2,185 | | | | 64 | % |

| 2 | | Jinliyuan Trading Ltd | | | 345 | | | | 10 | % |

| 3 | | Hubei Huawei Trading Ltd | | | 217 | | | | 6 | % |

| 4 | | Feishang Nonferrous Metals Ltd | | | 174 | | | | 5 | % |

| 5 | | Shuangli Trading Ltd | | | 173 | | | | 5 | % |

| TOTAL | | | | | 3,094 | | | | 90 | % |

*The total revenue from our nonferrous segment is $3.4 million

The following table shows our major customers (5% or more) for our fluorite business as of December 31, 2008:

| Number | | Customer | | Revenue* ($1,000) | | | Percentage (%) | |

| 1 | | Laiwu Steel Ltd | | | 925 | | | | 25 | % |

| 2 | | Inner Mongolia Huadesanli Trading Ltd | | | 781 | | | | 21 | % |

| 3 | | Handan Hongzhi Substance Ltd | | | 754 | | | | 20 | % |

| 4 | | Ningxia Jinhe Chemistry Ltd | | | 685 | | | | 19 | % |

| 5 | | Zibo Bofeng Fertilizer Ltd | | | 355 | | | | 10 | % |

| TOTAL | | | | | 3,500 | | | | 95 | % |

* Total revenue from our fluorite segment is $3.7 million.

Competition

Rapid industrialization and development in China have been the main drivers for its increase in non ferrous metal and fluorite consumption. In the current markets for nonferrous metals and fluorite, demand in general exceeds supply. In the near term, we do not foresee any difficulty in selling our products and therefore we do not expect to devote large financial resources to sales and promotion.

Our competitors mainly are similar companies in China.

Our main competitors in the fluorite business are:

| | · | Jiangxi Yingpeng Mining Co., Ltd., which produced 120,000 metric tons of fluorite ore and 120,000 metric tons of fluorite powder in 2007. |

| | · | Shandong Hongxing Fluorite Co., Ltd., which produced 110,000 metric tons of fluorite ore and 30,000 metric tons of fluorite powder in 2007. |

| | · | Gansu Gaotai Hongyuan Mining Co., Ltd., which produced 60,000 metric tons of fluorite ore and 20,000 metric tons of fluorite powder in 2007. |

| | · | Henan Tongbai Yinhe Mining Co., Ltd., which produced 40,000 metric tons of fluorite and 5,000 metric tons of fluorite powder in 2007. |

Our competitors in the zinc, lead and copper concentrates are local mining companies such as Inner Mongolia Wulatehouqi Huogeqi Copper Mine (Huogeqi Mining) and Dongshengmiao Mining Industry Co, Ltd, (Dongshengmiao Mining). Our production volume in zinc, lead and copper concentrates are relatively small compared to these local mining companies. As the demand for non ferrous metal concentrate exceeds the supply, we believe that we should have no difficulty in selling our products.

| Competitor | | Capacity |

| | | |

| Huogeqi Mining | | 1,000,000 metric tons of extracting and ore processing capacity |

| Dongshengmiao Mining | | 600,000 metric tons of extracting and ore processing capacity |

| Wancheng Trading Co.,Ltd | | 400,000 metric tons of extracting and ore processing capacity |

Business Strategy

Expansion of Production Capacity to Meet Demand

▼ Fluorite

We extracted approximately 122,000 metric tons of fluorite ore in 2008. In early 2006, we began a project at Xiangzhen Mining to produce 300,000 metric tons of fluorite ore, and the project was completed in November 2007. Initially at the newly expanded mine, we expect to extract 80,000 metric tons of fluorite ore and process them into 40,000 metric tons of fluorite lump and 40,000 metric tons of fluorite powder in 2009. From 2010 onwards, we expect to expand our extraction capacity to full capacity of 300,000 metric tons of fluorite ore per year.

We produced approximately 6,750 metric tons of fluorite powder in 2008. In early 2006, at our mine site, we started to build a plant with an annual processing capacity of 200,000 metric tons of fluorite ore. The new plant remained in trial production in 2008 and we have been engaged in solving certain technological problems related to the plant’s water supply. We expect to solve the plant’s technological problems and produce 40,000 metric tons of fluorite powder in 2009. After reaching its full capacity, we expect to produce approximately 100,000 metric tons of refined fluorite powder per year.

▼ Zinc, Copper and Lead

Due to supply issues in non-ferrous ores, Qianzhen did not produce any non-ferrous concentrates during the first six months of 2008. Taking advantage of the rapidly increasing price of concentrate sulphur, the Company changed to produce concentrate sulphur by utilizing accumulated sulphur-bearing tailings, in order to mitigate the impact of the supply issues on the Company’s production. The Company treated 77,463 metric tons of sulphur-bearing tailings and produced 18,000 metric tons of concentrate sulphur in 2008. No production is planned at Qianzhen Mining in 2009 due to the low grade of the ores supplied by Qingshan Metal and low price of copper. During this shutdown period, Qianzhen will look actively for partners with the help of the local governments and for opportunities to re-start production.

In July 2006, Xingzhen Mining began a project at Keyinbulake Multi-Metal Mine in Buerjin County, Aletai Zone, Xinjiang Uygur Autonomous Region. The project has a mining and processing capacity of 200,000 metric tons of mineralized zinc-copper material per year. It went into trial production at the end of the second quarter of 2008 and produced 1,850 metric tons of zinc concentrates and 108 metric tons of copper concentrates in 2008. In 2009, with the lower price of zinc and copper, the Company will produce 30,000 metric tons of zinc oxide ore and sell directly without further processing, and process 70,000 metric tons of ore to produce 8,700 metric tons of zinc concentrate, and 1,900 metric tons of copper concentrate if we have satifactory test results for high grade ore dressing or the prices of copper and zinc do not continue to fall.

In November 2007, we completed the acquisition of Tun-Lin Co. Ltd, a company that exists under the law of the Republic of Kyrgyzstan, which owns 100% of the equity in Kichi Chaarat, whose major asset is the subsoil use right for (i) mining for gold, copper and other metals within the Kuru-Tegerek licensed area; and (ii) exploration for gold, copper and other metals within the Kuru-Tegerek licensed area. The purpose of the acquisition was to enable the Company to explore, develop and mine the potential reserves of the Kuru-Tegerek licensed area. On July 2008, the development plan for the Kichi Chaarat deposit was approved by local authority and we plan to complete the construction of a mining facility in three years.

Exploration Activities

ü Keyinbulake Cu-Zn Mine

Following the exploration in 2008, further exploration activities are planned in 2009 in the southern and northern parts of Keyinbulake Cu-Zn Mine. The exploration details are scheduled as follows:

Table 1-3: Exploration Program for Keyinbulake Property

| Item | | Method | | Unit | | Quantity | |

| Geophysical | | Surface scanning | | km 2 | | | 2 | |

| Drilling | | four medium/deep holes | | m | | | 3500 | |

| Trenching | | - | | m 3 | | | 5000 | |

| Assaying | | Sampling and test | | - | | | - | |

The exploration activities listed above will be completed by a Geophysical Prospecting Team of Xinjiang Nonferrous Geophysical Prospecting Bureau at the end of August 2009 with a total budget of approximately $0.58 million, which will be funded by a shareholder (natural person) of Xingzhen Mining.

Acquire More Mineral Resources

To increase our reserve base and insure supply to our processing facilities, we plan to acquire domestic and foreign large-scale mines when the right opportunity arises. We also expect to acquire additional nonferrous metal mines and fluorite mines domestically that have good extracting and operating conditions and possess all necessary governmental licenses.

Competitive Advantages

We believe we have the following competitive advantages:

| | · | We own one of the best fluorite mines in China which has high purity fluorite ore and good extracting conditions with the single largest processing plant in northern China. |

| | · | We have increased our potential reserve base in nonferrous metals by completing an acquisition of a large gold and copper deposit in Republic of Kyrgyzstan. |

| | · | We have an experienced management team. Most of our executive officers have more than 20 years of experience in the mining industry. |

| | · | We have good relationships with local government agencies. |

| | · | Many of our subsidiaries are located in the western part of China and therefore enjoy many preferential tax and regulatory policies. |

Government Regulation

The following is a summary of the principal governmental laws and regulations that are or may be applicable to our operations in the PRC. The scope and enforcement of many of the laws and regulations described below are uncertain. We cannot predict the effect of further developments in the Chinese legal system, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement of laws.

The mining industry, including certain exploration and mining activities, is highly regulated in the PRC. Regulations issued or implemented by the State Council, the Ministry of Land and Resources, and other relevant government authorities cover many aspects of exploration and mining of natural resources, including entry into the mining industry, the scope of permissible business activities, interconnection and transmission line arrangements, tariff policy and foreign investment.

The principal regulations governing the mining business in the PRC include:

| | · | China Mineral Resources Law, which requires a mining business to have exploration and mining licenses from provincial or local land and resources agencies. |

| | · | China Mine Safety Law, which requires a mining business to have a safe production license and provides for random safety inspections of mining facilities. |

| | · | China Environmental Law, which requires a mining project to obtain an environmental feasibility study of the project. |

| | · | Foreign Exchange Controls. The principal regulations governing foreign exchange in the PRC are the Foreign Exchange Control Regulations (1996) and the Administration of Settlement, Sale and Payment of Foreign Exchange Regulations (1996), (“the Foreign Exchange Regulations”). Under the Foreign Exchange Regulations, Renminbi (“RMB”) is freely convertible into foreign currency for current account items, including the distribution of dividends. Conversion of RMB for capital account items, such as direct investment, loans and security investment, however, is still subject to the approval of the State Administration of Foreign Exchange (“SAFE”). Under the Foreign Exchange Regulations, foreign-invested enterprises are required to open and maintain separate foreign exchange accounts for capital account items. In addition, foreign-invested enterprises may only buy, sell and/or remit foreign currencies at those banks authorized to conduct foreign exchange business after providing valid commercial documents and, in the case of capital account item transactions, obtaining approval from SAFE. |

The Guidance to Businesses by Foreign Investments revised in 2007 by the Chinese government no longer allows foreign investments into the fields of exploration, development and mining of fluorite in China. The policy is intended to protect Chinese businesses.

Our operating subsidiaries in China have been authorized by land and resources departments of local governments. Chinese regulations require that mining enterprises procure an exploration or mining license from the land and resource department of local governments before they can carry out exploration or mining activities. This license ensures that an enterprise follow proper procedures in its own exploring or mining activities and in selling its products to customers. We have secured the necessary exploration or mining licenses from local governments. Most of our mining companies possess exploration or mining licenses and some of them are applying for mining licenses after exploration.

Chinese regulations also require that a mining company must have a safety certification from the PRC Administration of Work Safety before it can engage in mining and extracting activities. All of our operating subsidiaries have obtained safety certification from the Administration of Work Safety of local governments. In addition, all of our operating subsidiaries have passed government safety inspections.

We also have been granted an environmental certification from the PRC Bureau of Environmental Protection.

Employees

As of December 31, 2008, we employed 351 full-time employees, of whom approximately 2.6% are with our Beijing Representative Office, 20.8% are with Qianzhen Mining, 60.7% are with Xiangzhen Mining, 5.1% are with Tun-Lin Co. (gold and copper project in Kyrgyz), 2.3% are with Qingshan Metal (copper and zinc ore mining) and 8.5% are with Xingzhen Mining (holding exploration rights of copper ore and zinc ore). Approximately 26.5% of our employees are management personnel, and 6% are sales and procurement staff. In terms of education level, approximately 20% of our employees have a college degree or higher.

Under Chinese law, our employees have formed trade unions which protect employees’ rights, aim to assist in the fulfillment of our economic objectives, encourage employee participation in management decisions and assist in mediating disputes between us and union members. We believe that we maintain a satisfactory working relationship with our employees and we have not experienced any significant labor disputes or any difficulty in recruiting staff for our operations.

As required by applicable Chinese law, we have entered into employment contracts with all of our employees. We have also entered into a confidentiality agreement with all of our employees under which such employees are prohibited from disclosing confidential information of the Company or using it for other purposes than the benefit of the Company. Directors, officers, mid-level managers and some key employees in sales and R&D are required to sign a non-compete agreement which prohibits them from competing with the Company while they are employees of the Company and within two years after their employment with the Company is terminated.

Our employees in China participate in a state pension arrangement organized by Chinese municipal and provincial governments. We are required to contribute to the arrangement at the rate of 20% of the average monthly salary. In addition, we are required by Chinese law to cover employees in China with other types of social insurance. Our total contribution may amount to 30% of the average monthly salary. We have purchased social insurance for all of our employees. Expense related to social insurance was approximately $107,523 for fiscal year 2008.

Risk Factors

CAUTIONARY STATEMENT REGARDING FORWARD - LOOKING INFORMATION AND CERTAIN IMPORTANT FACTORS

In this Annual Report on Form 10-KSB we make, and from time to time we otherwise make, written and oral statements regarding our business and prospects, such as projections of future performance, statements of management’s plans and objectives, forecasts of market trends, and other matters that are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Statements containing the words or phrases “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimates,” “projects,” “believes,” “expects,” “anticipates,” “intends,” “target,” “goal,” “plans,” “objective,” “should” or similar expressions identify forward-looking statements, which may appear in documents, reports and filings with the Securities and Exchange Commission, news releases, written or oral presentations made by officers or other representatives made by us to analysts, stockholders, investors, news organizations and others, and discussions with management and other of our representatives. For such statements, we invoke the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

Our future results, including results related to forward-looking statements, involve a number of risks and uncertainties. No assurance can be given that the results reflected in any forward-looking statements will be achieved. Any forward-looking statement speaks only as of the date on which such statement is made. Our forward-looking statements are based upon assumptions that are sometimes based upon estimates, data, communications and other information from suppliers, government agencies and other sources that may be subject to revision. Except as required by law, we do not undertake any obligation to update or keep current either (i) any forward-looking statement to reflect events or circumstances arising after the date of such statement, or (ii) the important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or which are reflected from time to time in any forward-looking statement.

In addition to other matters identified or described by us from time to time in filings with the SEC, there are several important factors that could cause our future results to differ materially from historical results or trends, results anticipated or planned by us, or results that are reflected from time to time in any forward-looking statement. Some of these important factors, but not necessarily all important factors, include the following:

Risks Related to Our Business

We risk defaults under our convertible debt.

We entered into the Second Supplemental Indenture dated September 28, 2007 with the Bank of New York (the “Trustee”), which amended an Indenture dated December 27, 2006 under which our 6.75% Senior Convertible Notes Due 2012 initially purchased by Citadel Equity Fund Ltd were issued. Under the Second Supplemental Indenture, the Company covenants to achieve certain quarterly EBITDA targets for 2008 and 2009. If the Company fails to achieve such quarterly targets and does not cure it within fourteen days after it receives a written notice of default from the Trustee or the Convertible Notes Holders, such failure will constitute a default. The Company did not achieve the targets for the four fiscal quarters of 2008. So far, neither the Trustee nor the Convertible Note Holders have sent a written notice of default to the Company. However, the Trustee or the Convertible Note Holders could send a written notice of default any time in the future when the Company misses its quarterly target. The Company believes that it is very likely to miss its EBITDA target again and will unlikely be able to cure it within fourteen days.

Disruptions in the capital and credit markets related to the current national and worldwide financial crisis, which may continue indefinitely or intensify, could adversely affect our results of operations, cash flows and financial condition, or those of our customers and suppliers.

The current disruptions in the capital and credit markets may continue indefinitely or intensify, and adversely impact our results of operations, cash flows and financial condition, or those of our customers and suppliers. Disruptions in the capital and credit markets as a result of uncertainty, changing or increased regulation, reduced alternatives or failures of significant financial institutions could adversely affect our access to liquidity needed to conduct or expand our businesses or conduct acquisitions or make other discretionary investments, as well as our ability to effectively hedge our currency or interest rate. Such disruptions may also adversely impact the capital needs of our customers and suppliers, which, in turn, could adversely affect our results of operations, cash flows and financial condition.

We may not be able to secure financing needed for future operating needs on acceptable terms, or on any terms at all.

From time to time, we may seek additional financing to provide the capital required to maintain or expand our exploration activities and mining facilities, and equipment and/or working capital, as well as repay outstanding loans if cash flow from operations is insufficient to do so. We cannot predict with certainty the timing or amount of any such capital requirements. If such financing is not available on satisfactory terms, we may be unable to expand our business or to develop new business at the rate desired, and our operating results may suffer. If we are able to incur debt, we may be subject to certain restrictions imposed by the terms of the debt and the repayment of such debt may limit our cash flow and our ability to grow. If we are unable to incur debt, we may be forced to issue additional equity, which could have a dilutive effect on the then current holders of equity.

We receive a significant portion of our revenues from a small number of customers. Our business will be harmed if our customers reduce their orders from us.

A significant amount of our revenue is derived from only a small number of customers mainly in the iron and steel and fluorite chemical industries. Dependence on a few customers could expose us to the risk of substantial losses if a single dominant customer stops purchasing our products. If we lose any customers and are unable to replace them with other customers that purchase a similar number of our products and services, our revenues and net income would decline considerably.

We may not have sufficient supply of nonferrous ore.

Qianzhen Mining, one of our subsidiaries, has a 200,000 metric ton/year processing capacity for zinc-lead ore. However, it does not produce any ore it processes. Currently, it obtains its supply of ore from third parties. Its contracts with third parties will expire in June 2008. We may not be able to renew contracts or secure new contracts with third party suppliers. Although we plan to increase the quantity of nonferrous metal ore at Qingshan Metal to replace third party suppliers, we may not be able to produce a sufficient quantity to ensure the supply of ore for Qianzhen Mining. As a result, our revenues may be reduced and our business would suffer.

Inclement weather may affect our fluorite business.

Our fluorite business is conducted through Xiangzhen Mining which is located in an outlying area on the border between China’s Inner Mongolia Autonomous Region and Mongolia. The weather conditions there are very harsh, especially in winter. If there is a strong snow storm, our fluorite mining operations may have to be suspended for an indefinite period of time and we may not be able to ship our fluorite products to our customers in time. As a result, our revenues may be negatively impacted.

Our administrative costs could affect our ability to be profitable.

Our exploration and mining operations are scattered across several geographical locations in China and we will make acquisition of mines in the future. Our administrative costs may increase as a result and our profitability may be affected.

Our ability to operate our company effectively could be impaired if we lose key personnel

We depend on the services of key executives and a small number of personnel focused on the development of our mining projects. Additionally, the number of persons skilled in the development and operation of mining properties is limited and significant competition exists for these individuals. We cannot assure you that we will be able to employ key personnel or that we will be able to attract and retain qualified personnel in the future. We do not maintain “key person” life insurance to cover our executive officers. Due to the relatively small size of our company, our failure to retain or attract key personnel may delay or otherwise adversely affect the development of our projects, which would have a material adverse effect on our business.

We may not be able to attract and retain the additional personnel we will need to develop any of our projects

We are a small company with a limited operating history and relatively few employees. The development of any of our proposed projects will place substantial demands on us. We will be required to recruit additional personnel and to train, motivate and manage these new employees. There can be no assurance that we will be successful in attracting and retaining such personnel.

We may not be able to obtain or renew licenses, rights and permits required to develop or operate our mines, or we may encounter environmental conditions or requirements which would adversely affect our business

In the ordinary course of business, mining companies are required to seek governmental permits for expansion of existing operations or for the commencement of new operations. In addition to requiring permits for the development of our mines, we will need to obtain various mining during the life of the project. Obtaining and renewing the necessary governmental permits is a complex and time-consuming process. Obtaining or renewing necessary permits may increase costs and cause delays depending on the nature of the activity to be permitted and the interpretation of applicable requirements implemented by the permitting authority. There can be no assurance that all necessary permits will be obtained and, if obtained, will be renewed, or that in each case the costs involved will not exceed those that we previously estimated. It is possible that the costs and delays associated with compliance with such standards and regulations could become such that we would not proceed with the development or operation of a mine or mines.

Any material inaccuracies in our production estimates could adversely affect our results of operations

We have prepared estimates of future production. We cannot assure you that we will ever achieve our production estimates or any production at all. Our production estimates depend on, among other things:

| | · | the accuracy of our mineralization and reserves estimates; |

| | · | the accuracy of assumptions regarding ore grades and recovery rates; |

| | · | ground conditions and physical characteristics of the mineralization, such as hardness and the presence or absence of particular metallurgical characteristics; |

| | · | the accuracy of estimated rates and costs of mining and processing; and |

| | · | our ability to obtain and keep effective all permits for our mines and facilities. |

Our actual production may vary from our estimates if any of our assumptions prove to be incorrect.

Expansion of our business may put added pressure on our management and operational infrastructure, impeding our ability to meet any increased demand for our products and possibly hurting our operating results.

Our business plan is to significantly grow our operations to meet anticipated growth in demand for our products. Our planned growth includes the expansion of exploration and mining over the next few years. Although most of management personnel have extensive experience in the mining industry, their training is in mining operations rather than contemporary management principles. They may be not able to cope with the challenges presented by being a U.S. public company and the competitive business environment due to globalization. In addition, growth in our business may place a significant strain on our personnel, management, financial systems and other resources. The evolution of our business also presents numerous risks and challenges, including:

| | | the continued demand of our products by the iron and steel, and fluorite chemical industries; |

| | | our ability to successfully and rapidly expand our operations in response to potentially increasing demand; |

| | | the costs associated with such growth, which are difficult to quantify, but could be significant; |

| | | rapid technological change; and |

| | | the highly cyclical nature of the mining industry. |

If we are successful in obtaining rapid market growth of our products, we will be required to deliver large volumes of quality products to customers on a timely basis and at a reasonable cost to those customers. Meeting any such increased demand will require us to expand our manufacturing facilities, to increase our ability to purchase raw materials, to increase the size of our work force, to expand our quality control capabilities and to increase the scale upon which we provide our products. Such demands would require more capital (including working capital) than we currently have and we may be unable to meet the needs of our customers.

There is certain risk for the company to maintain listing on NYSE Amex.

The company is currently listed on NYSE Amex. To maintain the listing on Amex, the company shall meet the continual listing standards required by the Amex, which include but not limited to financial criteria. If a company falls below any criteria, the Amex will notify the company and review the appropriateness of continued listing. Once notified, the company shall submit a plan to return to compliance. If the Amex accepts the plan, it will monitor the company's performance throughout the plan period. If the company fails to achieve stated goals in a timely manner, the Amex will move to remove it from the listing. Therefore, the company faces the risk of delisting if it is not able to comply with the continual listing standards of Amex.

Risks Related to Our Industry

Fluctuations in the market price of fluorite and nonferrous metals could adversely affect the value of our company and our securities

The profitability of our operations will be directly related to the market price of the metals we mine and refine. The market prices of fluorite and nonferrous metals fluctuate widely and are affected by numerous factors beyond the control of any mining company. These factors include fluctuations with respect to the rate of inflation, the exchange rates of the Renminbi and other currencies, interest rates, global or regional political and economic conditions, banking industry fluctuations, global and regional demand, production costs in major metal producing areas and a number of other factors. Any drop in the price of the metals important to our operations would adversely impact our revenues, profits and cash flows. In particular, a sustained drop in prices could:

| | § | cause suspension of our development and, ultimately our mining operations, if such operations become uneconomic at the then-prevailing prices, thus further reducing revenues; |

| | § | prevent us from fulfilling our obligations under our agreements or under our permits and licenses which could cause us to lose our interests in, or be forced to sell, our properties; and |

| | § | reduce financing available to us. |

Furthermore, the need to reassess the feasibility of any of our projects if metal prices decline could cause substantial delays or might interrupt operations until the reassessment can be completed. Mineral reserve calculations and life-of-mine plans using significantly lower metal prices could result in reduced estimates of mineral reserves and in material write-downs of our investment in mining properties and increased amortization, reclamation and closure charges.

Mining is inherently dangerous and subject to conditions or events beyond our control, and any operating hazards could have a material adverse effect on our business

Mining involves various types of risks and hazards, including: environmental hazards, industrial accidents, metallurgical and other processing problems, unusual or unexpected rock formations, structure cave-in or slides, flooding, fires and interruption due to inclement or hazardous weather conditions.

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury or death, environmental damage, delays in mining, increased production costs, monetary losses and possible legal liability. We may not be able to obtain insurance to cover these risks at economically feasible premiums and some types of insurance may be unavailable or too expensive to maintain. We may suffer a material adverse effect on our business and the value of our securities may decline if we incur losses related to any significant events that are not covered by our insurance policies.

There is no guarantee that legal title to the properties in which we have an interest will not be challenged, which could result in the loss of our rights in those properties

The ownership and validity, or title, of unpatented mining claims are often uncertain and may be contested. A successful claim contesting our title or interest to a property could cause us to lose our rights to mine that property. In addition, the success of such a claimant could result in our not being compensated for our prior expenditures relating to the property.

The mining industry is intensely competitive, and we may have difficulty effectively competing with other mining companies in the future

Mines have limited lives and, as a result, we must continually seek to replace and expand our mineralization and reserves through the acquisition of new properties. Significant competition exists for the acquisition of properties producing or capable of producing fluorite and nonferrous metals. We may be at a competitive disadvantage in acquiring additional mining properties because we must compete with other individuals and companies, many of which may have greater financial resources and larger technical staffs than we have. As a result of this competition, we may be unable to acquire attractive mining properties on acceptable terms.

Shortages of critical parts, equipment and skilled labor may adversely affect our development projects

The industry has been impacted by increased worldwide demand for critical resources such as input commodities, drilling equipment, tires and skilled labor. These shortages have caused and may continue to cause unanticipated cost increases and delays in delivery times, potentially impacting operating costs, capital expenditures and production schedules.

Costs estimates and timing of new projects are uncertain

The capital expenditures and time required to develop new mines or other projects are considerable and changes in costs or construction schedules can affect project economics. There are a number of factors that can affect costs and construction schedules, including, among others:

| § | availability of labor, power, transportation, commodities and infrastructure; |

| | |

| § | increases in input commodity prices and labor costs; |

| | |

| § | fluctuations in exchange rates; |

| | |

| § | availability of financing; |

| | |

| § | difficulty of estimating construction costs over a period of years; and |

| | |

| § | delays in obtaining environmental or other government permits. |

Risks Relate to Doing Business in China

The Company’s business will be affected by PRC government regulation and the country’s economic environment because most of our sales will be in the China market.

Although we export products to other countries, most of our sales are in the PRC. It is anticipated that our products in China will continue to represent a significant portion of sales in the near future. As a result of our reliance on the China markets, our operating results and financial performance could be affected by any adverse changes in economic, political and social conditions in China.

There can be no assurance that future regulatory, judicial and legislative changes will not have a material adverse effect on us, that regulators or third parties will not raise material issues with regard to compliance or non-compliance with applicable laws or regulations, or that any changes in applicable laws or regulations will not have a material adverse effect on our business.

The economy of the PRC has been transitioning from a planned economy to market oriented economy. Although in recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reforms, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of productive assets in the PRC are still owned by the Chinese government. For example, all lands are state owned and are leased to business entities or individuals through governmental granting of state-owned land use rights or mining and exploration rights. The granting process is typically based on government policies at the time of granting and it could be lengthy and complex. This process may adversely affect our future business expansion. The Chinese government also exercises significant control over the PRC’s economic growth through the allocation of resources, controlling payment of foreign currency and providing preferential treatment to particular industries or companies. Uncertainties may arise with changing of governmental policies and measures. At present, our mining and exploration activities are subject to approvals from the relevant government authorities in China. Such governmental approval processes are typically lengthy and complex, and never certain to be obtained.

There are risks inherent in doing business in China.

The PRC is a developing country with a young market economic system overshadowed by the state. Its political and economic systems are very different from the more developed countries and are still in the state of change. China also faces many social, economic and political challenges that may produce major shocks and instabilities and even crises, in both its domestic arena and in its relationship with other countries, including but not limited to the United States. Such shocks, instabilities and crises may in turn significantly and adversely affect our performance.

Certain political and economic considerations relating to the PRC could adversely affect us.

While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the PRC government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC’s economic and social conditions as well as by changes in the policies of the PRC government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of additional restrictions on currency conversion.

The recent nature and uncertain application of many PRC laws applicable to us create an uncertain environment for business operations and they could have a negative effect on us.

The PRC legal system is a civil law system. Unlike the common law system, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects. In addition, as these laws, regulations and legal requirements are relatively recent, their interpretation and enforcement involve significant uncertainty.

A new Chinese law may impact our ability to make acquisitions of Chinese businesses.

On August 8, 2006, six PRC regulatory agencies namely, the PRC Ministry of Commerce, the State Assets Supervision and Administration Commission (“SASAC”), the State Administration for Taxation, the State Administration for Industry and Commerce, the China Securities Regulatory Commission (“CSRC”), and the State Administration of Foreign Exchange (“SAFE”), jointly adopted the Regulations on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “New M&A Rule”), which became effective on September 8, 2006. The New M&A Rule purports, among other things, to require offshore Special Purpose Ventures, or SPVs, formed after the effective date, for overseas listing purposes, through acquisitions of PRC domestic companies and controlled by PRC companies or individuals, to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock exchange.

The Company intends to make acquisitions of Chinese businesses in the future. There are uncertainties regarding the interpretation and application of current or future PRC laws and regulations, including the New M&A Rule and those uncertainties could make it difficult or impossible to make acquisitions of Chinese businesses in the future.

Foreign Investment Policy Change

On March 16, 2007, China's parliament, the National People's Congress, adopted the Enterprise Income Tax Law, which will take effect on January 1, 2008. The new income tax law sets a unified income tax rate for domestic and foreign companies at 25 percent and abolishes the favorable policy for foreign invested enterprises. After this law takes effect, newly established foreign invested enterprises will not enjoy favorable tax treatment as in effect under current tax laws. Some of our subsidiaries are benefiting from the preferred tax rates for foreign companies and will be subject to the new tax rate when their respective term of preferred tax rates expires. Our net income margin may be affected at that time.

Risks Relate to Doing Business in Kyrgyzstan

The Company’s business may be affected by Kyrgyzstan laws and its government regulations and the country’s economic environment.

The company indirectly controls Tun-Lin Limited Liability Company (“Tun-Lin”), a Kyrgyzstan Republic registered company which entirely owns Kichi-Chaarat closed joint stock company. The major asset of Kichi-Chaarat is the subsoil use right for (i) mining gold and other metals within the Kuru-Tegerek licensed area, and (ii) exploration of gold and other metals within the Kuru-Tegerek licensed area. As a result, the company’s operating results and financial performance could be affected by any adverse changes in economic, political and social conditions in Kyrgyzstan.

There can be no assurance that future regulatory, judicial and legislative changes will not have a material adverse effect on us, that regulators or third parties will not raise material issues with regard to compliance or non-compliance with applicable laws or regulations, or that any changes in applicable laws or regulations will not have a material adverse effect on our business.

The economy of the Kyrgyzstan has been transitioning from a planned economy to market oriented economy. At present, our exploration activities are subject to approvals from the relevant government authorities in Kyrgyzstan. Such governmental approval processes are typically lengthy and complex, and never certain to be obtained.

There are risks inherent in doing business in Kyrgyzstan.

The Kyrgyzstan is a developing country with a young market economic system overshadowed by the state. Its political and economic systems are very different from the more developed countries and are still in the state of change. Kyrgyzstan also faces many social, economic and political challenges that may produce major shocks and instabilities and even crises, in both its domestic arena and in its relationship with other countries, including but not limited to the United States and China. Such shocks, instabilities and crises may in turn significantly and adversely affect our performance.

Certain political and economic considerations relating to the Kyrgyzstan could adversely affect us.

Through controls on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the Kyrgyzstan government exerts considerable direct and indirect influence on the economy. Many of the economic reforms carried out by the Kyrgyzstan government are unprecedented or experimental, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the Kyrgyzstan’s economic and social conditions as well as by changes in the policies of the Kyrgyzstan government, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the interest rate or method of taxation, and the imposition of additional restrictions on currency conversion.

The recent nature and uncertain application of man y Kyrgyzstan laws applicable to us creates an uncertain environment for business operations and they could have a negative effect on us.

The Kyrgyzstan legal system is different from that of United States. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, employment, commerce, taxation and trade. However, the promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects. In addition, as these laws, regulations and legal requirements are relatively recent, their interpretation and enforcement involve significant uncertainty.

Risks Related to the Market for Our Stock

The market for our Common Stock is limited.

The shares of our common stock have been traded on the American Stock Exchange under the trading symbol “SHZ” since January 31, 2008. Before the listing on the American Stock Exchange, the shares of our common stock were traded on the OTC Bulletin Board.

We currently have approximately 642 shareholders. But the trading volume has been low. A viable public trading market may not develop for our shares or may take a period of time to develop. Such a market, if it does develop, could be subject to extreme price and volume fluctuations. In the absence of an active trading market:

| | | Shareholders may have difficulty buying and selling or obtaining market quotations; |

| | | |

| | | market visibility for our Common Stock may be limited; and |

| | | |

| | | a lack of visibility for our Common Stock may have a depressive effect on the market price for our Common Stock. |

You may face difficulties in protecting your interests, and your ability to protect your rights through the U.S. federal courts may be limited, as our subsidiaries are incorporated in non-U.S. jurisdictions, we conduct substantially all of our operations in China, and all of our officers reside outside the United States.

We conduct substantially all of our operations in China through our wholly owned subsidiaries in China. All of our officers reside outside the United States and some or all of the assets of those persons are located outside of the United States. As a result, it may be difficult or impossible for you to bring an action against us or against these individuals in China in the event that you believe that your rights have been infringed under the securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws of the PRC may render you unable to enforce a judgment against our assets or the assets of our directors and officers. As a result of all of the above, our public stockholders may have more difficulties in protecting their interests through actions against our management, directors or major stockholders than would stockholders of a corporation doing business entirely within the United States.

The trading prices of many companies that have business operations only in China have been volatile which may result in large fluctuations in the price of our Common Stock and losses for shareholders.

The stock market has experienced significant price and volume fluctuations that have particularly affected the trading prices of equity securities of many companies that have business operations only in China. These fluctuations have often been unrelated or disproportionate to the operating performance of many of these companies. Any negative change in the public’s perception of these companies could depress our stock price regardless of our operating results. The market price of our Common Stock has been and may continue to be volatile. We expect our stock price to be subject to fluctuations as a result of a variety of factors, including factors beyond our control. These factors include:

| | | actual or anticipated variations in our quarterly operating results; |

| | | |

| | | announcements of technological innovations or new products or services by us or our competitors; |

| | | |

| | | announcements relating to strategic relationships or acquisitions; |

| | | |

| | | additions or terminations of coverage of our Common Stock by securities analysts; |

| | | |

| | | statements by securities analysts regarding us or our industry; |

| | | |

| | | conditions or trends in the our industry; and |

| | | |

| | | changes in the economic performance and/or market valuations of other industrial fire safety companies. |

The prices at which our Common Stock trades will affect our ability to raise capital, which may have an adverse affect on our ability to fund our operations.

Our Common Stock may be considered to be a “penny stock” and, as such, the market for our Common Stock may be further limited by certain SEC rules applicable to penny stocks.

To the extent the price of our common stock remains below $5.00 per share, we have net tangible assets of $2,000,000 or less, or if we fall below certain other thresholds, our common shares will be subject to certain “penny stock” rules promulgated by the SEC. Those rules impose certain sales practice requirements on brokers who sell penny stock to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000). For transactions covered by the penny stock rules, the broker must make a special suitability determination for the purchaser and receive the purchaser’s written consent to the transaction prior to the sale. Furthermore, the penny stock rules generally require, among other things, that brokers engaged in secondary trading of penny stocks provide customers with written disclosure documents, monthly statements of the market value of penny stocks, disclosure of the bid and asked prices and disclosure of the compensation to the brokerage firm and disclosure of the sales person working for the brokerage firm. These rules and regulations adversely affect the ability of brokers to sell our common shares and limit the liquidity of our securities.

We may seek to make acquisitions that prove unsuccessful or strain or divert our resources.

We may seek to expand our business through the acquisition of related businesses and assets. We may not be able to complete any acquisition on favorable terms or at all. Acquisitions present risks that could materially and adversely affect our business and financial performance, including:

| | | the diversion of our management’s attention from our everyday business activities; |

| | | |

| | | the contingent and latent risks associated with the past operations of, and other unanticipated problems arising in, the acquired business; and |

| | | |

| | | the need to expand management, administration, and operational systems. |

If we make such acquisitions we cannot predict whether:

| | | we will be able to successfully integrate the operations and personnel of any new businesses into our business; |

| | | |

| | | we will realize any anticipated benefits of completed acquisitions; or |

| | | |

| | | there will be substantial unanticipated costs associated with acquisitions, including potential costs associated with environmental liabilities undiscovered at the time of acquisition. |

In addition, future acquisitions by us may result in:

| | | potentially dilutive issuances of our equity securities; |

| | | |

| | | the incurrence of additional debt; |

| | | restructuring charges; and |

| | | |

| | | the recognition of significant charges for depreciation and amortization related to intangible assets. |

We do not intend to pay any dividends on our Common Stock in the foreseeable future.

We currently intend to retain all future earnings, if any, to finance our current and proposed business activities and do not anticipate paying any cash dividends on our Common Stock in the foreseeable future. We may also incur indebtedness in the future that may prohibit or effectively restrict the payment of cash dividends on our Common Stock.

We are not currently compliant with certain Sarbanes-Oxley Act standards.

The enactment of the Sarbanes-Oxley Act in July 2002 created a significant number of new corporate governance and internal control requirements. Although we expect to implement the requisite changes to become compliant with existing requirements, and new requirements when they do apply to us, we may not be able to do so, or to do so in a timely manner. If we do not come into compliance with the Sarbanes-Oxley Act corporate governance requirements, we may not be able to continue listing our securities on either AMEX in the event we ever attempt to do so.

We will incur increased costs relating to corporate governance matters.

As a public reporting company, we will need to comply with the Sarbanes-Oxley Act of 2002 and the related rules and regulations adopted by the SEC, including expanded disclosures, accelerated reporting requirements and more complex accounting rules. Compliance with Section 404 of the Sarbanes-Oxley Act of 2002 and other requirements will increase our costs and require additional management resources. Additionally, these laws and regulations could make it more difficult or more costly for us to obtain certain types of insurance, including director and officer liability insurance, and we may be forced to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar coverage. The impact of these events could also make it more difficult for us to attract and retain qualified persons to serve on our board of directors, our board committees or as executive officers. We are presently evaluating and monitoring developments with respect to these laws and regulations and cannot predict or estimate the amount or timing of additional costs we may incur to respond to their requirements.

Certain stockholders can exert control over the Company and may not make decisions that further the best interests of all stockholders.

Our officers, directors and principal stockholders (greater than 5% stockholders) together currently own an aggregate of approximately 79.33% of our outstanding Common Stock on a fully diluted basis. Consequently, these stockholders, if they act individually or together, may exert a significant degree of influence over our management and affairs and over matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. In addition, this concentration of ownership may delay or prevent a change of control of us and might affect the market price of our Common Stock, even when a change of control may be in the best interest of all stockholders. Furthermore, the interests of this concentration of ownership may not always coincide with our interests or the interests of other stockholders, and accordingly, they could cause us to enter into transactions or agreements which we would not otherwise consider.

Our investors may lose their entire investment in our securities.

An investment in our securities is highly speculative and may result in the loss of the entire investment. Only potential investors who are experienced investors in high risk investments and who can afford to lose their entire investment should consider an investment in our securities.

ITEM 2. DESCRIPTION OF PROPERTY

General

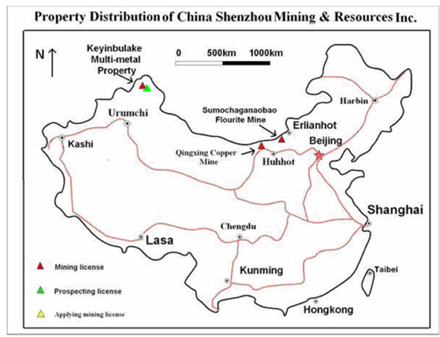

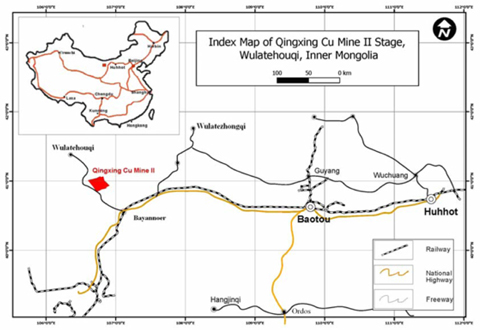

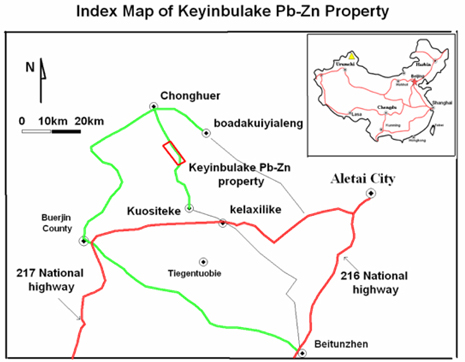

As of December 31, 2008, China Shen Zhou Mining & Resources Inc. owns two properties in the production in the Inner Mongolia Autonomous Region, the Peoples’ Republic of China (“PRC”), and two properties under development, one in Xinjiang Uygur Autonomous Region in the PRC and the other in Kyrgyz Republic.

The two properties in production are:

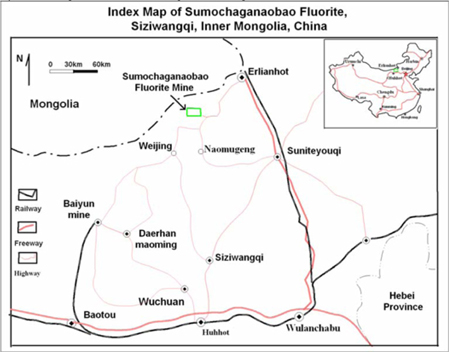

- Sumochaganaobao Fluorite Mine in Siziwangqi of Inner Mongolia Autonomous Region in the PRC (Xiangzhen Mining);

- Mining site No. 2 of Qingxing Copper Mine (Tanyaokou Copper Mine) in Wulatehouqi of Inner Mongolia Autonomous Region in the PRC (Qingshan Metal);

The two properties under development are:

- Keyinbulake Cu-Zn Multi-metal Mine located in Buerjin County, Aletai, Xinjiang Uygur Autonomous Region in the PRC (Xingzhen Mining).

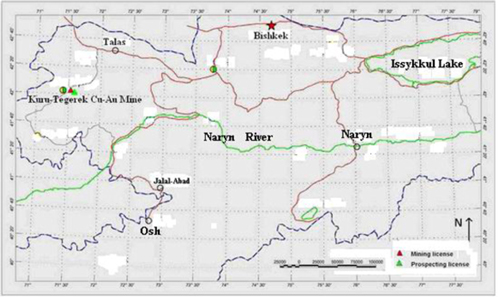

- Kuru-Tegerek Cu-Au Mine located in Kyrgyz Republic (Tun Lin).

| No. | | Name of property | | Type | | Ownership | | Status | | Location/Country |

| 1 | | Sumochaganaobao Fluorite Mine | | Non-metal Fluorite | | | 100 | % | Production | | Inner Mongolia, PRC |

| 2 | | Qingxing Copper Mine | | Copper and zinc | | | 60 | % | | | Inner Mongolia, PRC |

| 3 | | Keyinbulake Multi-metal Mine | | Copper and zinc | | | 90 | % | Development | | Inner Mongolia, PRC |

| 4 | | Kuru-Tegerek Cu-Au Mine | | Copper and gold | | | 100 | % | | | Kyrgyz Republic |

Figure 2-1: China Shen Zhou’s Properties in China

Figure 2-2: China Shen Zhou’s Property in Kyrgyzstan

China Shen Zhou Mining & Resources Inc. holds four mining licenses and three exploration licenses at December 31 of 2008. The licenses are:

-Mining license of Sumochaganaobao Fluorite Mine, Siziwangqi, Inner Mongolia, PRC;

-Mining license of Mining Site No. 2 of Qingxing Copper Mine, Wulatehouqi, Inner Mongolia, PRC;

-Mining license of Keyinbulake Cu-Zn Mine in Buerjin County, Xinjiang Uygur Autonomous Region, PRC;

-Mining license of Kuru-Tegerek Cu-Au Mine in Kyrgyz Republic;

-Exploration license of Southern Part of Keyinbulake Zn Mine in Xinjiang Uygur Autonomous Region of the PRC;

-Exploration license of Northern Part of Keyinbulake Zn Mine in Xinjiang Uygur Autonomous Region of the PRC;

-Exploration license of Kuru-Tegerek Cu-Au Property in the region of Kuru-Tegerek, Kyrgyz Republic

Tables 2-1/2 present detailed information about the licenses.

Table 2-1: 4 Mining Licenses Held by the Company

| Property | | Sumochaganaobao fluorite deposit (between prospecting line 21-04) | | Mining Site No. 2 of Qingxing Copper Mine (Tanyaokou Multi- metal Mine ) |

| License Number | | 1500000820156 | | 1500000820421 |

| Owner | | Inner Mongolia Xiangzhen Minin g Group Ltd. | | Qingshan Nonferrous Metal Development Co Ltd. |

| Validated period | | April 2008 to March 2011 | | September 2008 to September 2011 |

| Area | | 0.9088 km2 | | 0.6495km2 |

| Mining mode | | Underground mining | | Underground mining |

| Mining scale | | 150,000 metric tons/annum | | 100,000 metric tons/ annum |

| Ore types | | Fluorite | | Copper, Zinc and sulfur |

| Mining Level | | 1075m-497m | | 1455m-855m |

| Property | | Keyinbulake Cu-Zn Multi-metal Mine | | Kuru-Tegerek deposit (Tun Lin) |

| License Number | | 6500000712980 | | 8063-3300- AO( ИУ ) 21984940 |

| Owner | | Buerjin County Xingzhen Mining. | | Kichi Chaarat CJSC |

| Validated period | | August 2007.to August 2013 | | July 22, 2008 to December 31, 2021 |

| Area | | 1.955km2 | | 105 hectares (h) |

| Mining mode | | Underground mining | | - |

| Mining scale | | 21,000 metric tons/ annum | | - |

| Ore types | | Copper and zinc | | Gold, silver and copper |

| Mining Level | | 1420m-1516m | | - |

Table 2-2: 2 Exploration licenses held by the Company