QuickLinks -- Click here to rapidly navigate through this document

CARLISLE COMPANIES INCORPORATED

13925 Ballantyne Corporate Place, Suite 400

Charlotte, North Carolina 28277

(704) 501-1100

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

The 2006 Annual Meeting of Shareholders of Carlisle Companies Incorporated (the "Company") will be held at the offices of the Company, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina on Thursday, April 20, 2006, at 12:00 Noon for the following purposes:

1. To elect four (4) directors.

2. To transact any other business properly brought before the meeting.

Only shareholders of record at the close of business on February 24, 2006 will be entitled to vote whether or not they have transferred their stock since that date.

SHAREHOLDERS ARE URGED TO FILL IN, SIGN, DATE AND MAIL THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE.

| By Order of the Board of Directors | |||

| STEVEN J. FORD Secretary | |||

Charlotte, North Carolina

March 13, 2006

The enclosed Proxy is solicited by the Board of Directors. The cost of proxy solicitation will be borne by the Company. In addition to the solicitation of proxies by use of the mails, officers and regular employees of the Company may devote part of their time to solicitation by facsimile, telephone or personal calls. Arrangements may also be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material to beneficial owners and for reimbursement of their out-of-pocket and clerical expenses incurred in connection therewith. Proxies may be revoked at any time prior to voting. See "Voting by Proxy and Confirmation of Beneficial Ownership" beginning on page 21.

The mailing address of the principal executive offices of the Company is Carlisle Companies Incorporated, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277. The Company intends to mail this Proxy Statement and the enclosed Proxy, together with the 2005 Annual Report, on or about March 13, 2006. Upon written request mailed to the attention of the Secretary of the Company, at the address set forth above, the Company will provide without charge a copy of its 2005 Annual Report on Form 10-K filed with the Securities and Exchange Commission.

At the close of business on February 24, 2006, the Company had 30,623,921 shares of common stock ("Shares" or "Common Shares") outstanding, all of which are entitled to vote. The Company's Restated Certificate of Incorporation provides that each person who received Shares pursuant to the Agreement of Merger, dated March 7, 1986, which was approved by the shareholders of Carlisle Corporation and became effective on May 30, 1986, is entitled to five votes per Share. Persons acquiring Shares after May 30, 1986 (the effective date of the Merger) are entitled to one vote per share until the Shares have been beneficially owned (as defined in the Restated Certificate of Incorporation) for a continuous period of four years. Following continuous ownership for a period of four years, the Shares are entitled to five votes per share. The actual voting power of each holder of Shares will be based on shareholder records at the time of the Annual Meeting. See "Voting by Proxy and Confirmation of Beneficial Ownership" beginning on page 21. In addition, holders of Shares issued from the treasury, other than for the exercise of stock options, before the close of business on February 24, 2006 (the record date for determining shareholders entitled to vote at the Annual Meeting) will be entitled to five votes per share unless the Company's Board of Directors (the "Board of Directors" or "Board") determines otherwise at the time of authorizing such issuance.

1

A. Beneficial Owners.

The following table provides certain information as of December 31, 2005 with respect to any person who is known to the Company to be the beneficial owner of more than five percent (5%) of the Common Shares, the Company's only class of voting securities. As defined in Securities and Exchange Commission Rule 13d-3, "beneficial ownership" means essentially that a person has or shares voting or investment decision power over shares. It does not necessarily mean that the person enjoyed any economic benefit from those shares. The information included in the table is from Schedules 13G as filed by (i) Franklin Resources, Inc. (ii) JPMorgan Chase & Co., (iii) Lord, Abbett & Co., LLC, and (iv) Cramer Rosenthal McGlynn, LLC.

| Name and Address of Beneficial Owner | Number of Shares(1) | Percentage | |||

|---|---|---|---|---|---|

| Franklin Advisory Services, LLC One Parker Plaza, 9th Floor Fort Lee, New Jersey 07024 | 3,085,637 | 10.1 | % | ||

JPMorgan Chase & Co. 270 Park Avenue New York, New York 10017 | 2,151,913 | 7.0 | % | ||

Lord, Abbett & Co., LLC 90 Hudson Street Jersey City, New Jersey 07302 | 1,771,314 | 5.8 | % | ||

Cramer Rosenthal McGlynn, LLC 520 Madison Avenue New York, New York 10022 | 1,718,515 | 5.6 | % |

- (1)

- Based on the referenced Schedule 13G filing, each listed reporting person has sole voting and dispositive power in respect of the shares owned by such reporting person.

2

B. Nominees, Directors and Officers

The following table provides information as of January 31, 2006, as reported to the Company by the persons and members of the group listed, as to the number and the percentage of Common Shares beneficially owned by: (i) each director, nominee and executive officer named in the Summary Compensation Table on page 11; and (ii) all directors, nominees and current executive officers of the Company as a group.

| Name of Director/Executive or Number of Persons in Group | Number of Shares | Percentage | ||

|---|---|---|---|---|

| Donald G. Calder | 779,451(a)(c)(g)(l) | 2.56 | ||

| Robin S. Callahan | 12,496(g)(j) | .04 | ||

| Paul J. Choquette, Jr | 14,759(f)(g) | .05 | ||

| Peter L.A. Jamieson | 13,097(g)(m) | .04 | ||

| Peter F. Krogh | 11,002(g)(m) | .04 | ||

| Richmond D. McKinnish | 433,066(d)(e)(k) | 1.41 | ||

| Stephen P. Munn | 808,022(b)(d)(e)(l) | 2.64 | ||

| Anthony W. Ruggiero | 10,000(g)(m) | .03 | ||

| Lawrence A. Sala | 10,133(g)(m) | .03 | ||

| Eriberto R. Scocimara | 8,252(g) | .03 | ||

| Magalen C. Webert | 179,351(g)(h)(i)(m) | .59 | ||

| John W. Altmeyer | 129,707(d)(e)(k) | .42 | ||

| Barry Littrell | 49,724(d)(e)(k) | .16 | ||

| Carol P. Lowe | 22,788(d)(e)(k) | .07 | ||

| 17 Directors and current executive officers as a group | 2,194,405(a)-(m) | 7.00 |

- (a)

- Includes 3,000 Shares held by Mr. Calder's wife. Mr. Calder disclaims beneficial ownership of these Shares.

- (b)

- Includes 5,200 Shares held by Mr. Munn's wife. Mr. Munn disclaims beneficial ownership of these Shares.

- (c)

- Includes 276,392 Shares (.88%) held by a trust as to which Mr. Calder is a trustee. Mr. Calder disclaims beneficial ownership of these Shares.

- (d)

- Includes Shares allocated to the accounts of the following named officers participating in the Company's Employee Incentive Savings Plan as of December 31, 2005; Mr. Munn, 520 Shares; Mr. McKinnish, 14,968 Shares; Mr. Altmeyer, 4,257 Shares; Mr. Littrell, 1,140 Shares; and Mrs. Lowe, 525 Shares. Each participant in the Plan has the right to direct the voting of Shares allocated to his account. Shares are held by the trustee of the Employee Incentive Savings Plan in a commingled trust fund with beneficial interest allocated to each participant's account.

- (e)

- Includes Shares which the following named officers have the right to acquire within sixty (60) days through the exercise of stock options issued by the Company: Mr. Munn, 165,000 Shares; Mr. McKinnish, 327,000 Shares; Mr. Altmeyer, 107,000 Shares; Mr. Littrell, 41,334 Shares; and Mrs. Lowe, 19,667 Shares. Shares issued from the treasury of the Company pursuant to the exercise of stock options have one vote per share until such Shares have been held for a continuous period of four (4) years.

- (f)

- Includes 700 Shares held by Mr. Choquette's wife. Mr. Choquette disclaims beneficial ownership of these Shares.

- (g)

- Includes Shares which the following non-management directors have the right to acquire within sixty (60) days through the exercise of stock options issued by the Company: Mr. Calder, 9,000 Shares; Mrs. Callahan, 7,411 Shares; Mr. Choquette, 9,000 Shares; Mr. Jamieson, 9,000 Shares;

3

Mr. Krogh, 9,000 Shares; Mr. Ruggiero, 7,000 Shares; Mr. Sala, 8,000 Shares; Mr. Scocimara, 4,000 Shares; and Mrs. Webert, 8,000 Shares. Shares issued from the treasury of the Company pursuant to the exercise of stock options have one vote per share until such Shares have been held for a continuous period of four (4) years.

- (h)

- Includes 1,000 Shares held by Mrs. Webert's husband and 2,812 Shares held by Mrs. Webert's children. Mrs. Webert disclaims beneficial ownership of these Shares.

- (i)

- Includes 147,058 Shares held by a limited partnership as to which Mrs. Webert is an indirect owner. Mrs. Webert disclaims beneficial ownership of these Shares.

- (j)

- Includes 85 Shares held by Mrs. Callahan's husband. Mrs. Callahan disclaims beneficial ownership of these Shares.

- (k)

- Includes restricted Shares as follows: Mr. McKinnish, 10,000 Shares; Mr. Altmeyer, 6,750 Shares; Mr. Littrell, 7,250 Shares; and Mrs. Lowe, 2,500 Shares. Restricted Shares have one vote per share until such Shares have been held for a continuous period of four (4) years.

- (l)

- Includes 467,526 Shares (1.49%) held in an estate as to which Messrs. Calder and Munn are executors. Both Messrs. Calder and Munn disclaim beneficial ownership of these Shares.

- (m)

- The table does not include the following Share equivalent units ("Units") credited to the directors under the Company's Deferred Compensation Plan for Non-Employee Directors: Mr. Jamieson, 4,125 Units; Mr. Krogh, 2,694 Units; Mr. Ruggiero, 1,148 Units; Mr. Sala, 1,545 Units; and Mrs. Webert, 2,083 Units. The value of the Units will be paid to the director in cash upon his or her termination of service.

A. Election of Directors

The Company's Restated Certificate of Incorporation provides for a classified Board of Directors under which the Board is divided into three classes of directors, each class as nearly equal in number as possible.

At the Annual Meeting four (4) directors are to be elected. The directors will be elected to serve for a three-year term until the 2009 Annual Meeting and until their successors are elected and qualified. Directors will be elected by a plurality of the votes cast. Only votes cast for a nominee will be counted, except that the accompanying Proxy will be voted for the four nominees in the absence of instructions to the contrary. Abstentions, broker non-votes, and instruction on the accompanying Proxy to withhold authority to vote for one or more of the nominees will result in the respective nominees receiving fewer votes than if the votes were cast for the respective nominees. For voting purposes, proxies requiring confirmation of the date of beneficial ownership received by the Board of Directors with such confirmation not completed so as to show which Shares beneficially owned by the shareholder are entitled to five votes will be voted with one vote for each Share. See "Voting by Proxy and Confirmation of Beneficial Ownership" beginning on page 21. In the event any nominee is unable to serve (an event management does not anticipate), the Proxy will be voted for a substitute nominee selected by the Board of Directors or the number of directors will be reduced.

4

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" EACH OF THE FOLLOWING NOMINEES.

The following table sets forth certain information relating to each nominee, as furnished to the Company by the nominee. Except as otherwise indicated, each nominee has had the same principal occupation or employment during the past five years.

| Name | Age | Position with Company, Principal Occupation, and Other Directorships | Period of Service as Director(a) | |||

|---|---|---|---|---|---|---|

| Paul J. Choquette, Jr. | 67 | Chairman and Chief Executive Officer of Gilbane, Inc. the holding company for Gilbane Properties, Inc. and Gilbane Building Company, real estate development and construction management companies. Chairman of Corporate Governance and Nominating Committee and Member of Executive Committee of the Company. | April, 1991 to date. | |||

Stephen P. Munn | 63 | Chairman of the Board, since January, 1994; Chief Executive Officer from September, 1988 to February, 2001, of the Company. Director of Gannett Corporation. Chairman of Executive Committee of the Company. | September, 1988 to date. | |||

Lawrence A. Sala | 43 | Chairman, President and Chief Executive Officer of Anaren, Inc., manufacturer of microwave electronic components and subsystems for satellite and defense electronics, and telecommunications. Director of Anaren, Inc. Member of Audit, Corporate Governance and Nominating and Pension and Benefits Committees of the Company. | September, 2002 to date. | |||

Magalen C. Webert | 54 | Private investor. Member of Audit (through February, 2006), Pension and Benefits and Corporate Governance and Nominating (from February, 2006) Committees of the Company. | May, 1999 to date. |

5

Directors With Unexpired Terms

The following table sets forth certain information relating to each director whose term has not expired, as furnished to the Company by the director. Except as otherwise indicated, each director has had the same principal occupation or employment during the past five years.

| Name | Age | Position with Company, Principal Occupation, and Other Directorships | Period of Service as Director(a); Expiration | |||

|---|---|---|---|---|---|---|

Donald G. Calder | 68 | President of G.L. Ohrstrom & Co., Inc., a private investment firm. Director of Central Securities Corporation, Roper Industries, Inc., and Brown-Forman Corporation. Member of Audit, Corporate Governance and Nominating and Executive Committees of the Company. | December, 1984 to date. Term expires 2007. | |||

Robin S. Callahan | 59 | Past General Manager, Distribution and Marketing of International Business Machines, a computer manufacturer and provider of information technology services. Member of Audit, Executive, Compensation (from February, 2006) and Pension and Benefits (through February, 2006) Committees of the Company. | May, 1998 to date. Term expires 2007. | |||

Peter L.A. Jamieson | 67 | Director of Jardine Strategic Holdings, Ltd., a holding company which makes long-term strategic investments. Past Director of Robert Fleming Holdings Limited, an investment banking firm. Member of Audit, Compensation and Pension and Benefits Committees of the Company. | January, 1996 to date. Term Expires 2008. | |||

Peter F. Krogh | 69 | Dean Emeritus and Distinguished Professor, School of Foreign Service, Georgetown University. Director of Credit Suisse Mutual Funds. Chairman of Pension and Benefits Committee and Member of Compensation and Corporate Governance and Nominating Committees of the Company. | May, 1995 to date. Term Expires 2008. | |||

6

Richmond D. McKinnish | 56 | Chief Executive Officer, since February, 2001; President since March, 2000; Executive Vice President from March, 1999 to March, 2000. | February, 2001 to date. Term Expires 2008. | |||

Anthony W. Ruggiero | 64 | Past Executive Vice President and Chief Financial Officer of Olin Corporation, a metals and chemicals manufacturer and distributor. Director of Olin Corporation. Chairman of Audit Committee and Member of Compensation (through February, 2006), Executive and Pension and Benefits (from February, 2006) Committees of the Company. | August, 2001 to date. Term Expires 2008. | |||

Eriberto R. Scocimara | 70 | President, Chief Executive Officer and Director of Hungarian-American Enterprise Fund. Director of Quaker Fabrics Corporation, Roper Industries, Inc., and Euronet Worldwide, Inc. Chairman of Compensation Committee and Member of Executive Committee of the Company. | July, 1970 to date. Term expires 2007. |

- (a)

- Information reported includes service as a Director of Carlisle Corporation, the Company's predecessor.

B. Meetings of the Board and Certain Committees; Remuneration of Directors

During 2005, the Board of Directors of the Company held six (6) meetings. The annual fee paid to each director who is not a member of management was $35,000. Each non-management director may elect to receive the entire annual fee in cash or one-half of the fee in cash and the other half in Shares with a market value equal to that amount. In addition, a $5,000 annual attendance fee is paid to each non-management director who attends at least 75% of the aggregate of (i) the total number of Board of Directors meetings which he or she is eligible to attend, and (ii) all meetings of committees of the Board on which the director serves. For 2005, each non-management director attended at least 75% of such meetings and received a $5,000 annual attendance fee.

The Board has standing Executive, Audit, Compensation, Pension and Benefits and Corporate Governance and Nominating Committees.

The Executive Committee has the authority to exercise all powers of the Board of Directors between regularly scheduled Board meetings. During 2005, the Executive Committee did not meet. Each member of the Executive Committee (other than Mr. Munn, the Company's Chairman during 2005 and the Chairman of the Committee) received an annual fee of $15,000.

7

The Audit Committee has the sole authority to appoint and terminate the engagement of the independent auditors of the Company and its subsidiaries. The functions of the Audit Committee also include reviewing the arrangements for and the results of the auditors' examination of the Company's books and records, internal accounting control procedures, the activities and recommendations of the Company's internal auditors, and the Company's accounting policies, control systems and compliance activities. During 2005, the Audit Committee held twelve (12) meetings. Each member of the Audit Committee received an annual fee of $15,000. The Chairman of the Committee received an additional annual fee of $10,000.

The Compensation Committee administers the Company's incentive programs and decides upon annual salary adjustments and discretionary bonuses for various employees of the Company, including the executive officers. During 2005, the Compensation Committee held four (4) meetings. Each member of the Compensation Committee received an annual fee of $5,000. The Chairman of the Committee received an additional annual fee of $10,000.

The Pension and Benefits Committee monitors the performance of the Company's pension and benefits programs. During 2005, the Pension and Benefits Committee met twice. Each member of the Pension and Benefits Committee received an annual fee of $5,000. The Chairman of the Committee received an additional annual fee of $10,000.

The functions of the Corporate Governance and Nominating Committee include developing and maintaining a set of corporate governance guidelines, leading the search for individuals qualified to become members of the Board and recommending such individuals be nominated by the Board to be presented for shareholder approval at the Company's annual meetings, reviewing the Board's committee structure and recommending to the Board for its approval directors to serve as members of each committee, evaluating the performance of the chief executive officer, discussing succession planning and recommending a new chief executive officer if a vacancy occurs. During 2005, the Corporate Governance and Nominating Committee held four (4) meetings. Each member of the Corporate Governance and Nominating Committee received an annual fee of $5,000. The Chairman of the Committee received an additional annual fee of $10,000.

In addition, at its February, 2000 meeting, the Board of Directors adopted a Non-Employee Director Stock Option Plan. In February 2003, the Non-Employee Director Stock Option Plan was amended to condition option grants on the attainment of financial criteria established by the Board from time to time. With respect to the calendar year ended December 31, 2004, the financial criterion was a specified increase in earnings per share. The Company achieved the specified increase in earnings per share and, as a result, each eligible Non-Employee director received in 2005 an option to acquire 1,000 Shares at an option price of $64.18, which was equal to the closing market price of the Shares on the date of the grant. In April 2005, the Company's shareholders approved the further amendment of the Non-Employee Director Stock Option Plan to, among other things, (i) remove the formula and performance condition for automatic grants of nonqualified stock options, and (ii) expand the type of awards available for issuance under the Plan. Following the shareholders' approval of the amendment to the Plan, each non-employee director received in 2005 an option to acquire an additional 1,000 Shares at an option price of $72.80, which was equal to the closing market price of the Shares on the date of the additional grant. All options expire ten years following the date of grant.

At its December 2003 meeting, the Board also adopted the Deferred Compensation Plan for Non-Employee Directors. Under the Deferred Compensation Plan, which is effective on January 1, 2004, each non-employee director of the Company is entitled to defer up to 100% of his or her annual retainer and meeting fees. Each participant can direct the "deemed investment" of his or her account among the different investment funds offered by the Company from time to time. Initially, the investment options include (i) a fixed rate fund and (ii) Share equivalent units. All amounts held under the Deferred Compensation Plan are 100% vested amounts credited to a participant's account and

8

generally will be paid or commence to be paid after the participant terminates service as a director. At the participant's election, payments can be made in a lump sum or in quarterly installments. Payments under the Deferred Compensation Plan are made in cash from the Company's general assets. For the period January 1, 2005 to December 31, 2005, the fixed rate fund accrued interest at five and one-half percent (5.5%) per annum and the aggregate interest accrued for all participants in the Deferred Compensation Plan was $38,113.

C. Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's executive officers and directors, and persons who beneficially own more than ten percent (10%) of the Company's equity securities, to file reports of security ownership and changes in such ownership with the Securities and Exchange Commission (the "SEC"). Executive officers, directors and greater than ten-percent beneficial owners also are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely upon a review of copies of such forms and written representations from its executive officers and directors, the Company believes that all Section 16(a) filing requirements were complied with on a timely basis during and for 2005.

D. Corporate Governance Matters

Independence. The Board recognizes the importance of director independence. Under the rules of the New York Stock Exchange, to be considered independent, the Board must determine that a director does not have a direct or indirect material relationship with the Company. Moreover, a director will not be independent if, within the preceding three (3) years: (i) the director was employed by the Company or receives $100,000 per year in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service, (ii) the director was a partner of or employed by the Company's independent auditor, (iii) the director is part of an interlocking directorate in which an executive officer of the Company serves on the compensation committee of another company that employs the director, (iv) the director is an executive officer or employee of another company that makes payments to, or receives payments from, the Company for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million or 2% of such other company's consolidated gross revenues, or (v) the director had an immediate family member in any of the categories in (i) – (iv).

The Board has determined that nine (9) of the Company's eleven (11) directors are independent under these standards. The independent directors are as follows: Donald G. Calder, Robin S. Callahan, Paul J. Choquette, Jr., Peter L.A. Jamieson, Peter F. Krogh, Anthony W. Ruggiero, Lawrence A. Sala, Eriberto R. Scocimara and Magalen C. Webert. The other two directors are Richmond D. McKinnish, the Company's current President and Chief Executive Officer and Stephen P. Munn, the Company's former Chief Executive Officer who currently serves as Chairman of the Board.

In addition, each of the directors serving on the Audit, Compensation, Corporate Governance and Nominating and Pension and Benefits Committees are independent under the standards of the New York Stock Exchange.

Meetings of Non-Employee Directors. At the conclusion of each of the regularly scheduled Board meetings, the independent directors of the Board meet in executive session without management and elect a director among them to preside at the executive meeting.

Statement of Corporate Governance Guidelines and Principles. The Company has adopted a Statement of Corporate Governance Guidelines and Principles and has published the Statement on its website: www.carlisle.com. The Company will provide without charge a copy of the Statement to any shareholder upon written request mailed to the attention of the Company's Secretary at 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277.

9

Charters. The Company has adopted Charters for each of its Audit, Compensation, Pension and Benefits and Corporate Governance and Nominating Committees and has published the Charters on its website: www.carlisle.com. The Company will provide without charge a copy of the Charters to any shareholder upon written request mailed to the attention of the Company's Secretary at 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277.

Code of Ethics. The Company's Business Code of Ethics is published on its website: www.carlisle.com. The Company will provide without charge a copy of the Business Code of Ethics to any shareholder upon written request mailed to the attention of the Company's Secretary at 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277.

Communications with Board of Directors. Any security holder may communicate with the Board of Directors or with the non-management directors as a group by writing to the Company's Secretary at Carlisle Companies Incorporated, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277, Attention: Secretary. Any written communication will be forwarded to the Board for its consideration.

Directors are not required to attend the Company's Annual Meeting of Shareholders and none of the directors attended last year's Annual Meeting.

Nomination Process. At its February, 2003 meeting, the Board established a Corporate Governance and Nominating Committee. The Committee's Charter is published on the Company's website: www.carlisle.com. All directors serving on the Committee are "independent" under the standards established by the New York Stock Exchange.

As more fully described in its Charter, the Corporate Governance and Nominating Committee assists the Board by identifying individuals qualified to be directors and recommending such individuals be nominated by the Board for election to the Board by the shareholders. Director nominees should possess the highest personal and professional integrity, ethics and values, and be committed to representing the long-term interests of the Company's shareholders. Nominees should also have outstanding business, financial, professional, academic or managerial backgrounds and experience. Each nominee must be willing to devote sufficient time to fulfill his or her duties, and should be committed to serve on the Board for an extended period of time. Prior to accepting an invitation to serve on another public company board, directors must advise the Corporate Governance and Nominating Committee and the Committee will determine whether such service will create a conflict of interest and/or prevent the director from fulfilling his or her responsibilities.

The source of director candidates may include: other directors, management, third-party search firms and security holders. Security holders may submit director recommendations to the Corporate Governance and Nominating Committee by writing to the Company's Secretary at Carlisle Companies Incorporated, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277, Attention: Secretary. The writing should include whatever supporting material the security holder considers appropriate and should address the director nominee characteristics described in the immediately preceding paragraph and must be received at least 120 days prior to the applicable Annual Meeting. The Company has not retained a third-party search firm to identify candidates at this time, but may do so in the future in its discretion.

10

COMPENSATION OF EXECUTIVE OFFICERS

A. Summary Compensation Table

The following table discloses compensation received during the three fiscal years ended December 31, 2003-2005 by Mr. McKinnish, the Company's Chief Executive Officer, and by each of the four remaining most highly paid executive officers who served as executive officers during 2005:

| | | | | Long-Term Compensation Awards | | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual compensation(1) | | |||||||||||||

| Name and Principal Position | | Restricted Stock Award(s)($)(4) | Securities Underlying Options(#) | All Other Compensation ($)(2) | ||||||||||||

| Year | Salary($) | Bonus($) | ||||||||||||||

| Stephen P. Munn Chairman | 2005 2004 2003 | $ | 525,000 480,000 480,000 | $ | 225,000 100,000 — | — — — | 10,000 5,000 — | $ | 9,333 8,667 9,333 | |||||||

Richmond D. McKinnish President and Chief Executive Officer | 2005 2004 2003 | $ | 850,000 800,000 725,000 | $ | 1,100,000 850,000 800,000 | $ | 641,800 — — | 70,000 100,000 100,000 | $ | 9,333 10,667 9,333 | ||||||

John W. Altmeyer(3) Group President, Construction Materials | 2005 2004 2003 | $ | 402,300 330,000 300,000 | $ | 600,000 360,000 275,000 | $ | 64,180 99,872 244,280 | 15,000 10,000 12,000 | $ | 8,400 8,200 8,000 | ||||||

Barry Littrell(3) Group President, Industrial Components | 2005 2004 2003 | $ | 343,125 330,000 295,000 | $ | 170,000 170,000 210,000 | $ | 64,180 99,872 274,815 | 10,000 10,000 8,000 | $ | 9,333 8,667 8,000 | ||||||

Carol P. Lowe(5) Vice President and Chief Fianncial Officer | 2005 2004 2003 | $ | 250,000 188,333 137,800 | $ | 250,000 200,000 75,000 | $ | 64,180 91,665 — | 8,000 12,000 2,000 | $ | 9,333 8,667 7,512 | ||||||

- (1)

- Includes amounts earned in fiscal year.

- (2)

- Includes only contributions by the Company to the Company 401(k) plan.

- (3)

- Messrs. Altmeyer and Littrell were appointed Group President, Construction Materials and Group President, Industrial Components, respectively, on November 2, 2005.

- (4)

- Mr. McKinnish holds 10,000 restricted Shares which are valued at $691,500 on December 31, 2005. Mr. Altmeyer holds 6,750 restricted Shares which are valued at $466,763 on December 31, 2005. Mr. Littrell holds 7,250 restricted Shares which are valued at $501,338 on December 31, 2005. Mrs. Lowe holds 2,500 restricted Shares which are valued at $172,875 on December 31, 2005. During the period these Shares remain restricted, Messrs. McKinnish, Altmeyer, Littrell and Mrs. Lowe will receive any dividends declared on such Shares.

- (5)

- Mrs. Lowe was appointed Vice President and Chief Financial Officer effective May 6, 2004.

11

B. Stock Option Grants in 2005

The following table discloses information on stock option grants in fiscal 2005 to the named executive officers.

| | Individual Grants | | | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Number of Securities Underlying Options Granted (#) | % of Total Options Granted to Employees in Fiscal Year (%) | Exercise Price ($/Sh) | Expiration Date(1) | Pre-tax(2) Grant Date Present Value(3) | |||||||

| Stephen P. Munn | 10,000 | 4.34% | $ | 64.18 | 2/1/15 | $ | 206,300 | |||||

| Richmond D. McKinnish | 70,000 | 30.40% | $ | 64.18 | 2/1/15 | $ | 1,444,100 | |||||

| John W. Altmeyer | 15,000 | 6.51% | $ | 64.18 | 2/1/15 | $ | 309,450 | |||||

| Barry Littrell | 10,000 | 4.34% | $ | 64.18 | 2/1/15 | $ | 206,300 | |||||

| Carol P. Lowe | 8,000 | 3.47% | $ | 64.18 | 2/1/15 | $ | 165,040 | |||||

- (1)

- Options are exercisable, 33.3% on February 2, 2005, an additional 33.3% on February 2, 2006 and the balance on February 2, 2007 and, thereafter, cumulatively, through the expiration date. In addition, the options are immediately exercisable upon a Change of Control (as defined on page 13).

- (2)

- Prior to applicable federal, state and other taxes.

- (3)

- The Black-Scholes model used to calculate the hypothetical values at date of grant considers the following factors to estimate the options present value: the stock's historic volatility calculated using the quarterly market price of the Shares since March, 1990, the expected life of the option, risk-free interest rates and the Shares expected dividend yield. The assumptions used in the model for the valuation of options were: return volatility of 28.3%; expected life of 7 years; risk-free interest of 3.9%; and an expected dividend yield of 1.4%; resulting in a value of $20.63 per option.

C. Aggregated Option Exercises in 2005 and Year End Values

The following table discloses information on stock option exercises in fiscal 2005 by the named executive officers and the value of each officer's unexercised stock options on December 31, 2005.

| | | | Number of Securities Underlying Unexercised Options at Fiscal Year End(#) | Pre-tax(1) Value of Unexercised, In-the-money Options at Fiscal Year End($)(3) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | Shares Acquired on Exercise(#) | Pre-tax(1) Value Realized($)(2) | Exercisable/ Unexercisable | Exercisable/ Unexercisable | |||||||||||

| Stephen P. Munn | — | — | 163,333 | 1,667 | $ | 3,798,717 | $ | 20,133 | |||||||

| Richmond D. McKinnish | 52,504 | $ | 1,789,287 | 293,667 | 33,333 | $ | 5,526,033 | $ | 402,667 | ||||||

| John W. Altmeyer | 9,000 | $ | 382,500 | 103,667 | 3,333 | $ | 2,519,893 | $ | 40,267 | ||||||

| Barry Littrell | — | — | 38,001 | 3,333 | $ | 766,133 | $ | 40,267 | |||||||

| Carol P. Lowe | — | — | 19,000 | 4,000 | $ | 210,627 | $ | 40,053 | |||||||

- (1)

- Prior to applicable federal, state and other taxes.

- (2)

- Value realized is calculated by subtracting the exercise price from the fair market value of the Shares on the date of exercise.

- (3)

- Total value of options is calculated by subtracting the exercise price from $69.15 (the closing price of the Shares on December 30, 2005).

12

D. Pension Plan

The pension plans of the Company and its subsidiaries provide defined benefits including a cash balance formula whereby participants accumulate a cash balance benefit based upon a percentage of compensation allocation made annually to the participants' cash balance accounts. The allocation percentage ranges from 2% to 7% and is determined on the basis of each participant's years of service. The cash balance account is further credited with interest annually. The interest credit is based on the One Year Treasury Constant Maturities as published in the Federal Reserve Statistical Release over the one year period ending on the December 31st immediately preceding the applicable plan year. The interest rate for the plan year ending December 31, 2005 was 4.00%. Compensation covered by the pension plan of the Company and its subsidiaries includes total cash remuneration in the form of salaries and bonuses, including amounts deferred under Sections 401(k) and 125 of the Internal Revenue Code of 1986, as amended (the "Code").

The annual annuity benefit payable starting at normal retirement age (age 65 with five years of service) as accrued through December 31, 2005 under the pension plans of the Company and its subsidiaries for the executives named in the Summary Compensation table were as follows: Mr. Munn, $400,000; Mr. McKinnish, $542,011, Mr. Altmeyer, $53,573; Mr. Littrell, $21,902; and Mrs. Lowe, $7,150.

As of December 31, 2005, the full years of credited service under the plans for each of the following individuals were as follows: Mr. Munn, 16 years; Mr. McKinnish, 30 years; Mr. Altmeyer, 15 years; Mr. Littrell, 8 years; and Mrs. Lowe, 3 years.

Section 401(a)(17) of the Code currently places a limit of $210,000 on the amount of annual compensation covered under a qualified pension plan such as the one maintained by the Company (the "Retirement Plan"). Under an unfunded supplemental pension plan maintained by the Company, the Company will make payments as permitted by the Code to plan participants in an amount equal to the difference, if any, between the benefits that would have been payable under the Retirement Plan without regard to the limitations imposed by the Code and the actual benefits payable under the Retirement Plan as so limited.

E. Compensatory Arrangements and Related Transactions

The Company has outstanding agreements with certain executive employees of the Company selected by the Board of Directors. These agreements provide that the individuals will not, in the event of the commencement of steps to effect a Change of Control (defined generally as an acquisition of 20% or more of the outstanding voting Shares or a change in a majority of the Board of Directors), voluntarily leave the employ of the Company until a third person has terminated his or its efforts to effect a Change of Control or until a Change of Control has occurred.

In the event of a termination of the individual's employment within three (3) years of a Change in Control, the executive is entitled to three years' compensation, including bonus, retirement benefits equal to the benefits he would have received had he completed three additional years of employment, continuation of all life, accident, health, savings, and other fringe benefits for three years, and relocation assistance.

At any time prior to a Change of Control, the Board of Directors of the Company may amend, modify or terminate any such agreement. The Board of Directors may also, at any time, terminate an agreement with respect to any executive employee who is affiliated with any group seeking or accomplishing a Change of Control. Messrs. Munn, McKinnish, Altmeyer, Littrell and Mrs. Lowe are each a party to such an agreement.

13

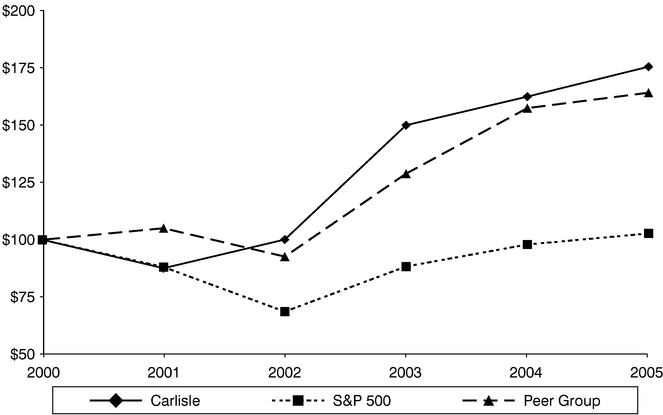

The following graph shows a five-year comparison of cumulative total returns, assuming reinvestment of dividends for the Company, the S&P 500 Composite Index and the Peer Group Index*.

The following table shows how a $100 investment in Carlisle Companies Incorporated has grown over the five-year period ending December 31, 2005 as compared to a $100 investment in the S&P 500 Composite Index and the Peer Group Index.* All values assume the reinvestment of dividends.

| Date | Carlisle | S&P 500 | Peer Group | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2000 | $ | 100.00 | $ | 100.00 | $ | 100.00 | |||

| 2001 | $ | 87.59 | $ | 88.11 | $ | 105.04 | |||

| 2002 | $ | 100.10 | $ | 68.64 | $ | 92.65 | |||

| 2003 | $ | 150.01 | $ | 88.33 | $ | 128.86 | |||

| 2004 | $ | 162.48 | $ | 97.94 | $ | 157.47 | |||

| 2005 | $ | 175.55 | $ | 102.75 | $ | 164.19 | |||

- *

- The Peer Group Index consists of Cooper Industries Inc., Crane Co., Danaher Corp., Dover Corp., Emerson Electric Co., General Electric, Illinois Tool Works Inc., Ingersoll-Rand Co., ITT Industries Inc., Parker-Hannifin Corp., Pentair Inc., Roper Industries Inc., SPX Corp., Teleflex Inc., Textron Inc., Tyco International Inc., and United Technologies Corp. Due to its acquisition in 2005, York International Corp. has been removed from the Peer Group Index. The Company believes that these public companies have similar industrial characteristics and constitute an appropriate index.

14

REPORT OF THE COMPENSATION COMMITTEE

The Compensation Committee is composed exclusively of independent, non-employee directors. The Compensation Committee reviews the compensation program for the Chief Executive Officer and other members of senior management, including the executive officers listed in the Summary Compensation Table on page 11 (the "named executives"), and determines and administers their compensation. In the case of both the Chairman and the Chief Executive Officer, the compensation determination made by the Compensation Committee is based in part on a report from the Corporate Governance and Nominating Committee.

Overview

The policies of the Compensation Committee are highly performance-related and are intended to motivate and reward individual performance that contributes to the attainment of the operational, financial and strategic goals established by management to build shareholder value. It is also the Compensation Committee's practice to provide a balanced mix of cash and equity-based compensation that the Compensation Committee believes appropriate to align the short-term and long-term interests of the Company's executives with that of its shareholders.

Members of senior management receive an annual base salary and are eligible for performance-based cash bonuses. In addition, senior executives are eligible for awards under the Company's Executive Incentive Program to encourage attainment of the Company's long-term goals. The Compensation Committee evaluates subjective individual and objective Company performance criteria in determining the size of the various components of compensation.

Base salaries are normally adjusted annually, based on general industry changes in salary levels, individual and Company performance as well as levels of duties and responsibilities.

Annual cash bonuses awarded to executive officers are based on a percentage of each officer's base salary. The percentage of base salary for each officer is determined each year by the Compensation Committee based on an evaluation of individual performances as reported to the Compensation Committee by the Chief Executive Officer, a review of overall Company and divisional performance criteria, such as sales (with an emphasis on organic growth), operating earnings, net earnings per share, cash flow generation (with an emphasis on working capital management), stock price performance, acquisitions, strategic accomplishments and other factors as the Compensation Committee deems appropriate.

The long-term incentive component of the Company's compensation program consists of awards under the Company's Executive Incentive Program. In 2005, the long-term incentive component included stock option awards and, in certain instances, a combination of stock option and restricted share awards.

All stock options are granted with an exercise price equal to the fair market value of the Shares on the date of grant, and option re-pricing is expressly prohibited by the terms of the Executive Incentive Program. Additionally, in order to provide an objective formula for determining the maximum amount of compensation an executive officer may receive on the exercise of stock options, no participant may receive options to acquire more than one hundred thousand (100,000) option Shares in any one fiscal year period. Stock options generally vest in three (3) equal installments on the date of grant and the first two (2) anniversaries of the date of grant. In addition, stock options have a maximum term of ten (10) years and are non-transferable.

Restricted Share grants are generally subject to a restriction period of at least two (2) years during which the Shares are subject to a substantial risk of forfeiture and may not be transferred. During the period of restriction, the grantee has the right to vote the restricted Shares and receive any dividends paid thereon.

15

While neither the number of stock options nor restricted Shares awarded to any executive officer by the Compensation Committee is determined by a pre-established plan or formula, the Compensation Committee reviews individual and Company performance criteria and other factors it deems appropriate in awarding stock options and restricted Shares.

In addition, in determining the appropriate compensation arrangement for the Chief Executive Officer and other members of senior management, the Compensation Committee considers the conclusions and recommendations of an independent benefits consulting firm retained to prepare a report (the "Consultant's Report") assessing the appropriateness of the compensation paid to the Company's senior officers in relation to the compensation paid to senior officers of comparable companies, which include many of the companies listed in the Peer Group included in the Performance Graph on page 14. The Consultant's Report included certain additional industry specific companies to more accurately assess compensation. Based on the Consultant's Report, the total cash compensation, including salary and bonus, paid to the Company's executive officers falls within the broad middle range of cash compensation paid by the companies included in the Consultant's Report.

Internal Revenue Code Section 162(m)

Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), limits the amount of individual compensation for certain executives that may be deducted by the employer for federal income tax purposes in any one fiscal year to $1 million unless such compensation is "performance-based." The determination of whether compensation is performance-based depends upon a number of factors. In general, the Compensation Committee intends to structure compensation programs for the Company's executive officers so as to take full advantage of the deductibility of compensation awards under Section 162(m). However, in instances deemed appropriate by the Compensation Committee, some level of non-deductible executive officer compensation expense may be approved.

Compensation of the Chief Executive Officer and Other Named Executives

Salary and bonus paid to Mr. McKinnish, the Company's Chief Executive Officer, in respect of 2005 were assessed on both qualitative and quantitative performance based measures consistent with the policies set forth above. For 2005, Mr. McKinnish received a salary increase of $50,000 and a bonus of $1,100,000. With respect to bonus compensation, the Compensation Committee set a maximum amount based on net income. In determining the final amount of Mr. McKinnish's bonus, the Compensation Committee also considered that the Company achieved pre-established performance measures relating to earnings per share growth, return on beginning equity, improvement in EBIT margin and organic sales growth. Moreover, the Compensation Committee found favorable the Company's share performance over the last three and five year periods as compared to the S&P 500 Composite Index and the Peer Group Index described on page 14 as follows: (i) the three year period ended December 31, 2005 (+41.34 points and +3.91 points, respectively), and (ii) the five year period ended December 31, 2005 (+72.80 points and +11.36 points, respectively). Further, quarterly dividends increased 6.67%, enabling the Company to pass on a portion of the Company's earnings to shareholders. In addition, the salary increase and bonus award reflect the conclusions and recommendations included in the Consultant's Report. As also reflected in the Consultant's Report, the total cash compensation paid to Mr. McKinnish in respect of 2005 falls within the broad middle range of cash compensation paid to chief executive officers of the companies included in the Consultant's Report.

The option and restricted share grants to Mr. McKinnish in 2005 were intended to more closely align his interest with the long-term interests of the Company's shareholders, and were consistent with the findings contained in the Consultant's Report. The Compensation Committee also took into account the size of prior grants to Mr. McKinnish.

16

With respect to compensation earned by the other executive officers of the Company in 2005 (including bonus compensation paid in 2006) the Compensation Committee reviewed and measured each executive's individual contributions to the progress made by the Company toward accomplishing its financial and strategic goals, including the Company's performance against prior year financial figures and ratios. The Compensation Committee determined, as reflected in the financial statements of the Company for the year ending December 31, 2005, that the Company, with respect to its continuing operations, performed favorably in 2005 against prior year sales (+10.5%) and earnings (+20.5%). With respect to stock performance, as described above, the Compensation Committee found that the Company's share price outperformed the S&P 500 Composite Index and the Peer Group Index over the last three and five year periods. Finally, the conclusions and recommendations set forth in the Consultant's Report also influenced the decisions by the Compensation Committee in respect of salary increases, bonus compensation as well as stock option and restricted share awards.

Conclusion

The Compensation Committee has reviewed all components of the Chief Executive Officer's and the named executives' compensation, including salary, bonus, equity and long-term incentive compensation, accumulated realized and unrealized stock option and restricted stock gains, the dollar value of all perquisites and other personal benefits as well as the Company's obligations under its pension plans. Based on this review, the Compensation Committee finds the Chief Executive Officer's and the named executives' total compensation, in the aggregate, to be reasonable and appropriate.

| CARLISLE COMPANIES INCORPORATED COMPENSATION COMMITTEE | |||

Eriberto R. Scocimara, Chairman Robin S. Callahan Peter L.A. Jamieson Peter F. Krogh | |||

17

The Audit Committee of the Board of Directors of the Company is comprised of five non-employee directors. The Board has made a determination that the members of the Audit Committee satisfy the requirements of the New York Stock Exchange as to independence, financial literacy and experience. The responsibilities of the Audit Committee are set forth in the Charter of the Audit Committee, which was amended and restated on September 3, 2003, and which is reviewed annually by the Committee. The Committee has the sole authority to appoint and terminate the engagement of the independent auditors of the Company and its subsidiaries. In 2005, the Audit Committee engaged Ernst & Young LLP as the Company's independent auditors replacing KPMG LLP. See "Selection of Auditors" beginning on page 19. The Committee also reviews the arrangements for and the results of the auditors' examination of the Company's books and records, internal accounting control procedures, the activities and recommendations of the Company's internal auditors, and the Company's accounting policies, control systems and compliance activities. The Board has determined that Anthony W. Ruggiero, the Chairman of the Audit Committee, is an "audit committee financial expert" as defined by the rules of the Securities and Exchange Commission. Below is a report on the Committee's activities relating to fiscal year 2005.

Review of Audited Financial Statements with Management

The Audit Committee reviewed and discussed the audited financial statements with the management of the Company.

Review of Financial Statements and Other Matters with Independent Accountant

The Audit Committee discussed with the independent auditors the audited financial statements and the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU Section 380), as may be modified or supplemented. The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), as may be modified or supplemented, and has discussed with the independent accountant the independent accountant's independence. In concluding that the auditors are independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the auditors were compatible with their independence. See "Selection of Auditors" beginning on page 19.

Recommendation that Financial Statements be Included in Annual Report

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the last fiscal year for filing with the Securities and Exchange Commission.

CARLISLE COMPANIES INCORPORATED

AUDIT COMMITTEE

Anthony W. Ruggiero, Chairman

Donald G. Calder

Robin S. Callahan

Peter L.A. Jamieson

Lawrence A. Sala

18

On May 4, 2005, the Audit Committee of the Board of Directors of the Company dismissed KPMG LLP ("KPMG") as the Company's independent public accounting firm and on May 17, 2005 engaged Ernst & Young LLP ("EY") as the Company's independent registered public accounting firm to audit the Company's financial statements and the effectiveness of the Company's internal controls over financial reporting for the year-ended December 31, 2005. EY's engagement commenced on May 17, 2005.

The audit reports of KPMG on the Company's consolidated financial statements as of and for each of the years ended December 31, 2004 and December 31, 2003 as well as the audit reports of KPMG on management's assessment of the effectiveness of internal control over financial reporting as of December 31, 2004 and the effectiveness of internal control over financial reporting as of December 31, 2004 did not contain an adverse opinion or disclaimer of opinion, nor were such audit reports qualified or modified as to uncertainty, audit scope or accounting principle.

During the years ended December 31, 2004 and December 31, 2003, and through May 4, 2005, there were no disagreements with KPMG on any matter of accounting principle or practice, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of KPMG, would have caused them to make reference thereto in their audit reports on the Company's financial statements for such years.

During the years ended December 31, 2004 and December 31, 2003, and through May 4, 2005, there were no "reportable events" requiring disclosure pursuant to paragraph (a)(1)(v) of Item 304 of Regulation S-K.

The Company provided KPMG with a copy of the foregoing disclosures. Attached as Exhibit 16.1 to the Company's related Form 8-K, dated May 10, 2005, is a copy of KPMG's letter, dated May 10, 2005, stating its agreement with such statements.

During the years ended December 31, 2004 and December 31, 2003, and prior to the date the Company engaged EY, the Company did not consult EY with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements or internal controls over financial reporting, or any other matters or reportable events as set forth in paragraph (a)(2)(i) and (ii) of Item 304 of Regulation S-K.

The Audit Committee has decided to retain EY to audit the accounts of the Company and its subsidiaries for the year ending December 31, 2006. One or more representatives of EY are expected to be present at the Annual Meeting and will be given an opportunity to make a statement, if they so desire, and to respond to appropriate questions of shareholders in attendance.

All services provided, or to be provided, by the Company's independent public accountants are subject to a pre-approval requirement of the Audit Committee. At its May 2005 meeting, the Audit Committee delegated to Mr. Ruggiero, the Chairman of the Audit Committee, pre-approval authority with respect to certain permissible non-audit services for 2005. Mr. Ruggiero's pre-approval authority was limited, in the aggregate, to engagements costing no more than $25,000.

19

Set forth below are the fees billed to the Company by EY and KPMG for the years ended December 31, 2005 and 2004.

| | 2005(a) | 2004(b) | ||||

|---|---|---|---|---|---|---|

| Audit Fees | $ | 2,333,352 | $ | 2,976,261 | ||

| Audit Related Fees | $ | 111,656 | $ | — | ||

| Tax Fees | $ | 66,913 | $ | 13,723 | ||

| All Other Fees | $ | 6,190 | $ | — | ||

- (a)

- The audit fees for 2005 include $959,746 billed by KPMG with respect to the 2004 audit. The remaining fees for 2005 were all billed by EY.

- (b)

- All fees for 2004 were billed by KPMG.

20

SHAREHOLDER PROPOSALS FOR PRESENTATION

AT THE 2007 ANNUAL MEETING

If a shareholder of the Company wishes to present a proposal for consideration for inclusion in the Proxy Statement for the 2007 Annual Meeting, the proposal must be sent by certified mail-return receipt requested and must be received at the executive offices of the Company, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277, Attn: Secretary, no later than November 13, 2006. All proposals must conform to the rules and regulations of the Securities and Exchange Commission. The Securities and Exchange Commission ("SEC") has amended Rule 14a-4, which governs the use by the Company of discretionary voting authority with respect to other shareholder proposals. SEC Rule 14a-4(c)(1) provides that, if the proponent of a shareholder proposal fails to notify the Company at least forty-five (45) days prior to the month and day of mailing the prior year's proxy statement, the proxies of the Company's management would be permitted to use their discretionary authority at the Company's next annual meeting of shareholders if the proposal were raised at the meeting without any discussion of the matter in the proxy statement. For purposes of the Company's 2007 Annual Meeting of Shareholders, the deadline is January 27, 2007.

VOTING BY PROXY AND CONFIRMATION OF BENEFICIAL OWNERSHIP

To ensure that your Shares will be represented at the Annual Meeting, please complete, sign, and return the enclosed Proxy in the envelope provided for that purpose whether or not you expect to attend. Shares represented by a valid proxy will be voted as specified.

Any shareholder may revoke a proxy by a later-dated proxy or by giving notice of revocation to the Company in writing (addressed to the Company at 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina 28277 Attention: Secretary) or by attending the Annual Meeting and voting in person.

The number of votes that each shareholder will be entitled to cast at the Annual Meeting will depend on when the Shares were acquired and whether or not there has been a change in beneficial ownership since the date of acquisition, with respect to each of such holder's Shares.

Shareholders whose Shares are held by brokers or banks or in nominee name are requested to confirm to the Company how many of the Shares they own as of February 24, 2006 were beneficially owned before February 24, 2002, entitling such shareholder to five votes per Share, and how many were acquired after February 23, 2002, entitling such shareholder to one vote per Share. If no confirmation of beneficial ownership is received from a shareholder prior to the Annual Meeting, it will be deemed by the Company that beneficial ownership of all such Shares was effected after February 23, 2002, and the shareholder will be entitled to one vote for each Share. If a shareholder provides incorrect information, he or she may provide correct information at any time prior to the voting of his or her Shares at the Annual Meeting.

Proxy Cards are being furnished to shareholders of record on February 24, 2006 whose Shares on the records of the Company show the following:

(i) that such shareholder had beneficial ownership of such Shares before February 24, 2002, and there has been no change since that date, thus entitling such shareholder to five votes for each Share; or

(ii) that beneficial ownership of such Shares was effected after February 23, 2002, thus entitling such shareholder to one vote for each Share; or

(iii) that the dates on which beneficial ownership of such Shares were effected are such that such shareholder is entitled to five votes for some Shares and one vote for other Shares.

21

Printed on the Proxy Card for each individual shareholder of record is the number of Shares for which he or she is entitled to cast five votes each and/or one vote each, as the case may be, as shown on the records of the Company.

Shareholders of record are urged to review the number of Shares shown on their Proxy Cards in the five-vote and one-vote categories. If the number of Shares shown in a voting category is believed to be incorrect, the shareholder should notify the Company in writing of that fact and either enclose the notice along with the Proxy Card in the postage-paid, return envelope, or mail the notice directly to the Company at the address indicated above. The shareholder should identify the Shares improperly classified for voting purposes and provide information as to the date beneficial ownership was acquired. Any notification of improper classification of votes must be made at least three (3) business days prior to the Annual Meeting or the shareholder will be entitled at the Annual Meeting to the number of votes indicated on the records of the Company.

In certain cases record ownership may change but beneficial ownership for voting purposes does not change. The Restated Certificate of Incorporation of the Company states the exceptions where beneficial ownership is deemed not to have changed upon the transfer of Shares. Shareholders should consult the pertinent provision of the Restated Certificate of Incorporation attached as Exhibit A to this Proxy Statement for those exceptions.

By resolution duly adopted by the Board of Directors of the Company pursuant to subparagraph B(v) of Article Fourth of the Restated Certificate of Incorporation, the following procedures have been adopted for use in determining the number of votes to which a shareholder is entitled.

(i) The Company may accept the written and signed statement of a shareholder to the effect that no change in beneficial ownership has occurred during the four years immediately preceding the date on which a determination is made of the shareholders of the Company who are entitled to vote or take any other action. Such statement may be abbreviated to state only the number of Shares as to which such shareholder is entitled to exercise five votes or one vote.

(ii) In the event the Vice President, Treasurer of the Company, in his or her sole discretion, taking into account the standards set forth in the Company's Restated Certificate of Incorporation, deems any such statement to be inadequate or for any reason deems it in the best interest of the Company to require further evidence of the absence of change of beneficial ownership during the four-year period preceding the record date, he or she may require such additional evidence and, until it is provided in form and substance satisfactory to him or her, a change in beneficial ownership during such period shall be deemed to have taken place.

(iii) Information supplementing that contemplated by paragraph (i) and additional evidence contemplated by paragraph (ii) may be provided by a shareholder at any time but must be furnished at least three business days prior to any meeting of shareholders at which such Shares are to be voted for any change to be effective at such meeting.

The presence, in person or by proxy, of the owners of a majority of the votes entitled to be cast is necessary for a quorum at the Annual Meeting.

All Shares in the Company's Employee Incentive Savings Plan that have been allocated to the account of a participant for which the Trustee receives voting instructions will be voted in accordance with those instructions and all such Shares for which the Trustee does not receive voting instructions will not be voted.

22

As of the date of this Proxy Statement, the Board of Directors of the Company knows of no other business which will be or is intended to be presented at the Annual Meeting. Should any further business come before the Annual Meeting or any adjourned meeting, it is the intention of the proxies named in the enclosed Proxy to vote according to their best judgment.

By Order of the Board of Directors

Steven J. Ford,

Secretary

Dated: March 13, 2006

23

EXHIBIT A

Subparagraph B of Article Fourth of the Restated Certificate

of Incorporation of Carlisle Companies Incorporated

(I) EACH OUTSTANDING SHARE OF COMMON STOCK SHALL ENTITLE THE HOLDER THEREOF TO FIVE (5) VOTES ON EACH MATTER PROPERLY SUBMITTED TO THE SHAREHOLDERS OF THE CORPORATION FOR THEIR VOTE, WAIVER, RELEASE OR OTHER ACTION: EXCEPT THAT NO HOLDER OF OUTSTANDING SHARES OF COMMON STOCK SHALL BE ENTITLED TO EXERCISE MORE THAN ONE (1) VOTE ON ANY SUCH MATTER IN RESPECT OF ANY SHARE OF COMMON STOCK WITH RESPECT TO WHICH THERE HAS BEEN A CHANGE IN BENEFICIAL OWNERSHIP DURING THE FOUR (4) YEARS IMMEDIATELY PRECEDING THE DATE ON WHICH A DETERMINATION IS MADE OF THE SHAREHOLDERS OF THE CORPORATION WHO ARE ENTITLED TO VOTE OR TO TAKE ANY OTHER ACTION.

(II) A CHANGE IN BENEFICIAL OWNERSHIP OF ANY OUTSTANDING SHARE OF COMMON STOCK SHALL BE DEEMED TO HAVE OCCURRED WHENEVER A CHANGE OCCURS IN ANY PERSON OR PERSONS WHO, DIRECTLY OR INDIRECTLY, THROUGH ANY CONTRACT, AGREEMENT, ARRANGEMENT, UNDERSTANDING, RELATIONSHIP OR OTHERWISE HAS OR SHARES ANY OF THE FOLLOWING:

(A) VOTING POWER, WHICH INCLUDES, WITHOUT LIMITATION, THE POWER TO VOTE OR TO DIRECT THE VOTING POWER OF SUCH SHARE OF COMMON STOCK.

(B) INVESTMENT POWER, WHICH INCLUDES, WITHOUT LIMITATION, THE POWER TO DIRECT THE SALE OR OTHER DISPOSITION OF SUCH SHARE OF COMMON STOCK.

(C) THE RIGHT TO RECEIVE OR TO RETAIN THE PROCEEDS OF ANY SALE OR OTHER DISPOSITION OF SUCH SHARE OF COMMON STOCK.

(D) THE RIGHT TO RECEIVE OR TO RETAIN ANY DISTRIBUTIONS, INCLUDING, WITHOUT LIMITATION, CASH DIVIDENDS, IN RESPECT OF SUCH SHARE OF COMMON STOCK.

(III) WITHOUT LIMITING THE GENERALITY OF THE FOREGOING SECTION (II) OF THIS SUBPARAGRAPH B, THE FOLLOWING EVENTS OR CONDITIONS SHALL BE DEEMED TO INVOLVE A CHANGE IN BENEFICIAL OWNERSHIP OF A SHARE OF COMMON STOCK.

(A) IN THE ABSENCE OF PROOF TO THE CONTRARY PROVIDED IN ACCORDANCE WITH THE PROCEDURES SET FORTH IN SECTION (V) OF THIS SUBPARAGRAPH B, A CHANGE IN BENEFICIAL OWNERSHIP SHALL BE DEEMED TO HAVE OCCURRED WHENEVER AN OUTSTANDING SHARE OF COMMON STOCK IS TRANSFERRED OF RECORD INTO THE NAME OF ANY OTHER PERSON.

(B) IN THE CASE OF AN OUTSTANDING SHARE OF COMMON STOCK HELD OF RECORD IN THE NAME OF A CORPORATION, GENERAL PARTNERSHIP, LIMITED PARTNERSHIP, VOTING TRUSTEE, BANK, TRUST COMPANY, BROKER, NOMINEE OR CLEARING AGENCY, IF IT HAS NOT BEEN ESTABLISHED PURSUANT TO THE PROCEDURES SET FORTH IN SECTION (V) OF THIS SUBPARAGRAPH B THAT THERE HAS BEEN NO CHANGE IN THE PERSON OR PERSONS WHO OR THAT DIRECT THE EXERCISE OF THE RIGHTS REFERRED TO IN CLAUSES (II) (A) THROUGH (II) (D), INCLUSIVE, OF THIS SUBPARAGRAPH B WITH RESPECT TO SUCH OUTSTANDING SHARE OF COMMON STOCK DURING THE PERIOD OF FOUR (4) YEARS

A-1

IMMEDIATELY PRECEDING THE DATE ON WHICH A DETERMINATION IS MADE OF THE SHAREHOLDERS OF THE CORPORATION ENTITLED TO VOTE OR TO TAKE ANY OTHER ACTION (OR SINCE MAY 30, 1986 FOR ANY PERIOD ENDING ON OR BEFORE MAY 30, 1990), THEN A CHANGE IN BENEFICIAL OWNERSHIP OF SUCH SHARE OF COMMON STOCK SHALL BE DEEMED TO HAVE OCCURRED DURING SUCH PERIOD.

(C) IN THE CASE OF AN OUTSTANDING SHARE OF COMMON STOCK HELD OF RECORD IN THE NAME OF ANY PERSON AS A TRUSTEE, AGENT, GUARDIAN OR CUSTODIAN UNDER THE UNIFORM GIFTS TO MINORS ACT AS IN EFFECT IN ANY JURISDICTION, A CHANGE IN BENEFICIAL OWNERSHIP SHALL BE DEEMED TO HAVE OCCURRED WHENEVER THERE IS A CHANGE IN THE BENEFICIARY OF SUCH TRUST, THE PRINCIPAL OF SUCH AGENT, THE WARD OF SUCH GUARDIAN, THE MINOR FOR WHOM SUCH CUSTODIAN IS ACTING OR IN SUCH TRUSTEE, AGENT, GUARDIAN OR CUSTODIAN.

(D) IN THE CASE OF OUTSTANDING SHARES OF COMMON STOCK BENEFICIALLY OWNED BY A PERSON OR GROUP OF PERSONS WHO, AFTER ACQUIRING, DIRECTLY OR INDIRECTLY, THE BENEFICIAL OWNERSHIP OF FIVE PERCENT (5%) OF THE OUTSTANDING SHARES OF COMMON STOCK, FAILS TO NOTIFY THE CORPORATION OF SUCH OWNERSHIP WITHIN TEN (10) DAYS AFTER SUCH ACQUISITION, A CHANGE IN BENEFICIAL OWNERSHIP OF SUCH SHARES OF COMMON STOCK SHALL BE DEEMED TO OCCUR ON EACH DAY WHILE SUCH FAILURE CONTINUES.

(IV) NOTWITHSTANDING ANY OTHER PROVISION IN THIS SUBPARAGRAPH B TO THE CONTRARY, NO CHANGE IN BENEFICIAL OWNERSHIP OF AN OUTSTANDING SHARE OF COMMON STOCK SHALL BE DEEMED TO HAVE OCCURRED SOLELY AS A RESULT OF:

(A) ANY EVENT THAT OCCURRED PRIOR TO MAY 30, 1986 OR PURSUANT TO THE TERMS OF ANY CONTRACT (OTHER THAN A CONTRACT FOR THE PURCHASE AND SALE OF SHARES OF COMMON STOCK CONTEMPLATING PROMPT SETTLEMENT), INCLUDING CONTRACTS PROVIDING FOR OPTIONS, RIGHTS OF FIRST REFUSAL, AND SIMILAR ARRANGEMENTS, IN EXISTENCE ON MAY 30, 1986 AND TO WHICH ANY HOLDER OF SHARES OF COMMON STOCK IS A PARTY; PROVIDED, HOWEVER, THAT ANY EXERCISE BY AN OFFICER OR EMPLOYEE OF THE CORPORATION OR ANY SUBSIDIARY OF THE CORPORATION OF AN OPTION TO PURCHASE COMMON STOCK AFTER MAY 30, 1986 SHALL, NOTWITHSTANDING THE FOREGOING AND CLAUSE (IV) (F) HEREOF, BE DEEMED A CHANGE IN BENEFICIAL OWNERSHIP IRRESPECTIVE OF WHEN THAT OPTION WAS GRANTED TO SAID OFFICER OR EMPLOYEE.

(B) ANY TRANSFER OF ANY INTEREST IN AN OUTSTANDING SHARE OF COMMON STOCK PURSUANT TO A BEQUEST OR INHERITANCE, BY OPERATION OF LAW UPON THE DEATH OF ANY INDIVIDUAL, OR BY ANY OTHER TRANSFER WITHOUT VALUABLE CONSIDERATION, INCLUDING, WITHOUT LIMITATION, A GIFT THAT IS MADE IN GOOD FAITH AND NOT FOR THE PURPOSE OF CIRCUMVENTING THE PROVISION OF THIS ARTICLE FOURTH.

(C) ANY CHANGES IN THE BENEFICIARY OF ANY TRUST, OR ANY DISTRIBUTION OF AN OUTSTANDING SHARE OF COMMON STOCK FROM TRUST, BY REASON OF THE BIRTH, DEATH, MARRIAGE OR DIVORCE OF ANY NATURAL PERSON, THE ADOPTION OF ANY NATURAL PERSON PRIOR TO AGE EIGHTEEN

A-2

(18) OR THE PASSAGE OF A GIVEN PERIOD OF TIME OR THE ATTAINMENT BY ANY NATURAL PERSON OF A SPECIFIC AGE, OR THE CREATION OR TERMINATION OF ANY GUARDIANSHIP OR CUSTODIAL ARRANGEMENT.

(D) ANY APPOINTMENT OF A SUCCESSOR TRUSTEE, AGENT, GUARDIAN OR CUSTODIAN WITH RESPECT TO AN OUTSTANDING SHARE OF COMMON STOCK IF NEITHER SUCH SUCCESSOR HAS NOR ITS PREDECESSOR HAD THE POWER TO VOTE OR TO DISPOSE OF SUCH SHARE OF COMMON STOCK WITHOUT FURTHER INSTRUCTIONS FROM OTHERS.

(E) ANY CHANGE IN THE PERSON TO WHOM DIVIDENDS OR OTHER DISTRIBUTIONS IN RESPECT OF AN OUTSTANDING SHARE OF COMMON STOCK ARE TO BE PAID PURSUANT TO THE ISSUANCE OR MODIFICATION OF A REVOCABLE DIVIDEND PAYMENT ORDER.

(F) ANY ISSUANCE OF A SHARE OF COMMON STOCK BY THE CORPORATION OR ANY TRANSFER BY THE CORPORATION OF A SHARE OF COMMON STOCK HELD IN TREASURY, UNLESS OTHERWISE DETERMINED BY THE BOARD OF DIRECTORS AT THE TIME OF AUTHORIZING SUCH ISSUANCE OR TRANSFER.

(G) ANY GIVING OF A PROXY IN CONNECTION WITH A SOLICITATION OF PROXIES SUBJECT TO THE PROVISIONS OF SECTION 14 OF THE SECURITIES EXCHANGE ACT OF 1934 AND THE RULES AND REGULATIONS THEREUNDER PROMULGATED.

(H) ANY TRANSFER, WHETHER OR NOT WITH CONSIDERATION, AMONG INDIVIDUALS RELATED OR FORMERLY RELATED BY BLOOD, MARRIAGE OR ADOPTION ("RELATIVES") OR BETWEEN A RELATIVE AND ANY PERSON (AS DEFINED IN ARTICLE SEVENTH) CONTROLLED BY ONE OR MORE RELATIVES WHERE THE PRINCIPAL PURPOSE FOR THE TRANSFER IS TO FURTHER THE ESTATE TAX PLANNING OBJECTIVES OF THE TRANSFEROR OR OF RELATIVES OF THE TRANSFEROR.

(I) ANY APPOINTMENT OF A SUCCESSOR TRUSTEE AS A RESULT OF THE DEATH OF THE PREDECESSOR TRUSTEE (WHICH PREDECESSOR TRUSTEE SHALL HAVE BEEN A NATURAL PERSON).

(J) ANY APPOINTMENT OF A SUCCESSOR TRUSTEE WHO OR WHICH WAS SPECIFICALLY NAMED IN A TRUST INSTRUMENT PRIOR TO MAY 30, 1986.

(K) ANY APPOINTMENT OF A SUCCESSOR TRUSTEE AS A RESULT OF THE RESIGNATION, REMOVAL OR FAILURE TO QUALIFY OF A PREDECESSOR TRUSTEE OR AS A RESULT OF MANDATORY RETIREMENT PURSUANT TO THE EXPRESS TERMS OF A TRUST INSTRUMENT: PROVIDED, THAT LESS THAN FIFTY PERCENT (50%) OF THE TRUSTEES ADMINISTERING ANY SINGLE TRUST WILL HAVE CHANGED (INCLUDING IN SUCH PERCENTAGE THE APPOINTMENT OF THE SUCCESSOR TRUSTEE) DURING THE FOUR (4) YEAR PERIOD PRECEDING THE APPOINTMENT OF SUCH SUCCESSOR TRUSTEE.

(V) FOR PURPOSES OF THIS SUBPARAGRAPH B, ALL DETERMINATIONS CONCERNING CHANGE IN BENEFICIAL OWNERSHIP, OR THE ABSENCE OF ANY SUCH CHANGE, SHALL BE MADE BY THE BOARD OF DIRECTORS OF THE CORPORATION OR, AT ANY TIME WHEN THE CORPORATION EMPLOYS A TRANSFER AGENT WITH RESPECT TO THE SHARES OF COMMON STOCK, AT THE CORPORATION'S REQUEST, BY SUCH TRANSFER AGENT ON THE CORPORATION'S BEHALF. WRITTEN PROCEDURES

A-3

DESIGNED TO FACILITATE SUCH DETERMINATION SHALL BE ESTABLISHED AND MAY BE AMENDED FROM TIME TO TIME, BY THE BOARD OF DIRECTORS. SUCH PROCEDURES SHALL PROVIDE, AMONG OTHER THINGS, THE MANNER OF PROOF OF FACTS THAT WILL BE ACCEPTED AND THE FREQUENCY WITH WHICH SUCH PROOF MAY BE REQUIRED TO BE RENEWED. THE CORPORATION AND ANY TRANSFER AGENT SHALL BE ENTITLED TO RELY ON ANY AND ALL INFORMATION CONCERNING BENEFICIAL OWNERSHIP OF THE OUTSTANDING SHARES OF COMMON STOCK COMING TO THEIR ATTENTION FROM ANY SOURCE AND IN ANY MANNER REASONABLY DEEMED BY THEM TO BE RELIABLE, BUT NEITHER THE CORPORATION NOR ANY TRANSFER AGENT SHALL BE CHARGED WITH ANY OTHER KNOWLEDGE CONCERNING THE BENEFICIAL OWNERSHIP OF OUTSTANDING SHARES OF COMMON STOCK.

(VI) IN THE EVENT OF ANY STOCK SPLIT OR STOCK DIVIDEND WITH RESPECT TO THE OUTSTANDING SHARES OF COMMON STOCK, EACH SHARE OF COMMON STOCK ACQUIRED BY REASON OF SUCH SPLIT OR DIVIDEND SHALL BE DEEMED TO HAVE BEEN BENEFICIALLY OWNED BY THE SAME PERSON FROM THE SAME DATE AS THAT ON WHICH BENEFICIAL OWNERSHIP OF THE OUTSTANDING SHARE OR SHARES OF COMMON STOCK, WITH RESPECT TO WHICH SUCH SHARE OF COMMON STOCK WAS DISTRIBUTED, WAS ACQUIRED.

(VII) EACH OUTSTANDING SHARE OF COMMON STOCK, WHETHER AT ANY PARTICULAR TIME THE HOLDER THEREOF IS ENTITLED TO EXERCISE FIVE (5) VOTES OR ONE (1) VOTE, SHALL BE IDENTICAL TO ALL OTHER SHARES OF COMMON STOCK IN ALL RESPECTS, AND TOGETHER THE OUTSTANDING SHARES OF COMMON STOCK SHALL CONSTITUTE A SINGLE CLASS OF SHARES OF THE CORPORATION.

A-4

Proxy—Carlisle Companies Incorporated | ||

Meeting Details

Proxy Solicited by The Board of Directors

For The Annual Meeting of Shareholders—April 20, 2006

Richmond D. McKinnish and Steven J. Ford, or either of them, each with the power of substitution and revocation, are hereby authorized to represent the undersigned, with all powers which the undersigned would possess if personally present, to vote the common shares of the undersigned at the annual meeting of shareholders of CARLISLE COMPANIES INCORPORATED to be held at the Company's principal office, 13925 Ballantyne Corporate Place, Suite 400, Charlotte, North Carolina, at 12:00 Noon on Thursday, April 20, 2006, and at any postponements or adjournments of that meeting, as set forth below, and in their discretion upon any other business that may properly come before the meeting.

YOUR VOTE IS IMPORTANT! PLEASE MARK, SIGN AND DATE THIS PROXY AND RETURN IT PROMPTLY IN THE ACCOMPANYING ENVELOPE.

(Continued and to be signed on reverse side.)

| o | Mark this box with an X if you have made changes to your name or address details above. |

Annual Meeting Proxy Card | ||

This proxy will be voted as specified or, if no choice is specified, will be voted FOR the election of the

A Election of Directors

| For | Withhold | |||

| 01—Paul J. Choquette, Jr. | o | o | ||

For | Withhold | |||

| 02—Stephen P. Munn | o | o | ||

For | Withhold | |||

| 03—Lawrence A. Sala | o | o | ||

For | Withhold | |||

| 04—Magalen C. Webert | o | o |

B Authorized Signatures—Sign Here—This section must be completed for your instructions to be executed.

NOTE: Please sign exactly as your name appears. If acting as attorney, executor, trustee, or in representative capacity, sign name and indicate title. Please vote, sign, date and return this proxy card promptly using the enclosed envelope.

Signature 1—Please keep signature within the box | Signature 2—Please keep signature within the box | Date (mm/dd/yyyy) | ||

Proxy—Carlisle Companies Incorporated | ||

Meeting Details

Proxy Solicited by The Board of Directors

For The Annual Meeting of Shareholders—April 20, 2006