UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-04605 |

|

First Financial Fund Inc. |

(Exact name of registrant as specified in charter) |

|

Fund Administrative Services

1680 38th Street, Suite 800

Boulder, CO | | 80301 |

(Address of principal executive offices) | | (Zip code) |

|

Fund Administrative Services

1680 38th Street, Suite 800

Boulder, CO 80301 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (303) 444-5483 | |

|

Date of fiscal year end: | March 31, 2006 | |

|

Date of reporting period: | September 30, 2005 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Letter from the Adviser September 30, 2005

Dear Shareholders:

TOTAL RETURN

Periods Ended 9/30/2005

| | | 6 Mos. | | 1 Yr | | 3 Yrs | | 5 Yrs | | 10 Yrs | |

| First Financial Fund's NAV | | | 6.6 | % | | | 13.6 | % | | | 26.9 | % | | | 28.1 | % | | | 19.4 | % | |

| S&P 500 | | | 5.0 | | | | 12.3 | | | | 16.7 | | | | -1.5 | | | | 9.5 | | |

| NASDAQ Composite* | | | 8.0 | | | | 14.1 | | | | 23.0 | | | | -9.9 | | | | 7.6 | | |

| NASDAQ Banks* | | | 2.0 | | | | 1.7 | | | | 11.2 | | | | 11.2 | | | | 12.1 | | |

| SNL All Daily | | | 0.7 | | | | 2.1 | | | | 15.8 | | | | 16.3 | | | | 15.5 | | |

| SNL MBS REITS | | | -7.9 | | | | -10.2 | | | | 17.9 | | | | 24.2 | | | | 14.2 | | |

Sources: Wellington Management Company, LLP and the Fund's custodian

* Principal Only

Periods greater than one year are annualized

The First Financial Fund, Inc. ("the Fund") returned 6.6% on NAV for the six month period ending September 30, 2005, outperforming many of its benchmarks for the period.

Consumers in the US are especially hard hit, as they face a marked increase in short-term interest rates in addition to surging energy prices. Federal Reserve officials have recently focused more on the strength of the US housing market and the upside risks to inflation and less on potential downside risks to the economy. We expect additional rate hikes in coming months, bringing the Federal Funds rate up to 4.25 percent.

The devastating impact of the hurricanes in the US will create a big hole in the US fiscal budget. While the recent deficit performance has been quite favorable thanks to a robust economic expansion, the deficit will soon rise again as the government starts to fund the rebuilding effort on the Gulf Coast. Following the devastation of the hurricane season, we believe the insurance industry will be a taking a new and harsher look at catastrophic exposure, providing less capacity at higher prices and abandoning what may come to be viewed as uninsurable risks.

Overall, the life insurance industry is viewed as a relative safe haven within the sector and has performed well this year, particularly as people remain nervous over housing and consumer spending.

Among brokerage firms, we believe pricing pressure will persist and there is more industry consolidation to come. Meanwhile, business continues to be extremely strong for the

1

investment banks, driven by many areas including mergers & acquisitions, equity underwriting, and equity trading.

Banks, which benefited from higher short-term interest rates, were once again among the outperformers this period including First Regional Bancorp, Berkshire Hills Bancorp, Taylor Capital Group and Canadian Western Bank. Other top contributors included Arbor Realty Trust, Ohio Casualty, Aspen Insurance and Sunrise Senior REIT. Woronoco Bancorp, AmeriServ Financial, Provident Financial Holdings and Mackinac Financial Corporation were among the largest detractors from performance.

We continue to be concerned about the degree of consumer leverage in the face of many economic headwinds. With plenty of liquidity in the financial markets at this time, discipline and resolve of management is likely to be tested. The Fund has an ample cash position to seek opportunities in the sector should these economic headwinds change the liquidity in the capital markets.

We appreciate your support of the Fund.

Nicholas C. Adams

2

Portfolio of Investments as of September 30, 2005 (Unaudited)

FIRST FINANCIAL FUND, INC.

| Shares | | Description | | Value (Note 1) | |

| | LONG TERM INVESTMENTS-85.7% | | | | |

| DOMESTIC COMMON STOCKS-79.4% | |

| | Banks & Thrifts-45.4% | | | | |

| | 72,600 | | | Alliance

Bankshares Corporation† | | $ | 1,205,160 | | |

| | 94,300 | | | Amegy Bancorp, Inc. | | | 2,134,009 | | |

| | 468,000 | | | AmeriServ Financial, Inc.† | | | 2,035,800 | | |

| | 73,900 | | | AmeriServ

Financial, Inc. (a)(b) | | | 289,318 | | |

| | 78,200 | | | Bancorp Rhode Island, Inc. | | | 2,867,594 | | |

| | 251,735 | | | Bancorp, Inc.† | | | 4,025,243 | | |

| | 40,500 | | | Bank of Oak Ridge† | | | 409,050 | | |

| | 441,600 | | | BankFinancial Corporation | | | 6,270,720 | | |

| | 92,100 | | | Benjamin Franklin Bancorp, Inc. | | | 1,267,628 | | |

| | 37,800 | | | CalNet Business Bank†(a) | | | 513,702 | | |

| | 124,200 | | | Capital Corporation of the West | | | 3,794,310 | | |

| | 180,100 | | | Cardinal Financial Corporation† | | | 1,737,965 | | |

| | 85,000 | | | Cardinal State Bank† | | | 1,066,835 | | |

| | 38,500 | | | Carolina Trust Bank† | | | 573,650 | | |

| | 282,010 | | | CCF Holding Company (c) | | | 5,121,302 | | |

| | 485,800 | | | Centennial Bank

Holdings, Inc. (a)(b)(d) | | | 5,100,900 | | |

| | 600,000 | | | Centennial C Corporation (a)(b) | | | 6,300,000 | | |

| | 3 | | | Central Pacific Financial

Corporation | | | 106 | | |

| | 56,000 | | | City National Corporation | | | 3,925,040 | | |

| | 38,900 | | | Coast Financial Holdings, Inc.† | | | 636,793 | | |

| | 8,400 | | | Coastal Banking Company, Inc.† | | | 174,720 | | |

| | 207,000 | | | Commerce Bancorp, Inc. | | | 6,352,830 | | |

| | 60,000 | | | Community Bank (a)(b) | | | 3,281,400 | | |

| | 66,000 | | | Community Bank of

Orange, N.A. (a)(b) | | | 258,390 | | |

| | 89,200 | | | Community Capital Bancshares, Inc. | | | 1,088,240 | | |

| | 86,100 | | | Connecticut Bank & Trust† | | | 848,085 | | |

| | 31,300 | | | Cornerstone Bancorp, Inc. | | | 1,123,670 | | |

| | 9,100 | | | Crescent Banking Company | | | 301,392 | | |

| | 78,834 | | | Dearborn Bancorp, Inc.† | | | 2,026,034 | | |

| | 6,800 | | | Enterprise Financial Services

Corporation | | | 144,296 | | |

| | 71,468 | | | F.N.B. Corporation | | | 1,347,886 | | |

| | 79,300 | | | FCB Bancorp, Inc. (a)(b) | | | 1,566,175 | | |

| | 100,000 | | | Federal City National Bank (a)(b) | | | 1,000,000 | | |

| | 33,599 | | | First Citizens BancShares, Inc.,

Class A | | | 5,733,669 | | |

| | 13,011 | | | First Indiana Corporation | | | 443,285 | | |

| | 106,263 | | | First Regional Bancorp† | | | 8,372,462 | | |

| | 340,775 | | | First Republic Bank | | | 12,005,503 | | |

| | 194,400 | | | First Security Group, Inc.† | | | 1,911,924 | | |

| | 66,726 | | | First Southern Bancorp (a)(d) | | | 1,634,787 | | |

| | 10,000 | | | First Trust Bank† | | | 207,500 | | |

| | 78,550 | | | Foothill Independent Bancorp | | | 1,659,761 | | |

| | 159,060 | | | Gateway Financial Holdings | | | 2,886,780 | | |

| | 75,500 | | | Greene County Bancshares, Inc. | | | 1,953,940 | | |

| | 83,972 | | | Greenville First Bancshares, Inc.† | | | 1,790,493 | | |

| | 18,600 | | | Heartland Financial USA, Inc. | | | 361,398 | | |

| Shares | | Description | | Value (Note 1) | |

| | Banks & Thrifts - continued | | | | |

| | 1,785 | | | Heritage Oaks Bancorp† | | $ | 44,625 | | |

| | 82,000 | | | IBERIABANK Corporation | | | 4,358,300 | | |

| | 122,400 | | | LSB Bancshares, Inc. | | | 2,129,760 | | |

| | 219,600 | | | MetroCorp Bancshares, Inc. | | | 5,138,640 | | |

| | 305,400 | | | North Valley Bancorp | | | 5,222,340 | | |

| | 57,000 | | | Northrim Bancorp, Inc. | | | 1,427,280 | | |

| | 49,280 | | | Parkway Bank† | | | 618,464 | | |

| | 130,500 | | | Pennsylvania Commerce Bancorp† | | | 4,656,240 | | |

| | 152,000 | | | Pilot Bancshares, Inc. (b) | | | 2,242,000 | | |

| | 50,400 | | | Preferred Bank Los Angeles | | | 2,025,576 | | |

| | 157,472 | | | Republic First Bancorp, Inc.† | | | 1,946,354 | | |

| | 330 | | | SCBT Financial Corporation | | | 10,421 | | |

| | 246,000 | | | Signature Bank† | | | 6,639,540 | | |

| | 246,100 | | | SNB Bancshares, Inc.† | | | 2,768,625 | | |

| | 111,615 | | | Southern Connecticut

Bancorp, Inc.† | | | 870,597 | | |

| | 302,900 | | | Square 1 Financial, Inc. (a)(b) | | | 3,029,000 | | |

| | 39,400 | | | State National Bancshares, Inc.† | | | 1,024,400 | | |

| | 76,335 | | | Sterling Bank | | | 858,769 | | |

| | 29,500 | | | SuffolkFirst Bank† | | | 324,500 | | |

| | 16,619 | | | Summit Bank Corporation | | | 246,294 | | |

| | 294,913 | | | Sun Bancorp, Inc.† | | | 6,219,715 | | |

| | 110,419 | | | Taylor Capital Group, Inc. | | | 4,176,047 | | |

| | 21,100 | | | Team Financial, Inc. | | | 319,665 | | |

| | 61,200 | | | Texas United Bancshares, Inc. | | | 1,197,072 | | |

| | 18,400 | | | The Bank Holdings, Inc.† | | | 366,556 | | |

| | 39,900 | | | TIB Financial Corporation | | | 1,240,890 | | |

| | 71,900 | | | Tidelands Bancshares, Inc. (a)(b) | | | 719,000 | | |

| | 130,000 | | | Transatlantic Bank (a)(b) | | | 1,768,000 | | |

| | 121,400 | | | UCBH Holdings, Inc. | | | 2,224,048 | | |

| | 115,500 | | | UMB Financial Corporation | | | 7,586,040 | | |

| | 125,400 | | | UnionBanCal Corporation | | | 8,742,888 | | |

| | 28,500 | | | UnionBancorp, Inc. | | | 595,650 | | |

| | 47,300 | | | Valley Commerce Bancorp† | | | 806,465 | | |

| | 161,238 | | | Wainwright Bank &

Trust Company | | | 1,678,488 | | |

| | 38,587 | | | Westbank Corporation | | | 557,582 | | |

| | 36,700 | | | Yardville National Bancorp | | | 1,293,675 | | |

| | | | 192,823,251 | | |

| | Savings & Loans-20.0% | | | | |

| | 116,000 | | | Abington Community

Bancorp, Inc.† | | | 1,453,480 | | |

| | 160,400 | | | Atlantic Coast Federal† | | | 2,240,788 | | |

| | 94,500 | | | Bankunited Financial Corporation,

Class A | | | 2,161,215 | | |

| | 124,326 | | | Berkshire Hills Bancorp, Inc. | | | 4,227,084 | | |

| | 129,280 | | | Broadway Financial Corporation (c) | | | 1,473,792 | | |

| | 60,100 | | | Carver Bancorp, Inc. | | | 997,059 | | |

| | 324,800 | | | CFS Bancorp, Inc. | | | 4,352,320 | | |

| | 24,400 | | | Charter Financial Corporation | | | 831,796 | | |

| | 238,500 | | | Citizens First Bancorp, Inc. | | | 5,089,590 | | |

| | 42,000 | | | Downey Financial Corporation | | | 2,557,800 | | |

| | 32,500 | | | Fidelity Federal Bancorp† | | | 471,250 | | |

See accompanying notes to financial statements. 3

Portfolio of Investments as of September 30, 2005 (Unaudited)

FIRST FINANCIAL FUND, INC.

| Shares | | Description | | Value (Note 1) | |

| Savings & Loans - continued | |

| | 14,040 | | | First Community Bank Corporation

of America† | | $ | 354,510 | | |

| | 57,538 | | | First Federal Bancshares, Inc. (c) | | | 1,139,252 | | |

| | 63,600 | | | First Place Financial Corporation | | | 1,410,012 | | |

| | 252,000 | | | FirstFed Bancorp, Inc. (c) | | | 2,746,800 | | |

| | 43,400 | | | Georgetown Bancorp, Inc.† | | | 392,770 | | |

| | 3,300 | | | HF Financial Corporation | | | 61,908 | | |

| | 90,000 | | | HMN Financial, Inc. | | | 2,824,200 | | |

| | 128,000 | | | Home Federal Bancorp, Inc. | | | 1,625,920 | | |

| | 46,900 | | | Jefferson Bancshares, Inc. | | | 606,886 | | |

| | 100,000 | | | K-Fed Bancorp | | | 1,250,010 | | |

| | 54,612 | | | LSB Corporation | | | 914,751 | | |

| | 310,300 | | | MidCountry Financial

Corporation (a)(b) | | | 4,654,500 | | |

| | 85,000 | | | Northwest Bancorp, Inc. | | | 1,806,250 | | |

| | 191,100 | | | Ocean Shore Holding Company† | | | 2,113,566 | | |

| | 163,300 | | | Pacific Premier Bancorp, Inc.† | | | 2,096,772 | | |

| | 94,800 | | | Parkvale Financial Corporation | | | 2,583,300 | | |

| | 69,725 | | | People's Bank | | | 2,020,630 | | |

| | 253,700 | | | People's Choice Financial

Corporation (b)(d) | | | 2,004,230 | | |

| | 165,930 | | | Perpetual Federal Savings Bank (c) | | | 4,521,592 | | |

| | 17,500 | | | Privee LLC (a)(b) | | | 2,362,500 | | |

| | 294,825 | | | Provident Financial

Holdings, Inc. (c) | | | 8,269,841 | | |

| | 40,650 | | | Redwood Financial, Inc.†(c) | | | 833,325 | | |

| | 90,000 | | | River Valley Bancorp (c) | | | 1,800,000 | | |

| | 52,637 | | | Riverview Bancorp, Inc. | | | 1,110,641 | | |

| | 5,300 | | | Rockville Financial, Inc. | | | 70,702 | | |

| | 203,000 | | | Rome Bancorp, Inc. | | | 2,129,470 | | |

| | 6,300 | | | Royal Financial, Inc. | | | 85,680 | | |

| | 289,600 | | | SI Financial Group, Inc. | | | 3,576,560 | | |

| | 100,000 | | | Sterling Eagle (a)(b) | | | 778,000 | | |

| | 110,500 | | | Third Century Bancorp (c) | | | 1,447,550 | | |

| | 145,400 | | | United Financial Bancorp, Inc.† | | | 1,615,394 | | |

| | | | 85,063,696 | | |

| | Mortgages & REITS-6.5% | | | | |

| | 579,800 | | | Aames Investment

Corporation; REIT | | | 3,641,144 | | |

| | 38,500 | | | Anworth Mortgage Asset

Corporation; REIT | | | 318,395 | | |

| | 143,200 | | | Arbor Realty Trust, Inc.; REIT (a)(d) | | | 4,023,920 | | |

| | 329,600 | | | Diamondrock Hospitality

Company; REIT†(a)(b)(d) | | | 3,872,800 | | |

| | 419,500 | | | Medical Properties

Trust, Inc.; REIT (a)(d) | | | 3,699,990 | | |

| | 180,300 | | | MFA Mortgage Investments,

Inc. REIT | | | 1,105,239 | | |

| | 441,900 | | | MortgageIT Holdings, Inc.; REIT | | | 6,283,818 | | |

| | 155,504 | | | Newcastle Investment Holdings

Corporation; REIT†(a)(d) | | | 777,520 | | |

| | 133,000 | | | RAIT Investment Trust REIT | | | 3,790,500 | | |

| | | | 27,513,326 | | |

| Shares | | Description | | Value (Note 1) | |

| | Insurance-3.9% | | | | |

| | 35,900 | | | American International

Group, Inc. | | $ | 2,224,364 | | |

| | 82,600 | | | Bristol West Holdings, Inc. | | | 1,507,450 | | |

| | 154,800 | | | Mercer Insurance Group, Inc.† | | | 2,020,140 | | |

| | 45,500 | | | Metlife, Inc. | | | 2,267,265 | | |

| | 168,400 | | | Ohio Casualty Corporation | | | 4,567,008 | | |

| | 42,900 | | | Phoenix Companies (The), Inc. | | | 523,380 | | |

| | 50,000 | | | ProAssurance Corporation† | | | 2,333,500 | | |

| | 85,900 | | | Seabright Insurance Holdings† | | | 1,111,546 | | |

| | | | 16,554,653 | | |

| | Diversified Financials Services-3.6% | | | | |

| | 53,845 | | | Bay View Capital Corporation | | | 824,905 | | |

| | 136,300 | | | Citigroup, Inc. | | | 6,204,376 | | |

| | 25,000 | | | CMET Financial

Holdings, Inc. (a)(d) | | | 1,223,250 | | |

| | 142,100 | | | Delta Financial Corporation (a)(b) | | | 1,037,330 | | |

| | 60,000 | | | Independence Financial (a)(b) | | | 600,000 | | |

| | 93,615 | | | Mackinac Financial Corporation (b) | | | 967,043 | | |

| | 74,631 | | | Peppercoin, Inc. (a) | | | 400,000 | | |

| | 265,000 | | | Resource Capital Corporation (a)(d) | | | 3,975,000 | | |

| | | | 15,231,904 | | |

| | | | | Total Domestic Common Stocks

(cost $263,567,191) | | | 337,186,830 | | |

| | FOREIGN COMMON STOCKS-5.4% | | | | |

| Bermuda-2.2% | |

| | 36,200 | | | Platinum Underwriters

Holdings, Ltd. | | | 1,082,018 | | |

| | 13,800 | | | White Mountains Insurance

Group, Ltd. | | | 8,335,200 | | |

| | | | 9,417,218 | | |

| | Canada-2.2% | | | | |

| | 253,174 | | | Canadian Western Bank | | | 8,149,733 | | |

| | 47,200 | | | Laurentian Bank of Canada | | | 1,261,134 | | |

| | | | 9,410,867 | | |

| | Germany-1.0% | | | | |

| | 152,217 | | | Bayerische Hypo-Und

Vereinsbank AG† | | | 4,301,719 | | |

| | | | | Total Foreign Common Stocks

(cost $13,731,050) | | | 23,129,804 | | |

See accompanying notes to financial statements. 4

Portfolio of Investments as of September 30, 2005 (Unaudited)

FIRST FINANCIAL FUND, INC.

| Shares | | Description | | Value (Note 1) | |

| | WARRANTS-0.9% | | | | |

| | 195,000 | | | Dime Bancorp, Inc.,

Warrant, Expires 11/22/05† | | $ | 31,200 | | |

| | 3,680 | | | The Bank Holdings, Inc.,

Warrant, Expires 5/21/06† | | | 32,016 | | |

| | 359,900 | | | Punjab National, Warrant,

Expires 1/19/09† | | | 3,696,173 | | |

| | | | | Total Warrants

(cost $3,271,412) | | | 3,759,389 | | |

| | | | | Total Long Term Investments

(cost $280,569,653) | | | 364,076,023 | | |

Par

Value | |

| SHORT TERM INVESTMENTS-14.6% | |

| | Repurchase Agreement-14.6% | | | | |

| $ | 62,100,000 | | | Agreement with Gold Tri-Party,

3.900% dated 9/30/2005, to be

repurchased at $62,120,183 on

10/3/2005, collateralized by

U.S. Government Agency

Securities with an aggregate

market value of $63,342,001,

rates ranging from 5.00-6 .00%,

and maturities from

3/1/2033 - 9/1/2034

(Cost $62,100,000) | | $ | 62,100,000 | | |

| | Total Investments-100.3% | | | | |

| | | | | (cost $342,669,653) | | | 426,176,023 | | |

| | | | | Other Assets and Liabilities-(0.3%) | | | (1,330,803 | ) | |

| | | | | Net Assets-100% | | $ | 424,845,220 | | |

† Non-income producing security.

(a) Indicates a fair valued security. Total market value for fair valued securities is $52,865,482 representing 12.44% of the total net assets.

(b) Private Placement restricted as to resale and does not have a readily available market.

(c) Affiliated Company. See Note 8 to Financial Statements

(d) Security exempt from registration pursuant to Rule 144A under the Securiites Act of 1933, as amended.

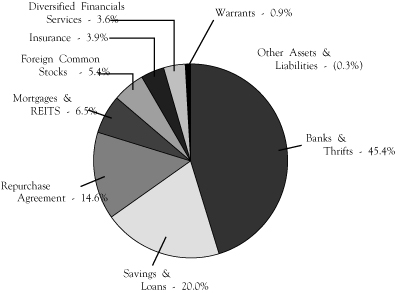

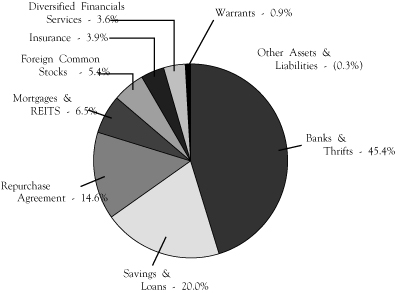

Investments as a % of Net Assets (Unaudited)

See accompanying notes to financial statements. 5

Statement of Assets and Liabilities FIRST FINANCIAL FUND, INC.

| Assets: | | September 30, 2005 (unaudited) | |

| Investments: | |

| Investments, at value of Unaffiliated Securities (Cost,$335,053,010 ) (Note 1) | | $ | 398,822,569 | | |

| Investments, at value of Affiliated Securities (Cost,$7,616,643) (Note 1 and Note 8) | | | 27,353,454 | | |

| Total Investments, at value. | | | 426,176,023 | | |

| Cash | | | 91,007 | | |

| Foreign currency (cost $419,221) | | | 419,935 | | |

| Receivable for investments sold | | | 2,297,002 | | |

| Dividends and interest receivable | | | 629,646 | | |

| Prepaid expenses and other assets | | | 145,065 | | |

| Total Assets | | | 429,758,678 | | |

| Liabilities: | | | |

| Payable for investments purchased | | $ | 3,937,055 | | |

| Investment advisory fees payable (Note 2) | | | 673,392 | | |

| Administration, co-administration and custodian fees payable (Note 2) | | | 127,680 | | |

| Legal and Audit fees payable | | | 55,883 | | |

| Interest due on loan payable to bank (Note 10) | | | 33,037 | | |

| Net unrealized depreciation on forward currency contracts | | | 1,359 | | |

| Accrued expenses and other payables | | | 85,052 | | |

| Total Liabilities | | | 4,913,458 | | |

| Net assets | | $ | 424,845,220 | | |

| Net assets consist of: | |

| Undistributed net investment income | | $ | 4,541,524 | | |

| Accumulated net realized gain on investments sold | | | 82,018,052 | | |

| Unrealized appreciation of investments | | | 83,504,843 | | |

| Par value of Common Stock (Note 4) | | | 23,062 | | |

| Paid-in Capitial in excess of par value of Common Stock | | | 254,757,739 | | |

| Total Net Assets | | $ | 424,845,220 | | |

| Net Asset Value, $424,845,220/23,062,973 shares outstanding | | $ | 18.42 | | |

See accompanying notes to financial statements. 6

FIRST FINANCIAL FUND, INC.

Statement of Operations

| Net Investment Income | | For the

Six Months Ended

September 30, 2005

(unaudited) | |

| Investment Income: | | | |

Dividends from unaffiliated securities

(net of foreign withholding

taxes of $33,123) | | $ | 4,725,200 | | |

| Dividends from affiliated securities | | | 292,679 | | |

| Interest | | | 377,116 | | |

| Total Investment Income | | | 5,394,995 | | |

| Expenses: | | | |

| Investment advisory fee (Note 2) | | | 1,323,988 | | |

Administration, co-administration and

custodian fees (Note 2) | | | 523,486 | | |

| Directors fees and expenses (Note 2) | | | 65,680 | | |

| Legal and Audit fees | | | 65,368 | | |

| Printing fees | | | 53,701 | | |

Interest on outstanding loan

payable (Note 10) | | | 45,934 | | |

| Insurance expenses | | | 44,553 | | |

| Other | | | 45,199 | | |

| Total Expenses | | | 2,167,909 | | |

| Net Investment Income | | | 3,227,086 | | |

Realized and Unrealized

Gain/(Loss) on Investments: | | | |

| Net realized gain on: | | | |

| Securities | | | 33,190,270 | | |

| Foreign currency related transactions | | | 16,731 | | |

| Net change in unrealized appreciation of: | | | |

| Securities | | | (10,219,018 | ) | |

| Foreign currency related transactions | | | (1,405 | ) | |

Net Realized and Unrealized Gain

On Investments | | | 22,986,578 | | |

Net Increase in Net Assets

Resulting from Operations | | $ | 26,213,664 | | |

FIRST FINANCIAL FUND, INC.

Statement of Changes in Net Assets

Increase/(Decrease)

in Net Assets | | Six Months

Ended

September 30,

2005

(unaudited) | | Year ended

March 31,

2005 | |

| Operations: | | | |

| Net investment income | | $ | 3,227,086 | | | $ | 8,564,288 | | |

Net realized gain on

investments sold during

the period | | | 33,207,001 | | | | 107,241,414 | | |

Net change in unrealized

appreciation of investments

during the period | | | (10,220,423 | ) | | | (44,769,003 | ) | |

Net increase in net assets

resulting from operations | | | 26,213,664 | | | | 71,036,699 | | |

| Distributions: | | | |

Dividends paid from net

investment income | | | - | | | | (8,660,724 | ) | |

Distributions paid from net

realized capital gains to

shareholders | | | - | | | | (107,575,314 | ) | |

Net asset value of shares issued

in connection with the

reinvestment of dividends

from net investment

income and distributions

from net realized gains

(0 and 271,590 shares

issued, respectively) | | | - | | | | 5,257,982 | | |

Net increase/(decrease) in net

assets for the period | | | 26,213,664 | | | | (39,941,357 | ) | |

| Net Assets: | | | |

| Beginning of period | | | 398,631,556 | | | | 438,572,913 | | |

End of period (including

undistributed net investment

income of $4,541,524 and

$1,314,438, respectively) | | $ | 424,845,220 | | | $ | 398,631,556 | | |

See accompanying notes to financial statements. 7

Financial Highlights FIRST FINANCIAL FUND, INC.

| | | Six Months

Ended

September 30,

2005 | | Year Ended March 31, | |

| | | (Unaudited) | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| OPERATING PERFORMANCE: | |

| Net asset value, beginning of period | | $ | 17.28 | | | $ | 19.24 | | | $ | 14.40 | | | $ | 15.46 | | | $ | 12.86 | | | $ | 8.72 | | |

| Net investment income | | | 0.14 | | | | 0.38 | | | | 0.15 | | | | 0.16 | | | | 0.19 | | | | 0.14 | | |

| Net realized and unrealized gain on investments | | | 1.00 | | | | 2.74 | | | | 7.36 | | | | 1.72 | | | | 3.99 | | | | 4.09 | | |

| Total from investment operations | | | 1.14 | | | | 3.12 | | | | 7.51 | | | | 1.88 | | | | 4.18 | | | | 4.23 | | |

| DISTRIBUTIONS: | |

Dividends paid from from net investment

income to shareholders | | | - | | | | (0.38 | ) | | | (0.16 | ) | | | (0.17 | ) | | | (0.20 | ) | | | (0.10 | ) | |

| Distributions paid from net realized capital gains | | | - | | | | (4.72 | ) | | | (2.59 | ) | | | (2.80 | ) | | | (1.46 | ) | | | - | | |

| Total distributions | | | - | | | | (5.10 | ) | | | (2.75 | ) | | | (2.97 | ) | | | (1.66 | ) | | | (0.10 | ) | |

| Accretive Impact of Capital Share Transactions | | | - | | | | 0.02 | | | | - | | | | - | | | | - | | | | - | | |

| Net Increase resulting from Fund share repurchase | | | - | | | | - | | | | 0.08 | | | | 0.03 | | | | 0.08 | | | | 0.01 | | |

| Net asset value, end of period (a) | | $ | 18.42 | | | $ | 17.28 | | | $ | 19.24 | | | $ | 14.40 | | | $ | 15.46 | | | $ | 12.86 | | |

| Market price per share, end of period (a) | | $ | 19.40 | | | $ | 18.02 | | | $ | 18.30 | | | $ | 13.97 | | | $ | 15.75 | | | $ | 11.29 | | |

| Total investment return based on market value (b) | | | 7.66 | % | | | 24.41 | % | | | 51.96 | % | | | 8.24 | % | | | 35.20 | % | | | 49.40 | % | |

| RATIOS AND SUPPLEMENTAL DATA: | |

| Ratio of operating expense to average net assets (c) | | | 1.02 | % | | | 1.03 | % | | | 1.09 | % | | | 1.27 | % | | | 0.97 | % | | | 1.09 | % | |

Ratio of operating expenses including interest

expense to average net assets (c) | | | 1.04 | % | | | 1.06 | % | | | 1.10 | % | | | 1.29 | % | | | 1.00 | % | | | 2.12 | % | |

Ratio of net investment income to

average net assets (c) | | | 1.55 | % | | | 1.94 | % | | | 0.86 | % | | | 0.99 | % | | | 1.32 | % | | | 1.33 | % | |

| Portfolio Turnover Rate | | | 31 | % | | | 79 | % | | | 87 | % | | | 74 | % | | | 114 | % | | | 85 | % | |

| Net assets, end of the period (in 000's) | | $ | 424,845 | | | $ | 398,632 | | | $ | 438,573 | | | $ | 339,389 | | | $ | 365,207 | | | $ | 315,392 | | |

Number of shares outstanding at the end of

period (in 000's) | | | 23,063 | | | | 23,063 | | | | 22,791 | | | | 23,576 | | | | 23,622 | | | | 24,525 | | |

(a) NAV and Market Value are published in The Wall Street Journal each Monday.

(b) Total investment return is calculated assuming a purchase of common stock at the current market value on the first day and a sale at the current market value on the last day of each period reported. Dividends and distributions are assumed for purposes of calculation to be reinvested at prices obtained under the dividend reinvestment plan. This calculation does not reflect brokerage commissions.

(c) Annualized.

Contained above is selected data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for the year indicated. This information has been determined based upon information provided in the financial statements and market price data for the Fund's shares.

See accompanying notes to financial statements. 8

Notes to Financial Statements (Unaudited) FIRST FINANCIAL FUND, INC.

First Financial Fund, Inc. (the "Fund") was incorporated in Maryland on March 3, 1986, as a closed-end, diversified management investment company. The Fund's primary investment objective is to achieve long-term capital appreciation with the secondary objective of current income by investing, under normal conditions, at least 65% of its assets in financial services companies, including savings and banking institutions and their holding companies, except for temporary or defensive purposes.

Note 1. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Securities Valuation: Securities for which market quotations are readily available, including securities listed on national securities exchanges and those traded over-the-counter, are valued at the last quoted sales price on the valuation date on which the security is traded. If such securities were not traded on the valuation date, but market quotations are readily available, they are valued at the most recently quoted bid price provided by an independent pricing service or by principal market makers. Securities traded on NASDAQ are valued at the NASDAQ Official Closing Price ("NOCP"). Securities for which market quotations are not readily available or for which the pricing agent or market maker does not provide a valuation or methodology, or provides a valuation or methodology that, in the ju dgment of the adviser, does not represent fair value ("Fair Value Securities"), are valued at fair value by a Pricing Committee appointed by the Board of Directors, in consultation with the adviser. In such circumstances, the adviser makes an initial written recommendation to the Pricing Committee regarding valuation methodology for each Fair Value Security. Thereafter, the adviser conducts periodic reviews of each Fair Value Security to consider whether the respective methodology and its application is appropriate and recommends methodology changes when appropriate. Prior to implementation, the Pricing Committee reviews and makes a determination regarding each initial methodology recommendation and any subsequent methodology changes. All methodology recommendations and any changes are reviewed by the entire Board of Directors on a quarterly basis.

Short-term securities which mature in more than 60 days are valued at current market quotations. Short-term securities which mature in 60 days or less are valued at amortized cost, which approximates fair value.

Repurchase Agreements: The Fund may enter into repurchase agreement transactions with United States financial institutions. It is the Fund's policy that its custodian take possession of the underlying collateral securities, the value of which exceeds the principal amount of the repurchase transaction, including accrued interest. To the extent that any repurchase transaction exceeds one business day, the value of the collateral is marked-to-market on a daily basis to maintain the adequacy of the collateral. If the seller defaults, and the value of the collateral declines or if bankruptcy proceedings are commenced with respect to the seller of the security, realization of the collateral by the Fund may be delayed or limited.

Foreign Currency: The books and records of the Fund are maintained in US dollars. Foreign currencies, investments and other assets and liabilities denominated in foreign currencies are translated into US dollars at the exchange rate prevailing at the end of the period, and purchases and sales of investment securities, income and expenses transacted in foreign currencies are translated at the exchange rate on the dates of such transactions. Foreign currency gains and losses result from fluctuations in exchange rates between trade date and settlement date on securities transactions, foreign currency transactions and the difference between the amounts of interest and dividends recorded on the books of the Fund and the amounts actually received. The portion of foreign currency gains and losses related to flu ctuation in the exchange rates between the initial purchase trade date and subsequent sale trade date is included in gains and losses on investment securities sold.

9

Notes to Financial Statements (Unaudited) FIRST FINANCIAL FUND, INC.

Securities Transactions and Net Investment Income: Securities transactions are recorded on the trade date. Realized gains or losses on sales of securities are calculated on the identified cost basis. Dividend income is recorded on the ex-dividend date, or for certain foreign securities, when the information becomes available to the portfolios. Interest income including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis.

Dividend income from investments in real estate investment trusts ("REITs") is recorded at management's estimate of the income included in distributions received. Distributions received in excess of this amount are recorded as a reduction of the cost of investments. The actual amounts of income and return of capital are determined by each REIT only after its fiscal year-end, and may differ from the estimated amounts.

Federal Income Taxes: The Fund intends to qualify as a registered investment company by complying with the requirements under subchapter M of the Internal Revenue Code of 1986, as amended, applicable to RICs and intends to distribute substantially all of its taxable net investment income to its shareholders. Therefore, no Federal income tax provision is required.

Income and capital gain distributions are determined and characterized in accordance with income tax regulations, which may differ from generally accepted accounting principles. These differences are primarily due to (1) differing treatments of income and gains on various investment securities held by the Fund, including timing differences and (2) the attribution of expenses against certain components of taxable investment income. The Internal Revenue Code of 1986, as amended, imposes a 4% nondeductible excise tax on the Fund to the extent the Fund does not distribute by the end of any calendar year at least (1) 98% of the sum of its net investment income for that year and its capital gains (both long-term and short-term) for its fiscal year and (2) certain undistributed amounts from previous years.

Dividends and Distributions to Shareholders: The Fund expects to declare and pay dividends from net investment income and distributions of net realized capital gains, if any, annually. Dividends and distributions to shareholders, which are determined in accordance with federal income tax regulations and which may differ from generally accepted accounting principles, are recorded on the ex-dividend date. Permanent book/tax differences related to income and gains are reclassified to paid-in-capital when they arise.

Note 2. Agreements

Wellington Management Company, LLP serves as the investment adviser (the "Investment Adviser") and makes investment decisions on behalf of the Fund. The Fund pays the Investment Adviser a quarterly fee at the following annualized rates: 0.75% of the Fund's average month-end net assets up to and including $50 million, and 0.625% of such assets in excess of $50 million.

Fund Administrative Services, LLC ("FAS"), serves as the Fund's Co-Administrator. Under the Administration Agreement, FAS provides certain administrative and executive management services to the Fund which include: providing the Fund's principal offices and executive officers, overseeing and administering all contracted service providers, making recommendations to the Board regarding policies of the Fund, conducting shareholder relations, authorizing expenses, and other administrative tasks. As of February 1, 2005, under the Administration Agreement, the Fund pays FAS a monthly fee, calculated at an annual rate of 0.20% of the value of the Fund's average monthly net assets up to $250 million; 0.18% of the Fund's average monthly net assets on the next $150 million; and 0.15% of the value of the Fund's average monthly net assets over $400 million. Prior to February 1, 2005, the fee was calculated at an annual rate of 0.15% of the value of the Fund's average monthly net assets. The equity owners of FAS are Evergreen Atlantic, LLC, a Colorado limited liability company ("EALLC") and the Lola Brown Trust No. 1B (the "Lola Trust"). The Lola Trust is a shareholder of the Fund, and the Lola Trust and EALLC are considered to be "affiliated persons" of the Fund as that term is defined in the Investment Company Act of 1940, as amended, (the "1940 Act").

10

Notes to Financial Statements (Unaudited) FIRST FINANCIAL FUND, INC.

The Fund pays each Director who is not a director, officer or employee of the Investment Adviser or FAS a fee of $8,000 per annum, plus $4,000 for each in-person meeting of the Board of Directors and $500 for each telephone meeting. In addition, the Chairman of the Board and the Chairman of the Audit Committee receive $1,000 per meeting and each member of the Audit Committee receives $500 per meeting. The Fund will also reimburse all non-interested Directors for travel and out-of-pocket expenses incurred in connection with such meetings.

Investors Bank & Trust Company ("Investors Bank") serves as the Fund's Co-Administrator and Custodian. As compensation for its services, Investors Bank receives certain out-of-pocket expenses, transaction fees and asset-based fees, which are accrued daily and paid monthly.

EquiServe Trust Company, N.A. ("EquiServe"), a wholly owned subsidiary of Computershare, serves as the Fund's Common Stock servicing agent ("Transfer Agent"), dividend-paying agent and registrar, and as compensation for EquiServe's services as such, the Fund pays EquiServe a monthly fee plus certain out-of-pocket expenses.

Note 3. Purchases and Sales of Securities

Cost of purchases and proceeds from sales of securities for the six months ended September 30, 2005 excluding short-term investments, aggregated $121,804,899 and $156,719,479 respectively.

On September 30, 2005, based on cost of $343,009,074 for federal income tax purposes, aggregate gross unrealized appreciation for all securities in which there is an excess of value over tax cost was $91,313,388 and aggregate gross unrealized depreciation for all securities in which there is an excess of tax cost over value was $8,146,439.

Note 4. Capital

At September 30, 2005, 50,000,000 of $0.001 par value Common Stock were authorized and 23,062,973 shares were issued and outstanding.

Note 5. Share Repurchase Program

In accordance with Section 23 (c) of the 1940 Act, the Fund may, from time to time, repurchase shares of the Fund in the open market at the option of the Board of Directors and upon such terms as the Directors shall determine.

For the six months ended September 30, 2005, the Fund did not repurchase any of its own shares. For the year ended March 31, 2005, the Fund did not repurchase any of its own shares.

Note 6. Significant Shareholders

On September 30, 2005, the Lola Trust and other entities affiliated with Stewart R. Horejsi and the Horejsi family owned 9,000,300 shares of Common Stock of the Fund, representing 39.02% of the total Fund shares outstanding.

Note 7. Borrowings

An agreement (the "Agreement") between the Fund and the Custodial Trust Company of Bear Stearns was reached, in which the Fund may borrow from the Custodial Trust Company an aggregate amount of up to the lesser of $50,000,000 or the maximum the Fund is permitted to borrow under the 1940 Act. For the six months ended September 30, 2005, the Fund had an outstanding loan for 73 days, with an average balance of $5,000,000, at an average rate of 4.53% and incurred $45,934 of interest expense. For the fiscal year ended March 31, 2005, the Fund had an outstanding loan for 50 days, with an average balance of $30,000,000, at an average rate of 3.48% and incurred $144,883 of interest expense.

11

Notes to Financial Statements (Unaudited) FIRST FINANCIAL FUND, INC.

Note 8. Transactions With Affiliated Companies

Transactions during the period with companies in which the Fund owned at least 5% of the voting securities were as follows:

Name of

Affiliate | | Beginning

Share Balance | | Ending

Share Balance | | Purchase

Cost | | Sales

Cost | | Dividend

Income | | Market

Value | |

| Broadway Financial Corporation | | | 129,280 | | | | 129,280 | | | | - | | | | - | | | | 6,464 | | | | 1,473,792 | | |

| CCF Holding Company | | | 282,010 | | | | 282,010 | | | | - | | | | - | | | | 19,741 | | | | 5,121,302 | | |

| FirstFed Bancorp, Inc. | | | 252,000 | | | | 252,000 | | | | - | | | | - | | | | 35,280 | | | | 2,746,800 | | |

| First Federal Bancshares, Inc. | | | 79,638 | | | | 57,538 | | | | - | | | | 544,572 | | | | 13,810 | | | | 1,139,252 | | |

| Perpetual Federal Savings Bank | | | 165,930 | | | | 165,930 | | | | - | | | | - | | | | 79,646 | | | | 4,521,592 | | |

| Provident Financial Holdings, Inc. | | | 456,525 | | | | 294,825 | | | | - | | | | 4,656,824 | | | | 93,798 | | | | 8,269,841 | | |

| Redwood Financial, Inc. | | | 40,650 | | | | 40,650 | | | | - | | | | - | | | | - | | | | 833,325 | | |

| River Valley Bancorp | | | 90,000 | | | | 90,000 | | | | - | | | | - | | | | 35,100 | | | | 1,800,000 | | |

| Third Century Bancorp | | | 110,500 | | | | 110,500 | | | | - | | | | - | | | | 8,840 | | | | 1,447,550 | | |

12

Additional Information (Unaudited) FIRST FINANCIAL FUND, INC.

Portfolio Information

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission ("SEC") for the first and third quarters of each fiscal year on Form N-Q. The Fund's Form N-Q is available (1) on the Fund's website located at http://www.firstfinancialfund.com; (2) on the SEC's website at http://www.sec.gov; or (3) for review and copying at the SEC's Public Reference Room ("PRR") in Washington, DC. Information regarding the operation of the PRR may be obtained by calling 1-800-SEC-0330.

Proxy Information

The policies and procedures used to determine how to vote proxies relating to securities held by the Fund are available on the Fund's website located at http://www.firstfinancialfund.com. Information regarding how the Portfolio voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available at http://www.sec.gov.

Senior Officer Code of Ethics

The Fund files a copy of its code of ethics that applies to the registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions (the "Senior Officer Code of Ethics"), with the SEC as an exhibit to its annual report on Form N-CSR. The Fund's Senior Officer Code of Ethics is available on the Fund's website located at http://www.firstfinancialfund.com.

Privacy Statement

Pursuant to SEC Regulation S-P (Privacy of Consumer Financial Information) the Directors of the Fund have established the following policy regarding information about the Fund's shareholders. We consider all shareholder data to be private and confidential, and we hold ourselves to the highest standards in its safekeeping and use. The Fund collects nonpublic information (e.g., your name, address, Social Security Number, Fund holdings) about shareholders from transactions in Fund shares. The Fund will not release information about current or former shareholders (except as permitted by law) unless one of the following conditions is met: (i) we receive your prior written consent; (ii) we believe the recipient to be you or your authorized representative; or (iii) we are required by law to release information to the recipient. The Fund has not and will not in the future give or sell information about its cu rrent or former shareholders to any company, individual, or group (except as permitted by law). The Fund will only use information about its shareholders as necessary to service or maintain shareholder accounts in the ordinary course of business. Internally, we also restrict access to shareholder personal data to those who have a specific need for the records. We maintain physical, electronic and procedural safeguards that comply with Federal standards to guard your personal data.

13

Board of Directors' Approval (Unaudited) FIRST FINANCIAL FUND, INC.

Discussion Regarding the Board of Directors' Approval of the Investment Advisory Contract

Wellington Management Company, LLP (the "Adviser") has entered into an Investment Advisory Agreement with the Fund (the "Agreement") pursuant to which the Adviser is responsible for managing the Fund's assets in accordance with its investment objectives, policies and limitations. The 1940 Act requires that the Board, including a majority of the Independent Directors, annually approve the terms of the Agreement. At a regularly scheduled meeting held on April 26, 2005, the Directors, by a unanimous vote (including a separate vote of the Independent Directors), approved the renewal of the Agreement.

Factors Considered

Generally, the Board considered a number of factors in renewing the Agreement including, among other things, (i) the nature, extent and quality of services to be furnished by the Adviser to the Fund; (ii) the investment performance of the Fund compared to relevant market indices and the performance of comparable closed-end funds; (iii) the advisory fees and other expenses paid by the Fund; (iv) the profitability to the Adviser of its investment advisory relationship with the Fund; (v) the extent to which economies of scale are realized and whether fee levels reflect any economies of scale; (vi) support of the Adviser by the Fund's principal shareholders; and (vii) the historical relationship between the Fund and the Adviser. The Board also reviewed the ability of the Adviser to provide investment management and supervision services to the Fund, including the background, education a nd experience of the key portfolio management and operational personnel, the investment philosophy and decision-making process of those professionals, and the ethical standards maintained by the Adviser.

Deliberative Process

To assist the Board in its evaluation of the quality of the Adviser's services and the reasonableness of the Adviser's fee under the Agreement, the Board received a memorandum from independent legal counsel to the Independent Directors discussing the factors generally regarded as appropriate to consider in evaluating investment advisory arrangements and the duties of directors in approving such arrangements. In connection with its evaluation, the Board also requested and received various materials relating to the Adviser's investment services under the Agreement. These materials included reports and presentations from the Adviser that described, among other things, the Adviser's organizational structure, financial condition, internal controls, policies and procedures on brokerage practices and trade allocation, comparative investment performance results, comparative sub-advisory fees, and compliance policies and pro cedures. The Board also considered information received from the Adviser throughout the year, including investment performance and returns as well as stock price and net asset value.

In advance of the April 26, 2005 meeting, the Independent Directors held a special telephonic meeting with counsel to the Fund and counsel to the Independent Directors. The purpose of the meeting was to discuss the renewal of the Agreement and review the materials provided to the Board by the Adviser in connection with the annual review process. The Board held additional discussions at the April 26, 2005 Board meeting, which included a private session among the Independent Directors and their independent legal counsel at which no employees or representatives of the Adviser were present.

The information below summarizes the Board's considerations in connection with its approval of the Agreement. In deciding to approve the Agreement, the Board did not identify a single factor as controlling and this summary does not describe all of the matters considered. However, the Board concluded that each of the various factors referred to below favored such approval.

14

Board of Directors' Approval (Unaudited) FIRST FINANCIAL FUND, INC.

Nature, Extent and Quality of the Services Provided; Ability to Provide Services

The Board received and considered various data and information regarding the nature, extent and quality of services provided to the Fund by the Adviser under the Agreement. The Adviser's most recent investment adviser registration form on the Securities and Exchange Commission's Form ADV was provided to the Board, as were the responses of the Adviser to information requests submitted to the Adviser by the Independent Directors through their independent legal counsel. The Board reviewed and analyzed the materials, which included information about the background, education and experience of the Adviser's key portfolio management and operational personnel and the amount of attention devoted to the Fund by the Adviser's portfolio management personnel. The Board also reviewed the Adviser's policies and procedures on side-by-side management of hedge funds and other accounts and any impact these have on the success of the Fund. The Board was satisfied that the Adviser's investment personnel, including Nicholas Adams, the Fund's principal portfolio manager, devote an adequate portion of their time and attention to the success of the Fund and its investment strategy. Based on the above factors, the Board concluded that it was generally satisfied with the nature, extent and quality of the investment advisory services provided to the Fund by the Adviser, and that the Adviser possessed the ability to continue to provide these services to the Fund in the future.

Investment Performance

The Board considered the investment performance of the Fund since inception, as compared to both relevant indices and the performance of two comparable closed-end financial services funds. The Board noted favorably that for the one-, three-, five-, ten-year, and since inception periods ended February 28, 2005, the Fund's performance based upon total return outperformed the Standard & Poor's 500 Index, the Fund's primary relevant benchmark, as well as the NASDAQ Composite, the NASDAQ Banks, the SNL All Daily, and the SNL MBS REITS, the Fund's secondary benchmarks. The Board acknowledged that the Fund also outperformed the two most comparable closed-end financial services funds over the same period. The Board also noted that the Fund received two Lipper 2004 Performance Achievement Certificates. According to Lipper, the Fund had the highest return of all closed-end equity funds for the 5 and 10 years end ed December 31, 2004, a category which consists of 102 and 93 closed-end funds, respectively.

Costs of Services Provided and Profits Realized by the Advisers

In evaluating the costs of the services provided to the Fund by the Advisers, the Board relied on statistical and other information regarding the Fund's total expense ratio and its various components, including management fees and investment-related expenses. This information included a comparison of the Fund's advisory fees to other financial services funds (including both closed-end and open-end funds). The Board acknowledged that the level of fees charged by the Adviser seem reasonable as compared to similarly situated financial services funds.

The Board also obtained information regarding the overall profitability of the Adviser. The profitability information was obtained to assist the Board in determining the overall benefits to the Adviser from its relationship to the Fund. Based on its analysis of this information, the Board determined that the level of profits earned by the Adviser from managing the Fund bear a reasonable relationship to the services rendered.

Based on these factors, the Board concluded that the fee under the Agreement was reasonable and fair in light of the nature and quality of the services provided by the Advisers.

Economies of Scale

The Board considered whether there have been economies of scale with respect to the management of the Fund, whether the Fund has appropriately benefited from any economies of scale, and whether the management fee rate is reasonable in relation to the Fund's assets and any economies of scale that may exist. The Board determined that no meaningful

15

Board of Directors' Approval (Unaudited) FIRST FINANCIAL FUND, INC.

economies of scale are being realized by the Adviser in managing the Fund's assets, principally because of the relatively small size of the Fund and because Mr. Adams had voluntarily limited the size of the other portfolios he is managing. The Board concluded that the existing breakpoint in the Fund's current advisory fee schedule was acceptable.

Shareholder Support and Historical Relationship with the Fund

The Board also weighed in on the views of the Fund's largest shareholders, which are affiliated with Mr. Stewart R. Horejsi. As of March 31, 2005, the Lola Brown Trust No. 1B and other entities affiliated with Mr. Horejsi and the Horejsi family held approximately 39.35% of the Fund's outstanding common shares. The Board understands from Mr. Horejsi that these shareholders are supportive of the Adviser and the renewal of the Agreement. The Board also noted that the Fund had not received any negative feedback from other Fund shareholders with respect to the levels of investment management fees and expenses experienced by the Fund.

Approval

The Board based its decision to approve the renewal of the Agreement on a careful analysis, in consultation with independent counsel, of these and other factors. In approving the Agreement, the Board concluded that the terms of the Fund's investment advisory agreement is reasonable and fair and that renewal of the Agreement is in the best interests of the Fund and its shareholders.

16

Meeting of Shareholders - Voting Results (Unaudited) FIRST FINANCIAL FUND, INC.

On August 24, 2005, the Fund held its Annual Meeting of Shareholders to consider the election of Directors of the Fund. The following votes were recorded:

| PROPOSAL 1: (Voting by all Shareholders): | |

| Election of Joel W. Looney as Director of the Fund | | # of Votes Cast | | % of Votes Cast | |

| Affirmative | | | 21,675,492.0335 | | | | 99.13 | | |

| Withheld | | | 189,532.4129 | | | | 0.87 | | |

| TOTAL | | | 21,865,024.4464 | | | | 100.0 | | |

| | | | | | | | | | |

| Election of Richard I. Barr as Director of the Fund | | # of Votes Cast | | % of Votes Cast | |

| Affirmative | | | 21,670,644.3012 | | | | 99.11 | | |

| Withheld | | | 194,380.1452 | | | | 0.89 | | |

| TOTAL | | | 21,865,024.4464 | | | | 100.0 | | |

| | | | | | | | | | |

| Election of Dr. Dean Jacobson as Director of the Fund | | # of Votes Cast | | % of Votes Cast | |

| Affirmative | | | 21,664,692.0335 | | | | 99.08 | | |

| Withheld | | | 200,332.4129 | | | | 0.92 | | |

| TOTAL | | | 21,865,024.4464 | | | | 100.0 | | |

| | | | | | | | | | |

| Election of Dennis R. Causier as Director of the Fund | | # of Votes Cast | | % of Votes Cast | |

| Affirmative | | | 21,675,621.0335 | | | | 99.13 | | |

| Withheld | | | 189,403.4129 | | | | 0.87 | | |

| TOTAL | | | 21,865,024.4464 | | | | 100.0 | | |

| | | | | | | | | | |

| Election of Susan L. Ciciora as Director of the Fund | | # of Votes Cast | | % of Votes Cast | |

| Affirmative | | | 21,655,689.4179 | | | | 99.04 | | |

| Withheld | | | 209,335.0285 | | | | 0.96 | | |

| TOTAL | | | 21,865,024.4464 | | | | 100.0 | | |

| | | | | | | | | | |

17

This Page Left Blank Intentionally.

This Page Left Blank Intentionally.

Directors

Richard I. Barr

Dennis R. Causier

Susan L. Ciciora

Dean L. Jacobson

Joel W. Looney

Investment Adviser

Wellington Management Company, LLP

75 State Street

Boston, MA 02109

Administrator

Fund Administrative Services, LLC

1680 38th Street, Suite 800

Boulder, CO 80301

Custodian

Investors Bank &Trust

200 Clarendon Street

Boston, MA 02116

Transfer Agent

EquiServe Trust Company, N.A.

P.O. Box 43011

Providence, RI 02940-3011

Independent Registered Public Accounting Firm

KPMG LLP

99 HighStreet

Boston, MA 02110-2371

Legal Counsel

Paul, Hastings, Janofsky & Walker LLP

515 South Flower Street, 25th Floor

Los Angeles, CA 90071-2228

The views expressed in this report and the information about the Fund's portfolio holdings are for the period covered by this report and are subject to change thereafter.

This report is for stockholder information. This is not a prospectus intended for use in the purchase or sale of Fund shares.

First Financial Fund, Inc.

1680 38th Street, Suite 800

Boulder, CO 80301

If you have questions regarding shares held in a brokerage account contact your broker, or, if you have physical possession of your shares in certificate form, contact the Fund's Transfer Agent and Shareholder Servicing Agent - EquiServe Trust Company, N.A. at

P.O. Box 43011

Providence, RI 02940-3011

(800) 451-6788

www.firstfinancialfund.com

The Fund's CUSIP number is:

320228109

www.firstfinancialfund.com

S E M I -

A N N U A L

R E P O R T

September 30, 2005

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

The Fund’s full schedule of investments is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not yet applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which the shareholders may recommend nominees to the Registrant’s Board of Directors, where those changes were implemented after the Registrant last provided disclosure in response to the requirements of Item 7(d)(2)(ii)(G) of Schedule 14A (17 CFR 240.14a-101), or this Item.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive and principal financial officers, or persons performing similar functions, have concluded that the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30a-3(c))) are effective, as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on their evaluation of these controls and procedures required by Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(b)).

2

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act (17 CFR 270.30a-3(d)) that occurred during the registrant’s second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not applicable.

(a)(2) Certifications pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 are attached hereto.

(a)(3) Not applicable.

(b) Certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 are attached hereto.

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) | First Financial Fund, Inc. |

| |

By (Signature and Title) | /s/ Stephen C. Miller |

| Stephen C. Miller, President

(Principal Executive Officer) |

|

Date | 12/6/05 | |

| | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the date indicated.

By (Signature and Title) | /s/ Stephen C. Miller |

| Stephen C. Miller, President

(Principal Executive Officer) |

|

Date | 12/6/05 | |

| | | |

By (Signature and Title) | /s/ Carl D. Johns |

| Carl D. Johns, Vice President and Treasurer

(Principal Financial Officer) |

|

Date | 12/6/05 | |

| | | |