Exhibit 99.1

Jefferies Investor Update October 10, 2024 digital

Safe Harbor This presentation contains forward - looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Specifically, statements concerning our ability to continue to grow the business by generating contracts, licensing software and AI solutions, growing our EBCD business and meeting RadNet's financial guidance, among others, are forward - looking statements within the meaning of the Safe Harbor. Forward - looking statements are based on management's current, preliminary expectations and are subject to risks and uncertainties which may cause our actual results to differ materially from the statements contained herein. These risks and uncertainties as well as those risks set forth in RadNet’s reports filed with the SEC, including RadNet’s annual report on Form 10 - K, for the year ended December 31, 2023. Undue reliance should not be placed on forward - looking statements, especially guidance on future financial performance, which speaks only as of the date it is made. RadNet undertakes no obligation to update publicly any forward - looking statements to reflect new information, events or circumstances after the date they were made, or to reflect the occurrence of unanticipated events.

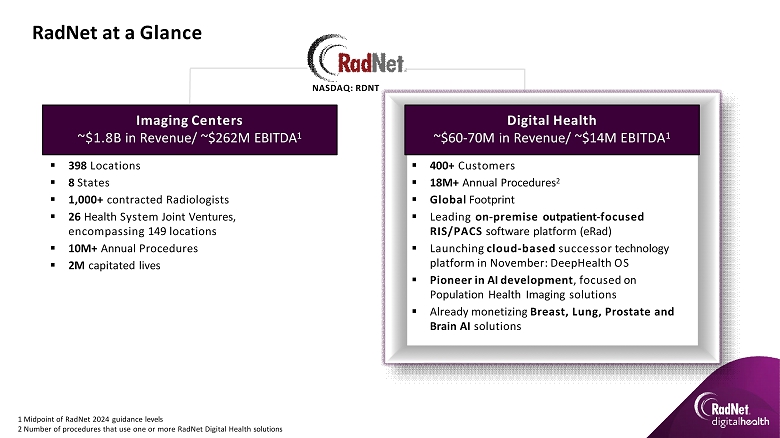

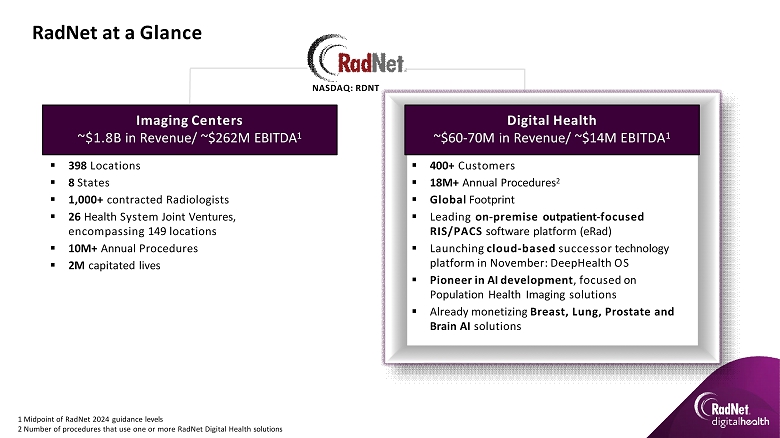

RadNet at a Glance NASDAQ: RDNT Imaging Centers ~$1.8B in Revenue/ ~$262M EBITDA 1 Digital Health ~$60 - 70M in Revenue/ ~$14M EBITDA 1 ▪ 398 Locations ▪ 8 States ▪ 1,000+ contracted Radiologists ▪ 26 Health System Joint Ventures, encompassing 149 locations ▪ 10M+ Annual Procedures ▪ 2M capitated lives ▪ 400+ Customers ▪ 18M+ Annual Procedures 2 ▪ Global Footprint ▪ Leading on - premise outpatient - focused RIS/PACS software platform (eRad) ▪ Launching cloud - based successor technology platform in November: DeepHealth OS ▪ Pioneer in AI development , focused on Population Health Imaging solutions ▪ Already monetizing Breast, Lung, Prostate and Brain AI solutions 1 Midpoint of RadNet 2024 guidance levels 2 Number of procedures that use one or more RadNet Digital Health solutions

4 History of RadNet Digital Health: Our evolution towards tech - enabled services Pre - 2010 RadNet licensed key workflow and clinical software solutions from 3 rd parties 7/2010 RadNet creates internal RIS development team in Prince Edward Island 10/2010 RadNet acquires PACS company eRAD, Inc. 9/2012 First installation of complete end - to - end eRAD workflow product (RIS/PACS) 6/2015 Completion of implement - tation of eRAD across all RadNet centers 6/2020 Completed acquisition of DeepHealth, Inc. – developer of Breast AI solutions 1/2022 Completed acquisitions of Aidence Holding B.V. and Quantib B.V., providing Lung, Prostate, and Brain AI solutions 11/2022 Enhanced Breast Cancer Detection (EBCD) AI - enabled Program Launched 7/2023 RadNet starts forming the Digital Health Executive team: Chief Technology Officer & Chief Commercial Officer to leverage & accelerate GenAI integrations 1/2024 Creation of the RadNet Digital Health Financial Reporting Segment 9/2024 Appointment of Kees Wesdorp as President & CEO of RadNet Digital Health to accelerate deployment & commerciali - zation 11/2024 Commercial launch of the DeepHealth OS at RSNA as eRAD’s successor Legend Radiology Informatics Clinical AI Overall Digital Health

RadNet Speaker Introductions Sham Sokka Chief Operations Officer & Chief Technology Officer, RadNet Digital Health Mark Stolper Executive Vice President and Chief Financial Officer, RadNet, Inc. Dr. Greg Sorensen Chief Science Officer, RadNet & Chief Product Leader, Clinical AI, RadNet Digital Health Kees Wesdorp , President & CEO RadNet Digital Health

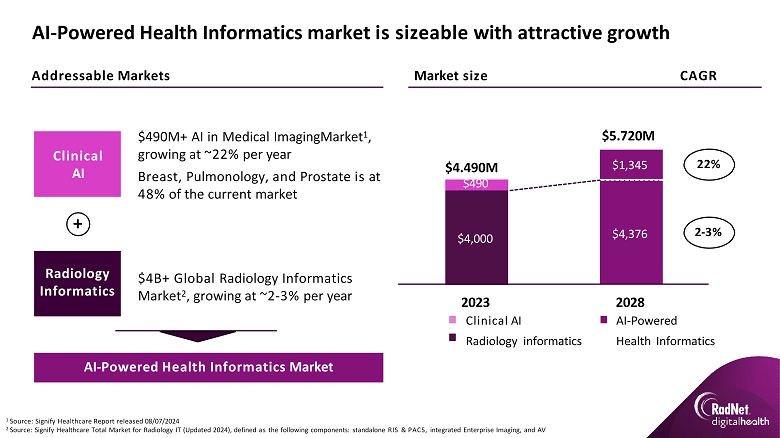

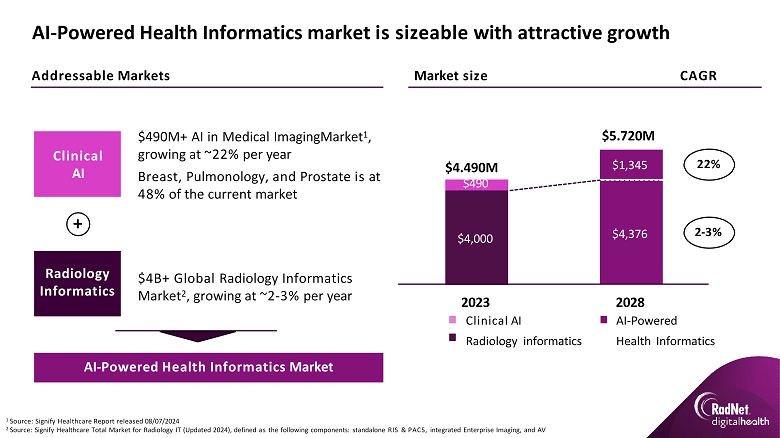

1 Source: Signify Healthcare Report released 08/07/2024 2 Source: Signify Healthcare Total Market for Radiology IT (Updated 2024), defined as the following components: standalone RIS & PACS, integrated Enterprise Imaging, and AV AI - Powered Health Informatics market is sizeable with attractive growth $4,000 $4,376 $490 $1,345 2023 Clinical AI Radiology informatics 2028 AI - Powered Health Informatics 2 - 3% 22% Addressable Markets Market size $4B+ Global Radiology Informatics Market 2 , growing at ~2 - 3% per year Radiology Informatics $490M+ AI in Medical ImagingMarket 1 , growing at ~22% per year Breast, Pulmonology, and Prostate is at 48% of the current market Clinical AI AI - Powered Health Informatics Market + $4.490M $5.720M CAGR

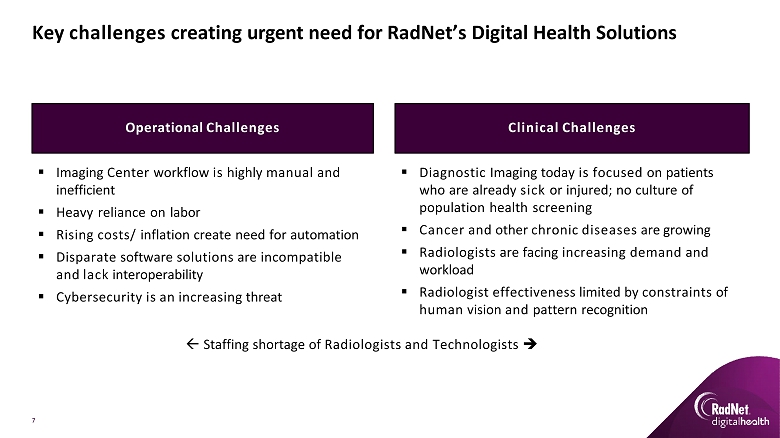

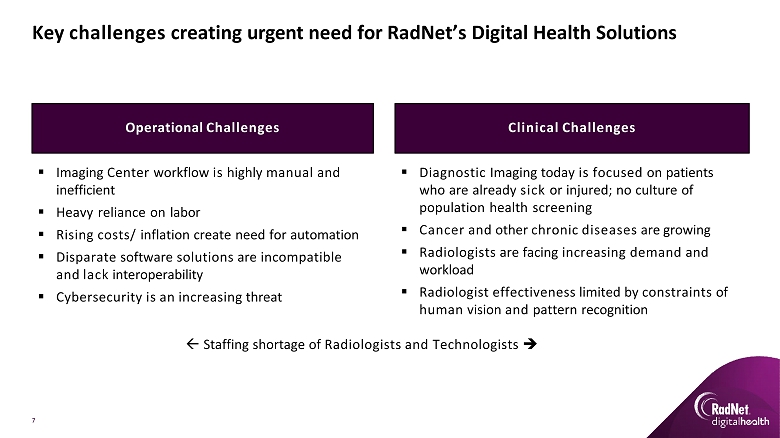

Key challenges creating urgent need for RadNet’s Digital Health Solutions Operational Challenges Clinical Challenges ▪ Imaging Center workflow is highly manual and inefficient ▪ Heavy reliance on labor ▪ Rising costs/ inflation create need for automation ▪ Disparate software solutions are incompatible and lack interoperability ▪ Cybersecurity is an increasing threat ▪ Diagnostic Imaging today is focused on patients who are already sick or injured; no culture of population health screening ▪ Cancer and other chronic diseases are growing ▪ Radiologists are facing increasing demand and workload ▪ Radiologist effectiveness limited by constraints of human vision and pattern recognition Staffing shortage of Radiologists and Technologists 7

RadNet is uniquely positioned to deliver Digital Health solutions Living clinical “lab” to test and implement ▪ 398 Locations with 1,000+ Contracted radiologists ▪ Expertise in operating imaging centers with efficiency and scale ▪ Rapid prototyping, development, validation, and clinical evidence generation ▪ Can deploy solutions and test operating and revenue models within RadNet centers Data as an asset ▪ Over 100M digital exams across diverse patient populations with demographics, clinicals, and reports, growing by over 10M exams per year ▪ Access to outcome data from joint venture and pathology relationships ▪ Ability to de - identify data and select data very specifically ▪ Data can be commercialized to others as a future business Embedded Patient and Payor Relationship ▪ Self - pay AI powered models (e.g., Enhanced Breast Cancer Detection – EBCD) can be implemented ▪ Existing relationships with Payors through the imaging business can be leveraged 8

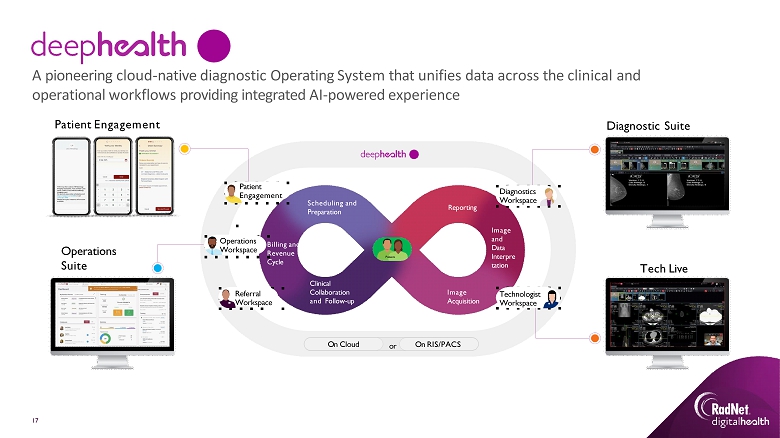

What is RadNet Digital Health? Radiology Informatics ($40 - 45M 2024E Revenue) 1 Clinical AI ($20 - 25M 2024E Revenue) 1 Software - as - a - Service (SaaS) solutions focused on end - to - end Radiology workflow Current Offerings Future Offerings AI Solutions enabling population health screening and preventative medicine On - Premise RIS/PACS Solutions (eRAD) Breast, Lung, Prostate, and Brain AI Solutions DeepHealth OS : A pioneering cloud - native diagnostic Operating System that unifies data across the clinical and operational workflow (Commercial launch in Nov 2024 – RSNA Show in Chicago) Areas of interest include Cardiovascular and Colorectal Imaging AI, and Body Compositional Analysis Currently, RadNet Digital Health software, workflow and AI products are being branded as AI - Powered Health Informatics ($60 - 70M 2024E Revenue) 1 9 1 Based upon RadNet's 2024 Financial Guidance for the aggregate of the Digital Health operating segment.

AI - Powered Health Informatics

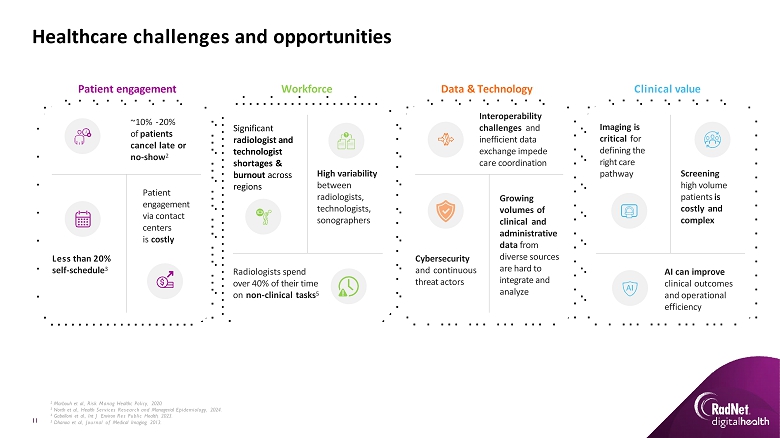

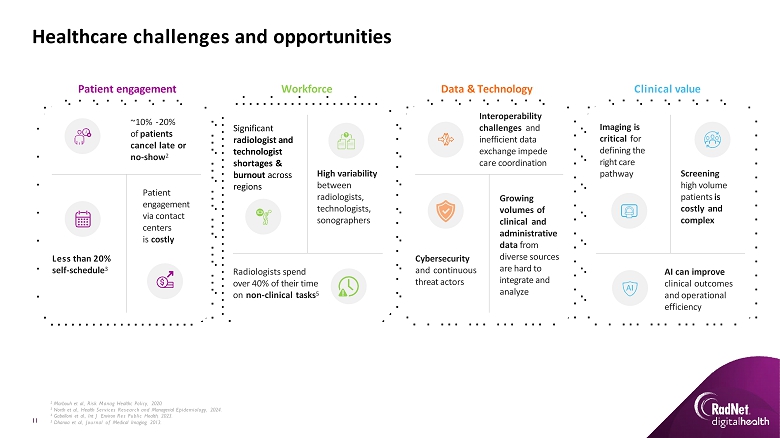

11 Healthcare challenges and opportunities Patient engagement Workforce Data & Technology Clinical value ~10% - 20% of patients cancel late or no - show 2 Imaging is critical for defining the right care pathway Screening high volume patients is costly and complex Patient engagement via contact centers is costly Less than 20% self - schedule 3 Radiologists spend over 40% of their time on non - clinical tasks 5 Interoperability challenges and inefficient data exchange impede care coordination Significant radiologist and technologist shortages & burnout across regions High variability between radiologists, technologists, sonographers Cybersecurity and continuous threat actors Growing volumes of clinical and administrative data from diverse sources are hard to integrate and analyze AI can improve clinical outcomes and operational efficiency 2 Marbouh et al., Risk Manag Healthc Policy, 2020. 3 North et al., Health Services Research and Managerial Epidemiology, 2024. 4 Gabelloni et al., Int J Environ Res Public Health, 2023. 5 Dhanoa et al., Journal of Medical Imaging, 2013.

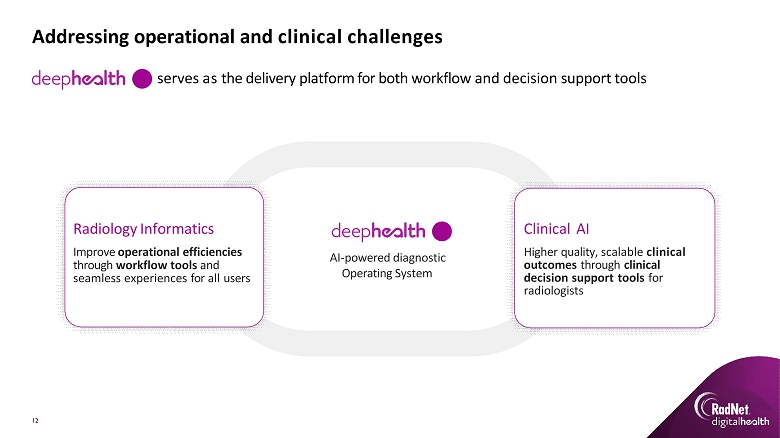

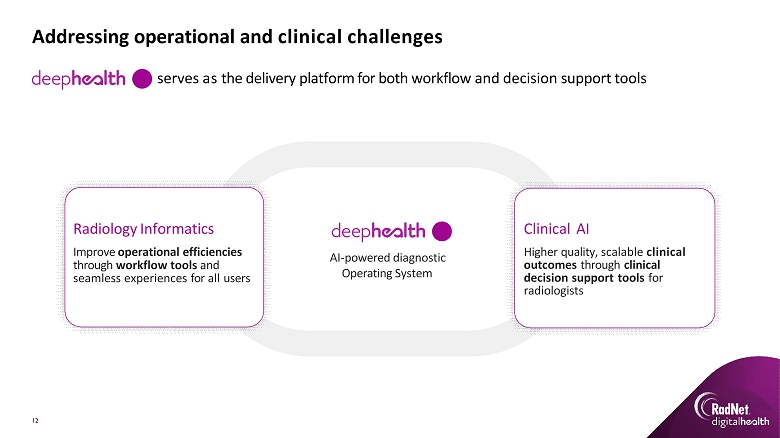

Addressing operational and clinical challenges serves as the delivery platform for both workflow and decision support tools Clinical AI Higher quality, scalable clinical outcomes through clinical decision support tools for radiologists Radiology Informatics Improve operational efficiencies through workflow tools and seamless experiences for all users AI - powered diagnostic Operating System 12

Radiology Informatics

Each step of the workflow has its own standalone tools Scheduling and Preparation Image Acquisition Reporting Billing and Revenue Cycle Image and Data Interpretation Clinical Collaboration and Follow - up Patients 14 The workflow complexity - siloed care delivery experience

Radiologist Technologist Referring Physician Clinical Providers Patient Liason Contact Center Rep Patient Engagement Operations Support Management Internal Operations The workflow complexity - siloed care delivery experience Each step of the workflow has its own standalone tools, with patient engagement representatives, internal operations, and clinical providers each interacting with multiple tools and data silos Scheduling and Preparation Image Acquisition Reporting Billing and Revenue Cycle Image and Data Interpretation Clinical Collaboration and Follow - up Patients 15

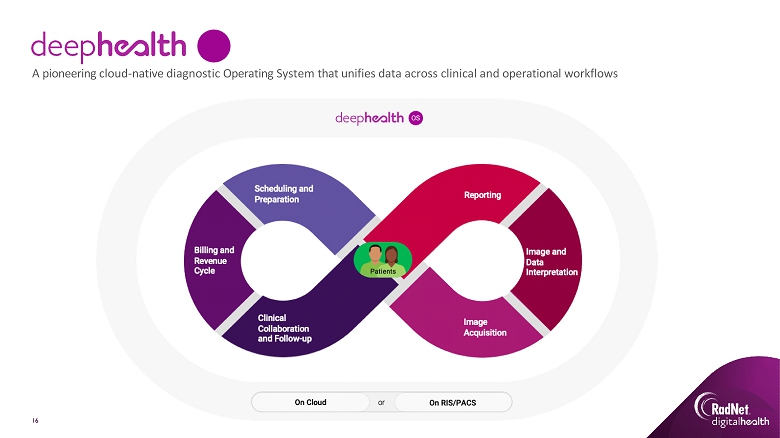

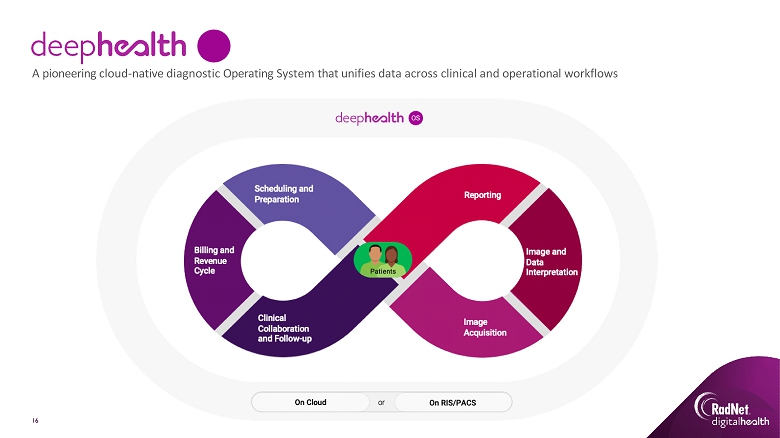

A pioneering cloud - native diagnostic Operating System that unifies data across clinical and operational workflows 16

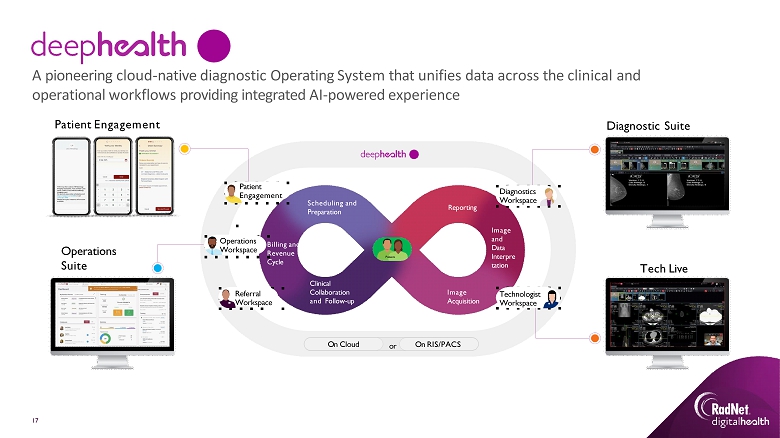

or On RIS/PACS On Cloud Patient Engagement Operations Workspace Referral Workspace Technologist Workspace Diagnostics Workspace Patients Scheduling and Preparation Clinical Collaboration and Follow - up Billing and Revenue Cycle Reporting Image and Data Interpre tation Image Acquisition A pioneering cloud - native diagnostic Operating System that unifies data across the clinical and operational workflows providing integrated AI - powered experience 17 Patient Engagement Operations Suite Diagnostic Suite Tech Live

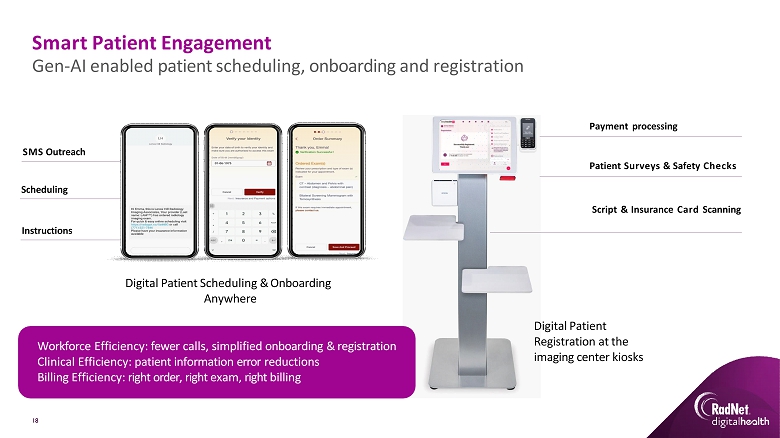

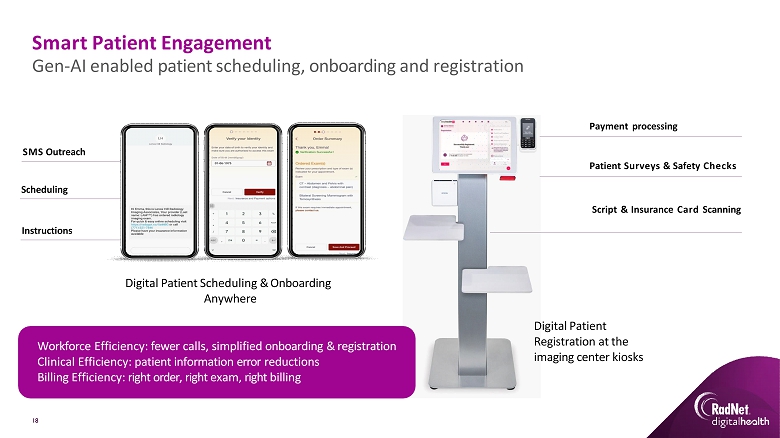

Instructions Scheduling Smart Patient Engagement Gen - AI enabled patient scheduling, onboarding and registration Digital Patient Scheduling & Onboarding Anywhere Digital Patient Registration at the imaging center kiosks Script & Insurance Card Scanning Payment processing 18 Patient Surveys & Safety Checks SMS Outreach Workforce Efficiency: fewer calls, simplified onboarding & registration Clinical Efficiency: patient information error reductions Billing Efficiency: right order, right exam, right billing

Collaboration Tools Smart Image Acquisition: Tech Live Multi - modality, Multi - vendor, AI - powered remote & collaborative scanning Patient Summary . Multi - MR Operations AI - assisted Safety & Quality Workforce Efficiency: 1 technologist operating 2+ scanners Patient Safety: AI - powered monitoring of imaging operations Clinical Efficiency: patient summaries speed - up exam prep and reduce errors 19

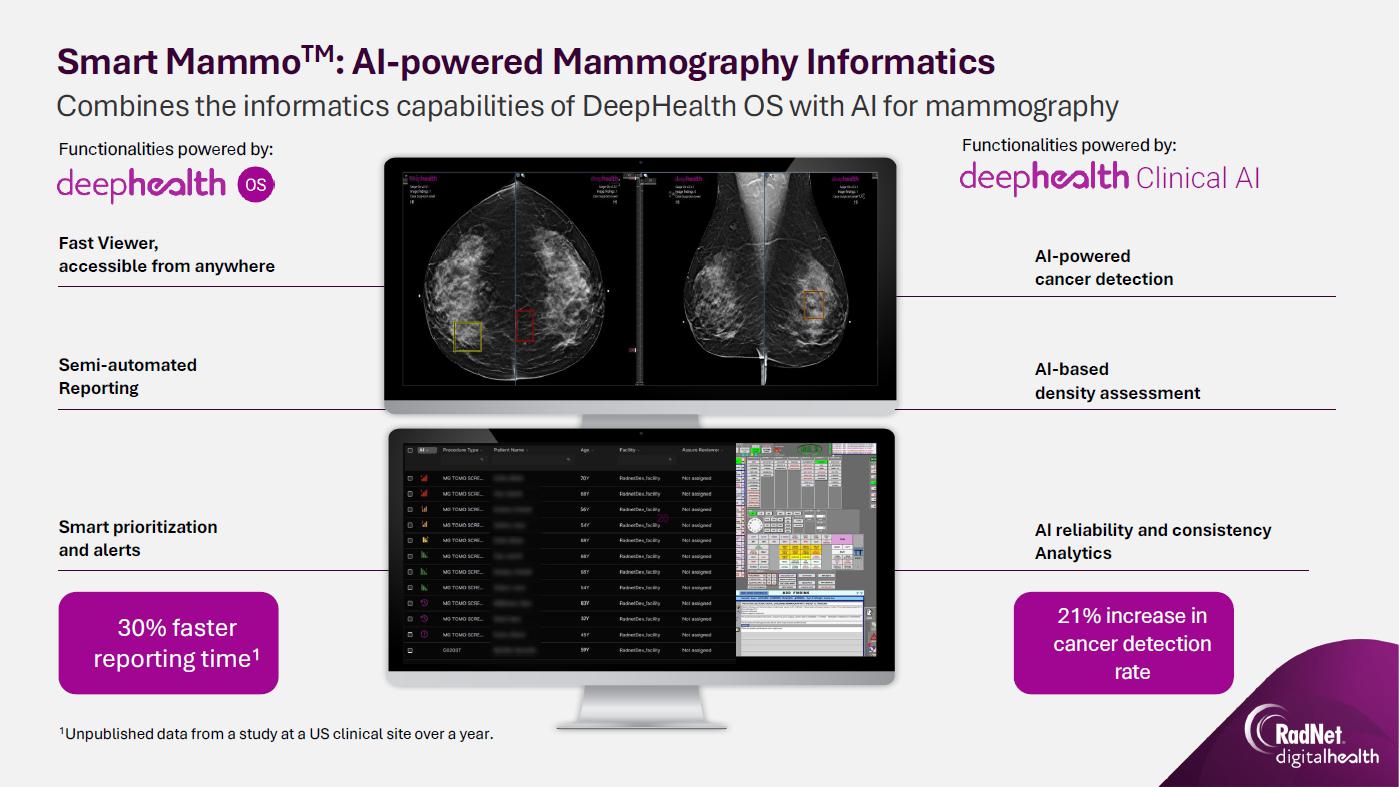

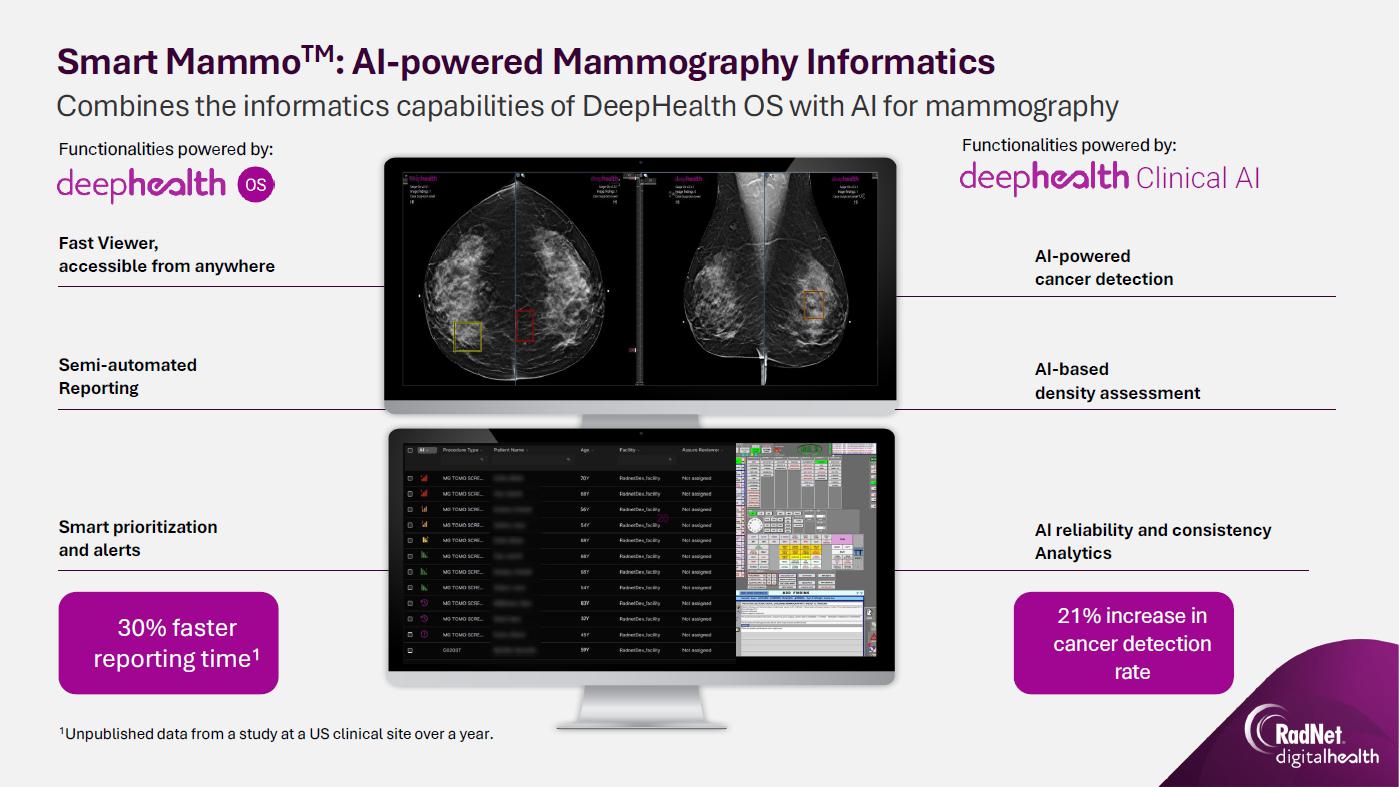

AI - powered cancer detection Fast Viewer, accessible from anywhere Semi - automated Reporting AI - based density assessment Smart prioritization and alerts AI reliability and consistency Analytics Combines the informatics capabilities of DeepHealth OS with AI for mammography Smart Mammo TM : AI - powered Mammography Informatics 20 30% faster reporting time 1 46% less cancers missed 2 1 Unpublished data from a study at a US clinical site over a year. 2 Saige - DX 510k pivotal study Functionalities powered by: Functionalities powered by: Clinical AI

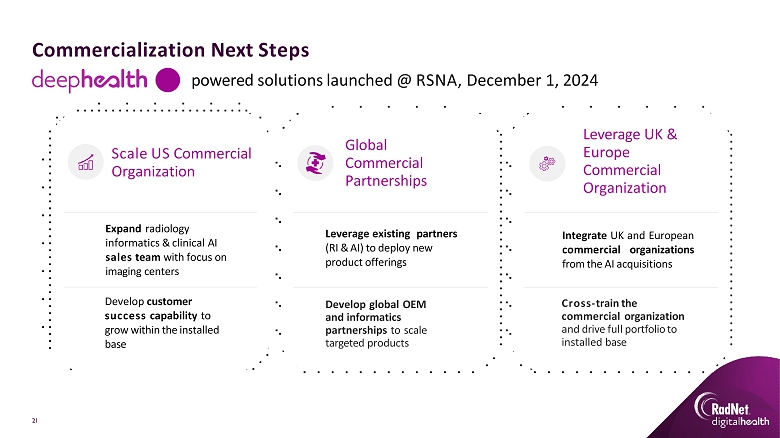

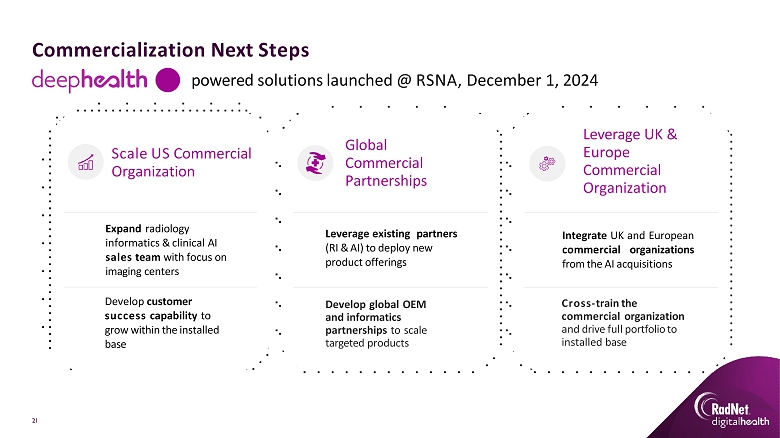

Commercialization Next Steps powered solutions launched @ RSNA, December 1, 2024 Leverage UK & Europe Commercial Organization Scale US Commercial Organization Global Commercial Partnerships Cross - train the commercial organization and drive full portfolio to installed base Develop global OEM and informatics partnerships to scale targeted products 21 Expand radiology informatics & clinical AI sales team with focus on imaging centers Develop customer success capability to grow within the installed base Leverage existing partners (RI & AI) to deploy new product offerings Integrate UK and European commercial organizations from the AI acquisitions

Clinical AI

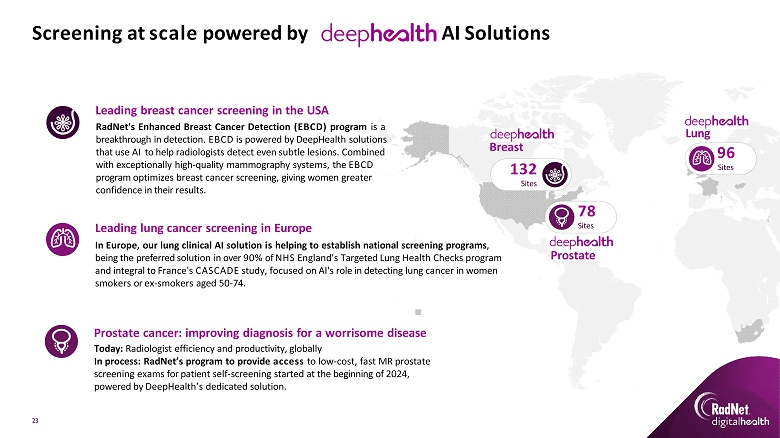

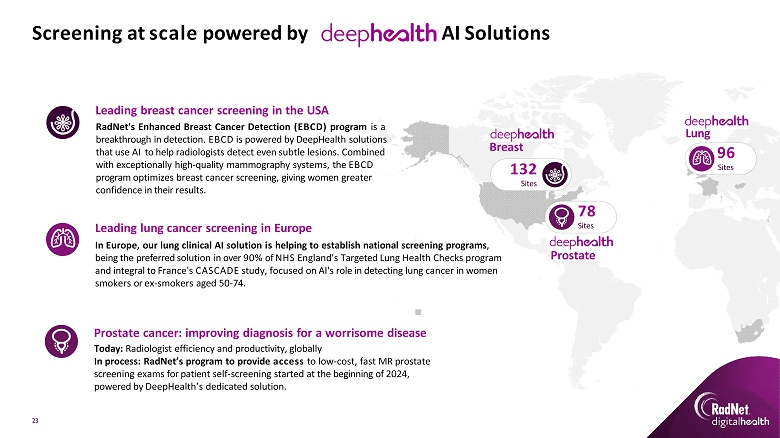

Screening at scale powered by AI Solutions Leading breast cancer screening in the USA RadNet's Enhanced Breast Cancer Detection (EBCD) program is a breakthrough in detection. EBCD is powered by DeepHealth solutions that use AI to help radiologists detect even subtle lesions. Combined with exceptionally high - quality mammography systems, the EBCD program optimizes breast cancer screening, giving women greater confidence in their results. Leading lung cancer screening in Europe In Europe, our lung clinical AI solution is helping to establish national screening programs , being the preferred solution in over 90% of NHS England's Targeted Lung Health Checks program and integral to France's CASCADE study, focused on AI's role in detecting lung cancer in women smokers or ex - smokers aged 50 - 74. 78 Sites 96 Sites Breast 132 Sites Lung Prostate Prostate cancer: improving diagnosis for a worrisome disease Today: Radiologist efficiency and productivity, globally In process: RadNet’s program to provide access to low - cost, fast MR prostate screening exams for patient self - screening started at the beginning of 2024, powered by DeepHealth’s dedicated solution. 23

Screening Mammogram in a 70 - Year - Old Patient

Screening Mammogram in a 70 - Year - Old Patient

Diagnosis: Moderately differentiated invasive ductal carcinoma (ER/PR positive, HER2 negative)

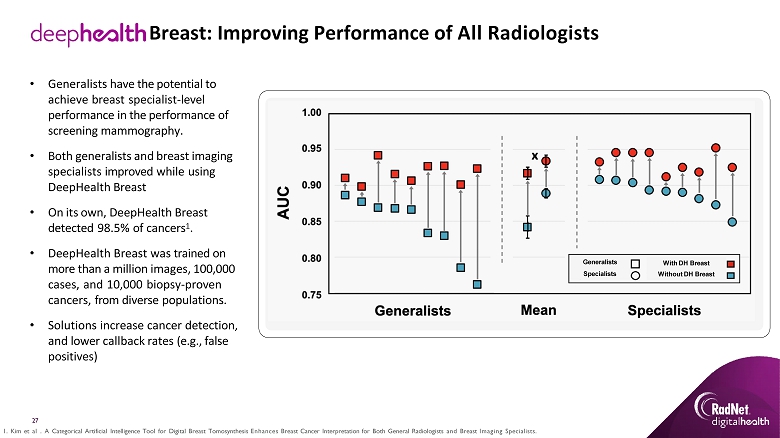

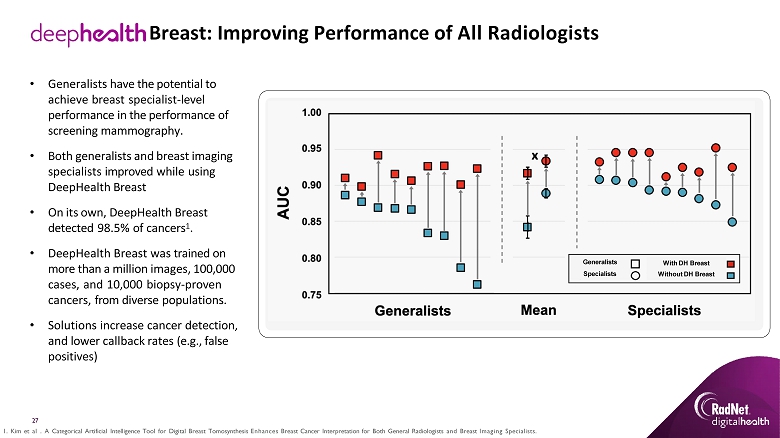

27 Breast: Improving Performance of All Radiologists • Generalists have the potential to achieve breast specialist - level performance in the performance of screening mammography. • Both generalists and breast imaging specialists improved while using DeepHealth Breast • On its own, DeepHealth Breast detected 98.5% of cancers 1 . • DeepHealth Breast was trained on more than a million images, 100,000 cases, and 10,000 biopsy - proven cancers, from diverse populations. • Solutions increase cancer detection, and lower callback rates (e.g., false positives) With DH Breast Without DH Breast 1. Kim et al . A Categorical Artificial Intelligence Tool for Digital Breast Tomosynthesis Enhances Breast Cancer Interpretation for Both General Radiologists and Breast Imaging Specialists. Generalists Specialists

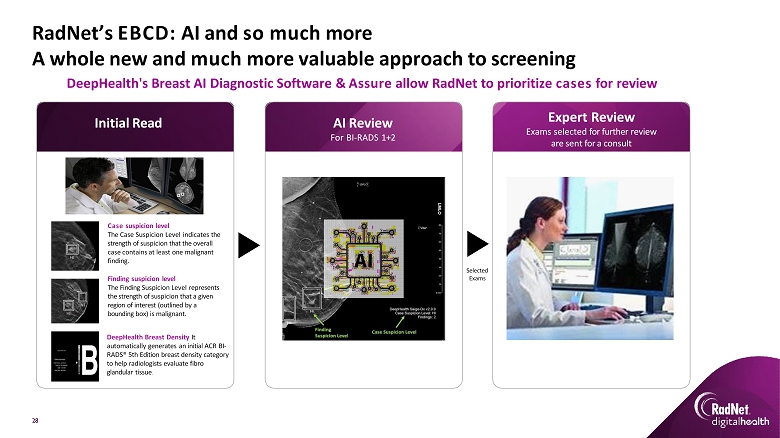

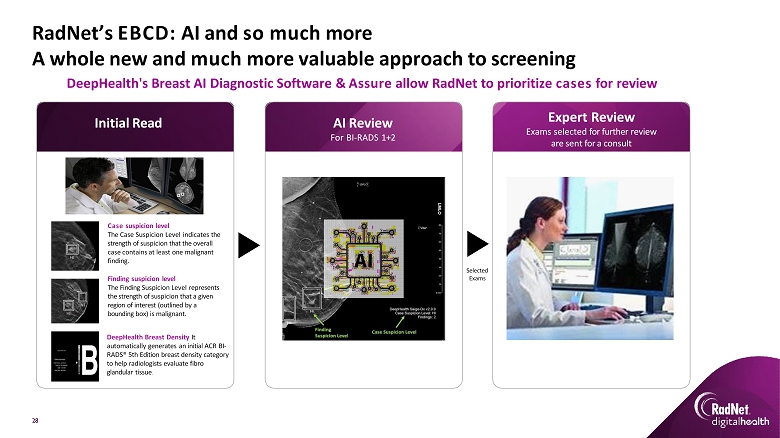

RadNet’s EBCD: AI and so much more A whole new and much more valuable approach to screening Initial Read AI Review For BI - RADS 1+2 Expert Review Exams selected for further review are sent for a consult Selected Exams DeepHealth's Breast AI Diagnostic Software & Assure allow RadNet to prioritize cases for review Case suspicion level The Case Suspicion Level indicates the strength of suspicion that the overall case contains at least one malignant finding. Finding suspicion level The Finding Suspicion Level represents the strength of suspicion that a given region of interest (outlined by a bounding box) is malignant. DeepHealth Breast Density It automatically generates an initial ACR BI - RADS® 5th Edition breast density category to help radiologists evaluate fibro glandular tissue . 28

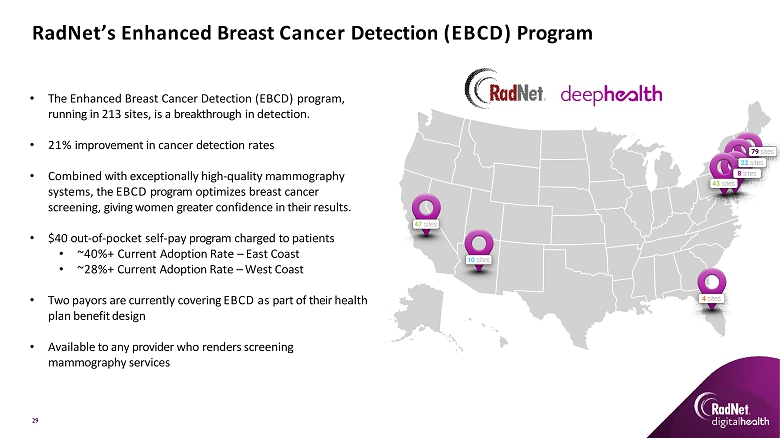

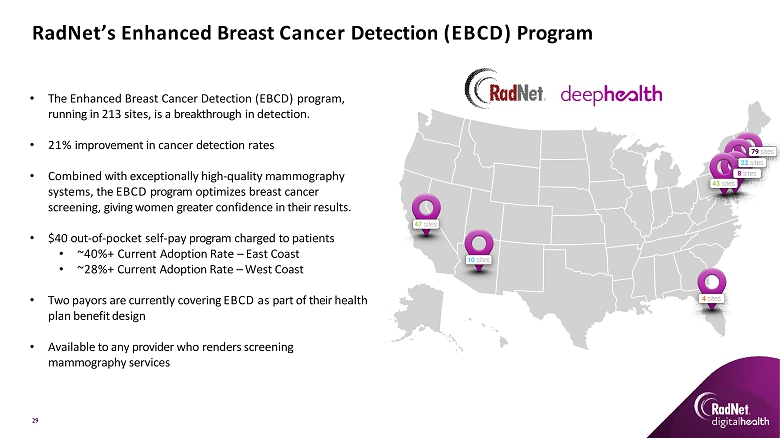

RadNet’s Enhanced Breast Cancer Detection (EBCD) Program • The Enhanced Breast Cancer Detection (EBCD) program, running in 213 sites, is a breakthrough in detection. • 21% improvement in cancer detection rates • Combined with exceptionally high - quality mammography systems, the EBCD program optimizes breast cancer screening, giving women greater confidence in their results. • $40 out - of - pocket self - pay program charged to patients • ~40%+ Current Adoption Rate – East Coast • ~28%+ Current Adoption Rate – West Coast • Two payors are currently covering EBCD as part of their health plan benefit design • Available to any provider who renders screening mammography services 29

EBCD | Clinical Impact at RadNet 108+ Radiologists detected additional cancers through EBCD reviews 30 Source: Data on file 17% Decrease in recall rates at one practice in 4 months through EBCD workflows 23% More breast cancers in dense tissue detected through the EBCD program 1500+ 1.5M+ Equity 21% Patients enrolling daily in EBCD Patients have received AI evaluations that power EBCD All Ages and Races benefited similarly from EBCD additional reviews Relevance Triple Negative or Late Stage cancers are detected at the same or higher rates through EBCD additional reviews More breast cancers detected through the EBCD program

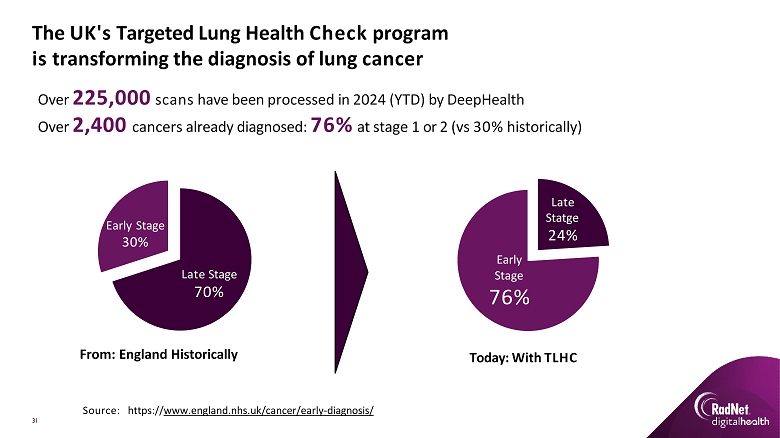

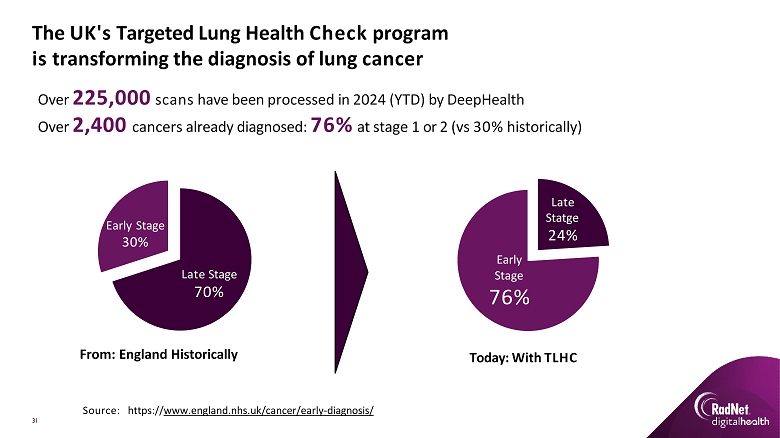

The UK's Targeted Lung Health Check program is transforming the diagnosis of lung cancer Over 225,000 scans have been processed in 2024 (YTD) by DeepHealth Over 2,400 cancers already diagnosed: 76% at stage 1 or 2 (vs 30% historically) From: England Historically Late Stage 70% Early Stage 30% Today: With TLHC Late Statge 24% Early Stage 76% Source: https:// www.england.nhs.uk/cancer/early - diagnosis/ 31

32 DeepHealth Lung Portfolio today Lung Tracker Effortless continuity in pulmonary nodule management Source: Data on file Lung Nodules Empowering Precision in Lung Cancer Care: Smart, Swift, Precise. Lung Reporting Enrich and standardize lung nodule reporting

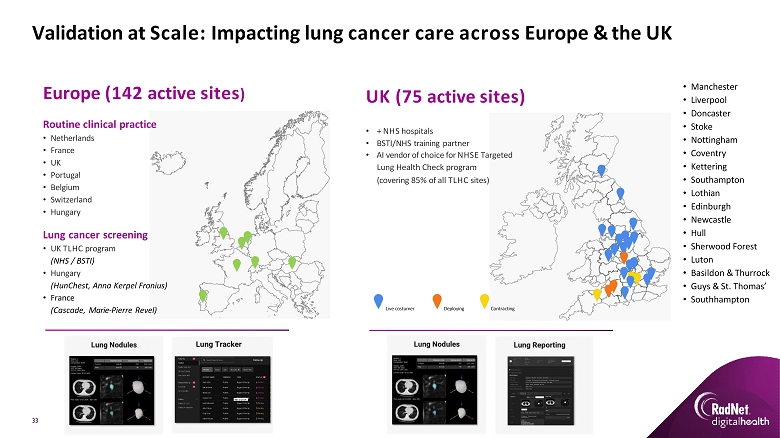

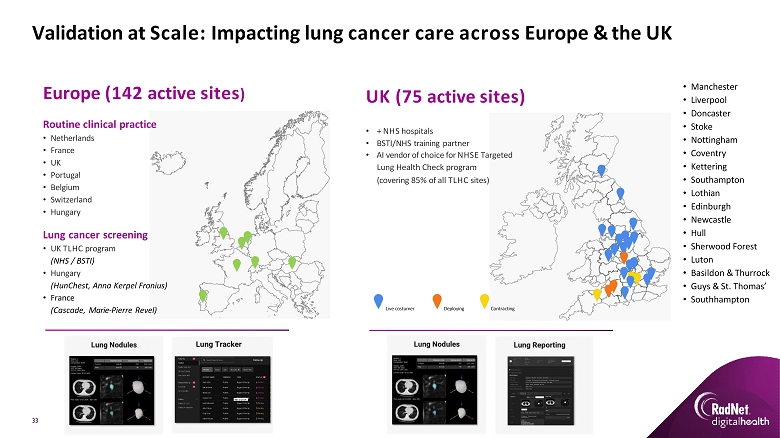

Validation at Scale: Impacting lung cancer care across Europe & the UK Europe (142 active sites ) Routine clinical practice • Netherlands • France • UK • Portugal • Belgium • Switzerland • Hungary Lung cancer screening • UK TLHC program (NHS / BSTI) • Hungary (HunChest, Anna Kerpel Fronius) • France (Cascade, Marie - Pierre Revel) UK (75 active sites) • + NHS hospitals • BSTI/NHS training partner • AI vendor of choice for NHSE Targeted Lung Health Check program (covering 85% of all TLHC sites) • Manchester • Liverpool • Doncaster • Stoke • Nottingham • Coventry • Kettering • Southampton • Lothian • Edinburgh • Newcastle • Hull • Sherwood Forest • Luton • Basildon & Thurrock • Guys & St. Thomas’ • Southhampton Deploying Contracting Live costumer 33

DeepHealth Prostate | Improving MRI interpretation Automated prostate segmentation results: • Prostate volume and PSA density to provide improved measurements compared to the current clinical standard • Heatmap guidance volume and PSA, which removes stress and facilitates evaluation of the transitional and anterior gland/the most challenging areas Visual representation of: • 3D rendered key images of a lesion in the prostate gland, ready to be exported and used by most Third Party biopsy system • Kinetic curve representation per ROI and of the full prostate gland User - friendly interface: • Customizable hanging layout • Seamless integration into existing workflows • Seamless scalability – easily accessible and quick to launch from any location Individual lesion overview: • Includes volume, location per PI - RADS region, PI - RADS scoring, associated kinetic curves, and pre - selected key images The prostate solution delivers a visual report that presents radiology findings in an easy - to - read, standardized format, supporting patient communication and containing: 34

Improves prostate cancer detection Günzel et al., European Urology Focus, 2024 Prostate Solution ▪ In the first prospective biopsy - proven evaluation of AI assistance in 262 men 1 ▪ Sensitivity of biopsy went from 92% to 97% 35 ▪ AI - assisted reads found csPCa in 24% of men when MRI was deemed negative by the radiologist ▪ If only targeted biopsies were performed based on the radiologist read, biopsies would have missed 8% of csPCa , versus AI - assisted read biopsies would have missed 1% ▪ In a prospective study of 150 subjects, additional prostate cancer lesions were found in 23% of the subjects and previously not diagnosed prostate cancer was found in 7% of the subjects 1 ▪ Research has shown that radiologists experienced a 27% decrease in lesion identification time when supported by the software 2

Financial Snapshot

Digital Health Segment Financials 37 Growth First 6 months 2023 First 6 months 2024 Digital Health Segment 34.4% $22.7M $30.5M Revenue 381.5% $1.4M $6.8M Adjusted EBITDA x AI Revenues increased by 128% versus the first half of FY23 x 202% YoY growth in the Breast AI revenue, driven by increasing EBCD adoption rates x 31% YoY growth in Lung AI revenue driven by new and existing customer growth in the UK x 150% YoY growth in Prostate & Brain AI revenue driven by new EU customers, and the RadNet Prostate program x Despite transitioning products, Informatics Revenues from external customers increased by 14% versus the first half of FY23, outpacing the market (~2 - 3% growth) x Growth driven by new customer acquisitions and increase in procedure volumes x Key Forward - looking highlights: x Full - Year Guidance at $60 - 70M (Revenue) and $13 - 15M (Adjusted EBITDA) x Upcoming Product Launches through the DeepHealth OS, TechLive (remote scanning), and others, will generate new SaaS revenue streams beginning in the upcoming quarters x What to expect in the next 6 months: x Strategic Partnership announcements with technology and distributor partners x Continued growth in AI Solutions across the UK, Netherlands, France, etc.

Jefferies Investor Tour at RSNA Date: December 3, 2024 Location: DeepHealth Booth 1340, South Hall Time: 8.30 to 10.00 AM (Central Time) Contact: Brian Tanquilut (Jefferies) btanquilut@jefferies.com 38 Want to learn more?

Q&A