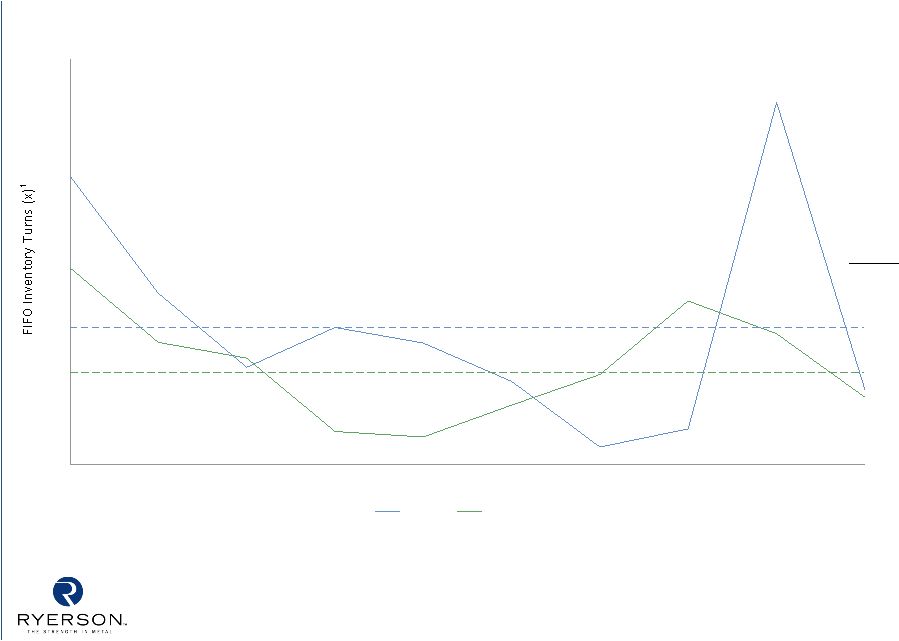

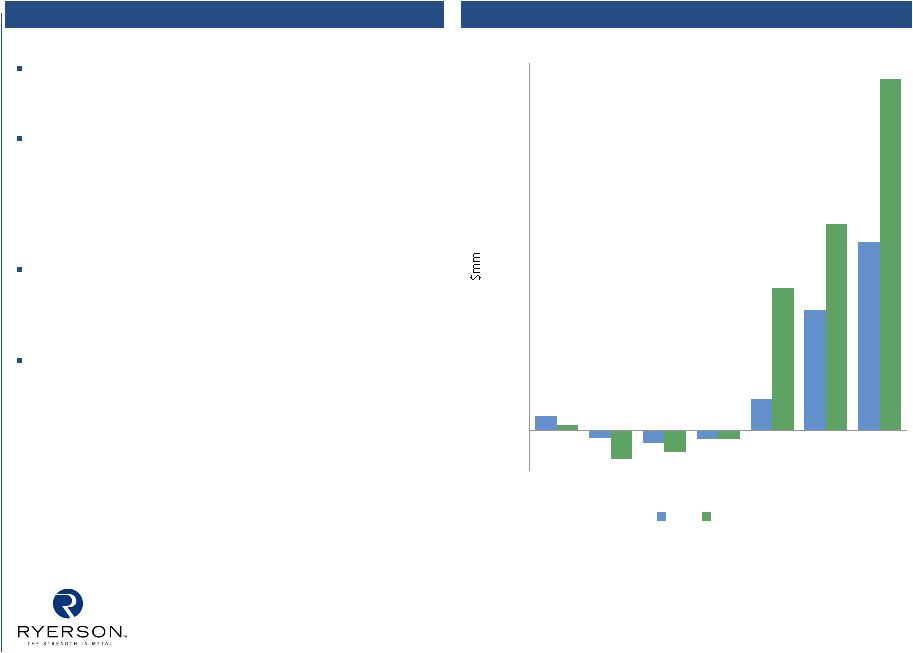

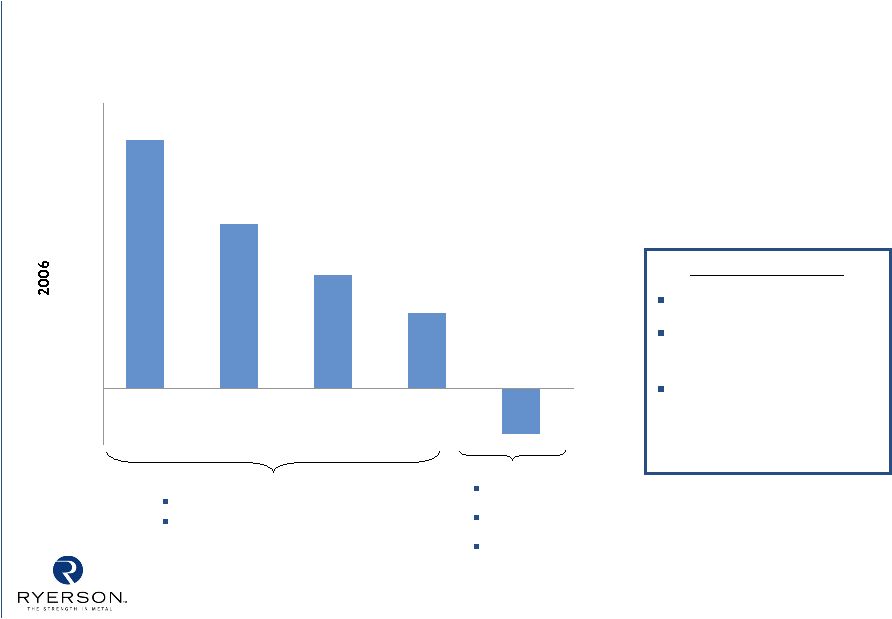

36 Industry Analysis Assumptions Methodology: • Gross Margin excludes impact of Depreciation and Amortization (D&A); if a company does not break out D&A on the income statement (such as Ryerson post 2002) 50% of D&A is allocated to Cost of Goods Sold and 50% is allocated to Operating Expenses (unless allocation noted otherwise in filings) • ROIC is calculated as tax-effected FIFO EBIT (adjusted for tax-effected LIFO charge) plus earnings from equity in affiliates, divided by the average invested capital over the period; invested capital is equal to total debt + minority interest + shareholders’ equity (adjusted for tax-effected LIFO reserve) • Inventory Turns: • RYI and Peers: Cost of Goods Sold (adjusted for LIFO impact) divided by the average inventory over the period (adjusted for LIFO reserve) • Metals Service Center Institute (MSCI): annual shipments divided by average inventory over the period; includes US and Canada; includes aluminum data since 2001 Ryerson Peer Group includes: A.M. Castle, Central Steel & Wire, Gibraltar Industries, Olympic Steel, Metals USA, Novamerican, Reliance Steel & Aluminum, Russel Metals, Samuel Manu-Tech, Shiloh Industries, Steel Technologies and Worthington Industries • Source of financials is company reports from SEC filings for public US companies, SEDAR for Canadian public companies, Central Steel & Wire Report to Stockholders through most recent period available; last reporting period ending 12/31/06 (Ryerson), 11/30/06 (Novamerican and Worthington), 10/31/06 (Shiloh Industries), 6/30/06 (Earle M. Jorgensen), 12/31/05 (Central Steel & Wire) and 9/30/06 for all other peers • Ryerson’s 1997 and 1998 results exclude the Inland Steel Company operations which were sold in 1998 Certain adjustments made to reported results: • all non-recurring items listed on the income statement; 35% tax rate for net income adjustment used • equity in earnings of affiliates was excluded from gross and operating margins when broken out in the income statement • Ryerson adjustments which are not broken out on the Company's income statement: $9.6mm charge from a change in the method of applying LIFO (2005) and a $16.2mm charge related to customer bankruptcy (2000) • Earle M. Jorgensen’s COLI income, which is treated as a credit against SG&A in its financials • All companies calendarized to December year end |