UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

Ryerson Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| Neil S. Novich Chairman, President & Chief Executive Officer |

April 16, 2007

Fellow Stockholder:

On behalf of Ryerson’s Board of Directors it is my pleasure to share with you Ryerson Inc.’s Annual Report for fiscal year 2006. The report summarizes the highlights from 2006, a pivotal year for us in which we accomplished a great deal to improve Ryerson’s overall business performance and outlook.

Looking back, 2006 was a year of change for both Ryerson and the metals industry in general. The year began with a shortage of stainless steel and ended with excess supply and record industry-wide inventories. This turbulence was reflected in our financial performance, with strong results in the first half 2006 and weaker results in the second half. Yet overall, Ryerson’s core business grew and we made excellent progress on improving Ryerson’s operating efficiency, growth opportunities and competitive position. We continued to advance with the rollout of SAP and the consolidation of multiple software platforms into a single, integrated platform. In addition, we improved our competitive position through joint ventures and acquisitions, such as our VSC-Ryerson China Limited joint venture and the acquisition of Lancaster Steel.

Looking ahead to 2007, we have embarked on a number of initiatives that we are confident will drive Ryerson’s goal of continuous improvement and delivering stockholder value. We are committed to achieving inventory turnover of five turns by the end of 2007 and meaningful inventory reductions by the end of the first quarter; addressing underperforming service centers for a targeted operating profit improvement of $30 million in 2007; and completing the SAP conversion of Integris, capturing additional savings of $10 million to achieve annualized synergy savings of $60 million by year-end 2007. With Ryerson Plus—our Lean Six Sigma process—we have a structured, data-driven approach to problem solving that is now helping us cut costs, improve productivity and share best practices across our organization.

As previously announced on February 14, 2007, the Board believes that implementing the Company’s current strategic plan will significantly enhance value for all stockholders. In addition, the Board directed its financial advisor, UBS Investment Bank, to assist the Board in comparing the Company’s current plan with other strategic alternatives which may create additional value for all stockholders. We are making good progress in this process.

We hope that you will find this annual report informative and we look forward to continued progress in 2007. Please send any comments or questions you have to our offices at 773-788-3720 or contact Ryerson’s Vice President—Finance and Treasurer, Terry Rogers, at Terence.Rogers@ryerson.com.

Sincerely,

Neil S. Novich

2621 West 15th Place

Chicago, IL 60608

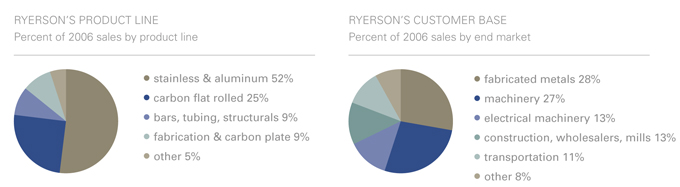

RYERSON INC. IS A LEADING DISTRIBUTOR AND PROCESSOR OF METALS IN NORTH AMERICA, WITH 2006 REVENUES OF $5.9 BILLION. THE COMPANY SERVICES CUSTOMERS THROUGH A NETWORK OF SERVICE CENTERS ACROSS THE UNITED STATES AND IN CANADA, MEXICO, INDIA, AND CHINA. RYERSON SUPPLIES MORE THAN 100,000 SHAPES, SIZES, AND GRADES OF STAINLESS STEEL AND ALUMINUM, CARBON AND ALLOY STEEL, NICKEL ALLOYS, BRASS AND COPPER.

ON JANUARY 1, 2006, THE COMPANY CHANGED ITS NAME FROM RYERSON TULL, INC. TO RYERSON INC.

Role of a Metal Service Center. The service center industry plays an important role as an intermediary between primary producers of metal and end users. As a metals service center, Ryerson provides an array of services not typically available from primary producers, including just-in-time inventory management; customer-specific, value-added processing; smaller order sizes; and consolidation of metals purchases with a single supplier.

Financial Highlights

dollars in millions, except per share data | 2006 | 2005 | ||||||

Net sales | $ | 5,908.9 | $ | 5,780.5 | ||||

Operating profit | 183.9 | (1) | 232.9 | (2) | ||||

Net income | 71.8 | (1) | 98.1 | (2) | ||||

Earnings per diluted share | $ | 2.50 | (1) | $ | 3.78 | (2) | ||

Weighted average shares outstanding (diluted, in millions) | 28.7 | 26.0 | ||||||

Supplemental data: | ||||||||

Earnings per diluted share — FIFO basis(3) | $ | 6.52 | $ | 2.32 | ||||

Tons shipped (000) | 3,292 | 3,499 | ||||||

Cash flow from operations | $ | (261.0 | ) | $ | 321.5 | |||

At year-end: | ||||||||

Total assets | $ | 2,537.3 | $ | 2,151.0 | ||||

Total debt | 1,206.5 | 877.2 | ||||||

Stockholders’ equity | 648.7 | 547.8 | ||||||

Total debt/capitalization | 65.0 | % | 61.6 | % | ||||

| (1) | 2006 results include restructuring and plant closure costs of $4.5 million, $2.8 million after-tax, or $0.10 per diluted share, and a gain on the sale of assets of $21.6 million, $13.2 million after-tax, or $0.46 per diluted share. |

| (2) | 2005 results include LIFO method change charge of $9.6 million, $5.8 million after-tax, or $0.22 per share, restructuring and plant closure costs of $4.0 million, or $2.4 million after-tax, or $0.09 per diluted share, a pension curtailment gain of $21.0 million, $12.8 million after-tax, or $0.49 per diluted share, and a gain on the sale of assets of $6.6 million, $4.0 million after-tax, or $0.15 per diluted share. |

| (3) | The company uses the LIFO method of accounting for approximately 88% of its inventory, which results in a better matching of costs and revenues. To supplement its consolidated financial statements presented on a GAAP (Generally Accepted Accounting Principles) basis, the company has provided net income and diluted earnings per share adjusted to reflect the effects of valuing inventory on a FIFO basis. While FIFO is an acceptable inventory valuation method under U.S. GAAP, the presentation of FIFO basis financial information is considered non-GAAP, as the company applies LIFO inventory valuation for financial reporting purposes. This non-GAAP financial information is not meant to be considered in isolation or as a substitute for net income or diluted earnings per share prepared in accordance with GAAP. |

Reconciliation of Reported Diluted EPS to EPS-FIFO Basis

dollars in millions, except per share data | 2006 | 2005 | |||||

Net income – reported | $ | 71.8 | $ | 98.1 | |||

add: After-tax LIFO charge (credit) | 115.1 | (37.5 | ) | ||||

Net income – FIFO basis | 186.9 | 60.6 | |||||

Dividends on preferred stock | 0.2 | 0.2 | |||||

Net income applicable to common stock – FIFO basis | $ | 186.7 | $ | 60.4 | |||

Earnings per Share | |||||||

As reported | $ | 2.50 | $ | 3.78 | |||

Effect of LIFO charge (credit) | 4.02 | (1.46 | ) | ||||

Diluted-FIFO basis | $ | 6.52 | $ | 2.32 | |||

Fellow stockholders

Ryerson is committed to continuous improvement. It is an integral part of our culture and our strategy. And it’s reflected in our performance — by the steady improvement in our operating results, relative to our peers, the current initiatives that are improving near-term performance, and by the effective implementation of our long-term strategy.

Long-Term Strategy

Our long-term strategy is based on three fundamental principles — a focus on operating efficiency, capturing organic growth, and acquisitions and joint ventures that enhance our competitive position. We continue to successfully implement this strategy.

Acquisitions and Joint Ventures. The 2005 acquisition of Integris Metals nearly doubled our size and created one company that offers an unparalleled range of products, leading processing and fabrication capabilities, and broad geographic reach. We intend to complete its integration in 2007 with the consolidation of additional service centers and the conversion of its facilities to SAP. The integration has gone very well and, in the process, we have identified greater than anticipated opportunities for synergy cost savings. As a result, we expect to achieve annualized cost savings of $60 million by year-end 2007 — an increase from our previous target of $50 million.

We continue to pursue companies with similar products and customer markets that complement our existing operations. And we plan to maximize the value of our acquisitions through active integration, enabling us to not only capture cost savings, but to share best practices, gain cross-selling opportunities, and structurally enhance our competitive position.

In October 2006, we acquired Lancaster Steel Service Company — a two-location, carbon products specialist with annual revenues of $66 million. The acquisition enhanced our competitive position in a number of products and added extensive processing capabilities, enabling us to bring outsourced processing in-house. In addition, the planned consolidation of two service centers should provide cost synergies.

Our international expansion has enabled us to access faster-growth markets, leverage our supplier relationships, and service our U.S. customers that have overseas operations. Our international joint ventures— including Collado Ryerson in Mexico, Tata Ryerson in India, and VSC-Ryerson China — have generated excellent growth, profitability, and return on investment. Total joint venture revenues (although not consolidated, due to our less than 50 percent ownership) are more than $400 million annually, up from virtually nothing in 2002. And from our existing platform in Mexico and Asia, we are exploring other opportunities for global expansion.

Reflecting Ryerson’s expanding worldwide presence and resources, our Customer Solutions

CHINA: OUR LATEST INTERNATIONAL EXPANSION

VSC-Ryerson China Limited provides Ryerson an entrée into the world’s largest and fastest growing metals consuming market. It also offers a platform from which to service the expanding needs of U.S. customers who have established a presence in China. The venture’s foundation is the metals service center network of Van Shung Chong Holdings Ltd. (VSC). This four-location network, with annual revenues of $140 million, is already a profitable business with a strong reputation and an excellent management team. Ryerson’s $28.3 million investment is primarily being used to fund expansion of the service center network. It will also support the addition of fabrication and new product lines that will increase its value-added services and differentiate VSC-Ryerson in the marketplace.

“Our success in Mexico and India, and now China, gives us the expertise we need to explore opportunities in other fast-growing regions of the world.”

FRANK MUÑOZ

VICE PRESIDENT, INTERNATIONAL

2

Team has been renamed Global Accounts. In addition to being the single point of contact for national accounts — which has been a profitable growth business — Global Accounts will also market our international capabilities to our domestic customers.

Information Systems Upgrade. We converted 21 of our largest and most complex service centers — representing 40 percent of our field employees — and shut down our largest legacy platform in 2006. We also began conversion of service centers that were formerly part of the Integris network. Through March 2007, we converted 25 percent of the Integris locations. Cost reductions from the conversion to a single, modern, integrated technology platform — which we intend to complete by the end of 2008 — are expected to generate a high return on investment. Moreover, the operational benefits — including more detailed and timely decision-making information, enhanced delivery performance and inventory management, and seamless links to customers and suppliers — can provide a true competitive advantage.

Ryerson Plus. We sell to world-class companies. That means we have to be world-class. All processes — including cost control, asset management, safety, and customer service — have to be as good as the best companies in the world. With Ryerson Plus, we have a structured, data-driven approach to problem solving and continuous improvement. We are pleased with our first full-year results and believe in the power of this program to help us cut costs, improve productivity, and share best practices across our organization.

Short-Term Initiatives

Complementing our long-term strategy are specific short-term initiatives designed to improve our operating performance in 2007:

Inventory Management. Inventory levels across the service center industry climbed in the second half of 2006. Our inventory expanded likewise. We’ve already implemented significant changes to our inventory management practices, improving forecasting capabilities, revising ordering parameters and safety stock levels, and upgrading our software tools, adding enhanced capabilities and a standardized process under SAP. Organizational changes support these improved business practices. Our goal is to reach inventory turnover of five times by the end of 2007.

RYERSON PLUSTM: TACKLING EXCESS SCRAP

The Ryerson Plus team knew the carbon cut-to-length line, with a scrap rate of more than seven percent, presented an opportunity to cut waste and costs. After identifying the variables that might be contributing to the high scrap rate, the team collected and analyzed the data. One of the problems was the internal coil handling system. The machine used to lift cut sheets from the bundle was scratching the steel. Replacing the magnet lift with suction cups eliminated scratching. When all the solutions were implemented, the scrap rate was cut in half, yielding savings of nearly $400,000 from one line alone. These solutions are now being rolled out to other coil processing lines. The potential savings are even greater in stainless and aluminum, where metal costs are higher.

“Ryerson Plus can tackle any area where improvement opportunity exists, and we can transfer the benefits across the company.”

NICOLE VAN HILL

DIRECTOR, RYERSON PLUS

MASTER BLACK BELT

3

Maintaining Service Center Standards. From an operational and financial standpoint, not all of our 100+ service centers are performing up to expectations. We’ve implemented major management changes at five underperforming service centers — which represent 20 percent of our assets — and taken actions to streamline their operations and reduce costs. We expect these actions to generate a $30 million improvement in operating profit in 2007.

2006 Financial Performance

An extraordinary run up in nickel surcharges on stainless steel, combined with record industry-wide inventories created challenging conditions in the second half of 2006. For the year, Ryerson generated revenues of $5.9 billion, compared with $5.8 billion for 2005. Earnings per share were $2.50 for 2006, versus $3.78 in 2005.

Rapidly rising metal prices, particularly in stainless steel and aluminum — which account for roughly one-half of revenues — had a significant effect on reported earnings under the LIFO inventory accounting method. To help in comparing our results with that of other industry participants, we’ve calculated supplemental information on our results on a FIFO basis. Diluted earnings per share on a supplemental FIFO basis would have been $6.52 for 2006, compared to $2.32 for 2005. (See reconciliation of non-GAAP financial information on page 1.)

Our balance sheet provides us with the necessary liquidity to invest in our business. Debt levels rose in 2006, driven by rising inventories, which we expect to reduce in 2007.

More to Come

We accomplished a great deal during 2006 in our long-term focus on improving Ryerson’s operating efficiency, growth opportunities, and competitive position—a strategy designed to enhance value for all stockholders. In addition to our current strategy, the Board of Directors has retained a financial advisor to assist in evaluating other strategic alternatives that may create additional value for stockholders.

In each of the last six years, since our restructuring in 2000, Ryerson’s performance relative to its peer group has improved, as measured by return on invested capital. And Ryerson is capable of an even higher level of performance. We have the short-term initiatives and long-term strategy to take us further. With the diligence and dedication of all of our employees, we will get there.

|

| Neil S. Novich |

| Chairman, President, and Chief Executive Officer |

| March 2007 |

CAPTURING NEW BUSINESS:

DIRECT SALES REPRESENTATIVES

Now in its fourth year, the Direct Sales Representative (DSR) program has been a key element in the success of Ryerson’s marketing efforts to build awareness and generate new business. These sales reps — who work from the service centers — know their local markets. As specialists in phone sales and business development, they provide a highly effective and efficient way to reach out to a significant, untapped market, educate prospects on the products and services provided by the company, and activate new customers.

“Our direct sales reps are seasoned sales people and specialists who know how to capture new business. And their commission-based compensation structure drives and rewards performance.”

PATTI BUCKLAND

VICE PRESIDENT, MARKETING

4

Board Members

Jameson A. Baxter is president of Baxter Associates, Inc., a private investment firm specializing in strategic planning and corporate finance.

Richard G. Cline is chairman of Hawthorne Investors, Inc., a private management advisory services and investment firm. He is retired chairman of Hussmann International, Inc., a manufacturer of refrigeration systems for the commercial food industry.

Russell M. Flaum is executive vice president of Illinois Tool Works, Inc., a manufacturer of engineered components and industrial systems.

James A. Henderson is retired chairman and chief executive officer of Cummins Inc., a manufacturer of diesel engines.

Gregory P. Josefowicz is retired chairman, president and chief executive officer of Borders Group, Inc., an operator of book superstores and mall-based bookstores.

James R. Kackley is retired audit partner of Arthur Andersen and chief financial officer of Anderson Worldwide, a professional services firm.

Dennis J. Keller is chairman of DeVry Inc., a publicly held higher education company.

Martha Miller de Lombera is retired vice president and general manager of Latin American North Market Development Organization of The Procter & Gamble Company, a manufacturer and marketer of a broad range of consumer products.

Neil S. Novich is chairman, president, and chief executive officer of Ryerson. He previously headed the Distribution and Logistics Practice at Bain & Company, an international management consulting firm.

Jerry K. Pearlman is retired chairman and chief executive officer of Zenith Electronics Corporation, a manufacturer of consumer electronics and cable television products.

Anré D. Williams is executive vice president – U.S. Commercial Card, American Express Company, a travel and financial services company.

Executive Officers (as of April 1, 2007)

Neil S. Novich

Chairman, President,

Chief Executive Officer

Jay M. Gratz

Executive Vice President

and Chief Financial Officer

Gary J. Niederpruem

Executive Vice President

Anita J. Pickens

Executive Vice President

James M. Delaney

President, Global Accounts

Stephen E. Makarewicz

President, Ryerson

South and Vice President,

Chicago Division

William Korda

Vice President,

Human Resources

M. Louise Turilli

Vice President and

General Counsel

Darell R. Zerbe

Vice President,

Information Technology

Chief Information Officer

Lily L. May

Vice President, Controller

and Chief Accounting Officer

Terence R. Rogers

Vice President,

Finance and Treasurer

Virginia M. Dowling

Vice President,

Deputy General Counsel

and Secretary

Important Information

The Company plans to file with the Securities and Exchange Commission (the “SEC”) and mail to its stockholders a Proxy Statement in connection with its 2007 Annual Meeting, and advises its security holders to read the Proxy Statement relating to the 2007 Annual Meeting when it becomes available because it will contain important information. Security holders may obtain a copy of the Proxy Statement and any other relevant documents (when available) that the Company files with the SEC at the SEC’s web site at http://www.sec.gov. The Proxy Statement and these other documents may be accessed at www.ryerson.com or obtained from the Company by directing a request to Ryerson Inc., ATTN: Investor Relations, 2621 West 15th Place, Chicago, IL 60608.

Certain Information Regarding Participants

The Company, its directors and named executive officers may be deemed to be participants in the solicitation of the Company’s security holders in connection with its 2007 Annual Meeting. Security holders may obtain information regarding the names, affiliations and interests of such individuals in the Company’s Annual Report on Form 10-K for the year ended December 31, 2006, its proxy statement, dated April 3, 2006, and its Current Report on Form 8-K with a filing date of March 6, 2007, each of which is filed with the SEC. To the extent holdings of the Company’s equity securities have changed since the amounts reflected in the proxy statement, dated April 3, 2006, such changes have been reflected on Initial Statements of Ownership on Form 3 and Statements of Change in Ownership on Form 4 filed with the SEC.

Stockholder Information

Corporate Office

Ryerson Inc.

2621 West 15th Place

Chicago, IL 60608

773-762-2121

www.ryerson.com

10-K Report

Stockholders may obtain a copy of Ryerson’s Form 10-K Annual Report for 2006 (excluding exhibits) without charge by writing the investor relations contact (or corporate secretary) at the corporate office. The company will furnish any exhibit upon payment of a $5.00 fee for each exhibit requested.

CEO and CFO Certification

In 2006, Ryerson’s CEO provided to the New York Stock Exchange certification regarding compliance with corporate governance listing standards. In addition, the Company’s CEO and CFO filed all required certifications, including Sarbanes-Oxley Section 302 certification concerning the quality of Ryerson’s public disclosures, as exhibits to its Annual Report on Form 10-K for the year ended December 31, 2006, filed with the U.S. Securities and Exchange Commission on March 14, 2007.

Investor Relations Contact

Terence R. Rogers

Vice President, Finance and Treasurer

773-788-3720

Stock Exchange Listing

Ryerson’s common stock is listed on the New York Stock Exchange under the symbol RYI.

Stock Transfer Agent

The Bank of New York

1-800-524-4458

Address stockholder inquiries to:

Shareholder Relations Department

P.O. Box 11258

Church Street Station

New York, NY 10286

E-mail address: Shareowner-svcs@bankofny.com

The Bank of New York’s Stock Transfer Website:

www.stockbny.com

Send certificates for transfer and address changes to:

Receive and Deliver Department

P.O. Box 11002

Church Street Station

New York, NY 10286

Stock Ownership

As of February 28, 2007, there were approximately 7,400 record holders of the company’s common stock.

Forward-Looking Statements

Certain statements in this publication may constitute “forward-looking statements” within the meaning of federal securities laws. The company’s Safe Harbor Statement, describing those statements and detailing certain risks and uncertainties involved with those statements, is found in the 2007 Annual Report on Form 10-K.