PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No.)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Sigma Designs, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) | Title of each class of securities to which transaction applies: |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) | Amount Previously Paid: |

(2) | Form, Schedule or Registration Statement No.: |

(3) | Filing Party: |

(4) | Date Filed: |

SIGMA DESIGNS, INC.

Notice of Annual Meeting of Shareholders

To be held August 18, 2016

July 20, 2016

To the Shareholders of Sigma Designs, Inc.:

The Annual Meeting of Shareholders of Sigma Designs, Inc., a California corporation (the “Company”), will be held at our principal executive offices located at 47467 Fremont Blvd., Fremont, California 94538 on August 18, 2016 at 9:30 a.m., Pacific Daylight Time, for the following purposes:

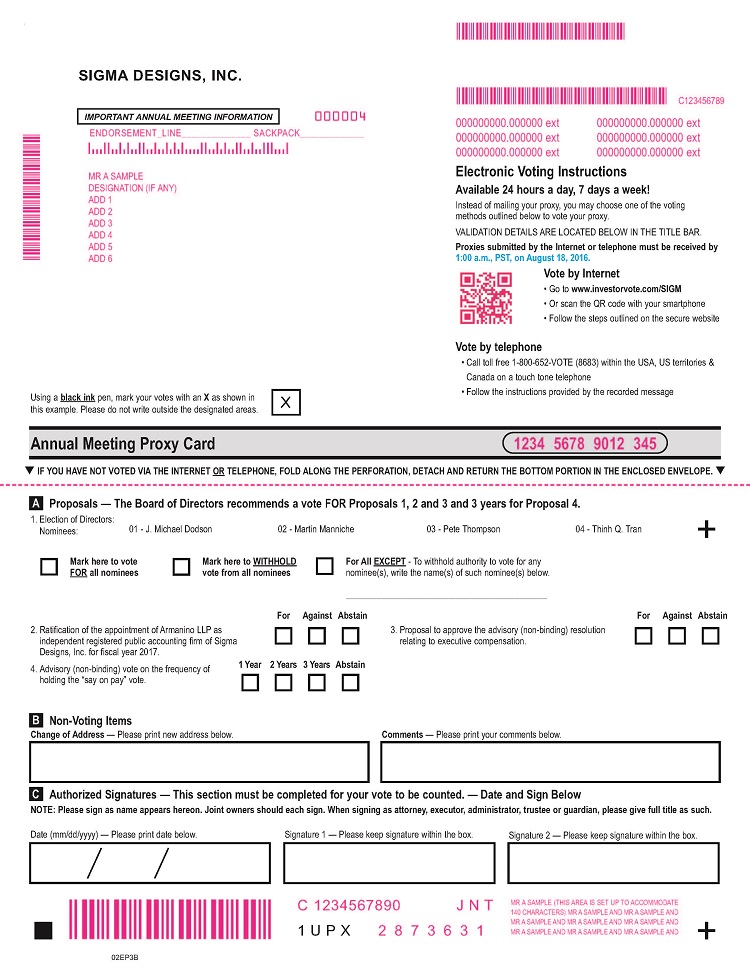

1. | To elect four directors; | |

2. | To ratify the appointment of Armanino LLP as the Company’s independent registered public accounting firm for fiscal year 2017; | |

3. | To hold an advisory vote on our executive compensation for our named executive officers (the “say-on-pay vote”); and | |

4. | To hold an advisory vote on the frequency of holding an advisory vote on our executive compensation. |

We will also transact any other business that may properly come before the Annual Meeting or at any adjournments or postponements of the Annual Meeting.

Shareholders of record as of the close of business on July 1, 2016 are entitled to notice of, and to vote at, the Annual Meeting and any postponement(s) or adjournment(s) thereof.

By Order of the Board of Directors

/s/ Elias Nader

Elias Nader

Secretary

YOUR VOTE IS VERY IMPORTANT

Whether or not you plan to attend the Annual Meeting of Shareholders, we urge you to vote and submit your proxy. You may vote over the internet, by telephone or by mail (if you request a paper copy of the proxy materials and wish to vote by mail). Please review the instructions under the section entitled “How do I vote my shares?” of the attached proxy statement regarding each of these voting options.

Sigma Designs, Inc.

PROXY STATEMENT

Annual Meeting of Shareholders

August 18, 2016

This proxy statement is being furnished to shareholders of Sigma Designs, Inc. in connection with the solicitation of proxies by our Board of Directors for use at our 2016 Annual Meeting of Shareholders, which is described below.

References to “the Company,” “we,” “us” or “our” throughout this proxy statement mean Sigma Designs, Inc.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Q: | When and where will the Annual Meeting be held? |

The 2016 Annual Meeting of Shareholders will be held on August 18, 2016, at 9:30 a.m., Pacific Time, at our principal executive offices, which are located at 47467 Fremont Blvd., Fremont, California 94538.

Q: | What items will be voted on at the Annual Meeting? |

As to all holders of our common stock, the purpose of the Annual Meeting is to:

• | Elect four directors; |

• | Ratify the appointment of Armanino LLP as our independent registered public accounting firm for fiscal year 2017; |

• | Hold an advisory vote on our executive compensation for our named executive officers; and |

• | Hold an advisory vote on the frequency of holding an advisory vote on our executive compensation. |

We will also transact any other business that may properly come before the Annual Meeting or at any adjournments or postponements of the Annual Meeting.

Q: | How does the Board recommend that I vote? |

Our Board unanimously recommends that you vote:

• | FOR each director nominee; |

• | FOR the ratification of the appointment of Armanino LLP as our independent registered public accounting firm for fiscal year 2017; and |

• | FOR the executive compensation of our named executive officers; and |

• | For an advisory vote every3 YEARSon our executive compensation. |

Q: | Who is entitled to vote at the Annual Meeting? |

Shareholders who owned shares of our common stock at the close of business on July 1, 2016, the record date for the Annual Meeting, may vote at the Annual Meeting.

Q: | How do I vote my shares? |

You may vote your shares in one of several ways, depending upon how you own your shares.

Shares registered directly in your name with Sigma Designs (through our transfer agent, Computershare):

• | Via Internet: Go to www.investorvote.com/SIGM and follow the instructions. Please follow the instructions provided with your proxy materials and on your proxy card or voting instruction card. |

• | In Writing: If you wish to vote by mail, complete, sign, date, and return the proxy card in the envelope that was provided to you, or provide it or a ballot distributed at the Annual Meeting directly to the Inspector of Election at the Annual Meeting when instructed. |

Shares of common stock held in “street” or “nominee” name (through a bank, broker or other nominee):

You may receive a separate voting instruction form from your bank, broker or other nominee holding your shares. You should follow the instructions in the voting instructions provided by your broker or nominee in order to instruct your broker or other nominee on how to vote your shares. The availability of telephone or internet voting will depend on the voting process of the broker or nominee. To vote in person at the Annual Meeting, you must obtain a proxy, executed in your favor, from the holder of record.

If you own shares in “street name” through a broker and do not instruct your broker how to vote, your broker may not vote your shares on proposals determined to be “non-routine.” Of the proposals included in this proxy statement, the proposal to ratify the appointment of Armanino LLP as our independent registered public accounting firm for the fiscal year 2017 is considered to be “routine.” Each of the other proposals is considered to be a “non-routine” matter. Therefore, if you do not provide your bank, broker or other nominee holding your shares in “street name” with voting instructions, those shares will count for quorum purposes, but will not be counted as shares present and entitled to vote on the other proposals. Therefore, it is important that you provide voting instructions to your bank, broker or other nominee.

Regardless of how you own your shares, if you are a shareholder of record, you may vote by attending the Annual Meeting on August 18, 2016, at 9:30 a.m., Pacific Time, at our principal executive offices, which are located at 47467 Fremont Blvd., Fremont, California 94538. If you hold your shares in “street” or “nominee,” you must obtain a proxy, executed in your favor, from the holder of record to vote in person at the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or vote by telephone or the internet so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you vote via the internet, by telephone or return a proxy card by mail, but do not select a voting preference, the persons who are authorized on the proxy card and through the internet and telephone voting facilities to vote your shares will vote:

• | FOR each director nominee; |

• | FOR the ratification of the appointment of Armanino LLP as our independent registered public accounting firm for fiscal year 2017; and |

• | FOR the executive compensation of our named executive officers; and |

• | For an advisory vote every3 YEARSon our executive compensation. |

Q: | Can I cumulate my votes? |

Every shareholder voting in the election of directors may cumulate such shareholder’s votes and give one candidate a number of votes equal to the number of directors to be elected multiplied by the number of votes to which the shareholder’s shares are entitled, or distribute such shareholder’s votes on the same principle among as many candidates as the shareholder may select, provided that votes cannot be cast for more than four candidates. However, no shareholder is entitled to cumulate votes for a particular candidate unless the candidate’s name has been placed in nomination prior to the voting and the shareholder, or any other shareholder, has given notice at the Annual Meeting prior to the voting of the intention to cumulate the shareholder’s votes. On all other matters, each share has one vote.

If you vote via the internet, by telephone or return a proxy card by mail, but do not select a voting preference, the persons who are authorized on the proxy card and through the internet and telephone voting facilities to vote your shares may vote cumulatively at the Annual Meeting in favor of one or more of the Company’s nominees for director, at the proxy holders’ sole discretion. The proxy holders will not cumulate or cast your votes for any nominee from whom you have withheld authority to vote.

Q: | What is the quorum requirement? |

A quorum of shareholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares as of the close of business on the Record Date are represented by shareholders present at the meeting or by proxy. At the close of business on the Record Date, there were 37,305,480 shares outstanding and entitled to vote. Therefore, in order for a quorum to exist, 18,652,275 shares must be represented by shareholders present at the meeting or by proxy.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, a majority of the votes present at the meeting may adjourn the meeting to another date.

Q: | How are votes counted? |

Votes will be counted by the inspector of elections appointed for the meeting, who will separately count “For” and “Withhold” votes with respect to the election of directors and, with respect to the proposals other than the election of directors, “For” and “Against” votes, abstentions and broker non-votes.

Q: | How many votes are needed to approve each proposal? |

• | For the election of directors, the four nominees receiving the most “For” votes (among the votes properly cast in person or by proxy) will be elected as directors to serve until the next annual meeting of shareholders or until their successors are duly elected and qualified. The election of directors is a matter on which a broker or other nominee is generally not empowered to vote using discretion; and therefore, broker non-votes may exist with respect to the election of directors. However, because the four nominees receiving the most “For” votes (among the votes properly cast in person or by proxy) will be elected as directors to serve until the next annual meeting of shareholders or until their successors are duly elected and qualified, broker non-votes will have no effect on the outcome of the election of candidates for director. Should any nominee(s) become unavailable to serve before the Annual Meeting, the proxies will be voted by the proxy holders for such other person(s) as may be designated as nominees by our Board of Directors or for such lesser number of nominees as may be prescribed by the Board of Directors. Votes cast for the election of any nominee who has become unavailable will be disregarded. |

• | To be approved, the ratification of the appointment Armanino LLP as our independent registered public accounting firm for fiscal 2017 requires a vote that satisfies two criteria: (i) the affirmative vote must constitute a majority of the voting power present or represented by proxyand voting, and (ii) the affirmative vote must constitute a majority of the voting power required to constitute the quorum. For purposes of this proposal, abstentions and broker non-votes will not affect the outcome under clause (i), which recognizes only actual votes cast. However, abstentions and broker non-votes will affect the outcome under clause (ii) if the number of affirmative votes, though a majority of the votes represented and cast, does not constitute a majority of the voting power required to constitute a quorum. The ratification of the appointment of the independent registered public accounting firm for fiscal 2017 is a matter on which a broker or other nominee is generally empowered to vote; and therefore, no broker non-votes are expected to exist with respect to this proposal. |

• | The say-on-pay vote presented in Proposal 3 is an advisory vote, and therefore, is not binding on the Company, our Compensation Committee or our Board of Directors. We value, however, the opinions of our shareholders and the Compensation Committee will take into account the result of the say-on-pay vote when determining future compensation for our named executive officers. |

• | The frequency of the say-on-pay vote presented in Proposal 4 is an advisory vote, and therefore, is not binding on the Company, our Compensation Committee or our Board of Directors. We value, however, the opinions of our shareholders and the Company, our Compensation Committee and our Board will take into account the result of the say-on-pay frequency vote. |

Q: | May I revoke my proxy? |

Yes. You may change your vote after you submit your proxy at any time before the applicable vote at the Annual Meeting by following the procedures below. If you are a shareholder of record, you may revoke your proxy in any one of three ways:

• | you may deliver a written notice of revocation to our Secretary at 47467 Fremont Blvd., Fremont, California 94538; |

• | you may submit another properly completed proxy bearing a later date; or |

• | you may attend the Annual Meeting and vote in person. |

If your shares are held by your broker, bank or other nominee, you should follow the instructions provided by them if you wish to change your vote.

Q: | Whom should I call if I have any questions? |

A: If you have any questions about the Annual Meeting, voting or your ownership of our Common Stock, please call 510-897-0200 or send an e-mail toir@sigmadesigns.com.

PROPOSAL 1

ELECTION OF DIRECTORS

Nominees

The Board of Directors, upon recommendation of the Corporate Governance and Nominating Committee, proposes the election of four directors of the Company to serve until the next annual meeting of shareholders or thereafter until their successors are duly elected and qualified. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the four nominees named below. If any nominee is unable or declines to serve as director at the time of the Annual Meeting, an event that the Company does not currently anticipate, proxies will be voted for any nominee designated by the Board of Directors to fill the vacancy. The number of authorized directors is currently fixed at five, but our Board of Directors has approved a reduction of the authorized number of directors to four effective immediately prior to the Annual Meeting.

Names of the nominees, and certain biographical information as of May 1, 2016, are set forth below:

Name | Age | Position |

J. Michael Dodson (1)(2) | 55 | Director |

Martin Manniche (3) | 48 | Director |

Pete Thompson (1)(2)(3) | 47 | Director |

Thinh Q. Tran | 62 | Director, President and Chief Executive Officer |

(1) | Member of the Audit Committee. |

(2) | Member of the Compensation Committee. |

(3) | Member of the Corporate Governance and Nominating Committee. |

J. Michael Dodson has served as a member of our Board of Directors since July 2013 and as our Lead Independent Director since January 2014. Mr. Dodson has served as Chief Operating Officer and Chief Financial Officer of Mattson Technology, Inc., a semiconductor wafer processing equipment manufacturing company, since October 2012 having joined Mattson in October 2011 as Executive Vice President and Chief Financial Officer in October 2011. In May 2016, Mattson was acquired by Beijing E-Town Dragon Semiconductor Industry Investment Center (Limited Partnership) (“E-Town Dragon”), and Mr. Dodson has continued to serve as Chief Financial Officer of Mattson Technology, a wholly owned subsidiary of E-Town Dragon. Prior to joining Mattson, Mr. Dodson served as Senior Vice President and Chief Financial Officer at DDi Corp., a provider of printed circuit board engineering and manufacturing services, from January 2010 until October 2011. Before joining DDi Corp., Mr. Dodson served as the CFO for three global public technology companies and Chief Accounting Officer for an S&P 500 company. Mr. Dodson started his career with Ernst & Young. Mr. Dodson received a bachelor’s degree in Accounting and Information Systems from the University of Wisconsin-Madison.

Mr. Dodson’s public company financial and operational experience enables him to provide our Company with valuable financial, accounting and executive insights. In addition, Mr. Dodson’s experience within the semiconductor industry provides additional industry experience that can assist the Board in managing the strategic direction of our Company. Finally, Mr. Dodson’s recent experience in the sale of Mattson Technology to E-Town Dragon, a company based in China, enables him to bring a current perspective on cross-border business transactions and other related matters, as a significant portion of our business takes place in Asia.

Martin Mannichehas served as a member of our Board of Directors since February 2014. Mr. Manniche is currently the Chairman and Chief Executive Officer of GreenWave Systems Inc., a technology development and services company, which he co-founded in September 2009. He previously served as Chief Technology Officer at Cisco Consumer Business Group from September 2005 to September 2009. Mr. Manniche also serves on the board of Telechips; a Kosdaq listed company, and has also previously held board positions at Analogix Semiconductor, Inc., Avega Systems Inc. and KiSS Technology A/S. Mr. Manniche received a degree in Business from Lyngby Uddannelsescenter in Denmark.

Mr. Manniche’s industry experience enables him to provide valuable insight that will assist the Board in managing the strategic direction of our Company. In addition, Mr. Manniche’s experience at both established and start-up companies, in addition to service on other company boards, will be valuable as we shape our plans for future growth and profitability.

Pete Thompsonhas served as a member of our Board of Directors since December 2013. Mr. Thompson has served as Vice President of Strategic Partnering of Sonos, Inc. since September 2015. From September 2013 to September 2015, Mr. Thompson served as the Senior Vice President of the TV & Media Division at Ericsson Corporation. Prior to Ericsson, Mr. Thompson held a variety of executive positions with Microsoft Corporation from January 2006 to September 2013, including Corporate Vice President of Mediaroom Business Unit, General Manager of Xbox Live, and General Manager of Surface. Prior to Microsoft, Mr. Thompson held management positions at T-Mobile USA and Hewlett-Packard. Mr. Thompson previously served on the Board of Directors of Seawell Networks, a Canadian-based company, until it was acquired by Arris Group, Inc. in April 2014. Thompson received a bachelor’s degree in International Economics from the University of California Los Angeles and an MBA from the Kellogg Graduate School of Management.

Mr. Thompson’s market awareness, knowledge and experience enable him to provide valuable insight to our Company. In addition, his diverse industry background and leadership experience, including operating large business units, will help drive our growth strategy in parallel with our efforts to operate profitably.

Thinh Q. Tran has served as a member of our Board of Directors since the founding of the company in 1982. One of our founders, Mr. Tran has served as our President and Chief Executive Officer and as Chairman of our Board of Directors since February 1982. Prior to founding us, Mr. Tran was employed by Amdahl Corporation and Trilogy Systems Corporation, both of which were involved in the IBM-compatible mainframe computer market. Mr. Tran received a bachelor’s degree in Electrical Engineering from the University of Wisconsin and a master’s degree in Electrical Engineering from Stanford University.

As our President and Chief Executive Officer, a position he has held for over 30 years, Mr. Tran has extensive knowledge of our business, products and operations. During his period of service as our President and Chief Executive Officer, Mr. Tran has established strong relationships with our key customers, suppliers and other industry participants. In addition, Mr. Tran brings significant senior leadership, industry and technology expertise to our Board.

Tor R. Braham is currently serving as a director but is not standing for reelection at the Annual Meeting. Mr. Braham’s biographical information is below.

Tor R. Braham joined the Board in June 2014. Mr. Braham served as Managing Director and Global Head, Technology, Mergers and Acquisitions for Deutsche Bank Securities, an international financial service group, from 2004 until 2012. Prior to that, he served as Managing Director and Co-head, West Coast U.S. Technology, Mergers and Acquisitions for Credit Suisse First Boston, an international financial services group, from October 2000 until 2004. Prior to that, Mr. Braham was an investment banker with UBS Securities and a lawyer at a prominent Silicon Valley law firm. Mr. Braham also serves on the board of directors of Yahoo, Inc. and Viavi Solutions, Inc. Mr. Braham received a bachelor’s degree in English from Columbia College and a juris doctorate from New York University School of Law.

There are no family relationships among any of our directors and executive officers.

Vote Required

The four nominees for director receiving the highest number of affirmative votes will be elected as directors. Unless marked to the contrary, proxies received will be voted “For” the nominees, subject to the proxy holders’ ability to cumulate votes, as described above.

The Board of Directors recommends a vote FOR the election of the nominees set forth above as directors of Sigma.

CORPORATE GOVERNANCE AND OTHER MATTERS

Director Independence

The Board of Directors has determined that each of Messrs. Braham, Dodson, Manniche and Thompson is an “independent director” within the meaning of Rule 5605(a)(2) of the NASDAQ Stock Market.

Board Leadership Structure

Our Chairman is responsible for presiding over each Board meeting. The Chairman also serves as liaison between the Chief Executive Officer and the other directors, approves meeting agendas and schedules and notifies other members of the Board of Directors regarding any significant concerns of shareholders or interested parties of which he becomes aware. The Chairman provides advice and counsel to our Chief Executive Officer.

In January 2014, we appointed J. Michael Dodson as our Lead Independent Director. Mr. Dodson, as our Lead Independent Director, performs the functions of the Chairman of the Board, which position is currently vacant.

Board of Directors - Risk Oversight

Companies face a variety of risks, including credit risk, liquidity risk and operational risk. For a detailed discussion of these risks, we encourage you to review our Annual Report on Form 10-K for the fiscal year ended January 31, 2016. The Board of Directors believes an effective risk management system will timely identify the material risks that the Company faces, communicate necessary information with respect to material risks to senior executives and, as appropriate, to the Board of Directors or relevant Board of Directors committee, implement appropriate and responsive risk management strategies consistent with the Company’s risk profile, and integrate risk management into the Company’s decision-making.

The Board of Directors retains the ultimate oversight over the Company’s risk management. The Board of Directors has designated the Audit Committee to take the active lead in overseeing company-wide risk management, and the Audit Committee makes periodic reports to the Board of Directors regarding briefings provided by management and advisors. The Board of Directors has designated the Compensation Committee to take the lead in overseeing a risk assessment of the Company’s compensation policies and practices to ensure that the Company’s compensation policies and practices do not motivate imprudent risk taking. The Corporate Governance and Nominating Committee is responsible for periodically evaluating the Company’s risk management process and system in light of the nature of the material risks the Company faces and the adequacy of the Company’s policies and procedures designed to address risk, and recommending to the Board of Directors any changes deemed appropriate by the Corporate Governance and Nominating Committee.

In addition to the formal compliance program, the Board of Directors encourages management to promote a corporate culture that incorporates risk management into the Company’s corporate strategy and day-to-day business operations. The Board of Directors also continually works, with the input of the Company’s executive officers, to assess and analyze the most likely areas of future risk for the Company.

Policy Prohibiting Margin Accounts, Pledges and Hedging

We believe that certain types of transactions by our insiders can lead to unintended negative consequences. For example, securities held in a margin account may be sold by a broker without the employee’s consent if the employee fails to meet a margin call. Similarly, securities pledged as collateral for a loan may be sold in foreclosure without the employee’s consent if the employee defaults on the loan. Because a margin sale or foreclosure sale may occur at a time when the shareholder is aware of material nonpublic information or otherwise is not permitted to trade in our securities, we require our officers to obtain pre-approval in writing from our compliance officer prior to entering into any pledge or margin arrangement. To date, our compliance officer has not granted approval for any such arrangement.

We have a policy in place that prohibits all employees, including officers, from directly or indirectly selling any equity security of our company if the person selling the security or his principal does not own the security sold, or if owning the security, does not deliver it against such sale within twenty days thereafter, or does not within five days after such sale deposit it in the mail or other usual channels for such a transaction. Generally, a short sale, as defined in our policy, means any transaction whereby one may benefit from a decline in our stock price. While employees who are not executive officers or directors are not prohibited by law from engaging in short sales of our securities, we believe it is inappropriate for any employees to engage in such transactions, and accordingly such transactions are prohibited by our policy. We also prohibit any employee from purchasing or selling, or making any offer to purchase or offer to sell, derivative securities relating to our securities, whether or not issued by us, such as exchange traded options to purchase or sell our securities (so called “puts” and “calls”). This policy does not prohibit the Company from granting derivative securities to our employees, such as options or restricted stock units, nor does it prohibit employees from exercising those derivative securities that are granted to them by the Company.

Board Meetings

The Board of Directors held 10 meetings during fiscal 2016. Each director attended at least 75% of the meetings held by the Board of Directors and of the committees on which such director served during fiscal 2016.

Committees of the Board

The Board of Directors has appointed an Audit Committee, a Compensation Committee and a Corporate Governance and Nominating Committee. The Board of Directors has determined that each director who serves on these committees is “independent,” as that term is defined by applicable listing standards of the NASDAQ Stock Market and Securities and Exchange Commission rules. The Board of Directors has approved a charter for each of these committees that can be found on our website at http://www.sigmadesigns.com under the “Corporate - Governance” heading.

Compensation Committee

The current members of the Compensation Committee are Messrs. Dodson, Braham and Thompson, each of whom is a non-management member of our Board of Directors. Mr. Thompson is currently the chairperson of the Compensation Committee. We believe that the composition of our Compensation Committee meets the criteria for independence under, and the functioning of our Compensation Committee complies with the applicable requirements of the Sarbanes-Oxley Act of 2002, the current rules of the NASDAQ Stock Market and Securities and Exchange Commission rules and regulations. The Compensation Committee’s primary functions, among others, are to review and make recommendations to the Board of Directors concerning our executive compensation policy, including establishing salaries, incentives and other forms of compensation for the Company’s executive officers, and to oversee a risk assessment of the Company’s compensation policies and practices. The Compensation Committee held five (5) meetings and acted by written consent four (4) times during fiscal 2016. Additional information concerning the Compensation Committee’s processes and procedures for the consideration and determination of executive compensation is set forth under the heading “Compensation Discussion and Analysis.” All of our directors serving on the Compensation Committee attended at least 75% of the meetings held in fiscal 2016.

Audit Committee

The Audit Committee currently consists of Messrs. Thompson, Braham, and Dodson, each of whom is a non-management member of our Board of Directors. Mr. Dodson is our audit committee financial expert as currently defined under Securities and Exchange Commission rules. Mr. Dodson is also currently the chairperson of the Audit Committee. The Audit Committee’s primary functions, among others, are to approve the selection, compensation, evaluation and replacement of, and oversee the work of, our independent registered public accounting firm, pre-approve all fees and terms of audit and non-audit engagements of such auditors, including the audit engagement letter, review Sigma’s accounting policies and its systems of internal accounting controls, and oversee company-wide risk management. We believe that the composition of our Audit Committee meets the criteria for independence under, and the functioning of our Audit Committee complies with the applicable requirements of, the Sarbanes-Oxley Act of 2002, the current rules of the NASDAQ Stock Market and Securities and Exchange Commission rules and regulations. The Audit Committee held six (6) meetings in fiscal 2016. All of our directors serving on the Audit Committee attended at least 75% of the meetings held in fiscal 2016.

Corporate Governance and Nominating Committee

The current members of the Corporate Governance and Nominating Committee are Messrs. Braham, Manniche and Thompson. During fiscal 2016, Mr. Braham served as the chairperson of the Corporate Governance and Nominating Committee. We believe that the composition of our Corporate Governance and Nominating Committee meets the criteria for independence under, and the functioning of our Corporate Governance and Nominating Committee complies with the applicable requirements of, the Sarbanes-Oxley Act of 2002, the NASDAQ Stock Market and Securities and Exchange Commission rules and regulations. The Corporate Governance and Nominating Committee is responsible for overseeing matters of corporate governance and for the development of general criteria regarding the qualifications and selection of members of the Board of Directors and recommending candidates for election to the Board of Directors. The Corporate Governance and Nominating Committee will consider recommendations of candidates for the Board of Directors submitted by shareholders of the Company. The Corporate Governance and Nominating Committee is also responsible for periodically evaluating the Company’s risk management process and system in light of the nature of the material risks the Company faces and the adequacy of the Company’s policies and procedures designed to address risk, and recommending to the Board of Directors any changes deemed appropriate by the Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee held one (1) meeting in fiscal 2016. All of our directors serving on the Corporate Governance and Nominating Committee attended at least 75% of the meetings held in fiscal 2016.

Compensation Committee Interlocks and Insider Participation

No member of our Compensation Committee was at any time during fiscal 2016 one of our officers or employees. None of our executive officers serves as a member of the Board of Directors or compensation committee of any entity that has one or more executive officers serving as a member of our Board of Directors or Compensation Committee.

Compensation Programs and Risk

The Company has conducted a risk assessment of the Company’s compensation policies and practices and concluded that the Company’s compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. This risk assessment was conducted by our Compensation Committee. Our Compensation Committee reported the findings of this assessment to our Board of Directors. In this regard, we note that:

• | the Company’s compensation programs, including its standard four-year vesting schedule for option awards, are weighted towards offering long-term incentives that reward sustainable performance; and |

• | the amount of compensation that the Company actually pays is at a reasonable and sustainable level, as determined by a review of the Company’s economic position and prospects, as well as the compensation offered by comparable companies. |

Based on this assessment, the Company concluded that it has a balanced compensation program that does not promote imprudent or excessive risk taking.

Fiscal 2016 Director Compensation

The compensation we pay our non-employee directors is reviewed by our compensation committee and ultimately approved, taking into account information from our Compensation Committee, by our full Board of Directors, which includes one employee director.

We have established a cash compensation program for our non-employee directors. In fiscal 2016, each non-employee director was entitled to the following cash compensation (each retainer is paid quarterly):

Annual retainer for service as Board member | $ | 60,000 | ||

Annual retainer for service as a chairperson of any committee of the Board | $ | 10,000 | ||

Annual retainer for service as chairperson of the Board | $ | 10,000 |

We do not have a policy of automatic equity incentive awards to our non-employee directors either for initial grants when first joining the Board of Directors or in connection with the re-election to the Board of Directors at an annual meeting of shareholders. However, our Board of Directors believes equity compensation is important to attract and retain non-employee directors and to better align their interest with those of our shareholders.

Each non-employee director who was re-elected to the Board at our 2015 annual meeting of shareholders received RSUs with the following terms: (i) a number of restricted stock units equal to $75,000 divided by the price per share of our Common Stock on the date of grant; (ii) the RSU will vest on the earlier of the one year anniversary from the date of grant or the date of the 2016 annual meeting; and (iii) such vesting shall fully accelerate upon a change in control of the Company. We anticipate granting equity awards to our non-employee directors following our annual meeting each year in such amounts to be determined by the Board at that time.

The following chart shows the compensation paid to each non-employee director for their service in fiscal 2016:

Director | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2)(3) | Total ($) | |||

Tor R. Braham | 60,000 | 74,996 | 134,996 | |||

J. Michael Dodson | 70,000 | 74,996 | 144,996 | |||

Martin Manniche | 60,000 | 74,996 | 134,996 | |||

Pete Thompson | 60,000 | 74,996 | 134,996 |

(1) | The amounts listed under “Fees Earned or Paid in Cash” are based on actual payments made to our non-employee directors. |

(2) | Amounts listed in this column represent the aggregate grant date fair value of awards granted for the corresponding fiscal year and calculated in accordance with FASB ASC 718, rather than amounts paid to or realized by the named individual. For the underlying assumptions for this expense, please refer to the footnotes to our consolidated financial statements in our Annual Report on Form 10-K for the corresponding fiscal year. There can be no assurance that awards will vest (in which case no value will be realized by the individual) or that the value on vesting will approximate the compensation expense recognized by us. |

(3) | Our non-employee directors who served during fiscal 2016 held restricted stock units as of January 30, 2016 as follows: |

Director | Restricted Stock Units | ||

Tor R. Braham | 58,022 | ||

J. Michael Dodson | 68,050 | ||

Martin Manniche | 53,829 | ||

Pete Thompson | 72,661 |

Director Nominations

The Corporate Governance and Nominating Committee is responsible for, among other things, determining the criteria for membership to the Board of Directors and recommending candidates for election to the Board of Directors.

The Corporate Governance and Nominating Committee regularly reviews the composition and size of the Board of Directors and makes recommendations to the Board of Directors. The Corporate Governance and Nominating Committee also oversees an annual evaluation of the performance of the Board of Directors as a whole and evaluates the performance of individual members of the Board of Directors.

In its evaluation of director candidates, including the members of the Board of Directors eligible for re-election, the Corporate Governance and Nominating Committee seeks to achieve a balance of knowledge, experience and capability on the Board of Directors and considers (1) the current size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board of Directors, (2) such factors as issues of character, judgment, expertise, business experience, length of service, independence, other commitments and the like, and (3) such other factors as the Corporate Governance and Nominating Committee may consider appropriate. Although we have no formal diversity policy for Board of Directors members, the Board of Directors and the Corporate Governance and Nominating Committee consider diversity of backgrounds and experiences and other forms of diversity when selecting nominees. While the Corporate Governance and Nominating Committee has not established specific minimum qualifications for Director candidates, the Corporate Governance and Nominating Committee believes that candidates and nominees must reflect a Board of Directors that is comprised of directors who (A) are predominantly independent, (B) are of high integrity, (C) have broad, business-related knowledge and experience at the policy-making level in business or technology, including their understanding of the digital media processing industry and the Company’s business in particular, (D) have qualifications that will increase overall Board of Directors effectiveness and (E) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to audit committee members. In evaluating and identifying candidates, the Corporate Governance and Nominating Committee has the authority to retain and terminate any third party search firm that is used to identify director candidates, and has the authority to approve the fees and retention terms of any search firm. After completing its review and evaluation of director candidates, the Corporate Governance and Nominating Committee selects, or recommends to the full Board of Directors for selection, the director nominees.

With regard to candidates who are properly recommended by shareholders or by other means, the Corporate Governance and Nominating Committee will review the qualifications of any such candidate, which review may, in the Corporate Governance and Nominating Committee’s discretion, include interviewing references for the candidate, direct interviews with the candidate, or other actions that the Corporate Governance and Nominating Committee deems necessary or proper.

The Corporate Governance and Nominating Committee recommended all of the nominees for election included in this Proxy Statement.

It is the policy of the Corporate Governance and Nominating Committee to consider recommendations for candidates to the Board of Directors from shareholders. A shareholder who wishes to suggest a prospective nominee for the Board of Directors should notify the Secretary of the Company or any member of the Corporate Governance and Nominating Committee in writing with any supporting material the shareholder considers appropriate. In addition, the Company’s Bylaws contain provisions that address the process by which a shareholder may nominate an individual to stand for election to the Board of Directors at the Company’s Annual Meeting of Shareholders. In order to nominate a candidate for director, a shareholder must give timely notice in writing to the Secretary of the Company and otherwise comply with the provisions of the Company’s Bylaws. To be timely, the Company’s Bylaws currently in effect provide that the Company must have received the shareholder’s notice not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the meeting. Our Board of Directors has adopted an amendment to our Bylaws that will be effective immediate after the Annual Meeting that provides that in order to be timely, the Company must have received the shareholder’s notice no later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the one-year anniversary of the annual meeting from the prior year; provided, however, that in the event that no annual meeting was held in the previous year or the date of the annual meeting has been changed by more than thirty days from the one-year anniversary of the date of the previous year’s meeting, notice by the shareholder to be timely must be so received not later than the close of business on the later of 120 days in advance of such meeting or 10 calendar days following the date on which public announcement of the date of the meeting is first made. Information required by the Bylaws to be in the notice include the name and contact information for the candidate and the person making the nomination and other information about the nominee that must be disclosed in proxy solicitations under Section 14 of the Securities Exchange Act of 1934 and the related rules and regulations under that section.

Shareholder nominations must be made in accordance with the procedures outlined in, and include the information required by, the Company’s Bylaws and must be addressed to:

Secretary

Sigma Designs, Inc.

47467 Fremont Blvd.

Fremont, California 94538

You can obtain a copy of the full text of the Bylaw provision by writing to the Company’s Secretary at the above address.

Communications with the Board of Directors

If you wish to communicate with the Board of Directors, you may send your communication in writing to:

Board of Directors

Sigma Designs, Inc.

47467 Fremont Blvd.

Fremont, California 94538

You must include your name and address in the written communication and indicate whether you are a shareholder of the Company. The communication will be directed to the Company’s Chief Financial Officer, who will log the date of receipt of a communication as well as the identity of the correspondent in the Company’s shareholder communications log. Our Chief Financial Officer will review and summarize the communication for the Board of Directors in a timely manner. The summary will be in the form of a memo, which will become part of the Company’s shareholder communications log. All members of the Board of Directors have access to the shareholder communications log. Our Chief Financial Officer will then forward the original shareholder communication along with the memo to each director (or the chairman of the applicable committee, if the communication is addressed to a committee) for review. If the communication is addressed to the Board of Directors, the Chairman of the Audit Committee will, on behalf of the Board of Directors, facilitate review of and, if appropriate, direct a response to the communication. If the communication is addressed to the members of one of our committees, the lead committee member will facilitate such review and appropriate response. Communications relating to accounting, internal controls or auditing matters will be handled in accordance with the Company’s “Complaint Procedures for Accounting and Auditing Matters.” The Company will retain all shareholder communications, the shareholder communications log and all related documentation as required under applicable law.

Attendance at Annual Shareholder Meetings by the Board of Directors

The Company has a policy of encouraging, but not requiring, directors to attend the Company’s Annual Meeting of Shareholders. All of our directors who were serving at that time attended the 2015 Annual Meeting of Shareholders.

Executive Officers

The names of our executive officers, their ages as of May 1, 2016, and their positions are shown below.

Name | Age | Position | ||

Thinh Q. Tran | 62 | President and Chief Executive Officer | ||

Elias N. Nader | 51 | Chief Financial Officer and Secretary | ||

Sal Cobar | 63 | Senior Vice President, Chief Marketing and Sales Officer |

Our Board appoints executive officers, who then serve at the Board’s discretion.

For information regarding Mr. Tran, please refer to “Board of Directors” above.

Elias N. Nader has served as our Chief Financial Officer since April 2014. Mr. Nader served as our interim chief financial officer from March 2013 to April 2014 and as our corporate controller from October 2012 to March 2013. Prior to joining us, Mr. Nader served as a chief financial officer consultant with various companies in Europe and the Middle East from October 2011 to September 2012. From June 2010 to September 2011, Mr. Nader served as group chief financial officer with Imperial Jet, a VIP business aircraft company based in Europe and the Middle East. From June 2005 to June 2010, Mr. Nader served as corporate controller at Dionex Corporation, a chromatography company based in Sunnyvale, California. Mr. Nader serves on the board of directors of YuMe, Inc., a global audience technology company. Mr. Nader received a bachelor’s degree in Business Administration from San Jose State University and an MBA from San Jose State University.

Sal Cobar has served as our Senior Vice President, Chief Marketing and Sales Officer since July 2015 and as Vice President, Worldwide Sales and Business Development from April 2010 to July 2015. From April 2007 to April 2010, Mr. Cobar served as Vice President of Worldwide Sales of Silicon Image, Inc., a developer of secure cores for high definition display and distribution for the television, set-top box and consumer markets. From April 2001 to April 2007, Mr. Cobar served as Silicon Image’s Senior Director, Strategic Accounts and Americas Sales, where he was instrumental in developing and spearheading Silicon Image’s overall strategic account sales initiatives as well as leading the Americas sales team of Silicon Image. Prior to joining Silicon Image, Mr. Cobar held several strategic sales and marketing positions during his 12-year tenure at Sun Microsystems. In those positions, Mr. Cobar had management and executive responsibilities for engineering, operations and the creation and execution of new markets for network-based thin client technology. In June 1980, Mr. Cobar joined Xerox Corporation for nine years driving multiple engineering and operations initiatives. Mr. Cobar received a bachelor’s degree in Systems Engineering from San Jose State University and an MBA from Golden Gate University.

Code of Ethics

The Company has adopted a Code of Business Conduct and Ethics, or the Code, which is applicable to our directors, officers and employees. The Code of Business Ethics and Conduct is available on the Company’s website at http://www.sigmadesigns.com-“Corporate”-“Governance.” The Company will disclose any amendment to the Code or waiver of a provision of the Code applicable to an officer or director in accordance with applicable law, including the name of the officer to whom the waiver was granted, on the Company’s website at http://www.sigmadesigns.com-“Corporate”-“Governance.”

Certain Relationships and Related Transactions

It is the Company’s policy that all employees, officers and directors must avoid any activity that is or has the appearance of conflicting with the interests of the Company. This policy is included in the Company’s Code of Business Conduct and Ethics. The Company conducts a review of all related party transactions for potential conflict of interest situations on an ongoing basis. The Company’s Audit Committee must approve any waiver of the Code of Business Conduct and Ethics for Senior Executives, including related party transactions. All waivers to the Code of Business Conduct and Ethics must be approved by the Company’s Board of Directors or a committee of the Board of Directors responsible for corporate governance.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee of the Board of Directors is composed of three directors, each of whom qualifies as “independent” under the current listing requirements of the NASDAQ Stock Market. The current members of the Audit Committee are Pete Thompson, Tor R. Braham and J. Michael Dodson. The Audit Committee acts pursuant to a written charter.

In performing its functions, the Audit Committee acts in an oversight capacity and necessarily relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent registered public accounting firm, who, in their report, express an opinion on the conformity of the Company’s annual financial statements with accounting principles generally accepted in the United States and on management’s assessment of and the effectiveness of the Company’s internal control over financial reporting. It is not the duty of the Audit Committee to plan or conduct audits, to determine that the Company’s financial statements are complete and accurate and are in accordance with generally accepted accounting principles, or to assess the Company’s internal control over financial reporting.

Within this framework, the Audit Committee has reviewed and discussed with management the Company’s audited financial statements as of and for the year ended January 31, 2016. The Audit Committee has also discussed with the independent registered public accounting firm the matters required to be discussed by Auditing Standards No. 16, “Communications with Audit Committees,” as adopted by the Public Company Accounting Oversight Board. In addition, the Audit Committee has received the written disclosures from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board, has discussed with the independent registered public accounting firm, Armanino LLP, the independence of that firm, and has considered whether the provision of non-audit services was compatible with maintaining the independence of that firm.

Based upon these reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended January 31, 2016 for filing with the SEC.

Audit Committee

J. Michael Dodson (Chairman)

Tor R. Braham

Pete Thompson

THE FOREGOING AUDIT COMMITTEE REPORT SHALL NOT BE DEEMED TO BE “SOLICITING MATERIAL” OR TO BE FILED WITH THE SEC, NOR SHALL SUCH INFORMATION BE INCORPORATED BY REFERENCE INTO ANY PAST OR FUTURE FILING UNDER THE SECURITIES ACT OF THE EXCHANGE ACT, EXCEPT TO THE EXTENT SIGMA SPECIFICALLY INCORPORATES BY REFERENCE INTO SUCH FILING.

PROPOSAL 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed the firm of Armanino LLP as the Company’s independent registered public accounting firm for the fiscal year 2017. Representatives of Armanino LLP are expected to be present at the Company’s Annual Meeting. They will have an opportunity to make a statement, if they desire to do so, and will be available to respond to appropriate questions.

Ratification of Appointment of Armanino LLP

Ratification will require the affirmative vote of a majority of the shares present and entitled to vote. Shareholder ratification of the selection of Armanino LLP as the Company’s independent registered public accounting firm is not required by the Company’s Bylaws or otherwise. However, the Board of Directors is submitting the selection of Armanino LLP to the shareholders for ratification as a matter of corporate practice. If the shareholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its shareholders.

Recommendation of the Board of Directors

The Board of Directors recommends a vote “FOR” ratification of Armanino LLP as the Company’s independent registered public accounting firm.

Fees Paid to Independent Registered Public Accounting Firm

The following table sets forth the fees billed for services rendered by Armanino LLP for each of our last two fiscal years.

2016 | 2015 | |||||||

Audit fees (1) | $ | 1,001,948 | $ | 996,340 | ||||

Tax-related fees (2) | 276,475 | 169,255 | ||||||

Total | $ | 1,278,423 | $ | 1,165,595 | ||||

(1) | Audit fees represent fees for professional services provided in connection with their audit of the Company’s consolidated financial statements, their audit of the effectiveness of internal control over financial reporting, reviews of the consolidated financial statements included in the Company’s quarterly reports on Form 10-Q and related statutory and regulatory filings. |

(2) | Tax fees represent fees for professional services related to tax returns, tax compliance, tax advice and tax planning. |

Pre-Approval Policies and Procedures

The Company’s Audit Committee is responsible for appointing, setting compensation for and overseeing the work of the Company’s independent registered public accounting firm. In connection with these responsibilities, the Company’s Audit Committee adopted a policy for pre-approving the services and associated fees of the Company’s independent registered public accounting firm. Under this policy, the Audit Committee must pre-approve all audit and audit related services. All of the services in fiscal 2015 and 2016 were pre-approved by the Audit Committee. The policy also mandates that no engagements of the Company’s independent registered public accounting firm for non-audit services may be entered into without the express approval of the Audit Committee.

PROPOSAL 3

ADVISORY VOTE ON OUR EXECUTIVE COMPENSATION

This Proposal 3, which is commonly referred to as a “say-on-pay” vote, provides you with the opportunity to advise our Board and Compensation Committee regarding your approval of the compensation of our named executive officers as described in the Executive Compensation section, accompanying compensation tables and narrative disclosure set forth in this proxy statement. This vote is not intended to address any specific item of compensation or the compensation of any particular named executive officer, but rather the overall compensation of our named executive officers as well as the philosophy and objectives of our executive compensation programs.

As described in the Compensation Discussion and Analysis, we design our named executive officer compensation programs to attract and retain highly qualified talent, align the interests of our executives with shareholders and to manage resources efficiently. Our compensation takes into account competitive practices and sound compensation governance principles.

Our Board asks that you indicate your support of the compensation of our named executive officers as disclosed in the Compensation Discussion and Analysis and Executive Compensation sections of this Proxy Statement. You are not being asked to approve the compensation paid to the members of our Board of Directors as disclosed above under “Director Compensation” or approve our policy regarding employee compensation as it related to our risk management as disclosed above under “Board of Directors – Risk Oversight.” Accordingly, we ask our shareholders to vote “For” the following resolution at the Annual Meeting:

“RESOLVED, the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussions is hereby approved, on an advisory basis.”

Although the vote is non-binding, our Board of Directors and the Compensation Committee will review the voting results. To the extent there is any significant negative vote on this proposal, we would attempt to consult directly with shareholders to better understand the concerns that influenced the vote. Our Board of Directors and the Compensation Committee would consider constructive feedback obtained through this process in making future decisions about executive compensation programs.

Required Vote

This vote, which is commonly referred to as the “say-on-pay vote,” is not binding on the Company, our Compensation Committee and our Board of Directors. We value, however, the opinions of our shareholders and the Compensation Committee will take into account the result of the vote on this proposal when determining future executive compensation.

Our Board of Directors recommends a vote FOR this proposal.

PROPOSAL 4

APPROVAL OF FREQUENCY FOR HOLDING AN

ADVISORY VOTE ON EXECUTIVE COMPENSATION

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934 (which was added by the Dodd-Frank Wall Street Reform and Consumer Protection Act and the related rules of the SEC), we are asking shareholders to vote, on an advisory basis, on how frequently they would like to hold an advisory vote on our executive compensation (which is referred to in this Proxy Statement as a “say-on-pay vote”). By voting on this Proposal 4, shareholders may indicate whether they would prefer an advisory vote on our executive compensation once every one, two or three years.

After careful consideration, our Board recommends holding an advisory vote on our named executive officer compensation once every three years (a “triennial” vote). We believe that a triennial vote will be the most effective means for conducting and responding to a say-on-pay vote. An advisory vote held every three years will provide our Board and the compensation committee with sufficient time to thoughtfully evaluate and respond to stockholder input and effectively implement desired changes to compensation programs. The results of a say-on-pay vote received at our Annual Meeting will be considered by our management and our Board as we develop our compensation policies for the coming fiscal year. Accordingly, we believe that a triennial vote is appropriate as it allows time for any changes to incentive programs to be designed, implemented, and for the results to be evaluated and reported shareholders. A triennial vote will also provide shareholders with sufficient time to evaluate the effectiveness of incentive programs, compensation strategies and our performance. Because our executive compensation programs do not generally change significantly from year to year, a triennial vote avoids the cost of including an additional proposal and vote in the annual meeting proxy statement more frequently.

You may cast your vote on your preferred voting frequency by choosing the option of one year, two years, three years or abstain from voting.

Required Vote

The option receiving the highest number of votes will be considered to be the preferred frequency for holding an advisory vote on our executive compensation. However, because this vote is advisory and non-binding on our Board or us in any way, our Board may decide that it is in the best interests of our shareholders and us to hold an advisory vote on executive compensation more or less frequently than the option receiving the highest number of votes. If you own shares through a bank, broker or other holder of record, you must instruct your bank, broker or other holder of record how to vote in order for them to vote your shares so that your vote can be counted on this proposal. Unless marked to the contrary, proxies received from shareholders of record will be voted “FOR” approval.

Our Board recommends a vote for the approval of an advisory vote every

3 YEARS on our executive compensation.

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

This section contains a discussion and analysis of how, and the reasons why, we compensate our Chief Executive Officer, Chief Financial Officer and our highest paid other executive officer, our Senior Vice President, Chief Marketing and Sales Officer, who we refer to collectively as our named executive officers. In this section, we discuss our executive officer compensation philosophy and objectives, the process under which our executive officer compensation is determined and the elements of our executive compensation program, including a discussion of our compensation decisions for fiscal 2016 and to date in fiscal 2017.

The Compensation Committee of our Board of Directors, which we refer to as the Committee in this section, administers the compensation program for our named executive officers. The Compensation Committee may not delegate its authority in these matters to other persons.

Our Executive Compensation Philosophy and Objectives

We are engaged in a dynamic and competitive industry. Our success depends upon our talented employees, and the leadership provided by our named executive officers is a key factor in our success. The Committee has designed our executive compensation program to achieve the following objectives:

• | Manage resources efficiently. Employee compensation is a significant expense for us. We strive to manage our compensation programs to balance our need to reward and retain executives with preserving shareholder value. |

• | Align the interests of our executives with shareholders. We believe our programs should reward our executive officers for contributions to increase our shareholder value. |

• | Attract and retain highly qualified talent. We compete for talented executives with leading technology companies worldwide along with both technology start-ups and established businesses. Our compensation programs allow us to attract and retain dynamic, experienced people who are motivated by the challenges and opportunities of growing our business. |

Our compensation program is designed to reward the contributions of our executive officers to our overall corporate performance. In late fiscal 2015, the Committee began a comprehensive evaluation of our executive compensation program to evaluate its market competiveness and to recognize the progress we had made in our business. This evaluation continued in early fiscal 2016, when the Committee’s focus was on our corporate-wide objective of operating profitably and increasing revenue growth. As a result, in fiscal 2016, the base salary for our executive officer compensation remained relatively flat, but we implemented a cash incentive bonus program.

In fiscal 2016, the Committee completed a comprehensive review of our executive officer compensation policies and programs. This review consisted, among other things, of a review of our executive officer compensation philosophy, pay practices, the implementation of an executive incentive compensation plan, a review of market comparable data and the use of an independent compensation consultant. In its review of market comparable data, the Committee observed that in fiscal 2015, the total direct compensation paid to our executive officers was significantly below the 50th percentile of our peer group of companies. As a result, the Committee established a multi-year objective of moving total direct compensation for our executive officers so that they would each be paid total direct compensation in or near the 50th percentile of our peer group of companies. As part of its review process, the Committee also reviewed the individual performance of each executive and the leadership demonstrated by the executive during the prior period. Although there were no qualitative or quantitative measures established prior to an evaluation of an individual’s performance, the Committee reviewed the contributions made by an officer to our overall business performance and the performance of the business department for which the officer is primarily responsible. The type of contributions can vary depending on the officer and the business department.

In fiscal 2017, the Committee reviewed our executive officer compensation, including a review of our executive officer compensation philosophy, pay practices, incentive plans, updated market comparable data and the use of an independent compensation consultant. The Committee also reviewed the individual performance of each executive officer and the contributions by the executive officer to our corporate performance in fiscal 2016 and to date in fiscal 2017.

Components of Compensation

In an effort to meet our compensation objectives, our executive compensation program consists of the following components:

• | Base salary. The Committee believes that base salary should provide executives with a predictable income sufficient to attract and retain strong talent in a competitive marketplace. The Committee generally sets executive base salaries at levels that it believes enables us to hire and retain individuals in a competitive environment, while taking into account our corporate objective of operating profitably. |

• | Equity Awards. The Committee believes that long-term equity incentives that vest over a period of time and focus executives on increasing long-term shareholder value are key retention devices for executives through use of multi-year vesting periods. The Committee also believes that equity awards should consist of a mix of stock options and restricted stock units to balance the incentives of the executives to increase our stock price beyond the current trading price when options are granted, with the certainty that full value awards, such as restricted stock units, will provide some level of compensation with the potential upside that would result with stock price appreciation. |

• | Executive Officer Bonus Plan. Historically, the Committee has awarded cash bonuses on a case-by-case basis in recognition of strong company performance or to reward significant individual contributions. In March 2015, the Committee adopted a fiscal 2016 cash incentive bonus plan for executive officers and awards under such plan are earned based on the achievement of certain company performance criteria. This cash incentive bonus structure was maintained by the Committee for fiscal 2017. |

• | Discretionary Cash Bonus Awards. The Committee has retained the discretion to determine individual cash bonus awards after the completion of a fiscal year. |

• | Change in Control and Severance Benefits. The Committee determined that change in control and severance arrangements are necessary to align our executive compensation with our peer group and serve as a strong retention device for our executive officers. |

• | General Benefits. We provide generally competitive benefits packages, such as medical, life and disability insurance, to our executives on the same terms as our other employees. |

The Committee views these components of executive compensation as related, but does not believe that compensation should be derived entirely from one component. The Committee has not adopted a formal or informal policy for allocating compensation between long-term and current compensation or between cash and non-cash compensation.

Our Process of Establishing Executive Compensation

Our executive compensation program is administered by the Committee. Late in fiscal 2015, the Committee retained an independent compensation consultant, Radford, to assist with the compensation-determination process for all executive officers, including our Chief Executive Officer, and to conduct a comparative study of our executive compensation. The Committee referred to the data provided by Radford toward the end of fiscal 2015 during the Committee’s review of executive compensation in fiscal 2016. Finally, the Committee also took into account the results of the shareholder advisory vote on our executive compensation from the 2015 annual meeting of shareholders, where the shareholders voted in favor of our executive compensation.

In making its compensation decisions in fiscal 2016, the Committee utilized the prior market assessment conducted by Radford. The Committee believed the peer group of companies identified by Radford was still relevant to the Company and, as such, did not engage Radford to update the data. This market assessment consisted of a review of compensation information from a select group of peer companies (identified below) and utilized information from a database selected by Radford. In late fiscal 2015, the Committee, with the assistance of Radford, developed the list of peer companies based on companies meeting one or more of the following criteria: (i) industry group, a company that competes within the semiconductor and related devices industry; (ii) annual revenue; and (iii) market cap size. The Committee took into account feedback provided by the management team in assessing which companies compete with us in the semiconductor and related devices industry. Based on the Committee’s approved criteria, the following companies were selected to form our peer group:

Alpha and Omega Semiconductor | Applied Micro Circuits | Audience |

DSP Group | Entropic Communication | Inphi |

Integrated Silicon Solution | Intermolecular | IXYS |

Lattice Semiconductor | MaxLinear | NeoPhotonics |

Peregrine Semiconductor | Pericom Semiconductor | Power Integrations |

PLX Technology | Silicon Image | Vitesse Semiconductor |

ViXS Systems |

|

|

The peer group of companies is the same group of companies used for fiscal 2015.

In fiscal 2017, the Committee utilized a market assessment provided by Radford, which assessment was based on the same peer group of companies used in prior years. However, certain companies were removed from the peer group as a result of being acquired in the prior year.

Our Compensation Program Decisions

Base Salary

In March 2015, after completing a comprehensive review of executive officer compensation policies and programs as discussed above, the Committee approved the following changes to our executive officers’ annual base salaries:

• | For our President and Chief Executive Officer, annual base salary was changed from $364,500 to $375,400, a three percent (3%) increase; |

• | For our Chief Financial Officer, annual base salary was changed from $275,000 to $283,300, a three percent (3%) increase; and |

• | For our Senior Vice President, Chief Marketing and Sales Officer, annual base salary was changed from $187,200 to $279,200, a 49% increase. This change in annual base salary was a result of the Committee’s decision to shift a significant amount of variable compensation previously based on sales commissions into base salary. As a result of these changes, the aggregate increase in total cash compensation was expected to be less than three percent (3%) compared to the prior fiscal year. |

In July 2016, after completing a review of executive officer compensation, including a review of market comparable data, the Committee approved the following changes to our executive officers’ annual base salaries:

• | For our President and Chief Executive Officer, annual base salary was changed from $375,400 to $394,200, a five percent (5%) increase; |

• | For our Chief Financial Officer, annual base salary was changed from $283,300 to $300,000, a six percent (6%) increase; and |

• | For our Senior Vice President, Chief Marketing and Sales Officer, annual base salary was changed from $279,200 to $287,600, a 3% increase. |

The Committee’s decision to increase base salary for each of our executive officers was in furtherance of its overall multi-year objective and philosophy to move total direct compensation in the 50th percentile compared to our peer group of companies.

Executive Officer Bonus Plan

In March 2015, the Committee approved a Fiscal 2016 Executive Officer Bonus Plan (the “2016 Bonus Plan”), in which each of our executive officers was eligible to participate. The material terms of the 2016 Bonus Plan were as follows:

• | Annual bonuses were earned and paid based on achievement against annual goals. The specific annual goals were based on achieving or exceeding certain operation income targets, as well as individual performance metrics specific to the executive’s role within the Company. These targets were designed to implement a pay-for-performance culture at the Company. |

• | Executive officers were eligible to earn cash bonuses upon the attainment of both financial and operational performance objectives. In the case of our Chief Executive Officer, one-third of his bonus was based on a revenue target for fiscal 2016 of $234 million, one-third of his bonus was based on a profitability target of $4.0 million for fiscal 2016 and the remaining one-third of the bonus was based on individual management objectives. In the case of our Chief Financial Officer, 25% of his bonus was based on a quarterly operating expense target of $26.4 million for the first quarter, $26.5 million for the second quarter, $27.6 million for the third quarter and $27.7 million for the fourth quarter (with each quarter equally weighted in determining the payout), 25% of his bonus was based on a profitability target of $4.0 million for fiscal 2016 and 50% of his bonus was based on individual management objectives, including managing the audit process, SEC reporting obligations and international tax activities. Our Senior Vice President, Chief Marketing and Sales Officer’s entire incentive bonus was based on a profitability target of $4.0 million for fiscal 2016. Although our most senior sales officer is focused on revenue growth, the Committee believed it was appropriate to re-inforce the importance of profitability as a corporate objective. Our Senior Vice President, Chief Marketing and Sales Officer was also incentivized by his sales commission plan, which provided a percentage commission based on a revenue target of $234 million. |

• | Payouts under the 2016 Bonus Plan were based on the level of attainment of the specified objectives. |

• | For our Chief Executive Officer, the total target cash bonus amount is 75% of base salary, or $281,550. |

• | For our Chief Financial Officer, the total target bonus amount is 45% of base salary, or $127,485. |

• | For our Senior Vice President, Chief Marketing and Sales Officer, the total target bonus amount is 45% of base salary, or $125,640, which includes the sales commission plan described below. |

In July 2016, the Committee approved a Fiscal 2017 Executive Officer Bonus Plan (the “2017 Bonus Plan”), in which each of our executive officers was eligible to participate. The material terms of the 2017 Bonus Plan were as follows: