UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

X-RITE, INCORPORATED

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

X-RITE, INCORPORATED

4300 44TH STREET, S.E.

GRAND RAPIDS, MICHIGAN 49512

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 18, 2011

April 5, 2011

Dear Shareholder:

You are cordially invited to attend the Annual Meeting of Shareholders of X-Rite, Incorporated, a Michigan corporation (“X-Rite” or the “Company”), which will be held on May 18, 2011, at 8:00 a.m., Central Daylight Time, at the offices of Winston & Strawn LLP, 35 West Wacker Drive, Chicago, Illinois 60601, for the following purposes:

1. To elect three directors to the Company’s Board of Directors as set forth in the accompanying Proxy Statement;

2. To approve a proposed amendment to the Company’s Articles of Incorporation to increase the number of authorized shares of common stock;

3. To approve the adoption of the X-Rite Incorporated 2011 Omnibus Long Term Incentive Plan;

4. To vote on a non-binding resolution to approve the compensation of the Company’s Named Executive Officers, as described in the Compensation Discussion and Analysis section, the tabular disclosure regarding such compensation, and the accompanying narrative disclosure, set forth in the Proxy Statement;

5. To vote on a non-binding basis to determine the frequency (whether annual, biennial or triennial) with which shareholders of the Company shall be entitled to have an advisory vote on executive compensation; and

6. To transact such other business as may properly come before the Annual Meeting and any postponement(s) or adjournment(s) thereof.

The record date for the Annual Meeting is March 22, 2011. Only shareholders of record as of the close of business on March 22, 2011 are entitled to receive notice of, and to vote at the Annual Meeting.

The Company is again pleased to take advantage of the Securities and Exchange Commission (the “SEC”) rules that allow issuers to furnish proxy materials to their shareholders via the Internet. These rules allow the Company to provide you with the information you need while lowering the costs and environmental impact associated with printing and mailing proxy materials for the Annual Meeting. On or about April 5, 2011, the Company will mail to its shareholders a notice containing instructions on how to access the proxy materials and vote on the matters described above. In addition, the notice will include instructions on how you can request a paper copy of the proxy materials.

We are pleased to offer multiple options for voting your shares. As detailed in the “Solicitation of Proxies” section of this Notice and Proxy Statement, you can vote your shares via the Internet or by telephone, mail or written ballot at the Annual Meeting. We encourage you to vote via the Internet as it is the most cost-effective method for us.

Whether you attend the meeting or not, your vote is important, and we encourage you to vote them promptly. In addition, you may revoke your proxy at any time before it is voted at the meeting. You may do so by delivering to the Secretary of X-Rite a signed written notice of revocation that is dated later than the date of your proxy, by executing and returning a proxy card dated later than the previous one or by attending the meeting and notifying the secretary of the meeting in writing prior to the voting of your proxy of your intention to vote in person. If you hold your shares through a bank or brokerage firm, you should follow the instructions of your bank or brokerage firm regarding revocation of proxies.

By order of the Board of Directors,

Rajesh K. Shah

Secretary

THE DATE OF THIS PROXY STATEMENT IS APRIL 5, 2011,

AND IT IS FIRST BEING DELIVERED OR OTHERWISE MADE AVAILABLE

TO SHAREHOLDERS ON OR ABOUT APRIL 5, 2011.

2

2010 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TABLE OF CONTENTS

i

ii

X-RITE, INCORPORATED

4300 44TH STREET, S.E.

GRAND RAPIDS, MICHIGAN 49512

PROXY STATEMENT

APRIL 5, 2011

SUMMARY OF THE ANNUAL MEETING

Time, Place and Purpose

This Proxy Statement is being furnished to shareholders as part of the solicitation of proxies by the Board of Directors for use at the Annual Meeting to be held on May 18, 2011, starting at 8:00 a.m., Central Daylight Time, at the offices of Winston & Strawn LLP, 35 West Wacker Drive, Chicago, Illinois 60601, and any adjournment or postponement thereof.

Agenda

At the Annual Meeting, shareholders will vote on the following proposals:

1. To elect three directors to the Company’s Board of Directors (the “Board”) as set forth in the Proxy Statement;

2. To approve a proposed amendment to the Company’s Articles of Incorporation to increase the number of authorized shares of common stock;

3. To approve the adoption of the X-Rite, Incorporated 2011 Omnibus Long Term Incentive Plan;

4. To vote on a non-binding resolution to approve the compensation of the Company’s Named Executive Officers, as described in the Compensation Discussion and Analysis section, the tabular disclosure regarding such compensation, and the accompanying narrative disclosure, set forth in the Proxy Statement;

5. To vote on an advisory (non-binding) basis to determine the frequency (whether annual, biennial or triennial) with which shareholders of the Company shall be entitled to have an advisory vote on executive compensation; and

6. To transact such other business as may properly come before the Annual Meeting and any postponement(s) or adjournment(s) thereof.

Voting Securities and Record Date

The holders of record of shares of the Company’s common stock, par value $.10 per share, as of the close of business on March 22, 2011, the record date for the Annual Meeting, are entitled to receive notice of, and to vote at, the Annual Meeting. On the record date, there were 85,928,254 shares of common stock outstanding.

Shareholders are entitled to one vote for each share of the Company’s common stock registered in their names at the close of business on the record date. A majority of the shares entitled to vote represented in person or by proxy will constitute a quorum for action at the Annual Meeting. Directors are elected by a plurality of the votes cast by shareholders entitled to vote on their election at a meeting at which a quorum is present. A “plurality” means that the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors to be elected at the Annual Meeting. Similarly, with respect to the proposal to approve, on a non-binding basis, the frequency of future non-binding votes on executive compensation, the

1

frequency alternative receiving the most votes will be the choice of the shareholders. For each other item, the affirmative vote of the holders of a majority of the shares represented in person or by proxy and entitled to vote on the item will be required for approval. Abstentions and proxies relating to “street name” shares that are voted by brokers on some matters, but not on other matters as to which authority to vote is withheld from the broker (“broker non-votes”) absent voting instructions from the beneficial owner, are counted for the purpose of determining the presence or absence of a quorum for the transactions of business. However, abstentions and broker non-votes will be disregarded in tabulating the votes on all matters brought before the meeting.

Notice and Access of Proxy Statement

The Company has again elected to deliver its proxy materials to shareholders electronically via the Internet, as permitted by rules adopted by the United States Securities and Exchange Commission (the “SEC”). Accordingly, the Company will send a Notice of Internet Availability of Proxy Materials (the “Notice”) to shareholders who have not previously opted to receive a printed copy of the proxy materials by mail or enrolled in the electronic delivery service described in “Electronic Delivery of Proxy Statement and Annual Report” above. Instructions on how to access the proxy materials and vote over the Internet and how to request a printed copy of the proxy materials may be found on the Notice. In addition, the Notice includes instructions on how shareholders may request to receive future proxy materials in printed form by mail or electronically by e-mail on an ongoing basis. The Company encourages you to take advantage of the availability of the proxy material on the Internet.

Electronic Delivery of Proxy Statement and Annual Report

This Proxy Statement and the 2010 Annual Report are available on the Company’s Internet site athttp://ir.xrite.com.

Shareholders can elect to receive future Proxy Statements and Annual Reports via e-mail instead of receiving paper copies in the mail or through notice and access as described in “Notice and Access of Proxy Statement” below. If you are a shareholder of record, you can enroll in the electronic delivery service and save the Company the cost of producing and mailing these documents by:

| | 1. | Following the instructions provided when you vote over the Internet, or |

| | 2. | Going to the Company’s Internet page athttp://ir.xrite.com and following the instructions provided to enroll in the electronic delivery service. |

If you are a shareholder of record and enroll in the electronic delivery service, you will receive an annual e-mail message containing the Internet address to access the Company’s Proxy Statement and Annual Report. The e-mail also will include instructions for voting over the Internet.

If you hold your shares in “street name,” and enroll in the electronic delivery service and your bank, broker or other holder of record participates in the service; you will receive an annual e-mail message containing the Internet address to use to access the Company’s Proxy Statement and Annual Report.

Proxies; Revocation

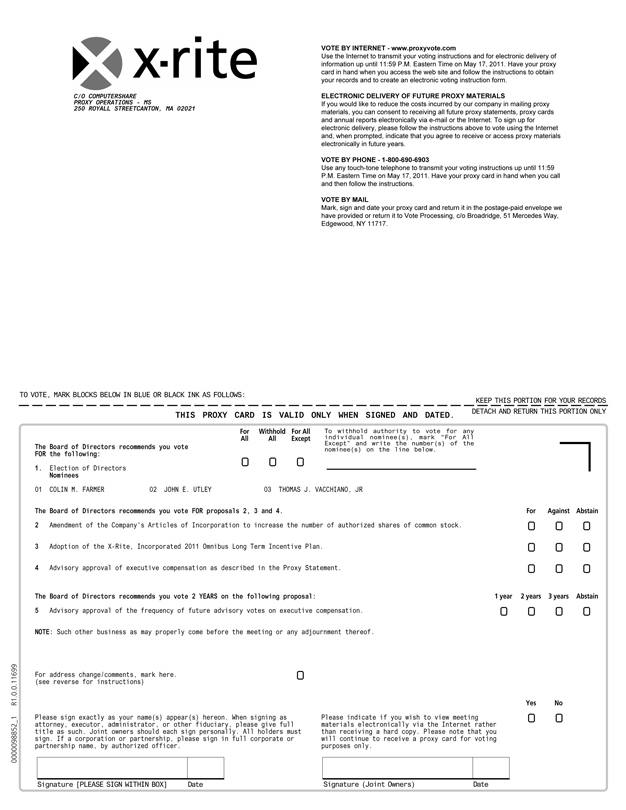

The use of a proxy allows a shareholder of X-Rite to be represented at the Annual Meeting if he or she is unable to attend the meeting in person. There are four (4) ways to vote your shares:

| | 1. | By the Internet at www.proxyvote.com; |

| | 2. | By toll-free telephone at 1-800-690-6903; |

| | 3. | By completing and mailing your proxy card; and |

| | 4. | By written ballot at the meeting. |

2

Telephone and Internet voting for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern time on May 17, 2011. If you vote your shares using any of the methods described above, the shares represented by the proxy will be voted at the meeting or at any adjournment or postponement thereof. Where shareholders specify a choice, the shares will be voted as specified. If no choice is specified on a properly executed proxy card, the shares represented by the proxy will be voted “FOR” the election of the directors listed as nominees in the proxy, “FOR” the amendment of the Company’s Articles of Incorporation, “FOR” the adoption of the X-Rite, Incorporated 2011 Omnibus Long Term Incentive Plan, “FOR” the advisory vote on executive compensation, and “FOR” the two year frequency option on the advisory vote on executive compensation. A proxy may be revoked prior to its exercise by (1) delivering to the Secretary of X-Rite a signed written notice of revocation that is dated later than the date of your proxy, (2) delivering of a later-dated proxy, including by telephone or Internet vote, or (3) attending the meeting in person and notifying the secretary of the meeting in writing prior to the vote of your proxy that you intend to vote your shares in person and voting your shares at the meeting. Attendance at the meeting, in and of itself, will not constitute a revocation of a proxy.

Shares Held Through a Bank, Broker or Other Nominee

If you are the beneficial owner of shares held in “street name” through a bank, broker or other nominee, such bank, broker or nominee, as the record holder of the shares, must vote those shares in accordance with your instructions. If you do not give instructions to your broker, your broker can vote your shares with respect to “discretionary” items but not with respect to “non-discretionary” items. On non-discretionary items for which you do not give instructions, the shares will be treated as “broker non-votes.” A discretionary item is a proposal that is considered routine under the rules of NASDAQ. Shares held in street name may be voted by your broker on discretionary items in the absence of voting instructions given by you. X-Rite does not expect that any matter other than those described above under “Agenda” will be brought before the Annual Meeting. If, however, other matters are properly presented at the Annual Meeting or any adjournment or postponement of the Annual Meeting, the persons appointed as proxies will have discretionary authority to vote the shares represented by duly executed proxies in accordance with their discretion and judgment. No items on the agenda for the Annual Meeting are considered routine matters.

If you have instructed your broker to vote your shares, the above-described options for revoking your proxy do not apply and instead you must follow the directions provided by your broker to change these instructions.

Solicitation of Proxies

The Board and management of the Company are making this solicitation of proxies from shareholders. The cost of the solicitation of proxies will be borne by the Company. In addition to the use of the mails, proxies may be solicited personally or by telephone or facsimile by regular employees of the Company without additional compensation. In addition, brokers, nominees, custodians, and other fiduciaries will be reimbursed by the Company for their expenses in connection with sending proxy materials to beneficial owners.

Adjournments and Postponements

Although it is not expected, the Annual Meeting may be adjourned or postponed. Any adjournment or postponement may be made without notice, other than an announcement made at the Annual Meeting, by approval of the holders of a majority of the outstanding shares of common stock present in person or represented by proxy at the Annual Meeting, whether or not a quorum exists. Any signed proxies received by X-Rite will be voted in favor of an adjournment or postponement in these circumstances, other than in the event a new record date is set. Any adjournment or postponement of the Annual Meeting will allow X-Rite shareholders who have already sent in their proxies to revoke them at any time prior to their exercise.

3

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Articles of Incorporation specify that the Board shall consist of at least six (6), but not more than nine (9) members, with the exact number to be fixed by the Board from time to time. The Board has fixed the number of directors at nine (9). The Articles of Incorporation also specify that the Board be divided into three classes, with the directors of the classes to hold office for staggered terms of three (3) years each.

The Board has nominated Colin M. Farmer, John E. Utley and Thomas J. Vacchiano, Jr. for election as directors to three-year terms expiring in 2014. Messrs. Farmer, Utley and Vacchiano are presently serving as directors of the Company. The Board has determined that Messrs. Farmer and Utley are independent, as further described below under “Director Independence.” All nominees have consented to being named in this Proxy Statement and to serve as directors of the Company if elected.

Unless otherwise specifically directed by a marking on a shareholder’s proxy, the persons named as proxy voters in the accompanying proxy will vote FOR the nominees described below. If any of these nominees were to become unable to serve as a director, which is not now anticipated, the Board may designate a substitute nominee, in which case the accompanying proxy will be voted for the substituted nominee. Alternatively, the Board may reduce the number of directors to be elected at the Annual Meeting. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Directors are elected by a plurality of the votes cast by shareholders entitled to vote on their election at a meeting at which a quorum is present. A “plurality” means that the individuals who receive the largest number of votes are elected as directors up to the maximum number of directors to be elected at the Annual Meeting. Any shares for which authority is withheld to vote for director nominees and broker non-votes have no effect on the election of directors except to the extent that the failure to vote for a director nominee results in another nominee receiving a larger number of votes.

The Board of Directors recommends a vote FOR the election of all the persons nominated by the Board.

Nominees for Election with Terms Expiring in 2014

Colin M. Farmer (37) is a Managing Director of OEP Holding Corporation. Prior to joining OEP Holding Corporation in October 2006, Mr. Farmer spent eight years at Harvest Partners, a middle-market private equity firm. He currently serves on the Board of Directors of NCO Group, Inc., a provider of accounts receivable management and related services. Mr. Farmer’s extensive knowledge of capital markets, finance and accounting is helpful to the Board’s consideration of financial matters. He works closely with management on capital markets activities and corporate and tax structuring initiatives. Mr. Farmer’s original nomination to serve on the Board was at the request of OEPX, LLC under the terms of the recapitalization of the Company in October 2008. Mr. Farmer has served as a director of the Company since 2008.

John E. Utley(70) is a general business consultant. He retired in 1999 as Acting Deputy President of Lucas Varity Automotive. Lucas Varity was headquartered in London, England before being sold to TRW, Inc. Prior to that, he served in several senior management positions for more than five years, including Senior Vice President Strategic Marketing for Varity Corporation, and served as Chairman of the Board of both Kelsey Hayes Co. and Walbro Corporation. Prior to the purchase of Kelsey Hayes by Varity Corporation. Mr. Utley served as President and Chief Operating Officer, Kelsey Hayes Co. Mr. Utley has served as the Chairman of the Board of X-Rite since 2003. Mr. Utley’s extensive executive experience, his background in global marketing, and history with the Company are valued by the Board.

Thomas J. Vacchiano, Jr.(59) is the President and Chief Executive Officer of the Company and has held that position since October 1, 2006. He joined X-Rite as its President in July 2006 as part of the Amazys Holding

4

AG (“Amazys”) acquisition. Prior to the Amazys acquisition, he served as Amazys’ President and Chief Executive Officer. Amazys was a color technology company headquartered in Switzerland and was publicly traded on the Swiss Stock Exchange. Mr. Vacchiano’s day-to-day leadership as Chief Executive Officer of X-Rite provides the Board with an intimate view of the Company’s challenges, opportunities, and operations. Mr. Vacchiano has served as a director of the Company since 2006.

DIRECTOR BIOGRAPHICAL INFORMATION AND QUALIFICATIONS

Set forth below is a description of the business experience of each of the Company’s directors other than Messrs. Farmer, Utley and Vacchiano, whose biographies are set forth above under “Proposal 1 Election of Directors.” The Board has determined that each nominee and continuing director brings a strong and unique background and set of skills to the Board, giving the Board as a whole diversity and experience in a wide variety of areas, including executive management, private equity, engineering, finance, manufacturing, marketing, and international business.

Continuing Directors with Terms Expiring in 2013

Gideon Argov(54) is President and Chief Executive Officer of Entegris, a materials integrity management company serving high technology industries. Mr. Argov became President and Chief Executive Officer of Entegris immediately after its merger with Mykrolis on August 5, 2005. He had served as Chief Executive Officer of Mykrolis since November 2004. Prior to joining Mykrolis, Mr. Argov was a special limited partner of Parthenon Capital, a Boston-based private equity firm, since 2001. Mr. Argov has served on the Company’s Board since 2006 when it acquired Amazys. Prior to that, Mr. Argov served on Amazys’ Board of Directors since 1997. Mr. Argov currently serves on the Board of Directors of Interline Brands, Inc. Mr. Argov’s experience as the Chief Executive Officer of Entegris provides the Board with the unique experience of providing products to high technology enterprises around the world. Mr. Argov also has an understanding of the color industry and the historical evolution of the markets that X-Rite operates in due to his long service on the board of Amazys prior to its acquisition by X-Rite in 2006. Mr. Argov has served as a director of the Company since 2006.

David A. Eckert (56) is a business consultant and has led a series of companies providing products and services to businesses worldwide. In 2010, Mr. Eckert served as the Chief Executive Officer and a member of the Board of Directors of Safety-Kleen Systems, Inc., an environmental solutions company. Prior to that, he served as President, Chief Executive Officer and a member of the Board of Directors of Iron Age Corporation from 2003 to 2007; Senior Executive Vice President for Kessler Financial Services, L.P; President, Chief Operating Officer and a member of the Board of Directors of Clean Harbors, Inc. from 1996 to 1998; and Co-Chairman of the Board of Directors and Co-Chief Executive Officer of Smith Valve Corporation from 1991 to 1996. He serves as Chair of the Advisory Board of Northwestern University’s McCormick School of Engineering and Applied Science. Mr. Eckert’s 30 years of experience as a Director, Chief Executive Officer, senior executive and management consultant across a wide range of industries provides the Board with a significant understanding of strategic and operational challenges. Mr. Eckert’s original nomination to serve on the Board was at the request of OEPX, LLC under the terms of the recapitalization of the Company in October 2008. Mr. Eckert has served as director since 2008.

L. Peter Frieder(68) is the President and Chief Executive Officer of Gentex Corporation, a designer, developer and manufacturer of integrated life support systems. He has held that position for more than five years. Mr. Frieder also serves as an advisor to the Chairman of Essilor, which designs and manufactures corrective lenses worldwide, and as a consultant to their Disruptive Technologies Team. Mr. Frieder’s experience leading an organization with ongoing research and development, engineering and manufacturing operations is particularly important to the Board’s discussions related to the strategy of the Company. Mr. Frieder has served as a director of the Company since 2003.

5

Continuing Directors with Terms Expiring in 2012

Bradley J. Coppens (29) is a Managing Director of OEP Holding Corporation. Prior to joining OEP Holding Corporation in 2006, Mr. Coppens worked in the investment banking division of JPMorgan Chase & Co. in the mergers and acquisitions department. He currently serves on the boards of directors of Prodigy Health Group, a privately-held benefits management company in the U.S., specializing in third-party health plan administration and medical management services, and Systagenix Wound Management, a worldwide leader in the advanced wound care market. Mr. Coppens has broad knowledge of capital markets, finance and accounting issues and has assisted directors and management teams in a variety of situations including capital raising, corporate restructuring and strategic planning activities. Mr. Coppens received his B.B.A. in accounting and finance from the Ross School of Business at the University of Michigan. Mr. Coppens’ nomination to serve on the Board was at the request of OEPX, LLC under the terms of the recapitalization of the Company in October 2008. Mr. Coppens has served as a director of the Company since 2010.

Daniel M. Friedberg(49) has been President and Chief Executive Officer of Sagard Capital Partners Management Corporation, the investment manager of Sagard, since its founding in 2005. Since 2005, he has also been a Vice President and Officer of Power Corporation of Canada, a diversified international management and holding company. Prior to that, he was a Partner at Bain & Company. Mr. Friedberg joined Bain & Company in 1987 in the London office, and was a founder of the Toronto office in 1989 and the New York office in 2000. Mr. Friedberg’s extensive experience in strategic and operational consulting in both private and public companies is a valuable asset to the Board. Mr. Friedberg’s original nomination to serve on the Board was at the request of Sagard Capital Partners, L.P. under the terms of the recapitalization of the Company in October 2008. Mr. Friedberg has served as a director of the Company since 2008.

Mark D. Weishaar(53) is Chief Executive Officer and President of Sturgis Molded Products, a custom injection molding company headquartered in Michigan, and has held that position since 1997. Mr. Weishaar is a certified public accountant and served as a Partner and Member of the Board of Directors of BDO Seidman, LLP where he worked for 15 years in various capacities. Mr. Weishaar is a financial expert with extensive knowledge of financial and accounting issues, which is valued in his role chairing the Audit Committee. Mr. Weishaar has served as a director of the Company since 2003.

DIRECTOR SELECTION CRITERIA AND REVIEW OF DIRECTOR NOMINEES

The Nominating and Governance Committee (“NGC”) reviews annually with the Board the composition of the Board as a whole and recommends, if necessary, measures to be taken so that the members of the Board reflect the appropriate balance of knowledge, experience, skills, expertise and diversity necessary to maximize the Board’s ability to manage and direct the affairs and business of the Company. Although the NGC does not have a formal policy with respect to diversity, the NGC considers diversity as one of a number of factors in identifying director nominees. The NGC views diversity broadly to include diversity of experience, skills and viewpoint as well as traditional concepts of diversity such as race and gender. The NGC seeks candidates with diverse viewpoints and backgrounds and who have substantial experience in and understanding of domestic and international operations, technology, marketing, finance, accounting and other disciplines relevant to the Company’s ongoing success. The NGC requires that directors are able to commit the requisite time for preparation and attendance at regularly scheduled Board and committee meetings, as well as be able to participate in other matters necessary to ensure good corporate governance is practiced.

Although there are no formal minimum criteria for director nominees, in making its recommendations to the Board, the NGC considers factors that are in the best interests of the Company and its shareholders, including the experience of each candidate; the potential contribution of each candidate to the diversity of backgrounds, experience and competencies which the Board desires to have represented; each candidate’s ability to devote sufficient time and effort to his or her duties as a director; independence and willingness to consider strategic

6

proposals; understanding of the Company’s business and technology; educational and professional background; personal accomplishments; independence from management; financial and accounting expertise and any other criteria established by the Board and any core competencies or technical expertise necessary for Board committees. In addition, the Committee assesses whether a candidate possesses the integrity, ethics and sound business judgment that are likely to enhance the Board’s ability to manage and direct the affairs and business of the Company, including, when applicable, to enhance the ability of committees of the Board to fulfill their duties.

The Board evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best represent shareholder interests through the exercise of sound judgment using its diversity of experience. In determining whether to recommend a director for re-election, the NGC also considers the director’s past attendance at meetings, participation in and contributions to the activities of the Board, and the results of the most recent Board self-evaluation.

In connection with the recapitalization in October 2008, the Company has agreed to use its reasonable best efforts to have the designees of the Company’s institutional investors OEPX, LLC (“OEP”), managed by One Equity Partners, LLC, and Sagard Capital Partners, L.P. (“Sagard”), elected to the Board. OEP has the right to designate (i) three directors to the Board for so long as it holds at least 30% of the outstanding common stock, (ii) two directors for so long as it holds at least 20% of the outstanding common stock and (iii) one director for so long as it holds at least 10% of the outstanding common stock. Sagard has the right to designate one director to the Board for so long as it holds at least 10% of the outstanding common stock. Neither OEP nor Sagard can designate any directors once their holdings fall below 10%, respectively, of the outstanding common stock. The election or appointment of the OEP and Sagard nominees is subject to satisfaction of all legal and governance requirements regarding service as a director of the Company and to the reasonable approval of the NGC.

OEP’s current designees on the Board are Bradley J. Coppens, David A. Eckert and Colin M. Farmer, and Sagard’s current designee is Daniel M. Friedberg. Mr. Farmer, whose term expires in 2011, has been nominated by the NGC and is included on the slate of nominees in this Proxy Statement to serve as a director with a term expiring in 2014. Mr. Eckert’s current term expires in 2013, and Messrs. Coppens’ and Friedberg’s current terms expire in 2012.

The NGC will consider shareholder recommendations for candidates for the Board, provided that the recommending shareholder follows the procedures set forth in Article IV.E. of the Company’s Articles of Incorporation for nominations by shareholders of persons to serve as directors. Pursuant to Article IV.E. of the Company’s Articles of Incorporation, nominations for directors must be received not later than 30 days prior to the date of the meeting (or within seven days after the Company mails, or otherwise gives notice of the date of such meeting, if such notice is given less than 40 days prior to the meeting date). Such notice must include the name of any recommended candidate for director, together with a brief biographical sketch, and a document indicating the candidate’s willingness to serve, if elected. To date, the Company has not received any recommendations from shareholders requesting that the NGC consider a candidate for inclusion in the slate of nominees in the Company’s Proxy Statement. To be included in the Company’s Proxy Statement relating to the 2012 Annual Meeting of shareholders or to be considered at the 2012 Annual Meeting, recommendations must be received in the manner specified in “Submission of Shareholder Proposals for 2012 Annual Meeting of Shareholders,” on page 52.

7

DIRECTOR INDEPENDENCE

The Board has determined that all of the non-employee directors are “independent” for purposes of compliance with NASDAQ listing standards and applicable law. Further, all of the members of the Audit Committee are also “independent” for purposes of Section 10A(m)(3) of the Securities Exchange Act of 1934. The independent directors are as follows:

| | |

Gideon Argov | | Daniel M. Friedberg |

Bradley J. Coppens | | L. Peter Frieder |

David A. Eckert | | John E. Utley |

Colin M. Farmer | | Mark D. Weishaar |

All of the members of the Company’s Audit Committee, the NGC and the Compensation Committee are independent directors.

BOARD LEADERSHIP STRUCTURE AND ITS COMMITTEES

The non-executive Chairman of the Board is John E. Utley. Under his leadership, the Board oversees, counsels, and directs management in the long-term interests of the Company and its shareholders. The Board believes that its current leadership structure with a separate Chief Executive Officer and independent Board Chairman ensures the effective, independent oversight of management on behalf of the Company’s shareholders and allows the Chief Executive Officer to focus on the execution of the Company’s day-to-day business, strategy and growth. The Board’s responsibilities include:

| | • | | Oversight of the conduct of the business and assessment of business risks; |

| | • | | Selection and evaluation of the performance of the Chief Executive Officer and other senior executives; and |

| | • | | Oversight of the process for maintaining the integrity of the Company’s financial statements and other public disclosures, and compliance with laws and ethics. |

The Board has adopted a charter for each of the four standing committees that addresses the composition and functioning of the committees. The Board has also adopted an Ethical Conduct Policy that applies to all of its employees, officers and Directors; and a Code of Ethics for Senior Executive Officers. The Company will disclose amendments to, or waivers from, provisions of its code of ethics, if any, that apply to the Chief Executive Officer, Chief Financial Officer, and Chief Accounting Officer by posting such information on the Company’s website. The Code of Ethics, committee charters, and Ethical Conduct Policy may be viewed on the Company’s Internet page athttp://ir.xrite.com under Corporate Governance and are also available in print by writing to the Company’s Corporate Secretary at X-Rite, Incorporated, 4300 44th Street, S.E., Grand Rapids, Michigan 49512.

The Board and its committees met throughout the year, and acted by written consent from time to time as appropriate. Board members are expected to make a reasonable effort to attend all meetings of the Board, all applicable committee meetings, and each Annual Meeting of Shareholders. All members of the Board attended the 2010 Annual Meeting of Shareholders and each of the current members of the Board is expected to attend the 2011 Annual Meeting of Shareholders. During fiscal 2010, the Board held five meetings. During fiscal 2010, each director attended at least 75 percent of the aggregate of the number of meetings of the Board plus the total number of meetings of all committees on which such director served.

The Board endeavors to schedule at least two Board meeting per year at key worksite locations. For example, in fiscal 2010, the Board held meetings in Grand Rapids, Michigan at the Company’s global

8

headquarters, and in Carlstadt, New Jersey, the Company’s Pantone subsidiary. The Company believes that it is important that the Board engage in both formal and informal discussions with members of senior management throughout the organization, as well as with various employee populations on a regular basis.

In accordance with NASDAQ rules, the Company’s non-employee directors meet regularly in executive sessions of the Board without management present.

The table below shows current membership for each of the standing Board committees:

| | | | | | |

Audit Committee | | Compensation Committee | | Nominating and Governance Committee | | Administrative Committee |

Mark D. Weishaar* | | Gideon Argov* | | L. Peter Frieder* | | Colin M. Farmer* |

Colin M. Farmer | | Bradley J. Coppens | | David A. Eckert | | Bradley J. Coppens |

Daniel M. Friedberg | | Daniel M. Friedberg | | Daniel M. Friedberg | | Daniel M. Friedberg |

John E. Utley | | Mark D. Weishaar | | John E. Utley, ex-officio | | L. Peter Frieder |

| | John E. Utley, ex-officio | | | | Thomas J. Vacchiano, Jr. |

| | | | | | |

Below is a description of each standing committee of the Board. Each committee has the authority to engage legal counsel or other advisors or consultants as it deems appropriate to carry out its responsibilities.

Audit Committee

The primary purpose of the Audit Committee is to assist the Board in its general oversight responsibilities for management’s conducting of the Company’s accounting and financial reporting processes; financial risk assessment; internal controls for finance, accounting, legal compliance and ethics; and audit functions. In addition, the Audit Committee is responsible for the appointment, retention, compensation, and oversight of the work of the Company’s independent public accounting firm. The Company’s management is responsible for preparing the Company’s financial statements, and the independent auditors are responsible for auditing the Company’s financial statements. The Audit Committee’s role is one of oversight and does not provide any expert assurance or certification as to the Company’s financial statements or the work of the independent auditors. The Committee’s specific responsibilities are delineated in the Audit Committee Charter. The Audit Committee Charter can be viewed on the Company’s website. The Board has determined that each Audit Committee member is financially literate and that Mark D. Weishaar is an “audit committee financial expert” as defined in Item 407(d) of Regulation S-K. Each member of the Audit Committee is “independent” for purposes of NASDAQ listing standards and Section 10A(m)(3) of the Securities Exchange Act of 1934. During 2010, the Audit Committee held four meetings. For a further description of the Audit Committee’s responsibility and findings, see “Audit Committee Report.”

Compensation Committee

The primary function of the Compensation Committee is to assist the Board in matters relating to compensation as may be appropriately delegated to it by the Board. The Compensation Committee has a role in helping the Board ensure a clear relationship between total compensation, organization performance, and returns to shareholders. This is based on the Board’s belief that total compensation programs, properly aligned with economic value creation and the values and goals of the Company are essential tools in the delivery of sustainable value to shareholders. The Compensation Committee has authority for reviewing and determining salaries, performance-based incentives, and other matters related to the compensation of the Company’s executive officers, and administering the Company’s equity plans, including the granting of equity awards. The Compensation Committee also reviews and determines various other compensation policies and matters,

9

including making recommendations to the Board and to management related to employee compensation and benefit plans. The Compensation Committee engaged Meridian Compensation Partners, LLC, a consulting firm experienced in all aspects of executive compensation analysis and design, to assist with its executive and director compensation analysis in fiscal year 2010. Meridian performs no other services for the Company. All of the members of the Compensation Committee are independent, non-employee directors of the Company. During 2010, the Compensation Committee held five meetings.

Nominating and Governance Committee

The primary function of the NGC is to assist the Board by recommending qualifications and standards to serve as a director of the Company, identifying individuals qualified to become directors of the Company, and developing and evaluating corporate governance standards and policies for the Company. The NGC also reviews and evaluates the Chief Executive Officer’s performance and advises the Company’s Compensation Committee on its findings. The NGC’s responsibility for determining director qualifications is discussed in greater detail under “Director Selection Criteria and Review of Director Nominees.” The NGC is composed entirely of independent, non-employee directors, and held four meetings in 2010.

Administrative Committee

The primary function of the Administrative Committee is to work actively with the CEO to provide strategic planning and annual budget recommendations for the review and consideration of the entire Board. The Administrative Committee also has the authority to approve any change in executive management appointments. Under the terms of our Series A Preferred Stock, the obligation of the Company to maintain the Administrative Committee terminates in the event that the shares of our Series A Preferred Stock are redeemed or the current holders our Series A Preferred Stock hold less than 25% of the outstanding shares of such stock.

Risk Oversight

The Board is responsible for overseeing management in the execution of its responsibilities and for assessing the Company’s approach to risk management. The Company has a consistent, systemic and integrated approach to risk management to help determine how best to identify, manage and mitigate significant risks throughout its global organization including macro-economic risks, such as inflation, reductions in economic growth, restrictions on access to markets and recession. The Board and its standing committees also review business-specific risks related to business strategy, operational execution, financial structure, legal and regulatory compliance, and corporate governance.

The Board receives and reviews regular reports on the Company’s strategy, operations and financial performance from management. In addition, the Board delegates specific areas of risk assessment responsibilities to different Board committees. For example:

Audit Committee:

| | • | | financial reporting, disclosures and internal controls, |

| | • | | ethics-related issues and Foreign Corrupt Practices Act regulatory compliance, |

| | • | | information technology controls, and |

| | • | | insurance coverage adequacy |

Compensation Committee:

| | • | | employee retention, and |

| | • | | compensation policies and practices |

10

Nominating and Governance Committee:

| | • | | corporate governance standards and policies |

Administrative Committee:

| | • | | corporate strategy and annual budget |

Director Compensation

The Compensation Committee performs an annual review and assesses the adequacy of levels of director compensation. Final compensation levels are approved by the full Board. Director compensation remains unchanged from 2010. For 2011, each director who is not an employee of the Company will receive a quarterly cash retainer of $18,250, plus additional quarterly retainers of $6,250 for the Chairman of the Board, $3,000 for the Chairman of the Audit Committee, $2,500 for the Chairman of the Compensation Committee, $1,500 for the Chairmen of the NGC and the Administrative Committee, $1,500 for Audit Committee members, $1,000 for the Compensation Committee members, and $750 for the NGC and Administrative Committee members. In addition, immediately following the 2011 Annual Meeting of Shareholders, each non-employee director will be granted equity in the form of stock options and restricted shares with an approximate aggregate value of $50,000 ($76,400 for the Chairman of the Board). All equity grants to the Board vest in full after one year.

The Company uses a modified Black-Scholes valuation applied on a consistent basis from year to year to determine the number of shares issued and options granted. All options were granted with an exercise price per share equal to the fair market value on the May 18, 2010 date of grant which was $3.49. The restricted stock and options vest after one year and the options have a ten year term. Messrs. Argov, Coppens, Eckert, Farmer, Friedberg, Frieder and Weishaar each received a stock option award to purchase 15,527 shares of X-Rite stock and 9,006 restricted shares of X-Rite stock. Mr. Utley, as Chairman, received a stock option award to purchase 23,725 shares of X-Rite stock and 13,761 restricted shares of X-Rite stock.

Mr. Vacchiano receives no additional compensation for serving as a director. Like all directors, he is eligible to receive reimbursement of any expenses incurred in attending Board and committee meetings.

DIRECTOR COMPENSATION IN FISCAL YEAR 2010

| | | | | | | | | | | | | | | | |

Current Directors | | Fees Earned

or Paid in

Cash

($)(1) | | | Stock

Awards

($)(2) | | | Option

Awards

($)(3) | | | Total

($) | |

Gideon Argov | | | 83,000 | | | | 31,431 | | | | 31,545 | | | | 145,976 | |

Bradley J. Coppens | | | 80,000 | | | | 31,431 | | | | 31,545 | | | | 142,976 | |

David A. Eckert | | | 76,000 | | | | 31,431 | | | | 31,545 | | | | 138,976 | |

Colin M. Farmer | | | 85,000 | | | | 31,431 | | | | 31,545 | | | | 147,976 | |

Daniel M. Friedberg | | | 89,000 | | | | 31,431 | | | | 31,545 | | | | 151,976 | |

L. Peter Frieder | | | 82,000 | | | | 31,431 | | | | 31,545 | | | | 144,976 | |

John E. Utley | | | 104,000 | | | | 48,026 | | | | 48,200 | | | | 200,226 | |

Mark D. Weishaar | | | 89,000 | | | | 31,431 | | | | 31,545 | | | | 151,976 | |

| | | | |

Former Directors | | | | | | | | | | | | |

David M. Cohen(4) | | | — | | | | — | | | | — | | | | — | |

| (1) | Retainer and fees earned by Messrs. Coppens and Farmer are paid directly to OEP, and those earned by Mr. Friedberg are paid directly to Sagard. |

11

| (2) | Reflects the aggregate grant date fair value compensation costs for financial statement reporting purposes in conformity with accounting principles generally accepted in the United States of America (“GAAP”) for the fiscal year ended January 1, 2011 in accordance with ASC Topic 718 for share-based awards granted in 2010. As of January 1, 2011, each non-employee director held the following number of shares of restricted stock outstanding that were still unvested: Mr. Argov: 9,006; Mr. Coppens: 9,006; Mr. Eckert: 9,006; Mr. Farmer: 9,006; Mr. Friedberg: 9,006; Mr. Frieder: 9,006; Mr. Utley: 13,761; and Mr. Weishaar: 9,006. Messrs. Coppens and Farmer hold their restricted shares for the benefit of OEP. Mr. Friedberg holds his restricted shares for the benefit of Sagard. |

| (3) | Reflects the aggregate grant date fair value compensation costs for financial statement reporting purposes in conformity with GAAP for the fiscal year ended January 1, 2011 in accordance with ASC Topic 718 for options granted in 2010. Assumptions used in the calculation of these amounts are included in footnote 8 to the Company’s audited financial statements for the fiscal year ended January 1, 2011 included in the Company’s Annual Report on Form 10-K filed with the SEC on March 17, 2011. As of January 1, 2011, each non-employee director had the following number of options outstanding: Mr. Argov: 207,038; Mr. Coppens: 191,300; Mr. Eckert: 188,924; Mr. Farmer: 191,300; Mr. Friedberg: 193,675; Mr. Frieder: 223,557; Mr. Utley: 345,935; and Mr. Weishaar: 234,817. Messrs. Coppens and Farmer hold their options for the benefit of OEP. Mr. Friedberg holds his options for the benefit of Sagard. The outstanding options that are exercisable as of March 22, 2011, or within 60 days thereafter, are included in the Securities Ownership of Management and Directors table. |

| (4) | Mr. Cohen resigned from the Board on March 17, 2010. |

Shareholder Communications with Directors

The Board has adopted a process for shareholder communications. Generally, shareholders who want to communicate with the Board or any individual director can write to X-Rite, Incorporated, Corporate Secretary, 4300 44th Street, S.E, Grand Rapids, Michigan 49512. Your letter should indicate that you are an X-Rite, Incorporated shareholder. Depending on the subject matter, management will forward the communication to the director or directors to whom it is addressed; attempt to handle the inquiry directly, for example where it is a request for information about the Company or it is a stock-related matter; or not forward the communication if it is primarily commercial in nature or if it relates to an improper or irrelevant topic.

At each Board meeting, a member of management presents a summary of all communications received since the last meeting that were not forwarded and makes those communications available to the directors on request.

12

PROPOSAL 2

APPROVAL OF INCREASE IN AUTHORIZED COMMON STOCK

Article III of the Company’s Articles of Incorporation currently provides for authorized capital stock consisting of 100,000,000 shares of common stock, par value $.10 per share, and 5,000,000 shares of preferred stock, par value $.10 per share. As of March 22, 2011 there were 85,928,254 shares of common stock outstanding, and 7,539,697 shares were reserved for issuance in connection with various employee benefit plans. As of March 22, 2011, there were 46,980 shares of preferred stock outstanding, and 4,953,020 shares of preferred stock were reserved for future issuance.

At a meeting held on March 2, 2011, the Board of Directors unanimously adopted a resolution approving an amendment to Article III of the Company’s Articles of Incorporation to increase the number of authorized shares of common stock from 100,000,000 to 150,000,000, and recommending the amendment for approval by the Company’s shareholders. The Board believes that the authorization of an additional 50,000,000 shares of common stock will provide increased flexibility for future growth and provide the opportunity for enhanced marketability of the Company’s common stock, although the Board has not yet decided to issue those shares for any particular purpose. The additional shares of common stock will be available for issuance from time to time, including for raising capital through the sale of common stock or securities convertible into common stock, in connection with a stock split or dividend, as consideration in connection with acquisitions and for attracting and retaining valuable employees and directors by issuing additional equity-based awards.

As is the case with the current authorized but unissued shares of common stock, the additional shares of common stock authorized by this proposed amendment could be issued upon approval by the Board without further vote of the Company’s shareholders except as may be required in particular cases by applicable law or NASDAQ rules. Under the Company’s Articles of Incorporation, shareholders do not have preemptive rights to subscribe to additional securities that may be issued by the Company, which means that current shareholders do not have a prior right to purchase any new issue of common stock in order to maintain their proportionate ownership interest in the Company. If we issue additional shares of common stock or securities convertible into common stock, such issuance would have a dilutive effect on the voting power and could have a dilutive effect on the earnings per share of the Company’s currently outstanding shares of common stock. Additionally, the Company has no current intention of using additional shares of common stock as an anti-takeover defense; however, such an issuance could be used to create impediments to or otherwise discourage persons attempting to gain control of the Company (through dilutive offerings or otherwise).

The affirmative vote of a majority of the outstanding shares of common stock is required for approval of this proposal. Since abstentions and broker non-votes are not affirmative votes, they will have the effect of votes cast against this proposal.

The Board unanimously recommends a vote FOR approval of the proposed increase in authorized common stock.

13

PROPOSAL 3

APPROVAL OF THE X-RITE, INCORPORATED 2011 OMNIBUS LONG TERM INCENTIVE PLAN

The Board believes that the continued growth and profitability of the Company depends, in part, on the ability of the Company to attract and retain highly qualified employees. In order to achieve this objective, the Board has determined that it is in the best interests of the Company and its shareholders to adopt the X-Rite, Incorporated 2011 Omnibus Long Term Incentive Plan (the “Plan”). The Board believes that the Plan will encourage stock ownership among officers and certain management employees, which will provide an incentive for such employees to expand and improve the profits and prosperity of the Company. The Board also believes the Plan will make service on the Board more attractive to present and prospective outside directors, as well as provide directors additional incentive to direct the Company effectively. Further, the Board believes the Plan will encourage stock ownership by certain consultants and advisors, which will provide an incentive to expand and improve the profits and prosperity of the Company and make continued service to the Company more attractive. Accordingly, on March 2, 2011, the Board adopted the Plan, subject to shareholder approval. A copy of the Plan is attached hereto asExhibit A. The following summary of the material features of the Plan is qualified in its entirety by reference to the complete text of the Plan.

The affirmative vote of a majority of the shares of common stock represented in person or by proxy at the Annual Meeting, will be required for the approval of the Plan.

Summary of the X-Rite, Incorporated 2011 Omnibus Long Term Incentive Plan

Purpose. The purpose of the Plan is to provide officers and key employees of the Company and its subsidiaries, members of the Board, and certain consultants and advisors who perform services for the Company or its subsidiaries with the opportunity to be granted shares of common stock or receive monetary payments based on the long term economic performance of the Company. If the Plan is approved by the shareholders, no further grants shall be made under the 2008 Omnibus Long Term Incentive Plan. Instead, all future grants will be made under the Plan.

Plan Administration. The Plan will be administered by a compensation committee (the “Committee”), which may consist of two or more “outside directors” as defined under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), and “non-employee directors” as defined under Rule 16b-3 of the Securities Exchange Act of 1934, as amended. The Committee will have the sole authority (consistent with the Plan document) to determine who receives an Award (defined below), the type, size and terms of the Award, the time when an Award will be granted, the duration of any applicable exercise and vesting period of an Award and the ability to accelerate an Award.

Indemnification. The Company will indemnify the Board, the Committee and Plan participants against any and all liabilities for actions taken in conjunction with the Plan or failure to act with respect to duties under the Plan, except in circumstances involving bad faith, gross negligence or willful misconduct.

Eligibility.All employees, officers and directors of the Company and its subsidiaries, as well as consultants and advisors to the Company or its subsidiaries will be eligible to participate in the Plan, as determined by the Committee.

Types of Awards. Awards may be granted in any combination of (a) Stock Options, (b) Stock Appreciation Rights, (c) Restricted Stock (d) Restricted Stock Units, (e) Performance Shares, (f) Performance Units, and (g) Other Incentive Awards in the form of cash or equity (collectively, “Awards”).

Share and Award Limitations. The aggregate number of shares of common stock that may be subject to Awards will be 6,000,000 shares of common stock, plus any shares of common stock that are or become

14

available for grants of awards under the Company’s 2008 Omnibus Long Term Incentive Plan, which may be authorized and unissued, subject to any adjustments as described in the following section. Shares subject to Awards that for any reason are cancelled or terminated without being delivered or are withheld to satisfy tax withholding obligations shall again be available for issuance under the Plan. The maximum number of shares of common stock that may be subject to Restricted Stock Awards, Restricted Stock Units, Performance Shares and Other Incentive Awards will be 4,500,000. The maximum number of shares of common stock with respect to which Restricted Stock Awards, Restricted Stock Units, Performance Shares and Other Incentive Awards may be granted in any one calendar year will be 750,000. The maximum number of Stock Options and Stock Appreciation Rights that may be granted to any individual in any one calendar year will be 500,000 and the maximum number of shares of common stock with respect to which Restricted Stock Awards, Restricted Stock Units and other awards that may be granted to any individual in any one calendar year will be 500,000. The aggregate fair market value of the common stock of the Company with respect to which Incentive Stock Options (as defined below) are exercisable for the first time by an individual in any calendar year is $100,000. The maximum aggregate dollar amount that may be paid to any individual during any one calendar year with respect to Performance Units or any Other Incentive Award paid in cash is $3,000,000.

Share and Award Adjustments. The number of shares available under the Plan and subject to any Award under the Plan will be adjusted to reflect a change in the Company’s capitalization, a reorganization or similar transaction or a stock dividend. The Committee will have the ability to make similar adjustments to awards to compensate for the diminution in the intrinsic value of shares of stock resulting from a reciprocal transaction such as a business combination, merger or acquisition.

Awards

Stock Options.Stock Options may be granted as either (i) incentive stock options within the meaning of Section 422(b) of the Code (“Incentive Stock Options”) or (ii) Stock Options that do not qualify as Incentive Stock Options (“Nonqualified Stock Options”). The exercise price per share of common stock subject to a Stock Option shall be determined by the Committee and may not be less than the fair market value of the Company’s common stock at the time of grant. The exercise period of each Stock Option granted shall be specified in an award agreement and will be no greater than 10 years. Incentive Stock Options may be granted only to employees of the Company or its subsidiaries, but may not be granted to a participant who, at the time of the grant, owns stock possessing more than 10% of the total combined voting power of all outstanding Company Stock except under certain conditions. In no event shall any outstanding Stock Option be cancelled with an exercise price greater than the then current fair market value of the common stock for purposes of reissuing any other Award to a participant at a lower exercise price, nor shall the exercise price of an outstanding Stock Option be reduced, without shareholder approval.

Stock Appreciation Rights.Stock Appreciation Rights provide a participant with the right to receive a payment in an amount equal to the excess of the (i) fair market value, or other specified value, of a specified number of shares of common stock on the date the right is exercised, over (ii) the fair market value of such shares on the date of grant, or other specified value that is at least equal to 100% of the fair market value of the Company’s common stock on the date of grant. Stock Appreciation Rights must expire no later than 10 years from the date of their grant or such shorter periods as may be specified in an award agreement. In no event shall any outstanding Stock Appreciation Right be cancelled with a grant price greater than the then current fair market value of the common stock for purposes of reissuing any other Award to a participant at a lower grant price, nor shall the grant price of an outstanding Stock Appreciation Right be reduced, without shareholder approval.

Restricted Stock Awards.Restricted Stock Awards consist of common stock transferred to participants, which may be subject to restrictions such as the ability to sell or the right of the Company to reacquire the shares

15

for no consideration upon termination of the participant’s employment within specified periods or prior to becoming vested.

Restricted Stock Units.Restricted Stock Units consist of the right to receive cash, common stock or a combination thereof at a date on or after vesting in accordance with terms and conditions established by the Committee, including the attainment of performance criteria specified by the Committee.

Performance Units. Performance Units have an initial value set by the Committee. Based on achievement of performance objectives established by the Committee, participants receive a certain number or value of Performance Units. Performance Units may be paid in cash, common stock or a combination thereof.

Performance Shares. Performance Shares have an initial value of the fair market value of the Company’s common stock on the date of grant. The Committee then establishes performance objectives and the individual receives a certain number or value of Performance Shares based on the attainment of the performance objectives at the end of the Performance Period. Performance Shares may be paid in cash, common stock or a combination thereof, as specified in an award agreement.

Other Incentive Awards. In addition to the aforementioned Award types, the Committee may grant other incentive awards that conform to the terms of the Plan and are payable in cash or common stock, including, without limitation, annual incentive awards.

Performance-Based Awards. Awards may be granted under the Plan such that they qualify for the performance-based compensation exemption of Section 162(m) of the Code (“Performance-Based Awards”). The granting, vesting or payment of such Performance-Based Awards will only be based on one or more of the following factors to be used by the Committee for creating performance-based goals applicable to a given period: net sales; pretax income before allocation of corporate overhead and bonus; budget; earnings per share; net income; division, group or corporate financial goals; return on stockholders’ equity; return on assets; attainment of strategic and operational initiatives; appreciation in and/or maintenance of the price of common stock or any other publicly traded securities of the Company; market share; gross profits; earnings before interest and taxes; earnings before interest, taxes, depreciation and amortization (“EBITDA”) or adjusted EBITDA; economic value-added models and comparisons with various stock market indices; reductions in costs; cash flow from operations; or any combination of the foregoing. Performance goals are selected by the Committee in its discretion and must be established in writing no later than the earlier of (i) the 90th day in the performance period, or (ii) the expiration of 25% of the performance period. The Committee must certify in writing that such performance goals are met before any Performance-Based Award amounts are distributed under the Plan. The Committee retains the discretion to revise any Performance-Based Awards earned by an individual downwards.

Deferrals. The Committee may permit an individual to defer the receipt of cash or shares of the Company’s common stock that would otherwise be payable to the individual under the terms of the Plan, subject to the provisions of Section 409A of the Code and any applicable Treasury Regulations or other official guidance thereunder.

Change in Control

The Committee may determine that, upon the occurrence of a change in control of the Company, all or a portion of each outstanding Award shall become exercisable, payable in full, or terminate within a specified number of days after notice to the participant.

16

Amendment and Termination of the Plan

The Board may amend or terminate any or all of the provisions of the Plan; provided, however, that no such action will be made without shareholder approval where the amendment would (i) increase the total number of shares which may be issued under the Plan or (ii) increase the maximum number of shares which may be issued to any individual participant under the Plan. No amendment or termination of the Plan may adversely affect in a material manner any right of any participant with respect to any Award previously granted without such participant’s written consent.

Certain Federal Income Tax Considerations

The following is a general description of the United States federal income tax consequences to participants and the Company relating to Incentive Stock Options, Nonqualified Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Units, Performance Shares and Other Incentive Awards that may be granted under the Plan. The Plan is not qualified under Section 401(a) of the Code. This discussion only applies to U.S. citizens and/or residents and does not purport to cover all tax consequences relating to awards granted under the Plan. This description is intended for use by the Company’s shareholders in determining how to vote at its Annual Meeting and not as tax advice to persons who receive Awards under the Plan.

Incentive Stock Options. A participant generally will not recognize income, and the Company will not be entitled to a deduction from income, at the time of grant of an Incentive Stock Option. If the option is exercised during employment, or within three months thereafter (or one year in the case of a permanently and totally disabled employee), the participant generally will not recognize any income and the Company will not be entitled to a deduction. However, the excess of the fair market value of the shares on the date of exercise over the option price generally is included in computing the participant’s alternative minimum taxable income.

Generally, if the participant disposes of shares acquired by exercise of an Incentive Stock Option within either two years after the date of grant or one year after the date of exercise, the participant will recognize ordinary income, and the Company will be entitled to a deduction equal to the excess of the fair market value of the shares on the date of exercise over the option price (limited generally to the gain on the sale). The balance of any gain or loss will be treated as a capital gain or loss to the participant. If shares are disposed of after the two year and one year periods described above expire, the Company will not be entitled to any deduction, and the entire gain or loss for the participant will be treated as a long-term capital gain or loss.

Nonqualified Stock Options. A participant generally will not recognize income, and the Company will not be entitled to a deduction from income, at the time of grant of a Nonqualified Stock Option. When the option is exercised, the participant will recognize ordinary income equal to the difference, if any, between the aggregate exercise prices paid and the fair market value, as of the date the option is exercised, of the shares received. The participant’s tax basis in shares acquired upon exercise will equal the exercise price paid plus the amount recognized by the participant as ordinary income. The Company generally will be entitled to a federal income tax deduction in the tax year in which the option is exercised, equal to the ordinary income recognized by the participant as described above. If the participant holds shares acquired through exercise of a Nonqualified Stock Option for more than one year after the exercise of the option, the gain or loss realized upon the sale of those shares generally will be a long-term capital gain or loss. The participant’s holding period for shares acquired upon the exercise of an option will begin on the date of exercise.

Stock Appreciation Rights. A participant generally will not recognize income, and the Company will not be entitled to a deduction from income, at the time of grant of a Stock Appreciation Right. When the Stock Appreciation Right is exercised, the participant will recognize ordinary income equal to the difference between the aggregate grant price and the fair market value, as of the date the Stock Appreciation Right is exercised, of the Company’s common stock. The participant’s tax basis in shares acquired upon exercise of a stock-settled

17

Stock Appreciation Right will equal the amount recognized by the participant as ordinary income. The Company generally will be entitled to a federal income tax deduction in the year in which the Stock Appreciation Right is exercised, equal to the ordinary income recognized by the participant as described above. If the participant holds shares acquired through exercise of a stock-settled Stock Appreciation Right for more than one year after the exercise of the Stock Appreciation Right, the gain or loss realized upon the sale of those shares will be a long-term capital gain or loss. The participant’s holding period for shares acquired upon the exercise of a stock-settled Stock Appreciation Right will begin on the date of exercise.

Restricted Stock.Restricted Stock subject to a substantial risk of forfeiture results in income recognition equal to the excess of the fair market value of shares over the purchase price (if any) only at the time the restrictions lapse (unless the Participant elects to accelerate recognition as of the date of grant through an election under Section 83(b) of the Code). The Company generally will have (at the time the participant recognizes income) a corresponding deduction.

Restricted Stock Units. Restricted Stock Units generally are subject to tax at the time of payment and the Company generally will have a corresponding deduction when the participant recognizes income.

Performance Units and Performance Shares.Performance Units and Performance Shares generally are subject to tax at the time of payment. The Company will generally have (at the time the participant recognizes income) a corresponding deduction.

Other Incentive Awards.Other Incentive Awards generally are subject to tax at the time of payment. The Company generally will have (at the time the participant recognizes income) a corresponding deduction.

Compliance with Section 409A of the Code. The American Jobs Creation Act of 2004, enacted on October 22, 2004, revised the federal income tax law applicable to certain types of awards that may be granted under the Plan. To the extent applicable, it is intended that the Plan and any grants made under the Plan either be exempt from, or, in the alternative, comply with the provisions of Section 409A of the Code, including the exceptions for stock rights and short-term deferrals. The Company intends to administer the Plan and any grants made thereunder in a manner consistent with the requirements of Section 409A of the Code.

Section 162(m) of the Code.Shareholder approval of the Plan is sought under applicable NASDAQ requirements and additionally so that the compensation payable under the Plan that is intended to qualify as performance-based compensation under Section 162(m) of the Code will be treated as such. If the Plan and the performance goals thereunder are approved by the shareholders and the Plan is administered in accordance with the performance-based compensation exception under Section 162(m) of the Code, payment of the full amounts calculated under the Plan should be deductible by the Company for federal income tax purposes.

New Plan Benefits

Awards under the Plan will be made at the discretion of the Compensation Committee. The Compensation Committee has established the 2011 annual incentive program for the Company’s executive officers as a performance award under the Plan. Other than the annual awards to non-employee directors, no decisions have been made on the amount and type of equity or long-term awards that are to be made under the Plan to participants in the future. The following table sets forth certain information relating to (i) the amount of the 2011 target bonus that would be payable under the performance award to the Company’s named executive officers and executive officers and employees if the Plan is approved, and (ii) the annual grant of equity awards to the Company’s non-employee directors. No amounts have been included relating to other equity awards as the amounts of any such awards are not determinable at this time.

18

NEW PLAN BENEFITS TABLE

| | | | | | | | |

Name and Position | | Dollar value ($) (1) | | | Awards granted ($) (2) | |

Thomas J. Vacchiano, Jr., | | | | | | | | |

President, Chief Executive Officer | | $ | 300,000 | | | | — | |

| | |

Rajesh K. Shah, | | | | | | | | |

Chief Financial Officer | | $ | 149,760 | | | | — | |

| | |

Francis Lamy, | | | | | | | | |

Executive Vice President, Chief Technology Officer | | $ | 161,793 | | | | — | |

| | |

Executive Officers as a Group | | $ | 611,553 | | | | — | |

Non-Employee Directors as a Group | | | — | | | $ | 426,400 | |

Non-Executive Officers as a Group | | $ | 675,610 | | | | — | |

| (1) | Reflects amount of the 2011 annual bonus target established under the Plan. |

| (2) | Reflects aggregate dollar value of annual equity grants to non-employee directors that will be made (50% in the form of stock options and 50% in the form of restricted stock) immediately following the 2011 annual meeting of shareholders. Each non-employee director will be granted equity in the form of stock options and restricted stock with an approximate aggregate value of $50,000 ($76,400 for the Chairman of the Board). Equity and long-term awards for other participants are subject to Compensation Committee discretion and not determinable at this time. |

The Board unanimously recommends that you vote FOR approval of the X-Rite, Incorporated 2011 Omnibus Long Term Incentive Plan.

19

PROPOSAL 4

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Company is providing its shareholders an advisory vote on executive compensation as required by Section 14A of the Exchange Act. Section 14A was added to the Exchange Act by Section 951 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”). On January 25, 2011, the SEC adopted final rules implementing the requirements of Exchange Act Section 14A, which requires an advisory vote on executive compensation for annual meetings taking place on or after January 21, 2011.

The advisory vote on executive compensation is a non-binding vote on the compensation of the Company’s Named Executive Officers (“NEOs”), as described under “Compensation Discussion and Analysis,” tabular disclosure regarding such compensation, and the accompanying narrative disclosure, set forth in this Proxy Statement. The advisory vote on executive compensation is not a vote on the Company’s general compensation policies, compensation of the Board, or the Company’s compensation policies as they relate to risk management, as described under “Risk Analysis of Compensation Policies for All Employees” on page 48. The Dodd-Frank Act requires the Company to hold the advisory vote on executive compensation at least once every three years.

The Company’s executive compensation programs are designed to attract, motivate and retain highly qualified executive officers who are able to achieve corporate objectives and create stockholder value. The Compensation Committee believes the Company’s executive compensation programs reflect a strong pay-for-performance philosophy and are well aligned with the shareholders’ long-term interests. For a more detailed discussion of the Company’s executive compensation programs, see “Compensation Discussion and Analysis.” The Compensation Committee believes the Company’s executive compensation programs have been effective at incenting the achievement of improved financial performance and returns to shareholders.

Overview of 2010

| | • | | 2010 net sales of $222.7 million up 16.2 percent from 2009 |

| | • | | 2010 operating income of $29.0 million up $25.2 million from 2009 |

| | • | | 2010 fully diluted earnings per share of $0.04 per share, compared to $(0.33) loss per share for 2009 |

| | • | | Strong year to date cash flow before financing of $31.4 million or 14.1 percent of sales |

| | • | | Reduced debt by $47.0 million year to date, including the payoff of the Company’s second lien credit facility in September 2010 |

Shareholders are being asked to vote on the following resolution: