| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

|

| MANAGEMENT INVESTMENT COMPANIES |

|

| Investment Company Act file number 811-4630 |

|

| John Hancock Investment Trust III |

| (Exact name of registrant as specified in charter) |

|

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

|

| Salvatore Schiavone |

| Treasurer |

|

| 601 Congress Street |

|

| Boston, Massachusetts 02210 |

| (Name and address of agent for service) |

|

| Registrant's telephone number, including area code: 617-663-4497 |

|

| Date of fiscal year end: | October 31 |

| |

| Date of reporting period: | April 30, 2011 |

ITEM 1. REPORTS TO STOCKHOLDERS.

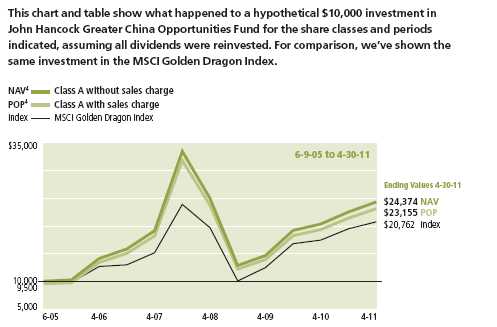

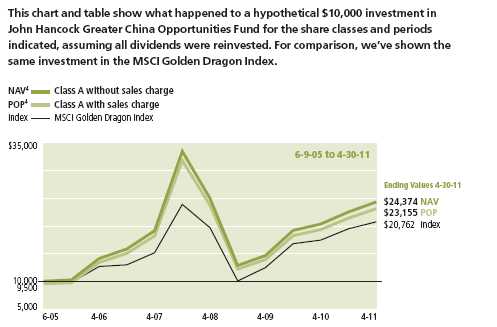

A look at performance

| | | | | | | | | |

| Total returns for the period ended April 30, 2011 | | | | |

| |

| | Average annual total returns (%) | Cumulative total returns (%) | | |

| | with maximum sales charge (POP) | with maximum sales charge (POP) | |

|

| | | | | Since | | | | | Since |

| | 1-year | 5-year | 10-year | inception | 6-months | 1-year | 5-year | 10-year | inception |

|

| Class A | 13.60 | 10.40 | — | 15.311 | 2.60 | 13.60 | 64.03 | — | 131.551 |

|

| Class B | 13.64 | 10.46 | — | 15.401 | 2.59 | 13.64 | 64.42 | — | 132.591 |

|

| Class C | 17.65 | 10.73 | — | 15.481 | 6.59 | 17.65 | 66.47 | — | 133.481 |

|

| Class I2 | 19.70 | 11.64 | — | 16.501 | 8.11 | 19.70 | 73.39 | — | 145.981 |

|

| Class NAV 2 | 20.19 | — | — | 6.963 | 8.30 | 20.19 | — | — | 33.933 |

|

Performance figures assume all distributions are reinvested. Public offering price (POP) figures reflect maximum sales charge on Class A shares of 5%, and the applicable contingent deferred sales charge (CDSC) on Class B shares and Class C shares. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC. Sales charge is not applicable for Class I and Class NAV shares.

The expense ratios of the Fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectuses for the Fund and may differ from those disclosed in the Financial Highlights tables in this report. The fee waivers and expense limitations are contractual at least until 2-29-12 for Class I. For Class A, Class B, Class C and Class NAV shares the net expenses equal the gross expenses. The expense ratios are as follows:

| | | | | | |

| | Class A | Class B | Class C | Class I | Class NAV | |

| | |

| Net (%) | 1.67 | 2.44 | 2.43 | 1.53 | 1.11 | |

| Gross (%) | 1.67 | 2.44 | 2.43 | 1.71 | 1.11 | |

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the Fund’s current performance may be higher or lower than the performance shown. For performance data current to the most recent month end, please call 1–800–225–5291 or visit the Fund’s Web site at www.jhfunds.com.

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder may pay on Fund distributions or on the redemption of Fund shares. The Fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

| |

| 6 | Greater China Opportunities Fund | Semiannual report |

| | | | |

| | Class B | Class C5 | Class I 2 | Class NAV 2 |

|

| Start date | 6-9-05 | 6-9-05 | 6-9-05 | 12-28-06 |

|

| NAV | $23,359 | $23,348 | $24,598 | $13,393 |

|

| POP | $23,259 | $23,348 | $24,598 | $13,393 |

|

| Index | $20,762 | $20,762 | $20,762 | $13,908 |

|

MSCI golden dragon Index (gross of foreign withholding taxes on dividends) is an unmanaged free float-adjusted market capitalization index that is designed to measure equity market performance in the China region. The MSCI Golden Dragon Index consists of the following Indexes: China, Hong Kong and Taiwan.

It is not possible to invest directly in an index. Index figures do not reflect sales charges or direct expenses, which would have resulted in lower values if they did.

1 From 6-9-05.

2 For certain types of investors, as described in the Fund’s Class I and Class NAV shares prospectuses.

3 From 12-28-06.

4 NAV represents net asset value and POP represents public offering price. Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

5 No contingent deferred sales charge applicable.

| | |

| | Semiannual report | Greater China Opportunities Fund | 7 |

Your expenses

These examples are intended to help you understand your ongoing operating expenses.

Understanding fund expenses

As a shareholder of the Fund, you incur two types of costs:

■ Transaction costs which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

■ Ongoing operating expenses including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the Fund’s actual ongoing operating expenses, and is based on the Fund’s actual return. It assumes an account value of $1,000.00 on November 1, 2010 with the same investment held until April 30, 2011.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 11-1-10 | on 4-30-11 | period ended 4-30-111 |

|

| Class A | $1,000.00 | $1,080.00 | $8.61 |

|

| Class B | 1,000.00 | 1,075.90 | 12.76 |

|

| Class C | 1,000.00 | 1,075.90 | 12.71 |

|

| Class I | 1,000.00 | 1,081.10 | 7.89 |

|

| Class NAV | 1,000.00 | 1,083.00 | 5.84 |

|

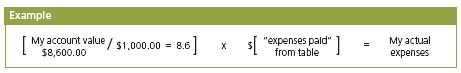

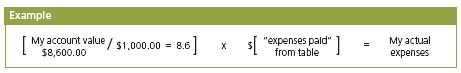

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at April 30, 2011, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| 8 | Greater China Opportunities Fund | Semiannual report |

Hypothetical example for comparison purposes

This table allows you to compare the Fund’s ongoing operating expenses with those of any other fund. It provides an example of the Fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the Fund’s actual return). It assumes an account value of $1,000.00 on November 1, 2010, with the same investment held until April 30, 2011. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 11-1-10 | on 4-30-11 | period ended 4-30-111 |

|

| Class A | $1,000.00 | $1,016.50 | $8.35 |

|

| Class B | 1,000.00 | 1,012.50 | 12.37 |

|

| Class C | 1,000.00 | 1,012.50 | 12.33 |

|

| Class I | 1,000.00 | 1,017.20 | 7.65 |

|

| Class NAV | 1,000.00 | 1,019.20 | 5.66 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the prospectus for details regarding transaction costs.

1 Expenses are equal to the Fund’s annualized expense ratio of 1.67%, 2.48%, 2.47%, 1.53% and 1.13% for Class A, Class B, Class C, Class I and Class NAV shares, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period).

| | |

| | Semiannual report | Greater China Opportunities Fund | 9 |

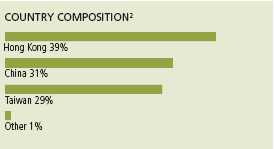

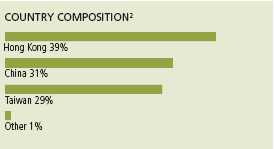

Portfolio summary

| | | | |

| Top 10 Holdings (33.3% of Net Assets on 4-30-11)1 | | | |

|

| Taiwan Semiconductor Manufacturing | | | BOC Hong Kong Holdings, Ltd. | 3.4% |

| Company, Ltd. | 4.2% | |

|

| | Bank of China, Ltd., Class H | 3.0% |

| Industrial & Commercial Bank | |

|

| of China, Ltd. | 4.0% | | China Shenhua Energy Company, Ltd. | 3.0% |

| |

|

| CNOOC, Ltd. | 3.8% | | China Minsheng Banking Corp. Ltd. | 2.9% |

| |

|

| China Mobile, Ltd. | 3.7% | | HTC Corp. | 2.8% |

| |

|

| | | | Evergrande Real Estate Group, Ltd. | 2.5% |

| |

|

| |

| Sector Composition2,3 | | | | |

|

| Financials | 38% | | Consumer Discretionary | 3% |

| |

|

| Information Technology | 17% | | Utilities | 2% |

| |

|

| Industrials | 12% | | Consumer Staples | 1% |

| |

|

| Materials | 10% | | Health Care | 1% |

| |

|

| Energy | 10% | | Other | 1% |

| |

|

| Telecommunication Services | 5% | | | |

| | |

1 Cash and cash equivalents not included in Top 10 Holdings.

2 As a percentage of net assets on 4-30-11.

3 Sector investing is subject to greater risks than the market as a whole. Because the Fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors.

| |

| 10 | Greater China Opportunities Fund | Semiannual report |

Fund’s investments

As of 4-30-11 (unaudited)

| | |

| | Shares | Value |

| Common Stocks 99.10% | | $114,714,832 |

|

| (Cost $85,852,876) | | |

| | | |

| China 31.34% | | 36,279,258 |

|

| Anhui Conch Cement Company, Ltd. | 537,000 | 2,538,936 |

|

| Bank of China, Ltd., Class H | 6,276,900 | 3,483,794 |

|

| China Longyuan Power Group Corp. | 1,699,000 | 1,746,817 |

|

| China Minsheng Banking Corp. Ltd. | 3,454,000 | 3,322,083 |

|

| China National Building Material Company, Ltd. | 312,000 | 658,260 |

|

| China Oilfield Services, Ltd. | 300,000 | 594,584 |

|

| China Pacific Insurance Group Company, Ltd. | 265,000 | 1,146,825 |

|

| China Rongsheng Heavy Industry Group Company, Ltd. | 2,700,000 | 2,277,263 |

|

| China Shenhua Energy Company, Ltd., Class H | 737,000 | 3,451,899 |

|

| Evergrande Real Estate Group, Ltd. | 4,022,000 | 2,878,034 |

|

| Industrial & Commercial Bank of China, Ltd. | 5,511,500 | 4,679,674 |

|

| International Mining Machinery Holdings, Ltd. | 1,379,500 | 1,424,573 |

|

| Ping An Insurance Group Company of China, Ltd. | 230,000 | 2,523,812 |

|

| Qihoo 360 Technology Company, Ltd., ADR (I) | 40,000 | 1,140,000 |

|

| Sinopharm Group Company, Ltd. | 300,000 | 1,035,249 |

|

| Xingda International Holdings, Ltd. | 705,000 | 812,573 |

|

| Yanzhou Coal Mining Company, Ltd., Class H | 180,000 | 703,134 |

|

| Zhongsheng Group Holdings Ltd. | 367,500 | 693,713 |

|

| Zhuzhou CSR Times Electric Company, Ltd. | 295,000 | 1,168,035 |

| | | |

| Hong Kong 38.68% | | 44,777,734 |

|

| AIA Group, Ltd. (I) | 675,600 | 2,283,535 |

|

| BOC Hong Kong Holdings, Ltd. | 1,267,000 | 3,984,991 |

|

| Cheung Kong Holdings, Ltd. | 110,000 | 1,737,458 |

|

| China Metal Recycling Holdings, Ltd. | 825,600 | 1,145,980 |

|

| China Mobile, Ltd. | 460,000 | 4,242,330 |

|

| China Overseas Land & Investment, Ltd. | 580,360 | 1,122,762 |

|

| China Resources Cement Holdings, Ltd. | 746,000 | 764,492 |

|

| China Resources Enterprises, Ltd. | 315,000 | 1,264,308 |

|

| Citic Pacific, Ltd. | 410,000 | 1,226,201 |

|

| CLP Holdings, Ltd. | 80,000 | 659,654 |

|

| CNOOC, Ltd. | 1,773,000 | 4,414,196 |

|

| Comba Telecom Systems Holdings Ltd. | 735,500 | 918,375 |

|

| COSCO Pacific, Ltd. | 824,000 | 1,701,846 |

|

| Daphne International Holdings, Ltd. | 1,134,000 | 906,762 |

|

| Digital China Holdings, Ltd. | 750,000 | 1,460,742 |

|

| Fook Woo Group Holdings, Ltd. (I) | 3,216,000 | 1,000,733 |

| | |

| See notes to financial statements | Semiannual report | Greater China Opportunities Fund | 11 |

| | |

| | Shares | Value |

| Hong Kong (continued) | | |

|

| Hong Kong Exchanges & Clearing, Ltd. | 78,000 | $1,781,694 |

|

| Hutchison Telecommunications Hong Kong Holdings, Ltd. | 1,200,000 | 377,016 |

|

| Hutchison Whampoa, Ltd. | 240,000 | 2,752,735 |

|

| Kerry Properties, Ltd. | 155,000 | 829,780 |

|

| Kunlun Energy Company, Ltd. | 1,348,000 | 2,386,917 |

|

| MTR Corp., Ltd. | 160,000 | 583,933 |

|

| Sino Land Company, Ltd. | 900,000 | 1,587,639 |

|

| Sun Hung Kai Properties, Ltd. | 145,000 | 2,272,801 |

|

| Techtronic Industries Company, Ltd. | 1,165,500 | 1,598,812 |

|

| Wharf Holdings, Ltd. | 241,000 | 1,772,042 |

| | | |

| Taiwan 29.08% | | 33,657,840 |

|

| Catcher Technology Company, Ltd. | 190,000 | 1,194,197 |

|

| Chinatrust Financial Holding Company, Ltd. | 1,350,000 | 1,239,686 |

|

| First Financial Holding Company, Ltd. (I) | 2,200,000 | 2,044,781 |

|

| First Steamship Company, Ltd. | 400,000 | 970,721 |

|

| Formosa Plastic Corp. | 500,000 | 2,046,390 |

|

| Gloria Material Technology Corp. (I) | 850,000 | 986,344 |

|

| Hon Hai Precision Industry Company, Ltd. | 708,600 | 2,690,507 |

|

| HTC Corp. | 70,000 | 3,191,754 |

|

| Huaku Development Company, Ltd. | 624,000 | 1,837,104 |

|

| J Touch Corp. (I) | 287,000 | 982,105 |

|

| KGI Securities Company, Ltd. | 2,261,000 | 1,188,383 |

|

| Nan Ya Plastics Corp. | 489,000 | 1,499,849 |

|

| Oriental Union Chemical Corp. | 1,000,000 | 1,471,206 |

|

| Taiwan Glass Industrial Corp. | 734,000 | 1,200,944 |

|

| Taiwan Mobile Company, Ltd. (I) | 600,000 | 1,549,007 |

|

| Taiwan Semiconductor Manufacturing Company, Ltd. | 1,892,089 | 4,863,774 |

|

| TPK Holding Company, Ltd. (I) | 48,000 | 1,436,685 |

|

| Wistron NeWeb Corp. | 350,000 | 1,348,299 |

|

| Yuanta Financial Holdings Company, Ltd. | 2,750,000 | 1,916,104 |

| |

| Total investments (Cost $85,852,876)† 99.10% | | $114,714,832 |

|

| |

| Other assets and liabilities, net 0.90% | | $1,038,196 |

|

| |

| Total net assets 100.00% | | $115,753,028 |

|

The percentage shown for each investment category is the total value of the category as a percentage of the net assets of the Fund.

| | |

| 12 | Greater China Opportunities Fund | Semiannual report | See notes to financial statements |

Notes to Schedule of Investments

ADR American Depositary Receipts

(I) Non-income producing security.

† At 4-30-11, the aggregate cost of investment securities for federal income tax purposes was $85,940,334. Net unrealized appreciation aggregated $28,774,498, of which $29,638,072 related to appreciated investment securities and $863,574 related to depreciated investment securities.

The Fund had the following sector composition as of 4-30-11 (as a percentage of total net assets).

| | | |

| Financials | 38% | | |

| Information Technology | 17% | | |

| Industrials | 12% | | |

| Materials | 10% | | |

| Energy | 10% | | |

| Telecommunication Services | 5% | | |

| Consumer Discretionary | 3% | | |

| Utilities | 2% | | |

| Consumer Staples | 1% | | |

| Health Care | 1% | | |

| Other | 1% | | |

| | |

| See notes to financial statements | Semiannual report | Greater China Opportunities Fund | 13 |

F I N A N C I A L S T A T E M E N T S

Financial statements

Statement of assets and liabilities 4-30-11 (unaudited)

This Statement of Assets and Liabilities is the Fund’s balance sheet. It shows the value of what the Fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| |

| Assets | |

|

| Investments, at value (Cost $85,852,876) | $114,714,832 |

| Foreign currency, at value (Cost $1,560,606) | 1,561,196 |

| Receivable for investments sold | 2,155,739 |

| Receivable for fund shares sold | 65,861 |

| Dividends receivable | 217,615 |

| Other receivables and prepaid expenses | 40,358 |

| | |

| Total assets | 118,755,601 |

| |

| Liabilities | |

|

| Due to custodian | 292,283 |

| Payable for investments purchased | 2,239,426 |

| Payable for fund shares repurchased | 247,994 |

| Payable to affiliates | |

| Accounting and legal services fees | 2,746 |

| Transfer agent fees | 33,583 |

| Distribution and service fees | 47,805 |

| Trustees’ fees | 5,224 |

| Management fees | 94,079 |

| Other liabilities and accrued expenses | 39,433 |

| | |

| Total liabilities | 3,002,573 |

|

| Net assets | |

|

| Capital paid-in | $89,925,698 |

| Accumulated net investment loss | (819,625) |

| Accumulated net realized gain (loss) on investments and foreign | |

| currency transactions | (2,216,124) |

| Net unrealized appreciation (depreciation) on investments and translation | |

| of assets and liabilities in foreign currencies | 28,863,079 |

| Net assets | $115,753,028 |

|

| Net asset value per share | |

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($78,164,972 ÷ 3,587,007 shares) | $21.79 |

| Class B ($17,014,014 ÷ 800,251 shares)1 | $21.26 |

| Class C ($17,578,321 ÷ 827,339 shares)1 | $21.25 |

| Class I ($1,968,456 ÷ 90,808 shares) | $21.68 |

| Class NAV ($1,027,265 ÷ 46,789 shares) | $21.96 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95%)2 | $22.94 |

1 Redemption price is equal to net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $50,000. On sales of $50,000 or more and on group sales the offering price is reduced.

| | |

| 14 | Greater China Opportunities Fund | Semiannual report | See notes to financial statements |

F I N A N C I A L S T A T E M E N T S

Statement of operations For the six-month period ended 4-30-11 (unaudited)

This Statement of Operations summarizes the Fund’s investment income earned and expenses incurred in operating the Fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Dividends | $313,881 |

| Less foreign taxes withheld | (15,319) |

| | |

| Total investment income | 298,562 |

| |

| Expenses | |

|

| Investment management fees (Note 4) | 586,571 |

| Distribution and service fees (Note 4) | 293,515 |

| Accounting and legal services fees (Note 4) | 9,100 |

| Transfer agent fees (Note 4) | 104,639 |

| Trustees’ fees (Note 4) | 5,283 |

| State registration fees (Note 4) | 52,167 |

| Printing and postage (Note 4) | 13,698 |

| Professional fees | 18,004 |

| Custodian fees | 7,679 |

| Registration and filing fees | 25,086 |

| Other | 8,666 |

| | |

| Total expenses | 1,124,408 |

| Less expense reductions (Note 4) | (9,377) |

| | |

| Net expenses | 1,115,031 |

| | |

| Net investment loss | (816,469) |

| |

| Realized and unrealized gain (loss) | |

|

| |

| Net realized gain (loss) on | |

| Investments | 20,385,374 |

| Foreign currency transactions | 77,608 |

| | 20,462,982 |

| Change in net unrealized appreciation (depreciation) of | |

| Investments | (10,776,618) |

| Translation of assets and liabilities in foreign currencies | (1,462) |

| | (10,778,080) |

| Net realized and unrealized gain | 9,684,902 |

| | |

| Increase in net assets from operations | $8,868,433 |

| | |

| See notes to financial statements | Semiannual report | Greater China Opportunities Fund | 15 |

F I N A N C I A L S T A T E M E N T S

Statements of changes in net assets

These Statements of Changes in Net Assets show how the value of the Fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of Fund share transactions.

| | |

| | Six months | |

| | ended | Year |

| | 4-30-11 | ended |

| | (unaudited) | 10-31-10 |

| |

| Increase (decrease) in net assets | | |

|

| |

| From operations | | |

| Net investment income (loss) | ($816,469) | $284,634 |

| Net realized gain | 20,462,982 | 18,005,705 |

| Change in net unrealized appreciation (depreciation) | (10,778,080) | 536,058 |

| | | |

| Increase in net assets resulting from operations | 8,868,433 | 18,826,397 |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | (253,588) | (547,243) |

| Class B | — | (1,013) |

| Class C | — | (1,047) |

| Class I | (11,244) | (39,523) |

| Class NAV | (6,591) | (9,338) |

| From net realized gain | | |

| | | |

| Total distributions | (271,423) | (598,164) |

| | | |

| From Fund share transactions (Note 5) | (12,798,109) | (33,526,221) |

| | | |

| Total decrease | (4,201,099) | (15,297,988) |

| |

| Net assets | | |

|

| Beginning of period | 119,954,127 | 135,252,115 |

| | | |

| End of period | $115,753,028 | $119,954,127 |

| | | |

| Accumulated undistributed net investment income (loss) | ($819,625) | $268,267 |

| | |

| 16 | Greater China Opportunities Fund | Semiannual report | See notes to financial statements |

Financial highlights

The Financial Highlights show how the Fund’s net asset value for a share has changed since the end of the previous period.

| | | | | | |

| CLASS A SHARES Period ended | 4-30-111 | 10-31-10 | 10-31-09 | 10-31-08 | 10-31-07 | 10-31-06 |

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $20.24 | $17.33 | $11.61 | $32.54 | $15.78 | $10.24 |

| Net investment income (loss)2 | (0.12) | 0.08 | 0.12 | 0.04 | 0.07 | 0.16 |

| Net realized and unrealized gain (loss) | | | | | | |

| on investments | 1.74 | 2.94 | 5.63 | (19.08) | 17.14 | 5.43 |

| Total from investment operations | 1.62 | 3.02 | 5.75 | (19.04) | 17.21 | 5.59 |

| Less distributions | | | | | | |

| From net investment income | (0.07) | (0.11) | (0.03) | (0.06) | (0.08) | (0.01) |

| From net realized gain | — | — | — | (1.83) | (0.37) | (0.04) |

| Total distributions | (0.07) | (0.11) | (0.03) | (1.89) | (0.45) | (0.05) |

| Net asset value, end of period | $21.79 | $20.24 | $17.33 | $11.61 | $32.54 | $15.78 |

| Total return (%)3 | 8.004 | 17.465 | 49.625 | (61.75)5 | 111.87 | 54.745 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $78 | $80 | $90 | $69 | $283 | $79 |

| Ratios (as a percentage of average | | | | | | |

| net assets): | | | | | | |

| Expenses before reductions | 1.676 | 1.73 | 1.95 | 1.77 | 1.68 | 1.92 |

| Expenses net of fee waivers | 1.676 | 1.70 | 1.95 | 1.77 | 1.68 | 1.89 |

| Expenses net of fee waivers and credits | 1.676 | 1.70 | 1.92 | 1.77 | 1.68 | 1.89 |

| Net investment income (loss) | (1.16)6 | 0.45 | 0.86 | 0.21 | 0.34 | 1.14 |

| Portfolio turnover (%) | 61 | 71 | 105 | 98 | 85 | 57 |

1 Semiannual period from 11-1-10 to 4-30-11. Unaudited.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Not annualized.

5 Total returns would have been lower had certain expenses not been reduced during the periods shown.

6 Annualized.

| | |

| See notes to financial statements | Semiannual report | Greater China Opportunities Fund | 17 |

| | | | | | |

| CLASS B SHARES Period ended | 4-30-111 | 10-31-10 | 10-31-09 | 10-31-08 | 10-31-07 | 10-31-06 |

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $19.76 | $16.95 | $11.41 | $32.16 | $15.63 | $10.21 |

| Net investment income (loss)2 | (0.20) | (0.06) | 0.01 | (0.09) | (0.07) | 0.09 |

| Net realized and unrealized gain (loss) | | | | | | |

| on investments | 1.70 | 2.87 | 5.53 | (18.83) | 16.98 | 5.37 |

| Total from investment operations | 1.50 | 2.81 | 5.54 | (18.92) | 16.91 | 5.46 |

| Less distributions | | | | | | |

| From net investment income | — | —3 | — | — | (0.01) | — |

| From net realized gain | — | — | — | (1.83) | (0.37) | (0.04) |

| Total distributions | — | — | — | (1.83) | (0.38) | (0.04) |

| Net asset value, end of period | $21.26 | $19.76 | $16.95 | $11.41 | $32.16 | $15.63 |

| Total return (%)4 | 7.595 | 16.586 | 48.556 | (62.02)6 | 110.50 | 53.596 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $17 | $17 | $19 | $15 | $55 | $16 |

| Ratios (as a percentage of average | | | | | | |

| net assets): | | | | | | |

| Expenses before reductions | 2.487 | 2.49 | 2.70 | 2.49 | 2.38 | 2.62 |

| Expenses net of fee waivers | 2.487 | 2.45 | 2.70 | 2.49 | 2.38 | 2.59 |

| Expenses net of fee waivers and credits | 2.487 | 2.45 | 2.67 | 2.49 | 2.38 | 2.59 |

| Net investment income (loss) | (1.97)7 | (0.31) | 0.11 | (0.43) | (0.32) | 0.63 |

| Portfolio turnover (%) | 61 | 71 | 105 | 98 | 85 | 57 |

1 Semiannual period from 11-1-10 to 4-30-11. Unaudited.2 Based on the average daily shares outstanding.3 Less than ($0.005) per share.4 Does not reflect the effect of sales charges, if any.5 Not annualized.6 Total returns would have been lower had certain expenses not been reduced during the periods shown.7 Annualized.

| | | | | | |

| CLASS C SHARES Period ended | 4-30-111 | 10-31-10 | 10-31-09 | 10-31-08 | 10-31-07 | 10-31-06 |

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $19.75 | $16.94 | $11.40 | $32.16 | $15.63 | $10.21 |

| Net investment income (loss)2 | (0.20) | (0.05) | 0.01 | (0.09) | (0.05) | 0.08 |

| Net realized and unrealized gain (loss) | | | | | | |

| on investments | 1.70 | 2.86 | 5.53 | (18.84) | 16.96 | 5.38 |

| Total from investment operations | 1.50 | 2.81 | 5.54 | (18.93) | 16.91 | 5.46 |

| Less distributions | | | | | | |

| From net investment income | — | —3 | — | — | (0.01) | — |

| From net realized gain | — | — | — | (1.83) | (0.37) | (0.04) |

| Total distributions | — | — | — | (1.83) | (0.38) | (0.04) |

| Net asset value, end of period | $21.25 | $19.75 | $16.94 | $11.40 | $32.16 | $15.63 |

| Total return (%)4 | 7.595 | 16.596 | 48.606 | (62.06)6 | 110.51 | 53.596 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $18 | $18 | $20 | $16 | $59 | $13 |

| Ratios (as a percentage of average | | | | | | |

| net assets): | | | | | | |

| Expenses before reductions | 2.477 | 2.48 | 2.71 | 2.49 | 2.38 | 2.62 |

| Expenses net of fee waivers | 2.477 | 2.44 | 2.71 | 2.49 | 2.38 | 2.59 |

| Expenses net of fee waivers and credits | 2.477 | 2.44 | 2.68 | 2.49 | 2.38 | 2.59 |

| Net investment income (loss) | (1.96)7 | (0.26) | 0.10 | (0.43) | (0.25) | 0.55 |

| Portfolio turnover (%) | 61 | 71 | 105 | 98 | 85 | 57 |

| |

1 Semiannual period from 11-1-10 to 4-30-11. Unaudited.

2 Based on the average daily shares outstanding.

3 Less than ($0.005) per share.

4 Does not reflect the effect of sales charges, if any.

5 Not annualized.

6 Total returns would have been lower had certain expenses not been reduced during the periods shown.

7 Annualized.

| | |

| 18 | Greater China Opportunities Fund | Semiannual report | See notes to financial statements |

| | | | | | |

| CLASS I SHARES Period ended | 4-30-111 | 10-31-10 | 10-31-09 | 10-31-08 | 10-31-07 | 10-31-06 |

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $20.14 | $17.24 | $11.57 | $32.69 | $15.82 | $10.26 |

| Net investment income (loss)2 | (0.11) | 0.01 | 0.18 | 0.04 | 0.09 | 0.24 |

| Net realized and unrealized gain (loss) | | | | | | |

| on investments | 1.74 | 3.02 | 5.53 | (19.14) | 17.28 | 5.42 |

| Total from investment operations | 1.63 | 3.03 | 5.71 | (19.10) | 17.37 | 5.66 |

| Less distributions | | | | | | |

| From net investment income | (0.09) | (0.13) | (0.04) | (0.19) | (0.13) | (0.06) |

| From net realized gain | — | — | — | (1.83) | (0.37) | (0.04) |

| Total distributions | (0.09) | (0.13) | (0.04) | (2.02) | (0.50) | (0.10) |

| Net asset value, end of period | $21.68 | $20.14 | $17.24 | $11.57 | $32.69 | $15.82 |

| Total return (%) | 8.113,4 | 17.614 | 49.494 | (61.89)4 | 112.93 | 55.434 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $2 | $3 | $5 | $1 | $6 | $4 |

| Ratios (as a percentage of average | | | | | | |

| net assets): | | | | | | |

| Expenses before reductions | 2.325 | 1.83 | 1.81 | 1.64 | 1.22 | 1.49 |

| Expenses net of fee waivers | 1.535 | 1.57 | 1.65 | 1.64 | 1.22 | 1.46 |

| Net investment income (loss) | (1.08)5 | 0.08 | 1.25 | 0.19 | 0.44 | 1.70 |

| Portfolio turnover (%) | 61 | 71 | 105 | 98 | 85 | 57 |

1 Semiannual period from 11-1-10 to 4-30-11. Unaudited.

2 Based on the average daily shares outstanding.

3 Not annualized.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Annualized.

| | | | | |

| CLASS NAV SHARES Period ended | 4-30-111 | 10-31-10 | 10-31-09 | 10-31-08 | 10-31-072 |

| Per share operating performance | | | | | |

|

| Net asset value, beginning of period | $20.42 | $17.47 | $11.66 | $32.72 | $18.15 |

| Net investment income (loss)3 | (0.06) | 0.20 | 0.24 | 0.24 | 0.35 |

| Net realized and unrealized gain (loss) | | | | | |

| on investments | 1.74 | 2.96 | 5.65 | (19.20) | 14.22 |

| Total from investment operations | 1.68 | 3.16 | 5.89 | (18.96) | 14.57 |

| Less distributions | | | | | |

| From net investment income | (0.14) | (0.21) | (0.08) | (0.27) | — |

| From net realized gain | — | — | — | (1.83) | — |

| Total distributions | (0.14) | (0.21) | (0.08) | (2.10) | — |

| Net asset value, end of period | $21.96 | $20.42 | $17.47 | $11.66 | $32.72 |

| Total return (%) | 8.305 | 18.17 | 50.844 | (61.51)4 | 80.285 |

| |

| Ratios and supplemental data | | | | | |

|

| Net assets, end of period (in millions) | $1 | $1 | $1 | —6 | $1 |

| Ratios (as a percentage of average net assets): | | | | | |

| Expenses before reductions | 1.137 | 1.11 | 1.12 | 1.17 | 1.127 |

| Expenses net of fee waivers | 1.137 | 1.11 | 1.12 | 1.17 | 1.127 |

| Net investment income (loss) | (0.60)7 | 1.08 | 1.63 | 1.16 | 1.567 |

| Portfolio turnover (%) | 61 | 71 | 105 | 98 | 85 |

| |

1 Semiannual period from 11-1-10 to 4-30-11. Unaudited.

2 The inception date for Class NAV shares is 12-28-06.

3 Based on the average daily shares outstanding.

4 Total returns would have been lower had certain expenses not been reduced during the periods shown.

5 Not annualized.

6 Less than $500,000.

7 Annualized.

| | |

| See notes to financial statements | Semiannual report | Greater China Opportunities Fund | 19 |

Notes to financial statements

(unaudited)

Note 1 — Organization

John Hancock Greater China Opportunities Fund (the Fund) is a non-diversified series of John Hancock Investment Trust III (the Trust), an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek long-term capital appreciation.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of Assets and Liabilities. Class A, Class B and Class C shares are offered to all investors. Class I shares are offered to institutions and certain investors. Class NAV shares are sold to John Hancock affiliated funds of funds. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage for each class may differ. Class B shares convert to Class A shares eight years after purchase.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from those estimates. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 p.m., Eastern Time. The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include market or issuer specific events, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the values by input classification of the Fund’s investments as of April 30, 2011, by major security category or type.

| | | | |

| | | | | LEVEL 3 |

| | | | LEVEL 2 | SIGNIFICANT |

| | TOTAL MARKET | LEVEL 1 | SIGNIFICANT | UNOBSERVABLE |

| | VALUE AT 4-30-11 | QUOTED PRICE | OBSERVABLE INPUTS | INPUTS |

|

| Common Stocks | | | | |

| China | $36,279,258 | $1,140,000 | 35,139,258 | — |

| Hong Kong | 44,777,734 | — | 44,777,734 | — |

| Taiwan | 33,657,840 | — | 33,657,840 | — |

| |

|

| Total Investments in | | | | |

| Securities | $114,714,832 | $1,140,000 | $113,574,832 | — |

| |

| 20 | Greater China Opportunities Fund | Semiannual report |

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. During the six-month period ended April 30, 2011, there were no significant transfers in or out of Level 1 or Level 2 assets.

In order to value the securities, the Fund uses the following valuation techniques. Equity securities held by the Fund are valued at the last sale price or official closing price on the principal securities exchange on which they trade. In the event there were no sales during the day or closing prices are not available, then securities are valued using the last quoted bid or evaluated price. Foreign securities and currencies, including forward foreign currency contracts, are valued in U.S. dollars, based on foreign currency exchange rates supplied by an independent pricing service. Certain securities and forward foreign currency contracts traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading.

Other portfolio securities and assets, where market quotations are not readily available, are valued at fair value, as determined in good faith by the Fund’s Pricing Committee, following procedures established by the Board of Trustees. Generally, trading in non-U.S. securities is substantially completed each day at various times prior to the close of trading on the NYSE. Significant market events that affect the values of non-U.S. securities may occur between the time when the valuation of the securities is generally determined and the close of the NYSE. During significant market events, these securities will be valued at fair value, as determined in good faith, following procedures established by the Board of Trustees. The Fund may use a fair valuation model to value non-U.S. securities in order to adjust for events which may occur between the close of foreign exchanges and the close of the NYSE.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation. Dividend income is recorded on the ex-date, except for dividends of foreign securities where the dividend may not be known until after the ex-date. In those cases, dividend income is recorded when the Fund becomes aware of the dividends.

Foreign currency translation. Assets, including investments and liabilities denominated in foreign currencies, are translated into U.S. dollar values each day at the prevailing exchange rate. Purchases and sales of securities, income and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on securities is reflected as a component of the realized and unrealized gains (losses) on investments.

Funds that invest internationally generally carry more risk than funds that invest strictly in U.S. securities. Funds investing in a single country or in a limited geographic region tend to be riskier than funds that invest more broadly. Risks can result from differences in economic and political conditions, regulations, market practices (including higher transaction costs) and accounting standards. Foreign investments are also subject to a decline in the value of a foreign currency versus the U.S. dollar, which reduces the dollar value of securities denominated in that currency.

The Fund may be subject to capital gains and repatriation taxes as imposed by certain countries in which it invests. Such taxes are generally based upon income and/or capital gains earned or repatriated. Taxes are accrued based upon net investment income, net realized gains and net unrealized appreciation.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the custodian agreement, the custodian may loan money to the Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any

| |

| Semiannual report | Greater China Opportunities Fund | 21 |

related costs or expenses. The custodian has a lien, security interest or security entitlement in any Fund property that is not segregated, to the maximum extent permitted by law for any overdraft.

In addition, effective March 30, 2011, the Fund and other affiliated funds have entered into an agreement with Citibank N.A. which enables them to participate in a $100 million unsecured committed line of credit. Prior to March 30, 2011, the Fund had a similar agreement with State Street Bank and Trust Company. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of Operations. For the six months ended April 30, 2011, the Fund had no borrowings under the line of credit.

Expenses. The majority of expenses are directly attributable to an individual fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net asset value of the class. Class-specific expenses, such as distribution and service fees, if any, transfer agent fees, state registration fees and printing and postage, for all classes, are calculated daily at the class level based on the appropriate net asset value of each class and the specific expense rates applicable to each class.

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

For federal income tax purposes, the Fund has a capital loss carryforward of $22,591,648 available to offset future net realized capital gains as of October 31, 2010. The loss carryforward expires as follows: October 31, 2016 — $11,108,627 and October 31, 2017 — $11,483,021.

Under the recently enacted Regulated Investment Company Modernization Act of 2010, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, any losses incurred during those future taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

As of October 31, 2010, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition or disclosure. The Fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares and pays dividends and capital gain distributions, if any, at least annually.

Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of expenses that may be applied differently to each class.

| |

| 22 | Greater China Opportunities Fund | Semiannual report |

Such distributions, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America.

Capital accounts within financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to wash sales loss deferrals.

Note 3 — Guarantees and indemnifications

Under the Fund’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

John Hancock Advisers, LLC (the Adviser) serves as investment adviser for the Trust. John Hancock Funds, LLC (the Distributor), an affiliate of the Adviser, serves as principal underwriter of the Trust. The Adviser and the Distributor are indirect wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The Fund has an investment management agreement with the Adviser under which the Fund pays a monthly management fee to the Adviser equivalent, on an annual basis, to the sum of: (a) 1.00% of the first $1,000,000,000 of the Fund’s average daily net assets; (b) 0.95% of the next $1,000,000,000; and (c) 0.90% of the Fund’s average daily net assets in excess of $2,000,000,000. The Adviser has a subadvisory agreement with John Hancock Asset Management a division of Manulife Asset Management (North America) LLC (formerly MFC Global Investment Management (U.S.A.) Limited), an indirectly owned subsidiary of MFC and an affiliate of the Adviser. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the six months ended April 30, 2011 were equivalent to an annual effective rate of 1.00% of the Fund’s average daily net assets.

The Adviser has contractually agreed to waive fees and reimburse expenses for Class I shares. This agreement excludes taxes, portfolio brokerage commissions, interest, litigation, indemnification expenses and other extraordinary expenses not incurred in the ordinary course of the Fund’s business. The fee waivers and expense reimbursements are such that the total operating expenses of Class I shares will not exceed 1.53% of the average total net assets of the class’s expenses. The fee waivers and expense reimbursements will continue in effect until February 29, 2012. Accordingly, these expense reductions amounted to $9,377 for Class I for the six months ended April 30, 2011.

Accounting and legal services. Pursuant to the Accounting and Legal Services Agreement, the Fund reimburses the Adviser for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services of the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred for the six months ended April 30, 2011, amounted to an annual rate of 0.02% of the Fund’s average daily net assets.

Distribution and service plans. The Fund has a distribution agreement with the Distributor. The Fund has adopted distribution and service plans with respect to Class A, Class B and Class C shares pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided

| | |

| | Semiannual report | Greater China Opportunities Fund | 23 |

as the distributor of shares of the Fund. The Fund may pay up to the following contractual rates of distribution and service fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the Fund’s shares.

| | | |

| CLASS | 12b–1 FEE | | |

| | |

| Class A | 0.30% | | |

| Class B | 1.00% | | |

| Class C | 1.00% | | |

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $51,922 for the six months ended April 30, 2011. Of this amount, $8,371 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $40,718 was paid as sales commissions to broker-dealers and $2,833 was paid as sales commissions to sales personnel of Signator Investors, Inc. (Signator Investors), a broker-dealer affiliate of the Adviser.

Class B and Class C shares are subject to contingent deferred sales charges (CDSC). Class B shares that are redeemed within six years of purchase are subject to CDSC, at declining rates, beginning at 5.00% of the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Class C shares that are redeemed within one year of purchase are subject to a 1.00% CDSC on the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the six months ended April 30, 2011, CDSCs received by the Distributor amounted to $20,943 and $2,508 for Class B and Class C shares, respectively.

Transfer agent fees. The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services or Transfer Agent), an affiliate of the Adviser. The transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. The Signature Services Cost includes a component of allocated John Hancock corporate overhead for providing transfer agent services to the Fund and to all other John Hancock affiliated funds. It also includes out-of-pocket expenses that are comprised of payments made to third-parties for recordkeeping services provided to their clients who invest in one or more John Hancock funds. In addition, Signature Services Cost may be reduced by certain revenues that Signature Services receives in connection with the service it provides to the funds. Signature Services Cost is calculated monthly and allocated, as applicable, to four categories of share classes: Institutional Share Classes, Retirement Share Classes, Municipal Bond Classes and all other Retail Share Classes. Within each of these categories, the applicable costs are allocated to the affected John Hancock affiliated funds and/or classes, based on the relative average daily net assets.

Class level expenses. Class level expenses for the six months ended April 30, 2011 were:

| | | | |

| | DISTRIBUTION | TRANSFER | STATE | PRINTING AND |

| CLASS | AND SERVICE FEES | AGENT FEES | REGISTRATION FEES | POSTAGE |

|

| Class A | $118,402 | $72,029 | $14,009 | $ 9,296 |

| Class B | 85,625 | 15,627 | 12,303 | 2,171 |

| Class C | 89,488 | 16,325 | 12,303 | 2,177 |

| Class I | — | 658 | 13,552 | 54 |

| | | | | |

| Total | $293,515 | $104,639 | $52,167 | $13,698 |

| |

| 24 | Greater China Opportunities Fund | Semiannual report |

Trustee expenses. The Trust compensates each Trustee who is not an employee of the Adviser or its affiliates. These Trustees may, for tax purposes, elect to defer receipt of this compensation under the John Hancock Group of Funds Deferred Compensation Plan (the Plan). Deferred amounts are invested in various John Hancock funds and remain in the funds until distributed in accordance with the Plan. The investment of deferred amounts and the offsetting liability are included within Other receivables and prepaid expenses and Payable to affiliates — Trustees’ fees, respectively, in the accompanying Statement of Assets and Liabilities.

Note 5 — Fund share transactions

Transactions in Fund shares for the six months ended April 30, 2011 and for the year ended October 31, 2010 were as follows:

| | | | |

| | Six months ended 4-30-11 | Year ended 10-31-10 |

| | Shares | Amount | Shares | Amount |

| Class A shares | | | | |

|

| Sold | 267,201 | $5,592,947 | 804,693 | $14,928,900 |

| Distributions reinvested | 11,278 | 230,411 | 26,559 | 497,448 |

| Repurchased | (667,178) | (13,920,037) | (2,033,781) | (36,774,293) |

| | | | | |

| Net decrease | (388,699) | ($8,096,679) | (1,202,529) | ($21,347,945) |

| |

| Class B shares | | | | |

|

| Sold | 44,834 | $913,851 | 127,785 | $2,320,362 |

| Repurchased | (123,999) | (2,538,706) | (387,415) | (6,846,177) |

| | | | | |

| Net decrease | (79,165) | ($1,624,855) | (259,630) | ($4,525,815) |

| |

| Class C shares | | | | |

|

| Sold | 40,630 | $828,665 | 132,836 | $2,369,389 |

| Distributions reinvested | — | — | 43 | 787 |

| Repurchased | (149,424) | (3,037,694) | (395,391) | (7,003,064) |

| | | | | |

| Net decrease | (108,794) | ($2,209,029) | (262,512) | ($4,632,888) |

| |

| Class I shares | | | | |

|

| Sold | 5,770 | $120,957 | 98,901 | $1,828,148 |

| Distributions reinvested | 196 | 3,979 | 1,285 | 23,933 |

| Repurchased | (49,274) | (1,024,911) | (231,115) | (4,274,907) |

| | | | | |

| Net decrease | (43,308) | ($899,975) | (130,929) | ($2,422,826) |

| |

| Class NAV shares | | | | |

|

| Sold | 9,851 | $206,220 | 19,390 | $351,391 |

| Distributions reinvested | 321 | 6,591 | 497 | 9,338 |

| Repurchased | (8,511) | (180,382) | (52,272) | (957,476) |

| | | | | |

| Net increase (decrease) | 1,661 | $32,429 | (32,385) | ($596,747) |

| |

| Net decrease | (618,305) | ($12,798,109) | (1,887,985) | ($33,526,221) |

|

Note 6 — Purchase and sale of securities

Purchases and sales of securities, other than short-term securities, aggregated $71,016,578 and $84,959,811, respectively, for the six months ended April 30, 2011.

| | |

| | Semiannual report | Greater China Opportunities Fund | 25 |

More information

| |

| Trustees | Investment adviser |

| Steven R. Pruchansky, Chairperson | John Hancock Advisers, LLC |

| James F. Carlin | |

| William H. Cunningham | Subadviser |

| Deborah C. Jackson* | John Hancock Asset Management |

| Charles L. Ladner,* Vice Chairperson | (formerly MFC Global Investment |

| Stanley Martin* | Management (U.S.A.) Limited) |

| Hugh McHaffie† | |

| Dr. John A. Moore | Principal distributor |

| Patti McGill Peterson* | John Hancock Funds, LLC |

| Gregory A. Russo | |

| John G. Vrysen† | Custodian |

| | State Street Bank and Trust Company |

| Officers | |

| Keith F. Hartstein | Transfer agent |

| President and Chief Executive Officer | John Hancock Signature Services, Inc. |

| | |

| Andrew G. Arnott | Legal counsel |

| Senior Vice President and Chief Operating Officer | K&L Gates LLP |

| | |

| Thomas M. Kinzler | |

| Secretary and Chief Legal Officer | |

| | |

| Francis V. Knox, Jr. | |

| Chief Compliance Officer | |

| | |

| Charles A. Rizzo | |

| Chief Financial Officer | |

| | |

| Salvatore Schiavone | |

| Treasurer | |

| |

| *Member of the Audit Committee | |

| †Non-Independent Trustee | |

The Fund’s proxy voting policies and procedures, as well as the Fund’s proxy voting record for the most recent twelve-month period ended June 30, are available free of charge on the Securities and Exchange Commission (SEC) Web site at www.sec.gov or on our Web site.

The Fund’s complete list of portfolio holdings, for the first and third fiscal quarters, is filed with the SEC on Form N-Q. The Fund’s Form N-Q is available on our Web site and the SEC’s Web site, www.sec.gov, and can be reviewed and copied (for a fee) at the SEC’s Public Reference Room in Washington, DC. Call 1-800-SEC-0330 to receive information on the operation of the SEC’s Public Reference Room.

We make this information on your fund, as well as monthly portfolio holdings, and other fund details available on our Web site www.jhfunds.com or by calling 1-800-225-5291.

| | |

| You can also contact us: | | |

| 1-800-225-5291 | Regular mail: | Express mail: |

| jhfunds.com | John Hancock Signature Services, Inc. | John Hancock Signature Services, Inc. |

| | P.O. Box 55913 | Mutual Fund Image Operations |

| | Boston, MA 02205-5913 | 30 Dan Road |

| | | Canton, MA 02021 |

| |

| 26 | Greater China Opportunities Fund | Semiannual report |

1-800-225-5291

1-800-554-6713 TDD

1-800-338-8080 EASI-Line

www.jhfunds.com

Now available: electronic delivery

www.jhfunds.com/edelivery

| |

| This report is for the information of the shareholders of John Hancock Greater China Opportunities Fund. | 080SA 4/11 |

| It is not authorized for distribution to prospective investors unless preceded or accompanied by a prospectus. | 6/11 |

ITEM 2. CODE OF ETHICS.

Not applicable at this time.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable at this time.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable at this time.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable at this time.

ITEM 6. SCHEDULE OF INVESTMENTS.

(a) Not applicable.

(b) Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable.

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

There were no material changes to previously disclosed John Hancock Funds – Governance Committee Charter.

ITEM 11. CONTROLS AND PROCEDURES.

(a) Based upon their evaluation of the registrant's disclosure controls and procedures as conducted within 90 days of the filing date of this Form N-CSR, the registrant's principal executive officer and principal financial officer have concluded that those disclosure controls and procedures provide reasonable assurance that the material information required to be disclosed by the registrant on this report is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms.

(b) There were no changes in the registrant's internal control over financial reporting that occurred during the registrant's most recent fiscal half-year (the registrant's second fiscal half-year in the case of an annual report) that have materially affected, or are reasonably likely to materially affect, the registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by Section 302 of the Sarbanes-Oxley Act of 2002 and Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(b) Separate certifications for the registrant's principal executive officer and principal financial officer, as required by 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, and Rule 30a-2(b) under the Investment Company Act of 1940, are attached. The certifications furnished pursuant to this paragraph are not deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of that section. Such certifications are not deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent that the Registrant specifically incorporates them by reference.

(c)(1) Submission of Matters to a Vote of Security Holders is attached. See attached “John Hancock Funds – Governance Committee Charter”.

(c)(2) Contact person at the registrant.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

John Hancock Investment Trust III

By:

/s/ Keith F. Hartstein

Keith F. Hartstein

President and

Chief Executive Officer

Date: June 20, 2011

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By:

/s/ Keith F. Hartstein

Keith F. Hartstein

President and

Chief Executive Officer

Date: June 20, 2011

By:

/s/ Charles A. Rizzo

Charles A. Rizzo

Chief Financial Officer

Date: June 20, 2011