SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under section 240.14a-12

LINEAR TECHNOLOGY CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| | o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: ___________ |

| (2) | Aggregate number of securities to which transaction applies: ___________ |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): __________ |

| (4) | Proposed maximum aggregate value of transaction: ______________ |

| (5) | Total fee paid: _____________ |

| | o | Fee paid previously with preliminary materials. |

| | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: __________________ |

| (2) | Form Schedule or Registration Statement No.: ___________________ |

| (3) | Filing Party: ________________ |

| (4) | Date Filed: ________________ |

LINEAR TECHNOLOGY CORPORATION

___________________________

Notice of Annual Meeting of Stockholders

To Be Held on November 1, 2006

TO THE STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Linear Technology Corporation, a Delaware corporation (the "Company"), will be held on November 1, 2006 at 3:00 p.m., local time, at the Company's principal executive offices, located at 720 Sycamore Drive, Milpitas, California 95035, for the following purposes:

| 1. | To elect five (5) directors to serve until the next Annual Meeting of Stockholders and until their successors are elected. |

| 2. | To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending July 1, 2007. |

| 3. | To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only stockholders of record of the Company's common stock at the close of business on September 5, 2006, the record date, are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to ensure your representation at the meeting, you are urged to mark, sign, date and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope enclosed for that purpose. Any stockholder attending the Annual Meeting may vote in person even if such stockholder has returned a proxy card.

FOR THE BOARD OF DIRECTORS

/s/ Arthur F. Schneiderman

Arthur F. Schneiderman

Secretary

Milpitas, California

September 25, 2006

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE. |

LINEAR TECHNOLOGY CORPORATION

___________________________

PROXY STATEMENT

FOR

2006 ANNUAL MEETING OF STOCKHOLDERS

___________________________

INFORMATION CONCERNING SOLICITATION

AND VOTING

General

The enclosed Proxy is solicited on behalf of the Board of Directors of Linear Technology Corporation, a Delaware corporation (the "Company"), for use at the Annual Meeting of Stockholders to be held November 1, 2006, at 3:00 p.m., local time, or at any adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the Company's principal executive offices, located at 720 Sycamore Drive, Milpitas, California 95035. The telephone number at that location is (408) 432-1900.

These proxy solicitation materials and the Company's Annual Report to Stockholders for the year ended July 2, 2006, including financial statements, were mailed on or about September 25, 2006 to all stockholders entitled to vote at the Annual Meeting.

Record Date and Voting Securities

Stockholders of record at the close of business on September 5, 2006 (the "Record Date") are entitled to notice of and to vote at the meeting. As of the Record Date, 304,952,466 shares of the Company's common stock, par value $0.001, were issued and outstanding. No shares of preferred stock are outstanding.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering to the Company (Attention: Paul Coghlan, Vice President of Finance and Chief Financial Officer) a written notice of revocation or a duly executed proxy card bearing a later date or by attending the Annual Meeting and voting in person.

Voting Rights and Solicitation of Proxies

On all matters other than the election of directors, each share has one vote. Each stockholder voting for the election of directors may cumulate such stockholder's votes and give one candidate a number of votes equal to the number of directors to be elected (which number is currently set at five) multiplied by the number of shares held by such stockholder, or may distribute such stockholder's votes on the same principle among as many candidates as the stockholder may select. However, no stockholder will be entitled to cumulate votes unless a stockholder has, prior to the voting, given notice at the meeting of the stockholder's intention to cumulate votes. If any stockholder gives such notice, all stockholders may cumulate their votes for the election of directors. In the event that cumulative voting is invoked, the proxy holders will have the discretionary authority to vote all proxies received by them in such a manner as to ensure the election of as many of the Board of Directors' nominees as possible.

The Company will bear the cost of soliciting proxies. Solicitation of proxies by mail may be supplemented by one or more of telephone, telegram, facsimile, e-mail or personal solicitation by directors, officers or regular employees of the Company. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to beneficial owners. No additional compensation will be paid to these persons for these services.

Quorum; Abstentions; Broker Non-Votes

Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspector of Elections. The Inspector will also determine whether or not a quorum is present. Except in certain specific circumstances or as discussed below, the affirmative vote of a majority of shares present in person or represented by proxy at a duly held meeting at which a quorum is present is required under Delaware law and the Company's Bylaws for approval of proposals presented to stockholders. A quorum consists of the presence, in person or by proxy, of a majority of shares of the Company's common stock entitled to vote.

When proxies are properly dated, executed and returned, the shares represented by those proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no instructions are indicated on a properly executed proxy, the shares represented by that proxy will be voted as recommended by the Board of Directors. If any other matters are properly presented for consideration at the Annual Meeting, the persons named in the enclosed proxy card and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. The Company does not currently anticipate that any other matters will be raised at the Annual Meeting.

Pursuant to Delaware law, the Inspector will include shares that are voted "WITHHELD" or "ABSTAIN" on a particular matter among the shares present and entitled to vote for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting generally, and also among the shares voting on that particular matter (the "Votes Cast"). Broker non-votes on a particular matter will be counted for purposes of determining the presence of a quorum, but will not be counted for purposes of determining the number of "Votes Cast" with respect to the matter on which the broker has expressly not voted. Accordingly, broker non-votes will not affect the determination as to whether the requisite approval has been obtained with respect to a particular matter.

Deadline for Receipt of Stockholder Proposals

Stockholders are entitled to present proposals for action at a forthcoming Annual Meeting of Stockholders if they comply with the requirements of the Company's Bylaws and the proxy rules established by the Securities and Exchange Commission. Stockholders' proposals that are to be submitted for inclusion in the Company's proxy statement and form of proxy card for next year's Annual Meeting must be received by the Company no later than 120 days prior to the one year anniversary date of the mailing of this Proxy Statement. Assuming a mailing date of September 25, 2006 for this Proxy Statement, the deadline for stockholder proposals for next year's Annual Meeting will be May 28, 2007.

In addition, under the Company's Bylaws, a stockholder wishing to make a proposal at next year's Annual Meeting, including nominating someone other than management's slate of nominees for election to the Board of Directors, must submit that proposal to the Company not less than 90 days prior to the meeting (or, if the Company gives less than 100 days notice of the meeting, then within ten days after that notice). The Company may refuse to acknowledge any proposal not made in compliance with the foregoing procedure.

The attached proxy card grants the proxy holders discretionary authority to vote on any matter raised at this year's Annual Meeting. In addition, assuming a mailing date of September 25, 2006 for this Proxy Statement, the proxy holders at next year's Annual Meeting will have similar discretionary authority to vote on any matter that is submitted to the Company after August 11, 2007.

PROPOSAL ONE

ELECTION OF DIRECTORS

Nominees

The Company's Bylaws currently provide for a Board of six directors, and all positions on the Board are currently filled. One director, Leo McCarthy, however, has indicated his intention not to stand for reelection for health reasons. Mr. McCarthy has served as a director of the Company since 1994, and his term will continue until the Annual Meeting, but end at that time. The Company currently does not have a candidate to replace Mr. McCarthy. Accordingly, the Bylaws will be amended, effective as of the date of the Annual Meeting, to reduce the authorized number of directors from six to five, and thus a slate of five nominees for election as directors is presented below.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for the Company's five nominees named below, all of whom are currently directors of the Company. In the event that any nominee of the Company is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any substitute nominee who is designated by the current Board of Directors to fill the vacancy. It is not expected that any nominee listed below will be unable or will decline to serve as a director. In the event that additional persons are nominated for election as directors, the proxy holders intend to vote all proxies received by them in such a manner as will ensure the election of as many of the nominees listed below as possible, and, in such event, the specific nominees to be voted for will be determined by the proxy holders. In any event, the proxy holders cannot vote for more than five persons. The term of office of each person elected as a director will continue until the next Annual Meeting of Stockholders or until his successor has been elected and qualified.

The names of the nominees, and certain information about them as of September 5, 2006, are set forth below.

| | | | | | | Director |

Name of Nominee | | Age | | Principal Occupation | | Since |

| Robert H. Swanson, Jr | | 68 | | Executive Chairman and Former Chief Executive | | 1981 |

| | | | | Officer of the Company | | |

| Lothar Maier | | 51 | | Chief Executive Officer of the Company | | 2005 |

| David S. Lee | | 69 | | President and Chief Executive Officer, | | |

| | | | | eOn Communication Corp | | 1988 |

| Richard M. Moley | | 67 | | Former President and Chief Executive | | |

| | | | | Officer, StrataCom, Inc. | | 1994 |

| Thomas S. Volpe | | 55 | | Chief Executive Officer, Volpe Investments LLC | | 1984 |

There are no family relationships among the Company's directors and executive officers.

Mr. Swanson, a founder of the Company, has served as Executive Chairman of the Board of Directors since January 2005. Prior to that time he served as Chairman of the Board of Directors and Chief Executive Officer since April 1999, and prior to that time as President, Chief Executive Officer and a director of the Company since its incorporation in September 1981. From August 1968 to July 1981, he was employed in various positions at National Semiconductor Corporation, a manufacturer of integrated circuits, including Vice President and General Manager of the Linear Integrated Circuit Operation and Managing Director in Europe. Mr. Swanson has a B.S. degree in Industrial Engineering from Northeastern University.

Mr. Maier was named Chief Executive Officer of Linear Technology in January 2005. Prior to that, Mr. Maier served as the Company's Chief Operating Officer for more than five years. Before joining Linear Technology, Mr. Maier held various management positions at Cypress Semiconductor Corp. from 1983 to 1999, most recently as Senior Vice President and Executive Vice President of Worldwide Operations. He holds a B.S. degree in Chemical Engineering from the University of California at Berkeley.

Mr. Lee is Chairman of the Boards of eOn Communication Corp., Cortelco and Spark Technology, and a Regent of the University of California. Mr. Lee originally co-founded Qume Corporation in 1973 and served as Executive Vice President until it was acquired by ITT Corporation in 1978. After the acquisition, Mr. Lee held the positions of Executive Vice President of ITT Qume until 1981, and President through 1983. From 1983 to 1985, he served as a Vice President of ITT and as Group Executive and Chairman of its Business Information Systems Group. In 1985, he became President and Chairman of Data Technology Corp. ("DTC"), and in 1988, DTC acquired and merged with Qume. Currently, Mr. Lee is a member of the board of directors of ESS Technology Inc., iBasis Inc., and Daily Wellness Co., in addition to the companies of which he is chairman. Mr. Lee served as a member of the President's Council on the 21st Century Workforce, appointed by President George Bush. Mr. Lee also served as an advisor to Presidents George Bush and Bill Clinton on the Advisory Committee on Trade Policy and Negotiation (Office of the U.S Trade Representative/Executive Officer of the President) and to Governor Pete Wilson on the California Economic Development Corporation (CalEDC) and the Council on California Competitiveness. Mr. Lee is a past Commissioner of the California Postsecondary Education Commission, as well as having founded and served as Chairman of the Chinese Institute of Engineers, the Asian American Manufacturers' Association and the Monte Science and Technology Association.

Mr. Moley served as Chairman, President and Chief Executive Officer of StrataCom, Inc., a network systems company, from June 1986 until its acquisition by Cisco Systems, Inc., a provider of computer internetworking solutions, in July 1996. Mr. Moley served as Senior Vice President and board member of Cisco Systems until November 1997, when he became a consultant and private investor. Mr. Moley served in various executive positions at ROLM Corporation, a telecommunications company, from 1973 to 1986. Prior to joining ROLM, he held management positions in software development and marketing at Hewlett-Packard Company. Mr. Moley serves as a director of Echelon Corporation, Calient Networks, Longboard, Inc. and Novera Optical.

Mr. Volpe has served as Managing Member of Volpe Investments LLC, a risk capital firm, since July 2001. From December 1999 to June 2001, Mr. Volpe served as Chairman of Prudential Volpe Technology Group. Mr. Volpe served as Chief Executive Officer of Volpe Brown Whelan & Company, LLC (formerly Volpe, Welty & Company), a private investment banking and risk capital firm, from its founding in April 1986 until its acquisition by Prudential Securities in December 1999. Until April 1986, he was President and Chief Executive Officer of Hambrecht & Quist Incorporated, an investment banking firm with which he had been affiliated since 1981. Mr. Volpe is a member of the board of directors of 7th Inning Stretch, LLC, Kline Hawkes & Co., LLC, Minor League Baseball and the Dubai Investment Group, LLC.

Board Meetings and Committees

The Board of Directors of the Company held a total of five meetings during the fiscal year ended July 2, 2006. No director attended fewer than 75% of the meetings of the Board of Directors and the Board committees upon which such director served. All directors attended the last Annual Meeting of Stockholders.

Audit Committee

The Audit Committee currently consists of directors Lee, McCarthy, Moley and Volpe, and held a total of five meetings during the last fiscal year. The Audit Committee is governed by a written charter that it has adopted. A copy of the Audit Committee charter was attached as an appendix to the Company's proxy statement for the Annual Meeting of Stockholders held on November 3, 2004 (the "2004 Proxy"). The Audit Committee appoints, compensates and oversees the Company's independent registered public accounting firm. The Audit Committee also approves the accounting fees paid to the independent accounting firm and pre-approves all audit and non-audit services to be provided by them. In addition, the Audit Committee also monitors the independence of the firm.

The Audit Committee meets independently with the independent accounting firm and with senior management to review the general scope of the Company's accounting activities, financial reporting and annual audit, matters relating to internal control systems, and the results of the annual audit.

The Audit Committee also reviews and approves any proposed transactions between the Company and officers and directors or their affiliates.

The Board of Directors has determined that Mr. Volpe is an "Audit Committee Financial Expert," as that phrase is defined in the rules of the Securities and Exchange Commission adopted pursuant to the Sarbanes-Oxley Act of 2002, and that each member of the Audit Committee qualifies as financially sophisticated under applicable Nasdaq listing standards.

Compensation Committee

The Compensation Committee of the Board of Directors currently consists of directors Lee, McCarthy, Moley and Volpe, and held a total of four meetings during the last fiscal year. The committee reviews and approves the Company's executive compensation policy, including the salaries and target bonuses of the Company's executive officers, and administers the Company's stock plans.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee currently consists of directors Lee, McCarthy, Moley and Volpe, and held one meeting during the last fiscal year. The Nominating and Corporate Governance Committee is governed by a written charter that it has adopted. A copy of the Nominating and Corporate Governance Committee charter was attached as an appendix to the 2004 Proxy. The Nominating and Corporate Governance Committee is responsible for proposing nominees for election by the Company's stockholders at the Annual Meeting. The committee reviews the size and composition of the Board and determines the criteria for membership. The committee also reviews and considers any nominees for election to the Board, including any nominee submitted by the stockholders. In addition, the committee reviews the composition of the Board committees and recommends persons to serve as committee members.

The committee oversees compliance by the Board and its committees with corporate governance aspects of the Sarbanes-Oxley Act and related SEC and Nasdaq rules. The committee also monitors the Company's Code of Business Conduct and Ethics and considers questions of possible conflicts of interest of Board members or corporate officers. In addition, the committee develops and reviews the Company's corporate governance guidelines, and evaluates director compensation in general.

Director Compensation

The Company currently pays each non-employee director an annual retainer of $45,000 and a fee of $1,500 for each meeting of the Board of Directors attended. Directors are generally eligible to receive stock options and other awards under the Company's equity incentive plans. During the fiscal year ended July 2, 2006, Messrs. Lee, McCarthy, Moley and Volpe each received an option to purchase 20,000 shares at an exercise price of $39.31. Each of these options vests as to 100% of the shares subject to the option one year from the date of grant. Mr. Volpe also currently receives an annual retainer of $15,000 as Chairman of the Audit Committee (in addition to his annual retainer of $45,000).

Corporate Governance Matters

Policy for Director Recommendations and Nominations

The Nominating and Corporate Governance Committee considers candidates for Board membership suggested by the Board of Directors, management and the Company's stockholders. It is the policy of the Nominating and Governance Committee to consider recommendations for candidates to the Board from stockholders holding at least 5% of the total outstanding shares of the Company. Stockholders must have held these shares continuously for at least twelve months prior to the date of the submission of the recommendation. The Nominating and Governance Committee will consider a nominee recommended by the Company's stockholders in the same manner as a nominee recommended by members of the Board of Directors or management.

A stockholder who desires to recommend a candidate for election to the Board of Directors should direct the recommendation in writing to the Company, attention of:

Nominating and Governance Committee

c/o Linear Technology Corporation

1630 McCarthy Blvd.

Milpitas, CA 95035

The notice must include:

| l | The candidate's name, and home and business contact information; |

| l | Detailed biographical data and relevant qualifications of the candidate; |

| l | A signed letter from the candidate confirming his or her willingness to serve; |

| l | Information regarding any relationships between the candidate and the Company within the last three years; and |

| l | Evidence of the required ownership of common stock by the recommending stockholder. |

In addition, a stockholder may nominate a person for election to the Board of Directors directly at the Annual Meeting of Stockholders, provided the stockholder has met the requirements set forth in the Company's Bylaws and the rules and regulations of the SEC related to stockholder nominees and proposals. The process for properly submitting a stockholder proposal, including a proposal to nominate a person for election to the Board of Directors at an Annual Meeting, is described above in the section entitled "Deadline for Receipt of Stockholder Proposals."

Where the Nominating and Governance Committee either identifies a prospective nominee or determines that an additional or replacement director is required, the Nominating and Governance Committee may take such measures that it considers appropriate in connection with evaluating the director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the committee, the Board of Directors or management. In its evaluation of director candidates, including the members of the Board of Directors eligible for re-election, the committee considers a number of factors, including the following:

| l | The current size and composition of the Board of Directors and the needs of the Board and the respective Board committees. |

| l | Such factors as judgment, independence, character and integrity, area of expertise, diversity of experience, length of service and potential conflicts of interest. |

| l | Such other factors as the committee may consider appropriate. |

The Nominating and Governance Committee has also specified the following minimum qualifications that it believes must be met by a nominee for a position on the Board:

| l | The highest personal and professional ethics and integrity. |

| l | Proven achievement and competence in the nominee's field and the ability to exercise sound business judgment. |

| l | Skills that are complementary to those of the existing Board members. |

| l | The ability to assist and support management and make significant contributions to the Company's success. |

| l | An understanding of the fiduciary responsibilities that are required of a member of the Board, and the commitment of time and energy necessary to diligently carry out those responsibilities. |

In connection with its evaluation, the Nominating and Governance Committee determines whether it will interview potential nominees. After completing the evaluation and interview, the Nominating and Governance Committee makes a recommendation to the full Board of Directors as to the persons who should be nominated for election to the Board, and the Board of Directors determines the actual nominees after considering the recommendation and report of the Nominating and Governance Committee.

Stockholder Communications to Directors

Stockholders may communicate directly with the members of the Company's Board of Directors by sending a written communication to the Board of Directors (or any individual director) at the following address: c/o Chief Financial Officer, Linear Technology Corporation, 720 Sycamore Drive, Milpitas, California 95035. All communications will be compiled by the Company's Chief Financial Officer and submitted to the Board or an individual director, as appropriate, on a periodic basis.

The Company encourages all incumbent directors and nominees for election to attend the Annual Meeting.

Director Independence

In July 2006, the Board of Directors undertook a review of the independence of its directors and director nominees and considered whether any such person had a material relationship with the Company or its management that could compromise his ability to exercise independent judgment in carrying out his responsibilities. As a result of this review, the Board of Directors affirmatively determined that all of the directors of the Company, with the exception of Mr. Swanson, the Company's Executive Chairman and former Chief Executive Officer, and Mr. Maier, the Company's current Chief Executive Officer, are independent of the Company and its management under the corporate governance standards of Nasdaq. In addition, the Board determined that each of the members of the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee satisfies the definition of independent director as established in the Nasdaq listing standards.

Code of Business Conduct and Ethics

The Board of Directors has adopted a Code of Business Conduct and Ethics that is applicable to all employees, officers and directors of the Company, including the Company's senior financial and executive officers. This Code is intended to deter wrongdoing and promote ethical conduct among the Company's directors, executive officers and employees. The Code of Business Conduct and Ethics is available on the Company's website at www.linear.com. The Company also intends to post amendments to or waivers from the Code of Business Conduct and Ethics on its website.

Vote Required and Recommendation of Board of Directors

The five nominees receiving the highest number of affirmative votes of the shares entitled to be voted will be elected as directors. Votes "withheld" will be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the meeting, but have no other legal effect upon the election of directors under Delaware law.

THE COMPANY'S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS VOTING "FOR" THE NOMINEES SET FORTH ABOVE.

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has selected Ernst & Young LLP, independent registered public accounting firm, to audit the financial statements of the Company for the year ending July 1, 2007, and recommends that the stockholders vote for ratification of such appointment. Although action by the stockholders is not required by law, the Board of Directors believes that it is desirable to request approval of this selection by the stockholders. In the event of a negative vote on such ratification, the Board of Directors will reconsider its selection. Ernst & Young LLP has audited the Company's financial statements since the fiscal year ended June 30, 1982. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting, will have the opportunity to make a statement, and are expected to be available to respond to appropriate questions from stockholders.

Fees Paid to Ernst & Young LLP

| | | Fees Paid to Ernst & Young | |

| | | 2005 | | 2006 | |

| Audit Fees(1) | | $ | 643,000 | | $ | 677,000 | |

| Audit-Related Fees(2) | | $ | 5,000 | | $ | 5,000 | |

| Tax Fees(3) | | $ | 126,000 | | $ | 121,000 | |

All Other Fees(4) | | $ | - | | $ | 5,000 | |

| (1) | Audit Fees consist of fees billed for professional services rendered for the audit of the Company's annual consolidated financial statements and review of the interim consolidated financial statements included in the Company's public reports and any other services that Ernst & Young normally provides to clients in connection with statutory and regulatory filings and accounting consultations in connection with the annual audit of consolidated financial statements. |

| (2) | Audit-Related Fees consist of assurance and related services provided by Ernst & Young that are reasonably related to the performance of the audit or review of the Company's consolidated financial statements but that are not reported under "Audit Fees." The services for the fees disclosed under this category are for procedures performed related to the Company's filing to comply with California environmental regulations. |

| (3) | Tax Fees consist of fees billed for professional services rendered for tax compliance, advice and planning. |

| (4) | All Other Fees consist of fees for products and services other than those reported above. |

Pre-Approval Process for Auditor Services

All services that have been rendered by Ernst & Young LLP are permissible under applicable laws and regulations. The Audit Committee pre-approves all audit and non-audit services. The Audit Committee pre-approved all audit and non-audit services for which the fees identified in the above table were incurred.

Vote Required; Recommendation of Board of Directors

The ratification of the appointment of Ernst & Young LLP as the Company's independent registered public accounting firm requires the affirmative vote of a majority of the Votes Cast on the proposal at the Annual Meeting.

THE COMPANY'S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS VOTING "FOR" THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING JULY 1, 2007.

BENEFICIAL SECURITY OWNERSHIP OF

DIRECTORS, EXECUTIVE OFFICERS AND CERTAIN OTHER BENEFICIAL OWNERS

The following table sets forth certain information known to the Company regarding the beneficial ownership of the Company's common stock, as of the Record Date, by (a) each beneficial owner of more than 5% of the Company's common stock, (b) the Company's Executive Chairman and former Chief Executive Officer, the Company's current Chief Executive Officer and the Company's three other most highly compensated executive officers during fiscal 2006 (collectively, the "Named Executive Officers"), (c) each director of the Company, and (d) all directors and executive officers of the Company as a group. Except as otherwise indicated, each person has sole voting and investment power with respect to all shares shown as beneficially owned, subject to community property laws where applicable.

| | | Common Stock | |

Beneficiary Owner | | Shares | | | |

| Capital Research and Management Company (1) | | | 38,829,630 | | | 12.7 | % |

| 333 South Hope Street | | | | | | | |

| Los Angeles, CA 90071 | | | | | | | |

| Fidelity Management & Research (2) | | | 18,534,234 | | | 6.1 | % |

| 82 Devonshire Street | | | | | | | |

| Boston, MA 02109 | | | | | | | |

| Goldman Sachs Group Inc. (2) | | | 16,537,881 | | | 5.4 | % |

| 85 Broad Stree | | | | | | | |

| New York, NY 10004 | | | | | | | |

| Robert H. Swanson, Jr. (3) | | | 2,271,400 | | | * | |

| Lothar Maier (4) | | | 668,196 | | | * | |

| David Bell (5) | | | 413,698 | | | * | |

| Paul Coghlan (6) | | | 869,127 | | | * | |

| Donald E. Paulus (7) | | | 184,253 | | | * | |

| David S. Lee (8) | | | 152,000 | | | * | |

| Leo T. McCarthy (9) | | | 189,800 | | | * | |

| Richard M. Moley (10) | | | 152,000 | | | * | |

| Thomas S. Volpe (11) | | | 216,000 | | | * | |

| All directors and executive officers as a group (16 persons) (12) | | | 8,091,947 | | | 2.6 | % |

| | | | | | | | |

| * | Less than one percent of the outstanding common stock. |

| (1) | Based on information reported on Schedule 13G filed with the Securities and Exchange Commission as of December 31, 2005. |

| (2) | Based on information reported on Schedule 13F filed with the Securities and Exchange Commission as of June 30, 2006. |

| (3) | Includes (i) 217,404 shares issued in the name of Robert H. Swanson, Jr. and Sheila L. Swanson, Trustees of the Robert H. Swanson, Jr. and Sheila L. Swanson Trust U/T/A dated May 27, 1976, (ii) 21,298 shares issued in the name of Robert H. Swanson, Jr. Trustee, Robert H. Swanson, Jr. Annuity, Trust 1, U/A June 17, 2002, (iii) 21,298 shares issued in the name of Robert H. Swanson, Jr. Trustee, Sheila L. Swanson Annuity, Trust 1, U/A June 17, 2002, (iv) 1,961,400 shares issuable pursuant to options exercisable within 60 days of September 5, 2006 and (v) 50,000 shares subject to Company rights of repurchase pursuant to a restricted stock purchase agreement. |

| (4) | Includes 583,060 shares issuable pursuant to options exercisable within 60 days of September 5, 2006 and 61,000 shares subject to Company rights of repurchase pursuant to restricted stock purchase agreements. |

| (5) | Includes (i) 339 shares issued in the name of David Bundy Bell and Bonnie Jean Bell, Trustees of the Bell Revocable Trust dated September 30, 1997, (ii) 361,890 shares issuable pursuant to options exercisable within 60 days of September 5, 2006 and (iii) 36,583 shares subject to Company rights of repurchase pursuant to restricted stock purchase agreements. |

| (6) | Includes 617,690 shares issuable pursuant to options exercisable within 60 days of September 5, 2006 and 43,751 shares subject to Company rights of repurchase pursuant to restricted stock purchase agreements. |

| (7) | Includes 132,280 shares issuable pursuant to options exercisable within 60 days of September 5, 2006 and 46,090 shares subject to Company rights of repurchase pursuant to restricted stock purchase agreements. |

| (8) | Consists of 152,000 shares issuable pursuant to options exercisable within 60 days of September 5, 2006. |

| (9) | Includes 18,000 shares issued in the name of Leo and Jacqueline McCarthy LLC and 15,000 shares issued in the name of the McCarthy Grandchildren's Trust. Also includes 120,000 shares issuable pursuant to options exercisable within 60 days of September 5, 2006. |

| (10) | Consists of 152,000 shares issuable pursuant to options exercisable within 60 days of September 5, 2006. |

| (11) | Consists of 216,000 shares issuable pursuant to options exercisable within 60 days of September 5, 2006. |

| (12) | Includes 6,091,540 shares issuable pursuant to options exercisable within 60 days of September 5, 2006 and 423,933 shares subject to Company rights of repurchase pursuant to restricted stock purchase agreements. |

SECURITIES AUTHORIZED FOR

ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table provides information as of July 2, 2006 about shares of the Company's common stock that may be issued upon exercise of outstanding options, warrants and rights under all of the Company's existing equity compensation plans, including the 1988 Stock Option Plan, 1996 Incentive Stock Option Plan, the 2001 Non-Statutory Stock Option Plan, the 2005 Equity Incentive Plan and the 2005 Employee Stock Purchase Plan, and the number of shares of common stock that remain available for future issuance under these plans.

| | | | | | | Number of securities | |

| | | | | | | remaining available for | |

| | | | | | | future issuance under | |

| | | | | | | equity compensation | |

| | | Number of securities | | | | plans (excluding | |

| | | issuable upon exercise | | Weighted-average | | securities issuable upon | |

| | | of outstanding options, | | exercise price of | | exercise of | |

| | | rights and restricted | | outstanding options | | outstanding options, | |

Plan category | | stock units | | rights and units | | rights and units) | |

| Equity compensation plans | | | | | | | |

| approved by security | | 19,484,755 | | $ 30.16 | | 5,403,324 | |

| holders | | | | | | | |

| Equity compensation plans | | | | | | | |

| not approved by security | | | | | | | |

| holders | | 15,738,152 | | $ 34.36 | | 12,957,537 | |

| Total | | 35,222,907 | (1) | $ 32.04 | | 18,360,771 | (1) |

| | | | | | | | |

(1) | The numbers of shares indicated consist of shares subject to outstanding options or available for future issuance, as appropriate, pursuant to the Company's 2001 Non-Statutory Stock Option Plan, which did not require the approval of and has not been approved by stockholders. Executive officers and directors of the Company are not eligible to participate under the 2001 Non-Statutory Stock Option Plan. See the description of the 2001 Non-Statutory Stock Option Plan below. |

2005 Equity Incentive Plan

The Company's 2005 Equity Incentive Plan was adopted by the Board of Directors in July 2005 and was approved by the Company's stockholders in November 2005. The 2005 Equity Incentive Plan provides for the following types of incentive awards: (i) stock options, (ii) stock appreciation rights, (iii) restricted stock, (iv) restricted stock units, and (v) performance shares and performance units. Each of these is referred to individually as an "Award." Employees, executive officers, directors and consultants who provide services to the Company and its subsidiaries are eligible to participate in the 2005 Equity Incentive Plan. A total of 6,469,222 shares of the Company's common stock have been reserved for issuance under the 2005 Equity Incentive Plan. These shares include shares that remained available for grant under the Company's 1996 Incentive Stock Option Plan at the time the stockholders approved the 2005 Equity Incentive Plan at the 2005 Annual Meeting of Stockholders and that were transferred into the 2005 Equity Incentive Plan at that time. In addition, any shares that would otherwise in the future return to the 1996 Incentive Stock Option Plan upon termination or expiration of options granted under that plan will be added to the shares available under the 2005 Equity Incentive Plan.

Section 162(m) of the Internal Revenue Code of 1986, as amended (the "Code"), places limits on the deductibility for federal income tax purposes of compensation paid to certain executive officers of the Company. In order to preserve the Company's ability to deduct the compensation income associated with Awards granted to such persons, the 2005 Equity Incentive Plan sets limits on the size of Awards that may be granted to employees, directors and consultants in any fiscal year of the Company or in connection with initial employment with the Company, as described below.

Options. The 2005 Equity Incentive Plan authorizes the granting to employees, including officers, of incentive stock options within the meaning of Section 422 of the Code, and for the granting to employees, officers, directors and consultants of nonqualified stock options. Incentive stock options may be granted only to employees, including employee directors and officers. The 2005 Equity Incentive Plan provides that a participant may not receive options for more than 5,000,000 shares in one fiscal year, except in connection with his or her initial service as an employee, in which case he or she may be granted options for an additional 5,000,000 shares.

The exercise price of an option is determined at the time the option is granted. In the case of an incentive stock option, the exercise price must be at least equal to the fair market value of the Company's common stock on the date of grant, except that the exercise price of an incentive stock option granted to any participant who owns more than 10% of the total voting power of all classes of the Company's outstanding stock must be at least 110% of the fair market value of the common stock on the grant date. The exercise price of nonqualified stock options under the 2005 Equity Incentive Plan must also be at least equal to the fair market value of the Company's common stock on the grant date. The 2005 Equity Incentive Plan permits options to be exercised with cash, check, other shares of the Company's stock, consideration received by the Company under a "cashless exercise" program or certain other forms of consideration.

Options granted under the 2005 Equity Incentive Plan generally vest at a rate of 1/10th of the shares subject to the option after each six-month period of continued service to the Company; however, the vesting schedule can vary on a grant-by-grant basis. The 2005 Equity Incentive Plan provides that vested options may be exercised for 3 months after any termination of employment and for up to 12 months after termination of employment as a result of death or disability. The Company may select alternative periods of time for exercise upon termination of service. The term of an option may not exceed ten years, except that, with respect to any participant who owns 10% of the voting power of all classes of the Company's outstanding capital stock, the term of an incentive stock option may not exceed five years. Currently, the Company generally grants options that have terms of seven years.

Stock Appreciation Rights. Stock appreciation rights may be granted under the 2005 Equity Incentive Plan. Stock appreciation rights are rights to receive the appreciation in the fair market value of the Company's common stock between the exercise date and the date of grant. The Company can pay the appreciation in either cash or shares of common stock. No participant may be granted stock appreciation rights covering more than 5,000,000 shares during any fiscal year, except that a participant may be granted stock appreciation rights covering up to an additional 5,000,000 shares in connection with his or her initial employment.

Restricted Stock. Restricted stock awards may be granted under the 2005 Equity Incentive Plan. Awards of restricted stock are rights to acquire or purchase shares of the Company's common stock that are subject to repurchase or reacquisition by the Company upon the termination of the participant's service with the Company for any reason (including death or disability). The Company's right to reacquire the shares lapses in accordance with terms and conditions established by the Administrator in its sole discretion, including, for example, based on the lapse of time or the achievement of specific performance goals. Currently, the vesting terms of restricted stock granted by the Company generally provide for annual vesting over a term of five years. No participant may be granted a right to purchase or acquire more than 1,500,000 shares of common stock during any fiscal year, except that a participant may be granted up to an additional 1,500,000 shares of restricted stock in connection with his or her initial employment.

Restricted Stock Units. Restricted stock units may be granted under the 2005 Equity Incentive Plan. Restricted stock units are the dollar value equivalent of shares and vest in accordance specific performance goals or other terms and conditions. Earned restricted stock units may be paid in cash, shares or a combination of cash and shares. Shares that underlie restricted stock units that are fully settled in cash are again available for future grants under the 2005 Equity Incentive Plan. If all restricted stock units have not vested by the date set forth in the Award agreement, the unearned restricted stock units are forfeited to the Company. No participant may be granted more than 1,500,000 restricted stock units during any fiscal year, except that a participant may be granted up to an additional 1,500,000 restricted stock units in connection with his or her initial employment.

Performance Units and Performance Shares. Performance units and performance shares may be granted under the 2005 Equity Incentive Plan. Performance units and performance shares are Awards that result in a payment to a participant only if the performance goals or other vesting criteria established by the Administrator are achieved. Performance units and performance shares have initial values equal to the fair market value of one share of the Company's common stock on the grant date, and are payable in cash, shares or a combination of cash and shares. No participant may receive more than 1,500,000 performance shares or performance units during any fiscal year, except that a participant may be granted performance shares or performance units covering up to an additional 1,500,000 shares in connection with his or her initial employment.

Change of Control. In the event of a "change of control," as defined in the 2005 Equity Incentive Plan, each outstanding Award will be treated as the Administrator determines in its sole discretion, including, without limitation, having the successor assume the Awards or provide substitute awards. In the absence of other action by the Administrator, all options and stock appreciation rights will become fully vested and exercisable as to all of the shares subject to such Awards, all restrictions on restricted stock and restricted stock units will lapse, all performance goals or other vesting criteria for performance shares and performance units will be deemed to have been achieved at target levels, and all other vesting terms and conditions of all Awards will be deemed to have been met. In such event, the Administrator will notify all participants as to the changes in their Awards, and, to the extent applicable, such Awards may be exercised for such period of time as the Administrator may determine from the date of the notice. All unexercised Awards will terminate upon expiration of that period.

With respect to Awards granted to non-employee directors that are assumed or substituted for, if the director is subsequently terminated as a director (other than voluntary resignation), then all his or her options and stock appreciation rights will become fully vested and exercisable as to all of the shares subject to such Awards, all restrictions on restricted stock and restricted stock units will lapse, all performance goals or other vesting criteria for performance shares and performance units will be deemed achieved at target levels, and all other vesting terms and conditions of all Awards will be deemed to have been met.

2005 Employee Stock Purchase Plan

The 2005 Employee Stock Purchase Plan (the "2005 Purchase Plan") was adopted by the Board of Directors in July 2005 and was approved by the Company's stockholders in November 2005. The purpose of the 2005 Purchase Plan is to provide employees with an opportunity to purchase the Company's common stock through regular payroll deductions. A total of 1,000,000 shares of common stock were initially reserved for issuance under the 2005 Purchase Plan, of which 893,767 shares remained available for issuance as of September 5, 2006.

Each employee of the Company or its designated subsidiaries who is a common law employee and whose customary employment with the Company or subsidiary is at least twenty hours per week and more than five months in a calendar year is eligible to participate in the 2005 Purchase Plan. No employee, however, may participate in the 2005 Purchase Plan (i) to the extent that, at the commencement of an offering period, the employee owns 5% or more of the total combined voting power of all classes of the Company's capital stock, or (ii) to the extent that his or her rights to purchase stock under all of the Company's employee stock purchase plans would accrue at a rate which exceeds $25,000 worth of stock (determined at the fair market value of the shares at the beginning of the applicable offering period) in any calendar year. The 2005 Purchase Plan is implemented by offering periods of approximately six months each, running from approximately May 1 to October 31 and November 1 to April 30. The Administrator has the power at any time to change the length of the offering periods, to subdivide each offering period into multiple purchase periods, and to have multiple offering periods running at one time. As the 2005 Purchase Plan is currently administered, deductions must be either 5% or 10% of an employee's eligible compensation for any given offering period.

As currently administered, the 2005 Purchase Plan enables participants to purchase shares of the Company's common stock at a purchase price of 85% of the fair market value of the Company's common stock on the last day of each offering period. The fair market value of the Company's common stock on any relevant date is the closing price per share as reported on the Nasdaq Global Market, or the mean of the closing bid and ask prices if no sales were reported, as quoted on such exchange or reported in The Wall Street Journal. The maximum number of shares a participant may purchase under the 2005 Purchase Plan is 300 shares per offering period.

A participant may discontinue his or her participation in the 2005 Purchase Plan at any time during the offering period, and participation ends automatically on termination of employment with the Company.

In the event of any merger or "change of control," as defined in the 2005 Purchase Plan, the successor corporation, or a parent or subsidiary of the successor corporation, may assume or substitute for each pending offering period under the 2005 Purchase Plan. In the event the successor corporation refuses to assume or substitute for such offering periods, the Administrator will shorten all offering periods then in progress by setting a new ending date, and all offering periods will end on the new ending date. The new ending date must be prior to the effective date of the merger or change of control. If the Administrator shortens any offering period then in progress, the Administrator will notify each participant prior to the new ending date that the ending date has been changed to the new date and that purchases under the 2005 Purchase Plan will occur automatically on that new date, unless the participant withdraws from the offering period.

1996 Incentive Stock Option Plan

The Company's 1996 Incentive Stock Option Plan (the "1996 Plan") was adopted by the Board of Directors in July 1996 and was approved by the Company's stockholders in November 1996. The 1996 Plan provides for the granting to employees, including officers, of incentive stock options, and for the granting to employees, officers, directors and consultants of nonqualified stock options. Incentive stock options may be granted only to employees, including employee directors and officers.

In order to preserve the Company's ability under Section 162(m) of the Code to deduct the compensation income associated with options granted to certain executive officers, the 1996 Plan provides that no employee, director or consultant may be granted, in any fiscal year of the Company, options to purchase more than 500,000 shares of common stock. Notwithstanding this limit, however, in connection with an individual's initial employment with the Company, he or she may be granted options to purchase up to an additional 500,000 shares of common stock.

The exercise price of an option is determined at the time the option is granted. Generally, in the case of an incentive stock option, the exercise price may not be less than 100% of the fair market value of the common stock on the date the option is granted. Nonqualified stock options, however, may be granted with a per share exercise price of less than 100% of the fair market value of the Company's common stock on the date the option is granted; provided that if a nonqualified stock option is intended to qualify as "performance-based compensation" within the meaning of Section 162(m) of the Internal Revenue Code, the exercise price may not be less than 100% of fair market value.

Options granted under the 1996 Plan generally vest at a rate of 1/10th of the shares subject to the option after each six month period of continued service to the Company; however, the vesting schedule can vary on a grant-by-grant basis. The 1996 Plan provides that vested options may be exercised for 3 months after any termination of employment and for up to 12 months after termination of employment as a result of death or disability. The Company may select alternative periods of time for exercise upon termination of service. The 1996 Plan permits options to be exercised with cash, check, other shares of the Company's stock, consideration received by the Company under a "cashless exercise" program or certain other forms of consideration.

The Company has also granted nonqualified options under the 1996 Plan that are immediately exercisable by the participant at an exercise price equal to the stock's par value per share. The shares of common stock received upon exercise of these options, however, are subject to repurchase by the Company upon the termination of the participant's service with the Company for any reason (including death or disability). This Company right of repurchase lapses in annual increments over a period of either three or five years.

In the event that the Company merges with or into another corporation, or sells substantially all of its assets, the 1996 Plan provides that each outstanding option must be assumed or substituted for by the successor corporation. If such substitution or assumption does not occur, each option will fully vest and become exercisable.

At the 2005 Annual Meeting, the Company's stockholders approved the 2005 Equity Incentive Plan to replace the 1996 Plan, which would otherwise have expired in July 2006. As part of the adoption of the 2005 Equity Incentive Plan, all shares remaining available for future grant under the 1996 Plan at that time were transferred to the 2005 Equity Incentive Plan. No further options or rights have been or will be granted under the 1996 Plan. As of September 5, 2006, there were 17,648,000 shares of common stock subject to outstanding options under the 1996 Plan, and no shares available for future grant.

1988 Stock Option Plan

The 1988 Stock Option Plan (the "1988 Plan") has terms substantially the same as the terms of the 1996 Plan. The Company no longer grants options under this plan. As of September 5, 2006, there were 1,237,700 shares of common stock subject to outstanding options under the 1988 Plan.

1986 Employee Stock Purchase Plan

The 1986 Employee Stock Purchase Plan (the "1986 Purchase Plan") was adopted by the Board of Directors in April 1986 and approved by the stockholders in May 1986. A total of 8,400,000 shares of the Company's common stock were reserved for issuance under the 1986 Purchase Plan. The 1986 Purchase Plan, which would have expired by its terms in May 2006, was terminated at the time the stockholders approved the 2005 Purchase Plan at the 2005 Annual Meeting of Stockholders. No further shares will be issued under the 1986 Purchase Plan.

The 1986 Purchase Plan was intended to qualify under Section 423 of the Code to permit eligible employees to purchase common stock periodically through payroll deductions. The 1986 Purchase Plan operated substantially the same as the 2005 Purchase Plan currently operates, provided that prior to the offering period commenced in November 2005, the purchase price per share under the 1986 Purchase Plan was the lower of 85% of the fair market value of the common stock on the first day of an offering period or 85% of the fair market value of the common stock on the last day of that offering period.

2001 Non-Statutory Stock Option Plan

In fiscal 2001, the Board of Directors approved the 2001 Non-Statutory Stock Option Plan (the "2001 Plan"). The 2001 Plan provides for the granting of non-qualified stock options to employees and consultants. The Company cannot grant options under the 2001 Plan to directors or executive officers of the Company.

Options granted under the 2001 Plan generally vest at a rate of 1/10th of the shares subject to the option after each six-month period of continued service to the Company; however, the vesting schedule can vary on a grant-by-grant basis. The 2001 Plan provides that vested options may be exercised for 3 months after any termination of employment and for up to 12 months after termination of employment as a result of death or disability. The Company may select alternative periods of time for exercise upon termination of service.

The Company may also grant options under the 2001 Plan that are immediately exercisable by the participant at a nominal exercise price. The shares of common stock received upon exercise of these options, however, are subject to repurchase by the Company upon the termination of the participant's service with the Company for any reason (including death or disability). This Company right of repurchase would generally lapse in annual increments over periods of three to five years, although the vesting schedule may vary on a grant-by-grant basis.

The exercise price of an option is determined at the time the option is granted and may be less than the current fair market value of the Company's common stock. The 2001 Plan permits options to be exercised with cash, check, other shares of the Company's stock, consideration received by the Company under a "cashless exercise" program or certain other forms of consideration.

In the event that the Company merges with or into another corporation, or sells substantially all of the Company's assets, the 2001 Plan provides that each outstanding option will be assumed or substituted for by the successor corporation. If such substitution or assumption does not occur, each option will fully vest and become exercisable.

As of September 5, 2006, there were a total of 30,000,000 shares of common stock reserved for issuance under the 2001 Plan, of which 15,861,267 were subject to outstanding options, and 12,781,657 shares remained available for future issuance.

EXECUTIVE OFFICER COMPENSATION

The following table sets forth all compensation received by the Named Executive Officers for services rendered to the Company in all capacities, for the three fiscal years ended July 2, 2006:

Summary Compensation Table

| | | | | Annual Compensation | | Long-Term Compensation | | | |

Name and Principal | | | | | | | | Other Annual | | Restricted Stock | | Securities | | | |

Position | | | | Salary ($) | | Bonus ($) (1) | | Compensation ($) | | Awards ($) (2) | | | | | |

| Robert H. Swanson, Jr. | | | 2006 | | $ | 305,307 | | $ | 1,587,600 | | $ | 336,794 (4 | ) | $ | 1,756,000 | | | - | | $ | 25,810 | |

| Executive Chairman | | | 2005 | | | 343,787 | | | 2,256,700 | | | 334,308 (4 | ) | | 10,188,750 | | | - | | | 27,398 | |

| | | | 2004 | | | 337,625 | | | 2,054,894 | | | 372,548 (4 | ) | | - | | | 200,000 | | | 21,668 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Lothar Maier | | | 2006 | | $ | 367,230 | | $ | 1,879,074 | | | - | | $ | - | | | - | | $ | 22,690 | |

| Chief Executive | | | 2005 | | | 339,991 | | | 1,607,970 | | | - | | | 1,222,650 | | | 150,000 | | | 24,240 | |

| Officer | | | 2004 | | | 289,365 | | | 939,680 | | | - | | | - | | | 200,000 | | | 18,776 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| David B. Bell | | | 2006 | | $ | 300,363 | | $ | 1,635,628 | | | - | | $ | 962,500 | | | - | | $ | 22,570 | |

| President | | | 2005 | | | 284,324 | | | 1,548,422 | | | - | | | 1,287,488 | | | 75,000 | | | 24,295 | |

| | | | 2004 | | | 247,906 | | | 909,433 | | | - | | | - | | | 100,000 | | | 19,078 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Paul Coghlan | | | 2006 | | $ | 336,228 | | $ | 1,795,892 | | | - | | $ | 857,795 | | | - | | $ | 23,980 | |

| Vice President | | | 2005 | | | 331,781 | | | 1,718,575 | | | - | | | 2,269,313 | | | 70,000 | | | 25,249 | |

| Finance and Chief | | | 2004 | | | 304,673 | | | 1,170,569 | | | - | | | - | | | 70,000 | | | 19,519 | |

| Financial Officer | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Donald E. Paulus (5) | | | 2006 | | $ | 236,077 | | $ | 653,334 | | | - | | $ | 449,295 | | | - | | $ | 22,450 | |

| Vice President and | | | 2005 | | | 232,654 | | | 630,948 | | | - | | | 972,563 | | | 35,000 | | | 24,545 | |

| General Manager of | | | 2004 | | | 204,545 | | | 402,390 | | | - | | | - | | | - | | | 19,409 | |

Power Products | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Includes cash profit sharing and cash bonuses earned for the fiscal year, whether accrued or paid. |

| (2) | Dollar value of shares of restricted stock awarded. The fair market value of the common stock on the day of the awards was $35.12 - 10/19/05, $38.50 - 1/17/06, $36.76 - 4/18/06 per share. Shares of restricted stock generally vest annually over a three-or five-year period, provided that the recipient continues to be an employee of the Company on each vesting date. Recipients receive dividends on the shares during the vesting period. The number of shares of restricted stock awarded to each of the Named Executive Officers and the fair market value of those shares as of the last trading day in fiscal 2006 was as follows: Mr. Swanson - 50,000 shares (fair market value - $1,674,500), Mr. Bell - 25,000 shares (fair market value - $837,250), Mr. Coghlan - 23,335 shares (fair market value - $781,489), and Mr. Paulus - 11,670 shares (fair market value - $390,828). |

| (3) | Includes insurance premiums paid by the Company under its life insurance program. Also includes 401(k) profit sharing distributions earned during the fiscal year. |

| (4) | Represents the imputed value of personal use by Mr. Swanson during the applicable fiscal year of the airplanes in which the Company owns fractional interests, plus related tax reimbursements. |

Option Grants in Last Fiscal Year

No stock options were granted to any Name Executive Officers during the year ended July 2, 2006.

Option Exercises and Holdings

The following table provides information with respect to option exercises in fiscal 2006 by the Named Executive Officers and the value of such officers' unexercised options at July 2, 2006.

Aggregated Option Exercises in Last Fiscal Year and Year-End Option Values

| | | | | | | Number of Shares Underlying | | Value of Unexercised | |

| | | Shares | | | | Unexercised Options at | | In-the-Money Options at | |

| | | Acquired On | | Value | | Fiscal Year-End (#) | | Fiscal Year-End ($) (2) | |

Name | | Exercise (#) | | Realized($)(1) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

| Robert H. Swanson, Jr. | | | 150,000 | | $ | 4,451,609 | | | 1,051,400 | | | 30,000 | | $ | 14,293,156 | | $ | 253,200 | |

| Lothar Maier | | | - | | | - | | | 279,560 | | | 10,500 | | $ | 1,436,789 | | $ | 88,620 | |

| David B. Bell | | | - | | | - | | | 188,390 | | | 10,500 | | $ | 2,133,822 | | $ | 88,620 | |

| Paul Coghlan | | | 260,000 | | | 7,845,785 | | | 374,190 | | | 22,500 | | $ | 5,115,339 | | $ | 189,900 | |

Donald E. Paulus | | | - | | | - | | | 20,780 | | | 6,000 | | $ | 136,503 | | $ | 24,720 | |

| (1) | Market value of underlying securities on the exercise date, minus the exercise price. |

| (2) | Value is based on the last reported sale price of the common stock on the Nasdaq National Market of $33.49 per share on June 30, 2006 (the last trading day for fiscal 2006), minus the exercise price. |

Employment Agreements

In January 2002, the Company entered into employment agreements with Mr. Swanson, its Executive Chairman and then Chief Executive Officer, Mr. Coghlan, its Chief Financial Officer and certain other officers at the time.

Employment Agreement with the Executive Chairman and Former Chief Executive Officer

Mr. Swanson's employment agreement provided for an annual base salary of $345,000 at the time the agreement was entered into. Mr. Swanson's annual base salary was subject to annual adjustment by the Compensation Committee, and was subsequently increased to $405,000 from the original amount. Mr. Swanson's employment agreement also entitled him to bonuses pursuant to his participation in the Company's Senior Executive Bonus Plan and Key Employee Incentive Bonus Plan.

In January 2005, Mr. Swanson voluntarily resigned as Chief Executive Officer, but agreed, at the request of the Board of Directors, to remain as Executive Chairman of the Board with duties requiring one to two days per week of Mr. Swanson's time. Pursuant to his employment agreement Mr. Swanson continues to receive his existing salary and bonus pro rated based on the number of full days Mr. Swanson performs services as Executive Chairman throughout each fiscal year, but his bonus may not exceed 50% of the target bonus for the relevant period. In addition, Mr. Swanson's benefits continue, and his stock options and restricted stock now vest at twice the rate, as if he had continued as Chief Executive Officer.

If, in the future, Mr. Swanson is involuntarily terminated as Executive Chairman of the Board for any reason other than cause (as defined in his employment agreement) or if he voluntarily resigns as an employee and as Executive Chairman, then 100% of his stock options and restricted stock will immediately vest, and he will receive continued payment of one year's base salary and annual target bonus payments. In addition, the Company will pay Mr. Swanson's group health and dental plan continuation coverage premiums until the earlier of 18 months from his termination and such time as Mr. Swanson and his dependents are covered by similar plans of a new employer.

If there is a change of control of the Company (as defined in his employment agreement), Mr. Swanson will receive similar benefits to those he is entitled to receive if he is involuntarily terminated by the Company other than for cause or if he voluntarily resigns as an employee and Executive Chairman of the Board, including immediate vesting in full of his options and restricted stock and payment of one year's salary and annual target bonus in a lump sum within five days of the change of control, whether or not he is terminated without cause or he resigns for good reason.

If Mr. Swanson should die while employed by the Company, 50% of his then unvested restricted stock and options will vest immediately.

The Company has a fractional ownership in two different aircraft operated by NetJets, Inc. So long as Mr. Swanson is Executive Chairman of the Board, he is entitled to use the Company's airplane for personal use for up to 35% of the available flight time in any year. To the extent use of the airplane results in imputed taxable income to Mr. Swanson, the Company will make additional payments to him, so that the net effect is the same as if no income were imputed to him.

If payments to Mr. Swanson under his employment agreement (together with any other payments or benefits Mr. Swanson receives) would trigger the excise tax provisions of Sections 280G and 4999 of the Code, Mr. Swanson will be paid an additional amount, so that he receives, net of the excise taxes, the amount he would otherwise have been entitled to receive in their absence.

Employment Agreement with Chief Financial Officer

The employment agreement with Mr. Coghlan, the Company's Chief Financial Officer, provided for an annual base salary of $285,000 at the time the agreement was entered into. Mr. Coghlan's annual base salary is subject to annual adjustment by the Board of Directors, and has been subsequently increased to $350,000 from the original amount. He is also entitled to bonuses pursuant to the Company's Senior Executive Bonus Plan and Key Employee Incentive Bonus Plan.

If Mr. Coghlan is involuntarily terminated by the Company for any reason other than cause (as defined in his employment agreement) or if he voluntarily resigns with good reason (as defined in the employment agreements), then he will receive continued payments of his base salary and bonus for six months, and his stock options and restricted stock will immediately vest to the extent they would have vested had he remained employed by the Company for an additional six months. In addition, the Company will pay Mr. Coghlan's group health and dental plan continuation coverage premiums until the earlier of six months from his termination and such time as he and his dependents are covered by similar plans of a new employer.

If, after a change of control (as defined in his employment agreement), Mr. Coghlan is involuntarily terminated for any reason other than cause, or if he voluntarily resigns with good reason, then 50% of his then unvested stock options and restricted stock will immediately vest, and he will receive continued payments of one year's base salary and 50% of his bonus. In addition, the Company will pay Mr. Coghlan's group health and dental plan continuation coverage premiums until the earlier of twelve months from his termination and such time as he and his dependents are covered by similar plans of a new employer.

If Mr. Coghlan should die while employed by the Company, 50% of his then unvested restricted stock and options will vest immediately.

If payments to Mr. Coghlan under his employment agreement (together with any other payments or benefits he receives) would trigger the excise tax provisions of Sections 280G and 4999 of the Code, and such payments are less than 3.59 multiplied by his "base amount" (as defined in Section 280G), then the payments will be reduced so that no portion of the payments will be subject to excise tax under Section 4999. If payments under Mr. Coghlan's employment agreement (together with any other payments or benefits he receives) would exceed 3.59 multiplied by his "base amount," then Mr. Coghlan will be paid an additional amount so that he receives, net of the excise taxes, the amount he would otherwise have been entitled to receive in their absence.

Compensation Committee Interlocks and Insider Participation

No executive officer of the Company served on the compensation committee of another entity or on any other committee of the board of directors of another entity performing similar functions during the last fiscal year.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company's executive officers and directors, and persons who own more than ten percent of the Company's common stock, to file reports of ownership on Form 3 and of changes in ownership on Forms 4 or 5 with the Securities and Exchange Commission and the National Association of Securities Dealers, Inc. Executive officers, directors and ten percent stockholders are also required by Commission rules to furnish the Company with copies of all Section 16(a) forms they file.

The Company reviews copies of any such forms and amendments it receives, as well as written representations from certain reporting persons that no Forms 5 were required for such persons. Based solely upon this review, the Company believes that its executive officers, directors and ten percent stockholders complied with all applicable Section 16(a) filing requirements during the fiscal year ended July 2, 2006, except that Mr. Reay, the Company's Vice President, Mixed Signal Products, reported one transaction late.

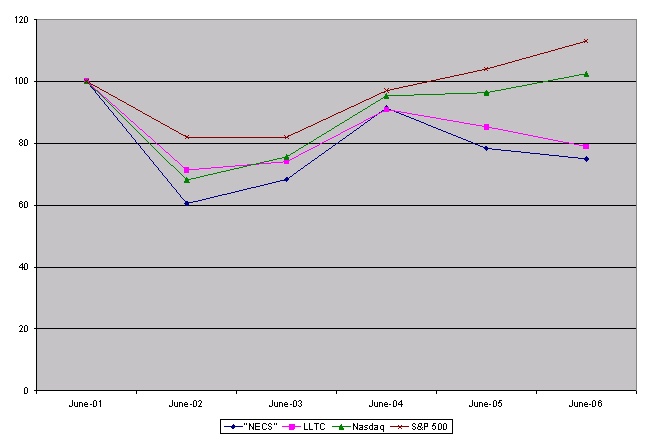

PERFORMANCE GRAPH

The following graph shows a five-year comparison of cumulative total stockholder return, calculated on a dividend-reinvested basis, for Linear Technology Corporation, the Nasdaq National Market and the Nasdaq Electronic Components Stocks (the "NECS") and the S&P 500. The graph assumes that $100 was invested in the Company's common stock, the Nasdaq National Market, the NECS and the S&P 500 on the last trading day of the Company's 2001 fiscal year. Note that historic stock price performance is not necessarily indicative of future stock price performance.

| | June 2001 | June 2002 | June 2003 | June 2004 | June 2005 | June 2006 |

LLTC | 100 | 71 | 74 | 91 | 85 | 79 |

Nasdaq | 100 | 68 | 76 | 95 | 96 | 102 |

NECS | 100 | 61 | 68 | 91 | 78 | 75 |

S&P 500 | 100 | 82 | 82 | 97 | 104 | 113 |

AUDIT COMMITTEE REPORT

The following is the Audit Committee's report submitted to the Board of Directors for the fiscal year ended July 2, 2006.

The Audit Committee of the Board of Directors has:

| l | reviewed and discussed the Company's audited financial statements for the fiscal year ended July 2, 2006 with the Company's management; |

| l | discussed with Ernst & Young LLP, the Company's independent registered public accounting firm, the materials required to be discussed by Statement of Auditing Standard 61; and |

| l | reviewed the written disclosures and the letter from Ernst & Young LLP required by Independent Standards Board No. 1 and discussed with Ernst & Young LLP its independence. |

Based on the Audit Committee's review of the matters noted above and its discussions with the Company's independent registered public accounting firm and the Company's management, the Audit Committee has recommended to the Board of Directors that the Company's financial statements for the fiscal year ended July 2, 2006 be included in the Company's 2006 Annual Report on Form 10-K.

Respectfully submitted by:

The Audit Committee

Thomas S. Volpe, Chairman

David S. Lee

Leo T. McCarthy

Richard M. Moley

COMPENSATION COMMITTEE REPORT

Introduction

The Compensation Committee of the Board of Directors is composed only of non-employee directors. It is responsible for reviewing and recommending for approval by the Board of Directors the Company's compensation practices, executive salary levels and variable compensation programs, both cash-based and equity-based. The Committee generally determines base salary levels for executive officers of the Company at or about the start of each fiscal year and determines actual bonuses at the end of each six-month fiscal period based upon Company and individual performance.

Compensation Philosophy

The Committee has adopted an executive pay-for-performance philosophy covering all executive officers, including the Executive Chairman and the Chief Executive Officer. This philosophy emphasizes variable compensation in order to align executive compensation with the Company's business objectives and performance and to attract, retain and reward executives who contribute both to the short-term and long-term success of the Company. Pay is sufficiently variable that above-average performance results in above-average total compensation, and below-average performance for the Company or the individual results in below-average total compensation. The focus is on corporate performance and individual contributions toward that performance.

Compensation Program

The Company has a comprehensive compensation program which consists of cash compensation, both fixed and variable, and equity-based compensation. The program has four principal components, which are intended to attract, retain, motivate and reward executives who are expected to manage both the short-term and long-term success of the Company. These components are:

Cash-Based Compensation