Exhibit 99.1

CORPORATE PRESENTATION WITH OVER 35 YEARS OF DISCOVERY ACTIVITY, XOMA CURRENTLY HAS OVER THREE DOZEN PARTNERED AND FULLY-FUNDED ASSETS WITH THE POTENTIAL TO DRIVE MILESTONE AND ROYALTY PAYMENTS, ALONG WITH MULTIPLE ADDITIONAL AUGUST 2018 PROGRAMS READY FOROUT-LICENSING 1

FORWARD-LOOKING STATEMENTS Certain statements in this presentation are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding: future monetization opportunities, active transactions with significant financial implications, collaborations poised for significant financial contribution, our library of value-generating assets, future potential for milestone and royalty payments, the potential of our unique antibody discovery engine, potential licensing of compounds in our endocrine asset pipeline, the prospects for our XOMA 213 asset for treatment of prolactinemia, the ability of our partners and their licensees to successfully develop their pipeline programs, the productivity of acquired assets that may not fulfill our revenue forecasts, upcoming internal milestones and value catalysts, our future cash needs, our strategy for value creation, and other statements that relate to future periods. These statements are based on assumptions that may not prove accurate, and actual results could differ materially from those anticipated due to certain risks inherent in the biotechnology industry and for companies engaged in the development of new products in a regulated market. Potential risks to XOMA meeting these expectations are described in more detail in XOMA’s most recent filing on Form10-K and in other SEC filings. Consider such risks carefully when considering XOMA’s prospects. Any forward-looking statements represent XOMA’s views only as of the date of this presentation and should not be relied upon as representing its views as of any subsequent date. XOMA disclaims any obligation to update any forward-looking statement, except as required by law. 2

W HAT DO THESE TWO GENIUSES HAVE IN COMMON? (and why is XOMA talking about them?) 3

WARREN BUFFET’S MODEL BUY & BUILD Buy good companies with good managementPRE-1970: teams who know how to SIGNIFICANT BUY AT A grow their business INTRINSIC DISCOUNT VALUE TO POST-1970: BUY & HOLD BUY AT A COMPANIES PRICE NEAR INTRINSIC THAT CAN VALUE, The principle of CONSISTENTLY INCREASE THEIR compound interest VALUE 4

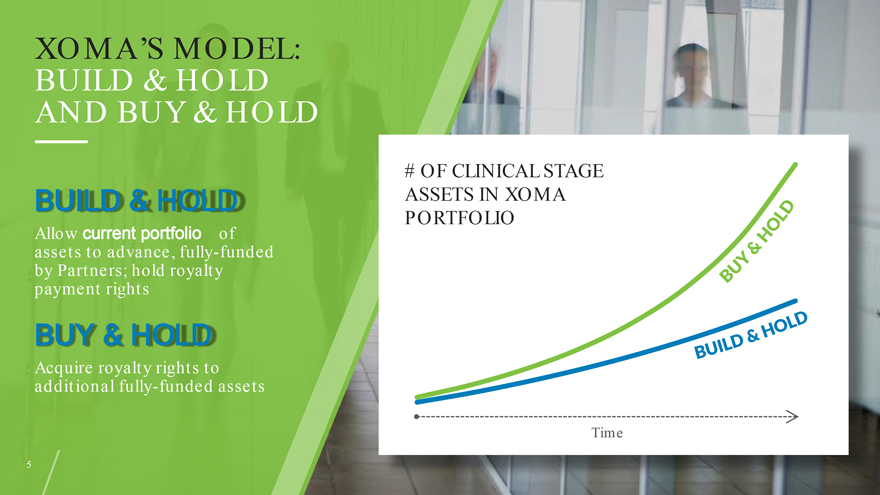

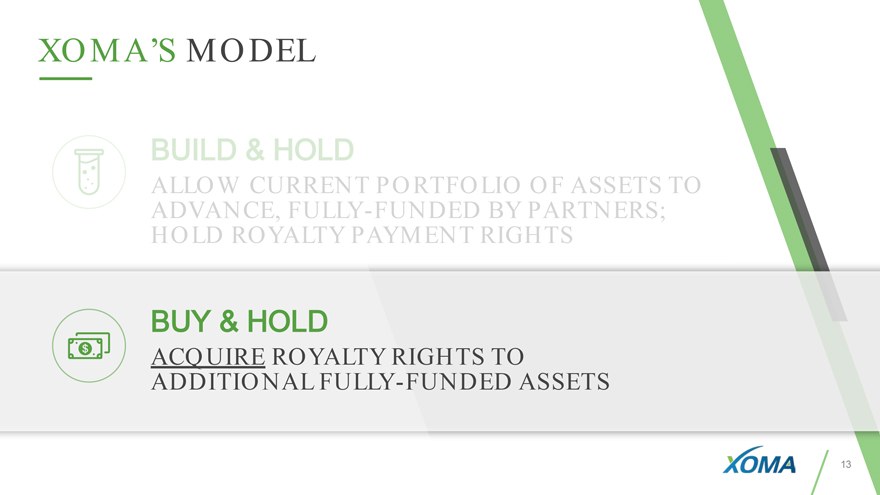

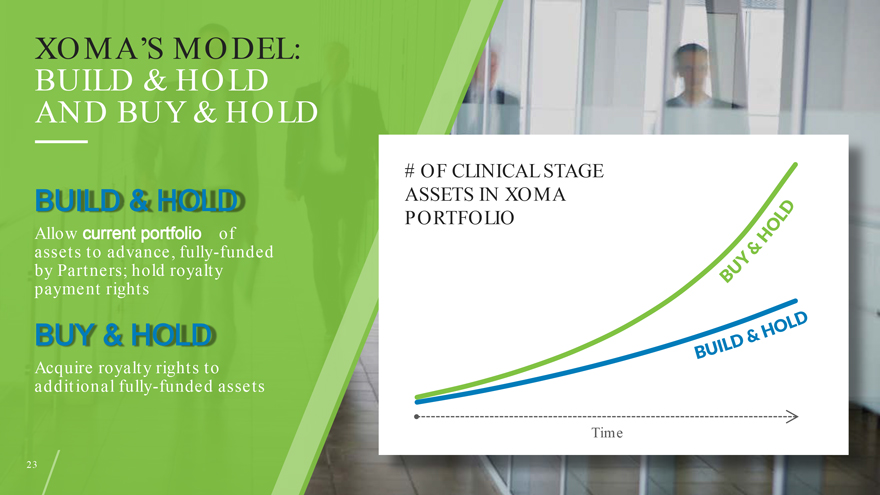

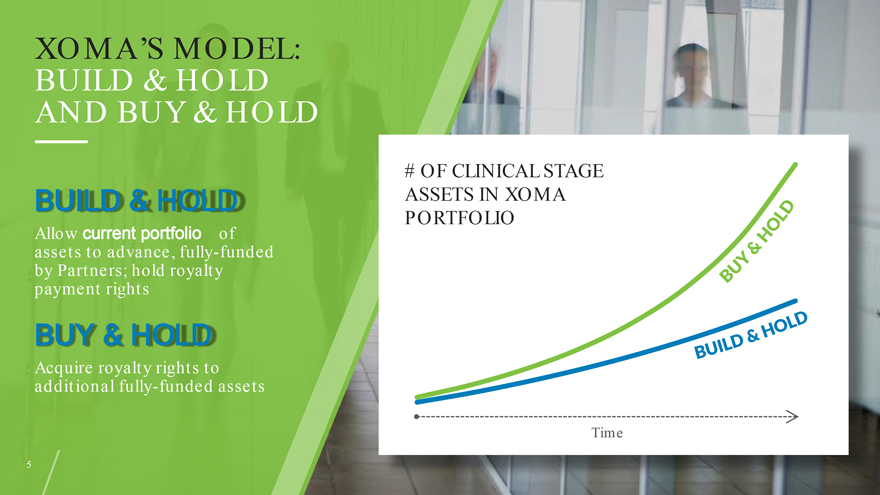

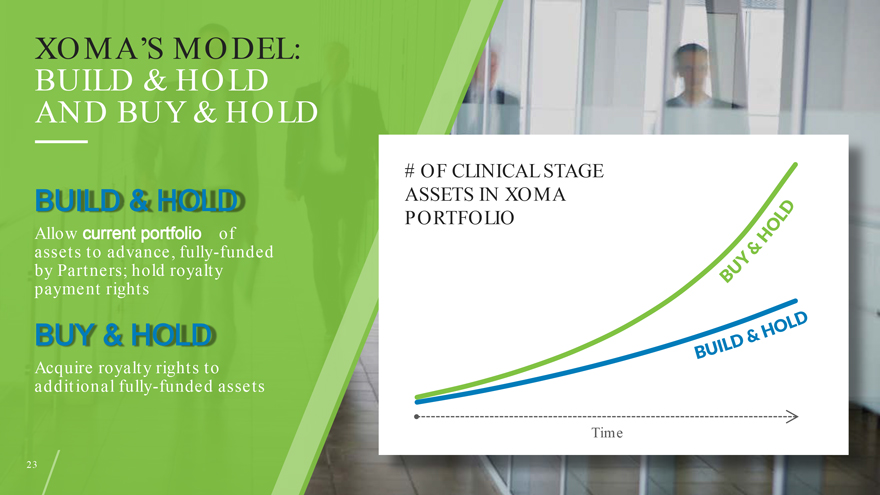

XOMA’S MODEL: BUILD & HOLD AND BUY & HOLD # OF CLINICAL STAGE BUILD & HOLD ASSETS IN XOMA PORTFOLIO Allow current portfolio of assets to advance, fully-funded by Partners; hold royalty payment rights BUY & HOLD Acquire royalty rights to additional fully-funded assets Time 5

XOMA’S MODEL BUILD & HOLD ALLOW ADVANCE, CURRENT FULLY- FUNDED PORTFOLIO BY PARTNERS; OF ASSETS TO HOLD ROYALTY PAYMENT RIGHTS 6

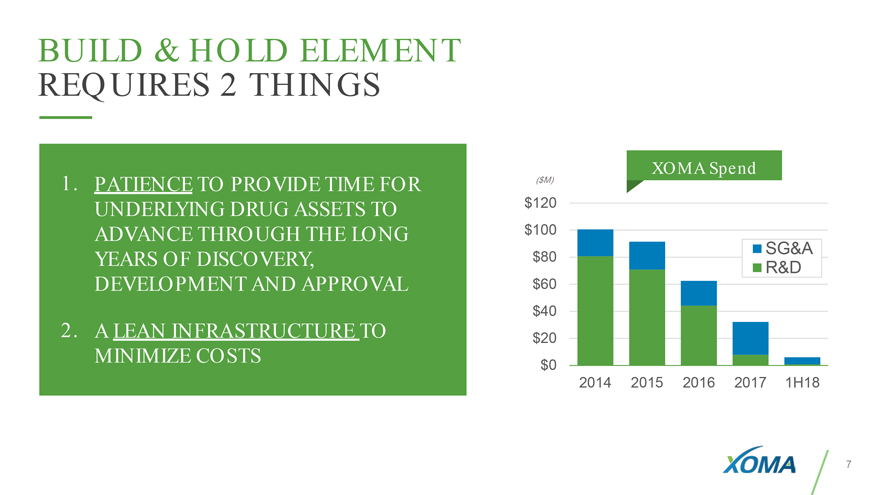

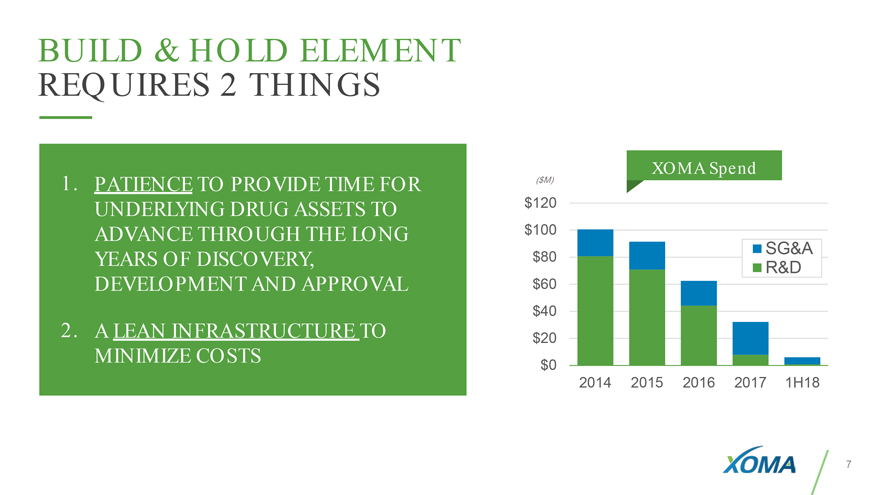

BUILD & HOLD ELEMENT REQUIRES 2 THINGS ($M) XOMA Spend 1. PATIENCE TO PROVIDE TIME FOR UNDERLYING DRUG ASSETS TO $120 ADVANCE THROUGH THE LONG $100 SG&A YEARS OF DISCOVERY, $80 $60 R&D DEVELOPMENT AND APPROVAL 2. A LEAN INFRASTRUCTURE TO $40 $20 MINIMIZE COSTS $0 2014 2015 2016 2017 1H18 7

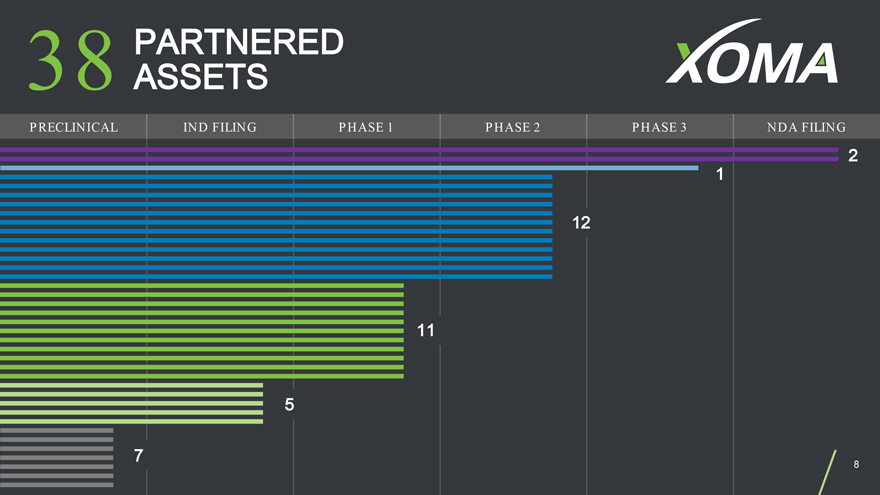

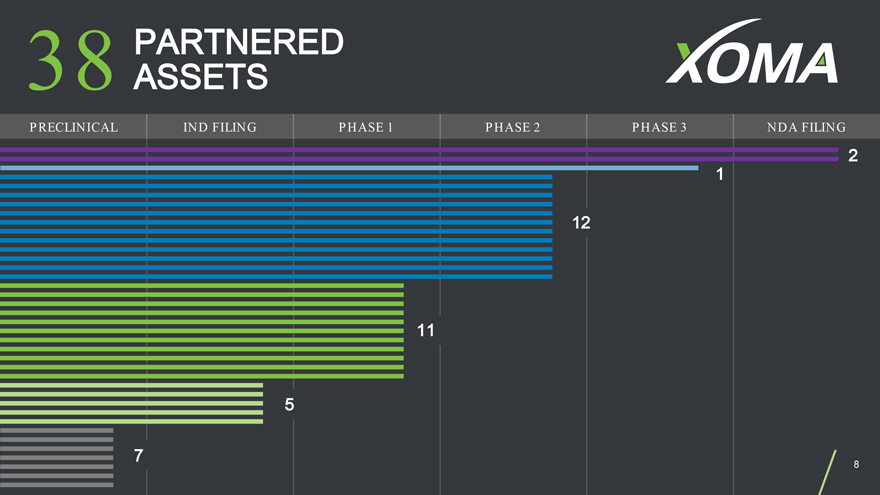

PARTNERED 38 ASSETS PRECLINICAL IND FILING PHASE 1 PHASE 2 PHASE 3 NDA FILING 2 1 12 11 5 7 8

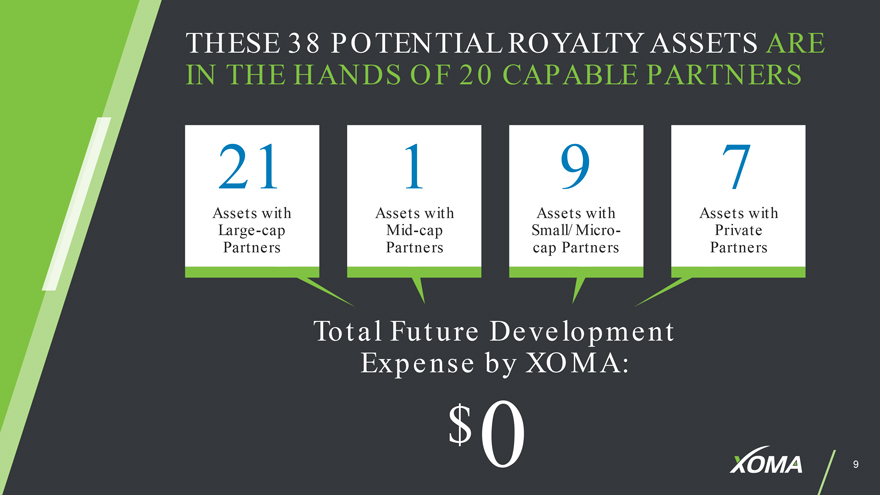

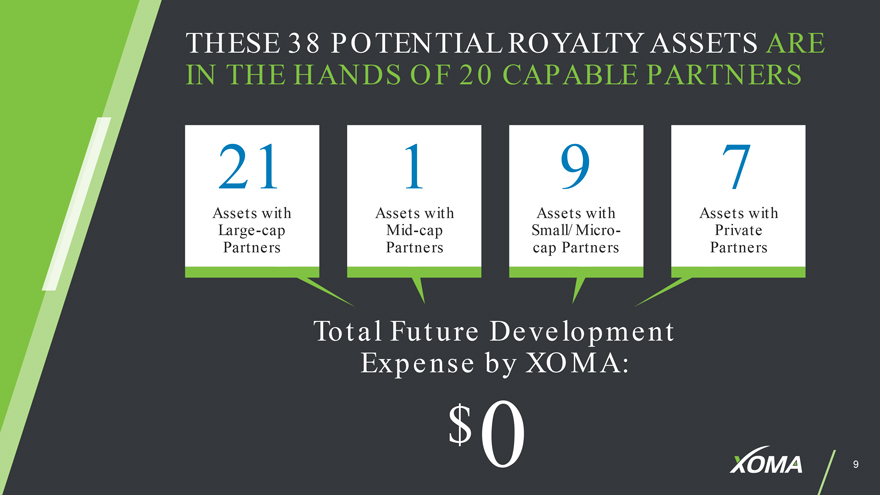

THESE 38 POTENTIAL ROYALTY ASSETS ARE IN THE HANDS OF 20 CAPABLE PARTNERS 21 1 9 7 Assets with Assets with Assets with Assets withLarge-capMid-cap Small/ Micro- Private Partners Partners cap Partners Partners Total Future Development Expense by XOMA: $0 9

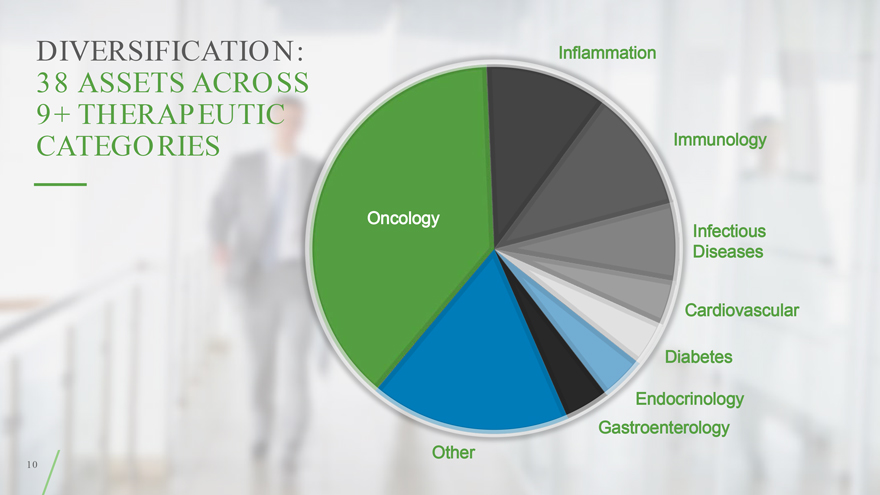

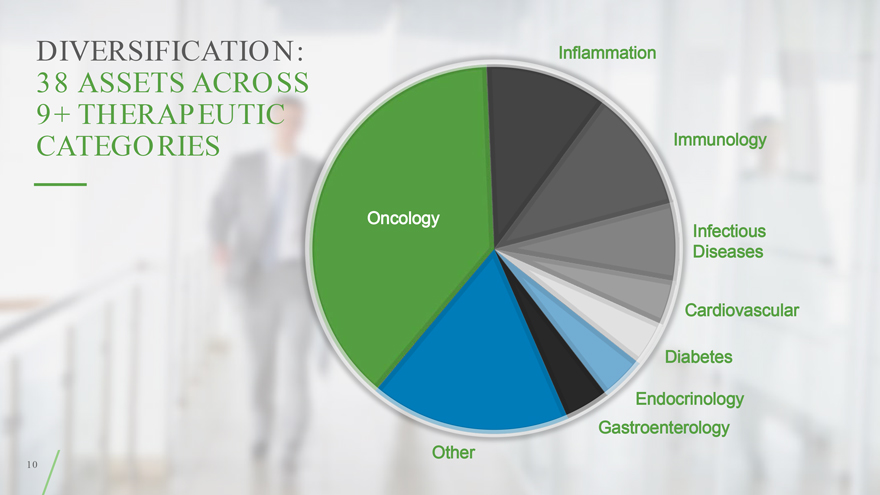

DIVERSIFICATION: 38 ASSETS ACROSS 9+ THERAPEUTIC CATEGORIES Immunology Infectious Diseases Cardiovascular Diabetes 10 Other

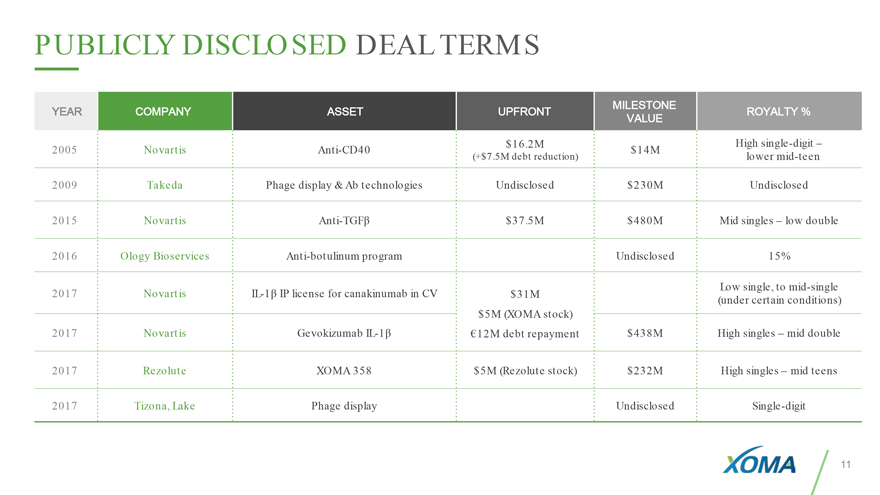

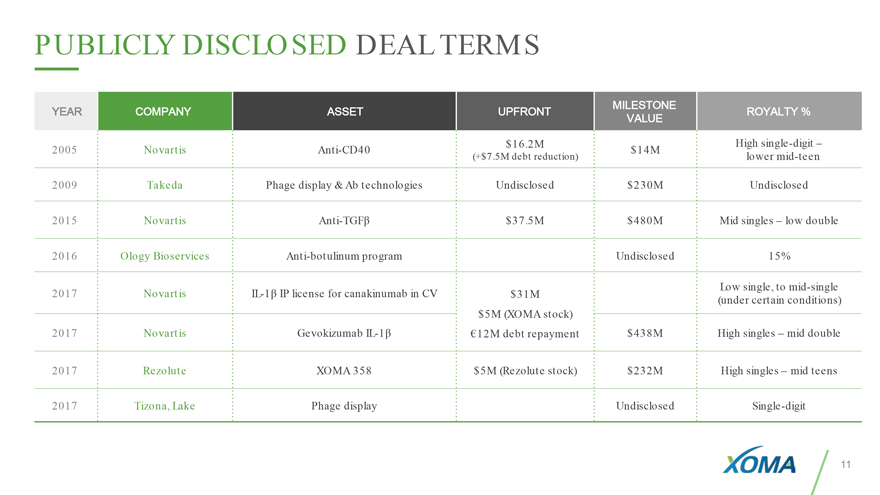

PUBLICLY DISCLOSED DEAL TERMS MILESTONE YEAR COMPANY ASSET UPFRONT ROYALTY % VALUE $16.2M High single-digit –2005 Novartis Anti-CD40 $14M (+$7.5M debt reduction) lowermid-teen 2009 Takeda Phage display & Ab technologies Undisclosed $230M Undisclosed 2015 NovartisAnti-TGFβ $37.5M $480M Mid singles – low double 2016 Ology Bioservices Anti-botulinum program Undisclosed 15% Low single, tomid-single 2017 NovartisIL-1â IP license for canakinumab in CV $31M (under certain conditions) $5M (XOMA stock) 2017 Novartis GevokizumabIL-1â €12M debt repayment $438M High singles – mid double 2017 Rezolute XOMA 358 $5M (Rezolute stock) $232M High singles – mid teens 2017 Tizona, Lake Phage display Undisclosed Single-digit 11

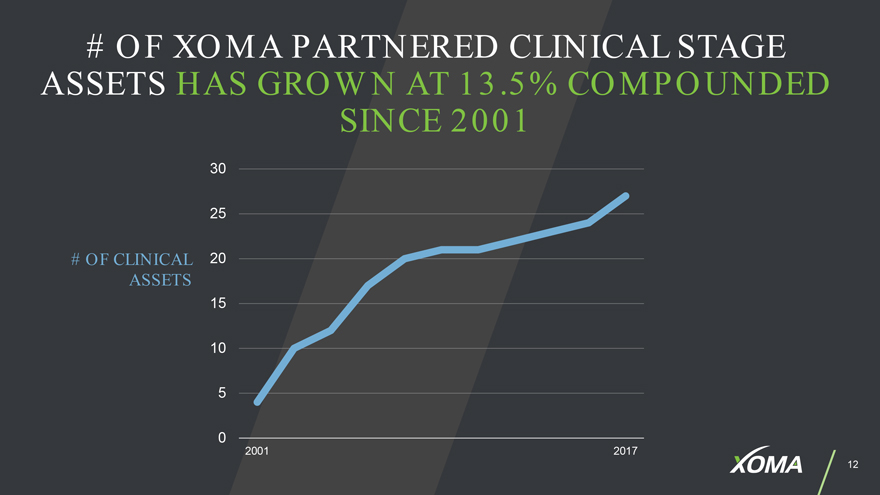

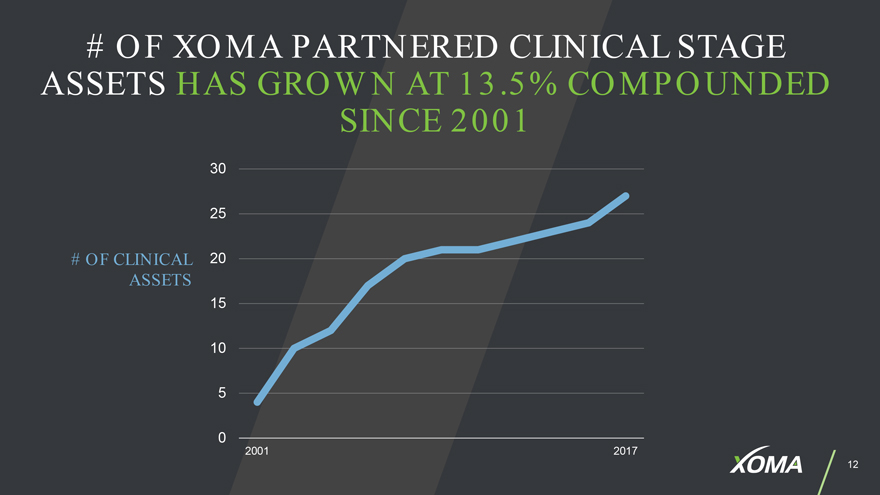

# OF XOMA PARTNERED CLINICAL STAGE ASSETS HAS GROW N AT 13.5% COMPOUNDED SINCE 2001 30 25 # OF CLINICAL 20 ASSETS 15 10 5 0 2001 2017 12

XOMA’S MODEL BUY & HOLD ACQUIRE ADDITIONAL ROYALTY FULLY- RIGHTS FUNDED TO ASSETS 13

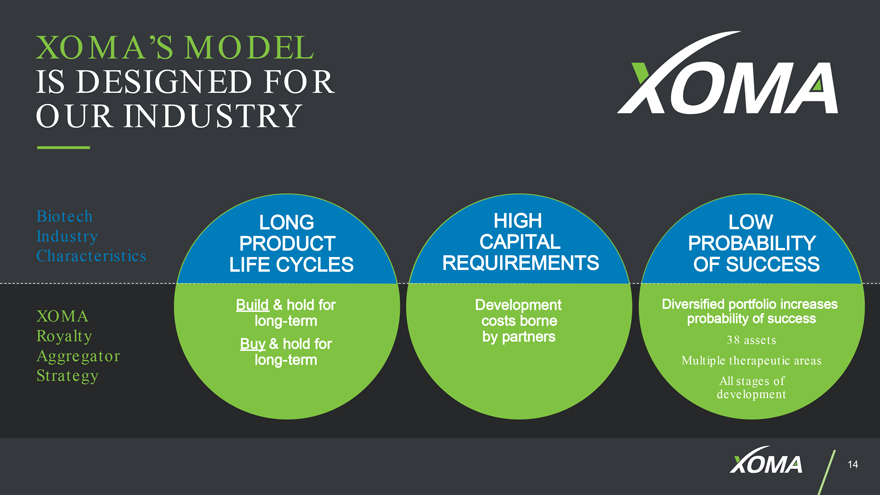

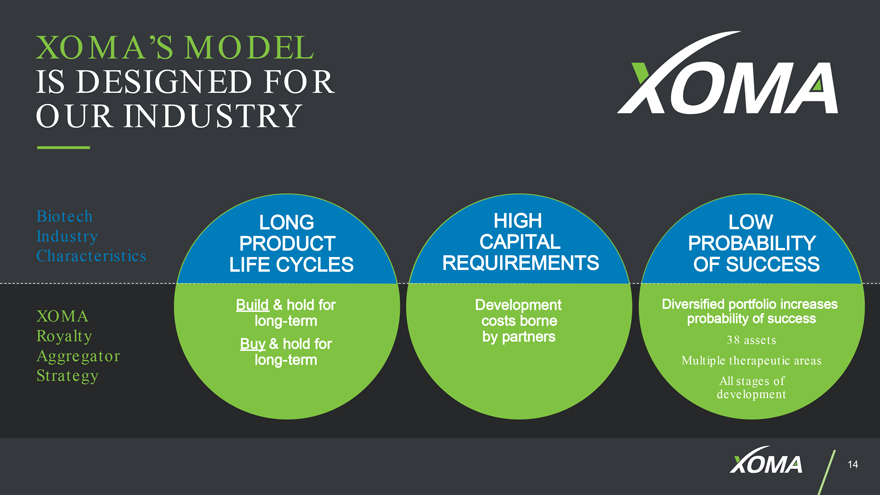

XOMA’S MODEL IS DESIGNED FOR OUR INDUSTRY Biotech LONG HIGH LOW Industry PRODUCT CAPITAL PROBABILITY Characteristics LIFE CYCLES REQUIREMENTS OF SUCCESS Build & hold for Development Diversified portfolio increases XOMA long-term costs borne probability of success Royalty Buy & hold for by partners 38 assets Aggregator long-term Multiple therapeutic areas Strategy All stages of development 14

DRUG DEVELOPMENT TAKES A LONG TIME AND IS CAPITAL INTENSIVE AVG. TIME TO AVG. $ CUMULATIVE PROB. CONDUCT (MONTHS) TO FUND OF SUCCESS PHASE 3 31 $210M 50% PHASE 2 26 $45M 16% PHASE 1 22 $30M 10% PRECLINICAL 37 $3M 5% Sources: Dimasi, Hansen & Grabowski, 2003, Tufts University; Hay, Rosenthal, Thomas & Craighead, 2011, Biomedtracker 15

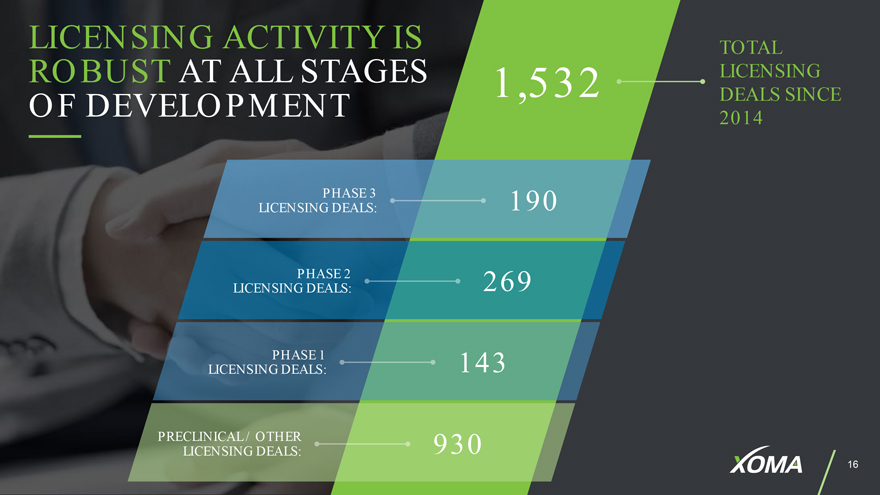

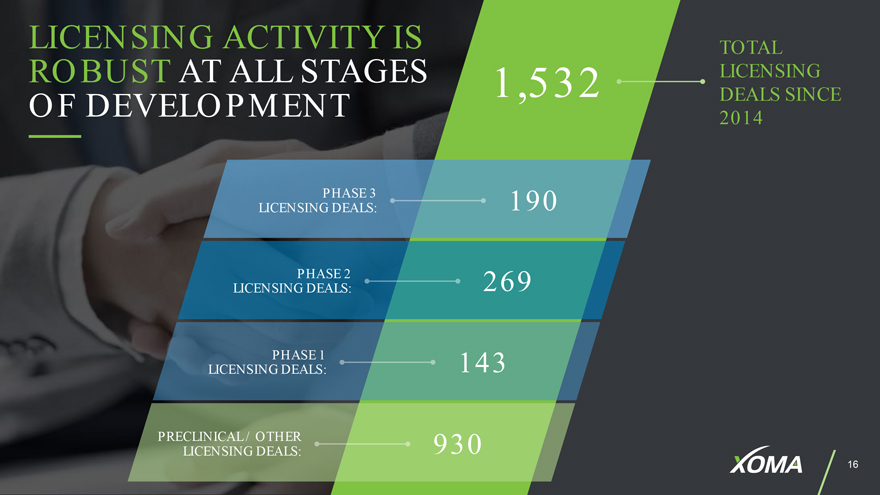

LICENSING ACTIVITY IS TOTAL ROBUST AT ALL STAGES 1,532 LICENSING OF DEVELOPMENT DEALS SINCE 2014 LICENSING PHASE DEALS: 3 190 LICENSING PHASE DEALS: 2 269 LICENSING PHASE DEALS: 1 143 PRECLINICAL LICENSING / OTHER DEALS: 930 16

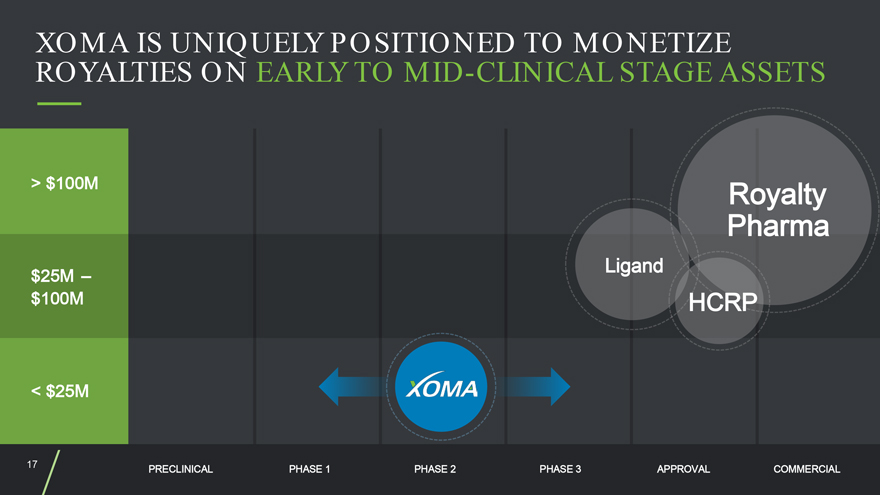

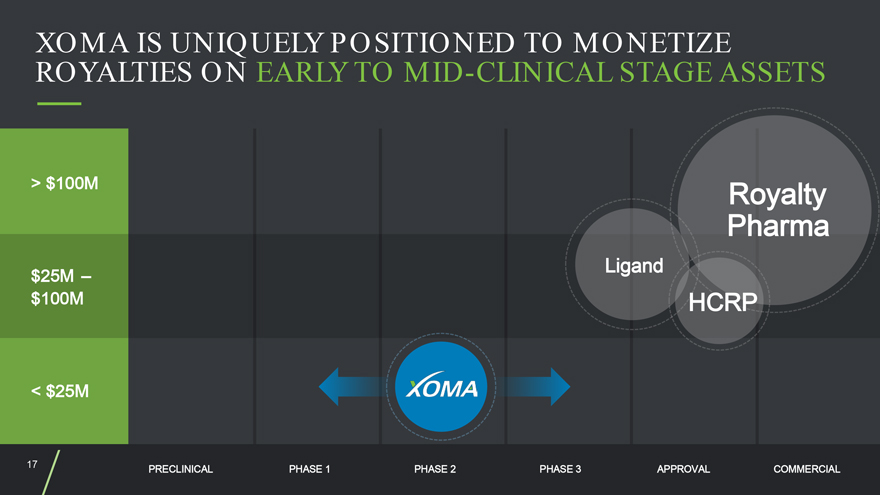

XOMA IS UNIQUELY POSITIONED TO MONETIZE ROYALTIES ON EARLY TOMID-CLINICAL STAGE ASSETS > $100M Royalty Pharma Ligand $25M –$100M HCRP < $25M 17 PRECLINICAL PHASE 1 PHASE 2 PHASE 3 APPROVAL COMMERCIAL

KEY ATTRIBUTES OF XOMA TARGET ASSETS RxPRE-COMMERCIAL THERAPEUTIC ASSETS Phase 1, 2, or 3 LONG DURATION OF MARKET EXCLUSIVITY Patent expiration or regulatory exclusivity HIGH REVENUE POTENTIAL High unmet need or clear clinical benefit over alternatives STRONG DEVELOPER/MARKETER Assets partnered with high-quality pharma/ biopharma companies 18

EXAMPLES OF OPPORTUNITIES XOMA W ILL TARGET BIOTECH ‘X’ Seeksnon-dilutive funding to take an additional program into clinical development to TECH ‘Y’ diversify risk s funding to hold lead am to participate in next inflection point 19

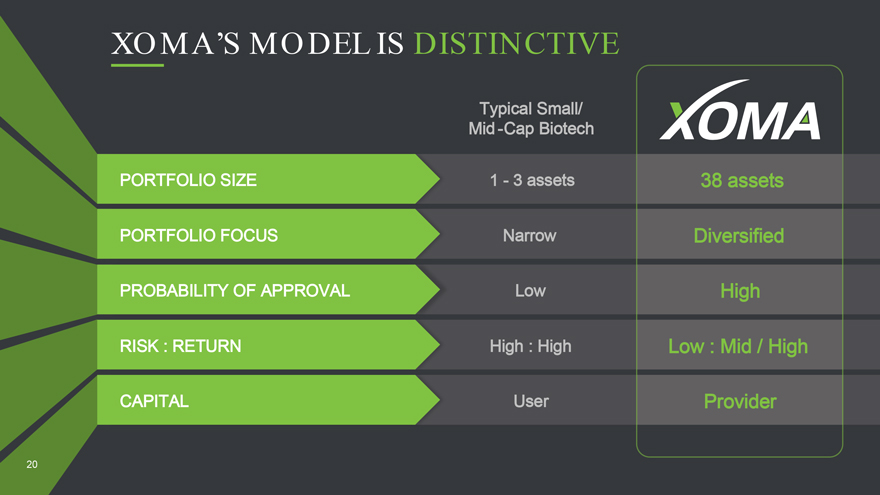

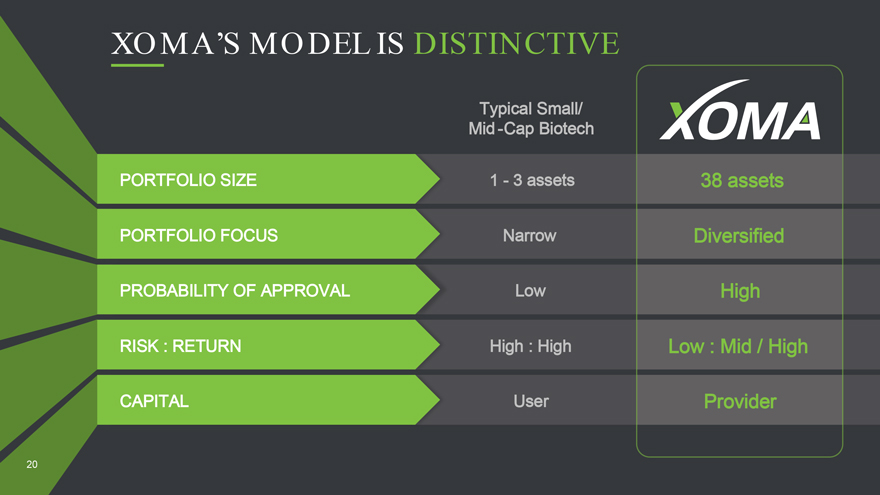

XOMA’S MODEL IS DISTINCTIVE Typical Small/ Mid-Cap Biotech PORTFOLIO SIZE 1 - 3 assets 38 assets PORTFOLIO FOCUS Narrow Diversified PROBABILITY OF APPROVAL Low High RISK : RETURN High : High Low : Mid / High CAPITAL User Provider 20

W HAT TO EXPECT FROM XOMA COMPOUND GROW TH IMPACT BUY & HOLD Expand portfolio of royalty BUILD & HOLD rights through acquisition of new potential royalty streams Allow current portfolio to continue to advance in hands of partners 21

COMPOUND INTEREST IS THE EIGHTH WONDER OF THE WORLD. HE W HO UNDERSTANDS IT … EARNS IT. HE W HO DOESN’T … PAYS IT. - Albert Einstein 22

XOMA’S MODEL: BUILD & HOLD AND BUY & HOLD # OF CLINICAL STAGE BUILD & HOLD ASSETS IN XOMA PORTFOLIO Allow current portfolio of assets to advance, fully-funded by Partners; hold royalty payment rights BUY & HOLD Acquire royalty rights to additional fully-funded assets Time 23