OPPENHEIMER HOLDINGS INC. INVESTOR PRESENTATION MARCH 2016 Presented by: Robert Lowenthal Senior Managing Director, Chairman of Management Committee Jeffrey Alfano Executive Vice President & Chief Financial Officer

SAFE HARBOR STATEMENT 2 This presentation and other written or oral statements made from time to time by representatives of Oppenheimer Holdings Inc. (the “company”) may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements may relate to such matters as anticipated financial performance, future revenues or earnings, business prospects, new products or services, anticipated market performance and similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements. The company cautions that a variety of factors could cause the company’s actual results to differ materially from the anticipated results or other expectations expressed in the company’s forwarding-looking statements. These risks and uncertainties include, but are not limited to, those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 (the “2015 Annual Report”). In addition, important factors that could cause actual results to differ materially from those in the forward-looking statements include those factors discussed in Part II, “Item 7. Management’s Discussion & Analysis of Financial Condition and Results of Operations – Factors Affecting ‘Forward-Looking Statements’” of our 2015 Annual Report. Any forward-looking statements herein are qualified in their entirety by reference to all such factors discussed in the 2015 Annual Report and the company’s other SEC filings. There can be no assurance that the company has correctly or completely identified and assessed all of the factors affecting the company’s business. The company does not undertake any obligation to publicly update or revise any forward-looking statements.

OVERVIEW 3 Oppenheimer is a leading investment bank and full-service investment firm that provides financial services and advice to high net worth investors, individuals, businesses and institutions. Private client services and asset management solutions tailored to individuals’ unique financial objectives Investment banking services and capital markets products for institutions and corporations Provides high quality service for the acquisition, refinance, rehabilitation and construction of multifamily and healthcare properties Wealth Management Capital Markets Commercial Mortgage Banking $78.7B Client Assets Under Administration 1,230+ Financial Advisors 85 offices in 24 states; 6 foreign jurisdictions $24.1B Client Assets Under Management +250 Institutional Sales Professionals 40 senior research analysts covering ~600 equity securities Note: Data as of December 31, 2015 Quick Facts

Economic growth – weakness in China’s economy Decline in oil and other commodity prices Interest rate environment Politics (U.S. Presidential Election 2016) 4 CURRENT ENVIRONMENT Global Industry Regulatory landscape Fintech revolution Demographics of wealth management Lower transaction volumes

5 BROKERAGE STOCKS TRADING AT CYCLICAL LOWS Ticker 3/28/16 Stock Price Tangible BV per Share(1) Price/TBVPS Ratio Goldman Sachs GS $153.84 $161.64 95.2% Morgan Stanley MS $24.72 $30.26 81.7% Raymond James Financial RJF $47.05 $29.86 157.6% Stifel Financial SF $28.81 $22.58 127.6% Oppenheimer Holdings OPY $14.35 $26.13 54.9% Piper Jaffray PJC $46.60 $40.20 115.9% JMP Group JMP $5.08 $5.88 86.4% FBR & Co FBRC $17.96 $30.09 59.7% Cowen Group COWN $3.52 $6.72 52.4% Source: S&P Capital IQ (1) Tangible book value per share as of December 31, 2015 Bulge Bracket Regionals Independents

6 OPPENHEIMER VALUE PROPOSITION Oppenheimer is currently trading at a significant discount: Market capitalization as a percentage of revenue: Client Assets Under Administration of $78.7 billion Client Assets Under Management of $24.1 billion 1,233 financial advisors – Value per financial advisor for precedent transactions announced during the period 2005 to 2015 ranged from $330,000 to $820,000 Ticker 3/28/16 Stock Price Tangible BV per Share Price/TBVPS Ratio Oppenheimer Holdings OPY $14.35 $26.13 54.9% Note: Market data as of March 28, 2016 and Financial data as of December 31, 2015 $192.4 million / $928.4 million = 20.7% 54.9% of Tangible Book Value38.9% of Book Value

Cultural Values Business Principles Talent & Leadership Technology Investments 7 OUR CULTURAL VALUES “Our core values and our culture are the most important and enduring strength of this firm. As we stay true to our principles, always doing what is right and best for our clients, then in the best and worst of times, we can feel justly proud of our efforts. As we make the changes necessary to evolve and to adapt, we face the future from a position of strength” Our reputation is based on integrity and trust Take responsibility for our actions and decisions Follow the spirit as well as the letter of the law Keep customer information secure Maintain an open dialogue with clients Respect our competitors

8 OUR BUSINESS PRINCIPLES Deeply committed to our clients and offer the same level of service to investors of all sizesClient Focus Recommendations for each client are tailored and based on a deep-seeded knowledge of individual goalsTailored Advice Our track record demonstrates a commitment to results driven investments and leadership in the financial marketplaceTrust Proven Expertise We have earned a role as a trusted advisor for our clients by consistently providing expertise, insight, and results Cultural Values Business Principles Talent & Leadership Technology Investments

Changed leadership in Private Client Division 14 new branch managers in the past year Recalibrate expectations of financial advisors New National Head of Recruitment New financial advisor recruitment deal Associate Financial Advisor Program Cultural Values Business Principles Talent & Leadership Technology Investments 9 INVESTING IN TALENT & LEADERSHIP Recruiting & Growth Key Initiatives Internship and Training Program Next Generation Program “Oppenheimer University” Professional Development Firm-wide Communications

Cultural Values Business Principles Talent & Leadership Technology Investments 10 TECHNOLOGY INVESTMENTS Made substantial investments in technology to keep up with regulatory and compliance needs as well as to better service our clients – New platform for all investment advisory programs – Launched new mobile application – Enhanced internal systems and implemented external systems to improve surveillance capabilities – Strengthened Know Your Client system to gather more information on our clients – Engaged outside data experts to review and analyze big data

0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% Wealth Management Capital Markets Commercial Mortgage Banking LET’S LOOK AT OUR RESULTS 11 Business Segment Results FY 2015 Shareholders' Equity at 12/31/15 (‘000s) $525,082 Book-value at 12/31/15 $38.84 Tangible Book-value at 12/31/15 $26.13 Market Cap at 3/28/16 (‘000s) $192,392 Share Price at 3/28/16 $14.35 FY 2015 Revenue (‘000s) $928,385 Total Revenue: $928M Operating Profit(1) (1) Operating Profit as reported. Does not include allocations to Corporate – Other category (2) Wealth Management represents Private Client and Asset Management business segments Snapshot (2)

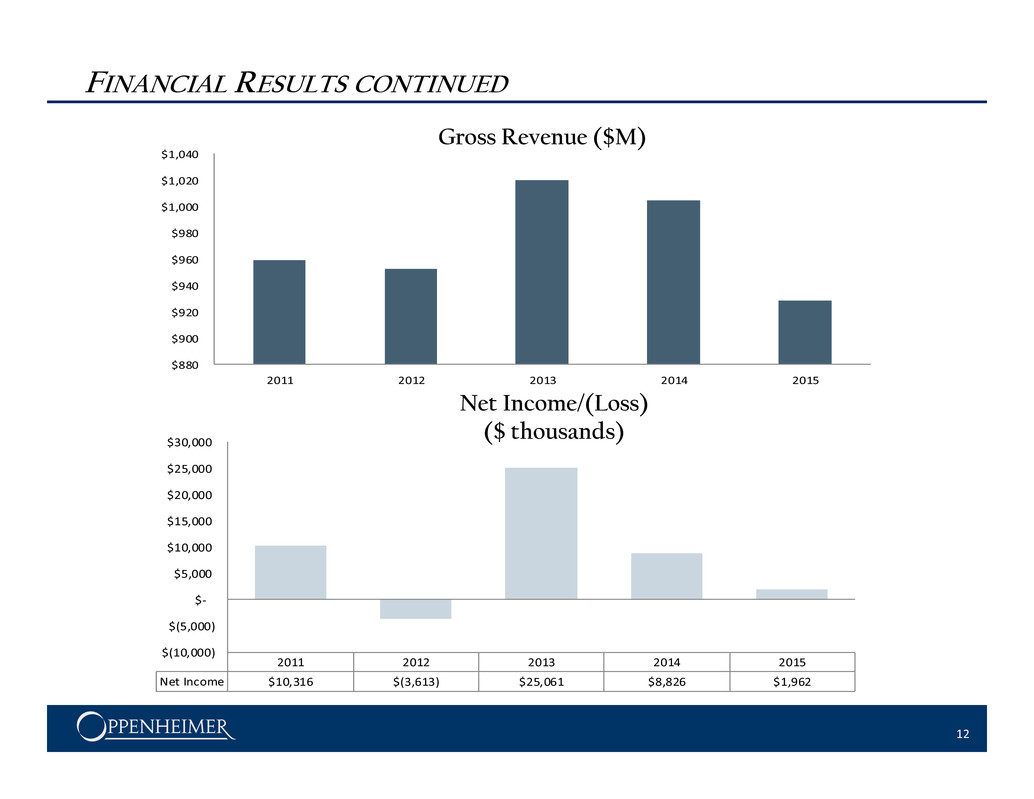

FINANCIAL RESULTS CONTINUED 12 Gross Revenue ($M) Net Income/(Loss) ($ thousands) $880 $900 $920 $940 $960 $980 $1,000 $1,020 $1,040 2011 2012 2013 2014 2015 2011 2012 2013 2014 2015 Net Income $10,316 $(3,613) $25,061 $8,826 $1,962 $(10,000) $(5,000) $‐ $5,000 $10,000 $15,000 $20,000 $25,000 $30,000

CAPITAL STRUCTURE AS OF DECEMBER 31, 2015 13 Conservative Risk Profile Ratios Equity to Assets: Capitalization to Assets: Debt to Equity: Gross Leverage Ratio: 20% 25% 29% 5.1x ($ in thousands) December 31, 2015 Total Assets: $2,692,964 Stockholders’ Equity: Long-Term Debt: $525,082 $150,000 Total Capitalization: $675,082 Capital Structure Straight-forward balance sheet Level 3 assets represent 3.9% of total assets (primarily ARS) Regulatory Net Capital of $144.8M Regulatory Excess Net Capital of $121.4M Long-term Debt Financing Secured Through 2018 Securities Inventory Composition $735M at December 31, 2015 Securities Trading Primarily a client-facing business (limited proprietary trading) High turnover of securities inventory 2015 VaR average of $708 thousand No significant losses during financial crisis Gross leverage ratio consistent around 5x

2.0% -0.7% 4.8% 1.7% 0.4% -2.0% 0.0% 2.0% 4.0% 6.0% 2011 2012 2013 2014 2015 1.9% -0.1% 4.3% 2.6% 0.7% -2.0% 0.0% 2.0% 4.0% 6.0% 2011 2012 2013 2014 2015 0.74 -0.27 1.77 0.62 0.14 5.70 -1.51 1.59 2.89 0.76 -0.50 0.00 0.50 1.00 1.50 2.00 2011 2012 2013 2014 2015 EPS - diluted EPS - basic 14 SELECT FINANCIAL MEASURES Book Value ROE Earnings per Share ($) Pretax Margin (%) $24.47 $24.34 $26.19 $26.27 $26.13 $33.22 $33.38 $34.88 $37.73 $37.16 $10 $15 $20 $25 $30 $35 $40 $45 2011 2012 2013 2014 2015 Tangible BV per share Book Value per Share

5.3 4.5 35.9 68.2 72 85.1 91.4 86.8 $0.0 $10.0 $20.0 $30.0 $40.0 $50.0 $60.0 $70.0 $80.0 $90.0 $100.0 Feb-08 2009 2010 2011 2012 2013 2014 2015 WE CONTINUE TO ADDRESS THE ARS MATTER 15 Company ($M)Client ($B) ARS Holdings $2.79 $1.30 $0.85 $0.58 $0.30 $0.24 $0.194 $0.167 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 Feb-08 2009 2010 2011 2012 2013 2014 2015 Auction Rate Securities (“ARS”) failed in Feb. 2008 with over $330B outstanding in market Oppenheimer clients held $2.8B in Feb. 2008 Settlements with New York Attorney General and Massachusetts Securities Division in Feb. 2010 ARS purchased from clients under regulatory settlements totals $111.7M through December 31, 2015 Eligible investors for future buybacks under the settlements with the regulators held approximately $57M of ARS as of December 31, 2015 Commitments to purchase under legal settlements and awards as of December 31, 2015 was $22.8M

‐ 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 2009 2010 2011 2012 2013 2014 2015 16 POSITIONED WELL FOR A RISING INTEREST RATE ENVIRONMENT Low interest rates have had significant impact on interest and fee revenues Gross interest revenues down approximately $74M annually since 2010 due to low interest rates Firm’s interest rate sensitive products: – Cash sweep balances – Margin lending – Firm investments (Auction Rate Securities) As of June 30, 2015, the Firm has consolidated its money market funds into FDIC-insured bank deposits Federal Reserve raised the target for federal funds rates by 25 bps in December 2015 Interest and Fee Revenues ($M) Cash Sweep Balances* ($M) *Money market funds plus FDIC-insured bank deposits F ed F un d s T arget R ate M i l l i o n s $111.4 $89.7 $45.5 $37.7 $33.8 $35.1 $35.5 $37.3 $41.4 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% $0 $20 $40 $60 $80 $100 $120 2007 2008 2009 2010 2011 2012 2013 2014 2015 Margin Interest Money Fund Sweep Program FDIC Money Market Product

THANK YOU FOR YOUR TIME