Oppenheimer Holdings Inc. Investor Presentation – September 2019

Safe Harbor Statement This presentation and other written or oral statements made from time to time by representatives of Oppenheimer Holdings Inc. (the “company”) may contain “forward‐looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward‐looking statements may relate to such matters as anticipated financial performance, future revenues or earnings, business prospects, new products or services, anticipated market performance and similar matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward‐looking statements. Forward‐looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on the company’s current beliefs, expectations and assumptions regarding the future of the company’s business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward‐looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of the company’s control. The company cautions that a variety of factors could cause the company’s actual results to differ materially from the anticipated results or other expectations expressed in the company’s forwarding‐looking statements. These risks and uncertainties include, but are not limited to, those risk factors discussed in Part I, “Item 1A. Risk Factors” of our Annual Report on Form 10‐K for the year ended December 31, 2018 filed with the SEC on March 1, 2019 (the “2018 10‐K”). In addition, important factors that could cause actual results to differ materially from those in the forward‐looking statements include those factors discussed in Part II, “Item 7. Management’s Discussion & Analysis of Financial Condition and Results of Operations – Factors Affecting ‘Forward‐ Looking Statements’” of our Quarterly Report on Form 10‐Q for the quarter ended June 30, 2019 filed with the SEC on July 26, 2019 (“2019 10‐Q2”). Any forward‐looking statements herein are qualified in their entirety by reference to all such factors discussed in the 2018 10‐K, the 2019 10‐Q2 and the company’s other SEC filings. There can be no assurance that the company has correctly or completely identified and assessed all of the factors affecting the company’s business. Therefore, you should not rely on any of these forward‐looking statements. Any forward‐looking statement made by the company in this presentation is based only on information currently available to the company and speaks only as of the date on which it is made. The company does not undertake any obligation to publicly update or revise any forward‐looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. 2

Table of Contents I. Company Overview II. Business Unit Update Wealth Management Capital Markets III. Financial Overview IV. Summary 3

I. Company Overview 4

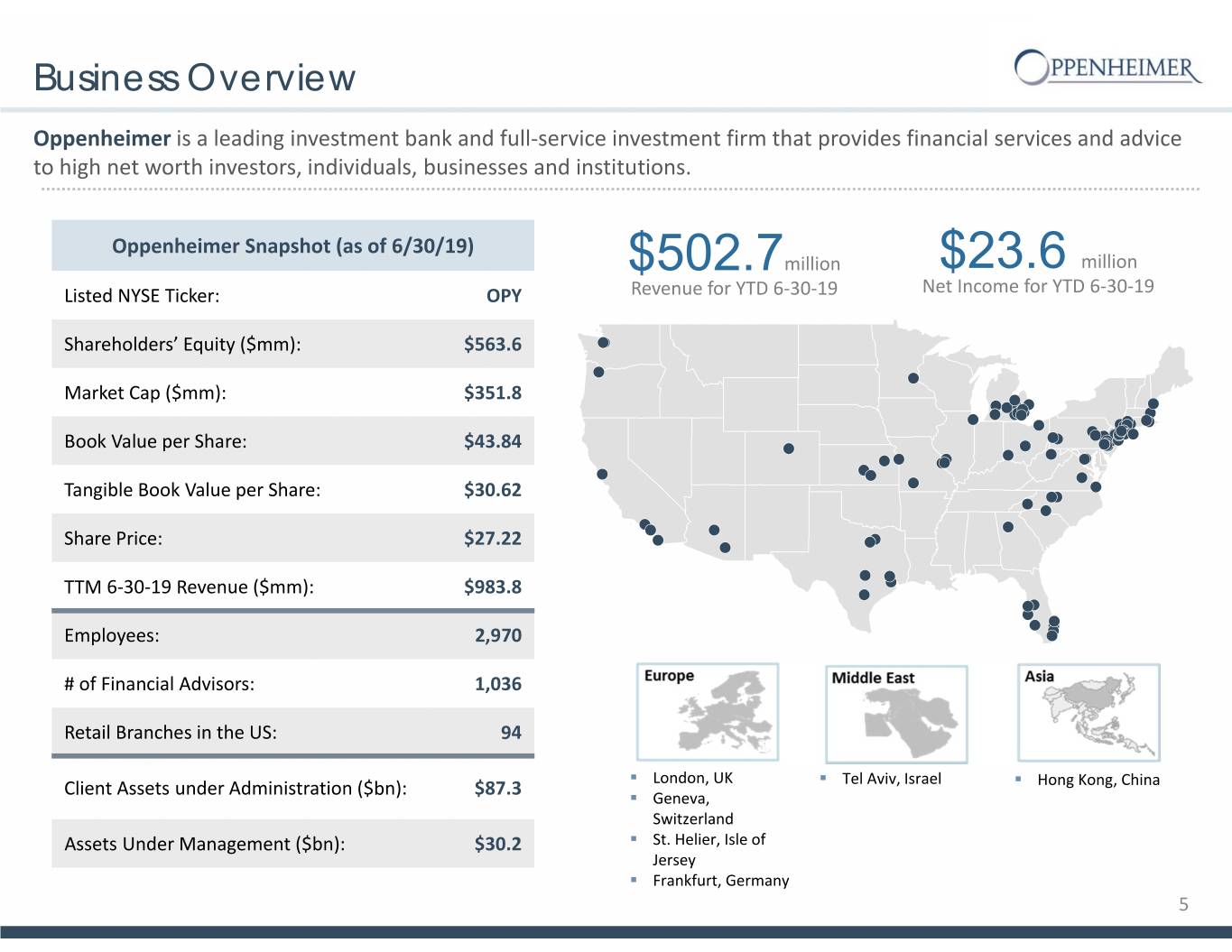

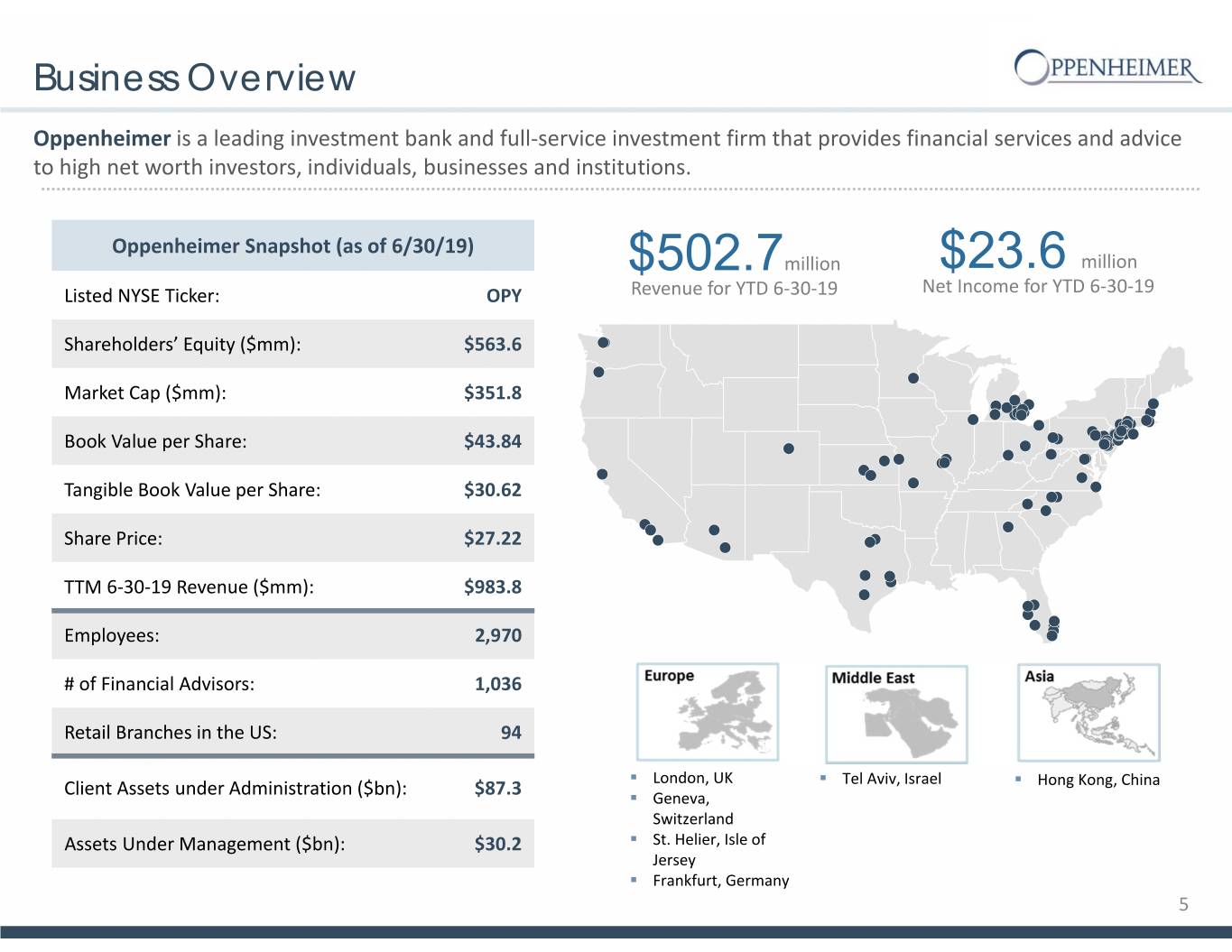

Business Overview Oppenheimer is a leading investment bank and full‐service investment firm that provides financial services and advice to high net worth investors, individuals, businesses and institutions. Oppenheimer Snapshot (as of 6/30/19) $502.7million $23.6 million Listed NYSE Ticker: OPY Revenue for YTD 6‐30‐19 Net Income for YTD 6‐30‐19 Shareholders’ Equity ($mm): $563.6 Market Cap ($mm): $351.8 Book Value per Share: $43.84 Tangible Book Value per Share: $30.62 Share Price: $27.22 TTM 6‐30‐19 Revenue ($mm): $983.8 Employees: 2,970 #of Financial Advisors: 1,036 Retail Branches in the US: 94 . London, UK . Tel Aviv, Israel . Hong Kong, China Client Assets under Administration ($bn): $87.3 . Geneva, Switzerland Assets Under Management ($bn): $30.2 . St. Helier, Isle of Jersey . Frankfurt, Germany 5

II. Business Unit Update 6

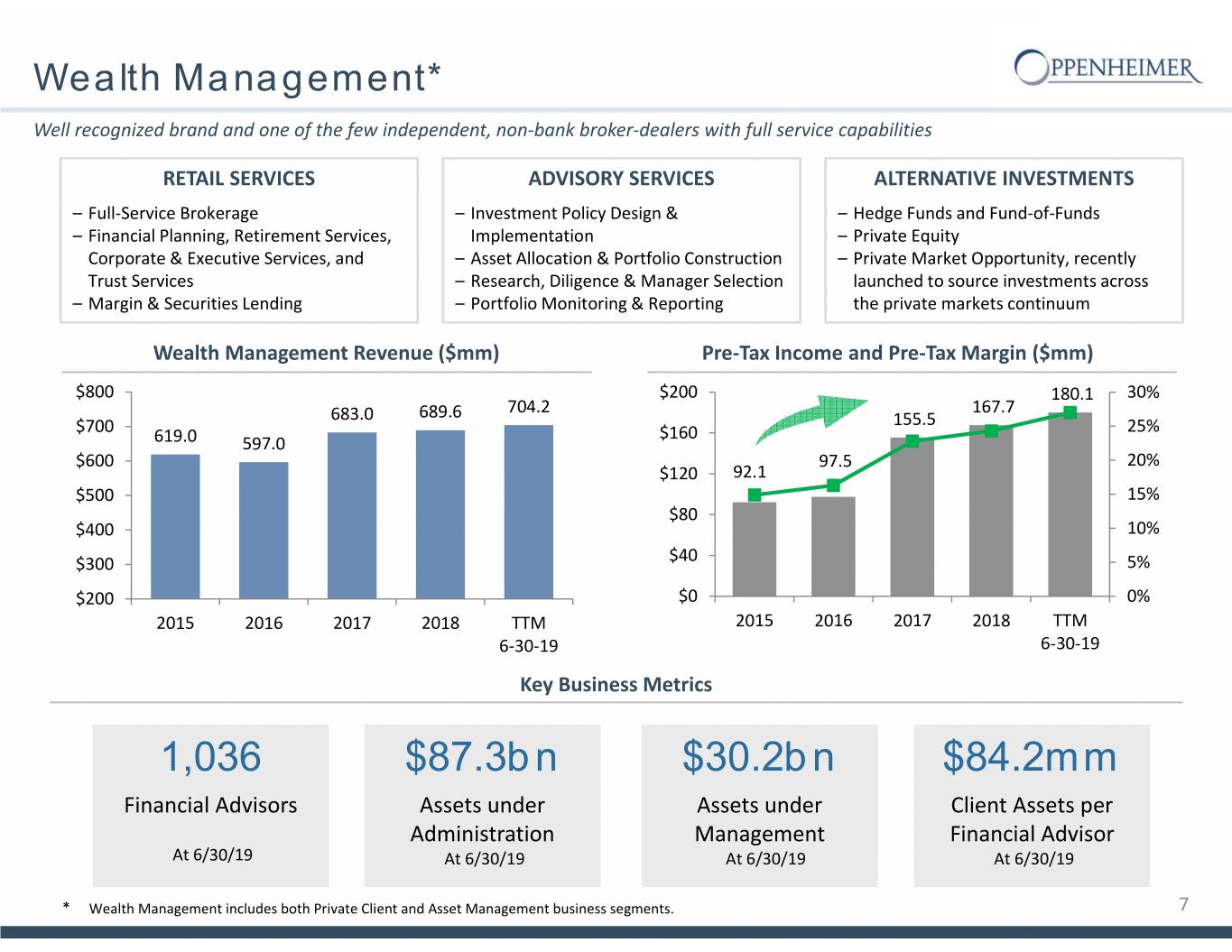

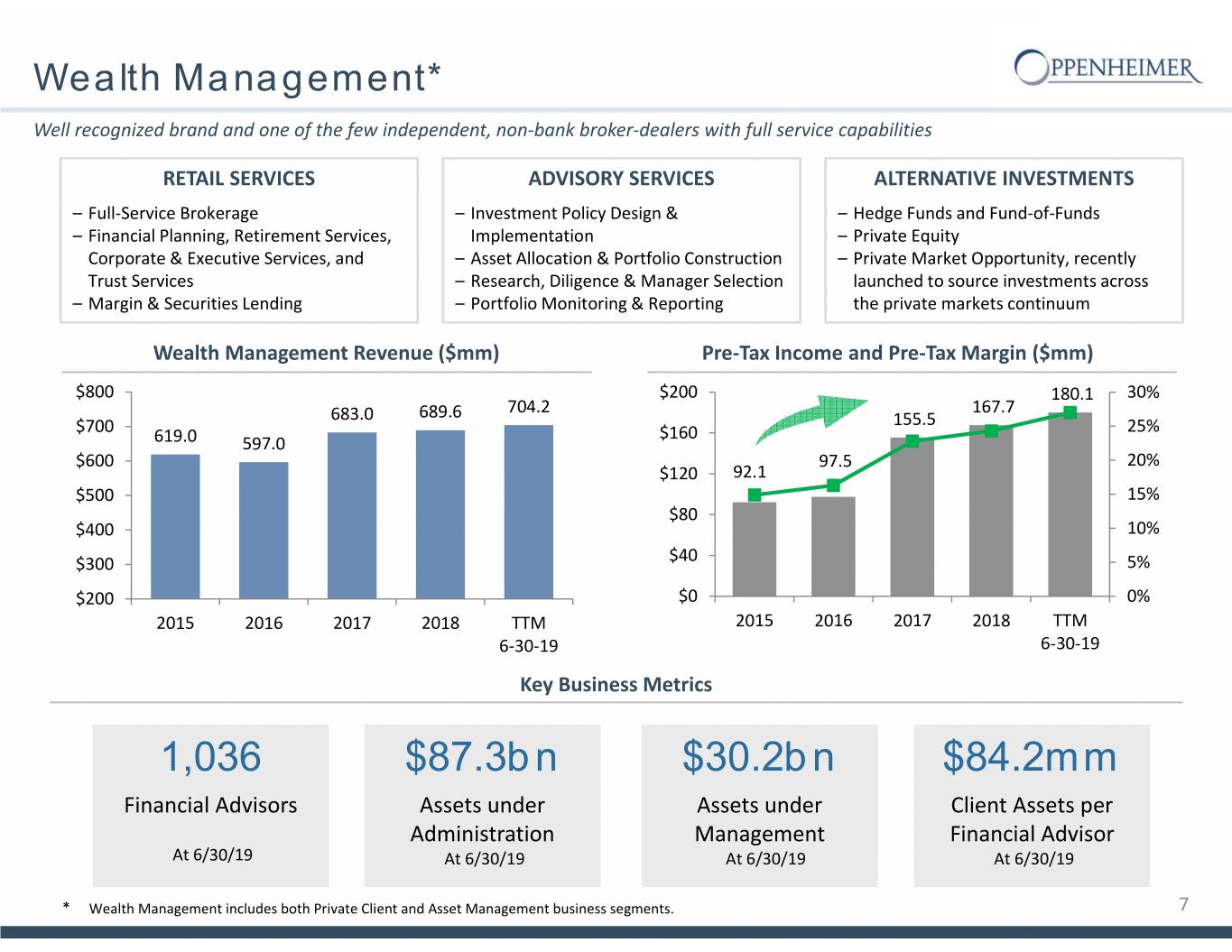

Wealth Management* Well recognized brand and one of the few independent, non‐bank broker‐dealers with full service capabilities RETAIL SERVICES ADVISORY SERVICES ALTERNATIVE INVESTMENTS –Full‐Service Brokerage – Investment Policy Design & –Hedge Funds and Fund‐of‐Funds –Financial Planning, Retirement Services, Implementation –Private Equity Corporate & Executive Services, and – Asset Allocation & Portfolio Construction –Private Market Opportunity, recently Trust Services – Research, Diligence & Manager Selection launched to source investments across –Margin & Securities Lending –Portfolio Monitoring & Reporting the private markets continuum Wealth Management Revenue ($mm) Pre‐Tax Income and Pre‐Tax Margin ($mm) $800 $200 180.1 30% 704.2 167.7 683.0 689.6 155.5 $700 $160 25% 619.0 597.0 $600 97.5 20% $120 92.1 $500 15% $80 $400 10% $300 $40 5% $200 $0 0% 2015 2016 2017 2018 TTM 2015 2016 2017 2018 TTM 6‐30‐19 6‐30‐19 Key Business Metrics 1,036 $87.3bn $30.2bn $84.2mm Financial Advisors Assets under Assets under Client Assets per Administration Management Financial Advisor At 6/30/19 At 6/30/19 At 6/30/19 At 6/30/19 * Wealth Management includes both Private Client and Asset Management business segments. 7

Capital Markets A leading capital markets business providing sophisticated investment banking, research and trading solutions INSTITUTIONAL EQUITIES INVESTMENT BANKING FIXED INCOME –Sales and Trading –Mergers & Acquisitions – Taxable Fixed Income – Equity Research – Equity Capital Markets –Non‐Taxable Fixed Income • 32 senior research analysts covering –Debt Capital Markets – Public Finance 500+ companies – Restructuring & Special Situations –Corporate Access (Conferences & NDRs) Capital Markets Revenue ($mm) TTM 6‐30‐19 Capital Markets Revenue Breakdown $350 280.0 272.7 285.8 $285.8mm $300 255.0 $250 232.0 $78.2 $200 27% Institutional Equities $127.1 $150 45% $100 Fixed Income $50 $80.5 28% $0 Investment Banking 2015 2016 2017 2018 TTM 6‐30‐19 Investment Banking Focus Industries Healthcare Technology Consumer Transportation & Finance & Real Energy & Retail Logistics Estate 8

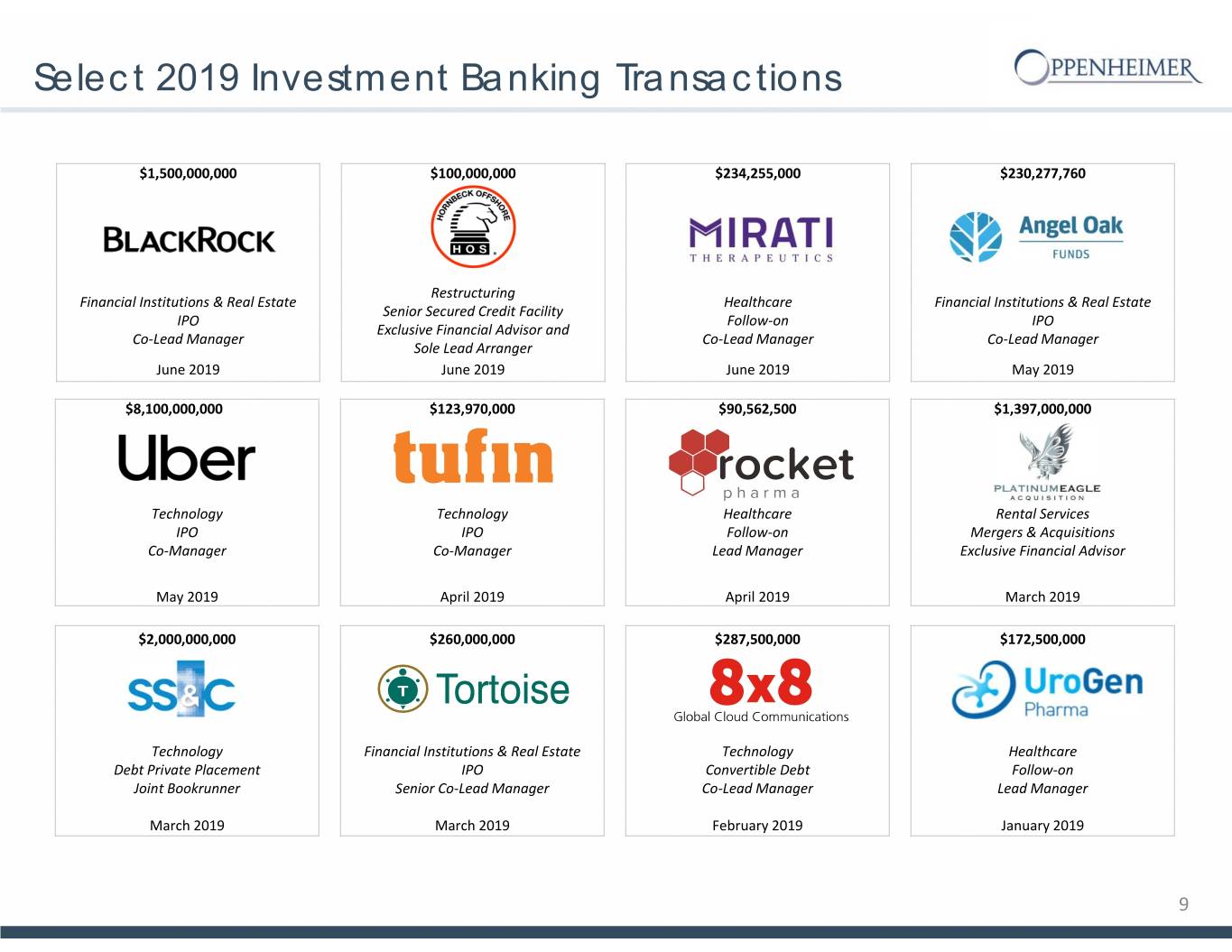

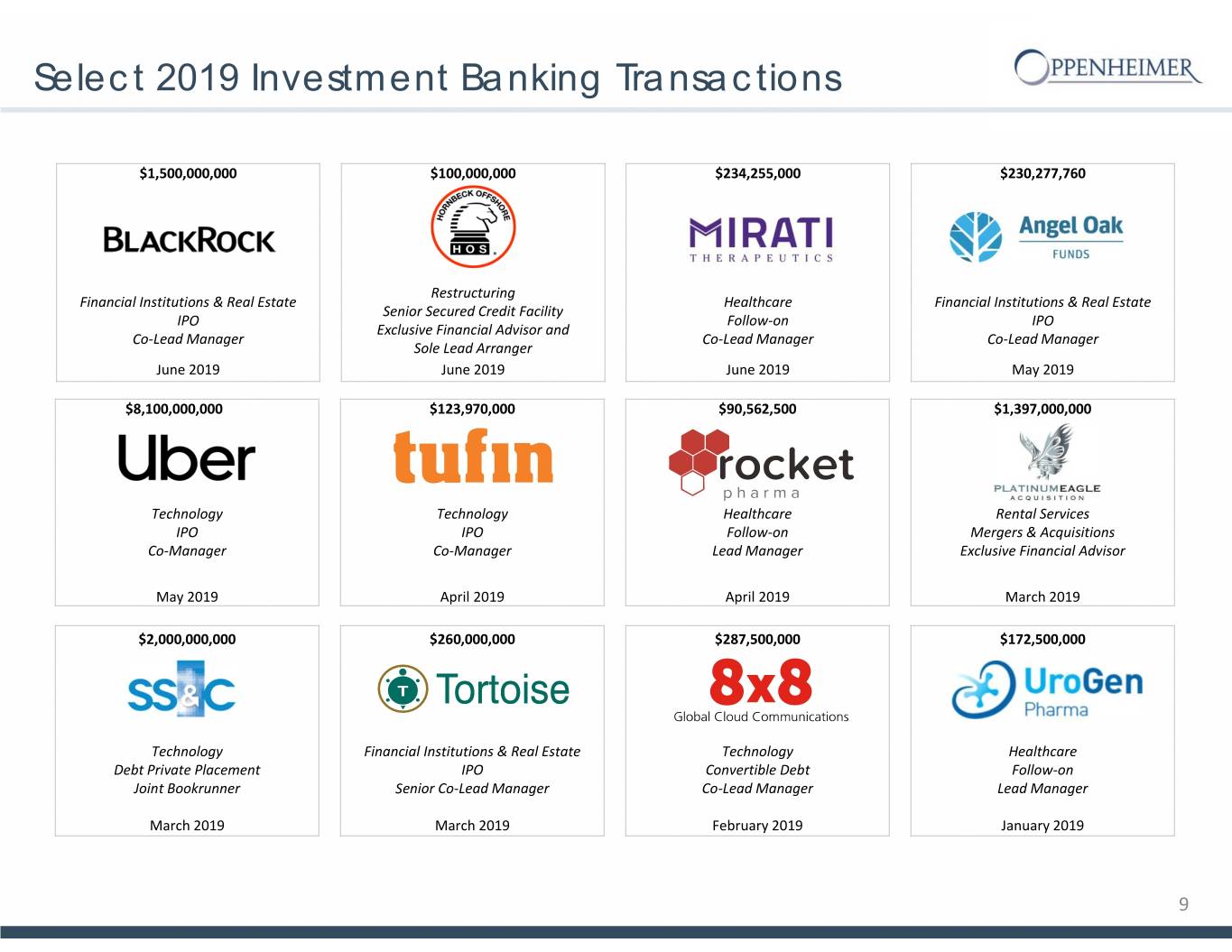

Select 2019 Investment Banking Transactions $1,500,000,000 $100,000,000 $234,255,000 $230,277,760 Restructuring Financial Institutions & Real Estate Healthcare Financial Institutions & Real Estate Senior Secured Credit Facility IPO Follow‐on IPO Exclusive Financial Advisor and Co‐Lead Manager Co‐Lead Manager Co‐Lead Manager Sole Lead Arranger June 2019 June 2019 June 2019 May 2019 $8,100,000,000 $123,970,000 $90,562,500 $1,397,000,000 Technology Technology Healthcare Rental Services IPO IPO Follow‐on Mergers & Acquisitions Co‐Manager Co‐Manager Lead Manager Exclusive Financial Advisor May 2019 April 2019 April 2019 March 2019 $2,000,000,000 $260,000,000 $287,500,000 $172,500,000 Technology Financial Institutions & Real Estate Technology Healthcare Debt Private Placement IPO Convertible Debt Follow‐on Joint Bookrunner Senior Co‐Lead Manager Co‐Lead Manager Lead Manager March 2019 March 2019 February 2019 January 2019 9

III. Financial Overview 10

Key 2Q-19 Announcements 1 . Announced participation in auction rate securities tender offer that will result in $20 Auction Rate million of additional liquidity in the 3Q‐19 . Participation in the tender offer resulted in an unrealized loss of $2.4 million in the Securities Tender 2Q‐19 Offer . Participation in the tender offer also resulted in a reduction in "Level 3" securities to zero at June 30, 2019 for the first time in over a decade 2 . Announced partial redemption of 6.75% Senior Secured Notes which took place on August 25, 2019 Senior Secured Note . Partial redemption will result in $1.7 million in costs associated with paying the call Redemption premium on the Senior Secured Notes in the 3Q‐19 . The redemption of 25% of the Senior Secured Notes will reduce interest costs by $3.8 million annually 3 . Announced an increase in its quarterly dividend from $0.11 to $0.12 per share, a Quarterly Dividend 9.1% increase, effective for the 2Q‐19 and paid on August 23, 2019 to holders of Class A non‐voting and Class B voting common stock of record on August 9, 2019 4 . Announced board approval of share repurchase program that authorizes purchase of up to 640,000 shares of Class A non‐voting common stock representing Share Repurchase approximately 5% of 12,756,308 currently issued and outstanding shares Program & Buybacks . Purchased 167,209 shares of Class A non‐voting common stock under share repurchase program during the 2Q‐19 for $4.3 million at an average share price of $25.82 11

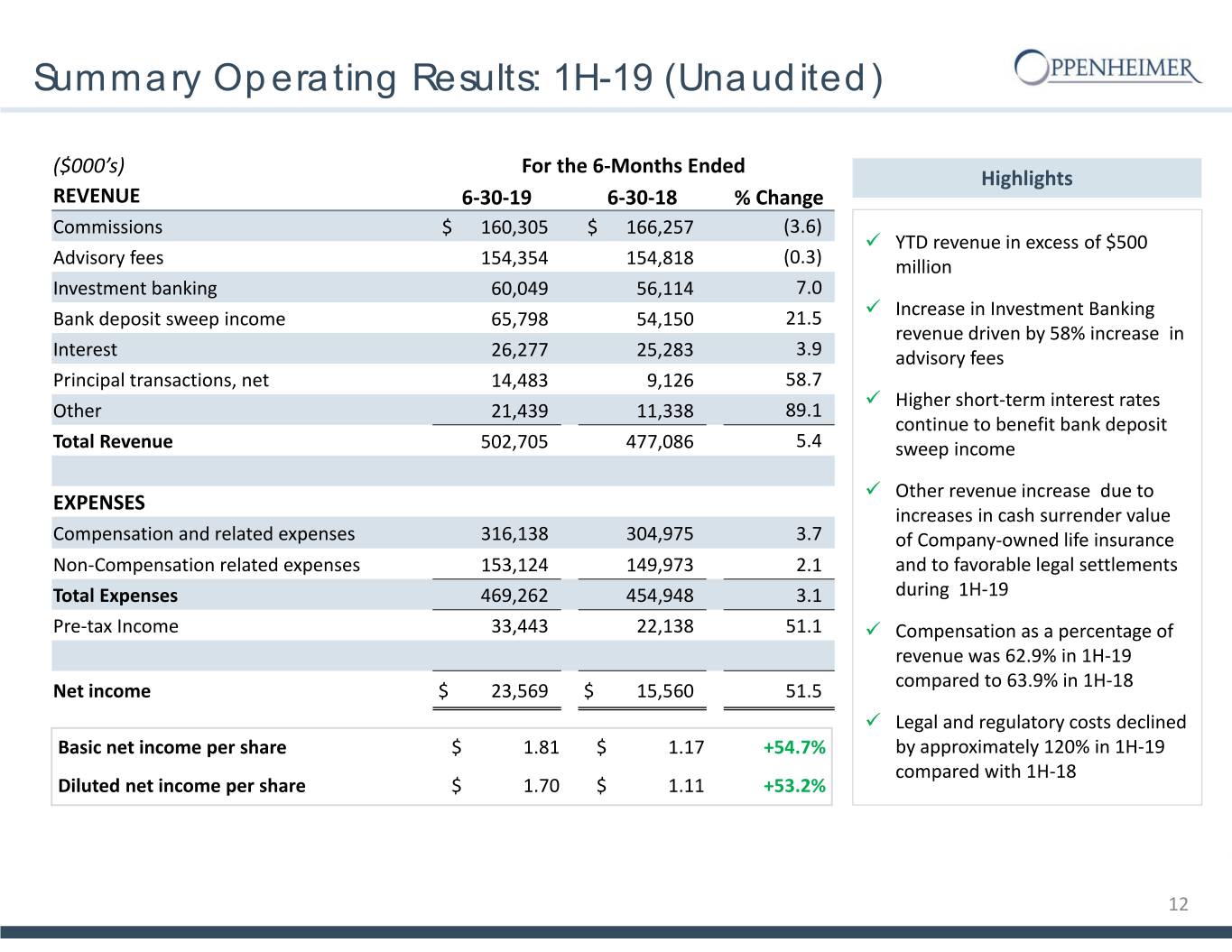

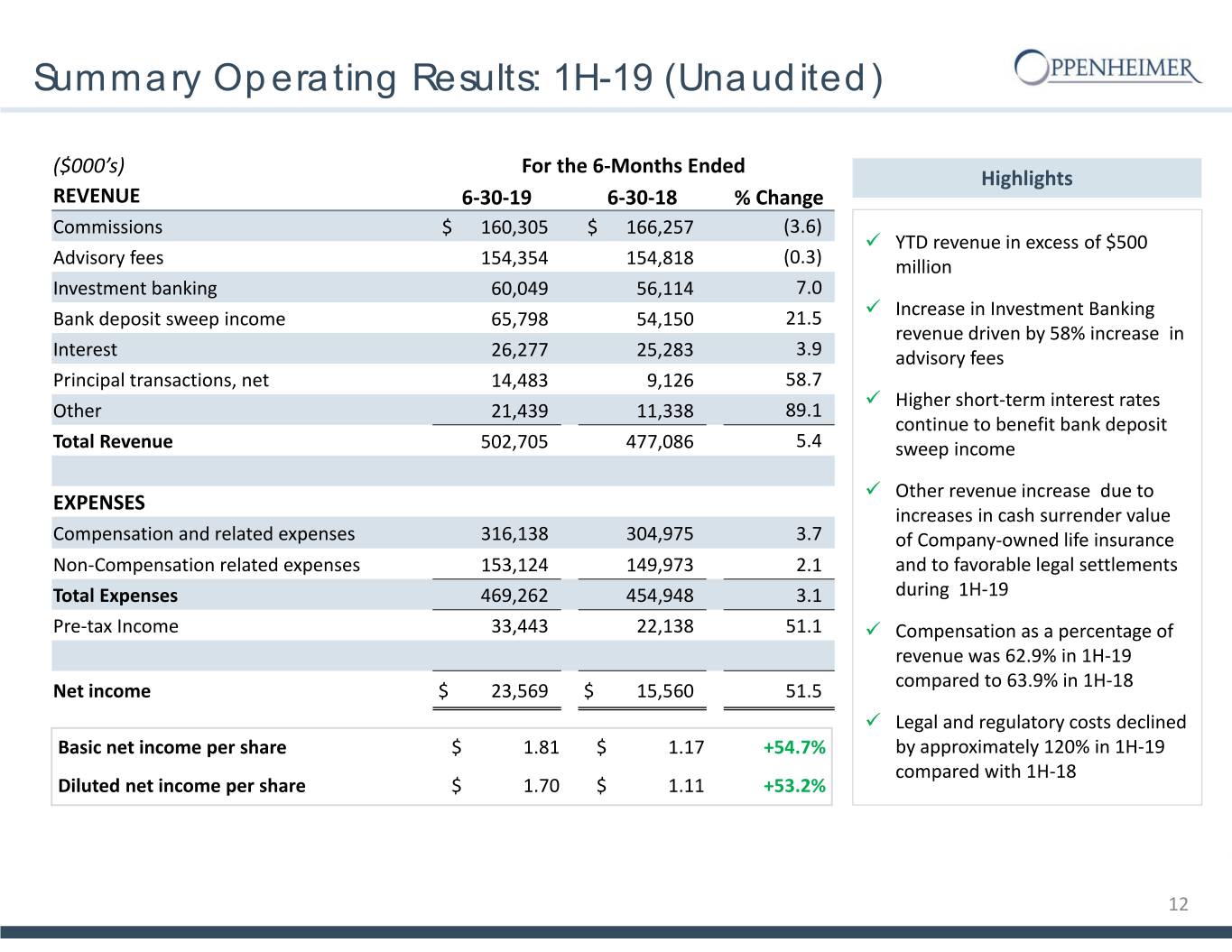

Summary Operating Results: 1H-19 (Unaudited) ($000’s) For the 6‐Months Ended Highlights REVENUE 6‐30‐19 6‐30‐18 % Change Commissions $ 160,305 $ 166,257 (3.6) YTD revenue in excess of $500 Advisory fees 154,354 154,818 (0.3) million Investment banking 60,049 56,114 7.0 Increase in Investment Banking Bank deposit sweep income 65,798 54,150 21.5 revenue driven by 58% increase in Interest 26,277 25,283 3.9 advisory fees Principal transactions, net 14,483 9,126 58.7 Higher short‐term interest rates Other 21,439 11,338 89.1 continue to benefit bank deposit Total Revenue 502,705 477,086 5.4 sweep income Other revenue increase due to EXPENSES increases in cash surrender value Compensation and related expenses 316,138 304,975 3.7 of Company‐owned life insurance Non‐Compensation related expenses 153,124 149,973 2.1 and to favorable legal settlements Total Expenses 469,262 454,948 3.1 during 1H‐19 Pre‐tax Income 33,443 22,138 51.1 Compensation as a percentage of revenue was 62.9% in 1H‐19 compared to 63.9% in 1H‐18 Net income $ 23,569 $ 15,560 51.5 Legal and regulatory costs declined Basic net income per share $ 1.81 $ 1.17 +54.7% by approximately 120% in 1H‐19 compared with 1H‐18 Diluted net income per share $ 1.70 $ 1.11 +53.2% 12

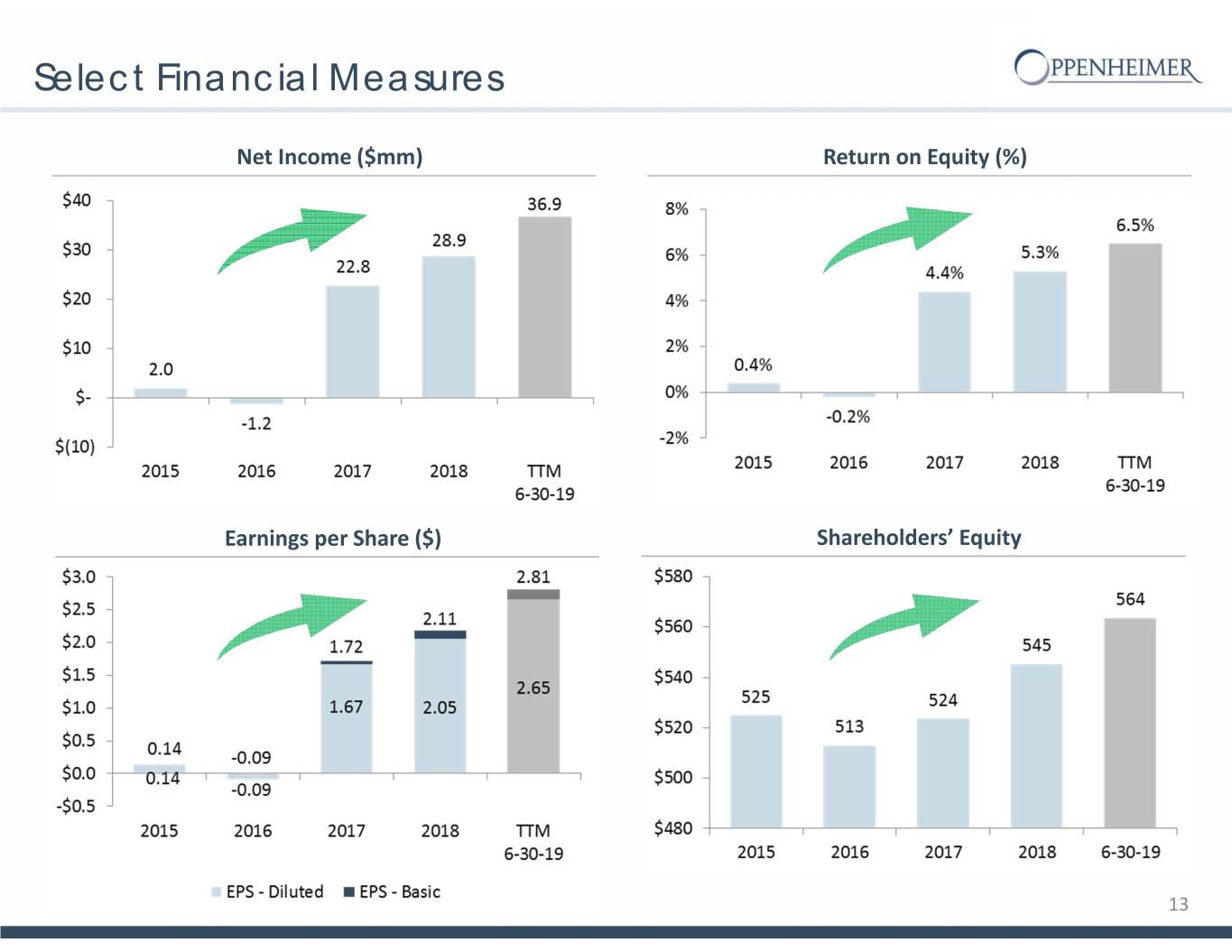

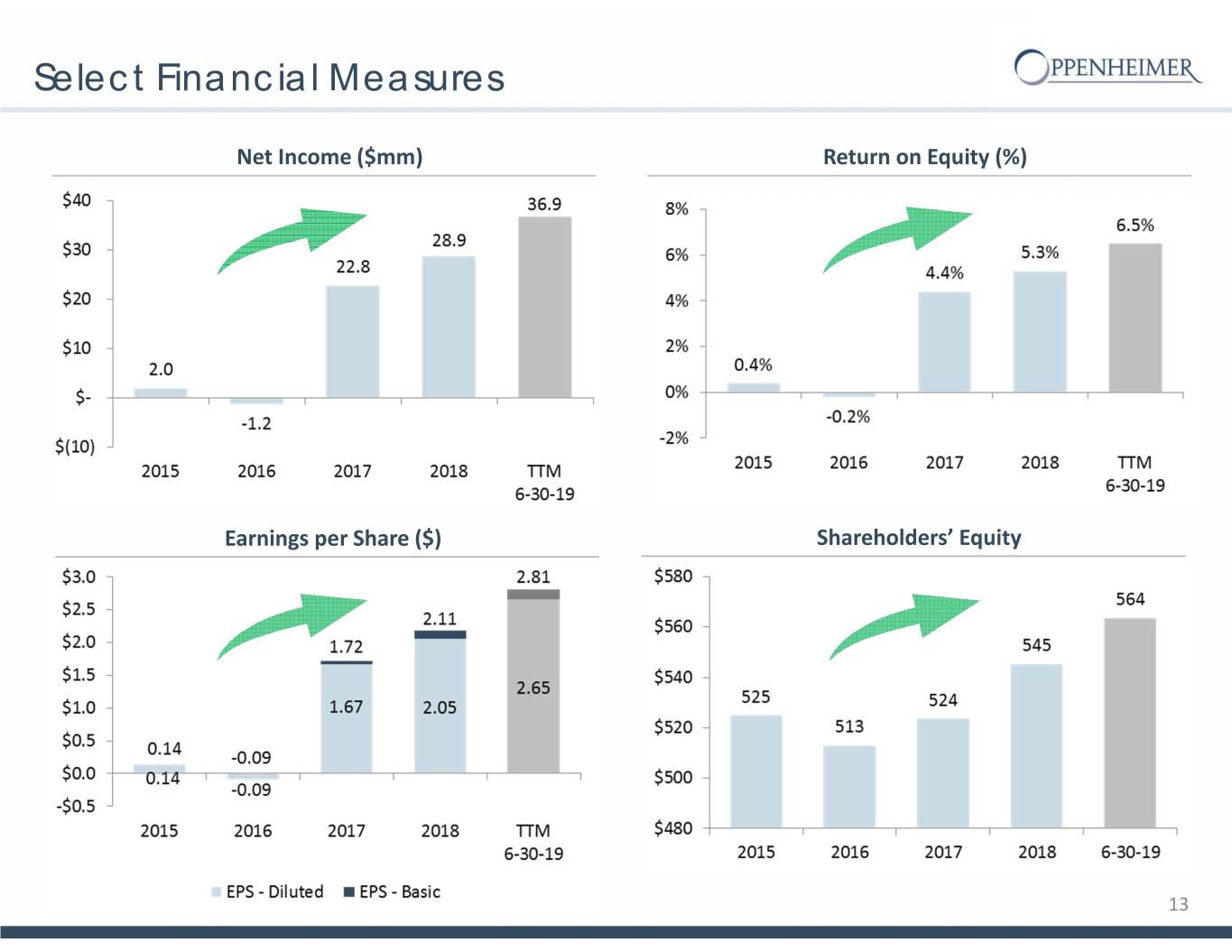

Select Financial Measures Net Income ($mm) Return on Equity (%) Earnings per Share ($) Shareholders’ Equity 13

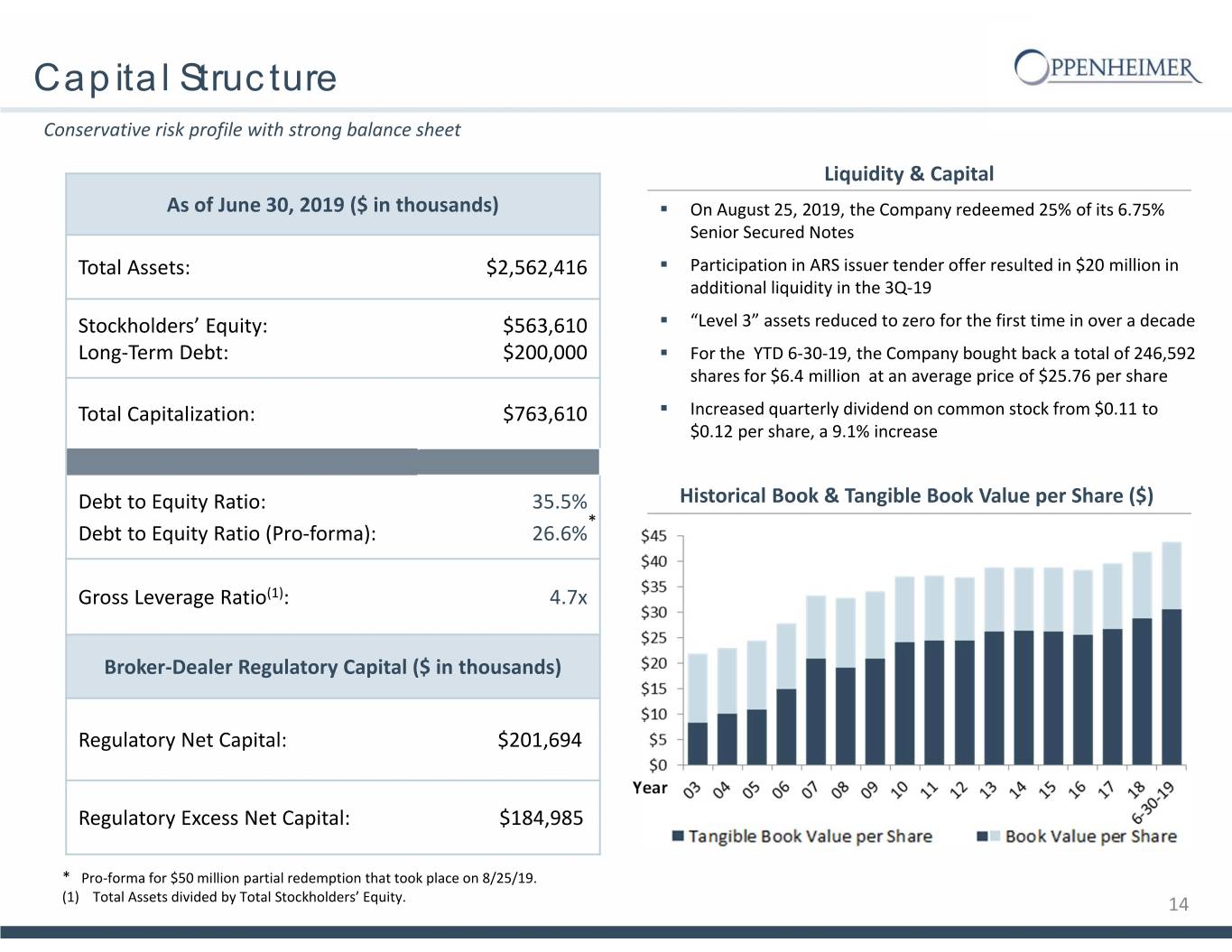

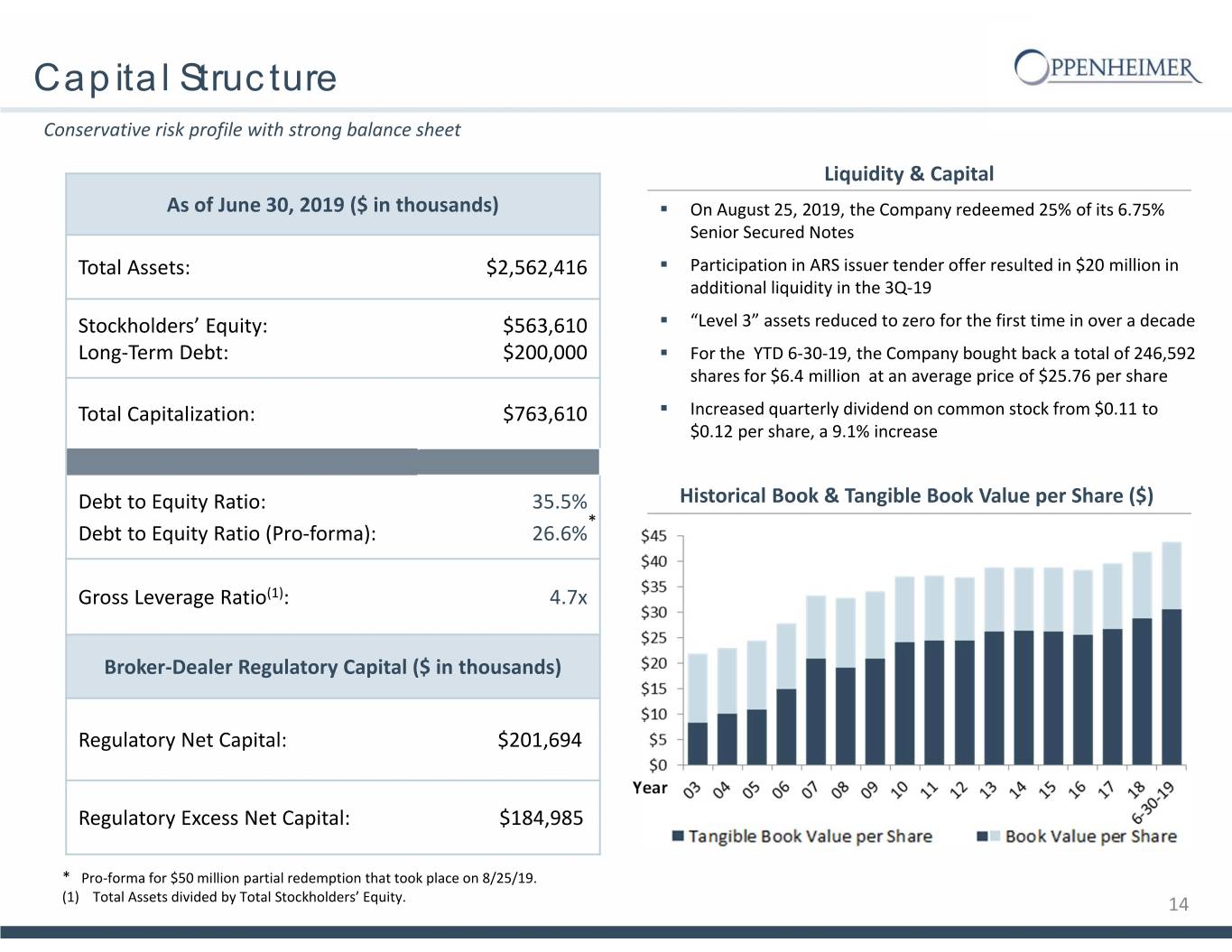

Capital Structure Conservative risk profile with strong balance sheet Liquidity & Capital As of June 30, 2019 ($ in thousands) . On August 25, 2019, the Company redeemed 25% of its 6.75% Senior Secured Notes Total Assets: $2,562,416 . Participation in ARS issuer tender offer resulted in $20 million in additional liquidity in the 3Q‐19 Stockholders’ Equity: $563,610 . “Level 3” assets reduced to zero for the first time in over a decade Long‐Term Debt: $200,000 . For the YTD 6‐30‐19, the Company bought back a total of 246,592 shares for $6.4 million at an average price of $25.76 per share Total Capitalization: $763,610 . Increased quarterly dividend on common stock from $0.11 to $0.12 per share, a 9.1% increase Debt to Equity Ratio: 35.5% Historical Book & Tangible Book Value per Share ($) * Debt to Equity Ratio (Pro‐forma): 26.6% Gross Leverage Ratio(1): 4.7x Broker‐Dealer Regulatory Capital ($ in thousands) Regulatory Net Capital: $201,694 Year Regulatory Excess Net Capital: $184,985 * Pro‐forma for $50 million partial redemption that took place on 8/25/19. (1) Total Assets divided by Total Stockholders’ Equity. 14

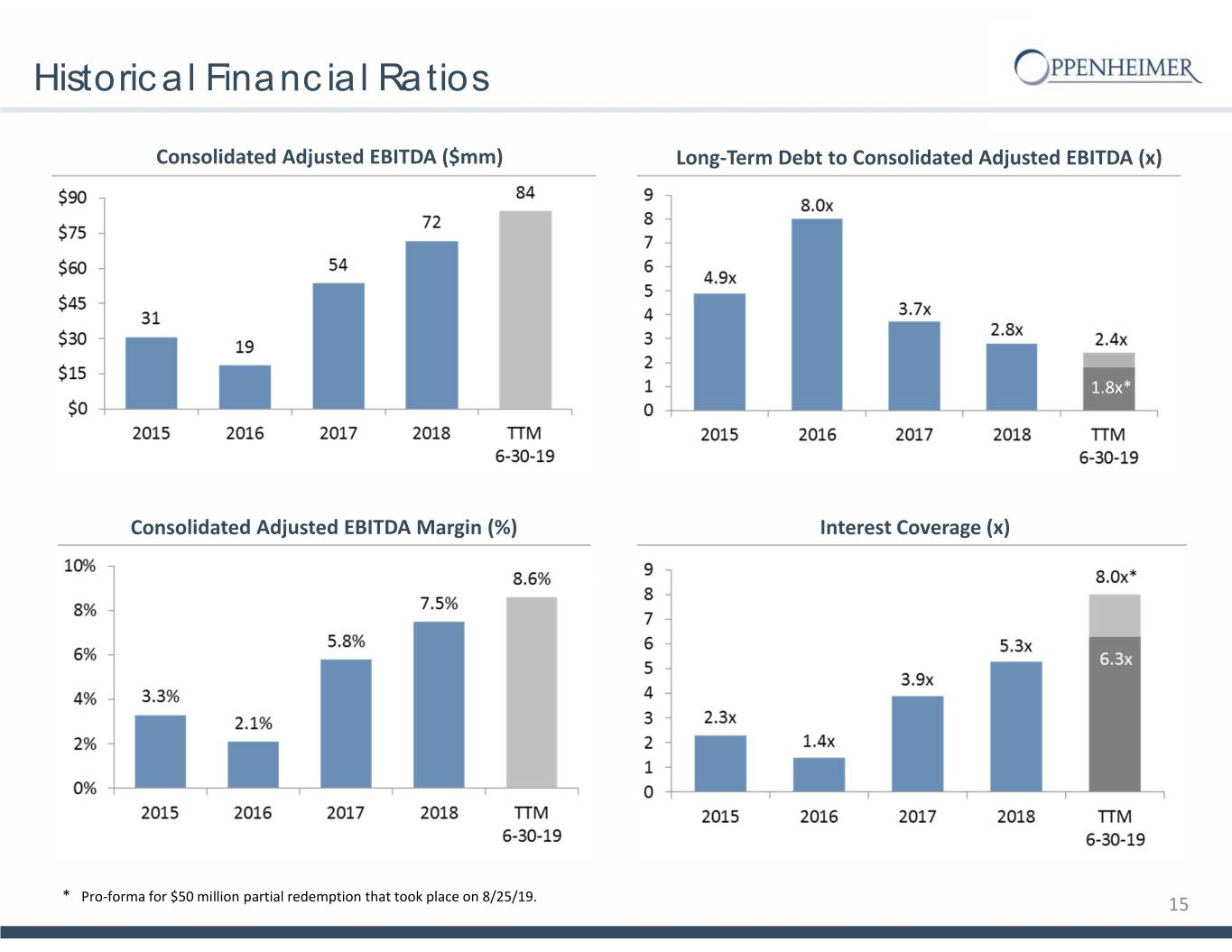

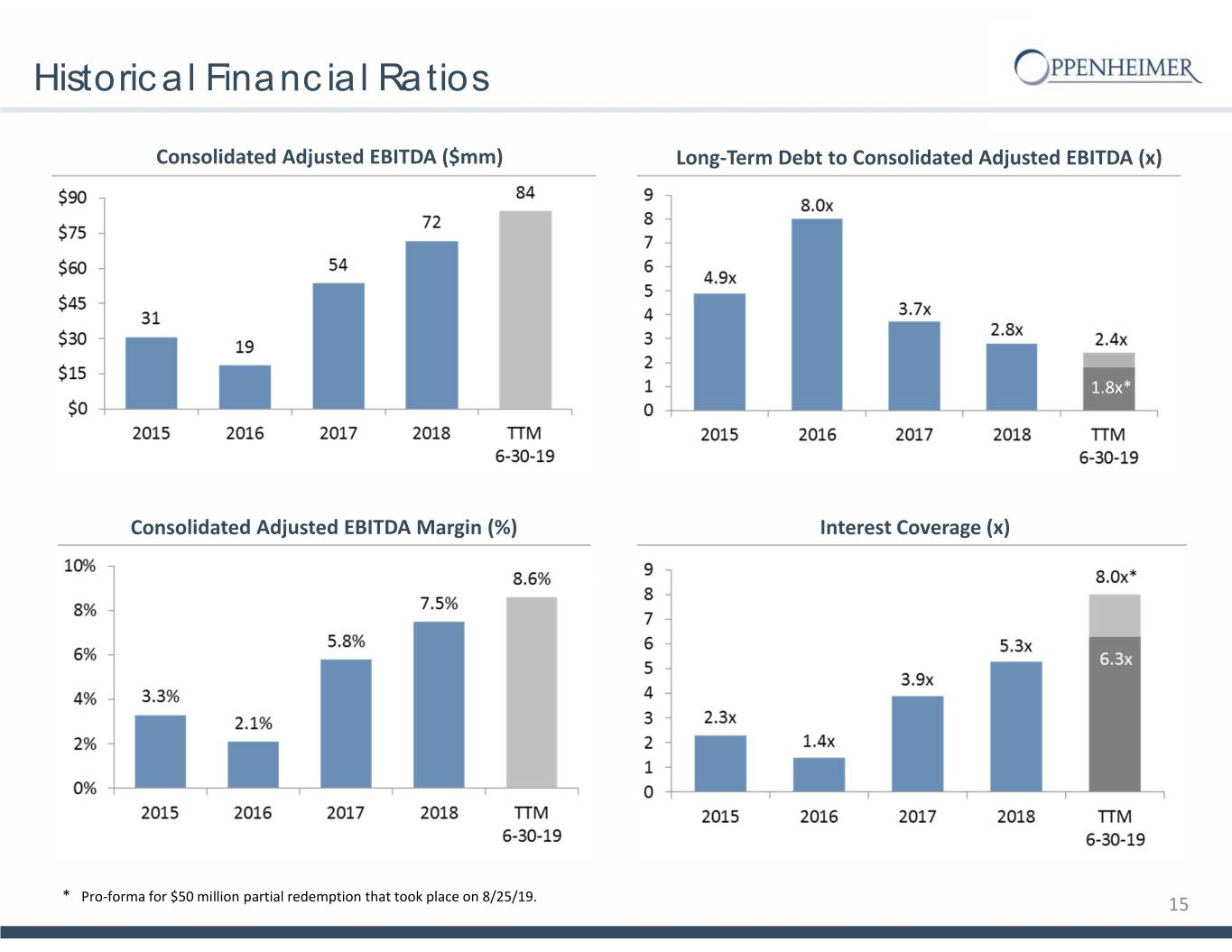

Historical Financial Ratios Consolidated Adjusted EBITDA ($mm) Long‐Term Debt to Consolidated Adjusted EBITDA (x) 1.8x* Consolidated Adjusted EBITDA Margin (%) Interest Coverage (x) * Pro‐forma for $50 million partial redemption that took place on 8/25/19. 15

IV. Summary 16

In Summary… . Firm’s operating results have significantly improved . Business model is low risk and well diversified with low leverage . Building momentum in investment banking business . Increasing shift from transaction‐based business to fee‐based business . Continue to benefit from interest rate environment . Investing in technology to enhance compliance efforts and to support business initiatives . ARS portfolio significantly reduced by tender offers and redemptions . Lower legal and regulatory costs . Conservative balance sheet . Reduced leverage as a result of additional liquidity . Reviewing prospects of independent wealth management channel . Investing in our future and poised for growth, organically and through acquisitions 17

For more information contact Investor Relations at info@opco.com