OPPENHEIMER HOLDINGS INC. Annual Report 2024

2024 2023 2022 2021 2020 In thousands except per share amounts and number of employees Gross revenue $1,432,496 $1,248,825 $1,110,941 $1,394,035 $1,198,667 Income before income taxes $105,757 $46,770 $45,554 $224,641 $169,000 Net income* $71,557 $30,179 $32,351 $158,964 $122,986 Basic earnings per share* $6.91 $2.81 $2.77 $12.57 $9.73 Total assets $3,382,726 $2,874,816 $2,714,392 $3,043,250 $2,713,903 Stockholders’ equity* $850,395 $789,166 $794,233 $823,196 $685,668 Book value per share $82.31 $76.72 $72.41 $65.66 $54.93 Total shares outstanding (Class A) 10,232 10,187 10,869 12,447 12,382 Number of employees 3,018 2,942 2,912 2,913 2,908 In billions Client Assets Under Administration $129.5 $118.2 $105.0 $122.1 $104.8 Assets Under Management $49.4 $43.9 $36.8 $46.2 $38.8 Financial Highlights GROSS REVENUE ($MM) NET INCOME* ($MM) BASIC EARNINGS PER SHARE* ($) STOCKHOLDERS’ EQUITY* ($MM) *Attributable to Oppenheimer Holdings Inc. BOOK VALUE PER SHARE ($) 242322 $8 2 $7 7 $7 2 242322 $6 .9 1 $2 .8 1 $2 .7 7 242322 $8 50 $7 89 $7 94 242322 $7 2 $3 0 $3 2 242322 $1 ,4 32 $1 ,2 49 $1 ,1 11 2

Dear Fellow Shareholders Albert G. Lowenthal Chairman of the Board Chief Executive Officer 3 The U.S. Economy continued to outperform during 2024. Despite widespread expectations for a downturn driven by high interest rates, the economy continued to expand producing growth of 2.8% for the year, more than respectable, and far ahead of the rest of the industrialized world. Economic growth, a reduction in interest rates and the high expectations for capital expenditures around Artificial Intelligence (AI) drove the U.S. Equity markets to new record highs with the S&P 500 reaching 5881.63 (up 23.3%) at year-end. Markets were again led by the “Magnificent Seven” which were up by 63% in 2024 (contributing over 50% of the increase in the index). The other major averages: the Dow Jones Industrial Average reached 42544.22 (up 12.9%) and the NASDAQ Composite reached 19310.79 (up 28.6%). Both short-term and long-term U.S. Treasury yields declined reflecting both Federal Reserve reductions in the overnight rate as well as lower inflation, as the rate of inflation continued its decline that began in 2022. With unemployment remaining low (4.1%), the U.S. consumer continued to be the most significant driver of economic activity, with consumer spending increasing both for goods and services. It was indeed a “goldilocks” economy (neither too hot nor too cold). The re-election of Donald Trump as President re-energized markets post-election with high expectations for tax relief, less regulation, and continued growth in the economy. This enthusiasm benefited crypto-currencies, equities, and housing prices as we turned to 2025. However, the realization that tariffs were going to be a reality, both stifling growth and feeding inflation, gave the markets pause as I write this letter. We live in a world of constant change, which is not always good news. We continue to watch the world around us and to evaluate the risks to our business as well as risks that could alter our way of life. Domestically, the primary issues surround the intractable and unstable condition of governance coming out of Washington. Although today one party dominates the Congress and the Executive Branch, continued high levels of spending and undecided tax policies dominate our news. Commentators assert that many of the new Administration’s actions will usurp the role of congress. Unbridled immigration seems to have come to a halt, but the treatment of residents, whether legally here or without documents has taken on a dark tone. Climate change also has shown itself to be capable of destroying immense swaths of property through wildfires, storms, and flooding. The risk to lives has become front and center based on recent events in North Carolina and Southern California as well as throughout the State of Florida. Geopolitical risks are reflected in the ongoing war In Ukraine, a still unstable Middle East, despite the ceasefire between Israel and Hamas and Hezbollah. Global tensions are also exacerbated by threats of economic warfare through tariffs and retaliatory threats to our supply lines. Throughout Europe, there are governance uncertainties with upcoming elections. The ever expanding threats from foreign sources to the security of our data, our vital utilities and our elections is an ongoing issue. We know that all of these risks are constantly influencing financial markets and we closely monitor the signals from the credit and equity markets, where shifting investor

sentiment is quickly reflected through volatility and fluctuating investor confidence. Advancements in AI and digital transformation presents both challenges and significant opportunities across our lives and throughout the financial markets. With all of these issues as a backdrop, at Oppenheimer, we made considerable progress in 2024 with our Wealth Management business significantly and positively impacting results. We no longer were plagued with the expense of arbitrations, but did see less of a boost from interest rates which were no longer rising, from our FDIC program which had a significantly smaller impact, as clients sought higher returns in longer term fixed income securities resulting in a significant decline in program balances. Our Client Assets under Management reached an all-time record at $49.4 billion, with Assets under Administration reaching a record high during the year, and ending with $129.5 billion at year-end. We saw a meaningful pick-up in the revenues derived from our Capital Markets Divisions as transactional revenues increased in both Equities and Fixed Income and we saw an increase in business from Investment Banking. The firm’s total revenues reached $1.432 billion up 14.7% driving earnings of $71.5 million or $6.91/share up from $30.2 million or $2.81/ share in 2023. We also saw our book value reach $82.31 per share, with tangible book value reaching $64.96 per share. These results drove a significant increase in our share price, but with a “downside” of negatively impacting pre- tax earnings by $32.6 million through the current expensing of liability- based awards to financial advisors based solely on the move in the price of OPY. While we increased our regular dividend to $.18 earlier in the year, we reduced our share buy-backs, given the significant movement in our share price, re-purchasing only 244k shares at an average price of $39.39/share for the entire year. Our shares outstanding at year-end were 10,331,401 and our shareholders’ equity reached an all-time record of $850.4 million. During the year, we redeemed our only bonded debt ($113 million) out of available funds, which otherwise would have matured in 2025, saving considerable interest expense over its remaining life. We find ourselves overcapitalized for our existing business, but we are carefully conserving capital for the right opportunity. We are continuously reviewing business opportunities for thoughtful expansion, but we are in an era of high valuations and companies and assets are, in many cases, priced for perfection, which in our experience is rarely what the future brings. We will continue to review expansion and investments with that in mind. In 2024, we solidified our position as a leader in wealth management, maintaining stability while expanding its capabilities and talent base. With a stable headcount of 931 year-over-year, we demonstrated strong retention The Major Indices Ended 2024 S&P 500 INDEX 23.3% DJIA 12.9% NASDAQ 28.6% WEALTH MANAGEMENT » Wealth Management reported revenue of $972.1 million for the year ended December 31, 2024, 9.2% higher compared with the prior year » The firm remains dedicated to identifying and pursuing strategic opportunities for expansion into new markets. Building on the successful establishment of its Nashville, TN branch in 2022, the firm further strengthened its presence by opening a new branch in Memphis, TN in 2024. We continue to target markets with robust demographic growth, established financial services ecosystems, and other key indicators of long-term potential » Financial advisor headcount was 931 at the end of the Q4 2024, unchanged from Q4 2023, representing the first year in many in which the addition of new advisors offset the retirement of existing advisors » Record $129.5 billion of Assets Under Administration (AUA) » Record Assets Under Management (AUM) were $49.4 billion » The increase in AUM from December 31, 2023 to December 31, 2024 was comprised of higher asset values of $6.4 billion on existing client holdings, offset by net distributions of $0.9 billion » Advisory fees increased 16.4% from the prior year due to higher billable AUM during the year » Interest revenue increased 4.2% from the prior year due to higher average margin loan balances » Bank deposit sweep income for the full year decreased $34.0 million or 19.7% from the prior year due to lower short-term interest rates and lower cash sweep balances 4

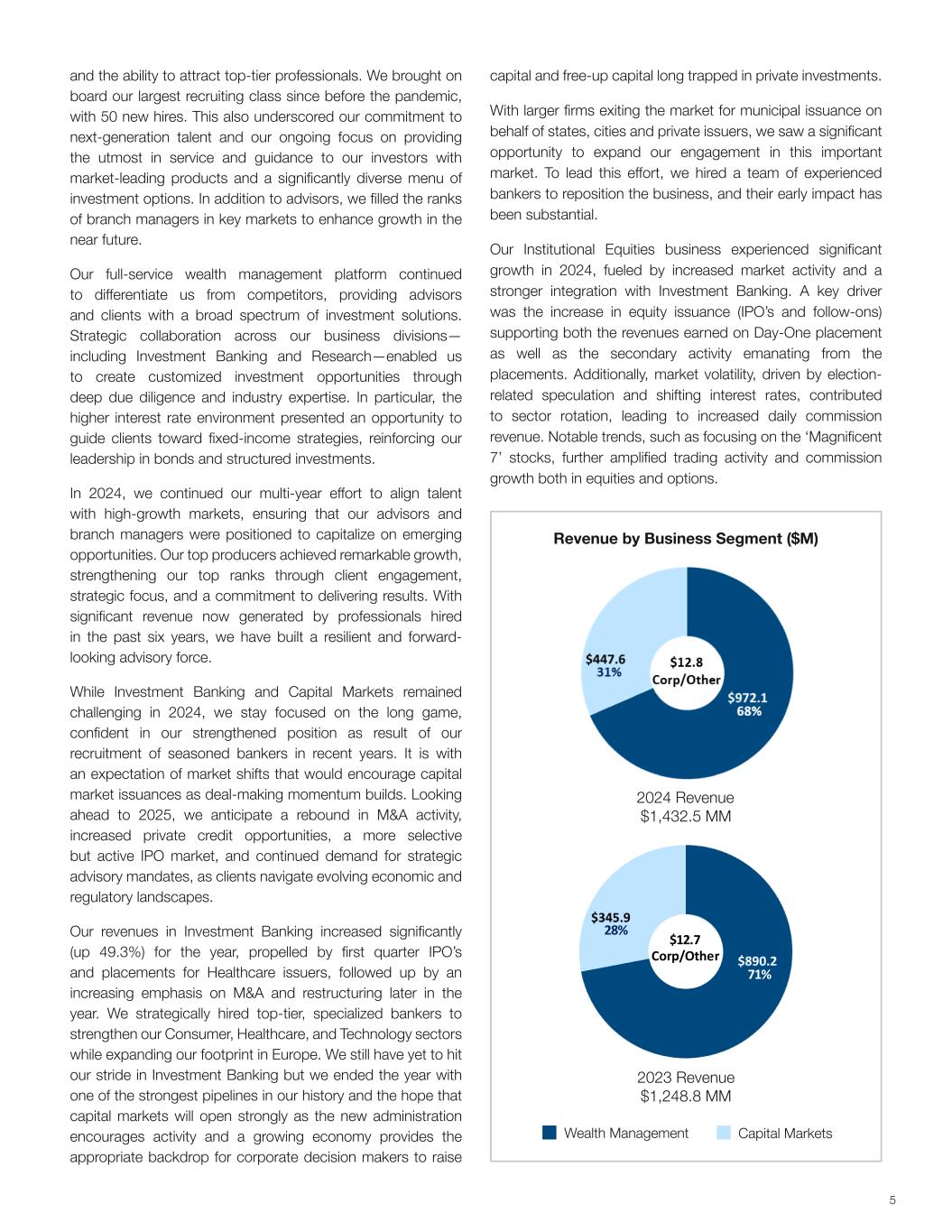

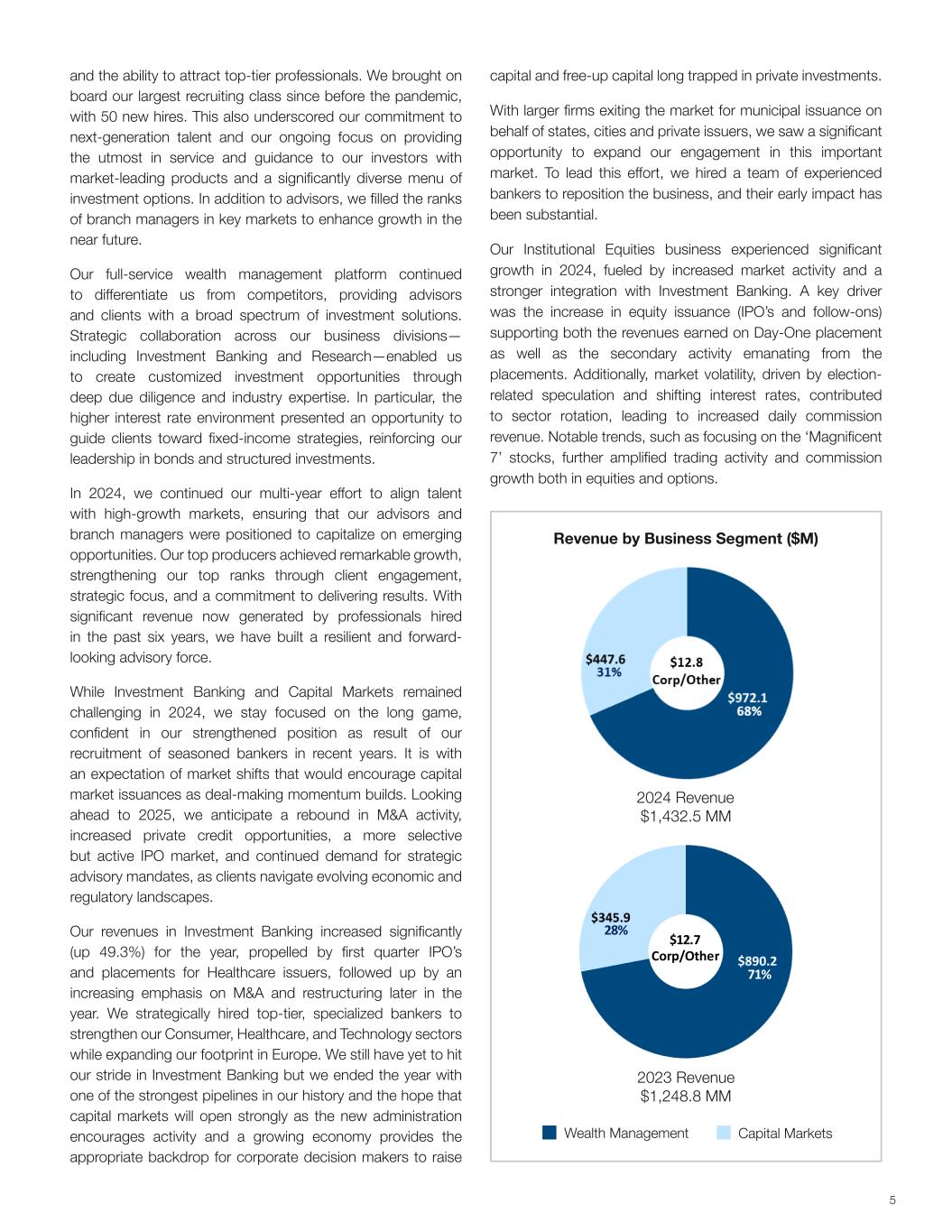

and the ability to attract top-tier professionals. We brought on board our largest recruiting class since before the pandemic, with 50 new hires. This also underscored our commitment to next-generation talent and our ongoing focus on providing the utmost in service and guidance to our investors with market-leading products and a significantly diverse menu of investment options. In addition to advisors, we filled the ranks of branch managers in key markets to enhance growth in the near future. Our full-service wealth management platform continued to differentiate us from competitors, providing advisors and clients with a broad spectrum of investment solutions. Strategic collaboration across our business divisions— including Investment Banking and Research—enabled us to create customized investment opportunities through deep due diligence and industry expertise. In particular, the higher interest rate environment presented an opportunity to guide clients toward fixed-income strategies, reinforcing our leadership in bonds and structured investments. In 2024, we continued our multi-year effort to align talent with high-growth markets, ensuring that our advisors and branch managers were positioned to capitalize on emerging opportunities. Our top producers achieved remarkable growth, strengthening our top ranks through client engagement, strategic focus, and a commitment to delivering results. With significant revenue now generated by professionals hired in the past six years, we have built a resilient and forward- looking advisory force. While Investment Banking and Capital Markets remained challenging in 2024, we stay focused on the long game, confident in our strengthened position as result of our recruitment of seasoned bankers in recent years. It is with an expectation of market shifts that would encourage capital market issuances as deal-making momentum builds. Looking ahead to 2025, we anticipate a rebound in M&A activity, increased private credit opportunities, a more selective but active IPO market, and continued demand for strategic advisory mandates, as clients navigate evolving economic and regulatory landscapes. Our revenues in Investment Banking increased significantly (up 49.3%) for the year, propelled by first quarter IPO’s and placements for Healthcare issuers, followed up by an increasing emphasis on M&A and restructuring later in the year. We strategically hired top-tier, specialized bankers to strengthen our Consumer, Healthcare, and Technology sectors while expanding our footprint in Europe. We still have yet to hit our stride in Investment Banking but we ended the year with one of the strongest pipelines in our history and the hope that capital markets will open strongly as the new administration encourages activity and a growing economy provides the appropriate backdrop for corporate decision makers to raise capital and free-up capital long trapped in private investments. With larger firms exiting the market for municipal issuance on behalf of states, cities and private issuers, we saw a significant opportunity to expand our engagement in this important market. To lead this effort, we hired a team of experienced bankers to reposition the business, and their early impact has been substantial. Our Institutional Equities business experienced significant growth in 2024, fueled by increased market activity and a stronger integration with Investment Banking. A key driver was the increase in equity issuance (IPO’s and follow-ons) supporting both the revenues earned on Day-One placement as well as the secondary activity emanating from the placements. Additionally, market volatility, driven by election- related speculation and shifting interest rates, contributed to sector rotation, leading to increased daily commission revenue. Notable trends, such as focusing on the ‘Magnificent 7’ stocks, further amplified trading activity and commission growth both in equities and options. 71.3 30% $12.7 Corp/Other 28% 71% Capital MarketsWealth Management Revenue by Business Segment ($M) 2024 Revenue $1,432.5 MM 2023 Revenue $1,248.8 MM 5

CAPITAL MARKETS Equities » Broadly improved volume, the added volatility, along with rapid sector rotation before and after the November election, helped over-all results for Equities in FY 2024, as revenues climbed to $167.6 million (+13%) » Core US Agency business notched a solid 7% revenue gain and UK /EU sales added 12%, while a recovery of equity new issuance (+59%) contributed to the strong performance throughout the year » The Derivatives team maintained their relevance and delivered a solid result ($21.72 million), while Convertible bond revenue declined slightly as issuance and secondary activity declined from 2023 (-16%). Both business lines experienced a very strong Q4 » Institutional Custody and Prime Service (CAPS) initiative began to pick up momentum in Q4 2024 with the addition of several early-stage clients to the platform » We anticipate important and continued focus on relevant research ideas and client service to be the dominant theme on a day-to-day basis in 2025 Fixed Income » Achieved record revenue, driven by strategic investments in credit-focused businesses including investment grade, emerging markets, high yield, and distressed debt » Sales and trading revenue increased 37.4% » Cross-firm collaboration with Investment Banking, Capital Markets, and Wealth Management enhanced client solutions and unlocked new business opportunities » Continued focus on evolving from a transactional buy/sell model to a deeper, advisory-driven approach — leveraging research, insights, and strategic guidance to deliver greater value Cross-firm collaboration with Investment Banking, Capital Markets, and Wealth Management enhanced our ability to meet evolving client needs. This systemic coordination—both internally and externally—helped us grow business with existing clients while unlocking new opportunities across firm business lines. The Institutional Derivatives business had a solid year, with a strong focus on developing complex, yield-enhancing strategies for clients. These strategies, while time-intensive, proved highly lucrative, enabling clients to optimize portfolio returns through derivative overlays. The Convertible Bond desk also had a standout year, benefiting from a rise in issuers utilizing convertible bond strategies as a financing tool. Meanwhile, our European Equities division continued to expand, reinforcing our global presence and strengthening client engagement across international markets. Equity Research also played a critical role in our growth including the appointment of a new Research Director. This resulted in re-focusing on enhancing the division’s research approach to be more relevant to institutional portfolio managers looking for deeper insights into industry focused emerging trends and opportunities. The research team continues to elevate best practices, accountability, and buy-side penetration, ensuring greater visibility for analysts and deeper institutional engagement. Our Fixed Income division achieved record revenue growth, surpassing previous high-water marks and solidifying our position in the middle market. This success was driven by important investments in experienced individuals with specialized and enhancing capabilities, particularly in credit focused areas such as investment grade, emerging markets, high yield, and distressed debt. Our deliberate approach is to deepen client relationships, and shift from a risk oriented model dependent on providing liquidity to a more engaged approach, leveraging research, insights, and strategic advice on individual and sector opportunities to drive value and enhance revenue. The Company remains committed to and actively engaged in the high- priority work of succession planning. As I write this letter, we have implemented a path to succession for key positions so as to be able to continue to operate at high levels of productivity across the Company. We stand on over 140 years of experience in investing in and financing America, and yet we still have the energy and opportunity of a newly formed company. One thing you can count on: We will continue to do what is needed in the ongoing pursuit of better ways to provide value to our clients. Across our platform, 2024 was a year of growth and development for the future. I announced my plans to retire as CEO in February, following a rigorous succession planning process that began in 1999, when my son Rob joined the company. Rob has been appointed by our Board of Directors to be the next CEO of the company. I am delighted with the outcome of this process and I am both comfortable and confident that the company’s best years are ahead of it. Oppenheimer heads into its next era with an incredibly strong foundation — a foundation of strong management, incredibly loyal and productive associates, and ample capital to support its road ahead. Our employees, consistently show ingenuity, a commitment to excellence, and a passion for our business that drives us continuously to a better future. 6

INVESTMENT BANKING Investment Banking » M&A and ECM fees up 14% and 12% YoY, respectively » Achieved our third-highest investment banking revenue in 2024, following the record-setting years of 2020 and 2021 » The number of bookrun transactions nearly doubled from the prior year with issuance increasing by 25% » Advised on several marquee transactions, including serving as exclusive financial advisor to CURO Group Holdings Corp. on its $2.1 billion Chapter 11 reorganization, the largest U.S. based financial services restructuring of 2024 » With strong client engagement and a healthy deal pipeline, we are optimistic about 2025, supported by a market environment expected to be favorable for deal-making Public Finance » Participated in 774 transactions totaling over $35 billion » Synergy with retail salesforce generated $211M in 2024 retail orders (over 8x growth YoY) Accomplishments in 2024: » 200% growth in senior managed negotiated transactions by deal volume YoY » #1 Municipal Note Underwriter (No. of issues) » #3 Illinois School District Senior Managing Underwriter by deal volume » #7 Municipal Bond and Note Underwriter (No. of issues) » #9 Texas School District Senior Managing Underwriter (No. of issues) » Leading Placement Agent in California » Industry traction and employee recognition by The Bond Buyer − 2024 Trailblazer − 2024 Rising Star Albert G. Lowenthal Chairman & CEO In a long career, I have learned: „ Have a clear vision of what you want to accomplish „ Focus on the long-term „ Be a partner to the people alongside you „ Be a good listener „ Be a student of the markets, of people, of life „ Make time your ally, plan for it, make the best of it „ Look to the future and always be optimistic After 40 years of association with Oppenheimer and its predecessors, and over 60 years in the industry, this company holds a special place in my heart. Oppenheimer has truly been my life’s work and I have treasured this extended period of watching it grow and prosper — and I have treasured the relationships built over these many years. I have learned everything I know about this business from those who taught me, when I was a greenhorn, similar to those who are the youngest employees we have today. Everyone has something important to share. My interaction with clients constantly reminds me of our significant responsibility to them and our need to listen to their needs and what they believe is important in their investing and in their lives. While I am turning over the leadership of the company, I am not retiring, but taking a step back and watching much more from the sidelines, as I assume the role of Executive Chairman. However old habits die slowly and I am still likely to be one of the first to arrive at the office, but hopefully, not the last to leave. The privilege and honor of being part of Oppenheimer has been the gift of a lifetime, and I will continue to treasure it. Once again, I thank our associates and our shareholders for their support and confidence. Sincerely, 7

Arizona 14624 N Scottsdale Road Scottsdale AZ 85254 480-596-1211 10195 N Oracle Road Oro Valley, AZ 85704 520-529-2553 California 2121 Palomar Airport Road Carlsbad CA 92011 760-476-3800 10880 Wilshire Boulevard Los Angeles CA 90024 310-446-7100 620 Newport Center Drive Newport Beach CA 92660 949-219-1000 580 California Street San Francisco CA 94104 415-438-3000 Colorado 3200 Cherry Creek S Drive Denver CO 80209 303-698-5300 Connecticut 1781 Highland Drive Cheshire CT 06410 203-272-9400 100 Mill Plain Road Danbury CT 06811 203-791-4600 29 West Street Litchfield CT 06759 860-567-8301 466 Heritage Road Southbury CT 06488 203-264-6511 263 Tresser Boulevard Stamford CT 06901 203-328-1160 District of Columbia 1801 K Street NW Washington DC 20006 202-296-3030 Florida 999 Yamato Road Boca Raton FL 33431 561-416-8600 110 E Atlantic Avenue Delray Beach FL 33432 561-894-7200 100 SE 3rd Avenue Fort Lauderdale FL 33394 954-356-8200 6700 Daniels Parkway Fort Myers FL 33912 239-561-2330 2811 Ponce de Leon Boulevard Coral Gables FL 33134 305-860-2600 11780 US Highway One North Palm Beach FL 33408 561-383-3900 1800 2nd Street Sarasota FL 34236 941-363-2800 4221 W Boy Scout Boulevard Tampa FL 33607 813-357-2800 Georgia 3438 Peachtree Road NE Atlanta GA 30326 404-262-5300 Illinois 227 E Center Drive Alton IL 62002 618-462-1968 500 W Madison Street Chicago IL 60661 312-360-5500 Kansas 10601 Mission Road Leawood KS 66206 913-383-5100 534 Kansas Avenue Topeka KS 66603 785-235-9281 1223 N Rock Road Wichita KS 67206 316-636-8925 Massachusetts 255 State Street Boston MA 02109 617-428-5500 Michigan 385 S Eton Street Birmingham MI 48009 248-593-3700 1400 Abbott Road East Lansing MI 48823 517-333-7775 130 Mayer Road Frankenmuth MI 48734 989-652-3251 9475 Holly Road Grand Blanc MI 48439 810-694-2980 63 Kercheval Avenue Grosse Pointe Farms MI 48236 313-886-1200 555 W Crosstown Parkway Kalamazoo MI 49008 269-381-4800 1007 W Ann Arbor Trail Plymouth MI 48170 734-454-3751 810 Michigan Street Port Huron MI 48060 810-987-1500 12900 Hall Road Sterling Heights MI 48313 586-726-5000 3106 Biddle Avenue Wyandotte MI 48192 734-284-9630 Minnesota 100 S Fifth Street Minneapolis MN 55402 612-337-2700 Missouri 16401 Swingley Ridge Road Chesterfield MO 63017 636-733-1000 4039 S Freemont Avenue Springfield MO 65804 816-932-7000 1 N Brentwood Boulevard St Louis MO 63105 314-746-2500 New Hampshire One Harbour Place Portsmouth NH 03801 603-436-7626 New Jersey 200 Park Avenue Florham Park NJ 07932 973-245-4600 222 Haddon Avenue Haddon Township NJ 08108 856-858-1043 302 Carnegie Center Princeton NJ 08540 609-734-0400 3 Harding Road Red Bank NJ 07701 732-224-9000 250 Pehle Avenue Saddle Brook NJ 07663 201-845-2300 382 Springfield Avenue Summit NJ 07901 908-273-2100 U.S. Branch Offices 8

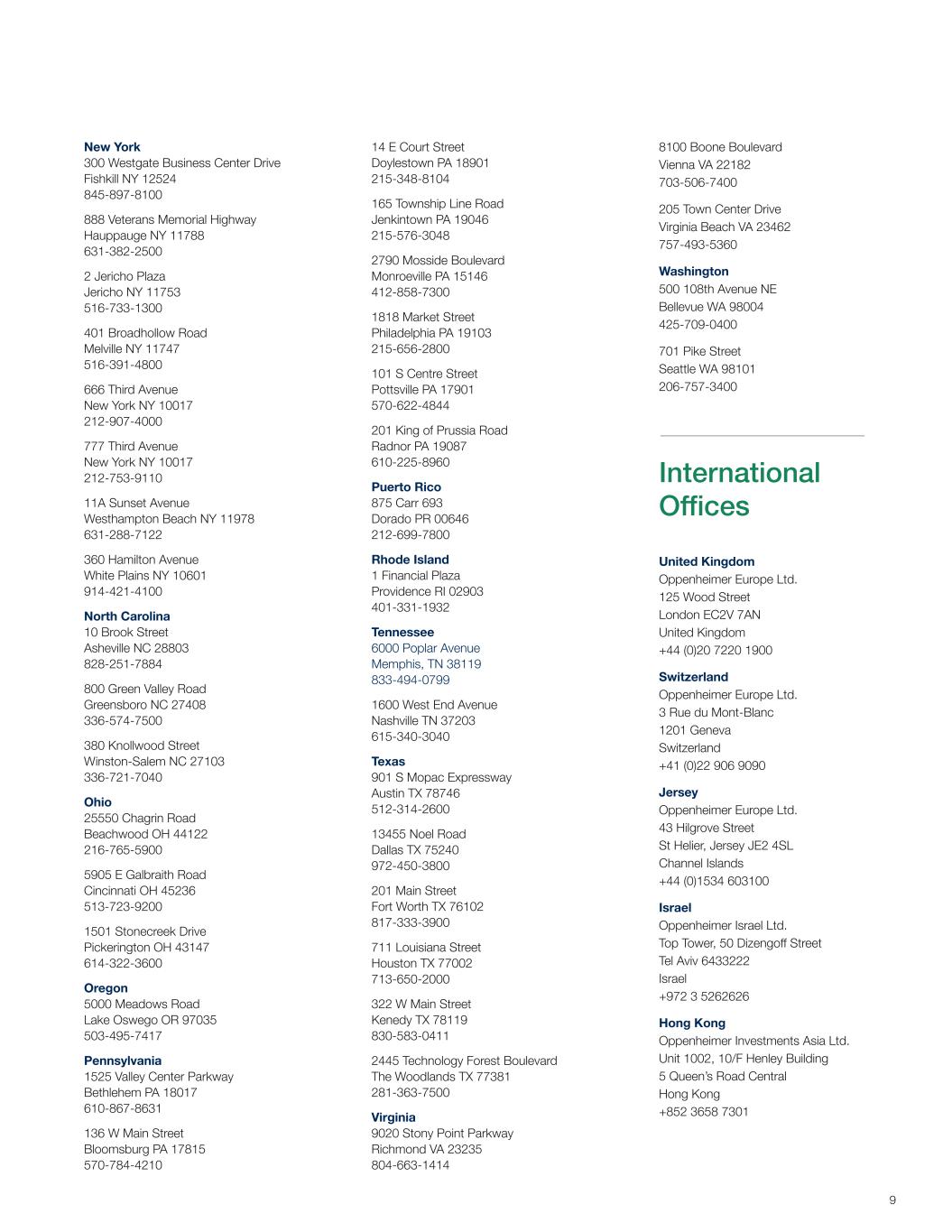

New York 300 Westgate Business Center Drive Fishkill NY 12524 845-897-8100 888 Veterans Memorial Highway Hauppauge NY 11788 631-382-2500 2 Jericho Plaza Jericho NY 11753 516-733-1300 401 Broadhollow Road Melville NY 11747 516-391-4800 666 Third Avenue New York NY 10017 212-907-4000 777 Third Avenue New York NY 10017 212-753-9110 11A Sunset Avenue Westhampton Beach NY 11978 631-288-7122 360 Hamilton Avenue White Plains NY 10601 914-421-4100 North Carolina 10 Brook Street Asheville NC 28803 828-251-7884 800 Green Valley Road Greensboro NC 27408 336-574-7500 380 Knollwood Street Winston-Salem NC 27103 336-721-7040 Ohio 25550 Chagrin Road Beachwood OH 44122 216-765-5900 5905 E Galbraith Road Cincinnati OH 45236 513-723-9200 1501 Stonecreek Drive Pickerington OH 43147 614-322-3600 Oregon 5000 Meadows Road Lake Oswego OR 97035 503-495-7417 Pennsylvania 1525 Valley Center Parkway Bethlehem PA 18017 610-867-8631 136 W Main Street Bloomsburg PA 17815 570-784-4210 14 E Court Street Doylestown PA 18901 215-348-8104 165 Township Line Road Jenkintown PA 19046 215-576-3048 2790 Mosside Boulevard Monroeville PA 15146 412-858-7300 1818 Market Street Philadelphia PA 19103 215-656-2800 101 S Centre Street Pottsville PA 17901 570-622-4844 201 King of Prussia Road Radnor PA 19087 610-225-8960 Puerto Rico 875 Carr 693 Dorado PR 00646 212-699-7800 Rhode Island 1 Financial Plaza Providence RI 02903 401-331-1932 Tennessee 6000 Poplar Avenue Memphis, TN 38119 833-494-0799 1600 West End Avenue Nashville TN 37203 615-340-3040 Texas 901 S Mopac Expressway Austin TX 78746 512-314-2600 13455 Noel Road Dallas TX 75240 972-450-3800 201 Main Street Fort Worth TX 76102 817-333-3900 711 Louisiana Street Houston TX 77002 713-650-2000 322 W Main Street Kenedy TX 78119 830-583-0411 2445 Technology Forest Boulevard The Woodlands TX 77381 281-363-7500 Virginia 9020 Stony Point Parkway Richmond VA 23235 804-663-1414 8100 Boone Boulevard Vienna VA 22182 703-506-7400 205 Town Center Drive Virginia Beach VA 23462 757-493-5360 Washington 500 108th Avenue NE Bellevue WA 98004 425-709-0400 701 Pike Street Seattle WA 98101 206-757-3400 International Offices United Kingdom Oppenheimer Europe Ltd. 125 Wood Street London EC2V 7AN United Kingdom +44 (0)20 7220 1900 Switzerland Oppenheimer Europe Ltd. 3 Rue du Mont-Blanc 1201 Geneva Switzerland +41 (0)22 906 9090 Jersey Oppenheimer Europe Ltd. 43 Hilgrove Street St Helier, Jersey JE2 4SL Channel Islands +44 (0)1534 603100 Israel Oppenheimer Israel Ltd. Top Tower, 50 Dizengoff Street Tel Aviv 6433222 Israel +972 3 5262626 Hong Kong Oppenheimer Investments Asia Ltd. Unit 1002, 10/F Henley Building 5 Queen’s Road Central Hong Kong +852 3658 7301 9

As filed with the U.S. Securities and Exchange Commission on February 28, 2022 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D. C. 20549 FORM 10-K (Mark One) x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2021 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 1-12043 OPPENHEIMER HOLDINGS INC. (Exact name of registrant as specified in its charter) Delaware 98-0080034 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 85 Broad Street, New York, NY 10004 (Address of principal executive offices) (Zip Code) Registrant's Telephone number, including area code: (212) 668-8000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered Class A non-voting common stock OPY The New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: Not Applicable (Title of class) Table of Contents Firm Financial Information Financial information, including our nnual Report on Form 10-K for the year ended December 31, 2024 is available at www.oppenheimer.com/about-us/investor-relations. To request a paper or email copy of our Annual Report on Form 10-K, without exhibits, at no charge, call (800) 221-5588, write to Oppenheimer Holdings Inc., Attention: Secretary, 85 Broad Street, 22nd Floor, New York, NY 10004, or email info@opco. com. Exhibits will be provided upon request and payment of a reasonable fee. 10

Headquarters Oppenheimer & Co. Inc. Oppenheimer Holdings Inc. 85 Broad Street New York, NY 10004 212-668-8000 Oppenheimer Asset Management Inc. 85 Broad Street New York, NY 10004 212-668-8000 Oppenheimer Trust Company of Delaware 3411 Silverside Road Wilmington DE 19810 302-529-2000 OPY Credit Corp. 85 Broad Street New York, NY 10004 212-668-8000 Freedom Investments, Inc. 375 Raritan Center Parkway Edison, NJ 08837 732-934-3000 Bondwave LLC 85 Broad Street New York, NY 10004 630-517-7000 Independent Registered Public Accounting Firm Deloitte & Touche LLP Registrar and Transfer Agent Computershare Investor Services PO Box 505000 Louisville, KY 40233 800-522-6645 Evan Behrens Independent Director Board Committee(s): • Audit • Compliance • Nominating and Corporate Governance Timothy M. Dwyer Independent Director Board Committee(s): • Audit* • Compensation • Compliance Paul M. Friedman Lead Independent Director Board Committee(s): • Compensation • Compliance* • Nominating and Corporate Governance Teresa A. Glasser Independent Director Board Committee(s): • Audit • Compliance Stacy J. Kanter Independent Director Board Committee(s): • Compensation • Compliance • Nominating and Corporate Governance* Albert G. Lowenthal Inside Director Chairman of the Board Chief Executive Officer Robert S. Lowenthal Inside Director President Head of Investment Banking R. Lawrence Roth Independent Director Board Committee(s): • Compensation* • Compliance • Nominating and Corporate Governance Suzanne Spaulding Independent Director • Audit • Compliance • Nominating and Corporate Governance * Committee Chair Albert G. Lowenthal Chairman of the Board Chief Executive Officer Dennis P. McNamara, Esq. Executive Vice President Secretary Robert S. Lowenthal President Head of Investment Banking Brad Watkins Executive Vice President Chief Financial Officer Officers Board of Directors Principal Offices 11

HEADQUARTERS Oppenheimer Holdings Inc. 85 Broad Street New York, NY 10004 www.oppenheimer.com Oppenheimer & Co. Inc. Transacts Business on All Principal Exchanges and Member SIPC. Vision To help build and protect our clients’ financial future. Mission To apply original thinking that anticipates and captures innovative investment opportunities that improve our clients’ outcomes. Values Entrepreneurial Bold Thinking Relentlessly Client Centric Responsive Family