Exhibit 99.8

FORM OF NOTICE OF TAX INFORMATION

The tax information is provided in connection with the prospectus of Royal Hawaiian Orchards, L.P. (the “Partnership”), dated __________ __, 2017.

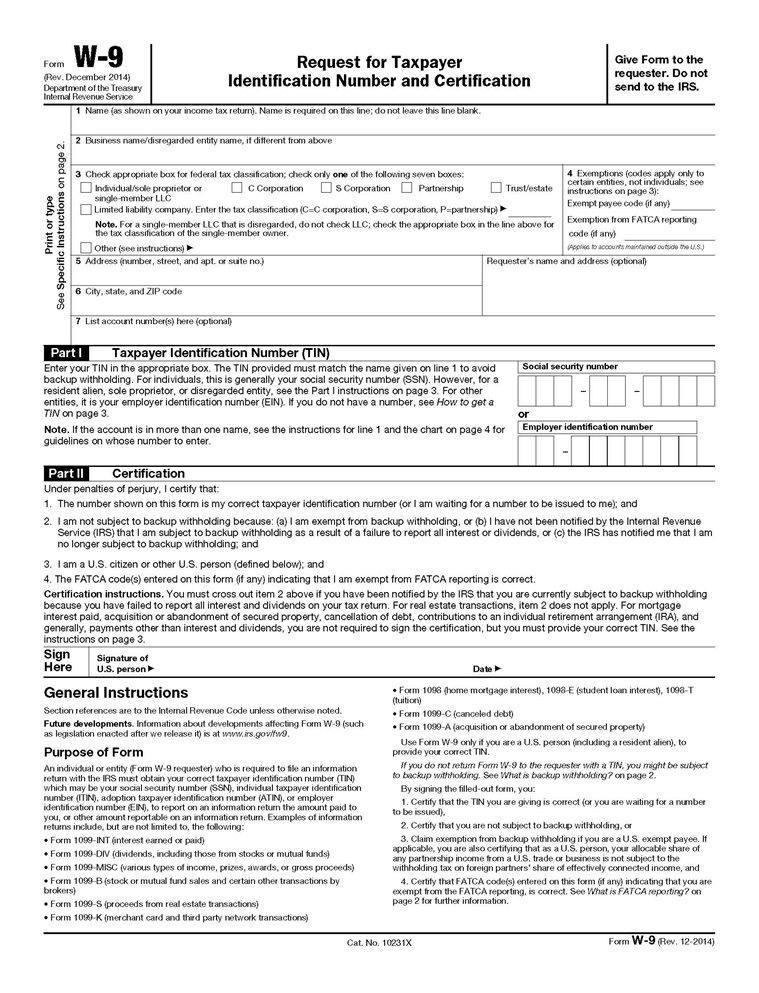

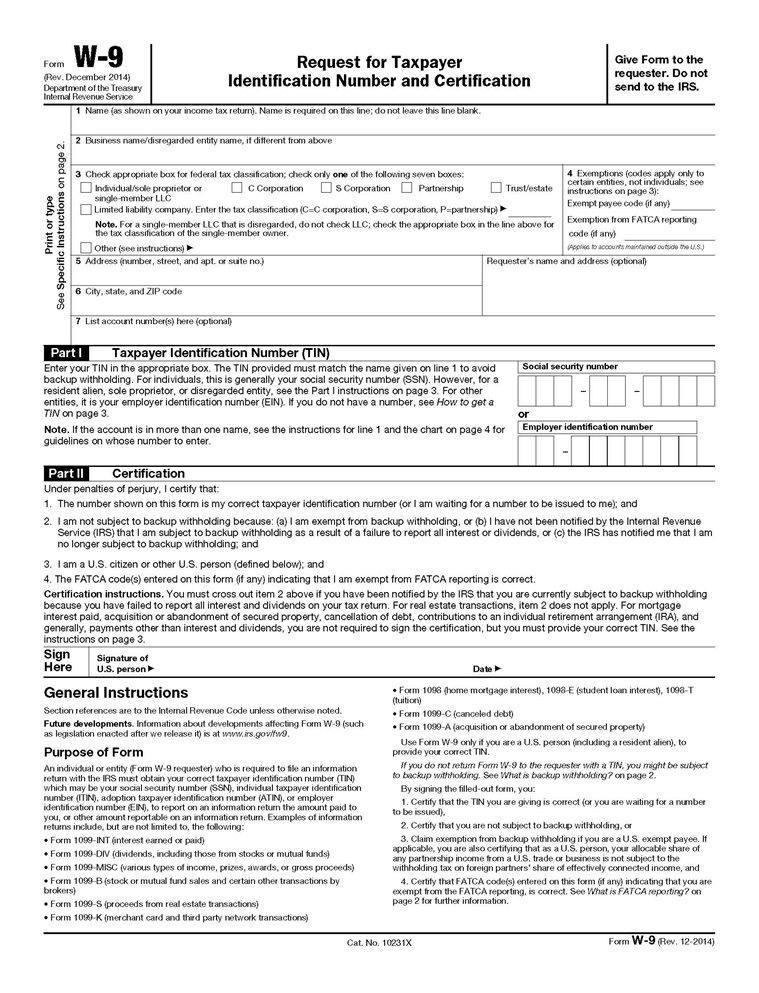

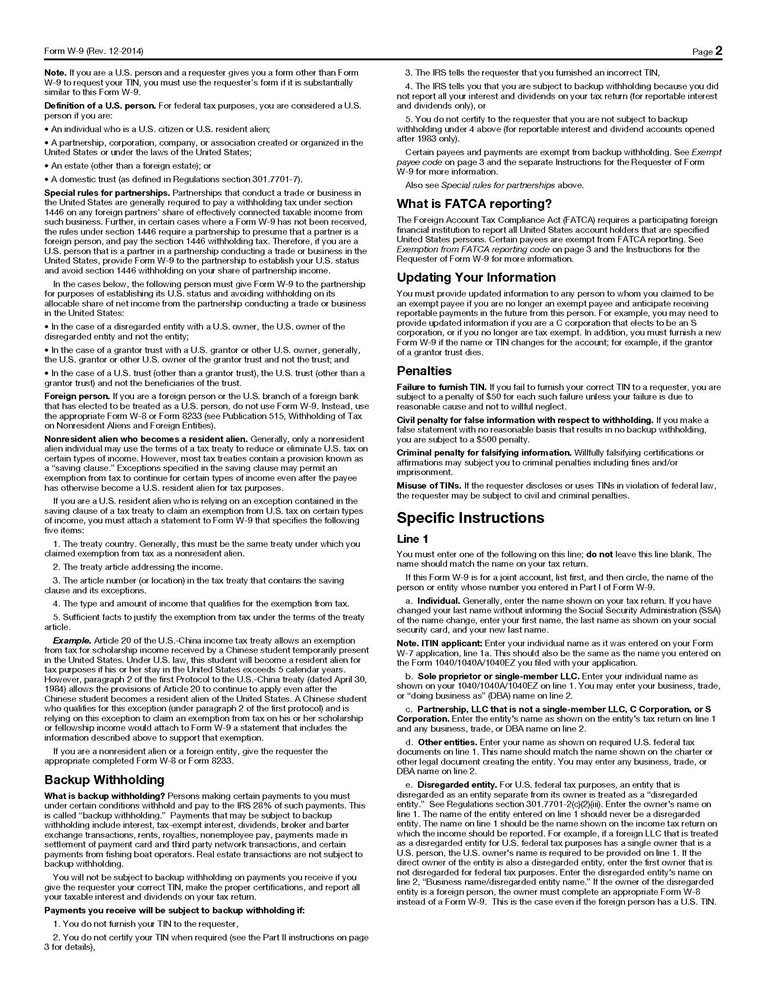

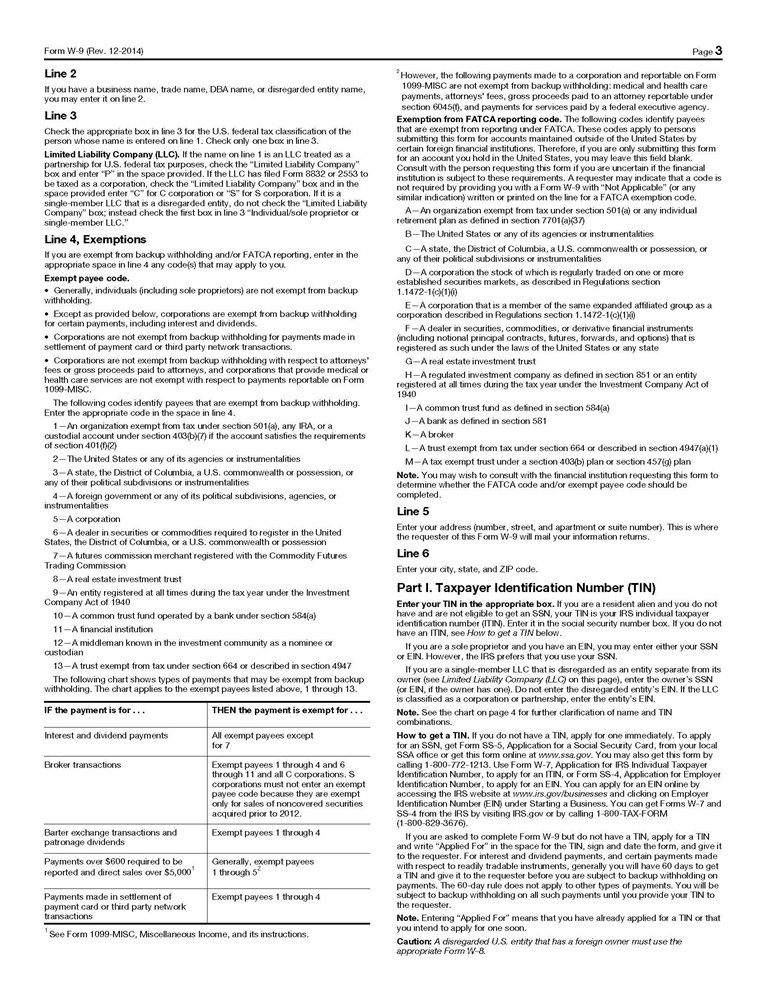

Under the U.S. federal income tax laws, distributions that may be made by the Partnership on depositary units (the “Depositary Units”) representing Class A units of limited partner interests in the Partnership may be subject to backup withholding. Generally such distributions will be subject to backup withholding unless the holder (i) is exempt from backup withholding or (ii) furnishes the payer with its correct taxpayer identification number (“TIN”) and certifies, under penalties of perjury, that the number provided is correct and provides certain other certifications. Each holder that exercises Rights and wants to avoid backup withholding with respect to any future distributions on the Depositary Units must provide American Stock Transfer & Trust Company, LLC (the “Subscription Agent”), as the Partnership’s agent in respect of the exercised Rights (the “Requester”), with a properly completed Form W-9 (set forth below) or a Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding (as applicable).

Certain holders (including, among others, certain foreign individuals) are exempt from these backup withholding and reporting requirements. In general, in order for a foreign individual holder to qualify as an exempt recipient, that holder must submit a properly completed Form W-8BEN (instead of a Form W-9), signed under the penalties of perjury, attesting to such holder’s foreign status. Such Form W-8BEN may be obtained from the Subscription Agent. Exempt U.S. holders should indicate their exempt status on Form W-9 to avoid possible backup withholding. See the General Instructions to the Form W-9 for additional instructions. Holders are urged to consult their tax advisers to determine whether they are exempt from withholding and reporting requirements.

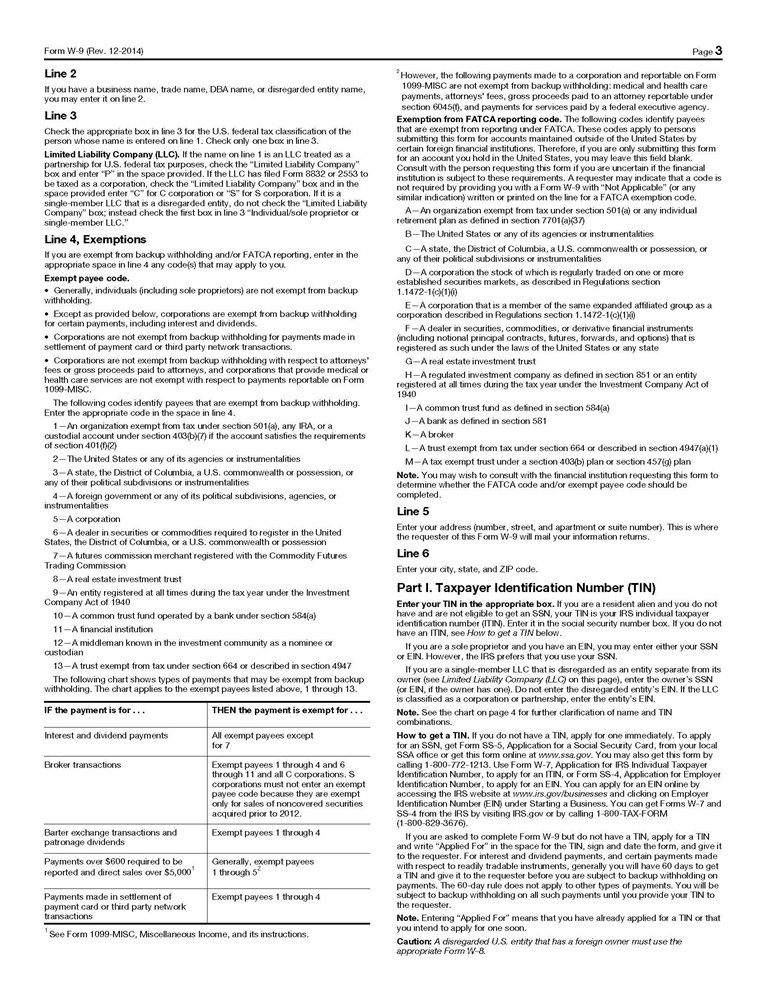

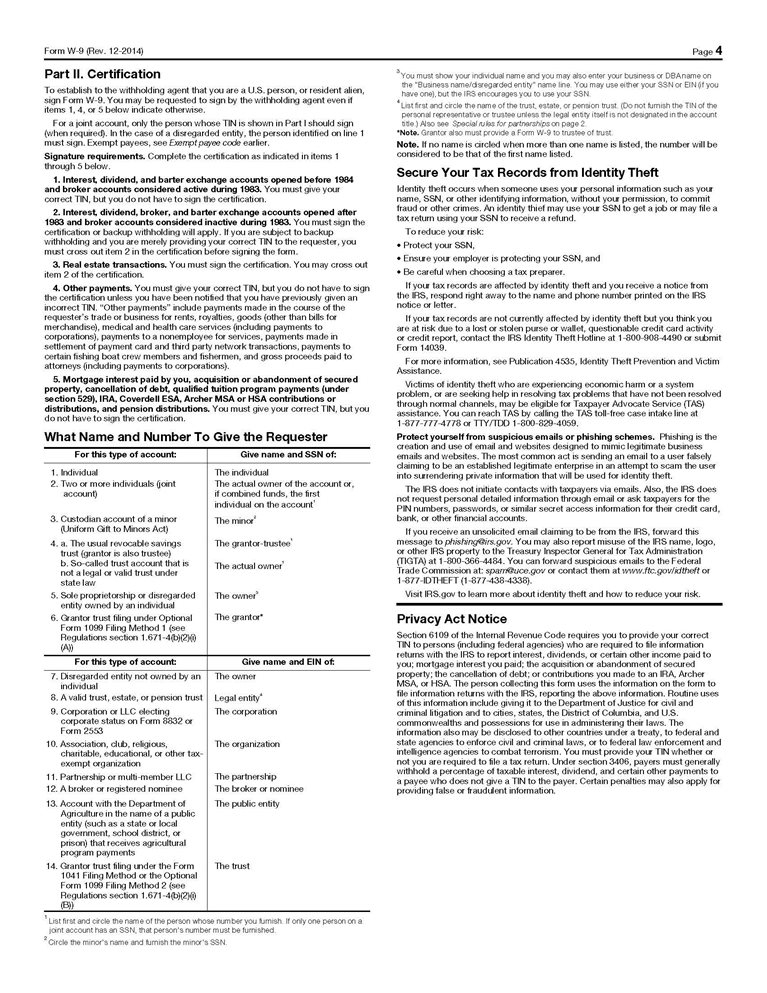

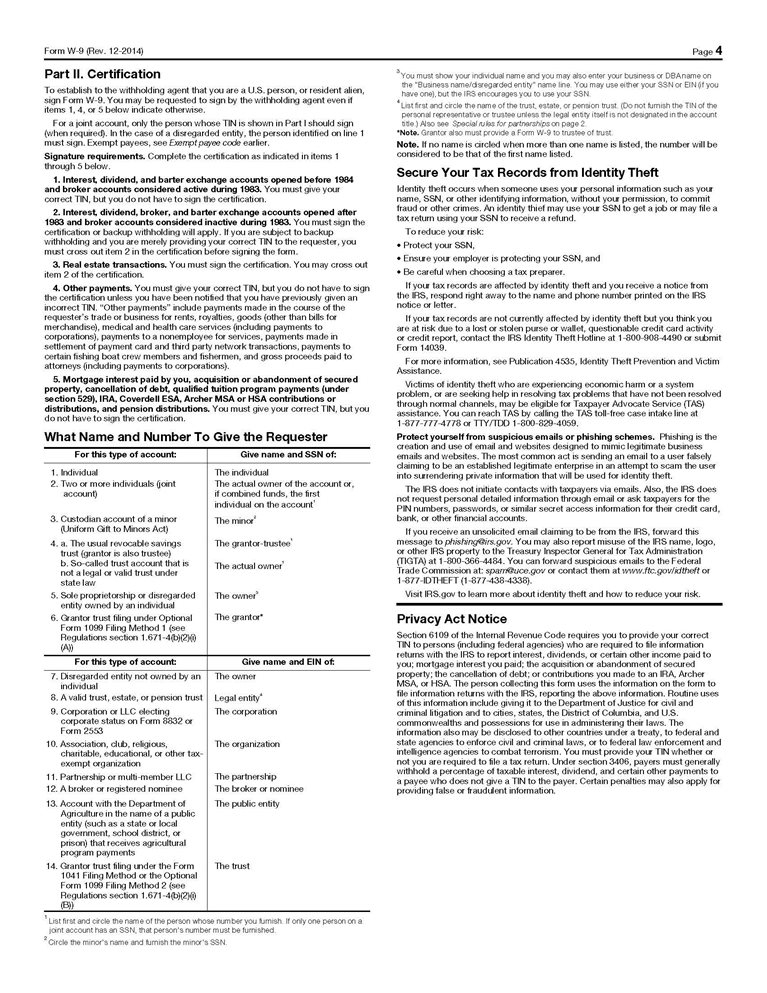

If backup withholding applies, the Partnership may be required to withhold (currently at a 28% rate) on any distribution made to a holder of Depositary Units. Backup withholding is not an additional tax. Rather, the amount of backup withholding can be credited against the U.S. federal income tax liability of the holder subject to backup withholding, provided that the required information is provided to the Internal Revenue Service (“IRS”). If backup withholding results in an overpayment of taxes, a refund may be obtained. A holder that exercises Rights is required to give the Subscription Agent the TIN of the record owner of the Depositary Units issued upon exercise of the Rights. If such record owner is an individual, the taxpayer identification number is generally the taxpayer’s social security number. For most other entities, the TIN is the employer identification number. If the Depositary Units are in more than one name or are not in the name of the actual owner, consult the General Instructions to the Form W-9 for additional guidelines on which number to report. If the Subscription Agent is not provided with the correct TIN, the holder may be subject to a penalty imposed by the IRS and to backup withholding.

If you do not have a TIN, consult the enclosed General Instructions to the Form W-9 for instructions on applying for a TIN, write “Applied For” in the space for the TIN in Part I of the Form W-9 and sign and date the Form W-9 and the Certificate of Awaiting Taxpayer Identification Number set forth herein. If you do not provide your TIN to the Subscription Agent within 60 days, backup withholding will begin and continue until you furnish your TIN to the Subscription Agent. Please note that writing “Applied For” on the form means that you have already applied for a TIN or that you intend to apply for one in the near future.

CERTIFICATE OF AWAITING TAXPAYER IDENTIFICATION NUMBER

I certify under penalties of perjury that a Taxpayer Identification Number has not been issued to me, and either (a) I have mailed or delivered an application to receive a taxpayer identification number to the appropriate Internal Revenue Service Center or Social Security Administration Office or (b) I intend to mail or deliver an application in the near future. I understand that, notwithstanding the information I provided in Part II of the Form W-9 (and the fact that I have completed this Certificate of Awaiting Taxpayer Identification Number), 28% of all payments made to me pursuant to this Offer to Purchase shall be retained until I provide a Taxpayer Identification Number to the Payor and that, if I do not provide my Taxpayer Identification Number within sixty (60) days, such retained amounts shall be remitted to the IRS as backup withholding.