During fiscal 2010, each director who was not a Company employee was compensated for his services as a director with a quarterly fee of $16,250. In addition, Gary Lederman as chairman of the Audit Committee and John Roglieri M.D. as chairman of the Compensation Committee were each compensated for serving as a Committee Chairman with an additional quarterly fee of $3,750. No director’s fees were paid to the Company’s employee directors.

The following table sets forth the compensation paid to the Company’s directors in fiscal 2010.

The Company’s Code of Ethics is applicable to the Company’s Senior Management, as well as its key financial and accounting personnel. It has been designed to deter wrongdoing and to promote;

The Code requires each covered person to deal ethically and honestly with the Company and to avoid business, financial or other direct or indirect interests or relationships that conflict with those of the Company or divide the covered person’s loyalty to the Company. Each covered person is required to sign an attestation of compliance with the Code at the end of each fiscal year.

In addition, it is the Company’s policy that transactions involving related persons (excluding executive officer compensation which is determined by the Compensation Committee) are to be presented to and assessed by the independent members of the board of directors. Related persons include the Company’s directors and executive officers, immediate family members of the

directors and executive officers, and certain large security holders and their family members. If the determination is made that a related person has or may have a material direct or indirect interest in any Company transaction and that the amount involved equals or exceeds $120,000, the Company’s independent directors will review, approve and ratify the transaction, if appropriate, and the transaction will be disclosed if required under SEC rules. If the related party at issue is a director of the Company or a family member of a director, then that director will not participate in the relevant discussion and review.

Information considered in evaluating such transactions include the nature of the related person’s interest in the transaction, the material terms of the transaction, the importance of the transaction to the Company and the related person, whether the transaction would impair the judgment of a director or an executive officer to act in the best interests of the Company, and any other matters that management or the independent directors deem appropriate. Corporate policy requires all directors and employees, including all executives, to disclose their interests (including indirect interests through family members) with individuals or entities doing business with the Company, to management and/or the Board of Directors, and to remove themselves from all decisions related to that organization.

No such transactions with related parties occurred in fiscal years 2008 through 2010.

Compensation Discussion and Analysis

Background

Through fiscal 2001, the Board of Directors, including the Company’s three executive officers, were responsible for reviewing the compensation paid to the Company’s executive officers, provided that none of the Company’s executive officers could vote with respect to his own compensation package. In fiscal 2002, the Company established a Compensation Committee consisting of three non-employee directors, Morton L. Topfer (Chairman), Gary Lederman and John Roglieri. Mr. Topfer resigned as a director and as a member of the Compensation Committee in February 2004. In March 2004, Dr. Roglieri became the Chairman of the Compensation Committee and Mr. Elias was elected as a member of the Committee. Mr. Benincasa was elected as a member of the Committee in June 2005.

In May 1997, the Company executed an employment agreement with Dr. Grodman which expired on October 31, 2004. Effective November 1, 2004, the Company executed a new seven year employment agreement with Dr. Grodman. On December 31, 2010, the Company executed a new employment agreement with Dr. Grodman expiring on October 31, 2017 and superseding the contract then in effect. The terms of the new employment agreement are described above. See “Employment Agreements with Named Officers.”

In May 1997, the Company also executed employment agreements with Messrs. Dubinett and Singer (each expiring on October 31, 2002). During fiscal 2002, the Compensation Committee authorized extensions of both Messrs. Dubinett and Singer’s contracts for two additional years, with the Company having the option to extend each agreement for two consecutive one-year periods in addition. In consideration for Messrs. Dubinett and Singer

23

executing the extension agreements, the Company agreed that the base compensation during each extension year would not be less than the total cash compensation paid to such individual in fiscal 2002. The Company’s option to extend Mr. Dubinett and Mr. Singer’s employment agreements was further extended through fiscal 2011 for Mr. Dubinett and through January 31, 2012 for Mr. Singer.

Executive Compensation Philosophy

The objective of the Company’s compensation program for its three executive officers is to reward them for their leadership and efficiency in their areas of responsibility and for their overall contribution to the Company’s performance (Dr. Grodman as chief executive officer, Mr. Dubinett as chief operating officer responsible for healthcare regulatory compliance and insurance matters, and Mr. Singer as chief financial officer responsible for all financial matters). Except for the Senior Management Incentive Bonus Plan, there are no specific performance objectives or targets required to be achieved.

The elements of compensation for each of the executive officers are the following cash amounts.

| | |

| (i) | Annual “Base Compensation” |

| (ii) | Participation in the Senior Management Incentive Bonus Plan |

In view of the fact that our three named executive officers own substantial equity interests in the Company, our compensation program for them focuses primarily on base salary, subject to annual increase based upon a review of the executive’s and the Company’s performance. In addition, to further incentivize our executive officers as well as certain other members of senior management, in 2005, we established a Senior Management Incentive Bonus Plan designed to assist in the Company’s profitability. The Plan is designed to encourage a “team effort” as all of the senior management participants are rewarded under the Plan if the Targets are achieved and none of them are rewarded under the Plan if the Targets are not achieved. Bonuses under the Plan are earned and paid only to the extent the Company’s Total Operating Income equaled certain designated percentages of Total Net Revenues (with an additional formula governing the 2010 Plan). Plan criteria were met with respect to fiscal 2007, 2009 and 2010 so that bonuses were earned and paid, but no bonuses were earned or paid under the Plan with respect to fiscal 2008 as the Plan’s targeted performances were not achieved. See “Senior Management Incentive Bonus Plans” herein.

Process for Determining Executive Compensation

Dr. Grodman’s 2004 seven year employment agreement was due to expire in October 2011. Dr. Grodman negotiated the terms of his new employment agreement directly with the Compensation Committee which did not have specific performance objectives for the Company to achieve in the future but believed that the steady increase in each of the past four years in the Company’s net revenues and profits were to a significant degree attributable to Dr. Grodman’s leadership as president and chief executive officer. The Committee believed it was important for the Company and its stockholders to secure Dr. Grodman’s services for another seven years. In

24

addition, the Compensation Committee relied in part on executive compensation studies furnished by Compensation Resources, Inc. See “Rationale for Current Agreements with Three Executive Officers”.

Mr. Dubinett and Mr. Singer have employment contracts which periodically are extended for relatively short periods. They each negotiate the terms of their contracts including their Base Compensation with Dr. Grodman who then recommends the terms to the Compensation Committee for approval. Since fiscal 2008, the Base Compensation and the increase in Base Compensation in each year for Mr. Dubinett and for Mr. Singer have been identical. This is because in the opinion of Dr. Grodman and the Compensation Committee, each of such executive officers has performed his duties flawlessly and to distinguish between them in compensation could cause the Company to lose the services of one of them. The relative short term of each of their employment agreements could allow for early termination if Dr. Grodman or the Compensation Committee is not satisfied with either officer’s performance. Furthermore, the increases in their Base Compensation in each of the past three fiscal years have been as follows and such increases include automatic increases in fiscal years 2008 and 2010 based upon increases in the Consumer Price Index.

Increases in Base Compensation for Each of

Mr. Dubinett and Mr. Singer Over the Prior Three Fiscal Years

| | | | | | | |

| | Amount | | Percentage Increase* | |

| |

| |

| |

Fiscal 2008 | | $ | 39,585 | | | 12 | % |

Fiscal 2009 | | | 18,490 | | | 5 | % |

Fiscal 2010 | | | 19,075 | | | 5 | % |

| |

| |

* Includes increases in fiscal 2008 and fiscal 2010 due to increases in the Consumer Price Index. |

In addition to their Base Compensation, Dr. Grodman, Mr. Dubinett and Mr. Singer have been and are participants in the Company’s Senior Management Incentive Compensation Plans.

Rationale for Current Employment Agreements with the Three Executive Officers

In December 2010, the Compensation Committee approved a new employment agreement (the “New Contract”) with Dr. Grodman ensuring that he would continue to serve as president of the Company through October 31, 2017. The New Contract superseded the employment agreement then in effect and due to expire on October 31, 2011 (the “Old Contract”). In negotiating Dr. Grodman’s New Contract, the Compensation Committee relied in part on executive compensation studies furnished by Compensation Resources, Inc., an independent executive compensation consulting firm (“CRI”). After taking into account the compensation paid to the chief executive officers of a peer group of nine publicly owned clinical testing laboratories (including the two major national laboratories, Quest Diagnostics, Inc. and Laboratory CP of America Holdings) CRI concluded that Dr. Grodman’s compensation package under the Old Contract was below (by over 20%) the comparable value delivered to the chief executive officers in the peer group and that Dr. Grodman’s compensation in its totality under

25

the New Contract was within a reasonable comparable range. The nine peer group publicly owned clinical testing laboratories used as a benchmark by CRI were;

| |

| Bioclinica Inc. |

| Genoptix Inc |

| Laboratory CP of Amer Hldgs |

| Medtox Scientific Inc. |

| Neogenomics Inc. |

| Orchid Cellmark Inc. |

| Psychemedics Corp. |

| Quest Diagnostics Inc. |

| Response Genetics Inc. |

The Compensation Committee also determined that the Base Compensation paid with respect to fiscal 2010, and the terms of the extension agreements with Messrs. Dubinett and Singer, were reasonable in relationship to the services performed, the responsibilities assumed and the results obtained, and were in the best interests of the Company. In connection with Dr. Grodman’s compensation, the Compensation Committee considered the Company’s increase in net revenues, patients serviced, working capital and shareholders’ equity in fiscal 2010 compared with the corresponding period in fiscal 2009. Furthermore, after a review of the base compensation paid to the named executive officers of the following companies, namely Alliance Healthcare Services, Inc., Bioclinica Inc., Genoptix Inc., Insight Health Svcs Hldg Corp, Laboratory Cp of America Hldgs, Medtox Scientific Inc., Quest Diagnostics Inc. and Radnet Inc., the Compensation Committee concluded that the base compensation to be paid to Messrs. Grodman, Dubinett and Singer for fiscal 2010 was well within the range of the base compensation levels of the named executive officers at such other companies and was appropriate.

Benefits and Perquisites

The Company’s policy is to provide health benefits as well as access to its 401(k) Plan to which it contributes a maximum of $500 per employee each year, to all of its employees including its three executive officers.

The Company leases automobiles for the use by its executive officers but amounts reflecting their personal use are reported as income to them subject to tax. Similarly, personal use of the Company airplane by any of the Company’s executive officers is reported as income to them, subject to tax. See Footnote (3) to the “Summary Compensation Table”.

Change in Control Benefits

The Company’s employment agreements with its three executive officers provide for substantial Severance Payments to them in the event of a change in control of the Company. This provision provides an additional level of financial security for the three executive officers. These executives could well be asked to evaluate a transaction purportedly expected to maximize shareholder value while resulting in the elimination of their jobs. The Severance Payment

26

provision (2.99 times the annual average of the preceding five years of compensation) could help to minimize the distraction caused by concerns over personal financial security in the context of a proposed change in control.

Stock Option Grant Practices

The Company has in the past granted stock options at an exercise price at least equal to the fair market value on the date of the grant. Due to the substantial stock ownership position of the Company’s three executive officers, no stock options have been granted to them (or restricted stock awarded to them) in the last three years.

Policy Regarding the One Million Dollar Deduction Limitation

Section 162(m) of the Internal Revenue Code generally disallows a tax deduction to public corporations for compensation in excess of $1,000,000 paid for any fiscal year to a corporation’s chief executive officer and to the four other most highly compensated executive officers in office as of the end of the fiscal year. The statute exempts qualifying performance-based compensation from the deduction limit if certain requirements are met. However, shareholder interests may at times be best served by not restricting the Compensation Committee’s discretion and flexibility in developing compensation programs, even though the programs may result in non-deductible compensation expenses. Accordingly, the Compensation Committee may from time to time approve elements of compensation for certain officers that are not fully deductible.

Compensation Committee Interlocks and Insider Participation

During fiscal 2010, the members of the Company’s Compensation Committee were:

| |

| John Roglieri M.D. – Chairman |

| Joseph Benincasa |

| Harry Elias |

| Gary Lederman |

No member of the Compensation Committee was an officer or employee of the Company in fiscal 2010 or was formerly an officer of the Company.

Compensation Committee Report

The members of the Company’s Compensation Committee hereby state;

| | |

| (A) | We have reviewed and discussed the Compensation Discussion and Analysis contained in this Proxy Statement and in the Company’s Annual Report on Form 10-K for the year ended October 31, 2010 with the Company’s Management, and |

| | |

| (B) | Based on such review and discussions, we recommended to the Company’s Board of Directors that the Compensation Discussion and Analysis be included in the |

27

| | |

| | Company’s Annual Report on Form 10-K for the year ended October 31, 2010 and in this Proxy Statement. |

| | |

| | COMPENSATION COMMITTEE |

| | |

| By | John Roglieri M.D., Chairman |

| | Joseph Benincasa |

| | Harry Elias |

| | Gary Lederman |

AUDIT COMMITTEE REPORT

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. It is the responsibility of the Company’s independent auditors to perform an independent audit of and express an opinion on the Company’s financial statements. The Audit Committee’s responsibility is one of review and oversight. In fulfilling its oversight responsibilities:

| | |

| (1) | The Audit Committee of the Board of Directors has reviewed and discussed with the Company’s management the audited financial statements. |

| | |

| (2) | The Audit Committee has discussed with MSPC, Certified Public Accountants and Advisors, A Professional Corporation (“MSPC”), the Company’s independent auditors, the matters required to be discussed by Statement on Auditing Standards No. 61, “Codification of Statements on Auditing Standards, AU § 380,” as modified or supplemented. |

| | |

| (3) | The Audit Committee has also received the written disclosures and the letter from MSPC required by the Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees), as modified or supplemented, and has discussed with MSPC. the independence of that firm as the Company’s auditors. |

| | |

| (4) | Based on the Audit Committee’s review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the Company’s audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended October 31, 2010, for filing with the Securities and Exchange Commission. |

Each of the Audit Committee members is independent, as defined in the Rules of the Nasdaq Stock Market, Inc.

The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting, auditing, or auditor independence. However, the Board of Directors has determined that Gary Lederman is qualified to serve as the “audit committee financial expert” of the Company as defined in Item 407(d) of Regulation S-K promulgated by the Securities and Exchange Commission. Members of the

28

Committee rely without independent verification on the information provided to them and on the representations made by management and the independent auditors.

| |

| Audit Committee |

| |

| Gary Lederman, Chairman |

| Joseph Benincasa, Member |

| Harry Elias, Member |

| John Roglieri, Member |

ADVISORY VOTE ON EXECUTIVE COMPENSATION (PROPOSAL TWO)

As required by Section 14A of the Exchange Act, the Company is affording its shareholders an advisory (non-binding) vote with respect to the compensation of our three Named Executive Officers (defined as “say on pay”). Accordingly, you may vote on the following resolution at the 2011 Annual Meeting:

| | |

| Resolved, that the shareholders of the Company approve, on an advisory basis, the compensation paid to the Company’s three Named Executive Officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, the accompanying compensation tables, and the related narrative discussion in the Company’s 2011 Annual Meeting Proxy Statement. | |

This is merely an advisory vote, and is not binding on the Company. However, the Board of Directors and the Compensation Committee (which is comprised of independent directors), expect to take into account the outcome of this vote when considering future executive compensation decisions to the extent they can determine the cause or causes of any significant negative voting results, Shareholders are encouraged to read the Company’s disclosure pursuant to Item 402 including the “Compensation Discussion and Analysis” section, the accompanying compensation tables and the related narrative disclosure in this Proxy Statement.

The Board of Directors recommends that you vote FOR the approval, on an advisory basis, of the resolution approving the Company’s compensation for its three Named Executive Officers. Proxies given without instructions will be voted FOR approval of this resolution.

ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY VOTE ON

EXECUTIVE COMPENSATION (PROPOSAL THREE)

As required by Section 14A of the Exchange Act, in addition to providing shareholders with the opportunity to cast an advisory vote regarding the executive compensation of its Named Executive Officers, this year the Company is providing shareholders with an advisory vote on whether the advisory vote on executive compensation should be held every one, two or three years.

29

The Board believes that a frequency of “every three years” for the advisory vote on executive compensation is the most appropriate choice for conducting and responding to a “say on pay�� vote for the Company. Shareholders who have concerns about executive compensation during the interval between “say on pay” votes may bring their specific concerns to the attention of the Board by letter addressed to the Secretary, Bio-Reference Laboratories, Inc, 481B Edward H. Ross Drive, Elmwood Park, NJ 07407. The Secretary will circulate any such letter to each member of the Board of Directors for the Board’s and the Compensation Committee’s consideration.

The proxy card provides shareholders with the opportunity to choose among four options (holding the vote every one, two or three years, or abstaining). Shareholders are being asked to vote on the following resolution.

| | |

| Resolved that the Company’s shareholders determine on an advisory basis, that the frequency with which the Company’s shareholders shall have an advisory vote on the compensation of the Company’s Named Executive Officers is: | |

| | |

| Choice 1 – every year

Choice 2 – every two years

Choice 3 – every three years; or

Choice 4 – abstain from voting | |

Although this advisory vote on the frequency of the “say on pay” vote is non-binding, the Board and the Compensation Committee will take into account the outcome of the vote when considering the frequency of future advisory votes on executive compensation.

The Board of Directors recommends that you vote for “Choice 3 – every three years” for future advisory votes on executive compensation, and proxies given without instruction will be so voted.

30

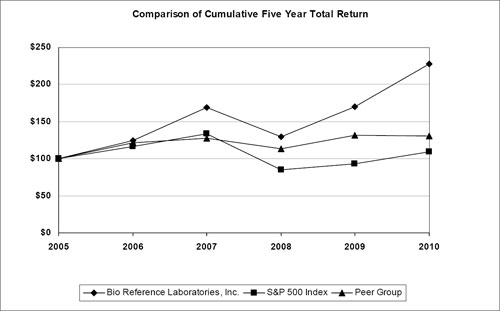

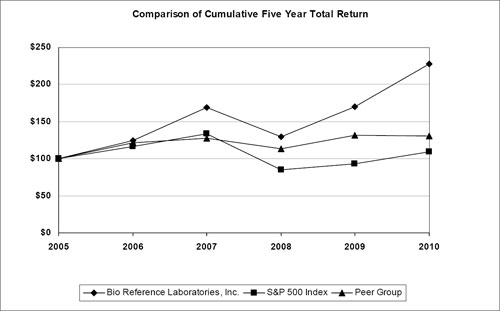

STOCK PRICE PERFORMANCE

Set forth below is a line graph comparing the yearly cumulative total return on the Company’s Common Stock for the five fiscal years ended October 31, 2010 based on the market price of the Common Stock as compared with the cumulative total return of companies in the S&P 500 Composite and with a peer group of nine publicly owned medical laboratories.

COMPARISON OF FIVE YEAR TOTAL RETURN

FOR BIO-REFERENCE LABORATORIES, INC.,

S&P 500 COMPOSITE AND

MEDICAL LABORATORY PEER GROUP

The Medical Laboratory peer group consists of the following companies: Bioclinica Inc., Genoptix Inc., Laboratory CP of Amer Hldgs, Medtox Scientific Inc., Neogenomics Inc., Orchid Cellmark Inc., Psychemedics Corp., Quest Diagnostics Inc., Response Genetics Inc.

31

AUDITORS

The firm of MSPC, has been selected by the Board of Directors to audit the accounts of the Company and its subsidiaries for the fiscal year ending October 31, 2011. MSPC and its predecessor firm have served as the Company’s auditors since 1988. Representatives of such firm are not expected to be present at the September 8, 2011 Annual Meeting of Stockholders.

Audit Fees

MSPC billed the Company approximately $270,000 for professional services rendered in connection with the audit of the Company’s annual financial statements for the fiscal year ended October 31, 2010 and the review of the financial statements included in its quarterly reports on Form 10-Q for such fiscal year compared to approximately $254,500 in billings for such services for the fiscal year ended October 31, 2009. In addition, MSPC billed the Company approximately $15,500 in fiscal 2010 for its audit of the Company’s 401(k) Plan for calendar year 2009 as compared to approximately $15,000 of such fees in fiscal 2009 with respect to calendar year 2008.

Audit-Related Fees

MSPC billed the Company approximately $11,400 for due diligence services rendered in relation to certain acquisitions during fiscal 2010 and approximately $73,500 for Sarbanes-Oxley (“SOX”) related audit fees.

Tax Fees

MSPC billed the Company approximately $64,000 for tax services for fiscal 2010 and approximately $70,100 for tax services for fiscal 2009.

All Other Fees

No other fees were billed to the Company by MSPC with respect to fiscal 2010 or fiscal 2009 other than for the services described above.

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee pre-approved each material non-audit engagement for services performed by the Company’s independent auditors in fiscal 2010. Prior to pre-approving any such non-audit engagement or service, it is the Committee’s practice to first gather information regarding the requested engagement or service in order to enable the Committee to assess the impact of the engagement or service on the auditor’s independence.

32

The Audit Committee has considered whether the provision of tax return preparation and other professional services to the Company by MSPC is compatible with such firm maintaining its independence and has concluded that such firm is independent with respect to the Company in its role as the Company’s principal accountant and auditor.

Stockholder Proposals for 2012 Annual Meeting

Under current rules of the Securities and Exchange Commission, stockholders wishing to submit proposals for inclusion in the Proxy Statement of the Board of Directors for the 2012 Annual Meeting of Stockholders (expected to be held in July 2013), must submit such proposals so as to be received by the Company at 481 Edward H. Ross Drive, Elmwood Park, New Jersey 07407 on or before March 1, 2013.

OTHER MATTERS

Management does not know of any other matters which are likely to be brought before the Meeting. However, in the event that any other matters properly come before the Meeting, the persons named in the enclosed proxy will vote said proxy in accordance with their judgment in said matters.

According to Securities and Exchange Commission rules, the information presented in this Proxy Statement under the captions “Compensation Committee Report, “Audit Committee Report” and “Stock Price Performance” will not be deemed to be “soliciting material” or deemed filed with the Securities and Exchange Commission under the Securities Act of 1933 or the Securities Exchange Act of 1934, and nothing contained in any previous filings made by the Company under such Acts shall be interpreted as incorporating by reference the information presented under said specified captions.

| | |

| By Order of the Board of Directors | |

| | |

| Marc D. Grodman, President | |

Elmwood Park, New Jersey

August 2, 2011

33

| | | |

|

| | |

| | |

| | |

| BIO-REFERENCE LABORATORIES, INC. | |

| | |

Revocable Proxy Solicited on Behalf of the Board of Directors

Annual Meeting of Stockholders - September 8, 2011 |

|

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS |

The undersigned, a Stockholder of BIO-REFERENCE LABORATORIES, INC. (the “Company”) hereby appoints Marc D. Grodman and Sam Singer or either of them, as proxy or proxies of the undersigned, with full power of substitution, to vote, in the name, place and stead of the undersigned, with all of the powers which the undersigned would possess if personally present, on behalf of the undersigned, all the shares which the undersigned is entitled to vote at the Annual Meeting of the Stockholders of BIO-REFERENCE LABORATORIES, INC. to be held at 9:00 A.M. (local time) on Thursday, September 8, 2011 at the Sheraton Crossroads Hotel, Crossroads Corporate Center, Route 17 North, Mahwah, New Jersey 07495-0001 and at any and all adjournments thereof. The undersigned directs that this proxy be voted as follows:

(Continued and to be signed on the reverse side)

ANNUAL MEETING OF STOCKHOLDERS OF

BIO-REFERENCE LABORATORIES, INC.

September 8, 2011

NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIAL:

The Notice of Meeting, Proxy Statement, Proxy Card

are available at www.bioreference.com

Please sign, date and mail

your proxy card in the

envelope provided as soon

as possible.

| | |

| Please detach along perforated line and mail in the envelope provided. |

|

| | | |

| | 20230403000000000000 6 | 090811 |

|

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF DIRECTORS AND “FOR” PROPOSALS 2, 3 AND 4.

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE x |

| | | | | | |

| 1. To elect two Class II directors, each to serve for a term of three years and until his successor is elected and qualified (Proposal One). |

| | | |

| | | NOMINEES: |

| o | FOR ALL NOMINEES | ¡ | Sam Singer |

| | | ¡ | Harry Elias |

| o | WITHHOLD AUTHORITY | | |

| | FOR ALL NOMINEES | | |

| | | | |

| o | FOR ALL EXCEPT | | |

| | (See instructions below) | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark“FOR ALL EXCEPT” and fill in the circle next to each nominee you wish to withhold, as shown here:  |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| To change the address on your account, please check the box at right and indicate your new address in the address space above. Please note that changes to the registered name(s) on the account may not be submitted via this method. | o |

| | | | | | |

| | | FOR | AGAINST | ABSTAIN |

2. | To hold an advisory vote on executive compensation as disclosed in these materials. | o | o | o |

| | | | | | |

| | 1 year | 2 years | 3 years | ABSTAIN |

3. | To hold an advisory vote on whether an advisory vote on executive compensation should be held every one, two or three years. | o | o | o | o |

|

| | | FOR | AGAINST | ABSTAIN |

4. | In their discretion, on all other matters as shall properly come before the meeting | o | o | o |

|

The Board of Directors recommends a vote FOR Proposals One and Two and for every three years on Proposal Three. UNLESS OTHERWISE SPECIFIED AS ABOVE, THIS PROXY WILL BE VOTED “FOR” THE ELECTION OF DIRECTORS (PROPOSAL ONE). IN ADDITION, DISCRETIONARY AUTHORITY IS CONFERRED AS TO ALL OTHER MATTERS THAT MAY COME BEFORE THE MEETING UNLESS SUCH AUTHORITY IS SPECIFICALLY WITHHELD. Stockholders who are present at the meeting may withdraw their Proxy and vote in person if they so desire.

PLEASE MARK, SIGN, AND RETURN YOUR PROXY PROMPTLY. No postage is required if returned in the enclosed envelope and mailed in the United States. Receipt of the Notice of Annual Meeting of Stockholders, the accompanying Proxy Statement of the Board of Directors and the Company’s Annual Report for the year ended October 31, 2010 is acknowledged. |

| | | | | | | |

Signature of Stockholder | | Date: | | Signature of Stockholder | | Date: | |

| | | |

| Note: | Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. | |

| |

| |