- BRO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

10-K/A Filing

Brown & Brown (BRO) 10-K/A2007 FY Annual report (amended)

Filed: 20 Mar 08, 12:00am

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the fiscal year ended December 31, 2007 |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the transition period from to |

Florida (State or other jurisdiction of incorporation or organization) 220 South Ridgewood Avenue, Daytona Beach, FL (Address of principal executive offices) |  | 59-0864469 (I.R.S. Employer Identification Number) 32114 (Zip Code) | ||||||||

Title of each class COMMON STOCK, $0.10 PAR VALUE | Name of each exchange on which registered NEW YORK STOCK EXCHANGE | |||||

| Large accelerated filer [X] | Accelerated filer [ ] | |||||

| Non-accelerated filer [ ] | Smaller reporting company [ ] | |||||

Explanatory Note

| Page No. | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Part I | ||||||||||

| Item 1. | Business | 3 | ||||||||

| Item 1A. | Risk Factors | 11 | ||||||||

| Item 1B. | Unresolved Staff Comments | 18 | ||||||||

| Item 2. | Properties | 18 | ||||||||

| Item 3. | Legal Proceedings | 18 | ||||||||

| Item 4. | Submission of Matters to a Vote of Security Holders | 18 | ||||||||

| Part II | ||||||||||

| Item 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 19 | ||||||||

| Item 6. | Selected Financial Data | 21 | ||||||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 22 | ||||||||

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 38 | ||||||||

| Item 8. | Financial Statements and Supplementary Data | 40 | ||||||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 71 | ||||||||

| Item 9A. | Controls and Procedures | 71 | ||||||||

| Item 9B. | Other Information | 72 | ||||||||

| Part III | ||||||||||

| Item 10. | Directors, Executive Officers and Corporate Governance | 72 | ||||||||

| Item 11. | Executive Compensation | 72 | ||||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters | 72 | ||||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 72 | ||||||||

| Item 14. | Principal Accounting Fees and Services | 72 | ||||||||

| Part IV | ||||||||||

| Item 15. | Exhibits and Financial Statement Schedules | 73 | ||||||||

| Signatures | 75 | |||||||||

| Exhibit Index | 76 | |||||||||

| – | material adverse changes in economic conditions in the markets we serve; |

| – | future regulatory actions and conditions in the states in which we conduct our business; |

| – | competition from others in the insurance agency, wholesale brokerage, insurance programs and service business; |

| – | a significant portion of business written by Brown & Brown is for customers located in California, Florida, Georgia, Michigan, New Jersey, New York, Pennsylvania, Texas and Washington. Accordingly, the occurrence of adverse economic conditions, an adverse regulatory climate, or a disaster in any of these states could have a material adverse effect on our business, although no such conditions have been encountered in the past; |

| – | the integration of our operations with those of businesses or assets we have acquired or may acquire in the future and the failure to realize the expected benefits of such integration; and |

| – | other risks and uncertainties as may be detailed from time to time in our public announcements and Securities and Exchange Commission (“SEC”) filings. |

| Florida | 38 | Minnesota | 3 | |||||||||||

| New York | 14 | Nevada | 3 | |||||||||||

| New Jersey | 11 | North Carolina | 3 | |||||||||||

| Texas | 11 | South Carolina | 3 | |||||||||||

| California | 10 | Wisconsin | 3 | |||||||||||

| Georgia | 8 | Connecticut | 2 | |||||||||||

| Colorado | 7 | Massachusetts | 2 | |||||||||||

| Illinois | 7 | Missouri | 2 | |||||||||||

| Pennsylvania | 7 | Montana | 2 | |||||||||||

| Virginia | 7 | New Hampshire | 2 | |||||||||||

| Washington | 7 | Alabama | 1 | |||||||||||

| Louisiana | 6 | Delaware | 1 | |||||||||||

| Arizona | 5 | Hawaii | 1 | |||||||||||

| Michigan | 5 | Kansas | 1 | |||||||||||

| Oklahoma | 5 | Nebraska | 1 | |||||||||||

| Arkansas | 4 | Ohio | 1 | |||||||||||

| Indiana | 4 | Oregon | 1 | |||||||||||

| Kentucky | 4 | Tennessee | 1 | |||||||||||

| New Mexico | 4 | West Virginia | 1 | |||||||||||

| | | | | | | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except percentages) | | 2007 | | % | | 2006 | | % | | 2005 | | % | ||||||||||||||

| Retail Division | $ | 548,038 | 59.9 | % | $ | 516,489 | 59.7 | % | $ | 489,566 | 63.1 | % | ||||||||||||||

| Wholesale Brokerage Division | 175,289 | 19.1 | 159,268 | 18.4 | 125,537 | 16.2 | ||||||||||||||||||||

| National Programs Division | 157,008 | 17.2 | 156,996 | 18.2 | 133,147 | 17.2 | ||||||||||||||||||||

| Services Division | 35,505 | 3.9 | 32,561 | 3.8 | 26,565 | 3.4 | ||||||||||||||||||||

| Other | (1,190 | ) | (0.1 | ) | (651 | ) | (0.1 | ) | 728 | 0.1 | ||||||||||||||||

| Total | $ | 914,650 | 100.0 | % | $ | 864,663 | 100.0 | % | $ | 775,543 | 100.0 | % | ||||||||||||||

| – | Dentists: The Professional Protector Plan® for Dentists offers comprehensive coverage for dentists, oral surgeons, dental schools and dental students, including practice protection and professional liability. This program, initiated in 1969, is endorsed by a number of state and local dental societies and is offered in 49 states, the District of Columbia, the U.S. Virgin Islands and Puerto Rico. |

| – | Lawyers: The Lawyer’s Protector Plan® (LPP®) was introduced in 1983, 10 years after we began marketing lawyers’ professional liability insurance. This program is presently offered in 43 states, the District of Columbia and Puerto Rico. |

| – | Optometrists and Opticians: The Optometric Protector Plan® (OPP®) and the Optical Services Protector Plan® (OSPP®) were created in 1973 and 1987, respectively, to provide professional liability, package and workers’ compensation coverages exclusively for optometrists and opticians. These programs insure optometrists and opticians nationwide. |

| – | CalSurance®: CalSurance® offers professional liability programs designed for insurance agents, financial advisors, registered representatives, securities broker-dealers, benefit administrators, real estate brokers and real estate title agents. CalSurance® also sells commercial insurance packages directly to customers in certain industry niches including destination resort and luxury hotels, independent pizza restaurants, and others. An important aspect of CalSurance® is Lancer Claims Services, which provides specialty claims administration for insurance companies underwriting CalSurance® product lines. |

| – | TitlePac®: TitlePac® provides professional liability products and services designed for real estate title agents and escrow agents in 47 states and the District of Columbia. |

| – | Florida Intracoastal Underwriters, Limited Company (“FIU”) is a managing general agency that specializes in providing insurance coverage for coastal and inland high-value condominiums and apartments. FIU has developed a specialty reinsurance facility to support the underwriting activities associated with these risks. |

| – | Public Risk Underwriters®, along with our similar offices in Florida and other states, are program administrators offering tailored property and casualty insurance products, risk management consulting, third-party administration and related services designed for municipalities, schools, fire districts, and other public entities. |

| – | Proctor Financial, Inc. (“Proctor”) provides insurance programs and compliance solutions for financial institutions that service mortgage loans. Proctor’s products include lender-placed fire and flood insurance, full insurance outsourcing, mortgage impairment, and blanket equity insurance. Proctor also writes surplus lines property business for its financial institutions clients and acts as a wholesaler for this line of business. |

| – | American Specialty Insurance & Risk Services, Inc. provides insurance and risk management services for clients in professional sports, motor sports, amateur sports, and the entertainment industry. |

| – | Parcel Insurance Plan® (PIP®) is a specialty insurance agency providing insurance coverage to commercial and private shippers for small packages and parcels with insured values of less than $25,000 each. |

| – | Professional Risk Specialty Group is a specialty insurance agency providing liability insurance products to various professional groups. |

| – | AFC Insurance, Inc. (“AFC”) is a managing general underwriter, specializing in tailored insurance products for the health and human services industry. AFC works with retail agents in all states and targets home healthcare, group homes for the mentally and physically challenged, and drug and alcohol facilities and programs for the developmentally disabled. |

| – | Acumen Re Management Corporation is a reinsurance underwriting management organization, primarily acting as an outsourced specific excess workers’ compensation facultative reinsurance underwriting facility. |

| – | Commercial Programs serves the insurance needs of certain specialty trade/industry groups. Programs offered include: |

| – | Wholesalers & Distributors Preferred Program®. Introduced in 1997, this program provides property and casualty protection for businesses principally engaged in the wholesale-distribution industry. |

| – | Railroad Protector Plan®. Also introduced in 1997, this program is designed for contractors, manufacturers and other entities that service the needs of the railroad industry. |

| – | Environmental Protector Plan®. Introduced in 1998, this program provides a variety of specialized coverages, primarily to municipal mosquito control districts. |

| – | Food Processors Preferred ProgramSM. This program, introduced in 1998, provides property and casualty insurance protection for businesses involved in the handling and processing of various foods. |

| SEC Public Reference Room 100 F Street NE Washington, D.C. 20549 |

| • | difficulties in staffing and managing foreign operations; |

| • | less flexible employee relationships, which limit our ability to prohibit employees from competing with us after their employment, and may make it difficult and expensive to terminate their employment; |

| • | political and economic instability (including acts of terrorism and outbreaks of war); |

| • | coordinating our communications and logistics across geographic distances and multiple time zones; |

| • | unexpected changes in regulatory requirements and laws; |

| • | adverse trade policies, and adverse changes to any of the policies of either the U.S. or any of the foreign jurisdictions in which we operate; |

| • | adverse changes in tax rates; |

| • | legal or political constraints on our ability to maintain or increase prices; |

| • | governmental restrictions on the transfer of funds to us from our operations outside the United States; and |

| • | burdens of complying with a wide variety of labor practices and foreign laws, including those relating to export and import duties, environmental policies and privacy issues. |

| | High | | Low | | Cash Dividends Per Common Share | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

2006 | ||||||||||||||

| First Quarter | $ | 33.23 | $ | 27.86 | $ | 0.050 | ||||||||

| Second Quarter | $ | 35.25 | $ | 28.15 | $ | 0.050 | ||||||||

| Third Quarter | $ | 32.50 | $ | 27.06 | $ | 0.050 | ||||||||

| Fourth Quarter | $ | 30.77 | $ | 28.00 | $ | 0.060 | ||||||||

2007 | ||||||||||||||

| First Quarter | $ | 29.02 | $ | 26.72 | $ | 0.060 | ||||||||

| Second Quarter | $ | 28.59 | $ | 25.03 | $ | 0.060 | ||||||||

| Third Quarter | $ | 29.15 | $ | 24.65 | $ | 0.060 | ||||||||

| Fourth Quarter | $ | 27.71 | $ | 23.10 | $ | 0.070 | ||||||||

| Plan Category | Number of Securities to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of securities remaining available for future issuance under equity compensation plans | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by shareholders | 1,253,468 | $ | 12.49 | 14,333,146 | ||||||||||

| Equity compensation plans not approved by shareholders | — | — | — | |||||||||||

| Total | 1,253,468 | $ | 12.49 | 14,333,146 | ||||||||||

| FISCAL YEAR ENDING | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

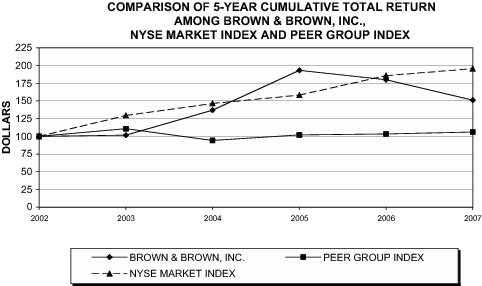

| COMPANY/INDEX/MARKET | 12/31/2002 | 12/31/2003 | 12/31/2004 | 12/30/2005 | 12/29/2006 | 12/31/2007 | |||||||||||||||||||||

| Brown & Brown Inc | 100.00 | 101.68 | 136.78 | 193.26 | 179.78 | 151.19 | |||||||||||||||||||||

| Customer Selected Stock List | 100.00 | 110.96 | 94.31 | 101.93 | 103.31 | 106.16 | |||||||||||||||||||||

| NYSE Market Index | 100.00 | 129.55 | 146.29 | 158.37 | 185.55 | 195.46 | |||||||||||||||||||||

| (in thousands, except per share data, number of employees and percentages)(1) | Year Ended December 31, | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | | 2006 | | 2005 | | 2004 | | 2003 | |||||||||||||||

REVENUES | |||||||||||||||||||||||

Commissions & fees(2) | $ | 914,650 | $ | 864,663 | $ | 775,543 | $ | 638,267 | $ | 545,287 | |||||||||||||

| Investment income | 30,494 | 11,479 | 6,578 | 2,715 | 1,428 | ||||||||||||||||||

| Other income, net | 14,523 | 1,862 | 3,686 | 5,952 | 4,325 | ||||||||||||||||||

| Total revenues | 959,667 | 878,004 | 785,807 | 646,934 | 551,040 | ||||||||||||||||||

EXPENSES | |||||||||||||||||||||||

| Employee compensation and benefits | �� | 444,101 | 404,891 | 374,943 | 314,221 | 268,372 | |||||||||||||||||

| Non-cash stock-based compensation | 5,667 | 5,416 | 3,337 | 2,625 | 2,272 | ||||||||||||||||||

| Other operating expenses | 131,371 | 126,492 | 105,622 | 84,927 | 74,617 | ||||||||||||||||||

| Amortization | 40,436 | 36,498 | 33,245 | 22,146 | 17,470 | ||||||||||||||||||

| Depreciation | 12,763 | 11,309 | 10,061 | 8,910 | 8,203 | ||||||||||||||||||

| Interest | 13,802 | 13,357 | 14,469 | 7,156 | 3,624 | ||||||||||||||||||

| Total expenses | 648,140 | 597,963 | 541,677 | 439,985 | 374,558 | ||||||||||||||||||

| Income before income taxes | 311,527 | 280,041 | 244,130 | 206,949 | 176,482 | ||||||||||||||||||

| Income taxes | 120,568 | 107,691 | 93,579 | 78,106 | 66,160 | ||||||||||||||||||

| Net income | $ | 190,959 | $ | 172,350 | $ | 150,551 | $ | 128,843 | $ | 110,322 | |||||||||||||

EARNINGS PER SHARE INFORMATION | |||||||||||||||||||||||

| Net income per share — diluted | $ | 1.35 | $ | 1.22 | $ | 1.08 | $ | 0.93 | $ | 0.80 | |||||||||||||

| Weighted average number of shares outstanding — diluted | 141,257 | 141,020 | 139,776 | 138,888 | 137,794 | ||||||||||||||||||

| Dividends declared per share | $ | 0.2500 | $ | 0.2100 | $ | 0.1700 | $ | 0.1450 | $ | 0.1213 | |||||||||||||

YEAR-END FINANCIAL POSITION | |||||||||||||||||||||||

| Total assets | $ | 1,960,659 | $ | 1,807,952 | $ | 1,608,660 | $ | 1,249,517 | $ | 865,854 | |||||||||||||

| Long-term debt | $ | 227,707 | $ | 226,252 | $ | 214,179 | $ | 227,063 | $ | 41,107 | |||||||||||||

Shareholders’ equity(3) | $ | 1,097,458 | $ | 929,345 | $ | 764,344 | $ | 624,325 | $ | 498,035 | |||||||||||||

| Total shares outstanding | 140,673 | 140,016 | 139,383 | 138,318 | 137,122 | ||||||||||||||||||

OTHER INFORMATION | |||||||||||||||||||||||

| Number of full-time equivalent employees | 5,047 | 4,733 | 4,540 | 3,960 | 3,517 | ||||||||||||||||||

| Revenue per average number of employees | $ | 196,251 | $ | 189,368 | $ | 184,896 | $ | 173,046 | $ | 159,699 | |||||||||||||

| Book value per share at year-end | $ | 7.80 | $ | 6.64 | $ | 5.48 | $ | 4.51 | $ | 3.63 | |||||||||||||

| Stock price at year-end | $ | 23.50 | $ | 28.21 | $ | 30.54 | $ | 21.78 | $ | 16.31 | |||||||||||||

| Stock price earnings multiple at year-end | 17.41 | 23.12 | 28.35 | 23.41 | 20.38 | ||||||||||||||||||

| Return on beginning shareholders’ equity | 21 | % | 23 | % | 24 | % | 26 | % | 28 | % | |||||||||||||

| (1) | All share and per share information has been restated to give effect to a two-for-one common stock split that became effective November 28, 2005. |

| (2) | See Note 2 to the Consolidated Financial Statements for information regarding business combination transactions which impact the comparability of this information. |

| (3) | Shareholders’ equity as of December 31, 2007, 2006, 2005, 2004 and 2003 included net increases of $13,000, $9,144,000, $4,446,000, $4,467,000 and $4,227,000, respectively, as a result of the Company’s applications of Statement of Financial Accounting Standards (“SFAS”) 115, “Accounting for Certain Investments in Debt and Equity Securities,” and SFAS 133, “Accounting for Derivatives Instruments and Hedging Activities.” |

| 2007 | Percent Change | 2006 | Percent Change | 2005 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

REVENUES | ||||||||||||||||||||||

| Commissions and fees | $ | 857,027 | 4.1 | % | $ | 823,615 | 11.2 | % | $ | 740,567 | ||||||||||||

| Profit-sharing contingent commissions | 57,623 | 40.4 | % | 41,048 | 17.4 | % | 34,976 | |||||||||||||||

| Investment income | 30,494 | 165.7 | % | 11,479 | 74.5 | % | 6,578 | |||||||||||||||

| Other income, net | 14,523 | 680.0 | % | 1,862 | (49.5 | )% | 3,686 | |||||||||||||||

| Total revenues | 959,667 | 9.3 | % | 878,004 | 11.7 | % | 785,807 | |||||||||||||||

EXPENSES | ||||||||||||||||||||||

| Employee compensation and benefits | 444,101 | 9.7 | % | 404,891 | 8.0 | % | 374,943 | |||||||||||||||

| Non-cash stock-based compensation | 5,667 | 4.6 | % | 5,416 | 62.3 | % | 3,337 | |||||||||||||||

| Other operating expenses | 131,371 | 3.9 | % | 126,492 | 19.8 | % | 105,622 | |||||||||||||||

| Amortization | 40,436 | 10.8 | % | 36,498 | 9.8 | % | 33,245 | |||||||||||||||

| Depreciation | 12,763 | 12.9 | % | 11,309 | 12.4 | % | 10,061 | |||||||||||||||

| Interest | 13,802 | 3.3 | % | 13,357 | (7.7 | )% | 14,469 | |||||||||||||||

| Total expenses | 648,140 | 8.4 | % | 597,963 | 10.4 | % | 541,677 | |||||||||||||||

| Income before income taxes | $ | 311,527 | 11.2 | % | $ | 280,041 | 14.7 | % | $ | 244,130 | ||||||||||||

| Net internal growth rate — core commissions and fees | (3.4 | )% | 4.0 | % | 3.1 | % | ||||||||||||||||

| Employee compensation and benefits ratio | 46.3 | % | 46.1 | % | 47.7 | % | ||||||||||||||||

| Other operating expenses ratio | 13.7 | % | 14.4 | % | 13.4 | % | ||||||||||||||||

| Capital expenditures | $ | 30,643 | $ | 14,979 | $ | 13,426 | ||||||||||||||||

| Total assets at December 31 | $ | 1,960,659 | $ | 1,807,952 | $ | 1,608,660 | ||||||||||||||||

| 2007 | For the years ended December 31, | |||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | 2006 | Total Net Change | Total Net Growth % | Less Acquisition Revenues | Internal Net Growth $ | Internal Net Growth % | ||||||||||||||||||||||||

| Florida Retail | $ | 175,330 | $ | 175,205 | $ | 125 | 0.1 | % | $ | 3,108 | $ | (2,983 | ) | (1.7)% | ||||||||||||||||

| National Retail | 242,762 | 202,763 | 39,999 | 19.7 | % | 40,808 | (809 | ) | (0.4)% | |||||||||||||||||||||

| Western Retail | 95,357 | 101,386 | (6,029 | ) | (5.9 | )% | 436 | (6,465 | ) | (6.4)% | ||||||||||||||||||||

Total Retail(1) | 513,449 | 479,354 | 34,095 | 7.1 | % | 44,352 | (10,257 | ) | (2.1)% | |||||||||||||||||||||

Wholesale Brokerage | 156,978 | 151,278 | 5,700 | 3.8 | % | 15,221 | (9,521 | ) | (6.3)% | |||||||||||||||||||||

| Professional Programs | 42,348 | 40,867 | 1,481 | 3.6 | % | 423 | 1,058 | 2.6% | ||||||||||||||||||||||

| Special Programs | 108,747 | 113,141 | (4,394 | ) | (3.9 | )% | 5,357 | (9,751 | ) | (8.6)% | ||||||||||||||||||||

Total National Programs | 151,095 | 154,008 | (2,913 | ) | (1.9 | )% | 5,780 | (8,693 | ) | (5.6)% | ||||||||||||||||||||

Services | 35,505 | 32,561 | 2,944 | 9.0 | % | 2,328 | 616 | 1.9% | ||||||||||||||||||||||

Total Core Commissions and Fees | $ | 857,027 | $ | 817,201 | $ | 39,826 | 4.9 | % | $ | 67,681 | $ | (27,855 | ) | (3.4)% | ||||||||||||||||

| For the years ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | 2006 | ||||||||||

| Total core commissions and fees | $ | 857,027 | $ | 817,201 | |||||||

| Profit-sharing contingent commissions | 57,623 | 41,048 | |||||||||

| Divested business | — | 6,414 | |||||||||

| Total commission & fees | $ | 914,650 | $ | 864,663 | |||||||

| 2006 | For the years ended December 31, | |||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2006 | 2005 | Total Net Change | Total Net Growth % | Less Acquisition Revenues | Internal Net Growth $ | Internal Net Growth % | ||||||||||||||||||||||||

| Florida Retail | $ | 175,885 | $ | 155,741 | $ | 20,144 | 12.9 | % | $ | 493 | $ | 19,651 | 12.6 | % | ||||||||||||||||

| National Retail | 206,661 | 198,033 | 8,628 | 4.4 | % | 11,417 | (2,789 | ) | (1.4 | )% | ||||||||||||||||||||

| Western Retail | 103,222 | 103,951 | (729 | ) | (0.7 | )% | 4,760 | (5,489 | ) | (5.3 | )% | |||||||||||||||||||

Total Retail(1) | 485,768 | 457,725 | 28,043 | 6.1 | % | 16,670 | 11,373 | 2.5 | % | |||||||||||||||||||||

Wholesale Brokerage | 151,278 | 120,889 | 30,389 | 25.1 | % | 25,616 | 4,773 | 3.9 | % | |||||||||||||||||||||

| Professional Programs | 40,867 | 41,930 | (1,063 | ) | (2.5 | )% | 43 | (1,106 | ) | (2.6 | )% | |||||||||||||||||||

| Special Programs | 113,141 | 90,933 | 22,208 | 24.4 | % | 9,255 | 12,953 | 14.2 | % | |||||||||||||||||||||

Total National Programs | 154,008 | 132,863 | 21,145 | 15.9 | % | 9,298 | 11,847 | 8.9 | % | |||||||||||||||||||||

Services | 32,561 | 26,565 | 5,996 | 22.6 | % | 4,496 | 1,500 | 5.6 | % | |||||||||||||||||||||

Total Core Commissions and Fees | $ | 823,615 | $ | 738,042 | $ | 85,573 | 11.6 | % | $ | 56,080 | $ | 29,493 | 4.0 | % | ||||||||||||||||

| For the years ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2006 | 2005 | ||||||||||

| Total core commissions and fees | $ | 823,615 | $ | 738,042 | |||||||

| Profit-sharing contingent commissions | 41,048 | 34,976 | |||||||||

| Divested business | — | 2,525 | |||||||||

| Total commission & fees | $ | 864,663 | $ | 775,543 | |||||||

| 2005 | For the years ended December 31, | |||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 | 2004 | Total Net Change | Total Net Growth % | Less Acquisition Revenues | Internal Net Growth $ | Internal Net Growth % | ||||||||||||||||||||||||

| Florida Retail | $ | 155,973 | $ | 140,895 | $ | 15,078 | 10.7 | % | $ | 5,694 | $ | 9,384 | 6.7 | % | ||||||||||||||||

| National Retail | 201,112 | 182,098 | 19,014 | 10.4 | % | 20,540 | (1,526 | ) | (0.8 | )% | ||||||||||||||||||||

| Western Retail | 104,879 | 107,529 | (2,650 | ) | (2.5 | )% | 2,699 | (5,349 | ) | (5.0 | )% | |||||||||||||||||||

Total Retail(1) | 461,964 | 430,522 | 31,442 | 7.3 | % | 28,933 | 2,509 | 0.6 | % | |||||||||||||||||||||

Wholesale Brokerage | 120,889 | 38,080 | 82,809 | 217.5 | % | 73,317 | 9,492 | 24.9 | % | |||||||||||||||||||||

| Professional Programs | 41,861 | 42,463 | (602 | ) | (1.4 | )% | 715 | (1,317 | ) | (3.1 | )% | |||||||||||||||||||

| Special Programs | 89,288 | 66,601 | 22,687 | 34.1 | % | 17,155 | 5,532 | 8.3 | % | |||||||||||||||||||||

Total National Programs | 131,149 | 109,064 | 22,085 | 20.2 | % | 17,870 | 4,215 | 3.9 | % | |||||||||||||||||||||

Services | 26,565 | 24,334 | 2,231 | 9.2 | % | — | 2,231 | 9.2 | % | |||||||||||||||||||||

Total Core Commissions and Fees | $ | 740,567 | $ | 602,000 | $ | 138,567 | 23.0 | % | $ | 120,120 | $ | 18,447 | 3.1 | % | ||||||||||||||||

| For the years ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 | 2004 | ||||||||||

| Total core commissions and fees | $ | 740,567 | $ | 602,000 | |||||||

| Profit-sharing contingent commissions | 34,976 | 30,652 | |||||||||

| Divested business | — | 5,615 | |||||||||

| Total commission & fees | $ | 775,543 | $ | 638,267 | |||||||

| (1) | The Retail segment includes commissions and fees reported in the “Other” column of the Segment Information in Note 16 which includes corporate and consolidation items. |

| 2007 | Percent Change | 2006 | Percent Change | 2005 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

REVENUES | ||||||||||||||||||||||

| Commissions and fees | $ | 514,639 | 5.8 | % | $ | 486,419 | 5.5 | % | $ | 461,236 | ||||||||||||

| Profit-sharing contingent commissions | 33,399 | 11.1 | % | 30,070 | 6.1 | % | 28,330 | |||||||||||||||

| Investment income | 260 | 87.1 | % | 139 | (12.6 | )% | 159 | |||||||||||||||

| Other income, net | 14,140 | NMF% | 1,361 | (7.9 | )% | 1,477 | ||||||||||||||||

| Total revenues | 562,438 | 8.6 | % | 517,989 | 5.5 | % | 491,202 | |||||||||||||||

EXPENSES | ||||||||||||||||||||||

| Employee compensation and benefits | 263,056 | 8.5 | % | 242,469 | 4.0 | % | 233,124 | |||||||||||||||

| Non-cash stock-based compensation | 3,243 | 9.0 | % | 2,976 | 35.4 | % | 2,198 | |||||||||||||||

| Other operating expenses | 88,359 | 6.5 | % | 82,966 | 2.3 | % | 81,063 | |||||||||||||||

| Amortization | 21,659 | 12.2 | % | 19,305 | (0.3 | )% | 19,368 | |||||||||||||||

| Depreciation | 5,723 | 1.8 | % | 5,621 | (0.4 | )% | 5,641 | |||||||||||||||

| Interest | 21,094 | 11.6 | % | 18,903 | (9.7 | )% | 20,927 | |||||||||||||||

| Total expenses | 403,134 | 8.3 | % | 372,240 | 2.7 | % | 362,321 | |||||||||||||||

| Income before income taxes | $ | 159,304 | 9.3 | % | $ | 145,749 | 13.1 | % | $ | 128,881 | ||||||||||||

| Net internal growth rate — core commissions and fees | (2.1 | )% | 2.5 | % | 0.6 | % | ||||||||||||||||

| Employee compensation and benefits ratio | 46.8 | % | 46.8 | % | 47.5 | % | ||||||||||||||||

| Other operating expenses ratio | 15.7 | % | 16.0 | % | 16.5 | % | ||||||||||||||||

| Capital expenditures | $ | 5,816 | $ | 5,952 | $ | 6,186 | ||||||||||||||||

| Total assets at December 31 | $ | 1,356,772 | $ | 1,103,107 | $ | 1,002,781 | ||||||||||||||||

| 2007 | Percent Change | 2006 | Percent Change | 2005 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

REVENUES | ||||||||||||||||||||||

| Commissions and fees | $ | 156,978 | 3.8 | % | $ | 151,278 | 25.1 | % | $ | 120,889 | ||||||||||||

| Profit-sharing contingent commissions | 18,311 | 129.2 | % | 7,990 | 71.9 | % | 4,648 | |||||||||||||||

| Investment income | 2,927 | (27.1 | )% | 4,017 | 151.2 | % | 1,599 | |||||||||||||||

| Other income (loss), net | 726 | NMF% | 61 | (365.2 | )% | (23 | ) | |||||||||||||||

| Total revenues | 178,942 | 9.5 | % | 163,346 | 28.5 | % | 127,113 | |||||||||||||||

EXPENSES | ||||||||||||||||||||||

| Employee compensation and benefits | 87,500 | 11.5 | % | 78,459 | 32.0 | % | 59,432 | |||||||||||||||

| Non-cash stock-based compensation | 791 | 52.4 | % | 519 | 216.5 | % | 164 | |||||||||||||||

| Other operating expenses | 31,522 | 10.3 | % | 28,582 | 44.3 | % | 19,808 | |||||||||||||||

| Amortization | 9,237 | 14.2 | % | 8,087 | 42.6 | % | 5,672 | |||||||||||||||

| Depreciation | 2,715 | 30.8 | % | 2,075 | 61.5 | % | 1,285 | |||||||||||||||

| Interest | 19,188 | 2.3 | % | 18,759 | 50.7 | % | 12,446 | |||||||||||||||

| Total expenses | 150,953 | 10.6 | % | 136,481 | 38.1 | % | 98,807 | |||||||||||||||

| Income before income taxes | $ | 27,989 | 4.2 | % | $ | 26,865 | (5.1 | )% | $ | 28,306 | ||||||||||||

| Net internal growth rate — core commissions and fees | (6.3 | )% | 3.9 | % | 24.9 | % | ||||||||||||||||

| Employee compensation and benefits ratio | 48.9 | % | 48.0 | % | 46.8 | % | ||||||||||||||||

| Other operating expenses ratio | 17.6 | % | 17.5 | % | 15.6 | % | ||||||||||||||||

| Capital expenditures | $ | 2,835 | $ | 2,085 | $ | 1,969 | ||||||||||||||||

| Total assets at December 31 | $ | 640,931 | $ | 618,374 | $ | 476,653 | ||||||||||||||||

| 2007 | Percent Change | 2006 | Percent Change | 2005 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

REVENUES | ||||||||||||||||||||||

| Commissions and fees | $ | 151,095 | (1.9 | )% | $ | 154,008 | 17.4 | % | $ | 131,149 | ||||||||||||

| Profit-sharing contingent commissions | 5,913 | 97.9 | % | 2,988 | 49.5 | % | 1,998 | |||||||||||||||

| Investment income | 513 | 18.8 | % | 432 | 17.7 | % | 367 | |||||||||||||||

| Other income, net | 27 | 35.0 | % | 20 | (95.2 | )% | 416 | |||||||||||||||

| Total revenues | 157,548 | 0.1 | % | 157,448 | 17.6 | % | 133,930 | |||||||||||||||

EXPENSES | ||||||||||||||||||||||

| Employee compensation and benefits | 62,755 | 3.4 | % | 60,692 | 11.9 | % | 54,238 | |||||||||||||||

| Non-cash stock-based compensation | 801 | 53.2 | % | 523 | 45.7 | % | 359 | |||||||||||||||

| Other operating expenses | 25,084 | (3.6 | )% | 26,014 | 27.4 | % | 20,414 | |||||||||||||||

| Amortization | 9,039 | 3.7 | % | 8,718 | 7.6 | % | 8,103 | |||||||||||||||

| Depreciation | 2,757 | 15.5 | % | 2,387 | 19.5 | % | 1,998 | |||||||||||||||

| Interest | 9,977 | (5.5 | )% | 10,554 | 1.2 | % | 10,433 | |||||||||||||||

| Total expenses | 110,413 | 1.4 | % | 108,888 | 14.0 | % | 95,545 | |||||||||||||||

| Income before income taxes | $ | 47,135 | (2.9 | )% | $ | 48,560 | 26.5 | % | $ | 38,385 | ||||||||||||

| Net internal growth rate — core commissions and fees | (5.6 | )% | 8.9 | % | 3.9 | % | ||||||||||||||||

| Employee compensation and benefits ratio | 39.8 | % | 38.5 | % | 40.5 | % | ||||||||||||||||

| Other operating expenses ratio | 15.9 | % | 16.5 | % | 15.2 | % | ||||||||||||||||

| Capital expenditures | $ | 1,831 | $ | 3,750 | $ | 3,067 | ||||||||||||||||

| Total assets at December 31 | $ | 570,295 | $ | 544,272 | $ | 445,146 | ||||||||||||||||

| 2007 | Percent Change | 2006 | Percent Change | 2005 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

REVENUES | ||||||||||||||||||||||

| Commissions and fees | $ | 35,505 | 9.0 | % | $ | 32,561 | 22.6 | % | $ | 26,565 | ||||||||||||

| Profit-sharing contingent commissions | — | — | — | — | — | |||||||||||||||||

| Investment income | 31 | (31.1 | )% | 45 | — | — | ||||||||||||||||

| Other (loss) income net | (144 | ) | (100.0 | )% | — | (100.0 | )% | 952 | ||||||||||||||

| Total revenues | 35,392 | 8.5 | % | 32,606 | 18.5 | % | 27,517 | |||||||||||||||

EXPENSES | ||||||||||||||||||||||

| Employee compensation and benefits | 19,416 | 7.0 | % | 18,147 | 16.5 | % | 15,582 | |||||||||||||||

| Non-cash stock-based compensation | 139 | 17.8 | % | 118 | (3.3 | )% | 122 | |||||||||||||||

| Other operating expenses | 5,467 | 8.0 | % | 5,062 | 16.7 | % | 4,339 | |||||||||||||||

| Amortization | 462 | 34.7 | % | 343 | 697.7 | % | 43 | |||||||||||||||

| Depreciation | 534 | 0.2 | % | 533 | 22.5 | % | 435 | |||||||||||||||

| Interest | 719 | 63.4 | % | 440 | NMF | % | 4 | |||||||||||||||

| Total expenses | 26,737 | 8.5 | % | 24,643 | 20.1 | % | 20,525 | |||||||||||||||

| Income before income taxes | $ | 8,655 | 8.7 | % | $ | 7,963 | 13.9 | % | $ | 6,992 | ||||||||||||

| Net internal growth rate — core commissions and fees | 1.9 | % | 5.6 | % | 9.2 | % | ||||||||||||||||

| Employee compensation and benefits ratio | 54.9 | % | 55.7 | % | 56.6 | % | ||||||||||||||||

| Other operating expenses ratio | 15.4 | % | 15.5 | % | 15.8 | % | ||||||||||||||||

| Capital expenditures | $ | 318 | $ | 588 | $ | 350 | ||||||||||||||||

| Total assets at December 31 | $ | 41,233 | $ | 32,554 | $ | 18,766 | ||||||||||||||||

| (in thousands, except per share data) | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | ||||||||||||||||||

| Total revenues | $ | 258,513 | $ | 246,644 | $ | 237,284 | $ | 217,226 | ||||||||||

| Income before income taxes | $ | 98,102 | $ | 84,496 | $ | 75,435 | $ | 53,494 | ||||||||||

| Net income | $ | 59,727 | $ | 52,012 | $ | 46,216 | $ | 33,004 | ||||||||||

| Net income per share: | ||||||||||||||||||

| Basic | $ | 0.43 | $ | 0.37 | $ | 0.33 | $ | 0.23 | ||||||||||

| Diluted | $ | 0.42 | $ | 0.37 | $ | 0.33 | $ | 0.23 | ||||||||||

| 2006 | ||||||||||||||||||

| Total revenues | $ | 230,582 | $ | 220,807 | $ | 211,965 | $ | 214,650 | ||||||||||

| Income before income taxes | $ | 81,436 | $ | 70,967 | $ | 65,565 | $ | 62,073 | ||||||||||

| Net income | $ | 50,026 | $ | 44,431 | $ | 40,270 | $ | 37,623 | ||||||||||

| Net income per share: | ||||||||||||||||||

| Basic | $ | 0.36 | $ | 0.32 | $ | 0.29 | $ | 0.27 | ||||||||||

| Diluted | $ | 0.36 | $ | 0.32 | $ | 0.29 | $ | 0.27 | ||||||||||

| (in thousands) | Total | Less Than 1 Year | 1-3 Years | 4-5 Years | After 5 Years | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Long-term debt | $ | 239,147 | $ | 11,443 | $ | 2,645 | $ | 100,059 | $ | 125,000 | ||||||||||||

| Capital lease obligations | 79 | 76 | 3 | — | — | |||||||||||||||||

| Other long-term liabilities | 13,635 | 11,229 | 320 | 428 | 1,658 | |||||||||||||||||

| Operating leases | 95,055 | 24,553 | 38,242 | 19,298 | 12,962 | |||||||||||||||||

| Interest obligations | 73,214 | 13,123 | 26,156 | 18,936 | 14,999 | |||||||||||||||||

| Unrecognized tax benefits | 507 | — | 507 | — | — | |||||||||||||||||

| Maximum future acquisition contingency payments | 226,206 | 120,985 | 68,332 | 36,889 | — | |||||||||||||||||

| Total contractual cash obligations | $ | 647,843 | $ | 181,409 | $ | 136,205 | $ | 175,610 | $ | 154,619 | ||||||||||||

| Page No. | ||||||

|---|---|---|---|---|---|---|

| Consolidated Statements of Income for the years ended December 31, 2007, 2006 and 2005 | 41 | |||||

| Consolidated Balance Sheets as of December 31, 2007 and 2006 | 42 | |||||

| Consolidated Statements of Shareholders’ Equity for the years ended December 31, 2007, 2006 and 2005 | 43 | |||||

| Consolidated Statements of Cash Flows for the years ended December 31, 2007, 2006 and 2005 | 44 | |||||

| Notes to Consolidated Financial Statements for the years ended December 31, 2007, 2006 and 2005 | 45 | |||||

| Note 1: Summary of Significant Accounting Policies | 45 | |||||

| Note 2: Business Combinations | 51 | |||||

| Note 3: Goodwill | 54 | |||||

| Note 4: Amortizable Intangible Assets | 54 | |||||

| Note 5: Investments | 55 | |||||

| Note 6: Fixed Assets | 55 | |||||

| Note 7: Accrued Expenses | 56 | |||||

| Note 8: Long-Term Debt | 56 | |||||

| Note 9: Income Taxes | 57 | |||||

| Note 10: Employee Savings Plan | 59 | |||||

| Note 11: Stock-Based Compensation | 59 | |||||

| Note 12: Supplemental Disclosures of Cash Flow Information | 62 | |||||

| Note 13: Commitments and Contingencies | 63 | |||||

| Note 14: Business Concentrations | 65 | |||||

| Note 15: Quarterly Operating Results (Unaudited) | 66 | |||||

| Note 16: Segment Information | 66 | |||||

| Note 17: Subsequent Events | 67 | |||||

| Report of Independent Registered Public Accounting Firm | 69 | |||||

| Management’s Report on Internal Control Over Financial Reporting | 70 | |||||

| Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) | 2007 | 2006 | 2005 | ||||||||||||

REVENUES | |||||||||||||||

| Commissions and fees | $ | 914,650 | $ | 864,663 | $ | 775,543 | |||||||||

| Investment income | 30,494 | 11,479 | 6,578 | ||||||||||||

| Other income, net | 14,523 | 1,862 | 3,686 | ||||||||||||

| Total revenues | 959,667 | 878,004 | 785,807 | ||||||||||||

EXPENSES | |||||||||||||||

| Employee compensation and benefits | 444,101 | 404,891 | 374,943 | ||||||||||||

| Non-cash stock-based compensation | 5,667 | 5,416 | 3,337 | ||||||||||||

| Other operating expenses | 131,371 | 126,492 | 105,622 | ||||||||||||

| Amortization | 40,436 | 36,498 | 33,245 | ||||||||||||

| Depreciation | 12,763 | 11,309 | 10,061 | ||||||||||||

| Interest | 13,802 | 13,357 | 14,469 | ||||||||||||

| Total expenses | 648,140 | 597,963 | 541,677 | ||||||||||||

| Income before income taxes | 311,527 | 280,041 | 244,130 | ||||||||||||

| Income taxes | 120,568 | 107,691 | 93,579 | ||||||||||||

| Net income | $ | 190,959 | $ | 172,350 | $ | 150,551 | |||||||||

| Net income per share: | |||||||||||||||

| Basic | $ | 1.36 | $ | 1.23 | $ | 1.09 | |||||||||

| Diluted | $ | 1.35 | $ | 1.22 | $ | 1.08 | |||||||||

| Weighted average number of shares outstanding: | |||||||||||||||

| Basic | 140,476 | 139,634 | 138,563 | ||||||||||||

| Diluted | 141,257 | 141,020 | 139,776 | ||||||||||||

| Dividends declared per share | $ | 0.25 | $ | 0.21 | $ | 0.17 | |||||||||

| At December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) | 2007 | 2006 | |||||||||

ASSETS | |||||||||||

| Current Assets: | |||||||||||

| Cash and cash equivalents | $ | 38,234 | $ | 88,490 | |||||||

| Restricted cash and investments | 254,404 | 242,187 | |||||||||

| Short-term investments | 2,892 | 2,909 | |||||||||

| Premiums, commissions and fees receivable | 240,680 | 282,440 | |||||||||

| Deferred income taxes | 17,208 | — | |||||||||

| Other current assets | 33,964 | 32,180 | |||||||||

| Total current assets | 587,382 | 648,206 | |||||||||

| Fixed assets, net | 62,327 | 44,170 | |||||||||

| Goodwill | 846,433 | 684,521 | |||||||||

| Amortizable intangible assets, net | 443,224 | 396,069 | |||||||||

| Investments | 355 | 15,826 | |||||||||

| Other assets | 20,938 | 19,160 | |||||||||

| Total assets | $ | 1,960,659 | $ | 1,807,952 | |||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||

| Current Liabilities: | |||||||||||

| Premiums payable to insurance companies | $ | 394,034 | $ | 435,449 | |||||||

| Premium deposits and credits due customers | 41,211 | 33,273 | |||||||||

| Accounts payable | 18,760 | 17,854 | |||||||||

| Accrued expenses | 90,599 | 86,009 | |||||||||

| Current portion of long-term debt | 11,519 | 18,082 | |||||||||

| Total current liabilities | 556,123 | 590,667 | |||||||||

| Long-term debt | 227,707 | 226,252 | |||||||||

| Deferred income taxes, net | 65,736 | 49,721 | |||||||||

| Other liabilities | 13,635 | 11,967 | |||||||||

| Commitments and contingencies (Note 13) | |||||||||||

| Shareholders’ Equity: | |||||||||||

| Common stock, par value $0.10 per share; authorized 280,000 shares; issued and outstanding 140,673 at 2007 and 140,016 at 2006 | 14,067 | 14,002 | |||||||||

| Additional paid-in capital | 231,888 | 210,543 | |||||||||

| Retained earnings | 851,490 | 695,656 | |||||||||

| Accumulated other comprehensive income, net of related income tax effect of $8 at 2007 and $5,359 at 2006 | 13 | 9,144 | |||||||||

| Total shareholders’ equity | 1,097,458 | 929,345 | |||||||||

| Total liabilities and shareholders’ equity | $ | 1,960,659 | $ | 1,807,952 | |||||||

| Common Stock | ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) | Shares Outstanding | Par Value | Additional Paid-In Capital | Retained Earnings | Accumulated Other Comprehensive Income | Total | ||||||||||||||||||||

| Balance at January 1, 2005 | 138,318 | $ | 13,832 | $ | 180,364 | $ | 425,662 | $ | 4,467 | $ | 624,325 | |||||||||||||||

| Net income | 150,551 | 150,551 | ||||||||||||||||||||||||

| Net unrealized holding loss on available-for-sale securities | (512 | ) | (512 | ) | ||||||||||||||||||||||

| Net gain on cash-flow hedging derivative | 491 | 491 | ||||||||||||||||||||||||

| Comprehensive income | 150,530 | |||||||||||||||||||||||||

| Common stock issued for employee stock benefit plans | 1,057 | 105 | 12,769 | 12,874 | ||||||||||||||||||||||

| Common stock issued to directors | 8 | 1 | 180 | 181 | ||||||||||||||||||||||

| Cash dividends paid ($0.17 per share) | (23,566 | ) | (23,566 | ) | ||||||||||||||||||||||

Balance at December 31, 2005 | 139,383 | 13,938 | 193,313 | 552,647 | 4,446 | 764,344 | ||||||||||||||||||||

| Net income | 172,350 | 172,350 | ||||||||||||||||||||||||

| Net unrealized holding gain on available-for-sale securities | 4,697 | 4,697 | ||||||||||||||||||||||||

| Net gain on cash-flow hedging derivative | 1 | 1 | ||||||||||||||||||||||||

| Comprehensive income | 177,048 | |||||||||||||||||||||||||

| Common stock issued for employee stock benefit plans | 624 | 62 | 16,372 | 16,434 | ||||||||||||||||||||||

| Income tax benefit from exercise of stock options | 604 | 604 | ||||||||||||||||||||||||

| Common stock issued to directors | 9 | 2 | 254 | 256 | ||||||||||||||||||||||

| Cash dividends paid ($0.21 per share) | (29,341 | ) | (29,341 | ) | ||||||||||||||||||||||

Balance at December 31, 2006 | 140,016 | 14,002 | 210,543 | 695,656 | 9,144 | 929,345 | ||||||||||||||||||||

| Net income | 190,959 | 190,959 | ||||||||||||||||||||||||

| Net unrealized holding gain on available-for-sale securities less amounts realized from sales in the current year | (9,093 | ) | (9,093 | ) | ||||||||||||||||||||||

| Net loss on cash-flow hedging derivative | (38 | ) | (38 | ) | ||||||||||||||||||||||

| Comprehensive income | 181,828 | |||||||||||||||||||||||||

| Common stock issued for employee stock benefit plans | 647 | 64 | 16,495 | 16,559 | ||||||||||||||||||||||

| Income tax benefit from exercise of stock options | 4,564 | 4,564 | ||||||||||||||||||||||||

| Common stock issued to directors | 10 | 1 | 286 | 287 | ||||||||||||||||||||||

| Cash dividends paid ($0.25 per share) | (35,125 | ) | (35,125 | ) | ||||||||||||||||||||||

Balance at December 31, 2007 | 140,673 | $ | 14,067 | $ | 231,888 | $ | 851,490 | $ | 13 | $ | 1,097,458 | |||||||||||||||

| Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) | 2007 | 2006 | 2005 | ||||||||||||

Cash flows from operating activities: | |||||||||||||||

| Net income | $ | 190,959 | $ | 172,350 | $ | 150,551 | |||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||||

| Amortization | 40,436 | 36,498 | 33,245 | ||||||||||||

| Depreciation | 12,763 | 11,309 | 10,061 | ||||||||||||

| Non-cash stock-based compensation | 5,667 | 5,416 | 3,337 | ||||||||||||

| Deferred income taxes | 325 | 11,480 | 10,642 | ||||||||||||

| Net gain on sales of investments, fixed assets and customer accounts | (30,944 | ) | (781 | ) | (2,478 | ) | |||||||||

| Changes in operating assets and liabilities, net of effect from acquisitions and divestitures: | |||||||||||||||

| Restricted cash and investments (increase) | (12,217 | ) | (12,315 | ) | (82,389 | ) | |||||||||

| Premiums, commissions and fees receivable decrease (increase) | 45,059 | (23,564 | ) | (84,058 | ) | ||||||||||

| Other assets decrease (increase) | 6,357 | (6,301 | ) | 1,072 | |||||||||||

| Premiums payable to insurance companies (decrease) increase | (53,119 | ) | 27,314 | 153,032 | |||||||||||

| Premium deposits and credits due customers increase (decrease) | 6,723 | (754 | ) | 1,754 | |||||||||||

| Accounts payable increase (decrease) | 533 | (3,561 | ) | 4,377 | |||||||||||

| Accrued expenses increase | 2,913 | 8,441 | 14,854 | ||||||||||||

| Other liabilities (decrease) increase | (115 | ) | (318 | ) | 1,088 | ||||||||||

Net cash provided by operating activities | 215,340 | 225,214 | 215,088 | ||||||||||||

Cash flows from investing activities: | |||||||||||||||

| Additions to fixed assets | (30,643 | ) | (14,979 | ) | (13,426 | ) | |||||||||

| Payments for businesses acquired, net of cash acquired | (212,303 | ) | (143,737 | ) | (262,181 | ) | |||||||||

| Proceeds from sales of fixed assets and customer accounts | 6,713 | 1,399 | 2,362 | ||||||||||||

| Purchases of investments | (2,695 | ) | (211 | ) | (299 | ) | |||||||||

| Proceeds from sales of investments | 21,715 | 119 | 896 | ||||||||||||

Net cash used in investing activities | (217,213 | ) | (157,409 | ) | (272,648 | ) | |||||||||

Cash flows from financing activities: | |||||||||||||||

| Proceeds from long-term debt | — | 25,000 | — | ||||||||||||

| Payments on long-term debt | (29,142 | ) | (87,432 | ) | (16,117 | ) | |||||||||

| Borrowings on revolving credit facility | 26,320 | 40,000 | 50,000 | ||||||||||||

| Payments on revolving credit facility | (26,320 | ) | (40,000 | ) | (50,000 | ) | |||||||||

| Income tax benefit from exercise of stock options | 4,564 | 604 | — | ||||||||||||

| Issuances of common stock for employee stock benefit plans | 11,320 | 11,274 | 9,717 | ||||||||||||

| Cash dividends paid | (35,125 | ) | (29,341 | ) | (23,566 | ) | |||||||||

Net cash (used in) provided by financing activities | (48,383 | ) | (79,895 | ) | (29,966 | ) | |||||||||

Net (decrease) increase in cash and cash equivalents | (50,256 | ) | (12,090 | ) | (87,526 | ) | |||||||||

| Cash and cash equivalents at beginning of year | 88,490 | 100,580 | 188,106 | ||||||||||||

Cash and cash equivalents at end of year | $ | 38,234 | $ | 88,490 | $ | 100,580 | |||||||||

| Year Ended December 31, | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) | 2007 | 2006 | 2005 | ||||||||||||

| Net income | $ | 190,959 | $ | 172,350 | $ | 150,551 | |||||||||

| Weighted average number of common shares outstanding | 140,476 | 139,634 | 138,563 | ||||||||||||

| Dilutive effect of stock options using the treasury stock method | 781 | 1,386 | 1,213 | ||||||||||||

| Weighted average number of shares outstanding | 141,257 | 141,020 | 139,776 | ||||||||||||

| Net income per share: | |||||||||||||||

| Basic | $ | 1.36 | $ | 1.23 | $ | 1.09 | |||||||||

| Diluted | $ | 1.35 | $ | 1.22 | $ | 1.08 | |||||||||

| (in thousands, except per share data) | Year Ended December 31, 2005 | |||||

|---|---|---|---|---|---|---|

| Net income as reported | $ | 150,551 | ||||

| Total stock-based employee compensation cost included in the determination of net income, net of related income tax effects | 2,061 | |||||

| Total stock-based employee compensation cost determined under fair value method for all awards, net of related income tax effects | (5,069 | ) | ||||

| Pro forma net income | $ | 147,543 | ||||

| Net income per share: | ||||||

| Basic, as reported | $ | 1.09 | ||||

| Basic, pro forma | $ | 1.06 | ||||

| Diluted, as reported | $ | 1.08 | ||||

| Diluted, pro forma | $ | 1.06 | ||||

| • | Compensation cost for all share-based awards (expected to vest) granted prior to, but not yet vested as of, January 1, 2006, based upon grant-date fair value estimated in accordance with the original provisions of SFAS 123; and |

| • | Compensation cost for all share-based awards (expected to vest) granted during the years ended December 31, 2007 and 2006, based upon grant-date fair value estimated in accordance with the provisions of SFAS 123R. |

| Year Ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) | 2007 | 2006 | |||||||||

| Non-cash stock-based compensation | $ | 17 | $ | (564 | ) | ||||||

| Increase (decrease) in: | |||||||||||

| Provisions for income taxes | 7 | (217 | ) | ||||||||

| Net income | $ | 10 | $ | (347 | ) | ||||||

| Basic earnings per share | $ | — | $ | — | |||||||

| Diluted earnings per share | $ | — | $ | — | |||||||

| Deferred tax liability (asset) | $ | 7 | $ | (217 | ) | ||||||

| Name | Business Segment | 2007 Date of Acquisition | Net Cash Paid | Notes Payable | Recorded Purchase Price | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ALCOS, Inc | Retail | March 1 | $ | 30,916 | $ | 3,563 | $ | 34,479 | ||||||||||||||

| Grinspec, Inc. | Retail | April 1 | 31,952 | — | 31,952 | |||||||||||||||||

| Sobel Affilates Inc. | Retail | April 1 | 33,057 | — | 33,057 | |||||||||||||||||

| The Combined Group, Inc, et al | Wholesale Brokerage | August 1 | 24,059 | — | 24,059 | |||||||||||||||||

| Evergreen Re, Incorporated. | Wholesale Brokerage | December 1 | 11,021 | 2,000 | 13,021 | |||||||||||||||||

| Other | Various | Various | 76,929 | 7,438 | 84,367 | |||||||||||||||||

| Total | $ | 207,934 | $ | 13,001 | $ | 220,935 | ||||||||||||||||

| (in thousands) | ALCOS | Grinspec | Sobel | Combined | Evergreen | Other | Total | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fiduciary cash | $ | 627 | $ | — | $ | — | $ | 2,686 | $ | — | $ | 716 | $ | 4,029 | ||||||||||||||||

| Other current assets | 1,224 | 669 | 286 | — | — | 1,310 | 3,489 | |||||||||||||||||||||||

| Fixed assets | 720 | — | 50 | 212 | 40 | 649 | 1,671 | |||||||||||||||||||||||

| Goodwill | 26,873 | 19,248 | 19,663 | 12,730 | 8,456 | 56,336 | 143,306 | |||||||||||||||||||||||

| Purchased customer accounts | 10,046 | 12,498 | 13,129 | 11,051 | 4,494 | 36,882 | 88,100 | |||||||||||||||||||||||

| Noncompete agreements | 130 | — | 31 | 66 | 31 | 459 | 717 | |||||||||||||||||||||||

| Other Assets | 115 | — | — | — | — | 10 | 125 | |||||||||||||||||||||||

| Total assets acquired | 39,735 | 32,415 | 33,159 | 26,745 | 13,021 | 96,362 | 241,437 | |||||||||||||||||||||||

| Other current liabilities | (2,173 | ) | (463 | ) | (102 | ) | (1,383 | ) | — | (11,246 | ) | (15,367 | ) | |||||||||||||||||

| Deferred income taxes | (3,083 | ) | — | — | — | — | (749 | ) | (3,832 | ) | ||||||||||||||||||||

| Other liabilities | — | — | — | (1,303 | ) | — | — | (1,303 | ) | |||||||||||||||||||||

| Total liabilities assumed | (5,256 | ) | (463 | ) | (102 | ) | (2,686 | ) | — | (11,995 | ) | (20,502 | ) | |||||||||||||||||

| Net assets acquired | $ | 34,479 | $ | 31,952 | $ | 33,057 | $ | 24,059 | $ | 13,021 | $ | 84,367 | $ | 220,935 | ||||||||||||||||

| Year Ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) | 2007 | 2006 | |||||||||

| (UNAUDITED) | |||||||||||

| Total revenues | $ | 1,017,711 | $ | 991,673 | |||||||

| Income before income taxes | $ | 330,525 | $ | 315,223 | |||||||

| Net income | $ | 202,605 | $ | 194,001 | |||||||

| Net income per share: | |||||||||||

| Basic | $ | 1.44 | $ | 1.39 | |||||||

| Diluted | $ | 1.43 | $ | 1.38 | |||||||

| Weighted average number of shares outstanding: | |||||||||||

| Basic | 140,476 | 139,634 | |||||||||

| Diluted | 141,257 | 141,020 | |||||||||

| Name | Business Segment | 2006 Date of Acquisition | Net Cash Paid | Notes Payable | Recorded Purchase Price | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Axiom Intermediaries, LLC | Wholesale Brokerage | January 1 | $ | 60,333 | $ | — | $ | 60,333 | ||||||||||||||

| Delaware Valley Underwriting Agency, Inc., et al (DVUA) | Wholesale Brokerage/ National Programs | September 30 | 46,333 | — | 46,333 | |||||||||||||||||

| Other | Various | Various | 32,029 | 3,696 | 35,725 | |||||||||||||||||

| Total | $ | 138,695 | $ | 3,696 | $ | 142,391 | ||||||||||||||||

| (in thousands) | Axiom | DVUA | Other | Total | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fiduciary cash | $ | 9,598 | $ | — | $ | — | $ | 9,598 | ||||||||||

| Other current assets | 445 | 7 | 567 | 1,019 | ||||||||||||||

| Fixed assets | 435 | 648 | 476 | 1,559 | ||||||||||||||

| Purchased customer accounts | 14,022 | 22,667 | 18,682 | 55,371 | ||||||||||||||

| Noncompete agreements | 31 | 52 | 581 | 664 | ||||||||||||||

| Goodwill | 45,600 | 24,942 | 17,107 | 87,649 | ||||||||||||||

| Other assets | — | 9 | — | 9 | ||||||||||||||

| Total assets acquired | 70,131 | 48,325 | 37,413 | 155,869 | ||||||||||||||

| Other current liabilities | (9,798 | ) | (1,843 | ) | (1,496 | ) | (13,137 | ) | ||||||||||

| Other liabilities | — | (149 | ) | (192 | ) | (341 | ) | |||||||||||

| Total liabilities assumed | (9,798 | ) | (1,992 | ) | (1,688 | ) | (13,478 | ) | ||||||||||

| Net assets acquired | $ | 60,333 | $ | 46,333 | $ | 35,725 | $ | 142,391 | ||||||||||

| Year Ended December 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) | 2006 | 2005 | |||||||||

| (UNAUDITED) | |||||||||||

| Total revenues | $ | 902,345 | $ | 842,698 | |||||||

| Income before income taxes | $ | 288,643 | $ | 263,326 | |||||||

| Net income | $ | 177,644 | $ | 162,389 | |||||||

| Net income per share: | |||||||||||

| Basic | $ | 1.27 | $ | 1.17 | |||||||

| Diluted | $ | 1.26 | $ | 1.16 | |||||||

| Weighted average number of shares outstanding: | |||||||||||

| Basic | 139,634 | 138,563 | |||||||||

| Diluted | 141,020 | 139,776 | |||||||||

| (in thousands) | Retail | Wholesale Brokerage | National Programs | Service | Total | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Balance as of January 1, 2006 | $ | 292,212 | $ | 137,750 | $ | 119,022 | $ | 56 | $ | 549,040 | ||||||||||||

| Goodwill of acquired businesses | 38,681 | 72,115 | 23,307 | 2,767 | 136,870 | |||||||||||||||||

| Goodwill disposed of relating to sales of businesses | (1,389 | ) | — | — | — | (1,389 | ) | |||||||||||||||

| Balance as of December 31, 2006 | 329,504 | 209,865 | 142,329 | 2,823 | 684,521 | |||||||||||||||||

| Goodwill of acquired businesses | 124,322 | 32,865 | 4,619 | 447 | 162,253 | |||||||||||||||||

| Goodwill disposed of relating to sales of businesses | (341 | ) | — | — | — | (341 | ) | |||||||||||||||

| Balance as of December 31, 2007 | $ | 453,485 | $ | 242,730 | $ | 146,948 | $ | 3,270 | $ | 846,433 | ||||||||||||

| 2007 | 2006 | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) | Gross Carrying Value | Accumulated Amortization | Net Carrying Value | Weighted Average Life (years) | Gross Carrying Value | Accumulated Amortization | Net Carrying Value | Weighted Average Life (years) | |||||||||||||||||||||||||||

| Purchased customer accounts | $ | 628,123 | $ | (187,543 | ) | $ | 440,580 | 14.9 | $ | 541,967 | $ | (149,764 | ) | $ | 392,203 | 14.9 | |||||||||||||||||||

| Noncompete agreements | 25,858 | (23,214 | ) | 2,644 | 7.7 | 25,589 | (21,723 | ) | 3,866 | 7.7 | |||||||||||||||||||||||||

| Total | $ | 653,981 | $ | (210,757 | ) | $ | 443,224 | $ | 567,556 | $ | (171,487 | ) | $ | 396,069 | |||||||||||||||||||||

| 2007 | 2006 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Carrying Value | Carrying Value | ||||||||||||||||||

| (in thousands) | Current | Non- Current | Current | Non- Current | |||||||||||||||

| Available-for-sale marketable equity securities | $ | 46 | $ | — | $ | 240 | $ | 15,181 | |||||||||||

| Non-marketable equity securities and certificates of deposit | 2,846 | 355 | 2,669 | 645 | |||||||||||||||

| Total investments | $ | 2,892 | $ | 355 | $ | 2,909 | $ | 15,826 | |||||||||||

| (in thousands) | Cost | Gross Unrealized Gains | Gross Unrealized Losses | Estimated Fair Value | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Marketable equity securities: | ||||||||||||||||||

| 2007 | $ | 25 | $ | 21 | $ | — | $ | 46 | ||||||||||

| 2006 | $ | 550 | $ | 14,871 | $ | — | $ | 15,421 | ||||||||||

| (in thousands) | Proceeds | Gross Realized Gains | Gross Realized Losses | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | $ | 21,715 | $ | 18,733 | $ | (780 | ) | |||||||

| 2006 | $ | 119 | $ | 25 | $ | — | ||||||||

| 2005 | $ | 896 | $ | 87 | $ | — | ||||||||

| (in thousands) | 2007 | 2006 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Furniture, fixtures and equipment | $ | 112,413 | $ | 90,146 | ||||||

| Leasehold improvements | 12,393 | 10,590 | ||||||||

| Land, buildings and improvements | 491 | 487 | ||||||||

| Total cost | 125,297 | 101,223 | ||||||||

| Less accumulated depreciation and amortization | (62,970 | ) | (57,053 | ) | ||||||

| Total | $ | 62,327 | $ | 44,170 | ||||||

| (in thousands) | 2007 | 2006 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Accrued bonuses | $ | 41,182 | $ | 42,426 | ||||||

| Accrued compensation and benefits | 19,702 | 16,213 | ||||||||

| Reserve for policy cancellations | 8,339 | 7,432 | ||||||||

| Accrued rent and vendor expenses | 8,302 | 7,937 | ||||||||

| Accrued interest | 4,488 | 4,524 | ||||||||

| Other | 8,586 | 7,477 | ||||||||

| Total | $ | 90,599 | $ | 86,009 | ||||||

| (in thousands) | 2007 | 2006 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Unsecured Senior Notes | $ | 225,000 | $ | 225,000 | ||||||

| Acquisition notes payable | 14,025 | 6,310 | ||||||||

| Revolving credit facility | — | — | ||||||||

| Term loan agreements | — | 12,857 | ||||||||

| Other notes payable | 201 | 167 | ||||||||

| Total debt | 239,226 | 244,334 | ||||||||

| Less current portion | (11,519 | ) | (18,082 | ) | ||||||

| Long-term debt | $ | 227,707 | $ | 226,252 | ||||||

| (in thousands) | 2007 | 2006 | 2005 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Current: | ||||||||||||||

| Federal | $ | 105,534 | $ | 83,792 | $ | 72,550 | ||||||||

| State | 14,709 | 12,419 | 10,387 | |||||||||||

| Total current provision | 120,243 | 96,211 | 82,937 | |||||||||||

| Deferred: | ||||||||||||||

| Federal | (168 | ) | 9,139 | 8,547 | ||||||||||

| State | 493 | 2,341 | 2,095 | |||||||||||

| Total deferred provision | 325 | 11,480 | 10,642 | |||||||||||

| Total tax provision | $ | 120,568 | $ | 107,691 | $ | 93,579 |

| 2007 | 2006 | 2005 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Federal statutory tax rate | 35.0 | % | 35.0 | % | 35.0 | % | ||||||||

| State income taxes, net of federal income tax benefit | 3.2 | 3.4 | 3.3 | |||||||||||

| Non-deductible employee stock purchase plan expense | 0.4 | 0.4 | — | |||||||||||

| Interest exempt from taxation and dividend exclusion | (0.5 | ) | (0.3 | ) | (0.2 | ) | ||||||||

| Other, net | 0.6 | — | 0.2 | |||||||||||

| Effective tax rate | 38.7 | % | 38.5 | % | 38.3 | % | ||||||||

| (in thousands) | 2007 | 2006 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Current: | ||||||||||

| Current deferred tax assets: | ||||||||||

| Deferred contingent revenue | $ | 17,208 | $ | — | ||||||

| Total current deferred tax assets | $ | 17,208 | $ | — | ||||||

| (in thousands) | 2007 | 2006 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Non-current: | ||||||||||

| Non-current deferred tax liabilities: | ||||||||||

| Fixed assets | $ | 3,783 | $ | 3,051 | ||||||

| Net unrealized holding gain of available-for-sale securities | 8 | 5,337 | ||||||||

| Prepaid insurance and pension | 2,522 | 2,516 | ||||||||

| Net gain on cash-flow hedging derivative | — | 22 | ||||||||

| Intangible assets | 72,943 | 51,127 | ||||||||

| Total non-current deferred tax liabilities | 79,256 | 62,053 | ||||||||

| Non current deferred tax assets: | ||||||||||

| Deferred compensation | 6,040 | 5,886 | ||||||||

| Accruals and reserves | 6,881 | 6,310 | ||||||||

| Net operating loss carryforwards | 829 | 634 | ||||||||

| Valuation allowance for deferred tax assets | (230 | ) | (498 | ) | ||||||

| Total non-current deferred tax assets | 13,520 | 12,332 | ||||||||

| Net non-current deferred tax liability | $ | 65,736 | $ | 49,721 | ||||||

| (in thousands) | ||||||

|---|---|---|---|---|---|---|

| Unrecognized tax benefits balance at January 1, 2007 | $ | 591 | ||||

| Gross increases for tax positions of prior years | 15,805 | |||||

| Gross decreases for tax positions of prior years | ||||||

| Settlements | (15,772 | ) | ||||

| Lapse of statute of limitations | (117 | ) | ||||

| Unrecognized tax benefits balance at December 31, 2007 | $ | 507 |

| Weighted- Average Grant Date Fair Value | Granted Shares | Awarded Shares | Shares Not Yet Awarded | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Outstanding at January 1, 2006 | $ | 5.21 | 5,851,682 | 5,125,304 | 726,378 | |||||||||||||

| Granted | $ | 18.48 | 262,260 | 868 | 261,392 | |||||||||||||

| Awarded | $ | 11.99 | — | 291,035 | (291,035 | ) | ||||||||||||

| Vested | $ | 6.43 | (28,696 | ) | (28,696 | ) | — | |||||||||||

| Forfeited | $ | 5.93 | (393,728 | ) | (352,341 | ) | (41,387 | ) | ||||||||||

| Outstanding at December 31, 2006 | $ | 5.92 | 5,691,518 | 5,036,170 | 655,348 | |||||||||||||

| Granted | $ | 15.74 | 323,495 | — | 323,495 | |||||||||||||

| Awarded | $ | — | — | — | — | |||||||||||||

| Vested | $ | 5.33 | (48,552 | ) | (48,552 | ) | — | |||||||||||

| Forfeited | $ | 8.95 | (391,505 | ) | (300,886 | ) | (90,619 | ) | ||||||||||

| Outstanding at December 31, 2007 | $ | 6.38 | 5,574,956 | 4,686,732 | 888,224 | |||||||||||||

| Stock Options | Shares Under Option | Weighted- Average Exercise Price | Weighted- Average Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in thousands) | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Outstanding at January 1, 2005 | 2,073,028 | $ | 10.56 | 6.9 | 36,580 | |||||||||||||

| Granted | 12,000 | $ | 22.06 | |||||||||||||||

| Exercised | (68,040 | ) | $ | 4.84 | ||||||||||||||

| Forfeited | — | $ | — | |||||||||||||||

| Expired | — | $ | — | |||||||||||||||

| Outstanding at December 31, 2005 | 2,016,988 | $ | 10.83 | 5.9 | $ | 35,064 | ||||||||||||

| Granted | — | $ | — | |||||||||||||||

| Exercised | (123,213 | ) | $ | 6.11 | ||||||||||||||

| Forfeited | (8,000 | ) | $ | 15.78 | ||||||||||||||

| Expired | — | $ | — | |||||||||||||||

| Outstanding at December 31, 2006 | 1,885,775 | $ | 11.11 | 4.9 | $ | 32,241 | ||||||||||||

| Granted | — | $ | — | |||||||||||||||

| Exercised | (632,307 | ) | $ | 8.38 | ||||||||||||||

| Forfeited | — | $ | — | |||||||||||||||

| Expired | — | $ | — | |||||||||||||||

| Outstanding at December 31, 2007 | 1,253,468 | $ | 12.49 | 4.3 | $ | 22,679 | ||||||||||||

| Ending vested and expected to vest at December 31, 2007 | 1,253,468 | $ | 12.49 | 4.3 | $ | 22,679 | ||||||||||||

| Exercisable at December 31, 2007 | 590,776 | $ | 8.68 | 3.3 | $ | 8,757 | ||||||||||||

| Exercisable at December 31, 2006 | 1,185,067 | $ | 8.29 | 4.2 | $ | 23,607 | ||||||||||||

| Exercisable at December 31, 2005 | 783,672 | $ | 4.88 | 5.2 | $ | 18,281 | ||||||||||||

| Options Outstanding | Options Exercisable | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Exercise Price | Number Outstanding | Weighted Average Remaining Contractual Life (years) | Weighted Average Exercise Price | Number Exercisable | Weighted Average Exercise Price | |||||||||||||||||||

| $ 4.84 | 382,792 | 2.3 | $ | 4.84 | 382,792 | $ | 4.84 | |||||||||||||||||

| $14.20 | 4,000 | 3.8 | $ | 14.20 | 4,000 | $ | 14.20 | |||||||||||||||||

| $15.78 | 854,676 | 5.2 | $ | 15.78 | 203,984 | $ | 15.78 | |||||||||||||||||

| $22.06 | 12,000 | 7.0 | $ | 22.06 | — | — | ||||||||||||||||||

| Totals | 1,253,468 | 4.3 | $ | 12.49 | 590,776 | $ | 8.68 | |||||||||||||||||

| (in thousands) | 2007 | 2006 | 2005 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Employee Stock Purchase Plan | $ | 3,234 | $ | 3,049 | $ | — | ||||||||

| Performance Stock Plan | 2,016 | 1,874 | 3,337 | |||||||||||

| Incentive Stock Option Plan | 417 | 493 | — | |||||||||||

| Total | $ | 5,667 | $ | 5,416 | $ | 3,337 | ||||||||

| (in thousands) | 2007 | 2006 | 2005 | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Unrealized holding (loss) gain on available-for-sale securities, net of tax benefit of $5,328 for 2007; net of tax effect of $2,752 for 2006; and net of tax benefit of $300 for 2005 | $ | (9,093 | ) | $ | 4,697 | $ | (512 | ) | ||||||

| Net (loss) gain on cash-flow hedging derivative, net of tax benefit of $22 for 2007, net of tax benefit of $0 for 2006; and net of tax effect of $289 for 2005 | $ | (38 | ) | $ | 1 | $ | 491 | |||||||

| Notes payable issued or assumed for purchased customer accounts | $ | 23,897 | $ | 36,957 | $ | 42,843 | ||||||||

| Notes received on the sale of fixed assets and customer accounts | $ | 9,689 | $ | 2,715 | $ | 1,855 | ||||||||

| (in thousands) | ||||||

|---|---|---|---|---|---|---|

| 2008 | $ | 24,553 | ||||

| 2009 | 21,177 | |||||

| 2010 | 17,065 | |||||

| 2011 | 11,624 | |||||

| 2012 | 7,674 | |||||

| Thereafter | 12,962 | |||||

| Total minimum future lease payments | $ | 95,055 | ||||

| (in thousands, except per share data) | First Quarter | Second Quarter | Third Quarter | Fourth Quarter | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | ||||||||||||||||||

| Total revenues | $ | 258,513 | $ | 246,644 | $ | 237,284 | $ | 217,226 | ||||||||||

| Total expenses | $ | 160,411 | $ | 162,148 | $ | 161,849 | $ | 163,732 | ||||||||||

| Income before income taxes | $ | 98,102 | $ | 84,496 | $ | 75,435 | $ | 53,494 | ||||||||||

| Net income | $ | 59,727 | $ | 52,012 | $ | 46,216 | $ | 33,004 | ||||||||||

| Net income per share: | ||||||||||||||||||

| Basic | $ | 0.43 | $ | 0.37 | $ | 0.33 | $ | 0.23 | ||||||||||

| Diluted | $ | 0.42 | $ | 0.37 | $ | 0.33 | $ | 0.23 | ||||||||||

| 2006 | ||||||||||||||||||

| Total revenues | $ | 230,582 | $ | 220,807 | $ | 211,965 | $ | 214,650 | ||||||||||

| Total expenses | $ | 149,146 | $ | 149,840 | $ | 146,400 | $ | 152,577 | ||||||||||

| Income before income taxes | $ | 81,436 | $ | 70,967 | $ | 65,565 | $ | 62,073 | ||||||||||

| Net income | $ | 50,026 | $ | 44,431 | $ | 40,270 | $ | 37,623 | ||||||||||

| Net income per share: | ||||||||||||||||||

| Basic | $ | 0.36 | $ | 0.32 | $ | 0.29 | $ | 0.27 | ||||||||||

| Diluted | $ | 0.36 | $ | 0.32 | $ | 0.29 | $ | 0.27 | ||||||||||

| Year Ended December 31, 2007 | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) | Retail | Wholesale Brokerage | National Programs | Services | Other | Total | |||||||||||||||||||||

| Total revenues | $ | 562,438 | $ | 178,942 | $ | 157,548 | $ | 35,392 | $ | 25,347 | $ | 959,667 | |||||||||||||||

| Investment income | 260 | 2,927 | 513 | 31 | 26,763 | 30,494 | |||||||||||||||||||||

| Amortization | 21,659 | 9,237 | 9,039 | 462 | 39 | 40,436 | |||||||||||||||||||||

| Depreciation | 5,723 | 2,715 | 2,757 | 534 | 1,034 | 12,763 | |||||||||||||||||||||

| Interest expense | 21,094 | 19,188 | 9,977 | 719 | (37,176 | ) | 13,802 | ||||||||||||||||||||

| Income before income taxes | 159,304 | 27,989 | 47,135 | 8,655 | 68,444 | 311,527 | |||||||||||||||||||||

| Total assets | 1,356,772 | 640,931 | 570,295 | 41,233 | (648,572 | ) | 1,960,659 | ||||||||||||||||||||

| Capital expenditures | 5,816 | 2,835 | 1,831 | 318 | 19,843 | 30,643 | |||||||||||||||||||||

| Year Ended December 31, 2006 | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) | Retail | Wholesale Brokerage | National Programs | Services | Other | Total | |||||||||||||||||||||

| Total revenues | $ | 517,989 | $ | 163,346 | $ | 157,448 | $ | 32,606 | $ | 6,615 | $ | 878,004 | |||||||||||||||

| Investment income | 139 | 4,017 | 432 | 45 | 6,846 | 11,479 | |||||||||||||||||||||

| Amortization | 19,305 | 8,087 | 8,718 | 343 | 45 | 36,498 | |||||||||||||||||||||

| Depreciation | 5,621 | 2,075 | 2,387 | 533 | 693 | 11,309 | |||||||||||||||||||||

| Interest expense | 18,903 | 18,759 | 10,554 | 440 | (35,299 | ) | 13,357 | ||||||||||||||||||||

| Income before income taxes | 145,749 | 26,865 | 48,560 | 7,963 | 50,904 | 280,041 | |||||||||||||||||||||

| Total assets | 1,103,107 | 618,374 | 544,272 | 32,554 | (490,355 | ) | 1,807,952 | ||||||||||||||||||||

| Capital expenditures | 5,952 | 2,085 | 3,750 | 588 | 2,604 | 14,979 | |||||||||||||||||||||

| Year Ended December 31, 2005 | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) | Retail | Wholesale Brokerage | National Programs | Services | Other | Total | |||||||||||||||||||||

| Total revenues | $ | 491,202 | $ | 127,113 | $ | 133,930 | $ | 27,517 | $ | 6,045 | $ | 785,807 | |||||||||||||||

| Investment income | 159 | 1,599 | 367 | — | 4,453 | 6,578 | |||||||||||||||||||||

| Amortization | 19,368 | 5,672 | 8,103 | 43 | 59 | 33,245 | |||||||||||||||||||||

| Depreciation | 5,641 | 1,285 | 1,998 | 435 | 702 | 10,061 | |||||||||||||||||||||

| Interest expense | 20,927 | 12,446 | 10,433 | 4 | (29,341 | ) | 14,469 | ||||||||||||||||||||

| Income before income taxes | 128,881 | 28,306 | 38,385 | 6,992 | 41,566 | 244,130 | |||||||||||||||||||||

| Total assets | 1,002,781 | 476,653 | 445,146 | 18,766 | (334,686 | ) | 1,608,660 | ||||||||||||||||||||

| Capital expenditures | 6,186 | 1,969 | 3,067 | 350 | 1,854 | 13,426 | |||||||||||||||||||||

| /s/ J. Hyatt Brown | /s/ Cory T. Walker | |||||

| J. Hyatt Brown Chief Executive Officer | Cory T. Walker Chief Financial Officer | |||||

ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

ITEM 13. | Certain Relationships and Related Transactions, and Director Independence. |

ITEM 14. | Principal Accounting Fees and Services. |

ITEM 15. | Exhibits and Financial Statement Schedules. |

| (a)1. | Financial statements |

| 2. | Consolidated Financial Statement Schedules. |

| 3. | Exhibits |

| 3.1 | Articles of Amendment to Articles of Incorporation (adopted April 24, 2003) (incorporated by reference to Exhibit 3a to Form 10-Q for the quarter ended March 31, 2003), and Amended and Restated Articles of Incorporation (incorporated by reference to Exhibit 3a to Form 10-Q for the quarter ended March 31, 1999). |

| 3.2 | Bylaws (incorporated by reference to Exhibit 3b to Form 10-K for the year ended December 31, 2002). |

| 10.1(a) | Lease of the Registrant for office space at 220 South Ridgewood Avenue, Daytona Beach, Florida dated August 15, 1987 (incorporated by reference to Exhibit 10a(3) to Form 10-K for the year ended December 31, 1993), as amended by Letter Agreement dated June 26, 1995; First Amendment to Lease dated August 2, 1999; Second Amendment to Lease dated December 11, 2001; Third Amendment to Lease dated August 8, 2002; and Fourth Amendment to Lease dated October 26, 2004 (incorporated by reference to Exhibit 10.2(a) to Form 10-K for the year ended December 31, 2005). |

| 10.1(b) | Lease Agreement for office space at 3101 W. Martin Luther King, Jr. Blvd., Tampa, Florida, dated July 1, 2004 and effective May 9, 2005, between Highwoods/Florida Holdings, L.P., as landlord and the Registrant, as tenant (incorporated by reference to Exhibit 10.2(b) to Form 10-K for the year ended December 31, 2005). |

| 10.1(c) | Lease Agreement for office space at Riedman Tower, Rochester, New York, dated January 3, 2001, between Riedman Corporation, as landlord, and the Registrant, as tenant (incorporated by reference to Exhibit 10b(3) to Form 10-K for the year ended December 31, 2001), and Lease for same office space at Riedman Tower, Rochester, New York, dated December 31, 2005, between Riedman Corporation, as landlord, and a subsidiary of the Registrant, as tenant (incorporated by reference to Exhibit 10.2(c) to Form 10-K for the year ended December 31, 2005). |

| 10.2 | Indemnity Agreement dated January 1, 1979, among the Registrant, Whiting National Management, Inc., and Pennsylvania Manufacturers’ Association Insurance Company (incorporated by reference to Exhibit 10g to Registration Statement No. 33-58090 on Form S-4). |

| 10.3 | Agency Agreement dated January 1, 1979 among the Registrant, Whiting National Management, Inc., and Pennsylvania Manufacturers’ Association Insurance Company (incorporated by reference to Exhibit 10h to Registration Statement No. 33-58090 on Form S-4). |

| 10.4(a) | Employment Agreement, dated as of July 29, 1999, between the Registrant and J. Hyatt Brown (incorporated by reference to Exhibit 10f to Form 10-K for the year ended December 31, 1999). |

| 10.4(b) | Portions of Employment Agreement, dated April 28, 1993 between the Registrant and Jim W. Henderson (incorporated by reference to Exhibit 10m to Form 10-K for the year ended December 31, 1993). |

| 10.4(c) | Employment Agreement, dated as of October 8, 1996, between the Registrant and J. Powell Brown. |

| 10.5 | Registrant’s 2000 Incentive Stock Option Plan (incorporated by reference to Exhibit 4 to Registration Statement No. 333-43018 on Form S-8 filed on August 3, 2000). |

| 10.6(a) | Registrant’s Stock Performance Plan (incorporated by reference to Exhibit 4 to Registration Statement No. 333-14925 on Form S-8 filed on October 28, 1996). |

| 10.6(b) | Registrant’s Stock Performance Plan as amended, effective January 23, 2008. |

| 10.7 | International Swap Dealers Association, Inc. Master Agreement dated as of December 5, 2001 between SunTrust Bank and the Registrant and letter agreement dated December 6, 2001, regarding confirmation of interest rate transaction (incorporated by reference to Exhibit 10p to Form 10-K for the year ended December 31, 2001). |

| 10.8 | Note Purchase Agreement, dated as of July 15, 2004, among the Company and the listed Purchasers of the 5.57% Series A Senior Notes due September 15, 2011 and 6.08% Series B Senior Notes due July 15, 2014. (incorporated by reference to Exhibit 4.1 to Form 10-Q for the quarter ended June 30, 2004). |