Exhibit 99.1 Exhibit 99.1 BB Brown & Brown INSURANCE Company Overview 2021 C 2021 Brown & Brown, Inc. All rights reserved.

This presentation and the statements made during our presentation may contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbors created by those laws. These forward-looking statements include information about possible or assumed future results of our operations. All statements, other than statements of historical facts, included in this document that address activities, events or developments that we expect or anticipate may occur in the future, including those relating to the potential effects of the COVID-19 pandemic (“COVID-19”) on our business, operations, financial performance and prospects, the market performance of our business segments, quarterly interest expense, share repurchases, margin expansion, changes in exposure units, the pipeline of acquisition candidates, future capital expenditures, growth in commissions and fees including Organic Revenue growth, business strategies, competitive strengths, goals, the benefits of new initiatives, plans, and references to future successes are forward-looking statements. Also, when we use words such as ‘anticipate’, ‘believe’, ‘estimate’, ‘expect’, ‘intend’, ‘plan’, ‘probably’ or similar expressions, we are making forward-looking statements. There are important uncertainties, events and factors that could cause our actual results or performance to differ materially from those forward-looking statements contained in this document or made during our presentation, including, but not limited to, the following: COVID-19 and the resulting governmental and societal responses, the severity and duration of COVID-19, and the resulting impact on the U.S. economy, the global economy, and the Company’s business, liquidity, customers, insurance carriers, and third parties; the inability to retain or hire qualified employees, as well as the loss of any of our executive officers or other key employees; acquisition-related risks that could negatively affect the success of our growth strategy, including the possibility that we may not be able to successfully identify suitable acquisition candidates, complete acquisitions, integrate acquired businesses into our operations and expand into new markets; a cybersecurity attack or any other interruption in information technology and/or data security and/or outsourcing relationships; the requirement for additional resources and time to adequately respond to dynamics resulting from rapid technological change; changes in data privacy and protection laws and regulations or any failure to comply with such laws and regulations; the loss of or significant change to any of our insurance company relationships, which could result in additional expense, loss of market share or material decrease in our profit-sharing contingent commissions, guaranteed supplemental commissions or incentive commissions; adverse economic conditions, natural disasters, or regulatory changes in states where we have a high concentration of our business; the inability to maintain our culture or a change in management, management philosophy or our business strategy; risks facing us in our Services Segment, including our third-party claims administration operations, that are distinct from those we face in our insurance intermediary operations; our failure to comply with any covenants contained in our debt agreements; the possibility that covenants in our debt agreements could prevent us from engaging in certain potentially beneficial activities; changes in estimates, judgments or assumptions used in the preparation of our financial statements; improper disclosure of confidential information; the limitations of our system of disclosure and internal controls and procedures in preventing errors or fraud, or in informing management of all material information in a timely manner; the potential adverse effect of certain actual or potential claims, regulatory actions or proceedings on our businesses, results of operations, financial condition or liquidity; changes in the U.S.-based credit markets that might adversely affect our business, results of operations and financial condition; the significant control certain existing shareholders have over the Company; risks related to our international operations, which may require more time and expense than our domestic operations to achieve or maintain profitability; risks associated with the current interest rate environment, and to the extent we use debt to finance our investments, changes in interest rates will affect our cost of capital and net investment income; disintermediation within the insurance industry, including increased competition from insurance companies, technology companies and the financial services industry, as well as the shift away from traditional insurance markets; changes in current U.S. or global economic conditions; effects related to pandemics, epidemics, or outbreaks of infectious diseases; conditions that result in reduced insurer capacity; quarterly and annual variations in our commissions that result from the timing of policy renewals and the net effect of new and lost business production; the possibility that one of the financial institutions we use fails or is taken over by the U.S. Federal Deposit Insurance Corporation; uncertainty in our business practices and compensation arrangements due to potential changes in regulations; regulatory changes that could reduce our profitability or growth by increasing compliance costs, technology compliance, restricting the products or services we may sell, the markets we may enter, the methods by which we may sell our products and services, or the prices we may charge for our services and the form of compensation we may accept from our customers, carriers and third parties; intangible asset risk, including the possibility that our goodwill may become impaired in the future; a decrease in demand for liability insurance as a result of tort reform litigation; changes in our credit ratings; volatility in our stock price; other risks and uncertainties identified in the Company's Annual Report on Form 10-K for the year ended December 31, 2020, and the Company’s other filings with the Securities and Exchange Commission; and other factors that the Company may not have currently identified or quantified. All forward-looking statements made herein are made only as of the date of this presentation, and the Company does not undertake any obligation to publicly update or correct any forward-looking statements to reflect events or circumstances that subsequently occur or of which the Company hereafter becomes aware. Information Regarding Forward-Looking Statements This presentation and the statements made during our presentation may contain certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are intended to be covered by the safe harbors created by those laws. These forward-looking statements include information about possible or assumed future results of our operations. All statements, other than statements of historical facts, included in this document that address activities, events or developments that we expect or anticipate may occur in the future, including those relating to the potential effects of the COVID-19 pandemic (“COVID-19”) on our business, operations, financial performance and prospects, the market performance of our business segments, quarterly interest expense, share repurchases, margin expansion, changes in exposure units, the pipeline of acquisition candidates, future capital expenditures, growth in commissions and fees including Organic Revenue growth, business strategies, competitive strengths, goals, the benefits of new initiatives, plans, and references to future successes are forward-looking statements. Also, when we use words such as ‘anticipate’, ‘believe’, ‘estimate’, ‘expect’, ‘intend’, ‘plan’, ‘probably’ or similar expressions, we are making forward-looking statements. There are important uncertainties, events and factors that could cause our actual results or performance to differ materially from those forward-looking statements contained in this document or made during our presentation, including, but not limited to, the following: COVID-19 and the resulting governmental and societal responses, the severity and duration of COVID-19, and the resulting impact on the U.S. economy, the global economy, and the Company’s business, liquidity, customers, insurance carriers, and third parties; the inability to retain or hire qualified employees, as well as the loss of any of our executive officers or other key employees; acquisition-related risks that could negatively affect the success of our growth strategy, including the possibility that we may not be able to successfully identify suitable acquisition candidates, complete acquisitions, integrate acquired businesses into our operations and expand into new markets; a cybersecurity attack or any other interruption in information technology and/or data security and/or outsourcing relationships; the requirement for additional resources and time to adequately respond to dynamics resulting from rapid technological change; changes in data privacy and protection laws and regulations or any failure to comply with such laws and regulations; the loss of or significant change to any of our insurance company relationships, which could result in additional expense, loss of market share or material decrease in our profit-sharing contingent commissions, guaranteed supplemental commissions or incentive commissions; adverse economic conditions, natural disasters, or regulatory changes in states where we have a high concentration of our business; the inability to maintain our culture or a change in management, management philosophy or our business strategy; risks facing us in our Services Segment, including our third-party claims administration operations, that are distinct from those we face in our insurance intermediary operations; our failure to comply with any covenants contained in our debt agreements; the possibility that covenants in our debt agreements could prevent us from engaging in certain potentially beneficial activities; changes in estimates, judgments or assumptions used in the preparation of our financial statements; improper disclosure of confidential information; the limitations of our system of disclosure and internal controls and procedures in preventing errors or fraud, or in informing management of all material information in a timely manner; the potential adverse effect of certain actual or potential claims, regulatory actions or proceedings on our businesses, results of operations, financial condition or liquidity; changes in the U.S.-based credit markets that might adversely affect our business, results of operations and financial condition; the significant control certain existing shareholders have over the Company; risks related to our international operations, which may require more time and expense than our domestic operations to achieve or maintain profitability; risks associated with the current interest rate environment, and to the extent we use debt to finance our investments, changes in interest rates will affect our cost of capital and net investment income; disintermediation within the insurance industry, including increased competition from insurance companies, technology companies and the financial services industry, as well as the shift away from traditional insurance markets; changes in current U.S. or global economic conditions; effects related to pandemics, epidemics, or outbreaks of infectious diseases; conditions that result in reduced insurer capacity; quarterly and annual variations in our commissions that result from the timing of policy renewals and the net effect of new and lost business production; the possibility that one of the financial institutions we use fails or is taken over by the U.S. Federal Deposit Insurance Corporation; uncertainty in our business practices and compensation arrangements due to potential changes in regulations; regulatory changes that could reduce our profitability or growth by increasing compliance costs, technology compliance, restricting the products or services we may sell, the markets we may enter, the methods by which we may sell our products and services, or the prices we may charge for our services and the form of compensation we may accept from our customers, carriers and third parties; intangible asset risk, including the possibility that our goodwill may become impaired in the future; a decrease in demand for liability insurance as a result of tort reform litigation; changes in our credit ratings; volatility in our stock price; other risks and uncertainties identified in the Company's Annual Report on Form 10-K for the year ended December 31, 2020, and the Company’s other filings with the Securities and Exchange Commission; and other factors that the Company may not have currently identified or quantified. All forward-looking statements made herein are made only as of the date of this presentation, and the Company does not undertake any obligation to publicly update or correct any forward-looking statements to reflect events or circumstances that subsequently occur or of which the Company hereafter becomes aware. BB C 2021 Brown & Brown, Inc. All rights reserved. 1

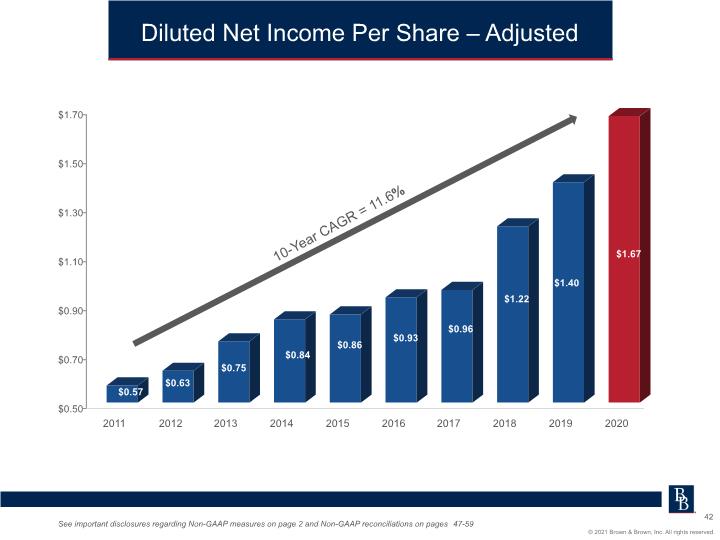

This presentation contains references to "non-GAAP financial measures" as defined in SEC Regulation G, including EBITDAC, EBITDAC Margin, Diluted Net Income Per Share – Adjusted, Net Debt, Total Debt Outstanding to EBITDAC, Net Debt Outstanding to EBITDAC, Free Cash Flow, Free Cash Flow Conversion, Free Cash Flow Yield, and Organic Revenue. We present these measures because we believe such information is of interest to the investment community and because we believe it provides additional meaningful methods of evaluating certain aspects of the Company’s operating performance from period to period on a basis that may not be otherwise apparent on a generally accepted accounting principles (“GAAP”) basis. This non-GAAP financial information should be considered in addition to, not in lieu of, the Company’s consolidated income statements and balance sheets as of the relevant date. Consistent with Regulation G, a description of such information is provided below and a reconciliation of such items to GAAP information can be found at the end of this presentation, as well as in our periodic filings with the SEC. Our method of calculating these non-GAAP financial measures may differ from the methods used by industry peers and, therefore, comparability may be limited. Revenue Measures – We believe that Organic Revenue, as defined below, provides a meaningful representation of the Company’s operating performance and improves the comparability of results between periods by eliminating the impact of certain items that have a high degree of variability. The Company has historically viewed Organic Revenue growth as an important indicator when assessing and evaluating the performance of its four segments. Organic Revenue, a non-GAAP measure, is our core commissions and fees less: (i) the core commissions and fees earned for the first 12 months by newly-acquired operations and (ii) divested business (core commissions and fees generated from offices, books of business or niches sold or terminated during the comparable period), and for the calculation of Organic Revenue growth in 2018 only (iii) the impact of the adoption of Accounting Standards Update No.2014-09, “Revenue from Contracts with Customers (Topic 606)” and Accounting Standards Codification Topic 340 – Other Assets and Deferred Cost (the “New Revenue Standard”) in order to be on a comparable basis with 2017. The term “core commissions and fees” excludes profit-sharing contingent commissions and guaranteed supplemental commissions, and therefore represents the revenues earned directly from specific insurance policies sold, and specific fee-based services rendered. “Organic Revenue” is reported in this manner in order to express the current year’s core commissions and fees on a comparable basis with the prior year’s core commissions and fees. The resulting net change reflects the aggregate changes attributable to: (i) net new and lost accounts, (ii) net changes in our customers’ exposure units, (iii) net changes in insurance premium rates or the commission rate paid to us by our carrier partners, and (iv) the net change in fees paid to us by our customers. Earnings Measures – We believe these non-GAAP measures, as defined below, provide a meaningful representation of the operating performance of the Company and improve the comparability of results between periods by eliminating the impact of certain items that have a high degree of variability. EBITDAC is defined as income before interest, income taxes, depreciation, amortization and the change in estimated acquisition earn-out payables. EBITDAC Margin is defined as EBITDAC divided by total revenues. Diluted Net Income Per Share – Adjusted is defined as diluted net income per share, excluding (i) the change in estimated acquisition earn-out payables, (ii) the net pretax loss on disposal of certain assets of Axiom Re in 2014, (iii) the impact of the change in the effective tax rate in 2017 only, associated with the one-time, non-cash impact of the Tax Cut and Jobs Act of 2017 (the “Tax Reform Act”). Other Non-GAAP Financial Measures – We believe these non-GAAP measures, as defined below, are useful to monitor our leverage and evaluate our balance sheet. Net Debt is defined as total debt outstanding less cash and cash equivalents Total Debt Outstanding to EBITDAC is defined as total debt outstanding divided by EBITDAC. Net Debt Outstanding to EBITDAC is defined as Net Debt outstanding divided by EBITDAC. Free Cash Flow is defined as net cash provided by operating activities less capital expenditures. Free Cash Flow Conversion is defined as free cash flow divided by total revenues. Free Cash Flow Yield is defined as free cash flow divided by fully diluted shares, as measured by the average share price for the year. Information Regarding Non-GAAP Measures This presentation contains references to "non-GAAP financial measures" as defined in SEC Regulation G, including EBITDAC, EBITDAC Margin, Diluted Net Income Per Share – Adjusted, Net Debt, Total Debt Outstanding to EBITDAC, Net Debt Outstanding to EBITDAC, Free Cash Flow, Free Cash Flow Conversion, Free Cash Flow Yield, and Organic Revenue. We present these measures because we believe such information is of interest to the investment community and because we believe it provides additional meaningful methods of evaluating certain aspects of the Company’s operating performance from period to period on a basis that may not be otherwise apparent on a generally accepted accounting principles (“GAAP”) basis. This non-GAAP financial information should be considered in addition to, not in lieu of, the Company’s consolidated income statements and balance sheets as of the relevant date. Consistent with Regulation G, a description of such information is provided below and a reconciliation of such items to GAAP information can be found at the end of this presentation, as well as in our periodic filings with the SEC. Our method of calculating these non-GAAP financial measures may differ from the methods used by industry peers and, therefore, comparability may be limited. Revenue Measures – We believe that Organic Revenue, as defined below, provides a meaningful representation of the Company’s operating performance and improves the comparability of results between periods by eliminating the impact of certain items that have a high degree of variability. The Company has historically viewed Organic Revenue growth as an important indicator when assessing and evaluating the performance of its four segments. • Organic Revenue, a non-GAAP measure, is our core commissions and fees less: (i) the core commissions and fees earned for the first 12 months by newly-acquired operations and (ii) divested business (core commissions and fees generated from offices, books of business or niches sold or terminated during the comparable period), and for the calculation of Organic Revenue growth in 2018 only (iii) the impact of the adoption of Accounting Standards Update No.2014-09, “Revenue from Contracts with Customers (Topic 606)” and Accounting Standards Codification Topic 340 – Other Assets and Deferred Cost (the “New Revenue Standard”) in order to be on a comparable basis with 2017. The term “core commissions and fees” excludes profit-sharing contingent commissions and guaranteed supplemental commissions, and therefore represents the revenues earned directly from specific insurance policies sold, and specific fee-based services rendered. “Organic Revenue” is reported in this manner in order to express the current year’s core commissions and fees on a comparable basis with the prior year’s core commissions and fees. The resulting net change reflects the aggregate changes attributable to: (i) net new and lost accounts, (ii) net changes in our customers’ exposure units, (iii) net changes in insurance premium rates or the commission rate paid to us by our carrier partners, and (iv) the net change in fees paid to us by our customers. Earnings Measures – We believe these non-GAAP measures, as defined below, provide a meaningful representation of the operating performance of the Company and improve the comparability of results between periods by eliminating the impact of certain items that have a high degree of variability. • EBITDAC is defined as income before interest, income taxes, depreciation, amortization and the change in estimated acquisition earn-out payables. • EBITDAC Margin is defined as EBITDAC divided by total revenues. • Diluted Net Income Per Share – Adjusted is defined as diluted net income per share, excluding (i) the change in estimated acquisition earn-out payables, (ii) the net pretax loss on disposal of certain assets of Axiom Re in 2014, (iii) the impact of the change in the effective tax rate in 2017 only, associated with the one-time, non-cash impact of the Tax Cut and Jobs Act of 2017 (the “Tax Reform Act”). Other Non-GAAP Financial Measures – We believe these non-GAAP measures, as defined below, are useful to monitor our leverage and evaluate our balance sheet. • Net Debt is defined as total debt outstanding less cash and cash equivalents • Total Debt Outstanding to EBITDAC is defined as total debt outstanding divided by EBITDAC. • Net Debt Outstanding to EBITDAC is defined as Net Debt outstanding divided by EBITDAC. • Free Cash Flow is defined as net cash provided by operating activities less capital expenditures. • Free Cash Flow Conversion is defined as free cash flow divided by total revenues. • Free Cash Flow Yield is defined as free cash flow divided by fully diluted shares, as measured by the average share price for the year. BB C 2021 Brown & Brown, Inc. All rights reserved. 2

Company Overview Company Overview BB C 2021 Brown & Brown, Inc. All rights reserved. 3

Investment Highlights Proven track record of profitable revenue growth – organic & via acquisitions Experienced leadership team & strong performance-based culture Balanced & highly diversified revenue base Platform operating model with broad distribution network that generates industry-leading financial metrics Strong liquidity and cash flow conversion support by disciplined capital strategy BB C 2021 Brown & Brown, Inc. All rights reserved. 4

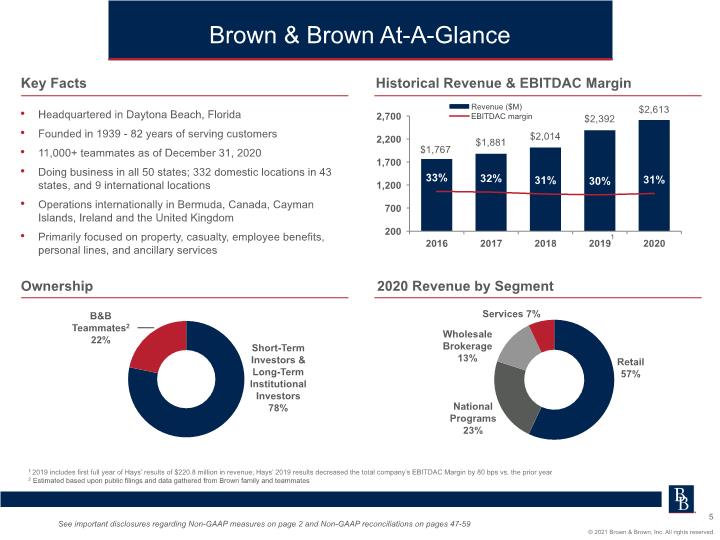

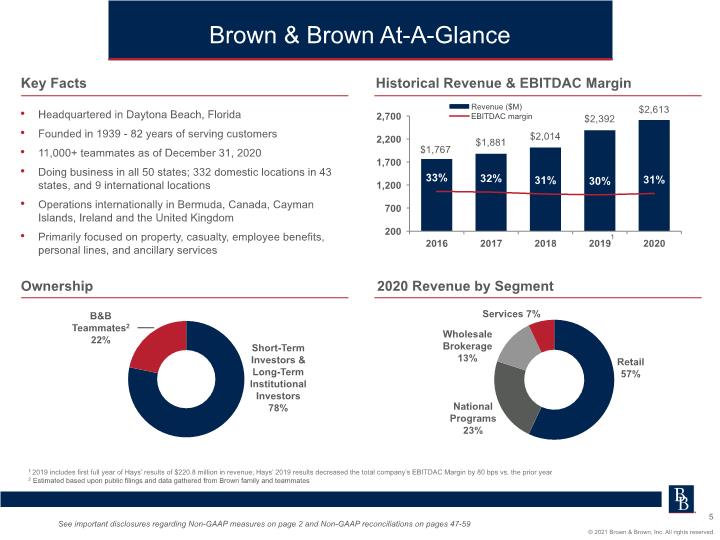

Brown & Brown At-A-Glance Key Facts Historical Revenue & EBITDAC Margin Ownership 2020 Revenue by Segment Headquartered in Daytona Beach, Florida Founded in 1939 - 82 years of serving customers 11,000+ teammates as of December 31, 2020 Doing business in all 50 states; 332 domestic locations in 43 states, and 9 international locations Operations internationally in Bermuda, Canada, Cayman Islands, Ireland and the United Kingdom Primarily focused on property, casualty, employee benefits, personal lines, and ancillary services Short-Term Investors & Long-Term Institutional Investors 78% B&B Teammates2 22% See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 1 2019 includes first full year of Hays’ results of $220.8 million in revenue; Hays’ 2019 results decreased the total company’s EBITDAC Margin by 80 bps vs. the prior year 2 Estimated based upon public filings and data gathered from Brown family and teammates Retail 57% National Programs 23% Wholesale Brokerage 13% Services 7% 1 Brown & Brown At-A-Glance Key Facts • Headquartered in Daytona Beach, Florida • Founded in 1939 - 82 years of serving customers • 11,000+ teammates as of December 31, 2020 • Doing business in all 50 states; 332 domestic locations in 43 states, and 9 international locations • Operations internationally in Bermuda, Canada, Cayman Islands, Ireland and the United Kingdom • Primarily focused on property, casualty, employee benefits, personal lines, and ancillary services Historical Revenue & EBITDAC Margin [BAR CHART] Ownership [BAR CHART] [BAR CHART] 2020 Revenue by Segment 1 2019 includes first full year of Hays’ results of $220.8 million in revenue; Hays’ 2019 results decreased the total company’s EBITDAC Margin by 80 bps vs. the prior year 2 Estimated based upon public filings and data gathered from Brown family and teammates See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 BB C 2021 Brown & Brown, Inc. All rights reserved. 5

Sales & Service Focused Ownership & Entrepreneur Decentralized Highly Competitive Common Goals Prideful Relationships Profit Oriented Lean High Quality & Integrity Power of Our Culture Power of Our Culture Lean Decentralized Profit Oriented Sales & Service Focused High Quality & Integrity Ownership & Entrepreneur Prideful Relationships Highly Competitive Common Goals [COMPANY LOGO] BB C 2021 Brown & Brown, Inc. All rights reserved. 6

Vision To Be the Leading Insurance Broker Delivering Innovative Solutions to Our Customers Vision To Be the Leading Insurance Broker Delivering Innovative Solutions to Our Customers People Recruiting & Enhancing Business Money Making Business Selling & Servicing Insurance Business Innovative Solutions Business BB C 2021 Brown & Brown, Inc. All rights reserved. 7

1 Middle-market defined as businesses with between 50 and 2,500 employees All Segments Offer Attractive Growth Opportunities Market Profile Market Profile All Segments Offer Attractive Growth Opportunities Source of Revenue Margin National Account Fees Low - Medium Middle - Market1 Fees/Commissions Medium Small Commercial Commissions Medium 1 Middle-market defined as businesses with between 50 and 2,500 employees BB C 2021 Brown & Brown, Inc. All rights reserved. 8

Decentralized Sales & Service Model Leverage National Scale – Sell & Service Locally IT Strategic Purchasing Branding Communications Finance/Treasury Acquisitions Legal Talent Development HR/Payroll Internal Audit/Compliance Acquisitions Segment Platforms IT Corporate Platforms Decentralized Sales & Service Model Corporate Platforms Acquisitions Branding Communications HR/Payroll Strategic Purchasing Talent Development IT Finance/Treasury Legal Internal Audit/Compliance Segment Platforms Acquisitions Carrier Relations Cross-Selling Knowledge Sharing Marketing IT Talent Development Leverage National Scale – Sell & Service Locally BB C 2021 Brown & Brown, Inc. All rights reserved. 9

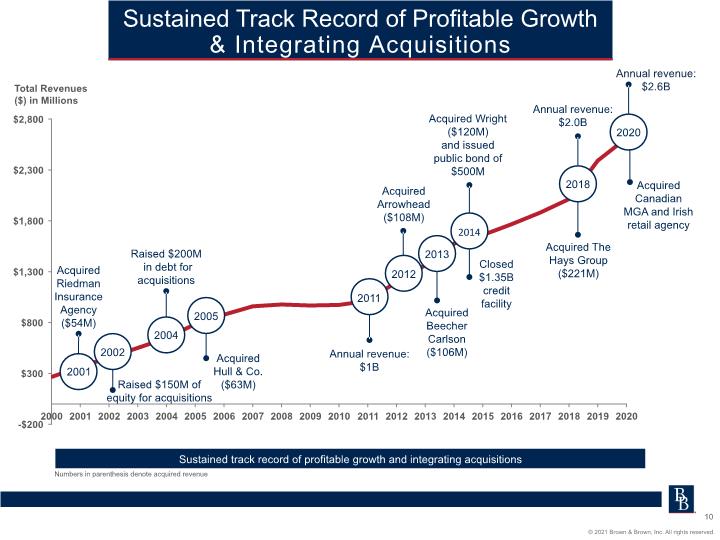

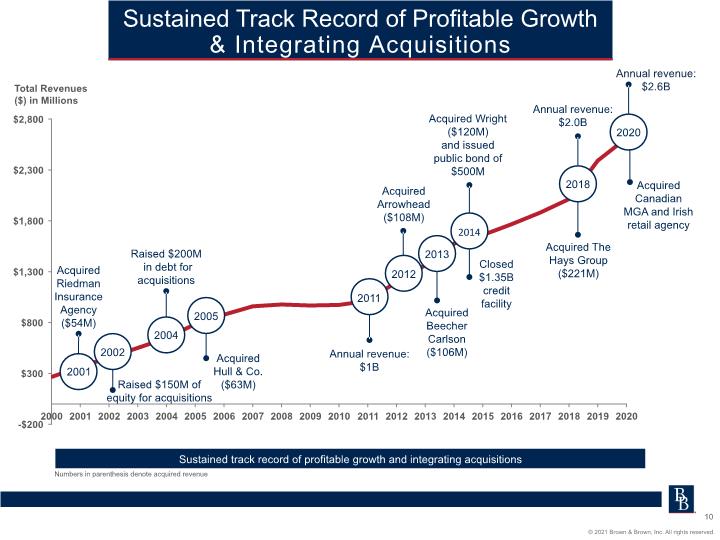

Sustained Track Record of Profitable Growth & Integrating Acquisitions Acquired Canadian MGA and Irish retail agency Sustained Track Record of Profitable Growth & Integrating Acquisitions [BAR CHART] Sustained track record of profitable growth and integrating acquisitions Numbers in parenthesis denote acquired revenue BB C 2021 Brown & Brown, Inc. All rights reserved. 10

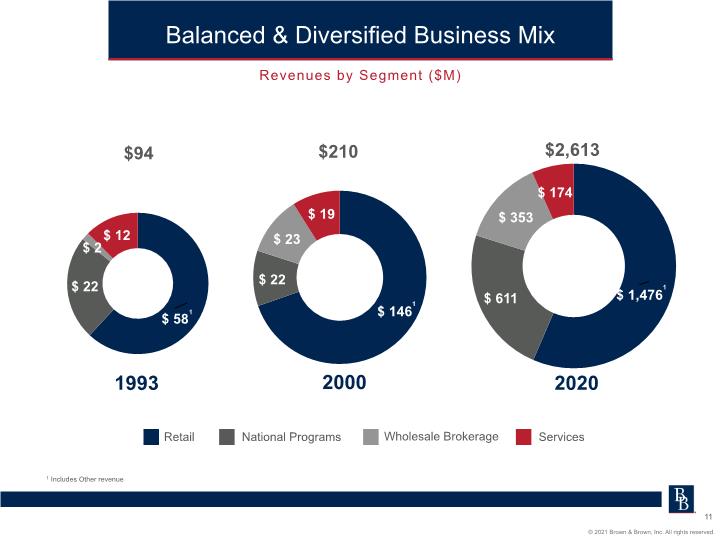

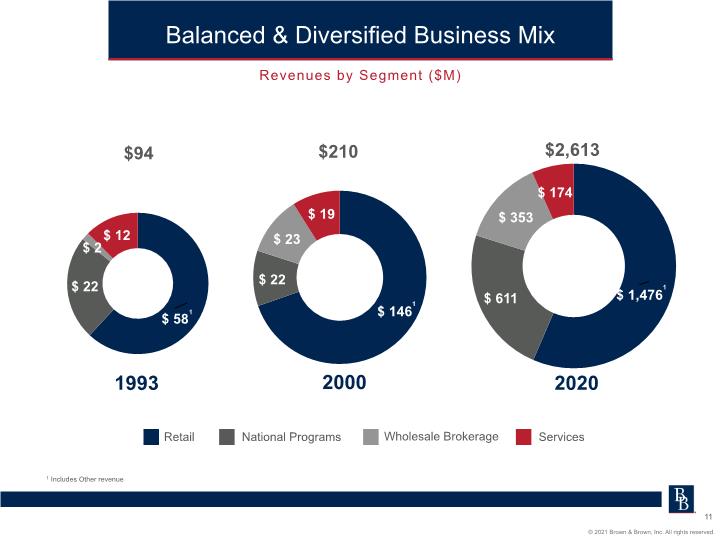

Revenues by Segment ($M) 1993 2020 2000 $2,613 $210 $94 Balanced & Diversified Business Mix 1 1 1 1 Includes Other revenue Balanced & Diversified Business Mix Revenues by Segment ($M) 1 Includes Other revenue [BAR CHART] BB C 2021 Brown & Brown, Inc. All rights reserved. 11

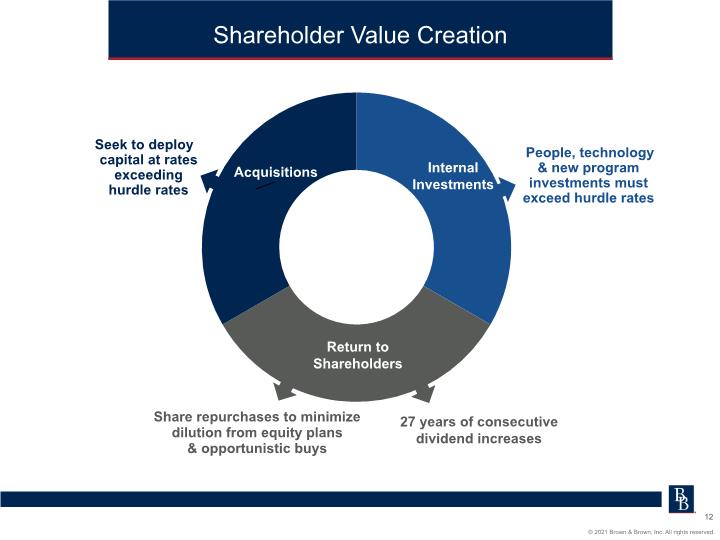

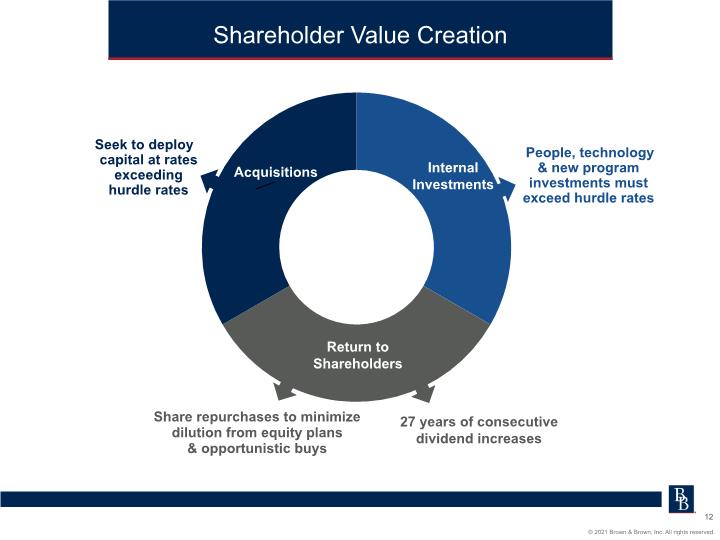

Shareholder Value Creation Internal Investments Acquisitions Return to Shareholders People, technology & new program investments must exceed hurdle rates Share repurchases to minimize dilution from equity plans & opportunistic buys Seek to deploy capital at rates exceeding hurdle rates 27 years of consecutive dividend increases Shareholder Value Creation [BAR CHART] BB C 2021 Brown & Brown, Inc. All rights reserved. 12

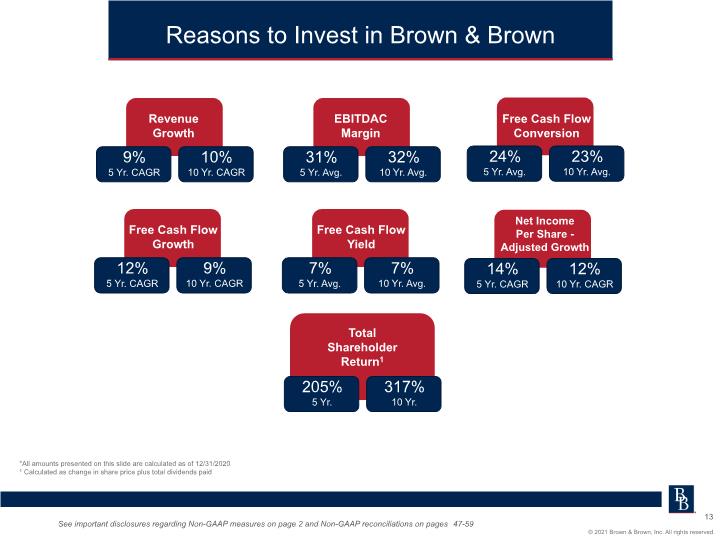

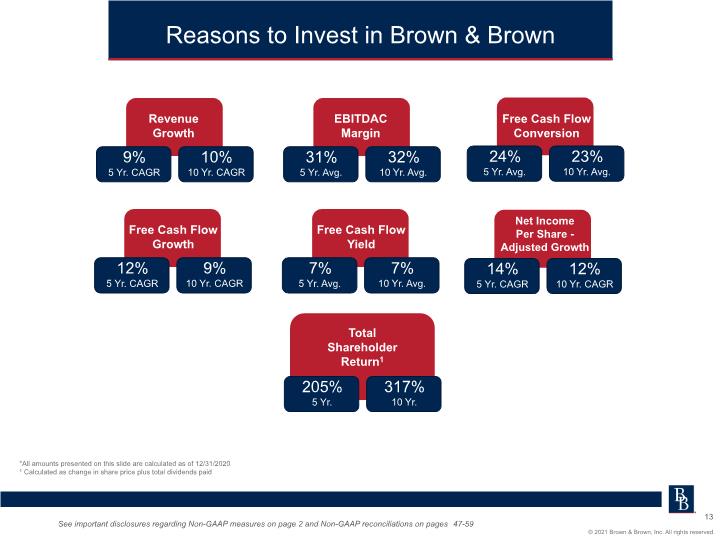

Reasons to Invest in Brown & Brown Revenue Growth 9% 5 Yr. CAGR 10% 10 Yr. CAGR EBITDAC Margin 31% 5 Yr. Avg. 32% 10 Yr. Avg. Free Cash Flow Conversion 24% 5 Yr. Avg. 23% 10 Yr. Avg. Free Cash Flow Growth 12% 5 Yr. CAGR 9% 10 Yr. CAGR Free Cash Flow Yield 7% 5 Yr. Avg. 7% 10 Yr. Avg. Net Income Per Share - Adjusted Growth 14% 5 Yr. CAGR 12% 10 Yr. CAGR Total Shareholder Return1 205% 5 Yr. 317% 10 Yr. See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 *All amounts presented on this slide are calculated as of 12/31/2020 1 Calculated as change in share price plus total dividends paid Reasons to Invest in Brown & Brown *All amounts presented on this slide are calculated as of 12/31/2020 1 Calculated as change in share price plus total dividends paid See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 BB C 2021 Brown & Brown, Inc. All rights reserved. 13

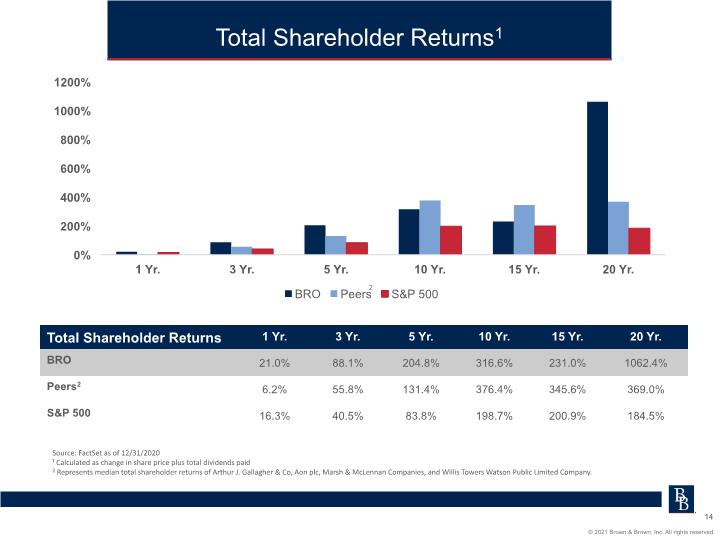

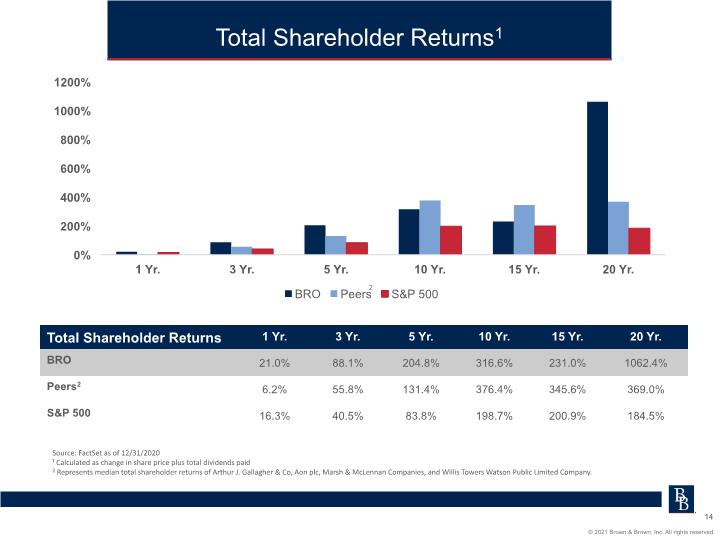

Source: FactSet as of 12/31/2020 ¹ Calculated as change in share price plus total dividends paid 2 Represents median total shareholder returns of Arthur J. Gallagher & Co, Aon plc, Marsh & McLennan Companies, and Willis Towers Watson Public Limited Company. Total Shareholder Returns1 [BAR CHART] Total Shareholder Returns 1 Yr. 3 Yr. 5 Yr. 10 Yr. 15 Yr. 20 Yr. BRO 21.0% 88.1% 204.8% 316.6% 231.0% 1062.4% Peers2 6.2% 55.8% 131.4% 376.4% 345.6% 369.0% S&P 500 16.3% 40.5% 83.8% 198.7% 200.9% 184.5% Source: FactSet as of 12/31/2020 ¹ Calculated as change in share price plus total dividends paid 2 Represents median total shareholder returns of Arthur J. Gallagher & Co, Aon plc, Marsh & McLennan Companies, and Willis Towers Watson Public Limited Company. BB C 2021 Brown & Brown, Inc. All rights reserved. 14

Retail Segment Retail Segment BB C 2021 Brown & Brown, Inc. All rights reserved. 15

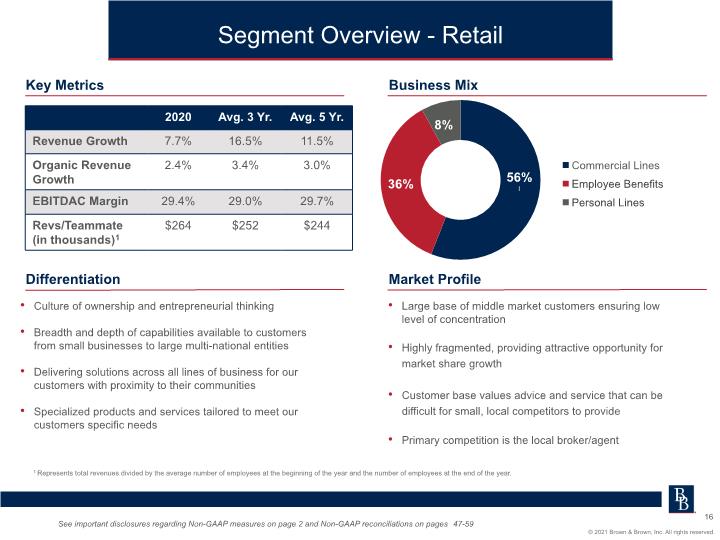

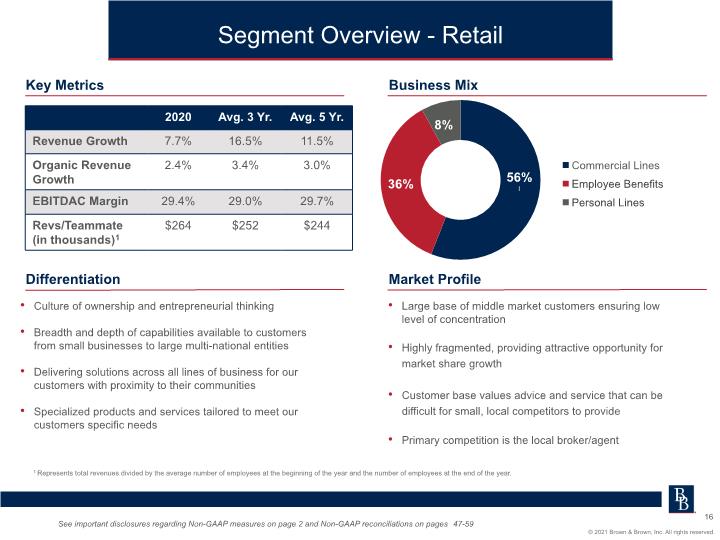

Segment Overview - Retail Key Metrics Business Mix Differentiation Market Profile Culture of ownership and entrepreneurial thinking Breadth and depth of capabilities available to customers from small businesses to large multi-national entities Delivering solutions across all lines of business for our customers with proximity to their communities Specialized products and services tailored to meet our customers specific needs Large base of middle market customers ensuring low level of concentration Highly fragmented, providing attractive opportunity for market share growth Customer base values advice and service that can be difficult for small, local competitors to provide Primary competition is the local broker/agent 1 Represents total revenues divided by the average number of employees at the beginning of the year and the number of employees at the end of the year. See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 Segment Overview - Retail Key Metrics 2020 Avg. 3 Yr. Avg. 5 Yr. Revenue Growth 7.7% 16.5% 11.5% Organic Revenue Growth 2.4% 3.4% 3.0% EBITDAC Margin 29.4% 29.0% 29.7% Revs/Teammate (in thousands)1 $264 $252 $244 Business Mix [BAR CHART] Differentiation • Culture of ownership and entrepreneurial thinking • Breadth and depth of capabilities available to customers from small businesses to large multi-national entities • Delivering solutions across all lines of business for our customers with proximity to their communities • Specialized products and services tailored to meet our customers specific needs Market Profile • Large base of middle market customers ensuring low level of concentration • Highly fragmented, providing attractive opportunity for market share growth • Customer base values advice and service that can be difficult for small, local competitors to provide • Primary competition is the local broker/agent 1 Represents total revenues divided by the average number of employees at the beginning of the year and the number of employees at the end of the year. See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 BB C 2021 Brown & Brown, Inc. All rights reserved. 16

The Retail Segment provides broad and deep expertise to our customers, while maintaining close proximity to the communities in which our customers operate their businesses. Breadth & Depth of Expertise Breadth & Depth of Expertise INDUSTRY Customers span hundreds of industry classifications with more than 15 primary industries COVERAGE Coverage placed for almost every line, with more than 15 lines MARKETS Placing coverage for 1,000+ carrier partners & with 50 significant carriers The Retail Segment provides broad and deep expertise to our customers, while maintaining close proximity to the communities in which our customers operate their businesses. BB C 2021 Brown & Brown, Inc. All rights reserved. 17

Property Casualty Workers’ Compensation Professional / Cyber Liability Captive Management & Actuarial Services Environmental Liability Claims & Loss Control Consulting / Analytics Group Medical, Benefits, Retirement & Savings Ancillary / Non-Medical Benefits F&I Dealership Services Revenue $1M $5B+ Employees 50 50,000+ Retail Capabilities Construction Manufacturing Educational Institutions Real Estate Public Entities Finance & Insurance Healthcare Retail Non-profits Retail Capabilities Revenue Employees BB C 2021 Brown & Brown, Inc. All rights reserved. 18

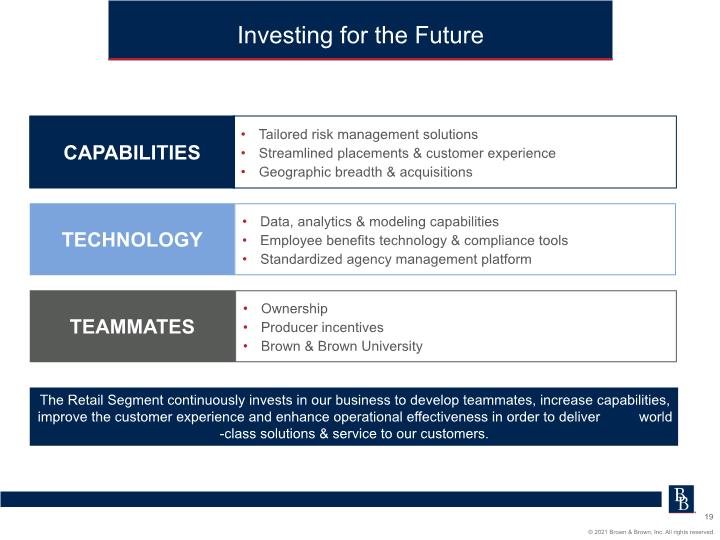

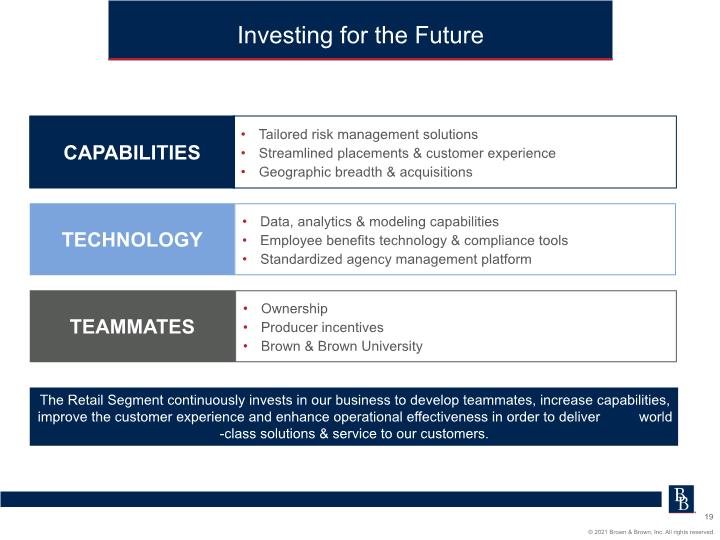

The Retail Segment continuously invests in our business to develop teammates, increase capabilities, improve the customer experience and enhance operational effectiveness in order to deliver world-class solutions & service to our customers. Investing for the Future Investing for the Future CAPABILITIES • Tailored risk management solutions • Streamlined placements & customer experience • Geographic breadth & acquisitions TECHNOLOGY • Data, analytics & modeling capabilities • Employee benefits technology & compliance tools • Standardized agency management platform TEAMMATES • Ownership • Producer incentives • Brown & Brown University The Retail Segment continuously invests in our business to develop teammates, increase capabilities, improve the customer experience and enhance operational effectiveness in order to deliver world-class solutions & service to our customers. BB C 2021 Brown & Brown, Inc. All rights reserved. 19

National Programs Segment National Programs Segment BB C 2021 Brown & Brown, Inc. All rights reserved. 20

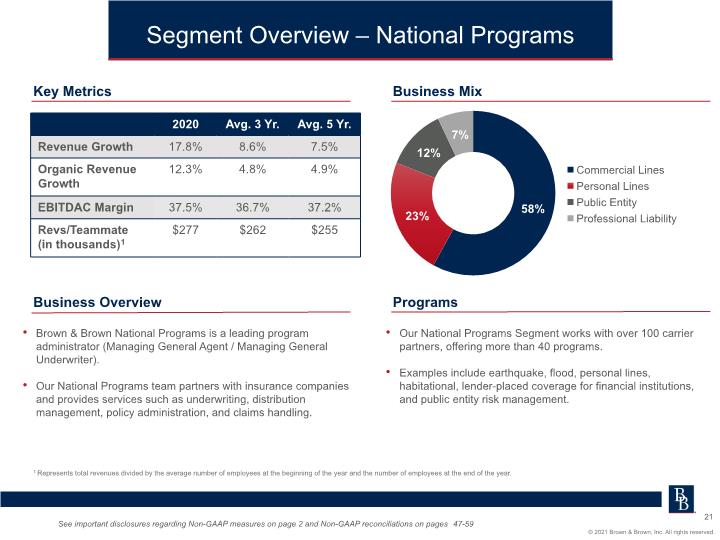

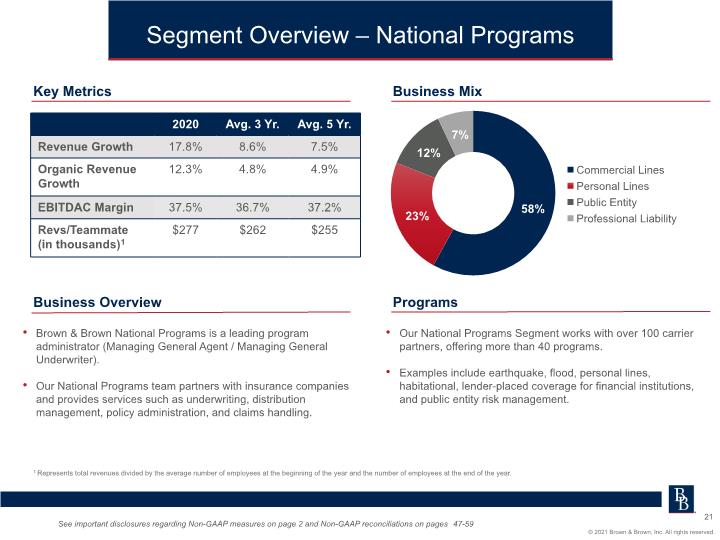

Segment Overview – National Programs Business Overview Programs Brown & Brown National Programs is a leading program administrator (Managing General Agent / Managing General Underwriter). Our National Programs team partners with insurance companies and provides services such as underwriting, distribution management, policy administration, and claims handling. Key Metrics Business Mix See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 1 Represents total revenues divided by the average number of employees at the beginning of the year and the number of employees at the end of the year. Our National Programs Segment works with over 100 carrier partners, offering more than 40 programs. Examples include earthquake, flood, personal lines, habitational, lender-placed coverage for financial institutions, and public entity risk management. Segment Overview – National Programs Key Metrics Business Mix 2020 Avg. 3 Yr. Revenue Growth 17.8% 8.6% 7.5% Organic Revenue Growth 12.3% 4.8% 4.9% EBITDAC Margin 37.5% 36.7% 37.2% Revs/Teammate (in thousands)1 $277 $262 $255 Business Overview Programs Commercial Lines Personal Lines Public Entity Professional Liability • Brown & Brown National Programs is a leading program administrator (Managing General Agent / Managing General Underwriter). • Our National Programs team partners with insurance companies and provides services such as underwriting, distribution management, policy administration, and claims handling. • Our National Programs Segment works with over 100 carrier partners, offering more than 40 programs. • Examples include earthquake, flood, personal lines, habitational, lender-placed coverage for financial institutions, and public entity risk management. BB C 2021 Brown & Brown, Inc. All rights reserved. 21 1 Represents total revenues divided by the average number of employees at the beginning of the year and the number of employees at the end of the year. See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59

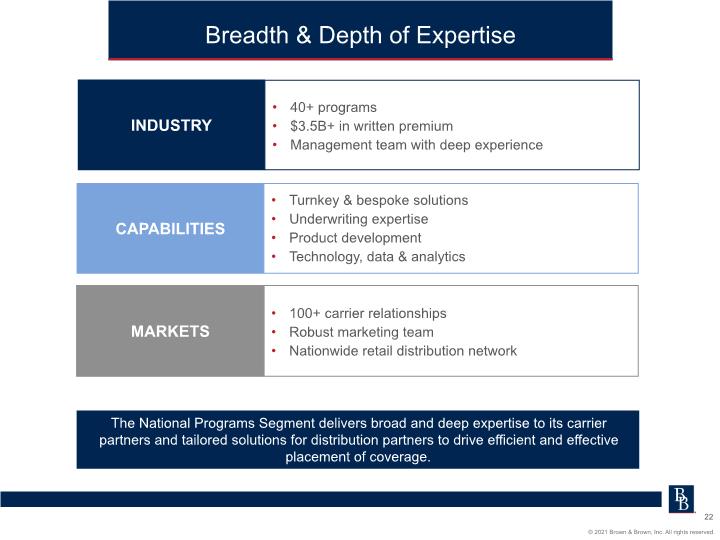

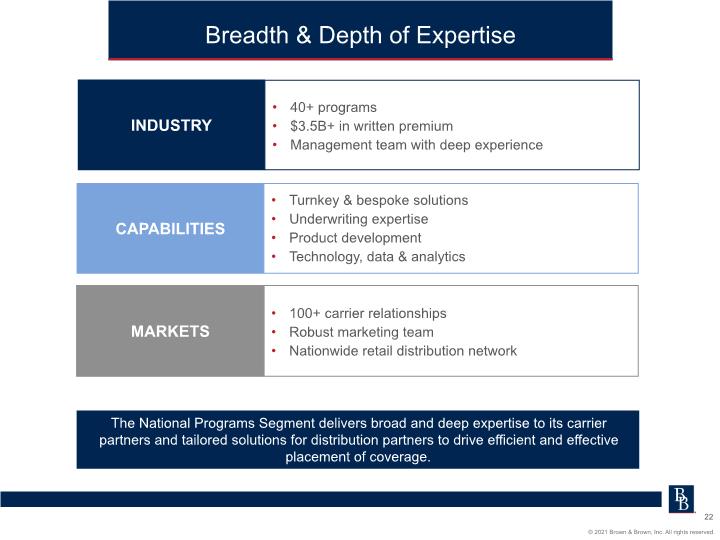

CAPABILITIES MARKETS 100+ carrier relationships Robust marketing team Nationwide retail distribution network The National Programs Segment delivers broad and deep expertise to its carrier partners and tailored solutions for distribution partners to drive efficient and effective placement of coverage. Breadth & Depth of Expertise Breadth & Depth of Expertise INDUSTRY • 40+ programs • $3.5B+ in written premium • Management team with deep experience CAPABILITIES • Turnkey & bespoke solutions • Underwriting expertise • Product development • Technology, data & analytics MARKETS • 100+ carrier relationships • Robust marketing team • Nationwide retail distribution network The National Programs Segment delivers broad and deep expertise to its carrier partners and tailored solutions for distribution partners to drive efficient and effective placement of coverage. BB C 2021 Brown & Brown, Inc. All rights reserved. 22

National Programs provides carriers with the complete infrastructure to launch and manage broad or niche programs. Solutions Carriers Focus On: Capital investments Established program metrics Portfolio underwriting management Reinsurance Risk management Solutions Carriers Focus On: • Capital investments • Established program metrics • Portfolio underwriting management • Reinsurance • Risk management Daily Program Support & Servicing: • Technology • Underwriting • Billing & collection • Claims administration & management • Operations & mailroom • Policy administration • Program management • Marketing & distribution National Programs provides carriers with the complete infrastructure to launch and manage broad or niche programs. BB C 2021 Brown & Brown, Inc. All rights reserved. 23

Wholesale Brokerage Segment Wholesale Brokerage Segment BB C 2021 Brown & Brown, Inc. All rights reserved. 24

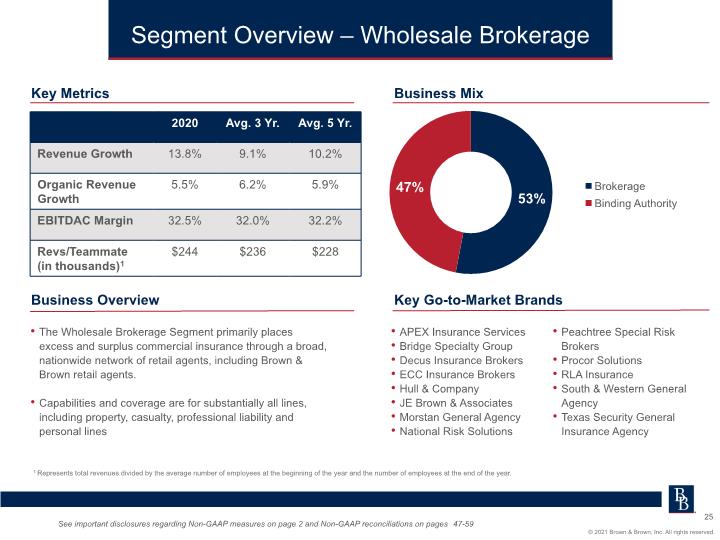

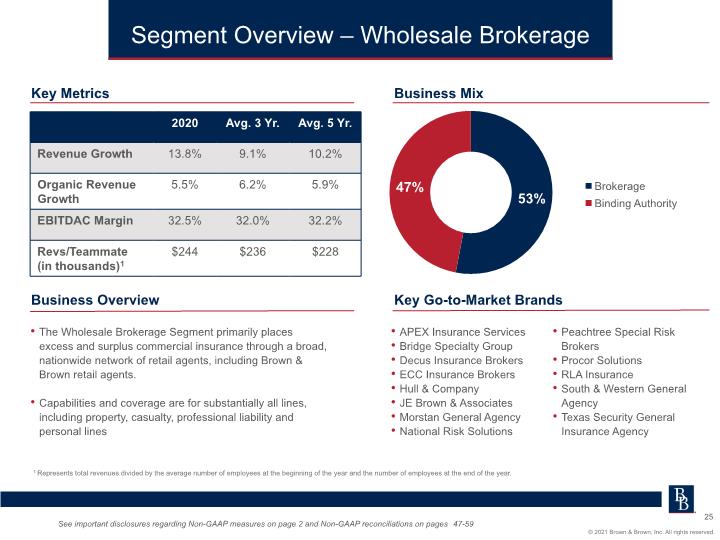

Segment Overview – Wholesale Brokerage Key Metrics Business Mix Business Overview Key Go-to-Market Brands The Wholesale Brokerage Segment primarily places excess and surplus commercial insurance through a broad, nationwide network of retail agents, including Brown & Brown retail agents. Capabilities and coverage are for substantially all lines, including property, casualty, professional liability and personal lines APEX Insurance Services Bridge Specialty Group Decus Insurance Brokers ECC Insurance Brokers Hull & Company JE Brown & Associates Morstan General Agency National Risk Solutions Peachtree Special Risk Brokers Procor Solutions RLA Insurance South & Western General Agency Texas Security General Insurance Agency See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 1 Represents total revenues divided by the average number of employees at the beginning of the year and the number of employees at the end of the year. Segment Overview – Wholesale Brokerage Key Metrics 2020 Avg. 3 Yr. Avg. 5 Yr. Revenue Growth 13.8% 9.1% 10.2% Organic Revenue Growth 5.5% 6.2% 5.9% EBITDAC Margin 32.5% 32.0% 32.2% Revs/Teammate (in thousands)1 $244 $236 $228 Business Mix [BAR CHART] Business Overview The Wholesale Brokerage Segment primarily places excess and surplus commercial insurance through a broad, nationwide network of retail agents, including Brown & Brown retail agents. Capabilities and coverage are for substantially all lines, including property, casualty, professional liability and personal lines Key Go-to-Market Brands APEX Insurance Services Bridge Specialty Group Decus Insurance Brokers ECC Insurance Brokers Hull & Company JE Brown & Associates Morstan General Agency National Risk Solutions Peachtree Special Risk Brokers Procor Solutions RLA Insurance South & Western General Agency Texas Security General Insurance Agency 1 Represents total revenues divided by the average number of employees at the beginning of the year and the number of employees at the end of the year. See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 BB C 2021 Brown & Brown, Inc. All rights reserved. 25

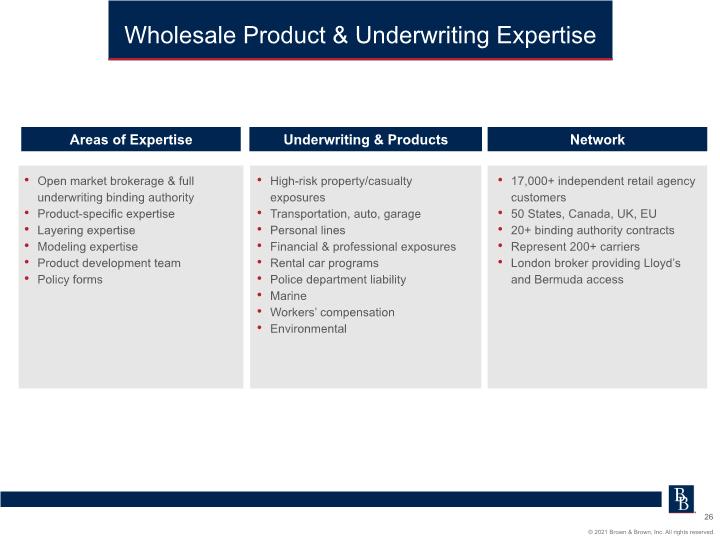

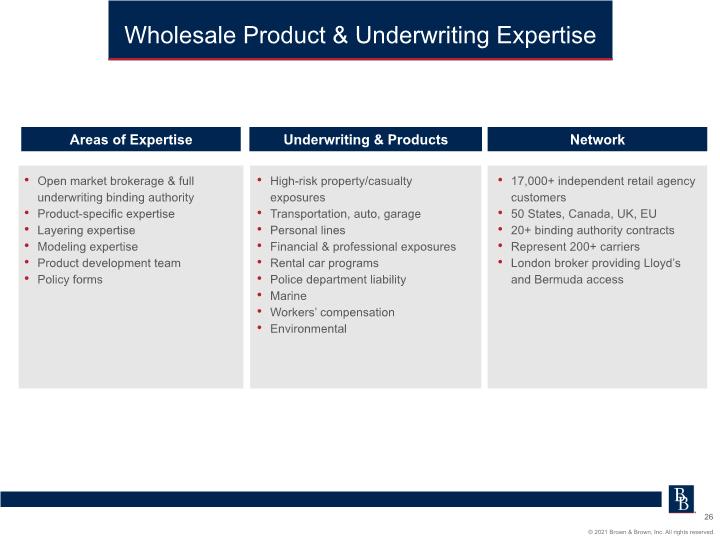

Open market brokerage & full underwriting binding authority Product-specific expertise Layering expertise Modeling expertise Product development team Policy forms High-risk property/casualty exposures Transportation, auto, garage Personal lines Financial & professional exposures Rental car programs Police department liability Marine Workers’ compensation Environmental 17,000+ independent retail agency customers 50 States, Canada, UK, EU 20+ binding authority contracts Represent 200+ carriers London broker providing Lloyd’s and Bermuda access Wholesale Product & Underwriting Expertise Areas of Expertise Underwriting & Products Network Wholesale Product & Underwriting Expertise Areas of Expertise Underwriting & Products Network • Open market brokerage & full underwriting binding authority • Product-specific expertise • Layering expertise • Modeling expertise • Product development team • Policy forms • High-risk property/casualty exposures • Transportation, auto, garage • Personal lines • Financial & professional exposures • Rental car programs • Police department liability • Marine • Workers’ compensation • Environmental • 17,000+ independent retail agency customers • 50 States, Canada, UK, EU • 20+ binding authority contracts • Represent 200+ carriers • London broker providing Lloyd’s and Bermuda access BB C 2021 Brown & Brown, Inc. All rights reserved. 26

Services Segment Services Segment BB C 2021 Brown & Brown, Inc. All rights reserved. 27

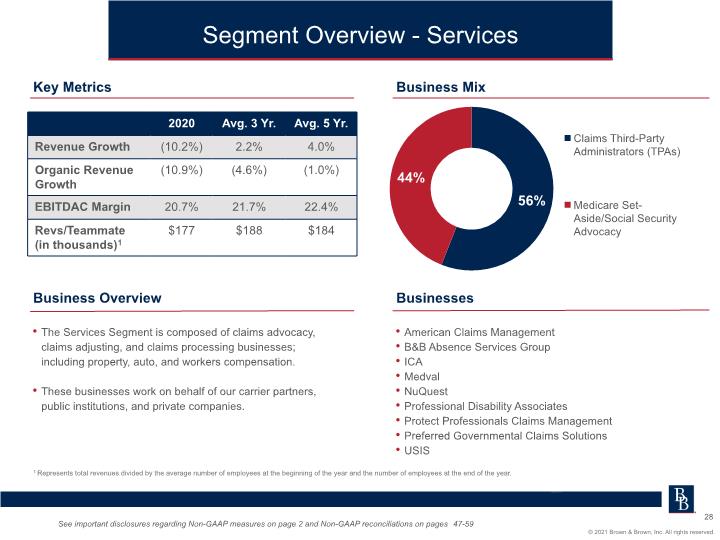

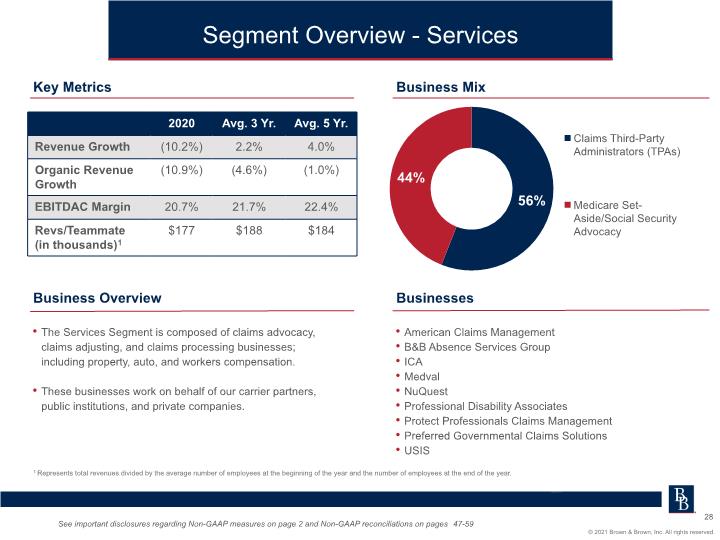

Segment Overview - Services Key Metrics Business Mix Business Overview Businesses The Services Segment is composed of claims advocacy, claims adjusting, and claims processing businesses; including property, auto, and workers compensation. These businesses work on behalf of our carrier partners, public institutions, and private companies. American Claims Management B&B Absence Services Group ICA Medval NuQuest Professional Disability Associates Protect Professionals Claims Management Preferred Governmental Claims Solutions USIS See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 1 Represents total revenues divided by the average number of employees at the beginning of the year and the number of employees at the end of the year. Segment Overview - Services Key Metrics 2020 Avg. 3 Yr. Avg. 5 Yr. Revenue Growth (10.2%) 2.2% 4.0% Organic Revenue Growth (10.9%) (4.6%) (1.0%) EBITDAC Margin 20.7% 21.7% 22.4% Revs/Teammate (in thousands)1 $177 $188 $184 Business Mix [BAR CHART] Business Overview • The Services Segment is composed of claims advocacy, claims adjusting, and claims processing businesses; including property, auto, and workers compensation. • These businesses work on behalf of our carrier partners, public institutions, and private companies. Businesses • American Claims Management • B&B Absence Services Group • ICA • Medval • NuQuest • Professional Disability Associates • Protect Professionals Claims Management • Preferred Governmental Claims Solutions • USIS 1 Represents total revenues divided by the average number of employees at the beginning of the year and the number of employees at the end of the year. See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 BB C 2021 Brown & Brown, Inc. All rights reserved. 28

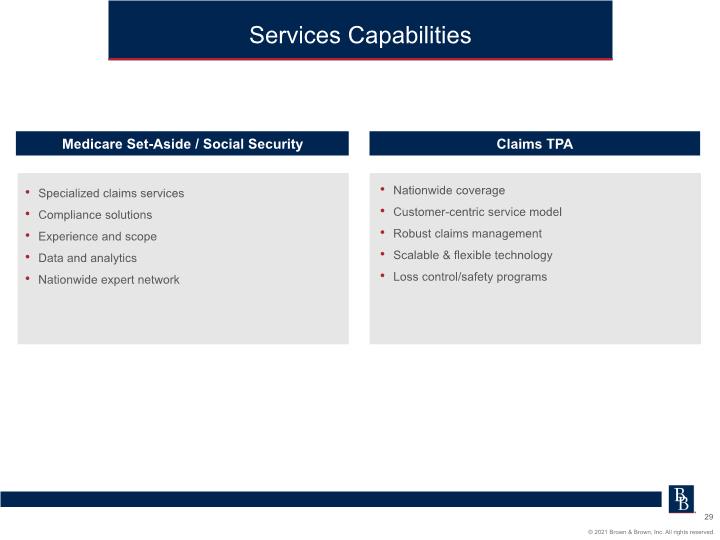

Specialized claims services Compliance solutions Experience and scope Data and analytics Nationwide expert network Nationwide coverage Customer-centric service model Robust claims management Scalable & flexible technology Loss control/safety programs Services Capabilities Claims TPA Medicare Set-Aside / Social Security Services Capabilities Medicare Set-Aside / Social Security Claims TAP Specialized claims services Compliance solutions Experience and scope Data and analytics Nationwide expert network Nationwide coverage Customer-centric service model Robust claims management Scalable & flexible technology Loss control/safety programs BB C 2021 Brown & Brown, Inc. All rights reserved. 29

Acquisitions Acquisitions BB C 2021 Brown & Brown, Inc. All rights reserved. 30

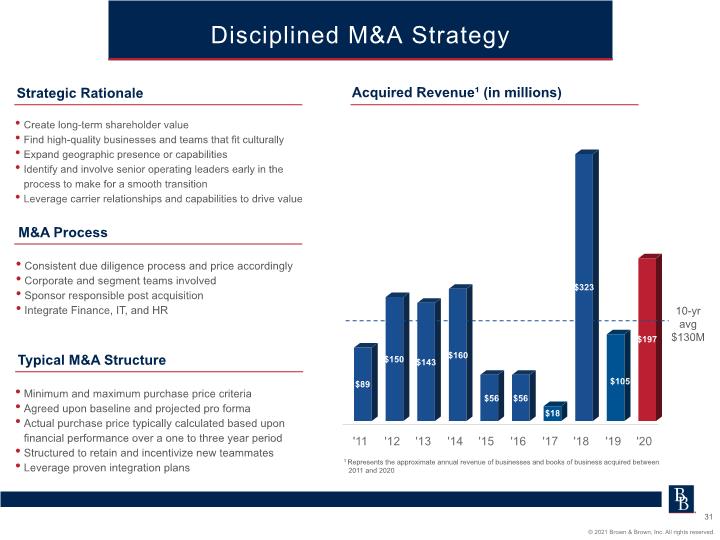

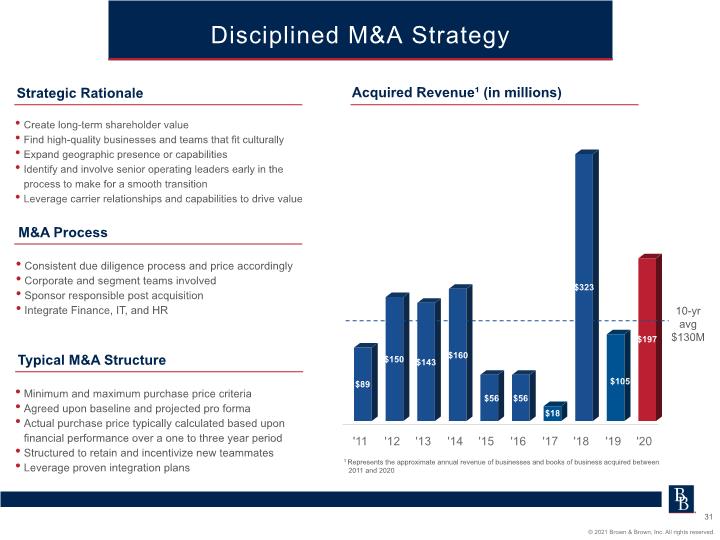

Disciplined M&A Strategy Consistent due diligence process and price accordingly Corporate and segment teams involved Sponsor responsible post acquisition Integrate Finance, IT, and HR Create long-term shareholder value Find high-quality businesses and teams that fit culturally Expand geographic presence or capabilities Identify and involve senior operating leaders early in the process to make for a smooth transition Leverage carrier relationships and capabilities to drive value 1 Represents the approximate annual revenue of businesses and books of business acquired between 2011 and 2020 Acquired Revenue¹ (in millions) Strategic Rationale M&A Process Typical M&A Structure Minimum and maximum purchase price criteria Agreed upon baseline and projected pro forma Actual purchase price typically calculated based upon financial performance over a one to three year period Structured to retain and incentivize new teammates Leverage proven integration plans 10-yr avg $130M Disciplined M&A Strategy Strategic Rationale • Create long-term shareholder value • Find high-quality businesses and teams that fit culturally Expand geographic presence or capabilities • Identify and involve senior operating leaders early in the process to make for a smooth transition Leverage carrier relationships and capabilities to drive value M&A Process • Consistent due diligence process and price accordingly • Corporate and segment teams involved • Sponsor responsible post acquisition • Integrate Finance, IT, and HR Typical M&A Structure • Minimum and maximum purchase price criteria • Agreed upon baseline and projected pro forma • Actual purchase price typically calculated based upon financial performance over a one to three year period • Structured to retain and incentivize new teammates • Leverage proven integration plans [BAR CHART] Acquired Revenue¹ (in millions) 1 Represents the approximate annual revenue of businesses and books of business acquired between 2011 and 2020 BB C 2021 Brown & Brown, Inc. All rights reserved. 31

Technology & Innovation Technology & Innovation BB C 2021 Brown & Brown, Inc. All rights reserved. 32

Technology Evolution Standardize Innovate Business Value Maturity Value Impact Information Technology Maturity Operational Excellence Service Excellence Technology Evolution Operational Excellence Service Excellence Information Technology Maturity Business Value Maturity BB C 2021 Brown & Brown, Inc. All rights reserved. 33

Innovation Agenda Prefill External, Third Party Data Aggregation Solution Creation Robotic Process Automation Predictive Analytics Claims, Marketing, Underwriting, Pricing & Operations Claims Settlement Automation AI-Based Applications Chatbots, Policy Checking & Commercial Underwriting Curated Quotes, Automated Placements, New Product Development Innovation Agenda AI-Based Applications Chatbots, Policy Checking & Commercial Underwriting Solution Creation Curated Quotes, Automated Placements, New Product Development Robotic Process Automation Predictive Analytics Claims, Marketing, Underwriting, Pricing & Operations Claims Settlement Automation Prefill External, Third Party Data Aggregation BB C 2021 Brown & Brown, Inc. All rights reserved. 34

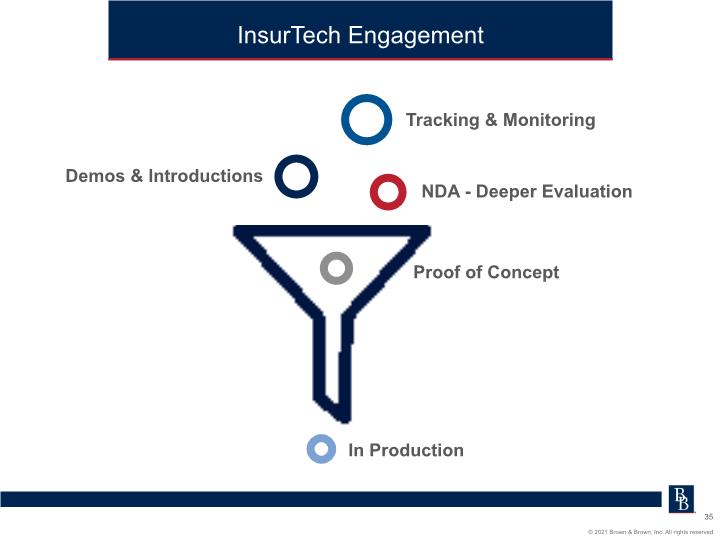

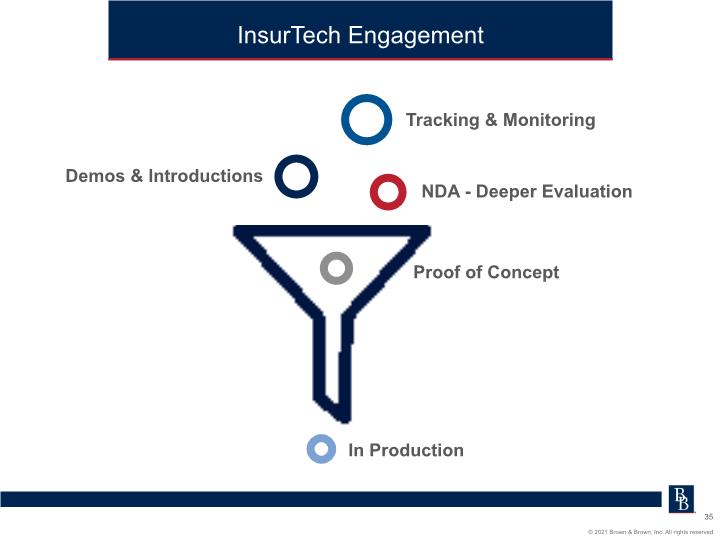

InsurTech Engagement Tracking & Monitoring InsurTech Engagement Demos & Introductions Tracking & Monitoring NDA - Deeper Evaluation Proof of Concept In Production BB C 2021 Brown & Brown, Inc. All rights reserved. 35

Financial Performance Financial Performance BB C 2021 Brown & Brown, Inc. All rights reserved. 36

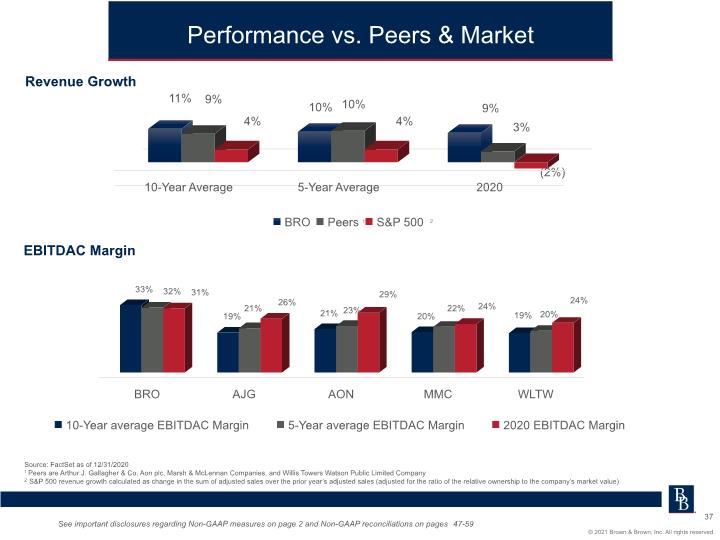

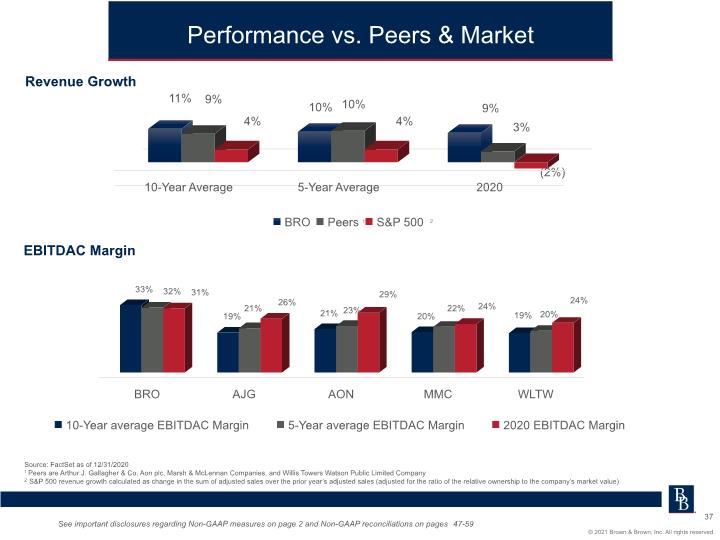

Performance vs. Peers & Market Source: FactSet as of 12/31/2020 1 Peers are Arthur J. Gallagher & Co, Aon plc, Marsh & McLennan Companies, and Willis Towers Watson Public Limited Company 2 S&P 500 revenue growth calculated as change in the sum of adjusted sales over the prior year’s adjusted sales (adjusted for the ratio of the relative ownership to the company’s market value) See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 1 2 Performance vs. Peers & Market Revenue Growth EBITDAC Margin [BAR CHART] [BAR CHART] Source: FactSet as of 12/31/2020 1 Peers are Arthur J. Gallagher & Co, Aon plc, Marsh & McLennan Companies, and Willis Towers Watson Public Limited Company 2 S&P 500 revenue growth calculated as change in the sum of adjusted sales over the prior year’s adjusted sales (adjusted for the ratio of the relative ownership to the company’s market value) See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 BB C 2021 Brown & Brown, Inc. All rights reserved. 37

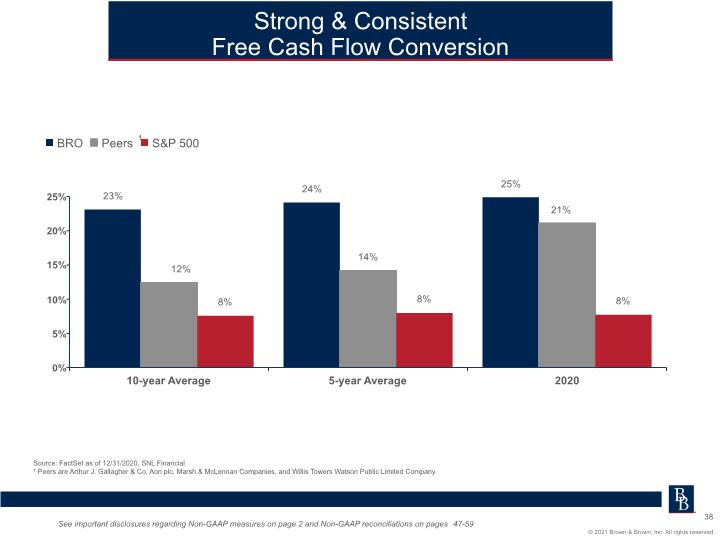

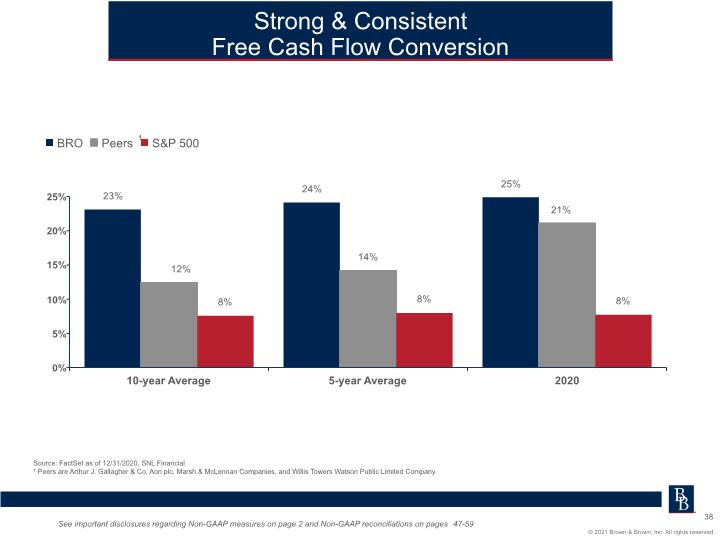

Strong & Consistent Free Cash Flow Conversion Source: FactSet as of 12/31/2020, SNL Financial 1 Peers are Arthur J. Gallagher & Co, Aon plc, Marsh & McLennan Companies, and Willis Towers Watson Public Limited Company 1 See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 Strong & Consistent Free Cash Flow Conversion [BAR CHART] Source: FactSet as of 12/31/2020, SNL Financial 1 Peers are Arthur J. Gallagher & Co, Aon plc, Marsh & McLennan Companies, and Willis Towers Watson Public Limited Company See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 BB C 2021 Brown & Brown, Inc. All rights reserved. 38

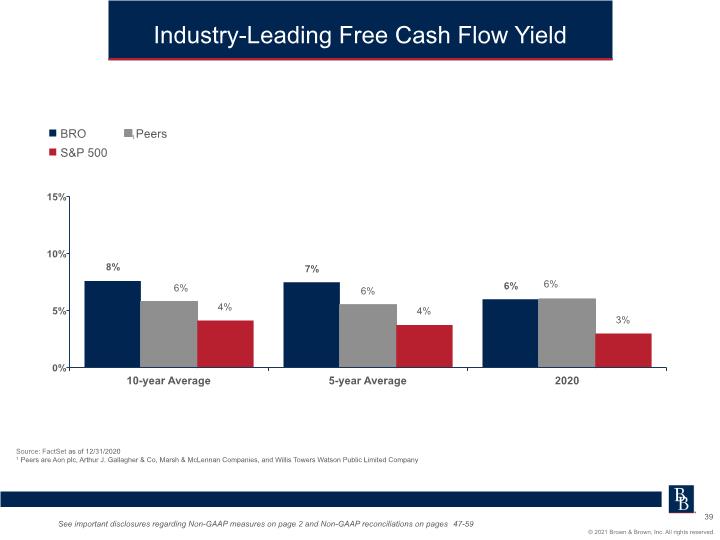

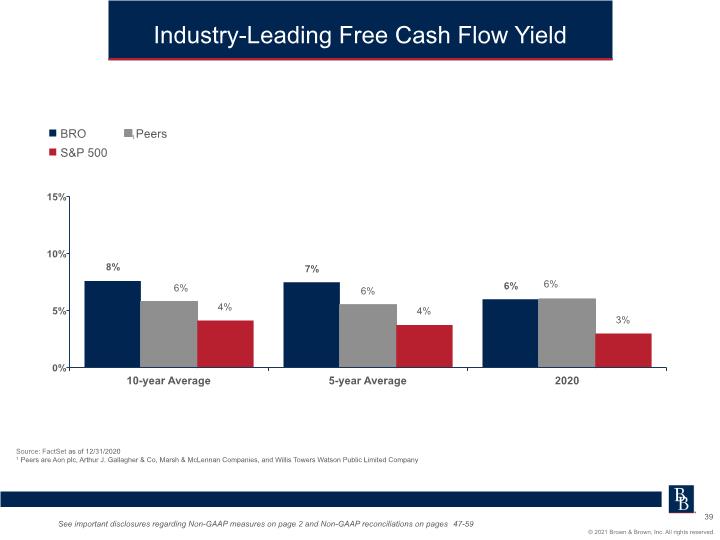

1 Industry-Leading Free Cash Flow Yield Source: FactSet as of 12/31/2020 1 Peers are Aon plc, Arthur J. Gallagher & Co, Marsh & McLennan Companies, and Willis Towers Watson Public Limited Company See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 Industry-Leading Free Cash Flow Yield Source: FactSet as of 12/31/2020 [BAR CHART] [BAR CHART] 1 Peers are Aon plc, Arthur J. Gallagher & Co, Marsh & McLennan Companies, and Willis Towers Watson Public Limited Company See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 BB C 2021 Brown & Brown, Inc. All rights reserved. 39

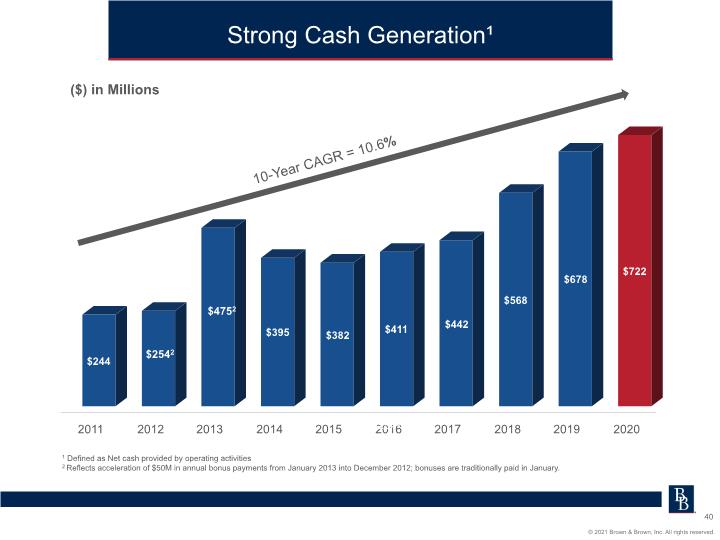

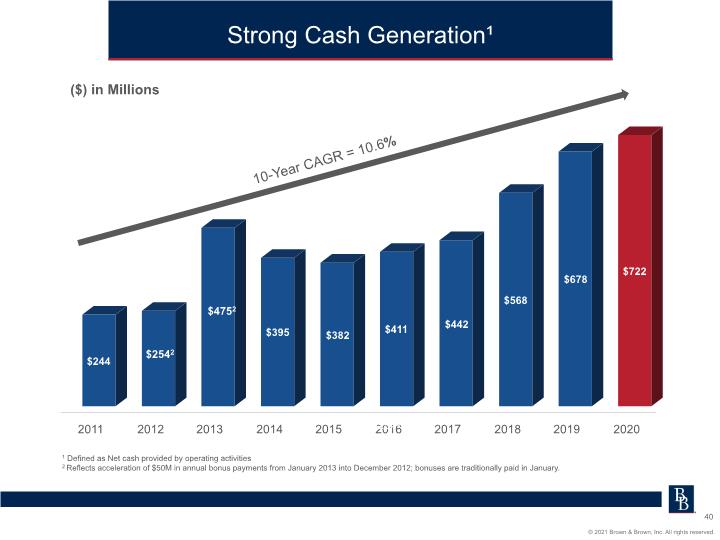

10-Year CAGR = 10.6% ($) in Millions $4752 $2542 1 Defined as Net cash provided by operating activities 2 Reflects acceleration of $50M in annual bonus payments from January 2013 into December 2012; bonuses are traditionally paid in January. Strong Cash Generation¹ Strong Cash Generation¹ 1 Defined as Net cash provided by operating activities [BAR CHART] 2 Reflects acceleration of $50M in annual bonus payments from January 2013 into December 2012; bonuses are traditionally paid in January. BB C 2021 Brown & Brown, Inc. All rights reserved. 40

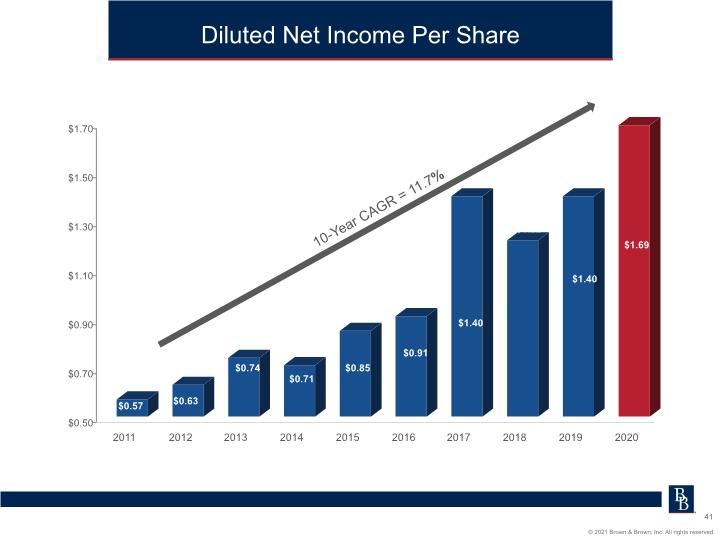

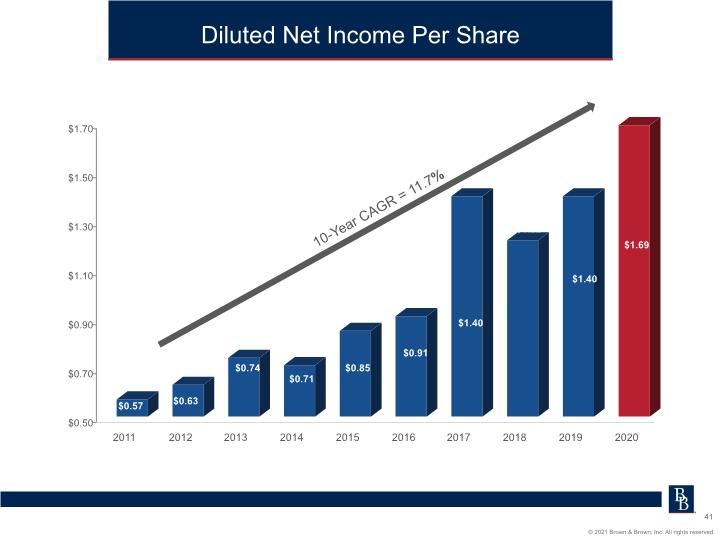

Diluted Net Income Per Share 10-Year CAGR = 11.7% Diluted Net Income Per Share [BAR CHART] BB C 2021 Brown & Brown, Inc. All rights reserved. 41

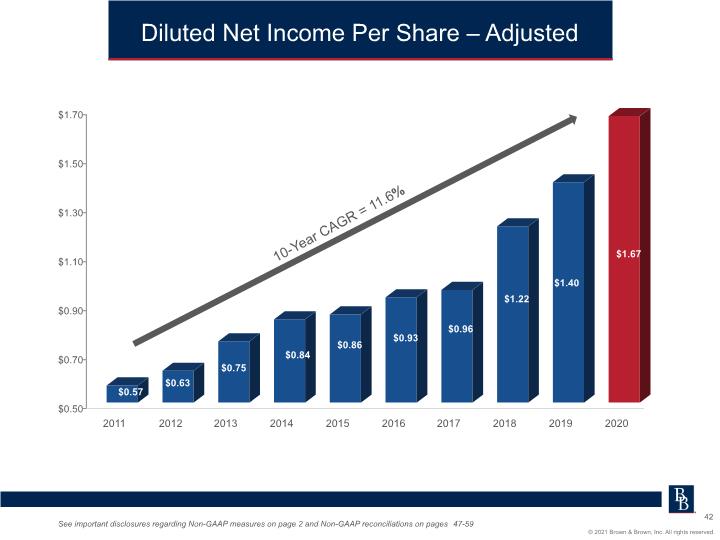

10-Year CAGR = 11.6% Diluted Net Income Per Share – Adjusted See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 Diluted Net Income Per Share – Adjusted [BAR CHART] See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 BB C 2021 Brown & Brown, Inc. All rights reserved. 42

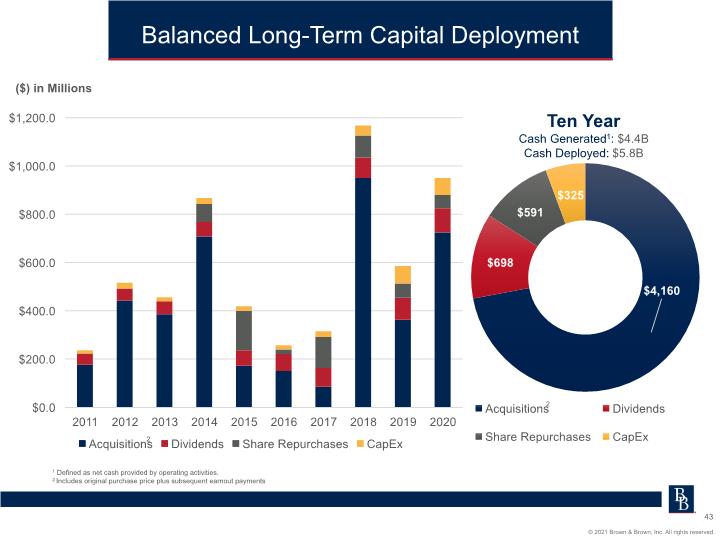

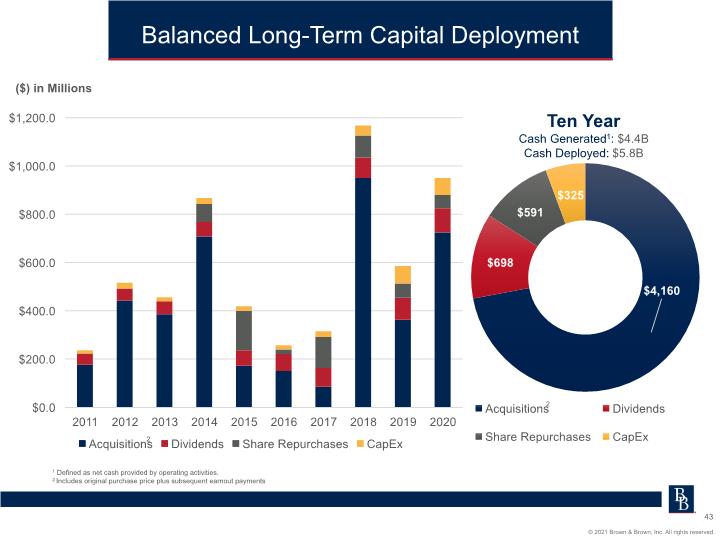

($) in Millions 1 Defined as net cash provided by operating activities. 2 Includes original purchase price plus subsequent earnout payments Balanced Long-Term Capital Deployment 2 2 Balanced Long-Term Capital Deployment [BAR CHART] 1 Defined as net cash provided by operating activities. 2 Includes original purchase price plus subsequent earnout payments BB C 2021 Brown & Brown, Inc. All rights reserved. 43

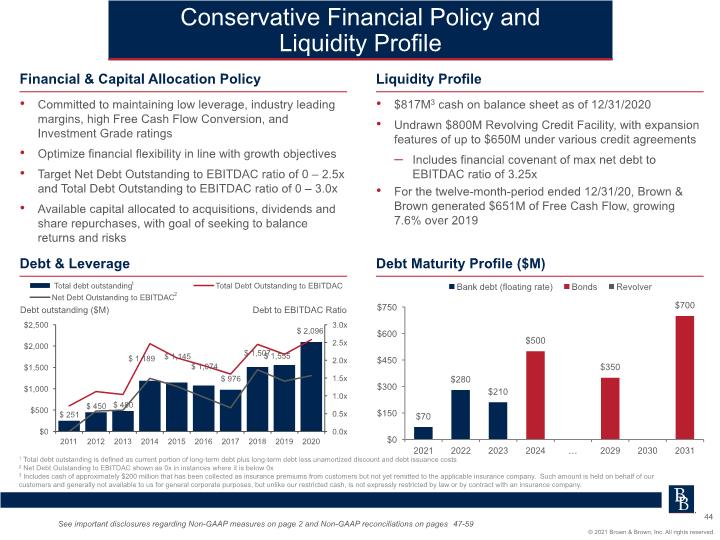

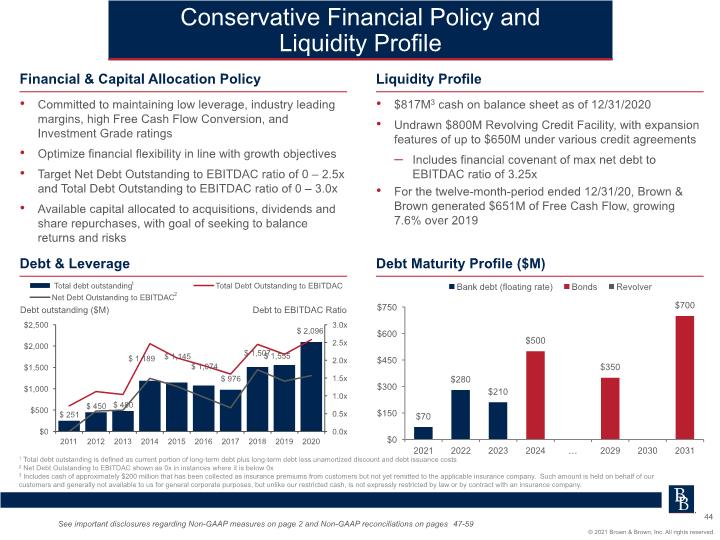

Financial & Capital Allocation Policy Liquidity Profile Committed to maintaining low leverage, industry leading margins, high Free Cash Flow Conversion, and Investment Grade ratings Optimize financial flexibility in line with growth objectives Target Net Debt Outstanding to EBITDAC ratio of 0 – 2.5x and Total Debt Outstanding to EBITDAC ratio of 0 – 3.0x Available capital allocated to acquisitions, dividends and share repurchases, with goal of seeking to balance returns and risks Conservative Financial Policy and Liquidity Profile $817M3 cash on balance sheet as of 12/31/2020 Undrawn $800M Revolving Credit Facility, with expansion features of up to $650M under various credit agreements Includes financial covenant of max net debt to EBITDAC ratio of 3.25x For the twelve-month-period ended 12/31/20, Brown & Brown generated $651M of Free Cash Flow, growing 7.6% over 2019 Debt & Leverage Debt Maturity Profile ($M) Debt outstanding ($M) Debt to EBITDAC Ratio 1 2 1 Total debt outstanding is defined as current portion of long-term debt plus long-term debt less unamortized discount and debt issuance costs 2 Net Debt Outstanding to EBITDAC shown as 0x in instances where it is below 0x 3 Includes cash of approximately $200 million that has been collected as insurance premiums from customers but not yet remitted to the applicable insurance company. Such amount is held on behalf of our customers and generally not available to us for general corporate purposes, but unlike our restricted cash, is not expressly restricted by law or by contract with an insurance company. See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 Conservative Financial Policy and Liquidity Profile Financial & Capital Allocation Policy • Committed to maintaining low leverage, industry leading margins, high Free Cash Flow Conversion, and Investment Grade ratings • Optimize financial flexibility in line with growth objectives • Target Net Debt Outstanding to EBITDAC ratio of 0 – 2.5x and Total Debt Outstanding to EBITDAC ratio of 0 – 3.0x • Available capital allocated to acquisitions, dividends and share repurchases, with goal of seeking to balance returns and risks Liquidity Profile • $817M3 cash on balance sheet as of 12/31/2020 • Undrawn $800M Revolving Credit Facility, with expansion features of up to $650M under various credit agreements – Includes financial covenant of max net debt to EBITDAC ratio of 3.25x • For the twelve-month-period ended 12/31/20, Brown & Brown generated $651M of Free Cash Flow, growing 7.6% over 2019 [BAR CHART] [BAR CHART] Debt & Leverage Debt Maturity Profile ($M) 1 Total debt outstanding is defined as current portion of long-term debt plus long-term debt less unamortized discount and debt issuance costs 2 Net Debt Outstanding to EBITDAC shown as 0x in instances where it is below 0x 3 Includes cash of approximately $200 million that has been collected as insurance premiums from customers but not yet remitted to the applicable insurance company. Such amount is held on behalf of our customers and generally not available to us for general corporate purposes, but unlike our restricted cash, is not expressly restricted by law or by contract with an insurance company. See important disclosures regarding Non-GAAP measures on page 2 and Non-GAAP reconciliations on pages 47-59 BB C 2021 Brown & Brown, Inc. All rights reserved. 44

Closing Comments Closing Comments BB C 2021 Brown & Brown, Inc. All rights reserved. 45

Closing Comments Business well positioned to capture future growth opportunities Economic outlook primary driver of exposure growth & premium rates increases remain positive Balanced capital strategy & liquidity to deliver long-term shareholder value Investing in technology to improve customer & teammate experience, data analytics & workflow efficiency Operating model consistently delivers industry leading financial metrics & shareholders’ returns BB C 2021 Brown & Brown, Inc. All rights reserved. 46

GAAP to Non-GAAP Reconciliation Appendix GAAP to Non-GAAP Reconciliation Appendix BB C 2021 Brown & Brown, Inc. All rights reserved. 47

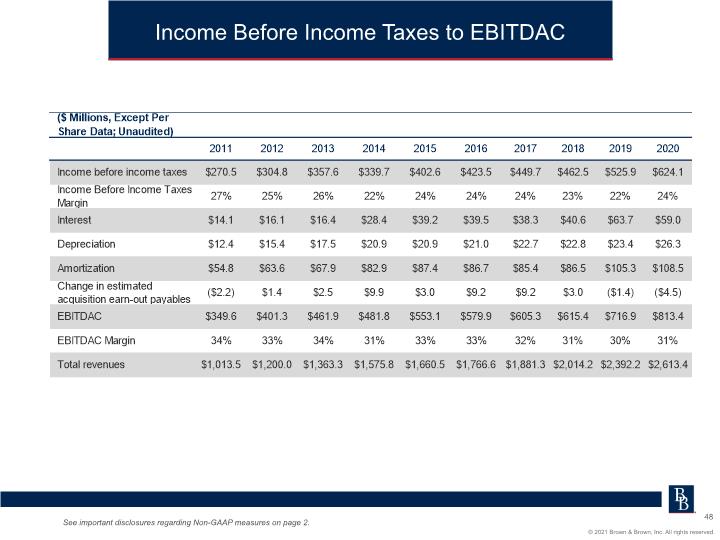

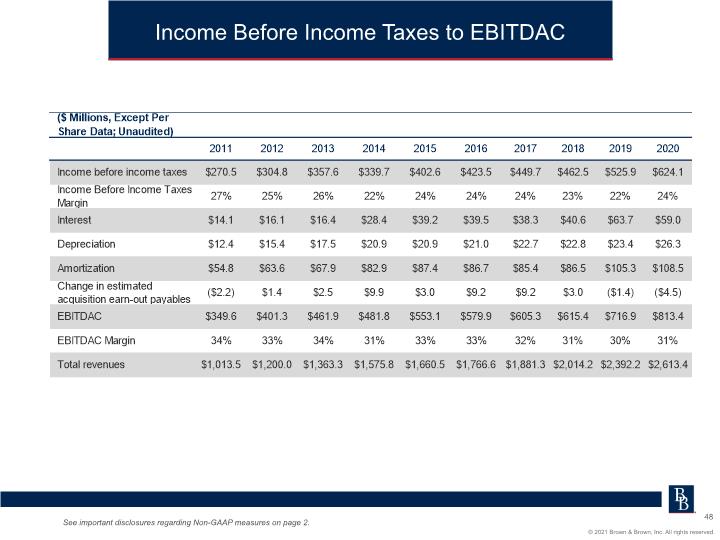

Income Before Income Taxes to EBITDAC See important disclosures regarding Non-GAAP measures on page 2. Income Before Income Taxes to EBITDAC ($ Millions, Except Per Share Data; Unaudited) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Income before income taxes $270.5 $304.8 $357.6 $339.7 $402.6 $423.5 $449.7 $462.5 $525.9 $624.1 Income Before Income Taxes Margin 27% 25% 26% 22% 24% 24% 24% 23% 22% 24% Interest $14.1 $16.1 $16.4 $28.4 $39.2 $39.5 $38.3 $40.6 $63.7 $59.0 Depreciation $12.4 $15.4 $17.5 $20.9 $20.9 $21.0 $22.7 $22.8 $23.4 $26.3 Amortization $54.8 $63.6 $67.9 $82.9 $87.4 $86.7 $85.4 $86.5 $105.3 $108.5 Change in estimated acquisition earn-out payables ($2.2) $1.4 $2.5 $9.9 $3.0 $9.2 $9.2 $3.0 ($1.4) ($4.5) EBITDAC $349.6 $401.3 $461.9 $481.8 $553.1 $579.9 $605.3 $615.4 $716.9 $813.4 EBITDAC Margin 34% 33% 34% 31% 33% 33% 32% 31% 30% 31% Total revenues $1,013.5 $1,200.0 $1,363.3 $1,575.8 $1,660.5 $1,766.6 $1,881.3 $2,014.2 $2,392.2 $2,613.4 See important disclosures regarding Non-GAAP measures on page 2. BB C 2021 Brown & Brown, Inc. All rights reserved. 48

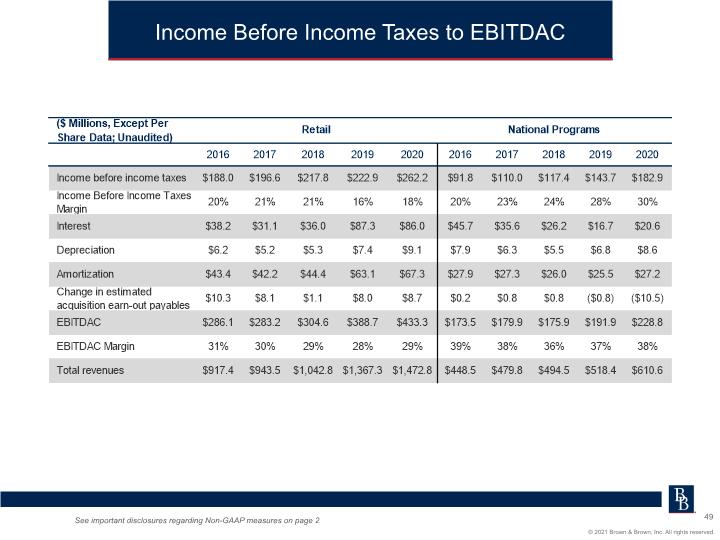

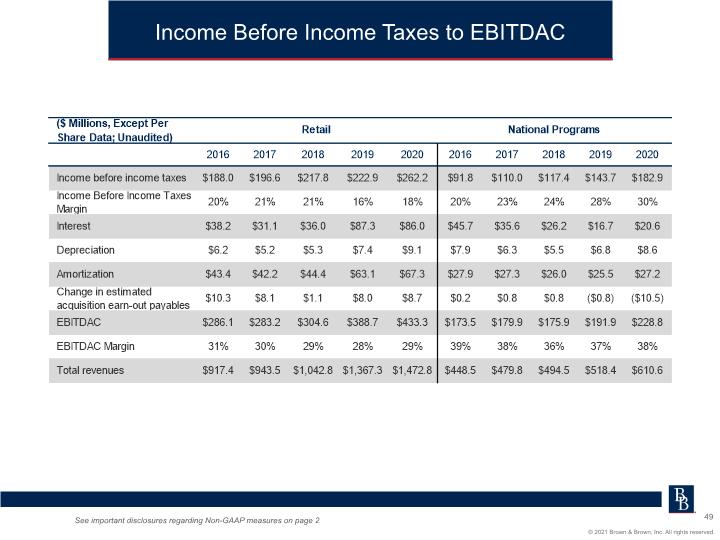

Income Before Income Taxes to EBITDAC See important disclosures regarding Non-GAAP measures on page 2 Income Before Income Taxes to EBITDAC ($ Millions, Except Per Share Data; Unaudited) Retail National Programs 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 Income before income taxes $188.0 $196.6 $217.8 $222.9 $262.2 $91.8 $110.0 $117.4 $143.7 $182.9 Income Before Income Taxes Margin 20% 21% 21% 16% 18% 20% 23% 24% 28% 30% Interest $38.2 $31.1 $36.0 $87.3 $86.0 $45.7 $35.6 $26.2 $16.7 $20.6 Depreciation $6.2 $5.2 $5.3 $7.4 $9.1 $7.9 $6.3 $5.5 $6.8 $8.6 Amortization $43.4 $42.2 $44.4 $63.1 $67.3 $27.9 $27.3 $26.0 $25.5 $27.2 Change in estimated acquisition earn-out payables $10.3 $8.1 $1.1 $8.0 $8.7 $0.2 $0.8 $0.8 ($0.8) ($10.5) EBITDAC $286.1 $283.2 $304.6 $388.7 $433.3 $173.5 $179.9 $175.9 $191.9 $228.8 EBITDAC Margin 31% 30% 29% 28% 29% 39% 38% 36% 37% 38% Total revenues $917.4 $943.5 $1,042.8 $1,367.3 $1,472.8 $448.5 $479.8 $494.5 $518.4 $610.6 See important disclosures regarding Non-GAAP measures on page 2 BB C 2021 Brown & Brown, Inc. All rights reserved. 49

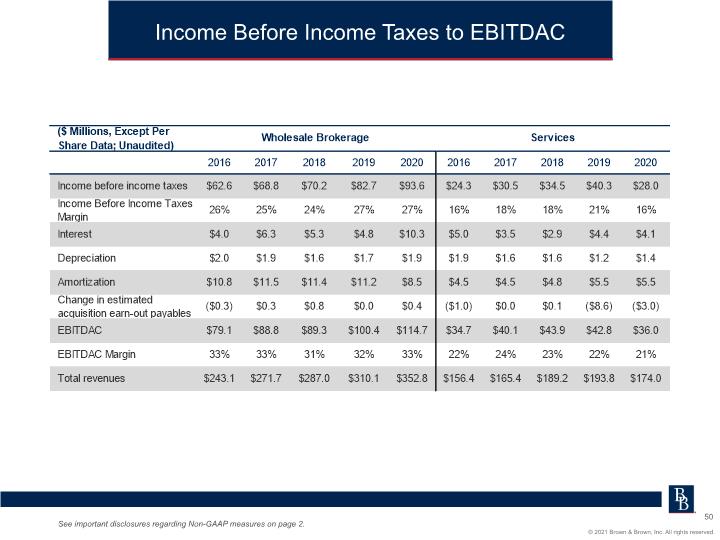

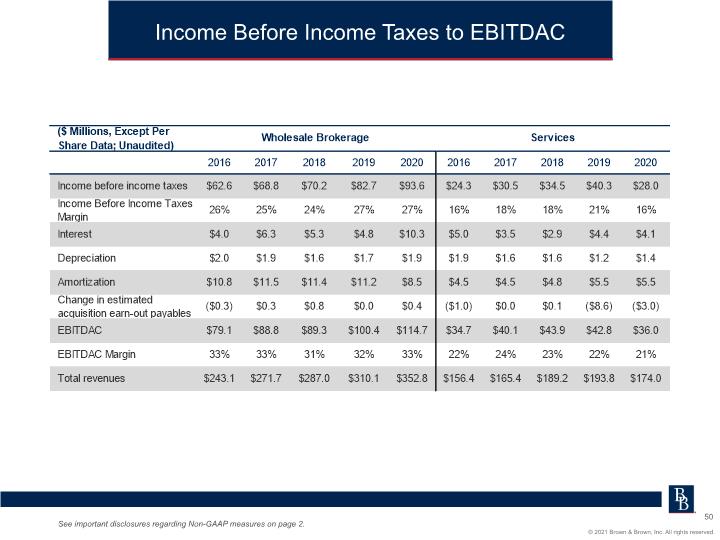

Income Before Income Taxes to EBITDAC See important disclosures regarding Non-GAAP measures on page 2. Income Before Income Taxes to EBITDAC ($ Millions, Except Per Share Data; Unaudited) Wholesale Brokerage Services 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 Income before income taxes $62.6 $68.8 $70.2 $82.7 $93.6 $24.3 $30.5 $34.5 $40.3 $28.0 Income Before Income Taxes Margin 26% 25% 24% 27% 27% 16% 18% 18% 21% 16% Interest $4.0 $6.3 $5.3 $4.8 $10.3 $5.0 $3.5 $2.9 $4.4 $4.1 Depreciation $2.0 $1.9 $1.6 $1.7 $1.9 $1.9 $1.6 $1.6 $1.2 $1.4 Amortization $10.8 $11.5 $11.4 $11.2 $8.5 $4.5 $4.5 $4.8 $5.5 $5.5 Change in estimated acquisition earn-out payables ($0.3) $0.3 $0.8 $0.0 $0.4 ($1.0) $0.0 $0.1 ($8.6) ($3.0) EBITDAC $79.1 $88.8 $89.3 $100.4 $114.7 $34.7 $40.1 $43.9 $42.8 $36.0 EBITDAC Margin 33% 33% 31% 32% 33% 22% 24% 23% 22% 21% Total revenues $243.1 $271.7 $287.0 $310.1 $352.8 $156.4 $165.4 $189.2 $193.8 $174.0 See important disclosures regarding Non-GAAP measures on page 2. BB C 2021 Brown & Brown, Inc. All rights reserved. 50

Net Cash Provided by Operating Activities to Free Cash Flow See important disclosures regarding Non-GAAP measures on page 2. Net Cash Provided by Operating Activities to Free Cash Flow ($ Millions, Except Per Share Data; Unaudited) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Stock Price, as of the 10th day of the fiscal year $11.32 $12.73 $15.70 $16.46 $16.05 $18.21 $22.67 $26.11 $27.99 $40.40 Total Shares 280,528 284,020 285,248 285,782 280,224 275,608 277,586 275,521 274,616 275,867 Equity Market Capitalization $3,175.6 $3,615.6 $4,478.4 $4,704.0 $4,497.6 $5,018.8 $6,292.9 $7,193.9 $7,686.5 $11,145.0 Net cash provided by operating activities $244.5 $254.3 $474.8 $397.8 $381.8 $411.0 $442.0 $567.5 $678.2 $721.6 Less Capital Expenditures $13.6 $24.0 $16.4 $24.9 $18.4 $17.8 $24.2 $41.5 $73.1 $70.7 Free Cash Flow $230.9 $230.3 $458.4 $369.9 $363.4 $393.3 $417.8 $526.0 $605.1 $650.9 Free Cash Flow $230.9 $230.3 $458.4 $369.9 $363.4 $393.3 $417.8 $526.0 $605.1 $650.9 Total revenues $1,013.5 $1,200.0 $1,363.3 $1,575.8 $1,660.5 $1,766.6 $1,881.3 $2,014.2 $2,392.2 $2,613.4 Free Cash Flow Conversion 23% 19% 34% 23% 22% 22% 22% 26% 25% 25% Free Cash Flow $230.9 $230.3 $458.4 $369.9 $363.4 $393.3 $417.8 $526.0 $605.1 $650.9 Divided by Equity Market Capitalization $3,175.6 $3,615.6 $4,478.4 $4,704.0 $4,497.6 $5,018.8 $6,292.9 $7,193.9 $7,686.5 $11,145.0 Free Cash Flow Yield 7% 6% 10% 8% 8% 8% 7% 7% 8% 6% See important disclosures regarding Non-GAAP measures on page 2. BB C 2021 Brown & Brown, Inc. All rights reserved. 51

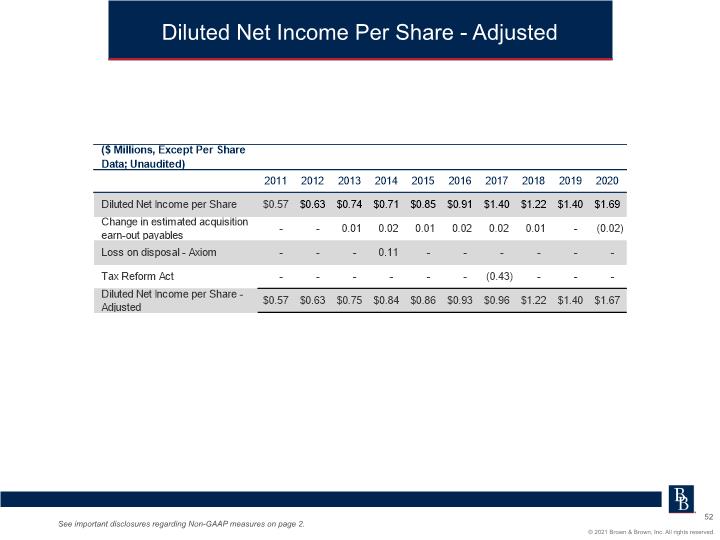

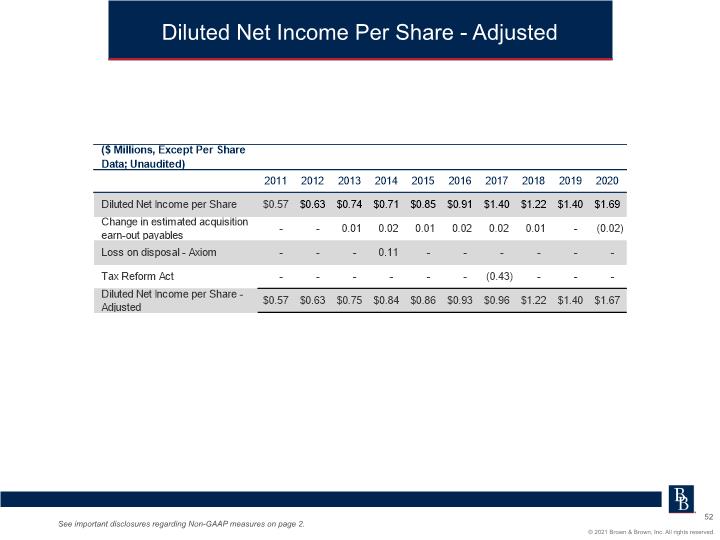

Diluted Net Income Per Share - Adjusted See important disclosures regarding Non-GAAP measures on page 2. Diluted Net Income Per Share - Adjusted ($ Millions, Except Per Share Data; Unaudited) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Diluted Net Income per Share $0.57 $0.63 $0.74 $0.71 $0.85 $0.91 $1.40 $1.22 $1.40 $1.69 Change in estimated acquisition earn-out payables - - 0.01 0.02 0.01 0.02 0.02 0.01 - (0.02) Loss on disposal - Axiom - - - 0.11 - - - - - - Tax Reform Act - - - - - - (0.43) - - - Diluted Net Income per Share - Adjusted $0.57 $0.63 $0.75 $0.84 $0.86 $0.93 $0.96 $1.22 $1.40 $1.67 See important disclosures regarding Non-GAAP measures on page 2. BB C 2021 Brown & Brown, Inc. All rights reserved. 52

See important disclosures regarding Non-GAAP measures on page 2. Reconciliation of Commissions & Fees to Organic Revenue ($ Millions; Unaudited) 2020 Retail National Programs Wholesale Brokerage Services Total 2020 2019 2020 2019 2020 2019 2020 2019 2020 2019 Commissions and fees $1,470.1 $1,364.8 $609.8 $516.9 $352.2 $309.4 $174.0 $193.6 $2,606.1 $2,384.7 Total change 105.3 92.9 42.8 (19.6) 221.4 Total growth % 7.7% 18.0% 13.8% (10.1%) 9.3% Contingent commissions (35.8) (34.2) (27.3) (17.5) (7.8) (7.5) 0.0 0.0 (70.9) (59.2) Guaranteed supplemental commissions (15.1) (11.1) 0.2 (10.6) (1.3) (1.4) 0.0 0.0 (16.2) (23.1) Core commissions and fees $1,419.2 $1,319.5 $582.7 $488.8 $343.1 $300.5 $174.0 $193.6 $2,519.0 $2,302.4 Acquisitions (79.6) (34.2) (25.8) (1.5) (141.1) Dispositions (11.8) (0.3) 0.0 0.0 (12.1) Organic Revenue $1,339.6 $1,307.7 $548.5 $488.5 $317.3 $300.5 $172.5 $193.6 $2,377.9 $2,290.3 Organic Revenue growth $31.9 $60.0 $16.8 ($21.1) $87.6 Organic Revenue growth % 2.4% 12.3% 5.5% (10.9%) 3.8% See important disclosures regarding Non-GAAP measures on page 2. BB C 2021 Brown & Brown, Inc. All rights reserved. 53

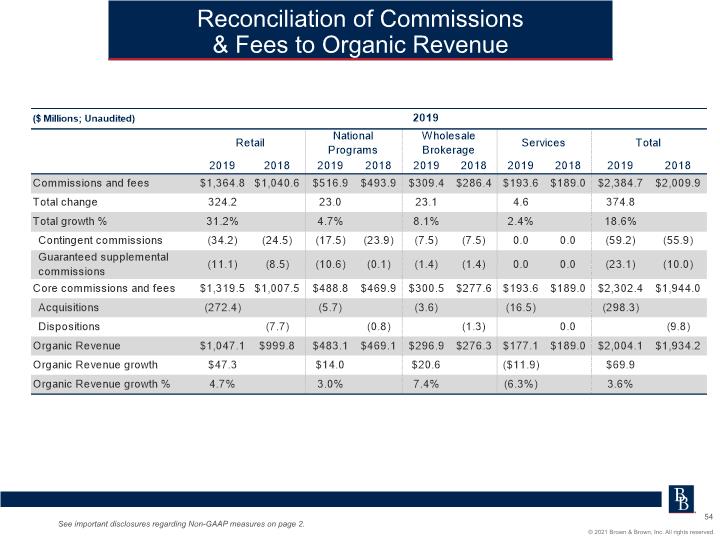

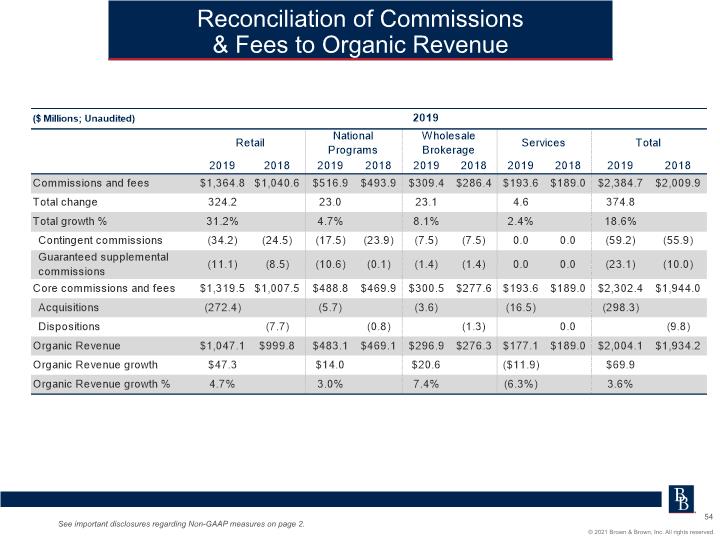

See important disclosures regarding Non-GAAP measures on page 2. Reconciliation of Commissions & Fees to Organic Revenue ($ Millions; Unaudited) 2019 Retail National Programs Wholesale Brokerage Services Total 2019 2018 2019 2018 2019 2018 2019 2018 2019 2018 Commissions and fees $1,364.8 $1,040.6 $516.9 $493.9 $309.4 $286.4 $193.6 $189.0 $2,384.7 $2,009.9 Total change 324.2 23.0 23.1 4.6 374.8 Total growth % 31.2% 4.7% 8.1% 2.4% 18.6% Contingent commissions (34.2) (24.5) (17.5) (23.9) (7.5) (7.5) 0.0 0.0 (59.2) (55.9) Guaranteed supplemental commissions (11.1) (8.5) (10.6) (0.1) (1.4) (1.4) 0.0 0.0 (23.1) (10.0) Core commissions and fees $1,319.5 $1,007.5 $488.8 $469.9 $300.5 $277.6 $193.6 $189.0 $2,302.4 $1,944.0 Acquisitions (272.4) (5.7) (3.6) (16.5) (298.3) Dispositions (7.7) (0.8) (1.3) 0.0 (9.8) Organic Revenue $1,047.1 $999.8 $483.1 $469.1 $296.9 $276.3 $177.1 $189.0 $2,004.1 $1,934.2 Organic Revenue growth $47.3 $14.0 $20.6 ($11.9) $69.9 Organic Revenue growth % 4.7% 3.0% 7.4% (6.3%) 3.6% See important disclosures regarding Non-GAAP measures on page 2. BB C 2021 Brown & Brown, Inc. All rights reserved. 54

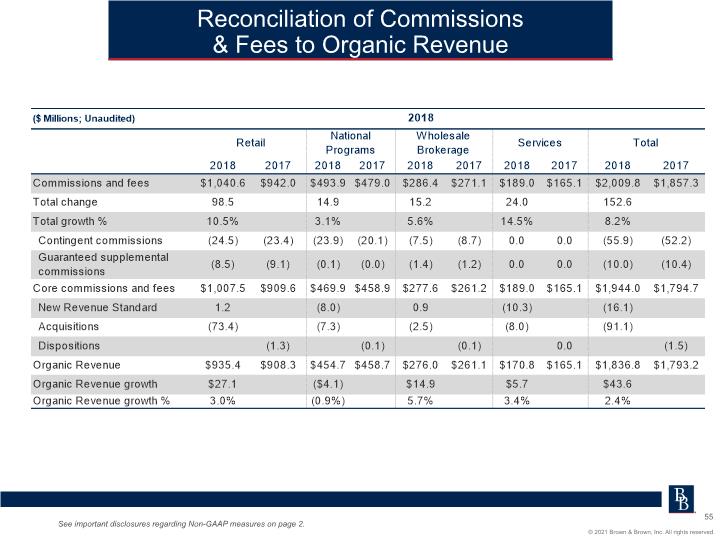

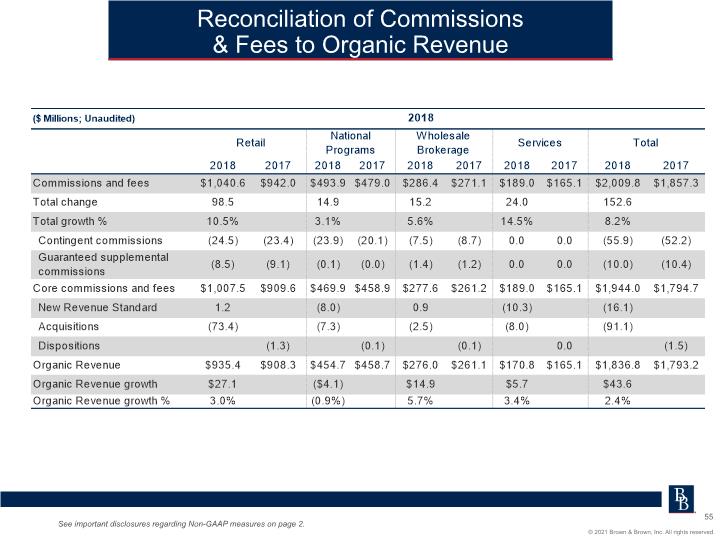

See important disclosures regarding Non-GAAP measures on page 2. Reconciliation of Commissions & Fees to Organic Revenue ($ Millions; Unaudited) 2018 Retail National Programs Wholesale Brokerage Services Total 2018 2017 2018 2017 2018 2017 2018 2017 2018 2017 Commissions and fees $1,040.6 $942.0 $493.9 $479.0 $286.4 $271.1 $189.0 $165.1 $2,009.8 $1,857.3 Total change 98.5 14.9 15.2 24.0 152.6 Total growth % 10.5% 3.1% 5.6% 14.5% 8.2% Contingent commissions (24.5) (23.4) (23.9) (20.1) (7.5) (8.7) 0.0 0.0 (55.9) (52.2) Guaranteed supplemental commissions (8.5) (9.1) (0.1) (0.0) (1.4) (1.2) 0.0 0.0 (10.0) (10.4) Core commissions and fees $1,007.5 $909.6 $469.9 $458.9 $277.6 $261.2 $189.0 $165.1 $1,944.0 $1,794.7 New Revenue Standard 1.2 (8.0) 0.9 (10.3) (16.1) Acquisitions (73.4) (7.3) (2.5) (8.0) (91.1) Dispositions (1.3) (0.1) (0.1) 0.0 (1.5) Organic Revenue $935.4 $908.3 $454.7 $458.7 $276.0 $261.1 $170.8 $165.1 $1,836.8 $1,793.2 Organic Revenue growth $27.1 ($4.1) $14.9 $5.7 $43.6 Organic Revenue growth % 3.0% (0.9%) 5.7% 3.4% 2.4% See important disclosures regarding Non-GAAP measures on page 2. BB C 2021 Brown & Brown, Inc. All rights reserved. 55

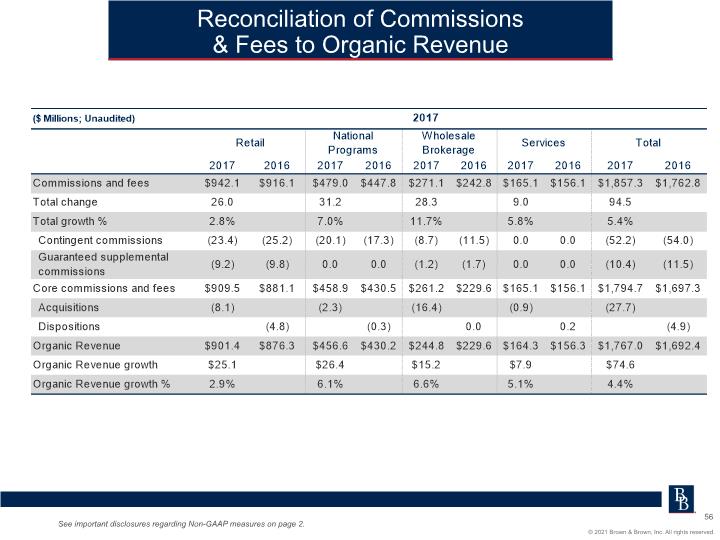

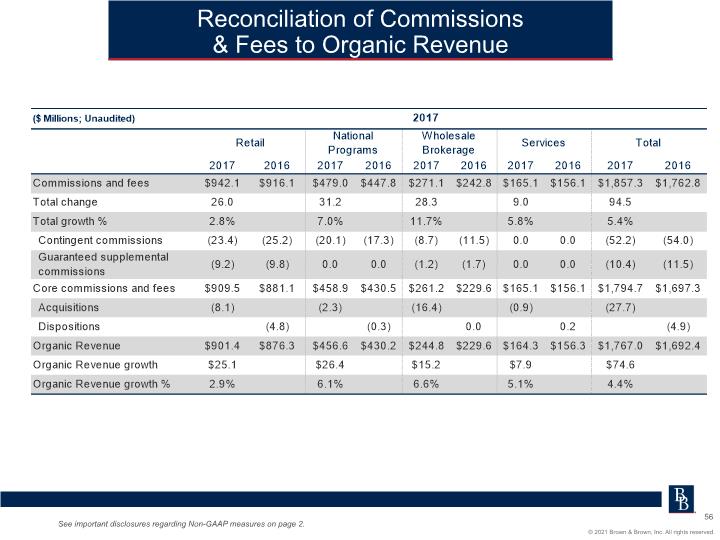

See important disclosures regarding Non-GAAP measures on page 2. Reconciliation of Commissions & Fees to Organic Revenue ($ Millions; Unaudited) 2017 Retail National Programs Wholesale Brokerage Services Total 2017 2016 2017 2016 2017 2016 2017 2016 2017 2016 Commissions and fees $942.1 $916.1 $479.0 $447.8 $271.1 $242.8 $165.1 $156.1 $1,857.3 $1,762.8 Total change 26.0 31.2 28.3 9.0 94.5 Total growth % 2.8% 7.0% 11.7% 5.8% 5.4% Contingent commissions (23.4) (25.2) (20.1) (17.3) (8.7) (11.5) 0.0 0.0 (52.2) (54.0) Guaranteed supplemental commissions (9.2) (9.8) 0.0 0.0 (1.2) (1.7) 0.0 0.0 (10.4) (11.5) Core commissions and fees $909.5 $881.1 $458.9 $430.5 $261.2 $229.6 $165.1 $156.1 $1,794.7 $1,697.3 Acquisitions (8.1) (2.3) (16.4) (0.9) (27.7) Dispositions (4.8) (0.3) 0.0 0.2 (4.9) Organic Revenue $901.4 $876.3 $456.6 $430.2 $244.8 $229.6 $164.3 $156.3 $1,767.0 $1,692.4 Organic Revenue growth $25.1 $26.4 $15.2 $7.9 $74.6 Organic Revenue growth % 2.9% 6.1% 6.6% 5.1% 4.4% See important disclosures regarding Non-GAAP measures on page 2. BB C 2021 Brown & Brown, Inc. All rights reserved. 56

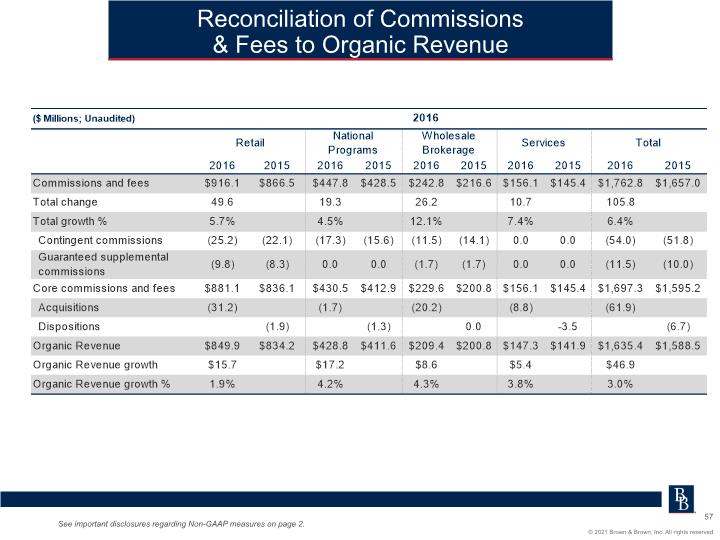

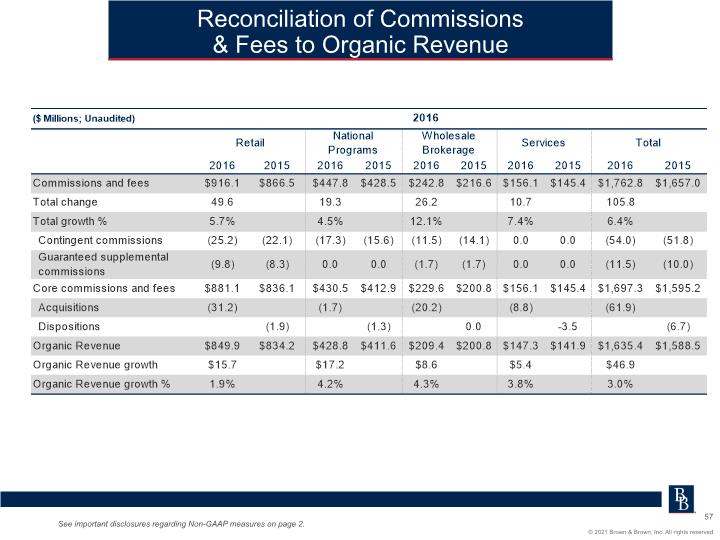

See important disclosures regarding Non-GAAP measures on page 2. Reconciliation of Commissions & Fees to Organic Revenue ($ Millions; Unaudited) 2016 Retail National Programs Wholesale Brokerage Services Total 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015 Commissions and fees $916.1 $866.5 $447.8 $428.5 $242.8 $216.6 $156.1 $145.4 $1,762.8 $1,657.0 Total change 49.6 19.3 26.2 10.7 105.8 Total growth % 5.7% 4.5% 12.1% 7.4% 6.4% Contingent commissions (25.2) (22.1) (17.3) (15.6) (11.5) (14.1) 0.0 0.0 (54.0) (51.8) Guaranteed supplemental commissions (9.8) (8.3) 0.0 0.0 (1.7) (1.7) 0.0 0.0 (11.5) (10.0) Core commissions and fees $881.1 $836.1 $430.5 $412.9 $229.6 $200.8 $156.1 $145.4 $1,697.3 $1,595.2 Acquisitions (31.2) (1.7) (20.2) (8.8) (61.9) Dispositions (1.9) (1.3) 0.0 -3.5 (6.7) Organic Revenue $849.9 $834.2 $428.8 $411.6 $209.4 $200.8 $147.3 $141.9 $1,635.4 $1,588.5 Organic Revenue growth $15.7 $17.2 $8.6 $5.4 $46.9 Organic Revenue growth % 1.9% 4.2% 4.3% 3.8% 3.0% See important disclosures regarding Non-GAAP measures on page 2. BB C 2021 Brown & Brown, Inc. All rights reserved. 57

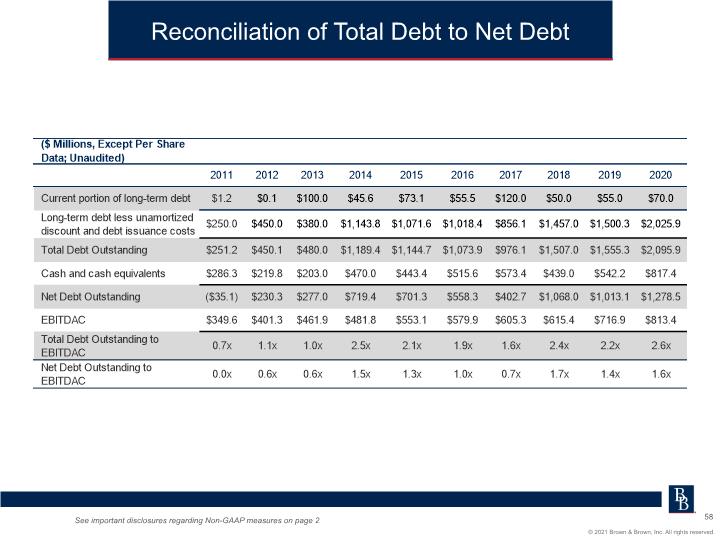

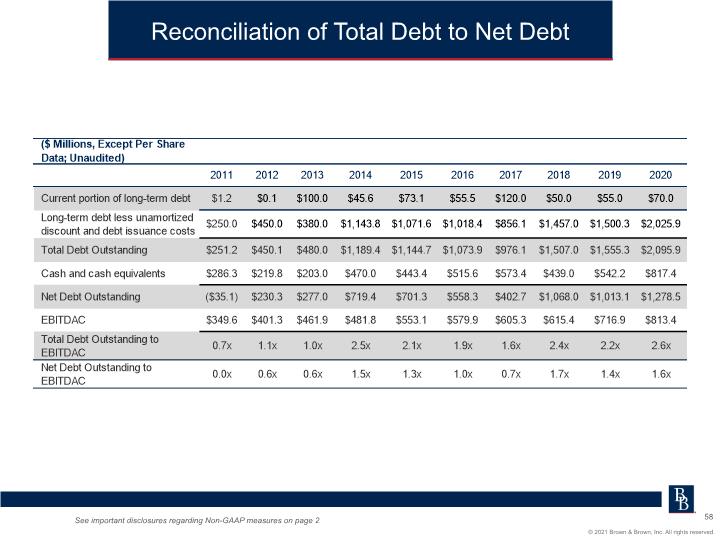

See important disclosures regarding Non-GAAP measures on page 2 Reconciliation of Total Debt to Net Debt ($ Millions, Except Per Share Data; Unaudited) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Current portion of long-term debt $1.2 $0.1 $100.0 $45.6 $73.1 $55.5 $120.0 $50.0 $55.0 $70.0 Long-term debt less unamortized discount and debt issuance costs $250.0 $450.0 $380.0 $1,143.8 $1,071.6 $1,018.4 $856.1 $1,457.0 $1,500.3 $2,025.9 Total Debt Outstanding $251.2 $450.1 $480.0 $1,189.4 $1,144.7 $1,073.9 $976.1 $1,507.0 $1,555.3 $2,095.9 Cash and cash equivalents $286.3 $219.8 $203.0 $470.0 $443.4 $515.6 $573.4 $439.0 $542.2 $817.4 Net Debt Outstanding ($35.1) $230.3 $277.0 $719.4 $701.3 $558.3 $402.7 $1,068.0 $1,013.1 $1,278.5 EBITDAC $349.6 $401.3 $461.9 $481.8 $553.1 $579.9 $605.3 $615.4 $716.9 $813.4 Total Debt Outstanding to EBITDAC 0.7x 1.1x 1.0x 2.5x 2.1x 1.9x 1.6x 2.4x 2.2x 2.6x Net Debt Outstanding to EBITDAC 0.0x 0.6x 0.6x 1.5x 1.3x 1.0x 0.7x 1.7x 1.4x 1.6x See important disclosures regarding Non-GAAP measures on page 2 BB C 2021 Brown & Brown, Inc. All rights reserved. 58

The Cheetah: Since our beginning, we have known that doing the best for our customers requires constant persistence and vision. The cheetah, which represents vision, swiftness, strength, and agility, embodies our company culture and has served as a symbol for Brown & Brown since the 1980s. For additional information: Andrew Watts Executive Vice President & Chief Financial Officer (386) 239-5770 | awatts@bbins.com The Cheetah: Since our beginning, we have known that doing the best for our customers requires constant persistence and vision. The cheetah, which represents vision, swiftness, strength, and agility, embodies our company culture and has served as a symbol for Brown & Brown since the 1980s. Brown & Brown INSURANC BB C 2021 Brown & Brown, Inc. All rights reserved. 59