Exhibit 99.2

Supplemental Information Regarding the Merger

Farmers & Merchants Bancorp, Inc. (NASDAQ: FMAO) Acquisition of Ossian Financial Services, Inc.

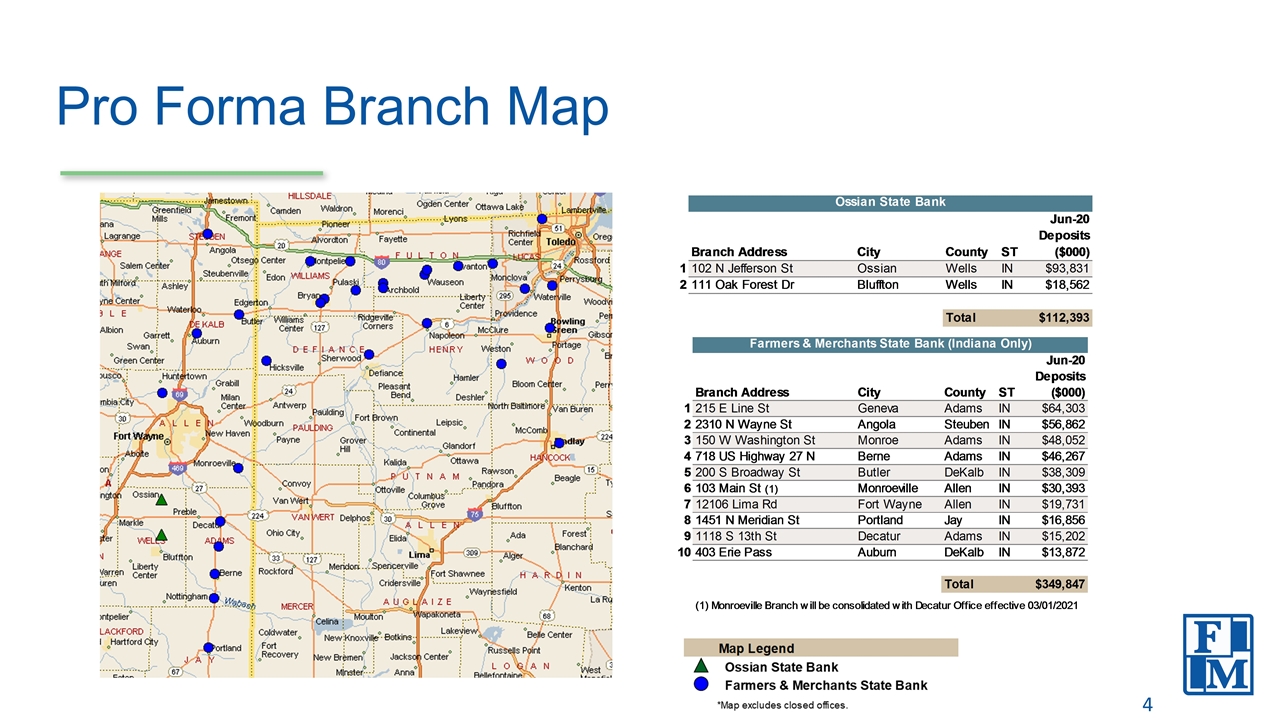

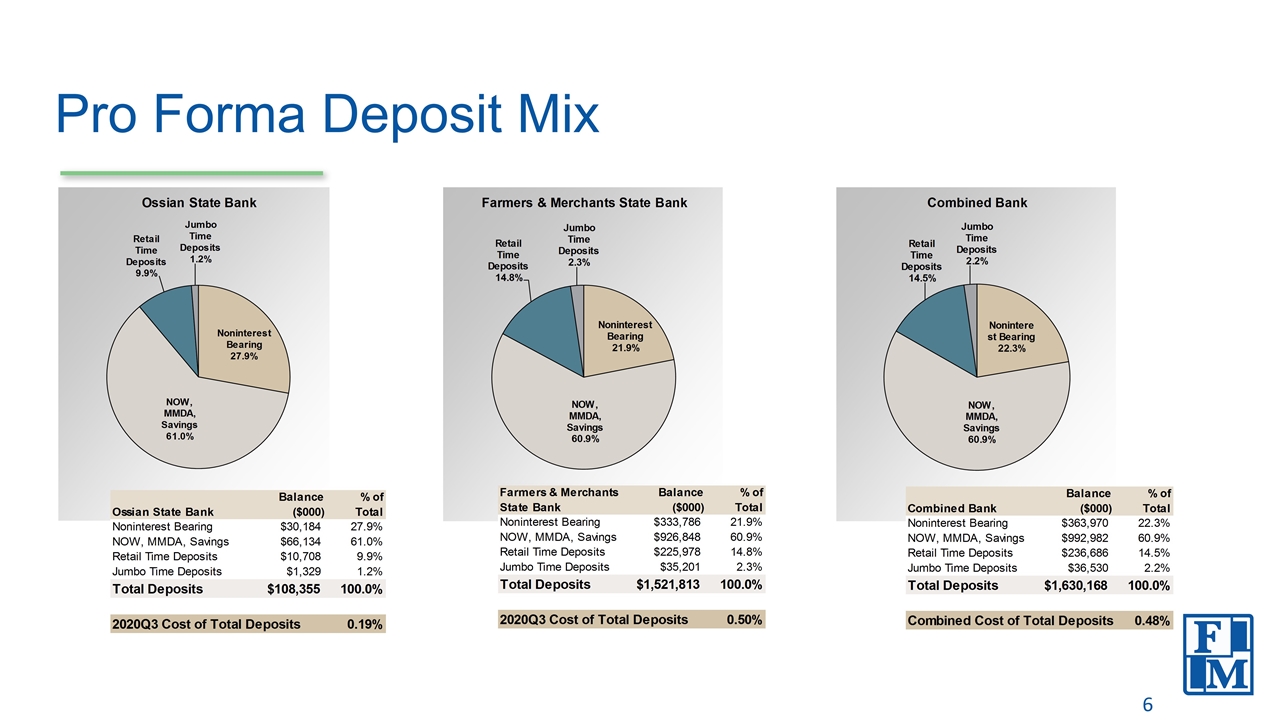

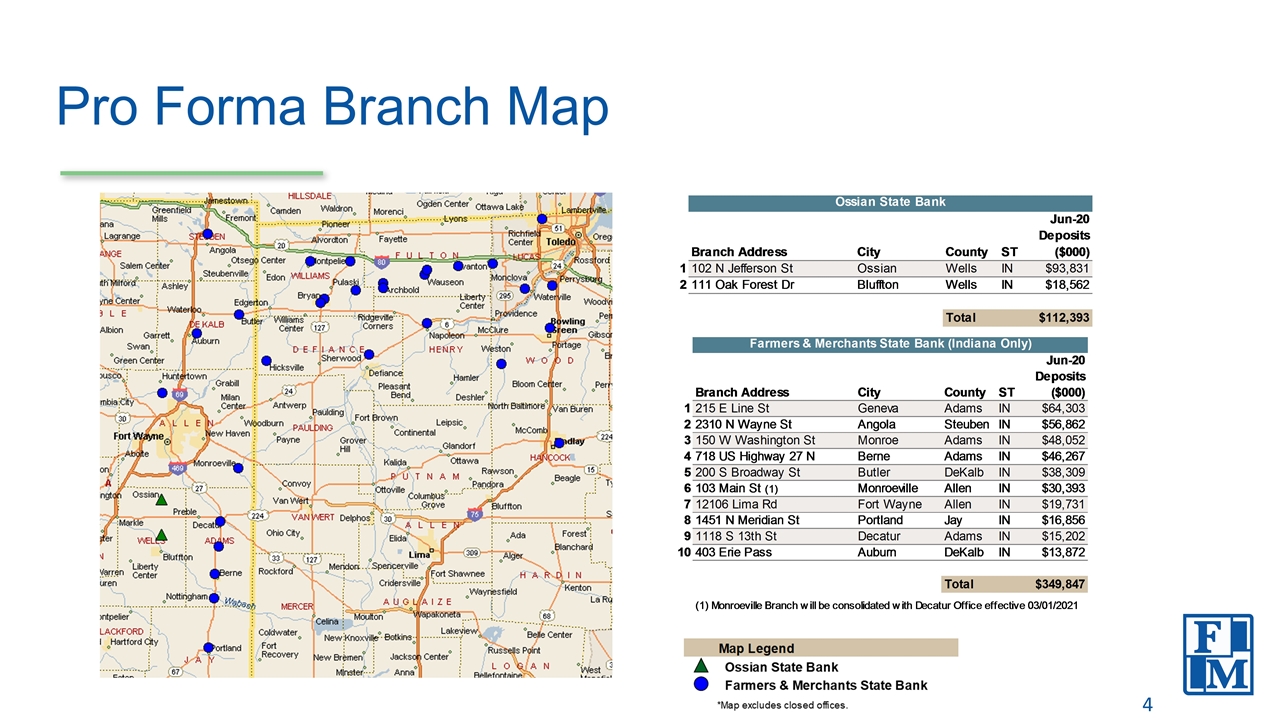

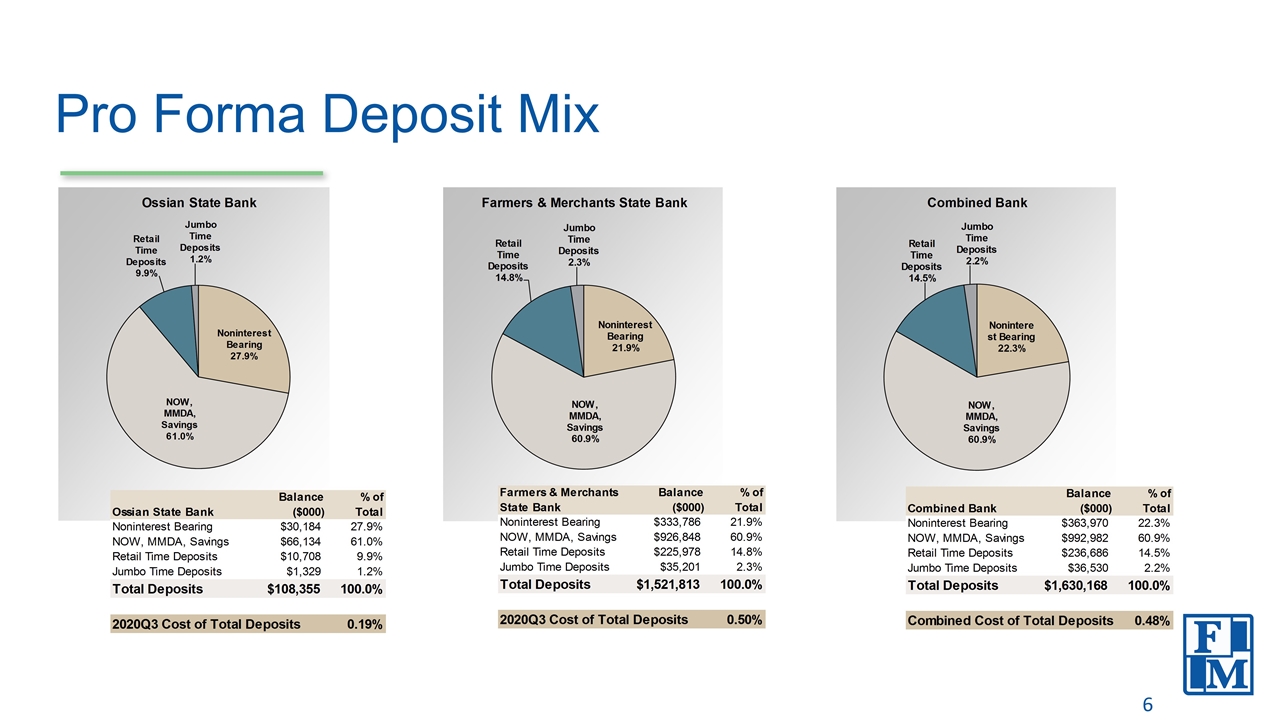

Farmers & Merchants Bancorp, Inc. (“FMAO”) to acquire Ossian Financial Services, Inc. (“OFSI”), the bank holding company for Ossian State Bank, a community bank based in Ossian, Indiana. Aggregate cash consideration equal to $20 million, subject to potential adjustments as defined in the definitive agreement. OFSI operates two full-service offices in Ossian and Bluffton. OFSI reported approximately $122 million in total assets, $58 million in loans and $108 million in deposits at September 30, 2020. Provides an attractive deposit mix with ~ 28% in noninterest bearing, 11% in time deposits and cost of deposits at 0.19% for the 3Q-2020. OFSI’s consolidated tangible equity equaled $11.9 million at September 30, 2020. OFSI (bank-level) reported (S-Corp.) normalized net income of $788,000 for the 9-month period ending September 30, 2020 and $1.3 million for the 12-month period ending December 31, 2019. OFSI represents a natural extension of FMAO’s community bank footprint and complementary fit with FMAO’s recent acquisition of Bank of Geneva completed in early 2019, along with the asset purchase of Adams County Financial Resources, a registered investment advisor, completed in 4Q-2020. After the transaction, FMAO will operate 11 offices in Indiana with total deposits of $462 million and total loans of $445 million. Transaction Overview Farmers & Merchants Bancorp, Inc. to acquire Ossian Financial Services, Inc.

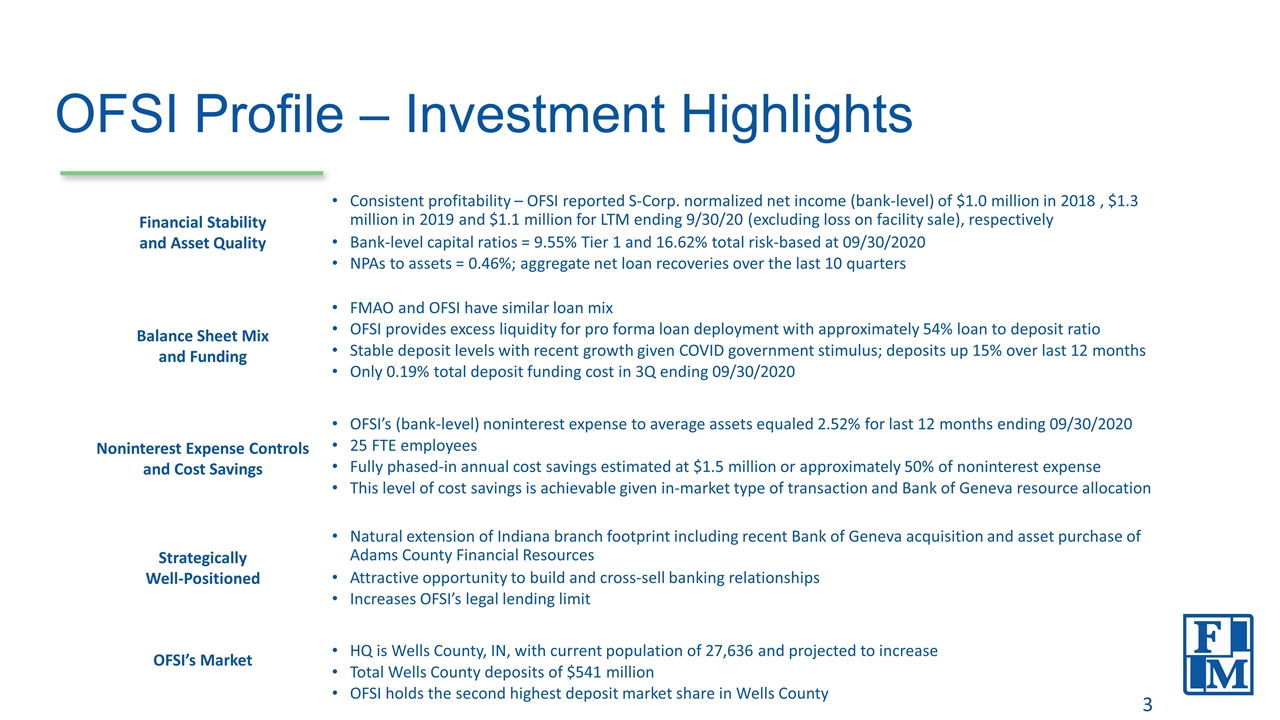

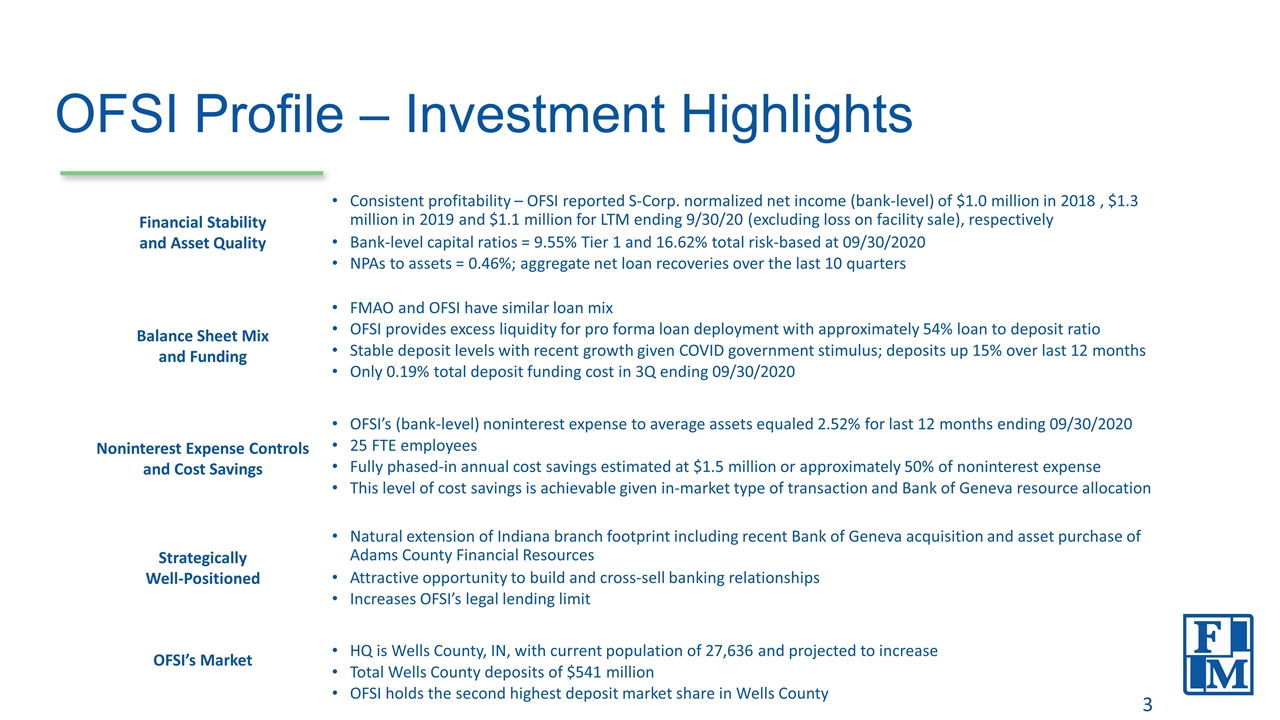

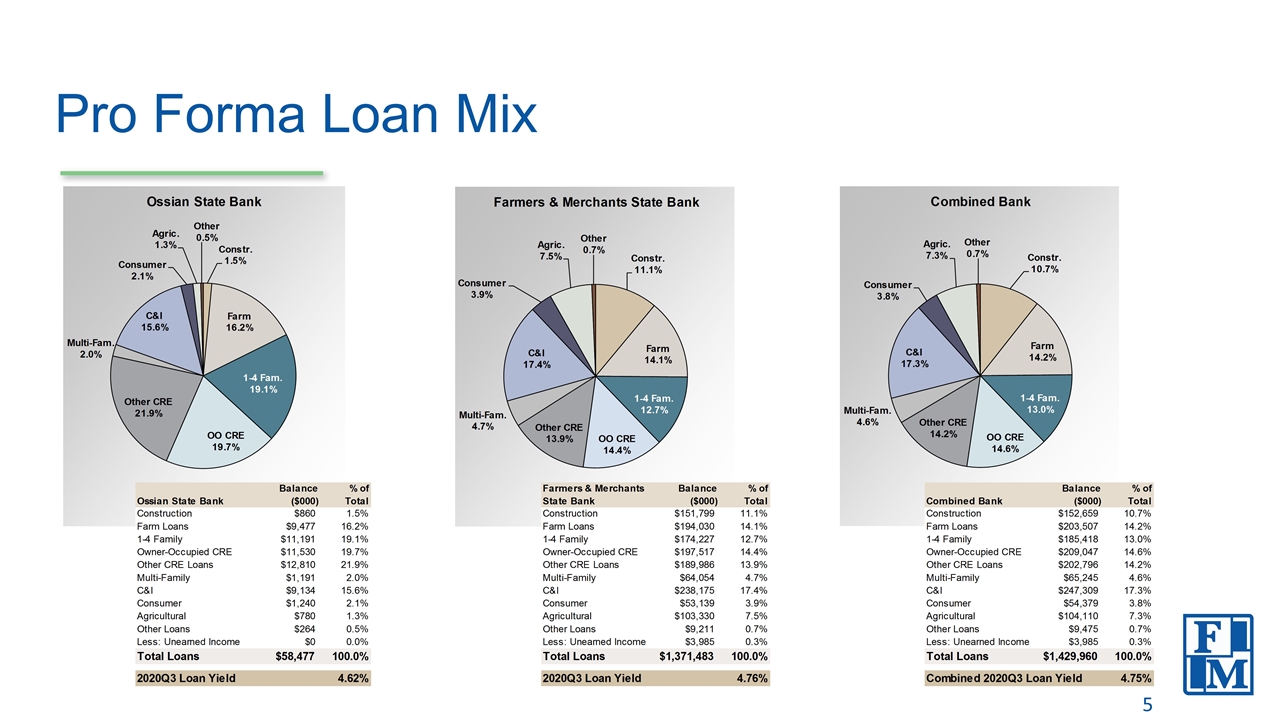

OFSI Profile – Investment Highlights Financial Stability and Asset Quality Consistent profitability – OFSI reported S-Corp. normalized net income (bank-level) of $1.0 million in 2018 , $1.3 million in 2019 and $1.1 million for LTM ending 9/30/20 (excluding loss on facility sale), respectively Bank-level capital ratios = 9.55% Tier 1 and 16.62% total risk-based at 09/30/2020 NPAs to assets = 0.46%; aggregate net loan recoveries over the last 10 quarters Balance Sheet Mix and Funding FMAO and OFSI have similar loan mix OFSI provides excess liquidity for pro forma loan deployment with approximately 54% loan to deposit ratio Stable deposit levels with recent growth given COVID government stimulus; deposits up 15% over last 12 months Only 0.19% total deposit funding cost in 3Q ending 09/30/2020 Noninterest Expense Controls and Cost Savings OFSI’s (bank-level) noninterest expense to average assets equaled 2.52% for last 12 months ending 09/30/2020 25 FTE employees Fully phased-in annual cost savings estimated at $1.5 million or approximately 50% of noninterest expense This level of cost savings is achievable given in-market type of transaction and Bank of Geneva resource allocation Strategically Well-Positioned Natural extension of Indiana branch footprint including recent Bank of Geneva acquisition and asset purchase of Adams County Financial Resources Attractive opportunity to build and cross-sell banking relationships Increases OFSI’s legal lending limit OFSI’s Market HQ is Wells County, IN, with current population of 27,636 and projected to increase Total Wells County deposits of $541 million OFSI holds the second highest deposit market share in Wells County

Pro Forma Branch Map

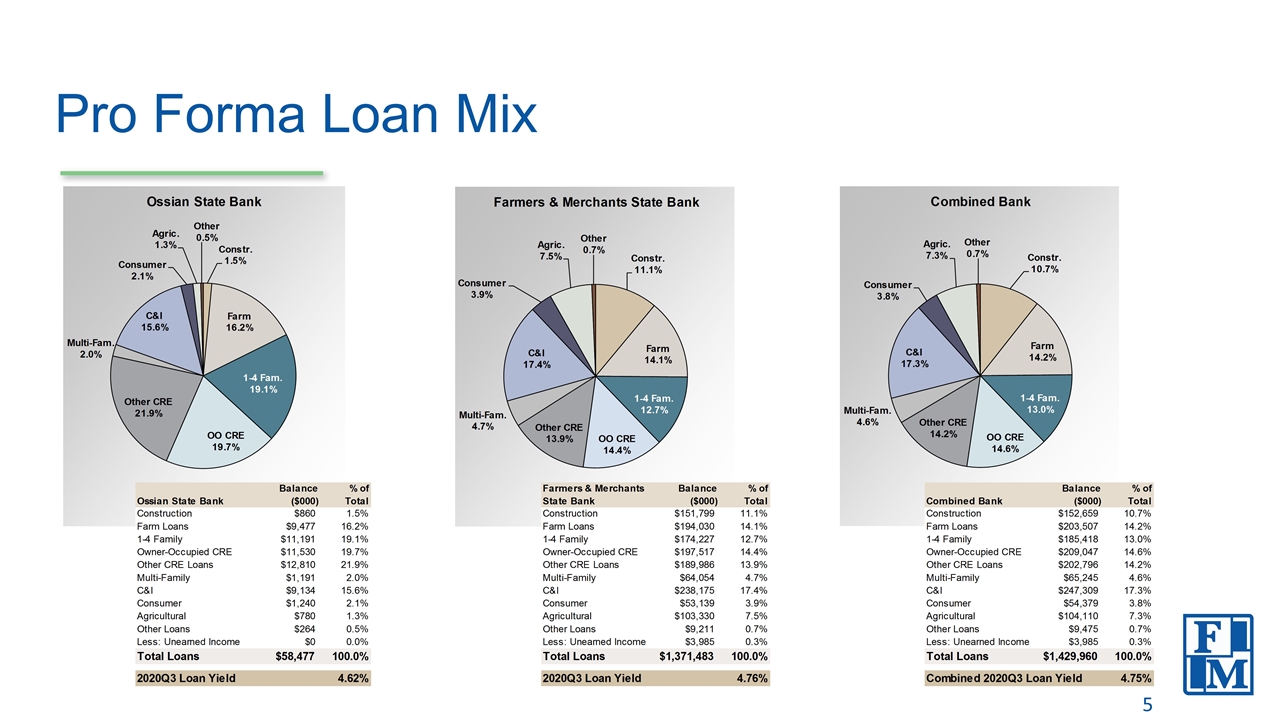

Pro Forma Loan Mix

Pro Forma Deposit Mix

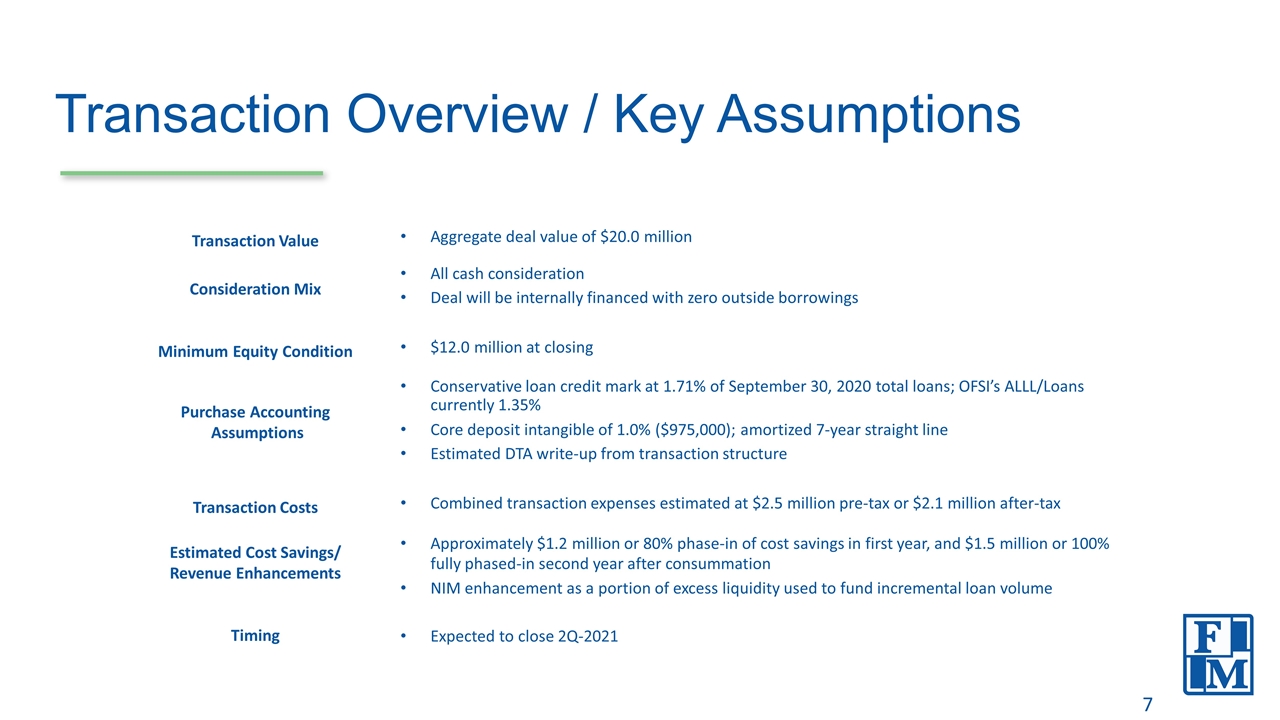

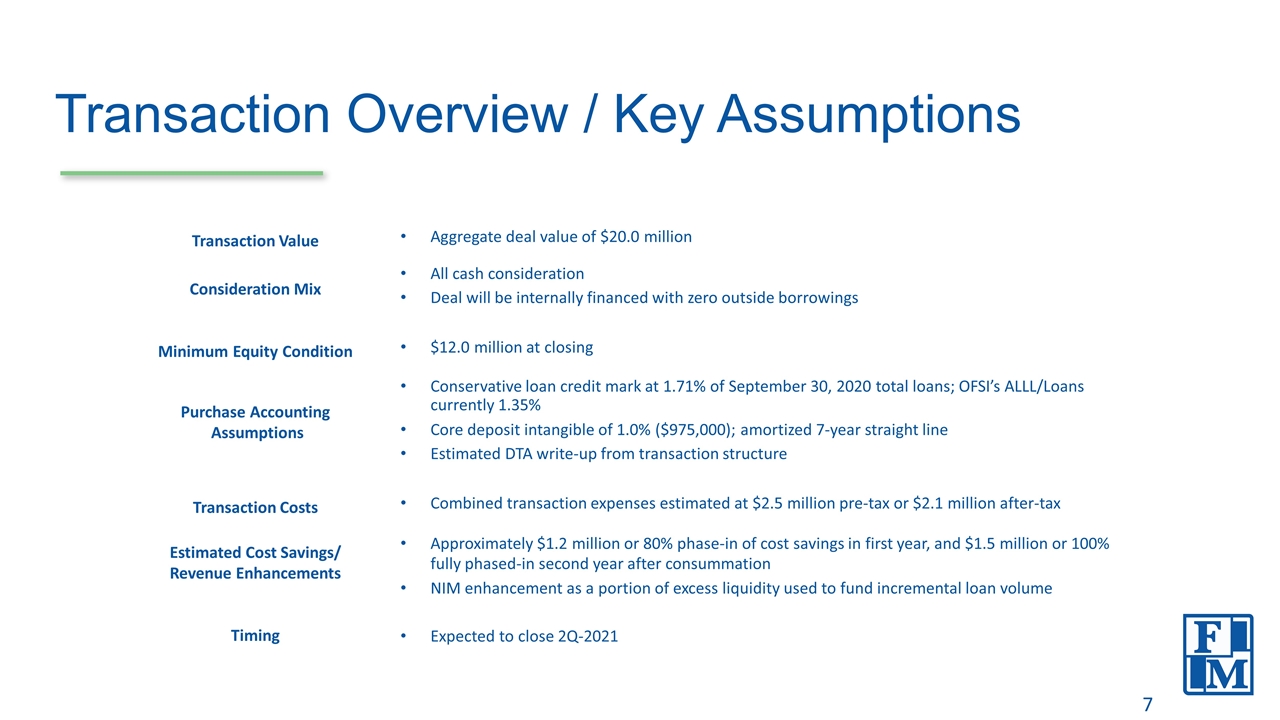

Transaction Overview / Key Assumptions Transaction Value Aggregate deal value of $20.0 million Consideration Mix All cash consideration Deal will be internally financed with zero outside borrowings Minimum Equity Condition $12.0 million at closing Purchase Accounting Assumptions Conservative loan credit mark at 1.71% of September 30, 2020 total loans; OFSI’s ALLL/Loans currently 1.35% Core deposit intangible of 1.0% ($975,000); amortized 7-year straight line Estimated DTA write-up from transaction structure Transaction Costs Combined transaction expenses estimated at $2.5 million pre-tax or $2.1 million after-tax Estimated Cost Savings/ Revenue Enhancements Timing Approximately $1.2 million or 80% phase-in of cost savings in first year, and $1.5 million or 100% fully phased-in second year after consummation NIM enhancement as a portion of excess liquidity used to fund incremental loan volume Expected to close 2Q-2021

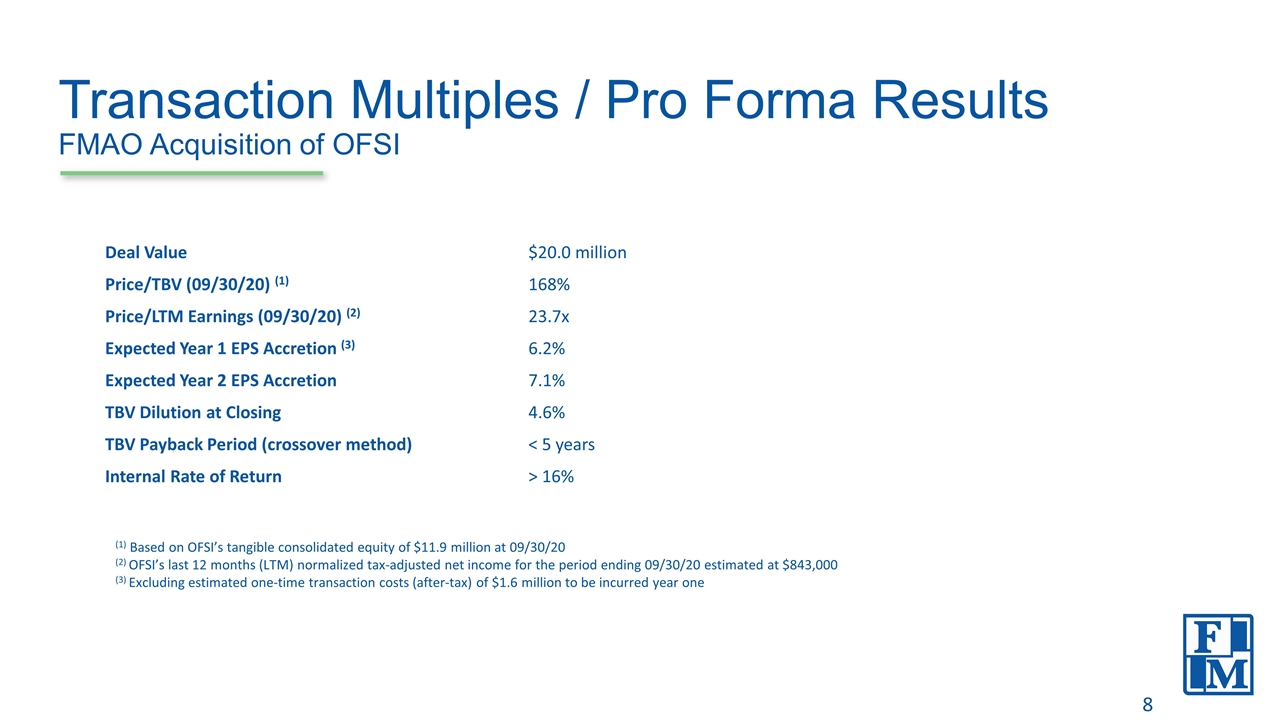

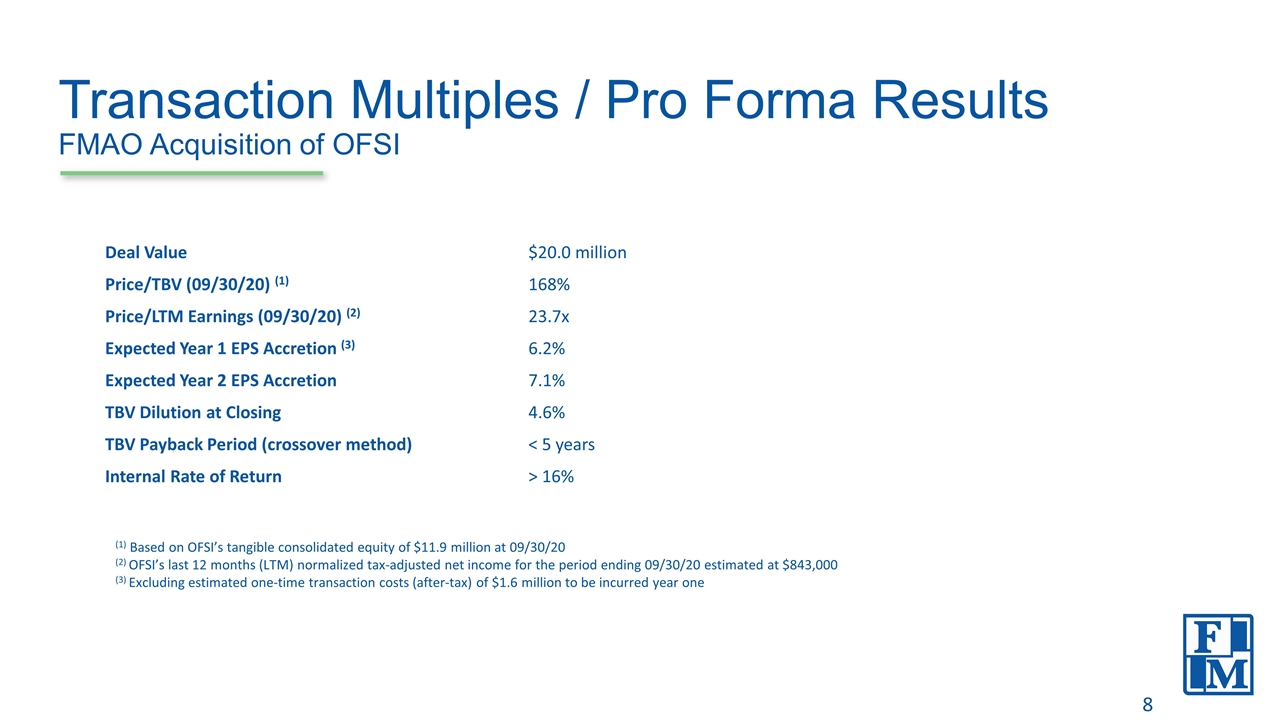

Transaction Multiples / Pro Forma Results FMAO Acquisition of OFSI Deal Value $20.0 million Price/TBV (09/30/20) (1) 168% Price/LTM Earnings (09/30/20) (2) 23.7x Expected Year 1 EPS Accretion (3) 6.2% Expected Year 2 EPS Accretion 7.1% TBV Dilution at Closing 4.6% TBV Payback Period (crossover method) < 5 years Internal Rate of Return > 16% (1) Based on OFSI’s tangible consolidated equity of $11.9 million at 09/30/20 (2) OFSI’s last 12 months (LTM) normalized tax-adjusted net income for the period ending 09/30/20 estimated at $843,000 (3) Excluding estimated one-time transaction costs (after-tax) of $1.6 million to be incurred year one

Forward-Looking Statements This presentation may contain “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Any statements about our expectations, beliefs, plans, strategies, predictions, forecasts, objectives or assumptions of future events or performance are not historical facts and may be forward-looking. These statements include, but are not limited to, the expected completion date, financial benefits and other effects of the proposed merger of FMAO and OFSI. These statements are often, but not always, made through the use of words or phrases such as “anticipates,” “believes,” “expects,” “can,” “could,” “may,” “predicts,” “potential,” “opportunity,” “should,” “will,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “expects,” “seeks,” “intends” and similar words or phrases. Accordingly, these statements involve estimates, known and unknown risks, assumptions and uncertainties that could cause actual strategies, actions or results to differ materially from those expressed in them, and are not guarantees of timing, future results or other events or performance. Because forward-looking statements are necessarily only estimates of future strategies, actions or results, based on management’s current expectations, assumptions and estimates on the date hereof, and there can be no assurance that actual strategies, actions or results will not differ materially from expectations, readers are cautioned not to place undue reliance on such statements. Factors that may cause such a difference include, but are not limited to, the reaction to the transaction of the companies’ customers, employees and counterparties; customer disintermediation; inflation; expected synergies, cost savings and other financial benefits of the proposed transaction might not be realized within the expected timeframes or might be less than projected; the requisite shareholder and regulatory approvals for the proposed transaction might not be obtained; credit and interest rate risks associated with FMAO’s and OFSI’s respective businesses, customers, borrowings, repayment, investment, and deposit practices; general economic conditions, either nationally or in the market areas in which FMAO and OFSI operate or anticipate doing business, are less favorable than expected; new regulatory or legal requirements or obligations; and other risks; certain risks and important factors that could affect FMAO’s future results are identified in its Annual Report on Form10-K for the year ended December 31, 2019 and other reports filed with the SEC, including among other things under the heading “Risk Factors” in such Annual Report on Form 10-K. Any forward-looking statement speaks only as of the date on which it is made, and FMAO undertakes no obligation to update any forward-looking state