AMAG Pharmaceuticals 2016 Financial Results and Intrarosa License Agreement February 14, 2017

Forward-Looking Statements 2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (PSLRA) and other federal securities laws. Any statements contained herein which do not describe historical facts, including, among others, statements regarding expected 2016 financial results, including revenues, adjusted EBITDA; AMAG’s anticipated expansion in women’s health through the licensing transaction with Endoceutics, Inc., including the expected timing for the closing of Intrarosa transaction; Makena’s position in the market and future growth drivers for Makena, including its potential market opportunity, filing a supplemental new drug application (sNDA) for the Makena subcutaneous (SC) auto-injector and customer engagement and outreach; beliefs that the current Makena SC auto-injector formulation offers benefits to physicians and patients, including the potential for greater convenience and alternative administration; AMAG’s beliefs that bioavailability is a key parameter and that the PK study demonstrated comparable bioavailability between the SC and intramuscular (IM) arms; expectations regarding timing for the submission of the Makena auto-injector sNDA (including expected timing for an FDA decision on the sNDA and commercial launch, if approved); growth drivers for Cord Blood Registry (CBR), including plans to differentiate CBR offerings and increase engagement and communications in the industry; expected timing for topline data and submission of the sNDA for the expanded Feraheme label (including expected timing for an FDA decision on the sNDA and commercial launch, if approved); growth drivers for Feraheme, including plans to optimize net revenue per gram, grow in key segments and expectations that the size of the addressable market, if the broader indication is approved, would double; expectations regarding the potential benefits, safety profile and commercial opportunity of Intrarosa and its’ strategic fit for AMAG’s women’s health business; the competitive landscape and breadth of the vulvovaginal atrophy (VVA) markets and Intrarosa’s market potential; expectations on timing of Intrarosa launch, AMAG’s ability to leverage existing commercial and medical affairs teams and to expand its current sales force and deploy its digital engagement platform, and Intrarosa label expansion opportunities (including timing of initiation of Phase 3 female sexual dysfunction study); AMAG’s belief that its well-positioned to improve women’s health care and that Intrarosa will build long-term shareholder value; expectations on timing of Rekynda NDA submission (including expected timing for an FDA decision on the sNDA and commercial launch, if approved); and the expected timing of initiation of the Velo Phase 2b/3a study are forward-looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward-looking statements. Such risks and uncertainties include, among others, (1) the possibility that the closing conditions set forth in the Intrarosa License Agreement, including, those related to antitrust clearance, will not be met and that the parties will be unable to consummate the proposed transactions; (2) the possibility that AMAG will not realize the expected benefits of the transaction, including the anticipated market opportunity and the ability of its current or expanded sales force to successfully commercialize Intrarosa; (3) the possibility that significant safety or drug interaction problems could arise with respect to Intrarosa; (4) the ability of AMAG to drive awareness of dyspareunia and the potential benefits of Intrarosa; (5) uncertainties regarding the manufacture of Intrarosa; (6) uncertainties relating to patents and proprietary rights associated with Intrarosa in the United States; (7) that the cost of the transaction to AMAG will be more than planned and/or will not provide the intended positive financial results; (8) that AMAG or Endoceutics will fail to fully perform their respective obligations under the Intrarosa License Agreement or the Intrarosa Supply Agreement; (9) uncertainty regarding AMAG’s ability to compete in the dyspareunia market in the United States; and (10) other risks identified in AMAG’s Securities and Exchange Commission (“SEC”) filings, including its Annual Report on Form 10-K for the year ended December 31, 2015, its Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016, June 30, 2016 and September 30, 2016 and subsequent filings with the SEC, including its Current Reports on Form 8-K filed with the SEC on January 9, 2017 and February 3, 2017, as well as in its upcoming Annual Report on Form 10-K for the year ended December 31, 2016. AMAG cautions you not to place undue reliance on any forward-looking statements, which speak only as of the date they are made. AMAG disclaims any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking statements. AMAG Pharmaceuticals® and Feraheme® are registered trademark of AMAG Pharmaceuticals, Inc. MuGard® is a registered trademark of Abeona Therapeutics, Inc. Makena® is a registered trademark of AMAG Pharmaceuticals IP, Ltd. Cord Blood Registry® and CBR® are registered trademarks of CBR Systems, Inc. Rekynda is a trademark of Palatin Technologies, Inc. IntrarosaTM is a trademark of Endoceutics, Inc.

Today’s Agenda 3 2016 Highlights and Recent Events1 5 Value Drivers and Upcoming Potential Product Launches 4 IntrarosaTM: Further Expansion into Women’s Health 3 2016 Financial Overview 6 Q&A 2 2016 Product Performance and 2017 Growth Drivers

2016 Highlights and Recent Events

2016 Highlights and Recent Events Makena Drove 44% quarterly sales growth over 4Q-2015 and 33% growth year over year through: ‒ Successful launch of single-dose, preservative free formulation ‒ Expansion of Makena @Home service, including enhanced agreement with Optum Home Health Completed Makena pharmacokinetic study and preparing sNDA filing for subcutaneous auto-injector - Feraheme Achieved record sales Completed enrollment in broad iron deficiency anemia (IDA) study to support 2017 sNDA filing - Cord Blood Registry (CBR) Added more than 40,000 stored units of cord blood and cord tissue Increased revenue per consumer by 8.5% over 2015 Achieved Financial and Business Development Goals Grew net revenue 27% to $532M Generated significant cash flow; ended 2016 with $579M of cash and equivalents Expanded product portfolio 5

Further Expanding AMAG’s Product Portfolio 6 Pregnancy & Birth Wellness Post-Menopausal Health Feraheme Makena Velo Option Cord Blood Registry Used for the treatment of iron deficiency anemia (IDA) in adult patients with chronic kidney disease (CKD) The only FDA-approved therapy to reduce recurrent preterm birth in certain at-risk women World’s largest umbilical cord stem cell collection and storage company At completion of a Phase 2b/3a clinical trial, AMAG has the option to acquire an orphan drug candidate for the treatment of severe preeclampsia Intrarosa1 Recently FDA-approved non-estrogen product to treat moderate-to-severe dyspareunia, and only FDA approved VVA (vulvar and vaginal atrophy) treatment without a boxed warning Recent successful completion of two Phase 3 clinical trials for on- demand treatment of hypoactive sexual desire disorder (HSDD) Rekynda MuGard Prescriptive mucoadhesive for the management of oral mucositis, a common side effect of radiation or chemotherapy Maternal and Women’s Health Hematology/Oncology 1 Announced exclusive U.S. license agreement for Intrarosa on February 14, 2017. The transaction license expected to close in the first half of 2017.

7 $67.4 $97.2 4Q-2015 4Q-2016 Makena: Strong Commercial Execution $251.6 $334.1 2015 2016 Fourth Quarter Revenue ($M) Full Year Revenue ($M) W O M E N ’ S H E A L T H : M A K E N A 2017 Growth Drivers Continue to take share from compounders Grow Makena @Home administration Greater share of voice with target customers Expand use in late preterm birth segment Majority of prescriptions flow through Makena Care Connection (~66%) Launch subcutaneous auto-injector1 2016 Accomplishments Successfully launched single-dose, preservative free formulation Increased market share to 42% Enhanced patient access to Makena Expanded Optum Home Health Services relationship Initiated and fully enrolled PK study +44% +33% 1 If regulatory approved is received.

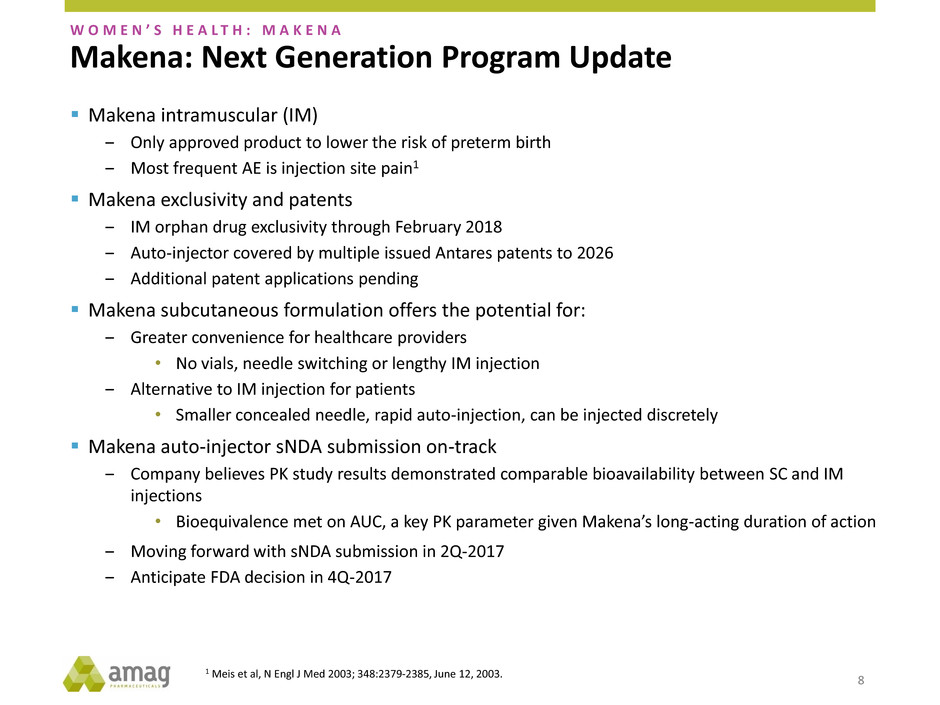

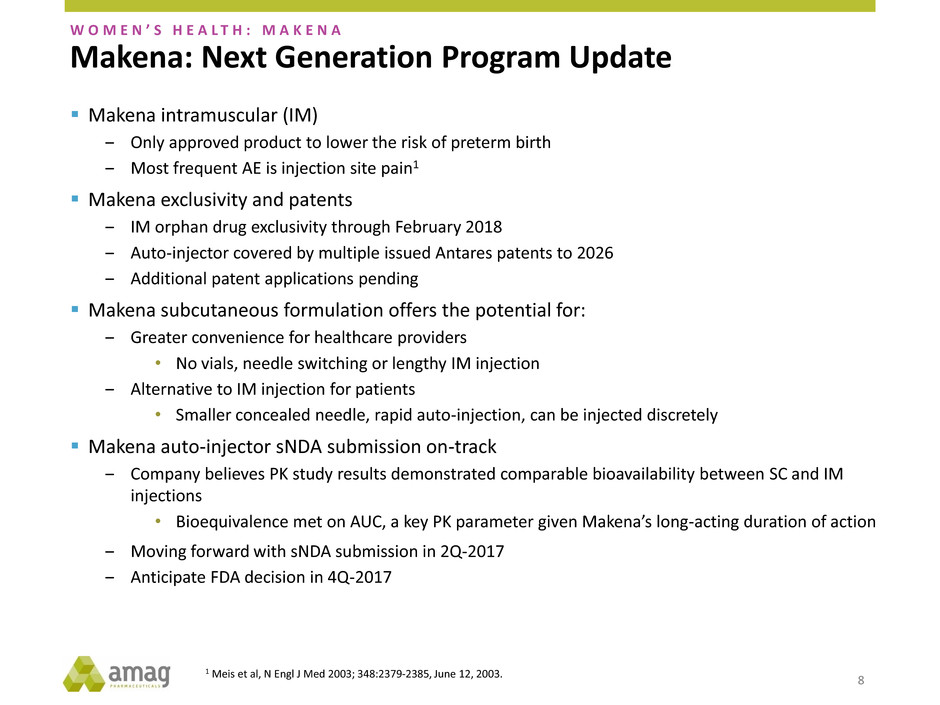

Makena intramuscular (IM) ‒ Only approved product to lower the risk of preterm birth ‒ Most frequent AE is injection site pain1 Makena exclusivity and patents ‒ IM orphan drug exclusivity through February 2018 ‒ Auto-injector covered by multiple issued Antares patents to 2026 ‒ Additional patent applications pending Makena subcutaneous formulation offers the potential for: ‒ Greater convenience for healthcare providers • No vials, needle switching or lengthy IM injection ‒ Alternative to IM injection for patients • Smaller concealed needle, rapid auto-injection, can be injected discretely Makena auto-injector sNDA submission on-track ‒ Company believes PK study results demonstrated comparable bioavailability between SC and IM injections • Bioequivalence met on AUC, a key PK parameter given Makena’s long-acting duration of action ‒ Moving forward with sNDA submission in 2Q-2017 ‒ Anticipate FDA decision in 4Q-2017 Makena: Next Generation Program Update W O M E N ’ S H E A L T H : M A K E N A 1 Meis et al, N Engl J Med 2003; 348:2379-2385, June 12, 2003. 8

9 CBR: Attractive Recurring Revenue Stream W O M E N ’ S H E A L T H : C O R D B L O O D R E G I S T R Y $24.1 $99.6 2015 2016 $118.6 2015 2016 GAAP Full Year Revenue ($M) $116.6 Non-GAAP, Pro Forma Full Year Revenue2,3 ($M) 1 Represents revenues from August 17, 2015 to December 31, 2015. CBR was acquired by AMAG on August 17, 2015. 2 Non-GAAP CBR revenue includes purchase accounting adjustments related to CBR deferred revenue of $1.4M and $17M for the fourth quarter and full year of 2016, respectively. 3 Represents pro forma revenue for 2015. AMAG acquired CBR on August 17, 2015. 1 2017 Growth Drivers Differentiate CBR’s offerings ‒ Highlight cord tissue storage offering ‒ Enhance product offerings Build value proposition on storing newborn stem cells Increase engagement with the HCP community 2016 Accomplishments Increased 4Q revenue to $29.1M (non-GAAP)2 Grew revenue per consumer 8.5% year-over-year Increased stored units by ~40k Began implementation of enhanced messaging to better target millennial families

10 $23.2 $26.3 4Q-2015 4Q-2016 Feraheme: Differentiated Product, Expect Future Growth $88.5 $97.1 2015 2016 Fourth Quarter Revenue1 ($M) Full Year Revenue1 ($M) 2017 Growth Drivers Continued growth in key segments Optimize net revenue per gram Prepare for expanded label to include IDA patients with all causes ‒ Would double addressable market, if approved Pull through recent GPO access wins 2016 Accomplishments Achieved $97M in revenues1 6% growth in grams over 2015 Expanded presence in integrated delivery networks and group purchasing organizations Completed enrollment in head-to-head trial for broader indication, accelerating sNDA filing by 6 months to mid-2017 +13% +10% H E M A T O L O G Y / O N C O L O G Y : F E R A H E M E 1 Represents revenues from Feraheme only. Excludes revenues from MuGard as reported on financial statements.

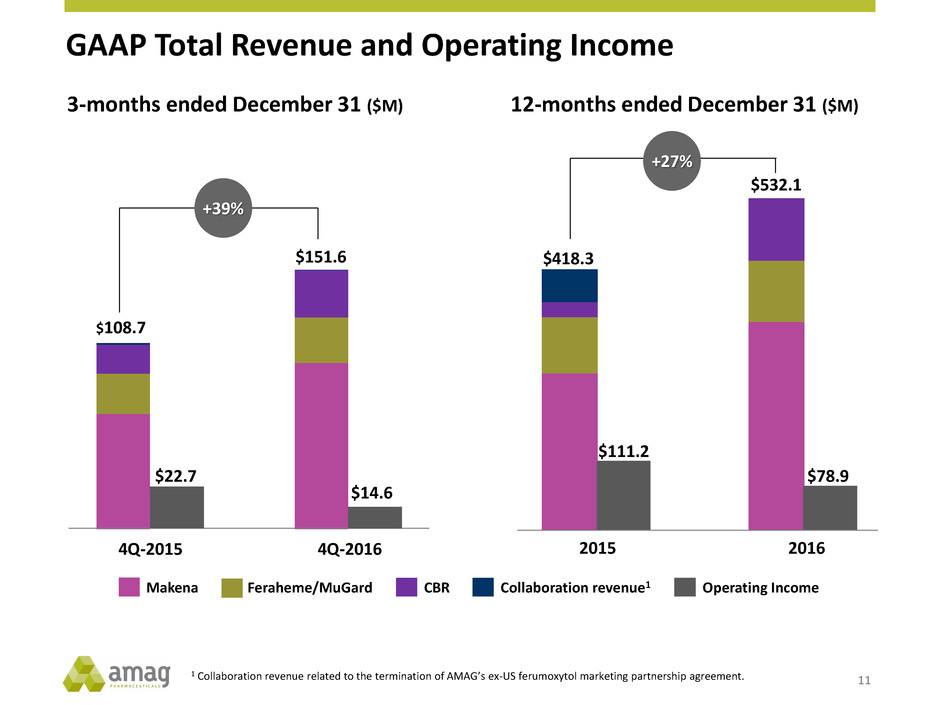

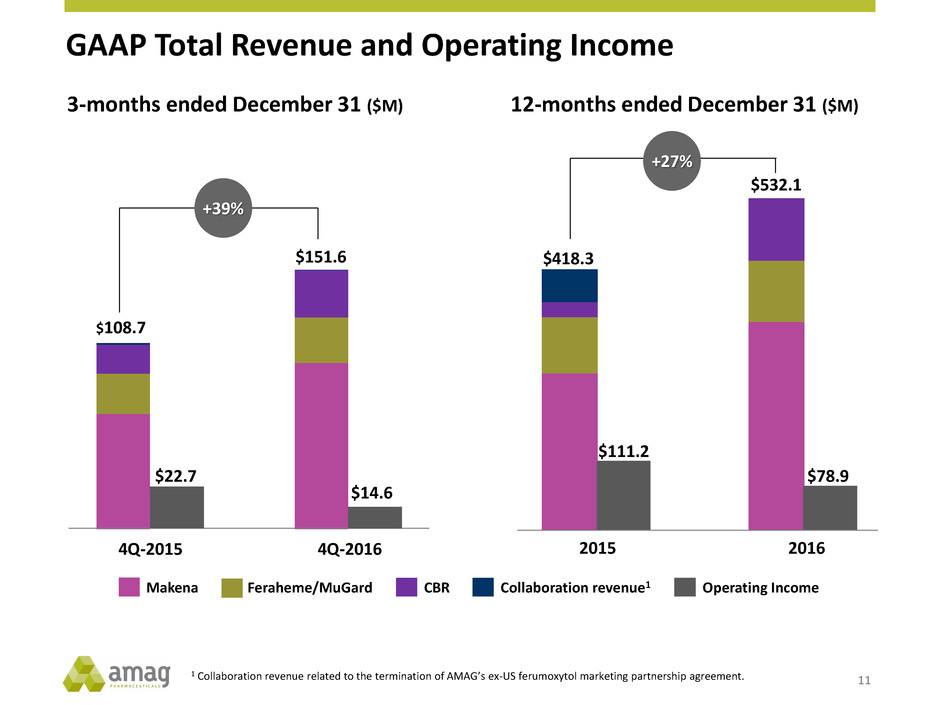

GAAP Total Revenue and Operating Income 11 $108.7 $151.6 +39% 1 Collaboration revenue related to the termination of AMAG’s ex-US ferumoxytol marketing partnership agreement. 3-months ended December 31 ($M) $22.7 $14.6 12-months ended December 31 ($M) 4Q-2015 4Q-2016 $418.3 $532.1 $111.2 $78.9 2015 2016 +27% Makena CBRFeraheme/MuGard Collaboration revenue1 Operating Income

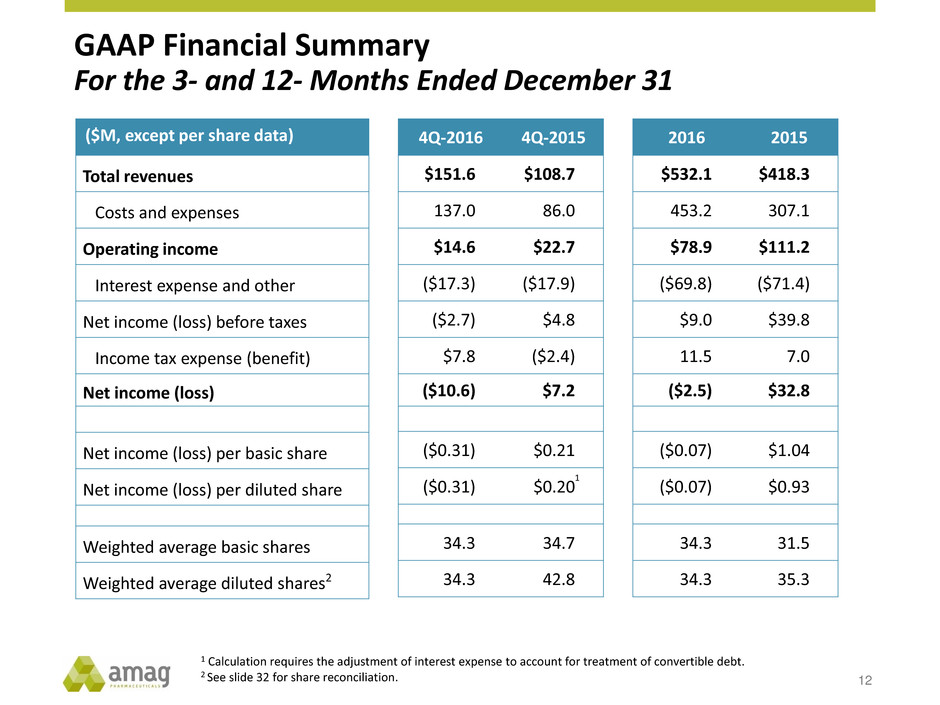

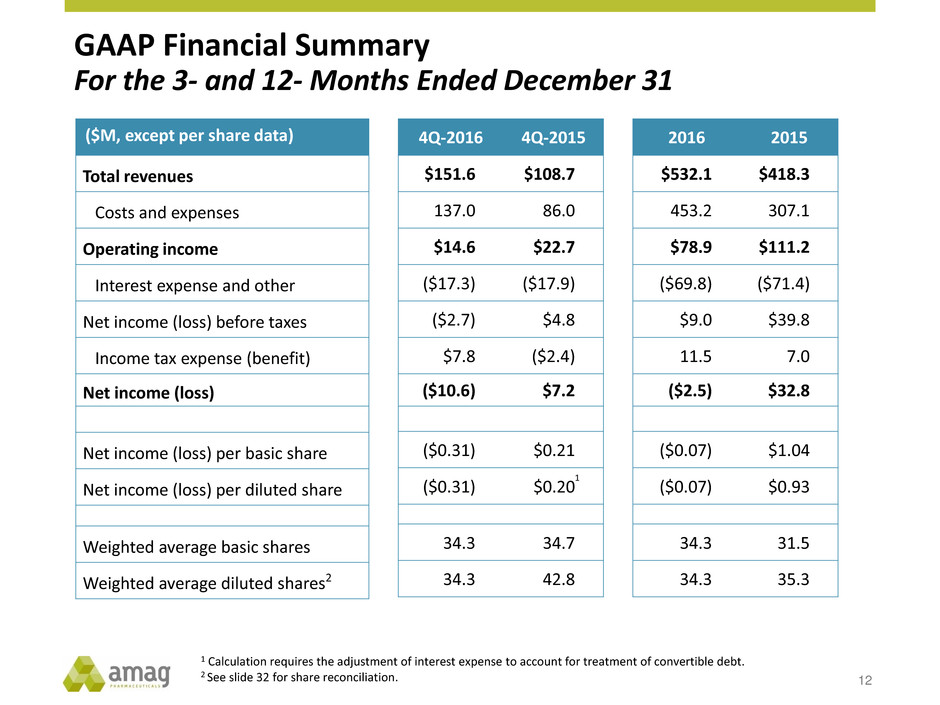

GAAP Financial Summary For the 3- and 12- Months Ended December 31 ($M, except per share data) Total revenues Costs and expenses Operating income Interest expense and other Net income (loss) before taxes Income tax expense (benefit) Net income (loss) Net income (loss) per basic share Net income (loss) per diluted share Weighted average basic shares Weighted average diluted shares2 1 Calculation requires the adjustment of interest expense to account for treatment of convertible debt. 2 See slide 32 for share reconciliation. 4Q-2016 4Q-2015 $151.6 $108.7 137.0 86.0 $14.6 $22.7 ($17.3) ($17.9) ($2.7) $4.8 $7.8 ($2.4) ($10.6) $7.2 ($0.31) $0.21 ($0.31) $0.20 34.3 34.7 34.3 42.8 2016 2015 $532.1 $418.3 453.2 307.1 $78.9 $111.2 ($69.8) ($71.4) $9.0 $39.8 11.5 7.0 ($2.5) $32.8 ($0.07) $1.04 ($0.07) $0.93 34.3 31.5 34.3 35.3 1 12

Non-GAAP Total Revenue and Adjusted EBITDA 13 $120.6 $153.0 +27% 3-months ended December 31 ($M) $61.3 $77.4 12-months ended December 31 ($M) 4Q-2015 4Q-2016 $397.4 $549.1 $213.4 $265.7 2015 2016 +38% Makena CBRFeraheme/MuGard Collaboration revenue4 Adjusted EBITDA 1 Represents CBR revenues from August 17, 2015 to December 31, 2015. CBR was acquired by AMAG on August 17, 2015. 2 Non-GAAP CBR revenue includes purchase accounting adjustments related to CBR deferred revenue of $11.8M and $19.1M for the fourth quarter and full year of 2015, respectively. 3 Non-GAAP CBR revenue includes purchase accounting adjustments related to CBR deferred revenue of $1.4M and $17M for the fourth quarter and full year of 2016, respectively. 4 Collaboration revenue related to the termination of AMAG’s ex-US ferumoxytol marketing partnership agreement. 33 1,22

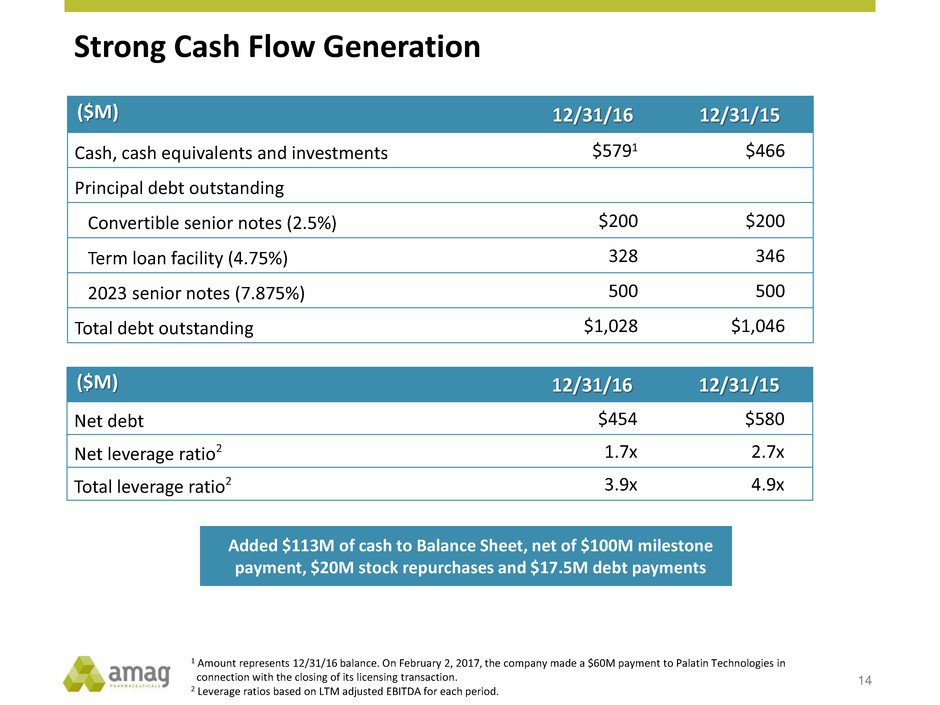

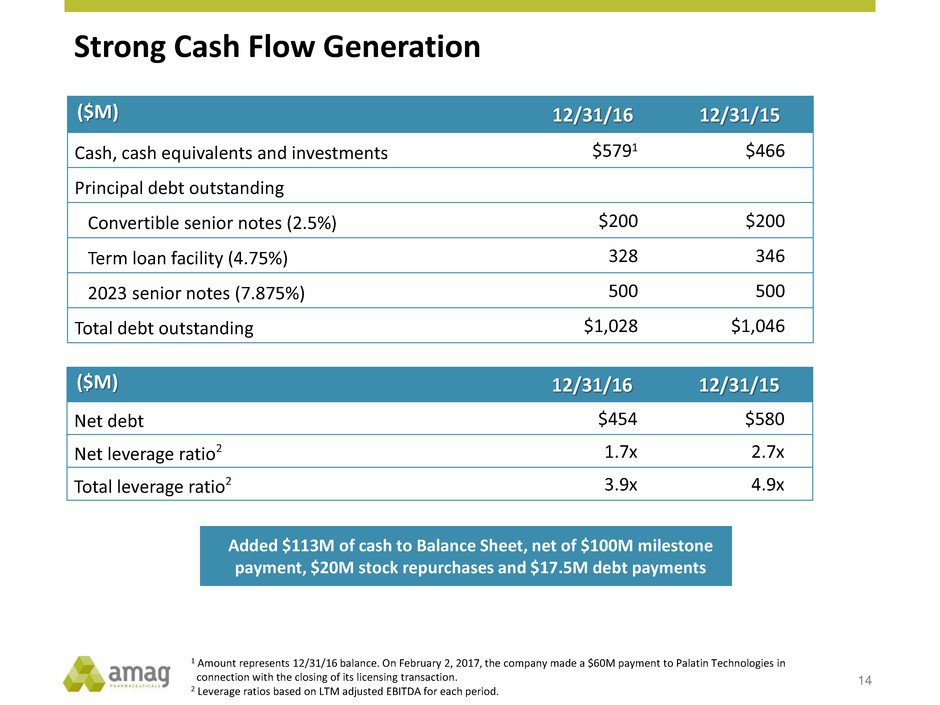

Strong Cash Flow Generation 14 ($M) 12/31/16 12/31/15 Cash, cash equivalents and investments $5791 $466 Principal debt outstanding Convertible senior notes (2.5%) $200 $200 Term loan facility (4.75%) 328 346 2023 senior notes (7.875%) 500 500 Total debt outstanding $1,028 $1,046 ($M) 12/31/16 12/31/15 Net debt $454 $580 Net leverage ratio2 1.7x 2.7x Total leverage ratio2 3.9x 4.9x Added $113M of cash to Balance Sheet, net of $100M milestone payment, $20M stock repurchases and $17.5M debt payments 1 Amount represents 12/31/16 balance. On February 2, 2017, the company made a $60M payment to Palatin Technologies in connection with the closing of its licensing transaction. 2 Leverage ratios based on LTM adjusted EBITDA for each period.

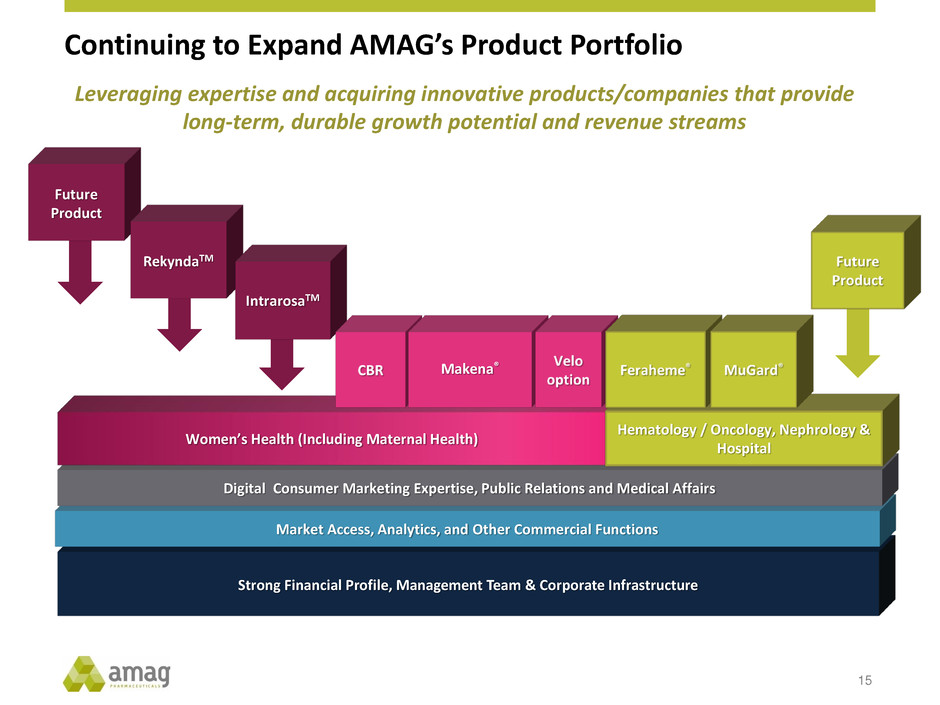

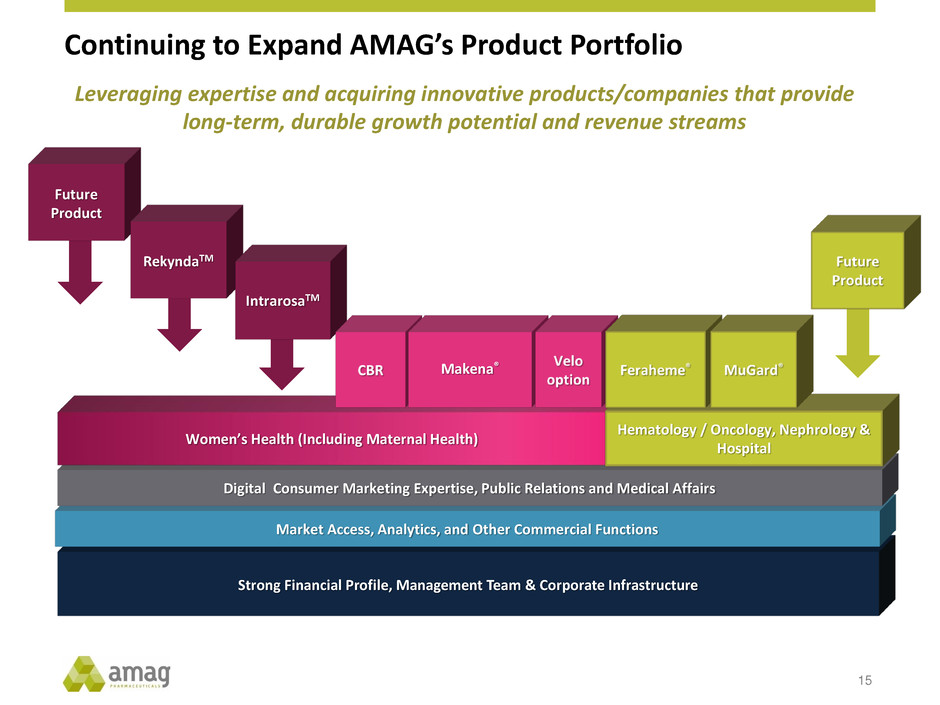

Strong Financial Profile, Management Team & Corporate Infrastructure Market Access, Analytics, and Other Commercial Functions Continuing to Expand AMAG’s Product Portfolio 15 Future Product Digital Consumer Marketing Expertise, Public Relations and Medical Affairs Women’s Health (Including Maternal Health) Hematology / Oncology, Nephrology & Hospital RekyndaTM IntrarosaTM Makena® Leveraging expertise and acquiring innovative products/companies that provide long-term, durable growth potential and revenue streams

IntrarosaTM (prasterone) A first-of-its-kind, non-estrogen women’s health therapy

Exclusive U.S. License for Intrarosa Will address a significant unmet need for post-menopausal women Strong safety and efficacy profile Large near-term commercial opportunity ‒ FDA approved in November 2016 ‒ 3 Orange Book listed patents out to 2031 Leverages AMAG’s current commercial platform in women’s health Capital efficient transaction structure Another key step forward in AMAG’s portfolio expansion strategy W O M E N ’ S H E A L T H : I N T R A R O S A 17

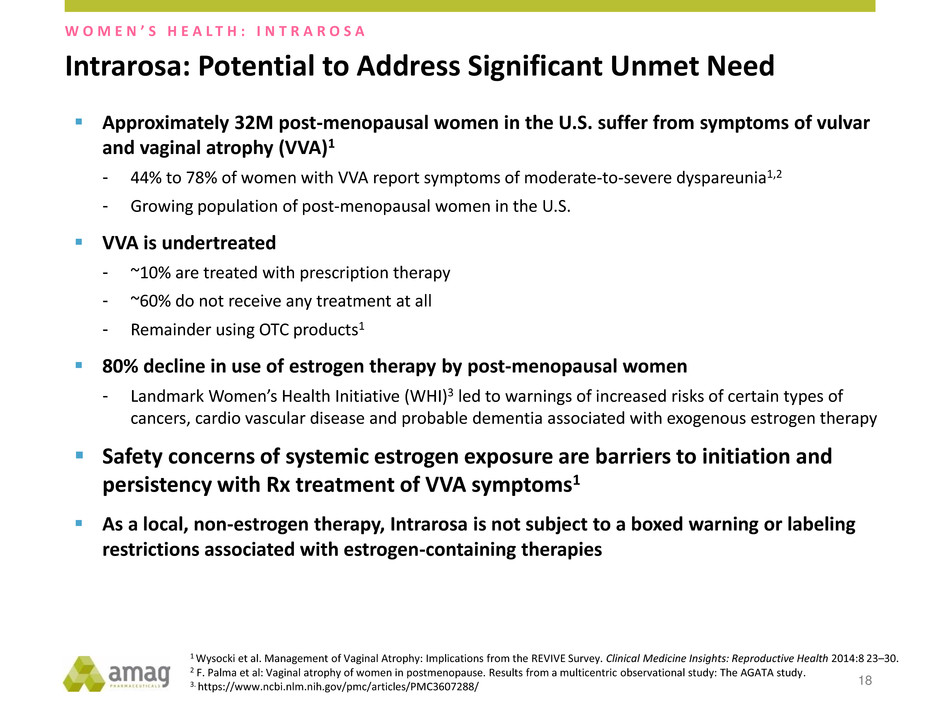

Intrarosa: Potential to Address Significant Unmet Need 18 Approximately 32M post-menopausal women in the U.S. suffer from symptoms of vulvar and vaginal atrophy (VVA)1 - 44% to 78% of women with VVA report symptoms of moderate-to-severe dyspareunia1,2 - Growing population of post-menopausal women in the U.S. VVA is undertreated - ~10% are treated with prescription therapy - ~60% do not receive any treatment at all - Remainder using OTC products1 80% decline in use of estrogen therapy by post-menopausal women - Landmark Women’s Health Initiative (WHI)3 led to warnings of increased risks of certain types of cancers, cardio vascular disease and probable dementia associated with exogenous estrogen therapy Safety concerns of systemic estrogen exposure are barriers to initiation and persistency with Rx treatment of VVA symptoms1 As a local, non-estrogen therapy, Intrarosa is not subject to a boxed warning or labeling restrictions associated with estrogen-containing therapies 1 Wysocki et al. Management of Vaginal Atrophy: Implications from the REVIVE Survey. Clinical Medicine Insights: Reproductive Health 2014:8 23–30. 2 F. Palma et al: Vaginal atrophy of women in postmenopause. Results from a multicentric observational study: The AGATA study. 3. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3607288/ W O M E N ’ S H E A L T H : I N T R A R O S A

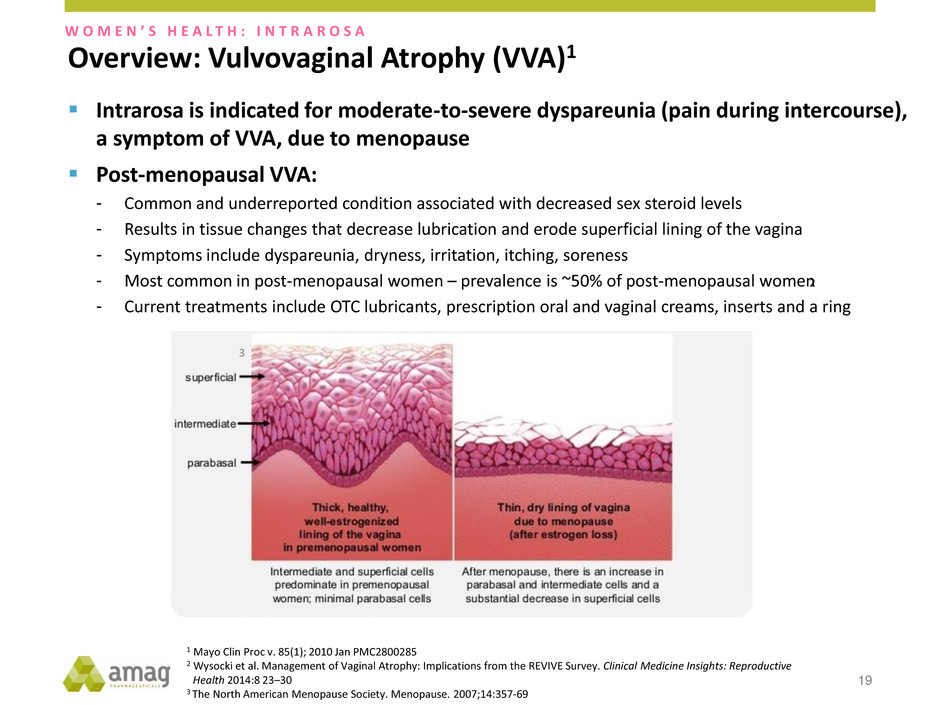

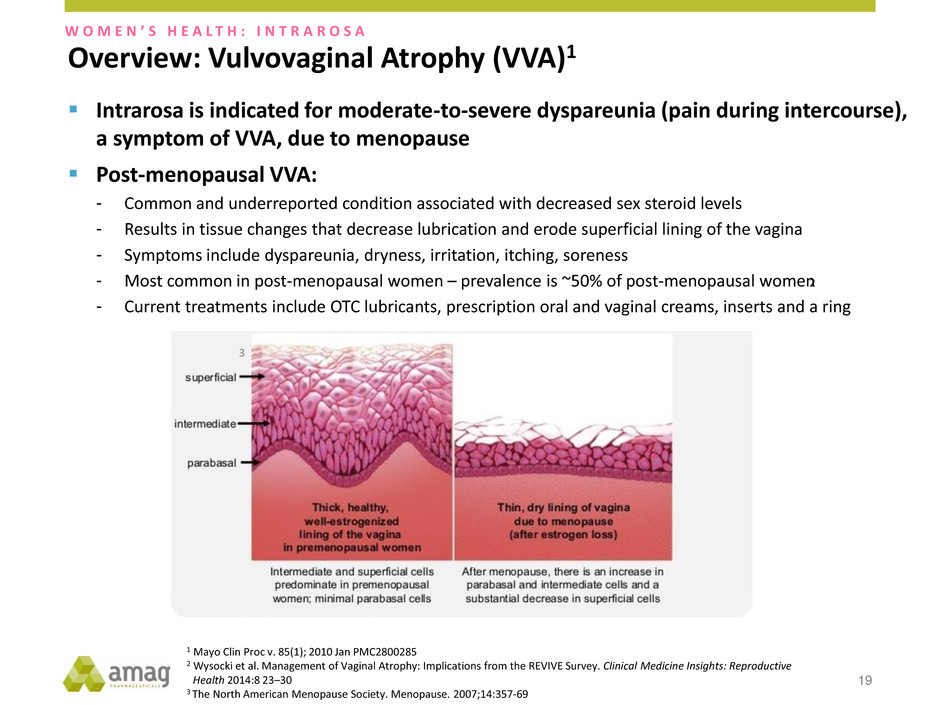

Overview: Vulvovaginal Atrophy (VVA)1 19 3 2 W O M E N ’ S H E A L T H : I N T R A R O S A Intrarosa is indicated for moderate-to-severe dyspareunia (pain during intercourse), a symptom of VVA, due to menopause Post-menopausal VVA: - Common and underreported condition associated with decreased sex steroid levels - Results in tissue changes that decrease lubrication and erode superficial lining of the vagina - Symptoms include dyspareunia, dryness, irritation, itching, soreness - Most common in post-menopausal women – prevalence is ~50% of post-menopausal women - Current treatments include OTC lubricants, prescription oral and vaginal creams, inserts and a ring 1 Mayo Clin Proc v. 85(1); 2010 Jan PMC2800285 2 Wysocki et al. Management of Vaginal Atrophy: Implications from the REVIVE Survey. Clinical Medicine Insights: Reproductive Health 2014:8 23–30 3 The North American Menopause Society. Menopause. 2007;14:357-69

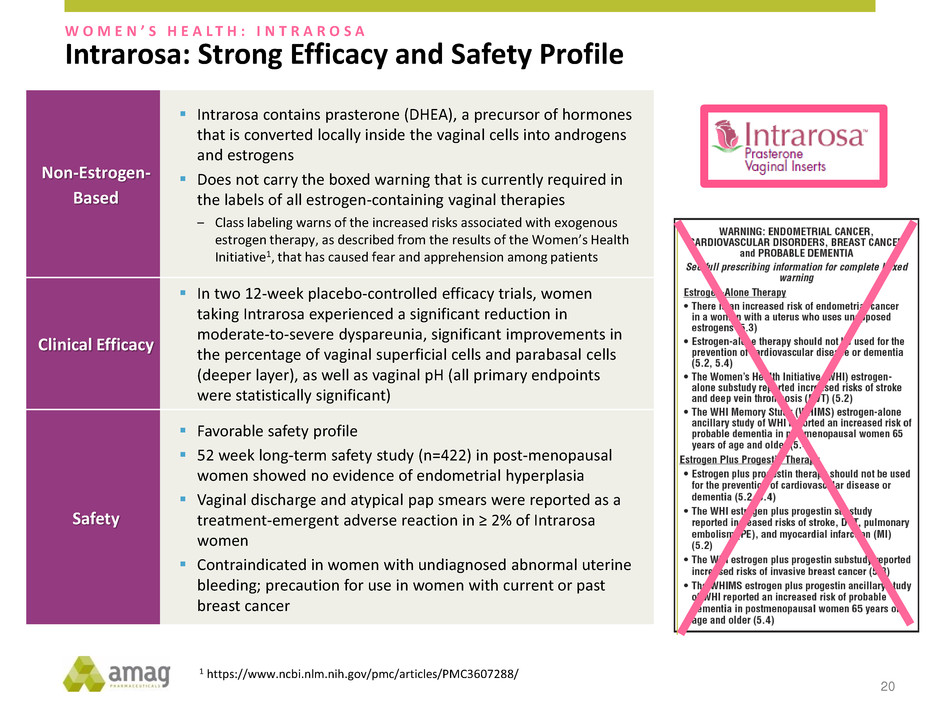

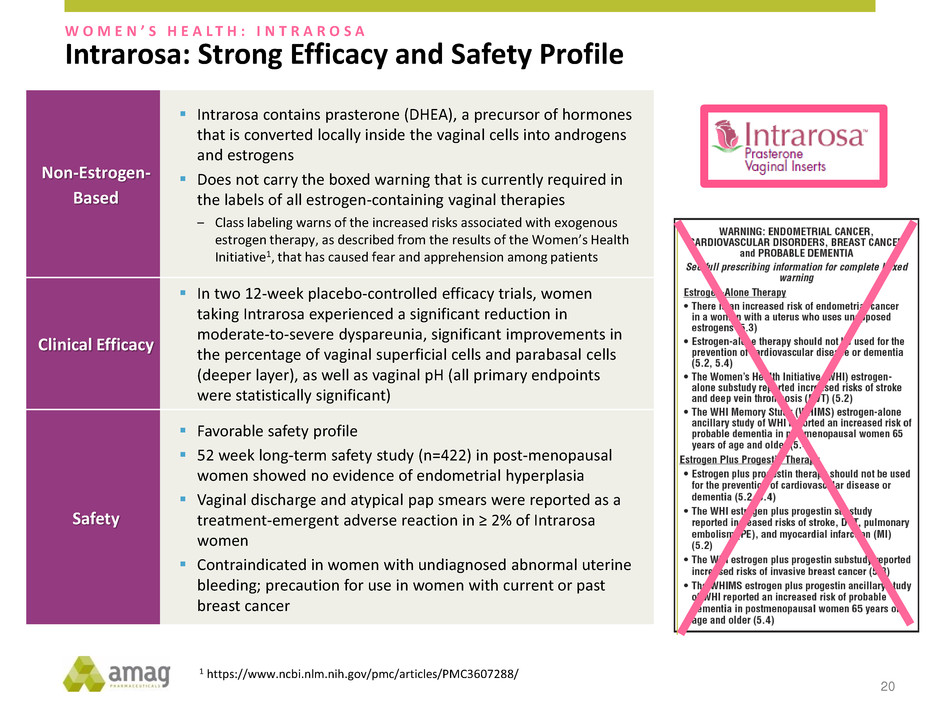

Non-Estrogen- Based Intrarosa contains prasterone (DHEA), a precursor of hormones that is converted locally inside the vaginal cells into androgens and estrogens Does not carry the boxed warning that is currently required in the labels of all estrogen-containing vaginal therapies ‒ Class labeling warns of the increased risks associated with exogenous estrogen therapy, as described from the results of the Women’s Health Initiative1, that has caused fear and apprehension among patients Clinical Efficacy In two 12-week placebo-controlled efficacy trials, women taking Intrarosa experienced a significant reduction in moderate-to-severe dyspareunia, significant improvements in the percentage of vaginal superficial cells and parabasal cells (deeper layer), as well as vaginal pH (all primary endpoints were statistically significant) Safety Favorable safety profile 52 week long-term safety study (n=422) in post-menopausal women showed no evidence of endometrial hyperplasia Vaginal discharge and atypical pap smears were reported as a treatment-emergent adverse reaction in ≥ 2% of Intrarosa women Contraindicated in women with undiagnosed abnormal uterine bleeding; precaution for use in women with current or past breast cancer 1 https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3607288/ Intrarosa: Strong Efficacy and Safety Profile W O M E N ’ S H E A L T H : I N T R A R O S A 20

Affected, but not yet seeking treatment Utilizing OTC treatments Previous estrogen therapy users Intrarosa: Sizable Untapped Market for Treating Dyspareunia 21 Currently on Rx estrogen therapy Safety concerns about estrogen- containing treatment options Efficacy and/or safety concerns about estrogen-containing treatment options Efficacy and/or not treating underlying pathology of VVA Unaware of condition/ treatment options and/or safety concerns Local (intra-vaginal) estrogen therapies = sales of >$1B per year1 1 Based on IMS SMART Tool NSP and NPA data. 2 IMS Health Plan Claims (April 2008-11). 3 AMAG estimate based on a) Wysocki et al. Management of Vaginal Atrophy: Implications from the REVIVE Survey. Clinical Medicine Insights: Reproductive Health 2014:8 23–30 and b) F. Palma et al: Vaginal atrophy of women in postmenopause. Results from a multicentric observational study: The AGATA study. 4 Trinity Partners, Quantitative Market Assessment, December 2016 (n=100 PCPs, 100 OBGYNS). 5 Based on multiple publications based on patient surveys. 1.7M women2 ~6M women3,4 ~12M women5 W O M E N ’ S H E A L T H : I N T R A R O S A

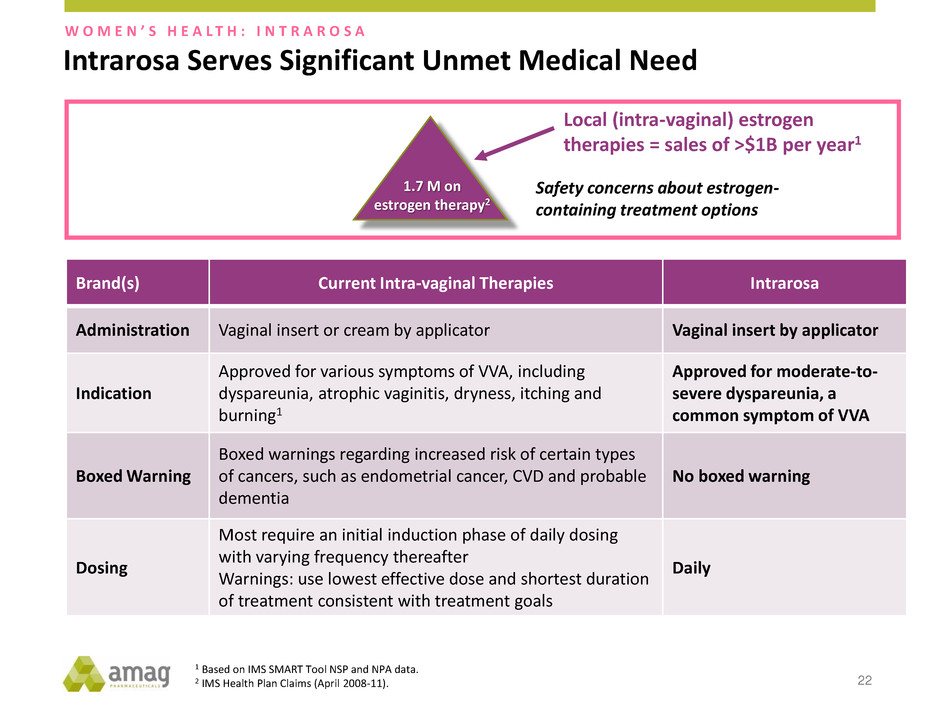

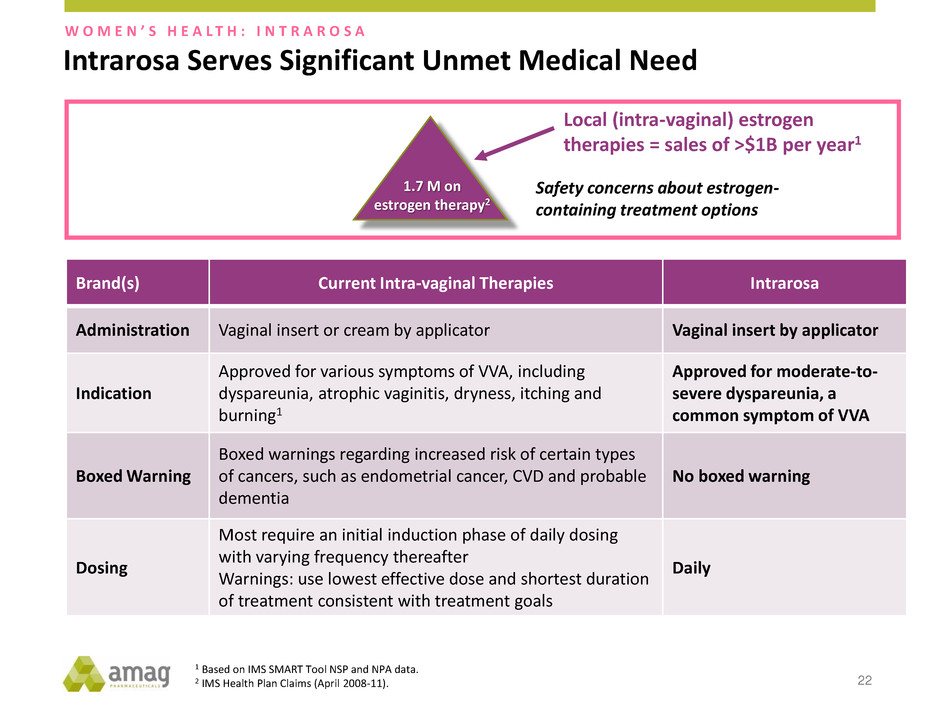

Intrarosa Serves Significant Unmet Medical Need 22 1.7 M on estrogen therapy2 Local (intra-vaginal) estrogen therapies = sales of >$1B per year1 Brand(s) Current Intra-vaginal Therapies Intrarosa Administration Vaginal insert or cream by applicator Vaginal insert by applicator Indication Approved for various symptoms of VVA, including dyspareunia, atrophic vaginitis, dryness, itching and burning1 Approved for moderate-to- severe dyspareunia, a common symptom of VVA Boxed Warning Boxed warnings regarding increased risk of certain types of cancers, such as endometrial cancer, CVD and probable dementia No boxed warning Dosing Most require an initial induction phase of daily dosing with varying frequency thereafter Warnings: use lowest effective dose and shortest duration of treatment consistent with treatment goals Daily 1 Based on IMS SMART Tool NSP and NPA data. 2 IMS Health Plan Claims (April 2008-11). Safety concerns about estrogen- containing treatment options W O M E N ’ S H E A L T H : I N T R A R O S A

Leverages AMAG’s Current Commercial Platform Leverage existing AMAG commercial and medical affairs teams - Deep relationships and experience with the OB/GYN community and women’s health KOLs - Successful patient access and commercial analytics platform - Strong record of consistent growth (40% in 2016) across current product portfolio - Significant experience building market awareness for new therapeutics and patient support programs Expand current women’s health sales force - Targeting ~25,000 OB/GYNs across the country - Dedicated new ~150-person team focused on the launch of Intrarosa - Maintain current 100-person team’s focus on Makena/CBR promotion and preparations for subcutaneous auto-injector launch1 - Future sales force flexibility as portfolio evolves (e.g., launch of Rekynda) Opportunities for label expansion and lifecycle management - Female Sexual Dysfunction Deploy digital engagement platform - Consumer education/content about novel treatment alternative to estrogen-containing therapy Preparing for mid-2017 launch of recently approved first-of-its-kind therapy W O M E N ’ S H E A L T H : I N T R A R O S A 231 If regulatory approved is received.

AMAG: At the Nexis of Key Drivers in Women’s Health Science Patients Healthcare Providers W O M E N ’ S H E A L T H : I N T R A R O S A Awareness-building capabilities and novel product create transformational opportunity New mechanism of action New therapeutic class Only non-estrogen therapy with no boxed warning Proven experience Expanded share of voice Broad patient access Congress engagement Ease of application Patient assistance and affordability programs Digital awareness & engagement 24

• $50M upfront cash payment and 600K shares of AMAG stock • Up to $10M on delivery of commercial supply for launch • $10M on the first anniversary of the effective date of the agreement • Sales milestones • $15M payment when net sales exceed $150M annually • $30M payment when net sales exceed $300M annually • $850M of payments triggered at various net sales levels exceeding $500M annually • Tiered royalties as a percent of net sales starting at mid-teens Intrarosa: Designed to Build Long-Term Shareholder Value 25 Transaction • Licensed U.S. rights from Endoceutics, a private pharmaceutical company based in Quebec City, Canada • Founded by Fernand Labrie, MD, PhD, a world-renowned endocrinologist • Endoceutics research/development focused in the field of women’s health • Endoceutics will supply product to AMAG Licensor • Hart-Scott-Rodino (HSR) review • Expect to close transaction in first half of 2017Timing • Will co-fund Phase 3 program of Intrarosa for the treatment of female sexual dysfunctionDevelopment

Upcoming Value Drivers and Potential Product Launches Frank Thomas President and Chief Operating Officer

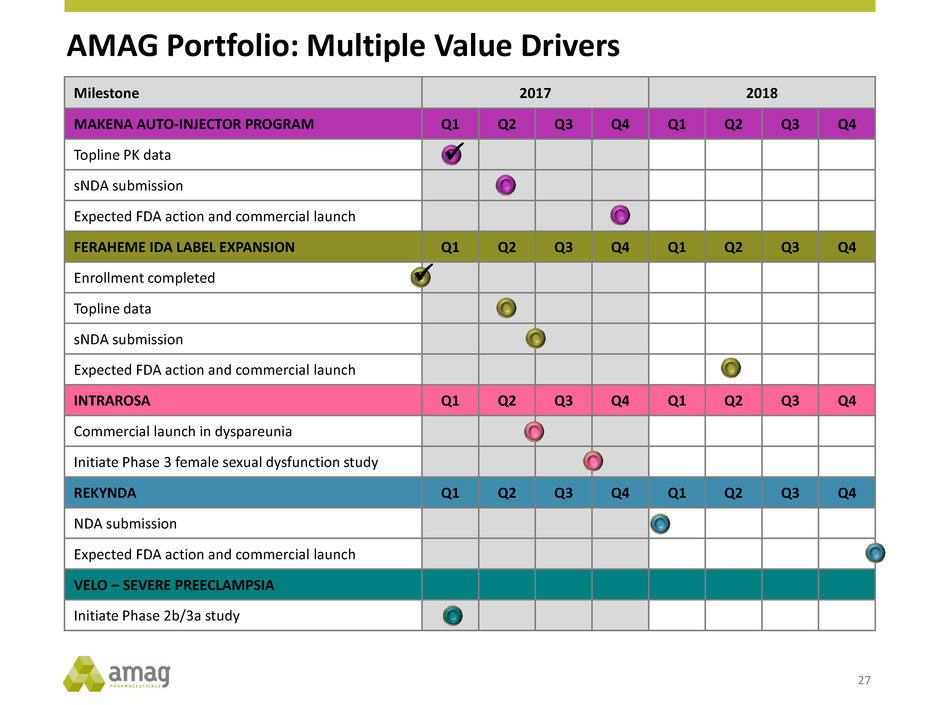

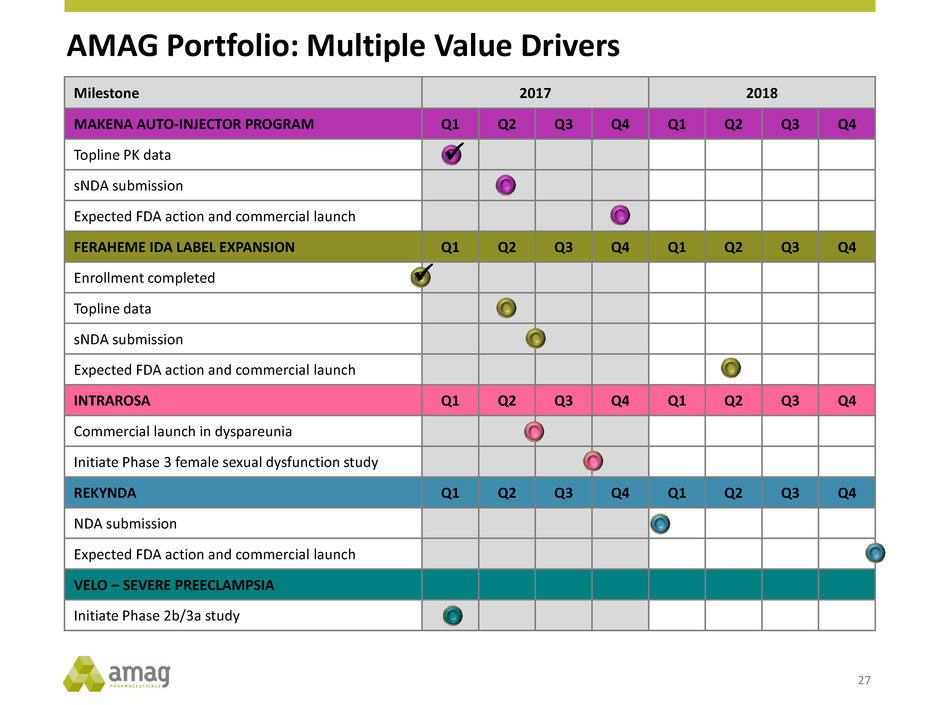

AMAG Portfolio: Multiple Value Drivers 27 Milestone 2017 2018 MAKENA AUTO-INJECTOR PROGRAM Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Topline PK data sNDA submission Expected FDA action and commercial launch FERAHEME IDA LABEL EXPANSION Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Enrollment completed Topline data sNDA submission Expected FDA action and commercial launch INTRAROSA Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Commercial launch in dyspareunia Initiate Phase 3 female sexual dysfunction study REKYNDA Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 NDA submission Expected FDA action and commercial launch VELO – SEVERE PREECLAMPSIA Initiate Phase 2b/3a study

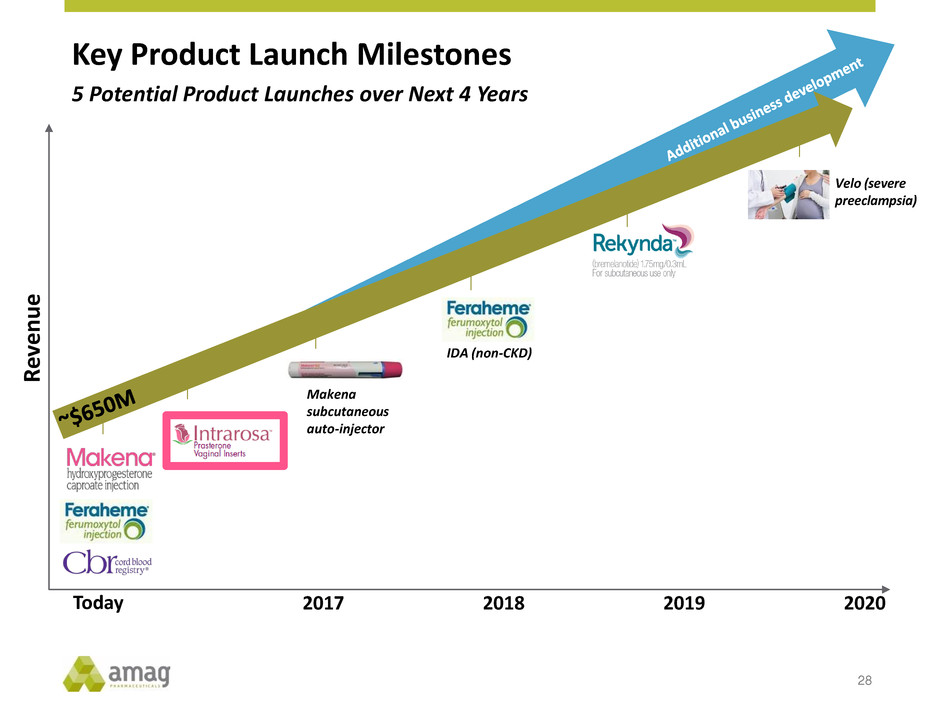

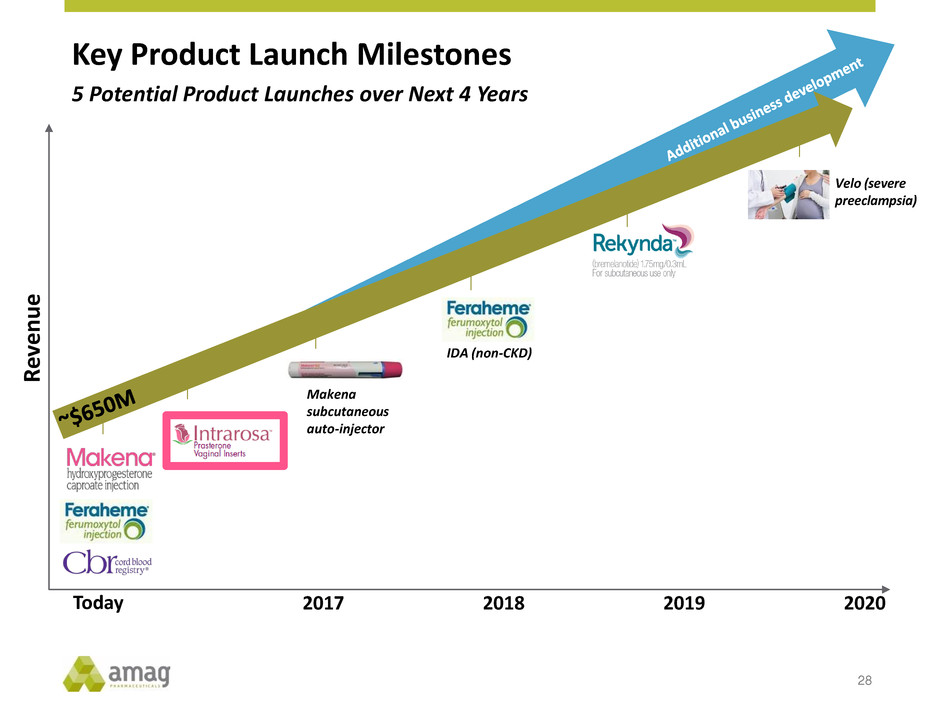

Key Product Launch Milestones 28 Makena subcutaneous auto-injector Velo (severe preeclampsia) IDA (non-CKD) R ev e nu e Today 2017 2018 2019 2020 5 Potential Product Launches over Next 4 Years

AMAG Pharmaceuticals Q&A February 14, 2017

Appendix

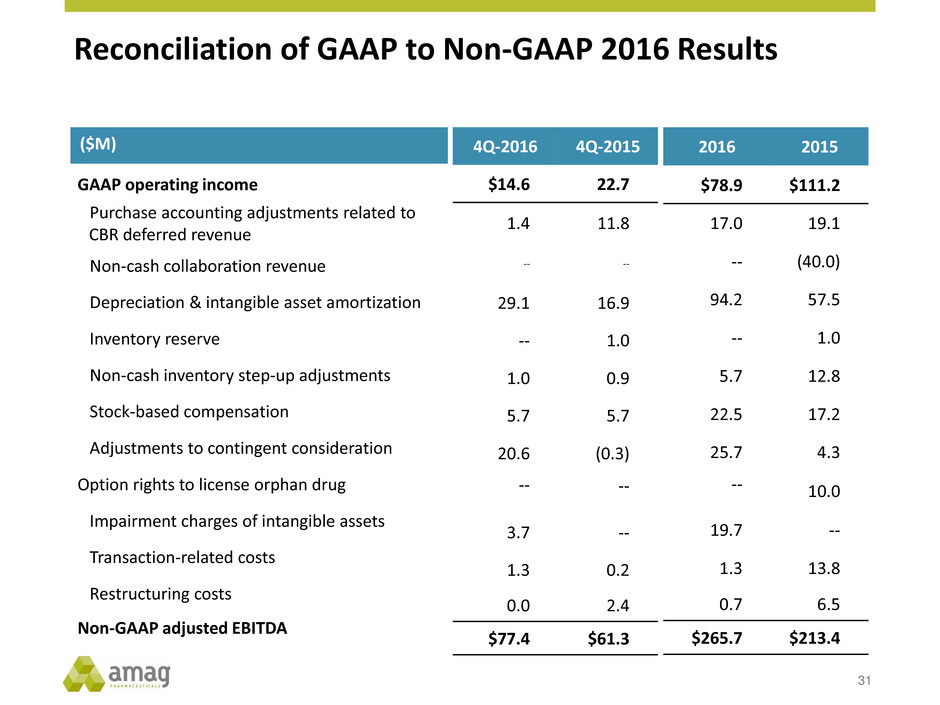

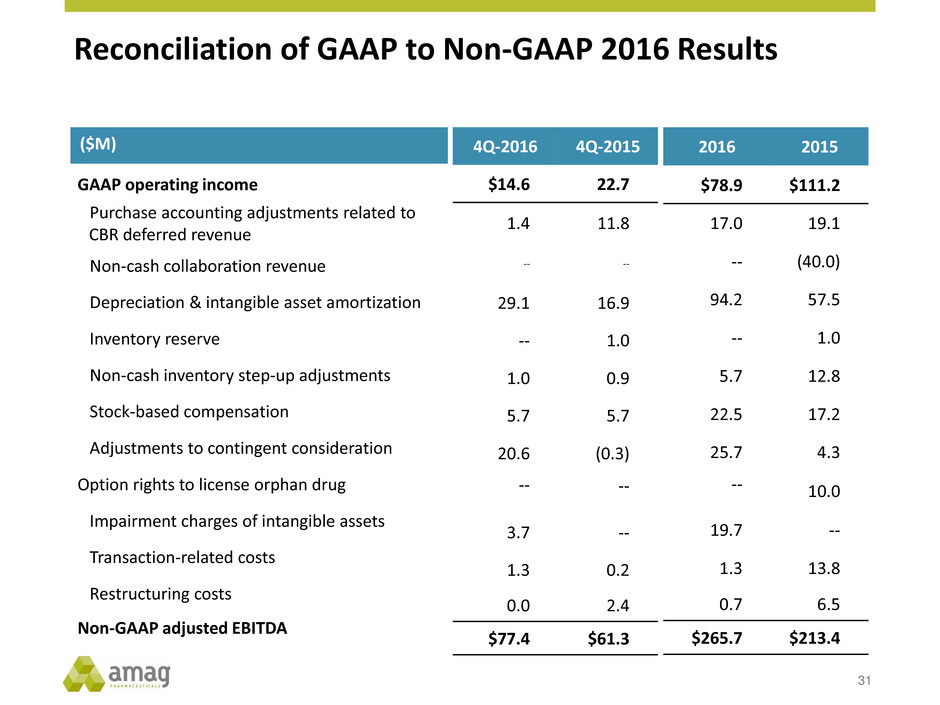

Reconciliation of GAAP to Non-GAAP 2016 Results 31 ($M) GAAP operating income Purchase accounting adjustments related to CBR deferred revenue Non-cash collaboration revenue Depreciation & intangible asset amortization Inventory reserve Non-cash inventory step-up adjustments Stock-based compensation Adjustments to contingent consideration Option rights to license orphan drug Impairment charges of intangible assets Transaction-related costs Restructuring costs Non-GAAP adjusted EBITDA 4Q-2016 4Q-2015 $14.6 22.7 1.4 11.8 -- -- 29.1 16.9 -- 1.0 1.0 0.9 5.7 5.7 20.6 (0.3) -- -- 3.7 -- 1.3 0.2 0.0 2.4 $77.4 $61.3 2016 2015 $78.9 $111.2 17.0 19.1 -- (40.0) 94.2 57.5 -- 1.0 5.7 12.8 22.5 17.2 25.7 4.3 -- 10.0 19.7 -- 1.3 13.8 0.7 6.5 $265.7 $213.4

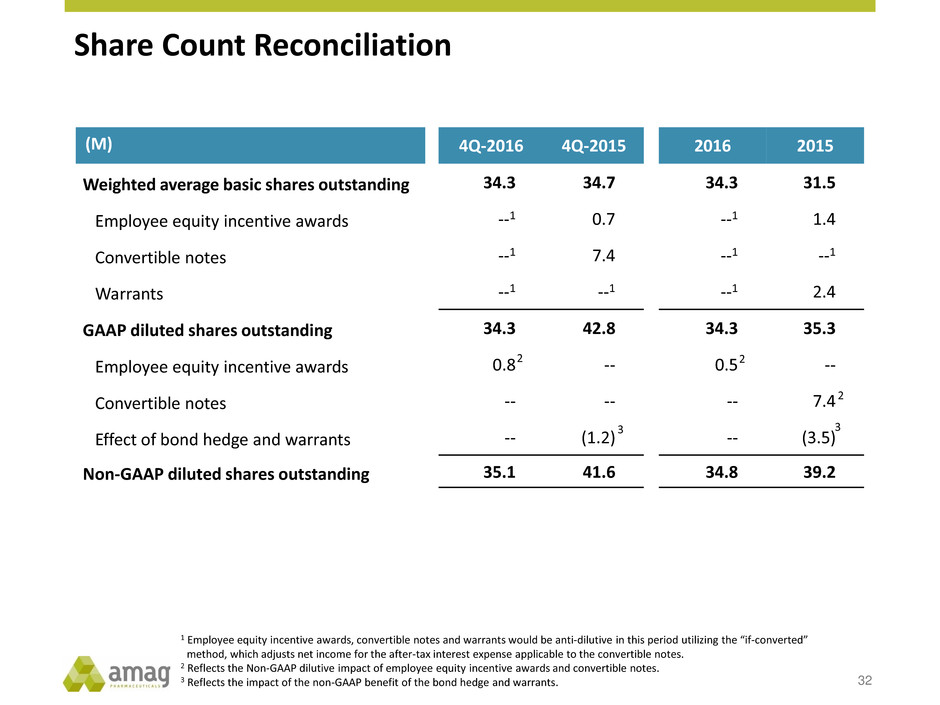

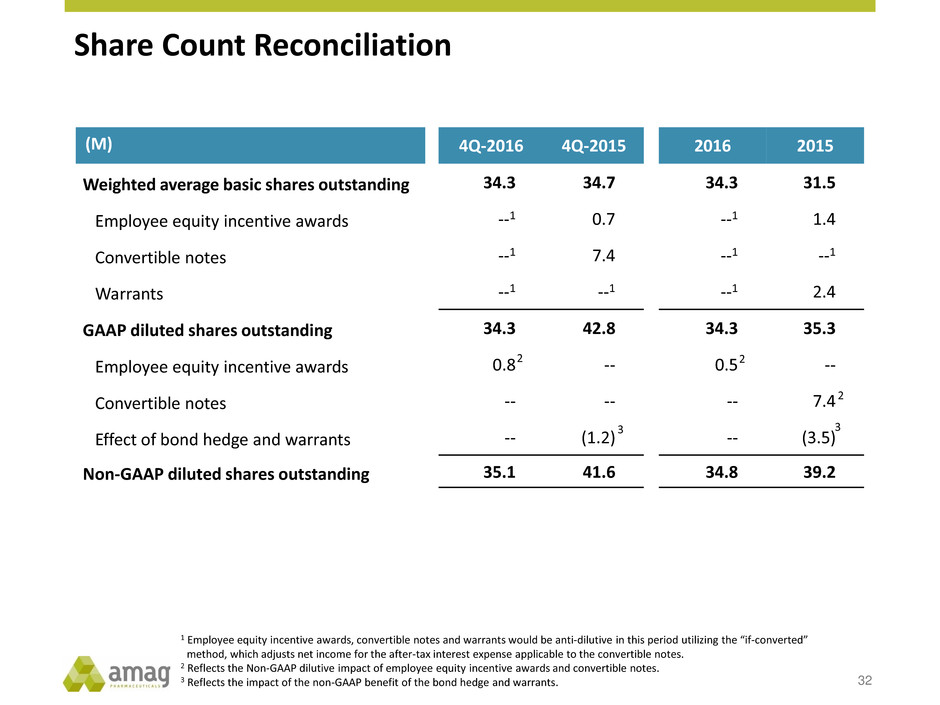

Share Count Reconciliation 32 (M) Weighted average basic shares outstanding Employee equity incentive awards Convertible notes Warrants GAAP diluted shares outstanding Employee equity incentive awards Convertible notes Effect of bond hedge and warrants Non-GAAP diluted shares outstanding 4Q-2016 4Q-2015 34.3 34.7 --1 0.7 --1 7.4 --1 --1 34.3 42.8 0.8 -- -- -- -- (1.2) 35.1 41.6 2016 2015 34.3 31.5 --1 1.4 --1 --1 --1 2.4 34.3 35.3 0.5 -- -- 7.4 -- (3.5) 34.8 39.2 1 Employee equity incentive awards, convertible notes and warrants would be anti-dilutive in this period utilizing the “if-converted” method, which adjusts net income for the after-tax interest expense applicable to the convertible notes. 2 Reflects the Non-GAAP dilutive impact of employee equity incentive awards and convertible notes. 3 Reflects the impact of the non-GAAP benefit of the bond hedge and warrants. 2 2 2 33

AMAG Pharmaceuticals 2016 Financial Results and Intrarosa License Agreement February 14, 2017