Analyst Day May 22, 2019 © 2019 AMAG Pharmaceuticals, Inc. All© rights 2019 reservedAMAG Pharmaceuticals, Inc. All rights reserved 1

Linda Lennox Vice President, Investor Relations 2

Forward-Looking Statements This presentation contains forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (PSLRA) and other federal securities laws. Any statements contained herein which do not describe historical facts, including, among others, statements regarding the anticipated regulatory timeline for AMAG’s products and product candidates and expectations for AMAG’s product portfolio; AMAG’s 2017-2022 strategic plan and progress on such plan; the potential for AMAG’s commercial platforms; expectations for AMAG’s product development timeline, including the timing for commercial launches, clinical trial enrollment and results and regulatory submissions; beliefs about the commercial opportunities, and the assumptions underlying such beliefs, for Vyleesi, ciraparantag and AMAG-423, including as to pricing, volume, patient population, including demographics and trends, and the prevalence of indications; beliefs about the data, science and addressable market for AMAG’s product candidates; anticipated safety profiles; anticipated reimbursement availability; expectations for patient sentiments and behaviors and the manner in which the proposed indications for AMAG’s product candidates present; beliefs about and expectations for clinical trial results; beliefs that new products will drive future growth and that commercial product opportunities can be maximized; AMAG’s expectations for its commercial product portfolio from 2019 through 2022, including the timing for key events; beliefs about revenue and adjusted EBITA opportunities and trajectories; AMAG’s business development goals and initiatives, including potential partnering opportunities and the availability of non-dilutive capital; beliefs that the EBITDA negative phase in 2019 is short-lived and that AMAG will return to EBITDA neutral in 2020 and AMAG’s 2019 development goals are forward‐looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward‐looking statements. Such risks and uncertainties include, among others, the risk that sales of Makena will continue to be negatively impacted by the supply disruption and recent and future generic entries in the market; the risk that AMAG may be unable to gain approval of its product candidates, including Vyleesi, AMAG-423 and ciraparantag, on a timely basis, or at all, including as a result of delays or set-backs in clinical trial enrollment, design or results; the potential for such approvals, if obtained, to include unanticipated restrictions or warnings and the risk that the costs and time investments for AMAG’s development efforts will be higher than anticipated, or that AMAG has over-estimated the market and potential revenues for its products and product candidates, if approved, including AMAG’s beliefs about the market opportunity for Vyleesi, AMAG-423 and ciraparantag; and those risks identified in AMAG’s filings with the U.S. Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10‐K for the year ended December 31, 2018, its Quarterly Report on Form 10-Q for the quarter ended March 31, 2019 and subsequent filings with the SEC, which are available at the SEC’s website at www.sec.gov. Any such risks and uncertainties could materially and adversely affect AMAG’s results of operations, its profitability and its cash flows, which would, in turn, have a significant and adverse impact on AMAG’s stock price. AMAG cautions you not to place undue reliance on any forward‐looking statements, which speak only as of the date they are made. AMAG disclaims any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward‐looking statements. AMAG Pharmaceuticals® and Feraheme® and the logo and designs are registered trademarks of AMAG Pharmaceuticals, Inc. VyleesiTM is a trademark of AMAG Pharmaceuticals, Inc. Makena® is a registered trademark of AMAG Pharma USA, Inc. Intrarosa® is a registered trademark of Endoceutics, Inc. Other trademarks referred in these materials are the property of their respective owners. © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 3

Cautionary Disclosure Regard AMAG’s Long-Term Outlook Slides 7, 9, 18, 41, 45-48, 51, 52 and 54 contain forward-looking estimates of AMAG’s growth trajectory in revenue and adjusted EBITDA on a multi- year timeframe based on a strategy of maximizing commercial product opportunities to fund investments in new products, with various assumptions, including certain assumptions about the progression and approval of AMAG’s product candidates. In addition to the risk factors and forward-looking statements disclosed above, these estimates involve risks and uncertainties related to: (i) the success of AMAG’s development pipeline; (ii) an increased focus on durable assets; (iii) ongoing efforts to leverage clinical development capabilities against later-stage, lower-risk development opportunities which are themselves subject to considerable risk; (iv) the cash-flows required to the fund AMAG’s evolving business model, including its development efforts; (v) the uncertain and highly speculative commercial potential of therapeutic areas of interest; and (vi) external pricing / reimbursement. The purpose of these long-term revenue and adjusted EBITDA estimates is not to provide financial guidance or forecasts, but rather to illustrate AMAG’s current growth model based on current plans for the advancement of Vyleesi, ciraparantag and AMAG-423 and potential future portfolio expansion. These estimates include assumptions based on current circumstances with respect to, among other things, (A) design, enrollment, timing and successful execution of clinical trials, (B) anticipated timetables for regulatory filings and related reviews and potential approvals of products, and approved indications, (C) cost and timing for development efforts and commercial launches, (D) forecasted volumes and pricing and (E) the performance of AMAG’s commercialized products. Additional risk factors include, among others, (i) the risk that AMAG’s commercial products will not achieve the level of revenues needed to support AMAG’s research and development efforts, including because such efforts require greater costs than anticipated or because such revenues fall short of expectations, (ii) the speculative nature of the addressable market for the indications being pursued for AMAG’s product candidates, (iii) the risk that the FDA will not approve AMAG’s product candidates for commercial use on the expected timeframe, for the anticipated indications, uses and label, or at all, and (iv) the risk that AMAG will not be able to continue to execute on its business plan. There can be no assurance that all or any of the assumptions and estimates built into our long-term models will prove correct, and we caution you not to place undue reliance on such statements and the overall progression of revenue or adjusted EBITDA for our products, as the timing of regulatory approvals, clinical study results, commercial launch, supply availability, competition, volume and pricing may turn out to be significantly different from our current estimates. You are strongly encouraged to read those risks and uncertainties identified above and in AMAG’s filings with the SEC. © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 4

Agenda for the Day Welcome Linda Lennox, AMAG Vice President, Investor Relations Strategic overview and outlook Bill Heiden, AMAG President and Chief Executive Officer AMAG-423 • Disease overview John Barton, MD, OB/GYN, MFM Specialist, Baptist Health, KY* • MOA, Phase 2a data, current Phase 2b/3a trial Baha Sibai, MD, Professor, Department of OB/GYN and Reproductive Sciences, McGovern Medical School, University of Texas Health Sciences, TX* • AMAG market opportunity Tony Casciano, AMAG Chief Commercial Officer • Q&A with panel Moderated by Julie Krop, MD, AMAG Chief Medical Officer Vyleesi™ • Condition, unmet medical need Sheryl Kingsberg, PhD, Chief, Division of Behavioral Medicine, University Hospitals Cleveland Medical Center, OH* • Role of Vyleesi in clinical practice David Portman, MD, Director Emeritus, Columbus Center for Women’s Health Research, Adjunct Instructor, Ohio State University* • Doctor/patient fireside chat Sheryl Kingsberg, PhD; HSDD patient • Vyleesi commercial launch overview Meghan Rivera, AMAG Vice President, Head of Women’s Health Sales & Marketing • Q&A with panel Moderated by Julie Krop, MD Ciraparantag • Unmet need, MOA, Phase 2 data, coagulometer Jack Ansell, MD, Professor of Medicine, Hofstra Northwell School of Medicine, NY* • Role of/need for reversal agent in ER setting Joseph Bledsoe, MD, Department of Emergency Medicine, Intermountain Healthcare, UT* • Role of reversal agent in cardiology practice C. Michael Gibson, MD, Interventional Cardiologist, Beth Israel Deaconess Medical Center, MA* • AMAG market opportunity Tony Casciano • Q&A with panel Moderated by Julie Krop, MD Financial evolution and business development Ted Myles, AMAG Chief Financial Officer Closing remarks / Q&A Bill Heiden * Key opinion leaders were compensated for their time and participation in this event. © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 5

Strategic Overview and Outlook Bill Heiden AMAG President and CEO 6

Key Take-Aways for Today View to 2022 is bright Valuable product • Current commercial products portfolio today will continue to perform well • Development-stage products Significant progress • Commercial products growing represent new & durable from 2017 to today • Development-stage products revenue opportunities address significant unmet • Return to cash flow positive • Expanded product portfolio medical needs and represent from 2 products to 6 products substantial commercial • Strong and proven commercial opportunities track record • Successful drug development capabilities 2 6 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 7

Agenda Strategic Overview Progress to Date Portfolio Value © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 8

Overview: 2017-2022 Strategic Plan Delivering Innovative Therapies Investing Innovation Expanding Creating new, durable revenue streams and capabilities and Acquiring/licensing profitable growth investing in the development-stage development products to address and launch of new unmet medical products needs Acquiring/Licensing Specialty Pharma: Acquiring/licensing cash generating products 2018 2019 2020 2021 2022 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 9

Agenda Strategic Overview Progress to Date Portfolio Value © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 10

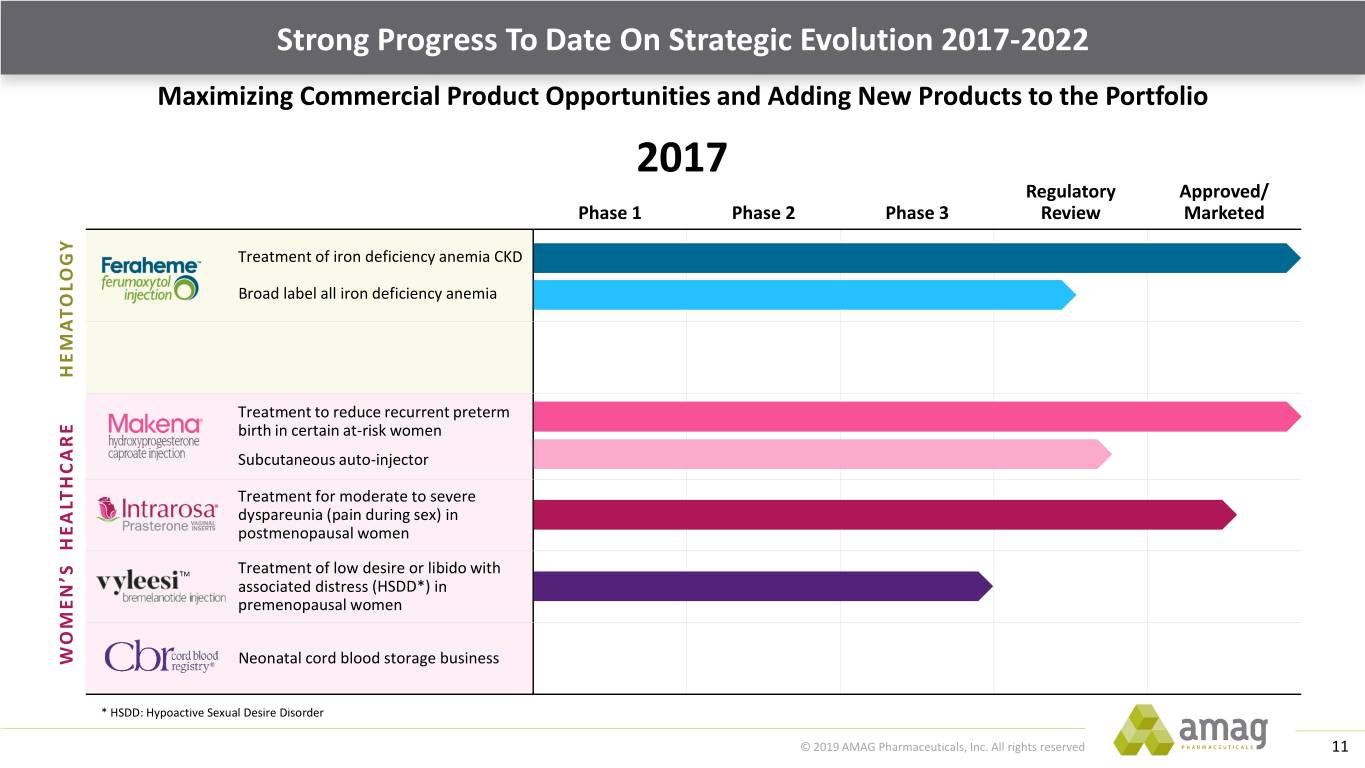

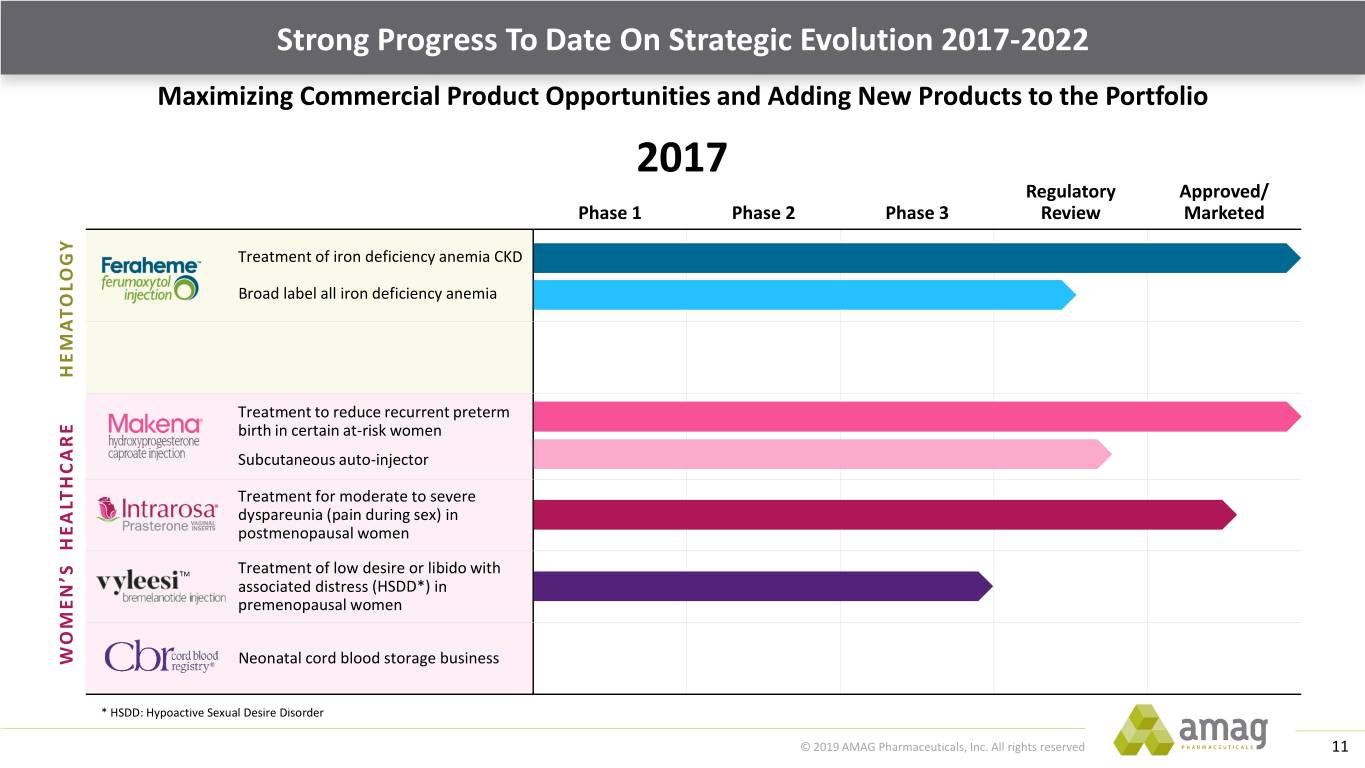

Strong Progress To Date On Strategic Evolution 2017-2022 Maximizing Commercial Product Opportunities and Adding New Products to the Portfolio 2017 Regulatory Approved/ Phase 1 Phase 2 Phase 3 Review Marketed Treatment of iron deficiency anemia CKD Broad label all iron deficiency anemia HEMATOLOGY Treatment to reduce recurrent preterm birth in certain at-risk women Subcutaneous auto-injector Treatment for moderate to severe dyspareunia (pain during sex) in postmenopausal women TM Treatment of low desire or libido with associated distress (HSDD*) in premenopausal women WOMEN’S HEALTHCARE Neonatal cord blood storage business * HSDD: Hypoactive Sexual Desire Disorder © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 11

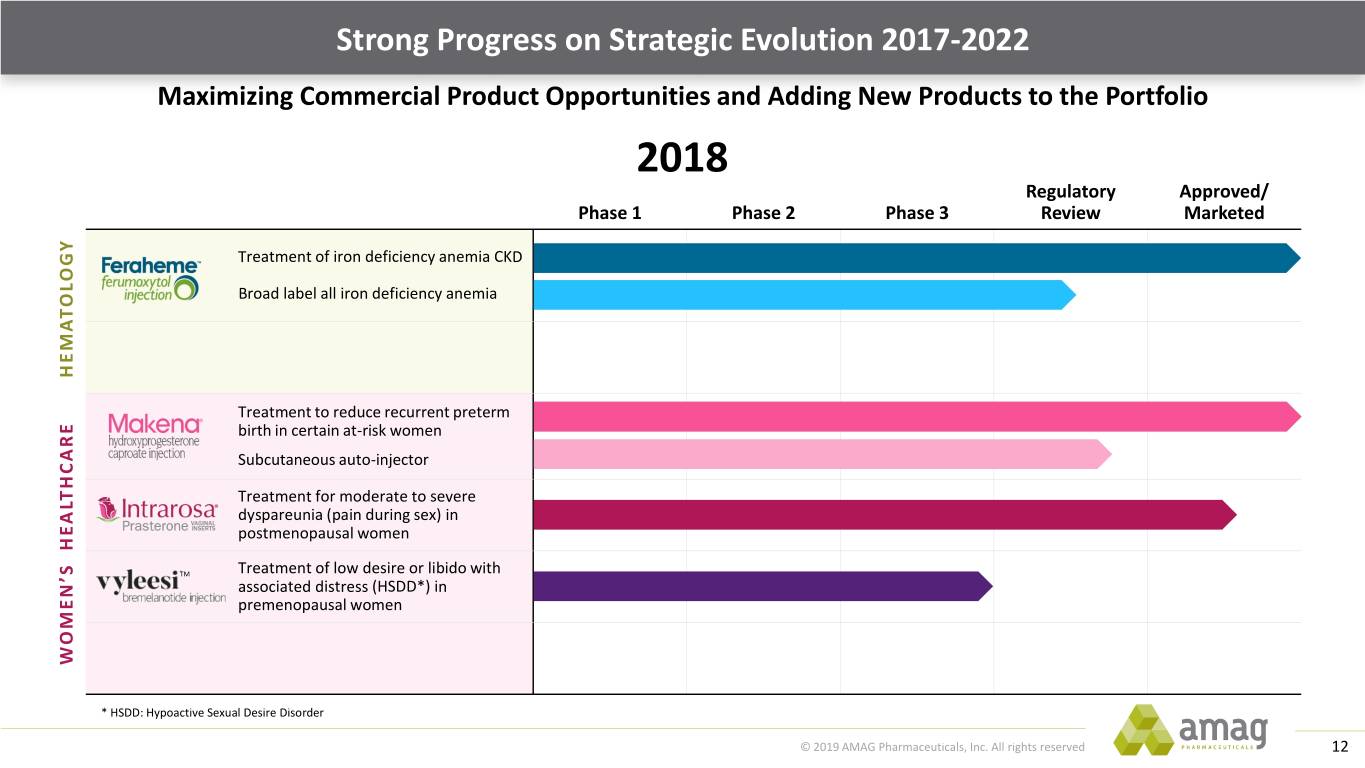

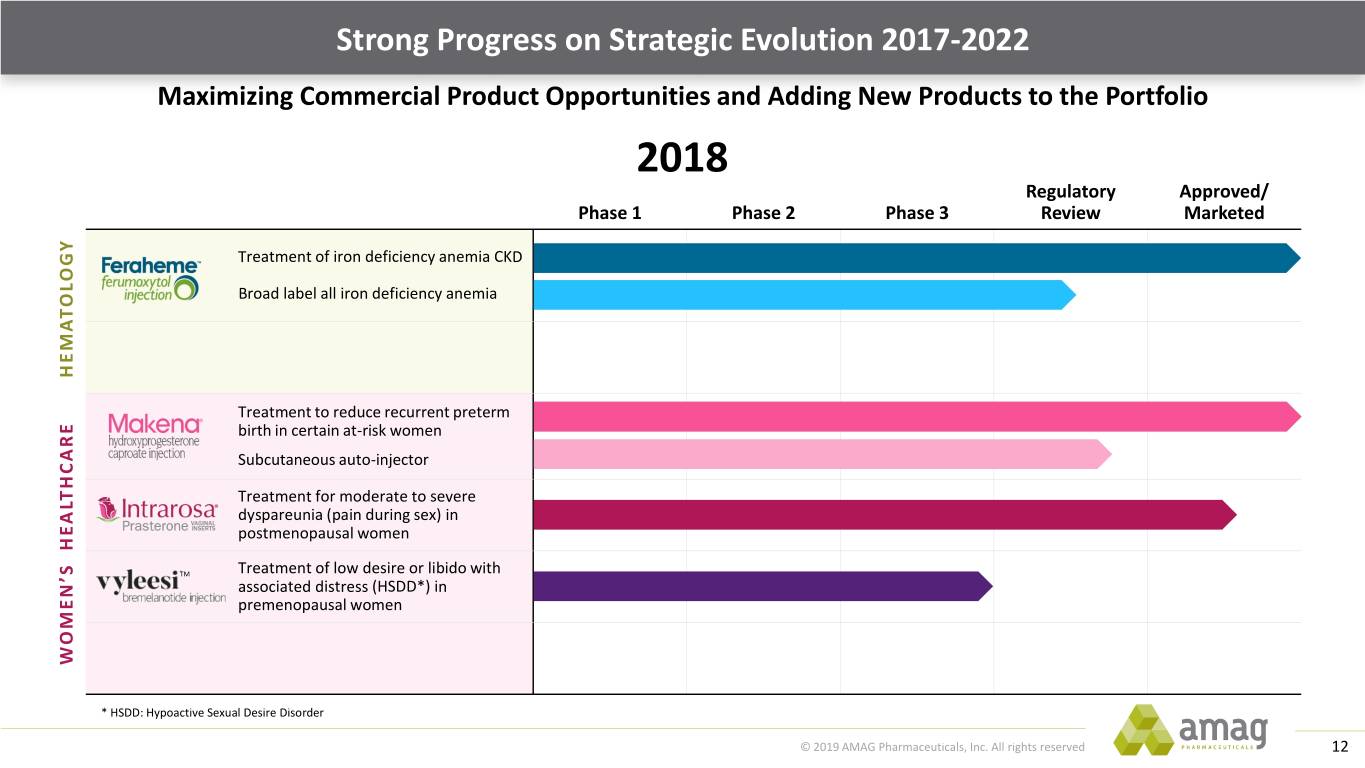

Strong Progress on Strategic Evolution 2017-2022 Maximizing Commercial Product Opportunities and Adding New Products to the Portfolio 2018 Regulatory Approved/ Phase 1 Phase 2 Phase 3 Review Marketed Treatment of iron deficiency anemia CKD Broad label all iron deficiency anemia HEMATOLOGY Treatment to reduce recurrent preterm birth in certain at-risk women Subcutaneous auto-injector Treatment for moderate to severe dyspareunia (pain during sex) in postmenopausal women TM Treatment of low desire or libido with associated distress (HSDD*) in premenopausal women WOMEN’S HEALTHCARE * HSDD: Hypoactive Sexual Desire Disorder © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 12

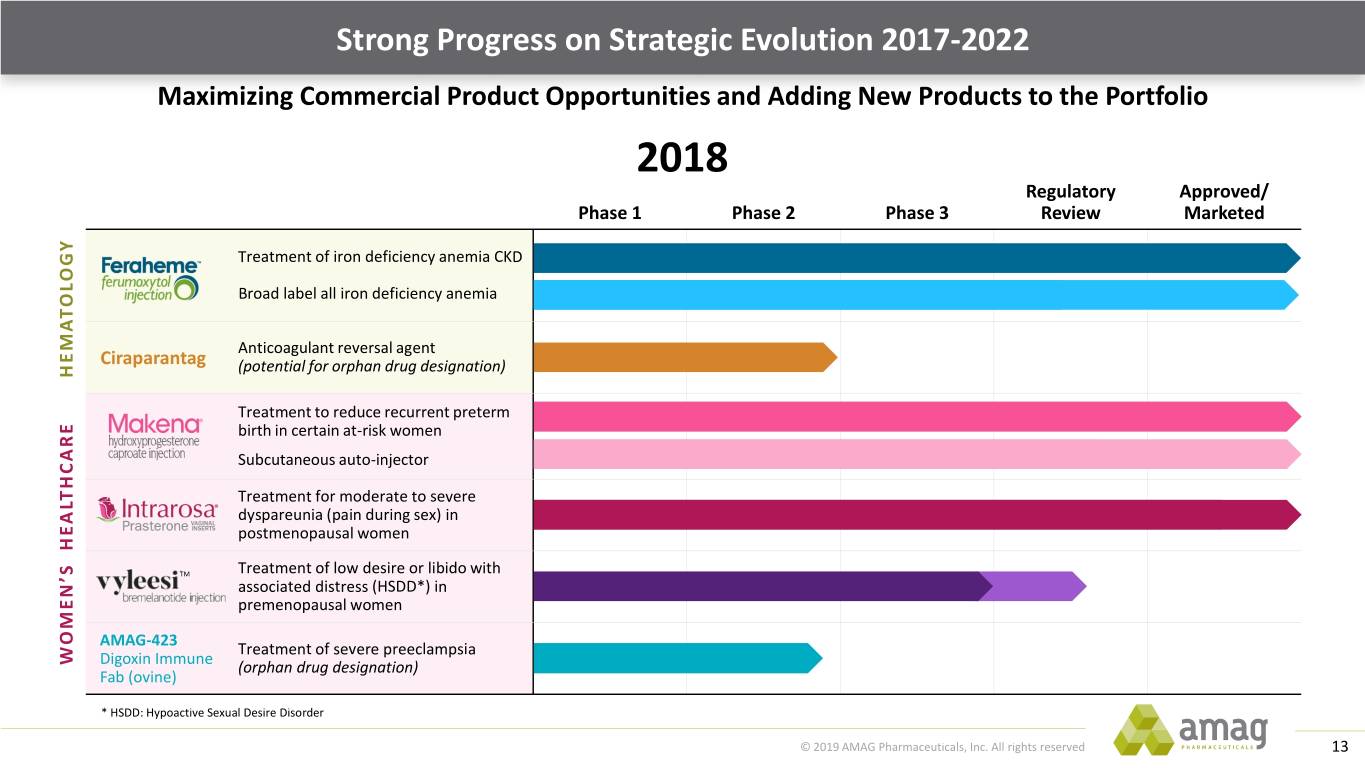

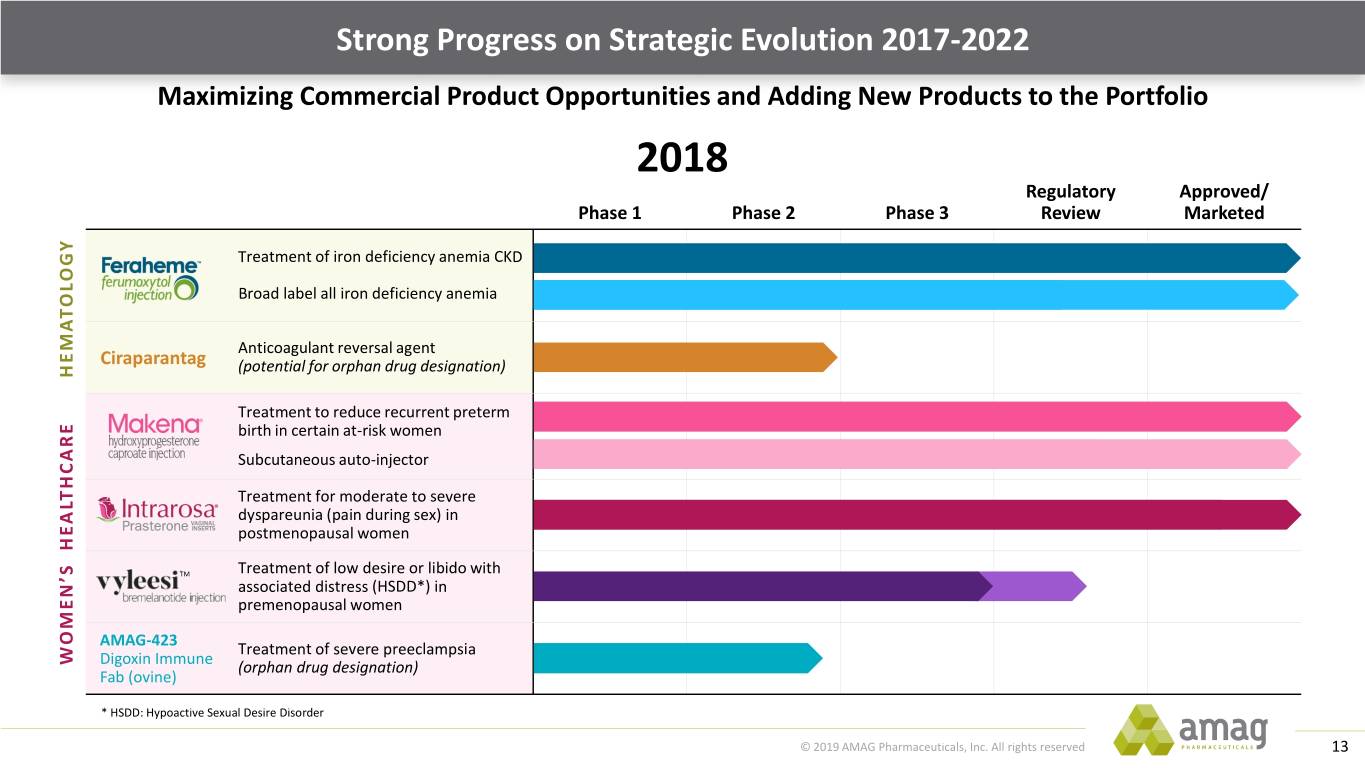

Strong Progress on Strategic Evolution 2017-2022 Maximizing Commercial Product Opportunities and Adding New Products to the Portfolio 2018 Regulatory Approved/ Phase 1 Phase 2 Phase 3 Review Marketed Treatment of iron deficiency anemia CKD Broad label all iron deficiency anemia Anticoagulant reversal agent Ciraparantag (potential for orphan drug designation) HEMATOLOGY Treatment to reduce recurrent preterm birth in certain at-risk women Subcutaneous auto-injector Treatment for moderate to severe dyspareunia (pain during sex) in postmenopausal women TM Treatment of low desire or libido with associated distress (HSDD*) in premenopausal women AMAG-423 Treatment of severe preeclampsia WOMEN’S HEALTHCAREDigoxin Immune (orphan drug designation) Fab (ovine) * HSDD: Hypoactive Sexual Desire Disorder © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 13

Strong Progress on Strategic Evolution 2017-2022 Historical Value Drivers Fund Future Value Drivers AMAG-423 ciraparantag Fundingfunding HISTORICAL Value of AMAG FUTURE Value of AMAG © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 14

AMAG: Diversified Product Portfolio Leveraging Two Strong Commercial Platforms Coming Soon ciraparantag AMAG-423 Commercial Hematology Women’s Health Maternal Health 48 Sales Representatives => 124 Sales Representatives => OB/GYNS Heme Clinics & Hospitals STRONG COMMERCIAL PLATFORM © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 15

AMAG Product Development Milestone Calendar 1H-2019 2H-2019 1H-2020 2H-2020 1H-2021 2H-2021 June 23 Potential PDUFA date commercial Vyleesi launch 423 - Target complete enrollment in Phase 2b/3a trial Topline data NDA submission Potential FDA approval AMAG Closed End of Phase 2 Complete NDA Potential Perosphere meeting with Phase 3a trials; submission1 FDA approval acquisition FDA; Initiate announce Phase 3a trials topline data Apply for orphan Initiate Ciraparantag and breakthrough Phase 3b/4 trial designation 1 Ciraparantag NDA submission expected to include only the first 50-100 patients in the Phase 3b clinical trial, based on precedent. © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 16

Agenda Strategic Overview Progress to Date Portfolio Value © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 17

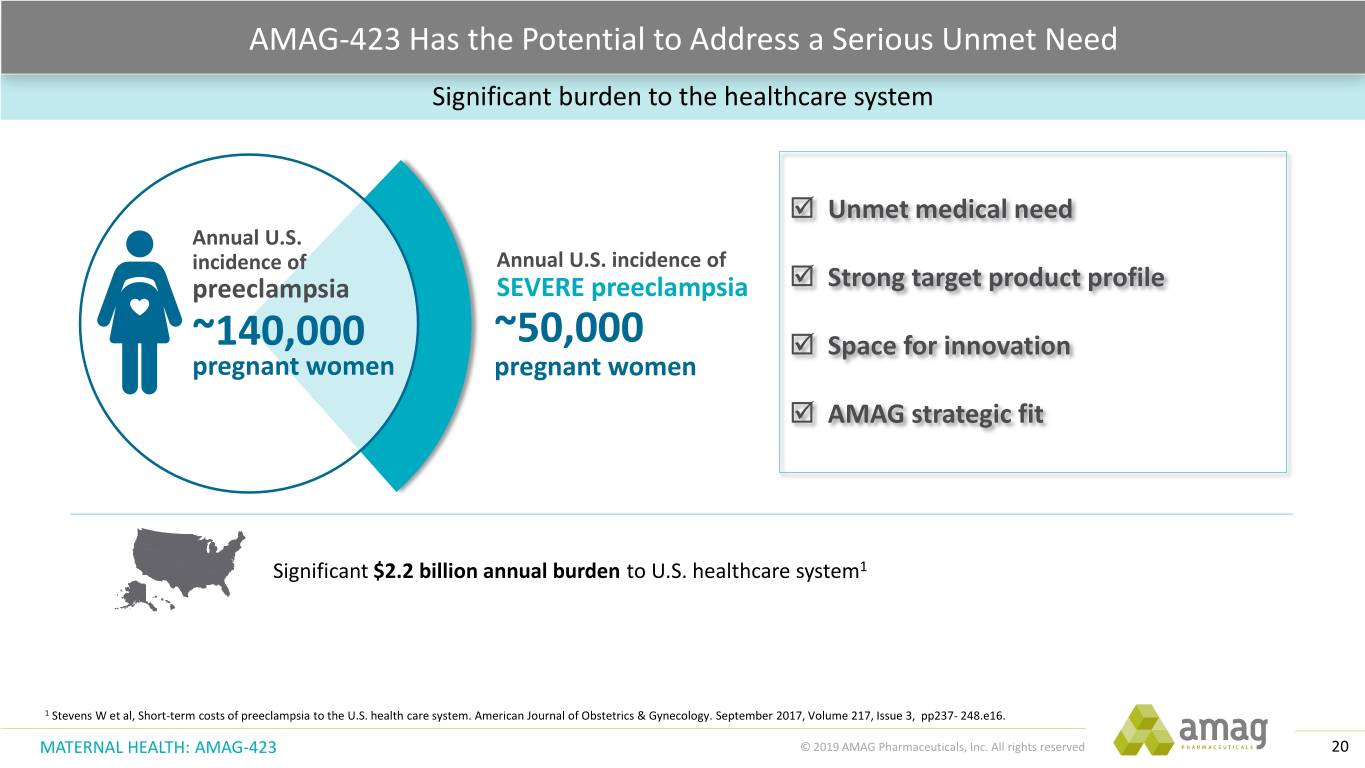

Unmet Medical Needs Representing Significant Commercial Opportunities Net Revenues Per Year For Every 1% of Market Penetration? AMAG-423 ciraparantag Affects 5.8 million U.S. premenopausal women1 ~6 million patients on NOAC / LMWH therapy1 Annual U.S. incidence of preeclampsia: (1 in 10 premenopausal women)2,3 Xarelto®, Eliquis®, Savaysa®, Pradaxa®, Lovenox® ~140,000 pregnant women1 98% (5.7M) of affected ~150,0002 estimated NOAC / LMWH Annual U.S. incidence of severe premenopausal women patients per year requiring a preeclampsia: not on therapy1 reversal agent ~50,000 pregnant women1,2 Every 1%Every 1%of equals affected Every Every1% 1% of equals patients Every Every1% 1%of equals patients $35M4 / year $36M3 / year $70M3 / Year patients treated = requiring reversal treated = with severe preeclampsia = 4 3 $70M3 / Year $35M / year $36M / year 1 Patient & Economic Flow Study sponsored by Palatin Technologies, Inc. and 1 Perosphere sponsored commercial assessment report conducted by a third 1 Ananth, C. V., Keyes, K. M., & Wapner, R. J. (2013). Pre-eclampsia rates conducted by Burke Inc., April 2016. party in May 2016. in the United States, 1980-2010: age-period-cohort analysis. The 2 Shifren JL, Monz BU, Russo PA, Segreti A, Johannes CB. Sexual problems and 2 AMAG estimate based on the following: (i) Zhu J., Alexander GC, et al. BMJ, 347, f6564. http://doi.org/10.1136/bmj.f6564. distress in United States women: prevalence and correlates. Obstet Pharmacotherapy 2018 September; 38(9): 907-920. (ii) Sindet-Pedersen C, et 2 AMAG Phase 2b/3a clinical trial population is a subset of the severe Gynecol. 2008;112(5):970–978. al. European Heart Journal - Cardiovascular Pharmacotherapy (2018) 4, 220– preeclampsia population. 3 Goldstein I, Kim NN, Clayton AH, et al. Hypoactive sexual desire disorder: 227. (iii) Garcia D, Alexander JH, et al. Blood 2014 124: 3692-3698. (iv) 3 Price reference: $140,000/patient average annual cost for orphan drug, International Society for the Study of Women’s Sexual Health (ISSWSH) expert www.aha-org/statistics/fast-facts-us-hospitals. (v) Balakrishna, P, et al. Blood EvaluatePharma®, Orphan Drug Report 2017. consensus panel review. Mayo Clin Proc. 2017;92(1):114‐128. 2017 130:5585. (vi) 4 Price reference: The currently approved product for treatment of HSDD www.cdc.gov/dhdsp/data_statistics/fact_sheets/fs_atrial_fibrillation.hem. (flibanserin) WAC (assume 50% gross to net discount) x 3 months of therapy. 3 Price reference: The currently approved reversal agent (coagulation factor Xa recombinant, inactivated-zhzo) price of ~$24,000. © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 18

Tony Casciano AMAG Chief Commercial Officer 19

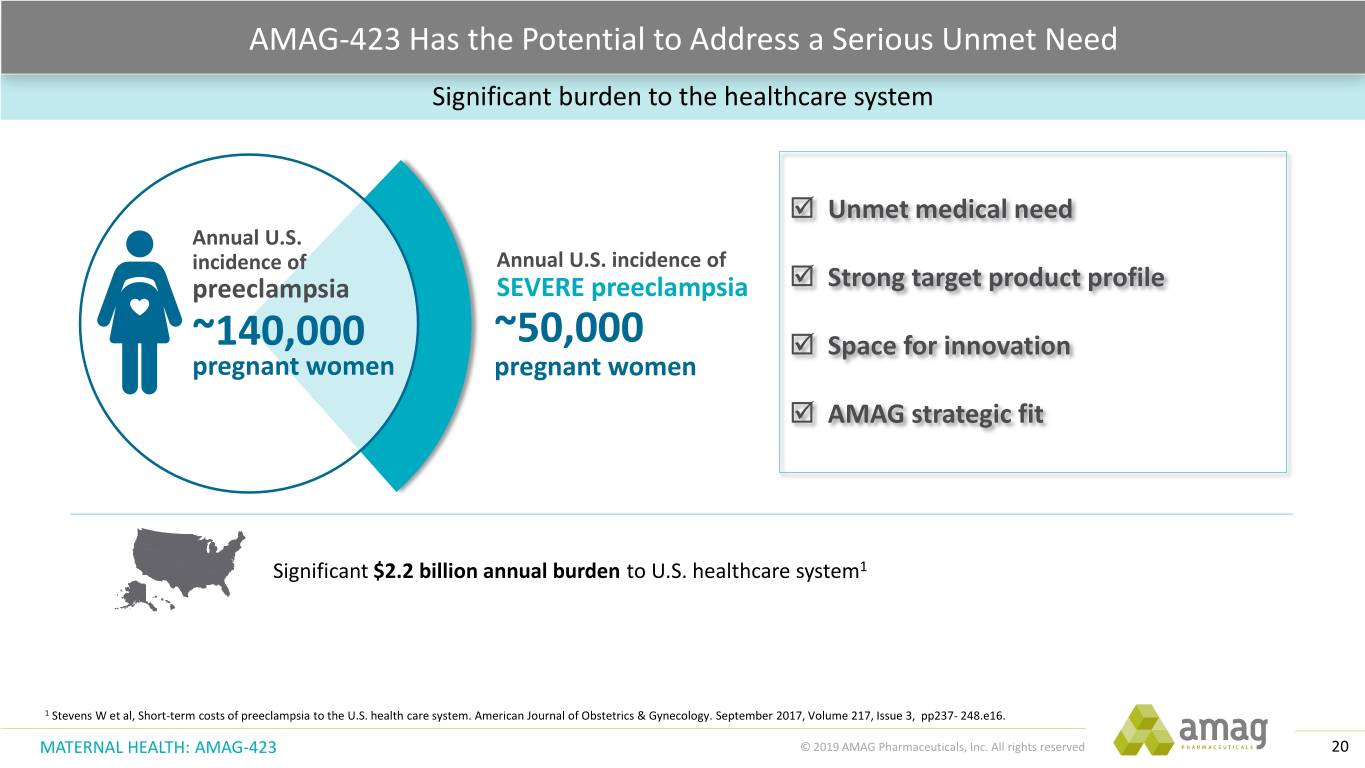

AMAG-423 Has the Potential to Address a Serious Unmet Need Significant burden to the healthcare system Unmet medical need Annual U.S. incidence of Annual U.S. incidence of preeclampsia SEVERE preeclampsia Strong target product profile ~140,000 ~50,000 Space for innovation pregnant women pregnant women AMAG strategic fit Significant $2.2 billion annual burden to U.S. healthcare system1 1 Stevens W et al, Short-term costs of preeclampsia to the U.S. health care system. American Journal of Obstetrics & Gynecology. September 2017, Volume 217, Issue 3, pp237- 248.e16. MATERNAL HEALTH: AMAG-423 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 20

TM TMaa Vyleesi (bremelanotide) Commercial Overview Meghan Rivera Vice President, Head of Women’s Health Sales and Marketing Vyleesi is an investigational product currently under review by FD. Safety and efficacy has not been established 21

Situation When it comes to female sexual health–and more specifically hypoactive sexual desire disorder (HSDD)–there’s a huge gap in the market. 22

The HSDD Market Provides Substantial Untapped Opportunity — 1/101,2 — Number of pre- menopausal women who have low desire with associated distress 1. Shifren JL, Monz BU, Russo PA, Segreti A, Johannes CB. Sexual problems and distress in United States women: prevalence and correlates. Obstet Gynecol. 2008;112(5):970–978. 2. Goldstein I, Kim NN, Clayton AH, et al. Hypoactive sexual desire disorder: International 23 Society for the Study of Women’s Sexual Health (ISSWSH) expert consensus panel review. Mayo Clin Proc. 2017;92(1):114‐128.

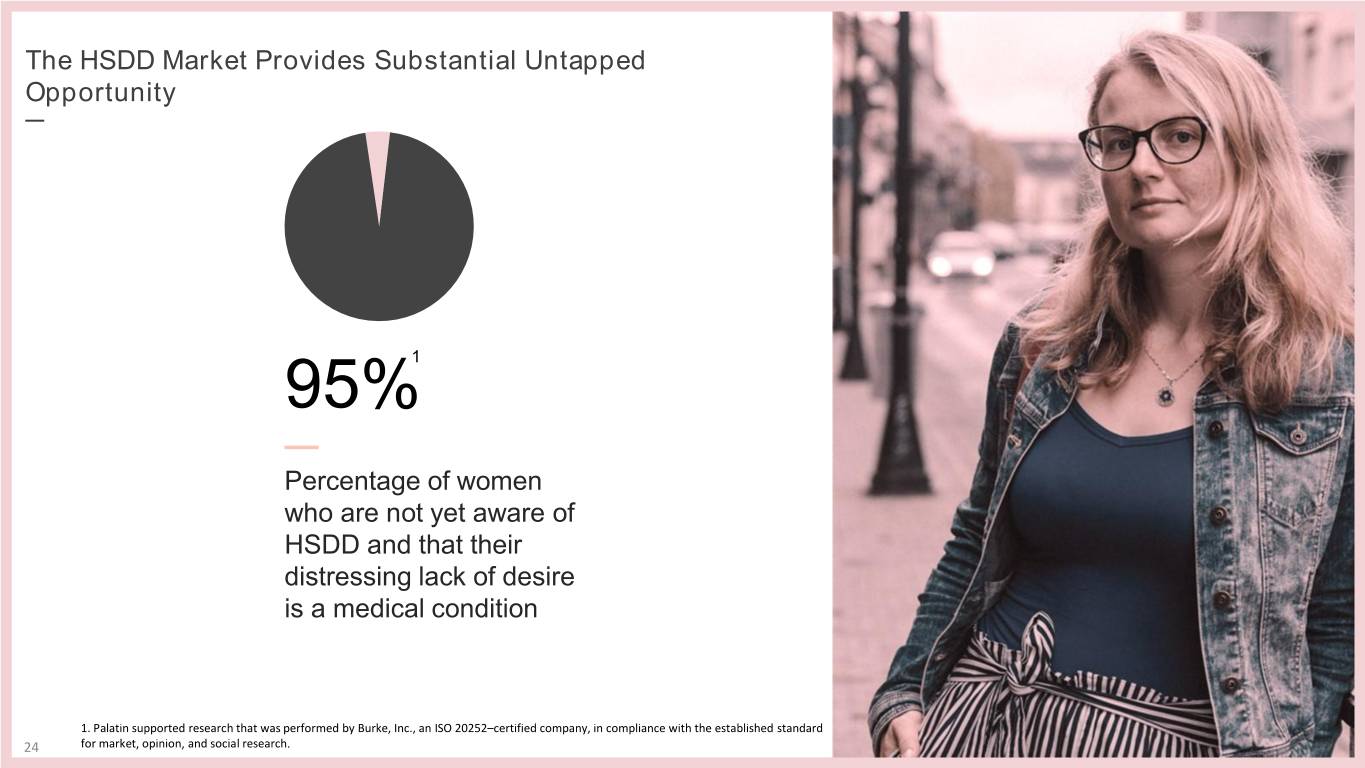

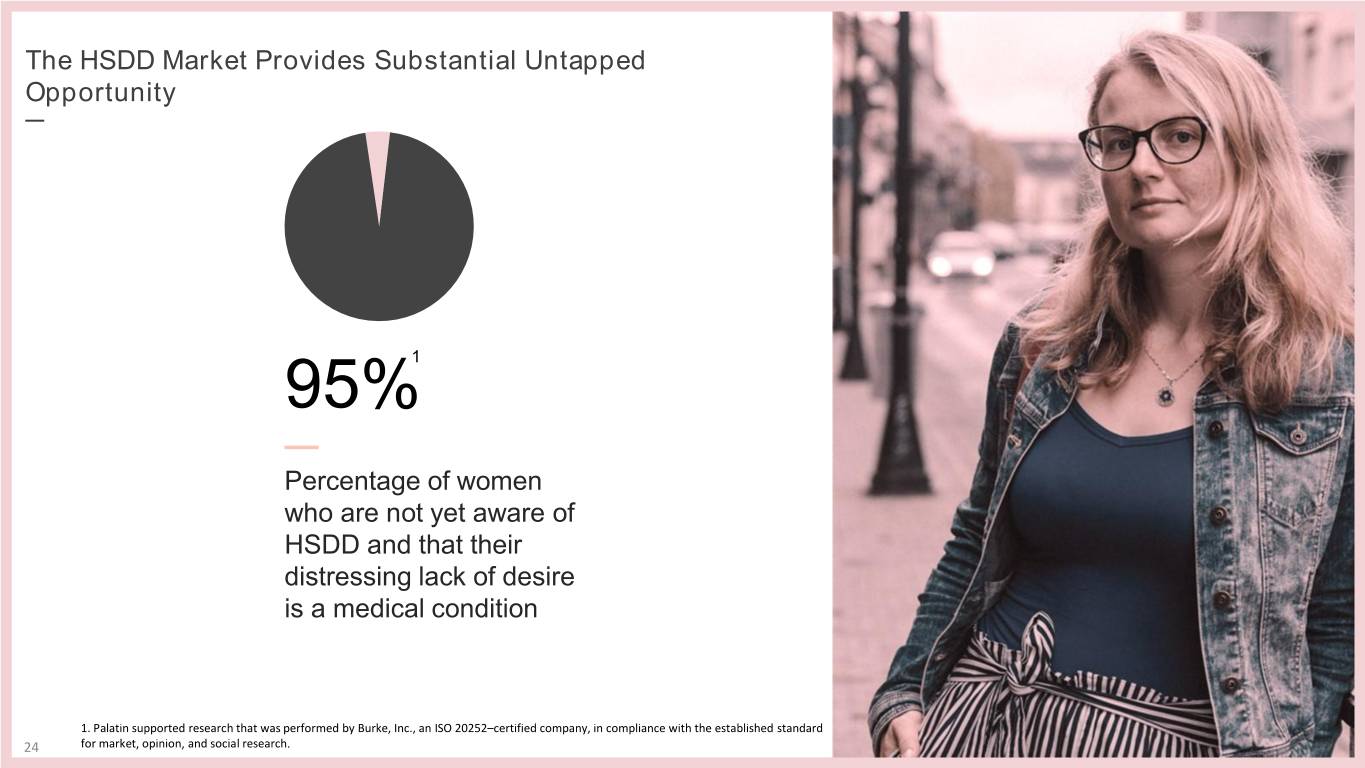

The HSDD Market Provides Substantial Untapped Opportunity — 95%1 — Percentage of women who are not yet aware of HSDD and that their distressing lack of desire is a medical condition 1. Palatin supported research that was performed by Burke, Inc., an ISO 20252–certified company, in compliance with the established standard 24 for market, opinion, and social research.

The HSDD Market Provides Substantial Untapped Opportunity — 91%1 — Percentage of HCPs not satisfied with current treatment options 1. Palatin supported research that was performed by Burke, Inc., an ISO 20252–certified company, in compliance with the established standard 25 for market, opinion, and social research.

Question How can women seek treatment for a condition that they don’t even know about? Answer AMAG will make HSDD part of the larger cultural conversation and connect with mass audiences. 26

Can it be Done?? Following the launch of a novel solution for depression, the rate of diagnosis, dialogue and understanging about the condition dramatically shifted. Similarly, with the introduction of Vyleesi, the landscape for the treatment of female sexual dysfunction will change fundamentally. 27

The “How” 28

An Approach with Proven Results Several health and wellness brands have embraced consumer branding principles and prioritized digital channels as growth engines, showing tremendous success. 29

A Focus on Digital Channels Focus paid media on social and digital channels where women already are. 30

Destigmatizing the Conversation Create an online community where women with HSDD can get a wealth of accurate resources, check their symptoms, and get support. 31

Accelerating Path to Treatment Create a line-up experience program to allow early adopters to get an advanced prescription through telemedicine. 32

Ensuring Provider Readiness Activate a sales force and HCP campaign that will ensure our grant rate allows us to capitalize on consumer interest. 33

The Initial Metrics Speak for Themselves Leading indicators of campaign performance continue to instill our confidence in our approach… - Close to 50% open rate on email to providers, more than double industry benchmark - In just week one, 2.82M impressions, 80k clicks to our community, and over 700 engagements with only one promoted post - 485% increase in daily click-through’s from HSDD search terms YoY 34

Experience, Experience, Experience Vyleesi is all about experience. From the experience of engaging with our brand to the meaningful impact we believe Vyleesi will have on women’s lives. And this gives us reason to believe that the experience will reverberate via word of mouth and earned media 35

In Summary • There is a significant market opportunity and unmet need • The Vyleesi experience will allow for reverberation and growth • A disruptive go-to-market strategy is critical to drive awareness and rapid uptake 36

Tony Casciano AMAG Chief Commercial Officer 37

Ciraparantag Has the Potential to Addresses a Serious Unmet Medical Need Significant cost associated with life-threatening bleeds Estimated NOAC/LMWH Patients on patients per year Unmet medical need requiring a reversal agent NOAC/LMWH Strong target product profile ~6 million ~150,000 Xarelto®, Eliquis®, Space for innovation Savaysa®, Pradaxa®, Lovenox® AMAG strategic fit Intracranial hemorrhage and major gastrointestinal bleeding with oral anticoagulants: 1-year costs ranged from $7,584 to $193,8041 1 www.amcp.org Vol. 19, No. 9 November/December 2013 JMCP Journal of Managed Care Pharmacy. HEMATOLOGY: CIRAPARANTAG © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 38

Ted Myles Chief Financial Officer

Agenda Financial Evolution Business Development © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 40

Overview: 2017-2022 Strategic Plan Delivering Innovative Therapies Investing Innovation Expanding Creating new, durable revenue streams and capabilities and Acquiring/licensing profitable growth investing in the development-stage development products to address and launch of new unmet medical products needs Acquiring/Licensing Specialty Pharma: Acquiring/licensing cash generating products 2018 2019 2020 2021 2022 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 41

2016 | Prior to the Business Evolution AMAG was Heavily Leveraged More than $1B in Debt, Near-Term Maturities and Restrictive Covenants Capital Structure Key Items 12/31/16 Cash: $578M Outstanding debt balance: $1,028M Total annual interest cost: $60M Debt Payments $M $500 $218 $258 $18 $18 $18 2017 2018 2019 2020 2021 2022 2023 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 42

2017 | Debt Reduction and Maturity Extensions Removed Term Loan and Extended Time to Maturity to Support New Product Launches Capital Structure Key Items 12/31/16 6/30/17 Cash: $578M $399M Outstanding debt balance: $1,028M $861M Total annual interest cost: $60M $51M Debt Payments $M $500 $320 $41 2017 2018 2019 2020 2021 2022 2023 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 43

2019 | Balance Sheet Evolved, Significantly De-levered and Extended Maturity Current capital structure supports development of innovative products Capital Structure Key Items 12/31/16 6/30/17 3/31/19 Cash: $578M $399M $267M Outstanding debt balance: $1,028M $861M $320M Total annual interest cost: $60M $51M $10M Debt Payments $M $320 2017 2018 2019 2020 2021 2022 2023 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 44

Maximize Commercial Product Opportunities to Fund Investments in New Products Revenues $1,000 (Millions) $500 $0 2018 2019 2020 2021 2022 Current Commercial Portfolio © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 45

Commercial Product Portfolio Expectations 2019-2022 • Continued growth through market expansion and increasing market share − Brand on track to achieve >$200M annual revenues • Continue to promote benefits of Makena subcutaneous auto-injector − 1Q19: SC auto-injector 54% market share of HPC market • PROLONG study results expected to be published 2H-2019 • Continue to grow and gain market share • Leverage 124 person sales force calling on OB/GYNs • Optimize efficiency and effectiveness of consumer campaign • Positive margin contributor by end of 2019 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 46

Strategic Evolution: New Products Drive Future Growth Current Commercial Products Provide Stable Cash Flows and Growth Potential Revenues $1,000 (Millions) $500 $0 2018 2019 2020 2021 2022 Current Commercial Portfolio © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 47

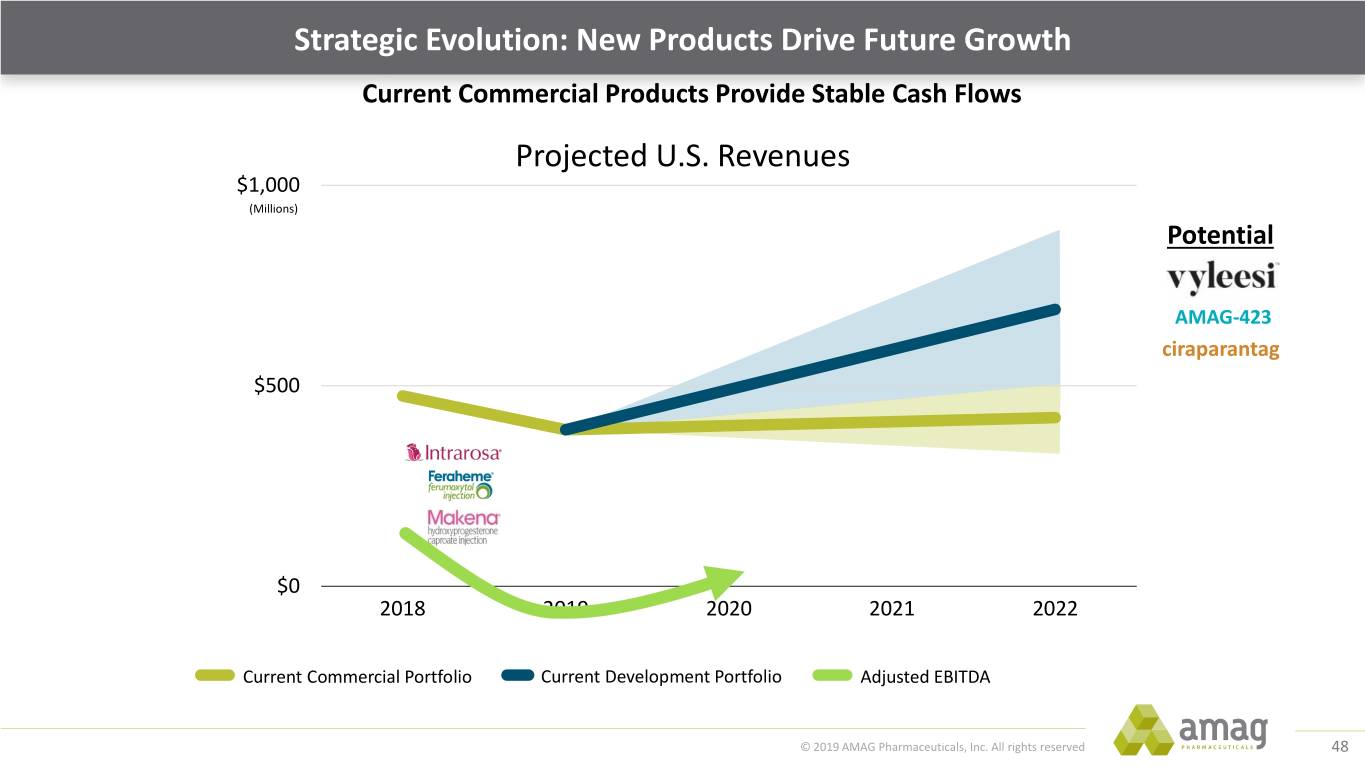

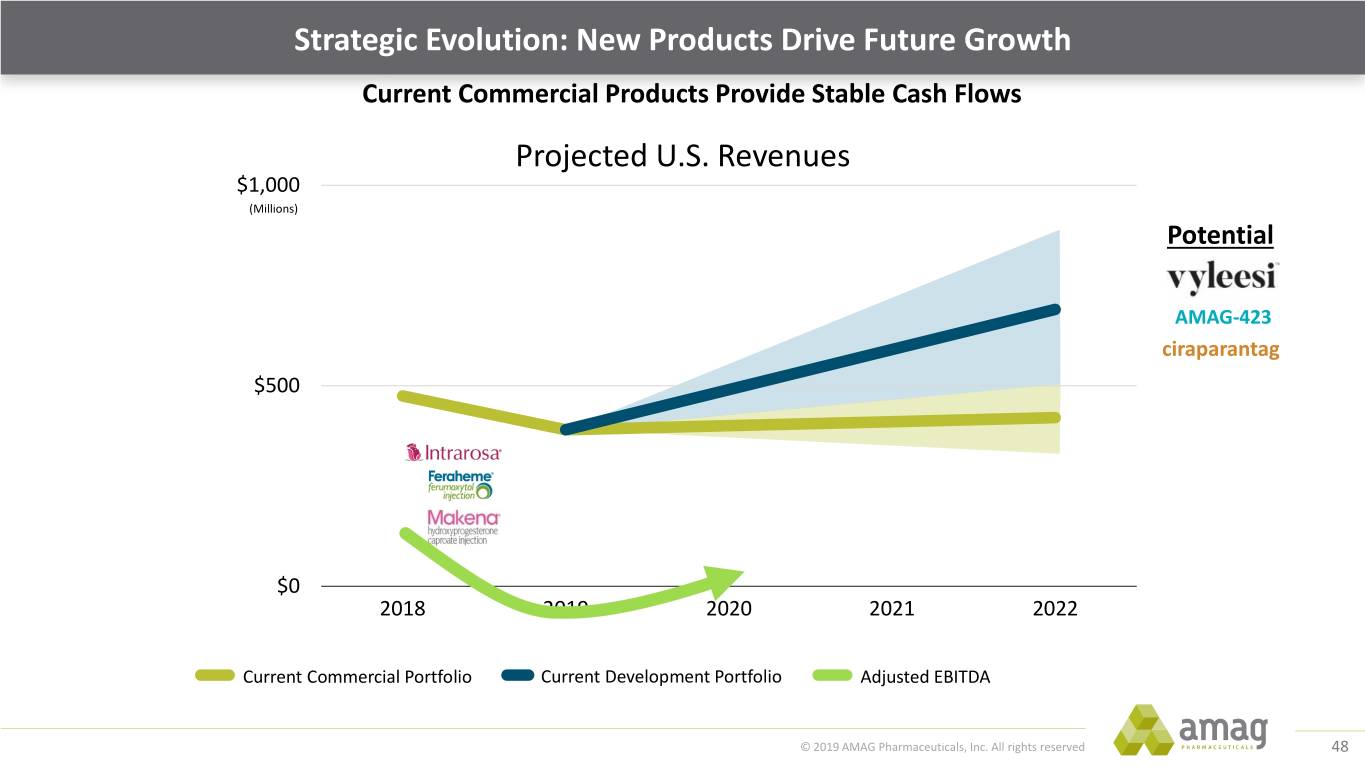

Strategic Evolution: New Products Drive Future Growth Current Commercial Products Provide Stable Cash Flows Projected U.S. Revenues $1,000 (Millions) Potential AMAG-423 ciraparantag $500 $0 2018 2019 2020 2021 2022 Current Commercial Portfolio Current Development Portfolio Adjusted EBITDA © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 48

Agenda AMAG Evolution Business Development © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 49

Future Portfolio Building: Search and Evaluation Criteria . Core therapeutic areas (TAs) (maternal health, Therapeutic hem/onc & select hospital) Criteria . Adjacent TAs (women’s health, nephrology) . Differentiated & durable Financial . Criteria Stage of development . Cash payback period and IRR Leverage . Physician relationships Core . Commercial execution skills Capabilities . Consumer / digital platform © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 50

Acquisition of Ciraparantag and AMAG-423 Provide Global Opportunities • Acquisition of ciraparantag and AMAG-423 provide AMAG with global opportunities • Opportunity for ex-U.S. out-licensing . Potential source of non-dilutive capital . Initiation of ex-U.S. development © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 51

In Summary • Transformation of balance sheet to support evolution of business plan • Short lived EBITDA-negative phase in 2019, return to EBITDA neutral in 2020 as pipeline matures and newer products begin to contribute cash flows • Recent pipeline additions provide global opportunities © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 52

Bill Heiden Closing Remarks 53

Key Take-Aways for Today View to 2022 is bright Valuable product • Current commercial products portfolio today will continue to perform well • Development-stage products Significant progress • Commercial products growing represent new & durable from 2017 to today • Development-stage products revenue opportunities address significant unmet • Return to cash flow positive • Expanded product portfolio medical needs and represent from 2 products to 6 products substantial commercial • Strong and proven commercial opportunities track record • Successful drug development capabilities 2 6 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 54

2019 Development Goals Commercial Products Continue to Fund Investments in Valuable Pipeline Products Regulatory Approved/ Phase 1 Phase 2 Phase 3 Review Marketed Treatment of iron deficiency anemia CKD Broad label all iron deficiency anemia Anticoagulant reversal agent Ciraparantag (potential for orphan drug designation) HEMATOLOGY Treatment to reduce recurrent preterm birth in certain at-risk women Subcutaneous auto-injector Treatment for moderate to severe dyspareunia (pain during sex) in postmenopausal women TM Treatment of low desire or libido with associated distress (HSDD*) in premenopausal women AMAG-423 Treatment of severe preeclampsia WOMEN’S HEALTHCAREDigoxin Immune (orphan drug designation) Fab (ovine) * HSDD: Hypoactive Sexual Desire Disorder © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 55

Thank you for coming! AMAG Analyst Day May 22, 2019 © 2019 AMAG Pharmaceuticals, Inc. All rights reserved 56