AMAG Pharmaceuticals Second Quarter 2020 Financial Results August 6, 2020 © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 1

Forward-Looking Statements This presentation contains forward‐looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. Any statements contained herein which do not describe historical facts, including, among others, expectations that AMAG can return to adjusted EBITDA positive in 2020; anticipated impacts of recent organizational changes; plans to focus on future value drivers and advance assets with the highest potential and probability of success; expectations as to COVID‐19 and its impact on revenues, operations and corporate functions; beliefs and expectations for the Makena retrospective study and interactions with the FDA; beliefs about market share; statements regarding 2020 financial guidance, including the impact of recent events on such guidance, such as the termination of the Palatin license agreement and costs associated with discontinuing the AMAG‐423 program, and beliefs about ciraparantag’s ability to act as a broad‐spectrum reversal agent , are based on management’s current expectations and beliefs and are forward‐looking statements which involve risks and uncertainties that could cause actual results to differ materially from those discussed in such forward‐looking statements. Such risks and uncertainties include, among others, risks and uncertainties related to the scale and scope of the COVID‐19 pandemic and its impact on AMAG’s revenues and operations, including clinical trials, as well as COVID‐19’s impact on AMAG’s business partners, healthcare providers, patients, employees and the health care industry and worldwide economies generally, risks related to AMAG’s ability to manage the recently streamlined business and achieve anticipated results in a timely manner or at all, including any unintended consequences from such efforts; the possibility that AMAG’s independent auditors will identify a material weakness as part of their review stemming from the immaterial accounting errors, or that they will identify other errors or corrections, including errors or corrections that could materially impact our financial statements; the accounting impact of our recent business development activity could have a material impact on our guidance; revenue expectations and estimates may be inaccurate, including as a result of regulatory action with respect to Makena or due to COVID‐19; AMAG may not successfully develop and obtain approval for ciraparantag or may face challenges in supporting its relationship with Norgine, as well as those risks identified in AMAG’s filings with the U.S. Securities and Exchange Commission (SEC), including its Annual Report on Form 10‐K for the year ended December 31, 2019, its Current Reports on Form 8‐K, its Quarterly Reports on Form 10‐Q, including for the quarter ended March 31, 2020, and in any subsequent filings with the SEC, including AMAG’s upcoming Form 10‐Q for the quarter ended June 30, 2020, which are available at the SEC’s website at www.sec.gov. Any such risks and uncertainties could materially and adversely affect AMAG’s results of operations, its profitability and its cash flows, which would, in turn, have a significant and adverse impact on AMAG’s stock price. AMAG cautions you not to place undue reliance on any forward‐looking statements, which speak only as of the date they are made. AMAG disclaims any obligation to publicly update or revise any such statements to reflect any change in expectations or in events, conditions or circumstances on which any such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward‐looking statements. AMAG Pharmaceuticals®, the logo and designs, and Feraheme® are registered trademarks of AMAG Pharmaceuticals, Inc. Makena® is a registered trademark of AMAG Pharma USA, Inc. Other trademarks referred to in this report are the property of their respective owners. © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 2

1 Making Progress Against our Strategic Evolution 2 Managing our Core Business AGENDA 3 Financial Update 4 Q&A © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 3

Making Progress Against Strategic Evolution Recent accomplishments help sharpen focus on future value drivers Building • Scott Myers appointed President & CEO on April 28, 2020 • Tony Casciano promoted to Chief Operating Officer Management Team • Brian Piekos promoted to Chief Financial Officer to Lead Evolution • Additional organizational changes to help create focused, biotech culture Advancing Assets with Highest Potential and Probability of Success Entered into exclusive licensing Completed divestment of women’s Decided to stop AMAG-423 trial agreement with Norgine to develop health assets and commercialize ciraparantag Independent Data Safety and Monitoring • Allows company to reduce operating expenses Board conducted interim analysis across Europe, Australia and New and return focus to core business and • Initiated interim analysis in light of extended Zealand opportunities in pipeline delays caused by COVID‐19 and ongoing • Provides AMAG with $30 million upfront • Intrarosa® rights sold to Millicent Pharma difficulties in enrolling trial payment and eligibility to receive up to $260 Limited for approximately $20.9 million upfront • No safety concerns million in development and commercial fixed consideration milestones1 in addition to sales royalties • Vyleesi® returned to Palatin Technologies • Norgine has committed to contribute one‐third of the costs of the Phase 3 clinical program 1 40.0 million of such milestones will be paid to the former equity holders of Perosphere Pharmaceuticals Inc. pursuant to the Agreement and Plan of Merger with Perosphere © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 4

Engagement During COVID-19 Protect the health of our employees AMAG’s Guiding Principles Do our part to stop the spread of COVID-19 During COVID-19 Support our customers and providers by helping them to focus on direct patient care Corporate Functions Remain Engaged • Supply chain remains intact • Regulatory interactions have continued © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 5

Makena Update: FDA Still Reviewing Pertinent Information AMAG is committed to generating additional information on efficacy Earlier this spring, AMAG submitted a proposal to the FDA to 1. RETROSPECTIVE STUDY generate additional data. The company proposed two Using secondary data sources observational studies that would support further defining the patient populations that most benefit from 17P as well as predictors of benefit in women with a singleton pregnancy with 2. PROSPECTIVE STUDY history of a spontaneous preterm birth. Primary data collection In mid-July, the FDA indicated they are still reviewing the Makena situation. AMAG has proactively initiated the first part of the retrospective study, which will be important in evaluating the baseline characteristics in patients overall and by treatment status (treated vs. untreated). © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 6

Managing Our Core Business Makena Revenue Slightly Impacted by COVID in the Quarter SECOND QUARTER REVENUE EXFACTORY TRENDS (doses) • Q2‐2020 ExFactory volume • Q2‐2020 Revenue of $22.3M $30.6 was 27% below Q2‐2019 was 5% below Q1 20201 $22.3 • Q2‐2020 Market Share of 66% • Q2 ‐2020 Average share was 3% above Q2 20191 above Q1‐20201 Q2-2019 Q2-2020 JAN FEB MAR APR MAY JUN • Limited impact to Makena revenue in the quarter due to COVID‐191 COVID-19 • Some softening of patient enrollments observed following field restructuring in May2 1 AMAG estimates market share and market growth using IQVIA data and internal analytics 2Source: MCC enrollment data © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 7

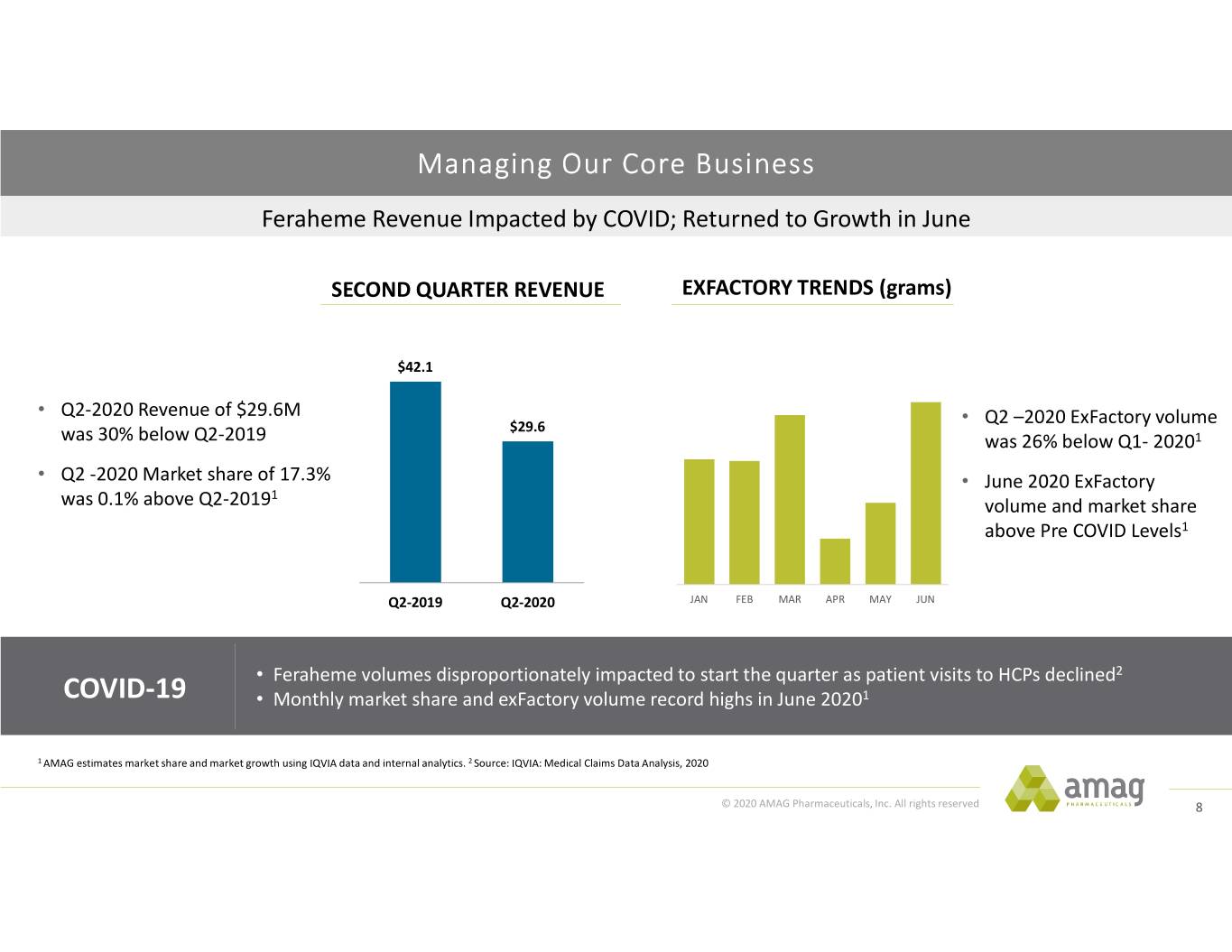

Managing Our Core Business Feraheme Revenue Impacted by COVID; Returned to Growth in June SECOND QUARTER REVENUE EXFACTORY TRENDS (grams) $42.1 • Q2‐2020 Revenue of $29.6M • $29.6 Q2 –2020 ExFactory volume was 30% below Q2‐2019 was 26% below Q1‐ 20201 • Q2 ‐2020 Market share of 17.3% • June 2020 ExFactory 1 was 0.1% above Q2‐2019 volume and market share above Pre COVID Levels1 Q2-2019 Q2-2020 JAN FEB MAR APR MAY JUN • Feraheme volumes disproportionately impacted to start the quarter as patient visits to HCPs declined2 COVID-19 • Monthly market share and exFactory volume record highs in June 20201 1 AMAG estimates market share and market growth using IQVIA data and internal analytics. 2 Source: IQVIA: Medical Claims Data Analysis, 2020 © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 8

Second Quarter Financial Results $M Q2-2020 Q2-2019 Feraheme $29.6 $42.1 Makena 22.3 30.6 • Revenues Intrarosa 1.2 4.9 – Decrease primarily due to negative impact of Other (0.4) 0.2 COVID‐19 during quarter and the October 2019 unfavorable FDA Advisory Committee Total revenues $52.8 $77.8 recommendation on Makena Cost of product sales $18.2 $24.2 Research and development 8.3 15.0 Selling, general and administrative 39.6 77.3 Gain on sale off assets (14.4) ‐‐ • Operating Expenses Restructuring 8.2 ‐‐ – R&D decline due to COVID‐driven delays and 2Q‐19 Impairment of intangible assets ‐‐ 77.4 Vyleesi expenses Total costs and expenses $59.8 $194.0 – S, G&A ~50% decline driven by exit of Women’s Health business and associated restructuring GAAP operating loss ($7.0) ($116.2) Non-GAAP adjusted EBITDA(1) ($1.7) ($24.7) 1 See slide 14 for a reconciliation of GAAP to non‐GAAP financial results. © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 9

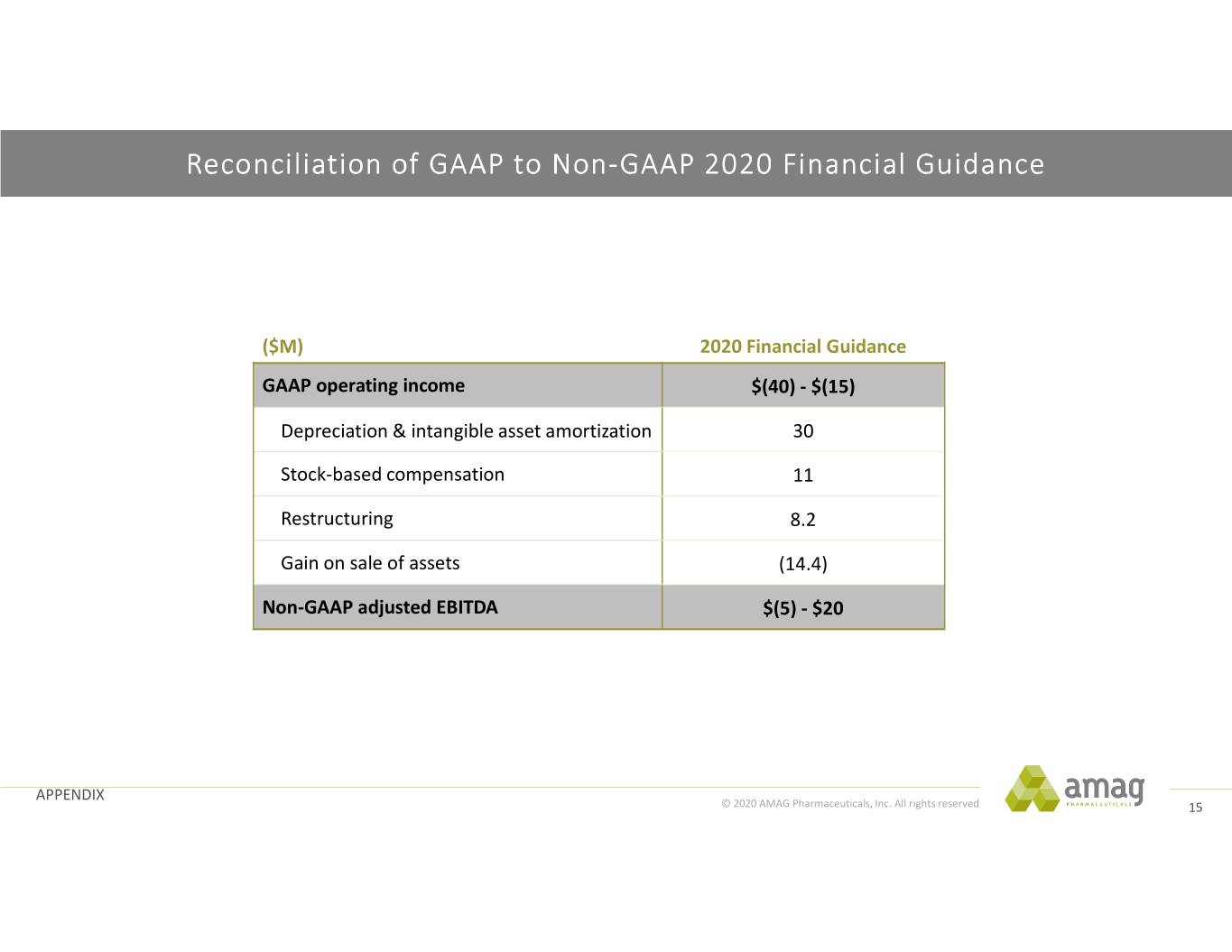

Reissued Guidance Confirms a Return to Positive Adjusted EBITDA 2020 FINANCIAL GUIDANCE1 ($M) Total revenue $225 ‐ $255 Operating loss $(40) ‐ $(15) Adjusted EBITDA2 $(5) ‐ $20 Risk‐adjusted topline view S, G&A expenses reduced by R&D expenses reduced due to given uncertainty caused by: ~$100M vs. 2019 discontinuation of AMAG‐423 program and COVID‐driven delays • COVID related business • Driven by Women’s Health disruption product divestitures and in ciraparantag development • Makena FDA Advisory associated restructuring Committee outcome 1 2020 Operating Loss financial guidance excludes the accounting impact of the following subsequent events announced in July: termination of the Vyleesi license agreement with Palatin and costs associated with discontinuing the AMAG‐423 program. 2 See slide 15 for a reconciliation of GAAP to non‐GAAP financial guidance. FINANCIAL © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 10

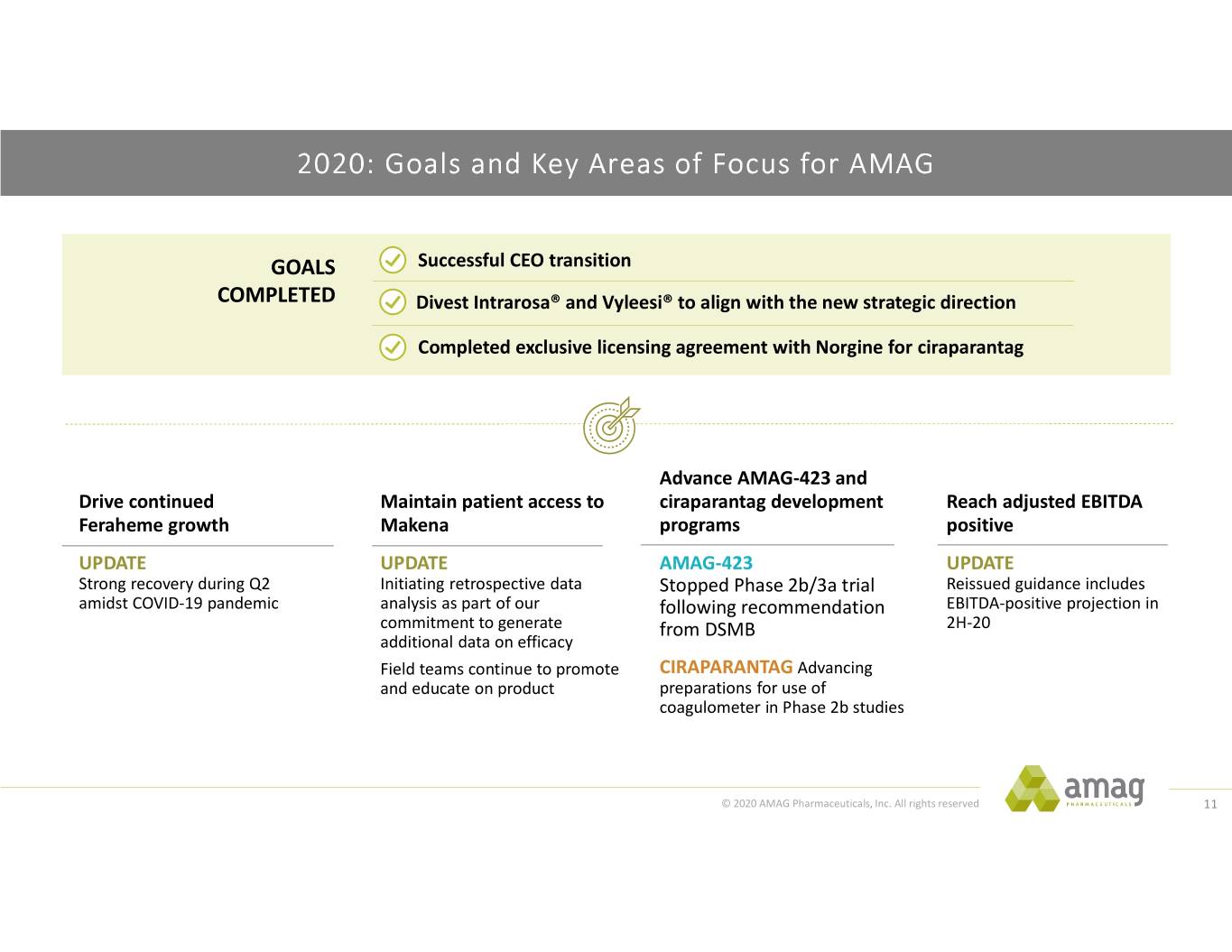

2020: Goals and Key Areas of Focus for AMAG GOALS Successful CEO transition COMPLETED Divest Intrarosa® and Vyleesi® to align with the new strategic direction Completed exclusive licensing agreement with Norgine for ciraparantag Advance AMAG-423 and Drive continued Maintain patient access to ciraparantag development Reach adjusted EBITDA Feraheme growth Makena programs positive UPDATE UPDATE AMAG-423 UPDATE Strong recovery during Q2 Initiating retrospective data Stopped Phase 2b/3a trial Reissued guidance includes amidst COVID‐19 pandemic analysis as part of our following recommendation EBITDA‐positive projection in commitment to generate from DSMB 2H‐20 additional data on efficacy Field teams continue to promote CIRAPARANTAG Advancing and educate on product preparations for use of coagulometer in Phase 2b studies © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 11

AMAG Pharmaceuticals Q&A © 2019 AMAG Pharmaceuticals, Inc. All© rights 2020 reservedAMAG Pharmaceuticals, Inc. All rights reserved 12

Appendix 13

Reconciliation of GAAP to Non-GAAP Financial Results ($M) YTD-2020 YTD-2019 Q2-2020 Q2-2019 GAAP operatingloss ($24.8) ($234.2) ($7.0) ($116.2) Depreciation andintangible asset amortization 19.7 9.1 9.4 4.7 Stock‐based compensation 5.9 8.7 2.1 4.5 Restructuring 8.2 7.4 8.2 ‐‐ Gain on Asset Sale (14.4) ‐‐ (14.4) ‐‐ Transaction / acquisition‐related costs ‐‐ 0.3 ‐‐ ‐‐ AcquiredIPR&D ‐‐ 74.9 ‐‐ ‐‐ Asset impairment charges ‐‐ 82.2 ‐‐ 82.2 Non-GAAP adjusted EBITDA ($5.4) ($51.6) ($1.7) ($24.7) © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 14

Reconciliation of GAAP to Non-GAAP 2020 Financial Guidance ($M) 2020 Financial Guidance GAAP operating income $(40) - $(15) Depreciation & intangible asset amortization 30 Stock‐based compensation 11 Restructuring 8.2 Gain on sale of assets (14.4) Non-GAAP adjusted EBITDA $(5) - $20 APPENDIX © 2020 AMAG Pharmaceuticals, Inc. All rights reserved 15

AMAG Pharmaceuticals Second Quarter 2020 Financial Results August 6, 2020 © 2019 AMAG Pharmaceuticals, Inc. All© rights 2020 reservedAMAG Pharmaceuticals, Inc. All rights reserved 16