UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Consent Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| | | | |

| ¨ | | Preliminary Consent Statement |

| |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ¨ | | Definitive Consent Statement |

| |

| x | | Definitive Additional Materials |

| |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

|

| Health Management Associates, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

Glenview Capital Partners, L.P. Glenview Capital Master Fund, Ltd. Glenview Institutional Partners, L.P. Glenview Offshore Opportunity Master Fund, Ltd. Glenview Capital Opportunity Fund, L.P. Glenview Capital Management, LLC Larry Robbins Mary Taylor Behrens Steven Epstein Kirk Gorman Stephen Guillard John McCarty JoAnn Reed Steven Shulman Peter Urbanowicz |

| (Name of Person(s) Filing Consent Statement, if other than the Registrant) |

|

| Payment of Filing Fee (check the appropriate box): |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rule 14a-6(i)(4) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0–11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5) | | Total fee paid: |

| | |

| | | | |

| | | | |

| |

| ¨ | | Fee paid previously with preliminary materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | | | |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | 3) | | Filing Party: |

| | | | |

| | 4) | | Date Filed: |

| | | | |

On August 5, 2013, Glenview Capital Partners, L.P., Glenview Capital Master Fund, Ltd., Glenview Institutional Partners, L.P., Glenview Offshore Opportunity Master Fund, Ltd., Glenview Capital Opportunity Fund, L.P., Glenview Capital Management, LLC and Larry Robbins posted a slide presentation relating to Health Management Associates, Inc. to www.revitalizehma.com. A copy of the slide presentation is filed herewith as Exhibit 1.

| The Rationale for a Complete and Prompt Change of the Board at HMA August 2013 |

| A proposed sale of HMA to Community Health Systems ("Community"), subject to approval from regulators and 70% of HMA shareholders Q2 results well below expectations, with Adjusted EBITDA and EPS falling 18% and 50% below consensus Materially reduced 2013 Guidance, reducing EBITDA and EPS by 12% and 29%, respectively These represent the 3rd straight earnings miss and 2nd consecutive reduction in 2013 guidance HMA's 2013 vs. 2012 EBITDA performance of -9% y/y is meaningfully below the peer average of +2% y/y 1 Consistent with a limited outside talent pool to recruit from, as well as the proposed sale to Community, names an internal divisional president with no prior public company leadership experience to interim president and CEO The receipt of 4 additional subpoenas regarding compliance and regulatory matters Voting is continuous and open - the Board change is authorized as soon as consents from 50% plus 1 share are delivered to HMA to replace and refresh the Board PAGE 2 Summary of Process to Revitalize HMA June 25 Glenview files consent solicitation documents with SEC July 18 Record date July 19 Consent solicitation commences with first votes cast HMA Board releases presentation expressing confidence in the performance of management and the Board, strong operational performance and the benefits of healthcare reform July 25 5 days later, HMA announces: July 30 Glenview confirms it will move forward with its efforts to Revitalize HMA July 30 1 2013 based on midpoint of guidance range. Peer index includes CYH, HCA, LPNT, THC, and UHS. Despite the significant nature of these announcements, the company has held no public conference calls and has allowed for no public question and answer sessions HMA chooses to meet individually with select shareholders rather than hold a public conference call with public analyst Q&A as is typical July 31- August 2 |

| PAGE 3 Two Separate & Distinct Votes for HMA Shareholders The vote to replace and refresh the Board of HMA is separate and distinct from the vote regarding the Community Proposal that will come in several months The Glenview Consent Solicitation to Revitalize HMA VOTE 1 Revitalize HMA August 2013 Who votes: Voting threshold: Deadline: Key Considerations: Shareholders of record as of July 18, 2013 50% plus 1 share of all outstanding shares must affirmatively vote for change to occur The votes are counted on a rolling basis and can be delivered to HMA as soon as the voting threshold is reached Which Board is best equipped to: Stabilize and improve operations? Preserve and strengthen the consideration paid in the Community Proposal? Move HMA constructively forward from a regulatory and compliance perspective? Provide reliable transparency so that shareholders may make a well informed decision? Scope and assess ideas for value creation? Glenview recommends shareholders vote promptly to enable the Fresh Alternative Board to begin their important work VOTE 2 Community Proposal Approximately December 2013 1 Shareholders Vote to Accept or Reject the Community Acquisition Proposal Who votes: Voting threshold: Key Considerations: Record date not yet established 70% of all outstanding shares must affirmatively vote for the sale to occur Will shareholders have enough information and enough confidence in the process to make an intelligent, value-maximizing decision? Regardless of which board shareholders choose, the Community Proposal will be put to a shareholder vote so all holders of record may decide the merits of selling the company 1 The date of the vote will be established by the Board of HMA in accordance with the terms of the Community Proposal. We believe that based upon the timeline for closing established in the announcement of the Community Proposal that a shareholder vote is likely to fall in the November to February timeframe - December is used for illustrative purposes. |

| Declined to $8.23, per HMA Board 1 $150-180 million 2 $13.78 + CVR PAGE 4 Building Value at HMA We believe we must replace the Board promptly to strengthen and secure the Community Proposal and to enhance investor understanding and confidence We believe every company has two values: Its independent value, based upon the value of its earnings, cash flows and net assets as a stand-alone company, and Its private market value based upon the sum of its independent value plus a share of the synergies that could be created by combining with another, similar company The two values are inextricably linked and proportional - the stronger the value of the Company independently, the higher its private market value The sitting Board of HMA has informed shareholders that as a result of the decline in profitability under their direction in 2013, the independent value of the Company has dropped from $11.04 to $8.231 As a result, the HMA Board has therefore decided to approve the deal with Community, which represents a 65% premium to their view of HMA's independent value according to their presentation 1 Per HMA Board presentation, "Creating Shareholder Value", filed July 31, 2013, p. 15 2 Per CYH / HMA merger presentation filed July 30, 2013. Independent Value + Value Equation: Synergies Private Market Value = Sitting Board + = Fresh Alternative Are there identifiable improvements? Are these comprehensive? Is this full and fair PMV? + = |

| PAGE 5 The Value of the Community Proposal is Enhanced by Revitalizing HMA We believe the two variable sources of consideration (CYH stock and CVR payment) would be enhanced by the involvement and oversight of the Fresh Alternative Board and an engaged Alvarez & Marsal management team The Community Proposal offers three sources of value: 1 $10.50 in cash Fixed 3 $0-$1.00 in a CVR $13.78 + CVR Total value of Community Proposal + = + $3.28 in CYH stock 2 Total Revitalizing HMA would enhance this proposal Floating proportionally to Community's stock price Community's stock should be higher, and therefore the value HMA shareholders receive will be greater if HMA is healthier at the time of transaction closing Floating proportionally to the expenses and cost to settle outstanding regulatory claims With respect to the CVR, we believe regulatory authorities may demand a smaller financial penalty if HMA has demonstrated a clear change in its compliance culture and approach Value of offer under sitting Board Potential value of offer under Fresh Alternative |

| PAGE 6 The August Vote: A Comparison of Results & Capabilities of each Board HMA Financial Health HMA Regulatory Challenges Strategic Alternatives 4 additional subpoenas in the past two months Extensive and expensive legal expenditures 9% Y/Y EBITDA decline1 30% Y/Y Earnings decline1 25% decline in "independent value"2 Independent value $8.23 per HMA Board2 Value established in duress Actively engaged and energized Board and Interim Management Four turnaround experts on the Board Seasoned financial executives with proven track records of value creation Changing the Board demonstrates complete culture change to regulators Two of the finest experts in healthcare compliance on the Board A fresh and modern approach to quality and compliance Prepared to identify, scope and communicate building blocks of performance improvement Commitment to provide transparent, unbiased financial information necessary for shareholder review Under Sitting Board Fresh Alternative Awaiting Your Consent to Begin Work 1 2013 based on the midpoint of HMA's guidance ranges provided in July 30, 2013 filing 2 Per HMA's Board presentation, "Creating Shareholder Value", filed July 31, 2013, p. 15 For these reasons, we believe that the odds that non-Glenview shareholders support a combination of HMA and Community are increased by changing the Board |

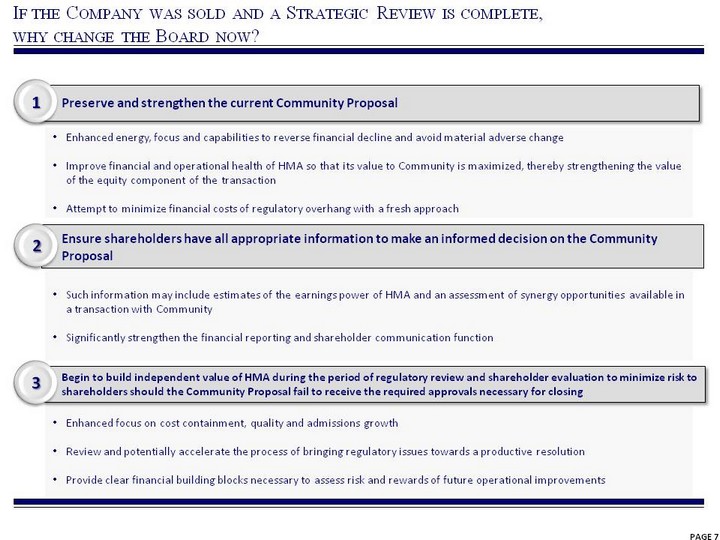

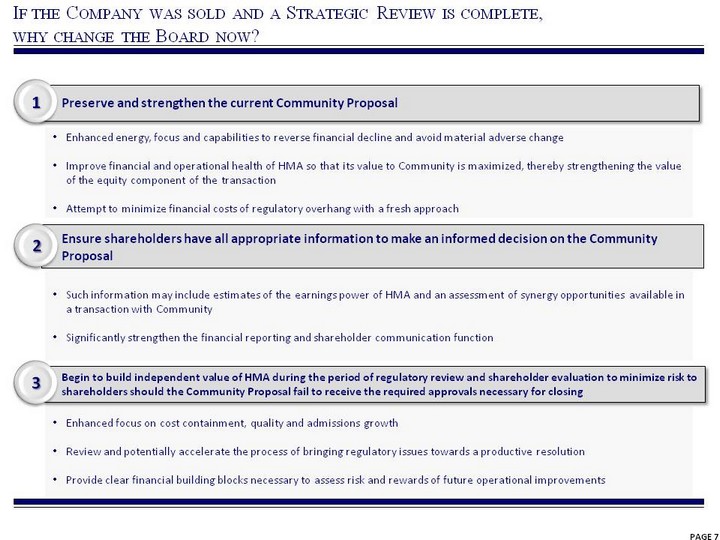

| Enhanced energy, focus and capabilities to reverse financial decline and avoid material adverse change Improve financial and operational health of HMA so that its value to Community is maximized, thereby strengthening the value of the equity component of the transaction Attempt to minimize financial costs of regulatory overhang with a fresh approach Such information may include estimates of the earnings power of HMA and an assessment of synergy opportunities available in a transaction with Community Significantly strengthen the financial reporting and shareholder communication function Enhanced focus on cost containment, quality and admissions growth Review and potentially accelerate the process of bringing regulatory issues towards a productive resolution Provide clear financial building blocks necessary to assess risk and rewards of future operational improvements Preserve and strengthen the current Community Proposal 2 Ensure shareholders have all appropriate information to make an informed decision on the Community Proposal 1 3 Begin to build independent value of HMA during the period of regulatory review and shareholder evaluation to minimize risk to shareholders should the Community Proposal fail to receive the required approvals necessary for closing PAGE 7 If the Company was sold and a Strategic Review is complete, why change the Board now? |

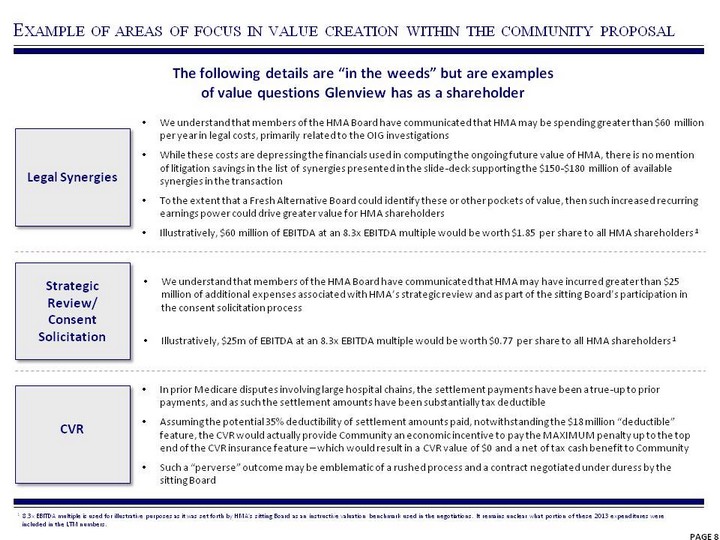

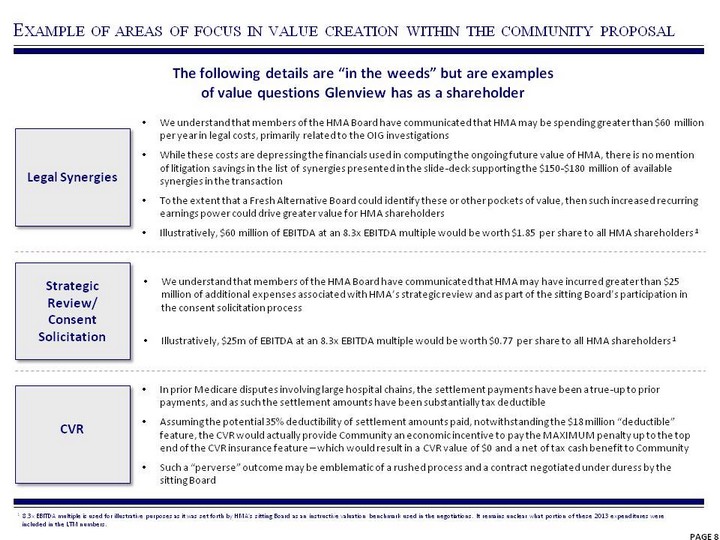

| PAGE 8 Example of areas of focus in value creation within the community proposal In prior Medicare disputes involving large hospital chains, the settlement payments have been a true-up to prior payments, and as such the settlement amounts have been substantially tax deductible Assuming the potential 35% deductibility of settlement amounts paid, notwithstanding the $18 million "deductible" feature, the CVR would actually provide Community an economic incentive to pay the MAXIMUM penalty up to the top end of the CVR insurance feature - which would result in a CVR value of $0 and a net of tax cash benefit to Community Such a "perverse" outcome may be emblematic of a rushed process and a contract negotiated under duress by the sitting Board We understand that members of the HMA Board have communicated that HMA may be spending greater than $60 million per year in legal costs, primarily related to the OIG investigations While these costs are depressing the financials used in computing the ongoing future value of HMA, there is no mention of litigation savings in the list of synergies presented in the slide-deck supporting the $150-$180 million of available synergies in the transaction To the extent that a Fresh Alternative Board could identify these or other pockets of value, then such increased recurring earnings power could drive greater value for HMA shareholders Illustratively, $60 million of EBITDA at an 8.3x EBITDA multiple would be worth $1.85 per share to all HMA shareholders 1 The following details are "in the weeds" but are examples of value questions Glenview has as a shareholder Legal Synergies We understand that members of the HMA Board have communicated that HMA may have incurred greater than $25 million of additional expenses associated with HMA's strategic review and as part of the sitting Board's participation in the consent solicitation process Illustratively, $25m of EBITDA at an 8.3x EBITDA multiple would be worth $0.77 per share to all HMA shareholders 1 Strategic Review/ Consent Solicitation CVR 1 8.3x EBITDA multiple is used for illustrative purposes as it was set forth by HMA's sitting Board as an instructive valuation benchmark used in the negotiations. It remains unclear what portion of these 2013 expenditures were included in the LTM numbers. |

| PAGE 9 Two Separate Votes on Values Under the Fresh Alternative Board, shareholders can expect: A heightened focus on performance, quality, accountability and cost A fresh perspective and approach to resolving legacy contingent liabilities harnessing the experience and skills of experts Greater financial transparency, and clear financial building blocks for shareholders to properly assess values Under the supervision of the sitting Board: The Board awarded 100-108% performance bonuses to senior executives while the Company clearly missed its guidance to Wall Street in 2012 The Board approved a management incentive plan that allowed senior executives to get full credit for performance goals despite missing them by a wide margin in 2013 to the extent that a sale of the Company is approved The Company published a slide deck on July 25th touting their strong operational and financial performance, five days before materially reducing financial guidance for 2013 and reporting a material miss for the quarter ended June 30th In the prior two quarters, in which HMA also missed expectations, the preannounced disappointing results were issued April 9th and January 13th This quarter instead, the Company chose to disclose its disappointing operating and financial performance and legal update concurrent with the announcement of the proposed sale of the Company Furthermore, rather than hold a public conference call to discuss these critical issues, and to engage in an on the record question and answer session as is customary with such events, the sitting Board chose for its Chairman and members of senior management to meet with a select group of shareholders with a focus on retaining their own Board seats In August, all shareholders may vote on the Board, which we believe is a question of principles and values In December, all shareholders will vote on the Community Proposal and determine if that is the best path to maximize dollar values for shareholders 1 2 As public market equity participants, we have an opportunity through this Consent Solicitation to vote our conscience, and to promote not only maximum value, but strong values |

| PAGE 10 Revitalize HMA We urge all shareholders to promptly consent to remove and replace the Board to Revitalize HMA For information on how to vote, please contact Bruce Goldfarb / Patrick McHugh / Lydia Mulyk at Okapi Partners: (212) 297-0720 or (877) 869-0171 |

| PAGE 12 A Holistic Approach to Addressing the Current Challenges at HMA The Fresh Alternative for HMA Proven managers, leaders and professionals capable of tackling the myriad of operating, cultural, financial and regulatory issues at HMA Mary Taylor Behrens Experience in executive compensation, human resources, succession planning, strategic planning and financial transactions in the healthcare industry Steven Epstein Extensive experience in healthcare law, and service on public, private company and educational institution boards Kirk Gorman Expertise in mergers and acquisitions, corporate finance and corporate governance along with extensive experience as an executive in the hospital industry and on public company boards Stephen Guillard Extensive executive leadership in healthcare services and experience on public and private company boards John McCarty Experience in turn-around situations and financial executive leadership in healthcare and risk assessment services Steven Shulman - Chairman Extensive turn-around experience in the healthcare industry and public and private company board experience Peter Urbanowicz Expertise in regulatory, compliance, financial and turn-around issues facing the healthcare industry, and advisor to multiple boards of directors, management teams, investors and lenders A cohesive team of healthcare visionaries with: Regulatory and compliance experience in areas germane to HMA Human resource, corporate finance, and turn-around and restructuring experience Strategic insight, capital allocation and financial expertise and appropriate oversight capabilities Profound healthcare operating and executive experience JoAnn Reed Extensive experience as a senior financial executive in healthcare services and service on public and private boards 1 2 3 4 5 |

| PAGE 13 New Proposed HMA Board Structure and Committee Composition Audit Committee John McCarty (Chair) Kirk Gorman Stephen Guillard Compensation Committee Compensation Committee Governance Committee Steven Epstein (Chair) Stephen Guillard John McCarty Peter Urbanowicz Mary Taylor Behrens (Chair) Steven Epstein Kirk Gorman JoAnn Reed JoAnn Reed (Chair) Mary Taylor Behrens Peter Urbanowicz Steven Shulman Chairman of the Board 1 Note: As Chairman of the Board, Steven Shulman will also serve as an ex officio member of all committees The Compliance & Quality Committee is a newly formed committee that does not currently exist at HMA Compliance & Quality Committee 2 |

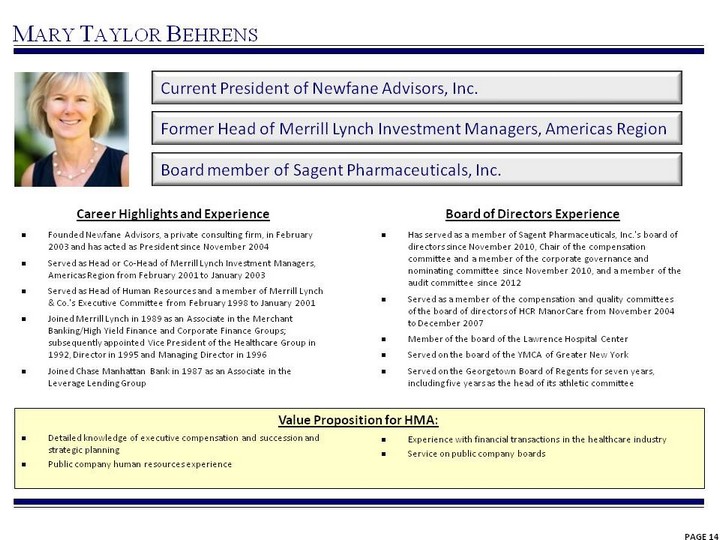

| PAGE 14 Mary Taylor Behrens Current President of Newfane Advisors, Inc. Former Head of Merrill Lynch Investment Managers, Americas Region Board member of Sagent Pharmaceuticals, Inc. Career Highlights and Experience Board of Directors Experience Founded Newfane Advisors, a private consulting firm, in February 2003 and has acted as President since November 2004 Served as Head or Co-Head of Merrill Lynch Investment Managers, Americas Region from February 2001 to January 2003 Served as Head of Human Resources and a member of Merrill Lynch & Co.'s Executive Committee from February 1998 to January 2001 Joined Merrill Lynch in 1989 as an Associate in the Merchant Banking/High Yield Finance and Corporate Finance Groups; subsequently appointed Vice President of the Healthcare Group in 1992, Director in 1995 and Managing Director in 1996 Joined Chase Manhattan Bank in 1987 as an Associate in the Leverage Lending Group Has served as a member of Sagent Pharmaceuticals, Inc.'s board of directors since November 2010, Chair of the compensation committee and a member of the corporate governance and nominating committee since November 2010, and a member of the audit committee since 2012 Served as a member of the compensation and quality committees of the board of directors of HCR ManorCare from November 2004 to December 2007 Member of the board of the Lawrence Hospital Center Served on the board of the YMCA of Greater New York Served on the Georgetown Board of Regents for seven years, including five years as the head of its athletic committee Value Proposition for HMA: Detailed knowledge of executive compensation and succession and strategic planning Public company human resources experience Experience with financial transactions in the healthcare industry Service on public company boards |

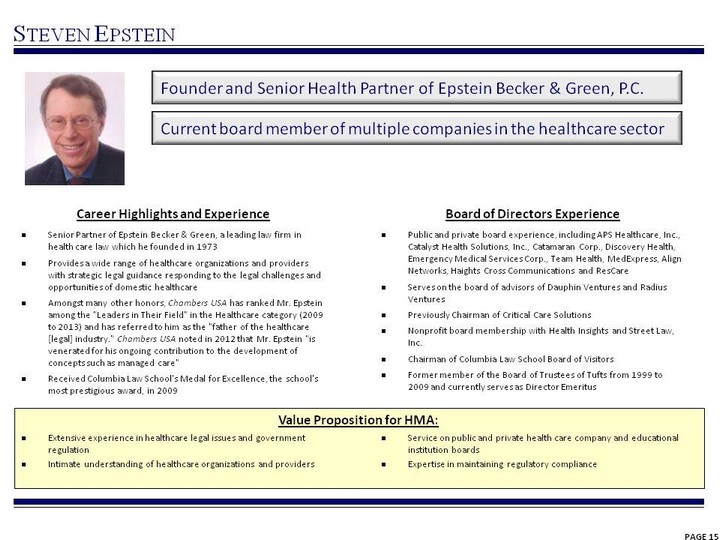

| PAGE 15 Steven Epstein Founder and Senior Health Partner of Epstein Becker & Green, P.C. Current board member of multiple companies in the healthcare sector Career Highlights and Experience Board of Directors Experience Senior Partner of Epstein Becker & Green, a leading law firm in health care law which he founded in 1973 Provides a wide range of healthcare organizations and providers with strategic legal guidance responding to the legal challenges and opportunities of domestic healthcare Amongst many other honors, Chambers USA has ranked Mr. Epstein among the "Leaders in Their Field" in the Healthcare category (2009 to 2013) and has referred to him as the "father of the healthcare [legal] industry." Chambers USA noted in 2012 that Mr. Epstein "is venerated for his ongoing contribution to the development of concepts such as managed care" Received Columbia Law School's Medal for Excellence, the school's most prestigious award, in 2009 Public and private board experience, including APS Healthcare, Inc., Catalyst Health Solutions, Inc., Catamaran Corp., Discovery Health, Emergency Medical Services Corp., Team Health, MedExpress, Align Networks, Haights Cross Communications and ResCare Serves on the board of advisors of Dauphin Ventures and Radius Ventures Previously Chairman of Critical Care Solutions Nonprofit board membership with Health Insights and Street Law, Inc. Chairman of Columbia Law School Board of Visitors Former member of the Board of Trustees of Tufts from 1999 to 2009 and currently serves as Director Emeritus Value Proposition for HMA: Extensive experience in healthcare legal issues and government regulation Intimate understanding of healthcare organizations and providers Service on public and private health care company and educational institution boards Expertise in maintaining regulatory compliance |

| PAGE 16 Kirk Gorman Current Executive Vice President and CFO of Jefferson Health System Former Senior Vice President and CFO of Universal Health Services Chairman of the board of CardioNet, Inc. Career Highlights and Experience Board of Directors Experience Currently the Executive Vice President and Chief Financial Officer of Jefferson Health System since September 2003 Employed by Universal Health Services Inc. from April 1987 to March 2003, where he served as Senior Vice President and Chief Financial Officer (1992 to 2003) and Vice President and Treasurer (1987 to 1992) President of Universal Health Realty Income Trust (1987-2003) Began his career at Mellon Bank where he became Senior Vice President Chairman of CardioNet, Inc. since October 2011 and a member of the Company's board since August 2008 Director and member of the audit committee of IASIS Healthcare, LLC's board since February 2004 Served as a Director of Physician's Dialysis, Inc. and member of the board of HCF Guernsey, Ltd. Served as Chairman on the board of Care Investment Trust from June 2007 to October 2009 and as a Trustee of Universal Health Realty Income Trust Former board member of VIASYS Healthcare, Inc. from November 2001 to December 2003 and from February 2005 until its acquisition by Cardinal Health in July 2007 Value Proposition for HMA: Knowledge of corporate finance and corporate governance Acute care and healthcare services mergers and acquisitions expertise Extensive experience as an executive in the hospital management industry Service on several public and private company boards |

| PAGE 17 Stephen Guillard Former COO and Executive Vice President of HCR ManorCare, Inc. Former Chairman, President and CEO of Harborside Healthcare Corp. Former Co-Founder, President and CEO of Diversified Health Services Career Highlights and Experience Board of Directors Experience Was responsible for HCR ManorCare's $4 billion hospice, home health care and pharmacy, skilled nursing, assisted living and rehabilitation businesses as Executive Vice President (June 2005 to January 2007); later served as the Company's Chief Operating Officer from January 2007 to December 2011 Served as Chairman, Chief Executive Officer and President of Harborside Healthcare Corporation from 1988 - 2005 Named by House Speaker John Boehner to serve on a new 15 member, congressionally mandated Commission on Long-Term Care in February 2013 Value Proposition for HMA: Extensive executive and director leadership in post-acute care services and operations Service on public and private company boards Successful track record in post-acute operations Extensive mergers and acquisitions expertise Serves as Chairman of The Alliance for Quality Nursing Home Care, a coalition of 18 national provider organizations that care for 650,00 elderly and disabled patients annually and employ approximately 425,000 caregivers nationwide Current director of naviHealth, Inc., a provider of post-acute care support solutions Previously served on the board of directors of HCR ManorCare, Inc. from 2006 to 2011 and was a member of the Company's quality committee Former Chairman of Harborside Healthcare Corporation Co-founded and served as Chairman, Chief Executive Officer and President of Diversified Health Services from 1982 to 1988 |

| PAGE 18 John McCarty Former Executive Vice President and Chief Financial Officer of SHPS, Inc. Former Chief Financial Officer of LabOne Inc. Former Senior Vice President and CFO of eai Healthcare Staffing Solutions Career Highlights and Experience Additional Relevant Experience Served as a consultant to Metalmark Capital Holdings, LLC from October 2011 to May 2012 Served as Executive Vice President and Chief Financial Officer of SHPS, Inc. from February 2006 to December 2009 Served as Executive Vice President and Chief Financial Officer of LabOne Inc. from April 2000 to March 2005 Served as Senior Vice President and Chief Financial Officer of eai Healthcare Staffing Solutions, Inc. from January to December of 1999 Former Chief Financial Officer of United Dental Care from November 1997 to November 1998 Served as Executive Vice President and Chief Financial Officer of NovaMed Eyecare Services, LLC. from May 1996 to October 1997 Value Proposition for HMA: Strong business and financial knowledge Experience in turn-around situations Diverse financial leadership in the healthcare industry Executive experience in risk assessment services Assistant Vice President of Corporate Finance and Vice President of Columbia Capital Corporation for Columbia/HCA prior to 1996; responsible for securing over $7 billion in financing for the company during his tenure Served as an investment banking advisor for Healthcare Markets Group Served as the Director of Corporate Finance at Humana |

| PAGE 19 JoAnn Reed Current Healthcare Services Consultant Director and Audit Committee member of American Tower, Inc. Career Highlights and Experience Board of Directors Experience Served as Chief Financial Officer of Medco Health Solutions from 1996 to March 2008 and as an advisor to the Company's CEO from April 2008 to April 2009 Joined Medco Containment Services, Inc. (Medco Health Solutions' predecessor) in 1988 as Director of Financial Planning and Analysis; appointed as the Senior Vice President of Finance for Medco in 1992 and as Chief Financial Officer in 1996 Served in various financial roles with Aetna/American Re-insurance Co., CBS Inc., Standard and Poor's, and Unisys/Timeplex Inc. prior to joining Medco Appointed as a Director and Chair of the Audit Committee of Mallinckrodt Pharmaceuticals in June 2013 Director and member of the Audit Committee of American Tower, Inc. since May 2007 Director and member of the Audit Committee of Waters Corporation since May 2006 Trustee for St. Mary's College of Notre Dame Former Director at Dynavox Inc. from April 2010 to December 2012 Former Chief Financial Officer of Medco Health Solutions Value Proposition for HMA: Extensive experience as a financial executive in the healthcare industry Deep accounting skillset gained from service on public company audit committees Service on public and private boards Corporate executive advisory expertise |

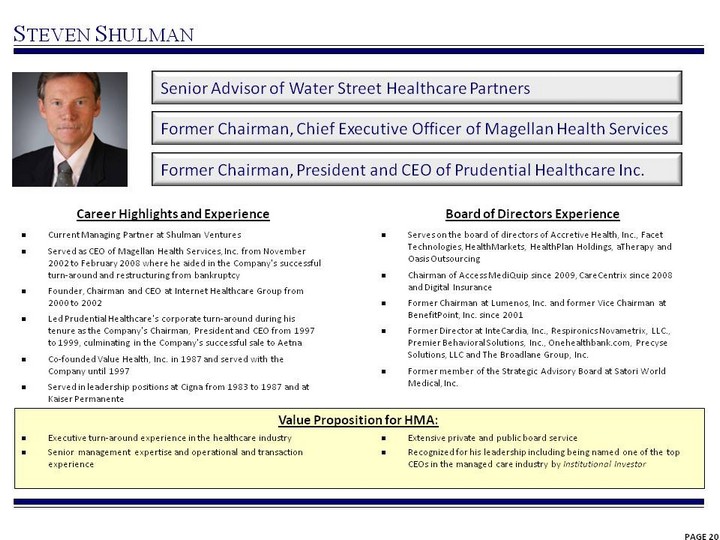

| PAGE 20 Steven Shulman Senior Advisor of Water Street Healthcare Partners Former Chairman, Chief Executive Officer of Magellan Health Services Former Chairman, President and CEO of Prudential Healthcare Inc. Career Highlights and Experience Board of Directors Experience Current Managing Partner at Shulman Ventures Served as CEO of Magellan Health Services, Inc. from November 2002 to February 2008 where he aided in the Company's successful turn-around and restructuring from bankruptcy Founder, Chairman and CEO at Internet Healthcare Group from 2000 to 2002 Led Prudential Healthcare's corporate turn-around during his tenure as the Company's Chairman, President and CEO from 1997 to 1999, culminating in the Company's successful sale to Aetna Co-founded Value Health, Inc. in 1987 and served with the Company until 1997 Served in leadership positions at Cigna from 1983 to 1987 and at Kaiser Permanente Serves on the board of directors of Accretive Health, Inc., Facet Technologies, HealthMarkets, HealthPlan Holdings, aTherapy and Oasis Outsourcing Chairman of Access MediQuip since 2009, CareCentrix since 2008 and Digital Insurance Former Chairman at Lumenos, Inc. and former Vice Chairman at BenefitPoint, Inc. since 2001 Former Director at InteCardia, Inc., Respironics Novametrix, LLC., Premier Behavioral Solutions, Inc., Onehealthbank.com, Precyse Solutions, LLC and The Broadlane Group, Inc. Former member of the Strategic Advisory Board at Satori World Medical, Inc. Value Proposition for HMA: Executive turn-around experience in the healthcare industry Senior management expertise and operational and transaction experience Extensive private and public board service Recognized for his leadership including being named one of the top CEOs in the managed care industry by Institutional Investor |

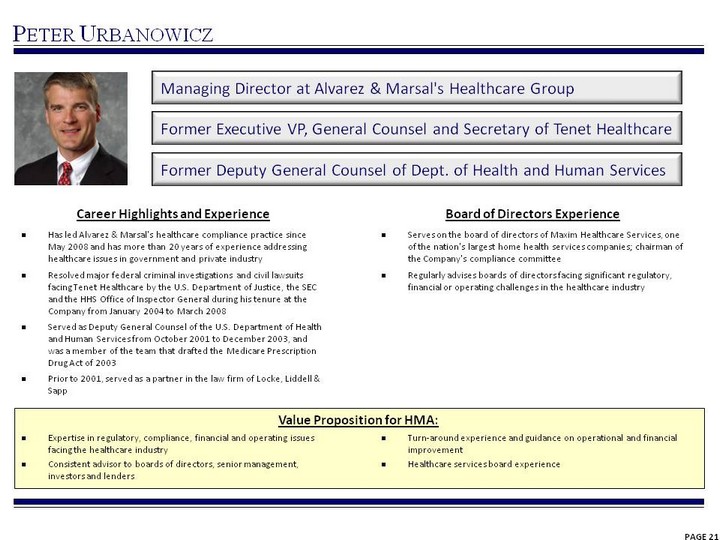

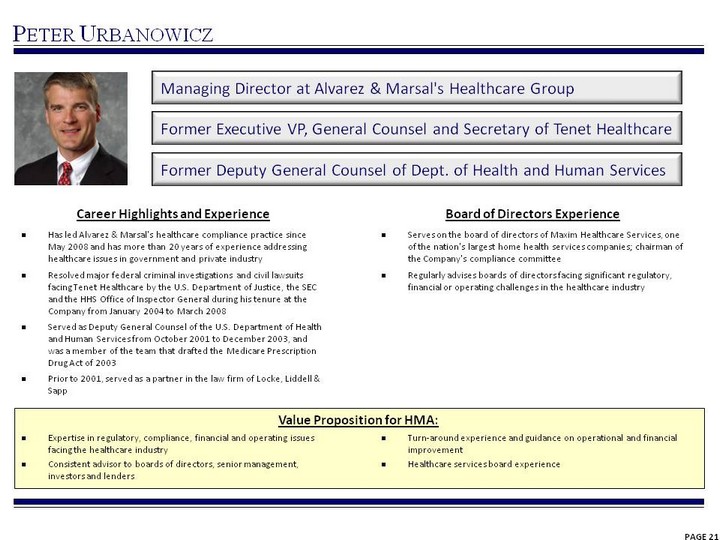

| PAGE 21 Peter Urbanowicz Managing Director at Alvarez & Marsal's Healthcare Group Former Executive VP, General Counsel and Secretary of Tenet Healthcare Former Deputy General Counsel of Dept. of Health and Human Services Career Highlights and Experience Board of Directors Experience Has led Alvarez & Marsal's healthcare compliance practice since May 2008 and has more than 20 years of experience addressing healthcare issues in government and private industry Resolved major federal criminal investigations and civil lawsuits facing Tenet Healthcare by the U.S. Department of Justice, the SEC and the HHS Office of Inspector General during his tenure at the Company from January 2004 to March 2008 Served as Deputy General Counsel of the U.S. Department of Health and Human Services from October 2001 to December 2003, and was a member of the team that drafted the Medicare Prescription Drug Act of 2003 Prior to 2001, served as a partner in the law firm of Locke, Liddell & Sapp Serves on the board of directors of Maxim Healthcare Services, one of the nation's largest home health services companies; chairman of the Company's compliance committee Regularly advises boards of directors facing significant regulatory, financial or operating challenges in the healthcare industry Value Proposition for HMA: Expertise in regulatory, compliance, financial and operating issues facing the healthcare industry Consistent advisor to boards of directors, senior management, investors and lenders Turn-around experience and guidance on operational and financial improvement Healthcare services board experience |

| PAGE 22 GLENVIEW CAPITAL PARTNERS, L.P., GLENVIEW CAPITAL MASTER FUND, LTD., GLENVIEW INSTITUTIONAL PARTNERS, L.P., GLENVIEW OFFSHORE OPPORTUNITY MASTER FUND, LTD., GLENVIEW CAPITAL OPPORTUNITY FUND, L.P., GLENVIEW CAPITAL MANAGEMENT, LLC AND LARRY ROBBINS (COLLECTIVELY, "GLENVIEW") TOGETHER WITH THE PROPOSED NOMINEES (COLLECTIVELY, WITH GLENVIEW, THE "PARTICIPANTS") HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (THE "SEC") A DEFINITIVE CONSENT STATEMENT AND ACCOMPANYING CONSENT CARD TO BE USED TO SOLICIT WRITTEN CONSENTS FROM THE STOCKHOLDERS OF HEALTH MANAGEMENT ASSOCIATES, INC. ("HMA" OR "THE COMPANY") IN CONNECTION WITH GLENVIEW'S INTENT TO TAKE CORPORATE ACTION BY WRITTEN CONSENT. ALL STOCKHOLDERS OF THE COMPANY ARE ADVISED TO READ THE DEFINITIVE CONSENT STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF WRITTEN CONSENTS FROM THE STOCKHOLDERS OF THE COMPANY BY THE PARTICIPANTS BECAUSE THEY CONTAIN IMPORTANT INFORMATION. INFORMATION RELATING TO THE PARTICIPANTS IS CONTAINED IN THE DEFINITIVE CONSENT STATEMENT FILED ON JULY 19, 2013. THE DEFINITIVE CONSENT STATEMENT AND FORM OF WRITTEN CONSENT ARE BEING FURNISHED TO SOME OR ALL OF THE STOCKHOLDERS OF THE COMPANY AND ARE, ALONG WITH OTHER RELEVANT DOCUMENTS, AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, GLENVIEW WILL PROVIDE COPIES OF THE DEFINITIVE CONSENT STATEMENT AND ACCOMPANYING CONSENT CARD (WHEN AVAILABLE) WITHOUT CHARGE UPON REQUEST TO OKAPI PARTNERS LLC, TELEPHONE: (877) 869-0171. Cautionary Statement Regarding Forward-Looking Statements This presentation may include "forward-looking statements" that reflect current views of future events. Statements that include the words "expect," "intend," "plan," "believe," "project," "anticipate," "will," "may," "would" and similar statements of a future or forward-looking nature are often used to identify forward-looking statements. Similarly, statements that describe our objectives, plans or goals are forward-looking. Glenview's forward-looking statements are based on its current intent, belief, expectations, estimates and projections regarding the Company and projections regarding the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties, assumptions and other factors that are difficult to predict and that could cause actual results to differ materially. Accordingly, you should not rely upon forward-looking statements as a prediction of actual results and actual results may vary materially from what is expressed in or indicated by the forward- looking statements. Except to the extent required by applicable law, no person undertakes any obligation to update publicly or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. |