INVESTOR PRESENTATION December 2021

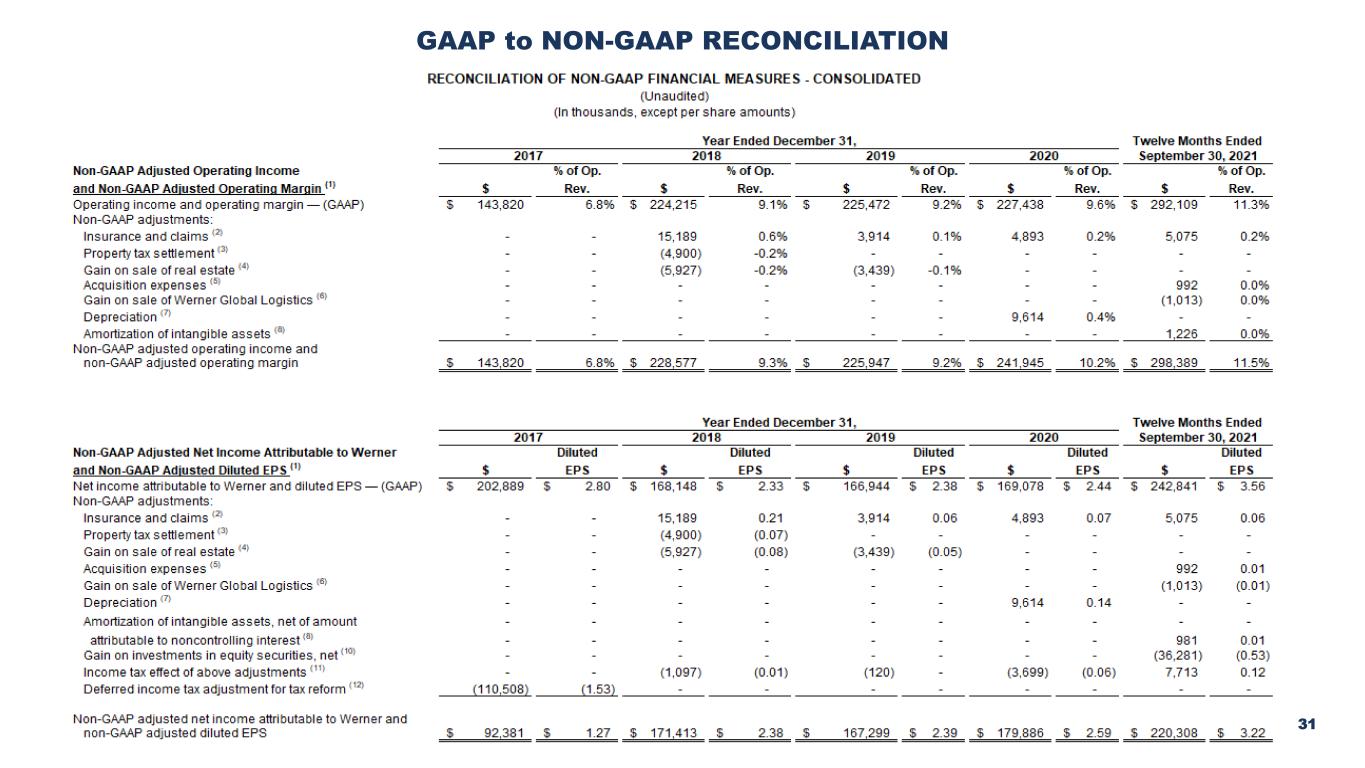

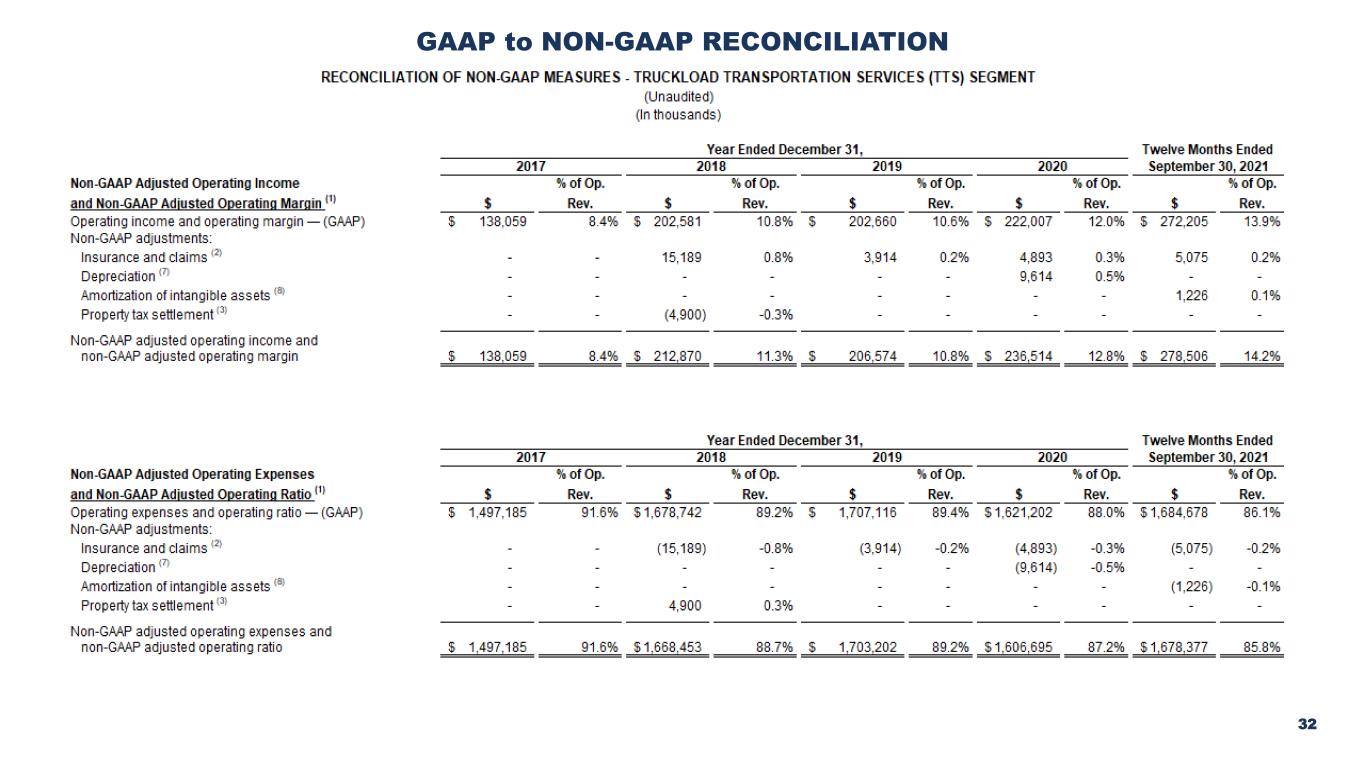

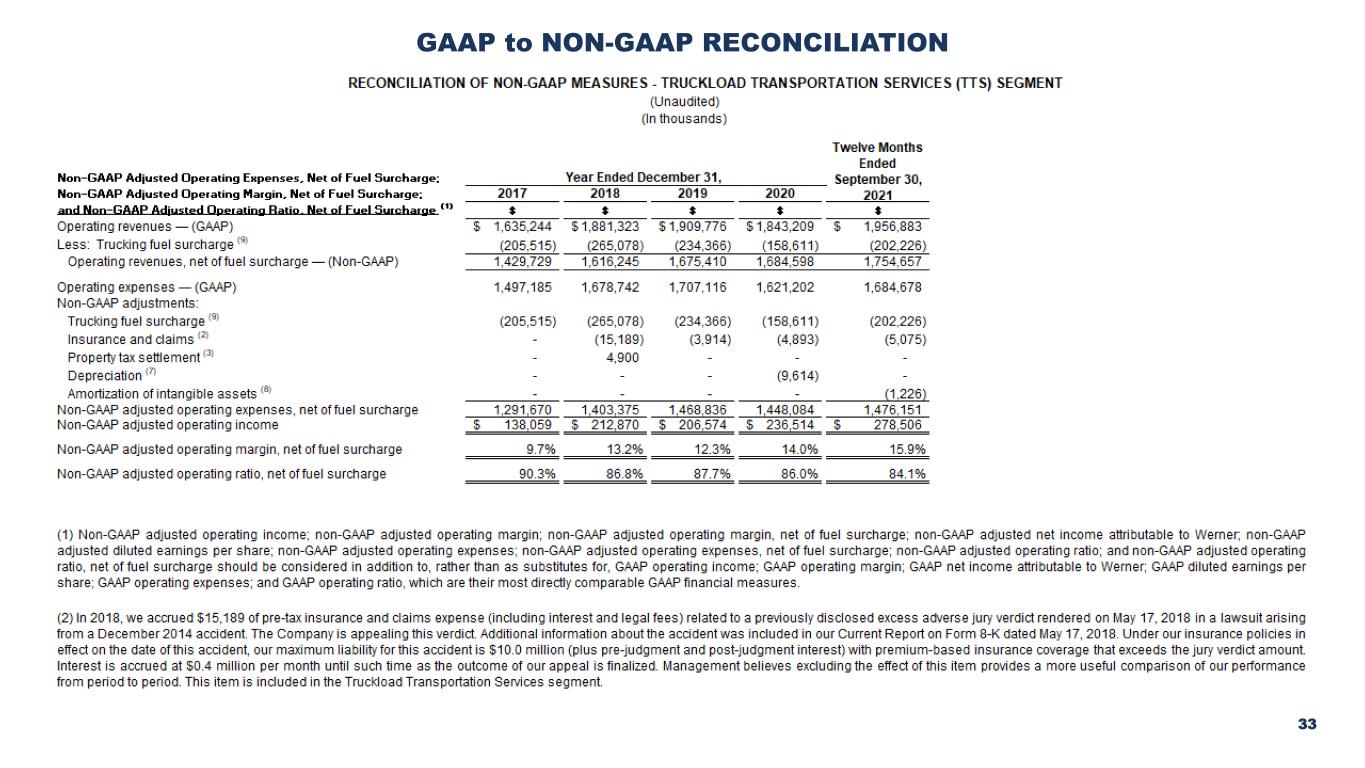

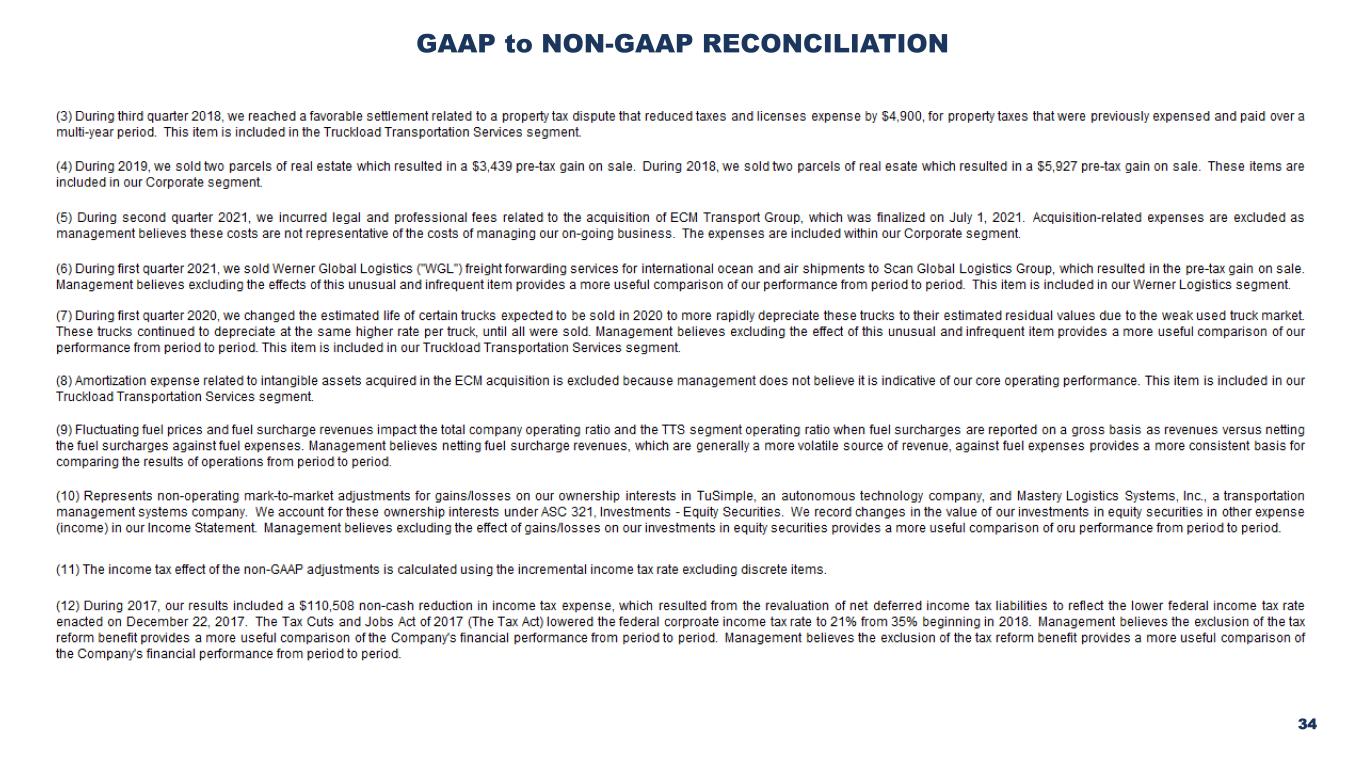

2 S A F E H A R B O R A N D N O N - G A A P F I N A N C I A L M E A S U R E S FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. Such forward-looking statements are based on information presently available to the Company’s management and are current only as of the date made. Such statements are by nature subject to uncertainties and risks, including but not limited to, the impact of the coronavirus pandemic (COVID-19) and the operational, financial and legal risks detailed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020. These risks and uncertainties could cause actual results or events to differ materially from historical results or those anticipated. For those reasons, undue reliance should not be placed on any forward-looking statement. The Company assumes no duty or obligation to update or revise any forward-looking statement, although it may do so from time to time as management believes is warranted or as may be required by applicable securities law. Any such updates or revisions may be made by filing reports with the U.S. Securities and Exchange Commission, through the issuance of press releases or by other methods of public disclosure. NON-GAAP FINANCIAL MEASURES This presentation, and certain information that management may discuss in connection with this presentation, references certain non-GAAP financial measures, including adjusted operating income; adjusted operating margin; adjusting operating margin, net of fuel surcharge; adjusted net income; adjusted diluted earnings per share (EPS); adjusted operating expenses; adjusted operating expenses, net of fuel surcharge; adjusted operating ratio; and adjusted operating ratio, net of fuel surcharge; and free cash flow, which are financial measures that are not in accordance with United States generally accepted accounting principles (“GAAP”). Reconciliations of the non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP are in an appendix to this presentation. Each such measure is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors and lenders. Management believes the use of non-GAAP measures assists external users of our financial statements, such as industry analysts, investors and lenders, in understanding the ongoing operating performance of our business by allowing more effective comparison between periods. The non-GAAP information provided is used by our management and may not be comparable to similar measures disclosed by other companies. Non-GAAP measures used herein should not be considered in isolation or as substitutes for analysis of our results as reported in accordance with GAAP.

3 Driven by a culture of superior service and safety excellence, with a new and innovative truck and trailer fleet, leading IT infrastructure and a strategic network of terminals and driver training schools Diversified operating portfolio with a strong customer base winning in their industry verticals Balanced revenue portfolio and consumer-centric freight base provide earnings and cash flow stability through the economic cycles Achieving ESG goals, backed by our committed leadership team Positioned to grow earnings and free cash flow while achieving long-term, sustainable shareholder value creation KEY WERNER MESSAGES 1 2 3 4 5

4 OUR CORE VALUES SUPPORT OUR BUSINESS PHILOSOPHY Provide creative capacity solutions and superior on-time customer service for our customers Operate premium modern trucks and trailers that are equipped with the latest safety technology, which inherently have fewer mechanical and maintenance issues and help attract and retain highly- qualified experienced drivers Evolve our business processes and technology to improve customer service and driver retention Focus on strategic and successful customers who value our broad geographic coverage, diversified truckload and logistics services, equipment capacity, technology, customized services and flexibility Support and encourage the diverse voices and perspectives of our associates, our customers and our suppliers ✓ ✓ ✓ ✓ ✓

BUSINESS OVERVIEW

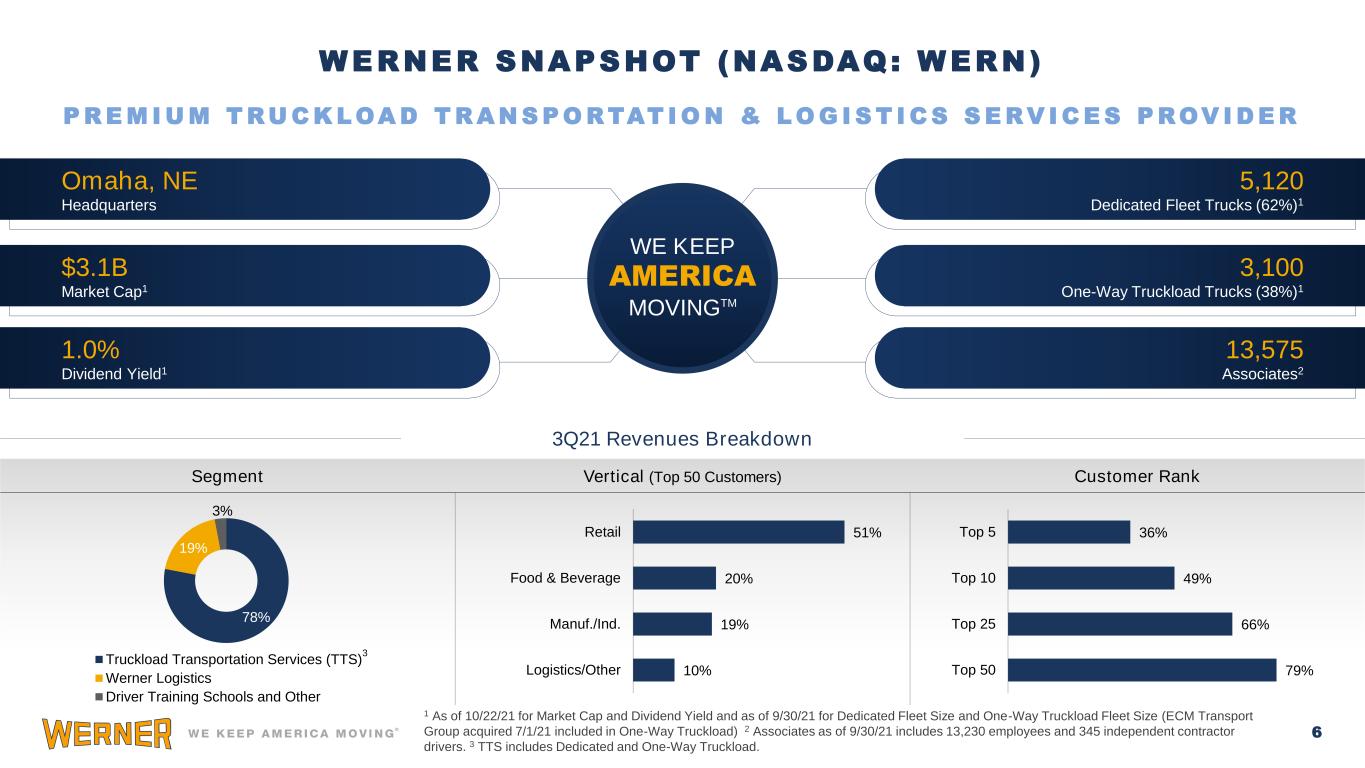

6 36% 49% 66% 79% Top 5 Top 10 Top 25 Top 50 Segment Vertical (Top 50 Customers) Customer Rank WERNER SNAPSHOT (NASDAQ: WERN) P R E M I U M T R U C K L OA D T R A N S P O R TAT I O N & L O G I S T I C S S E R V I C E S P R OV I D E R Omaha, NE Headquarters $3.1B Market Cap1 1.0% Dividend Yield1 WE KEEP AMERICA MOVINGTM 5,120 Dedicated Fleet Trucks (62%)1 3,100 One-Way Truckload Trucks (38%)1 13,575 Associates2 3Q21 Revenues Breakdown 10% 19% 20% 51% Logistics/Other Manuf./Ind. Food & Beverage Retail 78% 19% 3% Truckload Transportation Services (TTS) Werner Logistics Driver Training Schools and Other 3 1 As of 10/22/21 for Market Cap and Dividend Yield and as of 9/30/21 for Dedicated Fleet Size and One-Way Truckload Fleet Size (ECM Transport Group acquired 7/1/21 included in One-Way Truckload) 2 Associates as of 9/30/21 includes 13,230 employees and 345 independent contractor drivers. 3 TTS includes Dedicated and One-Way Truckload.

7 5,120 trucks1 150+ dedicated fleets 3,100 trucks1 14 terminals 36 drop-yards 5 strategic regional centers in North America HIGHLY ATTRACTIVE LINES OF BUSINESS IN TWO SEGMENTS • Consistent and reliable revenue stream, through economic upturns and downturns • Deep, tenured customer relationships, with customers winning in their verticals • Longer-term contracts (3-5 years) with annual pricing renewals • Stickiness through contract terms and high on-time service requirements and performance • 4th largest dedicated truckload carrier in North America2 • Expertise at navigating the freight cycle, advantaged by size, fleet mix and flexibility • Ability to generate premium revenue / truck • Scale allows more efficient operations, fewer empty miles, and premium service solutions such as Expedited, Cross-Border, Engineered, Regional and Temperature Controlled • Deep service portfolio including Truckload Logistics, Intermodal, and Final Mile • Seamless, asset light, high-service solutions executed through a diverse network of partner carriers, agents and rail partners • Innovation focused with leading digital platform strategy to augment the best talent in the industry 1 As of 9/30/21 2 Source: Transport Topics Truckload Transportation Services (TTS)1 Logistics2

8 Tremendous scale – among the top 5 U.S. public truckload carriers* as measured by truck count Recent ECM Transport Group (ECM) truckload acquisition July 2021 – expands footprint in the strategic Mid-Atlantic, Ohio and Northeast regions by 500 trucks, 2,000 trailers and over 500 professional drivers Over 90% of the U.S. population is within 150 miles of a Werner Dedicated fleet location, terminal, or a driving school Werner Driver Training Schools – provides access to the best trained talent in an ultra competitive driver market OUR FOOTPRINT * Source: Transport Topics Omaha, NE Brownstown, MI Lehigh Valley, PA Joliet, IL El Paso, TX Laredo, TX Lake City, FL Fontana, CA Dallas, TX HQ Dunn, NC Columbus, OH Bethlehem, PA Jacksonville, FL Tampa, FL San Antonio, TX Grandview, MO West Memphis, AR Lithia Springs, GA Springfield, OH Phoenix, AZ Henderson, CO Orlando, FL Savannah, GA Millington, TN Werner Driver Training SchoolsWerner Terminals ECM Terminals Northwood, OH Fremont, OH York, PA Cheswick, PA Hunker, PA Meadow Lands, PA Richmond, IN Akron, OH St. Louis, MO Jackson, MS Werner Terminals, Regional Logistics Offices and Driver Training Schools Network Werner Regional Logistics Offices Atlanta, GA Chicago, IL Toronto, ON, CA

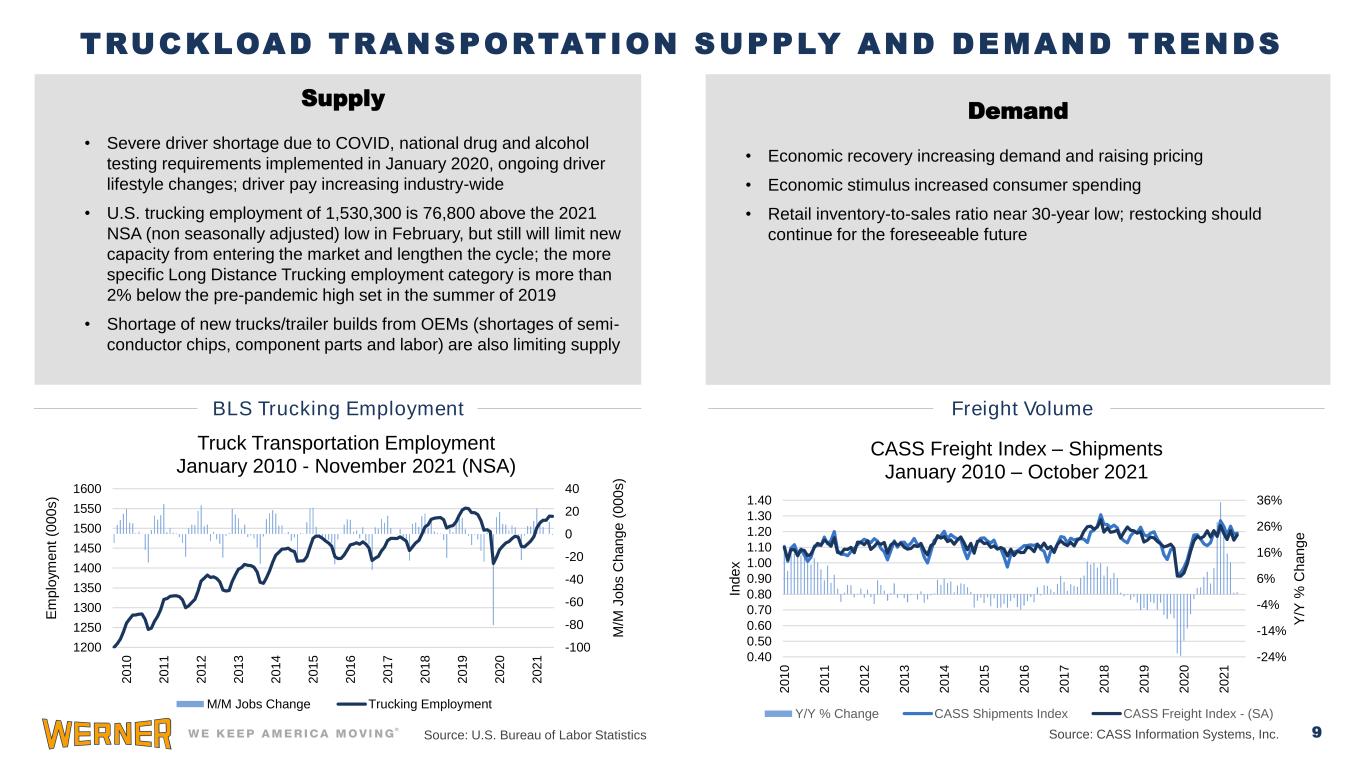

9 -100 -80 -60 -40 -20 0 20 40 1200 1250 1300 1350 1400 1450 1500 1550 1600 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 M /M J o b s C h a n g e ( 0 0 0 s ) E m p lo ym e n t (0 0 0 s ) Truck Transportation Employment January 2010 - November 2021 (NSA) M/M Jobs Change Trucking Employment Supply • Severe driver shortage due to COVID, national drug and alcohol testing requirements implemented in January 2020, ongoing driver lifestyle changes; driver pay increasing industry-wide • U.S. trucking employment of 1,530,300 is 76,800 above the 2021 NSA (non seasonally adjusted) low in February, but still will limit new capacity from entering the market and lengthen the cycle; the more specific Long Distance Trucking employment category is more than 2% below the pre-pandemic high set in the summer of 2019 • Shortage of new trucks/trailer builds from OEMs (shortages of semi- conductor chips, component parts and labor) are also limiting supply TRUCKLOAD TRANSPORTATION SUPPLY AND DEMAND TRENDS Source: U.S. Bureau of Labor Statistics BLS Trucking Employment Freight Volume Demand • Economic recovery increasing demand and raising pricing • Economic stimulus increased consumer spending • Retail inventory-to-sales ratio near 30-year low; restocking should continue for the foreseeable future -24% -14% -4% 6% 16% 26% 36% 0.40 0.50 0.60 0.70 0.80 0.90 1.00 1.10 1.20 1.30 1.40 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 1 9 2 0 2 0 2 0 2 1 Y /Y % C h a n g e In d e x CASS Freight Index – Shipments January 2010 – October 2021 Y/Y % Change CASS Shipments Index CASS Freight Index - (SA) Source: CASS Information Systems, Inc.

10 TAILWINDS SUPPORTING NEAR -TERM GROWTH Customer Alignment Lower Cost BaseHigher Velocity Supply Chain Greater Demand for E-Commerce Has Increased Supply Chain Velocity • E-Commerce driving demand; need for forward-deployed inventory nearer to the customer; the retail competitive landscape is shrinking e-commerce delivery times • Truckload carriers positioned well vs. rail intermodal as a result of greater route flexibility and superior velocity • Werner Dedicated and Final Mile offer creative delivery solutions for high velocity shipments in time-specific delivery windows for retail and other customers Enhanced Alignment With Customers Supplying Essential Products • Designed strategy with leading shippers providing essential goods to consumers (i.e., discount retail, beverage, home improvement retail) • Shippers expect superior on-time, damage-free service with no surprises • Werner intentionally partners with winning customers in their industry verticals, as they leverage their supply chain to be a competitive advantage Reduced Costs and Werner’s Driver Strategy Improving Competitiveness • Werner’s driver strategy and vast network of alliance partners are focused on attracting and retaining the top talent; facilitates the expansion of capacity to meet anticipated freight demand in a rebounding economy • Continuously focused on safety and on- time service while improving cost efficiency

11 Breadth Diversified truckload transportation portfolio (Dedicated TL, One-Way TL, Logistics) Scale Top 5 Truckload carrier*, Top 4 Dedicated carrier* and growing Logistics provider North America Footprint Comprehensive North American footprint including industry leading cross-border coverage via asset and asset light solutions Strong Portfolio Diversified operating portfolio with a strong customer base who are winning in their industry verticals Talent Access to top talent through our large, vertically-integrated driver training school network owned and managed by Werner; highly qualified drivers with extensive safety training COMPETITIVE ADVANTAGES ACROSS ALL BUSINESS CYCLES Core Strengths Sustainable Competitive Advantages • Deep, long-term customer relationships by delivering superior, award-winning on-time service • Durable financial position sustained with strong free cash flow and industry-leading revenue per truck per week • Enhanced value-added technology platform; further improves customer, driver, non-driver and supplier experience • Industry leader committed to continuously reducing our environmental impact (e.g., aerodynamic trucks and trailers, alternative fuels and electric truck exploration and integration) • Performance-driven, accountable culture led by experienced leadership; transparent, one-voice communications * Source: Transport Topics

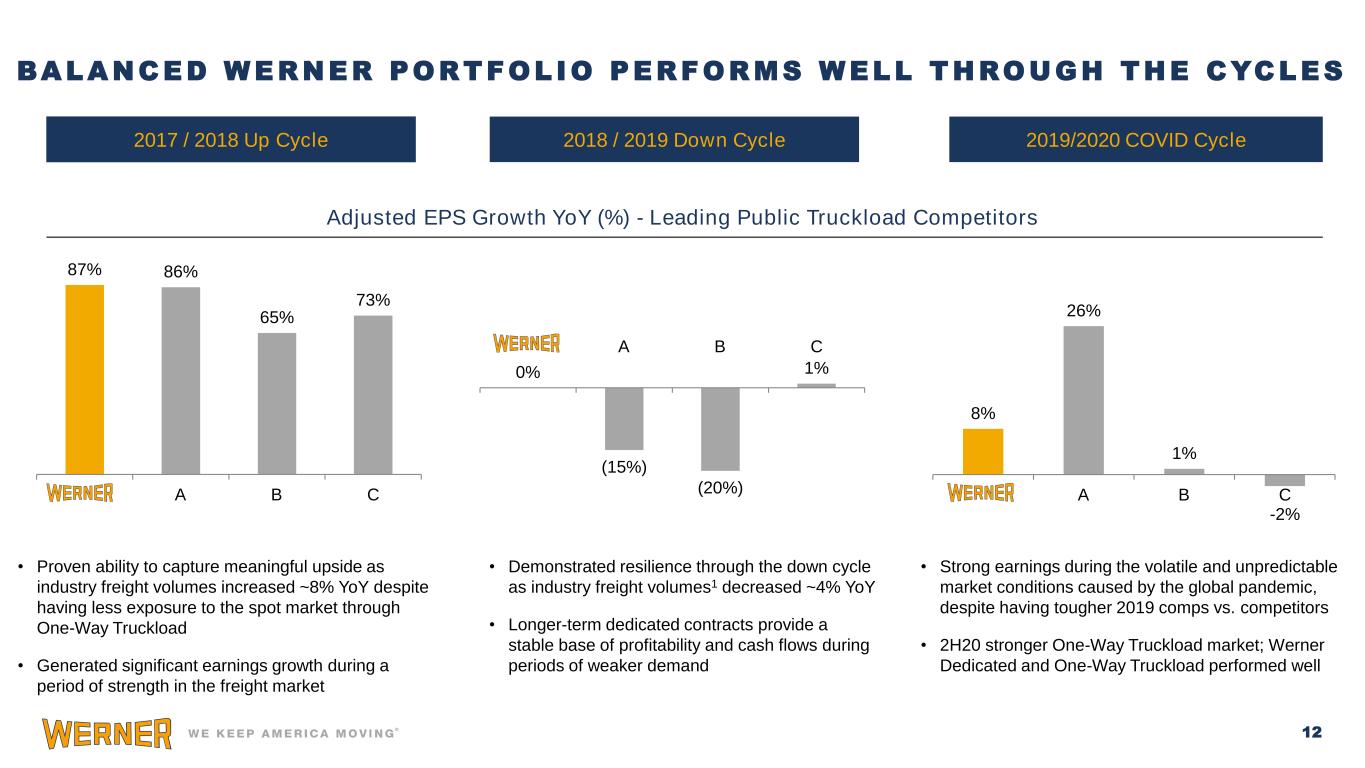

12 BALANCED WERNER PORTFOLIO PERFORMS WELL THROUGH THE CYCLES 87% 86% 65% 73% A B C 0% (15%) (20%) 1% A B C 2017 / 2018 Up Cycle 2018 / 2019 Down Cycle • Demonstrated resilience through the down cycle as industry freight volumes1 decreased ~4% YoY • Longer-term dedicated contracts provide a stable base of profitability and cash flows during periods of weaker demand • Proven ability to capture meaningful upside as industry freight volumes increased ~8% YoY despite having less exposure to the spot market through One-Way Truckload • Generated significant earnings growth during a period of strength in the freight market Adjusted EPS Growth YoY (%) - Leading Public Truckload Competitors 8% 26% 1% -2% A B C 2019/2020 COVID Cycle • Strong earnings during the volatile and unpredictable market conditions caused by the global pandemic, despite having tougher 2019 comps vs. competitors • 2H20 stronger One-Way Truckload market; Werner Dedicated and One-Way Truckload performed well

STRATEGY

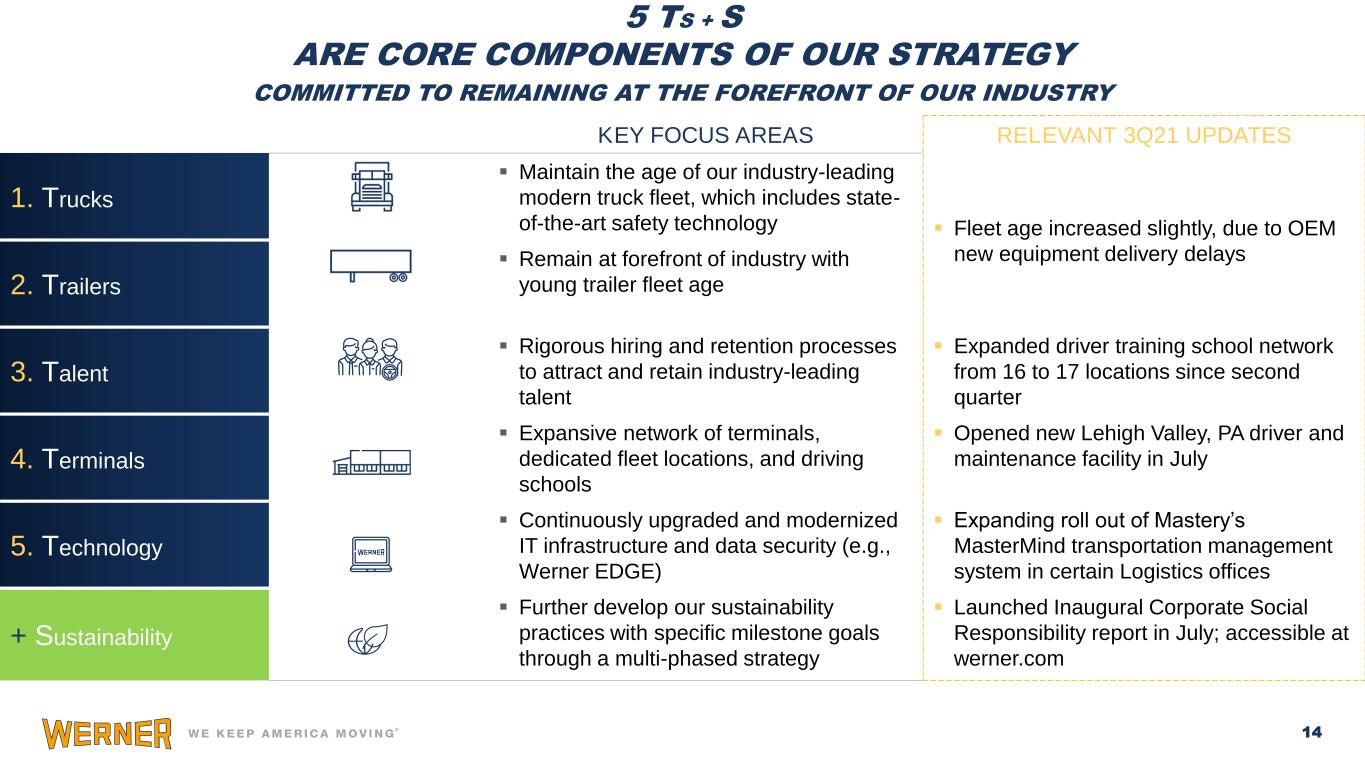

14 5 TS + S ARE CORE COMPONENTS OF OUR STRATEGY KEY FOCUS AREAS RELEVANT 3Q21 UPDATES 1. Trucks ▪ Maintain the age of our industry-leading modern truck fleet, which includes state- of-the-art safety technology ▪ Fleet age increased slightly, due to OEM new equipment delivery delays 2. Trailers ▪ Remain at forefront of industry with young trailer fleet age 3. Talent ▪ Rigorous hiring and retention processes to attract and retain industry-leading talent ▪ Expanded driver training school network from 16 to 17 locations since second quarter 4. Terminals ▪ Expansive network of terminals, dedicated fleet locations, and driving schools ▪ Opened new Lehigh Valley, PA driver and maintenance facility in July 5. Technology ▪ Continuously upgraded and modernized IT infrastructure and data security (e.g., Werner EDGE) ▪ Expanding roll out of Mastery’s MasterMind transportation management system in certain Logistics offices + Sustainability ▪ Further develop our sustainability practices with specific milestone goals through a multi-phased strategy ▪ Launched Inaugural Corporate Social Responsibility report in July; accessible at werner.com COMMITTED TO REMAINING AT THE FOREFRONT OF OUR INDUSTRY

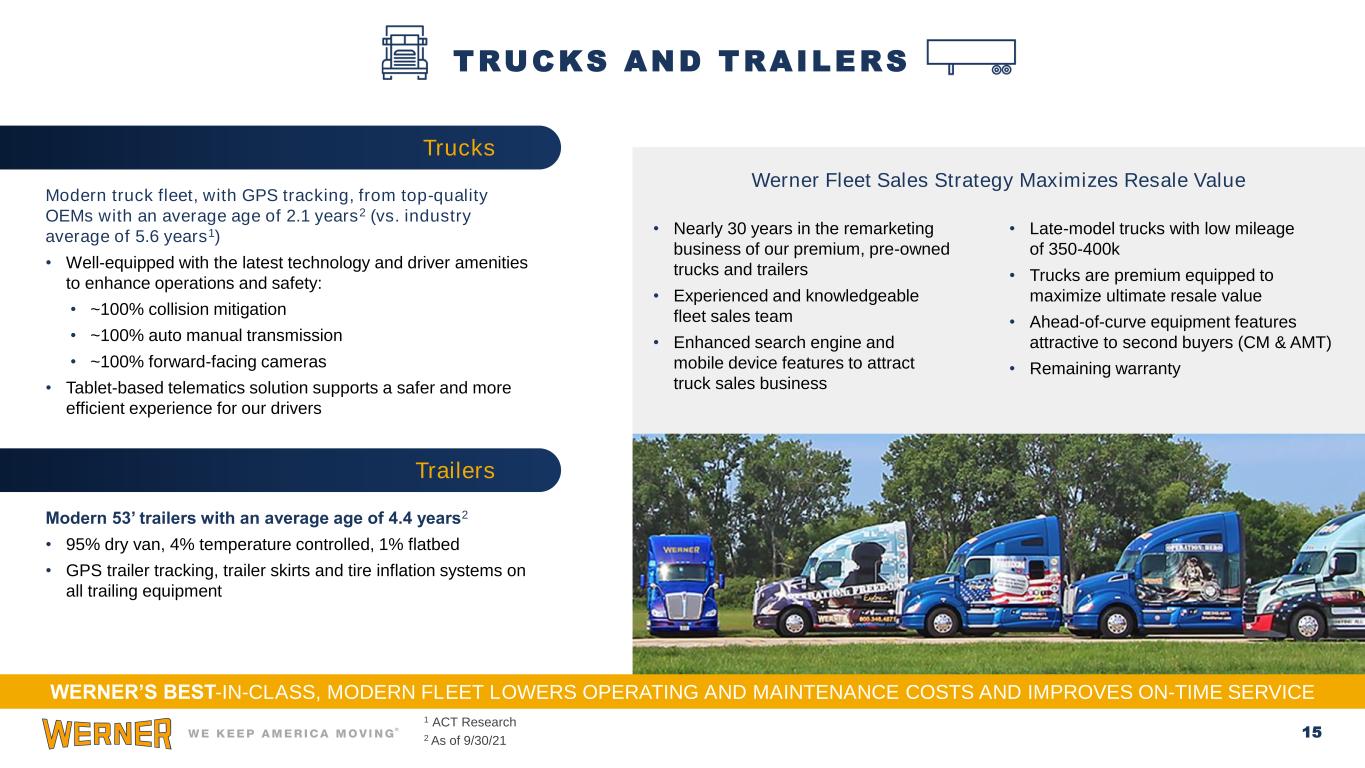

15 Werner Fleet Sales Strategy Maximizes Resale Value TRUCKS AND TRAILERS WERNER’S BEST-IN-CLASS, MODERN FLEET LOWERS OPERATING AND MAINTENANCE COSTS AND IMPROVES ON-TIME SERVICE Modern truck fleet, with GPS tracking, from top-quality OEMs with an average age of 2.1 years2 (vs. industry average of 5.6 years1) • Well-equipped with the latest technology and driver amenities to enhance operations and safety: • ~100% collision mitigation • ~100% auto manual transmission • ~100% forward-facing cameras • Tablet-based telematics solution supports a safer and more efficient experience for our drivers Trucks Modern 53’ trailers with an average age of 4.4 years2 • 95% dry van, 4% temperature controlled, 1% flatbed • GPS trailer tracking, trailer skirts and tire inflation systems on all trailing equipment 1 ACT Research 2 As of 9/30/21 Trailers • Nearly 30 years in the remarketing business of our premium, pre-owned trucks and trailers • Experienced and knowledgeable fleet sales team • Enhanced search engine and mobile device features to attract truck sales business • Late-model trucks with low mileage of 350-400k • Trucks are premium equipped to maximize ultimate resale value • Ahead-of-curve equipment features attractive to second buyers (CM & AMT) • Remaining warranty

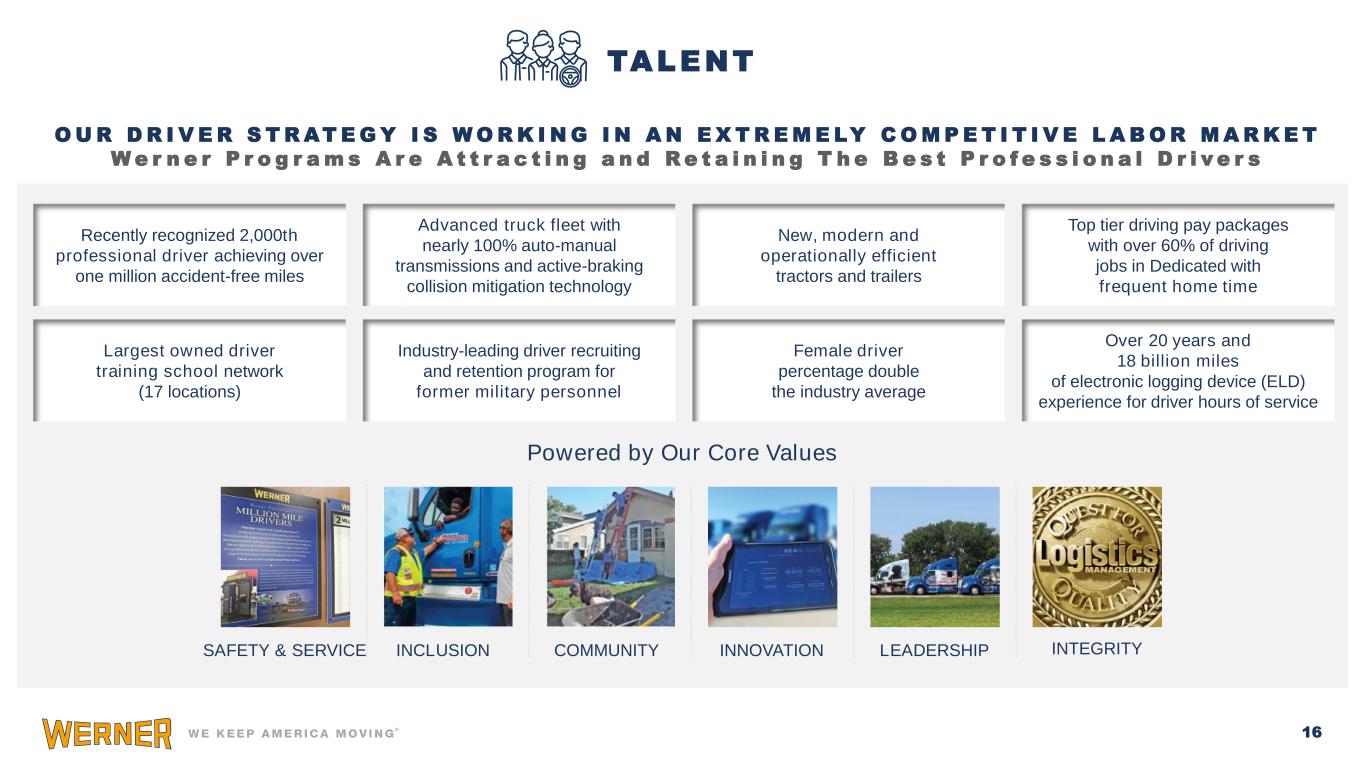

16 TALENT Powered by Our Core Values SAFETY & SERVICE INCLUSION COMMUNITY INNOVATION LEADERSHIP INTEGRITY O U R D R I V E R S T R AT E G Y I S W O R K I N G I N A N E X T R E M E LY C O M P E T I T I V E L A B O R M A R K E T W e r n e r P r o g r a m s A r e A t t r a c t i n g a n d R e t a i n i n g T h e B e s t P r o f e s s i o n a l D r i v e r s Recently recognized 2,000th professional driver achieving over one million accident-free miles Advanced truck fleet with nearly 100% auto-manual transmissions and active-braking collision mitigation technology New, modern and operationally efficient tractors and trailers Top tier driving pay packages with over 60% of driving jobs in Dedicated with frequent home time Largest owned driver training school network (17 locations) Industry-leading driver recruiting and retention program for former military personnel Female driver percentage double the industry average Over 20 years and 18 billion miles of electronic logging device (ELD) experience for driver hours of service

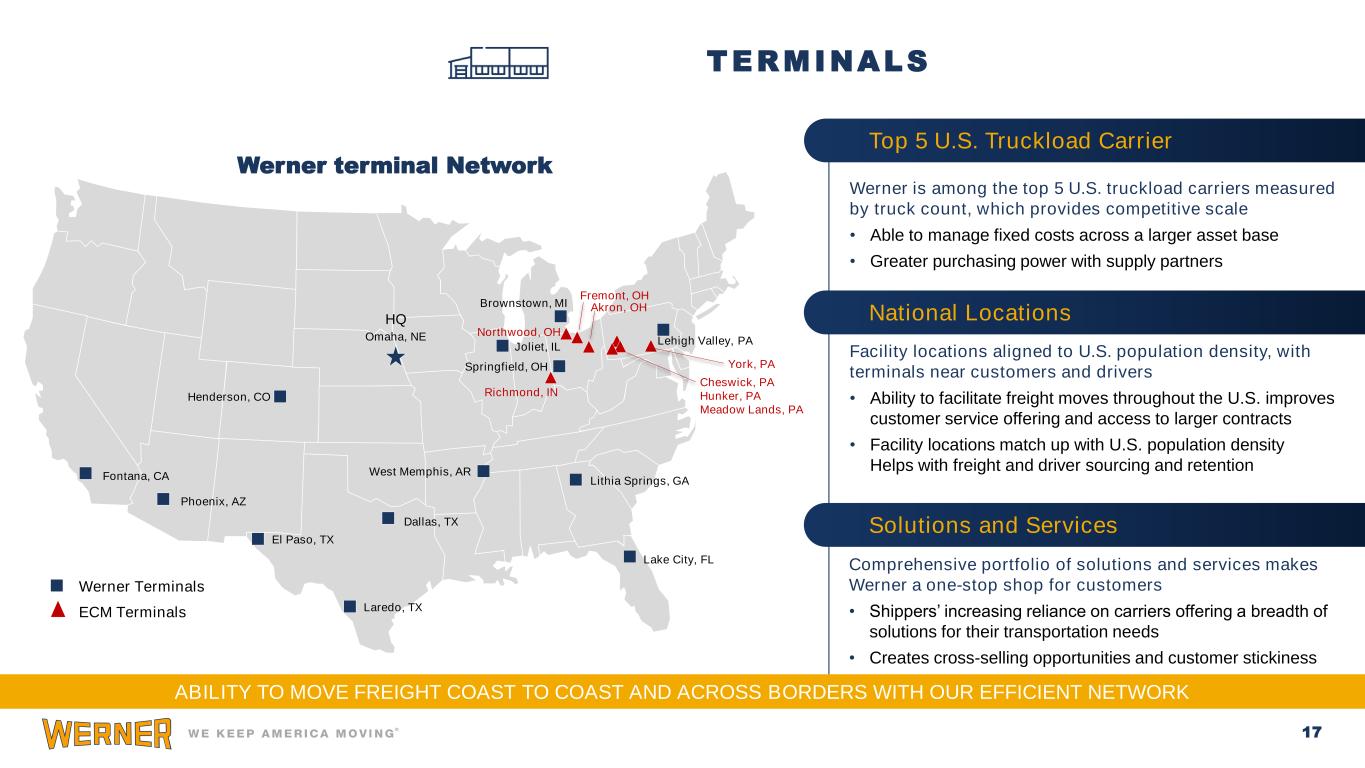

17 TERMINALS Omaha, NE Brownstown, MI Lehigh Valley, PA Joliet, IL El Paso, TX Laredo, TX Lake City, FL Fontana, CA Dallas, TX HQ West Memphis, AR Lithia Springs, GA Springfield, OH Phoenix, AZ Henderson, CO Werner Terminals ECM Terminals Northwood, OH Fremont, OH York, PA Cheswick, PA Hunker, PA Meadow Lands, PA Richmond, IN Akron, OH Werner terminal Network ABILITY TO MOVE FREIGHT COAST TO COAST AND ACROSS BORDERS WITH OUR EFFICIENT NETWORK Werner is among the top 5 U.S. truckload carriers measured by truck count, which provides competitive scale • Able to manage fixed costs across a larger asset base • Greater purchasing power with supply partners Top 5 U.S. Truckload Carrier Facility locations aligned to U.S. population density, with terminals near customers and drivers • Ability to facilitate freight moves throughout the U.S. improves customer service offering and access to larger contracts • Facility locations match up with U.S. population density Helps with freight and driver sourcing and retention National Locations Comprehensive portfolio of solutions and services makes Werner a one-stop shop for customers • Shippers’ increasing reliance on carriers offering a breadth of solutions for their transportation needs • Creates cross-selling opportunities and customer stickiness Solutions and Services

18 Drivers • Cutting-Edge Telematics • DriveWerner App • Breakdown Management • Safety Event Management Shippers • Final Mile • Shipment Tracking Third-Party Carriers • Optimize freight management • Streamline work processes • Manage preferences Infrastructure TECHNOLOGY Innovative Technology Processes & Systems Committed to continued investment to improve our technology capabilities • Werner Edge will advance performance and safety of drivers, shippers, carriers and associates • Strengthens customer and driver experience • Supports market leadership Maintain an IT Executive Steering Committee to prioritize, rank and measure technology initiatives with the objective of: • Aligning with our operational priorities • Supporting our business strategies • Generating a strong and consistent ROI Consistent Investment to Remain at the Forefront of Technology & Innovation

19 Werner had the 2nd highest overall weighted score in the dry freight category in 2021 38th annual awards, August 2021 Dry freight public company truckload award winners Quest for Quality 2021 2020 2019 2018 2017 X X X X X Quest for Quality is widely regarded as the most important measure of customer satisfaction and performance excellence in transportation and logistics (4,100 shipper surveys) Quest for Quality (Logistics Management) Werner is one of only two public truckloads to win this award in the last 5 years in the dry freight category 2021 2020 2019 X X X Third-party logistics winners 5 dry freight rating criteria: On-time Performance, Value, Information Technology, Customer Service, Equipment and Operations 5 logistics rating criteria: Carrier Selection Negotiation, Order Fulfillment, Transportation Distribution, Inventory Management, Information Technology

COMMITMENT TO SUSTAINABILITY

21 Formally launched ESG program, adding Sustainability as a strategic pillar Q4 2020 Created two new roles and hired diverse leaders • AVP of Sustainability • AVP of Diversity, Inclusion, and Learning Created 3 initial Associate Resource Groups (ARGs) Q1 2021 Q2 2021 5Ts + S Strategy Trucks Trailers Talent Terminals Technology + Sustainability • Adopted SASB Disclosure Framework • Signed UN Global Compact and aligned with specific SDGs that support Werner values, strategy, and aspirations July 2021 • Published inaugural CSR Report • Launched WernerBlue, our branded Sustainability endeavor • Set new ESG goals and milestones While ESG concepts have long been woven into the fabric of Werner’s history, the release of our inaugural CSR report further elevates our commitment to conducting business in a socially and environmentally responsible manner. We are excited to demonstrate our ongoing commitment to Sustainability, and we fully anticipate transformative growth and positive impact enabled by our ESG endeavor in the years to come. Derek J. Leathers, Chairman, President and Chief Executive Officer, Werner Enterprises THE EVOLUTION OF OUR ESG EFFORT

22 Environmental Build on Strong Foundation as an Industry Leader, Focused on Reducing Our Environmental Impact through Young and Innovative Fleet Social Foster and Empower an Inclusive Culture that Upholds Our Core Values and Provides Equal Opportunities for All; Uphold Relentless Focus on Safety Governance Continue to Uphold Transparency, Ethics and Integrity in Our Governance Practices with Emphasis on Creating a More Diverse Board with Complementary Skills Aligned with Long-term Strategy By 2022 • Create an advancement and retention plan to increase and elevate women and diverse talent in the management pipeline • Institute an employee volunteer hours program • Create a standalone ESG board committee • Form a task force comprising senior leadership, associates and board members to further the goals of WernerBlue 2025 • Disclose Scope 1 and Scope 2 greenhouse gas emissions • Double Blue Brigade volunteer hours to +3,300 annually • Double associate training hours devoted to human trafficking awareness 2030 • Double intermodal usage, thereby further reducing emissions 2035 • Achieve 55% reduction in greenhouse gas emissions1 1 All new goals and milestones with the exception of 2035 GHG Emission target, which was first announced on November 10, 2020 SETTING NEW ESG GOALS AND MILESTONES 1

FINANCIAL OVERVIEW

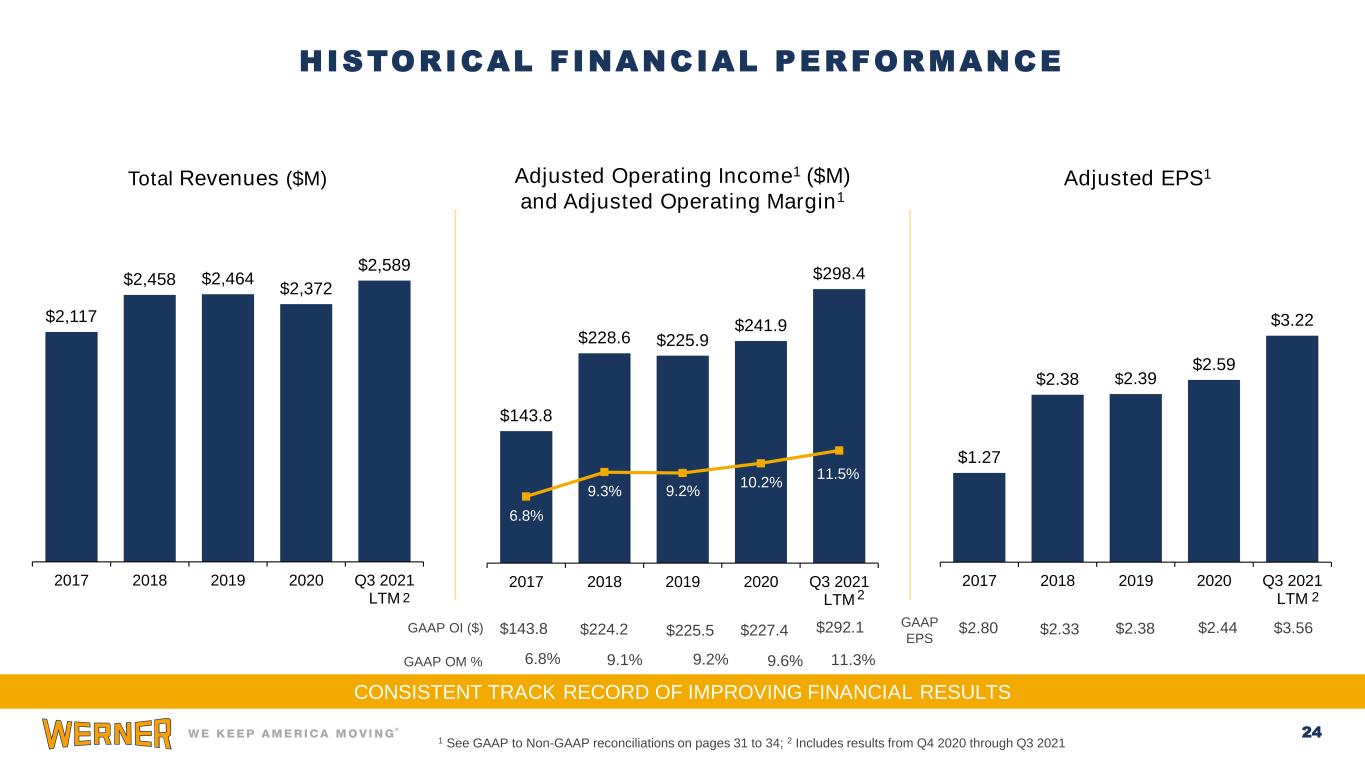

24 $2,117 $2,458 $2,464 $2,372 $2,589 2017 2018 2019 2020 Q3 2021 LTM $0.0 $10 .0 $20 .0 $30 .0 $40 .0 $50 .0 $60 .0 $70 .0 $80 .0 $90 .0 $100.0 $110.0 $120.0 $130.0 $140.0 $150.0 $160.0 $170.0 $180.0 $190.0 $200.0 $210.0 $220.0 $230.0 $240.0 $250.0 $260.0 $270.0 $280.0 $290.0 $300.0 $310.0 $320.0 $330.0 $340.0 $350.0 $360.0 $370.0 $380.0 $390.0 $400.0 $410.0 $420.0 $430.0 $440.0 $450.0 $460.0 $470.0 $480.0 $490.0 $500.0 $510.0 $520.0 $530.0 $540.0 $550.0 $560.0 $570.0 $580.0 $590.0 $600.0 $610.0 $620.0 $630.0 $640.0 $650.0 $660.0 $670.0 $680.0 $690.0 $700.0 $710.0 $720.0 $730.0 $740.0 $750.0 $760.0 $770.0 $780.0 $790.0 $800.0 $810.0 $820.0 $830.0 $840.0 $850.0 $860.0 $870.0 $880.0 $890.0 $900.0 $910.0 $920.0 $930.0 $940.0 $950.0 $960.0 $970.0 $980.0 $990.0 $1,000.0 $1,010.0 $1,020.0 $1,030.0 $1,040.0 $1,050.0 $1,060.0 $1,070.0 $1,080.0 $1,090.0 $1,100.0 $1,110.0 $1,120.0 $1,130.0 $1,140.0 $1,150.0 $1,160.0 $1,170.0 $1,180.0 $1,190.0 $1,200.0 $1,210.0 $1,220.0 $1,230.0 $1,240.0 $1,250.0 $1,260.0 $1,270.0 $1,280.0 $1,290.0 $1,300.0 $1,310.0 $1,320.0 $1,330.0 $1,340.0 $1,350.0 $1,360.0 $1,370.0 $1,380.0 $1,390.0 $1,400.0 $1,410.0 $1,420.0 $1,430.0 $1,440.0 $1,450.0 $1,460.0 $1,470.0 $1,480.0 $1,490.0 $1,500.0 $1,510.0 $1,520.0 $1,530.0 $1,540.0 $1,550.0 $1,560.0 $1,570.0 $1,580.0 $1,590.0 $1,600.0 $1,610.0 $1,620.0 $1,630.0 $1,640.0 $1,650.0 $1,660.0 $1,670.0 $1,680.0 $1,690.0 $1,700.0 $1,710.0 $1,720.0 $1,730.0 $1,740.0 $1,750.0 $1,760.0 $1,770.0 $1,780.0 $1,790.0 $1,800.0 $1,810.0 $1,820.0 $1,830.0 $1,840.0 $1,850.0 $1,860.0 $1,870.0 $1,880.0 $1,890.0 $1,900.0 $1,910.0 $1,920.0 $1,930.0 $1,940.0 $1,950.0 $1,960.0 $1,970.0 $1,980.0 $1,990.0 $2,000.0 $2,010.0 $2,020.0 $2,030.0 $2,040.0 $2,050.0 $2,060.0 $2,070.0 $2,080.0 $2,090.0 $2,100.0 $2,110.0 $2,120.0 $2,130.0 $2,140.0 $2,150.0 $2,160.0 $2,170.0 $2,180.0 $2,190.0 $2,200.0 $2,210.0 $2,220.0 $2,230.0 $2,240.0 $2,250.0 $2,260.0 $2,270.0 $2,280.0 $2,290.0 $2,300.0 $2,310.0 $2,320.0 $2,330.0 $2,340.0 $2,350.0 $2,360.0 $2,370.0 $2,380.0 $2,390.0 $2,400.0 $2,410.0 $2,420.0 $2,430.0 $2,440.0 $2,450.0 $2,460.0 $2,470.0 $2,480.0 $2,490.0 $2,500.0 $2,510.0 $2,520.0 $2,530.0 $2,540.0 $2,550.0 $2,560.0 $2,570.0 $2,580.0 $2,590.0 $2,600.0 $2,610.0 $2,620.0 $2,630.0 $2,640.0 $2,650.0 $2,660.0 $2,670.0 $2,680.0 $2,690.0 $2,700.0 $2,710.0 $2,720.0 $143.8 $228.6 $225.9 $241.9 $298.4 6.8% 9.3% 9.2% 10.2% 11.5% $0.0 $10 .0 $20 .0 $30 .0 $40 .0 $50 .0 $60 .0 $70 .0 $80 .0 $90 .0 $100.0 $110.0 $120.0 $130.0 $140.0 $150.0 $160.0 $170.0 $180.0 $190.0 $200.0 $210.0 $220.0 $230.0 $240.0 $250.0 $260.0 $270.0 $280.0 $290.0 $300.0 $310.0 $320.0 2017 2018 2019 2020 Q3 2021 LTM 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% Total Revenues ($M) Adjusted Operating Income1 ($M) and Adjusted Operating Margin1 Adjusted EPS1 $1.27 $2.38 $2.39 $2.59 $3.22 2017 2018 2019 2020 Q3 2021 LTM $0.00 1 See GAAP to Non-GAAP reconciliations on pages 31 to 34; 2 Includes results from Q4 2020 through Q3 2021 HISTORICAL FINANCIAL PERFORMANCE CONSISTENT TRACK RECORD OF IMPROVING FINANCIAL RESULTS 2 2 2 $143.8 $224.2 $225.5 $227.4 $292.1 6.8% 9.1% 9.2% 9.6% 11.3% GAAP OI ($) GAAP OM % $2.80 $2.33 $2.38 $2.44 $3.56GAAP EPS

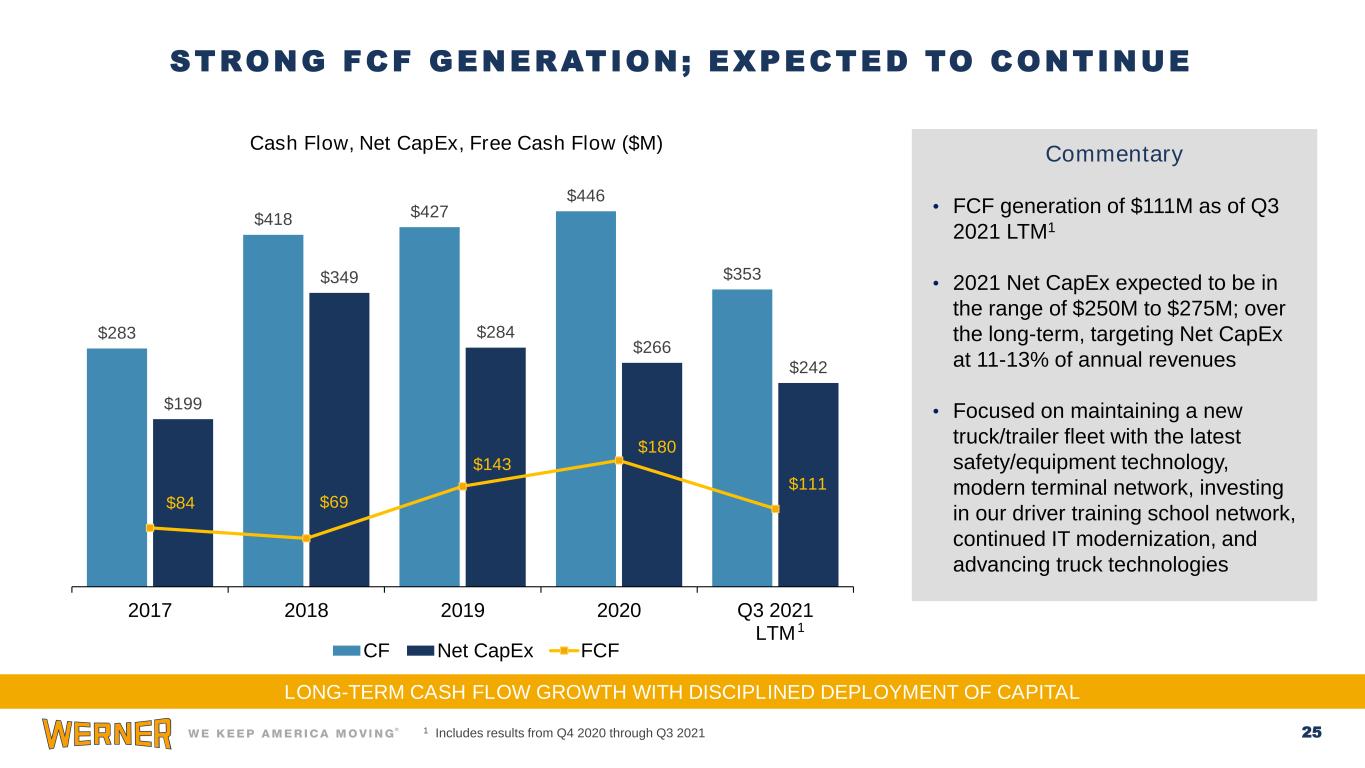

25 $283 $418 $427 $446 $353 $199 $349 $284 $266 $242 $84 $69 $143 $180 $111 2017 2018 2019 2020 Q3 2021 LTM CF Net CapEx FCF Commentary • FCF generation of $111M as of Q3 2021 LTM1 • 2021 Net CapEx expected to be in the range of $250M to $275M; over the long-term, targeting Net CapEx at 11-13% of annual revenues • Focused on maintaining a new truck/trailer fleet with the latest safety/equipment technology, modern terminal network, investing in our driver training school network, continued IT modernization, and advancing truck technologies STRONG FCF GENERATION; EXPECTED TO CONTINUE 1 Includes results from Q4 2020 through Q3 2021 1 LONG-TERM CASH FLOW GROWTH WITH DISCIPLINED DEPLOYMENT OF CAPITAL Cash Flow, Net CapEx, Free Cash Flow ($M)

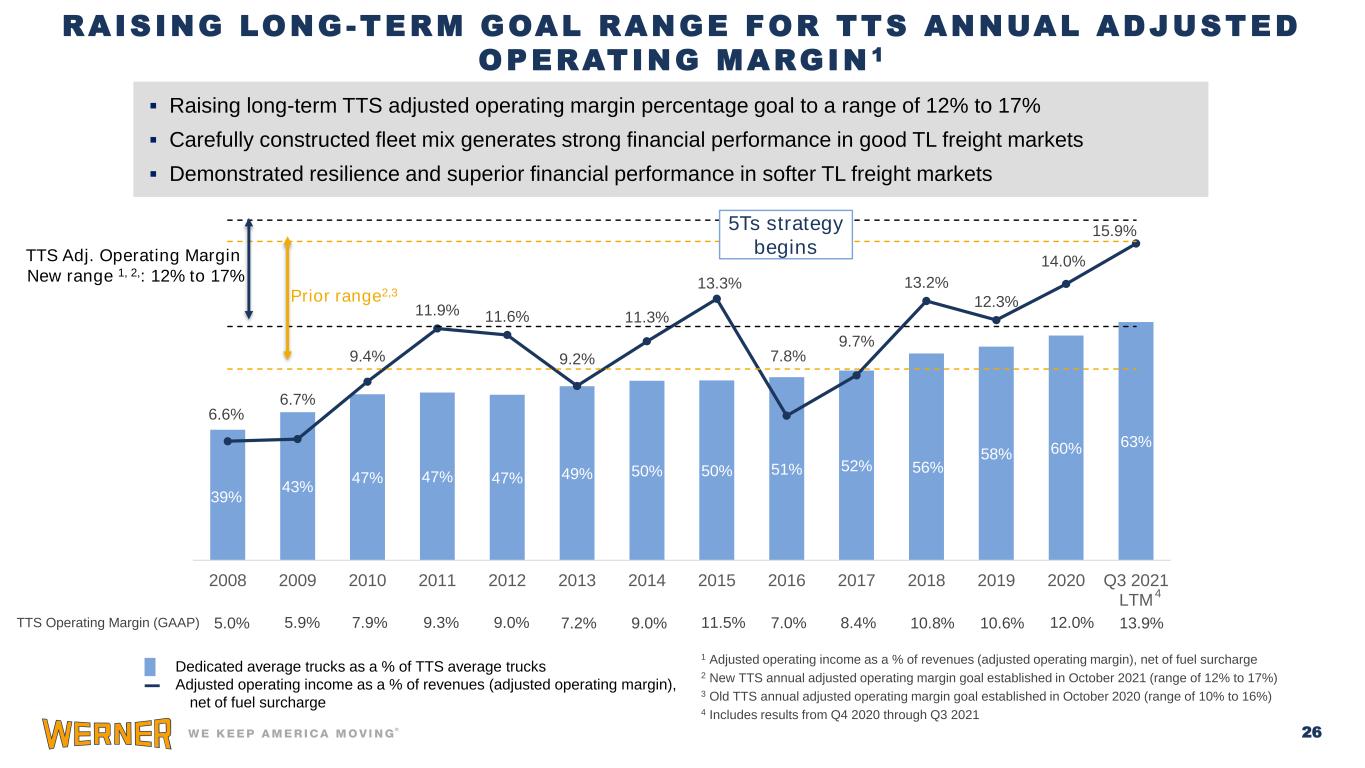

26 39% 43% 47% 47% 47% 49% 50% 50% 51% 52% 56% 58% 60% 63% 6.6% 6.7% 9.4% 11.9% 11.6% 9.2% 11.3% 13.3% 7.8% 9.7% 13.2% 12.3% 14.0% 15.9% 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Q3 2021 LTM 5Ts strategy begins 4 TTS Adj. Operating Margin New range 1, 2,: 12% to 17% Prior range2,3 1 Adjusted operating income as a % of revenues (adjusted operating margin), net of fuel surcharge 2 New TTS annual adjusted operating margin goal established in October 2021 (range of 12% to 17%) 3 Old TTS annual adjusted operating margin goal established in October 2020 (range of 10% to 16%) 4 Includes results from Q4 2020 through Q3 2021 RAISING LONG-TERM GOAL RANGE FOR TTS ANNUAL ADJUSTED OPERATING MARGIN 1 █ Dedicated average trucks as a % of TTS average trucks ▬ Adjusted operating income as a % of revenues (adjusted operating margin), net of fuel surcharge ▪ Raising long-term TTS adjusted operating margin percentage goal to a range of 12% to 17% ▪ Carefully constructed fleet mix generates strong financial performance in good TL freight markets ▪ Demonstrated resilience and superior financial performance in softer TL freight markets 5.0% 5.9% 7.9% 9.3% 9.0% 7.2% 9.0% 11.5% 7.0% 8.4% 10.8% 10.6% 12.0% 13.9%TTS Operating Margin (GAAP)

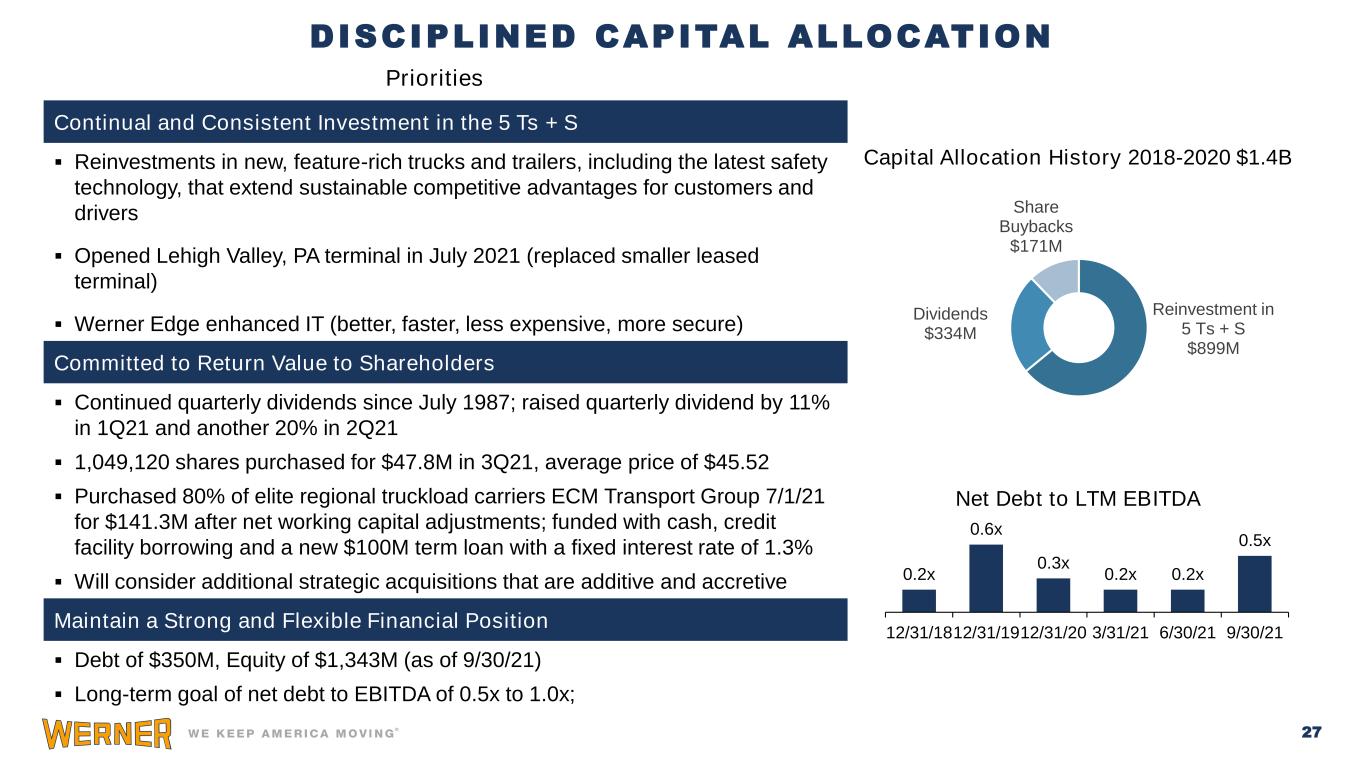

27 0.2x 0.6x 0.3x 0.2x 0.2x 0.5x 12/31/1812/31/1912/31/20 3/31/21 6/30/21 9/30/21 Net Debt to LTM EBITDA Continual and Consistent Investment in the 5 Ts + S ▪ Reinvestments in new, feature-rich trucks and trailers, including the latest safety technology, that extend sustainable competitive advantages for customers and drivers ▪ Opened Lehigh Valley, PA terminal in July 2021 (replaced smaller leased terminal) ▪ Werner Edge enhanced IT (better, faster, less expensive, more secure) Committed to Return Value to Shareholders ▪ Continued quarterly dividends since July 1987; raised quarterly dividend by 11% in 1Q21 and another 20% in 2Q21 ▪ 1,049,120 shares purchased for $47.8M in 3Q21, average price of $45.52 ▪ Purchased 80% of elite regional truckload carriers ECM Transport Group 7/1/21 for $141.3M after net working capital adjustments; funded with cash, credit facility borrowing and a new $100M term loan with a fixed interest rate of 1.3% ▪ Will consider additional strategic acquisitions that are additive and accretive Maintain a Strong and Flexible Financial Position ▪ Debt of $350M, Equity of $1,343M (as of 9/30/21) ▪ Long-term goal of net debt to EBITDA of 0.5x to 1.0x; Priorities Capital Allocation History 2018-2020 $1.4B Reinvestment in 5 Ts + S $899M Dividends $334M Share Buybacks $171M DISCIPLINED CAPITAL ALLOCATION

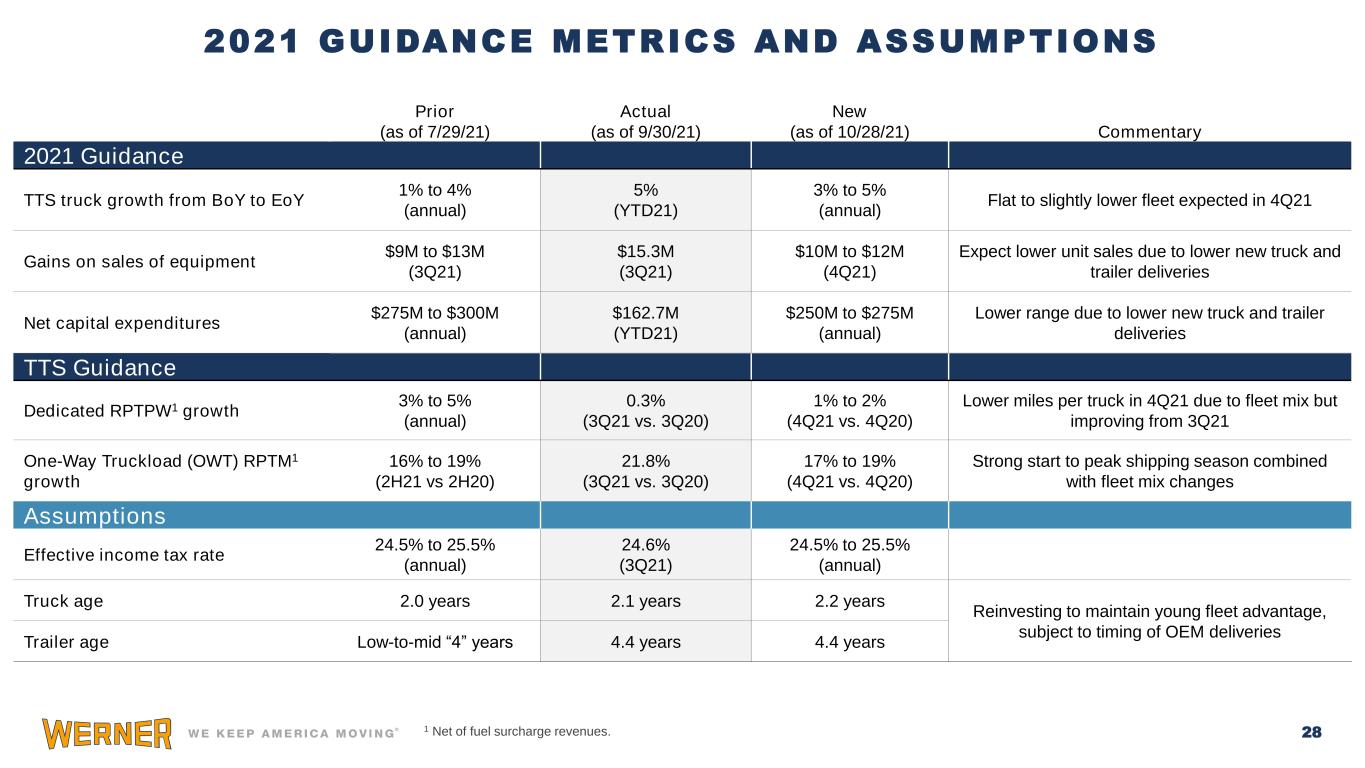

28 Prior (as of 7/29/21) Actual (as of 9/30/21) New (as of 10/28/21) Commentary 2021 Guidance TTS truck growth from BoY to EoY 1% to 4% (annual) 5% (YTD21) 3% to 5% (annual) Flat to slightly lower fleet expected in 4Q21 Gains on sales of equipment $9M to $13M (3Q21) $15.3M (3Q21) $10M to $12M (4Q21) Expect lower unit sales due to lower new truck and trailer deliveries Net capital expenditures $275M to $300M (annual) $162.7M (YTD21) $250M to $275M (annual) Lower range due to lower new truck and trailer deliveries TTS Guidance Dedicated RPTPW1 growth 3% to 5% (annual) 0.3% (3Q21 vs. 3Q20) 1% to 2% (4Q21 vs. 4Q20) Lower miles per truck in 4Q21 due to fleet mix but improving from 3Q21 One-Way Truckload (OWT) RPTM1 growth 16% to 19% (2H21 vs 2H20) 21.8% (3Q21 vs. 3Q20) 17% to 19% (4Q21 vs. 4Q20) Strong start to peak shipping season combined with fleet mix changes Assumptions Effective income tax rate 24.5% to 25.5% (annual) 24.6% (3Q21) 24.5% to 25.5% (annual) Truck age 2.0 years 2.1 years 2.2 years Reinvesting to maintain young fleet advantage, subject to timing of OEM deliveries Trailer age Low-to-mid “4” years 4.4 years 4.4 years 1 Net of fuel surcharge revenues. 2021 GUIDANCE METRICS AND ASSUMPTIONS

INVEST WITH US Executing in strong freight market; expected to continue well into 2022 • Achieved record 3Q21 Adjusted operating income and Adjusted EPS, our fifth consecutive record-setting quarter • Positioned to deliver cash flow stability through the cycle Focused on operational excellence and our performance • Aligning with leading edge technology partners • Expanding driver training school network Achieving ESG goals, backed by committed management team • Issued Inaugural Corporate Social Responsibility (CSR) report in July; available at werner.com Positioned to continue growing earnings and free cash flow • While achieving long-term, sustainable shareholder value creation ✓ ✓ ✓ ✓ 29

APPENDIX

GAAP to NON-GAAP RECONCILIATION 31

GAAP to NON-GAAP RECONCILIATION 32

GAAP to NON-GAAP RECONCILIATION 33

GAAP to NON-GAAP RECONCILIATION 34

F O R M O R E I N F O R M A T I O N , V I S I T W E R N E R . C O M