The following table contains information concerning the grant of options under the stock option plans to each of the Named Executive Officers during the year ended December 31, 2005. There were no SARs issued in 2005.

The following table sets forth information for each of the Named Executive Officers with respect to the value of options and SARs exercised during the year ended December 31, 2005 and the value of outstanding and unexercised options and SARs held as of December 31, 2005, based upon the closing market value of the Common Stock of $43.61 per share on December 31, 2005.

The Company has entered into a three year employment agreement with Mr. Galanski with an initial term that expired in March 2004 that generally provided for Mr. Galanski’s employment during that period and the issuance of a stock grant of 100,000 shares of Common Stock subject to vesting provisions of 25% per year. Under certain conditions in the event of a change in control, Mr. Galanski is entitled to his base salary for the remaining term of his employment agreement. In accordance with its terms, Mr. Galanski’s employment agreement was automatically renewed in 2006 for a one year period through March 2007.

The Company has also entered into agreements with Messrs. Duca, Hope and Malvasio providing for their employment. In general, the agreements provide for the continuation of their base salary for up to one year in the case of a termination by the Company without cause.

COMPENSATION OF DIRECTORS

Currently, each director who is not an officer or employee of the Company is paid $1,000 for attending each Board meeting, Audit Committee or Underwriting Advisory Committee meeting and $500 for attending each Compensation, Corporate Governance and Nominating, Executive or Finance Committee meeting and $20,000 worth of the Company’s Common Stock based on the market price at the end of the year. Fees for attendance at meetings via teleconference are $500 for Board meetings and $350 for committee meetings. In addition, annually the chairperson of the Audit Committee receives $15,000 and the chairpersons of the Compensation, Corporate Governance and Nominating, Finance, and Underwriting Advisory Committees each receive $7,500.

Effective May 31, 2006, the Board has revised the compensation of directors to provide that each director who is not an officer or employee of the Company will receive an annual payment, payable in the first quarter of each year for service during the preceding year, consisting of $20,000 in cash and $25,000 in restricted shares of the Company’s Common Stock (based on the closing price of the Company’s Common Stock on the last business day of such preceding year), as well as a fee of $2,000 for each Board meeting attended and $1,000 for each telephonic Board meeting attended. In addition, members of the Audit Committee of the Board will be paid $2,000 for each Audit Committee meeting attended in person and $1,000 for each Audit Committee meeting attended by telephone, and members of all other Board committees will be paid $1,000 for each committee meeting attended in person and $500 for each committee meeting attended by telephone. The chairmen of the Audit Committee and the Compensation Committee will also be paid annual retainers of $20,000 and $10,000, respectively. Chairmen of other Board committees will no longer receive annual retainers for their services as chairmen.

2005 STOCK INCENTIVE PLAN

At the May 20, 2005 Annual Meeting, the Stockholders approved the 2005 Stock Incentive Plan (the “2005 Stock Plan”). The Company filed a Registration Statement relating to the 2005 Stock Plan. The 2005 Stock Plan authorizes the issuance in the aggregate of 1,000,000 incentive stock options, non-incentive stock options, restricted shares and stock appreciation rights for the Company’s Common Stock (the “Awards”). The 2005 Stock Plan provides for discretionary grants of Awards to all employees, non-employee directors and consultants to the Company or any of its subsidiaries, or any corporation acquired by the Company or any of its subsidiaries. The Compensation Committee does not intend to authorize the issuance of any options, restricted shares or stock appreciation rights under any of the other plans described below.

The purposes of the 2005 Stock Plan are to facilitate fair, adequate and competitive compensation and to induce certain individuals to remain in the employ of, or to continue to serve as directors of or as independent consultants to the Company and its present and future subsidiaries, to attract new individuals to enter into such employment and service and to encourage such individuals to secure or increase on reasonable terms their stock ownership in the Company. The Board believes that the granting of Awards under the 2005 Stock Plan will promote continuity of management, increased incentive and personal interest in the welfare of the Company and aid in securing its continued growth and financial success.

The 2005 Stock Plan will terminate ten years from its adoption. The Board of Directors may at any time terminate the 2005 Stock Plan or make such modifications to the 2005 Stock Plan as it may deem advisable. The Board, however, may not, without approval by the Stockholders of the Company, increase the number of shares of Common Stock as to which Awards may be granted under the 2005 Stock Plan, change the manner of determining stock option or SAR prices or change the class of persons eligible to participate in the 2005 Stock Plan.

The 2005 Stock Plan is administered by the Compensation Committee consisting of two or more members of the Board. The members of the Compensation Committee are appointed annually by, and serve at the pleasure of, the Board. In the event that no Compensation Committee is appointed, the 2005 Plan shall be administered by the Board.

The Compensation Committee has discretion to determine the participants under the 2005 Stock Plan, the types, terms and conditions of the Awards, including performance and other earnout and/or vesting contingencies, permit transferability of Awards to an immediate family member of a participant or a trust established on behalf of such immediate family member, interpret the 2005 Stock Plan’s provisions and administer the 2005 Stock Plan in a manner that is consistent with its purpose.

10

Under the 2005 Stock Plan, the Compensation Committee may grant Awards in the form of options to purchase shares of Common Stock. All stock options issued under the 2005 Stock Plan are exercisable upon vesting for one share of the Company’s Common Stock. The initial per share exercise price for an incentive stock option may not be less than 100% of the fair market value of a share of Common Stock on the date of grant, or 110% of such fair market value with respect to a participant who, at such time, owns stock representing more than 10% of the total combined voting power of the Common Stock. The initial per share exercise price for a non-incentive stock option may not be less than 100% of the fair market value of a share of Common Stock on the date of grant.

No option granted pursuant to the 2005 Stock Plan may be exercised more than 10 years after the date of grant, except that incentive stock options granted to participants who own more than 10% of the total combined voting power of the Common Stock at the time the incentive stock option is granted may not be exercised more than five years after the date of grant. Any option granted to a non-employee director of the Company or any of its subsidiaries shall be 10 years in duration.

The 2005 Stock Plan also permits the grant of restricted shares of Common Stock, herein referred to as Stock Awards. A Stock Award is a grant of shares or of a right to receive shares of Common Stock (or their cash equivalent or a combination of both) in the future. Each Stock Award will be subject to conditions, restrictions and contingencies established by the Compensation Committee. In making a determination regarding the allocation of such shares, the Compensation Committee may take into account the nature of the services rendered by the respective individuals, their present and potential contributions to the success of the Company and its subsidiaries and such other factors as the Compensation Committee in its discretion shall deem relevant.

The 2005 Stock Plan also permits the grant of stock appreciation rights (“SARs”), which is a grant of the right to receive shares of Common Stock of an aggregate fair market value equal to the value of the SAR. The value of a SAR with respect to one share of Common Stock on any date is the excess of the fair market value of a share on such date over the base value of such SAR. The base value of any SAR with respect to one share of Common Stock shall equal the fair market value of a share of Common Stock as of the date the SAR is granted.

Participants shall not have any interest or voting rights in shares covered by their Awards until the Awards shall have been exercised in the case of options and SARs and the shares shall have vested in the case of Stock Awards. The 2005 Stock Plan also has provisions related to both the payment by the Company of a stock dividend and if a change in control should occur.

On March 22, 2006, the Compensation Committee established a long term incentive award program (the “LTI Program”) intended to promote the retention of certain key underwriters and other employees of the Company. To be eligible for an award consisting of restricted shares of the Company’s Common Stock under the LTI Program, employees should generally have been employed by the Company for at least three years and participate at designated levels in the Company’s employee bonus program. Participation in the LTI Program is at the discretion of the Committee. While awards may be made annually, no employee will generally receive awards in two consecutive years. Shares awarded under the LTI Program are issued pursuant to the 2005 Stock Plan.

2002 STOCK INCENTIVE PLAN

At the May 30, 2002 Annual Meeting, the Stockholders approved the 2002 Stock Incentive Plan (the “2002 Stock Plan”). The Company filed a Registration Statement relating to the 2002 Stock Plan.

Pursuant to the 2002 Stock Plan, the Company may grant to eligible persons awards including, but not limited to, incentive stock options, non-incentive stock options and restricted shares of Common Stock. The 2002 Stock Plan authorized awards relating to an aggregate of up to 1,000,000 shares of Common Stock, of which no more than 100,000 awards may be in the form of restricted stock grants.

The 2002 Stock Plan is administered by the Compensation Committee consisting of two or more members of the Board. The members of the Compensation Committee are appointed annually by, and serve at the pleasure of, the Board. In the event that no Compensation Committee is appointed, the 2002 Stock Plan shall be administered by the Board of Directors.

11

No option granted pursuant to the 2002 Stock Plan may be exercised more than 10 years after the date of grant, except that incentive stock options granted to participants who own more than 10% of the total combined voting power of the Common Stock at the time the incentive stock option is granted may not be exercised more than five years after the date of grant.

As a result of the approval of the 2005 Stock Plan at the May 20, 2005 Annual Meeting of Stockholders, no further options have been or will be issued under the 2002 Stock Plan.

STOCK OPTION PLANS AND STOCK APPRECIATION RIGHTS PLAN

In 1986 and 1987, the Company adopted two stock option plans which allowed for the grant to key employees of the Company, its subsidiaries and affiliates, of options to purchase an aggregate of 900,000 shares of Common Stock. The Company filed a Registration Statement relating to the aggregate of the 900,000 shares of Common Stock which may be issued upon the exercise of options granted or that may be granted under these two plans, an incentive stock option plan and a non-qualified stock option plan (together, the “Stock Option Plans”). The stock options vest at a rate of 25% per year. The Stock Option Plans are administered by the Compensation Committee of the Board. As a result of the approval of the 2002 Stock Plan at the May 30, 2002 Annual Meeting of Stockholders, no further options have been or will be issued under the Stock Option Plans.

In 1996, the Company adopted a phantom stock appreciation rights plan (the “SARs Plan”) which allows for the grant to key employees of the Company and its affiliates of up to 300,000 SARs. The Compensation Committee administers the SARs Plan and approves the employees who will receive grants of the rights. The SARs vest at a rate of 25% per year. Upon exercise of a stock appreciation right, the key employee is entitled to receive cash in an amount equal to the difference between the fair market value of the Common Stock at the exercise date and the exercise price (which shall not be less than 90% of the fair market value of the Common Stock at the date of grant). As a result of the approval of the 2005 Stock Plan at the May 20, 2005 Annual Meeting of Stockholders, no further SARs have been or will be issued under the SARs Plan.

EQUITY COMPENSATION PLAN INFORMATION

The following chart includes information as of December 31, 2005 with respect to equity compensation plans where equity securities of the Company may be issued:

| | | A | | B | | C |

| | | | | | | | | Number of securities |

| | | | | | | | | remaining available for |

| | | Number of securities to | | | | | future issuance under |

| | | be issued upon exercise | | Weighted-average | | equity compensation |

| | | of outstanding stock | | exercise price of | | plans (excluding |

| | | options and vesting of | | outstanding stock | | securities reflected in |

| Plan Category | | unvested stock grants(3) | | options | | column A) |

| Equity compensation plans approved by | | | | | | | | | |

| security holders(1) | | 648,708 | | | $ | 21.85 | | 946,246 | |

| Equity compensation plans not approved by | | | | | | | | | |

| security holders(2) | | 5,000 | | | | | | — | |

| Total | | 653,708 | | | | | | 946,246 | |

____________________

| (1) | Consists of the 2005 Stock Plan, the 2002 Stock Plan and the Stock Option Plans. |

| |

| (2) | Consists of the remaining unvested stock grants under Mr. Hope’s 2002 employment agreement. |

| |

| (3) | Column A includes 99,708 unvested stock grants. |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation Committee has ever been an officer or employee of the Company or of any of its subsidiaries or affiliates. None of our executive officers has served on the board of directors or on the compensation committee of any other entity where any officer of such entity served either on the Company’s Board or on its Compensation Committee.

12

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Board’s Compensation Committee is charged, among other things, to make periodic reviews of the Company’s compensation arrangements with executive officers and to make recommendations to the Board of Directors with respect to such arrangements. The Compensation Committee’s function is more fully described in its charter, which the Board has adopted and is available on our website atwww.navg.com under the Corporate Governance link.

In 2004, the Compensation Committee engaged a nationally recognized executive compensation consultant to provide an extensive analysis of our employee compensation practices, with a particular emphasis on developing a more structured incentive compensation program. Based upon this extensive review, the Compensation Committee, in concert with management, developed a new annual incentive compensation plan which can be used for all employees (the “Annual Incentive Program” or “AIP”). The Annual Incentive Program divides employees into groups which are subject to performance indicators and objectives appropriate for that particular group, based upon responsibilities, skills, and other relevant factors. At the more senior level these objectives are largely related to the Company’s overall performance, whereas at mid-level and lower levels, these objectives are more heavily weighted to business unit and individual performance. Furthermore, at the more senior levels, greater proportions of incentive compensation are paid in Common Stock, vesting over time, rather than in cash. We encourage our employees to own the Company’s stock, and have their equity at risk, so as to focus them on the long term interests of Stockholders. As of December 31, 2005, 170 out of the Company’s 275 employees directly own stock that was either granted to them by the Company or was purchased by them through the Company’s Employee Stock Purchase Plan.

The principal objectives of the Company’s compensation policies are to attract and retain qualified employees and to provide incentives and rewards for such employees to enhance the profitability and growth of the Company and thus lead to long-term enhancement of Stockholder value. The management compensation program currently consists of the following elements: annual payments of salary, the Executive Performance Incentive Plan (which provides for a bonus for designated individuals that will qualify for tax deductibility under section 162(m) of the Code), the Annual Incentive Program, and the 2005 Stock Incentive Plan (which provides for restricted stock grants and the grant of stock options and stock appreciation rights). The following describes components of the Company’s management compensation program for the year ended December 31, 2005 and the related factors considered by the Compensation Committee in determining compensation.

Base Salaries

Base salaries were determined after evaluating a number of factors, including local market conditions, job performance and amounts paid to executives with comparable experience, qualifications and responsibilities at other insurance companies and underwriting management companies. Salary payments were made to compensate ongoing performance throughout the year.

Executive Performance Incentive Plan

The Company’s Executive Performance Incentive Plan currently provides for annual incentive payments to the Chairman and to the President and Chief Executive Officer of the Company based upon the Company’s results. It is intended to provide a direct linkage between Company performance and compensation. The Executive Performance Incentive Plan is administered by the Compensation Committee which selects the key executives of the Company who shall be eligible to receive awards under this plan along with the target and maximum pay-out level, and the performance targets. Under the Executive Performance Incentive Plan, eligible executives may receive up to 150% of their base salary.

Annual Incentive Program

The Company’s AIP awards bonuses to various employees, other than the Chairman and the President and Chief Executive Officer, depending upon each employee’s position of responsibility within the organization. It promotes the Company’s pay-for-performance philosophy by providing such employees with the potential for cash and stock awards. The awards under the AIP are based on corporate performance (including combined ratio, return on equity, change in gross written premium, achievement of budget, and expense reduction), divisional performance and individual performance, with the guidelines established by the Compensation Committee.

13

2005 Stock Incentive Plan

At the May 20, 2005 Annual Meeting, the Stockholders approved the 2005 Stock Plan. This 2005 Plan reflects the evolution of the Compensation Committee’s philosophy in favor of performance-based restricted stock grants over stock options and SARs. We believe that this is in the long term interests of our Stockholders. As a result of the approval of the 2005 Stock Plan, the Compensation Committee has determined that no further awards will be issued under any other approved plan, including the 2002 Stock Plan. The purposes of the 2005 Stock Plan are to facilitate fair, adequate and competitive compensation and to induce certain individuals to remain in the employ of, or to continue to serve as directors or as independent consultants to the Company and its present and future subsidiary corporations, to attract new individuals to enter into such employment and service and to encourage such individuals to secure or increase their stock ownership in the Company.

Benefits

Executive officers also participate in those benefit arrangements which are available to most of our employees, including health and welfare benefit plans, pension plans and a 401(k) plan.

The Compensation Committee reviewed the compensation arrangements of the Chairman and of the President and Chief Executive Officer as follows:

Chairman

The Compensation Committee reviewed the 2005 compensation levels of Terence N. Deeks, the Company’s Chairman, within the context of industry information regarding executives with comparable experience, qualifications and responsibilities at other insurance companies and underwriting management companies. The Compensation Committee also considered local market conditions and job performance, as well as the significant stock ownership position of Mr. Deeks in the Company. Mr. Deeks’ compensation consisted of the following for 2005:

Salary. A base salary of $325,000.

Bonus. Participation in the Executive Performance Incentive Plan. Mr. Deeks received a bonus of $285,000 for 2005, representing a payout of approximately 87.5% under the Executive Performance Incentive Plan. The maximum payout under the Executive Performance Incentive Plan is 150% of base salary. Mr. Deeks will again participate in this plan for 2006.

Stock Grants/ Options/SARs. Mr. Deeks was not awarded any stock grants, stock options, or SARs in 2005.

Benefits. Participation in the Company’s benefit programs which included health and welfare benefit plans, a pension plan and a 401(k) plan.

President and Chief Executive Officer

The Compensation Committee reviewed the 2005 compensation levels of Stanley A. Galanski, President and Chief Executive Officer of the Company. Mr. Galanski’s compensation consisted of the following for 2005:

Salary. A base salary of $400,000. Effective March 1, 2006, Mr. Galanski’s base salary was increased to $500,000.

Bonus. Participation in the Executive Performance Incentive Plan. Mr. Galanski received a bonus for 2005 of $350,000, representing a payout of 87.5% under the Executive Performance Incentive Plan. The maximum payout under the Executive Performance Incentive Plan is 150% of base salary. Mr. Galanski will again participate in this plan for 2006.

Stock Grants/Stock Options/SARs. Mr. Galanski was awarded a stock grant of 100,000 shares of Common Stock in 2001, vesting in four annual 25,000 share increments. During 2005, the fourth 25,000 share increment vested. Mr. Galanski elected to accept 16,500 shares with the economic equivalent of the balance being used by him to satisfy applicable withholding obligations. Mr. Galanski was awarded stock options in February 2004 to purchase 30,000 shares of Common Stock at $29.11 per share. The stock options vest at the rate of 25% per year. During 2005, the first 7,500 stock options vested. Mr. Galanski was awarded a stock grant in December 2004 of 13,793 shares of Common Stock, the equivalent of $400,000, valued based on the closing price of the Common Stock on the grant

14

date. The December 2004 stock grant vested 50% upon issuance and 50% on January 1, 2006. Of the 6,896 shares that vested on January 1, 2006, Mr. Galanski elected to accept 4,456 shares with the economic equivalent of the balance being used by him to satisfy applicable withholding obligations.

Benefits. Participation in the Company’s benefit programs which included health and welfare benefit plans, a pension plan and a 401(k) plan.

In setting Mr. Galanski’s compensation package, a number of factors were considered, including: (i) the unique skills and experience of Mr. Galanski; (ii) total compensation of senior executives at other insurance companies and underwriting management firms; and (iii) the importance of Mr. Galanski, at the time such package was set, to the continued growth, success, and future of the Company, and the need to provide him with a significant incentive as well as to motivate him and retain his services as President and Chief Executive Officer. In addition to these factors, Mr. Galanski’s compensation package was designed to be consistent with the Company’s compensation policies, notably payment for performance. Since Mr. Galanski joined the Company in 2001, the Company’s earnings per share have increased from $.84 to $1.73, its book value per share has increased from $17.05 to $28.30, and its share price has increased from $13.31 to $43.61. (All figures are as of December 31, 2000 and December 31, 2005, respectively.) Also, see the Five Year Performance Graph included herein.

The Compensation Committee will continue to evaluate the Company’s management compensation program on an ongoing basis to assure that the Compensation Committee’s compensation policies are consistent with the objective of enhancing Stockholder value. Under section 162(m) of the Code, effective in 1994, annual compensation in excess of $1.0 million paid to the chief executive officer or any of the four other highest compensated officers of any publicly held corporation will not be deductible in certain circumstances. Generally, “performance-based” compensation, as defined in section 162(m), is not subject to the limitation if certain requirements are satisfied. The Compensation Committee intends to structure the Company’s annual incentive plan for executive officers so that such compensation qualifies as performance-based compensation under section 162(m). However, the Compensation Committee may award compensation that is not fully deductible if it determines that such an award is consistent with the Company’s compensation philosophy and in the best interests of the Company and its Stockholders.

| The Compensation Committee: |

| H. J. Mervyn Blakeney |

| Leandro S. Galban, Jr. (Chairman) |

| John F. Kirby |

15

AUDIT COMMITTEE REPORT

The Audit Committee of the Board is responsible for providing independent, objective oversight of the Company’s accounting functions, internal controls and financial reporting process. The Audit Committee is composed of three directors, each of whom meets the independence requirements of the NASDAQ stock market and the SEC. The Audit Committee operates under a written charter approved by the Board, which was reviewed in 2005.

The Company’s management is responsible for the internal controls and financial reporting process. The independent registered public accounting firm KPMG LLP is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with generally accepted accounting principles and to issue a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes.

In connection with these responsibilities, the Audit Committee met with management and the independent auditors to discuss the audited December 31, 2005 financial statements. The Audit Committee also discussed with the independent auditors the matters required by Statement on Auditing Standards No. 61,Communication with Audit Committees, as currently in effect. The Audit Committee also received written disclosures from the independent auditors required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees, as currently in effect, and the Audit Committee discussed with the independent auditors that firm’s independence.

The Audit Committee also reviewed, and discussed with management and KPMG LLP, management’s report and KPMG LLP’s report and attestation on internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act of 2002. Management is responsible for those activities required to ensure compliance with this legislation.

Based upon the Audit Committee’s discussions with management and the independent auditors, and the Audit Committee’s review of the representations of management, the Audit Committee recommended that the Board of Directors include the audited consolidated financial statements in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, to be filed with the SEC.

| The Audit Committee: |

| Peter A. Cheney |

| Robert W. Eager, Jr. |

| Robert F. Wright (Chairman) |

16

PROPOSAL 2

AMENDMENT OF THE COMPANY’S RESTATED CERTIFICATE OF INCORPORATION TO

INCREASE THE NUMBER OF AUTHORIZED SHARES OF THE COMPANY’S COMMON STOCK

The Company’s Board of Directors has adopted, and recommends that Stockholders approve at the Annual Meeting of Stockholders, a proposal to amend ARTICLE FOURTH of the Company’s Restated Certificate of Incorporation to increase the number of authorized shares of Common Stock of the Company from 20,000,000 shares to 50,000,000 shares. The Board of Directors believes that the proposed amendment to the Restated Certificate of Incorporation shown below is in the best interests of the Company and its Stockholders. The proposed amendment reads in its entirety as follows:

| | “ARTICLE FOURTH: The total number of shares of capital stock which the Corporation is authorized to issue shall be 51,000,000, of which 50,000,000 shall be shares of Common Stock having par value of $.10 per share and 1,000,000 shall be shares of Preferred Stock having par value of $.10 per share.” |

As of April 4, 2006, approximately 16.7 million shares of Common Stock were issued and outstanding and approximately 1.7 million unissued shares were reserved for issuance under the Company’s 2005 Stock Plan, 2002 Stock Plan, the Stock Option Plans, and other compensation arrangements, and the Employee Stock Purchase Plan leaving approximately 1.6 million shares of Common Stock unissued and unreserved. As of April 4, 2006, none of the Company’s 1,000,000 shares of authorized Preferred Stock have been issued.

The Board of Directors believes that increasing the number of authorized shares of Common Stock will enhance the Company’s flexibility to react quickly to today’s competitive, fast-changing environment. Additional shares of Common Stock will be available in the event the Board of Directors determines that it is necessary or appropriate to raise additional capital through the sale of equity securities, to acquire another company or its assets, to establish strategic relationships with corporate partners, to provide equity incentives to employees and officers, to permit future stock splits in the form of stock dividends or for other corporate purposes.

If the proposed amendment is approved by the Stockholders, the Board of Directors may issue such additional shares without soliciting further Stockholder approval, except as may be required by applicable law. The additional shares, when issued, will have the same voting and other rights as the Company’s currently authorized Common Stock. Stockholders shall not have any preemptive rights to subscribe for additional shares of stock.

The increase in the authorized number of shares of Common Stock and the subsequent issuance of such shares could have the effect of delaying or preventing a change in control of the Company without further action by the Stockholders. Shares of authorized and unissued Common Stock could, within the limits imposed by applicable law, be issued in one or more transactions which would make a change in control of the Company more difficult, and therefore less likely. Any such issuance of additional stock could have the effect of diluting the earnings per share and book value per share of outstanding shares of Common Stock and such additional shares could be used to dilute the stock ownership or voting rights of a person seeking to obtain control of the Company. While it may be deemed to have potential anti-takeover effects, the proposed amendment to increase the authorized Common Stock is not prompted by any specific effort or takeover threat currently perceived by management.

Approval of this proposal requires the affirmative vote of the holders of at least a majority of the voting power of all outstanding shares of Common Stock. Abstentions and broker non-votes will be counted as present for purposes of determining if a quorum is present but will not be counted as an affirmative vote for this proposal. Therefore, abstentions and broker non-votes will have the effect of a vote against this proposal.

The Company does not have any current intentions, plans, arrangements, commitments or understandings to issue any shares of its capital stock except in connection with its existing 2005 Stock Plan, 2002 Stock Plan, the Stock Option Plans, and other stock compensation arrangements and its Employee Stock Purchase Plan. If approved, this proposal will become effective upon the filing of a Certificate of Amendment to the Restated Certificate of Incorporation with the Secretary of State of the State of Delaware containing substantially this amendment, which the Company intends to do promptly after the Annual Meeting.

The Board recommends a vote “FOR” Proposal 2. Proxies will be so voted unless Stockholders specify otherwise in their proxies.

17

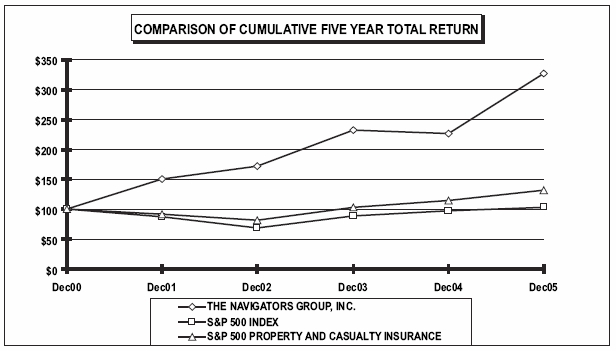

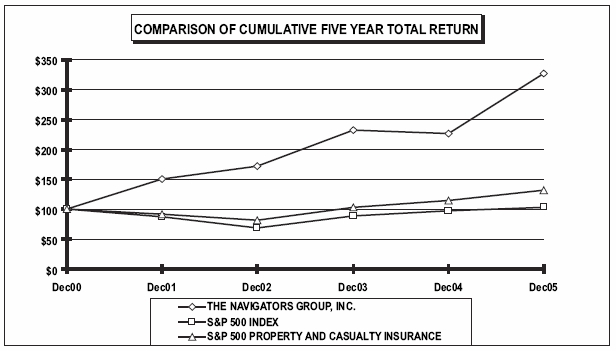

FIVE YEAR PERFORMANCE GRAPH

The comparison of five year cumulative returns among the Company, the companies listed in the Standard & Poor’s 500 Index (“S&P 500 Index”) and the S&P Property & Casualty Insurance Index (“Insurance Index”) is as follows:

| | | | | INDEXED RETURNS |

| | | | | | | Years Ending | | |

| | | Base | | | | | | | | | | |

| | | Period | | | | | | | | | | |

| Company / Index | | Dec00 | | Dec01 | | Dec02 | | Dec03 | | Dec04 | | Dec05 |

| The Navigators Group, Inc. | | 100 | | 150.99 | | 172.39 | | 231.89 | | 226.18 | | 327.59 |

| S&P 500 Index | | 100 | | 88.11 | | 68.64 | | 88.33 | | 97.94 | | 102.75 |

| S&P 500 P&C Insurance Index | | 100 | | 91.98 | | 81.85 | | 103.46 | | 114.24 | | 131.51 |

The Stock Performance Graph, as presented above, which was prepared with the aid of Standard & Poor’s, reflects the cumulative return on the Company’s Common Stock, the S&P 500 Index and the Insurance Index, respectively, assuming an original investment in each of $100 on December 31, 2000 (the “Base”) and reinvestment of dividends to the extent declared. Cumulative returns for each year subsequent to 2000 are measured as a change from this Base.

18

PROPOSAL 3

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

KPMG LLP, Certified Public Accountants, has been appointed by the Board, upon the recommendation of the Audit Committee after evaluating the performance and independence of KPMG LLP, as independent auditors for the Company to examine and report on its December 31, 2006 financial statements, which appointment will be submitted to the Stockholders for ratification at the Meeting. Submission of the appointment of the auditors to the Stockholders for ratification will not limit the authority of the Board or its Audit Committee to appoint another accounting firm to serve as independent auditors if the present auditors resign or their engagement is otherwise terminated.

The Board recommends a vote “FOR” Proposal 3.Proxies will be so voted unless Stockholders specify otherwise in their proxies.

Representatives of KPMG LLP are expected to be present at the Annual Meeting, with the opportunity to make a statement if they desire to do so, and to be available to respond to appropriate questions. The following table presents fees for professional audit services rendered by KPMG LLP for the audit of the Company’s annual financial statements for 2005 and 2004, and fees billed for other services rendered by KPMG LLP related to those periods.

| | 2005 | | 2004 |

| Audit Fees(1) | $ | 1,820,410 | | $ | 2,172,122 |

| Audit Related Fees(2) | | 163,428 | | | — |

| Tax Fees(3) | | 136,593 | | | 186,070 |

| Total | $ | 2,120,431 | | $ | 2,358,192 |

| (1) | Audit fees consisted primarily of fees for the annual audit of the Company’s financial statements and internal control over financial reporting including the requirements of Section 404 of the Sarbanes-Oxley Act, as well as quarterly reviews and statutory audits. |

| |

| (2) | Audit related fees consisted primarily of services in connection with registration statements and the issuance of related consents and comfort letters. To a lesser extent, the audit related fees consisted of the review of the Company’s response to a comment letter received from the Securities and Exchange Commission relating to the 2004 Form 10-K, which process concluded in February 2006. |

| |

| (3) | Tax fees consisted primarily of tax compliance and advisory services. |

The Audit Committee approves each engagement of the independent auditors in advance. The Audit Committee’s chairperson has been authorized to approve such services subject to ratification at the next Audit Committee meeting.

ALL OTHER MATTERS WHICH MAY PROPERLY

COME BEFORE THE ANNUAL MEETING

Management does not know of any other matters to be brought before the Annual Meeting except those set forth in the notice thereof. If other business is properly presented for consideration at the Annual Meeting, it is intended that the proxies will be voted by the persons named therein in accordance with their judgment on such matters.

STOCKHOLDER APPROVAL

The presence of the holders of a majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting, whether in person or represented by proxy, is necessary to constitute a quorum. Abstentions are counted as present and entitled to vote for purposes of determining a quorum. With respect to Proposal 1, directors are elected by the affirmative vote of a plurality of the votes cast by the shares entitled to vote. Votes may be cast in favor or withheld; votes that are withheld will have no effect on the results. Approval of Proposal 2 requires the

19

affirmative vote of the holders of the majority of the voting power of all outstanding shares of Common Stock and approval of Proposal 3 requires the affirmative vote of the holders of a majority of the total number of shares of Common Stock represented at the Annual Meeting. Abstentions are not counted as votes “for” or “against” these proposals and therefore will have the effect of a vote against Proposals 2 and 3 but will have no effect on Proposal 1. Shares held by brokers as nominees or in “street name” for which the broker does not have discretionary authority to vote and has not received specific instructions on how to vote from the customer are not voted and are referred to as “broker non-votes”. Shares that are the subject of broker non-votes will be counted as shares not entitled to vote and therefore will have no effect on the outcome of Proposals 1 and 3, but will have the effect of a vote against Proposal2. Stockholders are entitled to one vote per share on all matters submitted for consideration at the Annual Meeting.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than 10% of our Common Stock, to file certain reports regarding the ownership of the Common Stock with the SEC. These insiders are required by the SEC’s regulations to furnish the Company with copies of all Section 16(a) forms they file. To our knowledge, based solely on review of the copies of such reports furnished to us and written representations that no reports were required, all of our directors, executive officers and 10% Stockholders made all required filings on time except for one late Form 4 filing by each of Messrs. Eisdorfer, Malvasio, Margarella and Wiley and Ms. Keller. The filings all related to stock grants (aggregating 7,421 shares) which were granted by the Company’s Compensation Committee as part of each person’s 2004 bonus. In addition, there was one late Form 3 filing by Mr. Orol disclosing his employment with the Company.

We have adopted a code of business conduct and ethics, referred to as our Corporate Code of Ethics and Conduct, that applies to all employees, officers and directors and meets the requirements of the rules of the SEC and of the NASDAQ. In addition, we have adopted a Code of Ethics that applies to our Chief Executive Officer and our senior financial officers which meets the SEC requirements. Both the Corporate Code of Ethics and Conduct and the Code of Ethics are available on our website atwww.navg.com under the Corporate Governance link. Any amendments to or waiver of the Corporate Code of Ethics and Conduct and the Code of Ethics will be disclosed on our website under the same link promptly following the date of such amendment or waiver. In addition, in accordance with NASDAQ listing requirements, the Company also intends to disclose on a Form 8-K any waivers from the Corporate Code of Ethics and Conduct that are granted to directors and executive officers.

ABSENCE OF DISSENTERS’ OR APPRAISAL RIGHTS

Under Section 262 of the Delaware General Corporation Law, Stockholders have the right to dissent from certain corporate actions. In such cases, dissenting Stockholders are entitled to have their shares appraised and be paid the fair value of their shares provided that certain procedures perfecting their rights are followed. The proposals described in this Proxy Statement do not entitle a Stockholder to exercise any such dissenters’ or appraisal rights.

STOCKHOLDERS’ PROPOSALS AND COMMUNICATIONS

Any proposal by a Stockholder of the Company intended to be presented at the 2007 Annual Meeting of Stockholders must be received by the Company at its principal executive office no later than December 15, 2006 for inclusion in the Company’s proxy statement and form of proxy relating to that meeting. Any such proposal must also comply with the other requirements of the proxy solicitation rules of the SEC.

The Board of Directors believes that it is important for Stockholders to have a process to send communications to the Board. Accordingly, Stockholders desiring to send a communication to the Board, or to a specific director, may do so by delivering a letter to the Secretary of the Company at c/o Corporate Secretary, The Navigators Group, Inc., Reckson Executive Park, 6 International Drive, Rye Brook, New York 10573. The mailing envelope must contain a clear notation indicating that the enclosed letter is a “Stockholder-Board Communication” or “Stockholder-Director Communication-name of specific director or directors”. All such letters must identify the author as a Stockholder and clearly state whether the intended recipients of the letter are all members of the Board or certain specified individual directors. The Secretary of the Company will open such communications and make copies, and then circulate them to the appropriate director or directors.

20

FORM 10-K ANNUAL REPORT

UPON WRITTEN REQUEST BY A STOCKHOLDER, WE WILL FURNISH THAT PERSON, WITHOUT CHARGE, A COPY OF THE ANNUAL REPORT ON FORM 10-K FOR 2005 WHICH IS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION, INCLUDING THE FINANCIAL STATEMENTS AND SCHEDULES THERETO. The Form 10-K Annual Report for 2005 provided to Stockholders will not include the documents listed in the exhibit index of the Form 10-K. Upon written request, we will furnish to the Stockholder copies of any exhibits for a nominal charge. Requests should be addressed to The Navigators Group, Inc., Attn: Gail Kalter, Investor Relations Department, Reckson Executive Park, 6 International Drive, Rye Brook, New York 10573. In addition, we make available through our website atwww.navg.com under the Financial Information link, free of charge, our Annual Report on Form 10-K including exhibits, quarterly reports on Form 10-Q including exhibits, current reports on Form 8-K including exhibits, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC.

SOLICITATION AND EXPENSES OF SOLICITATION

Our officers and employees may solicit proxies. Proxies may be solicited by personal interview, mail and telephone. Brokerage houses and other institutions, nominees and fiduciaries will be requested to forward solicitation material to the beneficial owners of Common Stock, and will be reimbursed for their reasonable out-of-pocket expenses in forwarding such solicitation material. The costs of preparing this Proxy Statement and all other costs in connection with the solicitation of proxies for the Annual Meeting of Stockholders are being borne by the Company. It is estimated that said costs will be nominal.

Your cooperation in giving this matter your immediate attention and in returning your proxy promptly will be appreciated.

| By Order of the Board of Directors,

|

|  |

| BRADLEYD. WILEY |

| Secretary |

New York, New York

April 27, 2006

21

THE NAVIGATORS GROUP, INC.

6 INTERNATIONAL DRIVE

ATTN: CORPORATE SECRETARY

RYE BROOK, NY 10573

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to The Navigators Group, Inc., c/o ADP, 51 Mercedes Way, Edgewood, NY 11717.

| | | |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | NAVGT1 | KEEP THIS PORTION FOR YOUR RECORDS |

| |

| | | DETACH AND RETURN THIS PORTION ONLY |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

THE NAVIGATORS GROUP, INC.

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

|

| 1. | Election of Directors: | | | | | | | | | |

| Nominees – | | | | For

All | Withhold

For All | For All

Except | | To withhold authority to vote for any individual nominee, mark “For All Except” and write number(s) of nominee(s) on the line below. | |

| (1) H.J. Mervyn Blakeney | (6) Leandro S. Galban, Jr. |

| | (2) Peter A. Cheney | | (7) John F. Kirby | | | | | | |

| | (3) Terence N. Deeks | | (8) Marc M. Tract | | | | | | |

| | (4) Robert W. Eager, Jr. | | (9) Robert F. Wright | | ¨ | ¨ | ¨ | | |

| | (5) Stanley A. Galanski | | | | | | | | | | | |

| | | | | | | | | | | For | Against | Abstain |

| | The Board of Directors Recommends a Vote FOR PROPOSAL 1. | | | | |

| | | | | | | | | | | | | |

| 2. | Amendment of Restated Certificate of Incorporation to increase the number of authorized shares of the Company's Common Stock. | | ¨ | ¨ | ¨ |

| | | | | | | | | | | | | |

| | The Board of Directors Recommends a Vote FOR PROPOSAL 2. | | | | |

| | | | | | | | | | | | | |

| 3. | Ratification of the appointment of KPMG LLP as the Company’s independent registered public accounting firm for 2006. | | ¨ | ¨ | ¨ |

| | | | | | | | | | | | | |

| | The Board of Directors Recommends a Vote FOR PROPOSAL 3. | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Please sign this Proxy Form which is solicited on behalf of the Board of Directors, and return it promptly in the enclosed postage prepaid envelope. Please sign exactly as name appears hereon. | | | | | | | | | |

| | Yes | | No | | | |

HOUSEHOLDING ELECTION - Please indicate if you consent to receive certain future investor communications in a single package per household. | | | | | | | |

| | ¨ | | ¨ | | | |

| | | | | | | |

| | | | | | |

| | | | |

| |

| Signature [PLEASE SIGN WITHIN BOX] | Date | | Signature (Joint Owners) | Date | |

THE NAVIGATORS GROUP, INC.

One Penn Plaza

New York, New York 10119

PROXY FOR THE MAY 31, 2006 ANNUAL MEETING OF STOCKHOLDERS

Elliot S. Orol and Bradley D. Wiley, or any one of them, with power of substitution, are hereby authorized as proxies to represent and to vote the shares of the undersigned at the Annual Meeting of Stockholders of The Navigators Group, Inc. to be held at 10:00 a.m., Wednesday, May 31, 2006, at the Doral Arrowwood, 975 Anderson Hill Road, Rye Brook, New York 10573, and at any adjournment thereof. The proxies are to vote the shares of the undersigned as instructed on the reverse side and in accordance with their judgment on all other matters which may properly come before the Annual Meeting.

IF NOT OTHERWISE SPECIFIED, THIS PROXY WILL BE VOTED FOR THE ELECTION OF ALL DIRECTOR NOMINEES AND FOR PROPOSALS 2 AND 3.

(Continued and to be signed on the reverse side.)