QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on May 27, 2004

Registration No. 333-114335

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

POSTER FINANCIAL GROUP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 7990 | | 56-2370836 |

(State or Other Jurisdiction of

Organization or Incorporation) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

129 East Fremont Street

Las Vegas, Nevada 89101

(702) 385-7111

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant's Principal Executive Offices)

SEE TABLE OF ADDITIONAL REGISTRANTS

Joanne M. Beckett, Esq.

Senior Vice President and General Counsel

Poster Financial Group, Inc.

129 East Fremont Street

Las Vegas, Nevada 89101

(702) 385-7111

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

With a copy to:

Phyllis G. Korff, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New York, New York 10036-6522

(212) 735-3000

Approximate Date of Commencement of Proposed Sale to the Public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment is filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to the said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

Name of Additional Registrant*

| | State or Other

Jurisdiction of

Incorporation or

Formation

| | Primary Standard

Industrial

Classification

Code Number

| | I.R.S. Employer

Identification

Number

|

|---|

| GNLV, CORP. | | Nevada | | 7990 | | 88-0135579 |

| GNL, CORP. | | Nevada | | 7990 | | 88-0237066 |

| Golden Nugget Experience, LLC | | Nevada | | 7990 | | 88-0462234 |

- *

- Addresses and telephone numbers of principal executive offices are the same as those of Poster Financial Group, Inc.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated May 27, 2004

PROSPECTUS

Poster Financial Group, Inc.

Offer to exchange $155,000,000 aggregate principal amount of 83/4% Senior Secured Notes due 2011 (CUSIP Nos. 73751N AA 5 and U7317T AA 4) for $155,000,000 aggregate principal amount of 83/4% Senior Secured Notes due 2011, which have been registered under the Securities Act of 1933, as amended

The exchange offer will expire at midnight, New York City time, on , 2004, unless Poster Financial Group, Inc. extends the exchange offer in its sole and absolute discretion

Terms of the exchange offer:

- •

- We will exchange the new notes to be issued for all outstanding old notes that are validly tendered and not withdrawn pursuant to the exchange offer.

- •

- The new notes will be our senior secured obligations and will be guaranteed on a senior secured basis by all our restricted subsidiaries. The new notes and new guarantees will rank equally in right of payment with all our and our guarantors' existing and future senior indebtedness and will rank senior in right of payment to all our and our guarantors' future subordinated indebtedness. The new notes and new guarantees will be secured by a pledge of capital stock of our restricted subsidiaries and a security interest in substantially all of our and our guarantors' current and future assets that will be junior to the security interest granted to the lenders under our credit facility. As a result, in the event that the lenders under our credit facility exercise their rights with respect to our or our guarantors' assets that are pledged to secure our or our guarantors' obligations under the credit facility, the proceeds of the liquidation of these assets will first be applied to repay obligations secured by liens under our credit facility before the notes are repaid.

- •

- You may withdraw tenders of old notes at any time prior to the expiration of the exchange offer.

- •

- The terms of the new notes are substantially identical to those of the old notes, except that the transfer restrictions and registration rights relating to the old notes will not apply to the new notes.

- •

- The exchange of old notes for notes will not be a taxable transaction for U.S. federal income tax purposes, but you should see the discussion under the heading "Material U.S. Federal Tax Consequences."

- •

- Neither we nor any of the guarantors will receive any cash proceeds from the exchange offer.

- •

- We issued the old notes in a transaction not requiring registration under the Securities Act, and as a result, their transfer is restricted. We are making the exchange offer to satisfy your registration rights as a holder of the old notes.

See "Risk Factors" beginning on page 18 for a discussion of risks you should consider prior to tendering your outstanding old notes for exchange.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. Neither the Nevada Gaming Commission nor the Nevada State Gaming Control Board has passed upon the accuracy or adequacy of this prospectus or the investment merits of the notes being offered by this prospectus.

Prospectus dated , 2004

TABLE OF CONTENTS

| Summary | | 1 |

| Risk Factors | | 18 |

| Forward-Looking Statements | | 32 |

| Market and Industry Data | | 32 |

| The Exchange Offer | | 33 |

| Use of Proceeds | | 40 |

| Capitalization | | 40 |

| Unaudited Pro Forma Condensed Consolidated Financial Data | | 41 |

| Selected Historical Consolidated Financial Data of Poster Financial and the Golden Nugget Group (Predecessor Company) | | 48 |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | | 52 |

| Business | | 70 |

| Regulation | | 84 |

| Management | | 91 |

| Security Ownership of Certain Beneficial Owners and Management | | 97 |

| Certain Relationships and Related Party Transactions | | 99 |

| Description of Certain Indebtedness and Other Obligations | | 100 |

| Description of the Notes | | 101 |

| Material U.S. Federal Tax Consequences | | 153 |

| Plan of Distribution | | 157 |

| Legal Matters | | 158 |

| Experts | | 158 |

| Where You Can Find More Information | | 158 |

| Index to Financial Statements | | F-1 |

This prospectus contains summaries of the material terms of certain documents. Copies of these documents, except for certain exhibits and schedules, will be made available to you without charge upon written or oral request to us. Requests for documents or other additional information should be directed to Poster Financial Group, Inc., 129 East Fremont Street, Las Vegas, Nevada 89101, Attention: General Counsel, telephone (702) 385-7111.To obtain timely delivery of documents or information, we must receive your request no later than five (5) business days before the expiration date of the exchange offer.

ii

SUMMARY

The following summary highlights information about us and the exchange offer. It is not complete and does not contain all of the information that may be important to you in making a decision to exchange your old notes for new notes. For a more complete understanding of us and the exchange offer, we urge you to read this entire prospectus carefully, including the "Risk Factors" section, the financial statements included herein, the notes to those statements and the documents to which we have referred you. In this prospectus, unless the context requires otherwise, the terms the "Company," "we," "us," and "our" refer to Poster Financial Group, Inc. and its subsidiaries and the terms "issuer" and "Poster Financial" refer only to Poster Financial Group, Inc. and not its subsidiaries. In this prospectus, our parent company, PB Gaming, Inc., is referred to as "PB Gaming." In this prospectus, "old notes" refers to the 83/4% Senior Secured Notes due 2011 issued on December 3, 2003, "new notes" refers to the 83/4% Senior Secured Notes due 2011 offered hereby and "notes" refers to both the old notes and the new notes.

The Company

We own and operate the Golden Nugget hotel-casinos in Las Vegas and Laughlin, Nevada, which are referred to in the prospectus as the "Golden Nugget—Las Vegas" and the "Golden Nugget—Laughlin," respectively. The following table sets forth information about each of the Golden Nugget properties:

Property

| | Slot

Machines

| | Table

Games

| | Casino

Space

(square feet)

| | Hotel Rooms

|

|---|

| Golden Nugget—Las Vegas | | 1,260 | | 58 | | 35,000 | | 1,907 |

| Golden Nugget—Laughlin | | 1,042 | | 12 | | 32,000 | | 300 |

| | |

| |

| |

| |

|

| Total | | 2,302 | | 70 | | 67,000 | | 2,207 |

| | |

| |

| |

| |

|

We believe that the Golden Nugget brand name is one of the most recognized in the gaming industry and we expect to continue to capitalize on the strong name recognition and high level of quality and value associated with it. With our long-standing commitment to quality and service, the Golden Nugget—Las Vegas has received the prestigious AAA Four Diamond Award, awarded by the American Automobile Association, a North American motoring and leisure travel organization, for 27 consecutive years. This award was given to approximately 992 of the approximately 30,000 eligible lodging establishments in the United States evaluated by the AAA in 2004. According to the AAA, establishments that receive the AAA Four Diamond Award are upscale in all areas and offer an extensive array of amenities and a high degree of hospitality, service and attention to detail.

We target out-of-town customers at both of our properties while also catering to the local customer base. We believe that the Golden Nugget—Las Vegas is the leading downtown destination for out-of-town customers. The property offers the same complement of services as our Las Vegas Strip competitors, but we believe that our customers prefer the boutique experience we offer and the downtown environment. We emphasize the property's wide selection of amenities and provide a luxury room product and personalized services at an attractive value. We have also increased our use of table and slot hosts to provide more personalized customer service and to attract higher-end players to the property. At the Golden Nugget—Laughlin, we focus on providing a high level of customer service, a quality dining experience at an appealing value, a slot product with highly competitive pay tables and a superior player rewards program. We recently implemented higher casino odds and raised betting limits at both our properties in order to energize the Golden Nugget brand and elevate our gaming profile.

We acquired the Golden Nugget properties from MGM MIRAGE on January 23, 2004. As a smaller, more focused company than MGM MIRAGE, we have been able to streamline management decision-making, particularly because our senior management and majority stockholders are physically

1

present at the Golden Nugget—Las Vegas and because the Golden Nugget properties are now operated as a stand-alone business seperate from MGM MIRAGE. We expect that this will enable us to react more quickly to marketing opportunities and will shorten the time required to develop and implement our programs. We have begun to seek increased operating efficiencies between the Golden Nugget properties in areas such as advertising, purchasing, human resources and through departmental consolidations. We utilize our extensive customer databases at the properties to develop business strategies and marketing initiatives for our business. In addition, we have begun to implement unique and focused marketing campaigns to increase awareness of the Golden Nugget brand and generate increased customer visits. We have also begun to implement initiatives to cross-sell the properties, conduct joint sales initiatives and create and market vacation packages that include both destinations.

Our principal executive offices are located at 129 East Fremont Street, Las Vegas, Nevada 89101, and our telephone number is (702) 385-7111. The Web site addresses of the Golden Nugget—Las Vegas and the Golden Nugget—Laughlin arewww.goldennugget.com andwww.gnlaughlin.com, respectively. The information on these Web sites is not a part of this prospectus and the Website addresses are provided for informational purposes only.

Golden Nugget—Las Vegas

Property Overview

The 1,907-room Golden Nugget—Las Vegas is the largest, by number of guestrooms and suites, and, we believe, the most luxurious hotel-casino in downtown Las Vegas. The casino contains 1,260 slot machines and 58 table games, as well as a race and sports book. The property, together with its two stand-alone parking facilities comprised of over 1,000 parking spaces, occupies approximately seven and one-half acres. The Golden Nugget—Las Vegas has five award-winning restaurants, spa and salon facilities, a 400-seat showroom, an entertainment lounge, an outdoor pool, meeting and banquet facilities, a Starbucks store and two retail facilities. The property has benefited from The Fremont Street Experience, an entertainment and special events venue that opened in December 1995, and from a series of capital improvements to the property completed in 2001 and 2002.

Downtown Las Vegas

The downtown Las Vegas gaming market consists of over 510,000 square feet of casino space and includes 13 hotel-casinos with approximately 8,110 hotel rooms. The Golden Nugget—Las Vegas accounts for approximately 6.9% of the total casino space and 23.5% of the total hotel inventory in downtown Las Vegas. In 2003, the downtown Las Vegas market generated approximately $658.0 million of gaming revenues, of which the casino revenues of the Golden Nugget—Las Vegas accounted for approximately 18.5%.

We are poised to take advantage of the many recent and projected developments that we expect will continue to drive additional traffic downtown, such as those described below.

- •

- The Fremont Street Experience.The Fremont Street Experience is a unique entertainment attraction located in the center of downtown Las Vegas on Fremont Street, where the Golden Nugget—Las Vegas is located. This attraction converted Fremont Street into a five-block-long pedestrian mall, topped with a 90-foot by 1,400-foot special effects canopy 90 feet above the mall. Over 25,000 visitors daily watch the sound and light shows and enjoy many of the special events and amenities offered at The Fremont Street Experience, such as car shows, motorcycle festivals, boxing matches, live concerts, street performers and various merchandise vendors. In the second quarter of 2004, the four-block celestial vault that currently contains 2.1 million lights is expected to be upgraded to the newest light emitting diode (LED) technology featuring over 12 million lights. We expect to benefit from increased visitors as a result of heightened national and local promotion of The Fremont Street Experience upon completion of the upgrade. The

2

Business Strategy

Our goal at the Golden Nugget—Las Vegas is to maintain the property's position as the leading downtown destination for out-of-town customers. Customer satisfaction and loyalty are critical components of our strategy. We work to create the best possible gaming and entertainment experience for our customers by providing comfortable and attractive surroundings with attentive service from friendly and experienced employees. In addition, we emphasize the property's wide selection of amenities, including its high-quality room and suite products, spa, salon, pool, meeting and banquet facilities, special events and entertainment and fine dining. By providing a luxury room product and services at an appealing value to customers, we expect to continue to maintain our competitive advantages, generate increased customer visits and maintain room occupancy rates above industry averages. We intend to continue to leverage the more than 25,000 daily visitors to The Fremont Street Experience by attracting them to our property and retaining them as customers.

Our business strategy for the Golden Nugget—Las Vegas includes the following:

- •

- Emphasize slot play, the most consistently profitable element of the property's gaming business, and the property's rewards program to drive growth in our slot revenues and to continue to provide the newest gaming equipment and fastest service to our slot players;

- •

- Incorporate "ticket-in/ticket-out" technology in our slot machines, a ticket-based system in which slot machines and players utilize printed tickets instead of cash, to improve customer satisfaction, expand functionality of our machines and generate operational efficiencies;

- •

- Enhance our table game operations by continuing to market our table games through special events, such as card tournaments and golf and sports-related outings; by providing preferred

3

Capital Improvements

During 2001 and 2002, several significant capital improvement projects were completed at the Golden Nugget—Las Vegas at a cost of approximately $30.0 million, and an additional $11.0 million was spent on repair and maintenance during that period. These projects included the remodeling of all standard rooms and guest hallways, including 423 rooms in the North Tower that were completed in 2001 and 1,382 rooms in the South Tower that were completed in 2002. In addition, the pool was completely updated, the convention level was remodeled, a full-service business center was opened and two of the Penthouse suites were remodeled. Additions and upgrades to the property's dining and nightlife options include ZAX, the new award-winning 115-seat restaurant that opened in mid-2002 and Claude's Bar, which was upgraded in late 2002. Maintenance and repair costs at the Golden Nugget—Las Vegas were approximately $7.3 million in 2003.

Golden Nugget—Laughlin

Property Overview

The Golden Nugget—Laughlin is located on approximately 13 acres with 600 feet of Colorado River frontage near the center of the tourist strip in Laughlin, Nevada, 90 miles south of Las Vegas. The Golden Nugget—Laughlin contains over 1,000 slot machines, 12 table games and 300 hotel rooms. In addition to its casino and hotel facilities, the Golden Nugget—Laughlin features five dining options, a variety of bars and retail shops, a nightclub, a Swenson's Ice Cream Shop and a Starbucks store. Other amenities at the Golden Nugget—Laughlin include a swimming pool, a parking garage with over 1,390 spaces, and approximately four and one-half acres of recreational vehicle surface parking, which can be used for future commercial development. The Golden Nugget—Laughlin also owns and operates a 78-room motel in Bullhead City, Arizona, across the Colorado River from the property.

The Laughlin gaming market, excluding a Native American hotel-casino, consists of nine hotel-casinos with approximately 458,000 square feet of casino space and approximately 10,800 hotel and motel rooms. In 2003, the Laughlin market generated $553.3 million of gaming revenues.

Business Strategy

Our strategy at the Golden Nugget—Laughlin is to provide a high level of customer service, an attractive property, a quality dining experience at an appealing value, a slot product with highly competitive pay tables and a superior player rewards program. The property's intimate size facilitates contact with players by property management, including those at the most senior levels. We focus on making our dining options a point of differentiation for the property, including our new waterfront restaurant, The Deck, which is one of the only indoor/outdoor dining options in Laughlin. The property also currently has the only Starbucks store in Laughlin. We intend to continue to maintain quality service and product offerings consistent with the reputation of the Golden Nugget brand which, combined with an active events calendar, we expect will keep high-value guests returning and will introduce new guests to the property.

Our business strategy for the Golden Nugget—Laughlin includes the following:

- •

- Emphasize slot play, which generates approximately 63.0% of the property's gross revenues, including by continuing the upgrade of the slot management system to allow for the expansion of the "ticket-in/ticket-out" environment to increase opportunities for promotional programs, operational efficiencies and improved guest satisfaction, by offering highly personalized guest

4

Management

The members of the senior management team at the Golden Nugget properties have an average of over 14 years of industry experience, including an average of 9 years at the Golden Nugget properties. Maurice Wooden, our Chief Operating Officer and one of our directors, joined the property in 1987 and has served as President and Chief Operating Officer of the Golden Nugget—Las Vegas since 2000. Mr. Wooden has over 18 years of experience in the gaming industry. Dawn Allen, our Chief Financial Officer and a Senior Vice President, joined the property in 1993 and served as a Vice President and Chief Financial Officer of the Golden Nugget—Las Vegas since 2000, becoming Senior Vice President in February 2004.

The Acquisition and Poster Financial

Poster Financial is a holding company that was incorporated in June 2003 for the purpose of acquiring the entities that own and operate the Golden Nugget hotel-casinos in Las Vegas and Laughlin, Nevada. On June 24, 2003, Poster Financial entered into a stock purchase agreement with MGM MIRAGE, as parent, Mirage Resorts, Incorporated, as seller, GNLV, CORP. ("GNLV"), GNL, CORP. ("GNL"), and Golden Nugget Experience, LLC ("Golden Nugget Experience"), a wholly owned subsidiary of GNLV, in which Poster Financial agreed to purchase all the issued and outstanding shares of capital stock of GNLV and GNL from Mirage Resorts, Incorporated (the "Acquisition"). GNLV and GNL, respectively, own and operate the Golden Nugget—Las Vegas and the Golden Nugget—Laughlin. GNLV and its subsidiaries and GNL are collectively referred to in this prospectus as the "Golden Nugget Group." On January 23, 2004, Poster Financial completed the Acquisition and acquired all the issued and outstanding shares of capital stock of GNLV and GNL and, as a result, indirect ownership of the Golden Nugget—Las Vegas and the Golden Nugget—Laughlin. See "Business—The Acquisition"

In 1990, Timothy N. Poster, our Chairman and Chief Executive Officer, founded Las Vegas Reservation Systems, Inc., the precursor to Travelscape.com, Inc., which was co-founded in 1998 by Mr. Poster and Thomas C. Breitling, our President, Secretary, Treasurer and one of our directors. Travelscape.com, an online hotel and vacation package reservation site, became a leading consumer travel wholesaler and was sold to Expedia, Inc. in March 2000 for approximately $105.0 million. Subsequent to the sale, Mr. Poster served as a member of the Board of Directors of Station Casinos, Inc., where he furthered his relationships and experience in the Las Vegas gaming and hospitality industries. Mr. Poster resigned from his board position with Station Casinos on June 26, 2003 to focus exclusively on the Acquisition.

5

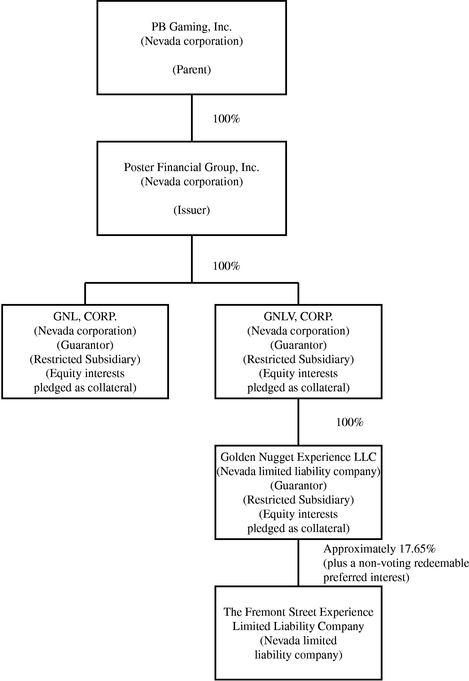

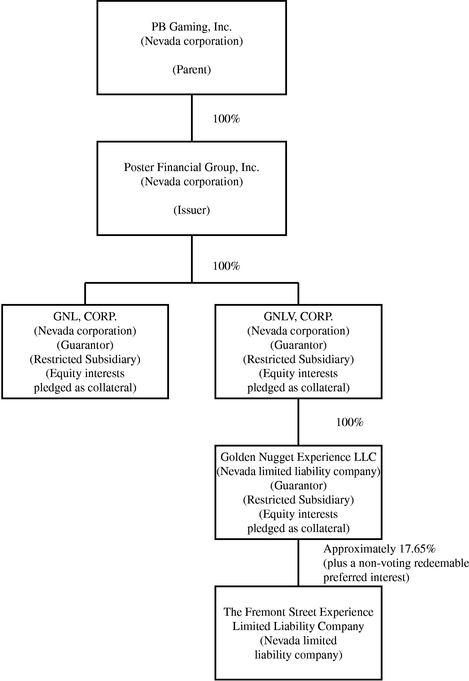

Our Organizational Structure

The following diagram reflects our organizational structure.

6

Summary of the Terms of the Exchange Offer

On December 3, 2003, we completed the private offering of $155,000,000 aggregate principal amount of our 83/4% Senior Secured Notes due 2011. As part of that offering, we entered into a registration rights agreement with the initial purchaser of the old notes in which we agreed, among other things, to deliver this prospectus to you and to complete an exchange offer for the old notes. Below is a summary of the terms of the exchange offer.

| New Notes | | $155.0 million aggregate principal amount of 83/4% Senior Secured Notes due December 1, 2011, the issuance of which has been registered under the Securities Act of 1933. The form and terms of the new notes are identical in all material respects to those of the old notes, except that the transfer restrictions and registration rights provisions relating to the old notes do not apply to the new notes. |

Exchange Offer |

|

We are offering to issue up to $155.0 million aggregate principal amount of the new notes in exchange for a like principal amount of the old notes to satisfy our obligations under the registration rights agreement that we entered into when the old notes were issued. |

|

|

In order to be exchanged, an old note must be properly tendered and accepted. All old notes that are validly tendered and not withdrawn will be exchanged. We will issue new notes promptly after the expiration of the exchange offer. |

Expiration Date |

|

The exchange offer will expire at midnight, New York City time, on , 2004, unless extended in our sole and absolute discretion. |

Representations Made Upon Tendering |

|

As a condition to your participation in the exchange offer, you will be required to represent that: |

|

|

• |

|

you are not an "affiliate," as defined in Rule 405 under the Securities Act, of ours; |

|

|

• |

|

any notes you receive in the exchange offer are being acquired by you in the ordinary course of your business; |

|

|

• |

|

at the time of commencement of the exchange offer, neither you nor, to your knowledge, anyone receiving notes from you, has any arrangement or understanding with any person to participate in the distribution, as defined in the Securities Act, of the old notes or the new notes in violation of the Securities Act; |

|

|

• |

|

if you are not a participating broker-dealer, you are not engaged in, and do not intend to engage in, the distribution, as defined in the Securities Act, of the old notes or the new notes; and |

|

|

• |

|

if you are a broker-dealer, you will receive the new notes for your own account in exchange for old notes that were acquired by you as a result of market making or |

|

|

|

|

|

7

|

|

|

|

other trading activities and that you will deliver a prospectus in connection with any resale of the new notes you receive. For further information regarding resales of the new notes by participating broker-dealers, see the discussion under the caption "Plan of Distribution." |

Withdrawal Rights |

|

You may withdraw any old notes tendered in the exchange offer at any time prior to midnight, New York City time, on , 2004. For further information regarding the withdrawal of tendered old notes, see "The Exchange Offer—Terms of the Exchange Offer; Period for Tendering Old Notes" and the "The Exchange Offer—Withdrawal Rights." |

Non-Acceptance of Notes |

|

If we decide for any reason not to accept any old notes tendered for exchange, the old notes will be returned to the registered holder at our expense promptly after the expiration or termination of the exchange offer. In the case of old notes tendered by book-entry transfer into the exchange agent's account at The Depository Trust Company ("DTC"), any withdrawn or unaccepted old notes will be credited to the tendering holder's account at DTC. |

Conditions to the Exchange Offer |

|

The exchange offer is subject to certain conditions, which we may waive. See the discussion below under the caption "The Exchange Offer—Conditions to the Exchange Offer" for more information regarding the conditions to the exchange offer. |

Procedures for Tendering

Old Notes |

|

Unless you comply with the procedures described below under the caption "The Exchange Offer—Guaranteed Delivery Procedures," you must do one of the following on or prior to the expiration or termination of the exchange offer to participate in the exchange offer: |

|

|

• |

|

tender your old notes by sending the certificates for your old notes, in proper form for transfer, a properly completed and duly executed letter of transmittal and all other documents required by the letter of transmittal, to HSBC Bank USA, as exchange agent, at the address listed below under the caption "The Exchange Offer—Exchange Agent"; or |

|

|

• |

|

tender your old notes by using the book-entry transfer procedures described below and transmitting a properly completed and duly executed letter of transmittal, or an agent's message instead of the letter of transmittal, to the exchange agent. In order for a book-entry transfer to constitute a valid tender of your old notes in the exchange offer, HSBC Bank USA, as exchange agent, must receive a confirmation of book-entry transfer of your old notes into the exchange agent's account at DTC prior to the expiration or termination of the exchange offer. For more information regarding the use of book- |

|

|

|

|

|

8

|

|

|

|

entry transfer procedures, including a description of the required agent's message, see the discussion below under the caption "The Exchange Offer—Book-Entry Transfers." |

|

|

Furthermore, as a condition to your participation in the exchange offer, you will be required to make the representations set forth above under the heading "—Representations Made Upon Tendering." |

Guaranteed Delivery Procedures |

|

If you are a registered holder of old notes and wish to tender your old notes in the exchange offer, but |

|

|

• |

|

the old notes are not immediately available; |

|

|

• |

|

time will not permit your old notes or other required documents to reach the exchange agent before the expiration or termination of the exchange offer; or |

|

|

• |

|

the procedure for book-entry transfer cannot be completed prior to the expiration or termination of the exchange offer; |

|

|

then you may tender old notes by following the procedures described below under the caption "The Exchange Offer—Guaranteed Delivery Procedures." |

Special Procedures for Beneficial Owners |

|

If you are a beneficial owner whose old notes are registered in the name of the broker, dealer, commercial bank, trust company or other nominee and you wish to tender your old notes in the exchange offer, you should promptly contact the person in whose name the old notes are registered and instruct that person to tender on your behalf. If you wish to tender in the exchange offer on your behalf, prior to completing and executing the letter of transmittal and delivering your old notes, you must either make appropriate arrangements to register ownership of the old notes in your name, or obtain a properly completed bond power from the person in whose name the old notes are registered. |

Resales |

|

Based on interpretations by the staff of the SEC, as set forth in no-action letters issued to third parties, we believe that the new notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act as long as: |

|

|

• |

|

you are acquiring the new notes in the ordinary course of your business; |

|

|

• |

|

you are not participating, do not intend to participate and have no arrangement or understanding with any person to participate, in a distribution of the old notes or the new notes; and |

|

|

|

|

|

9

|

|

• |

|

you are not an affiliate of ours. |

|

|

If you are an affiliate of ours or are engaged in or intend to engage in or have any arrangement or understanding with any person to participate in the distribution of the old notes or the new notes: |

|

|

• |

|

you cannot rely on the applicable interpretations of the staff of the SEC; and |

|

|

• |

|

you must comply with the registration requirements of the Securities Act in connection with any resale transaction. |

|

|

Each broker or dealer that receives new notes for its own account in exchange for old notes that were acquired as a result of market-making or other trading activities must acknowledge that it will comply with the registration and prospectus delivery requirements of the Securities Act in connection with any offer, resale, or other transfer of the new notes issued in the exchange offer, including information with respect to any selling holder required by the Securities Act in connection with any resale of the new notes. |

|

|

Furthermore, any broker-dealer that acquired any of its old notes directly from Poster Financial may not rely on the applicable interpretation of the staff of the SEC's position contained in Exxon Capital Holdings Corp., SEC no-action letter (May 13, 1988), Morgan, Stanley & Co. Inc., SEC no-action letter (June 5, 1991) and Shearman & Sterling, SEC no-action letter (July 2, 1993). |

|

|

As a condition to its participation in the exchange offer, each holder will be required to represent that it is not our affiliate or a broker-dealer that acquired the old notes directly from us. |

Material U.S. Federal Tax Consequences |

|

The exchange of old notes for notes in the exchange offer will not be a taxable transaction for United States federal income tax purposes. See the discussion below under the caption "Material U.S. Federal Tax Consequences" for more information regarding the tax consequences of the exchange offer to you. |

Use of Proceeds |

|

We will not receive any cash proceeds from the exchange offer. |

Exchange Agent |

|

HSBC Bank USA is the exchange agent for the exchange offer. You can find the address and telephone number of the exchange agent below under the caption "The Exchange Offer—Exchange Agent." |

Broker-Dealers |

|

Each broker-dealer that receives notes for its own account in exchange for old notes, where such old notes were acquired by such broker-dealer as a result of market-making activities or |

|

|

|

|

|

10

|

|

other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such notes. See "Plan of Distribution." |

Consequences of Not Exchanging Old Notes |

|

If you do not exchange your old notes in the exchange offer, you will continue to be subject to the restrictions on transfer described in the legend on your old notes. In general, you may offer or sell your old notes only: |

|

|

• |

|

if they are registered under the Securities Act and applicable state securities laws; |

|

|

• |

|

if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities laws; or |

|

|

• |

|

if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws. |

|

|

We do not currently intend to register the old notes under the Securities Act. Under some circumstances, however, holders of the old notes, including holders who are not permitted to participate in the exchange offer or who may not freely sell notes received in the exchange offer, may require us to file, and to cause to become effective, a shelf registration statement covering resales of the old notes by these holders. For more information regarding the consequences of not tendering your old notes and our obligations to file a shelf registration statement, see "The Exchange Offer—Consequences of Exchanging or Failing to Exchange Old Notes." |

11

Summary of the Terms of the New Notes

The terms of the new notes we are issuing in this exchange offer and the old notes that are outstanding are identical in all material respects, except:

- •

- the new notes will be registered under the Securities Act; and

- •

- the new notes will not contain transfer restrictions and registration rights that relate to the old notes.

The new notes will evidence the same debt as the old notes and will be governed by the same indenture.

| New Notes Offered | | $155.0 million aggregate principal amount of 83/4% senior secured notes due 2011. |

Issuer |

|

Poster Financial Group, Inc. |

Guarantees |

|

All payments with respect to the notes are fully, unconditionally and irrevocably guaranteed, jointly and severally, by all our current and future restricted subsidiaries on a senior secured basis. Our "restricted subsidiaries," which are subject to many of the restrictive covenants in the indenture, currently are GNLV and GNL, our wholly owned subsidiaries, and Golden Nugget Experience, a wholly owned subsidiary of GNLV. See "—Our Organizational Structure." If we cannot make any payment on the notes when due, our guarantors must make the payment instead. |

Maturity Date |

|

December 1, 2011. |

Interest Payment Dates |

|

June 1 and December 1 of each year, commencing on June 1, 2004. |

Ranking |

|

The notes and guarantees will rank: |

|

|

• |

|

equally in right of payment with all our and our guarantors' existing and future senior indebtedness; |

|

|

• |

|

senior in right of payment to all our and our guarantors' future subordinated indebtedness; |

|

|

• |

|

effectively junior to (1) our and our guarantors' obligations under our senior credit facility and any other existing and future obligations of ours or of our guarantors that are secured by a first priority lien on the collateral securing the new notes, to the extent of the value of such collateral and (2) our and our guarantors' obligations under any existing and future obligations that are secured by liens on assets that are not part of the collateral securing the new notes, to the extent of the value of such assets; and |

|

|

• |

|

structurally subordinated to all liabilities, including trade payables, of any subsidiaries that are not guarantors. |

12

|

|

As of March 31, 2004, we had total consolidated indebtedness of approximately $176.7 million, of which approximately $21.7 million ranked equally in right of payment with the notes, including approximately $21.2 million outstanding under our senior credit facility (excluding approximately $3.7 million outstanding under letters of credit). As of that date, we would have been able to incur approximately $25.1 million of additional indebtedness related to first lien obligations under the terms of the indenture governing the notes. In the event that the lenders under our senior credit facility exercise their rights with respect to our or our guarantors' assets that are pledged to secure our or our guarantors' obligations under the credit facility, the proceeds of the liquidation of these assets will first be applied to repay obligations secured by liens under the credit facility before the notes are repaid. |

Security |

|

The old notes and guarantees are, and the new notes and guarantees will be, secured by a pledge of capital stock of our restricted subsidiaries and a security interest in substantially all of our and our guarantors' current and future assets that will be junior to the security interest granted to the lenders under our senior credit facility. |

Optional Redemption |

|

On or after December 1, 2007, we may redeem all or part of the notes at any time at the redemption prices listed in the section "Description of the Notes— Optional Redemption." |

|

|

Prior to December 1, 2006, we may redeem up to 35% of the aggregate principal amount of the notes with the net cash proceeds of certain public equity offerings. |

Redemption Based on

Gaming Laws |

|

The notes are subject to mandatory disposition and redemption requirements following certain determinations by gaming authorities. |

Change of Control Offer, Asset Sale Offer and Events of Loss Offer |

|

If we experience specific kinds of changes of control and, under certain circumstances if we sell assets or experience an event of loss, we must offer to repurchase the notes at the prices listed in the Description of the Notes. See "Description of the Notes—Repurchase at the Option of Holders—Change of Control," "—Asset Sales" and "—Events of Loss." |

Certain Covenants |

|

We will issue the new notes under the indenture between us, the guarantors and HSBC Bank USA, the trustee. The indenture (among other things) limits our and our restricted subsidiaries' ability to: |

|

|

• |

|

incur additional indebtedness; |

|

|

• |

|

pay dividends on or purchase our stock; |

|

|

• |

|

make other restricted payments and investments; |

|

|

• |

|

create liens on our assets; |

13

|

|

• |

|

place restrictions on distributions and other payments from our subsidiaries; |

|

|

• |

|

transfer or sell assets; |

|

|

• |

|

merge or consolidate with other entities; and |

|

|

• |

|

enter into certain transactions with affiliates. |

|

|

Each of these covenants is subject to a number of important exceptions and qualifications. See "Description of the Notes—Certain Covenants." |

| Absence of Established Market for Notes | | The new notes are a new issue of securities, and currently there is no market for them. We do not intend to apply for the new notes to be listed on any securities exchange or to arrange for any quotation system to quote them. The initial purchaser of the old notes has advised us that it intends to make a market for the new notes, but it is not obligated to do so. The initial purchaser of the old notes may discontinue any market-making in the new notes at any time in its sole discretion. Accordingly, we cannot assure you that a liquid market will develop for the new notes. |

For a discussion of certain factors that you should consider in deciding whether to exchange the old notes for the new notes, see "Risk Factors" beginning on page 18.

14

Summary Historical and Pro Forma Financial Data

The following table sets forth summary historical financial data for (i) Poster Financial as of March 31, 2004, for the three months ended March 31, 2004 and for the period from inception (June 2, 2003) to December 31, 2003; (ii) summary historical data for the combined Golden Nugget Group (the predecessor company to Poster Financial) for the three months ended March 31, 2004 and 2003 and for each of the three years in the period ended December 31, 2003; and (iii) summary pro forma financial information for Poster Financial after giving effect to the offering of the notes, borrowings under our senior credit facility, and the Acquisition for the three months ended March 31, 2004 and 2003 and for the year ended December 31, 2004.

The effects of the offering of the notes, borrowings under our senior credit facility and the Acquisition are fully reflected in the summary historical financial data as of March 31, 2004. Accordingly, no pro forma balance sheet data has been presented. The pro forma statement of operations data and other pro forma financial data gives effect to the offering of the notes, borrowings under our senior credit facility, and the Acquisition as if they had occurred on January 1, 2003. The pro forma statements of operations data and other pro forma financial data are presented for informational purposes only and are not necessarily indicative of the operating results that would have occurred if the offering of the notes, borrowings under our senior credit facility, and the Acquisition had been completed as of the dates indicated, nor is it necessarily indicative of future operating results.

You should read this table in conjunction with "Use of Proceeds," "Unaudited Pro Forma Condensed Consolidated Financial Data," "Selected Historical Consolidated Financial Data of Poster Financial and the Golden Nugget Group (Predecessor Company)," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the financial statements and related notes included in this prospectus.

| | As of March 31, 2004

|

|---|

| Balance sheet data: | | | |

| | Cash and cash equivalents | | $ | 24,590 |

| | Total assets | | | 268,753 |

| | Total debt | | | 176,654 |

| | Stockholder's equity | | | 51,683 |

| | Historical

| | Pro Forma

| |

|---|

| | Poster Financial(7)

| | Golden Nugget Group

| | Poster Financial(7)

| |

|---|

| | Period of

inception

(June 2,

2003) to

December 31,

2003

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|---|

| |

| |

| |

| |

| | Three Months

Ended

March 31,

| | Period From

Jan 1, 2004 to

Jan 22,

| | Year Ended

December 31,

| | Three Months Ended

March 31,

| |

|---|

| | Three Months

Ended

March 31,

2004

| | Year Ended December 31,

| |

|---|

| | 2001(6)

| | 2002

| | 2003

| | 2003

| | 2004

| | 2003

| | 2003

| | 2004

| |

|---|

| | (dollars in thousands, except ratios)

| |

|---|

| Statements of operations data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net revenues | | $ | — | | $ | 53,882 | | $ | 222,982 | | $ | 221,802 | | $ | 231,232 | | $ | 61,674 | | $ | 14,805 | | $ | 231,232 | | $ | 61,674 | | $ | 68,687 | |

| | Operating income (loss)(1)(2) | | | (383 | ) | | 7,120 | | | 6,551 | | | 3,730 | | | 8,398 | | | 5,528 | | | 1,208 | | | 19,937 | | | 8,764 | | | 10,914 | |

| | Interest expense | | | 1,161 | | | (3,951 | ) | | 6,424 | | | 4,018 | | | 3,413 | | | (897 | ) | | (209 | ) | | 16,097 | | | (4,032 | ) | | (4,019 | ) |

| | Net income (loss)(3) | | | (1,479 | ) | | 3,162 | | | (210 | ) | | (529 | ) | | 2,911 | | | 3,105 | | | 668 | | | 3,103 | | | 4,557 | | | 6,811 | |

| Other financial data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Net cash provided by operating activities | | | 104 | | | 3,057 | | | 16,429 | | | 13,921 | | | 19,202 | | | 8,468 | | | 5,012 | | | N/A | | | N/A | | | N/A | |

| | Net cash used in investing activities | | | (159,578 | ) | | (44,299 | ) | | (13,424 | ) | | (21,331 | ) | | (8,419 | ) | | (2,634 | ) | | (4,671 | ) | | N/A | | | N/A | | | N/A | |

15

| | Net cash provided by (used in) financing activities | | | 159,474 | | | 65,832 | | | (6,332 | ) | | 7,051 | | | (4,219 | ) | | (4,063 | ) | | (8,452 | ) | | N/A | | | N/A | | | N/A | |

| | Capital expenditures | | | 30 | | | 203,847 | | | 12,776 | | | 20,610 | | | 7,390 | | | 2,430 | | | 4,436 | | | N/A | | | N/A | | | N/A | |

| | Depreciation and amortization | | | — | | | 2,769 | | | 14,781 | | | 13,732 | | | 13,722 | | | 3,434 | | | 806 | | | 13,020 | | | 3,255 | | | 3,255 | |

| | EBITDA(4) | | | (318 | ) | | 9,882 | | | 20,555 | | | 16,664 | | | 21,383 | | | 8,787 | | | 1,990 | | | 32,220 | | | 11,844 | | | 14,085 | |

| | Ratio of earnings to fixed charges(5) | | | — | | | 1.8 | x | | 1.04 | x | | — | | | 2.34 | x | | 5.7 | x | | 5.4x | | | — | | | 2.2 | x | | 2.7 | x |

- (1)

- In connection with the Acquisition, we entered into employment agreements with certain key executives. The employment agreements include aggregate signing bonuses of $800,000. The charge is approximately $1,460,000 after consideration of an income tax gross-up, as provided by the employment agreements, which amount was recorded as a charge to earnings in the three months ended March 31, 2004. Such amount is excluded as a charge from pro forma net income (loss) for all periods presented because it is a non-recurring item directly related to the transaction. In addition to signing bonuses, the employment agreements provide for incentive bonuses in the event that a targeted level of EBITDA (as defined) is exceeded. The incentive bonuses in the amount of $1,688,000 are included as pro forma adjustments because the 2004 target EBITDA was achieved on a pro forma basis for the year ended December 31, 2003 and is probable to be achieved in 2004.

- (2)

- The Golden Nugget Group has historically been charged a management fee of 5.0% of gross revenues by MGM MIRAGE and its affiliates for executive, financial, SEC reporting, tax and similar services provided by MGM MIRAGE and its subsidiaries, collectively referred to as "corporate functions." The fee also included the cost to the Golden Nugget Group of licensing the rights to use trademarks owned by MGM MIRAGE and its subsidiaries, including the "Golden Nugget" name and logo. Each of the Golden Nugget Group's properties has a chief operating officer and key financial, accounting and marketing personnel, and the properties share an in-house legal function. Management has determined a representative annual cost for replacing the corporate functions previously provided by MGM MIRAGE and its subsidiaries of approximately $1.3 million based on staffing and other departmental costs for those positions that are incremental to these property level personnel. Such amount also includes an estimated allocation of actual, historical costs for external audit and financial reporting, regulatory oversight and compliance, and similar functions that are necessary to present the Golden Nugget Group as a stand-alone business. In connection with the closing of the Acquisition (see Note 3 to the combined financial statements of the Golden Nugget Group), the Golden Nugget Group acquired all rights to the Golden Nugget name and associated trademarks and is no longer subject to a licensing or royalty fee.

- (3)

- For all historical periods presented, prior to the Acquisition, GNLV, CORP. and GNL, CORP. were subject to income taxes as subsidiaries of MGM MIRAGE. Accordingly, the historical combined results of operations of the Golden Nugget Group reflect a provision (or benefit) for income taxes. PB Gaming has elected to be treated as a Subchapter S corporation and has elected to have each of Poster Financial, GNLV and GNL treated as a qualified Subchapter S subsidiary for federal income tax purposes. As a result, the owners of PB Gaming will be taxed on the income of PB Gaming, Poster Financial and the Golden Nugget Group at a personal level and PB Gaming, Poster Financial and the Golden Nugget Group generally will not be subject to federal income taxation at the corporate level.

- (4)

- EBITDA consists of net income (loss) plus (i) interest expense, (ii) income tax provision (or less income tax benefit), and (iii) depreciation and amortization expense. EBITDA is presented as a measure of operating performance because we believe analysts, investors and others frequently use

16

it in the evaluation of companies in our industry, in particular for the ability of a company to meet its debt service requirements and as a measure of liquidity. Other companies in our industry may calculate EBITDA differently, particularly as it relates to non-recurring, unusual items. Furthermore, funds depicted by EBITDA differ from amounts calculated under the definition of EBITDA used in our senior credit facility and in employment agreements that we have entered into with certain key employees. For example, the definition of EBITDA in our senior credit facility is further adjusted for, among other things, extraordinary gains and interest income and is used to determine compliance with financial covenants.

- EBITDA is not a measurement of financial performance or liquidity under GAAP and you should not consider it as an alternative to cash flow from operating activities, as an alternative to net income or as an indication of operating performance or any other measure of performance derived in accordance with GAAP. In addition, EBITDA is not intended to be a measure of free cash flow for management's discretionary use as the funds depicted by EBITDA may be required for, among other things, debt service, distributions to our stockholders, and capital expenditures. Furthermore, the use of such funds may be limited by the terms of the indenture governing the notes, our senior credit facility and any other agreements that may, from time to time, govern our indebtedness.

The following table provides a reconciliation of net income (loss) to EBITDA:

| | Historical

| | Pro Forma

|

|---|

| | Poster Financial

| | Golden Nugget Group

| | Poster Financial

|

|---|

| | Period from

inception

(June 2,

2003) to

December 31,

2003

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

|---|

| |

| |

| |

| |

| | Three Months

Ended

March 31,

| | Period from

Jan 1, 2004 through Jan 22,

| | Year Ended

December 31,

| |

| |

|

|---|

| | Three Months

Ended

March 31,

2004

| | Year Ended December 31,

| | Three Months

Ended

March 31,

2003

| | Three Months

Ended

March 31,

2004

|

|---|

| | 2001

| | 2002

| | 2003

| | 2003

| | 2004

| | 2003

|

|---|

| | (dollars in thousands)

|

|---|

| Net income (loss) | | $ | (1,479 | ) | $ | 3,162 | | $ | (210 | ) | $ | (529 | ) | $ | 2,911 | | $ | 3,105 | | $ | 668 | | $ | 3,103 | | $ | 4,557 | | $ | 6,811 |

| Interest expense | | | 1,161 | | | 3,951 | | | 6,424 | | | 4,018 | | | 3,413 | | | 897 | | | 209 | | | 16,097 | | | 4,032 | | | 4,019 |

| Income tax provision (benefit) | | | — | | | — | | | (440 | ) | | (557 | ) | | 1,337 | | | 1,351 | | | 307 | | | — | | | — | | | — |

| Depreciation and amortization | | | — | | | 2,769 | | | 14,781 | | | 13,732 | | | 13,722 | | | 3,434 | | | 806 | | | 13,020 | | | 3,255 | | | 3,255 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

| EBITDA | | $ | (318 | ) | $ | 9,882 | | $ | 20,555 | | $ | 16,664 | | $ | 21,383 | | $ | 8,787 | | $ | 1,990 | | $ | 32,220 | | $ | 11,844 | | $ | 14,085 |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

- (5)

- For purposes of calculating this ratio, earnings consist of income (before income taxes and equity in loss of unconsolidated joint venture) plus fixed charges. Fixed charges consist of interest expense and the portion of rental expense representative of interest expense. There was no capitalized interest incurred or amortized in any of the periods presented. Earnings were insufficient to cover fixed charges by the following approximate amounts in the periods indicated: Poster Financial for the period from inception (June 2, 2003) to December 31, 2003 ($1.5 million); Golden Nugget Group for the year ended December 31, 2002 ($0.2 million) and for the pro forma year ended December 31, 2003 ($0.6 million).

- (6)

- During the third quarter of 2001, management of MGM MIRAGE responded to a decline in business volumes caused by the September 11, 2001 terrorist attacks. MGM MIRAGE implemented cost containment strategies that included a significant reduction in payroll and refocusing of marketing programs, including at the hotel-casinos operated by the Golden Nugget Group. A $0.3 million restructuring charge against earnings, primarily related to the accrual of severance pay, extended health care coverage and other related costs was recorded in connection with personnel reductions. All costs relating to the restructuring were paid out to terminated personnel by December 31, 2001.

In the third quarter of 2001, MGM MIRAGE reassessed the carrying value of certain assets, and the Golden Nugget Group recognized an impairment charge of $1.9 million. The charge relates to assets of the Golden Nugget Group that were abandoned in response to the September 11, 2001 terrorist attacks, primarily in-progress construction projects.

- (7)

- Poster Financial is a holding company that was formed in June 2003 for the purpose of acquiring the entities that own and operate the Golden Nugget hotel-casinos in Las Vegas and Laughlin, Nevada. At December 31, 2003, Poster Financial had only a limited operating history and initial capitalization.

17

RISK FACTORS

You should consider carefully each of the following risks and all other information contained in this prospectus before deciding to invest in the notes.

Risks Relating to Our Indebtedness

Our substantial indebtedness could adversely affect our financial results and prevent us from fulfilling our obligations under the notes.

As of March 31, 2004, we had total consolidated indebtedness of approximately $176.7 million. Our senior credit facility provides for a five-year senior secured term loan of $20.0 million and a five-year senior secured revolving credit facility of up to $15.0 million, subject to certain conditions. As of March 31, 2004, there was $20 million outstanding under the term loan and approximately $1.2 million outstanding under the revolving credit facility. We are also able to incur additional indebtedness in the future, subject to compliance with the terms of the agreements governing our indebtedness at the time. If we add new indebtedness to our debt levels following the date of this prospectus, it could increase the risks that we face.

Our substantial indebtedness could have important consequences to you. For example, it could:

- •

- make it difficult for us to satisfy our obligations under the notes;

- •

- limit our ability to obtain additional financing in the future for working capital, capital expenditures, general corporate purposes or other purposes;

- •

- limit our ability to use operating cash flow in other areas of our business because we must dedicate a significant portion of these funds to make mandatory payments on our indebtedness;

- •

- make us vulnerable to economic downturns and reduce our flexibility in responding to changing business, regulatory and economic conditions;

- •

- affect the cost of our borrowings to the extent that fluctuations in interest rates are not covered by interest rate hedge agreements because the borrowings under our senior credit facility are payable at variable rates; and

- •

- limit our ability to compete with others who are not as highly leveraged, including our ability to explore business opportunities.

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors over which we may have little or no control.

Our ability to service our indebtedness will depend on our future performance, which will be affected by prevailing economic conditions and financial, business, competitive, legislative, regulatory and other factors. Many of these factors are beyond our control. If we cannot generate sufficient cash flow from operations to make scheduled payments on the notes or meet our other obligations and commitments because of our failure to implement our business strategy, or if there are material adverse developments in our business, liquidity or capital requirements or for any other reason, we might be required to take one or more actions. These actions might include seeking one or more waivers from our lenders, which may require consent payments and a modification of the terms of our existing indebtedness or additional restrictions on our ability to incur indebtedness, the refinancing of our debt, obtaining additional financing, selling assets, obtaining additional equity capital or reducing or delaying capital expenditures. There is no assurance that we could complete these actions on a timely basis or on satisfactory terms, if at all, or that we would be permitted to take such actions by the terms of the indenture governing the notes or our senior credit facility. In addition, Nevada's gaming laws and

18

regulations may require certain approvals in connection with our undertaking certain financing transactions.

Our debt agreements impose restrictions on our operations.

The indenture governing the notes and our senior credit facility impose operating and financial restrictions on us. These restrictions include, among other things, limitations on our ability and the ability of our restricted subsidiaries to:

- •

- incur additional debt or refinance existing debt;

- •

- create liens or other encumbrances;

- •

- make distributions with respect to our or our restricted subsidiaries' equity (other than distributions for taxes) or make other restricted payments;

- •

- make investments, capital expenditures, loans or other guarantees;

- •

- sell or otherwise dispose of our assets; and

- •

- merge or consolidate with another entity.

Our senior credit facility contains certain financial covenants, including a minimum fixed charge coverage ratio, minimum levels of EBITDA and a maximum senior debt to EBITDA ratio. Our ability to borrow funds for any purpose will depend on our satisfying these tests.

If we fail to comply with the financial covenants or other restrictions contained in our senior credit facility, the indenture or any future financing agreements, an event of default could occur. An event of default could result in the acceleration of some or all of our debt and the imposition of further restrictions on our ability to operate and finance our business. We will not have, and may not be able to obtain, sufficient funds to repay our indebtedness if it is accelerated, including our obligations under the notes.

Risks Related to Our Business and the Gaming Industry

We face substantial competition in the hotel and casino industry, and the continued growth of gaming on Native American tribal lands, particularly in California, could have a material adverse effect on us.

The hotel and casino industry in general, and the markets in which we compete in particular, are highly competitive. If other hotels or casinos operate more successfully, if existing hotels and casinos are enhanced or expanded, or if additional hotels and casinos are established in and around the locations in which the Golden Nugget hotel-casinos conduct business, competition will further increase and we may lose market share. In addition, we compete, and will in the future compete, with all forms of legalized gambling. These ventures could divert customers from the Golden Nugget properties and thus adversely affect our business, financial condition and results of operations. We also face competition from all other types of entertainment.

Many Native American tribes conduct casino gaming operations throughout the United States. Other Native American tribes are either in the process of establishing, or are considering establishing, gaming operations at additional locations, including sites in California and Arizona. The competitive impact on Nevada gaming establishments, including the Golden Nugget properties, from the continued growth of gaming in jurisdictions outside Nevada cannot be determined at this time but, depending on the nature, location and extent of the growth of those operations, the impact could be material. In some instances, Native American gaming facilities operate under regulatory requirements and tax environments that are less stringent than those imposed on state-licensed casinos, which could provide them with a competitive advantage. The operations of the Golden Nugget—Laughlin have been adversely impacted by the growth of Native American gaming in southern California. The continued

19

growth of Native American gaming establishments in California and other states could have a material adverse effect on our business, financial condition and results of operations.

Some of our competitors have greater financial, selling and marketing, technical and other resources than we do. We must continually attract customers to our properties, which requires us to maintain a high level of investment in marketing and customer service. There can be no assurance that we will be able to compete effectively with our competitors.

The gaming industry is highly regulated, and licensing and gaming authorities have significant control over our operations, which could have an adverse effect on our business, financial condition and results of operations.

We conduct licensed gaming operations in Nevada, and various regulatory authorities, including the Nevada State Gaming Control Board and the Nevada Gaming Commission, require us to hold various licenses and registrations, findings of suitability, permits and approvals to engage in gaming operations and to meet requirements of suitability. These gaming authorities also control approval of ownership interests in gaming operations. These gaming authorities may deny, limit, condition, suspend or revoke our gaming licenses, registrations, findings of suitability or the approval of any of our ownership interests in any of the licensed gaming operations conducted in Nevada, any of which could have a significant adverse effect on our business, financial condition and results of operations, for any cause they may deem reasonable. If we violate gaming laws or regulations that are applicable to us, we may have to pay substantial fines or forfeit assets. If, in the future, we operate or have an ownership interest in casino gaming facilities located outside of Nevada, we may also be subject to the gaming laws and regulations of those other jurisdictions.

Potential changes in the tax or regulatory environment could harm our business.

If additional gaming regulations are adopted or existing ones are modified in Nevada, those regulations could impose significant restrictions or costs that could have a significant adverse effect on us. From time to time, various proposals are introduced in the federal and Nevada state and local legislatures that, if enacted, could adversely affect the tax, regulatory, operational or other aspects of the gaming industry and our business. Legislation of this type may be enacted in the future. For example, pursuant to legislation signed into law by the Governor of Nevada on July 23, 2003, the license fees on the number of gaming devices operated and on gross revenues were increased and the range of events covered by the casino entertainment tax was expanded. In October 2003, we also became subject to a state payroll tax based on the wages we pay employees. If there is a material increase in federal, state or local taxes and fees, our business, financial condition and results of operations could be adversely affected.

We are also subject to a variety of other rules and regulations, including zoning, health and public safety, environmental, construction and land-use laws and laws and regulations governing the sale and serving of alcoholic beverages. Any changes to these laws, rules and regulations or adoption of additional laws, rules and regulations applicable to us could have a material adverse effect on our business, financial condition and results of operations.

We are heavily dependent on MGM MIRAGE to provide us with many key services for our business.

Many key systems and services required for the operation of our business are currently provided by MGM MIRAGE. Under the transition services agreement we entered into with MGM MIRAGE in connection with the Acquisition, MGM MIRAGE has agreed to provide us with many key systems and services required for operation of our race and sports book operations, retail and inventory management services for our retail stores, certain information system services, certain preferential reservation and seating arrangements at the MGM Grand Garden and Star of the Desert venues,

20

horticulture services and, in the case of Golden Nugget—Las Vegas, continued supply of bakery products. MGM MIRAGE has agreed to provide these services for varying transition periods. See "Business—The Acquisition—Transition Services Agreement." We believe that it is necessary for MGM MIRAGE to provide these services for us under the transition services agreement in order to facilitate consistent service and satisfaction to our customers while the Golden Nugget properties transition to new ownership under Poster Financial. Consequently, we are, and for the near term will be, heavily dependent on our relationship with MGM MIRAGE.

Once the transition periods specified in the transition services agreement have expired, or if MGM MIRAGE does not or is unable to perform its obligations under the transition services agreement, we will be required to provide these systems and services ourselves or to obtain substitute arrangements with third parties. We may be unable to provide these systems and services due to financial or other constraints or be unable to implement substitute arrangements on terms that are favorable to us, or at all, which would have a material adverse effect on our business, financial condition and results of operations.

The Golden Nugget properties did not have a recent operating history as a stand-alone group prior to the Acquisition.

Although the businesses of the Golden Nugget properties have a substantial operating history, prior to the Acquisition they had not been recently operated as a stand-alone group. Following the Acquisition, the businesses of the Golden Nugget properties no longer have access to the borrowing capacity, cash flow, assets and services of MGM MIRAGE and its other properties as they did while under MGM MIRAGE's control. We are a significantly smaller company than MGM MIRAGE, with significantly fewer resources and less diversified operations. Consequently, our results of operations are more susceptible than those of MGM MIRAGE to competitive and market factors specific to the business of the Golden Nugget properties.

In addition, certain key systems and services required for the operation of the Golden Nugget properties that were provided by MGM MIRAGE and its affiliates prior to the Acquisition are no longer provided by MGM MIRAGE and its affiliates. These systems and services include, among others, cash management and treasury services, internal audit services, marketing and advertising, risk management, insurance, human resources and employee benefit plans, corporate purchasing, casino and hotel credit and collections and energy procurement. Our inability to provide these systems and services or our inability to obtain arrangements with third parties to provide these systems and services on terms which are favorable to us, or at all, would have a material adverse effect on our business, financial condition and results of operations.

We cannot assure you that we will be able to continue to manage the Golden Nugget properties as they were managed under the control of MGM MIRAGE or continue to attract a sufficient number of guests, gaming customers and other visitors to the Golden Nugget properties to make our operations profitable as a stand-alone business.

Economic downturns, terrorism and the uncertainty of war, as well as other factors affecting discretionary consumer spending, could have a material adverse effect on our business, financial condition and results of operations.

The strength and profitability of our business depends on consumer demand for hotel-casino resorts and gaming in general and for the type of amenities we offer. Changes in consumer preferences or discretionary consumer spending could harm our business.

During periods of economic contraction, our revenues may decrease while some of our costs remain fixed, resulting in decreased earnings. This is because the gaming and other leisure activities we offer at the Golden Nugget properties are discretionary expenditures, and participation in these

21

activities may decline during economic downturns because consumers have less disposable income. Even an uncertain economic outlook may adversely affect consumer spending in our gaming operations and related facilities, as consumers spend less in anticipation of a potential economic downturn.

The terrorist attacks which occurred on September 11, 2001, the potential for future terrorist attacks and ongoing war activities, such as the recent wars in Afghanistan and Iraq, have had a negative impact on travel and leisure expenditures, including lodging, gaming and tourism. Leisure and business travel, especially travel by air, remain particularly susceptible to global geopolitical events. Many of our customers travel by air, and the cost and availability of air service and the impact of events like those of September 11, 2001, can affect our business. Furthermore, insurance coverage against loss or business interruption resulting from war and some forms of terrorism is not available to us. We cannot predict the extent to which ongoing war activities, future security alerts or additional terrorist attacks may interfere with our operations.

We rely heavily on certain markets, and changes adversely impacting those markets could have a material adverse effect on our business, financial condition and results of operations.

The Golden Nugget properties are both located in Nevada and, as a result, our business is subject to greater risks than a more diversified gaming company. These risks include, but are not limited to, risks related to local economic and competitive conditions, changes in local and state governmental laws and regulations (including changes in laws and regulations affecting gaming operations and taxes) and natural and other disasters. Any economic downturn in Nevada or any terrorist activities or disasters in or around Nevada could have a significant adverse effect on our business, financial condition and results of operations. In addition, there can be no assurance that gaming industry revenues in, or leisure travel to and throughout, Nevada or the surrounding local markets will continue to grow.

We also draw a substantial number of customers from other geographic areas, including southern California, Arizona and the Midwest. A recession or downturn in any region constituting a significant source of our customers could result in fewer customers visiting, or customers spending less at, the Golden Nugget properties, which would adversely affect our results of operations. Additionally, there is one principal interstate highway between Las Vegas and southern California, where a large number of our customers reside. Capacity restraints of that highway or any other traffic disruptions may affect the number of customers who visit our facilities.

We use significant amounts of electricity, natural gas and other forms of energy, and energy price increases may adversely affect our results of operations.

We use significant amounts of electricity, natural gas and other forms of energy. While no shortages of energy have been experienced, any substantial increases in the cost of electricity and natural gas in the United States, such as those increases recently experienced in Nevada, may increase our cost of operations, which would negatively affect our operating results. The extent of the impact is subject to the magnitude and duration of the energy price increases, but this impact could be material. In addition, higher energy and gasoline prices affecting our customers may increase their cost of travel to our hotel-casinos and result in reduced visits to our properties and a reduction in our revenues.

Timothy N. Poster and Thomas C. Breitling, our Chief Executive Officer and President, respectively, did not have experience in operating a company in the casino industry prior to the Acquisition.