received, including, but not limited to, interest rate, credit and liquidity risk associated with such investments.

As of February 28, 2023, the Fund had securities on loan, which were classified as common stocks in the Investment Portfolio. The value of the related collateral exceeded the value of the securities loaned at period end. As of period end, the remaining contractual maturity of the collateral agreements was overnight and continuous.

Foreign Currency Translations. The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars at the prevailing exchange rates at period end. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the prevailing exchange rates on the respective dates of the transactions.

Net realized and unrealized gains and losses on foreign currency transactions represent net gains and losses between trade and settlement dates on securities transactions, the acquisition and disposition of foreign currencies, and the difference between the amount of net investment income accrued and the U.S. dollar amount actually received. The portion of both realized and unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed but is included with net realized and unrealized gain/appreciation and loss/depreciation on investments.

Taxes. The Fund’s policy is to comply with the requirements of the Internal Revenue Code, as amended, which are applicable to regulated investment companies, and to distribute all of its taxable income to its shareholders.

Additionally, the Fund may be subject to taxes imposed by the governments of countries in which it invests and are generally based on income and/or capital gains earned or repatriated. Estimated tax liabilities on certain foreign securities are recorded on an accrual basis and are reflected as components of interest income or net change in unrealized gain/loss on investments. Tax liabilities realized as a result of security sales are reflected as a component of net realized gain/loss on investments.

At February 28, 2023, the aggregate cost of investments for federal income tax purposes was $334,136,053. The net unrealized appreciation for all investments based on tax cost was $101,472,058. This consisted of aggregate gross unrealized appreciation for all investments for which there was an excess of value over tax cost of $142,439,929 and aggregate gross unrealized depreciation for all investments for which there was an excess of tax cost over value of $40,967,871.

The Fund has reviewed the tax positions for the open tax years as of August 31, 2022 and has determined that no provision for income tax and/or uncertain tax positions is required in the Fund’s financial

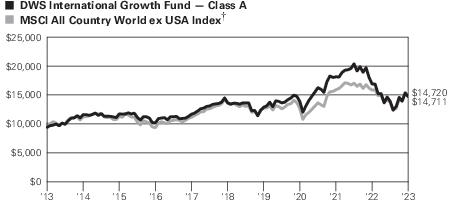

Yearly periods ended February 28

Yearly periods ended February 28