UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-04665 |

Commonwealth International Series Trust

(Exact name of registrant as specified in charter)

| 5847 San Felipe, Suite 850, Houston , TX | 77057 |

| (Address of principal executive offices) | (Zip code) |

BISYS Fund Services Ohio, Inc.

3435 Stelzer Road

Columbus, Ohio 43219

(Name and address of agent for service)

| Registrant’s telephone number, including area code: | 888-345-1898 |

| Date of fiscal year end: | October 31 |

| Date of reporting period: | October 31, 2006 |

Item 1. Reports to Stockholders.

The Commonwealth International

Series Trust

Australia/New Zealand Fund

Japan Fund

Global Fund

Real Estate Securities Fund

ANNUAL REPORT

October 31, 2006

630-A Fitzwatertown Road, Willow Grove, PA 19090 * 888.345.1898

Commonwealth Australia/New Zealand Fund (CNZLX)

Commonwealth Japan Fund (CNJFX)

Commonwealth Global Fund (CNGLX)

Commonwealth Real Estate Securities Fund (CNREX)

www.commonwealthfunds.com

Dear Shareholder:

We are pleased to present this annual report on the Commonwealth International Series Trust on behalf of its separate series: the Commonwealth Australia/New Zealand Fund, Commonwealth Japan Fund, Commonwealth Global Fund and Commonwealth Real Estate Securities Fund (each a “Fund” and together the “Funds”) for the twelve months ended October 31, 2006.

To obtain a Prospectus and other information about a Commonwealth Fund, please visit www.commonwealthfunds.com or call 1-888-345-1898. Please read the Prospectus carefully before investing.

Commonwealth Australia/New Zealand Fund

Performance Overview

The Commonwealth Australia/New Zealand Fund’s Net Asset Value (“NAV”) as of October 31, 2006, was $17.44 per share compared to $16.43 per share on October 31, 2005. On December 29, 2005, the Fund made distributions of $1.23 per share. For the twelve months under review, Commonwealth Australia/New Zealand Fund posted a 14.6% cumulative total return, assuming reinvestment of gross distributions. For the same period the Funds’ benchmarks, the Australian All Ordinaries Index1 and, the New Zealand Exchange Limited 50 Free Float Total Return Index2, posted returns of 32.6% and 10.2%, respectively. We do not attempt to track any index, but rather undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments. The Fund’s total return is presented net of Fund expenses, which means the Fund’s performance is reduced by applicable Fund fees and expenses whereas the index returns do not include any such fees. Performance data represents past performance, and does not guarantee future results. Investment return and principal value will fluctuate, and your investment may result in a gain or loss when you sell your shares. An investor should consider the Fund’s investment objectives, risks, charges and expenses carefully before investing. This and other important information about the Fund can be found in the Fund’s Prospectus.

With equities outperforming fixed-income (bonds) in both countries, the Fund’s 29.7% bond allocation at year-end was a drag on performance. A decline in the New Zealand dollar versus the U.S. dollar during the year also detracted from returns. However, higher commodity prices and increasing interest rates lifted the Australian dollar versus the U.S. dollar nearly 3.7% over the year. New Zealand equities have made strong returns over the year, reflecting buoyant global economic conditions. While New Zealand equities underperformed global equities, the return from the local market has been much stronger than expected. This probably reflects the undercurrent from strong global equity markets, particularly from the outperforming Australian market, and strong liquidity conditions, with significant private equity money looking for equity exposure and little new equity supply in New Zealand.

COMMONWEALTH INTERNATIONAL SERIES TRUST

| |

PORTFOLIO ALLOCATION (As of 10/31/06) (unaudited) |

| Country/Asset Class* | % of Total Value |

| New Zealand Equities | 50.4% |

| New Zealand Bonds | 21.9% |

| Australia Equities | 19.8% |

| Australia Bonds | 7.8% |

| Short-Term Investments | 0.1% |

*Short term investments include foreign currency valued at the then-current exchange rate. Percentages are based on total market value of investment securities. Holdings are subject to change.

Economic and Market Overview

Recent dataflow in New Zealand on economic activity suggests that growth in the second half of the year will probably be a little stronger than previously expected. The large decline in oil prices and still-surprising strength in the housing market are key reasons for this optimism. The big question is whether the more positive flow of activity data is a sign of a permanent shift up to a strong growth profile, or simply reflects data volatility and, to some extent, the short-term boost from lower fuel prices.

The recent mix of data - some recovery in domestic demand, but also tighter monetary conditions via a stronger currency - suggests a change to the risk profile of the outlook for the economy. The recent strength of the currency, if sustained, puts downside risk to the domestic sector, by perhaps keeping the Reserve Bank of New Zealand on the sidelines, and stimulating demand via cheaper imports.

If 2006 can be categorized as a year of when Australia’s economic growth was restrained by capacity constraints and cost pressures, the 2007 outlook looks set to be dominated by the passing of the supportive factors of loose fiscal and financial conditions to the more negative forces of a peak in the terms of trade, severe drought, flat business investment outlook, slowing household income and employment growth and a moderation in system credit growth.

COMMONWEALTH INTERNATIONAL SERIES TRUST

In short, on the basis of normal cyclical developments, there is reason to believe that 2007 will prove to be a more challenging year for economic growth. However, there is an additional subtext to Australia’s economic outlook that may prove pivotal to the economic outlook. There has already been a marked increase in household saving through 2006, partly reflecting an inflation ‘surprise’ that has challenged assumptions on the path of interest rates and real income growth. While this is probably best interpreted as a period of ‘precautionary’ saving, material changes in the regulatory environment raises the prospect of a ‘structural’ rise in savings sufficient to generate a weaker consumption trend in 2007 and 2008.

| 1. | The Australian All Ordinaries Index is a capitalization-weighted index. The index is made up of the largest 500 companies as measured by market cap that are listed on the Australian Stock Exchange. The index was developed with a base value of 500 as of 1979. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index. |

| 2. | The New Zealand Exchange Limited 50 Free Float Total Return Index is a modified market capitalization weighted index. This index consists of the top 50 companies by free float adjusted market capitalization that are listed on the New Zealand Stock Exchange. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index. |

COMMONWEALTH INTERNATIONAL SERIES TRUST

Commonwealth Japan Fund

Performance Overview

The Commonwealth Japan Fund’s NAV as of October 31, 2006, was $4.33 per share compared to $4.15 per share on October 31, 2005. On December 29, 2005, the Japan Fund made distributions of $0.05 per share. For the twelve months under review, Commonwealth Japan Fund posted a 5.6% cumulative total return, assuming reinvestment of gross distributions. The Fund underperformed its benchmark, the Tokyo Stock Price Index3, which posted a return of 12.7%, for the same period. We do not attempt to track any index, but rather undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments. The Fund’s total return is presented net of Fund expenses, which means the Fund’s performance is reduced by applicable Fund fees and expenses whereas the index returns do not include any such fees. Performance data represents past performance, and does not guarantee future results. Investment return and principal value will fluctuate, and your investment may result in a gain or loss when you sell your shares. An investor should consider the Fund’s investment objectives, risks, charges and expenses carefully before investing. This and other important information about the Fund can be found in the Fund’s Prospectus.

We believe that Japanese equities underperformed global equities for a number of reasons, including conservative corporate earnings forecasts, downward revisions to economic growth forecasts and uncertainty over Prime Minister Abe’s economic policies. The Commonwealth Japan Fund trailed the Tokyo Stock Price Index during the last twelve months. The principal reason for the underperformance was stock and sector selection, fixed-income securities (8.3%) in the portfolio, and Fund expenses.

| |

PORTFOLIO ALLOCATION (As of 10/31/06) (unaudited) |

| Sector* | % of Total Value |

| Industrial | 25.2% |

| Consumer Cyclical | 20.7% |

| Financial | 17.2% |

| Consumer Non-Cyclical | 11.7% |

| Fixed Income & Other | 8.3% |

| Utilities | 5.6% |

| Technology | 4.0% |

| Communications | 3.1% |

| Basic Materials | 1.8% |

| Funds | 1.5% |

| Energy | 0.9% |

*Allocation is based on Bloomberg level 1 industry sector. Fixed income & other includes foreign currency valued at the then-current exchange. Percentages are based on total market value of investment securities. Holdings subject to change.

COMMONWEALTH INTERNATIONAL SERIES TRUST

Economic and Market Overview

During the fiscal year under review, the financial and economic environment was characterized by continued robust economic growth overseas, particularly in China and the United States. In Japan, as consumer prices began to increase, the Bank of Japan ended quantitative easing in March 2006 but short-term market interest rates continued to be close to zero. Long-term market interest rates showed a degree of weakness over the first half of the year but later increased, anticipating the end of quantitative easing by the Bank of Japan. At the same time, as interest rates further increased in the U.S., the interest rate spread between Japan and the U.S. widened and in the Yen/Dollar foreign exchange market there was a trend to Yen weakness and dollar strength.

Japan’s economic expansion, now close to being the longest-lasting since the Second World War, continues. Activity in the corporate sector in particular remains encouragingly robust, with the Bank of Japan’s September Tankan survey of corporate sentiment showing a stronger than expected improvement in business optimism, with both overall borrowing and borrowing by small companies rising strongly in the second quarter of 2006 in year-on-year terms. Contrary to previous recoveries, this time the pick-up has spread to the non-manufacturing sector, arguing well for the sustainability of the current expansion. We expect continued strength in the corporate sector to allow gross fixed investment to continue to make a large, albeit declining, contribution to economic growth. Annual gross domestic product, at around 2% in both 2007 and 2008, will remain respectable, even if rather slower than the rate of 2.5-3% a year seen in 2005-06.

| 3. | The TOPIX, also known as the Tokyo Stock Price Index, is a capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange. The index calculation excludes temporary issues and preferred stocks, and had a base value of 100 as of 1/04/68. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index. |

COMMONWEALTH INTERNATIONAL SERIES TRUST

Commonwealth Global Fund

Performance Overview

The Commonwealth Global Fund’s NAV as of October 31, 2006, was $17.07 per share compared to $15.06 per share on October 31, 2005. On December 29, 2005, the Global Fund made distributions of $0.37 per share. For the twelve months under review, Commonwealth Global Fund posted an 16.0% cumulative total return, assuming reinvestment of gross distributions. The Fund underperformed its benchmark, the Morgan Stanley Capital International (MSCI) World Index4, which posted a 22.0% total return for the same period. We do not attempt to track any index, but rather undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments. The Fund’s total return is presented net of Fund expenses, which means the Fund’s performance is reduced by applicable Fund fees and expenses whereas the index returns do not include any such fees. Performance data represents past performance, and does not guarantee future results. Investment return and principal value will fluctuate, and your investment may result in a gain or loss when you sell your shares. An investor should consider the Fund’s investment objectives, risks, charges and expenses carefully before investing. This and other important information about the Fund can be found in the Fund’s Prospectus.

Factors affecting the Fund’s returns included rising short-term interest rates in the U.S. and most other developed economies, slowing gross domestic product in the U.S., a weaker dollar versus most other major currencies, volatile commodity prices, and continued unrest in the Middle-East. The Commonwealth Global Fund trailed the MSCI World Index during the last twelve months. The principal reason for the deficit was stock selection and the presence of bonds (4.9%), preferred stock (1.6%) and short-term investments (2.5%) as equities outperformed fixed income securities during the period. Although higher energy prices prevailed during most of the year in review, contrary to conventional wisdom, two of the best performing portfolio securities were Continental Airlines and British Airways.

| |

PORTFOLIO ALLOCATION (As of 10/31/06) (unaudited) |

| Country/Region* | % of Total Value |

| North America | 41.9% |

| Europe | 31.4% |

| Emerging Markets | 9.9% |

| Bonds, Pfd. Stock, & Short Term Investments | 9.0% |

| Japan | 5.0% |

| Developed Asia ex-Japan | 2.8% |

*Short-term investments include cash & cash equivalents. Percentages based on total market value of investment securities. Holdings subject to change.

COMMONWEALTH INTERNATIONAL SERIES TRUST

Economic and Market Overview

The world economy is currently experiencing its longest run of above-trend growth since 1984-89. Indeed, this is already the longest period of global growth in excess of 4% per year since before the first oil shock of 1973. The current global expansion is being driven to an unprecedented extent by rapid growth among developing economies. According to the IMF’s World Economic Outlook database, developing economies have grown at an average annual rate of 7.3% per year over the four years to 2006, accounting for nearly two-thirds of the increase in total global gross domestic product during this period.

The growth of many developing economies has been partially fostered by what can be thought of as the ‘outsourcing’ of production of many goods and services previously produced in ‘advanced’ economies. Thus, the pace of growth in the ‘developing world’, and in the world economy as a whole, will still be influenced by swings in demand from the ‘advanced’ economies and (in particular) from the United States. In that context, the recent signs of a slowdown in the U.S. economy are of considerable importance to the global economy.

The marked downturn in the U.S. housing sector has precipitated a broader-based slowdown in U.S. economic activity. Falling home prices, sharply lower mortgage equity withdrawal and increased debt servicing and fuel costs have moderated household spending growth, while employment gains have weakened. Fortunately, the U.S. corporate sector remains healthy and business investment should continue to support growth in the year ahead. In addition, the recent bond market rally has helped to ease financial conditions which, combined with a marked fall in oil and gasoline prices, could offer some support for the embattled household sector going into 2007. Nonetheless, these factors may not be enough to prevent U.S. growth slowing to below 3% in 2007.

The Eurozone economy is steaming ahead at a growth rate quite a bit above potential. Business sentiment has turned increasingly upbeat again, with some forward-looking components indicating a strong finish to 2006. Eurozone businesses are still driving economic activity, thanks to high profit margins, high capacity utilization and still relatively low interest rates. Households too are increasingly optimistic about the near-term, although not as upbeat as businesses.

| 4. | The MSCI World Index is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance. As of May 2005 the MSCI World Index consisted of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index. |

COMMONWEALTH INTERNATIONAL SERIES TRUST

Commonwealth Real Estate Securities Fund

Performance Overview

The Commonwealth Real Estate Securities Fund’s NAV as of October 31, 2006, was $14.06 per share compared to $11.85 per share on October 31, 2005. On December 29, 2005, the Real Estate Securities Fund made distributions of $0.11 per share. For the twelve months under review, Commonwealth Real Estate Securities Fund posted a 19.7% cumulative total return, assuming reinvestment of gross distributions. The Fund underperformed its benchmark, the Morgan Stanley Capital International (MSCI) US REIT Index5, which posted a 37.8% total return for the same period. We do not attempt to track any index, but rather undertake investments on the basis of fundamental research. We also invest a portion of the Fund’s assets in fixed income investments. The Fund’s total return is presented net of Fund expenses, which means the Fund’s performance is reduced by applicable Fund fees and expenses whereas the index returns do not include any such fees. Performance data represents past performance, and does not guarantee future results. Investment return and principal value will fluctuate, and your investment may result in a gain or loss when you sell your shares. An investor should consider the Fund’s investment objectives, risks, charges and expenses carefully before investing. This and other important information about the Fund can be found in the Fund’s Prospectus.

The Fund’s underperformance of the MSCI US REIT Index may be in part explained by our strategy of investing in REIT’s (40.4%) as well as fixed income and real estate-related securities, as REIT’s outperformed the aforementioned during the period. REIT Indices such as the MSCI US REIT Index, which is comprised of only equity REIT’s, continued their outperformance of the broader market indices. In addition, the Fund continued to build and diversify its portfolio during the period and at times held cash and equivalents until investment opportunities arose.

| |

PORTFOLIO ALLOCATION (As of 10/31/06)* (unaudited) |

| Asset Allocation* | % of Total Value |

| U.S. REITS | 40.4% |

| International | 18.9% |

| Bonds, Pfd. Stock & Short-Term Investments | 15.1% |

| U.S. Other Real Estate | 12.0% |

| Closed End Funds | 8.6% |

| Exchange Traded Funds | 5.0% |

*Percentages are based on total market value of investment securities.

COMMONWEALTH INTERNATIONAL SERIES TRUST

Economic and Market Overview

REIT’s continued their impressive performance for the seventh consecutive year outpacing the broader market indices. Against a back drop of relatively low real interest rates, strong demand, a resilient consumer and healthy economic growth, REIT indices such as the MSCI US REIT Index posted returns of almost 37.7% for the period ended October 31, 2006. Given this and improving fundaments for most REIT sectors, REIT Mutual Funds once again witnessed strong inflows of capital after dropping in 2005. As of October, approximately $3.9 billion of capital flowed into REIT Funds, up from $2.0 billion in 2005.

Backed by strong demand and limited supply, most REIT’s saw increasing rents and occupancy levels, the share prices of Office, Hotel and Industrial REIT’s increased to all time highs. At the same time, the downturn in the residential (homebuilding) sector has improved the performance of residential REIT’s such as apartment REITS as limited supply and condo conversions have allowed apartments to realize higher occupancies and rents. The sector has also benefited from higher interest rates and the reduced affordability of single family homes.

Through the first half of 2006, more than $35 billion in REIT mergers, acquisitions and privatization deals have been finalized. REIT’s valuations have been justified by the large pools of investment cash from private equity investors. The year has seen several REIT’s either acquired or taken private, such as Brookfield Properties and Blackstone Group’s acquisition of Trizec Properties in June. More deals are in the works which may be supporting REIT’s share values.

In June of 2006, the Federal Reserve raised interest rates to 5.25% for the seventeenth consecutive time dating back to 2004. The Fed has since paused raising rates and we believe is one of the contributing factors that has caused the yield on the Ten Year Treasury to decline. Given the strong price outperformance of REIT shares, they now yield around an average 4.25%, less than the approximate 4.6% yield of the ten year U.S. Treasury, which may be an indication of overvaluations.

| 5. | The MSCI US REIT Index is a free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index. MSCI started calculating and maintaining the MSCI US REIT Index on June 20, 2005. Prior to this date the MSCI US REIT Index (then known as the Morgan Stanley REIT Index) was calculated and maintained by the AMEX. |

Management Review

In the following interview, the Funds’ Senior Portfolio Manager Robert W. Scharar discusses the Commonwealth International Series Trust’s operations, strategy and the market environment during the twelve-month period ended October 31, 2006.

Who is the advisor?

The Funds’ investment advisor is FCA Corp (“FCA”). FCA is a registered investment advisor located at 5847 San Felipe, Suite 850, Houston, Texas 77057. FCA and its predecessors have been in business since 1975.

COMMONWEALTH INTERNATIONAL SERIES TRUST

Who is the underwriter?

The principal underwriter of the Funds is Matrix Capital Group, Inc., 335 Madison Avenue, 11th Floor, New York, NY 10017.

Why do our Funds include shares of foreign companies?

We invest in companies outside the United States because we believe that there are significant investment opportunities in select foreign markets. We also believe that U.S. investors benefit from the diversification that investments outside the United States can provide. For a U.S. investor, allocation of a portion of the investor’s portfolio to international securities can provide the potential to diminish risk and achieve more consistent long-term performance in the investor’s overall portfolio. International investing also offers exposure to many leading companies and fast growing national economies.

What are some of the factors influencing a Fund’s portfolio turnover?

Each Fund generally invests in equity securities with the view to hold them long-term. The portfolio’s securities are evaluated on their long-term prospects. A particular Fund may experience higher or lower turnover ratios in certain years. Factors influencing portfolio turnover include, but are not limited to the following: rebalancing portfolio securities to take advantage of long-term opportunities and/or to reallocate between fixed income and equity securities; investing new Fund subscriptions; or selling securities to cover Fund redemptions. Higher levels of portfolio activity by a Fund may result in higher transaction costs and/or more realized gains or losses, the impact of which is borne by the Fund’s shareholders.

How can the size of the Fund impact the Funds’ expense ratio?

The operating expense ratios of mutual funds that invest overseas can be expected to be higher than those of mutual funds investing exclusively in securities of United States issuers, since certain costs (such as custodial, valuation, brokerage and communications) are higher when investing abroad. As with every mutual fund, size has an impact on the expense ratio. Typically, larger funds can have lower expense ratios as there is an increased opportunity to spread out fixed and semi-fixed costs necessary to operate the fund among a greater number of shareholders. Such fund expenses are allocated on a daily basis among all its shareholders. This is evidenced by the Commonwealth’s own Australia/New Zealand Fund which grew from assets of $4.53 million and an expense ratio of 5.74% on 10/31/01 to assets of $35.09 million and an expense ratio of 2.94% on 10/31/06.

Other Matters

The Commonwealth Funds, as previously disclosed in the Funds’ 2005 Annual Report and 2006 Semi- Annual Report to its shareholders filed with the SEC, were the subject of an investigation by the staff of the SEC concerning the Funds’ policies, procedures and disclosures relating to market timing transactions in the Australia/New Zealand and Japan Funds by certain investors, and use of the Funds’ borrowing authority to meet large redemption requests. There has been no allegation that anyone at FCA (the “Advisor”) or the Funds entered into any agreements or arrangements with market timers to permit market timing transactions in violation of Funds’ policies, or engaged in any deceptive practices to circumvent Fund policies.

As previously noted in the Funds’ 2006 Semi-annual Report, the SEC staff determined not to recommend that the SEC bring any enforcement action against the Funds or the Funds’ Trustees. Further, the staff also determined that it would not recommend any enforcement action against the Advisor and Mr. Robert W. Scharar, an interested Trustee and President of the Funds and President of the Advisor, relating to the adequacy of the Funds’ prospectus disclosure regarding the volume of, and the Funds’ policies governing, frequent short-term transactions in the Funds. However, the staff indicated that it was prepared to recommend an administrative proceeding against the Advisor and Mr. Scharar arising from the use of the Funds’ line of credit in excess of the Funds’ borrowing limitations set forth in the Funds’ prospectus.

COMMONWEALTH INTERNATIONAL SERIES TRUST

The Advisor and Mr. Scharar, without admitting or denying any of the SEC’s findings, reached a settlement with the SEC to resolve this matter without further litigation. Under the terms of the settlement, the SEC issued an administrative order dated November 29, 2006 sanctioning Mr. Scharar and the Advisor for violations of Sections 13(a)(2) and 34(b) of the Act through a censure, a civil monetary penalty of $25,000 each, and an order that they cease and desist future violations of these provisions. The order acknowledges that Mr. Scharar and FCA cooperated with the SEC staff in its investigation and took remedial steps by, among other things, making a payment, with interest, to the Australia/New Zealand Fund and the Japan Fund of certain amounts of interest incurred by those Funds on the amounts borrowed in excess of borrowing limitations. The payments made amounted to $6,148 and $13,753 for the Australia/New Zealand Fund and the Japan Fund, respectively. These amounts are reflected as expense reimbursement by advisor in the Statement of Operations. A portion of the initial payment made to the Japan Fund was deposited into the custody account of the Australia/New Zealand Fund and the Japan Fund in error. Accordingly, the Japan Fund has a receivable as of October 31, 2006 in the amount of $6,344 and the Australia/New Zealand Fund has a corresponding payable due from the Japan Fund in the same amount. Mr. Scharar will remain an officer and trustee of the Funds and FCA will remain the Funds -Advisor. In his capacity as the Funds President and Trustee, Mr. Scharar requested, during the year ended -October 31, 2006, that the Trust indemnify him for legal fees and expenses associated with his defense of this matter. On December 19, 2006, the Independent Trustees after considering all relevant facts and materials, including the opinion of Fund Counsel, has approved reimbursement of a portion of such legal fees and expenses excluding the fines, as well as the allocation of this indemnity cost to each of the funds based upon their relative average daily net assets.

Expenses incurred by the Funds in connection with this investigation impacted the net assets of the Funds and impacted each Fund’s NAV and the value of the investment made by each of the Funds’ shareholders.

In Closing: As we look forward to starting our fifteenth year as the Advisor to the Commonwealth Funds, we would like to take this opportunity to thank you for your support and continued interest in our Family of Funds. If you have any questions, please feel free to contact us.

| | |

| Robert W. Scharar | Wesley R. Yuhnke | Carlos Rubio |

| President and Portfolio Manager | Assistant Portfolio Manager | Assistant Portfolio Manager |

| Commonwealth International Series | Commonwealth International Series | Commonwealth International Series |

This report is intended for the shareholders of the family of funds of the Commonwealth International Series Trust. It may not be distributed to prospective investors unless it is preceded or accompanied by the current Funds’ Prospectus which may be obtained at www.commonwealthfunds.com or from the principal underwriter of the Funds or your broker.

We advise you to consider each Fund’s objectives, risks, charges and expenses carefully before investing in that Fund. The Prospectus contains information about those and other important matters relating to the Funds. Please read the Prospectus carefully before you invest.

COMMONWEALTH INTERNATIONAL SERIES TRUST

INFORMATION ABOUT YOUR FUNDS’ EXPENSES

As a shareholder of the Funds, you incur ongoing costs, including management fees; distribution; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2006 through October 31, 2006.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

| | | Beginning | | End | | Expense Paid | | Expense Ratio | |

| | | Account Value | | Account Value | | During Period* | | Expenses Paid | |

| | | 05/01/06 | | 10/31/06 | | 5/1/06 - 10/31/06 | | 5/1/06 - 10/31/06 | |

| Australia/New Zealand Fund | | $ | 1,000.00 | | $ | 1,065.40 | | $ | 18.22 | | | 3.50 | % |

| Japan Fund | | $ | 1,000.00 | | | 909.70 | | | 18.19 | | | 3.78 | % |

| Global Fund | | $ | 1,000.00 | | | 1,007.70 | | | 15.84 | | | 3.13 | % |

| Real Estate Securities Fund | | $ | 1,000.00 | | | 1,066.00 | | | 17.34 | | | 3.33 | % |

* Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year.

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | Beginning | | End | | Expense Paid | | Expense Ratio | |

| | | Account Value | | Account Value | | During Period* | | Expenses Paid | |

| | | 05/01/06 | | 10/31/06 | | 5/1/06 - 10/31/06 | | 5/1/06 - 10/31/06 | |

| Australia/New Zealand Fund | | $ | 1,000.00 | | $ | 1,007.56 | | $ | 17.71 | | | 3.50 | % |

| Japan Fund | | $ | 1,000.00 | | | 1,006.15 | | | 19.11 | | | 3.78 | % |

| Global Fund | | $ | 1,000.00 | | | 1,009.43 | | | 15.85 | | | 3.13 | % |

| Real Estate Securities Fund | | $ | 1,000.00 | | | 1,008.42 | | | 16.86 | | | 3.33 | % |

* Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by the number of days in the most recent fiscal half-year divided by the number of days in the fiscal year.

COMMONWEALTH INTERNATIONAL SERIES TRUST

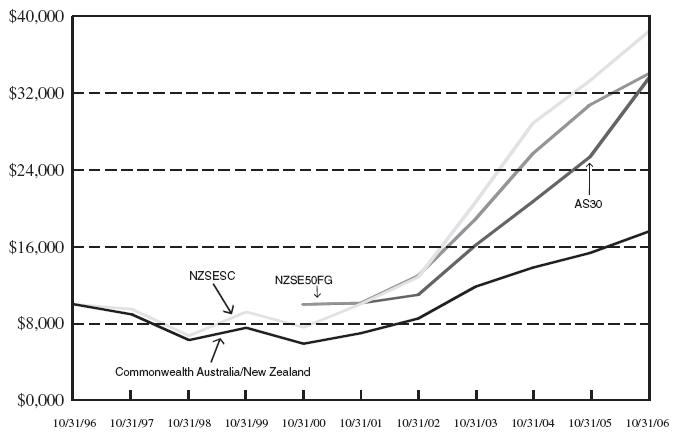

Comparison of Change in Value of a $10,000 Investment in Commonwealth Australia/New Zealand Fund* and the NZSCI**, NZSE50FG*** and AS30**** Indices

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions and the redemption of Fund shares. Otherwise, returns would have been lower. You should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. This and other information can be found in the Funds’ prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds’ directly at 888-345-1898 or by contacting your investment - representative. Please read it carefully before you invest or send money.

COMMONWEALTH INTERNATIONAL SERIES TRUST

| | | Average Annual Total Return | |

| | | as of October 31, 2006 | |

| | | 1 Year | | 5 Year | | 10 Year | |

| Commonwealth Australia/New Zealand Fund | | | 14.58 | % | | 20.24 | % | | 5.81 | % |

| New Zealand Small Companies Index | | | 15.12 | % | | 30.73 | % | | 14.38 | % |

| New Zealand Limited 50 Free Float Total Return Index | | | 10.21 | % | | 27.28 | % | | — | |

| Australian All Ordinaries Index | | | 32.62 | % | | 27.14 | % | | — | |

| * | The Fund’s performance assumes the reinvestment of all income dividends and capital gains distributions, if any. |

| ** | New Zealand Small Companies Index is capitalization-weighted index of all New Zealand equities excluding those on the New Zealand Stock Exchange 40 Index. It is not possible to invest directly into an index. |

| *** | The New Zealand Exchange Limited 50 Free Float Total Return Index is a modified market capitalization weighted index. This index consists of the top 50 companies by free float adjusted market capitalization that are listed on the New Zealand Exchange Limited. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index. |

| **** | The Australian All Ordinaries Index is a cap-weighted index. The index is made up of the largest 500 companies as measured by market cap that are listed on the Australian Stock Exchange. The index was developed with a base value of 500 as of 1979. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index. |

COMMONWEALTH INTERNATIONAL SERIES TRUST

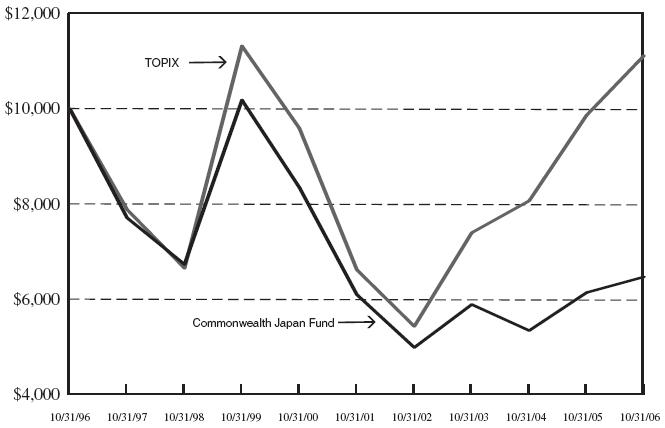

Comparison of Change in Value of a $10,000 Investment in Commonwealth Japan Fund* and the TOPIX**

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions and the redemption of Fund shares. Otherwise, returns would have been lower. You should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. This and other information can be found in the Funds’ prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contacting your investment representative. Please read it carefully before you invest or send money.

| | | Average Annual Total Return | |

| | | as of October 31, 2006 | |

| | | 1 Year | | 5 Year | | 10 Year | |

| Commonwealth Japan Fund | | | 5.60 | % | | 1.24 | % | | (4.24 | )% |

| TOPIX | | | 12.70 | % | | 10.93 | % | | 1.06 | % |

| * | The Fund’s performance assumes the reinvestment of all income dividends and capital gains distributions, if any. |

| ** | The TOPIX, also known as the Tokyo Stock Price Index, is a capitalization-weighted index of all the companies listed on the First Section of the Tokyo Stock Exchange. The index calculation excludes temporary issues and preferred stocks, and has a base value of 100 as of 1/04/68. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index. |

COMMONWEALTH INTERNATIONAL SERIES TRUST

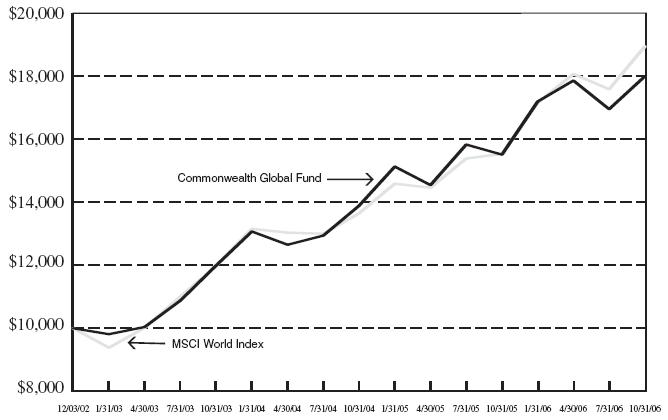

Comparison of Change in Value of a $10,000 Investment in Commonwealth Global Fund* ** and the MSCI World Index***

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions and the redemption of Fund shares. Otherwise, returns would have been lower. You should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. This and other information can be found in the Funds’ prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contacting your investment representative. Please read it carefully before you invest or send money.

| | | Annual Total Return | |

| | | as of October 31, 2006 | |

| | | 1 Year | | Inception* | |

| Commonwealth Global Fund | | | 16.04 | % | | 16.22 | % |

| MSCI World Index | | | 21.97 | % | | 17.75 | % |

| * | The Commonwealth Global Fund commenced operations on December 3, 2002. |

| ** | The Fund’s performance assumes the reinvestment of all income dividends and capital gains distributions, if any. |

| *** | The MSCI World Index is a free float-adjusted market capitalization index that is designed to measure global developed market equity performance. As of May 2005 the MSCI World Index consisted of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index. |

COMMONWEALTH INTERNATIONAL SERIES TRUST

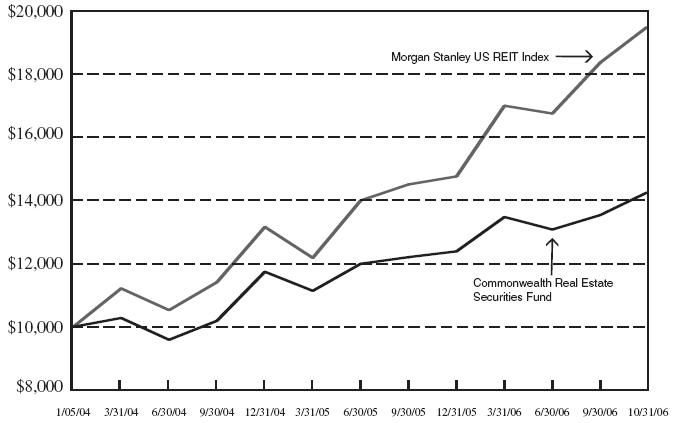

Comparison of Change in Value of a $10,000 Investment in Commonwealth Real Estate Securities Fund* ** and the MSCI US REIT Index***.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The graph and the average annual total returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions and the redemption of Fund shares. Otherwise, returns would have been lower. You should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. This and other information can be found in the Funds’ prospectus, which can be obtained from www.commonwealthfunds.com, by calling the Funds directly at 888-345-1898 or by contacting your investment representative. Please read it carefully before you invest or send money.

| | | Annual Total Return | |

| | | as of October 31, 2006 | |

| | | 1 Year | | Inception* | |

| Commonwealth Real Estate Securities Fund | | | 19.74 | % | | 13.44 | % |

| Morgan Stanley US REIT Index | | | 37.77 | % | | 26.71 | % |

| * | Real Estate Securities Fund commenced operations on January 5, 2004. |

| ** | The Fund’s performance assumes the reinvestment of all income dividends and capital gains distributions, if any. All market indices are unmanaged, do not incur fees and it is not possible to invest directly in any index. |

| *** | The MSCI US REIT Index is a free float-adjusted market capitalization weighted index that is comprised of equity REITs that are included in the MSCI US Investable Market 2500 Index, with the exception of specialty equity REITs that do not generate a majority of their revenue and income from real estate rental and leasing operations. The index represents approximately 85% of the US REIT universe. Index returns assume reinvestment of dividends and, unlike Fund returns, do not reflect any fees or expenses. It is not possible to invest directly into an index. MSCI started calculating and maintaining the MSCI US REIT Index on June 20, 2005. Prior to this date the MSCI US REIT Index (then known as the Morgan Stanley REIT Index) was calculated and maintained by the AMEX. |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

AUSTRALIA (27.08%) | | | | | |

COMMON STOCK (19.41%) | | | | | |

| | | | | | |

APPAREL (0.93%) | | | | | |

| Billabong International, Ltd. | | | 27,000 | | $ | 327,924 | |

| | | | | | | | |

BUILDING MATERIALS (1.68%) | | | | | | | |

| James Hardie Industries NV - ADR | | | 5,200 | | | 158,652 | |

| Rinker Group, Ltd. | | | 30,000 | | | 429,225 | |

| | | | | | | 587,877 | |

CHEMICALS (0.43%) | | | | | | | |

| Nufarm, Ltd. | | | 20,000 | | | 151,871 | |

| | | | | | | | |

COMMERCIAL SERVICES (0.83%) | | | | | | | |

| Brambles Industries, Ltd. | | | 30,000 | | | 290,162 | |

| | | | | | | | |

E-COMMERCE/SERVICES (0.39%) | | | | | | | |

| Webjet, Ltd. * | | | 440,000 | | | 136,934 | |

| | | | | | | | |

FOOD & BEVERAGES (2.81%) | | | | | | | |

| Burns Philp & Co., Ltd. * | | | 500,000 | | | 424,384 | |

| Goodman Fielder, Ltd. | | | 150,000 | | | 241,621 | |

| Woolworths, Ltd. | | | 20,000 | | | 320,299 | |

| | | | | | | 986,304 | |

HEALTHCARE (0.73%) | | | | | | | |

| Sonic Healthcare, Ltd. | | | 25,000 | | | 254,443 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

HOUSEHOLD PRODUCTS (0.59%) | | | | | |

| Corporate Express Australia, Ltd. | | | 50,000 | | $ | 207,740 | |

| | | | | | | | |

INSURANCE (1.63%) | | | | | | | |

| QBE Insurance Group, Ltd. | | | 30,000 | | | 573,269 | |

| | | | | | | | |

MINING (4.60%) | | | | | | | |

| Jubilee Mines NL | | | 75,000 | | | 756,679 | |

| Oxiana, Ltd. | | | 240,000 | | | 621,242 | |

| Pan Australian Resources, Ltd. * | | | 900,000 | | | 235,210 | |

| | | | | | | 1,613,131 | |

| | | | | | | | |

OIL & GAS (1.79%) | | | | | | | |

| Alinta, Ltd. | | | 6,930 | | | 56,882 | |

| Origin Energy, Ltd. | | | 102,702 | | | 570,181 | |

| | | | | | | 627,063 | |

| | | | | | | | |

RETAIL (1.43%) | | | | | | | |

| Just Group, Ltd. | | | 165,000 | | | 501,567 | |

| | | | | | | | |

TRANSPORTATION (1.16%) | | | | | | | |

| Toll Holdings, Ltd. | | | 34,000 | | | 407,018 | |

| | | | | | | | |

UTILITIES (0.41%) | | | | | | | |

| AGL Energy, Ltd. * | | | 12,000 | | | 142,636 | |

| | | | | | | | |

| | | | | | | | |

TOTAL COMMON STOCK (Cost $4,142,186) | | | | | | 6,807,939 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Principal | | Value | |

BONDS (7.67%) | | | | | |

| Australia Government Bond, 6.75%, due 11/15/06 † | | | 1,000,000 | | $ | 775,254 | |

| CBA Capital Australia, Ltd., 7.71%, due 04/15/15 # | | | 300,000 | | | 205,774 | |

| Citigroup, Inc., 5.75%, due 02/23/07 † | | | 500,000 | | | 386,246 | |

| Commonwealth Bank of Australia, 8.50%, due 06/01/10 | | | 300,000 | | | 332,180 | |

| Hanson Australia Funding, Ltd., 5.25%, due 03/15/13 | | | 250,000 | | | 243,616 | |

| Queensland Treasury Corp., 8.00%, due 09/14/07 † | | | 431,000 | | | 338,472 | |

| Telstra Corp., Ltd., 6.375%, due 04/01/12 | | | 400,000 | | | 410,843 | |

TOTAL BONDS (Cost $2,700,823) | | | | | | 2,692,385 | |

TOTAL AUSTRALIA (Cost $6,843,009) | | | | | | 9,500,324 | |

| | | Shares | | | |

| | | | | | |

NEW ZEALAND (70.84%) | | | | | |

COMMON STOCK (42.05%) | | | | | |

| | | | | | |

AGRICULTURE (3.01%) | | | | | |

| Allied Farmers, Ltd. | | | 372,786 | | | 539,040 | |

| PGG Wrightson, Ltd. | | | 457,263 | | | 517,143 | |

| | | | | | | 1,056,183 | |

| | | | | | | | |

AIRLINES (0.42%) | | | | | | | |

| Air New Zealand, Ltd. | | | 150,000 | | | 146,554 | |

| | | | | | | | |

APPLIANCES (2.71%) | | | | | | | |

| Fisher & Paykel Appliances Holdings, Ltd. | | | 250,000 | | | 635,743 | |

| Scott Technology, Ltd. * | | | 195,245 | | | 313,995 | |

| | | | | | | 949,738 | |

| | | | | | | | |

CHEMICALS (2.13%) | | | | | | | |

| Nuplex Industries, Ltd. | | | 166,355 | | | 746,452 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

COMMERCIAL SERVICES (3.30%) | | | | | |

| Mowbray Collectables, Ltd. | | | 511,593 | | $ | 531,160 | |

| Taylors Group, Ltd. | | | 519,431 | | | 626,421 | |

| | | | | | | 1,157,581 | |

| | | | | | | | |

FINANCIAL SERVICES (2.44%) | | | | | | | |

| Canterbury Building Society | | | 251,354 | | | 673,465 | |

| Loan & Building Society | | | 63,333 | | | 184,539 | |

| | | | | | | 858,004 | |

| | | | | | | | |

HEALTHCARE (6.18%) | | | | | | | |

| Fisher & Paykel Healthcare Corp. | | | 263,195 | | | 736,343 | |

| Ryman Healthcare, Ltd. | | | 164,485 | | | 946,849 | |

| Wakefield Health, Ltd. | | | 100,532 | | | 484,721 | |

| | | | | | | 2,167,913 | |

| | | | | | | | |

HUMAN RESOURCES (0.41%) | | | | | | | |

| Allied Work Force Group, Ltd. | | | 127,500 | | | 142,710 | |

| | | | | | | | |

METAL FABRICATION/HARDWARE (2.88%) | | | | | | | |

| Methven, Ltd. | | | 450,000 | | | 569,998 | |

| Steel & Tube Holdings, Ltd. | | | 140,000 | | | 440,959 | |

| | | | | | | 1,010,957 | |

MISCELLANEOUS MANUFACTURING (0.93%) | | | | | | | |

| Skellerup Holdings, Ltd. | | | 300,000 | | | 325,481 | |

| | | | | | | | |

MULTIMEDIA (2.06%) | | | | | | | |

| Sky Network Television, Ltd. | | | 189,745 | | | 721,524 | |

| | | | | | | | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

PORTS (5.59%) | | | | | |

| Port of Tauranga, Ltd. | | | 175,000 | | $ | 726,644 | |

| South Port of New Zealand, Ltd. | | | 1,027,930 | | | 1,234,012 | |

| | | | | | | 1,960,656 | |

| | | | | | | | |

REAL ESTATE (4.93%) | | | | | | | |

| AMP NZ Office Trust | | | 400,000 | | | 308,098 | |

| Calan Healthcare Properties Trust | | | 901,813 | | | 797,974 | |

| ING Property Trust | | | 758,633 | | | 624,936 | |

| | | | | | | 1,731,008 | |

| | | | | | | | |

RETAIL (0.92%) | | | | | | | |

| Pumpkin Patch, Ltd. | | | 50,000 | | | 133,864 | |

| Restaurant Brands New Zealand, Ltd. | | | 302,000 | | | 190,012 | |

| | | | | | | 323,876 | |

| | | | | | | | |

TELECOMMUNICATIONS (1.34%) | | | | | | | |

| Team Talk, Ltd. | | | 300,000 | | | 471,190 | |

| | | | | | | | |

TRANSPORTATION (0.37%) | | | | | | | |

| Toll NZ, Ltd. * | | | 70,000 | | | 131,663 | |

| | | | | | | | |

UTILITIES (2.43%) | | | | | | | |

| Infratil, Ltd. | | | 277,729 | | | 854,283 | |

| | | | | | | | |

TOTAL COMMON STOCK (Cost $10,559,546) | | | | | | 14,755,773 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

PREFERRED STOCK (0.99%) | | | | | |

BANKS (0.99%) | | | | | |

| ASB Capital, Ltd. | | | 500,000 | | $ | 348,215 | |

| | | | | | | | |

TOTAL PREFERRED STOCK (Cost $364,406) | | | | | | 348,215 | |

| | | �� | | | | | |

INVESTMENT COMPANIES (6.25%) | | | | | | | |

| AMP Investments' World Index Fund * | | | 791,119 | | | 778,136 | |

| New Zealand Investment Trust Plc | | | 220,169 | | | 1,413,645 | |

TOTAL INVESTMENT COMPANIES (Cost $1,482,066) | | | | | | 2,191,781 | |

| | | Principal | | | |

| | | | | | |

BONDS (21.46%) | | | | | |

| ANZ National Bank, Ltd., 7.04%, due 07/23/12 # | | | 1,000,000 | | | 678,478 | |

| ANZ National Bank, Ltd., 3.75%, due 01/05/09 | | | 300,000 | | | 292,095 | |

| Fletcher Building Finance, Ltd., 8.60%, due 03/15/08 # | | | 775,000 | | | 528,364 | |

| Fonterra Cooperative Group, Ltd., Perpetual Variable Rate Notes, 7.75% # ** | | | 90,000 | | | 66,314 | |

| Generator Bonds, Ltd., 8.00%, due 08/20/08 # | | | 270,000 | | | 183,768 | |

Global Corporate Credit, Ltd. Credit Linked Notes, 7.20%, due 12/30/08 # | | | 1,138,000 | | | 754,652 | |

Global Corporate Credit, Ltd. Credit Linked Notes, 8.25%, due 12/30/08 # | | | 1,126,000 | | | 748,957 | |

Global Equity Market Securities, Ltd., zero coupon, due 01/18/08 # | | | 3,350,000 | | | 3,051,778 | |

| GPG Finance Plc, 8.70%, due 12/15/08 # | | | 1,500,000 | | | 1,026,157 | |

| Housing Corp. of New Zealand, 8.00%, due 11/15/06 # | | | 300,000 | | | 201,137 | |

TOTAL BONDS (Cost $6,226,591) | | | | | | 7,531,700 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Principal | | Value | |

SHORT TERM INVESTMENTS (0.09%) | | | | | |

| Forsyth Barr Money Market, 6.75%# (Cost $34,163) | | | 49,745 | | $ | 33,321 | |

| | | | | | | | |

TOTAL NEW ZEALAND (Cost $18,666,772) | | | | | | 24,860,790 | |

TOTAL INVESTMENTS (Cost $25,509,781) (97.92%) | | | | | | 34,361,114 | |

ASSETS IN EXCESS OF OTHER LIABILITIES (2.08%) | | | | | | 730,118 | |

NET ASSETS (100%) | | | | | | 35,091,232 | |

| * | Non-income producing investment. |

| ** | Rate shown represents the rate at October 31, 2006, is subject to change and resets annually. |

| † | Principal amount shown is in Australian Dollars; Value shown is in U.S. Dollars. |

| # | Principal amount shown is in New Zealand Dollars; Value shown is in U.S. Dollars. |

| ADR | American Depositary Receipt |

The accompanying notes are an integral part of these financial statements.

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH JAPAN FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

COMMON STOCK (89.73%) | | | | | |

| | | | | | |

AUTOMOBILE MANUFACTURERS (1.42%) | | | | | |

| Toyota Motor Corp. - ADR | | | 1,000 | | $ | 118,000 | |

| | | | | | | | |

AUTOMOBILE PARTS & EQUIPMENT (5.25%) | | | | | | | |

| Denso Corp. | | | 3,000 | | | 114,403 | |

| NGK Spark Plug Co., Ltd. | | | 6,000 | | | 126,459 | |

| Sumitomo Rubber Industries, Inc. | | | 10,000 | | �� | 114,830 | |

| Tokai Rika Co., Ltd. | | | 4,000 | | | 80,031 | |

| | | | | | | 435,723 | |

| | | | | | | | |

BANKS (5.67%) | | | | | | | |

| Bank of Fukuoka, Ltd. | | | 10,000 | | | 79,860 | |

| Mitsubishi UFJ Financial Group, Inc. - ADR | | | 10,000 | | | 127,500 | |

| Sumitomo Mitsui Financial Group, Inc. | | | 24 | | | 262,665 | |

| | | | | | | 470,025 | |

| | | | | | | | |

BUILDING MATERIALS (1.94%) | | | | | | | |

| Taiheiyo Cement Corp. | | | 40,000 | | | 160,746 | |

| | | | | | | | |

CHEMICALS (1.82%) | | | | | | | |

| JSR Corp. | | | 6,000 | | | 150,827 | |

| | | | | | | | |

COMMERCIAL SERVICES (0.65%) | | | | | | | |

| Shinwa Art Auction Co., Ltd. | | | 21 | | | 53,687 | |

| | | | | | | | |

COMPUTERS (3.02%) | | | | | | | |

| Melco Holdings, Inc. | | | 4,500 | | | 132,743 | |

| TDK Corp. - ADR | | | 1,500 | | | 117,300 | |

| | | | | | | 250,043 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH JAPAN FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

DISTRIBUTION/WHOLESALE (1.85%) | | | | | |

| Marubeni Corp. | | | 30,000 | | $ | 153,649 | |

| | | | | | | | |

ELECTRONICS (7.39%) | | | | | | | |

| Fanuc, Ltd. | | | 1,500 | | | 130,178 | |

| Fujitsu, Ltd. | | | 10,000 | | | 81,570 | |

| Hoya Corp. | | | 4,000 | | | 154,589 | |

| Taiyo Yuden Co., Ltd. | | | 10,000 | | | 154,076 | |

| TOYO Corp. | | | 8,000 | | | 92,618 | |

| | | | | | | 613,031 | |

| | | | | | | | |

ENGINEERING & CONSTRUCTION (2.08%) | | | | | | | |

| Kajima Corp. | | | 36,000 | | | 172,066 | |

| | | | | | | | |

FINANCIAL SERVICES (0.75%) | | | | | | | |

| Nissin Co., Ltd. - ADR | | | 11,520 | | | 61,978 | |

| | | | | | | | |

FOOD & BEVERAGES (0.80%) | | | | | | | |

| Kirin Brewery Co., Ltd. | | | 5,000 | | | 66,521 | |

| | | | | | | | |

HEALTHCARE - PRODUCTS (4.15%) | | | | | | | |

| Nakanishi, Inc. | | | 1,500 | | | 182,634 | |

| Terumo Corp. | | | 4,000 | | | 161,772 | |

| | | | | | | 344,406 | |

| | | | | | | | |

HOME FURNISHINGS (1.39%) | | | | | | | |

| Alpine Electronics, Inc. | | | 8,000 | | | 115,532 | |

| | | | | | | | |

HUMAN RESOURCES (1.73%) | | | | | | | |

| Intelligence, Ltd. | | | 66 | | | 143,337 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH JAPAN FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

INSURANCE (5.08%) | | | | | |

| Aflac, Inc. | | | 3,000 | | $ | 134,760 | |

| Millea Holdings, Inc. - ADR | | | 3,750 | | | 140,175 | |

| T&D Holdings, Inc. | | | 2,000 | | | 146,210 | |

| | | | | | | 421,145 | |

| | | | | | | | |

INTERNET SERVICES (0.68%) | | | | | | | |

| Internet Initiative Japan, Inc. - ADR * | | | 7,000 | | | 56,700 | |

| | | | | | | | |

LEISURE & RECREATION (5.02%) | | | | | | | |

| Nintendo Co., Ltd. | | | 1,000 | | | 204,523 | |

| Resorttrust, Inc. | | | 2,800 | | | 84,272 | |

| Sankyo Co., Ltd. | | | 2,500 | | | 127,613 | |

| | | | | | | 416,408 | |

| | | | | | | | |

MACHINERY (4.82%) | | | | | | | |

| Kubota Corp. - ADR | | | 2,000 | | | 87,320 | |

| Meidensha Corp. | | | 38,000 | | | 139,062 | |

| Nidec Corp. - ADR | | | 9,000 | | | 173,610 | |

| | | | | | | 399,992 | |

| | | | | | | | |

METAL FABRICATION/HARDWARE (0.89%) | | | | | | | |

| NEOMAX Co., Ltd. | | | 4,000 | | | 73,533 | |

| | | | | | | | |

MISCELLANEOUS MANUFACTURING (0.81%) | | | | | | | |

| Amano Corp. | | | 5,000 | | | 67,291 | |

| | | | | | | | |

OIL & GAS (0.87%) | | | | | | | |

| AOC Holdings, Inc. | | | 4,000 | | | 72,507 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH JAPAN FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

PHARMACEUTICALS (3.16%) | | | | | |

| Chugai Pharmaceutical Co., Ltd. | | | 6,500 | | $ | 133,385 | |

| Takeda Pharmaceutical Co., Ltd. | | | 2,000 | | | 128,425 | |

| | | | | | | 261,810 | |

| | | | | | | | |

PRINTING (1.18%) | | | | | | | |

| Tosho Printing Co., Ltd. | | | 30,000 | | | 97,473 | |

| | | | | | | | |

PUBLISHING (1.72%) | | | | | | | |

| Kadokawa Holdings, Inc. | | | 4,000 | | | 142,277 | |

| | | | | | | | |

REAL ESTATE (5.74%) | | | | | | | |

| Recrm Research Co., Ltd. | | | 50 | | | 97,473 | |

| Sumitomo Realty & Development Co., Ltd. | | | 6,000 | | | 199,051 | |

| Tokyo Tatemono Co., Ltd. | | | 15,000 | | | 179,044 | |

| | | | | | | 475,568 | |

| | | | | | | | |

RETAIL (3.51%) | | | | | | | |

| Sundrug Co., Ltd. | | | 4,000 | | | 91,659 | |

| Yamada Denki Co., Ltd. | | | 2,000 | | | 199,051 | |

| | | | | | | 290,710 | |

| | | | | | | | |

TELECOMMUNICATIONS (0.74%) | | | | | | | |

| Allied Telesis Holdings KK * | | | 35,000 | | | 61,348 | |

| | | | | | | | |

TEXTILES (1.84%) | | | | | | | |

| Ichikawa Co., Ltd. | | | 35,000 | | | 152,324 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH JAPAN FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

TRANSPORTATION (8.19%) | | | | | |

| East Japan Railway Co. | | | 15 | | $ | 104,912 | |

| Hankyu Holdings, Inc. | | | 22,000 | | | 132,051 | |

| Keihin Electric Express Railway Co., Ltd. | | | 13,000 | | | 92,702 | |

| Keio Corp. | | | 18,000 | | | 120,046 | |

| Tobu Railway Co., Ltd. | | | 18,000 | | | 88,649 | |

| Yamato Holdings, Co., Ltd. | | | 9,000 | | | 140,516 | |

| | | | | | | 678,876 | |

| | | | | | | | |

UTILITIES (5.57%) | | | | | | | |

| Hokkaido Electric Power Co., Inc. | | | 6,000 | | | 143,132 | |

| Toho Gas Co., Ltd. | | | 35,000 | | | 163,396 | |

| Tohoku Electric Power Co., Inc. | | | 7,000 | | | 155,017 | |

| | | | | | | 461,545 | |

| | | | | | | | |

TOTAL COMMON STOCK (Cost $5,761,141) | | | | | | 7,439,078 | |

| | | | | | | | |

INVESTMENT COMPANIES (1.26%) | | | | | | | |

| Morgan Stanley Asia Pacific Fund, Inc. | | | 6,000 | | | 104,580 | |

TOTAL INVESTMENT COMPANIES (Cost $66,360) | | | | | | 104,580 | |

| | | Principal | | | |

| | | | | | |

BONDS (8.28%) | | | | | |

| Aflac, Inc., 6.50%, due 04/15/09 | | | 78,000 | | | 80,420 | |

| Bank of Tokyo-Mitsubishi UFJ, Ltd., 8.40%, due 04/15/10 | | | 48,000 | | | 52,692 | |

| Osaka Gas Co., Ltd., 7.125%, due 02/07/07 | | | 200,000 | | | 200,616 | |

| SMBC International Finance NV, 8.50%, due 06/15/09 | | | 150,000 | | | 161,364 | |

| Toyota Motor Credit Corp., Step-up bond, due 02/04/25 | | | 200,000 | | | 191,643 | |

TOTAL BONDS (Cost $696,619) | | | | | | 686,735 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH JAPAN FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Expiration Date | | | | | |

| | | Exercise Price | | Contracts (b) | | | |

CALL OPTIONS PURCHASED (0.61%) | | | | | | | |

| iShares MSCI Japan Index Fund | | | 01/20/07, 10 | | | 50 | | $ | 18,500 | |

| Sony Corp. | | | 01/20/07, 25 | | | 20 | | | 32,400 | |

TOTAL CALL OPTIONS PURCHASED (Cost $47,460) | | | | | | | | | 50,900 | |

TOTAL INVESTMENTS (Cost $ 6,571,580) (99.88%) | | | | | | | | | 8,281,293 | |

ASSETS IN EXCESS OF OTHER LIABILITIES, NET (0.12%) | | | | | | | | | 9,902 | |

NET ASSETS - (100%) | | | | | | | | | 8,291,195 | |

| * | Non-income producing investment |

| ADR | American Depositary Receipt |

| (b) | Each contract is equivalent to 100 shares |

The accompanying notes are an integral part of these financial statements.

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH GLOBAL FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

COMMON STOCK (80.91%) | | | | | |

| | | | | | |

BRAZIL (2.58%) | | | | | |

| Cia de Saneamento Basico do Estado de Sao Paulo - ADR | | | 10,000 | | $ | 302,300 | |

| Cia Vale do Rio Doce - ADR | | | 12,000 | | | 305,280 | |

| | | | | | | 607,580 | |

| | | | | | | | |

CANADA (1.67%) | | | | | | | |

| Biovail Corp. | | | 8,000 | | | 123,760 | |

| Vitran Corp., Inc. * | | | 16,000 | | | 268,800 | |

| | | | | | | 392,560 | |

| | | | | | | | |

FRANCE (5.97%) | | | | | | | |

| Arkema - ADR * | | | 6,130 | | | 299,270 | |

| BNP Paribas - ADR | | | 6,000 | | | 329,875 | |

| France Telecom SA - ADR | | | 10,000 | | | 261,000 | |

| Thomson - ADR | | | 9,200 | | | 159,528 | |

| Total SA - ADR | | | 5,200 | | | 354,328 | |

| | | | | | | 1,404,001 | |

| | | | | | | | |

GERMANY (5.17%) | | | | | | | |

| Deutsche Bank AG -ADR | | | 3,000 | | | 379,050 | |

| E.ON AG - ADR | | | 8,000 | | | 321,040 | |

| SAP AG - ADR | | | 5,000 | | | 248,200 | |

| Siemens AG - ADR | | | 3,000 | | | 269,430 | |

| | | | | | | 1,217,720 | |

| | | | | | | | |

GREAT BRITAIN (11.10%) | | | | | | | |

| Anglo American Plc - ADR | | | 13,000 | | | 294,840 | |

| British Airways Plc - ADR * | | | 3,800 | | | 332,120 | |

| GlaxoSmithKline Plc - ADR | | | 8,000 | | | 426,000 | |

| Intercontinental Hotels Group Plc - ADR | | | 22,642 | | | 440,613 | |

| Lloyds TSB Group Plc - ADR | | | 6,900 | | | 295,734 | |

| National Grid Plc - ADR | | | 3,071 | | | 194,855 | |

| Signet Group Plc - ADR | | | 8,000 | | | 183,840 | |

| Tate & Lyle Plc - ADR | | | 4,000 | | | 240,464 | |

| Vodafone Group Plc - ADR | | | 7,875 | | | 203,569 | |

| | | | | | | 2,612,035 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH GLOBAL FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

GUERNSEY (1.65%) | | | | | |

| Amdocs, Ltd. * | | | 10,000 | | $ | 387,600 | |

| | | | | | | | |

HONG KONG (0.61%) | | | | | | | |

| China Netcom Group Corp. (Hong Kong), Ltd. - ADR | | | 4,000 | | | 143,760 | |

| | | | | | | | |

INDIA (2.24%) | | | | | | | |

| ICICI Bank, Ltd. - ADR | | | 10,000 | | | 351,500 | |

| Satyam Computer Services, Ltd. - ADR | | | 8,000 | | | 176,880 | |

| | | | | | | 528,380 | |

| | | | | | | | |

ISRAEL (0.31%) | | | | | | | |

| Teva Pharmaceutical Industries, Ltd. - ADR | | | 2,198 | | | 72,468 | |

| | | | | | | | |

MEXICO (1.57%) | | | | | | | |

| Grupo Televisa SA - ADR | | | 15,000 | | | 370,200 | |

| | | | | | | | |

NETHERLANDS (4.30%) | | | | | | | |

| ABN AMRO Holding NV - ADR | | | 10,706 | | | 312,294 | |

| ING Groep NV - ADR | | | 10,842 | | | 480,626 | |

| Unilever NV - NYS | | | 9,000 | | | 217,800 | |

| | | | | | | 1,010,720 | |

| | | | | | | | |

PORTUGAL (1.08%) | | | | | | | |

| Portugal Telecom SGPS SA - ADR | | | 20,300 | | | 253,547 | |

| | | | | | | | |

SOUTH KOREA (1.58%) | | | | | | | |

| Korea Electric Power Corp. - ADR | | | 8,000 | | | 158,240 | |

| KT Corp. - ADR | | | 9,500 | | | 212,610 | |

| | | | | | | 370,850 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH GLOBAL FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

SPAIN (1.24%) | | | | | |

| Banco Santander Central Hispano SA - ADR | | | 17,000 | | $ | 291,040 | |

| | | | | | | | |

SWITZERLAND (1.12%) | | | | | | | |

| Nestle SA - ADR | | | 3,100 | | | 264,803 | |

| | | | | | | | |

UNITED STATES (38.72%) | | | | | | | |

| Advanced Micro Devices, Inc. * | | | 1,868 | | | 39,732 | |

| AGCO Corp. * | | | 20,000 | | | 535,000 | |

| American National Insurance | | | 2,998 | | | 347,768 | |

| BJ'S Wholesale Club, Inc. * | | | 5,075 | | | 145,399 | |

| Bunge, Ltd. | | | 6,500 | | | 416,715 | |

| Chemed Corp. | | | 5,200 | | | 184,548 | |

| Compass Bancshares, Inc. | | | 6,150 | | | 345,999 | |

| Conmed Corp. * | | | 7,720 | | | 171,307 | |

| Continental Airlines, Inc. * | | | 10,000 | | | 368,800 | |

| Dentsply International, Inc. | | | 6,700 | | | 209,576 | |

| DST Systems, Inc. * | | | 7,385 | | | 456,319 | |

| Electronic Arts, Inc. * | | | 10,000 | | | 528,900 | |

| Headwaters, Inc. * | | | 10,000 | | | 247,500 | |

| International Rectifier Corp. * | | | 10,000 | | | 359,700 | |

| KVH Industries, Inc. * | | | 16,000 | | | 174,720 | |

| Lifepoint Hospitals, Inc. * | | | 15,000 | | | 532,500 | |

| Lubrizol Corp. | | | 5,055 | | | 227,475 | |

| Lufkin Industries, Inc. | | | 10,000 | | | 603,400 | |

| Lyondell Chemical Co. | | | 10,000 | | | 256,700 | |

| National Oilwell Varco, Inc. * | | | 3,633 | | | 219,433 | |

| Norfolk Southern Corp. | | | 9,000 | | | 473,130 | |

| Pentair, Inc. | | | 12,760 | | | 420,314 | |

| Prudential Financial, Inc. | | | 3,000 | | | 230,790 | |

| Quanex Corp. | | | 6,487 | | | 217,379 | |

| SanDisk Corp. * | | | 5,000 | | | 240,500 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH GLOBAL FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

UNITED STATES (CONTINUED) | | | | | |

| SCANA Corp. | | | 6,075 | | $ | 242,757 | |

| Smith International, Inc. | | | 4,490 | | | 177,265 | |

| Todco * | | | 4,000 | | | 136,520 | |

| Varian Semiconductor Equipment Associates, Inc. * | | | 10,000 | | | 364,900 | |

| XTO Energy, Inc. | | | 5,000 | | | 233,300 | |

| | | | | | | 9,108,346 | |

TOTAL COMMON STOCK (Cost $13,915,949) | | | | | | 19,035,610 | |

| | | | | | | | |

INVESTMENT COMPANIES (10.30%) | | | | | | | |

| Commonwealth Australia/New Zealand Fund (a) | | | 37,625 | | | 656,183 | |

| Commonwealth Japan Fund (a) | | | 37,032 | | | 159,978 | |

| iShares MSCI EMU Index Fund | | | 2,000 | | | 194,780 | |

| iShares MSCI Japan Index Fund | | | 25,000 | | | 344,500 | |

| iShares S&P Europe 350 Index Fund | | | 1,500 | | | 150,360 | |

| iShares S&P Latin America 40 Index Fund | | | 1,500 | | | 230,100 | |

| iShares S&P/TOPIX 150 Index Fund | | | 3,500 | | | 424,900 | |

| Morgan Stanley Asia Pacific Fund, Inc. | | | 15,000 | | | 261,450 | |

TOTAL INVESTMENT COMPANIES (Cost 1,769,240) | | | | | | 2,422,251 | |

| | | | | | | | |

PREFERRED STOCK (1.56%) | | | | | | | |

| Equity Office Properties Trust | | | 1,000 | | | 59,776 | |

| Chesapeake Energy Corp. | | | 1,000 | | | 100,000 | |

| HSBC USA, Inc. | | | 8,000 | | | 208,000 | |

TOTAL PREFERRED STOCK (Cost $341,870) | | | | | | 367,776 | |

| | | | | | | | |

BONDS (4.94%) | | | | | | | |

| EnCana Corp., 4.60%, due 8/15/09 | | | 135,000 | | | 132,687 | |

| JP Morgan Chase & Co., 0.00%, due 2/10/11 | | | 150,000 | | | 151,500 | |

| Mexico Government International Bond, 4.625%, due 10/08/08 | | | 200,000 | | | 198,350 | |

| SMBC International Finance NV, 8.50%, due 6/15/09 | | | 270,000 | | | 290,455 | |

| Toyota Motor Credit Corp., Step-up Bond, due 2/04/25 | | | 200,000 | | | 191,643 | |

| Vodafone Group Plc, 3.95%, due 1/30/08 | | | 200,000 | | | 196,944 | |

TOTAL BONDS (Cost $1,173,786) | | | | | | 1,161,579 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH GLOBAL FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

SHORT TERM INVESTMENTS (1.58%) | | | | | |

| Fifth Third Bank Repurchase Agreement, 4.48%, dated 10/31/06, due | | | | | |

| 11/01/06, repurchase price $370,947 (Collateralized by | | | | | |

| FNCI, 4.50%, due 11/01/06, market value $382,257) | | | | | |

| (Cost $370,901) | | | 370,901 | | $ | 370,901 | |

| | | | | | | | |

TOTAL INVESTMENTS (Cost $17,571,746) (99.29%) | | | | | | 23,358,117 | |

ASSETS IN EXCESS OF OTHER LIABILITIES (0.71%) | | | | | | 166,846 | |

NET ASSETS - (100%) | | | | | | 23,524,963 | |

| * | Non-income producing investment. |

| ADR | American Depositary Receipt |

| (a) | Affiliated by having the same Investment Advisor. |

The accompanying notes are an integral part of these financial statements.

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH REAL ESTATE SECURITIES FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

COMMON STOCK (71.32%) | | | | | |

| | | | | | |

BUILDING MATERIALS (12.46%) | | | | | |

| Cemex SA de CV - ADR | | | 11,538 | | $ | 354,678 | |

| CRH Plc - ADR | | | 9,200 | | | 329,268 | |

| James Hardie Industries NV - ADR | | | 6,900 | | | 210,519 | |

| Lafarge SA - ADR | | | 5,000 | | | 167,750 | |

| Rinker Group, Ltd. - ADR | | | 6,000 | | | 428,160 | |

| Universal Forest Products, Inc. | | | 1,800 | | | 81,684 | |

| USG Corp. * | | | 5,000 | | | 244,450 | |

| | | | | | | 1,816,509 | |

| | | | | | | | |

DISTRIBUTION/WHOLESALE (1.31%) | | | | | | | |

| Wolseley Plc - ADR | | | 8,000 | | | 190,560 | |

| | | | | | | | |

FINANCIAL SERVICES (1.85%) | | | | | | | |

| Delta Financial Corp. | | | 17,000 | | | 163,200 | |

| Fannie Mae | | | 1,800 | | | 106,668 | |

| | | | | | | 269,868 | |

| | | | | | | | |

HOME BUILDERS (2.71%) | | | | | | | |

| Desarrolladora Homex SA de CV - ADR * | | | 9,000 | | | 395,100 | |

| | | | | | | | |

INSURANCE (1.67%) | | | | | | | |

| First American Corp. | | | 3,500 | | | 142,905 | |

| Stewart Information Services Corp. | | | 2,700 | | | 100,062 | |

| | | | | | | 242,967 | |

| | | | | | | | |

LODGING (1.23%) | | | | | | | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 3,000 | | | 179,220 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH REAL ESTATE SECURITIES FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

REAL ESTATE (5.53%) | | | | | |

| Alto Palermo SA - ADR | | | 17,000 | | $ | 214,200 | |

| Hang Lung Properties, Ltd. - ADR | | | 18,000 | | | 196,189 | |

| IRSA Inversiones y Representaciones SA - GDR * | | | 10,000 | | | 143,700 | |

| St. Joe Co.# | | | 2,000 | | | 107,560 | |

| WP Carey & Co. LLC | | | 5,000 | | | 144,450 | |

| | | | | | | 806,099 | |

| | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - APARTMENTS (4.60%) | | | | | | | |

| Camden Property Trust | | | 3,900 | | | 314,808 | |

| Education Realty Trust, Inc. | | | 9,000 | | | 139,230 | |

| GMH Communities Trust | | | 15,500 | | | 216,535 | |

| | | | | | | 670,573 | |

| | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - DIVERSIFIED (3.59%) | | | | | | | |

| First Potomac Realty Trust | | | 4,000 | | | 123,760 | |

| PS Business Parks, Inc. | | | 3,500 | | | 230,475 | |

| Washington Real Estate Investment Trust | | | 4,000 | | | 168,600 | |

| | | | | | | 522,835 | |

| | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - HEALTH CARE (1.07%) | | | | | | | |

| Senior Housing Properties Trust | | | 6,800 | | | 155,924 | |

| | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - HOTELS (9.48%) | | | | | | | |

| DiamondRock Hospitality Co. | | | 12,000 | | | 202,440 | |

| Equity Inns, Inc. | | | 11,000 | | | 184,580 | |

| Hersha Hospitality Trust | | | 12,000 | | | 131,520 | |

| Highland Hospitality Corp. | | | 17,300 | | | 239,086 | |

| Host Hotels & Resorts, Inc. | | | 11,636 | | | 268,326 | |

| Strategic Hotels & Resorts, Inc. | | | 10,000 | | | 212,700 | |

| Winston Hotels, Inc. | | | 11,900 | | | 143,990 | |

| | | | | | | 1,382,642 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH REAL ESTATE SECURITIES FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

REAL ESTATE INVESTMENT TRUSTS - MANUFACTURED HOMES (0.99%) | | | | | |

| American Land Lease, Inc. | | | 5,600 | | $ | 145,040 | |

| | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - MORTGAGE (1.32%) | | | | | | | |

| American Mortgage Acceptance Corp. | | | 4,000 | | | 71,760 | |

| RAIT Investment Trust | | | 4,000 | | | 120,240 | |

| | | | | | | 192,000 | |

| | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - OFFICE PROPERTY (7.01%) | | | | | | | |

| American Financial Realty Trust | | | 12,000 | | | 140,040 | |

| BioMed Realty Trust, Inc. | | | 4,000 | | | 128,920 | |

| Equity Office Properties Trust | | | 4,100 | | | 174,250 | |

| HRPT Properties Trust | | | 10,100 | | | 120,190 | |

| Kilroy Realty Corp. | | | 2,400 | | | 180,792 | |

| Maguire Properties, Inc. | | | 3,000 | | | 128,280 | |

| Republic Property Trust | | | 12,000 | | | 149,280 | |

| | | | | | | 1,021,752 | |

| | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - REGIONAL MALLS (1.60%) | | | | | | | |

| General Growth Properties, Inc. | | | 4,500 | | | 233,550 | |

| | | | | | | | |

REAL ESTATE INVESTMENT TRUSTS - SHOPPING CENTERS (6.03%) | | | | | | | |

| Acadia Realty Trust | | | 4,800 | | | 122,640 | |

| Agree Realty Corp. | | | 4,400 | | | 154,264 | |

| Kite Realty Group Trust | | | 10,000 | | | 183,400 | |

| Saul Centers, Inc. | | | 4,100 | | | 199,260 | |

| Trustreet Properties, inc. | | | 3,500 | | | 59,395 | |

| Weingarten Realty Investors | | | 3,450 | | | 160,425 | |

| | | | | | | 879,384 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH REAL ESTATE SECURITIES FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

REAL ESTATE INVESTMENT TRUSTS - STORAGE (3.21%) | | | | | |

| Extra Space Storage, Inc. | | | 13,200 | | $ | 243,408 | |

| Public Storage, Inc. | | | 2,500 | | | 224,275 | |

| | | | | | | 467,683 | |

REAL ESTATE INVESTMENT TRUSTS - WAREHOUSING/INDUSTRIAL (1.52%) | | | | | | | |

| Prologis | | | 3,500 | | | 221,445 | |

| | | | | | | | |

RETAIL-BUILING PRODUCTS (2.91%) | | | | | | | |

| Home Depot, Inc. | | | 3,300 | | | 123,189 | |

| Kingfisher Plc - ADR | | | 12,000 | | | 120,499 | |

| Lowe's Cos., Inc. | | | 6,000 | | | 180,841 | |

| | | | | | | 424,529 | |

SAVINGS AND LOANS (1.23%) | | | | | | | |

| New York Community Bancorp, Inc. | | | 11,000 | | | 179,850 | |

TOTAL COMMON STOCK (Cost $7,122,133) | | | | | | 10,397,530 | |

| | | | | | | | |

INVESTMENT COMPANIES (13.54%) | | | | | | | |

| AEW Real Estate Income Fund | | | 16,000 | | | 357,280 | |

| AIM Select Real Estate Income Fund | | | 16,000 | | | 309,760 | |

| DWS RREEF Real Estate Fund, Inc. | | | 9,000 | | | 230,400 | |

| iShares Cohen & Steers Realty Majors Index Fund | | | 3,000 | | | 293,610 | |

| iShares Dow Jones U.S. Real Estate Index Fund | | | 3,200 | | | 262,976 | |

| LMP Real Estate Income Fund | | | 16,000 | | | 350,240 | |

| streetTRACKS Dow Jones Wilshire REIT ETF Fund | | | 1,950 | | | 169,845 | |

TOTAL INVESTMENT COMPANIES (Cost $1,408,392) | | | | | | 1,974,111 | |

COMMONWEALTH INTERNATIONAL SERIES TRUST

COMMONWEALTH REAL ESTATE SECURITIES FUND

SCHEDULE OF INVESTMENTS - OCTOBER 31, 2006

| | | Shares | | Value | |

PREFERRED STOCK (2.60%) | | | | | |