FCA Corp will also seek to sell a stock when it believes its price is unlikely to appreciate longer term, other comparable investments offer better opportunities for the Fund, or in the course of adjusting the Fund’s emphasis(es) on a given country or sector. The Australia/New Zealand Fund generally invests in equity securities with the view to hold them long-term and debt securities to hold to maturity. The Australia/New Zealand Fund’s portfolio securities are evaluated on their long-term prospects.

An investment in the Fund may lose value and is not guaranteed or insured by a bank, the Federal Deposit Insurance Corporation, or any other government agency.

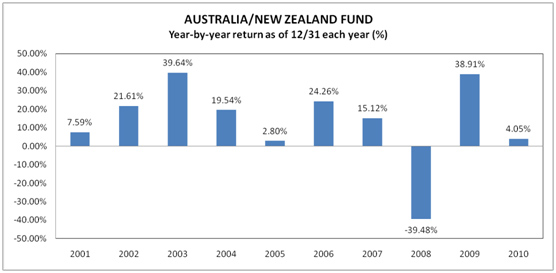

The bar chart and performance table below illustrate the variability of the Australia/New Zealand Fund’s returns. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how its average annual returns for 1, 5, and 10 years compare with those of a broad measure of market performance. The performance of the comparative indices does not reflect deductions for fees, expenses or taxes. Updated information on the Australia/New Zealand Fund’s results can be obtained by visiting www.commonwealthfunds.com.

Average Annual Total Return as of December 31, 2010 as compared to comparable indexes.

After-tax returns are calculated using the historical highest federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Australia/New Zealand Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

FCA Corp is the investment adviser to the Australia/New Zealand Fund.

Robert W. Scharar, Lead Portfolio Manager, has managed the Australia/New Zealand Fund since 1991.

Wesley Yuhnke, Assistant Portfolio Manager, has managed the Australia/New Zealand Fund since 2002.

Ronald Manning, Assistant Portfolio Manager, has managed the Australia/New Zealand Fund since 2007.

For important information about purchase and sale of fund shares, tax information and financial intermediary compensation, please turn to the sections of this prospectus entitled “Purchase and Sale of Fund Shares,” “Tax Information” and “Financial Intermediary Compensation” on page 26 of the prospectus.

The investment objective of the Africa Fund (the “Africa Fund”) is to provide long-term capital appreciation and current income.

This table describes the fees and expenses you may pay if you buy and hold shares of the Africa Fund.

The following example is intended to help you compare the cost of investing in the Africa Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000.00 in the Africa Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year, and that the Africa Fund’s operating expenses remain the same. Although, your actual costs may be higher or lower, based on these assumptions your costs would be:

The Africa Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Africa Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Africa Fund’s performance.

The Fund may invest up to 15% of its net assets in illiquid securities.

reliance on investment strategy judgments about the “growth” potential of particular companies or the relative “value” of particular securities may prove to be incorrect or inconsistent with the overall market’s assessment of these characteristics, which may result in lower-than-expected returns.

An investment in the Fund may lose value and is not guaranteed or insured by a bank, the Federal Deposit Insurance Corporation, or any other government agency.

The Fund recently commenced operations and, as a result, does not have a full calendar year of performance history. Investors should be aware that past performance is not necessarily an indication of how the Fund will perform in the future.

FCA Corp is the investment adviser to the Africa Fund.

Robert W. Scharar, Lead Portfolio Manager, has managed the Africa Fund since its inception.

Wesley Yuhnke, Assistant Portfolio Manager, has managed the Africa Fund since its inception.

Ronald Manning, Assistant Portfolio Manager, has managed the Africa Fund since its inception.

For important information about purchase and sale of fund shares, tax information and financial intermediary compensation, please turn to the sections of this prospectus entitled “Purchase and Sale of Fund Shares,” “Tax Information” and “Financial Intermediary Compensation” on page 26 of the prospectus.

The investment objective of the Commonwealth Japan Fund (the “Japan Fund”) is to provide long-term capital appreciation and current income.

This table describes the fees and expenses you may pay if you buy and hold shares of the Japan Fund.

The following example is intended to help you compare the cost of investing in the Japan Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000.00 in the Japan Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year, and that the Japan Fund’s operating expenses remain the same. Although, your actual costs may be higher or lower, based on these assumptions your costs would be:

The Japan Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Japan Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Japan Fund’s performance. During the most recent fiscal year, the Japan Fund’s portfolio turnover rate was 10% of the average value of its portfolio.

FCA Corp will also seek to sell a stock when it believes its price is unlikely to appreciate longer term, other comparable investments offer better opportunities for the Japan Fund, or in the course of adjusting the Fund’s emphasis(es) on a given sector. The Japan Fund generally invests in equity securities with the view to hold them long-term and debt securities to hold to maturity. The Japan Fund’s portfolio securities are evaluated on their long-term prospects.

An investment in the Fund may lose value and is not guaranteed or insured by a bank, the Federal Deposit Insurance Corporation, or any other government agency.

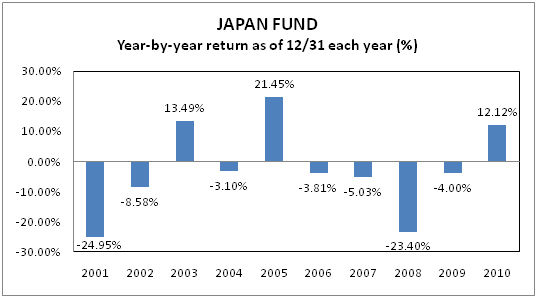

The bar chart and performance table below illustrate the variability of the Japan Fund’s returns. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how its average annual returns for 1, 5, and 10 years compare with those of a broad measure of market performance. Updated information on the Japan Fund’s results can be obtained by visiting www.commonwealthfunds.com.

Average Annual Total Return as of December 31, 2010 as compared to comparable index.

After-tax returns are calculated using the historical highest federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Japan Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

FCA Corp is the investment adviser to the Japan Fund.

Robert W. Scharar, Lead Portfolio Manager, has managed the Japan Fund since 1997.

Wesley Yuhnke, Assistant Portfolio Manager, has managed the Japan Fund since 2002.

Ronald Manning, Assistant Portfolio Manager, has managed the Japan Fund since 2007.

For important information about purchase and sale of fund shares, tax information and financial intermediary compensation, please turn to the sections of this prospectus entitled “Purchase and Sale of Fund Shares,” “Tax Information” and “Financial Intermediary Compensation” on page 26 of the prospectus.

The investment objective of the Commonwealth Global Fund (the “Global Fund”) is to provide long-term capital appreciation and current income.

This table describes the fees and expenses you may pay if you buy and hold shares of the Global Fund.

The following example is intended to help you compare the cost of investing in the Global Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000.00 in the Global Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year, and that the Global Fund’s operating expenses remain the same. Although, your actual costs may be higher or lower, based on these assumptions your costs would be:

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Global Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Global Fund’s performance. During the most recent fiscal year, the Global Fund’s portfolio turnover rate was 10% of the average value of its portfolio.

factors, including, among other things, economic, political, or market events, changes in relative valuations (to both a company’s growth prospects and to other issuers), and liquidity requirements. In selecting investments for the Fund, FCA Corp will assess factors it deems relevant and applicable under the particular circumstances, including, among others:| • | | Potential for capital appreciation (to both a company’s growth prospects and to other issuers); |

| • | | Earnings growth potential and/or sustainability; |

| • | | Price of security relative to historical and/or future cash flow; |

| • | | Sustainable franchise value; |

| • | | Price of a security relative to price of underlying stock, if a convertible security; |

| • | | Yield on security relative to yield of other fixed-income securities; |

| • | | Interest or dividend income; |

| • | | Call and/or put features; |

| • | | Price of a security relative to price of other comparable securities; |

| • | | Size of issue; and |

| • | | Impact of security on diversification of the portfolios. |

</R>

FCA Corp will also seek to sell a stock when it believes its price is unlikely to appreciate longer term, other comparable investments offer better opportunities for the Global Fund, or in the course of adjusting the Global Fund’s emphasis(es) on a given country or sector. The Global Fund generally invests in equity securities with the view to hold them long-term and debt securities to hold to maturity. The Global Fund’s portfolio securities are evaluated on their long-term prospects.

Principal Risks

<R>

Stock Market Risk: The Global Fund’s investments will fluctuate in price. This means that the Global Fund’s share price will go up and down, and Global Fund shareholders can lose money. Investments in stocks of any type involve risk because stock prices have no guaranteed value. Stock prices may fluctuate in response to various factors, including market conditions, political and other events, and developments affecting the particular issuer or its industry or geographic segment.Debt Securities Risk: Investments in debt and/or fixed income securities tend to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each. The Fund may invest in securities rated investment-grade or below investment-grade (“junk bonds”), and it may invest in debt securities that are of comparable quality that are not rated. The Fund could lose money or experience a lower rate of return if it holds junk bonds that are subject to higher credit risks and are less liquid than other fixed income or debt instruments. Junk bonds are often considered speculative and have significantly higher credit risk than investment-grade bonds.

Foreign Securities Risk: Foreign securities risks to which the Fund will be exposed are differences in securities markets in other countries, in tax policies, in the level of regulation and in accounting standards, as well as risks associated with fluctuations in currency values. Further, there is often less publicly available information about foreign issuers, and there is the possibility of negative governmental actions and of political and social unrest. The Global Fund may not be able to participate in rights and offerings that are not registered for sale to a U.S. investor. Securities in foreign markets also are generally less liquid and have greater price fluctuation than is typical in the U.S. for securities of comparable issuers. Transactions in foreign securities generally involve currency exchange cost and risk and often take longer to settle than do securities in the U.S., which may make it more difficult for a Fund

</R>

23

<R>

to liquidate positions. This in turn may cause delays in the Global Fund’s receipt of proceeds and an associated loss of potential dividend and interest income or the incurrence of interest cost on debt incurred to cover the period required until the receipt of the proceeds of these same securities. Additionally, although depositary receipts provide a convenient means to invest in non-U.S. securities, such investments involve risks generally similar to investments directly in foreign securities. The issuers of unsponsored depositary receipts may not receive information from the foreign issuer, and it is under no obligation to distribute shareholder communications or other information received from the foreign issuer of the deposited securities or to pass through voting rights to the holders of the depositary receipts. Additionally, although depositary receipts have risks similar to the securities that they represent, they may involve higher expenses, may trade at a discount (or premium) to the underlying security, may not pass through voting and other shareholder rights, and may be less liquid than the underlying securities listed on an exchange. To the extent that the Fund invests in issuers (or depositary receipts of issuers) located in emerging markets, the foreign securities risk may be heightened.Currency Risk. Investments that are denominated in a currency other than the U.S. dollar, or currency-related derivative instruments, are subject to the risk that the value of a particular currency will change in relation to one or more other currencies including the U.S. dollar.

Small Capitalization Risk: Investing in small capitalization companies may be subject to special risks associated with narrower product lines, more limited financial resources, smaller management groups, and a more limited trading market for their stocks as compared with larger companies. In addition, the earnings and prospects of smaller companies may be more volatile than those of larger companies and smaller companies may experience higher failure rates than do larger companies.

Risks Associated with Natural Resources Investments: Should the Global Fund invest in securities of companies involved in oil and gas, timber or mining activities, such investments will involve an increased number of risks, including geological risks, environmental liabilities, governmental regulations, and other risks involved in exploration, mining, distribution and marketing oil, gas, and other minerals, which can result in a higher degree of overall risk for the Global Fund.

Commodities-Related Risk. Should the Fund invest in securities of companies involved in oil and gas or mining activities, such investments will involve a high degree of risk, including geological risks, environmental liabilities, governmental regulations, and other risks involved in exploration, mining, distribution of, and marketing oil, gas, and other minerals. These types of investments may be affected by changes in markets, economies, weather and political and regulatory developments.

Derivatives Risk. The value of derivatives may rise or fall more rapidly than other investments. For some derivatives, it is possible to lose more than the amount invested in the derivative. If the Fund uses derivatives to “hedge” the overall risk of its portfolio, it is possible that the hedge may not succeed. Over the counter derivatives are also subject to counterparty risk, which is the risk that the other party to the contract will not fulfill its contractual obligation to complete the transaction with the Fund. Other risks of investments in derivatives include imperfect correlation between the value of these instruments and the underlying assets; risks of default by the other party to the derivative transactions; risks that the transactions may result in losses that offset gains in portfolio positions; and risks that the derivative transactions may not be liquid.

Risks Associated with Investments in Other Investment Companies: The Global Fund may invest in shares of other investment companies, including open-end funds and closed-end funds and exchange-traded funds (“ETFs”). When the Global Fund invests in other investment companies and ETFs, it will indirectly bear its proportionate share of any fees and expenses payable directly by the other investment company. Therefore, the Global Fund will incur higher expenses, many of which may be duplicative. In addition, the Global Fund may be affected by losses of the underlying funds and the level of risk arising

</R>

24

<R>

from the investment practices of the underlying funds (such as the use of derivative transactions by the underlying funds). ETFs and closed-end funds are subject to additional risks such as the fact that the market price of its shares may trade above or below its net asset value or an active market may not develop. The Global Fund has no control over the investments and related risks taken by the underlying funds in which it invests.Management Risk. FCA Corp’s judgments about the attractiveness and potential appreciation of a security may prove to be inaccurate and may not produce the desired results. Additionally, FCA Corp’s reliance on investment strategy judgments about the “growth” potential of particular companies or the relative “value” of particular securities may prove to be incorrect or inconsistent with the overall market’s assessment of these characteristics, which may result in lower-than-expected returns.

</R>

Abusive Trading Activities. Frequent short-term purchases, redemptions or exchanges in Global Fund shares (sometimes referred to as “market timing” or “frequent trading activities”) may result in a dilution in the value of Global Fund shares for other shareholders. Such activity may create transaction costs that are borne by all shareholders, may disrupt the orderly management of the Global Fund’s portfolio investments, and may affect the Global Fund’s cost and performance for other shareholders. The Board of Trustees has adopted policies to discourage abusive trading activities and has approved procedures to implement those policies. There is no guarantee that these procedures can detect or prevent all abusive trading activities and, therefore, such activities may occur.

An investment in the Fund may lose value and is not guaranteed or insured by a bank, the Federal Deposit Insurance Corporation, or any other government agency.

25

FUND’S PAST PERFORMANCE

<R>

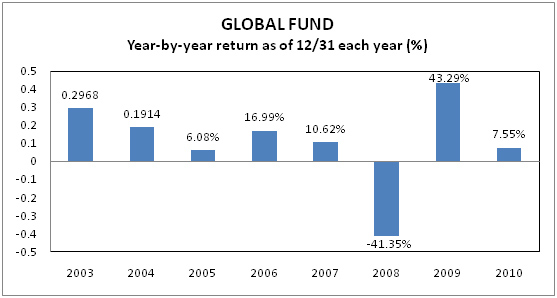

The bar chart and performance table below illustrate the variability of the Global Fund’s returns. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how its average annual returns for 1-year, 5-year, and since inception periods compare with those of a broad measure of market performance. The performance of the comparative index does not reflect deductions for fees, expenses or taxes. Updated information on the Global Fund’s results can be obtained by visiting www.commonwealthfunds.com.

</R>

| For the periods included in the bar chart: |

| | | |

| Best Quarter | | 21.24%, 2nd Quarter, 2009 |

| Worst Quarter | | (26.79)%, 4th Quarter, 2008 |

Average Annual Total Return as of December 31, 2010 as compared to comparable index.

| | | | | | | | | | | | Since Inception |

| | | | 1 Year | | | 5 Years | | | (December 3, 2002) |

| Return Before Taxes | | | 7.55 | % | | | 3.19 | % | | | 8.31 | % |

| | | | | | | | | | | | | |

| Return After Taxes on Distribution | | | 7.55 | % | | | 2.84 | % | | | 7.94 | % |

| | | | | | | | | | | | | |

| Return After Taxes on Distribution and Redemptions | | | 4.91 | % | | | 2.75 | % | | | 7.28 | % |

| | | | | | | | | | | | | |

| MSCI World Index | | | 12.34 | % | | | 2.99 | % | | | 8.28 | % |

| | | | | | | | | | | | | |

26

After-tax returns are calculated using the historical highest federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Global Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Management

FCA Corp is the investment adviser to the Global Fund.

Portfolio Managers

<R>

Robert W. Scharar, Lead Portfolio Manager, has managed the Global Fund since 2002.

Wesley Yuhnke, Assistant Portfolio Manager, has managed the Global Fund since 2002.

Ronald Manning, Assistant Portfolio Manager, has managed the Global Fund since 2007.

</R>

For important information about purchase and sale of fund shares, tax information and financial intermediary compensation, please turn to the sections of this prospectus entitled “Purchase and Sale of Fund Shares,” “Tax Information” and “Financial Intermediary Compensation” on page 26 of the prospectus.

27

COMMONWEALTH REAL ESTATE SECURITIES FUND (CNREX)

Investment Objective

The investment objective of the Commonwealth Real Estate Securities Fund (the “Real Estate Securities Fund”) is to provide long-term capital appreciation and current income.

Fees and Expenses of the Fund

This table describes the fees and expenses you may pay if you buy and hold shares of the Real Estate Securities Fund.

| | SHAREHOLDER FEES (fees paid directly from your investment) | | | |

| | Redemption Fee (as a percentage of the amount redeemed or exchanged within 14 days and a $15 fee for redemptions paid by wire) | | 2.00 | % |

| | ANNUAL FUND OPERATING EXPENSES

(expenses that you pay each year as a percentage of the value of your investment) | | | |

| | Management Fee | | 0.75 | % |

| | Distribution (12b-1) Fees1 | | 0.25 | % |

| | Other Expenses | | 2.22 | % |

| | Acquired Fund Fees and Expenses2 | | 0.07 | % |

| | Total Annual Fund | | | |

| | Operating Expenses | | 3.29 | % |

| <R> |

| | 1. | | The Real Estate Securities Fund has adopted a Rule 12b-1 Plan that permits it to pay up to 0.35% of its average net assets each year. The Board of Trustees has adopted a resolution to spend not more than 0.25% of the Fund’s average net assets under the Rule 12b-1 Plan until, at the earliest, March 1, 2013. |

| </R> |

| |

| | 2. | | The term “Acquired Funds” refers to other investment companies in which the Real Estate Securities Fund invests and represents the pro rata expense indirectly incurred by the Fund as a result of investing in other investment companies, including ETFs, closed-end funds and money market funds (but excluding REITs) that have their own expenses. These fees and expenses are not used to calculate the Fund’s net asset value. The Total Annual Fund Operating Expenses will not correlate to the expense ratio in the Fund’s financial statements. |

Example:

The following example is intended to help you compare the cost of investing in the Real Estate Securities Fund with the cost of investing in other mutual funds.

The example assumes that you invest $10,000.00 in the Real Estate Securities Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year, and that the Real Estate Securities Fund’s operating expenses remain the same. Although, your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | | 3 Years | | 5 Years | | 10 Years |

| $332 | | $1,013 | | $1,717 | | $3,585 |

Portfolio Turnover

The Real Estate Securities Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Real Estate Securities Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Real Estate Securities Fund’s performance. During the most recent fiscal year, the Real Estate Securities Fund’s portfolio turnover rate was 21% of the average value of its portfolio.

Principal Investment Strategies

<R>

Under normal market conditions, the Real Estate Securities Fund invests at least 80% of its net assets in real estate securities. Investments made by the Real Estate Securities Fund are in issuers in real estate and related industries (i.e., those issuers whose fortunes are impacted by the real estate market). The Real Estate Securities Fund invests primarily in equity securities (including common stock and preferred stock and securities convertible into common stock) as well as in the debt securities of companies in real estate industries, which may include commercial and/or residential real estate investment trusts (“REITs”), publicly traded real estate development companies, real estate management companies, building supply companies, timber companies, real property holdings and other publicly-traded companies involved in real estate related activities and industries. The Real Estate Securities Fund may invest in securities denominated in any currency. The Real Estate Securities Fund’s investments may include issuers of any market capitalization. In addition to buying equity and debt securities, the Real Estate Securities Fund may invest in depositary receipts, which are dollar-denominated depositary receipts that, typically, are issued by a United States bank or trust company and represent the deposit with that bank or trust company of a security of a foreign issuer. These depositary receipts may be sponsored or unsponsored. The Real Estate Securities Fund may invest in shares of other investment companies, including open-end and closed-end funds and exchange-traded funds. The Real Estate Securities Fund may invest in emerging market countries. The Real Estate Securities Fund may invest in companies that focus on natural resources production, refining and development.The Fund’s investments in debt securities may include obligations of governmental issuers, commercial paper and other companies regardless of credit quality and regardless of whether such securities are rated or unrated by nationally recognized statistical rating organizations (“NRSROs”). The determination as to whether to make a particular investment in debt securities is based on FCA Corp’s analysis of the risk of the debt security versus the price and return of such debt security. The Fund’s debt investments may include securities that are viewed as being of a credit quality that is below investment-grade (i.e., “junk bonds”) based on ratings established by NRSROs regardless of whether such debt security is rated or not.

The Fund may also enter into derivative transactions. The Fund may use derivative transactions for any purpose consistent with its investment objective, such as for hedging, obtaining market exposure, and generating premium income. The derivative securities that the Fund may purchase or sell (write) exchange-traded put or call options on stocks or stock indices. The Fund also may enter into foreign currency forward contracts.

FCA Corp has long-term investment goals and its process seeks to identify potential portfolio investments that can be held over an indefinite time horizon. FCA Corp evaluates its beliefs and adjusts portfolio holdings in light of prevailing market conditions and other factors, including, among other things, economic, political, or market events, changes in relative valuations (to both a company’s growth prospects and to other issuers), and liquidity requirements. In selecting investments for the Fund, FCA Corp will assess factors it deems relevant and applicable under the particular circumstances, including, among others:

</R>

29

| <R> |

| • | | Potential for capital appreciation (to both a company’s growth prospects and to other issuers); |

| • | | Earnings growth potential and/or sustainabilty; |

| • | | Price of security relative to historical and/or future cash flow; |

| • | | Sustainable franchise value; |

| • | | Price of a security relative to price of underlying stock, if a convertible security; |

| • | | Yield on security relative to yield of other fixed-income securities; |

| • | | Interest or dividend income; |

| • | | Call and/or put features; |

| • | | Price of a security relative to price of other comparable securities; |

| • | | Size of issue; and |

| • | | Impact of security on diversification of the portfolios. |

</R>

FCA Corp will also seek to sell a stock when it believes its price is unlikely to appreciate longer term, other comparable investments offer better opportunities for the Real Estate Securities Fund, or in the course of adjusting the Real Estate Securities Fund’s emphasis(es) on a given sector. The Real Estate Securities Fund generally invests in equity securities with the view to hold them long-term and debt securities to hold to maturity. The Real Estate Securities Fund’s portfolio securities are evaluated on their long-term prospects.

Principal Risks

<R>

Stock Market Risk: The Real Estate Securities Fund’s investments will fluctuate in price. This means that the Real Estate Securities Fund’s share price will go up and down, and Real Estate Securities Fund shareholders can lose money. Investments in stocks of any type involve risk because stock prices have no guaranteed value. Stock prices may fluctuate in response to various factors, including market conditions, political and other events, and developments affecting the particular issuer or its industry or geographic segment.Debt Securities Risk: Investments in debt and/or fixed income securities tend to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each. The Fund may invest in securities rated investment-grade or below investment-grade (“junk bonds”), and it may invest in debt securities that are of comparable quality that are not rated. The Fund could lose money or experience a lower rate of return if it holds junk bonds that are subject to higher credit risks and are less liquid than other fixed income or debt instruments. Junk bonds are often considered speculative and have significantly higher credit risk than investment-grade bonds.

Small Capitalization Risk: Investing in small capitalization companies may be subject to special risks associated with narrower product lines, more limited financial resources, smaller management groups, and a more limited trading market for their stocks as compared with larger companies. In addition, the earnings and prospects of smaller companies may be more volatile than those of larger companies and smaller companies may experience higher failure rates than do larger companies.

Foreign Securities Risk: Foreign securities risks to which the Fund will be exposed are differences in securities markets in other countries, in tax policies, in the level of regulation and in accounting standards, as well as risks associated with fluctuations in currency values. Further, there is often less publicly available information about foreign issuers, and there is the possibility of negative governmental actions and of political and social unrest. The Real Estate Securities Fund may not be able

</R>

30

<R>

to participate in rights and offerings that are not registered for sale to a U.S. investor. Securities in foreign markets also are generally less liquid and have greater price fluctuation than is typical in the U.S. for securities of comparable issuers. Transactions in foreign securities generally involve currency exchange cost and risk and often take longer to settle than do securities in the U.S., which may make it more difficult for a Fund to liquidate positions. This in turn may cause delays in the Real Estate Securities Fund’s receipt of proceeds and an associated loss of potential dividend and interest income or the incurrence of interest cost on debt incurred to cover the period required until the receipt of the proceeds of these same securities. Additionally, although depositary receipts provide a convenient means to invest in non-U.S. securities, such investments involve risks generally similar to investments directly in foreign securities. The issuers of unsponsored depositary receipts may not receive information from the foreign issuer, and it is under no obligation to distribute shareholder communications or other information received from the foreign issuer of the deposited securities or to pass through voting rights to the holders of the depositary receipts. Additionally, although depositary receipts have risks similar to the securities that they represent, they may involve higher expenses, may trade at a discount (or premium) to the underlying security, may not pass through voting and other shareholder rights, and may be less liquid than the underlying securities listed on an exchange. To the extent that the Fund invests in issuers (or depositary receipts of issuers) located in emerging markets, the foreign securities risk may be heightened.Currency Risk. Investments that are denominated in a currency other than the U.S. dollar, or currency-related derivative instruments, are subject to the risk that the value of a particular currency will change in relation to one or more other currencies including the U.S. dollar.

Risks Associated with Natural Resources Investments: Should the Real Estate Securities Fund invest in securities of companies involved in oil and gas, timber or mining activities, such investments will involve an increased number of risks, including geological risks, environmental liabilities, governmental regulations, and other risks involved in exploration, mining, distribution and marketing oil, gas, and other minerals, which can result in a higher degree of overall risk for the Real Estate Securities Fund.

Commodities-Related Risk. Should the Fund invest in securities of companies involved in oil and gas or mining activities, such investments will involve a high degree of risk, including geological risks, environmental liabilities, governmental regulations, and other risks involved in exploration, mining, distribution of, and marketing oil, gas, and other minerals. These types of investments may be affected by changes in markets, economies, weather and political and regulatory developments.

Risks Associated with Real Estate Investment Trusts: The Real Estate Securities Fund may invest in equity interests or debt obligations issued by REITs. REITs are pooled investment vehicles which invest primarily in income producing real estate or real estate related loans or interests. Equity REITs invest the majority of their assets directly in real property and derive income primarily from the collection of rents. Equity REITs can also realize capital gains by selling property that has appreciated in value. Mortgage REITs invest the majority of their assets in real estate mortgages and derive income from the collection of interest payments. Similar to investment companies, REITs are not taxed on income distributed to shareholders provided they comply with certain requirements of the Internal Revenue Code of 1986, as amended (the “Code”). The Real Estate Securities Fund will indirectly bear its proportionate share of expenses incurred by REITs in which the Fund invests in addition to the expenses incurred directly by the Real Estate Securities Fund. The Real Estate Securities Fund will be subject to risks similar to those associated with the direct ownership of real estate, including: declines in the value of real estate, risks related to general and local economic conditions, dependency on management skill, heavy cash flow dependency, possible lack of availability of mortgage funds, overbuilding, extended vacancies of properties, increased competition, increases in property taxes and operating expenses, changes in zoning laws, losses due to costs resulting from the clean-up of environmental problems, liability to third parties for damages resulting from environmental problems, casualty or condemnation losses, limitations

</R>

31

<R>

on rents, changes in neighborhood values and the appeal of properties to tenants, changes in interest rates and changes in the tax laws.

</R>

Additionally, equity REITs may be affected by changes in the value of the underlying property owned by the REITs, while mortgage REITs may be affected by the quality of any credit extended. REITs are dependent upon management skills, are not diversified, are subject to heavy cash flow dependency, default by borrowers and self-liquidation. REITs are also subject to the possibilities of failing to qualify for tax free pass-through of income under the Code and failing to maintain their exemption from registration under the Investment Company Act of 1940, as amended (the “1940 Act”).

REITs (especially mortgage REITs) are also subject to interest rate risks. When interest rates decline, the value of a REIT’s investment in fixed rate obligations can be expected to rise. Conversely, when interest rates rise, the value of a REIT’s investment in fixed rate obligations can be expected to decline. In contrast, as interest rates on adjustable rate mortgage loans are reset periodically, yields on a REIT’s investment in such loans will gradually align themselves to fluctuate less dramatically in response to interest rate fluctuations than would investments in fixed rate obligations.

Finally, investments in REITs also involve the following risks: limited financial resources, infrequent or limited trading, and abrupt or erratic price movements.

<R>

Risks Associated with Investments in Other Investment Companies: The Real Estate Securities Fund may invest in shares of other investment companies, including open-end funds and closed-end funds and exchange-traded funds (“ETFs”). When the Fund invests in other investment companies and ETFs, it will indirectly bear its proportionate share of any fees and expenses payable directly by the other investment company. Therefore, the Fund will incur higher expenses, many of which may be duplicative. In addition, the Fund may be affected by losses of the underlying funds and the level of risk arising from the investment practices of the underlying funds (such as the use of derivative transactions by the underlying funds). ETFs and closed-end funds are subject to additional risks such as the fact that the market price of its shares may trade above or below its net asset value or an active market may not develop. The Fund has no control over the investments and related risks taken by the underlying funds in which it invests.Derivatives Risk. The value of derivatives may rise or fall more rapidly than other investments. For some derivatives, it is possible to lose more than the amount invested in the derivative. If the Fund uses derivatives to “hedge” the overall risk of its portfolio, it is possible that the hedge may not succeed. Over the counter derivatives are also subject to counterparty risk, which is the risk that the other party to the contract will not fulfill its contractual obligation to complete the transaction with the Fund. Other risks of investments in derivatives include imperfect correlation between the value of these instruments and the underlying assets; risks of default by the other party to the derivative transactions; risks that the transactions may result in losses that offset gains in portfolio positions; and risks that the derivative transactions may not be liquid.

Management Risk. FCA Corp’s judgments about the attractiveness and potential appreciation of a security may prove to be inaccurate and may not produce the desired results. Additionally, FCA Corp’s reliance on investment strategy judgments about the “growth” potential of particular companies or the relative “value” of particular securities may prove to be incorrect or inconsistent with the overall market’s assessment of these characteristics, which may result in lower-than-expected returns.

</R>

Abusive Trading Activities. Frequent short-term purchases, redemptions or exchanges in Real Estate Securities Fund shares (sometimes referred to as “market timing” or “frequent trading activities”) may result in a dilution in the value of Real Estate Securities Fund shares for other shareholders. Such activity may create transaction costs that are borne by all shareholders, may disrupt the orderly

32

management of the Real Estate Securities Fund’s portfolio investments, and may affect the Real Estate Securities Fund’s cost and performance for other shareholders. The Board of Trustees has adopted policies to discourage abusive trading activities and has approved procedures to implement those policies. There is no guarantee that these procedures can detect or prevent all abusive trading activities and, therefore, such activities may occur.

An investment in the Fund may lose value and is not guaranteed or insured by a bank, the Federal Deposit Insurance Corporation, or any other government agency.

FUND’S PAST PERFORMANCE

<R>

The bar chart and performance table below illustrate the variability of the Real Estate Securities Fund’s returns. The Fund’s past performance (before and after taxes) does not necessarily indicate how the Fund will perform in the future. The information provides some indication of the risks of investing in the Fund by showing changes in its performance from year to year and by showing how its average annual returns for 1-year, 5-year, and since inception periods compare with those of a broad measure of market performance. The performance of the comparative index does not reflect deductions for fees, expenses or taxes. Updated information on the Real Estate Securities Fund’s results can be obtained by visiting www.commonwealthfunds.com.

</R>

| For the periods included in the bar chart: |

| | | |

| Best Quarter | | 23.12%, 2nd Quarter, 2009 |

| Worst Quarter | | (28.77)%, 4th Quarter, 2008 |

33

Average Annual Total Return as of December 31, 2010 as compared to comparable index.

| | | | | | | | | Since Inception |

| | | 1 Year | | 5 Year | | (January 5, 2004) |

| Return Before Taxes | | 15.97 | % | | (0.80 | )% | | 2.52 | % |

| | | | | | | | | | |

| Return After Taxes on Distribution | | 15.97 | % | | (1.10 | )% | | 2.26 | % |

| | | | | | | | | | |

| Return After Taxes on Distribution and Redemptions | | 10.38 | % | | (0.66 | )% | | 2.18 | % |

| |

| |

| MSCI US REIT Index | | 28.48 | % | | 2.99 | % | | 7.98 | % |

After-tax returns are calculated using the historical highest federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their Real Estate Securities Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Management

FCA Corp is the investment adviser to the Real Estate Securities Fund.

Portfolio Managers

<R>

Robert W. Scharar, Lead Portfolio Manager, has managed the Real Estate Securities Fund since 2002.

Wesley Yuhnke, Assistant Portfolio Manager, has managed the Real Estate Securities Fund since 2002.

Ronald Manning, Assistant Portfolio Manager, has managed the Real Estate Securities Fund since 2007.

</R>

For important information about purchase and sale of fund shares, tax information and financial intermediary compensation, please turn to the sections of this prospectus entitled “Purchase and Sale of Fund Shares,” “Tax Information” and “Financial Intermediary Compensation” on page 26 of the prospectus.

<R>

COMMONWEALTH AUSTRALIA/NEW ZEALAND FUND

AFRICA FUND

COMMONWEALTH JAPAN FUND

COMMONWEALTH GLOBAL FUND

COMMONWEALTH REAL ESTATE SECURITIES FUND

</R>

Purchase and Sale of Fund Shares

The minimum initial investment in each series portfolio of the Trust – the Australia/New Zealand Fund; the Africa Fund; the Japan Fund; the Global Fund; and the Real Estate Securities Fund – is $200 and there is no minimum for subsequent investments, with the exception of continuous investment plans. The Funds reserve the right to redeem the accounts of shareholders with balances under $200 as a result of selling or exchanging shares. A redemption resulting from this minimum investment policy will be made upon sixty days (60) written notice to the shareholder unless the balance is increased to an amount in excess of $200. In the event that stockholder’s account falls below $200 due to market fluctuation, the Fund will not redeem the account.

You may redeem shares of the Funds at any time by writing to or calling the Funds’ transfer agent. You may also redeem shares by contacting any broker-dealer authorized to take orders for the Funds. Finally, you may arrange for periodic withdrawals of $50 or more if you invest at least $5,000 in a Fund. Under this arrangement, you must elect to have all your dividends and distributions reinvested in shares of the Fund. Your withdrawals under this plan may be monthly, quarterly, semi-annual or annual.

Tax Information

You will generally be subject to federal income tax each year on dividend and distribution payments, as well as on any gain realized when you sell (redeem) or exchange your Fund shares. If you hold Fund shares through a tax-deferred account (such as a retirement plan), you generally will not owe tax until you receive a distribution from the account.

Financial Intermediary Compensation

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

35

<R>

ADDITIONAL INFORMATION ABOUT

THE FUNDS’ PRINCIPAL INVESTMENT STRATEGIES

</R>

Principal Objectives and Investment Strategies

The investment objective of each series portfolio of the Trust – the Australia/New Zealand Fund; the Africa Fund; the Japan Fund; the Global Fund; and the Real Estate Securities Fund – is to provide long-term capital appreciation and current income.

<R>

Under normal market conditions, each Fund (other than the Global Fund) invests at least 80% of its assets in the country (or countries for the Africa Fund) or asset class specified in its name (i.e. Japan, Africa, Australia/New Zealand or real estate securities). “Assets” means net assets, plus the amount of borrowings for investment purposes. The 80% investment will be comprised of securities of issuers organized under the particular country’s (or countries for the Africa Fund) law (i.e., Japan, Africa, Australia or New Zealand); issuers that are listed on the particular country’s or countries’ stock exchanges (i.e., Japan, Africa, Australia or New Zealand) regardless of the country in which the issuer is organized; issuers that derive 50% or more of their total revenue from goods and/or services produced or sold in the particular country (or countries for the Africa Fund) (i.e., Japan, Africa, Australia or New Zealand); and issues of government entities of the particular country or countries (i.e., Japan, Africa, Australia or New Zealand). Investments made by the Real Estate Securities Fund are in issuers in real estate and related industries (i.e., those issuers whose fortunes are impacted by the real estate market). Each Fund’s 80% investment strategy (other than the Global Fund) can be changed without shareholder approval. Under normal market conditions, the Global Fund invests at least 40% of its net assets in the securities of, and depositary receipts represented by, foreign issuers. Shareholders will be given 60 days advance notice if any Fund decides to change its strategy.In addition to buying equity and debt securities, the Funds may invest in sponsored and un-sponsored depositary receipts related to the designated securities. Depositary receipts are dollar-denominated depositary receipts that, typically, are issued by a United States bank or trust company and represent the deposit with that bank or trust company of a security of a foreign issuer. Depositary receipts are publicly traded on exchanges or over-the-counter in the United States. Depositary receipts, in which the Africa Fund may invest, are receipts for foreign-based corporations traded in capital markets around the world. Although depositary receipts provide a convenient means to invest in non-U.S. securities, these investments involve risks generally similar to investments directly in foreign securities. Further discussion about these risks can be found below under the section “The Funds’ Principal Risks.” Depositary receipts may, or may not, be sponsored by the issuer. There are certain risks and costs associated with investments in un-sponsored depositary receipt programs. Because the issuer is not involved in establishing the program (such programs are often initiated by broker-dealers), the underlying agreement for payment and service is between the depository and the shareholders. Expenses related to the issuance, cancellation and transfer of the depositary receipts, as well as costs of custody and dividend payment services may be passed through, in whole or in part, to shareholders. The availability of regular reports regarding the issuer is also a risk as they may not as readily be available in a timely fashion for review by the Funds’ investment adviser, FCA Corp.

Investments in debt securities may include obligations of governmental issuers, as well as obligations of companies regardless of credit quality, including those below investment-grade as determined by NRSROs or if unrated, as determined by FCA Corp (i.e., junk bonds). The Funds’ may invest in commercial paper without regard to credit quality. The credit quality of a security is assessed prior to the time of purchase. Subsequent to its purchase by a Fund, a rated security may cease to be rated or its rating may be downgraded, or in the case of a security that is unrated, it FCA Corp may determine that the credit quality of the security since its original purchase has deteriorated.

</R>

36

The Africa Fund may invest up to 15% of its net assets in illiquid securities.

In seeking to reduce downside risk, FCA Corp will attempt whenever possible to: (i) diversify among companies, industries, and as to the Global Fund without restriction to any particular region such as Asia or Europe or any particular country such as the United States or Japan; (ii) focus on companies with reasonable valuations; and (iii) as to the Global Fund, generally focus on countries with developed economies. FCA Corp will also seek to sell a stock when it believes its price is unlikely to appreciate longer term, other comparable investments offer better opportunities for the Funds, or in the course of adjusting one or more of the Fund’s emphasis(es) on a given country or sector.

Each Fund generally invests in equity securities, without regard to capitalization, with the view to hold them long-term and debt securities to hold to maturity. The Funds’ portfolio securities are evaluated on their long-term prospects.

A particular Fund may experience higher or lower turnover ratios in certain years. Factors influencing portfolio turnover include, but are not limited to the following: rebalancing portfolio securities to take advantage of long-term opportunities and/or to reallocate between fixed income and equity securities; investing new Fund subscriptions, Fund income or security sales proceeds; and/or selling securities to cover shareholder redemptions. As portfolio turnover may involve paying brokerage commissions and other transactions costs, there could be additional expenses for such Fund. High rates of portfolio turnover may also result in the realization of short-term capital gains. The payment of taxes on these gains could adversely affect such Fund’s performance. Any distributions resulting from such gains will be considered ordinary income for federal income tax purposes. See the “Financial Highlights” section of this Prospectus for the Funds’ portfolio turnover rates for prior periods.

<R>

The Funds may also engage in options and foreign currency forward transactions, which are sometimes referred to as derivative transactions. The derivative transactions that the Fund may purchase or sell (write) include exchange-traded put or call options on stocks or stock indices. The Fund also may purchase or sell (write) index foreign currency forward contracts or options on such contracts. The Fund may use derivatives in various ways, including as a substitute for taking a position in the reference asset or to gain exposure to certain asset classes. Under such circumstances, the derivatives may have economic characteristics similar to those of the reference asset, and the investment in the derivatives may be applied toward meeting a requirement to invest a certain percentage of its net assets in instruments with such characteristics. The Fund may use derivatives to hedge (or reduce) its exposure to a portfolio asset or risk. The Fund may also use derivatives for leverage, to manage cash and to generate premium income.Australia/New Zealand Fund

The Australia/New Zealand Fund invests primarily in equity securities, without regard to capitalization, including common and preferred stock and securities convertible into common stock, and debt securities denominated in one of those countries’ currencies and securities of Australian/New Zealand issuers. Australian/New Zealand issuers include: issuers that are organized under Australian or New Zealand law; issuers that are listed on the Australian and/or New Zealand stock exchanges regardless of the country in which the issuer is organized; issuers that derive 50% or more of their total revenue from goods and/or services produced or sold in Australia and/or New Zealand; and Australian and/or New Zealand government entities. The Australia/New Zealand Fund may also consider an issuer to be an Australian or New Zealand issuer if it issues securities denominated in the local currency of either Australia or New Zealand.

</R>

37

<R>

Africa FundThe Africa Fund invests primarily in equity securities, without regard to capitalization, including common and preferred stock and securities convertible into common stock, and debt securities denominated in African currencies and securities of African issuers. African issuers include: issuers that are organized under the laws of a country located on the continent of Africa; issuers that are listed on a stock exchange of a country located in Africa regardless of the country in which the issuer is organized; issuers that derive 50% or more of their total revenue from goods and/or services produced or sold in one or more countries in Africa; and government entities of countries located in Africa. The Africa Fund may also consider an issuer to be an African issuer if its issues securities denominated in a local currency of a country located on the continent of Africa.

Japan Fund

The Japan Fund invests primarily in equity securities, without regard to capitalization, including common and preferred stock and securities convertible into common stock, and debt securities denominated in Yen and securities of Japanese issuers. Japanese issuers include issuers that are organized under Japanese law; issuers that are listed on one of more of the Japanese stock exchanges, regardless of the country in which the issuer is organized; issuers that derive 50% or more of their total revenue from goods and/or services produced or sold in Japan; and Japanese government entities. The Japan Fund may also consider an issuer to be a Japanese issuer if it issues securities denominated in the Japanese Yen.

</R>

Global Fund

The Global Fund invests primarily in U.S. and foreign equity securities, without regard to capitalization, including common and preferred stock and securities convertible into common stock, and debt securities. Although the Fund can invest in companies of any size and from any country, it generally focuses on established companies in countries with developed economies.

Real Estate Securities Fund

The Real Estate Securities Fund invests primarily in equity securities, without regard to capitalization, including common stock and preferred stock and securities convertible into common stock, and debt securities of companies in real estate industries, which may include commercial and residential REITs, publicly traded real estate development companies, real estate management companies, building supply companies, timber companies, real property holdings and other publicly-traded companies involved in real estate related activities and industries.

ADDITIONAL INFORMATION ABOUT THE FUNDS’ PRINCIPAL RISKS

<R>

Stock Market Risk (Each Fund): Each Fund’s investments will fluctuate in price. This means that the Funds’ share prices will go up and down, and Fund shareholders can lose money. From time to time, each Fund’s performance may be better or worse than funds with similar investment policies. Their performance is also likely to differ from that of funds that use different strategies for selecting stocks. Because of their specialized nature (foreign securities or real estate securities), each Fund should be considered a part of an overall investment program and not as a balanced investment program. Investments in stocks of any type involve risk because stock prices have no guaranteed value. Stock prices may fluctuate — at times dramatically — in response to various factors, including market conditions, political and other events, and developments affecting the particular issuer or its industry or geographic segment.

</R>

38

<R>

Debt Securities Risk (Each Fund): Investments in debt and/or fixed income securities also contain risk factors. The value of these securities tends to fluctuate inversely with changes in interest rates. Changes in an issuer’s financial strength or creditworthiness also can affect the value of the securities it issues. Convertible and preferred stocks, which have some characteristics of both equity and fixed income securities, also contain, to varying degrees depending on their structure, the associated risks of each. The Funds may invest in various rated investment-grade securities, including securities rated below investment-grade (“junk bond”), and they may invest in debt securities that are of comparable quality that are not rated. The Funds could lose money or experience a lower rate of return if they hold junk bonds that are subject to higher credit risks and are less liquid than other fixed income or debt instruments. Junk bonds are often considered speculative and have significantly higher credit risk than investment-grade bonds.Foreign Securities Risk (Each Fund): The risks associated with foreign issuers are different from the risks associated with securities of U.S. issuers. Foreign securities risks to which the Funds will be exposed are differences in securities markets in other countries, in tax policies, in the level of regulation and in accounting standards, as well as risks associated with fluctuations in currency values. Further, there is often less publicly available information about foreign issuers, and there is the possibility of negative governmental actions and of political and social unrest. The Funds may not be able to participate in rights and offerings that are not registered for sale to a U.S. investor. Securities in these markets also are generally less liquid and have greater price fluctuation than is typical in the U.S. for securities of comparable issuers. Transactions in foreign securities generally involve currency exchange cost and risk and often take longer to settle than do securities in the U.S., which may make it more difficult for a Fund to liquidate positions. This, in turn, may cause delays in a Fund’s receipt of proceeds and an associated loss of potential dividend and interest income or the incurrence of interest cost on debt incurred to cover the period required until the receipt of the proceeds of these same securities.

Risks Associated with Investments in Certain Regions (Each Fund): The Japan Fund, the Africa Fund and the Australia/New Zealand Fund, by focusing their investments on Japan issuers, African issuers and Australian and New Zealand issuers, respectively, may be exposed to additional risks that other funds that invest in securities of issuers in a broader region may not be exposed. For instance, financial, economic or political instabilities that impact a specific country (such as Japan, African countries, Australia and/or New Zealand), but that do not impact the broader Pacific-rim region (for the Japan and Australia/New Zealand Fund), could impact a Fund to a larger degree than other mutual funds that invest in securities of issuers in a broader geographical area.

Emerging Markets Risk (Africa Fund, Global Fund and Real Estate Securities Fund). To the extent that a Fund invests in issuers located in emerging markets, the foreign securities risk may be heightened. Due to political changes, changes in taxation, or currency controls that could adversely affect investments located in emerging market countries, investments of this nature may be more volatile than investments made in the markets of more developed foreign countries with more mature economies. Economies in emerging countries generally are dependent heavily upon commodity prices and international trade and, accordingly, have been and may continue to be affected adversely by the economies of their trading partners, trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. A Fund may invest in countries which are susceptible to fluctuations in certain commodity markets. Any negative changes in commodity markets could have an adverse impact on those economies. In addition, companies in the materials and/or natural resources sector may be adversely impacted by the volatility of commodity prices, exchange rates, depletion of resources, over-production, litigation and government regulations, among other factors. Also, companies in the materials and/or natural resources sector are at risk of liability for environmental damage and product liability claims.

</R>

39

<R>

Currency Risk. Investments that are denominated in a currency other than the U.S. dollar, or currency-related derivative instruments, are subject to the risk that the value of a particular currency will change in relation to one or more other currencies including the U.S. dollar. Among the factors that may affect currency values are trade balances, the level of short-term interest rates, differences in relative values of similar assets in different currencies, long-term opportunities for investment and capital appreciation and political developments. The Funds may try to hedge these risks by investing in foreign currencies and in currency-related derivatives, such as currency futures contracts, forward foreign currency exchange contracts, options thereon, or any combination thereof, but there can be no assurance that such strategies will be effective. Currency-related derivatives typically involve the use of leverage and, as a result, a small investment in such instruments could have a potentially large impact on the Fund’s performance. Such instruments also may be subject to the risks noted below under “Derivatives Risk.”Small Capitalization Risk (Each Fund): Investing in small capitalization companies may be subject to special risks associated with narrower product lines, more limited financial resources, smaller management groups, and a more limited trading market for their stocks as compared with larger companies. In addition, the earnings and prospects of smaller companies may be more volatile than those of larger companies and smaller companies may experience higher failure rates than do larger companies. As a result, stocks of small capitalization companies may decline significantly in market downturns. These securities may be traded over-the-counter or listed on an exchange.

Risks Associated with Natural Resources Investments (Each Fund): Should a Fund invest in securities of companies involved in oil and gas, timber or mining activities, such investments will involve an increased number of risks, including geological risks, environmental liabilities, governmental regulations, and other risks involved in exploration, mining, distribution and marketing oil, gas, and other minerals, which can result in a higher degree of overall risk for the Fund.

Commodities-Related Risk. (Each Fund) Should the Fund invest in securities of companies involved in oil and gas or mining activities, such investments will involve a high degree of risk, including geological risks, environmental liabilities, governmental regulations, and other risks involved in exploration, mining, distribution of, and marketing oil, gas, and other minerals. These types of investments may be affected by changes in markets, economies, weather and political and regulatory developments.

Illiquidity Risk (Africa Fund): The Africa Fund may, at times, invest up to 15% of its net assets in illiquid securities, by virtue of the absence of a readily available market for certain of its investments, or because of legal or contractual restrictions on sales. The Fund could lose money if it is unable to dispose of an investment at a time that is most beneficial to the Fund.

Risks Associated with Real Estate Investment Trusts (Real Estate Securities Fund): The Real Estate Securities Fund may invest in equity interests or debt obligations issued by REITs. REITs are pooled investment vehicles which invest primarily in income producing real estate or real estate related loans or interests. REITs are generally classified as equity REITs, mortgage REITs or a combination of equity and mortgage REITs. Equity REITs invest the majority of their assets directly in real property and derive income primarily from the collection of rents. Equity REITs can also realize capital gains by selling property that has appreciated in value. Mortgage REITs invest the majority of their assets in real estate mortgages and derive income from the collection of interest payments. Similar to investment companies, REITs are not taxed on income distributed to shareholders provided they comply with certain requirements of the Code. The Real Estate Securities Fund will indirectly bear its proportionate share of expenses incurred by REITs in which the Fund invests in addition to the expenses incurred directly by the Real Estate Securities Fund. Because the Real Estate Securities Fund may invest in real estate related

</R>

40

industries, the Fund will be subject to risks similar to those associated with the direct ownership of real estate, including: declines in the value of real estate, risks related to general and local economic conditions, dependency on management skill, heavy cash flow dependency, possible lack of availability of mortgage funds, overbuilding, extended vacancies of properties, increased competition, increases in property taxes and operating expenses, changes in zoning laws, losses due to costs resulting from the clean-up of environmental problems, liability to third parties for damages resulting from environmental problems, casualty or condemnation losses, limitations on rents, changes in neighborhood values and the appeal of properties to tenants, changes in interest rates and changes in the tax laws.

Investing in REITs involves certain unique risks in addition to those risks associated with investing in the real estate industry in general. Equity REITs may be affected by changes in the value of the underlying property owned by the REITs, while mortgage REITs may be affected by the quality of any credit extended. REITs are dependent upon management skills, are not diversified, are subject to heavy cash flow dependency, default by borrowers and self-liquidation. REITs are also subject to the possibilities of failing to qualify for tax free pass-through of income under the Code and failing to maintain their exemption from registration under the 1940 Act.

REITs (especially mortgage REITs) are also subject to interest rate risks. When interest rates decline, the value of a REIT’s investment in fixed rate obligations can be expected to rise. Conversely, when interest rates rise, the value of a REIT’s investment in fixed rate obligations can be expected to decline. In contrast, as interest rates on adjustable rate mortgage loans are reset periodically, yields on a REIT’s investment in such loans will gradually align themselves to fluctuate less dramatically in response to interest rate fluctuations than would investments in fixed rate obligations.

Finally, investments in REITs also involve the following risks: limited financial resources, infrequent or limited trading, and abrupt or erratic price movements.

<R>

Risks Associated with Investments in Other Investment Companies (Each Fund): Each of the Funds may invest in shares of other investment companies, including open-end funds and closed-end funds and exchange-traded funds (“ETFs”). When a Fund invests in other investment companies and ETFs, it will indirectly bear its proportionate share of any fees and expenses payable directly by the other investment company. Therefore, a Fund will incur higher expenses, many of which may be duplicative. In addition, a Fund may be affected by losses of the underlying funds and the level of risk arising from the investment practices of the underlying funds (such as the use of derivative transactions by the underlying funds). ETFs are subject to additional risks such as the fact that the market price of its shares may trade above or below its net asset value or an active market may not develop. The Funds have no control over the investments and related risks taken by the underlying funds in which it invests.ETFs are subject to the following risks that do not apply to non-exchange traded funds: (i) ETF’s shares may trade at a market price above or below its net asset value; (ii) an active trading market for an ETF’s shares may not develop or be maintained; (iii) the ETF may employ an investment strategy that utilizes high leverage ratios; and (iv) trading of an ETF’s shares may be halted if the listing exchange’s officials deem such action appropriate, the shares are de-listed from the exchange, or the activation of market-wide “circuit breakers” (which are tied to large decreases in stock prices) halts stock trading generally.

Commodities-Related Risk. Should a Fund invest in securities of companies involved in oil and gas or mining activities, such investments will involve a high degree of risk, including geological risks, environmental liabilities, governmental regulations, and other risks involved in exploration, mining, distribution of, and marketing oil, gas, and other minerals. Natural resources companies may be affected by changes in overall market movements, commodity price volatility, changes in interest rates, or sectors

</R>

41

<R>

affecting a particular industry or commodity such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

</R>

Abusive Trading Activities. Frequent short-term purchases, redemptions or exchanges in Fund shares (sometimes referred to as “market timing” or “frequent trading activities”) may result in a dilution in the value of Fund shares for other shareholders. Such activity may create transaction costs that are borne by all shareholders, may disrupt the orderly management of the Funds’ portfolio investments, and may affect the Funds’ cost and performance for other shareholders. Because certain of the Funds invest in foreign securities, they are subject to the risk of market timing or frequent trading activities by investors who are seeking to predict current and future market movements or who believe that trading in those Funds will allow them to take advantage of time differences between the U.S. and some foreign markets. The Funds’ Board has adopted policies to discourage abusive trading activities and has approved procedures to implement those policies. There is no guarantee that these procedures can detect all abusive trading activities and, therefore, such activities may occur. Please see the “Abusive Trading Policy” section for more information.

See also “Risk Factors,” and “Investment Policies,” and “Investment Restrictions” discussed in the Statement of Additional Information that is incorporated herein by reference and made a part hereof.

Portfolio Holdings

A description of the Funds’ policies and procedures with respect to the disclosure of the Funds’ portfolio securities is available in the Funds’ Statement of Additional Information. Complete holdings (as of the dates of such reports) are available in reports on Form N-Q and Form N-CSR filed with the SEC.

GENERAL INFORMATION

General

<R>

The Funds have authority, but it is not a principal investment strategy, to invest in money market instruments of U.S. or foreign issuers. They may invest in instruments issued or backed by U.S. or foreign banks or savings associations. Under normal markets conditions, the Funds may invest up to 5% of their assets in interest-bearing savings deposits of commercial or savings banks. For temporary defensive purposes under unusual market conditions, the Funds may invest in these instruments without limit, which can cause the Funds to fail to meet their investment objectives during such periods and lose benefits when markets begins to improve. The Funds may also lend their portfolio securities in an amount up to 5% of their net assets. These loans will be fully collateralized at all times. The Funds may, but are not obligated to, enter into forward foreign currency exchange contracts to hedge against fluctuations in exchange rates between the U.S. and foreign currencies.

</R>

42

The Funds’ Investment Advisor

<R>

The Funds’ investment advisor, FCA Corp, which is registered with the SEC as an investment advisor, is located at 791 Town & Country Blvd., Suite 250, Houston, Texas 77024. FCA Corp acts as investment advisor to all five Funds, as well as to other entities focusing on real estate and other investment related activities and carries on other financial planning and investment advisory activities for its clients. FCA Corp manages each Fund’s portfolio investments and places orders for Fund portfolio transactions. For its services, it receives advisory fees from each Fund other than the Africa Fund that are based on 0.75% of each Fund’s average net assets. The Adviser receives fees from the Africa Fund that are based on 1.25% of the Fund’s average net assets.

</R>

A discussion regarding the basis of the Board’s renewal of the Investment Advisory Agreement with FCA Corp and each of the Australia/New Zealand, Japan, Global and Real Estate Funds is available in the Funds’ Semi-Annual Report to shareholders for the period ended April 30, 2011. A discussion regarding the basis of the Board’s approval of the Investment Advisory Agreement with FCA Corp and the Africa Fund will be available in that Fund’s Annual Report to shareholders for the fiscal year ending October 31, 2011.

The Funds’ Portfolio Managers