William Blair Healthcare Conference Jack Kenny, Chief Executive Officer June 6, 2019 Exhibit 99.1

Forward Looking Statements The Private Securities Litigation Reform Act of 1995 provides a safe harbor from civil litigation for forward-looking statements accompanied by meaningful cautionary statements. Except for historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, which may be identified by words such as “continues,” “estimates”, “anticipates”, “projects”, “plans”, “seeks”, “may”, “will”, “expects”, “intends”, “believes”, “should” and similar expressions or the negative versions thereof and which also may be identified by their context. All statements that address operating performance or events or developments that Meridian expects or anticipates will occur in the future, including, but not limited to, statements relating to per share diluted earnings and revenue, are forward-looking statements. Such statements, whether expressed or implied, are based upon current expectations of the Company and speak only as of the date made. Specifically, Meridian’s forward-looking statements are, and will be, based on management’s then-current views and assumptions regarding future events and operating performance. Meridian assumes no obligation to publicly update or revise any forward-looking statements even if experience or future changes make it clear that any projected results expressed or implied therein will not be realized. These statements are subject to various risks, uncertainties and other factors that could cause actual results to differ materially, including, without limitation, the following: Meridian’s operating results, financial condition and continued growth depends, in part, on its ability to introduce into the marketplace enhancements of existing products or new products that incorporate technological advances, meet customer requirements and respond to products developed by Meridian’s competition, its ability to effectively sell such products and its ability to successfully expand and effectively manage increased sales and marketing operations. While Meridian has introduced a number of internally developed products and acquired products, there can be no assurance that it will be successful in the future in introducing such products on a timely basis or in protecting its intellectual property, and unexpected or costly manufacturing costs associated with its introduction of new products or acquired products could cause actual results to differ from expectations. Meridian relies on proprietary, patented and licensed technologies. As such, the Company’s ability to protect its intellectual property rights, as well as the potential for intellectual property litigation, would impact its results. Ongoing consolidations of reference laboratories and formation of multi-hospital alliances may cause adverse changes to pricing and distribution. Recessionary pressures on the economy and the markets in which our customers operate, as well as adverse trends in buying patterns from customers, can change expected results. Costs and difficulties in complying with laws and regulations, including those administered by the United States Food and Drug Administration, can result in unanticipated expenses and delays and interruptions to the sale of new and existing products, as can the uncertainty of regulatory approvals and the regulatory process (including the currently ongoing study and other FDA actions regarding the Company’s LeadCare products). The international scope of Meridian’s operations, including changes in the relative strength or weakness of the U.S. dollar and general economic conditions in foreign countries, can impact results and make them difficult to predict. One of Meridian’s growth strategies is the acquisition of companies and product lines. There can be no assurance that additional acquisitions will be consummated or that, if consummated, will be successful and the acquired businesses will be successfully integrated into Meridian’s operations. There may be risks that acquisitions may disrupt operations and may pose potential difficulties in employee retention, and there may be additional risks with respect to Meridian’s ability to recognize the benefits of acquisitions, including potential synergies and cost savings or the failure of acquisitions to achieve their plans and objectives. Meridian cannot predict the outcome of goodwill impairment testing and the impact of possible goodwill impairments on Meridian’s earnings and financial results. Meridian cannot predict the possible impact of U.S. health care legislation enacted in 2010 – the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act – and any modification or repeal of any of the provisions thereof initiated by Congress or the presidential administration, and any similar initiatives in other countries on its results of operations. Efforts to reduce the U.S. federal deficit, breaches of Meridian’s information technology systems, trade wars, increased tariffs, and natural disasters and other events could have a materially adverse effect on Meridian’s results of operations and revenues. In the past, the Company has identified a material weakness in our internal control over financial reporting, which has been remediated, but the Company can make no assurances that a material weakness will not be identified in the future, which if identified and not properly corrected, could materially adversely affect our operations and result in material misstatements in our financial statements. In addition to the factors described in this paragraph, as well as those factors identified from time to time in our filings with the Securities and Exchange Commission, Part I, Item 1A Risk Factors of our most recent Annual Report on Form 10-K contains a list and description of uncertainties, risks and other matters that may affect the Company. Readers should carefully review these forward-looking statements and risk factors, and not place undue reliance on our forward-looking statements.

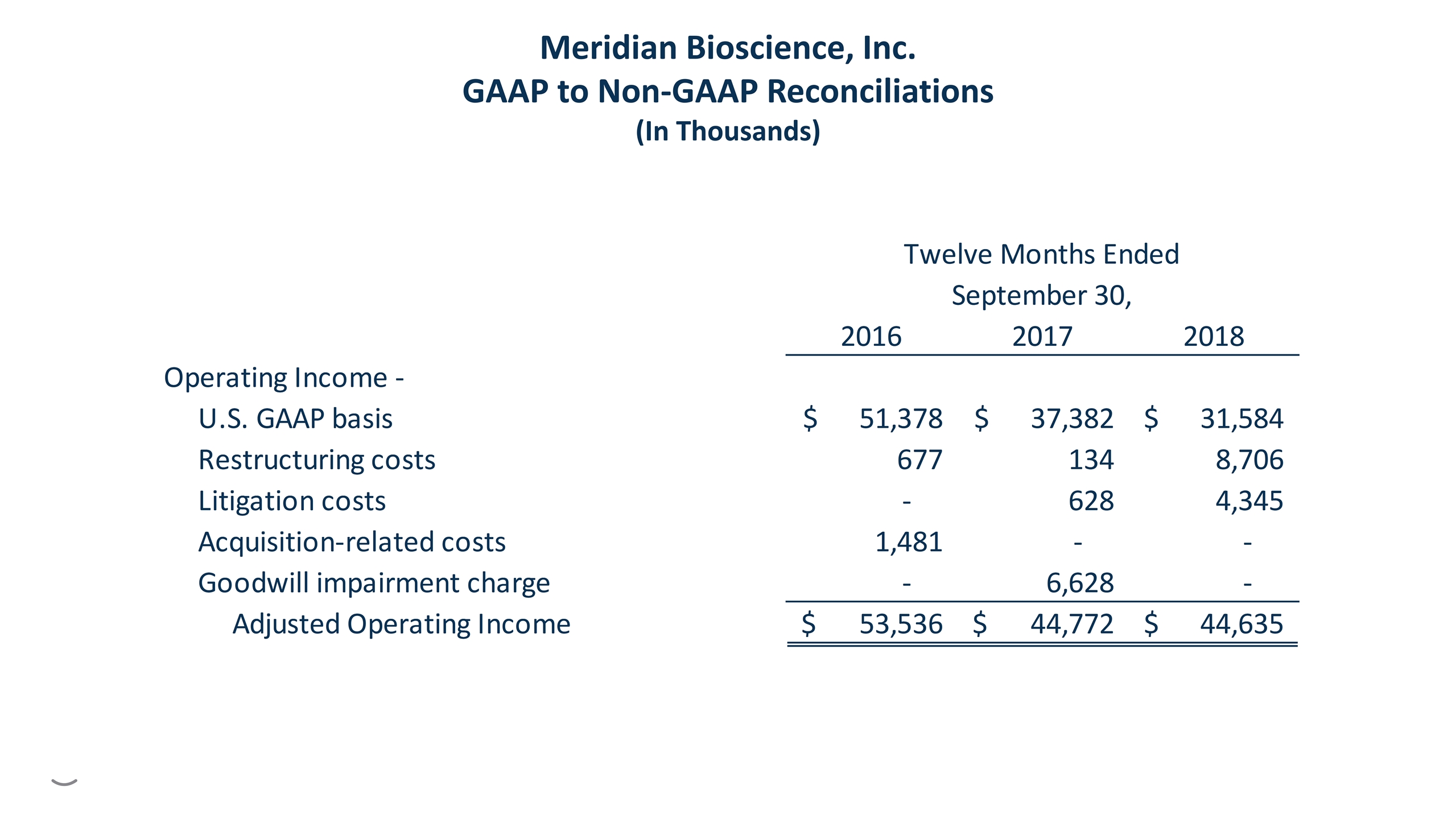

Non-GAAP Financial Measures Certain financial measures presented in this presentation, such as operating expenses, operating income, net earnings and diluted earnings per share, excluding as applicable the effects of restructuring costs, litigation costs, goodwill impairment charge, and certain one-time effects of the U.S. tax reform act, are not recognized under generally accepted accounting principles in the United States of America, or U.S. GAAP. Management believes this non-GAAP financial information is useful to an investor in evaluating our performance, as these measures (i) help investors to more meaningfully evaluate and compare the results of operations from period to period by removing the impacts of these non-routine items; and (ii) are used by management for various purposes, including evaluating performance from period to period in presentations to our board of directors, and as a basis for strategic planning and forecasting. While we believe these financial measures are commonly used by investors to evaluate our performance and that of our competitors, the non-GAAP measures in this presentation may be different from non-GAAP measures used by other companies and should not be considered as an alternative to performance measures derived in accordance with U.S. GAAP. In addition, the non-GAAP measures presented herein are not based on any comprehensive set of accounting rules or principles. These non-GAAP measures have limitations, in that they do not reflect all amounts associated with our results as determined in accordance with U.S. GAAP, and they should not be considered as alternatives to information attributable to Meridian Bioscience, Inc. determined in accordance with U.S. GAAP. See the consolidated financial statements included in our reports filed with the U.S. Securities and Exchange Commission for our U.S. GAAP results. Additionally, for reconciliations of the non-GAAP measures included herein to our closest reported U.S. GAAP measures, refer to the reconciliations included in the Meridian Bioscience, Inc. Form 10-K filed November 29, 2018 and the reconciliations included herein.

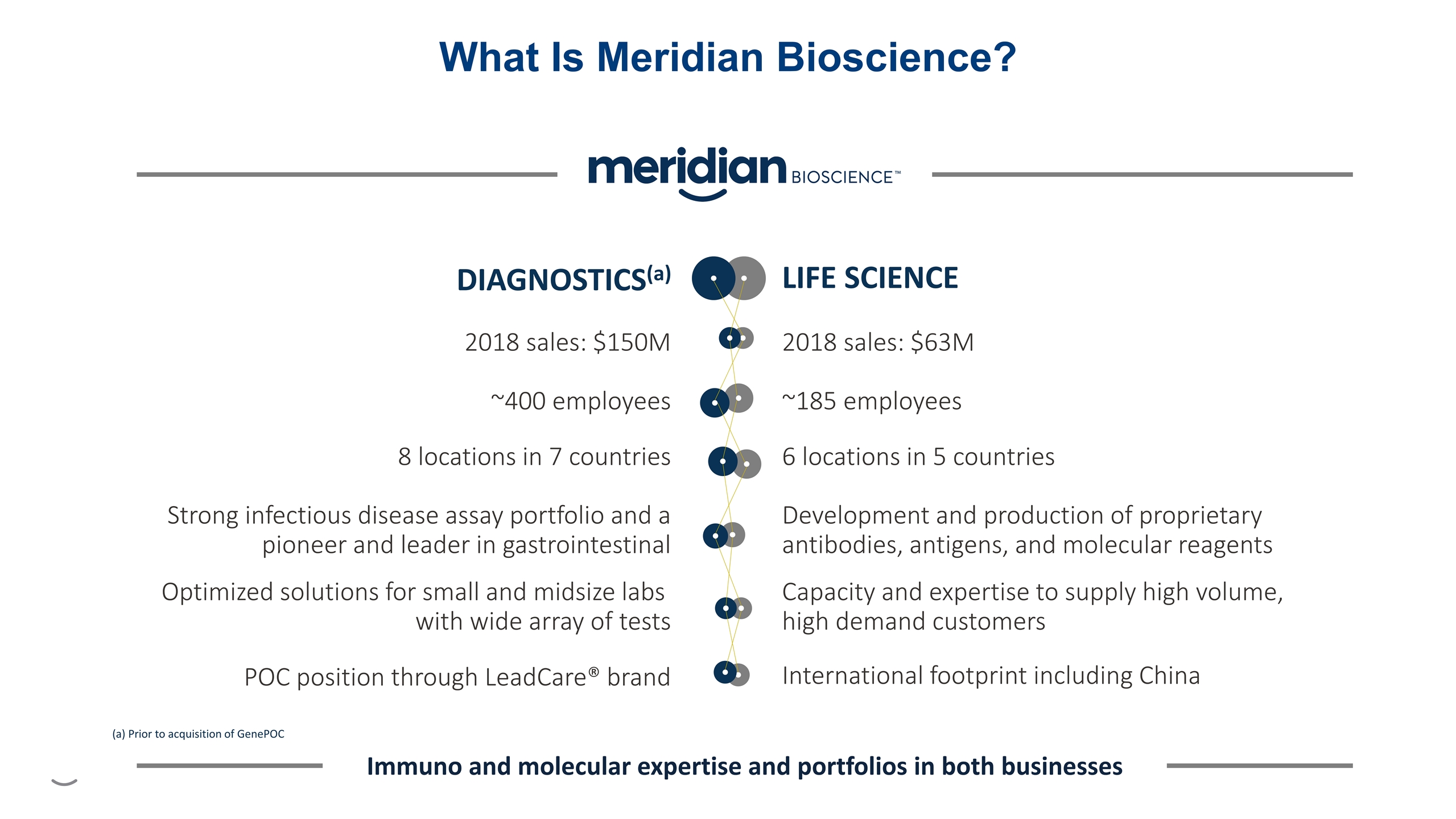

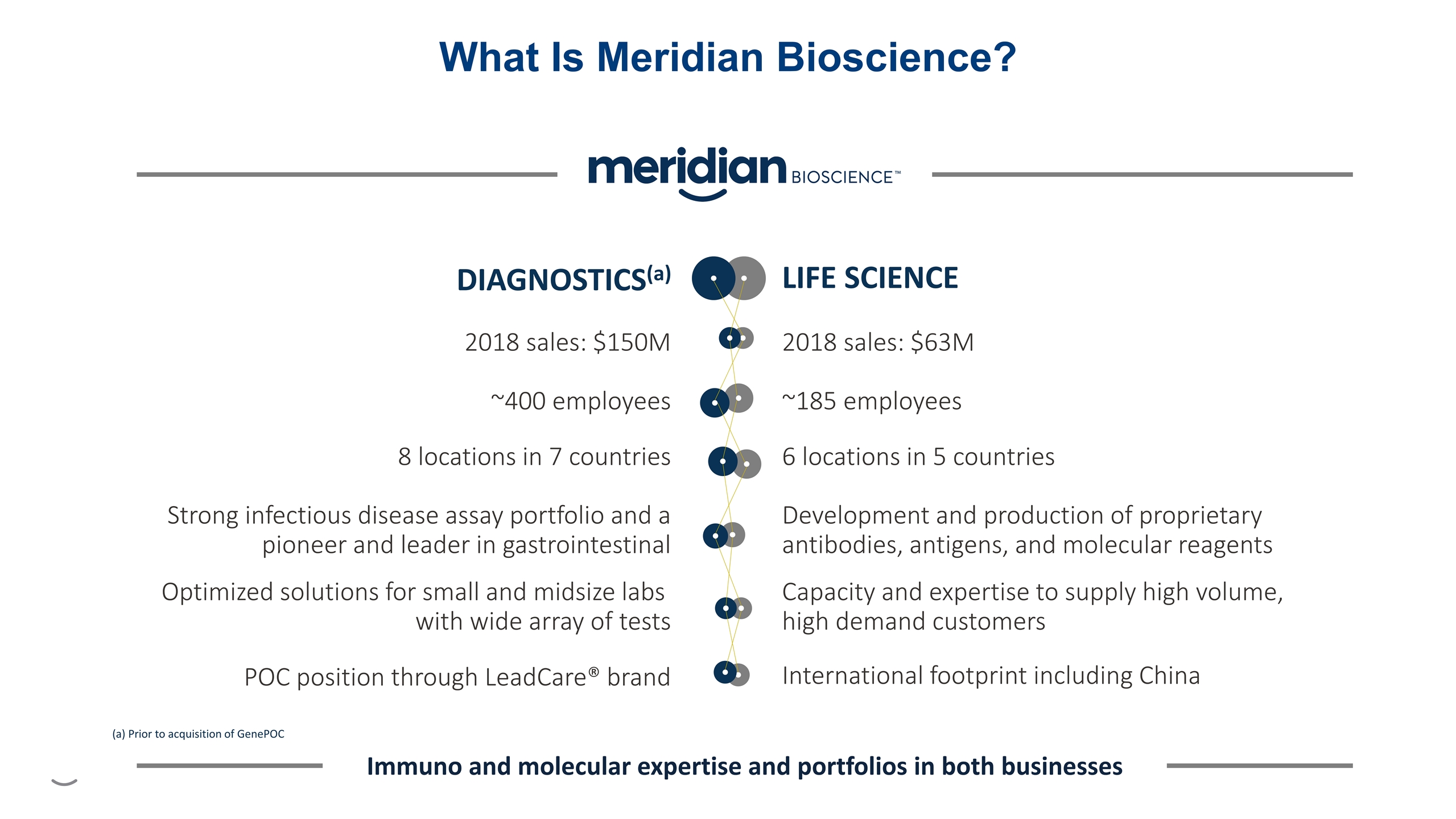

What Is Meridian Bioscience? 2018 sales: $63M ~185 employees 6 locations in 5 countries Development and production of proprietary antibodies, antigens, and molecular reagents Capacity and expertise to supply high volume, high demand customers International footprint including China LIFE SCIENCE 2018 sales: $150M ~400 employees 8 locations in 7 countries Strong infectious disease assay portfolio and a pioneer and leader in gastrointestinal POC position through LeadCare® brand Optimized solutions for small and midsize labs with wide array of tests DIAGNOSTICS(a) Immuno and molecular expertise and portfolios in both businesses (a) Prior to acquisition of GenePOC

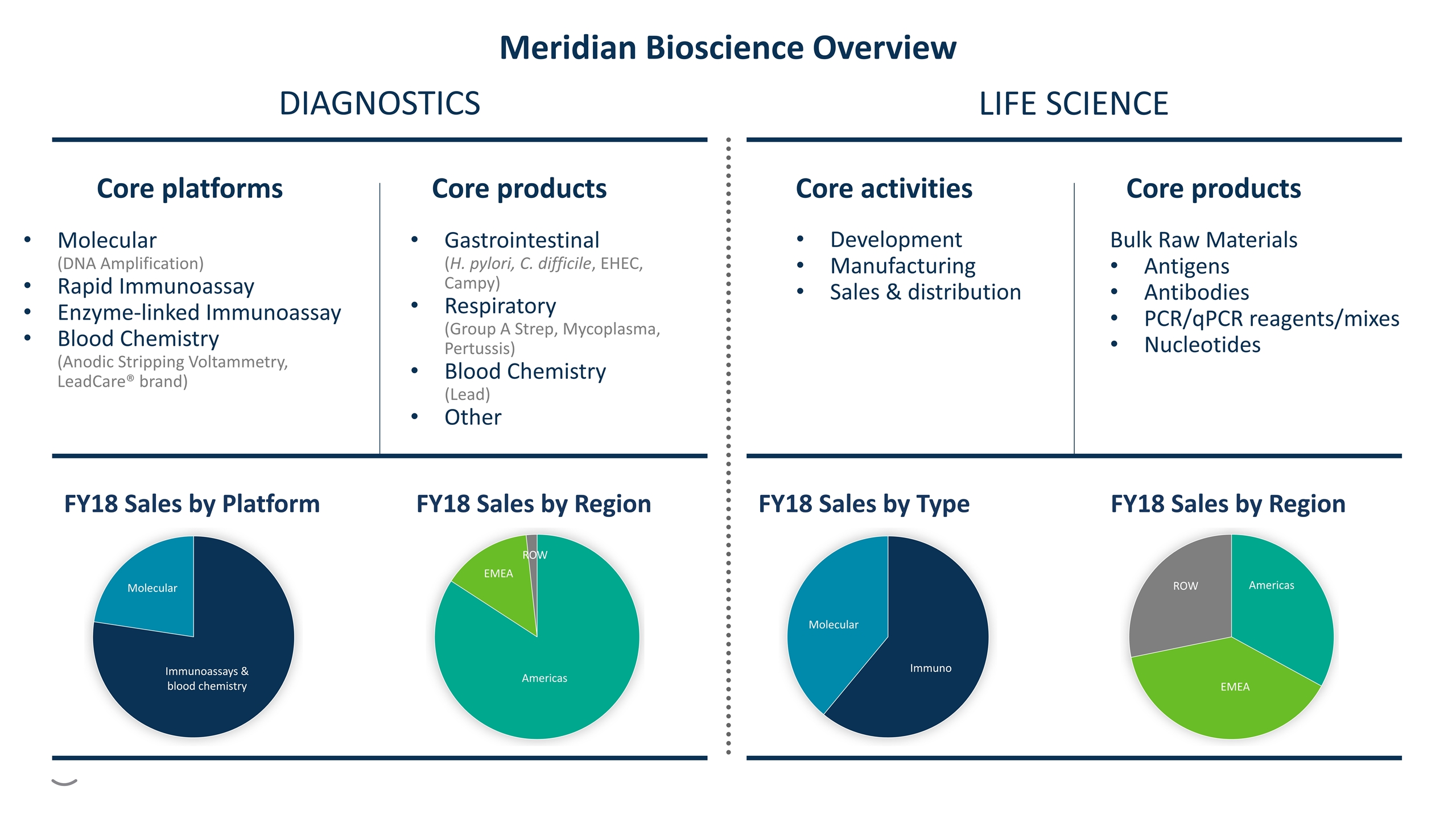

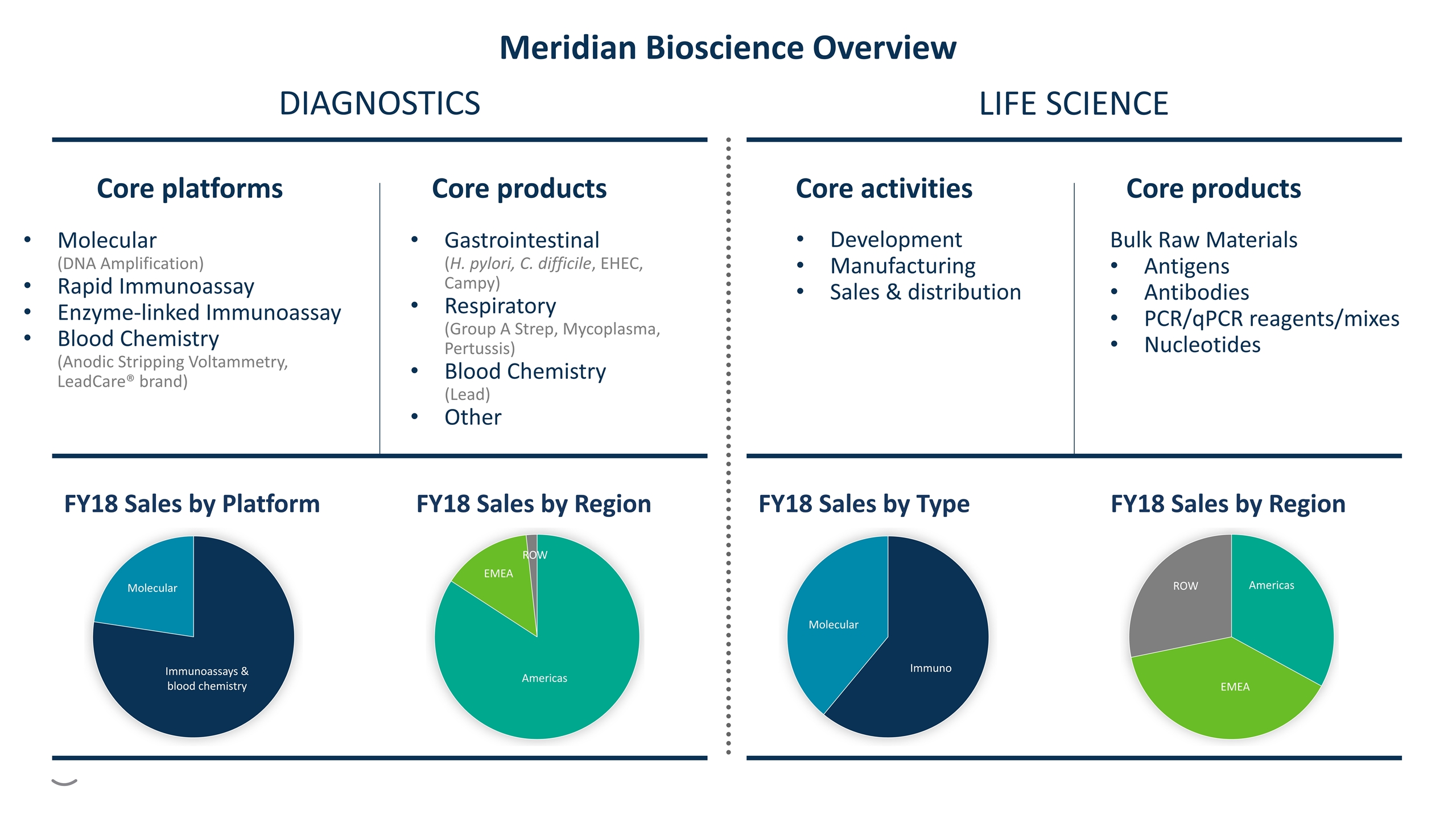

FY18 Sales by Platform FY18 Sales by Region Core platforms Molecular (DNA Amplification) Rapid Immunoassay Enzyme-linked Immunoassay Blood Chemistry (Anodic Stripping Voltammetry, LeadCare® brand) Core products Gastrointestinal (H. pylori, C. difficile, EHEC, Campy) Respiratory (Group A Strep, Mycoplasma, Pertussis) Blood Chemistry (Lead) Other FY18 Sales by Type FY18 Sales by Region Core activities Core products Bulk Raw Materials Antigens Antibodies PCR/qPCR reagents/mixes Nucleotides DIAGNOSTICS LIFE SCIENCE Development Manufacturing Sales & distribution Meridian Bioscience Overview

Manage competitive pressures and product life cycles Leverage cost structure and operational efficiency Focus resources on core target markets Redeploy available capital to support investment in the business Increase investment in R&D, acquisitions Strategic Imperatives G G G G G Reposition the business for sustainable, long-term top line growth and bottom line returns

Life Science

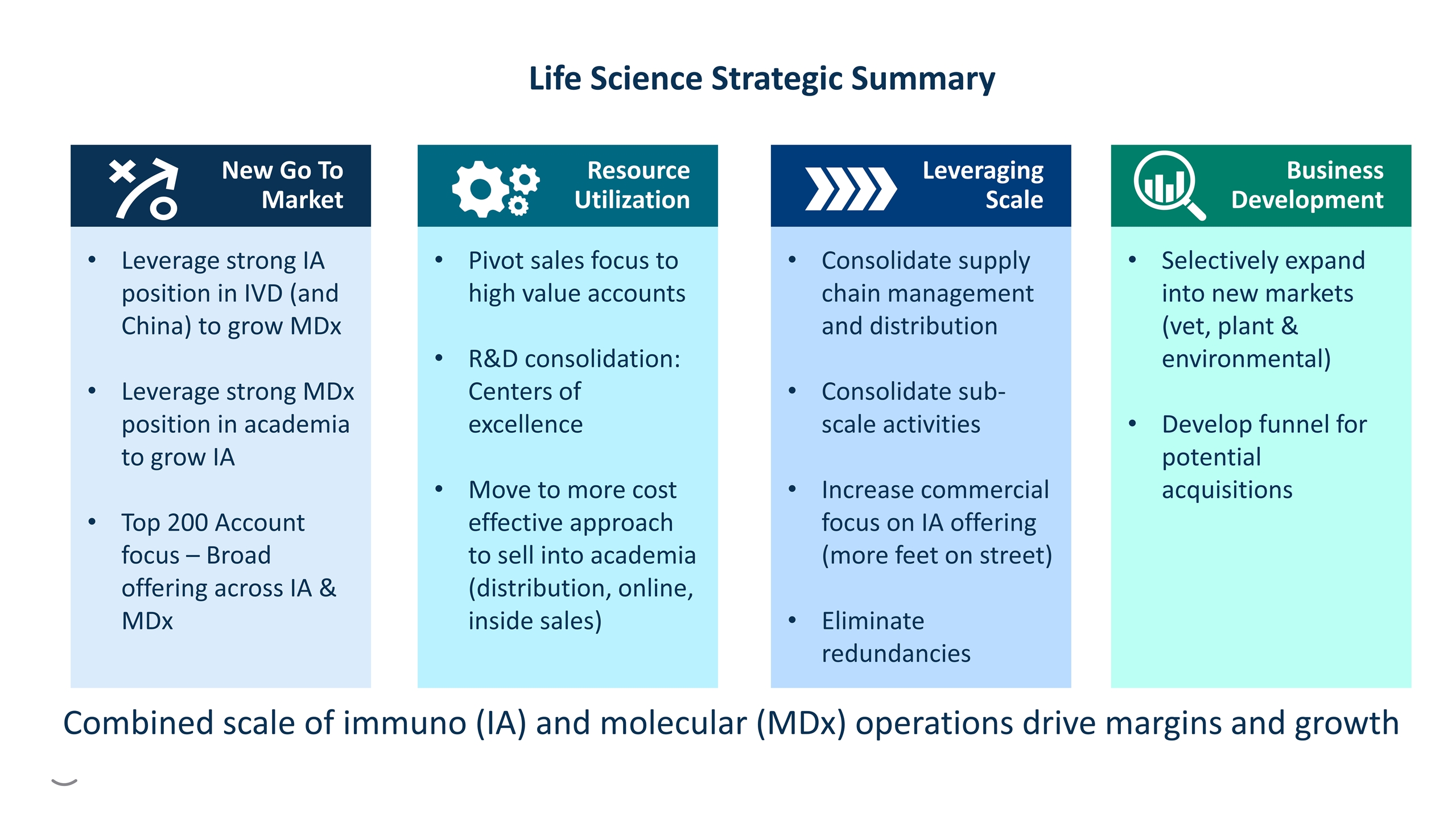

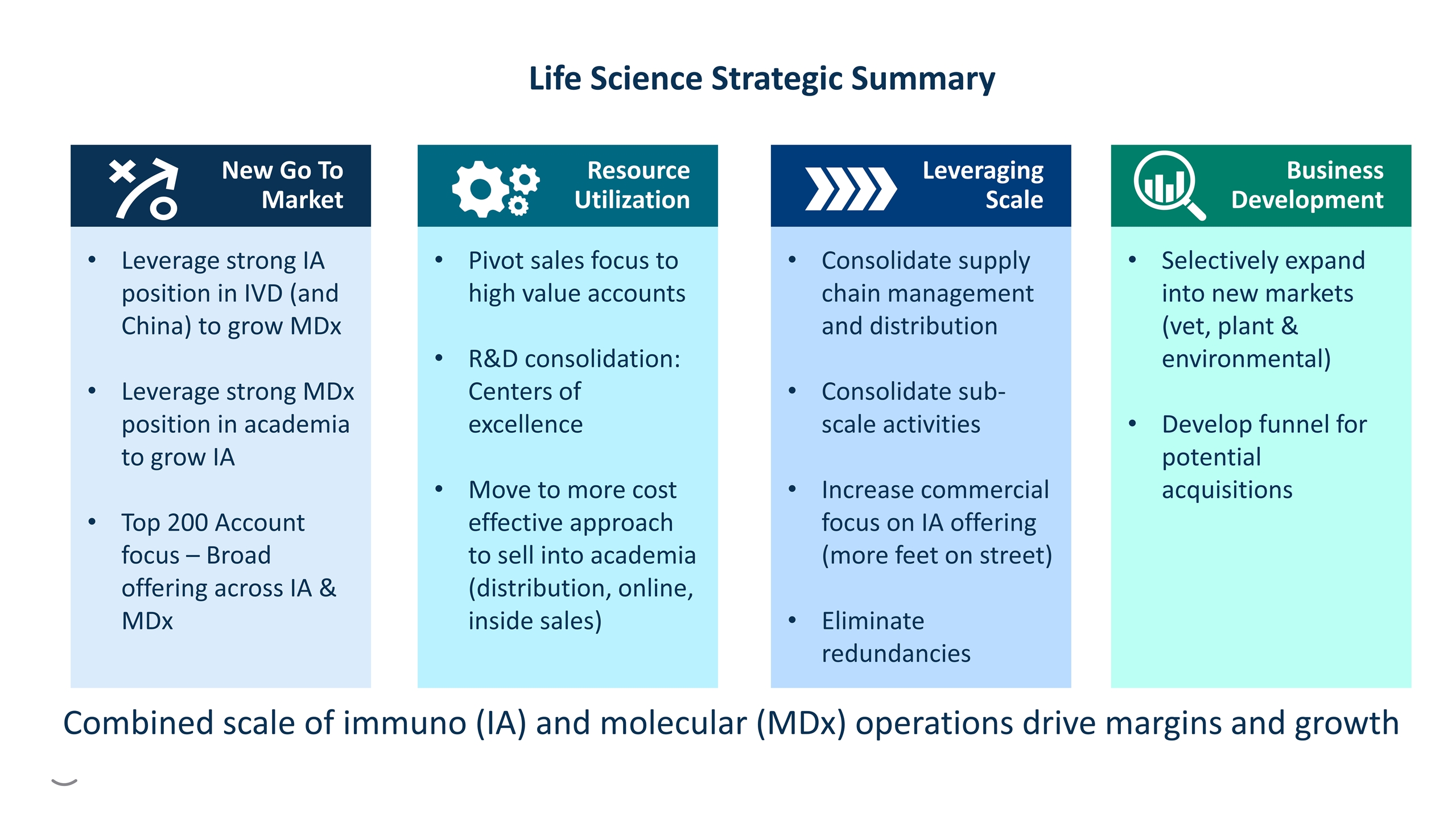

Pivot sales focus to high value accounts R&D consolidation: Centers of excellence Move to more cost effective approach to sell into academia (distribution, online, inside sales) Resource Utilization Leverage strong IA position in IVD (and China) to grow MDx Leverage strong MDx position in academia to grow IA Top 200 Account focus – Broad offering across IA & MDx New Go To Market Leveraging Scale Consolidate supply chain management and distribution Consolidate sub-scale activities Increase commercial focus on IA offering (more feet on street) Eliminate redundancies Business Development Selectively expand into new markets (vet, plant & environmental) Develop funnel for potential acquisitions Life Science Strategic Summary Combined scale of immuno (IA) and molecular (MDx) operations drive margins and growth

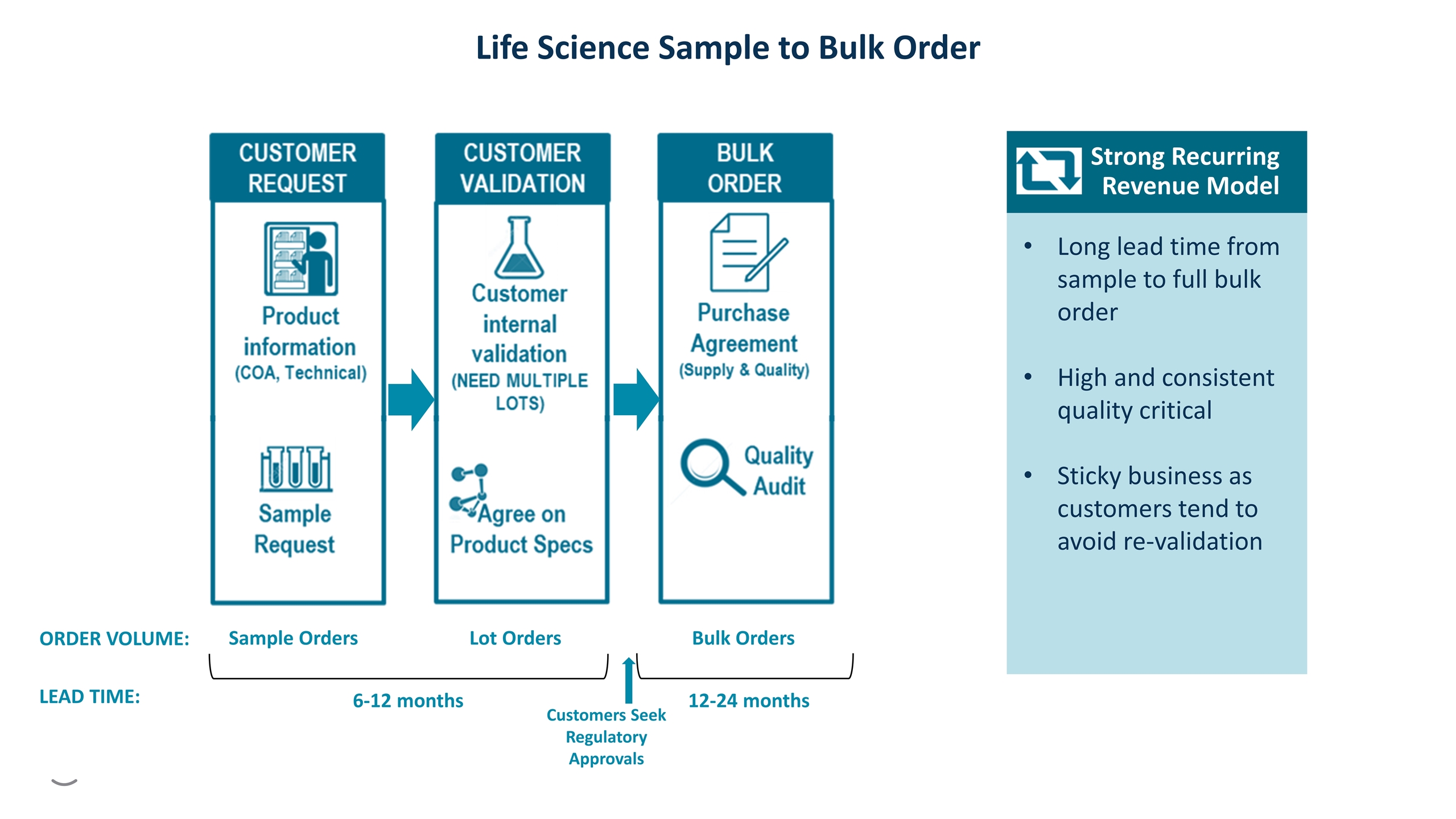

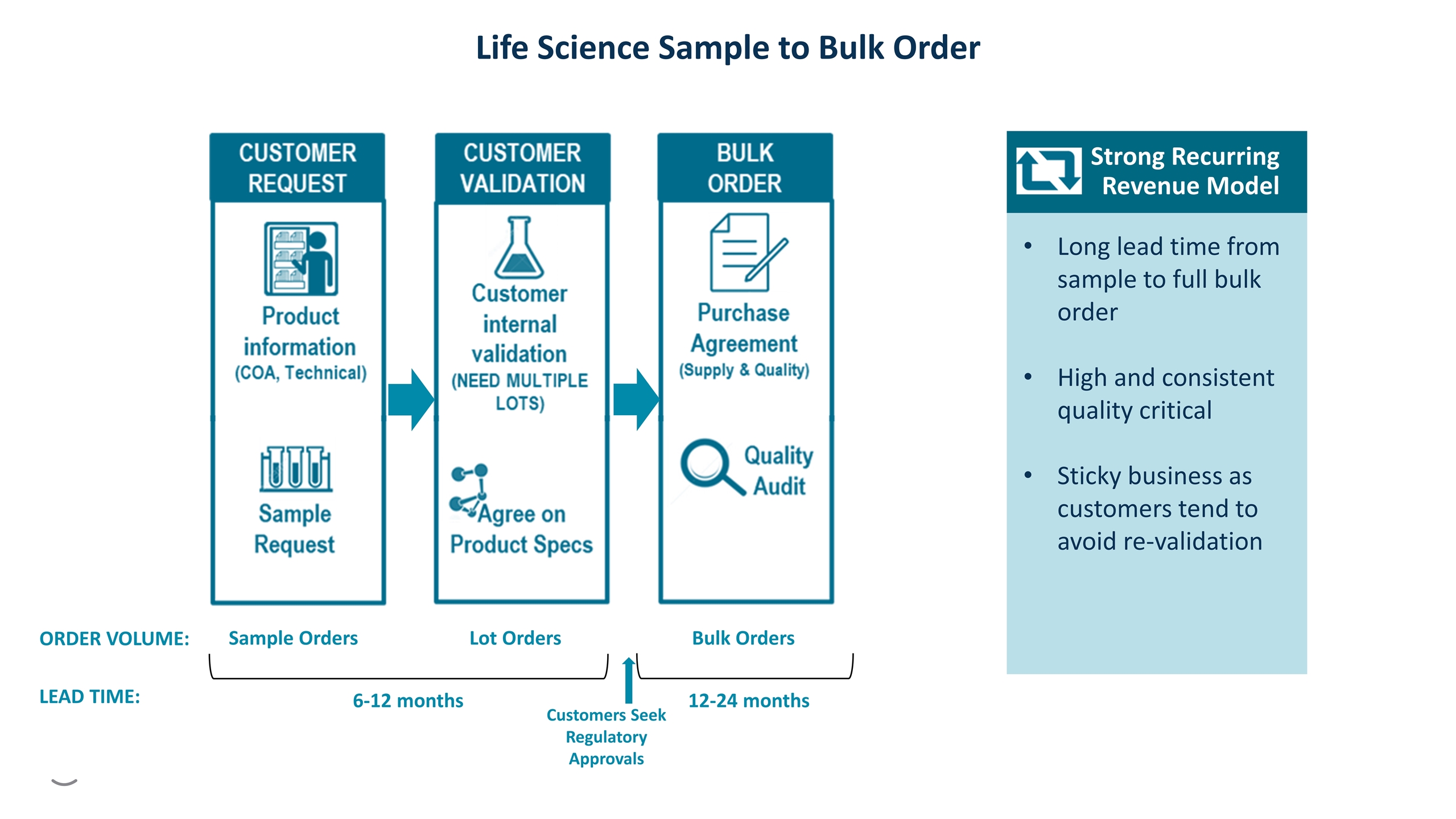

Life Science Sample to Bulk Order ORDER VOLUME: Sample Orders Lot Orders Bulk Orders 6-12 months LEAD TIME: 12-24 months Customers Seek Regulatory Approvals Long lead time from sample to full bulk order High and consistent quality critical Sticky business as customers tend to avoid re-validation Strong Recurring Revenue Model

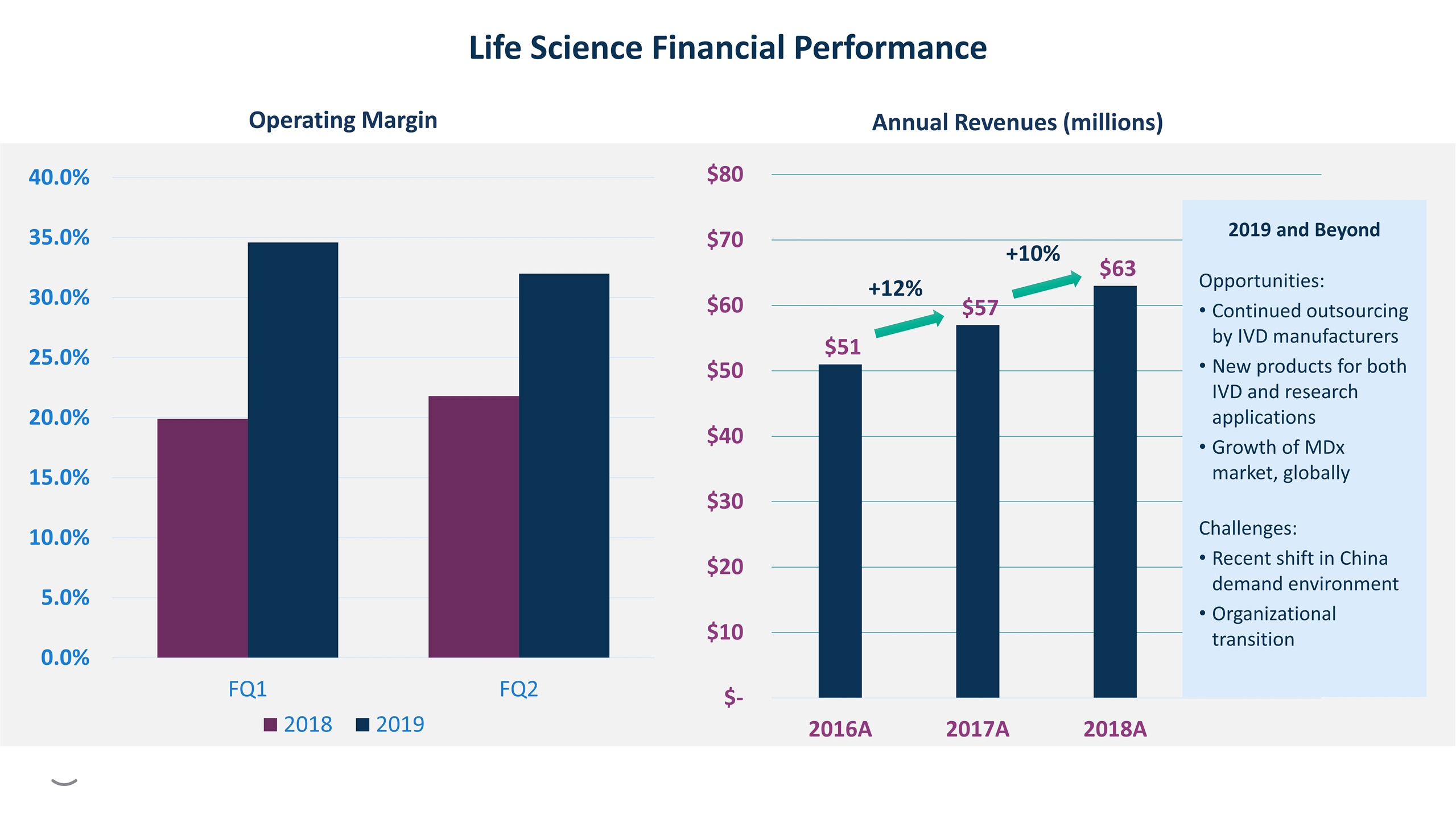

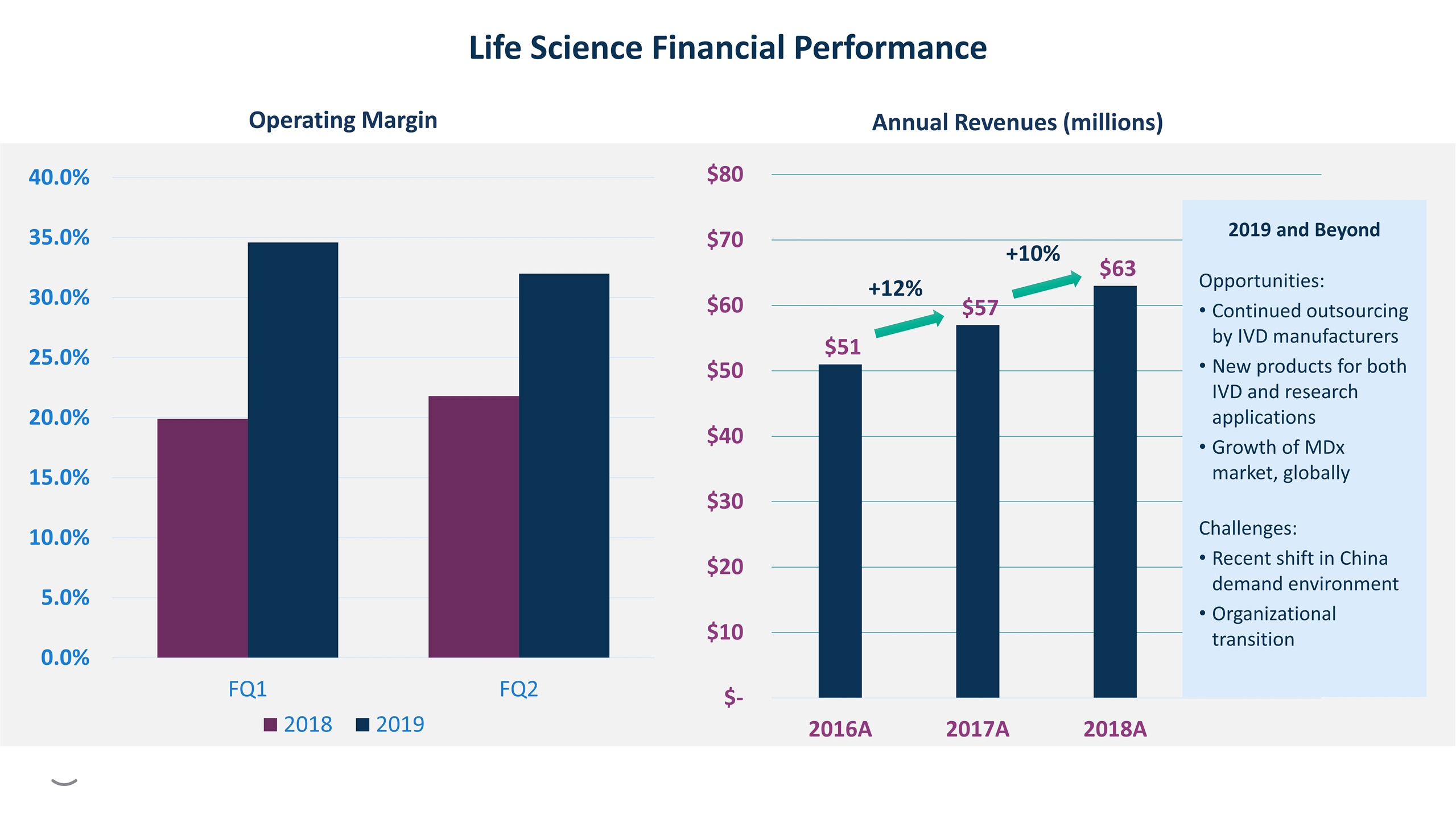

Annual Revenues (millions) Life Science Financial Performance +12% +10% Operating Margin 2019 and Beyond Opportunities: Continued outsourcing by IVD manufacturers New products for both IVD and research applications Growth of MDx market, globally Challenges: Recent shift in China demand environment Organizational transition

Diagnostics

Vision The health system’s (IDNs) trusted partner, spanning the continuum of care from the physician office to the hospital laboratory, delivering expertise and innovation in gastrointestinal disease testing and supporting the well-being of our children to improve health outcomes and build a healthier community. Commercial excellence Key Focus Activities Product lifecycle management Operational efficiency New product development

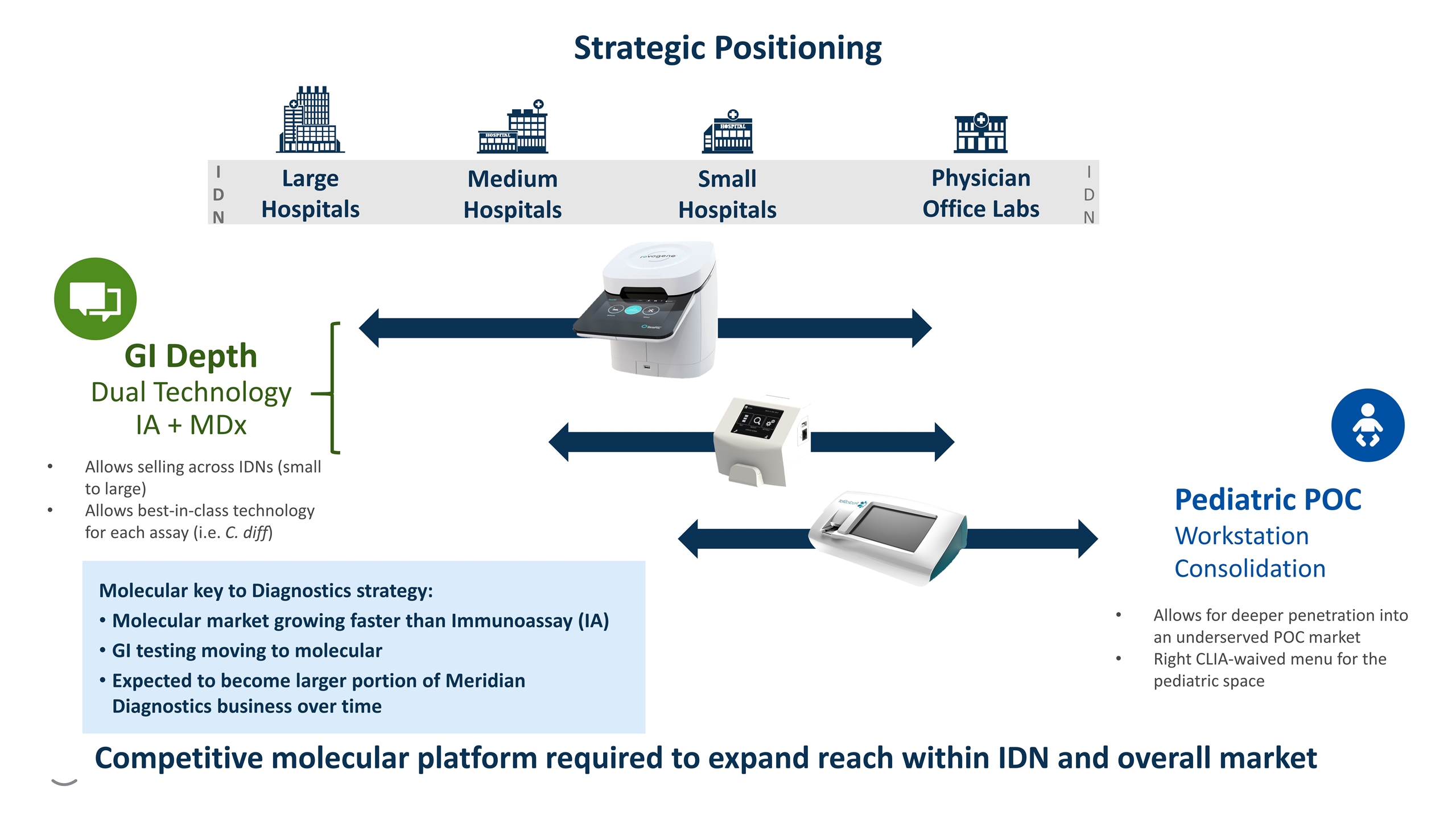

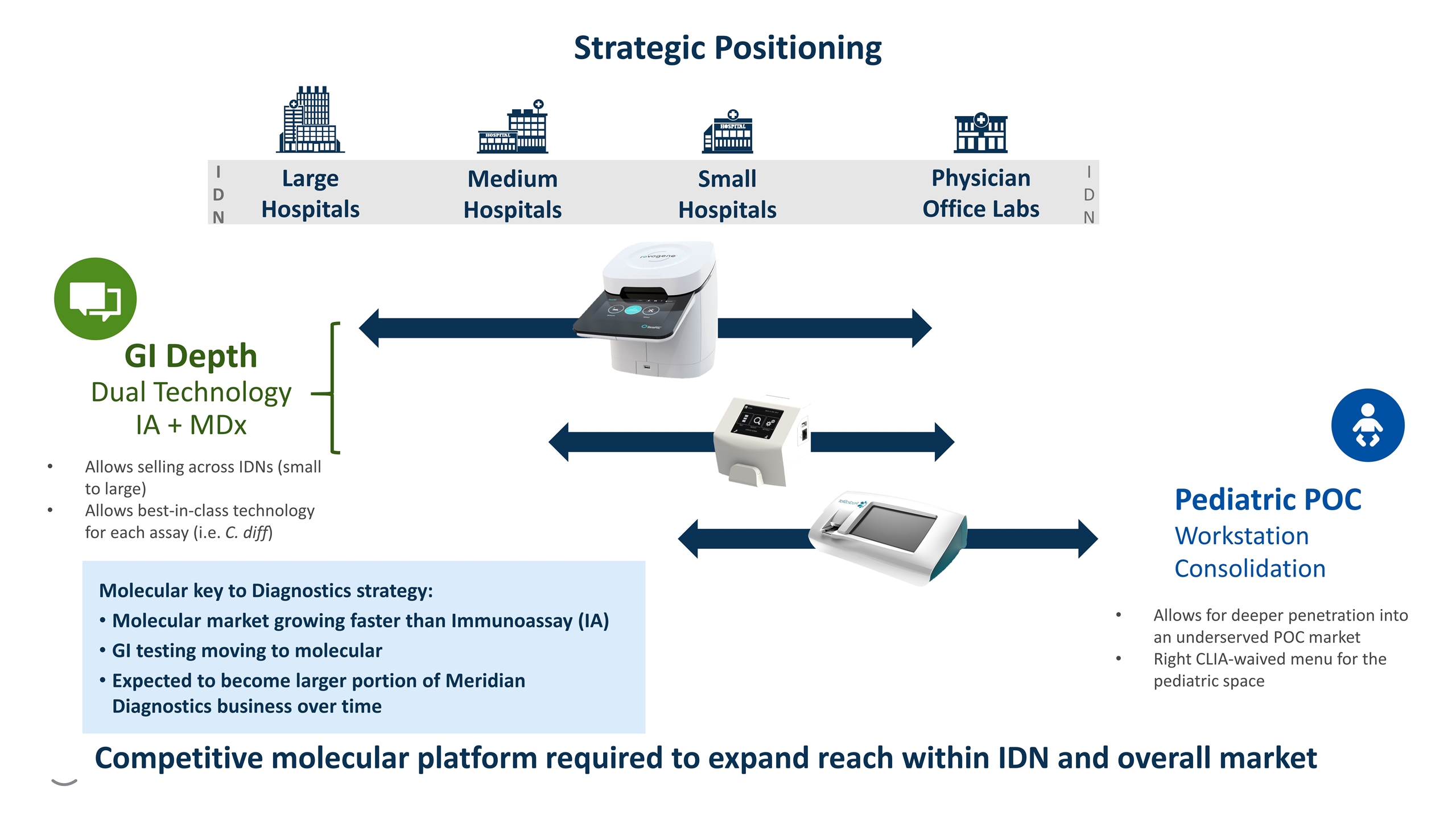

Strategic Positioning I D N I D N Physician Office Labs Large Hospitals Medium Hospitals Small Hospitals Allows selling across IDNs (small to large) Allows best-in-class technology for each assay (i.e. C. diff) GI Depth Dual Technology IA + MDx Pediatric POC Workstation Consolidation Allows for deeper penetration into an underserved POC market Right CLIA-waived menu for the pediatric space Molecular key to Diagnostics strategy: Molecular market growing faster than Immunoassay (IA) GI testing moving to molecular Expected to become larger portion of Meridian Diagnostics business over time Competitive molecular platform required to expand reach within IDN and overall market

by Molecular Diagnostics Platform Acquisition of GenePOC and revogeneTM Platform

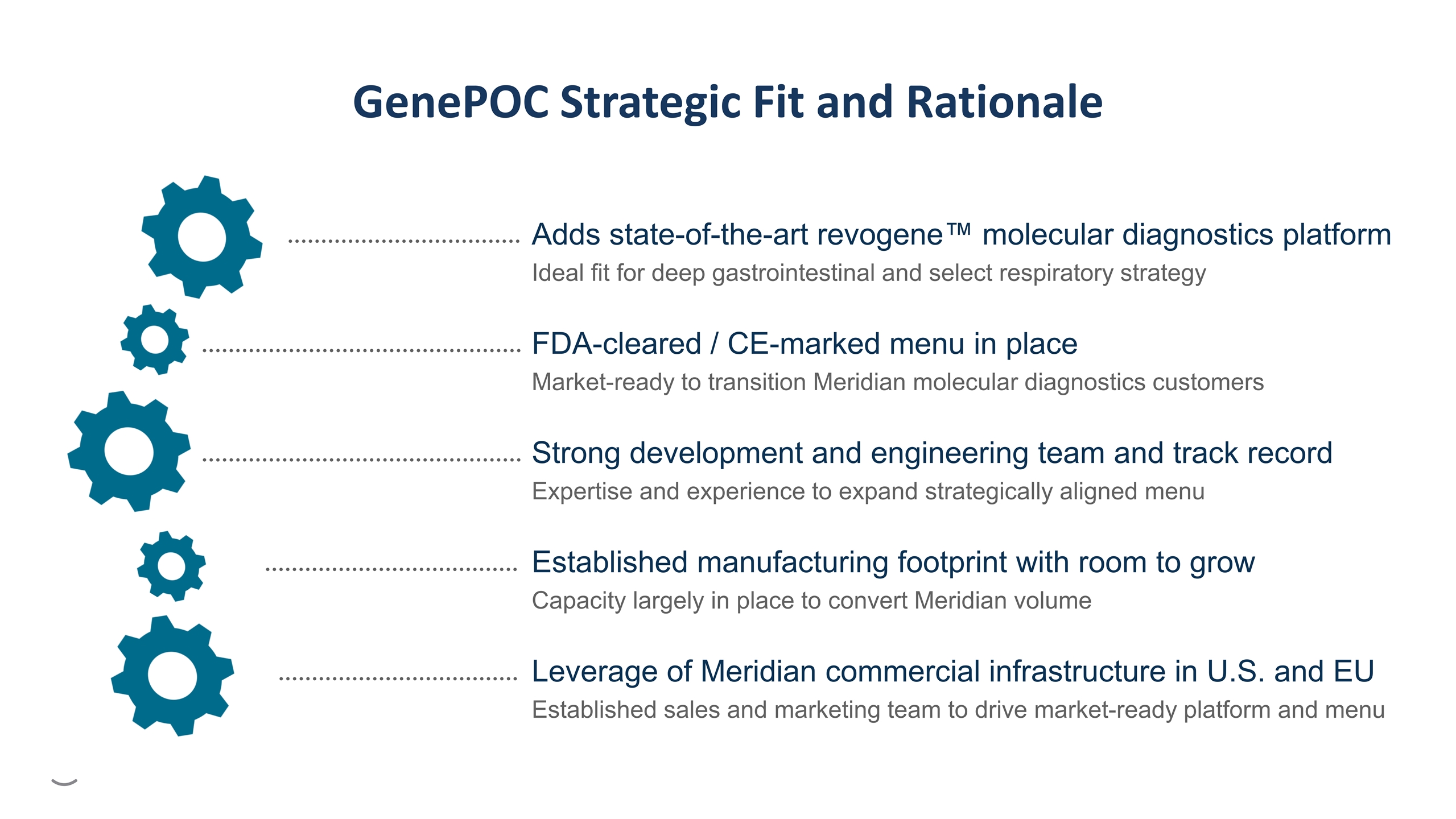

Adds state-of-the-art revogene™ molecular diagnostics platform Ideal fit for deep gastrointestinal and select respiratory strategy GenePOC Strategic Fit and Rationale FDA-cleared / CE-marked menu in place Market-ready to transition Meridian molecular diagnostics customers Strong development and engineering team and track record Expertise and experience to expand strategically aligned menu Established manufacturing footprint with room to grow Capacity largely in place to convert Meridian volume Leverage of Meridian commercial infrastructure in U.S. and EU Established sales and marketing team to drive market-ready platform and menu

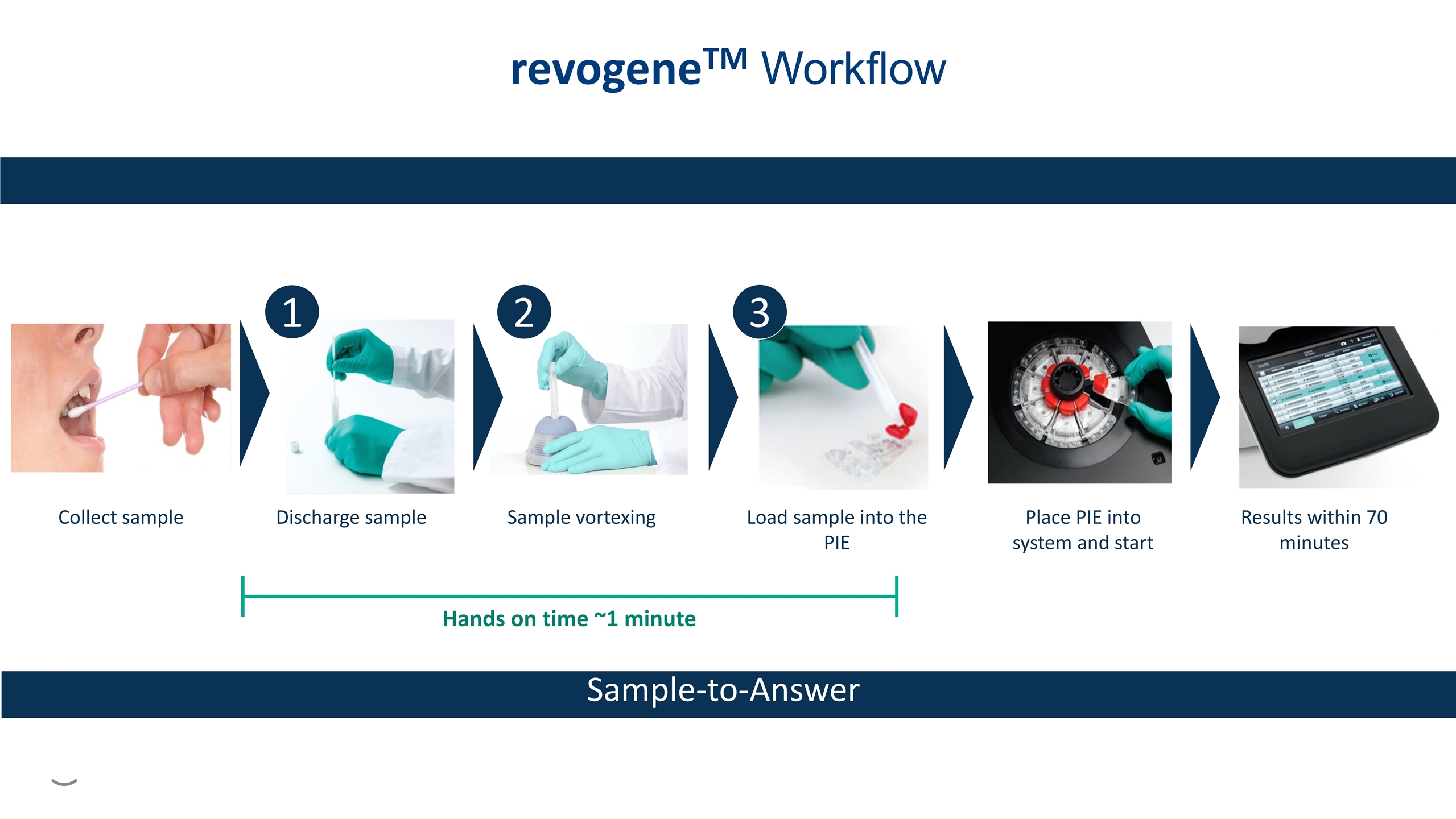

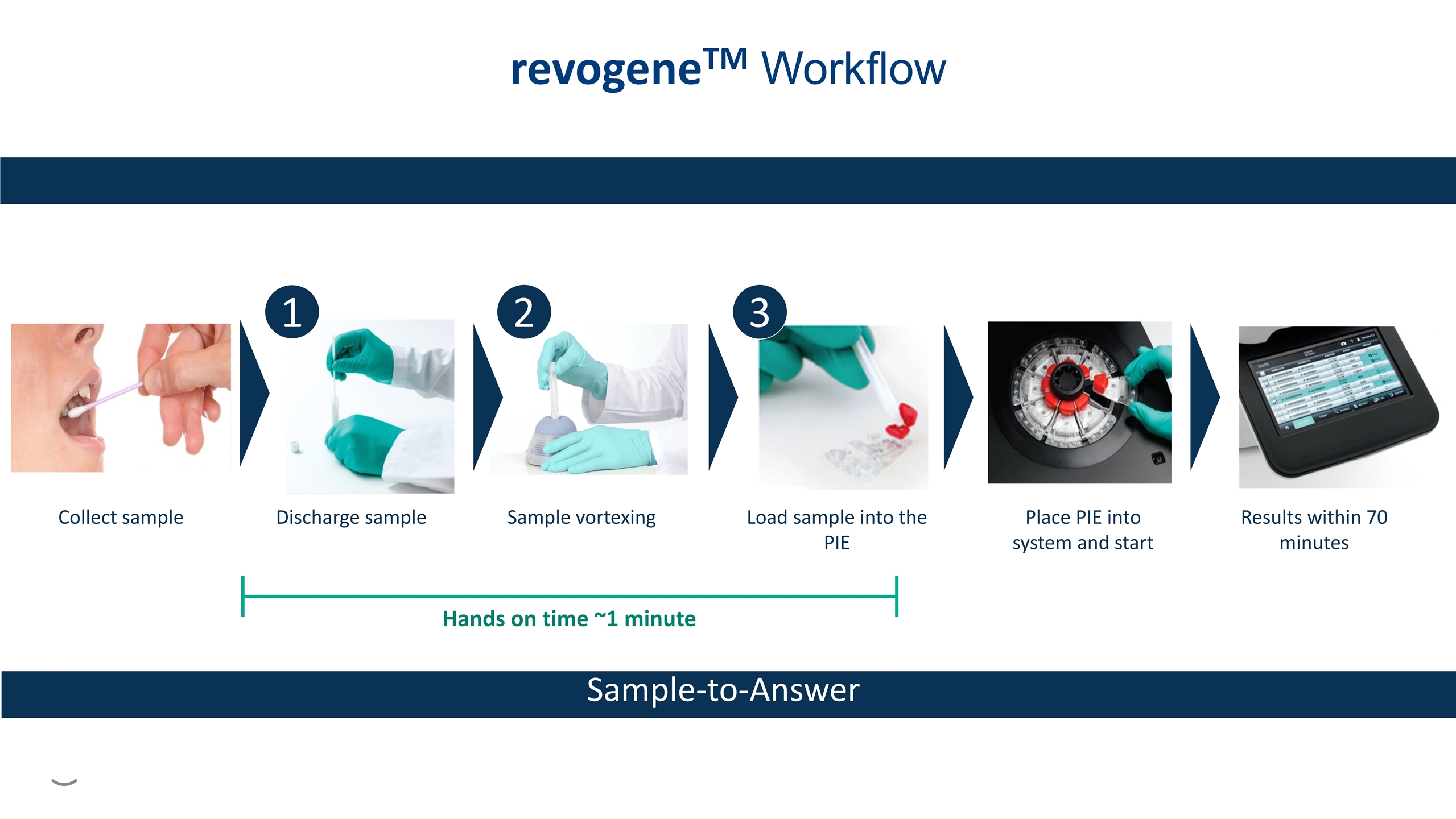

Discharge sample Hands on time ~1 minute Collect sample Sample vortexing Load sample into the PIE Place PIE into system and start Results within 70 minutes 1 2 3 revogeneTM Workflow Sample-to-Answer

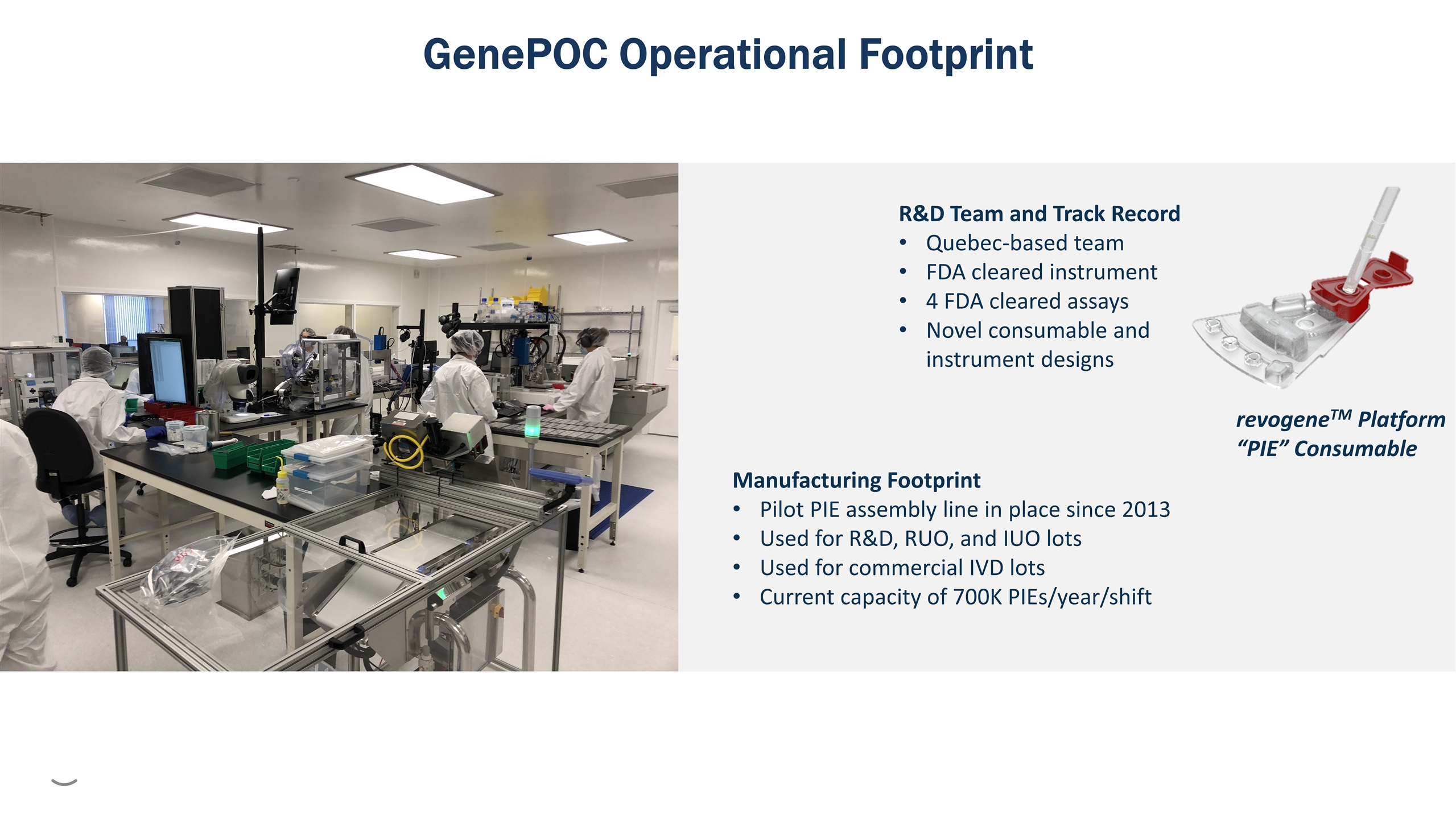

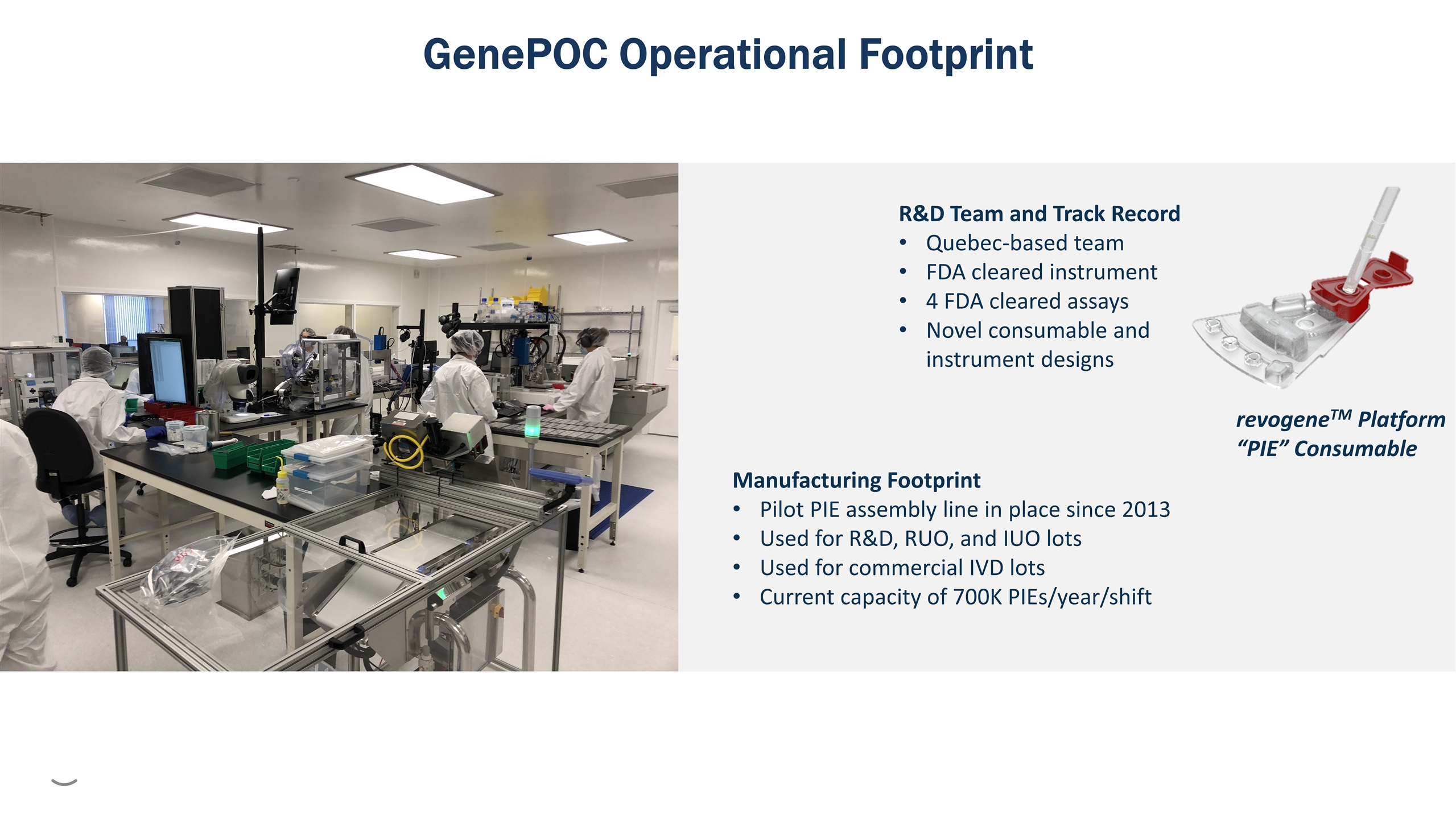

R&D Team and Track Record Quebec-based team FDA cleared instrument 4 FDA cleared assays Novel consumable and instrument designs Manufacturing Footprint Pilot PIE assembly line in place since 2013 Used for R&D, RUO, and IUO lots Used for commercial IVD lots Current capacity of 700K PIEs/year/shift GenePOC Operational Footprint revogeneTM Platform “PIE” Consumable

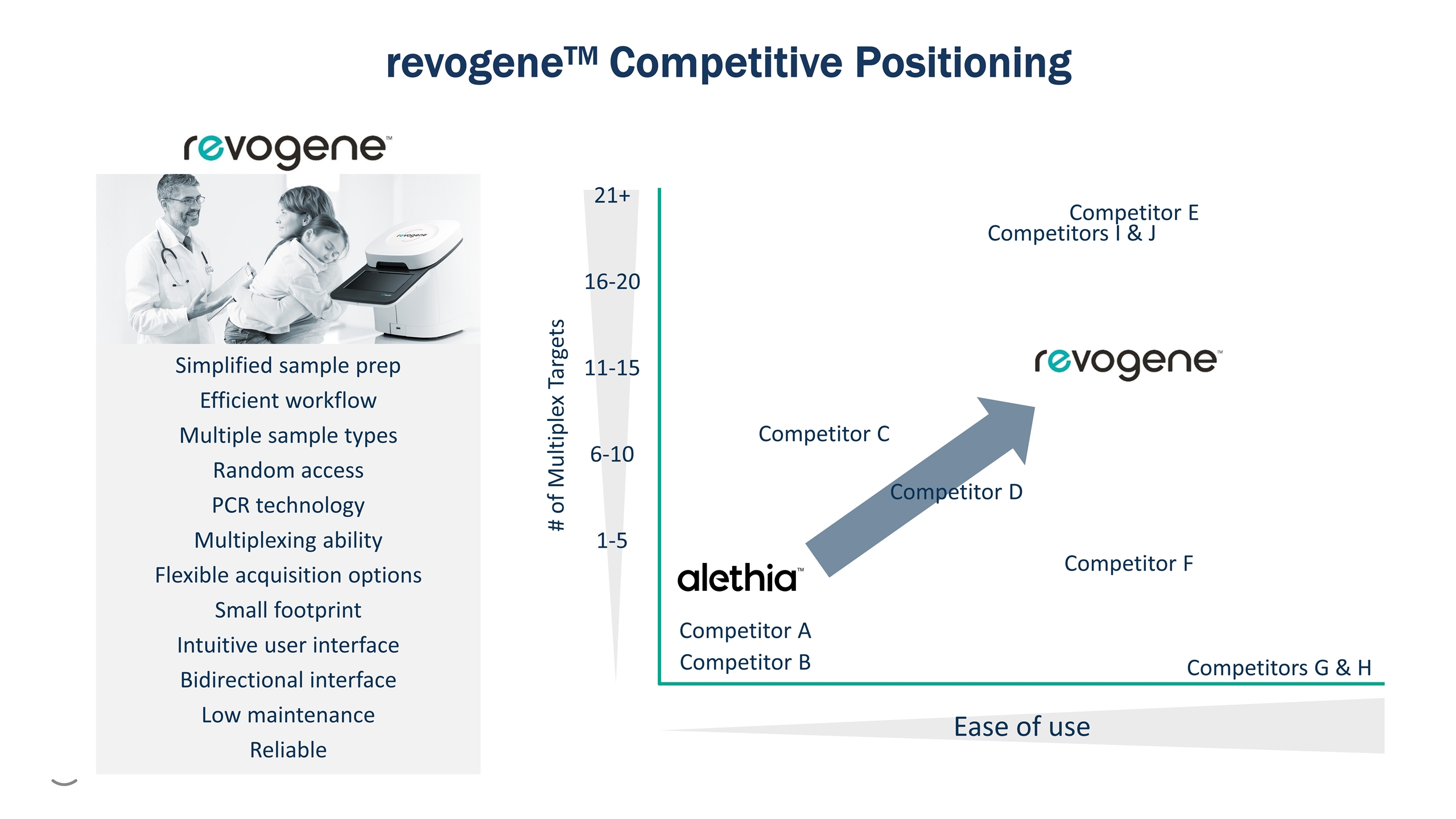

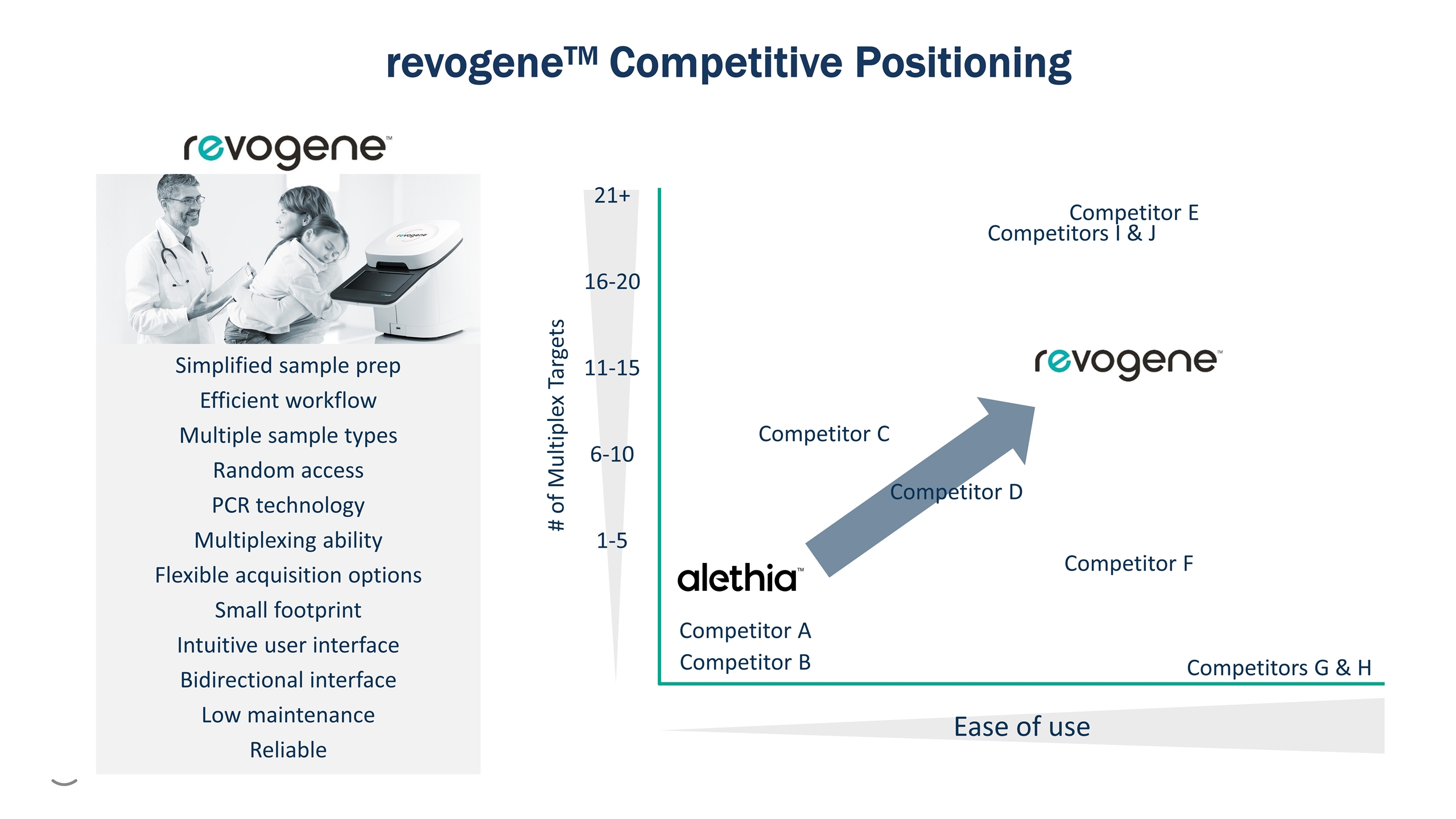

Ease of use # of Multiplex Targets 1-5 11-15 6-10 16-20 21+ Competitor A Simplified sample prep Efficient workflow Multiple sample types Random access PCR technology Multiplexing ability Flexible acquisition options Small footprint Intuitive user interface Bidirectional interface Low maintenance Reliable Competitor B Competitor C Competitor D Competitors G & H Competitor F Competitor E Competitors I & J revogeneTM Competitive Positioning

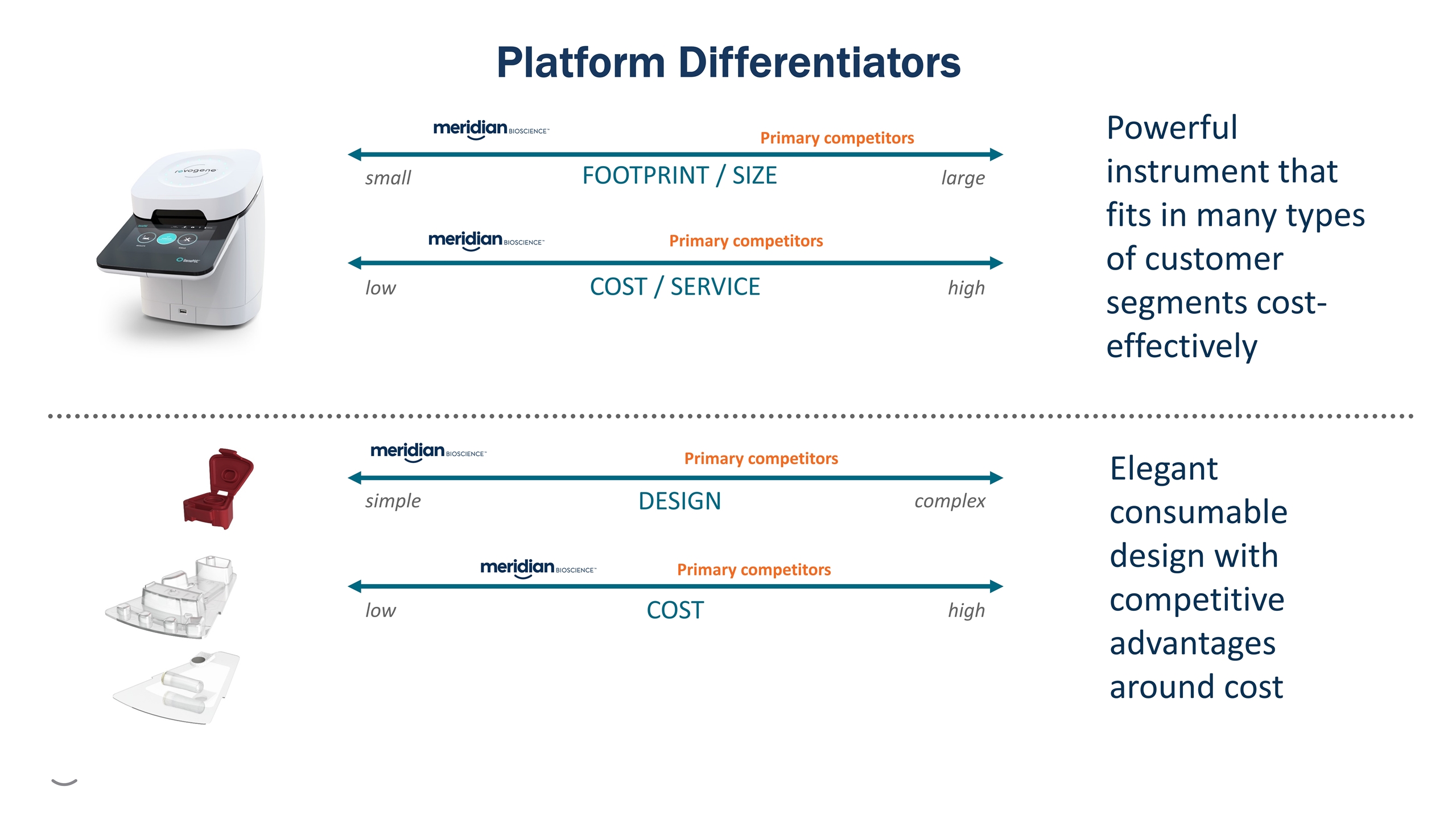

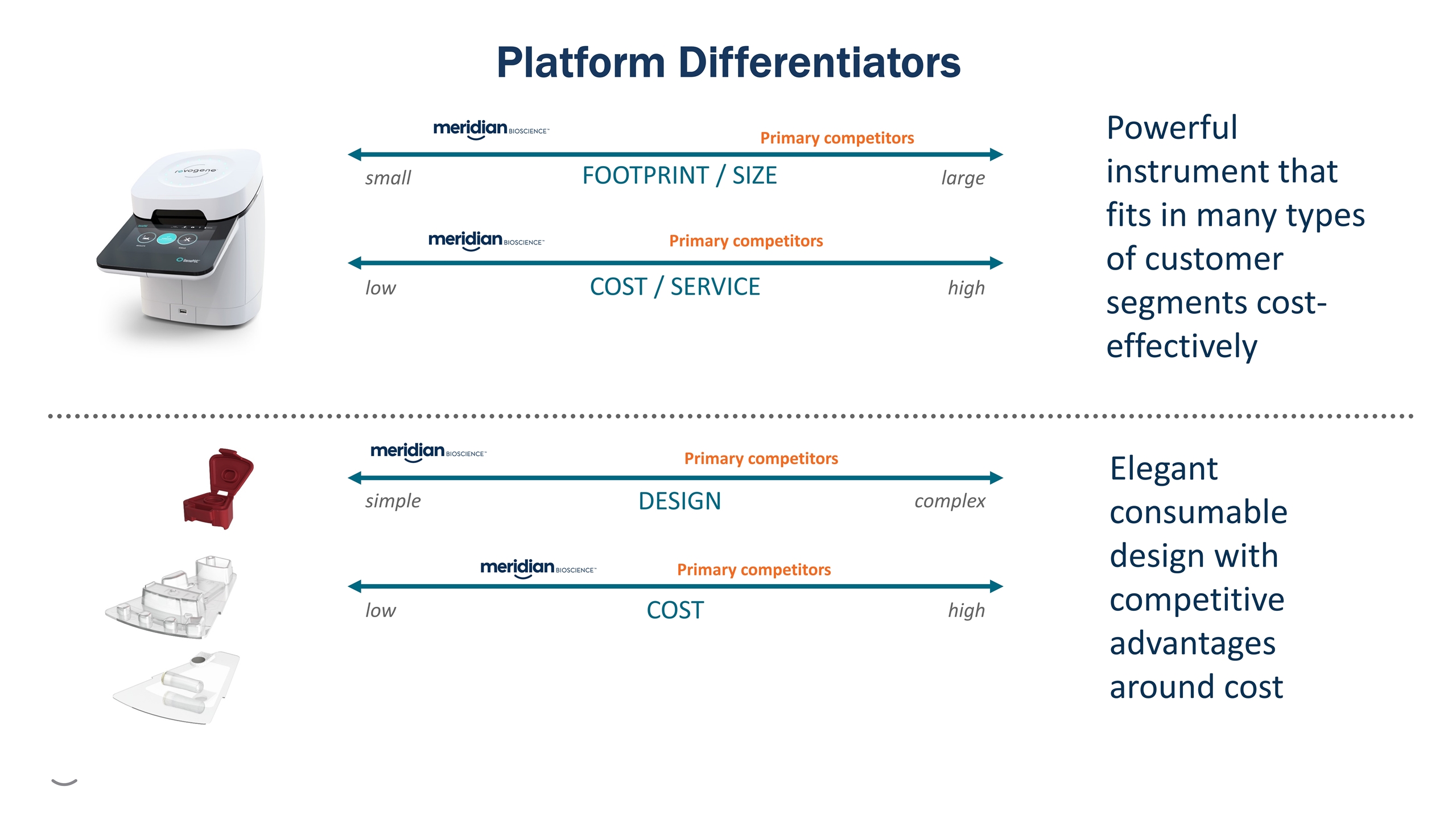

low high simple complex small large low high FOOTPRINT / SIZE COST / SERVICE DESIGN COST Primary competitors Primary competitors Primary competitors Primary competitors Powerful instrument that fits in many types of customer segments cost-effectively Elegant consumable design with competitive advantages around cost Platform Differentiators

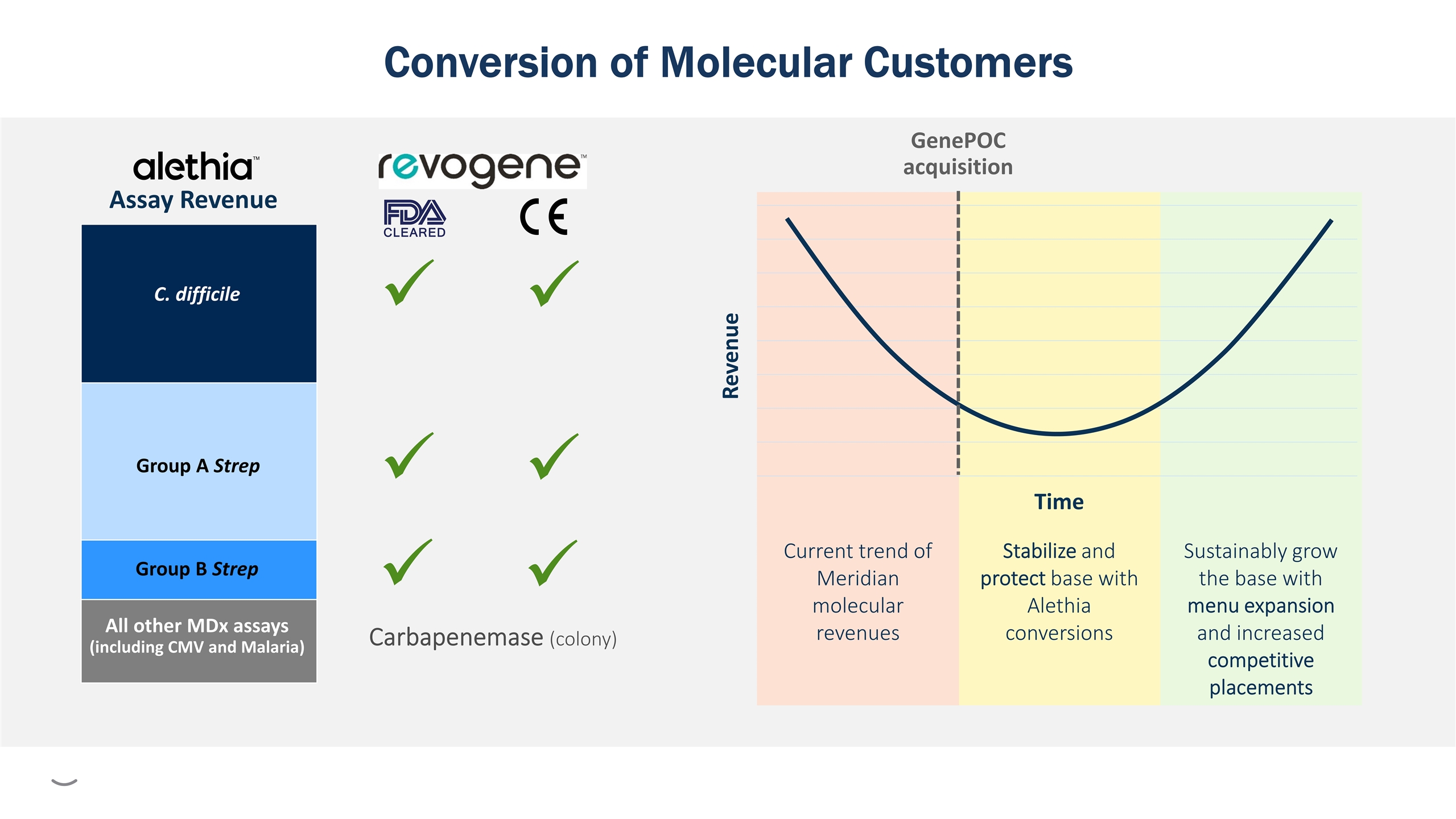

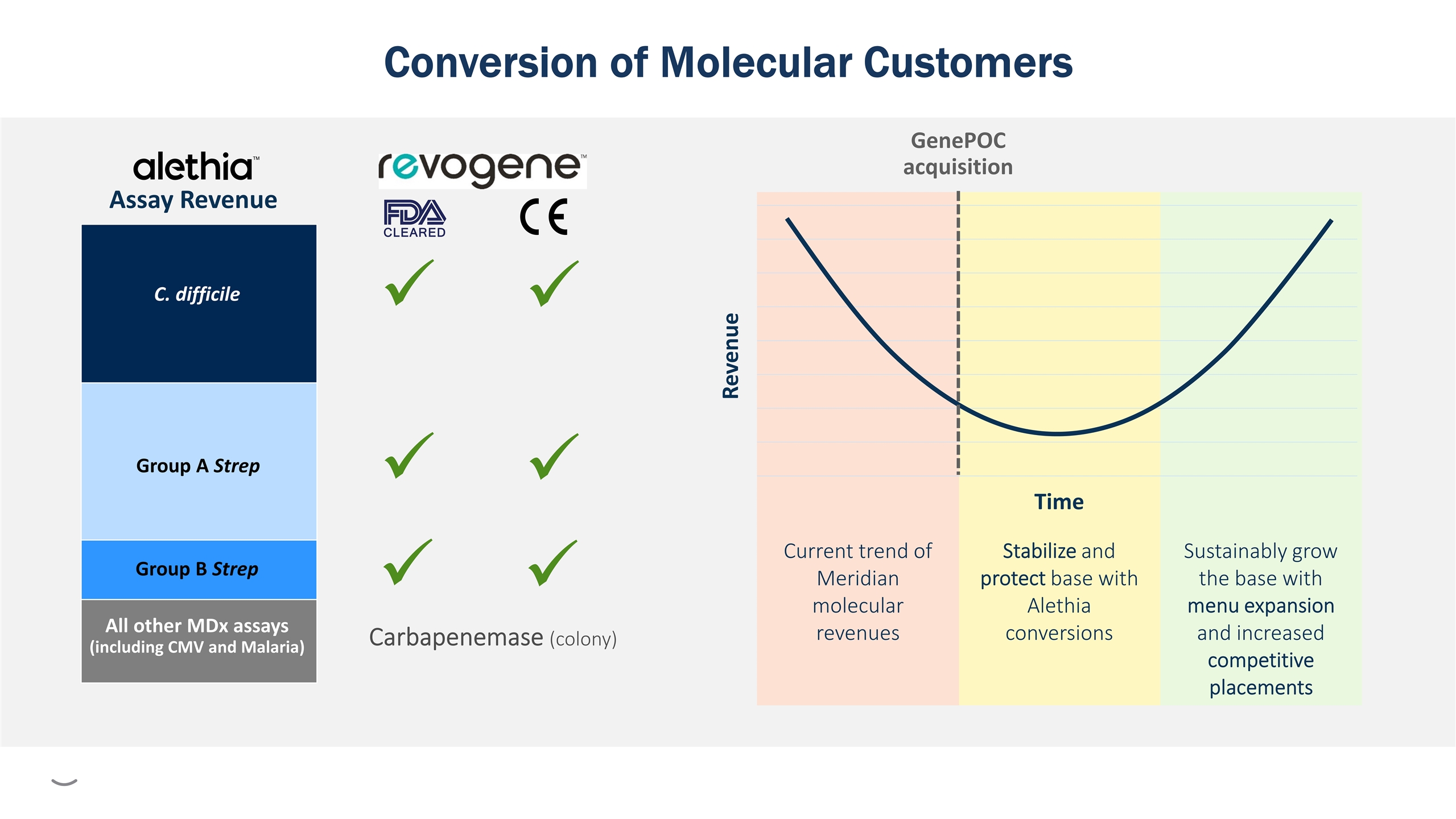

Sustainably grow the base with menu expansion and increased competitive placements Stabilize and protect base with Alethia conversions Current trend of Meridian molecular revenues GenePOC acquisition Conversion of Molecular Customers All other MDx assays (including CMV and Malaria) C. difficile Group A Strep Carbapenemase (colony)

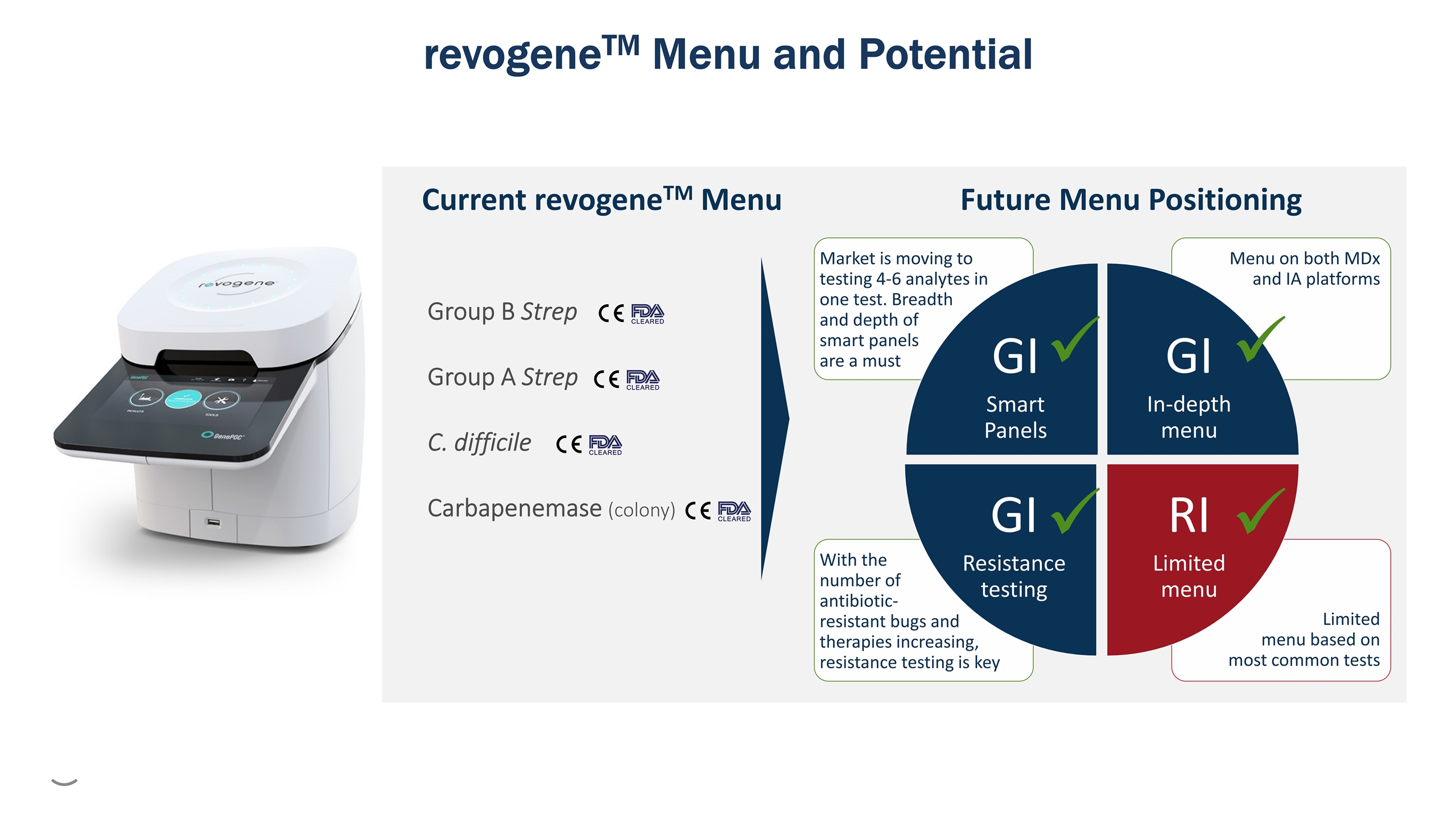

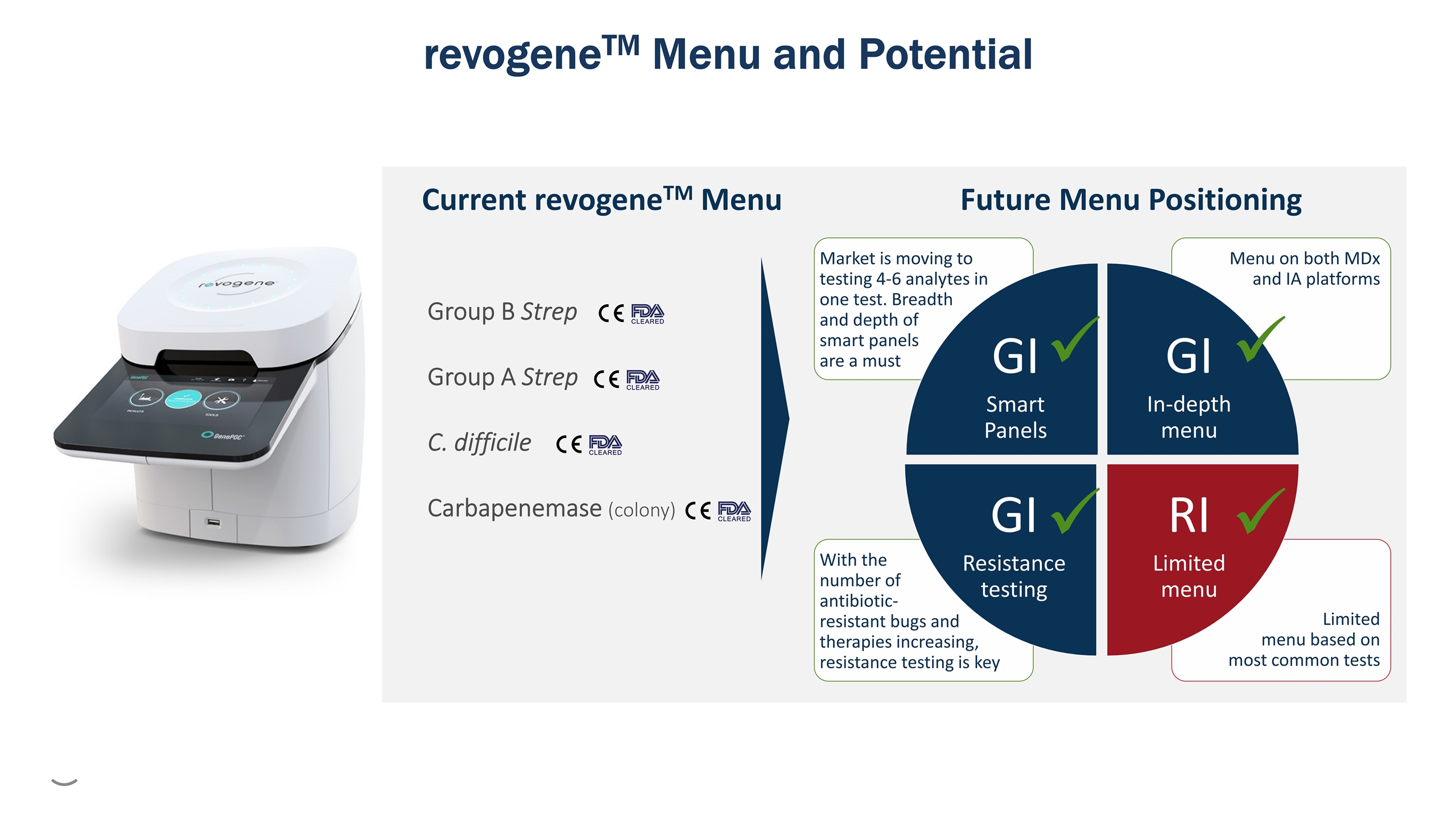

Future Menu Positioning Group B Strep Group A Strep C. difficile Carbapenemase (colony) Current revogeneTM Menu revogeneTM Menu and Potential Limited menu based on most common tests With the number of antibiotic- resistant bugs and therapies increasing, resistance testing is key Menu on both MDx and IA platforms Market is moving to testing 4-6 analytes in one test. Breadth and depth of smart panels are a must GI Smart Panels GI In-depth menu RI Limited menu GI Resistance testing

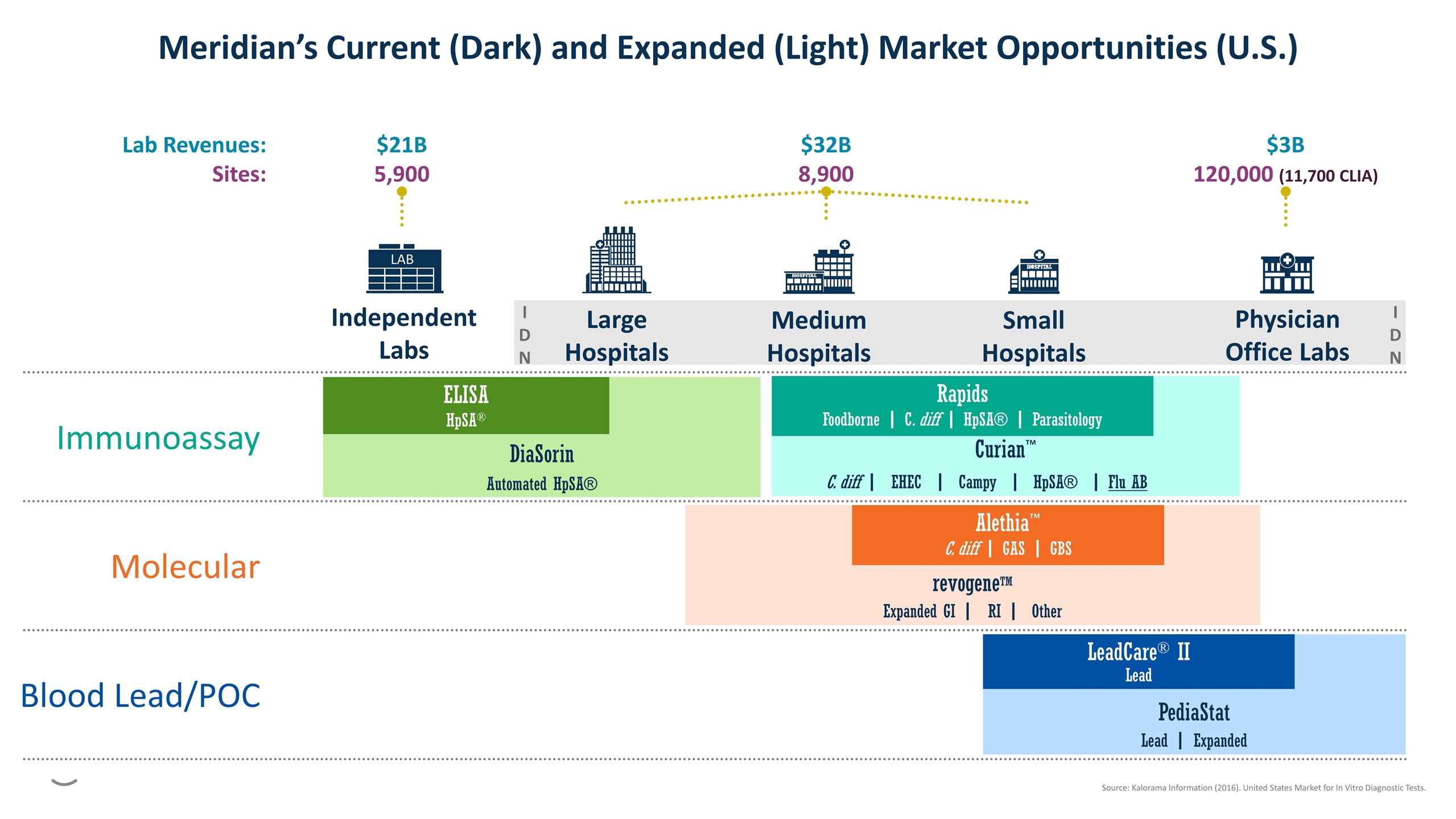

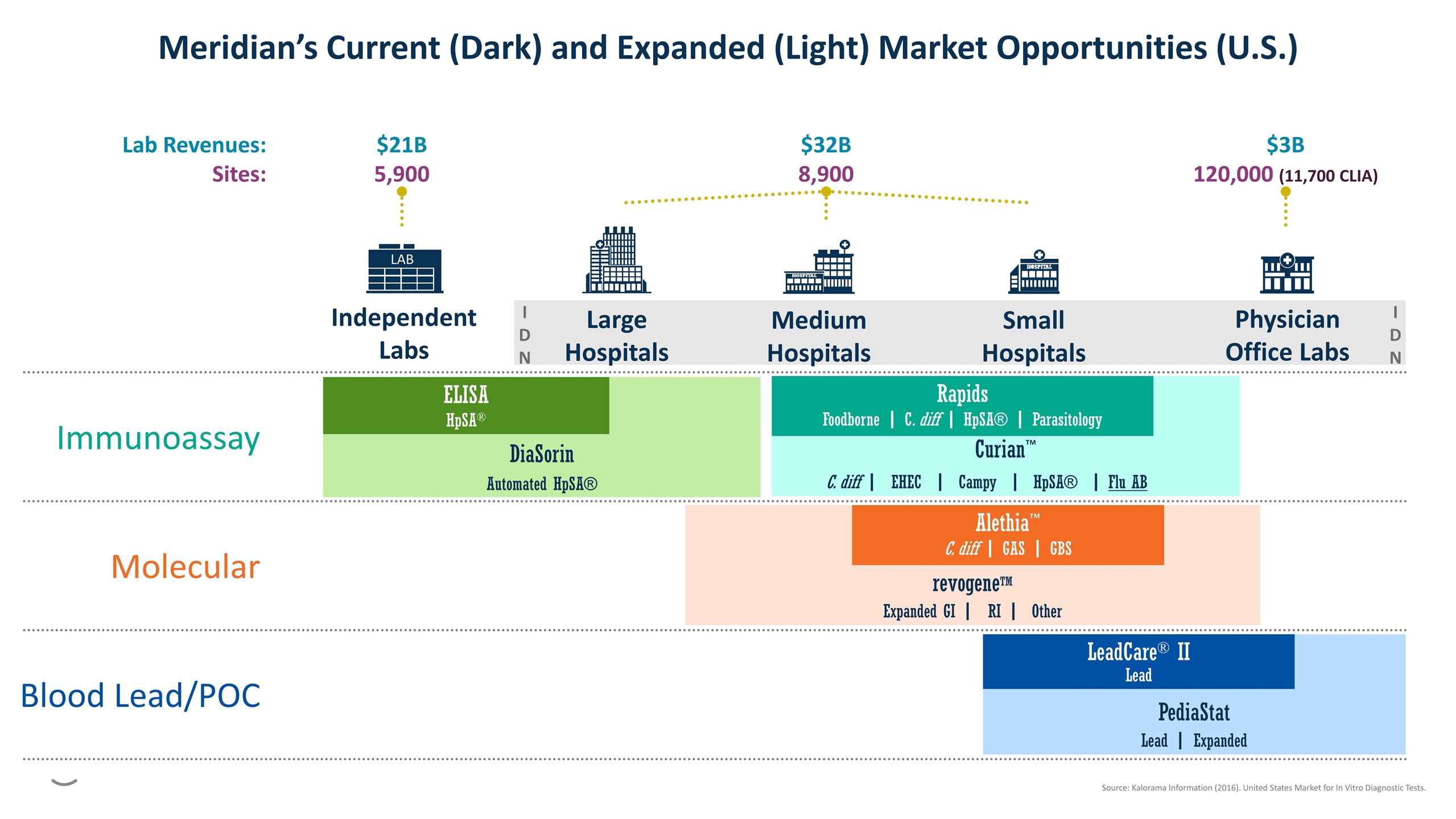

I D N I D N $21B 5,900 $32B 8,900 $3B 120,000 (11,700 CLIA) Physician Office Labs Independent Labs LAB Large Hospitals Medium Hospitals Small Hospitals Lab Revenues: Sites: Immunoassay DiaSorin Automated HpSA® ELISA HpSA® Curian™ C. diff | EHEC | Campy | HpSA® | Flu AB Rapids Foodborne | C. diff | HpSA® | Parasitology Molecular revogeneTM Expanded GI | RI | Other Alethia™ C. diff | GAS | GBS Blood Lead/POC PediaStat Lead | Expanded LeadCare® II Lead Meridian’s Current (Dark) and Expanded (Light) Market Opportunities (U.S.) Source: Kalorama Information (2016). United States Market for In Vitro Diagnostic Tests.

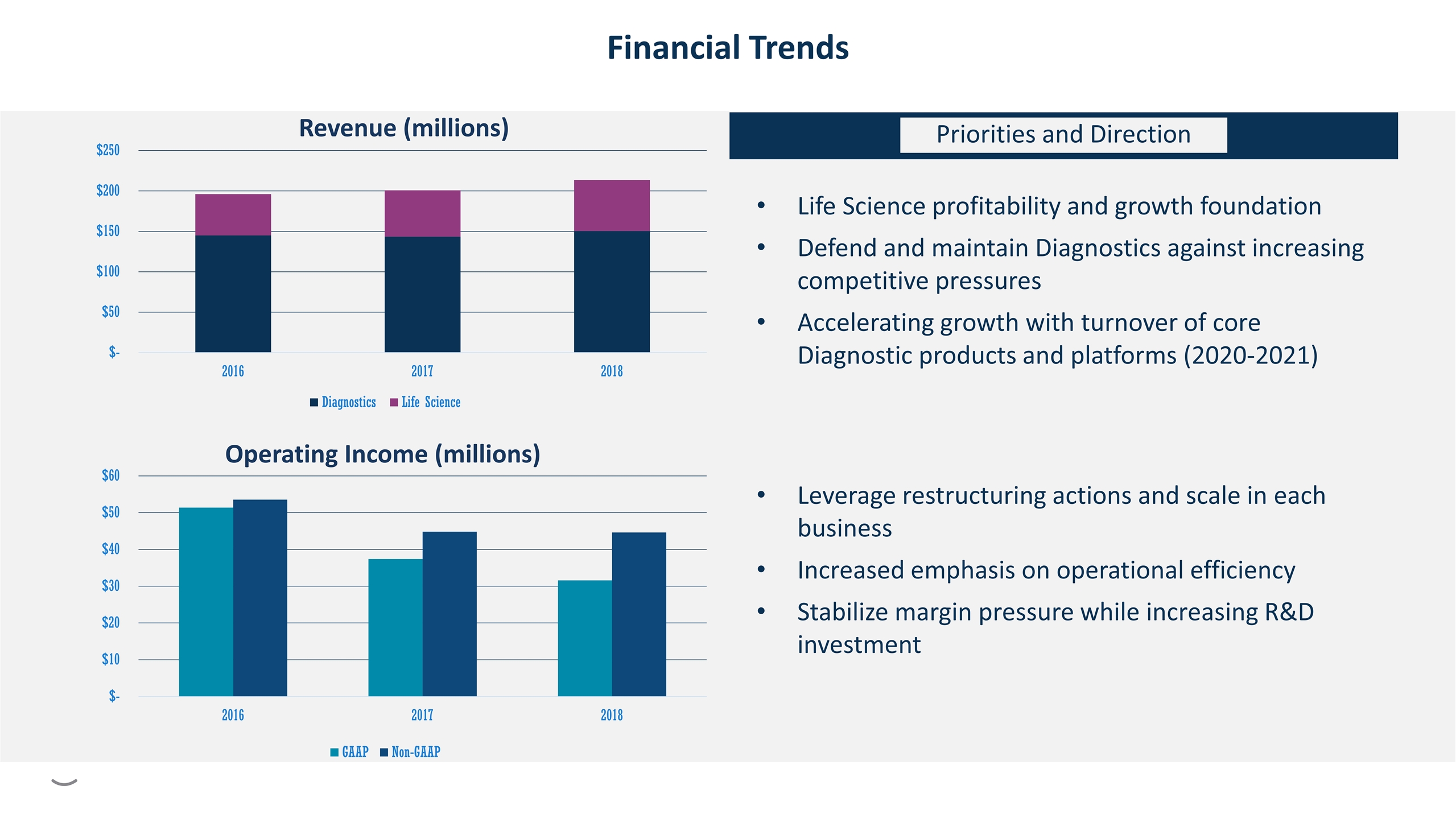

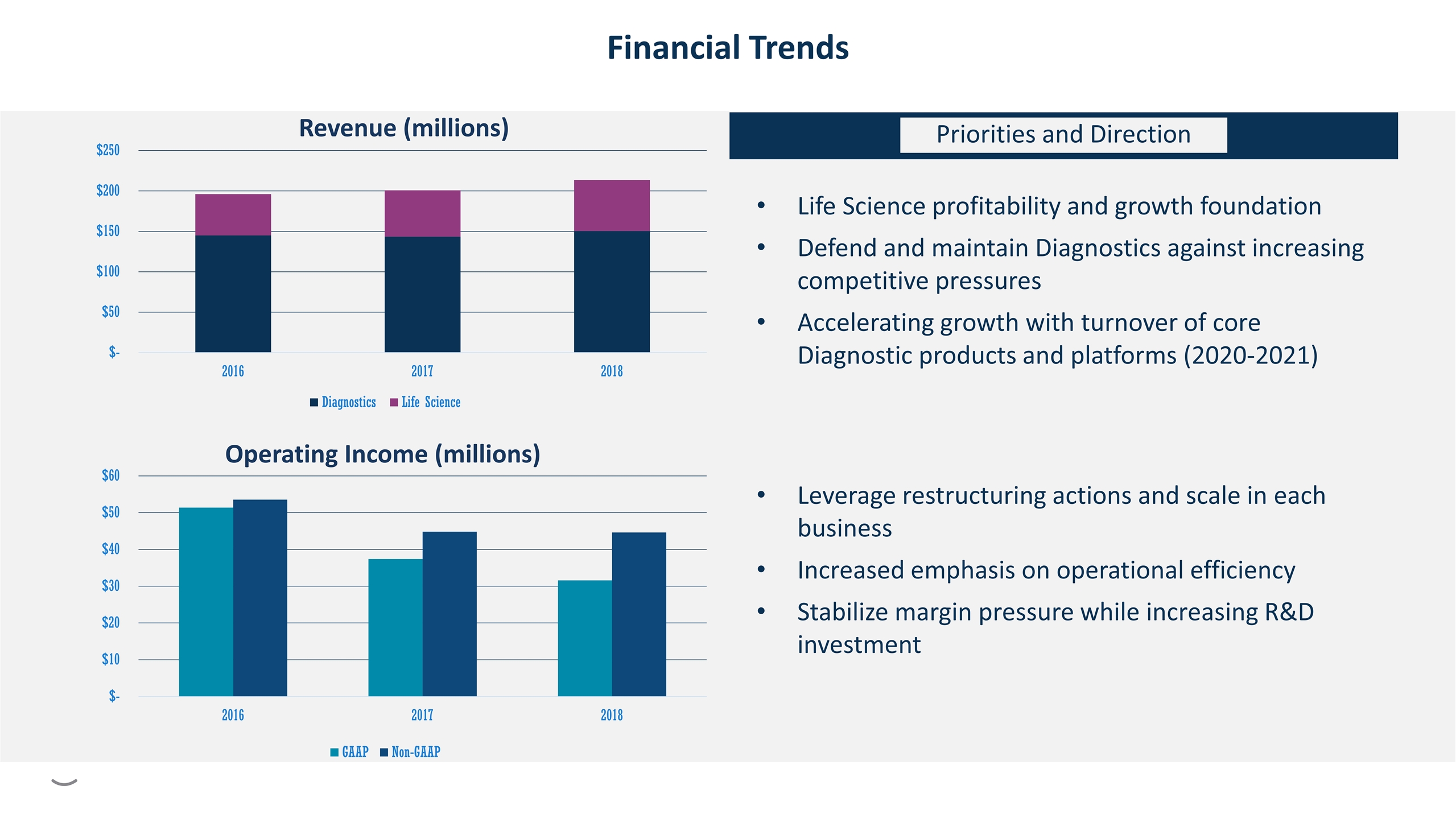

Revenue (millions) Financial Trends Operating Income (millions) Life Science profitability and growth foundation Defend and maintain Diagnostics against increasing competitive pressures Accelerating growth with turnover of core Diagnostic products and platforms (2020-2021) Leverage restructuring actions and scale in each business Increased emphasis on operational efficiency Stabilize margin pressure while increasing R&D investment Priorities and Direction

Manage competitive pressures and product life cycles Leverage cost structure and operational efficiency Focus resources on core target markets Redeploy available capital to support investment in the business Increase investment in R&D, acquisitions G G G G G Reposition the business for sustainable, long-term top line growth and bottom line returns

APPENDIX

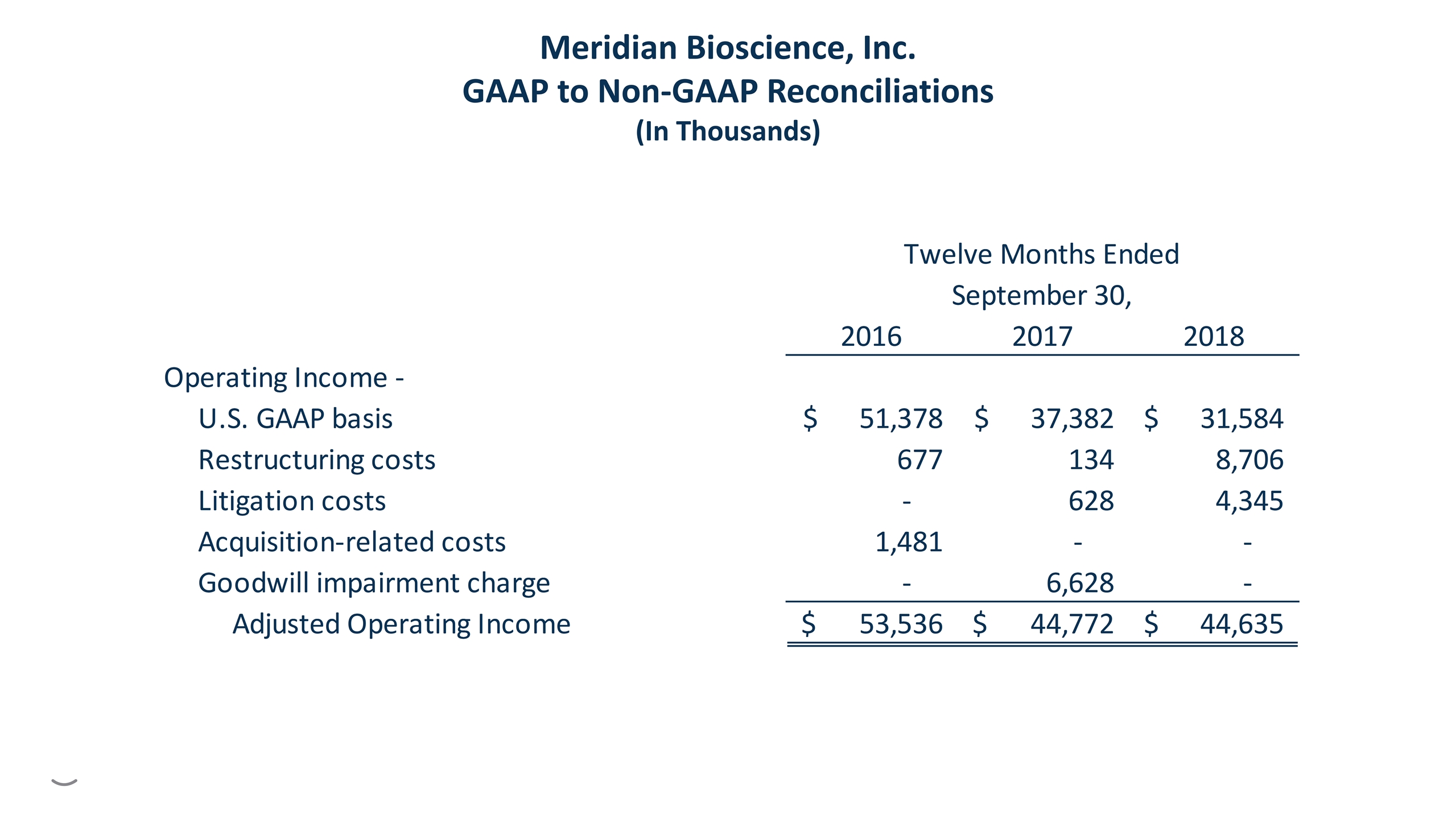

Meridian Bioscience, Inc. GAAP to Non-GAAP Reconciliations (In Thousands)