QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Level 3 Communications, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

LEVEL 3 COMMUNICATIONS, INC.

1025 Eldorado Boulevard

Broomfield, CO 80021

April , 2005

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Level 3 Communications, Inc. ("Level 3") to be held at 9:00 a.m. on May 17, 2005, at The Orpheum Theater, 409 South 16th Street, Omaha, Nebraska 68102.

At the Annual Meeting you will be asked to consider and act upon the following matters:

- •

- the reelection to our Board of Directors of three directors as Class II Directors for a three-year term until the 2008 Annual Meeting of Stockholders; and

- •

- the approval of the grant to our Board of Directors of discretionary authority to amend our amended and restated certificate of incorporation to effect a reverse stock split at one of four ratios; and

- •

- the approval of the amendment and restatement of our certificate of incorporation; and

- •

- the transaction of such other business as may properly come before the Annual Meeting.

Our Board of Directors recommends that you reelect three Class II directors for a three-year term until the 2008 Annual Meeting of Stockholders, approve the proposed granting to our Board of Directors of discretionary authority to amend the amended and restated certificate of incorporation to effect a reverse stock split and approve the amendment and restatement of the certificate of incorporation. See "REELECTION OF CLASS II DIRECTORS PROPOSAL," "REVERSE STOCK SPLIT PROPOSAL" and "AMENDMENT AND RESTATEMENT OF CERTIFICATE OF INCORPORATION PROPOSAL."

Information concerning the matters to be considered and voted upon at the Annual Meeting is contained in the attached Notice of Annual Meeting and Proxy Statement. It is important that your shares be represented at the Annual Meeting, regardless of the number you hold. To ensure your representation at the Annual Meeting, you are urged to complete, date, sign and return the enclosed proxy as promptly as possible. A postage-prepaid envelope is enclosed for that purpose. In addition, to ensure your representation at the Annual Meeting, you may vote your shares by (a) calling the toll free telephone number indicated on the proxy card or (b) accessing the special web site indicated on the proxy card, each as more fully explained in the telephone and internet voting instructions. If you attend the Annual Meeting you may vote in person even if you have previously returned a proxy card.Please note that if you hold your shares of our common stock through your broker, you will not be able to vote in person at the meeting.

| | | Sincerely, |

|

|

|

| | | Walter Scott, Jr.

Chairman of the Board |

LEVEL 3 COMMUNICATIONS, INC.

1025 Eldorado Boulevard

Broomfield, CO 80021

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held May 17, 2005

To the Stockholders of Level 3 Communications, Inc.:

The Annual Meeting of Stockholders of Level 3 Communications, Inc., a Delaware corporation ("Level 3"), will be held at The Orpheum Theater, 409 South 16th Street, Omaha, Nebraska 68102 at 9:00 a.m. on May 17, 2005, for the following purposes:

- 1.

- To reelect three directors as Class II Directors of the Board of Directors of Level 3 for a three-year term until the 2008 Annual Meeting of Stockholders; and

- 2.

- To approve the granting to the Level 3 Board of Directors of discretionary authority to amend the Level 3 amended and restated certificate of incorporation to effect a reverse stock split at one of four ratios; and

- 3.

- To approve an amendment and restatement of the Level 3 Communications, Inc. Certificate of Incorporation; and

- 4.

- To authorize the transaction of such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

The Board of Directors has fixed the close of business on March 30, 2005, as the record date for the determination of the holders of our common stock, entitled to notice of, and to vote at, the meeting. Accordingly, only holders of record of Level 3 common stock at the close of business on that date will be entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. As of May 7, 2005, ten days prior to the Annual Meeting, a list of stockholders entitled to notice of the Annual Meeting and that have the right to vote at the Annual Meeting will be available for inspection at the Level 3 Communications, Inc. offices located at 1025 Eldorado Boulevard, Broomfield, Colorado 80021.

The three Class II Directors will be elected by a plurality of the votes cast by holders of Level 3 common stock present in person or by proxy and entitled to vote at the Annual Meeting.

The proposal to grant to the Board of Directors discretionary authority to amend the amended and restated certificate of incorporation to effect a reverse stock split at one of four ratios requires the affirmative vote of the holders of a majority of the votes entitled to be cast in respect of all outstanding shares of Level 3 common stock. The proposal to adopt an amendment and restatement of the Level 3 certificate of incorporation requires the affirmative vote of the holders of a majority of the votes entitled to be cast in respect of all outstanding shares of Level 3 common stock. The proposal to authorize the transaction of such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof requires the affirmative vote of a majority of the votes cast by people present in person or by proxy at the Annual Meeting.

The matters to be considered at the Annual Meeting are more fully described in the accompanying Proxy Statement, which forms a part of this Notice.

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING. TO ENSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, HOWEVER, YOU ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE. A POSTAGE-PREPAID ENVELOPE IS ENCLOSED FOR THAT PURPOSE. IN ADDITION, TO ENSURE YOUR REPRESENTATION

AT THE ANNUAL MEETING, YOU MAY VOTE YOUR SHARES BY A) CALLING THE TOLL FREE TELEPHONE NUMBER OR B) ACCESSING THE INTERNET AS MORE FULLY EXPLAINED IN THE TELEPHONE AND INTERNET VOTING INSTRUCTIONS. ANY STOCKHOLDER ATTENDING THE ANNUAL MEETING MAY VOTE IN PERSON EVEN IF THAT STOCKHOLDER HAS RETURNED A PROXY.

PLEASE NOTE THAT IF YOU HOLD YOUR SHARES OF LEVEL 3 COMMON STOCK THROUGH YOUR BROKER AND NOT DIRECTLY IN YOUR NAME, YOU WILL NOT BE ABLE TO VOTE IN PERSON AT THE ANNUAL MEETING.

| | | By Order of the Board of Directors |

|

|

|

Dated: April , 2005 | | Walter Scott, Jr.

Chairman of the Board |

2

LEVEL 3 COMMUNICATIONS, INC.

1025 Eldorado Boulevard

Broomfield, CO 80021

Proxy Statement

April , 2005

ANNUAL MEETING OF STOCKHOLDERS

May 17, 2005

We are furnishing you this Proxy Statement in connection with the solicitation of proxies on behalf of the Board of Directors of Level 3 Communications, Inc. ("Level 3", the "Company," "we," "us," or "our") to be voted at the Annual Meeting of Stockholders to be held on Tuesday, May 17, 2005, or any adjournment or postponements thereof. This Proxy Statement, the Notice of Annual Meeting, the accompanying Proxy and the Annual Report to Stockholders are first being mailed to Stockholders on or about April , 2005. We sometimes refer to our Board of Directors as the Board and to this document as the Proxy Statement.

VOTING PROCEDURES

Your vote is very important. You can vote the shares of Level 3 common stock that are held directly in your name and not through your brokerage account at the Annual Meeting if you are present in person or represented by proxy. You may revoke your proxy at any time before the Annual Meeting by delivering written notice to our Secretary, by submitting a proxy bearing a later date or by appearing in person and casting a ballot at the Annual Meeting. If we receive a properly executed proxy before voting at the Annual Meeting is closed, the persons named as the Proxy on the proxy card will vote the proxy in accordance with the directions provided on that card. If you do not indicate how your shares are to be voted, your shares will be voted as recommended by the Board. If you wish to give a proxy to someone other than the persons named on the proxy card, you should cross out the names contained on the proxy card and insert the name(s) of the person(s) who hold(s) your proxy. Please note that the person(s) to whom you give your proxymust be present in person at the Annual Meeting to vote your shares.

Who can vote?

Stockholders of record as of the close of business on March 30, 2005, are entitled to vote at the Annual Meeting. On that date, shares of our common stock were outstanding and eligible to vote. Each share is entitled to one vote on each matter presented at the Annual Meeting.

How do I vote?

You can vote in person at the Annual Meeting. Alternatively, a stockholder who holds shares of our common stock of record and not in "street name" may vote shares by giving a proxy via mail, telephone or the Internet. To vote your proxy by mail, indicate your voting choices, sign and date your Proxy and return it in the postage-paid envelope provided. You may vote by telephone or the Internet by following the instructions on your Proxy. Your telephone or Internet delivery authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned your Proxy via the mail.

If you hold your shares through a broker, bank or other nominee, that institution will send you separate instructions describing the procedure for voting your shares.You can only vote your shares held through a broker, bank or other nominee by following the voting procedures sent to you by that institution. You will not be able to vote your shares held through a broker, bank or other nominee in person at the Annual Meeting.

What shares are represented by the Proxy?

The Proxy that we are delivering represents all the shares registered in your name with our transfer agent—Wells Fargo Shareowner Services. The Proxy that is delivered by your broker, bank or other nominee represents the shares held by you in an account at that institution.

If you are an employee who participates in our 401(k) Plan or the Software Spectrum 401(k) Plan, your Proxy does not include the shares of our common stock that are attributable to the units that you hold in the Level 3 Stock Fund as part of the 401(k) Plan. Shares held by employees through the Level 3 401(k) Plan and the Software Spectrum 401(k) Plan are voted by the administrator of the 401(k) Plan.

How are votes counted?

If you return a signed and dated Proxy but do not indicate how the shares are to be voted, those shares will be voted as recommended by the Board. A valid Proxy also authorizes the individuals named as proxies to vote your shares in their discretion on any other matters which, although not described in the Proxy Statement, are properly presented for action at our Annual Meeting. If you indicate on your Proxy that you wish to "abstain" from voting on an item, your shares will not be voted on that item. Abstentions are not counted in determining the number of shares voted for or against any nominee for Director or any other proposal, but will be counted to determine whether there is a quorum present.

If you do not provide voting instructions to your broker or nominee at least ten days before the Annual Meeting, the nominee has discretion to vote those shares on matters that The Nasdaq Stock Market has determined are routine. However, a nominee cannot vote shares on non-routine matters without your instructions. This is referred to as a "broker non-vote." Broker non-votes are counted in determining whether a quorum is present.

What vote is required?

In order to have a quorum present at the Annual Meeting, a majority of our shares of common stock that are outstanding and entitled to vote at the Annual Meeting must be represented in person or by proxy. If a quorum is not present, the Annual Meeting will be rescheduled for a later date. Directors must be elected by a plurality of the votes cast. The proposals to grant to the Board of Directors discretionary authority to amend the amended and restated certificate of incorporation to effect a reverse stock split at one of four ratios and to amend and restate our certificate of incorporation each require the affirmative vote of the holders of a majority of the votes entitled to be cast in respect of all outstanding shares of Level 3 common stock. The proposal to authorize the transaction of such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof requires the affirmative vote of a majority of the votes cast by people present in person or by proxy at the Annual Meeting. For those situations that require an affirmative vote of the holders of a majority of the votes entitled to be cast in respect of all outstanding shares of our common stock, broker non-votes and abstentions will have the effect of a "no" vote. In all other cases, broker non-votes and abstentions will have no effect on the outcome.

Who will tabulate the vote?

Our transfer agent, Wells Fargo Shareowners Services, will tally the vote, which will be certified by an inspector of election who is a Level 3 employee.

2

Who will bear the expenses of our solicitation? How will we solicit votes?

We will bear our own cost of solicitation of proxies. In addition to the use of the mail, proxies may be solicited by our directors and officers by personal interview, telephone, telegram, facsimile or e-mail. Our directors and officers will not receive additional compensation for this solicitation but may be reimbursed for out-of-pocket expenses incurred in connection with these activities. Arrangements may also be made with brokerage firms and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of shares of our common stock held of record by these people, in which case we will reimburse these brokerage firms, custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by them in connection with these forwarding activities.

REELECTION OF CLASS II DIRECTORS PROPOSAL

Effective after the Annual Meeting, our Board will consist of nine directors, divided into three classes, designated Class I, Class II and Class III. At that time, each of the Classes will consist of three directors. Three of the current four Class II directors are standing for reelection.

At the Annual Meeting, the directors that are standing for reelection will be reelected to hold office for a three-year term until the 2008 Annual Meeting, or until their successors have been elected and qualified. If any nominee shall, prior to the Annual Meeting, become unavailable for election as a director, the persons named in the accompanying form of proxy will, in their discretion, vote for that nominee, if any, as may be recommended by the Board, or the Board may reduce the number of directors to eliminate the vacancy.

One of the current Class II directors, Mr. Mogens C. Bay, has decided not to seek reelection to the Board.

Explanatory Note

On March 31, 1998, we separated the operations of our former construction business from the diversified or non-construction related portion of our business into a new corporation (the "Split-off"). In connection with the Split-off, we changed the company's name to "Level 3 Communications, Inc." and the construction business was renamed "Peter Kiewit Sons', Inc." Information presented in this Proxy Statement relating to periods prior to March 31, 1998, relates to information for the members of the Board and our executive officers during those periods.

Information as to Nominees for Reelection as Class II Directors

The respective ages, positions with Level 3, if any, business experience, directorships in other companies and Board committee memberships, of the nominees for election are set forth below. All information is presented as of March 17, 2005. None of these directors is an employee of the Company.

Admiral James O. Ellis, Jr. U.S. Navy (ret.), 57, has been a director of the Company since March 2005. Admiral Ellis most recently served as Commander, U.S. Strategic Command in Omaha, Nebraska, before retiring in July 2004 after 35 years of service in the U.S. Navy. As Commander of the Strategic Command, he was responsible for the global command and control of U.S. strategic forces. In his Naval career, he held numerous commands, including Commander, U.S. Allied Forces Southern Europe. A graduate of the U.S. Naval Academy, he also holds M.S. degrees in Aerospace Engineering from the Georgia Institute of Technology and in Aeronautical Systems from the University of West Florida. He served as a Naval aviator and was a graduate of the U.S. Naval Test Pilot School. Admiral Ellis is also a member of the Board of Directors of Lockheed Martin Corporation.

Richard R. Jaros, 53, has been a director of the Company since June 1993 and served as President of the Company from 1996 to 1997. Mr. Jaros served as Executive Vice President of the Company from

3

1993 to 1996 and Chief Financial Officer of the Company from 1995 to 1996. He also served as President and Chief Operating Officer of CalEnergy from 1992 to 1993, and is presently a director of MidAmerican Energy Holdings Company ("MidAmerican") and Commonwealth Telephone Enterprises, Inc. ("Commonwealth Telephone"). Mr. Jaros is a member of the Board's Compensation Committee and Audit Committee.

Dr. Albert C. Yates, 63, has been a director of the Company since March 2005. Dr. Yates retired after 12 years as president of Colorado State University in Fort Collins, Colorado in June 2003. He was also a chancellor of the Colorado State University System until October 2003, and is a former member of the board of the Federal Reserve Board of Kansas City-Denver Branch and the board of directors of First Interstate Bank. He currently serves as a director of Molson Coors Brewing Company and StarTek, Inc.

The Board unanimously recommends a vote FOR the nominees named above.

Information as to Continuing Directors

The respective ages, positions with Level 3, if any, business experience, directorships in other companies and Level 3 Board committee chairmanships, of the remaining members of the Level 3 Board are set forth below. All information is presented as of March 17, 2005.

Walter Scott, Jr., 73, has been the Chairman of the Board of the Company since September 1979, and a director of the Company since April 1964. Mr. Scott has been Chairman Emeritus of Peter Kiewit Sons', Inc. ("PKS") since the Split-off. Mr. Scott is also a director of PKS, Berkshire Hathaway Inc., MidAmerican, Commonwealth Telephone and Valmont Industries, Inc. Mr. Scott is also the Chairman of the Executive Committee of the Board.

James Q. Crowe, 55, has been the Chief Executive Officer of the Company since August 1997, and a director of the Company since June 1993. Mr. Crowe was also President of the Company until February 2000. Mr. Crowe was President and Chief Executive Officer of MFS Communications Company, Inc. ("MFS") from June 1993 to June 1997. Mr. Crowe also served as Chairman of the Board of WorldCom, Inc. from January 1997 until July 1997, and as Chairman of the Board of MFS from 1992 through 1996. Mr. Crowe is presently a director of Commonwealth Telephone. Mr. Crowe is a member of the Executive Committee of the Board.

Robert E. Julian, 65, has been a director of the Company since March 1998. From 1992 to 1995 Mr. Julian served as Executive Vice President and Chief Financial Officer of the Company. Mr. Julian is the Chairman of the Audit Committee of the Board.

Arun Netravali, 58, has been a director of the Company since April 2003. Prior to that, Mr. Netravali was Chief Scientist for Lucent Technologies from January 2002 until his retirement in April 2003, working with academic and investment communities to identify and implement important new networking technologies. Prior to that position, Mr. Netravali was President of Bell Labs as well as Lucent's Chief Technology Officer and Chief Network Architect from June 1999 to January 2002. Bell Labs serves as the research and development organization for Lucent Technologies. Mr. Netravali is a member of the Compensation Committee of the Board.

John T. Reed, 61, has been a director of the Company since March 2003. Mr. Reed is also a Director of and a member of the Audit Committee of Bridges Investment Fund, Inc., a mutual fund. Mr. Reed was Chairman of HMG Properties, the real estate investment banking joint venture of McCarthy Group, Inc. from 2000 until February 2005. Prior to that, he was Chairman of McCarthy & Co., the investment banking affiliate of McCarthy Group. Mr. Reed is also a director of McCarthy Group. Prior to joining McCarthy Group in 1997, Mr. Reed spent 32 years with Arthur Andersen, LLP. Mr. Reed is the Chairman of the Nominating and Governance Committee of the Board and a member of the Audit Committee of the Board.

4

Michael B. Yanney, 71, has been a director of the Company since March 1998. He has served as Chairman of the Board, President and Chief Executive Officer of America First Companies L.L.C. for more than the last five years. Mr. Yanney is also a director of Burlington Northern Santa Fe Corporation. Mr. Yanney is the Chairman of the Compensation Committee of the Board and a member of the Board's Executive Committee and Nominating and Governance Committee.

Corporate Governance

We adopted Corporate Governance Guidelines that address the governance activities of the Board and include criteria for determining the independence of the members of our Board. These guidelines are in addition to the requirements of the Securities and Exchange Commission and The Nasdaq Stock Market. The Guidelines also include requirements for the standing committees of the Board, responsibilities for Board members and the annual evaluation of the Board's and its committees' effectiveness. The Corporate Governance Guidelines are available on our website atwww.level3.com. At any time that these guidelines are not available on our website, we will provide a copy upon written request made to Investor Relations, Level 3 Communications, Inc., 1025 Eldorado Boulevard, Broomfield, Colorado 80021. Any information that is included in the Level 3 website is not part of this Proxy Statement.

Independence

The Board also evaluates the independence of each Director in accordance with applicable laws and regulations and its Corporate Governance Guidelines. Based on the recommendation of our Nominating and Governance Committee, the Board has determined that the following Directors are "independent" as required by applicable laws and regulations, by the listing standards of The Nasdaq Stock Market and by the Board's Corporate Governance Guidelines: James O. Ellis, Jr., Richard R. Jaros, Robert E. Julian, Arun Netravali, John T. Reed, Michael B. Yanney and Albert C. Yates. The Board has also concluded that the members of each of the Audit, Compensation and Nominating and Governance Committees are "independent" in accordance with these same standards.

Code of Ethics

We adopted a code of ethics that complies with the standards mandated by the Sarbanes-Oxley Act of 2002. The complete code of ethics is available on our website atwww.level3.com. At any time that the code of ethics is not available on our website, we will provide a copy upon written request made to Investor Relations, Level 3 Communications, Inc., 1025 Eldorado Boulevard, Broomfield, Colorado 80021. Any information that is included in the Level 3 website is not part of this Proxy Statement. If we amend the code of ethics, or grant any waiver from a provision of the code of ethics that applies to our executive officers or directors, we will publicly disclose such amendment or waiver as required by applicable law, including by posting such amendment or waiver on our website atwww.level3.com or by filing a Current Report on Form 8-K.

Stockholder Communications with Directors

A stockholder who wishes to communicate directly with the Board, a committee of the Board or with an individual director, should send the communication to:

Level 3 Communications, Inc.

Board of Directors [or committee name or

Director's name, as appropriate]

1025 Eldorado Boulevard

Broomfield, Colorado 80021

5

The Company will forward all stockholder correspondence about Level 3 to the Board, committee or individual Director, as appropriate. Please note that we will not forward communications that are spam, junk mail and mass mailings, service complaints, service inquiries, new service suggestions, resumes and other forms of job inquiries, surveys, and business solicitations or advertisements.

Executive Committee

The Executive Committee exercises, to the maximum extent permitted by law, all powers of the Board between Board meetings, except those functions assigned to specific committees. The members of the Executive Committee are Walter Scott, Jr. (Chairman), James Q. Crowe and Michael B. Yanney. The Executive Committee did not meet during 2004.

Audit Committee

The Audit Committee of the Board is responsible for appointing, setting compensation, and overseeing the work of our independent public accountants. The Audit Committee reviews the services provided by our independent registered public accounting firm, consults with the independent registered public accounting firm and reviews the need for internal auditing procedures and the adequacy of internal controls. The members of the Audit Committee are Robert E. Julian (Chairman), Richard R. Jaros and John T. Reed. We believe that the members of the Audit Committee are independent within the meaning of the listing standards of The Nasdaq Stock Market. The Board has determined that Mr. Robert E. Julian, Chairman of the Audit Committee, qualifies as a "financial expert" as defined by the Securities and Exchange Commission. In making the determination, the Board considered Mr. Julian's credentials and financial background and found that he was qualified to serve as the "financial expert." The Audit Committee met six times during 2004 and took action by unanimous written consent one time. In addition, the Audit Committee met nine times to review the status of the Company's efforts relating to compliance with Section 404 of The Sarbanes Oxley Act of 2002.

The Audit Committee has chosen KPMG, LLP as our registered public accounting firm for 2005. As part of its responsibilities, the Audit Committee is required to pre-approve the audit and non-audit services performed by the independent public accountants in order to assure the public accountant's independence. The Audit Committee has adopted a pre-approval process with respect to the provision of audit and non-audit services to be performed by KPMG LLP. This pre-approval process requires the Audit Committee to review and approve all audit services and permitted non-audit services to be performed by KPMG LLP. Pre-approval fee levels for all services to be provided by KPMG LLP are established annually by the Audit Committee. Audit services are subject to specific pre-approval while audit-related services, tax services and all other services may be granted pre-approvals within specified categories. Any proposed services exceeding these levels require specific pre-approval by the Audit Committee. Additionally, the Audit Committee may delegate either type of pre-approval authority to one or more of its members. A report, for informational purposes only, of any pre-approval decisions made by a single member of the Audit Committee is made to the full Audit Committee on at least a quarterly basis. One hundred percent of the services that required pre-approval by the Audit Committee received that approval.

One or more representatives of KPMG LLP will be present at the Annual Meeting. Although they will not make a statement at the meeting, they will be available to answer appropriate questions.

The Audit Committee operates pursuant to a written charter. A copy of the Audit Committee's charter is available on our website atwww.level3.com.

6

Compensation Committee

The Compensation Committee is responsible for overseeing our compensation strategy and policies to provide that we are able to attract key employees, that employees are rewarded appropriately for their contributions, that employees are motivated to achieve our objectives, that key employees are retained, and that such strategy and policies support our objectives, including the interests of our stockholders. The Compensation Committee also approves the salaries, bonuses and other compensation for all officers at the level of group vice president and above and reviews and recommends to the full Board, the compensation and benefits for non-employee Directors. The members of the Compensation Committee are Michael B. Yanney (Chairman), Mogens C. Bay, Richard R. Jaros and Arun Netravali. Level 3 believes that the members of the Compensation Committee are independent within the meaning of the listing standards of The Nasdaq Stock Market. The Compensation Committee met four times in 2004 and took action by unanimous written consent one time.

The Compensation Committee operates pursuant to a written charter. A copy of the Compensation Committee's charter is available on our website atwww.level3.com.

None of the members of the Compensation Committee is an officer or employee of the Company.

Nominating and Governance Committee

The Nominating and Governance Committee provides oversight and guidance to the Board to ensure that the membership, structure, policies, and practices of the Board and its committees facilitate the effective exercise of the Board's role in the governance of the Company. The Committee reviews and evaluates the policies and practices with respect to the size, composition, independence and functioning of the Board and its committees and reflects those policies and practices in Corporate Governance Guidelines, and evaluates the qualifications of, and recommends to the full Board, candidates for election as Directors. The Nominating and Governance Committee has adopted a written charter. The members of the Nominating and Governance Committee are John T. Reed (Chairman), Mogens C. Bay and Michael B. Yanney. Level 3 believes that the members of the Nominating and Governance Committee are independent within the meaning of the listing standards of The Nasdaq Stock Market. The Nominating and Governance Committee met two times in 2004.

The Nominating and Governance Committee operates pursuant to a written charter. A copy of the Nominating and Governance Committee's charter is available on our website atwww.level3.com.

Nomination Procedures

In exploring potential candidates for director, the Nominating and Governance Committee considers individuals recommended by members of the committee, other directors, members of management and stockholders or self-nominated individuals. The committee is advised of all nominations that are submitted to us and determines whether it will further consider the candidates using the criteria described below.

In order to be considered, each proposed candidate must:

- •

- be ethical;

- •

- have proven judgment and competence;

- •

- have professional skills and experience in dealing with a large, complex organization or in dealing with complex issues that are complementary to the background and experience represented on the Board and that meet the needs of Level 3;

7

- •

- have demonstrated the ability to act independently and be willing to represent the interests of all stockholders and not just those of a particular philosophy or constituency; and

- •

- be willing and able to devote sufficient time to fulfill his/her responsibilities to Level 3 and its stockholders.

After the Nominating and Governance Committee has completed its evaluation, it presents its recommendation to the full Board for its consideration and approval. In presenting its recommendation, the committee also reports on other candidates who were considered but not selected.

We will report any material change to this procedure in a quarterly or annual filing with the Securities and Exchange Commission and any new procedure will be available on our website atwww.level3.com.

Our By-laws require that a stockholder who wishes to nominate an individual for election as a Director at our Annual Meeting must give us advance written notice not less than 60 days prior to the anniversary date of the prior year's Annual Meeting and not more than 90 days prior to the anniversary date of the prior year's Annual Meeting, in connection with next year's Annual Meeting and provide specified information. Stockholders may request a copy of the requirements from the Secretary, Level 3 Communications,��Inc., 1025 Eldorado Boulevard, Broomfield, Colorado 80021.

Board of Directors' Meetings

The Board had nine meetings in 2004 and acted by unanimous written consent action on one occasion. In 2004, no director attended less than 75% of the meetings of the Board, and no director attended less than 75% of the meetings of the committees of which he was a member. Although we do not have a formal policy, it is expected that our Board members will attend our annual meetings.

Section 16(a) Beneficial Ownership Reporting Compliance

Except as set forth below, to our knowledge, no person that was a director, executive officer or beneficial owner of more than 10% of the outstanding shares of our common stock failed to timely file all reports required under Section 16(a) of the Securities Exchange Act of 1934.

In connection with the distribution of shares of our common stock pursuant to our 1998 Deferred Stock Purchase Plan in 2004, on one occasion a Form 4 reporting such distributions was not timely filed for Messrs. Charles C. Miller, Kevin J. O'Hara, Thomas C. Stortz, Sureel A. Choksi and Eric J. Mortensen. In connection with a quarterly grant of restricted stock to non-employee directors as part of their annual compensation, on one occasion, a Form 4 reporting that grant was not timely filed for Messrs. Mogens C. Bay, Richard R. Jaros, Robert E. Julian, David C. McCourt, Arun Netravali, John T. Reed and Michael B. Yanney. In addition, a Form 4 reporting the indirect acquisition of shares of Level 3 common stock was not timely filed for Mr. Michael B. Yanney.

Directors' Compensation

During 2004, each of our directors who were not employed by us during 2004 earned fees consisting of a $30,000 annual cash retainer. Messrs. Yanney, Julian and Reed each earned an additional $20,000 annual cash retainer for serving as chairman of the Compensation Committee, Audit Committee, and Nominating and Governance Committee, respectively. Any member of the Board who was not employed by us during 2004 earned a $10,000 annual cash retainer for each non-chair membership on a standing committee of the Board. In addition to the annual cash compensation, each non-employee member of the Board received quarterly grants of restricted stock having a value of $37,500 at the time of grant, which amounted to an annual aggregate grant value of $150,000 for each such director. A total of 364,800 shares of restricted stock were granted to these directors for 2004

8

compensation. These shares of restricted stock will vest 100% on the later of April 1, 2005 and the first trading day on which transactions in our securities are permitted by our insider trading policy. In addition, Mr. Netravali received $20,000 as compensation for the performance of certain special committee duties at the request of the Board.

Executive Compensation

The Compensation Committee (the "Committee") is responsible for determining the cash and equity compensation of the Company's executive officers, including James Q. Crowe, Chief Executive Officer. The Committee reviews and approves the cash compensation of certain of Level 3's other senior executives based upon the recommendations of Mr. Crowe.

In order to attract and retain highly qualified employees, the Committee believes that it is important to provide a work environment that encourages each individual to perform to his or her potential and facilitates cooperation towards shared goals and a compensation program designed to attract the kinds of individuals the Company needs and to align employees' interests with the Company's stockholders.

As part of its efforts to satisfy the need to attract, retain and motivate the individuals who possess the skills necessary to grow Level 3's business, management and the Committee believe that the Company's compensation philosophy needs to reflect the Company's core beliefs about rewarding its employees. These core beliefs include:

- •

- employee ownership as a demonstration of an economic stake in the Level 3 business that aligns employees' interests with those of our stockholders;

- •

- employees sharing appropriately with investors in the value that their results help to create;

- •

- compensation principles that are broad based and intended to be appropriate across business groups—communications and information services—and within each business group, provide all employees with the opportunity to participate in compensation programs based on the value that they help to create; and

- •

- the creation and maintenance of a work environment that encourages each individual to perform to his or her potential and facilitates cooperation towards shared goals.

With respect to compensation programs that reflect these core beliefs, the Committee believes that short-term financial rewards alone are not sufficient to attract and retain qualified employees. A properly designed long-term compensation program is a necessary component of employee recruitment and retention. In this regard the Company's philosophy is to pay annual cash salary compensation for executives that is moderately less than the annual cash salary compensation paid by competitors and a performance based cash bonus, which, if the Company's goals are met, when added to the annual salary results in a total annual cash compensation that is moderately greater than the total annual cash compensation paid on average by competitors. In addition, employees may, from time to time, receive additional cash bonus compensation relating to the individual employee's contribution to the Company achieving special initiatives or programs.

The Compensation Committee also believes that a critical component of Level 3's compensation philosophy is having the ability to provide appropriate incentives to employees through a long term incentive program that is tied to stock price performance. The Company currently has two complementary, equity based, long term incentive or LTI programs. The first is an innovative stock-indexed program referred to as the Outperform Stock Option or OSO program, which is administered

9

under the Company's 1995 Stock Plan, as amended. The second is a 401(k) Plan matching contribution in the form of shares of Level 3 common stock. The 1995 Stock Plan, as amended, affords the Committee flexibility to use a variety of means to provide the appropriate incentives as part of a long term compensation program. From time to time, the Committee evaluates the structure of the Company's LTI programs and may make modifications to these programs to reflect the changing needs for the Company to continue to attract, retain and motivate its employees. These changes may be based, in part, on market conditions and the LTI programs of competitors.

The Company continues to believe that the qualified candidates it seeks, as well as the current employees it wants to retain and motivate, place particular emphasis on equity based, LTI programs. In determining the type of equity based LTI compensation to deliver, Level 3 has historically designed its compensation programs based on the performance of the Level 3 common stock between the date that an award is made and the date that the award is exercised by the employee.

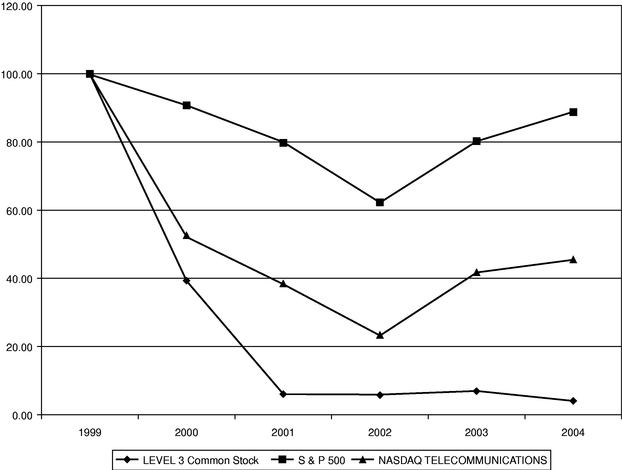

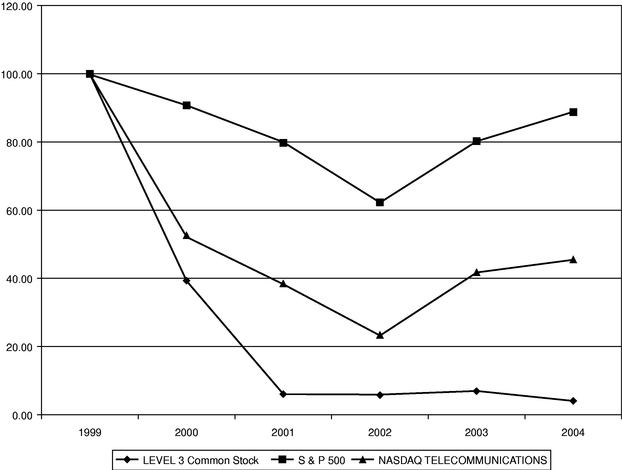

With respect to the determination of the compensation of executive officers, the Committee considers the following factors (ranked in order of importance): (i) Level 3's performance measured by attainment of specific objectives; (ii) the individual performance of each executive officer; (iii) comparative industry compensation levels; and (iv) historical cash and compensation levels. The comparable industry compensation data is based in part on public telecommunications companies that are included in the Nasdaq Telecommunications Stock Index, which was chosen as the peer group for the Performance Graph, and on other publicly traded telecommunications and high growth technology companies with comparable market capitalization.

In the latter part of 2003, the Committee determined that it would consider the payment of a 2004 cash bonus to Mr. Crowe based upon additional evidence of the attainment of objectives that were first identified in the latter part of 2002 and were described in detail in the Committee's report for the year ended December 31, 2003. These 2003 objectives included:

- •

- achieve free cash flow breakeven by year-end 2003, while balancing a focus on Long-Term Value Creation (as measured by net present value of future cash flows and other appropriate measures) for the communications business;

- •

- grow revenue, at industry-leading margins, by: using existing assets to create new services; concentrate on customers in particular industries (for example, financial services); and alternative means for the company to distribute its services without the use of a specific sales force (that is, alternative distribution channels such as value added resellers); and

- •

- successfully integrate the assets acquired in the Genuity transaction and develop a core competency at integrating future acquisitions.

At the end of the first quarter 2004, the Committee determined to award Mr. Crowe a cash bonus of $2,000,000 to reflect the Company's continuing achievement of these 2003 objectives, with an emphasis on the first quarter 2004's cash flow results. Mr. Crowe did not receive any additional equity based compensation for continuing to achieve these 2003 objectives during the first part of 2004.

In the early part of 2004, based on management's recommendation, the Committee established the following objectives for the 2004 senior management cash bonus program:

- •

- substantially improve the communications business' methods and processes for new service development;

- •

- introduce new services in the communications business that meet the Company's strategic and financial criteria;

10

- •

- produce significant revenue from new services, that is, services other than managed modem, transport and colocation services;

- •

- achieve budgeted financial targets.

In addition to performance against these criteria, the Committee considered a number of additional factors in exercising its discretion to determine 2004 cash bonus awards, in addition to the general compensation philosophy outlined above. These factors included: the prevailing market and economic conditions; other special bonus initiatives or objectives that were established and approved by the Compensation Committee during the course of the fiscal year; and non-budgeted business activities such as mergers, acquisitions, divestitures, private and public capital markets transactions and re-financings.

During 2004, the Company made the following progress in meeting the objectives outlined by the Committee.

With respect to substantially improving the communications business' methods and processes for new service development, Level 3 developed a new service development process. This process was established with stages or "gates" along the path of developing a new service to determine if a concept was ready to progress along the development path. This new service development process is now being used for the introduction of all new services and has helped to identify the need for market segmentation research in the early stages of new service development as a key to successfully launching a new service. Challenges remain with the new service development process, including making the process as efficient as possible.

With respect to the objective of introducing new services in the communications business that meet the Company's strategic and financial criteria, the Company did launch several new services during 2004 and the Company was able to maintain the communications business' industry leading gross margins at a level that was consistent with 2003. The Company saw significant customer demand for its wholesale Voice-over-IP (or VoIP) services, particularly (3)VoIPSM Local Inbound and (3)Voice® Termination services. Level 3 also saw key customer contracting success with the launch of its new (3)VoIPSM Enhanced Local and consumer oriented VoIP service, including winning a significant percentage of large scale contracts that were put to bid during 2004. With these successes, however, challenges were identified as well including disappointing results from other new service offerings. Although the Company successfully created an alternative distribution channel through the use of distribution partners and value added resellers, the amount of revenue generated through this alternative distribution channel from the services that were designed to use this channel was disappointing.

In considering the objective of producing significant revenue from new services, that is, services other than managed modem, transport and colocation services, the Company's results were disappointing. However, the company's results relating to achieving other budgeted financial targets were generally in line with the Committee's expectations, with the exception of "consolidated free cash flow."

Merger and acquisition activities during the year were very successful and contributed positively to the Company's results for 2004. These activities included transactions relating to the managed modem or dial-up businesses of ICG Communications, Allegiance Communications, KMC Telecom and Sprint Communications. The integration efforts for each of these transaction is either completed or ahead of expected completion targets. In addition, these transactions are expected to be cash flow positive either ahead of, or in line with, management's expectations.

Finally, during the fall of 2004, the Company successfully accessed the capital markets with an offering of $345 million aggregate principal amount of 5.25% Convertible Senior Notes due 2011 and accessed the secured term loan market by obtaining a $730 million term loan that matures also in 2011.

11

The Company used the majority of the net proceeds of these transactions to fund a cash tender offer for the purchase of approximately $1.1 billion aggregate principal amount of the Company's senior unsecured notes maturing in 2008. This transaction resulted in a net reduction of long term debt of approximately $32 million and an annual cash interest expense savings of approximately $29 million.

The Compensation Committee is satisfied with Mr. Crowe's leadership of the Company and his performance during 2004 given the challenging circumstances in the communications industry and the successes that are described above. However, giving consideration to the challenges also described above and the cash bonus paid earlier in 2004, the Committee determined not to pay Mr. Crowe any additional cash bonus for his 2004 performance. In addition, Mr. Crowe, as well as Messrs. O'Hara and Miller, had determined in the spring of 2004 that they would not participate in the Company's outperform stock option program during 2004. Although the Compensation Committee determined to award cash bonuses to other members of the Company's senior management based upon the successes described above, Mr. Crowe did not receive any further cash bonus for 2004 performance, and did not receive any grants of outperform stock options.

In making compensation decisions for our executive officers, the Committee takes into consideration the tax deductibility limitations of Section 162(m) of the Internal Revenue Code. Our OSO program is intended to meet the requirements for "qualified performance-based compensation" that is exempt from these deductibility limitations. However, the Committee does not believe it is advisable to adopt a strict policy against paying nondeductible compensation, and may do so in appropriate circumstances.

The Compensation Committee:

Mogens C. Bay

Richard R. Jaros | | Arun Netravali

Michael B. Yanney, Chairman |

For the year ended December 31, 2004

Stock Ownership Guidelines

The Compensation Committee has adopted guidelines for Level 3 common stock ownership by directors, the Vice Chairman, the Chief Executive Officer, the Chief Operating Officer, the President, the Chief Financial Officer, Executive Vice Presidents and the Controller. These guidelines are based on a dollar value of our common stock. The following table summarizes these guidelines.

| CEO | | $ | 10,000,000 |

| COO/President/Vice Chairman | | $ | 2,500,000 |

| Executive Vice Presidents/CFO | | $ | 1,000,000 |

| Controller | | $ | 500,000 |

| Directors | | $ | 250,000 |

The Compensation Committee will review these guidelines at least annually, and may update or modify the guidelines based on a variety of factors including the composition of our senior management team and stock market conditions. Stock held by the individual, his or her spouse and minor children, along with shares of our common stock held in the individual's Level 3 401(k) Plan account and in trusts for the benefit of these individuals will be included for purposes of determining the individuals satisfaction of the ownership guidelines.

The Compensation Committee has concluded that grants of restricted stock will not be made to assist individuals in meeting the ownership guidelines. In addition, the Compensation Committee has

12

concluded not to force individuals to make either private or open market purchases of our common stock to meet the ownership guidelines. Rather, the Compensation Committee has concluded that until such time as the individual is in compliance with these guidelines, 25% of the after tax value of any Outperform Stock Option exercise or restricted stock grant that has vested should be held by the individual in the form of shares of our common stock until such time as the guideline has been met. The failure of an individual to make a good faith effort to meet the guidelines in a timely manner and to maintain their compliance with the guidelines will be a significant factor in the Compensation Committee's and senior management's determinations of the individual's future bonus payments and long term incentive compensation awards.

Executive Compensation Summary

The table below shows the annual compensation of our chief executive officer and our next four most highly compensated executive officers for the 2004 fiscal year (the "Named Executive Officers").

Summary Compensation Table

| |

| | Annual Compensation

| | Long Term Compensation

| |

|

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual

Compensation ($)

| | Restricted

Stock

Award(s) ($)(1)

| | Securities

underlying

Options/SARs (#)(2)

| | All Other

Compensation ($)(3)

|

|---|

James Q. Crowe

CEO | | 2004

2003

2002 | | 389,423

374,615

365,000 | | 2,000,000

5,500,000

1,261,862 | | —

—

— | | —

—

— | | —

—

— | | 17,100

18,000

— |

Keith R. Coogan

CEO Software Spectrum |

|

2004

2003

2002 |

|

446,538

421,730

406,461 |

|

1,487,620

220,116

1,858,443 |

|

—

—

— |

|

—

—

— |

|

—

—

— |

|

10,002

1,414

2,350 |

Kevin J. O'Hara

President and COO |

|

2004

2003

2002 |

|

384,231

369,615

360,000 |

|

1,000,000

2,500,000

1,511,700 |

|

—

—

— |

|

500,000

—

— |

|

—

—

— |

|

4,100

6,000

40,124 |

Charles C. Miller, III

Vice Chairman and Executive Vice President |

|

2004

2003

2002 |

|

373,846

357,692

300,000 |

|

750,000

2,000,000

1,134,750 |

|

—

—

— |

|

500,000

—

— |

|

—

—

— |

|

17,100

18,000

46,812 |

Sureel A. Choksi

Executive Vice President |

|

2004

2003

2002 |

|

363,077

339,735

332,789 |

|

500,000

739,400

610,562 |

|

—

—

— |

|

250,000

—

— |

|

—

—

— |

|

17,100

18,000

33,117 |

- (1)

- Shares of restricted stock were awarded after the completion of fiscal year 2004 for performance during fiscal year 2004. These shares of restricted stock will vest in equal annual installments on each of the first three anniversaries of the date of grant. No shares of restricted stock were held at the end of the most recently completed fiscal year. The holder of these shares of restricted stock will have no rights to any dividends that we may declare and pay until the shares of restricted stock have vested in whole or in part.

- (2)

- See discussion below regarding Outperform Stock Option grants.

- (3)

- The amounts in this column represent employer matching contributions to the Named Executive Officers' 401(k) Plan accounts and profit sharing contributions that were also made to the Named Executive Officers' 401(k) Plan accounts for 2004. The contributions made by us were made in the form of units of our common stock as part of the Level 3 401(k) Plan.

13

Our Named Executive Officers did not receive any additional perquisite compensation that requires disclosure. We permit the personal use of our aircraft by certain members of our senior management. This personal use of our aircraft is done pursuant to an Aircraft Time-Share Agreement, which provides that we will charge the individual the cost to operate the aircraft as allowed by Part 91 of the U.S. Federal Aviation Administration regulations for personal use of corporate aircraft. We received a total payment in the amount of $188,474 from Mr. James Q. Crowe, Chief Executive Officer under his agreement for the period January 1, 2004 to December 31, 2004, and a total payment in the amount of $104,996 from Mr. Kevin J. O'Hara, President, and Chief Operating Officer under his agreement for the same period.

No Named Executive Officer received any stock options (see below for a description of the grants of Outperform Stock Options to the Named Executive Officers), stock appreciation rights ("SARs") or long-term incentive performance ("LTIP") payouts for the fiscal year ended December 31, 2004.

Aggregate Options/SAR Exercises and Fiscal Year End Option/SAR Value Table

| |

| |

| | Number of Securities Underlying Unexercised Options/SARs at FY-End (#)

| | Value of Unexercised

In-the-Money Options/SARs

at FY-End ($)(1)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized ($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| James Q. Crowe | | — | | — | | — | | — | | | — | | — |

| Keith R. Coogan | | — | | — | | — | | — | | | — | | — |

| Kevin J. O'Hara | | — | | — | | 500,000 | | — | | $ | 0 | | — |

| Charles C. Miller, III | | — | | — | | — | | — | | | — | | — |

| Sureel A. Choksi | | — | | — | | 100,000 | | — | | $ | 0 | | — |

- (1)

- On December 31, 2004 (the last trading day of 2004), the last reported sale price for our common stock as reported by The Nasdaq Stock Market was $3.39.

Outperform Stock Option Grants

To date, our Outperform Stock Option program has been the primary component of our long term incentive, stock-based compensation programs. The OSO program was designed so that the Level 3 common stock price must increase relative to the performance of a broad-based, market stock index before OSO holders receive any return on their options. In other words, our common stock price must pass a "hurdle" of a stock index growth prior to the OSO having any value upon exercise. Currently, the broad-based, market stock index used in the OSO program is the S&P® 500 Index, although the Compensation Committee reserves the right to select another broad-based, market stock index for use in this program. In July 2000, we adopted a convertible outperform stock option program, ("C-OSO") as an extension of the existing OSO plan. The program offers similar features to those of an OSO, but provides an employee with the greater of the value of a single share of our common stock at exercise, or the calculated OSO value of a single OSO at the time of exercise.

14

The following table summarizes OSO program grants to the Named Executive Officers during 2004.

OSO Program Grants In Last Fiscal Year

| | Individual Grants

| | Total Number of Awards at FY-End (#)(1)

| | Value of Total Unexercised

In-the Money Awards at FY-End ($)(2)

|

|---|

Name

| | Number of Awards

Granted(3)

| | Expiration

Date

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

James Q. Crowe

OSO Awards | | — | | — | | 2,047,670 | | 104,118 | | 24,955 | | — |

Keith R. Coogan

OSO Awards |

|

7,020

7,020

35,063

31,875 |

|

01/01/08

04/01/08

07/01/08

10/01/08 |

|

15,836 |

|

97,337 |

|

— |

|

77,393 |

Kevin J. O'Hara

OSO Awards |

|

— |

|

— |

|

1,033,220 |

|

52,089 |

|

12,768 |

|

— |

Charles C. Miller, III

OSO Awards |

|

— |

|

— |

|

736,931 |

|

37,221 |

|

9,286 |

|

— |

Sureel A. Choksi(4)

OSO Awards |

|

8,259

8,259

50,000

50,000 |

|

01/01/08

04/01/08

07/01/08

10/01/08 |

|

268,947 |

|

138,337 |

|

5,804 |

|

121,400 |

- (1)

- For OSOs granted prior to August 2002, vesting is in equal quarterly installments over two years. For OSOs granted after August 2002, 50% of the award vests on the first anniversary of the award, and the remaining 50% vests in equal quarterly installments so that the award is fully vested at the end of the second year after the date of the award. No OSO award, including a vested OSO award, granted prior to March 1, 2001 can be exercised until the second anniversary of the date of its grant. OSOs awarded after the March 1, 2001 awards can be exercised upon vesting. OSOs awarded after August 1, 2002 can be exercised upon vesting, subject to a portion of such awards that can not be exercised until the second anniversary of the date of its grant. The OSO awards provide for acceleration of vesting and the lifting of the two year prohibition on exercise (with respect to OSO awards granted prior to March 1, 2001 and OSO awards granted after August 1, 2002) in the event of a change of control, as defined in our 1995 Stock Plan, as amended.

- (2)

- OSO value at December 31, 2004 has been computed based upon the OSO formula and multiplier as of that date and the closing sale price of our common stock on that date. The value of an OSO is subject to change based upon the performance of our common stock relative to the performance of the S&P® 500 Index from the time of the grant of the OSO award until the award has been exercised. Since the value of an OSO depends on the degree to which our common stock outperforms the S&P® 500 Index, neither the grant date present value nor the potential realizable value at assumed rates of stock price appreciation can be reliably calculated.

- (3)

- OSOs have an initial exercise price that is equal to the closing market price of our common stock on the trading day immediately prior to the date of grant. This exercise price is referred to as the Initial Price. When an employee elects to exercise an OSO, the Initial Price is adjusted upward or downward—as of the date of that exercise—by a percentage that is equal to the aggregate percentage increase or decrease in the S&P 500® Index over the period beginning on the date of grant and ending on the trading day immediately preceding the date of exercise of the OSOs.

15

- (4)

- Mr. Choksi also holds 200,000 C-OSOs as of December 31, 2004, which are fully vested and had a value of $678,000 as of that date. These C-OSOs expire on September 1, 2005.

Certain Relationships and Related Transactions

We permit the personal use of our aircraft by certain members of our senior management. This personal use of our aircraft is done pursuant to an Aircraft Time-Share Agreement, which provides that we will charge the individual the cost to operate the aircraft as allowed by Part 91 of the U.S. Federal Aviation Administration regulations for personal use of corporate aircraft. We received a total payment in the amount of $188,474 from Mr. James Q. Crowe, Chief Executive Officer under his agreement for the period January 1, 2004 to December 31, 2004, and a total payment in the amount of $104,996 from Mr. Kevin J. O'Hara, President, and Chief Operating Officer under his agreement for the same period.

Messrs. Scott and Bay are members of the Board of Directors of Peter Kiewit Sons', Inc. ("PKS") as well as members of the Board of the Company.

Level 3 and PKS are parties to various aircraft operating agreements pursuant to which PKS provides Level 3 with aircraft maintenance, operations and related services. During 2004, Level 3 incurred costs to PKS of approximately $104,000 pursuant to these agreements.

In connection with the Split-off, Level 3 and PKS entered into various agreements intended to implement the Split-off, including a tax-sharing agreement.

Tax Sharing Agreement. Level 3 and PKS have entered into a tax sharing agreement (the "Tax Sharing Agreement") that defines each company's rights and obligations with respect to deficiencies and refunds of federal, state and other taxes relating to operations for tax years (or portions thereof) ending prior to the Split-off and with respect to certain tax attributes of Level 3 and PKS after the Split-off. Under the Tax Sharing Agreement, with respect to periods (or portions thereof) ending on or before the Split-off, Level 3 and PKS generally will be responsible for paying the taxes relating to such returns (including any subsequent adjustments resulting from the re-determination of such tax liabilities by the applicable taxing authorities) that are allocable to the non-construction business and the construction business, respectively.

The Tax Sharing Agreement also provides that Level 3 and PKS will indemnify the other from certain taxes and expenses that would be assessed on PKS and Level 3, respectively, if the Split-off were determined to be taxable, but solely to the extent that such determination arose out of the breach by Level 3 or PKS, respectively, of certain representations made to the Internal Revenue Service in connection with the private letter ruling issued with respect to the Split-off. Under the Tax Sharing Agreement, if the Split-off were determined to be taxable for any other reason, those taxes and certain other taxes associated with the Split-off (together, "Split-off Taxes") would be allocated 82.5% to Level 3 and 17.5% to PKS. The Tax Sharing Agreement, however, provides that Split-off Taxes will be allocated one-half to each of Level 3 and PKS if a Forced Conversion Determination is made. As a result of the Forced Conversion Determination, the Split-off Taxes would be so allocated. Finally, the Tax Sharing Agreement provides, under certain circumstances, for certain liquidated damage payments from Level 3 to PKS if the Split-off were determined to be taxable, which are intended to compensate stockholders of PKS indirectly for taxes assessed upon them in that event. Those liquidated damage payments, however, are reduced because of the Forced Conversion Determination.

Mine Management Agreement. In 1992, PKS and Level 3 entered into a mine management agreement (the "Mine Management Agreement") pursuant to which Kiewit Mining Group Inc. ("KMG"), a subsidiary of PKS, provides mine management and related services for Level 3's coal mining properties. In consideration of the provision of such services, KMG receives a fee equal to 30% of the adjusted operating income of the coal mining properties. Level 3 incurred expenses for services

16

provided by KMG under the Mine Management Agreement of approximately $6 million for the year ended December 31, 2004. The term of the Mine Management Agreement expires on January 1, 2016.

In connection with the Split-off, the Mine Management Agreement was amended to provide KMG with a right of offer in the event that Level 3 were to determine to sell any or all of its coal mining properties. Under the right of offer, Level 3 would be required to offer to sell those properties to KMG at the price that Level 3 would seek to sell the properties to a third party. If KMG were to decline to purchase the properties at that price, Level 3 would be free to sell them to a third party for an amount greater than or equal to that price. If Level 3 were to sell the properties to a third party, thus terminating the Mine Management Agreement, it would be required to pay KMG an amount equal to the discounted present value to KMG of the Mine Management Agreement, determined, if necessary, by an appraisal process.

REVERSE STOCK SPLIT PROPOSAL

We are asking stockholders to approve a proposal to grant the Board discretionary authority to effect a reverse stock split pursuant to one of four alternative ratios. A reverse stock split would reduce the number of outstanding shares of our common stock, and the holdings of each stockholder, according to the same formula. The proposal calls for four possible reverse stock split ratios: 1-for-5, 1-for-10, 1-for-15 and 1-for-20. If the proposal is approved, the Board may in its discretion amend the amended and restated the certificate of incorporation to effect a reverse stock split using one of the ratios included in the proposal at any time prior to May 17, 2006. The Board will also have the sole discretion not to effect any reverse stock split.

We are asking stockholders to approve this proposal in an effort to raise our stock price to a level that may result in a broader investor base finding our common stock a more attractive investment.

The Board has unanimously adopted a resolution seeking stockholder approval of, and recommends that you vote FOR, the proposal.

If the proposal is approved, the Board will have the discretion to effect one reverse stock split at any time prior to May 17, 2006, using one of the approved ratios, or to choose not to effect a reverse stock split at all, based on its determination of which action is in the best interests of Level 3 and its stockholders. The Board reserves its right to elect not to proceed, and abandon, the reverse stock split if it determines, in its sole discretion, that this proposal is no longer in the best interests of our stockholders.

We currently have 1.5 billion authorized shares of common stock. As of March 30, 2005, the record date for the Annual Meeting, shares of common stock were outstanding. "Authorized" shares represent the number of shares of common stock that we are permitted to issue under our certificate of incorporation. Since we do not have any shares of our common stock that we have repurchased, which are referred to as "treasury shares," the number of shares of common stock "outstanding" represents the number of shares of common stock that we have actually issued from the pool of authorized shares of common stock. The reverse stock split, if implemented, would have the principal effect of reducing both the outstanding number of shares of common stock and the authorized number of shares of common stock by the ratio selected by the Board, and, except for the effect of fractional shares, each stockholder's proportionate ownership interest in the Company would be the same immediately before and after the reverse stock split.

Purposes of the Reverse Stock Split

The purpose of the reverse stock split is to attempt to increase the per share trading value of our common stock. Our Board intends to effect the proposed reverse stock split only if it believes that a decrease in the number of shares outstanding is likely to improve the trading price for our common stock, and only if the implementation of a reverse stock split is determined by the Board to be in the

17

best interest of Level 3 and its stockholders. If the trading price of our common stock increases without a reverse stock split, the Board may exercise its discretion not to implement a reverse split.

We believe that a number of institutional investors and investment funds are reluctant to invest, and in some cases may be prohibited from investing, in lower-priced stocks and that brokerage firms are reluctant to recommend lower-priced stocks to their clients. By effecting a reverse stock split, we may be able to raise our common stock price to a level where our common stock would be viewed more favorably by potential investors.

Other investors may also be dissuaded from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. A higher stock price after a reverse stock split should reduce this concern.

The combination of lower transaction costs and increased interest from institutional investors and investment funds could have the effect of improving the trading liquidity of our common stock.

Our common stock currently trades on the Nasdaq National Market under the symbol "LVLT." The Nasdaq National Market has several continued listing criteria that companies must satisfy in order to remain listed on the exchange. One of these criteria is that the Level 3 common stock have a trading price that is greater than or equal to $1.00 per share. Today, Level 3 meets all of the Nasdaq National Market's continued listing criteria, including the minimum trading price requirement. Although we do not believe that we currently have an issue relating to the continued listing of our common stock on the Nasdaq National Market, we believe that approval of this proposal would provide the Board with the ability to meet the continued listing standard in the future, to the extent that our common stock price would not otherwise meet the minimum trading requirement.

The Board believes that stockholder approval of four potential exchange ratios (rather than a single exchange ratio) provides the Board with the flexibility to achieve the desired results of the reverse stock split. If the stockholders approve this proposal, the Board would effect a reverse stock split only upon the Board's determination that a reverse stock split would be in the best interests of the stockholders at that time. To effect a reverse stock split, the Board would set the timing for such a split and select the specific ratio from among the four ratios described in this Proxy Statement. No further action on the part of stockholders will be required to either implement or abandon the reverse stock split. If the proposal is approved by stockholders, and the Board determines to implement any of the reverse stock split ratios, we would communicate to the public, prior to the effective date of the reverse split, additional details regarding the reverse split, including the specific ratio the Board selects.

You should keep in mind that the implementation of a reverse stock split does not have an effect on the actual or intrinsic value of the Level 3 business or a stockholder's proportional ownership in the Company. You should also consider that in many cases, the market price of a company's shares declines after a reverse stock split.

The reverse stock split proposal is not conditioned on the stockholders approving the amendment and restatement of the certificate of incorporation proposal described below.

Certain Risks Associated with the Reverse Stock Split

There can be no assurance that the total market capitalization of our common stock (the aggregate value of all Level 3 common stock at the then market price) after the proposed reverse stock split will be equal to or greater than the total market capitalization before the proposed reverse stock split or that the per share market price of our common stock following the reverse stock split will increase in proportion to the reduction in the number of shares of our common stock outstanding before the reverse stock split.

There can be no assurance that the market price per new share of our common stock after the reverse stock split will remain unchanged or increase in proportion to the reduction in the number of old shares of our common stock outstanding before the reverse stock split. For example, based on the

18

closing price of our common stock on March 16, 2005 of $2.34 per share, if the Board were to implement the reverse stock split and utilize a ratio of 1-for-10, we cannot assure you that the post-split market price of our common stock would be $23.40 (that is, $2.34 × 10) per share or greater. In many cases, the market price of a company's shares declines after a reverse stock split.

Accordingly, the total market capitalization of our common stock after the proposed reverse stock split may be lower than the total market capitalization before the proposed reverse stock split. Moreover, in the future, the market price of our common stock following the reverse stock split may not exceed or remain higher than the market price prior to the proposed reverse stock split.

If the reverse stock split is effected, the resulting per-share stock price may not attract institutional investors or investment funds and may not satisfy the investing guidelines of such investors and, consequently, the trading liquidity of our common stock may not improve.

While the Board believes that a higher stock price may help generate investor interest, there can be no assurance that the reverse stock split will result in a per-share price that will attract institutional investors or investment funds or that such share price will satisfy the investing guidelines of institutional investors or investment funds. As a result, the trading liquidity of our common stock may not necessarily improve.

A decline in the market price of our common stock after the reverse stock split may result in a greater percentage decline than would occur in the absence of a reverse stock split, and the liquidity of our common stock could be adversely affected following such a reverse stock split.