| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-04524) |

| | |

| Exact name of registrant as specified in charter: | Putnam Global Income Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | October 31, 2021 |

| | |

| Date of reporting period: | November 1, 2020 — April 30, 2021 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Global Income

Trust

Semiannual report

4 | 30 | 21

Message from the Trustees

June 7, 2021

Dear Fellow Shareholder:

With summer at hand, it’s worth asking whether the economy has returned to normal. More than half of the 50 states have lifted pandemic-related restrictions. First-quarter growth in U.S. gross domestic product was 6%, reflecting a return nearly to pre-pandemic levels of economic output. The global economy is a different story. Beyond our shores, many nations lag the United States in vaccination rates and business activity.

While there are reasons to feel some relief, it’s important to recognize what may be a new normal. The pandemic is not in the past, and many of the changes precipitated by it could last. During this time, dynamic, well-managed companies have adapted to seize new, more sustainable growth opportunities.

Putnam’s active philosophy is well suited to this time. Putnam’s investment teams are analyzing companies, industries, consumers, and even governments. They try to understand the fundamentals of what has stayed the same and what has changed to uncover valuable investment insights or potential risks.

Thank you for investing with Putnam.

Investing in today’s bond markets requires a broad-based approach, the flexibility to exploit a range of sectors and opportunities, and a keen understanding of the complex global interrelationships that drive the markets. With support from more than 90 fixed-income professionals, the fund’s managers actively position the portfolio in securities from a broad range of sectors.

The fund’s management team has an average of more than 25 years of experience.

Putnam Global Income Trust invests in a number of sectors, from international sovereign debt and investment-grade corporate bonds to a wide range of mortgage-backed securities.

Investing for income from global sources

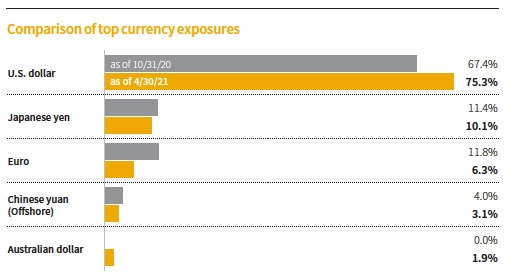

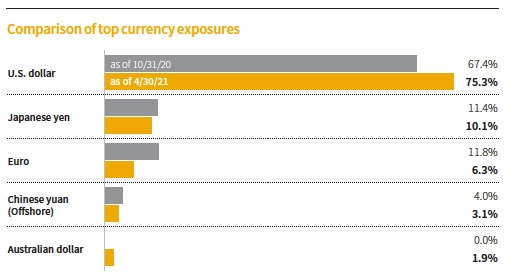

The fund provides exposure to a variety of currencies to seek to benefit from changes in exchange rates.

Illustration shows the fund’s five largest currency exposures as of 4/30/21.

Allocations in each currency may vary over time.

Fund allocations are shown as a percentage of the fund’s net assets as of 4/30/21. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the use of different classifications of securities for presentation purposes, and rounding. Allocations may not total 100% because the table includes the notional value of certain derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time. For more information on current fund holdings, see pages 19–76.

All Bloomberg Barclays indices provided by Bloomberg Index Services Limited.

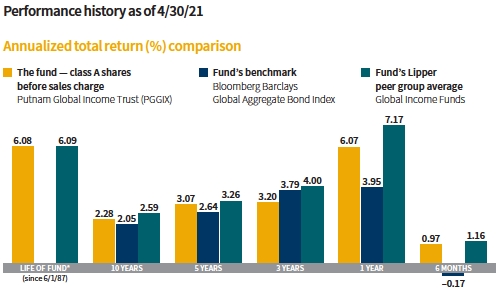

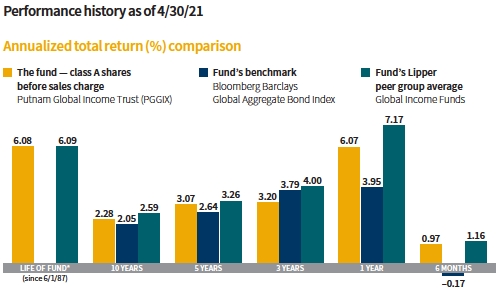

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will fluctuate, and you may have a gain or a loss when you sell your shares. Performance of class A shares assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart do not reflect a sales charge of 4.00%; had they, returns would have been lower. See below and pages 10–12 for additional performance information. For a portion of the periods, the fund had expense limitations, without which returns would have been lower. To obtain the most recent month-end performance, visit putnam.com.

Returns for periods less than one year are cumulative.

All Bloomberg Barclays indices provided by Bloomberg Index Services Limited.

Lipper peer group average provided by Lipper, a Refinitiv company.

* The fund’s benchmark, the Bloomberg Barclays Global Aggregate Bond Index, was introduced on 12/31/89, which post-dates the inception of the fund’s class A shares.

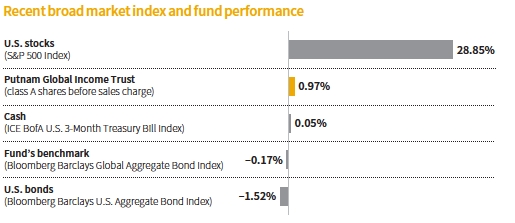

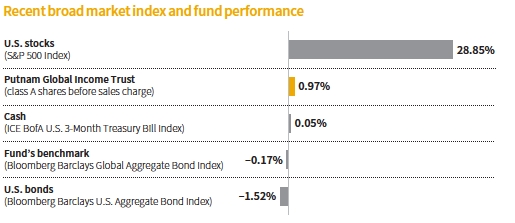

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 4/30/21. See above and pages 10–12 for additional fund performance information. Index descriptions can be found on page 16.

All Bloomberg Barclays indices provided by Bloomberg Index Services Limited.

Please describe the investing environment during the period.

Financial markets proved to be surprisingly resilient during the six-month reporting period ended April 30, 2021. Encouraging vaccine news bolstered investor optimism about the strength of the economic recovery in 2021. President Biden’s $1.9 trillion American Rescue Plan in early March and the gradual easing of mobility restrictions provided a further boost to market sentiment. Rising prices for stocks and commodities also helped lift the overall market environment. However, concerns about the potential inflationary impact of additional stimulus on top of a recovering economy led to an exodus from government bonds. This moved longer-term interest rates higher and pressured the credit market.

The yield on the benchmark 10-year U.S. Treasury note rose to 1.65% on April 30, 2021, from 0.88% at the beginning of the reporting period. Similarly, the 30-year U.S. Treasury note yield rose to 2.30% from 1.65%. Outside the United States, interest rates moved higher as well. Within this environment, ascending bond yields weighed on investment-grade [IG] debt despite marginal spread tightening. [Spreads

Allocations are shown as a percentage of the fund’s net assets as of 4/30/21. Cash and net other assets, if any, represent the market value weights of cash, derivatives, short-term securities, and other unclassified assets in the portfolio. Summary information may differ from the portfolio schedule included in the financial statements due to the inclusion of derivative securities, any interest accruals, the use of different classifications of securities for presentation purposes, and rounding. Allocations may not total 100% because the table includes the notional value of certain derivatives (the economic value for purposes of calculating periodic payment obligations), in addition to the market value of securities. Holdings and allocations may vary over time.

are the yield advantage credit-sensitive bonds offer over comparable-maturity U.S. Treasuries. Bond prices rise as yield spreads tighten and decline as spreads widen.] High-yield credit, meanwhile, posted a modest gain, aided by better-than-expected corporate earnings and higher oil prices.

How did the fund perform for the six months ended April 30, 2021?

The fund returned 0.97%, outperforming the benchmark Bloomberg Barclays Global Aggregate Bond Index. Bloomberg Barclays Global Aggregate Bond Index declined 0.17% during the period.

Which holdings and strategies aided the fund’s relative outperformance?

Within our mortgage-credit holdings, commercial mortgage-backed securities [CMBS] provided the greatest boost to relative performance during the period. Our positions in cash [as opposed to synthetic] CMBS increased in value as spreads tightened. An overweight allocation to investment-grade corporate bonds also contributed. IG corporate spreads tightened marginally, resulting in a slight increase in bond prices.

What about detractors?

The fund’s interest-rate and yield-curve positioning was the only material relative detractor during the period. We maintain structural duration positions in the portfolio. We believe duration has been a very good risk diversifier and normally benefits during risk-off periods

when interest rates decline. During the first few months of this year, however, these positions suffered amid rising interest rates.

How did the fund use derivatives?

The fund used futures to hedge treasury term-structure risk and for yield-curve positioning. Forwards were used to hedge currency exposures and gain exposure to currencies. Interest-rate swaps were used to hedge term-structure risk, for yield-curve positioning, and to gain exposure to rates in various countries. Options [swaptions] were used to help hedge duration and convexity, isolate prepayment risk, and manage downside risks. Credit default swaps were used to hedge credit and market risks, gain liquid exposure to individual names, and gain exposure to specific sectors. Total return swaps were used to hedge sector exposure and inflation, as well as to gain exposure to specific sectors and inflation.

What are your current views on the various sectors in which the fund invests?

For corporate credit, we have a positive view of fundamentals and the market’s supply-and-demand backdrop. However, we are more neutral toward valuation. From a supply-and-demand standpoint, new issuance of investment-grade corporate bonds in calendar 2020 reached a record level of $1.7 trillion. We think new issuance is likely to decline this year, and lower supply could lift existing bond prices higher. Overall, we believe reduced bond issuance should be positive for the market’s technical backdrop. Investment-grade corporate spreads have tightened, and valuations in this sector appear to be less

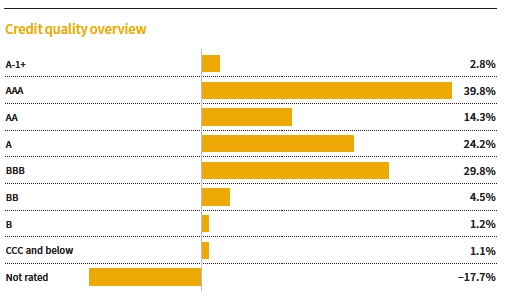

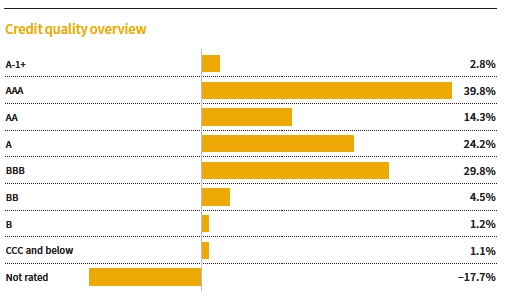

Credit qualities are shown as a percentage of the fund’s net assets as of 4/30/21. A bond rated BBB or higher (A-3 or higher, for short-term debt) is considered investment grade. This chart reflects the highest security rating provided by one or more of Standard & Poor’s, Moody’s, and Fitch. To-be-announced (TBA) mortgage commitments, if any, are included based on their issuer ratings. Ratings may vary over time.

Cash, derivative instruments, and net other assets are shown in the not-rated category. Payables and receivables for TBA mortgage commitments are included in the not-rated category and may result in negative weights. The fund itself has not been rated by an independent rating agency.

attractive. Therefore, security selection and sector rotation will be important as we navigate this market. We believe investment-grade corporate debt is more attractive to non-U.S. investors as rates rise in the United States.

Within the CMBS market, while there continues to be a degree of negative sentiment toward certain property types, the availability of Covid-19 vaccines has sparked optimism that social-distancing measures could be meaningfully eased by the middle of 2021. As a result, we continue to have conviction in the fund’s CMBX exposure. [CMBX Index is an unmanaged index that tracks the performance of a basket of CMBS issued in a particular year.] We believe current valuations fairly compensate investors for existing risk levels and provide an attractive risk premium.

Within residential mortgage credit, against the backdrop of robust home sales and a rebound in mortgage originations, we continue to find value across numerous market segments. In prepayment-sensitive areas of the market, we continue to find value in agency interest-only [IO] collateralized mortgage obligations as well as inverse IOs backed by jumbo loans and more seasoned collateral. Overall, we view prepayment-related opportunities as attractive sources of diversification for the fund.

As for non-U.S. sovereign debt in developed and emerging markets, we think the economic recovery will be strongest in countries with large service sectors and effective vaccine distribution. We also prefer countries that can contain government expenditures despite political pressures to raise them.

What is your near-term outlook for the economy?

As the economy reopens amid widespread distribution of Covid-19 vaccines, we believe gross domestic product growth will be robust, particularly in the second and third quarters of 2021. We’re also anticipating a strong recovery in corporate earnings growth. Since growth expectations are already built into asset market pricing, we are cautiously watching the coming months for economic data surprises. We believe U.S. Treasury yields could rise further this year as growth trends higher. That said, we think the trend toward higher rates will be more gradual, as bond investors adjust their growth and inflation outlooks, leading to periods of market volatility.

This chart shows how the fund’s top currency holdings have changed over the past six months. Allocations are shown as a percentage of the fund’s net assets. Holdings and allocations may vary over time.

In addition to interest rates and Covid-19 vaccine progress, we will also watch inflation metrics. Given base effects from the prior year and the expected demand surge upon re-opening, we believe the inflation surge will be temporary. However, we have few instances in the past 20 years when monetary and fiscal policies were aligned strongly toward an easing bias. Over the next few months, we will be monitoring components of the inflation basket for signs that may prompt the Federal Reserve to shift its dovish posture sooner than currently expected.

Thank you, Mike, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk.

ABOUT DERIVATIVES

Derivatives are an increasingly common type of investment instrument, the performance of which is derived from an underlying security, index, currency, or other area of the capital markets. Derivatives employed by the fund’s managers generally serve one of two main purposes: to implement a strategy that may be difficult or more expensive to invest in through traditional securities, or to hedge unwanted risk associated with a particular position.

For example, the fund’s managers might use currency forward contracts to capitalize on an anticipated change in exchange rates between two currencies. This approach would require a significantly smaller outlay of capital than purchasing traditional bonds denominated in the underlying currencies. In another example, the managers may identify a bond that they believe is undervalued relative to its risk of default, but may seek to reduce the interest-rate risk of that bond by using interest-rate swaps, a derivative through which two parties “swap” payments based on the movement of certain rates. In other examples, the managers may use options and futures contracts to hedge against a variety of risks.

Like any other investment, derivatives may not appreciate in value and may lose money. Derivatives may amplify traditional investment risks through the creation of leverage and may be less liquid than traditional securities. And because derivatives typically represent contractual agreements between two financial institutions, derivatives entail “counterparty risk,” which is the risk that the other party is unable or unwilling to pay. Putnam monitors the counterparty risks we assume. For example, Putnam often enters into collateral agreements that require the counterparties to post collateral on a regular basis to cover their obligations to the fund. Counterparty risk for exchange-traded futures and centrally cleared swaps is mitigated by the daily exchange of margin and other safeguards against default through their respective clearinghouses.

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended April 30, 2021, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance information as of the most recent calendar quarter-end and expense information taken from the fund’s current prospectus. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and principal value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance information does not reflect any deduction for taxes a shareholder may owe on fund distributions or on the redemption of fund shares. For the most recent month-end performance, please visit the Individual Investors section at putnam.com or call Putnam at 1-800-225-1581. Class R, R5, R6, and Y shares are not available to all investors. See the Terms and definitions section in this report for definitions of the share classes offered by your fund.

Fund performance Total return for periods ended 4/30/21

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | Annual | | Annual | | Annual | | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

| Class A (6/1/87) | | | | | | | | | |

| Before sales charge | 6.08% | 25.35% | 2.28% | 16.33% | 3.07% | 9.92% | 3.20% | 6.07% | 0.97% |

| After sales charge | 5.96 | 20.33 | 1.87 | 11.68 | 2.23 | 5.52 | 1.81 | 1.83 | –3.07 |

| Class B (2/1/94) | | | | | | | | | |

| Before CDSC | 5.88 | 17.97 | 1.67 | 12.03 | 2.30 | 7.44 | 2.42 | 5.28 | 0.59 |

| After CDSC | 5.88 | 17.97 | 1.67 | 10.03 | 1.93 | 4.44 | 1.46 | 0.28 | –4.41 |

| Class C (7/26/99) | | | | | | | | | |

| Before CDSC | 5.90 | 18.11 | 1.68 | 12.16 | 2.32 | 7.47 | 2.43 | 5.37 | 0.67 |

| After CDSC | 5.90 | 18.11 | 1.68 | 12.16 | 2.32 | 7.47 | 2.43 | 4.37 | –0.33 |

| Class R (12/1/03) | | | | | | | | | |

| Net asset value | 5.82 | 22.32 | 2.04 | 15.01 | 2.84 | 9.11 | 2.95 | 5.90 | 0.85 |

| Class R5 (7/2/12) | | | | | | | | | |

| Net asset value | 6.23 | 29.25 | 2.60 | 18.47 | 3.45 | 11.06 | 3.56 | 6.51 | 1.21 |

| Class R6 (7/2/12) | | | | | | | | | |

| Net asset value | 6.24 | 30.00 | 2.66 | 18.75 | 3.50 | 11.29 | 3.63 | 6.49 | 1.17 |

| Class Y (10/4/05) | | | | | | | | | |

| Net asset value | 6.21 | 28.55 | 2.54 | 17.94 | 3.35 | 10.77 | 3.47 | 6.43 | 1.18 |

Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. After-sales-charge returns for class A shares reflect the deduction of the maximum 4.00% sales charge levied at the time of purchase. Class B share returns after contingent deferred sales charge (CDSC) reflect the applicable CDSC, which is 5% in the first year, declining over time to 1% in the sixth year, and is eliminated thereafter. Class C share returns after CDSC reflect a 1% CDSC for the first year that is eliminated thereafter. Class R, R5, R6, and Y shares have no initial sales charge or CDSC. Performance for class B, C, R, and Y shares before their inception is derived from the historical performance of class A shares, adjusted for the applicable sales charge (or CDSC) and the higher operating expenses for such shares, except for class Y shares, for which 12b-1 fees are not applicable. Performance for class R5 and R6 shares prior to their inception is derived from the historical performance of class Y shares and has not been adjusted for the lower investor servicing fees applicable to class R5 and R6 shares; had it, returns would have been higher.

For a portion of the periods, the fund had expense limitations, without which returns would have been lower.

Class B and C share performance reflects conversion to class A shares after eight years.

Comparative index returns For periods ended 4/30/21

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | Annual | | Annual | | Annual | | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

| Bloomberg Barclays | | | | | | | | | |

| Global Aggregate | —* | 22.47% | 2.05% | 13.93% | 2.64% | 11.81% | 3.79% | 3.95% | –0.17% |

| Bond Index | | | | | | | | | |

| Lipper Global Income | | | | | | | | | |

| Funds category | 6.09% | 29.97 | 2.59 | 17.52 | 3.26 | 12.52 | 4.00 | 7.17 | 1.16 |

| average† | | | | | | | | | |

Index and Lipper results should be compared with fund performance before sales charge, before CDSC, or at net asset value.

All Bloomberg Barclays indices provided by Bloomberg Index Services Limited.

* The fund’s benchmark, the Bloomberg Barclays Global Aggregate Bond Index, was introduced on 12/31/89, which post-dates the inception of the fund’s class A shares.

† Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 4/30/21, there were 211, 208, 188, 166, 109, and 1 fund(s), respectively, in this Lipper category.

Fund price and distribution information For the six-month period ended 4/30/21

| | | | | | | | |

| Distributions | Class A | Class B | Class C | Class R | Class R5 | Class R6 | Class Y |

| Number | 6 | 6 | 6 | 6 | 6 | 6 | 6 |

| Income | $0.102 | $0.054 | $0.053 | $0.087 | $0.122 | $0.127 | $0.118 |

| Capital gains | — | — | — | — | — | — | — |

| Total | $0.102 | $0.054 | $0.053 | $0.087 | $0.122 | $0.127 | $0.118 |

| | Before | After | Net | Net | Net | Net | Net | Net |

| | sales | sales | asset | asset | asset | asset | asset | asset |

| Share value | charge | charge | value | value | value | value | value | value |

| 10/31/20 | $12.45 | $12.97 | $12.39 | $12.39 | $12.45 | $12.44 | $12.45 | $12.44 |

| 4/30/21 | 12.47 | 12.99 | 12.41 | 12.42 | 12.47 | 12.47 | 12.47 | 12.47 |

| | Before | After | Net | Net | Net | Net | Net | Net |

| Current rate | sales | sales | asset | asset | asset | asset | asset | asset |

| (end of period) | charge | charge | value | value | value | value | value | value |

| Current dividend rate1 | 1.64% | 1.57% | 0.77% | 0.87% | 1.44% | 2.02% | 2.12% | 1.92% |

| Current 30-day | | | | | | | | |

| SEC yield | | | | | | | | |

| (with expense | | | | | | | | |

| limitation)2,3 | N/A | 1.65 | 0.97 | 0.99 | 1.47 | 2.04 | 2.12 | 1.96 |

| Current 30-day | | | | | | | | |

| SEC yield | | | | | | | | |

| (without expense | | | | | | | | |

| limitation)3 | N/A | 1.37 | 0.68 | 0.70 | 1.19 | 1.75 | 1.83 | 1.68 |

The classification of distributions, if any, is an estimate. Before-sales-charge share value and current dividend rate for class A shares, if applicable, do not take into account any sales charge levied at the time of purchase. After-sales-charge share value, current dividend rate, and current 30-day SEC yield, if applicable, are calculated assuming that the maximum sales charge (4.00% for class A shares) was levied at the time of purchase. Final distribution information will appear on your year-end tax forms.

1 Most recent distribution, including any return of capital and excluding capital gains, annualized and divided by share price before or after sales charge at period-end.

2 For a portion of the period, the fund had expense limitations, without which yields would have been lower.

3 Based only on investment income and calculated using the maximum offering price for each share class, in accordance with SEC guidelines.

Fund performance as of most recent calendar quarter Total return for periods ended 3/31/21

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | Annual | | Annual | | Annual | | |

| | (life of fund) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

| Class A (6/1/87) | | | | | | | | | |

| Before sales charge | 6.09% | 29.47% | 2.62% | 18.46% | 3.45% | 8.34% | 2.71% | 8.45% | 0.89% |

| After sales charge | 5.96 | 24.29 | 2.20 | 13.72 | 2.61 | 4.01 | 1.32 | 4.12 | –3.14 |

| Class B (2/1/94) | | | | | | | | | |

| Before CDSC | 5.88 | 21.87 | 2.00 | 14.09 | 2.67 | 5.90 | 1.93 | 7.67 | 0.52 |

| After CDSC | 5.88 | 21.87 | 2.00 | 12.09 | 2.31 | 2.90 | 0.96 | 2.67 | –4.48 |

| Class C (7/26/99) | | | | | | | | | |

| Before CDSC | 5.90 | 22.03 | 2.01 | 14.14 | 2.68 | 5.84 | 1.91 | 7.66 | 0.50 |

| After CDSC | 5.90 | 22.03 | 2.01 | 14.14 | 2.68 | 5.84 | 1.91 | 6.66 | –0.50 |

| Class R (12/1/03) | | | | | | | | | |

| Net asset value | 5.82 | 26.25 | 2.36 | 17.02 | 3.19 | 7.45 | 2.42 | 8.18 | 0.76 |

| Class R5 (7/2/12) | | | | | | | | | |

| Net asset value | 6.23 | 33.38 | 2.92 | 20.53 | 3.81 | 9.38 | 3.03 | 8.82 | 1.05 |

| Class R6 (7/2/12) | | | | | | | | | |

| Net asset value | 6.25 | 34.26 | 2.99 | 21.01 | 3.89 | 9.69 | 3.13 | 8.87 | 1.08 |

| Class Y (10/4/05) | | | | | | | | | |

| Net asset value | 6.21 | 32.66 | 2.87 | 20.00 | 3.71 | 9.10 | 2.95 | 8.74 | 1.02 |

See the discussion following the fund performance table on page 10 for information about the calculation of fund performance.

Your fund’s expenses

As a mutual fund investor, you pay ongoing expenses, such as management fees, distribution fees (12b-1 fees), and other expenses. In the most recent six-month period, your fund’s expenses were limited; had expenses not been limited, they would have been higher. Using the following information, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You may also pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial representative.

Expense ratios

| | | | | | | |

| | Class A | Class B | Class C | Class R | Class R5 | Class R6 | Class Y |

| Net expenses for the fiscal year | | | | | | | |

| ended 10/31/20* | 0.89% | 1.64% | 1.64% | 1.14% | 0.55% | 0.48% | 0.64% |

| Total annual operating expenses for the | | | | | | | |

| fiscal year ended 10/31/20 | 1.20% | 1.95% | 1.95% | 1.45% | 0.86% | 0.79% | 0.95% |

| Annualized expense ratio for the | | | | | | | |

| six-month period ended 4/30/21 | 0.88% | 1.63% | 1.63% | 1.13% | 0.55% | 0.48% | 0.63% |

Fiscal year expense information in this table is taken from the most recent prospectus, is subject to change, and may differ from that shown for the annualized expense ratio and in the financial highlights of this report.

Expenses are shown as a percentage of average net assets.

* Reflects Putnam Management’s contractual obligation to limit certain fund expenses through 2/28/22.

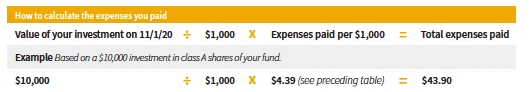

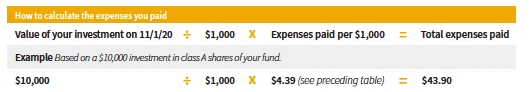

Expenses per $1,000

The following table shows the expenses you would have paid on a $1,000 investment in each class of the fund from 11/1/20 to 4/30/21. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | |

| | Class A | Class B | Class C | Class R | Class R5 | Class R6 | Class Y |

| Expenses paid per $1,000*† | $4.39 | $8.11 | $8.11 | $5.63 | $2.74 | $2.39 | $3.14 |

| Ending value (after expenses) | $1,009.70 | $1,005.90 | $1,006.70 | $1,008.50 | $1,012.10 | $1,011.70 | $1,011.80 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/21. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the period; then multiplying the result by the number of days in the period; and then dividing that result by the number of days in the year.

Estimate the expenses you paid

To estimate the ongoing expenses you paid for the six months ended 4/30/21, use the following calculation method. To find the value of your investment on 11/1/20, call Putnam at 1-800-225-1581.

Compare expenses using the SEC’s method

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the following table shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total costs) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | |

| | Class A | Class B | Class C | Class R | Class R5 | Class R6 | Class Y |

| Expenses paid per $1,000*† | $4.41 | $8.15 | $8.15 | $5.66 | $2.76 | $2.41 | $3.16 |

| Ending value (after expenses) | $1,020.43 | $1,016.71 | $1,016.71 | $1,019.19 | $1,022.07 | $1,022.41 | $1,021.67 |

* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, which represents the ongoing expenses as a percentage of average net assets for the six months ended 4/30/21. The expense ratio may differ for each share class.

† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period; then multiplying the result by the number of days in the six-month period; and then dividing that result by the number of days in the year.

Consider these risks before investing

International investing involves currency, economic, and political risks. Emerging-market securities carry illiquidity and volatility risks. Lower-rated bonds may offer higher yields in return for more risk. Funds that invest in government securities are not guaranteed. Mortgage-backed investments, unlike traditional debt investments, are subject to prepayment risk, which means that they may increase in value less than other bonds when interest rates decline and decline in value more than other bonds when interest rates rise. The fund concentrates on a limited group of industries and is non-diversified. Because the fund may invest in fewer issuers than a diversified fund, it is vulnerable to common economic forces and may result in greater losses and volatility. Bond investments are subject to interest-rate risk (the risk of bond prices falling if interest rates rise) and credit risk (the risk of an issuer defaulting on interest or principal payments). Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds. Risks associated with derivatives include increased investment exposure (which may be considered leverage) and, in the case of over-the-counter instruments, the potential inability to terminate or sell derivatives positions and the potential failure of the other party to the instrument to meet its obligations. Unlike bonds, funds that invest in bonds have fees and expenses. The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political, or financial market conditions; investor sentiment and market perceptions; government actions; geopolitical events or changes; and factors related to a specific issuer, geography, industry, or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. Our investment techniques, analyses, and judgments may not produce the outcome we intend. The investments we select for the fund may not perform as well as other securities that we do not select for the fund. We, or the fund’s other service providers, may experience disruptions or operating errors that could have a negative effect on the fund. You can lose money by investing in the fund.

Terms and definitions

Important terms

Total return shows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Before sales charge, or net asset value, is the price, or value, of one share of a mutual fund, without a sales charge. Before-sales-charge figures fluctuate with market conditions, and are calculated by dividing the net assets of each class of shares by the number of outstanding shares in the class.

After sales charge is the price of a mutual fund share plus the maximum sales charge levied at the time of purchase. After-sales-charge performance figures shown here assume the 4.00% maximum sales charge for class A shares.

Contingent deferred sales charge (CDSC) is generally a charge applied at the time of the redemption of class B or C shares and assumes redemption at the end of the period. Your fund’s class B CDSC declines over time from a 5% maximum during the first year to 1% during the sixth year. After the sixth year, the CDSC no longer applies. The CDSC for class C shares is 1% for one year after purchase.

Share classes

Class A shares are generally subject to an initial sales charge and no CDSC (except on certain redemptions of shares bought without an initial sales charge).

Class B shares are closed to new investments and are only available by exchange from another Putnam fund or through dividend and/or capital gains reinvestment. They are not subject to an initial sales charge and may be subject to a CDSC.

Class C shares are not subject to an initial sales charge and are subject to a CDSC only if the shares are redeemed during the first year.

Class R shares are not subject to an initial sales charge or CDSC and are only available to employer-sponsored retirement plans.

Class R5 shares are not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are only available to employer-sponsored retirement plans.

Class R6 shares are not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are generally only available to employer-sponsored retirement plans, corporate and institutional clients, and clients in other approved programs.

Class Y shares are not subject to an initial sales charge or CDSC and carry no 12b-1 fee. They are generally only available to corporate and institutional clients and clients in other approved programs.

Fixed-income terms

Current rate is the annual rate of return earned from dividends or interest of an investment. Current rate is expressed as a percentage of the price of a security, fund share, or principal investment.

Mortgage-backed security (MBS), also known as a mortgage “pass-through,” is a type of asset-backed security that is secured by a mortgage or collection of mortgages. The following are types of MBSs:

• Agency credit-risk transfer security (CRT) is backed by a reference pool of agency mortgages. Unlike a regular agency pass-through, the principal invested in a CRT is not backed by a U.S. government agency. To compensate investors for this risk, a CRT typically offers a higher yield than conventional pass-through securities. Similar to a CMBS, a CRT is structured into various tranches for investors, offering different levels of risk and yield based on the underlying reference pool.

• Agency “pass-through” has its principal and interest backed by a U.S. government agency, such as the Federal National Mortgage Association (Fannie Mae), Government National Mortgage Association (Ginnie Mae), and Federal Home Loan Mortgage Corporation (Freddie Mac).

• Collateralized mortgage obligation (CMO) represents claims to specific cash flows from pools of home mortgages. The streams of principal and interest payments on the mortgages are distributed to the different classes of CMO interests in “tranches.” Each tranche may have different principal balances, coupon rates, prepayment risks, and maturity dates. A CMO is highly sensitive to changes in interest rates and any resulting change in the rate at which homeowners sell their properties, refinance, or otherwise prepay loans. CMOs are subject to prepayment, market, and liquidity risks.

° Interest-only (IO) security is a type of CMO in which the underlying asset is the interest portion of mortgage, Treasury, or bond payments.

• Non-agency residential mortgage-backed security (RMBS) is an MBS not backed by Fannie Mae, Ginnie Mae, or Freddie Mac. One type of RMBS is an Alt-A mortgage-backed security.

• Commercial mortgage-backed security (CMBS) is secured by the loan on a commercial property.

Yield curve is a graph that plots the yields of bonds with equal credit quality against their differing maturity dates, ranging from shortest to longest. It is used as a benchmark for other debt, such as mortgage or bank lending rates.

Comparative indexes

Bloomberg Barclays Global Aggregate Bond Index is an unmanaged index of global investment-grade fixed-income securities.

Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged index of U.S. investment-grade fixed-income securities.

CMBX Index is an unmanaged index that tracks the performance of a basket of CMBS issued in a particular year.

ICE BofA (Intercontinental Exchange Bank of America) U.S. 3-Month Treasury Bill Index is an unmanaged index that seeks to measure the performance of U.S. Treasury bills available in the marketplace.

S&P 500 Index is an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). BARCLAYS® is a trademark and service mark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. Neither Bloomberg nor Barclays approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or limited, as to the results to be obtained therefrom, and to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

ICE Data Indices, LLC (“ICE BofA”), used with permission. ICE BofA permits use of the ICE BofA indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofA indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services.

Lipper, a Refinitiv company, is a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

Other information for shareholders

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single notice of internet availability, or a single printed copy, of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2020, are available in the Individual Investors section of putnam.com and on the SEC’s website, www.sec.gov. If you have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT within 60 days of the end of such fiscal quarter. Shareholders may obtain the fund’s Form N-PORT on the SEC’s website at www.sec.gov.

Prior to its use of Form N-PORT, the fund filed its complete schedule of its portfolio holdings with the SEC on Form N-Q, which is available online at www.sec.gov.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of April 30, 2021, Putnam employees had approximately $580,000,000 and the Trustees had approximately $81,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

Liquidity risk management program

Putnam, as the administrator of the fund’s liquidity risk management program (appointed by the Board of Trustees), presented the most recent annual report on the program to the Trustees in April 2021. The report covered the structure of the program, including the program documents and related policies and procedures adopted to comply with Rule 22e-4 under the Investment Company Act of 1940, and reviewed the operation of the program from January 2020 through December 2020. The report included a description of the annual liquidity assessment of the fund that Putnam performed in November 2020. The report noted that there were no material compliance exceptions identified under Rule 22e-4 during the period. The report included a review of the governance of the program and the methodology for classification of the fund’s investments. The report also included a discussion of liquidity monitoring during the period, including during the market liquidity challenges caused by the Covid-19 pandemic, and the impact those challenges had on the liquidity of the fund’s investments. Putnam concluded that the program has been operating effectively and adequately to ensure compliance with Rule 22e-4.

Financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfolio lists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilities shows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share, which is calculated separately for each class of shares. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operations shows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added to or subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assets shows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlights provide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

The fund’s portfolio 4/30/21 (Unaudited)

| | |

| U.S. GOVERNMENT AND AGENCY | Principal | |

| MORTGAGE OBLIGATIONS (62.7%)* | amount | Value |

| U.S. Government Guaranteed Mortgage Obligations (2.5%) | | |

| Government National Mortgage Association Pass-Through Certificates | | |

| 4.50%, TBA, 5/1/51 | $1,000,000 | $1,081,563 |

| 4.00%, TBA, 5/1/51 | 2,000,000 | 2,135,000 |

| 3.50%, TBA, 5/1/51 | 1,000,000 | 1,060,156 |

| 3.00%, TBA, 5/1/51 | 2,000,000 | 2,092,344 |

| | | 6,369,063 |

| U.S. Government Agency Mortgage Obligations (60.2%) | | |

| Uniform Mortgage-Backed Securities | | |

| 4.00%, TBA, 5/1/51 | 5,000,000 | 5,371,875 |

| 3.50%, TBA, 6/1/51 | 6,000,000 | 6,376,172 |

| 3.50%, TBA, 5/1/51 | 8,000,000 | 8,513,750 |

| 3.00%, TBA, 6/1/51 | 2,000,000 | 2,092,812 |

| 3.00%, TBA, 5/1/51 | 5,000,000 | 5,235,547 |

| 2.50%, TBA, 6/1/51 | 29,000,000 | 30,005,938 |

| 2.50%, TBA, 5/1/51 | 77,000,000 | 79,857,424 |

| 2.00%, TBA, 5/1/51 | 14,000,000 | 14,136,718 |

| | | 151,590,236 |

| Total U.S. government and agency mortgage obligations (cost $156,714,923) | $157,959,299 |

| |

| | Principal | |

| U.S. TREASURY OBLIGATIONS (0.1%)* | amount | Value |

| U.S. Treasury Notes 0.25%, 9/30/25 i | $247,000 | $242,090 |

| Total U.S. treasury obligations (cost $242,090) | | $242,090 |

| |

| | Principal | |

| MORTGAGE-BACKED SECURITIES (35.5%)* | amount | Value |

| Agency collateralized mortgage obligations (3.7%) | | |

| Federal Home Loan Mortgage Corporation | | |

| REMICs IFB Ser. 4076, Class MS, IO, ((-1 x 1 Month US LIBOR) | | |

| + 6.70%), 6.585%, 7/15/40 | $514,617 | $42,483 |

| REMICs IFB Ser. 4979, Class SN, IO, ((-1 x 1 Month US LIBOR) | | |

| + 6.05%), 5.944%, 6/25/50 | 1,886,939 | 354,765 |

| REMICs Ser. 4355, Class DI, IO, 4.00%, 3/15/44 | 451,866 | 17,724 |

| REMICs Ser. 4193, Class PI, IO, 4.00%, 3/15/43 | 518,846 | 71,745 |

| REMICs Ser. 4369, Class IA, IO, 3.50%, 7/15/44 | 540,534 | 60,362 |

| REMICs Ser. 4141, Class PI, IO, 3.00%, 12/15/42 | 1,055,180 | 107,644 |

| REMICs Ser. 4165, Class TI, IO, 3.00%, 12/15/42 | 2,352,584 | 229,231 |

| REMICs Ser. 4206, Class IP, IO, 3.00%, 12/15/41 | 774,303 | 52,919 |

| Federal National Mortgage Association | | |

| REMICs IFB Ser. 12-116, Class SA, IO, ((-1 x 1 Month US LIBOR) | | |

| + 7.20%), 7.094%, 10/25/42 | 868,069 | 189,838 |

| REMICs IFB Ser. 10-46, Class SB, IO, ((-1 x 1 Month US LIBOR) | | |

| + 6.45%), 6.344%, 5/25/40 | 170,268 | 29,191 |

| REMICs IFB Ser. 12-103, Class LS, IO, ((-1 x 1 Month US LIBOR) | | |

| + 6.00%), 5.894%, 9/25/42 | 870,504 | 147,986 |

| REMICs Ser. 15-28, IO, 5.50%, 5/25/45 | 1,220,826 | 241,113 |

| REMICs Ser. 17-113, IO, 5.00%, 1/25/38 | 666,614 | 75,491 |

| REMICs Ser. 12-124, Class JI, IO, 3.50%, 11/25/42 | 431,150 | 35,501 |

| | |

| | Principal | |

| MORTGAGE-BACKED SECURITIES (35.5%)* cont. | amount | Value |

| Agency collateralized mortgage obligations cont. | | |

| Federal National Mortgage Association | | |

| REMICs Ser. 13-55, Class IK, IO, 3.00%, 4/25/43 | $564,804 | $59,098 |

| REMICs Ser. 13-35, Class IP, IO, 3.00%, 6/25/42 | 907,811 | 47,673 |

| REMICs Ser. 13-55, Class PI, IO, 3.00%, 5/25/42 | 805,310 | 32,282 |

| REMICs Ser. 13-23, Class PI, IO, 3.00%, 10/25/41 | 696,604 | 14,189 |

| REMICs Ser. 14-28, Class AI, IO, 3.00%, 3/25/40 | 808,686 | 28,105 |

| Government National Mortgage Association | | |

| IFB Ser. 10-171, Class SB, IO, ((-1 x 1 Month US LIBOR) + 6.45%), | | |

| 6.334%, 12/16/40 | 579,598 | 116,575 |

| IFB Ser. 16-77, Class SL, IO, ((-1 x 1 Month US LIBOR) + 6.15%), | | |

| 6.034%, 3/20/43 | 819,558 | 83,210 |

| Ser. 16-75, Class LI, IO, 6.00%, 1/20/40 | 811,882 | 170,408 |

| IFB Ser. 20-32, Class GS, IO, ((-1 x 1 Month US LIBOR) + 6.10%), | | |

| 5.984%, 3/20/50 | 1,343,141 | 222,308 |

| Ser. 18-21, Class IN, IO, 5.00%, 2/20/48 | 378,432 | 66,578 |

| Ser. 14-76, IO, 5.00%, 5/20/44 | 363,845 | 64,441 |

| Ser. 14-25, Class QI, IO, 5.00%, 1/20/44 | 691,745 | 116,926 |

| Ser. 10-35, Class UI, IO, 5.00%, 3/20/40 | 118,063 | 23,207 |

| Ser. 10-9, Class UI, IO, 5.00%, 1/20/40 | 249,058 | 48,878 |

| Ser. 09-121, Class UI, IO, 5.00%, 12/20/39 | 79,031 | 15,411 |

| Ser. 18-153, Class AI, IO, 4.50%, 9/16/45 | 6,751,908 | 1,175,237 |

| Ser. 15-80, Class IA, IO, 4.50%, 6/20/45 | 888,461 | 158,380 |

| Ser. 18-127, Class IB, IO, 4.50%, 6/20/45 | 202,187 | 20,983 |

| Ser. 13-182, Class IQ, IO, 4.50%, 12/16/43 | 705,496 | 127,197 |

| Ser. 12-91, Class IN, IO, 4.50%, 5/20/42 | 1,178,777 | 211,057 |

| Ser. 10-35, Class AI, IO, 4.50%, 3/20/40 | 541,933 | 49,379 |

| Ser. 10-35, Class QI, IO, 4.50%, 3/20/40 | 401,905 | 70,027 |

| Ser. 16-138, Class GI, IO, 4.00%, 10/20/46 | 4,006,930 | 535,831 |

| Ser. 16-47, Class CI, IO, 4.00%, 9/20/45 | 1,348,041 | 149,498 |

| Ser. 14-116, Class IL, IO, 4.00%, 8/20/44 | 814,169 | 106,549 |

| Ser. 13-24, Class PI, IO, 4.00%, 11/20/42 | 219,381 | 28,241 |

| Ser. 16-83, Class PI, IO, 3.50%, 6/20/45 | 1,773,735 | 247,554 |

| Ser. 13-27, Class PI, IO, 3.50%, 12/20/42 | 191,425 | 21,258 |

| Ser. 12-136, Class BI, IO, 3.50%, 11/20/42 | 789,642 | 127,451 |

| Ser. 14-102, Class IG, IO, 3.50%, 3/16/41 | 525,084 | 34,240 |

| Ser. 15-124, Class NI, IO, 3.50%, 6/20/39 | 343,546 | 9,894 |

| Ser. 16-H16, Class EI, IO, 2.484%, 6/20/66 W | 2,952,738 | 245,373 |

| Ser. 17-H04, Class BI, IO, 2.472%, 2/20/67 W | 2,738,036 | 262,068 |

| Ser. 17-H02, Class BI, IO, 2.457%, 1/20/67 W | 2,976,958 | 272,850 |

| Ser. 16-H20, Class NI, IO, 2.40%, 9/20/66 W | 2,567,413 | 194,482 |

| Ser. 16-H23, Class NI, IO, 2.385%, 10/20/66 W | 3,734,395 | 314,809 |

| Ser. 17-H19, Class MI, IO, 2.065%, 4/20/67 W | 1,766,018 | 156,116 |

| Ser. 16-H13, Class EI, IO, 1.929%, 4/20/66 W | 2,133,949 | 182,698 |

| Ser. 15-H26, Class DI, IO, 1.911%, 10/20/65 W | 2,141,659 | 172,305 |

| Ser. 15-H09, Class AI, IO, 1.758%, 4/20/65 W | 4,382,544 | 298,399 |

| Ser. 15-H26, Class EI, IO, 1.717%, 10/20/65 W | 2,230,867 | 145,453 |

| Ser. 15-H03, Class DI, IO, 1.665%, 1/20/65 W | 3,816,824 | 273,285 |

| Ser. 14-H21, Class AI, IO, 1.659%, 10/20/64 W | 2,360,389 | 168,305 |

| Ser. 16-H01, Class AI, IO, 1.653%, 1/20/66 W | 1,779,212 | 115,247 |

| | |

| | Principal | |

| MORTGAGE-BACKED SECURITIES (35.5%)* cont. | amount | Value |

| Agency collateralized mortgage obligations cont. | | |

| Government National Mortgage Association | | |

| Ser. 15-H25, Class AI, IO, 1.617%, 9/20/65 W | $2,359,302 | $149,580 |

| Ser. 14-H12, Class BI, IO, 1.573%, 5/20/64 W | 2,972,805 | 183,826 |

| Ser. 16-H07, Class HI, IO, 1.495%, 2/20/66 W | 3,004,387 | 240,351 |

| | | 9,213,205 |

| Commercial mortgage-backed securities (19.3%) | | |

| BANK | | |

| Ser. 19-BN24, Class AS, 3.283%, 11/15/62 W | 425,000 | 459,000 |

| Ser. 19-BN23, Class AS, 3.203%, 12/15/52 | 268,000 | 284,640 |

| FRB Ser. 20-BN30, Class XA, IO, 1.446%, 12/15/53 W | 4,992,702 | 483,774 |

| FRB Ser. 19-BN20, Class XA, IO, 0.96%, 9/15/62 W | 9,971,727 | 598,304 |

| Barclays Commercial Mortgage Trust | | |

| Ser. 19-C3, Class B, 4.096%, 5/15/52 | 290,000 | 308,385 |

| Ser. 19-C5, Class AS, 3.366%, 11/15/52 W | 835,000 | 896,119 |

| FRB Ser. 20-C8, Class XA, IO, 1.973%, 10/15/53 W | 4,720,285 | 638,897 |

| Bear Stearns Commercial Mortgage Securities Trust 144A FRB | | |

| Ser. 06-PW14, Class X1, IO, 0.76%, 12/11/38 W | 67,860 | 699 |

| Benchmark Mortgage Trust | | |

| Ser. 18-B8, Class AS, 4.532%, 1/15/52 W | 634,000 | 729,596 |

| Ser. 19-B13, Class AM, 3.183%, 8/15/57 | 242,000 | 257,101 |

| BXMT, Ltd. 144A FRB Ser. 21-FL4, Class A, 1.17%, 5/15/38 | | |

| (Cayman Islands) | 612,000 | 612,379 |

| CD Commercial Mortgage Trust Ser. 17-CD3, Class A4, | | |

| 3.631%, 2/10/50 | 267,000 | 294,061 |

| CFCRE Commercial Mortgage Trust FRB Ser. 17-C8, Class B, | | |

| 4.199%, 6/15/50 W | 427,000 | 463,454 |

| CFCRE Commercial Mortgage Trust 144A FRB Ser. 11-C2, Class E, | | |

| 5.935%, 12/15/47 W | 1,053,000 | 1,029,977 |

| Citigroup Commercial Mortgage Trust | | |

| FRB Ser. 13-GC17, Class C, 5.26%, 11/10/46 W | 256,000 | 262,830 |

| FRB Ser. 18-C6, Class B, 4.907%, 11/10/51 W | 251,000 | 291,173 |

| Ser. 14-GC21, Class AS, 4.026%, 5/10/47 | 694,000 | 748,944 |

| Citigroup Commercial Mortgage Trust 144A | | |

| FRB Ser. 14-GC19, Class D, 5.262%, 3/10/47 W | 185,000 | 194,840 |

| FRB Ser. 06-C5, Class XC, IO, 0.715%, 10/15/49 W | 2,299,318 | 31 |

| COMM Mortgage Trust | | |

| FRB Ser. 13-CR13, Class C, 5.046%, 11/10/46 W | 417,000 | 454,530 |

| FRB Ser. 14-CR17, Class C, 4.944%, 5/10/47 W | 692,000 | 737,923 |

| FRB Ser. 14-CR18, Class C, 4.901%, 7/15/47 W | 393,000 | 403,252 |

| FRB Ser. 14-UBS6, Class C, 4.593%, 12/10/47 W | 110,000 | 115,340 |

| FRB Ser. 15-CR24, Class B, 4.525%, 8/10/48 W | 501,000 | 550,987 |

| FRB Ser. 15-LC19, Class C, 4.376%, 2/10/48 W | 420,000 | 447,768 |

| Ser. 14-CR21, Class B, 4.339%, 12/10/47 W | 433,000 | 466,438 |

| Ser. 14-LC15, Class AM, 4.198%, 4/10/47 | 451,000 | 488,035 |

| Ser. 14-CR19, Class AM, 4.08%, 8/10/47 | 574,000 | 622,459 |

| Ser. 15-CR27, Class AM, 3.984%, 10/10/48 | 284,000 | 312,325 |

| Ser. 17-COR2, Class AM, 3.803%, 9/10/50 | 353,000 | 389,843 |

| Ser. 16-COR1, Class AM, 3.494%, 10/10/49 | 439,000 | 475,322 |

| FRB Ser. 14-UBS6, Class XA, IO, 1.034%, 12/10/47 W | 8,774,405 | 211,946 |

| FRB Ser. 15-LC21, Class XA, IO, 0.83%, 7/10/48 W | 10,509,202 | 260,664 |

| | |

| | Principal | |

| MORTGAGE-BACKED SECURITIES (35.5%)* cont. | amount | Value |

| Commercial mortgage-backed securities cont. | | |

| COMM Mortgage Trust 144A | | |

| FRB Ser. 13-CR11, Class C, 5.285%, 8/10/50 W | $525,000 | $538,443 |

| FRB Ser. 12-CR2, Class D, 4.992%, 8/15/45 W | 400,000 | 375,586 |

| Credit Suisse Commercial Mortgage Trust 144A | | |

| FRB Ser. 06-C4, Class AX, IO, 1.002%, 9/15/39 W | 7,248 | — |

| FRB Ser. 07-C2, Class AX, IO, 0.049%, 1/15/49 W | 653,633 | — |

| Credit Suisse First Boston Mortgage Securities Corp. 144A FRB | | |

| Ser. 03-C3, Class AX, IO, 2.267%, 5/15/38 W | 5,498 | 42 |

| CSAIL Commercial Mortgage Trust | | |

| FRB Ser. 15-C1, Class C, 4.405%, 4/15/50 W | 819,000 | 790,941 |

| Ser. 19-C15, Class A4, 4.053%, 3/15/52 | 819,000 | 927,150 |

| Ser. 19-C17, Class AS, 3.278%, 9/15/52 | 596,000 | 631,743 |

| CSMC Trust FRB Ser. 16-NXSR, Class C, 4.506%, 12/15/49 W | 822,000 | 710,136 |

| DBUBS Mortgage Trust 144A | | |

| FRB Ser. 11-LC3A, Class D, 5.517%, 8/10/44 W | 1,164,000 | 1,141,133 |

| Ser. 11-LC2A, Class B, 4.998%, 7/10/44 W | 329,000 | 328,802 |

| Federal Home Loan Mortgage Corporation | | |

| Multifamily Structured Pass-Through Certificates FRB Ser. K113, | | |

| Class XAM, IO, 1.693%, 6/25/30 W | 2,243,000 | 280,137 |

| Multifamily Structured Pass-Through Certificates FRB Ser. K111, | | |

| Class X1, IO, 1.681%, 5/25/30 W | 2,252,615 | 274,796 |

| Multifamily Structured Pass-Through Certificates FRB Ser. K105, | | |

| Class X1, IO, 1.645%, 1/25/30 W | 2,316,318 | 267,007 |

| Multifamily Structured Pass-Through Certificates FRB Ser. K104, | | |

| Class XAM, IO, 1.505%, 1/25/30 W | 3,017,000 | 330,249 |

| Multifamily Structured Pass-Through Certificates FRB Ser. K113, | | |

| Class X1, IO, 1.49%, 6/25/30 W | 3,028,889 | 321,574 |

| Multifamily Structured Pass-Through Certificates FRB Ser. K098, | | |

| Class X1, IO, 1.269%, 8/25/29 W | 2,803,221 | 233,483 |

| Multifamily Structured Pass-Through Certificates FRB Ser. K118, | | |

| Class X1, IO, 1.055%, 9/25/30 W | 4,597,483 | 354,868 |

| Multifamily Structured Pass-Through Certificates FRB Ser. K123, | | |

| Class X1, IO, 0.866%, 12/25/30 W | 4,692,534 | 297,244 |

| Multifamily Structured Pass-Through Certificates FRB Ser. K125, | | |

| Class X1, IO, 0.678%, 1/25/31 W | 6,259,021 | 292,515 |

| Multifamily Structured Pass-Through Certificates FRB Ser. K087, | | |

| Class X1, IO, 0.51%, 12/25/28 W | 13,534,840 | 362,279 |

| GS Mortgage Securities Corp., II FRB Ser. 13-GC10, Class XA, IO, | | |

| 1.631%, 2/10/46 W | 6,977,110 | 149,422 |

| GS Mortgage Securities Trust | | |

| FRB Ser. 12-GCJ7, Class C, 5.806%, 5/10/45 W | 273,000 | 283,920 |

| Ser. 17-GS7, Class AS, 3.663%, 8/10/50 | 354,000 | 383,028 |

| FRB Ser. 20-GC47, Class C, 3.57%, 5/12/53 W | 418,000 | 428,169 |

| Ser. 19-GC40, Class AS, 3.412%, 7/10/52 | 542,000 | 582,921 |

| Ser. 19-GC42, Class AS, 3.212%, 9/1/52 | 368,000 | 389,822 |

| Ser. 16-GS3, Class A4, 2.85%, 10/10/49 | 452,000 | 484,408 |

| GS Mortgage Securities Trust 144A | | |

| FRB Ser. 10-C1, Class D, 6.183%, 8/10/43 W | 428,000 | 212,115 |

| FRB Ser. 11-GC3, Class D, 5.558%, 3/10/44 W | 180,000 | 180,195 |

| Ser. 12-GC6, Class AS, 4.948%, 1/12/45 | 236,000 | 240,264 |

| FRB Ser. 13-GC14, Class B, 4.90%, 8/10/46 W | 282,000 | 301,632 |

| | |

| | Principal | |

| MORTGAGE-BACKED SECURITIES (35.5%)* cont. | amount | Value |

| Commercial mortgage-backed securities cont. | | |

| JPMBB Commercial Mortgage Securities Trust | | |

| FRB Ser. 14-C19, Class C, 4.831%, 4/15/47 W | $777,000 | $819,894 |

| FRB Ser. 14-C22, Class C, 4.705%, 9/15/47 W | 225,000 | 211,139 |

| FRB Ser. 13-C12, Class B, 4.236%, 7/15/45 W | 285,000 | 295,054 |

| Ser. 15-C29, Class B, 4.118%, 5/15/48 W | 586,000 | 629,095 |

| FRB Ser. 15-C33, Class XA, IO, 1.06%, 12/15/48 W | 3,406,636 | 124,140 |

| FRB Ser. 14-C22, Class XA, IO, 0.98%, 9/15/47 W | 9,496,833 | 224,620 |

| FRB Ser. 13-C12, Class XA, IO, 0.574%, 7/15/45 W | 19,995,427 | 145,867 |

| JPMBB Commercial Mortgage Securities Trust 144A | | |

| FRB Ser. 13-C17, Class D, 5.051%, 1/15/47 W | 505,000 | 505,935 |

| FRB Ser. 14-C23, Class D, 4.12%, 9/15/47 W | 437,000 | 440,011 |

| JPMorgan Chase Commercial Mortgage Securities Trust | | |

| Ser. 12-C6, Class AS, 4.117%, 5/15/45 | 264,000 | 270,706 |

| Ser. 19-COR5, Class AS, 3.669%, 6/13/52 | 804,000 | 876,962 |

| Ser. 13-C10, Class AS, 3.372%, 12/15/47 | 259,000 | 265,801 |

| Ser. 13-LC11, Class AS, 3.216%, 4/15/46 | 339,000 | 352,458 |

| FRB Ser. 19-COR5, Class XA, IO, 1.655%, 6/13/52 W | 8,389,198 | 771,937 |

| FRB Ser. 06-CB17, Class X, IO, 1.144%, 12/12/43 W | 256,841 | 5,017 |

| FRB Ser. 13-C16, Class XA, IO, 1.081%, 12/15/46 W | 8,662,229 | 170,317 |

| FRB Ser. 07-LDPX, Class X, IO, 0.581%, 1/15/49 W | 57,866 | 1 |

| FRB Ser. 06-LDP8, Class X, IO, 0.284%, 5/15/45 W | 358,260 | 3 |

| JPMorgan Chase Commercial Mortgage Securities Trust 144A | | |

| FRB Ser. 10-C2, Class C2, 5.874%, 11/15/43 W | 237,000 | 228,705 |

| FRB Ser. 12-C6, Class E, 5.313%, 5/15/45 W | 1,313,000 | 643,370 |

| FRB Ser. 12-C8, Class D, 4.825%, 10/15/45 W | 747,000 | 657,332 |

| LB-UBS Commercial Mortgage Trust FRB Ser. 07-C2, Class XW, IO, | | |

| 0.336%, 2/15/40 W | 17,869 | 1 |

| LB-UBS Commercial Mortgage Trust 144A | | |

| FRB Ser. 06-C6, Class XCL, IO, 0.777%, 9/15/39 W | 1,162,626 | 2,149 |

| FRB Ser. 07-C2, Class XCL, IO, 0.336%, 2/15/40 W | 114,523 | 5 |

| Mezz Cap Commercial Mortgage Trust 144A FRB Ser. 07-C5, Class X, | | |

| IO, 7.004%, 12/15/49 W | 1,175 | — |

| Morgan Stanley Bank of America Merrill Lynch Trust | | |

| FRB Ser. 14-C14, Class C, 5.218%, 2/15/47 W | 220,000 | 236,365 |

| Ser. 14-C18, Class C, 4.676%, 10/15/47 W | 289,000 | 308,363 |

| FRB Ser. 14-C17, Class C, 4.636%, 8/15/47 W | 591,000 | 590,918 |

| FRB Ser. 15-C24, Class B, 4.487%, 5/15/48 W | 253,000 | 276,970 |

| Ser. 13-C8, Class B, 3.694%, 12/15/48 W | 389,000 | 401,402 |

| Morgan Stanley Bank of America Merrill Lynch Trust 144A | | |

| FRB Ser. 12-C5, Class E, 4.819%, 8/15/45 W | 687,000 | 696,380 |

| FRB Ser. 12-C6, Class D, 4.759%, 11/15/45 W | 278,000 | 275,738 |

| FRB Ser. 13-C9, Class D, 4.248%, 5/15/46 W | 274,000 | 249,340 |

| Morgan Stanley Capital I Trust | | |

| Ser. 07-HQ11, Class C, 5.558%, 2/12/44 W | 74,034 | 7,403 |

| Ser. 16-BNK2, Class AS, 3.282%, 11/15/49 | 464,000 | 496,002 |

| Morgan Stanley Capital I Trust 144A | | |

| FRB Ser. 11-C3, Class B, 5.434%, 7/15/49 W | 541,000 | 543,244 |

| FRB Ser. 11-C3, Class D, 5.434%, 7/15/49 W | 185,000 | 178,732 |

| | |

| | Principal | |

| MORTGAGE-BACKED SECURITIES (35.5%)* cont. | amount | Value |

| Commercial mortgage-backed securities cont. | | |

| Multifamily Connecticut Avenue Securities Trust 144A FRB | | |

| Ser. 19-01, Class M7, 1.806%, 10/15/49 | $442,179 | $440,029 |

| UBS Commercial Mortgage Trust FRB Ser. 17-C7, Class XA, IO, | | |

| 1.18%, 12/15/50 W | 4,766,831 | 240,712 |

| UBS Commercial Mortgage Trust 144A FRB Ser. 12-C1, Class C, | | |

| 5.754%, 5/10/45 W | 285,000 | 289,418 |

| UBS-Barclays Commercial Mortgage Trust 144A FRB Ser. 12-C4, | | |

| Class XA, IO, 1.746%, 12/10/45 W | 2,403,038 | 39,140 |

| Wells Fargo Commercial Mortgage Trust | | |

| FRB Ser. 15-C30, Class C, 4.648%, 9/15/58 W | 432,000 | 471,842 |

| Ser. 18-C46, Class B, 4.633%, 8/15/51 | 226,000 | 258,661 |

| Ser. 17-RC1, Class C, 4.591%, 1/15/60 | 383,000 | 422,529 |

| FRB Ser. 13-LC12, Class C, 4.405%, 7/15/46 W | 363,000 | 316,166 |

| FRB Ser. 15-C29, Class C, 4.354%, 6/15/48 W | 287,000 | 312,830 |

| Ser. 19-C49, Class AS, 4.244%, 3/15/52 | 354,000 | 403,544 |

| Ser. 18-C45, Class A4, 4.184%, 6/15/51 | 366,000 | 416,703 |

| FRB Ser. 20-C57, Class C, 4.158%, 8/15/53 W | 481,000 | 516,572 |

| FRB Ser. 16-LC25, Class AS, 4.094%, 12/15/59 W | 504,000 | 556,563 |

| Ser. 16-BNK1, Class AS, 2.814%, 8/15/49 | 663,000 | 682,338 |

| FRB Ser. 19-C52, Class XA, IO, 1.762%, 8/15/52 W | 3,635,845 | 373,550 |

| FRB Ser. 16-LC25, Class XA, IO, 1.111%, 12/15/59 W | 4,747,030 | 180,368 |

| WF-RBS Commercial Mortgage Trust | | |

| Ser. 14-C19, Class B, 4.723%, 3/15/47 W | 899,000 | 948,993 |

| Ser. 13-C18, Class AS, 4.387%, 12/15/46 W | 826,000 | 885,274 |

| Ser. 13-UBS1, Class AS, 4.306%, 3/15/46 W | 525,000 | 555,571 |

| Ser. 14-C22, Class AS, 4.069%, 9/15/57 W | 397,000 | 431,597 |

| Ser. 13-C12, Class AS, 3.56%, 3/15/48 | 348,000 | 363,719 |

| Ser. 13-C11, Class AS, 3.311%, 3/15/45 | 386,000 | 399,113 |

| FRB Ser. 13-C14, Class XA, IO, 0.848%, 6/15/46 W | 11,899,383 | 129,019 |

| WF-RBS Commercial Mortgage Trust 144A | | |

| Ser. 11-C4, Class E, 5.317%, 6/15/44 W | 163,000 | 114,237 |

| FRB Ser. 11-C4, Class C, 5.317%, 6/15/44 W | 292,000 | 290,521 |

| FRB Ser. 12-C10, Class D, 4.574%, 12/15/45 W | 298,000 | 165,983 |

| FRB Ser. 12-C10, Class XA, IO, 1.665%, 12/15/45 W | 3,486,205 | 60,329 |

| | | 48,751,757 |

| Residential mortgage-backed securities (non-agency) (12.5%) | | |

| American Home Mortgage Investment Trust FRB Ser. 07-1, | | |

| Class GA1C, (1 Month US LIBOR + 0.19%), 0.296%, 5/25/47 | 295,637 | 165,636 |

| Arroyo Mortgage Trust 144A Ser. 19-3, Class A3, 3.416%, 10/25/48 W | 226,135 | 230,382 |

| BankUnited Trust FRB Ser. 05-1, Class 1A1, (1 Month US LIBOR | | |

| + 0.60%), 0.706%, 9/25/45 | 151,116 | 144,261 |

| Bellemeade Re, Ltd. 144A | | |

| FRB Ser. 19-4A, Class M1C, (1 Month US LIBOR + 2.50%), 2.606%, | | |

| 10/25/29 (Bermuda) | 190,000 | 190,394 |

| FRB Ser. 20-2A, Class M1A, (1 Month US LIBOR + 2.30%), 2.406%, | | |

| 8/26/30 (Bermuda) | 90,990 | 91,254 |

| BRAVO Residential Funding Trust 144A | | |

| Ser. 19-NQM1, Class A3, 2.996%, 7/25/59 W | 136,017 | 138,131 |

| Ser. 21-A, Class A1, 1.991%, 10/25/59 | 287,333 | 287,333 |

| | |

| | Principal | |

| MORTGAGE-BACKED SECURITIES (35.5%)* cont. | amount | Value |

| Residential mortgage-backed securities (non-agency) cont. | | |

| Carrington Mortgage Loan Trust FRB Ser. 06-NC2, Class A4, | | |

| (1 Month US LIBOR + 0.24%), 0.346%, 6/25/36 | $180,000 | $174,208 |

| Chevy Chase Funding, LLC Mortgage-Backed Certificates | | |

| 144A FRB Ser. 06-4A, Class A2, (1 Month US LIBOR + 0.18%), | | |

| 0.286%, 11/25/47 | 277,409 | 220,082 |

| Citigroup Mortgage Loan Trust, Inc. FRB Ser. 05-2, Class 1A2A, | | |

| 2.80%, 5/25/35 W | 191,231 | 198,629 |

| COLT Mortgage Loan Trust 144A Ser. 20-2, Class A2, | | |

| 3.094%, 3/25/65 W | 665,000 | 686,147 |

| Countrywide Alternative Loan Trust | | |

| FRB Ser. 06-OA10, Class 1A1, (1 Month US LIBOR + 0.96%), | | |

| 1.102%, 8/25/46 | 151,048 | 145,115 |

| FRB Ser. 06-OA7, Class 1A2, (1 Month US LIBOR + 0.94%), | | |

| 1.082%, 6/25/46 | 343,031 | 313,015 |

| FRB Ser. 06-OA10, Class 4A1, (1 Month US LIBOR + 0.38%), | | |

| 0.486%, 8/25/46 | 351,108 | 310,963 |

| FRB Ser. 06-OA19, Class A1, (1 Month US LIBOR + 0.18%), | | |

| 0.296%, 2/20/47 | 210,663 | 164,662 |

| Eagle Re, Ltd. 144A FRB Ser. 18-1, Class M1, (1 Month US LIBOR | | |

| + 1.70%), 1.806%, 11/25/28 (Bermuda) | 258,096 | 258,930 |

| Federal Home Loan Mortgage Corporation | | |

| Structured Agency Credit Risk Debt FRN Ser. 16-DNA3, Class M3, | | |

| (1 Month US LIBOR + 5.00%), 5.106%, 12/25/28 | 848,421 | 898,297 |

| Structured Agency Credit Risk Debt FRN Ser. 15-HQA2, Class M3, | | |

| (1 Month US LIBOR + 4.80%), 4.906%, 5/25/28 | 263,356 | 273,272 |

| Structured Agency Credit Risk Debt FRN Ser. 14-HQ3, Class M3, | | |

| (1 Month US LIBOR + 4.75%), 4.856%, 10/25/24 | 74,360 | 75,138 |

| Structured Agency Credit Risk Debt FRN Ser. 15-DNA3, Class M3, | | |

| (1 Month US LIBOR + 4.70%), 4.806%, 4/25/28 | 949,823 | 984,555 |

| Structured Agency Credit Risk Debt FRN Ser. 16-DNA2, Class M3, | | |

| (1 Month US LIBOR + 4.65%), 4.756%, 10/25/28 | 1,416,539 | 1,484,475 |

| Structured Agency Credit Risk Debt FRN Ser. 16-HQA3, Class M3, | | |

| (1 Month US LIBOR + 3.85%), 3.956%, 3/25/29 | 500,000 | 518,945 |

| Structured Agency Credit Risk Debt FRN Ser. 16-DNA4, Class M3, | | |

| (1 Month US LIBOR + 3.80%), 3.906%, 3/25/29 | 235,623 | 245,270 |

| Structured Agency Credit Risk Debt FRN Ser. 14-HQ2, Class M3, | | |

| (1 Month US LIBOR + 3.75%), 3.856%, 9/25/24 | 196,177 | 201,483 |

| Structured Agency Credit Risk Debt FRN Ser. 17-DNA2, Class M2, | | |

| (1 Month US LIBOR + 3.45%), 3.556%, 10/25/29 | 282,000 | 292,784 |

| Structured Agency Credit Risk Debt FRN Ser. 17-DNA3, Class M2, | | |

| (1 Month US LIBOR + 2.50%), 2.606%, 3/25/30 | 250,000 | 255,580 |

| Structured Agency Credit Risk Debt FRN Ser. 17-DNA3, Class M2B, | | |

| (1 Month US LIBOR + 2.50%), 2.606%, 3/25/30 | 639,000 | 652,574 |

| Structured Agency Credit Risk Debt FRN Ser. 17-DNA2, Class M1, | | |

| (1 Month US LIBOR + 1.20%), 1.306%, 10/25/29 | 70,289 | 70,384 |

| Federal Home Loan Mortgage Corporation 144A | | |

| Structured Agency Credit Risk Trust FRB Ser. 19-DNA1, Class M2, | | |

| (1 Month US LIBOR + 2.65%), 2.756%, 1/25/49 | 56,748 | 57,854 |

| Structured Agency Credit Risk Trust FRB Ser. 19-DNA2, Class M2, | | |

| (1 Month US LIBOR + 2.45%), 2.556%, 3/25/49 | 5,574 | 5,668 |

| Structured Agency Credit Risk Trust FRB Ser. 18-HRP2, Class M3, | | |

| (1 Month US LIBOR + 2.40%), 2.506%, 2/25/47 | 130,000 | 131,851 |

| | |

| | Principal | |

| MORTGAGE-BACKED SECURITIES (35.5%)* cont. | amount | Value |

| Residential mortgage-backed securities (non-agency) cont. | | |

| Federal Home Loan Mortgage Corporation 144A | | |

| Structured Agency Credit Risk Trust FRB Ser. 19-HQA1, Class M2, | | |

| (1 Month US LIBOR + 2.35%), 2.456%, 2/25/49 | $10,859 | $10,990 |

| Structured Agency Credit Risk Trust FRB Ser. 18-HQA2, Class M2, | | |

| (1 Month US LIBOR + 2.30%), 2.406%, 10/25/48 | 11,800 | 11,970 |

| Structured Agency Credit Risk Trust REMICs FRB Ser. 20-HQA1, | | |

| Class M2, (1 Month US LIBOR + 1.90%), 2.006%, 1/25/50 | 201,066 | 201,967 |

| Structured Agency Credit Risk Trust REMICs FRB Ser. 20-HQA4, | | |

| Class M1, (1 Month US LIBOR + 1.30%), 1.406%, 9/25/50 | 7,865 | 7,865 |

| Structured Agency Credit Risk Trust REMICs FRB Ser. 20-DNA5, | | |

| Class M1, (US 30 Day Average SOFR + 1.30%), 1.31%, 10/25/50 | 15,212 | 15,212 |

| Federal National Mortgage Association | | |

| Connecticut Avenue Securities FRB Ser. 16-C01, Class 1M2, | | |

| (1 Month US LIBOR + 6.75%), 6.856%, 8/25/28 | 74,368 | 78,935 |

| Connecticut Avenue Securities FRB Ser. 16-C02, Class 1M2, | | |

| (1 Month US LIBOR + 6.00%), 6.106%, 9/25/28 | 467,337 | 493,541 |

| Connecticut Avenue Securities FRB Ser. 16-C03, Class 2M2, | | |

| (1 Month US LIBOR + 5.90%), 6.006%, 10/25/28 | 60,559 | 63,824 |

| Connecticut Avenue Securities FRB Ser. 15-C04, Class 1M2, | | |

| (1 Month US LIBOR + 5.70%), 5.806%, 4/25/28 | 278,388 | 295,151 |

| Connecticut Avenue Securities FRB Ser. 15-C04, Class 2M2, | | |

| (1 Month US LIBOR + 5.55%), 5.656%, 4/25/28 | 683,970 | 721,133 |

| Connecticut Avenue Securities FRB Ser. 16-C03, Class 1M2, | | |

| (1 Month US LIBOR + 5.30%), 5.406%, 10/25/28 | 339,206 | 356,885 |

| Connecticut Avenue Securities FRB Ser. 15-C03, Class 2M2, | | |

| (1 Month US LIBOR + 5.00%), 5.106%, 7/25/25 | 1,996,154 | 2,021,432 |

| Connecticut Avenue Securities FRB Ser. 14-C04, Class 2M2, | | |

| (1 Month US LIBOR + 5.00%), 5.106%, 11/25/24 | 64,843 | 66,389 |

| Connecticut Avenue Securities FRB Ser. 16-C05, Class 2M2, | | |

| (1 Month US LIBOR + 4.45%), 4.556%, 1/25/29 | 549,551 | 573,372 |

| Connecticut Avenue Securities FRB Ser. 16-C07, Class 2M2, | | |

| (1 Month US LIBOR + 4.35%), 4.456%, 5/25/29 | 692,557 | 720,939 |

| Connecticut Avenue Securities FRB Ser. 15-C01, Class 1M2, | | |

| (1 Month US LIBOR + 4.30%), 4.406%, 2/25/25 | 134,833 | 137,921 |

| Connecticut Avenue Securities FRB Ser. 16-C06, Class 1M2, | | |

| (1 Month US LIBOR + 4.25%), 4.356%, 4/25/29 | 1,896,912 | 1,976,109 |

| Connecticut Avenue Securities FRB Ser. 16-C04, Class 1M2, | | |

| (1 Month US LIBOR + 4.25%), 4.356%, 1/25/29 | 2,462,681 | 2,580,827 |

| Connecticut Avenue Securities FRB Ser. 15-C02, Class 1M2, | | |

| (1 Month US LIBOR + 4.00%), 4.106%, 5/25/25 | 58,618 | 59,564 |

| Connecticut Avenue Securities FRB Ser. 15-C02, Class 2M2, | | |

| (1 Month US LIBOR + 4.00%), 4.106%, 5/25/25 | 98,622 | 99,872 |

| Connecticut Avenue Securities FRB Ser. 17-C01, Class 1M2, | | |

| (1 Month US LIBOR + 3.55%), 3.656%, 7/25/29 | 1,175,904 | 1,215,393 |

| Connecticut Avenue Securities FRB Ser. 14-C03, Class 2M2, | | |

| (1 Month US LIBOR + 2.90%), 3.006%, 7/25/24 | 799,376 | 809,292 |

| Connecticut Avenue Securities FRB Ser. 18-C05, Class 1M2, | | |

| (1 Month US LIBOR + 2.35%), 2.456%, 1/25/31 | 60,768 | 61,604 |

| Connecticut Avenue Securities FRB Ser. 17-C05, Class 1M2A, | | |

| (1 Month US LIBOR + 2.20%), 2.306%, 1/25/30 | 82,071 | 82,327 |

| Connecticut Avenue Securities FRB Ser. 17-C02, Class 2ED3, | | |

| (1 Month US LIBOR + 1.35%), 1.456%, 9/25/29 | 243,727 | 244,794 |

| | |

| | Principal | |

| MORTGAGE-BACKED SECURITIES (35.5%)* cont. | amount | Value |

| Residential mortgage-backed securities (non-agency) cont. | | |

| Federal National Mortgage Association | | |

| Connecticut Avenue Securities FRB Ser. 17-C01, Class 1EB1, | | |

| (1 Month US LIBOR + 1.25%), 1.356%, 7/25/29 | $230,000 | $230,036 |

| Connecticut Avenue Securities FRB Ser. 17-C07, Class 1EB2, | | |

| (1 Month US LIBOR + 1.00%), 1.106%, 5/25/30 | 603,000 | 602,117 |

| Federal National Mortgage Association 144A | | |

| Connecticut Avenue Securities Trust FRB Ser. 19-R01, Class 2M2, | | |

| (1 Month US LIBOR + 2.45%), 2.556%, 7/25/31 | 43,963 | 44,211 |

| Connecticut Avenue Securities Trust FRB Ser. 19-HRP1, Class M2, | | |

| (1 Month US LIBOR + 2.15%), 2.256%, 11/25/39 | 61,093 | 60,194 |

| Connecticut Avenue Securities Trust FRB Ser. 20-R01, Class 1M2, | | |

| (1 Month US LIBOR + 2.05%), 2.156%, 1/25/40 | 1,646,072 | 1,656,586 |

| GCAT Trust 144A Ser. 20-NQM2, Class A2, 2.272%, 4/25/65 | 162,998 | 165,540 |

| GSAA Home Equity Trust Ser. 06-15, Class AF3A, 5.882%, 9/25/36 W | 1,018,873 | 468,002 |

| Home Re, Ltd. 144A FRB Ser. 18-1, Class M1, (1 Month US LIBOR | | |

| + 1.60%), 1.706%, 10/25/28 (Bermuda) | 87,005 | 87,004 |

| Homeward Opportunities Fund I Trust 144A Ser. 20-2, Class A2, | | |

| 2.635%, 5/25/65 W | 200,000 | 206,202 |

| JP Morgan Alternative Loan Trust FRB Ser. 07-S1, Class A1, (1 Month | | |

| US LIBOR + 0.28%), 0.386%, 4/25/47 | 258,472 | 252,657 |

| Legacy Mortgage Asset Trust 144A | | |

| Ser. 20-GS5, Class A1, 3.25%, 6/25/60 | 278,365 | 283,236 |

| FRB Ser. 19-GS7, Class A1, 3.25%, 11/25/59 | 361,649 | 364,181 |

| FRB Ser. 20-GS1, Class A1, 2.882%, 10/25/59 | 693,391 | 698,938 |

| Merrill Lynch Mortgage Investors Trust FRB Ser. 05-A2, Class A2, | | |

| 2.783%, 2/25/35 W | 105,882 | 109,754 |

| Morgan Stanley Resecuritization Trust 144A Ser. 15-R4, Class CB1, | | |

| 0.934%, 8/26/47 W | 170,000 | 163,532 |

| New Residential Mortgage Loan Trust 144A FRB Ser. 18-4A, | | |

| Class A1M, (1 Month US LIBOR + 0.90%), 1.006%, 1/25/48 | 93,836 | 94,625 |

| OSW Structured Asset Trust 144A FRB Ser. 20-RPL1, Class A1, | | |

| 3.199%, 12/26/59 | 303,942 | 305,935 |

| Pretium Mortgage Credit Partners, LLC 144A Ser. 20-RPL2, | | |

| Class A1, 3.179%, 6/27/69 | 239,342 | 240,047 |

| Renaissance Home Equity Loan Trust FRB Ser. 03-4, Class A1, | | |

| (1 Month US LIBOR + 1.04%), 1.146%, 3/25/34 | 177,367 | 175,088 |

| Structured Asset Mortgage Investments II Trust | | |

| FRB Ser. 07-AR7, Class 1A1, (1 Month US LIBOR + 0.85%), | | |

| 0.956%, 5/25/47 | 360,726 | 301,306 |

| FRB Ser. 07-AR1, Class 2A1, (1 Month US LIBOR + 0.18%), | | |

| 0.286%, 1/25/37 | 188,022 | 179,183 |

| Triangle Re, Ltd. 144A FRB Ser. 21-1, Class M1B, (1 Month US LIBOR | | |

| + 3.00%), 3.106%, 8/25/33 (Bermuda) | 250,000 | 250,339 |

| Vista Point Securitization Trust 144A FRB Ser. 20-2, Class A2, | | |

| 1.986%, 4/25/65 W | 217,741 | 220,470 |

| WaMu Mortgage Pass-Through Certificates Trust | | |

| FRB Ser. 05-AR10, Class 1A3, 3.09%, 9/25/35 W | 126,686 | 127,660 |

| FRB Ser. 05-AR12, Class 1A8, 2.896%, 10/25/35 W | 400,806 | 397,218 |

| FRB Ser. 05-AR13, Class A1C3, (1 Month US LIBOR + 0.98%), | | |

| 1.086%, 10/25/45 | 186,768 | 185,684 |

| | |

| | Principal | |

| MORTGAGE-BACKED SECURITIES (35.5%)* cont. | amount | Value |

| Residential mortgage-backed securities (non-agency) cont. | | |

| WaMu Mortgage Pass-Through Certificates Trust | | |

| FRB Ser. 05-AR9, Class A1C3, (1 Month US LIBOR + 0.96%), | | |

| 1.066%, 7/25/45 | $281,094 | $267,489 |

| FRB Ser. 05-AR1, Class A1B, (1 Month US LIBOR + 0.78%), | | |

| 0.886%, 1/25/45 | 163,162 | 157,956 |