April 2019 Investor Presentation Exhibit 99.1

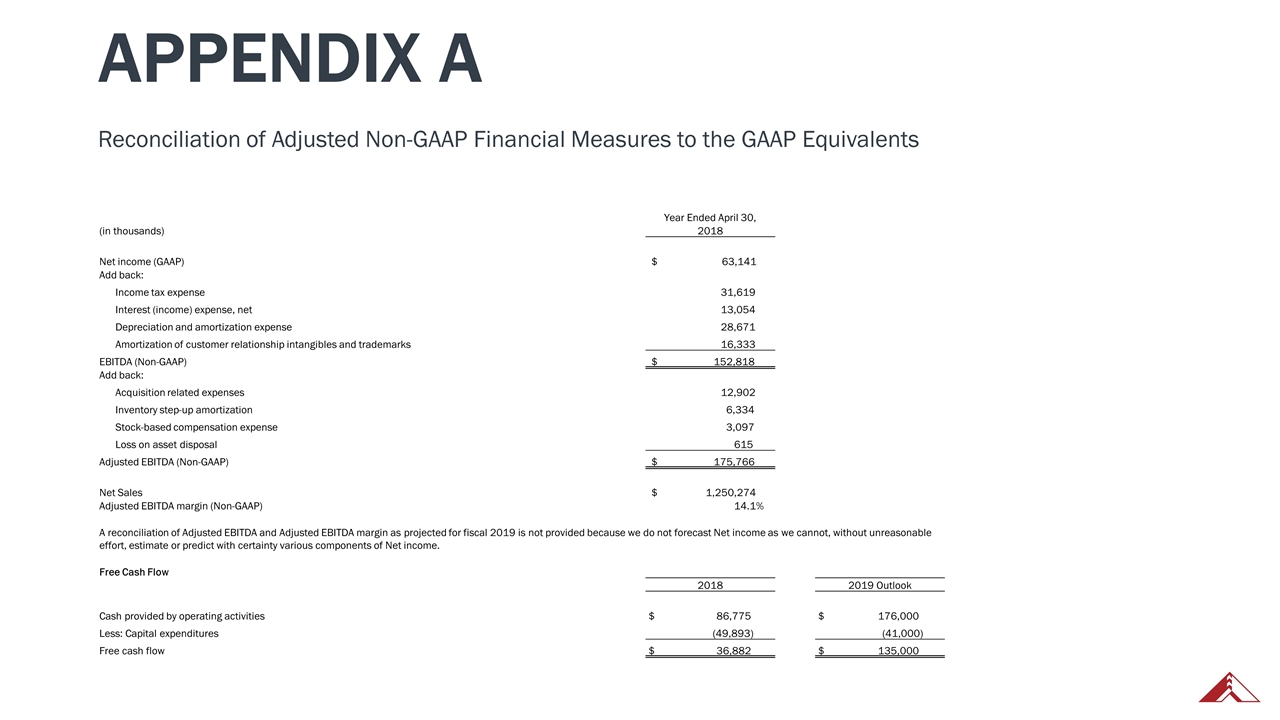

Legal Disclosure Forward-Looking Statements This communication contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements as to expected future financial and operating results. These forward-looking statements may be identified by the use of words such as “anticipate,” “estimate,” “forecast,” “expect,” “believe,” “should,” “could,” “would,” “plan,” “may,” “intend,” “prospect,” “goal,” “will,” “predict,” or “potential” or other similar words or variations thereof. These statements are based on the current beliefs and expectations of the management of American Woodmark and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially from those expressed herein. These risks and uncertainties are detailed in American Woodmark’s filings with the Securities and Exchange Commission (“SEC”), including in its Annual Report on Form 10-K for the year ended April 30, 2018 under the heading “Risk Factors,” its Quarterly Report on Form 10-Q for the period ended October 31, 2018 under the heading “Risk Factors” and its Quarterly Report on Form 10-Q for the period ended January 31, 2019 under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Forward-Looking Statements” and “Risk Factors.” These reports, as well as the other documents filed by American Woodmark with the SEC, are available free of charge at the SEC’s website at www.sec.gov. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures, including Adjusted EBITDA Margin and Free Cash Flow. These measures are intended to serve as a supplement to, and not a substitute for, the most comparable GAAP measures. Reconciliations of these non-GAAP financial measures to the most comparable GAAP financial measures are provided in Appendix A of this presentation.

“With our people as our foundation, there is no limit to what we can accomplish.” Cary Dunston, Chairman & CEO

Creating Value Through People American Woodmark focuses on our culture of caring throughout all levels of the company. This exemplifies our mission statement of creating value through people and our four guiding principles. Customer Satisfaction Provide the best possible quality, service and value to the greatest number of people by doing whatever is reasonable and sometimes unreasonable. Integrity Do what is right: act fairly and responsibly, care about the dignity of each person and be a good citizen within the community. Teamwork Understand that we must all work together in order to succeed. Realize that each person must contribute to the team to be part of the team. Excellence Strive to perform every job or action in a superior way. Be innovative, always helping others become the best they can be.

Meet Our Leadership Team Our leaders operate with integrity, always staying true to American Woodmark's vision. S. Cary Dunston Chairman & CEO M. Scott Culbreth Senior Vice President Chief Financial Officer R. Perry Campbell Senior Vice President Sales and Marketing Rob Adams Senior Vice President Value Stream Operations

Executive Summary A quick look at our market strengths

Strategic Focus We make disciplined long-term strategic investments while still paying attention to the market. Superior Customer Experience From design to post-installation services, our focus is on the customer experience across all channels and product platforms. Culture We have a culture that celebrates the power of story and creating value through people. How we win in the market Our ability to consistently perform for our customers, employees and investors is built on three critical factors:

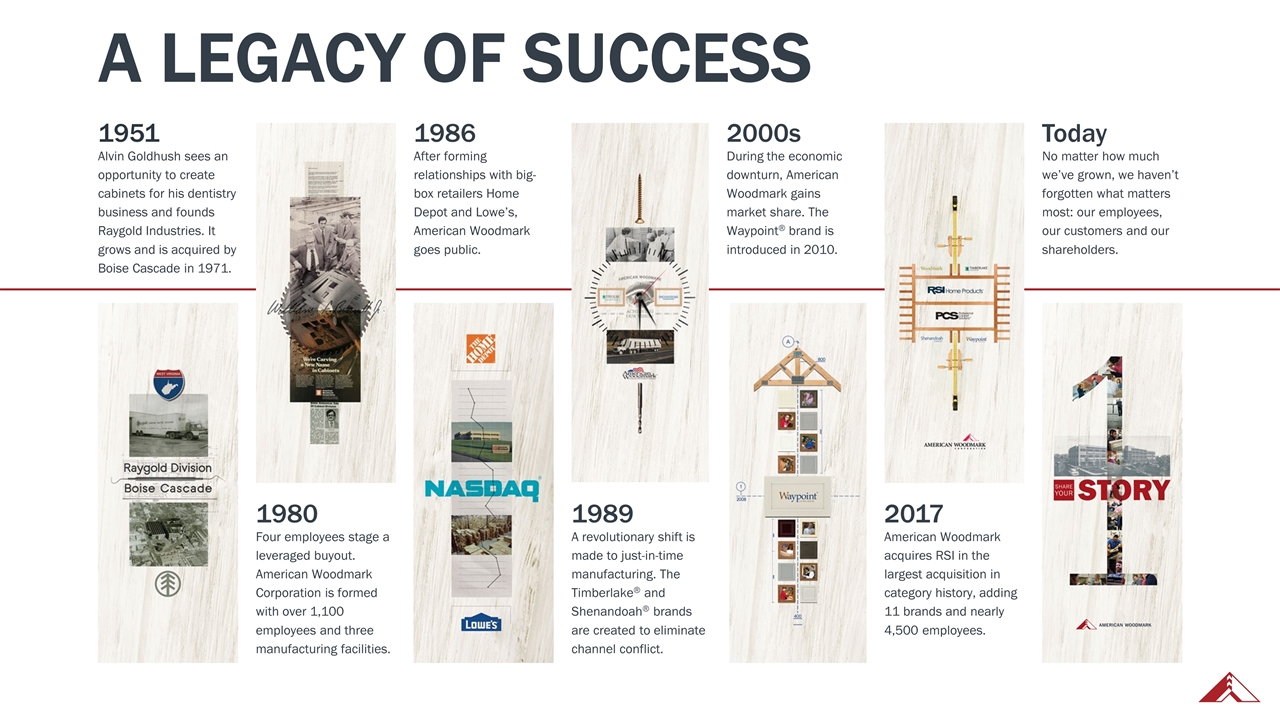

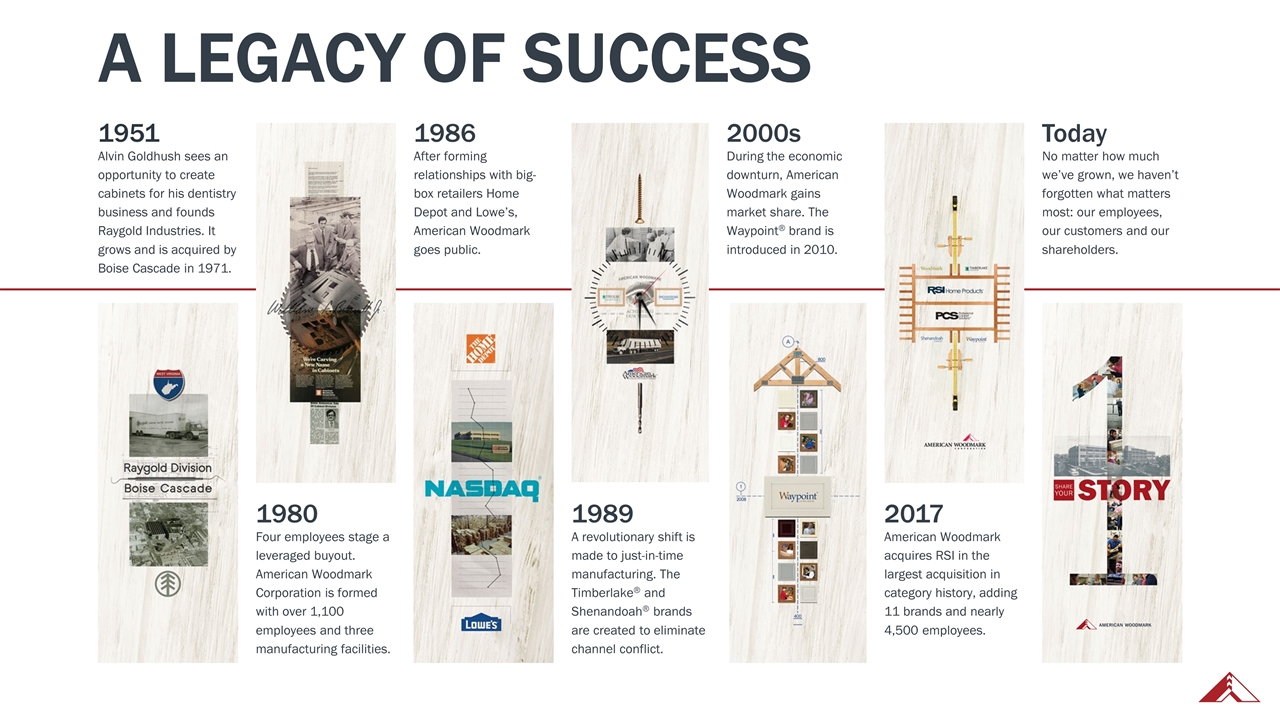

Today No matter how much we’ve grown, we haven’t forgotten what matters most: our employees, our customers and our shareholders. 1989 A revolutionary shift is made to just-in-time manufacturing. The Timberlake® and Shenandoah® brands are created to eliminate channel conflict. 2000s During the economic downturn, American Woodmark gains market share. The Waypoint® brand is introduced in 2010. 1951 Alvin Goldhush sees an opportunity to create cabinets for his dentistry business and founds Raygold Industries. It grows and is acquired by Boise Cascade in 1971. 1986 After forming relationships with big-box retailers Home Depot and Lowe’s, American Woodmark goes public. 2017 American Woodmark acquires RSI in the largest acquisition in category history, adding 11 brands and nearly 4,500 employees. 1980 Four employees stage a leveraged buyout. American Woodmark Corporation is formed with over 1,100 employees and three manufacturing facilities. A Legacy of Success

A Market Primed for Growth Source: Home Improvement Institute (HIRI) Outlook for the US Economy and Home Improvement Spending, May 22, 2018. The market continues to look strong in our category. Projected cabinet industry sales of $17.1 billion by 2021 are driven by a mix of positive indicators in the new construction and remodel sectors. Remodeling activity on the rise. Deferred remodel spending during the recession and a high volume of homes built 1996–2006 aging into potential remodel projects. Pent-up demand for homes. Housing starts and a shift toward lower-priced homes over-indexes future growth. Our acquisition of RSI allows us to capitalize. Housing starts are strong. Up to ~900K new single-family homes in 2018. Projections indicate more to come. 1.2 million single-family housing starts in 2020–2021 fueled by millennial first-time homebuyers. Single Family Improvement Products Market

One Company Strategically focused on success

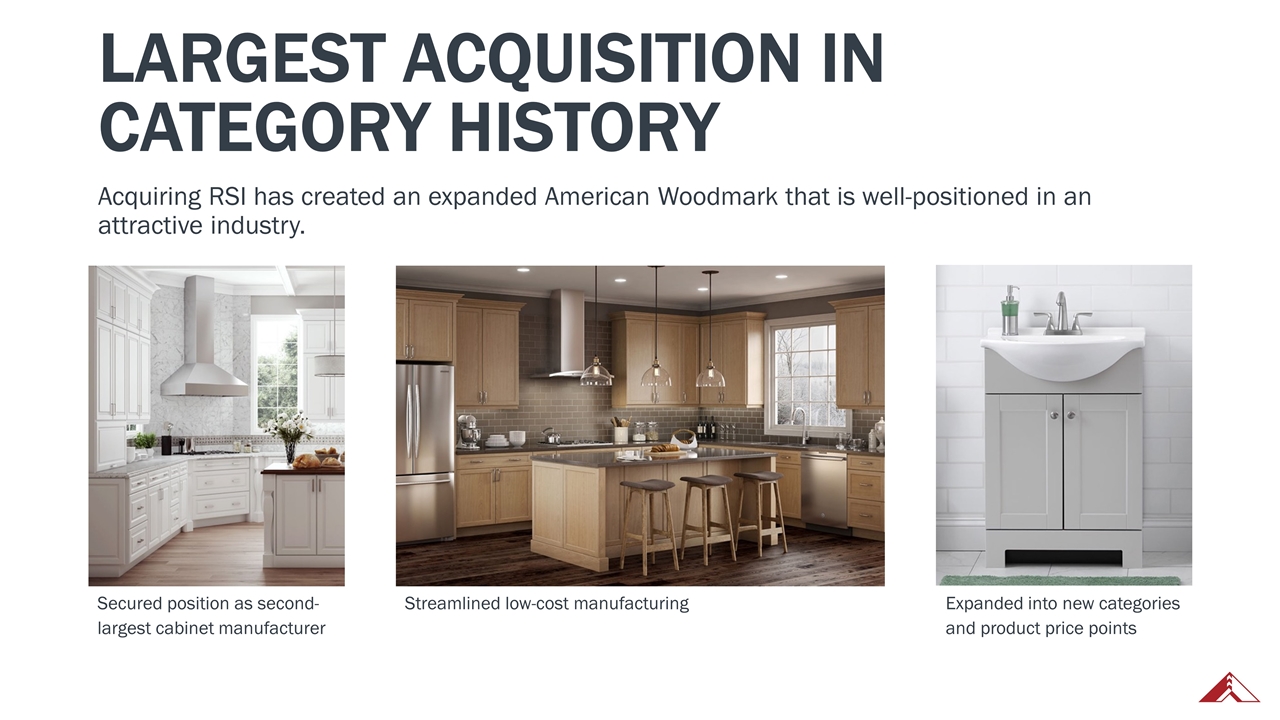

Largest Acquisition in Category History Acquiring RSI has created an expanded American Woodmark that is well-positioned in an attractive industry. Secured position as second-largest cabinet manufacturer Streamlined low-cost manufacturing Expanded into new categories and product price points

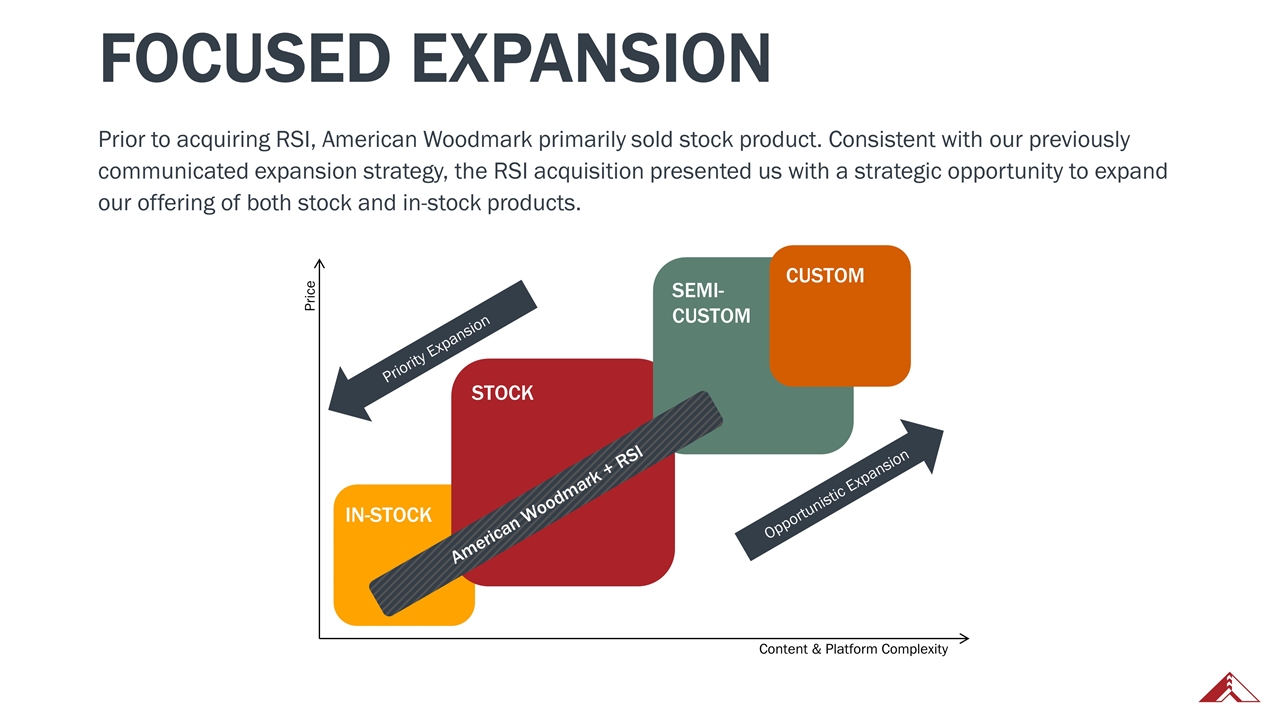

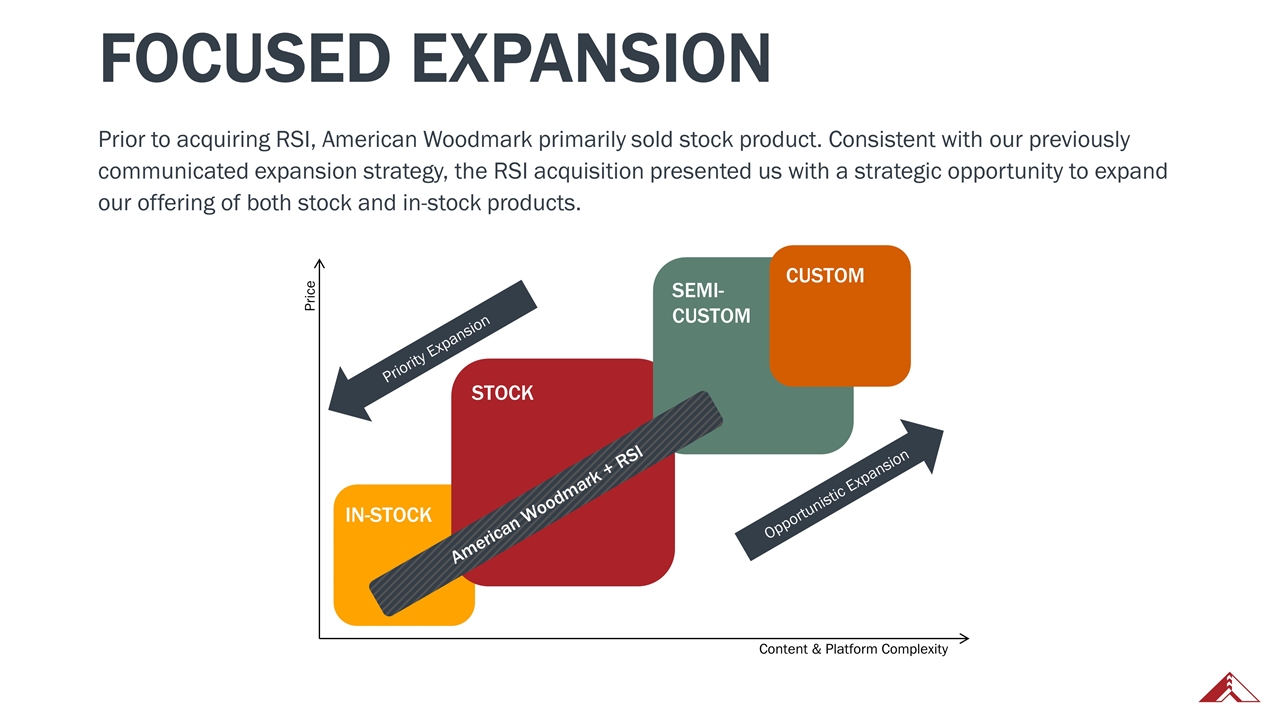

Focused Expansion Prior to acquiring RSI, American Woodmark primarily sold stock product. Consistent with our previously communicated expansion strategy, the RSI acquisition presented us with a strategic opportunity to expand our offering of both stock and in-stock products. Priority Expansion Opportunistic Expansion Price Content & Platform Complexity IN-STOCK STOCK SEMI- CUSTOM CUSTOM American Woodmark + RSI

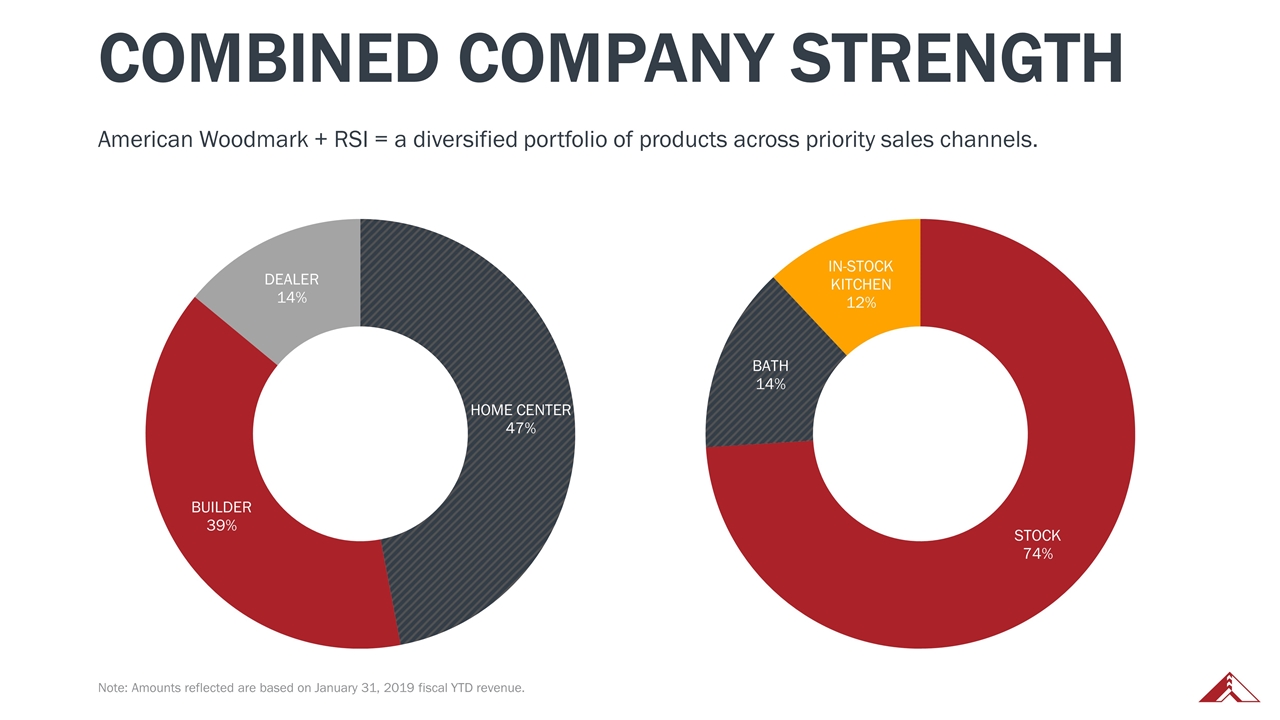

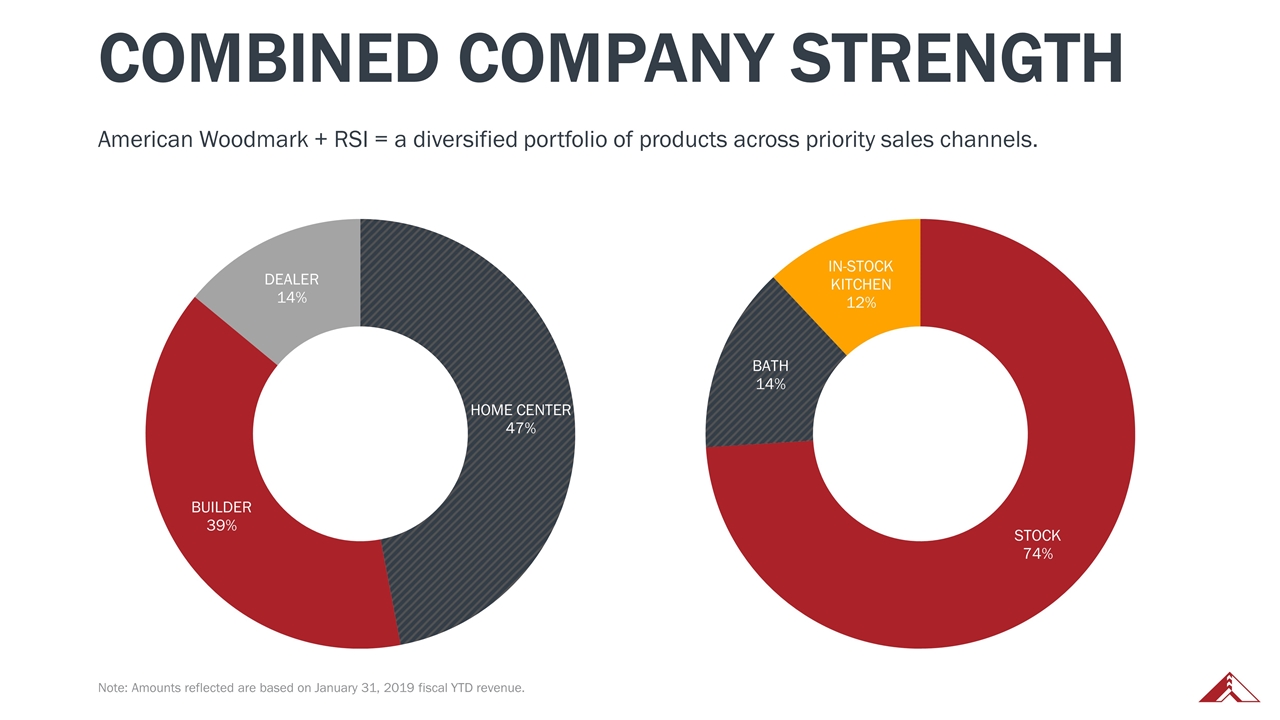

Combined Company Strength Note: Amounts reflected are based on January 31, 2019 fiscal YTD revenue. American Woodmark + RSI = a diversified portfolio of products across priority sales channels.

The Right Product Mix American Woodmark has a broad range of value-focused solutions for kitchen, bath and home organization. A Strong Portfolio of Brands Over 15 brands supporting the home center, builder and dealer channels. Creating New Brands to Leverage Opportunities Our new Origins by Timberlake™ brand offers lower price point products for sub-$300K homes. Combined Company Strength

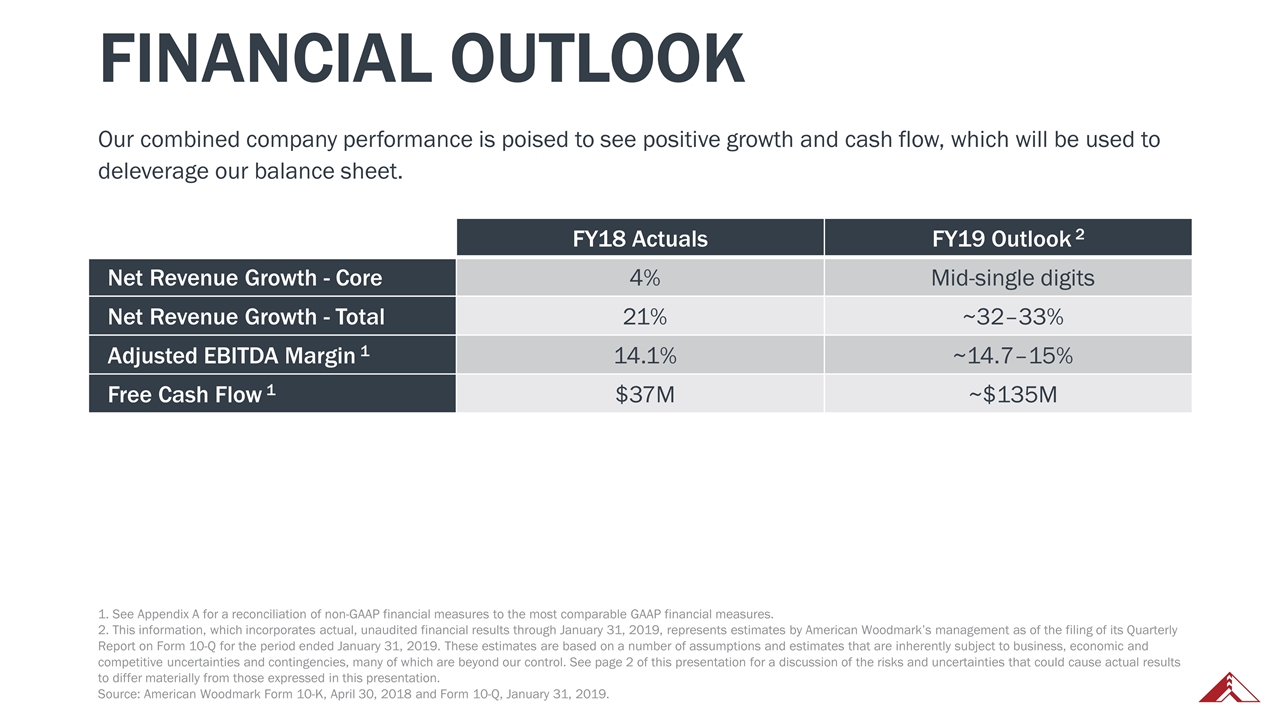

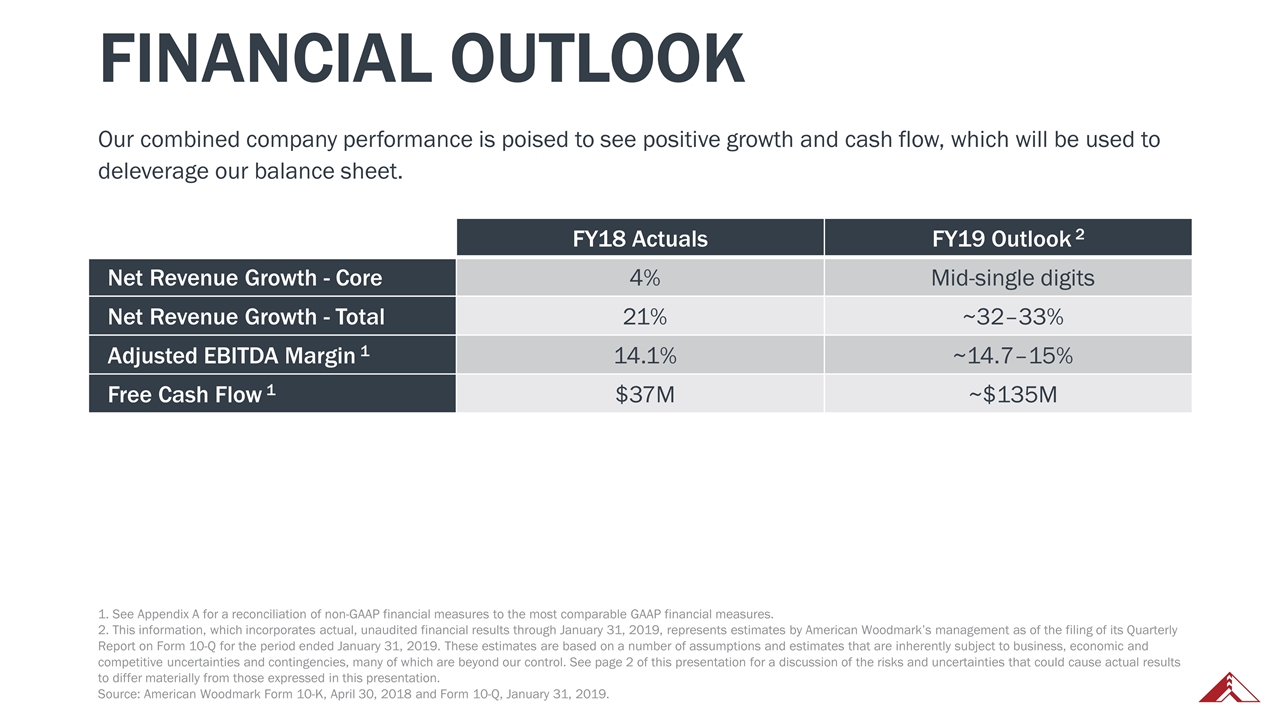

Financial Outlook FY18 Actuals FY19 Outlook 2 Net Revenue Growth - Core 4% Mid-single digits Net Revenue Growth - Total 21% ~32–33% Adjusted EBITDA Margin 1 14.1% ~14.7–15% Free Cash Flow 1 $37M ~$135M Our combined company performance is poised to see positive growth and cash flow, which will be used to deleverage our balance sheet. 1. See Appendix A for a reconciliation of non-GAAP financial measures to the most comparable GAAP financial measures. 2. This information, which incorporates actual, unaudited financial results through January 31, 2019, represents estimates by American Woodmark’s management as of the filing of its Quarterly Report on Form 10-Q for the period ended January 31, 2019. These estimates are based on a number of assumptions and estimates that are inherently subject to business, economic and competitive uncertainties and contingencies, many of which are beyond our control. See page 2 of this presentation for a discussion of the risks and uncertainties that could cause actual results to differ materially from those expressed in this presentation. Source: American Woodmark Form 10-K, April 30, 2018 and Form 10-Q, January 31, 2019.

Our Competitive Strengths

Competitive Strengths Ensuring that customers receive the products on time, so homeowners are satisfied Understanding channels and how to better serve them Providing the right products at the right price to meet demand Manufacturing an array of products to the highest standard

Home Center Channel American Woodmark has focused on the home center channel from our inception in 1980. The acquisition of RSI has allowed us to further diversify within this space. Our low-cost manufacturing and operational excellence allows for an attractive price point. National logistics platform and Special Order customer service meets and exceeds expectations. Home Depot “Partner of the Year” award recipient.

In the midst of the last recession, American Woodmark made a strategic decision to leverage our conservative approach to cash flow to launch a dealer-focused brand, Waypoint Living Spaces®. Why? We foresaw an opportunity to expand into the dealer channel and position ourselves to capitalize on pent-up remodeling demand once the financial climate was more favorable. The dealer channel is currently the largest channel in the industry. $435B Forecasted home improvement spend in 2020 Source: Home Improvement Institute (HIRI) Home Improvement Products Market Forecast Update, March 2018. HIS/HIRI Report No. 63. Dealer/Distributor Channel

American Woodmark has focused on the new construction market for over 25 years and in that time has built the largest cabinetry brand in the builder channel. Our strong market share is driven by our focus on serving builder customers through our local service centers and experienced teams. We’ve built a turnkey solution for new home builds. In 2018, we launched Origins by Timberlake™ to leverage our low-cost manufacturing platform and promote additional share gains in the opening price points of the new home construction industry. 1.2M+ Projected single-family homes built in 2020 - 2021 Source: Home Improvement Institute (HIRI) Outlook for the US Economy and Home Improvement Spending. May 22, 2018. Builder Channel

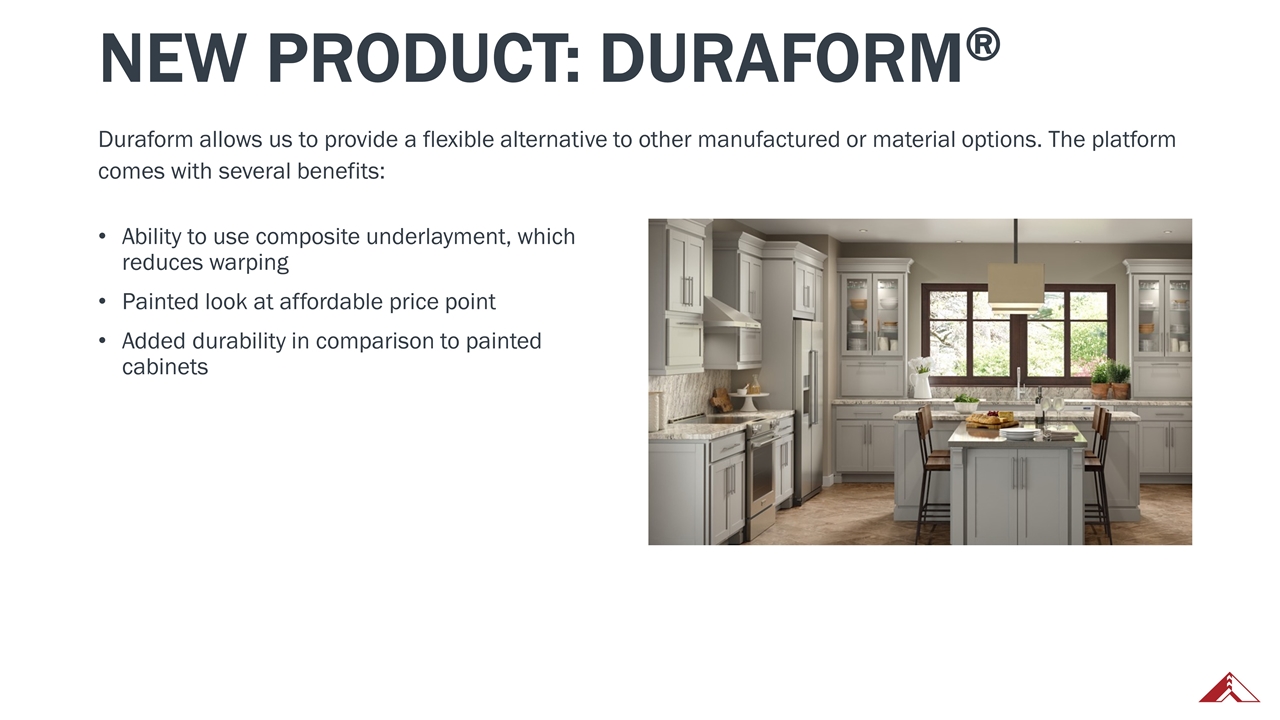

New Product: Duraform® Ability to use composite underlayment, which reduces warping Painted look at affordable price point Added durability in comparison to painted cabinets Duraform allows us to provide a flexible alternative to other manufactured or material options. The platform comes with several benefits:

Best-in-Industry Manufacturing Capabilities Vertically integrated production and assembly lines Standardized product construction Investments in automation Strategically located labor-intensive manufacturing in lower-cost Mexican facilities Opportunities Available capacity to drive additional sales Leverage service platform to drive growth Utilize our lower-cost manufacturing facilities in Mexico Real-world innovation: Vision scan chop system, vacuum kilns, manufacturing intelligence and analytics Manufacturing Innovation

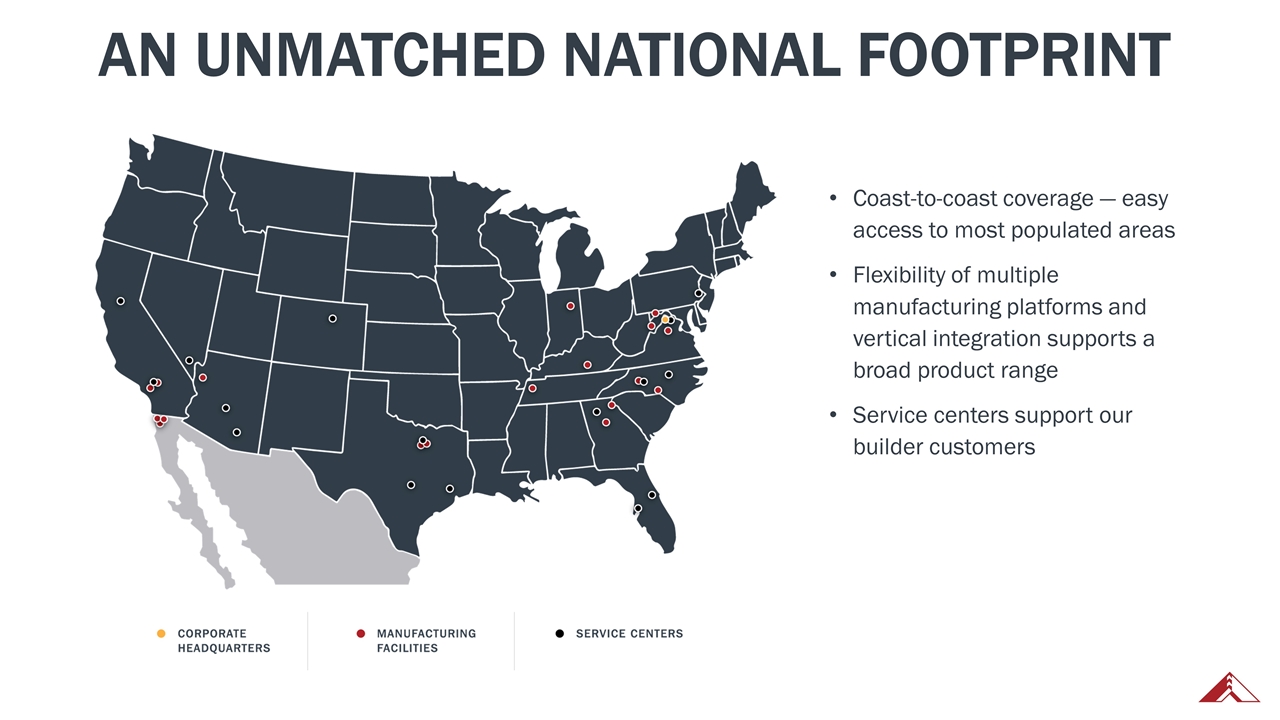

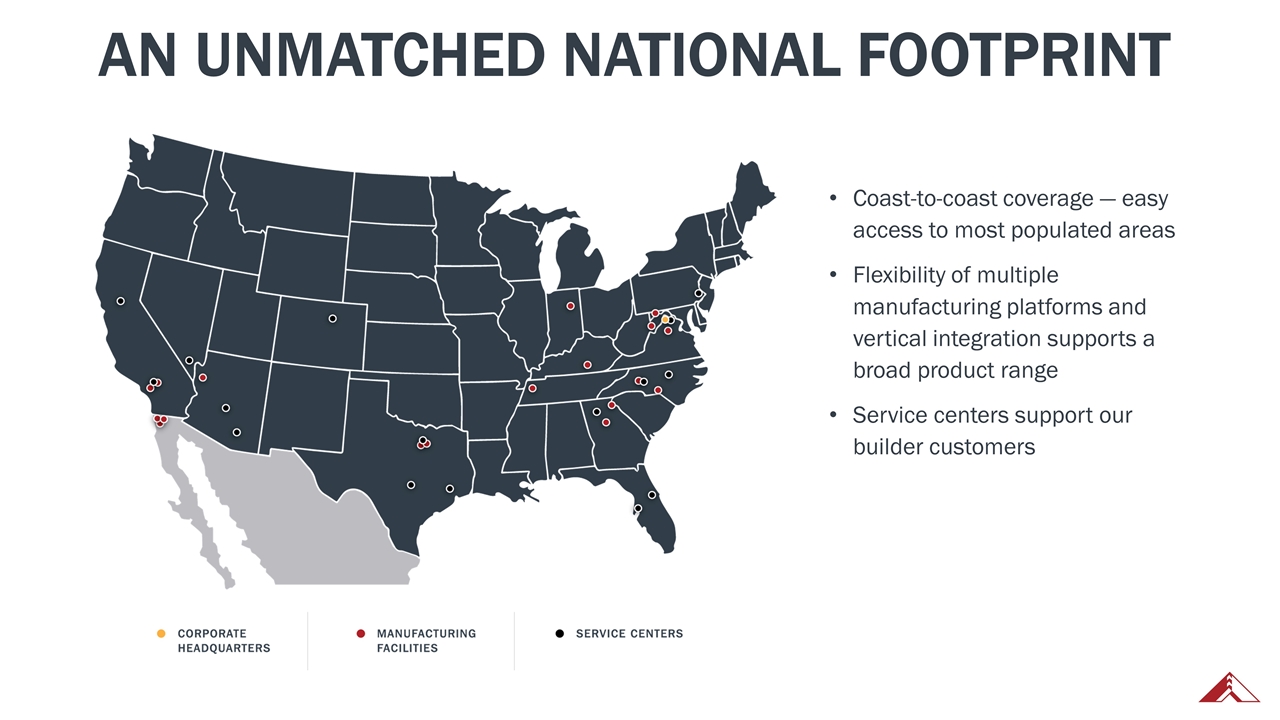

An Unmatched National Footprint Coast-to-coast coverage — easy access to most populated areas Flexibility of multiple manufacturing platforms and vertical integration supports a broad product range Service centers support our builder customers

A key competitive advantage is our ability to handle all parts of the process from design to installation. Excellent customer service means we meet the demands of customers, ensuring a consistent experience. Turnkey Builder Solution

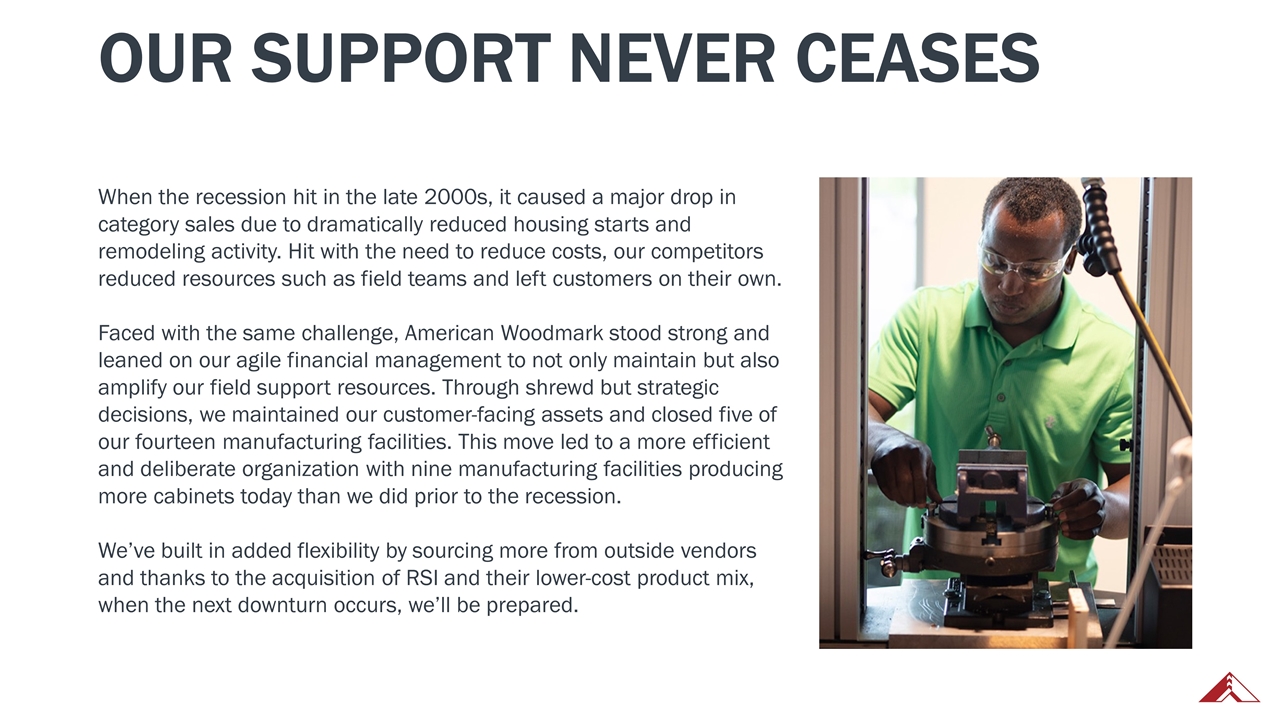

Our Support Never Ceases When the recession hit in the late 2000s, it caused a major drop in category sales due to dramatically reduced housing starts and remodeling activity. Hit with the need to reduce costs, our competitors reduced resources such as field teams and left customers on their own. Faced with the same challenge, American Woodmark stood strong and leaned on our agile financial management to not only maintain but also amplify our field support resources. Through shrewd but strategic decisions, we maintained our customer-facing assets and closed five of our fourteen manufacturing facilities. This move led to a more efficient and deliberate organization with nine manufacturing facilities producing more cabinets today than we did prior to the recession. We’ve built in added flexibility by sourcing more from outside vendors and thanks to the acquisition of RSI and their lower-cost product mix, when the next downturn occurs, we’ll be prepared.

Strategic Outlook Building on our strengths

A core component of our success is our focus on staying ahead of the game. Operational Efficiency We continue to invest in technology to increase the efficiency of manufacturing and the quality of our product. Value Stream Fortification We constantly seek to identify consumer solutions that will lead to expansion into adjacent segments or up the value stream. Market Expansion We recognize opportunities to further expand within the builder channel. Planning for the Future

WHY INVEST IN AMERICAN WOODMARK? It’s simple. We are continuing to grow and position ourselves as a leader in the industry, and it’s our key differentiators that set us up for success in all parts of the business. 5 6 4 2 1 3 Leader and innovator in all major sales channels — home center, builder, and dealer/distributor. A culture that encourages employees to take ownership, which in turn creates a better product for our customers. An unmatched and steadfast dedication to customer service. Focus on strategic and pragmatic business decisions and a spirit of perseverance. National logistics network and best-in-industry manufacturing capabilities. American Woodmark is poised to capitalize on opportunities in the market with the acquisition of RSI.

Questions? Contact: Kevin Dunnigan Treasury Director (540) 665-9100

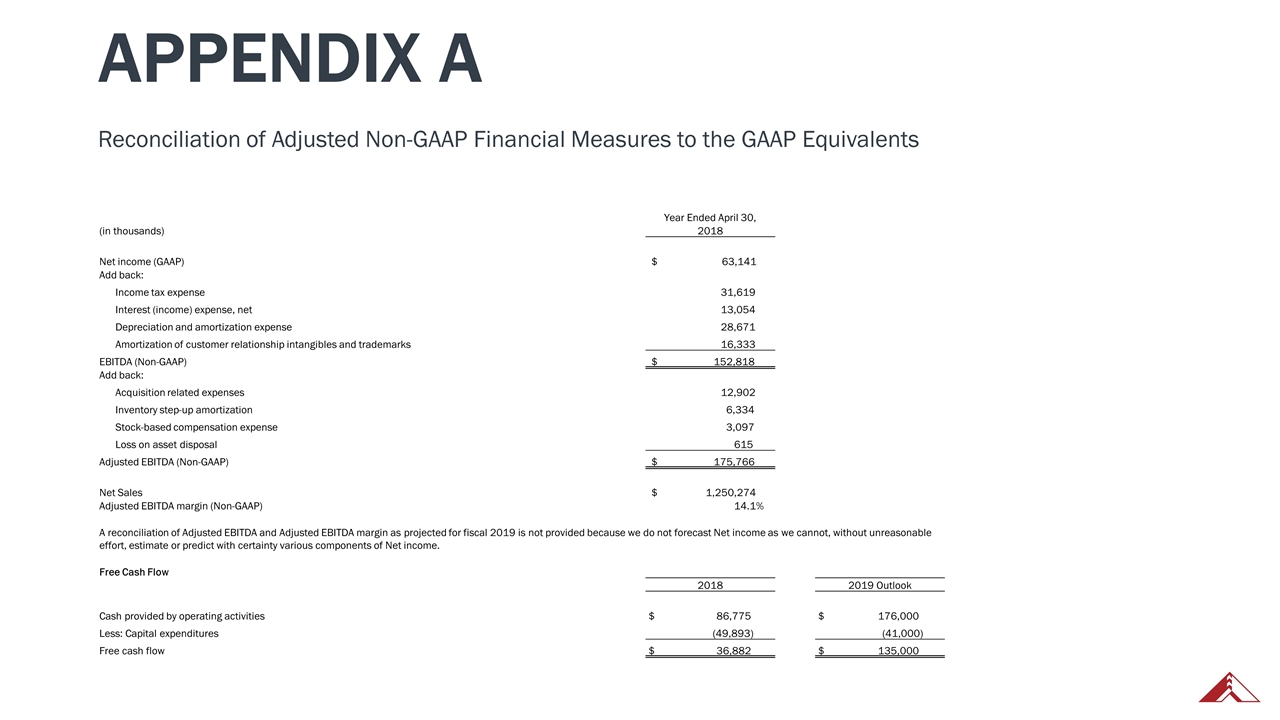

Appendix A Reconciliation of Adjusted Non-GAAP Financial Measures to the GAAP Equivalents Year Ended April 30, (in thousands) 2018 Net income (GAAP) $ 63,141 Add back: Income tax expense 31,619 Interest (income) expense, net 13,054 Depreciation and amortization expense 28,671 Amortization of customer relationship intangibles and trademarks 16,333 EBITDA (Non-GAAP) $ 152,818 Add back: Acquisition related expenses 12,902 Inventory step-up amortization 6,334 Stock-based compensation expense 3,097 Loss on asset disposal 615 Adjusted EBITDA (Non-GAAP) $ 175,766 Net Sales $ 1,250,274 Adjusted EBITDA margin (Non-GAAP) 14.1% A reconciliation of Adjusted EBITDA and Adjusted EBITDA margin as projected for fiscal 2019 is not provided because we do not forecast Net income as we cannot, without unreasonable effort, estimate or predict with certainty various components of Net income. Free Cash Flow 2018 2019 Outlook Cash provided by operating activities $ 86,775 $ 176,000 Less: Capital expenditures (49,893) (41,000) Free cash flow $ 36,882 $ 135,000