UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-04704

The Primary Trend Fund, Inc.

700 North Water Street

Milwaukee, WI 53202

(Address of principal executive offices)

Arnold Investment Counsel Incorporated

700 North Water Street

Wisconsin, WI 53202

(Name and address of agent for service)

Registrant's telephone number, including area code: (414) 271-2726

Date of fiscal year end: June 30

Date of reporting period: June 30, 2007

Item 1. Reports to Stockholders

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1)

ANNUAL REPORT

The Primary

Trend Fund

MILWAUKEE, WISCONSIN

JUNE 30, 2007

MESSAGE TO SHAREHOLDERS . . .

“We are entering some rarefied air at this stage of the game. Typically, the stock market tends to follow a four-year cycle from trough-to-trough and based on the bottom made in 2002-03, this bull has defied history and is stretching the rubber band quite a bitÉ In our minds, we still view Ben Bernanke’s commandeering of the yield curve and its effect on the bond market as a major unknown. But more importantly, we are leery of the hedge fund industry’s vulnerability in a rising-rate environment and the esoteric and exotic by-products that seem to implode when markets go awry.” |

The Primary Trend Funds

December 31, 2006 – Semi-Annual Report

It seems quite obvious what the potential “fly in the ointment” is for this stock market – the subprime implosion and its ripple effect upon the credit markets – from the highest quality end of the spectrum (U.S. Treasuries) to the weak sisters in the junk bond camp. Hedge funds, private-equity shops and the rest of the Wall Street financial engineers have created $400 trillion of these exotic credit instruments.

Over the past year, however, while the housing market’s cauldron of trouble continues to simmer, the equity markets have put on a spectacular display of robust performance. This has been capped by the DJIA’s recent climb above 14,000 for the first time ever. And it has been led by the transition from the more aggressive small- to mid-cap names to investors’ appetite for the more seasoned large-cap blue chips. As 2007 unfolds, we believe this shift will only become more pronounced as investors seek the safety of blue chips.

For the 12 months ended 6/30/07, the Standard & Poor’s SmallCap 600 Index and the Standard & Poor’s MidCap 400 Index registered total returns of +16.04% and +18.51%, respectively, while the Standard & Poor’s 500 Index returned +20.59%. For the same period, long bonds (30-year U.S. Treasuries) returned +5.75%, while cash provided the risk-free rate of return of +5.19%.

For the 12 months ended 6/30/07, the Primary Trend Fund generated the following total return for its shareholders:

The Primary Trend Fund | +17.56% |

The Primary Trend Fund

As investors, we’ve never been accused of being short-term or churning the portfolio. This is most obvious in our sector weightings. Health Care stocks still comprise the largest sector investment in the Primary Trend Fund portfolio with a 16.9% concentration. This compares to the S&P 500 Composite’s Healthcare weighting of 11.8%. While we sold our Bristol-Myers Squibb position on merger news and have taken some profits in Abbott Labs, we have also beefed up our Eli Lilly position and added two new names to our drug stable: Amgen and Mylan Labs. Performance by pharmaceutical stocks has been strong over the past year, but valuations are still attractive and institutional demand for these equities is still lukewarm – both appealing ingredients to long-term value investors.

The Primary Trend Fund’s second most important sector over the past year is Financials – not because we are overweighted in these stocks, but just the opposite – because we are underweighted. At 21.0% of the S&P 500 Composite, Financials (banks, brokerages, insurance, mortgage, et al.) are the biggest piece of the market pie. By contrast, the Primary Trend Fund has a scant 8.0% invested in financial stocks (Allstate, Chubb, New York Community Bancorp and PartnerRe). While the S&P GIC Financials Index returned +14.69% over the past year (through 6/30/07), it has been bleeding red in the past six months (-0.79%), while the stock market has been hitting new all-time highs. As we will discuss later, poor relative performance by the Financials is a harbinger of tough times in the stock market. The

MESSAGE TO SHAREHOLDERS . . . (continued)

subprime mess is a direct contributor to this sector’s weakness. We do not foresee the Primary Trend Fund committing more dollars to this sector until a full-fledged correction occurs in the stock market and the “bad news” no longer affects individual names in the financial arena.

The Consumer Discretionary sector is the second-largest investment theme in the Primary Trend Fund with a 12.9% exposure (slightly greater than the S&P 500’s weighting of 10.0%). We sold our restaurant holdings in Darden Restaurants and McDonald’s due to price appreciation. However, we have replaced them with our initial foray into the housing market – Home Depot as a play on the do-it-yourself retail market and KB Home as a direct play on the troubled home-building industry. We expect our media/entertainment holdings (CBS, Journal Communications and Marcus Corporation) to contribute to portfolio performance over the next 6-12 months.

Cash now represents 22.4% of the Primary Trend Fund’s portfolio. As is always the case, raising cash is NOT a premeditated portfolio strategy – it is merely the result of selling holdings, taking profits and finding few investment stories that have the appropriate risk/reward profile for our shareholders in the current stock market climate. We have not parlayed that cash into the bond market because we are negative on the outlook for interest rates (i.e., we believe interest rates will rise and, therefore, bond prices will fall). We fully expect to put much of that 22% cash cushion back to work in the equity market as bargains are created over the course of the latter half of 2007.

Extended Bull

It’s been a fantastic voyage for this bull market since it bottomed in late 2002/early 2003. As measured by the Dow Jones Industrial Average, the stock market has nearly doubled over the past four-plus years. The Dow has gone from 7,500 to 14,000, or +87%. The venerable Dow climbed to a new all-time high in October 2006, finally surpassing its Tech Bubble record high of January 2000. And it has made no less than 32 new all-time highs in 2007 alone, culminating in a climb above 14,000 in July (the DJIA closed at 14,000.41 on 7/19/07).

The bull market has not been a solo flight by the blue-chip Dow either. Red chip stock indices such as the S&P MidCap 400 and S&P SmallCap 600 have led the march to new highs. But this bull market is a little long in the tooth at this stage. Historically, the U.S. equity market follows a pattern known as the “Four-Year Cycle.” As its name implies, the stock market has a tendency to make significant bottoms every four years (give or take a few months). Based on the market’s last significant bottom made in late 2002/early 2003, the stock market was due for a bottom in late 2006/early 2007. We have eclipsed those time parameters and have now entered a phase that Walter Deemer (market guru of Deemer Technical Research) likes to call an “Extended Bull Market.” According to his work, Wall Street has experienced two extended bull markets (those that stretched beyond the “four-year cycle”) – in 1961 and 1987. Both ended with nasty declines.

Warning Shots Across the Bow

A funny thing has happened on the way to new highs, however – the stock market has quietly taken on some water.

There have been a number of “bad news” events over the past year that could have derailed this market but didn’t: the ongoing Iraq war; oil prices above $70 per barrel; a Shanghai market meltdown that spread globally; and subprime mortgage lender, New Century Financial, going belly up. On Wall Street, this is called “climbing the wall of worry.” As seasoned contrarians, we welcome the “doubting Thomas” effect on stock prices.

However, recently, there have been a few more warning shots across the bow of this bull market ship. As we mentioned earlier in our discussion of the Primary Trend Fund portfolio, the Financial Sector has been very weak –

2

MESSAGE TO SHAREHOLDERS . . . (continued)

underperforming the S&P 500 Composite since the beginning of the year. Why is this significant? The Financial Sector is typically the leadership in a healthy stock market environment. When it no longer leads, it spells trouble for the broad market. The extended bull market of 2007 has lost its “mojo.”

The second warning shot is the recent loss of momentum by the Utility Sector. Like the Financials, Utilities are interest-rate sensitive equities and relinquishing the leadership reins is a caution flag. The Utilities have underperformed since May and individual utility stocks have been extremely volatile of late.

Lastly, the bond market has taken it on the chin lately and yields on the 5-year, 10-year and 30-year U.S. Treasury bonds have all made a critical breakout to the upside in May. We believe this means higher interest rates – maybe even approaching 6% (currently 4.6% to 4.9%). Higher interest rates have almost always put the kibosh on any existing bull run.

These three warning shots may be foretelling what the lingering effects of this subprime fallout will have on the stock market. We do not believe that the subprime bomb that is going off in the collateralized debt obligation (CDO) markets can be contained. “Junk”-rated CDOs have lost nearly 65% of their value since the beginning of the year. The ripple effect already has A-rated paper (investment grade, mind you) plummeting 45% year to date (-36% just in the last month). Another residual casualty: Milwaukee-based MGIC just announced that it was taking a $1 billion hit (together with its partner) due to an investment in a subprime lender. What happens in the subprime market is definitely not staying in the subprime market. And the stock market may finally be taking notice.

The one positive constant during this entire bull rally over the past four-plus years has been the underlying market breadth. When the majority of stocks are going up, as is indicative in the uptrending NYSE Advance-Decline Indicator, it is difficult for any correction to snowball into a full-fledged bear market. Any divergence in this breadth indicator would be yet another warning shot across the bow.

Fed Chairman Bernanke has his hands full trying to rein in inflation as well as contain the subprime fallout. We believe there will be more damage inflicted upon the financial markets as more air is let out of the housing balloon. But herein lies the opportunity for our shareholders in the Primary Trend Fund … Crisis = Opportunity.

Today, we see more risk in the stock market than we are comfortable with, but the Primary Trend’s portfolio is already strategically positioned to capitalize on market opportunities, and we think 2007 will have plenty. In addition, we believe the stocks in the portfolio will be strong leaders going forward.

All of us at Arnold Investment Counsel appreciate the trust you have placed in us. By continuing to adhere to our disciplined, long-term value-oriented investment philosophy, we expect to reward our shareholders with superior performance in the years ahead.

Sincerely,

|  |

| Lilli Gust | Barry S. Arnold |

| President | Vice President |

| Chief Investment Officer |

3

EXPENSE EXAMPLE (Unaudited)

For the Six Months Ended June 30, 2007

As a shareholder of the Primary Trend Fund, you incur ongoing costs, including management fees and other Fund expenses. If you invest through a financial intermediary, you may also incur additional costs such as a transaction fee charged on the purchase or sale of the Fund or an asset-based management fee. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2007 to June 30, 2007.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any costs that may be associated with investing in the Fund through a financial intermediary. Therefore, the second line of the table is useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if any costs associated with investing through a financial intermediary were included, your costs would have been higher.

| Beginning | Ending | Expenses paid | ||||||||||

| account value | account value | during period | ||||||||||

| 1/1/07 | 6/30/07 | 1/1/07-6/30/071 | ||||||||||

| Actual | $ | 1,000.00 | $ | 1,068.10 | $ | 8.09 | ||||||

| Hypothetical (5% return before expenses) | 1,000.00 | 1,017.18 | 7.89 | |||||||||

| 1 | Expenses are equal to the Fund’s annualized expense ratios (1.54% for the Trend Fund), multiplied by the average account value over the period, and multiplied by 0.4959 (to reflect the one-half year period). |

4

PORTFOLIO OF INVESTMENTS

As of June 30, 2007

The Primary Trend Fund

Market | |||||||||||

Shares | Cost | Value | |||||||||

COMMON STOCKS 77.2% | |||||||||||

| 9,000 | Abbott Laboratories (Pharmaceuticals) | $ | 298,404 | $ | 481,950 | ||||||

| 35,000 | ADC Telecommunications, Inc.* (Communications Equipment) | 573,489 | 641,550 | ||||||||

| 5,000 | Allstate Corp. (Insurance) | 135,401 | 307,550 | ||||||||

| 5,000 | Amgen, Inc.* (Biotechnology) | 274,475 | 276,450 | ||||||||

| 10,000 | Anheuser-Busch Companies, Inc. (Beverages) | 350,805 | 521,600 | ||||||||

| 23,333 | Aqua America, Inc. (Water Utilities) | 479,140 | 524,759 | ||||||||

| 10,000 | AT&T, Inc. (Diversified Telecommunications) | 240,000 | 415,000 | ||||||||

| 6,998 | BP plc (Oil, Gas & Consumable Fuels) | 143,640 | 504,836 | ||||||||

| 10,000 | Campbell Soup Co. (Food Products) | 299,630 | 388,100 | ||||||||

| 20,000 | CBS Corp. (Media) | 569,600 | 666,400 | ||||||||

| 12,000 | Chubb Corp. (Insurance) | 327,730 | 649,680 | ||||||||

| 12,000 | Coca-Cola Co. (Beverages) | 512,540 | 627,720 | ||||||||

| 30,000 | Del Monte Foods Co. (Food Products) | 342,607 | 364,800 | ||||||||

| 15,000 | Eli Lilly & Co. (Pharmaceuticals) | 816,628 | 838,200 | ||||||||

| 23,000 | General Electric Co. (Industrial Conglomerates) | 668,649 | 880,440 | ||||||||

| 15,000 | Home Depot, Inc. (Specialty Retail) | 567,650 | 590,250 | ||||||||

| 7,000 | Johnson & Johnson (Pharmaceuticals) | 299,250 | 431,340 | ||||||||

| 30,000 | Journal Communication, Inc. (Media) | 386,541 | 390,300 | ||||||||

| 10,000 | KB Home (Home Construction) | 431,189 | 393,700 | ||||||||

| 25,000 | Kraft Foods, Inc. (Food Products) | 805,050 | 881,250 | ||||||||

| 25,000 | Marcus Corp. (Hotels, Restaurants & Leisure) | 516,129 | 594,000 | ||||||||

| 30,000 | Micron Technology, Inc.* (Semiconductors) | 345,950 | 375,900 | ||||||||

| 28,000 | Microsoft Corp. (Software) | 738,458 | 825,160 | ||||||||

| 20,000 | Motorola, Inc. (Communications Equipment) | 356,300 | 354,000 | ||||||||

| 10,000 | Mylan Laboratories, Inc. (Pharmaceuticals) | 198,200 | 181,900 | ||||||||

| 25,000 | New York Community Bancorp, Inc. (Thrifts & Mortgage Finance) | 437,395 | 425,500 | ||||||||

| 12,000 | Occidental Petroleum Corp. (Oil, Gas & Consumable Fuels) | 121,944 | 694,560 | ||||||||

| 6,000 | PartnerRe Ltd. (Insurance) | 200,735 | 465,000 | ||||||||

| 30,000 | Pfizer, Inc. (Pharmaceuticals) | 725,809 | 767,100 | ||||||||

| 40,000 | Pier 1 Imports, Inc. (Specialty Retail) | 295,096 | 339,600 | ||||||||

| 30,000 | Schering-Plough Corp. (Pharmaceuticals) | 520,799 | 913,200 | ||||||||

| 11,160 | United Technologies Corp. (Aerospace & Defense) | 231,525 | 791,579 | ||||||||

| Total Common Stocks | 13,210,758 | 17,503,374 | |||||||||

(continued)

5

PORTFOLIO OF INVESTMENTS (continued)

As of June 30, 2007

The Primary Trend Fund (continued)

Principal | Market | ||||||||||

Amount | Cost | Value | |||||||||

BONDS AND NOTES 1.7% | |||||||||||

Corporate Bond | |||||||||||

| $ | 400,000 | Alabama Power Co., | |||||||||

| 3.13%, 5/1/08 | $ | 398,892 | $ | 392,616 | |||||||

| Total Bonds and Notes | 398,892 | 392,616 | |||||||||

SHORT-TERM INVESTMENTS 22.7% | |||||||||||

Variable Rate Demand Notes | |||||||||||

| 5,155,061 | US Bank Demand Note | ||||||||||

| 5.07%, 7/5/07 | 5,155,061 | 5,155,061 | |||||||||

| Total Short-Term Investments | 5,155,061 | 5,155,061 | |||||||||

TOTAL INVESTMENTS 101.6% | $ | 18,764,711 | 23,051,051 | ||||||||

| Liabilities less Other Assets (1.6)% | (353,603 | ) | |||||||||

NET ASSETS 100.0% | $ | 22,697,448 | |||||||||

* Non-income producing

Summary of Investments by Sector

Percent of | ||

Sector | Investment Securities | |

| Short-term (cash) | 22.4% | |

| Health Care | 16.9% | |

| Consumer Discretionary | 12.9% | |

| Consumer Staples | 12.1% | |

| Information Technology | 9.5% | |

| Financials | 8.0% | |

| Industrials | 7.2% | |

| Energy | 5.2% | |

| Utilities | 4.0% | |

| Telecommunication Services | 1.8% | |

| Total Investments | 100.0% | |

Top Ten Equity Holdings

Percent of | ||

Security | Investment Securities | |

| Schering-Plough Corp. | 4.0% | |

| Kraft Foods, Inc. | 3.8% | |

| General Electric Co. | 3.8% | |

| Eli Lilly & Co. | 3.6% | |

| Microsoft Corp. | 3.6% | |

| United Technologies Corp. | 3.4% | |

| Pfizer, Inc. | 3.3% | |

| Occidental Petroleum Corp. | 3.0% | |

| CBS Corp. | 2.9% | |

| Chubb Corp. | 2.8% | |

| Total | 34.2% | |

See notes to financial statements.

6

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2007

The Primary | ||||

Trend Fund | ||||

| Assets: | ||||

| Investments, at Value: | ||||

| Common Stocks | $ | 17,503,374 | ||

| Bonds and Notes | 392,616 | |||

| Short-Term Investments | 5,155,061 | |||

| Total Investments (Cost $18,764,711) | 23,051,051 | |||

| Dividends Receivable | 30,790 | |||

| Interest Receivable | 25,201 | |||

| Prepaid Expenses and Other Assets | 2,733 | |||

| Total Assets | 23,109,775 | |||

| Liabilities: | ||||

| Payable for Investments Purchased | 358,975 | |||

| Professional Fees | 24,357 | |||

| Accrued Investment Advisory Fees | 13,852 | |||

| Transfer Agent Fees | 6,287 | |||

| Administration and Accounting Fees | 3,659 | |||

| Other | 5,197 | |||

| Total Liabilities | 412,327 | |||

| Net Assets | $ | 22,697,448 | ||

| Shares Outstanding | 1,573,153 | |||

| Net Asset Value Per Share | $ | 14.43 | ||

| Net Assets Consist of: | ||||

| Capital Stock ($0.01 par value, 30,000,000 shares authorized) | $ | 16,723,030 | ||

| Undistributed Net Investment Income | 132,236 | |||

| Undistributed Net Realized Gain | 1,555,842 | |||

| Net Unrealized Appreciation of Investments | 4,286,340 | |||

| Net Assets | $ | 22,697,448 | ||

See notes to financial statements.

7

STATEMENT OF OPERATIONS

For the year ended June 30, 2007

The Primary | ||||

Trend Fund | ||||

| Income: | ||||

| Dividends | $ | 375,549 | ||

| Interest | 167,682 | |||

| Total Income | 543,231 | |||

| Expenses: | ||||

| Investment Advisory Fees | 139,221 | |||

| Administration and Accounting Fees | 43,428 | |||

| Shareholder Servicing Costs | 37,378 | |||

| Professional Fees | 36,086 | |||

| Printing | 12,440 | |||

| Registration Fees | 8,723 | |||

| Custodial Fees | 4,332 | |||

| Pricing | 3,249 | |||

| Insurance | 2,698 | |||

| Directors | 2,500 | |||

| Postage | 2,214 | |||

| Other | 1,022 | |||

| Total Expenses | 293,291 | |||

| Net Investment Income | 249,940 | |||

| Net Realized Gain on Investments | 1,727,779 | |||

| Change in Net Unrealized Appreciation on Investments | 1,029,544 | |||

| Net Realized and Unrealized Gain on Investments | 2,757,323 | |||

| Net Increase in Net Assets From Operations | $ | 3,007,263 | ||

See notes to financial statements.

8

STATEMENTS OF CHANGES IN NET ASSETS

The Primary | ||||||||

Trend Fund | ||||||||

Year Ended | Year Ended | |||||||

June 30, 2007 | June 30, 2006 | |||||||

| Operations: | ||||||||

| Net Investment Income | $ | 249,940 | $ | 296,904 | ||||

| Net Realized Gain on Investments | 1,727,779 | 765,393 | ||||||

| Change in Net Unrealized | ||||||||

| Appreciation on Investments | 1,029,544 | (27,842 | ) | |||||

| Net Increase in Net Assets from Operations | 3,007,263 | 1,034,455 | ||||||

| Distributions to Shareholders: | ||||||||

| From Net Investment Income | (326,388 | ) | (152,106 | ) | ||||

| From Net Realized Gains | (843,044 | ) | (706,269 | ) | ||||

| Decrease in Net Assets from Distributions | (1,169,432 | ) | (858,375 | ) | ||||

| Fund Share Transactions: | ||||||||

| Proceeds from Shares Sold | 3,671,744 | 283,123 | ||||||

| Reinvested Distributions | 1,085,219 | 805,621 | ||||||

| Cost of Shares Redeemed | (1,098,968 | ) | (1,269,283 | ) | ||||

| Net Increase (Decrease) in Net Assets | ||||||||

| from Fund Share Transactions | 3,657,995 | (180,539 | ) | |||||

| Total Increase (Decrease) in Net Assets | 5,495,826 | (4,459 | ) | |||||

| Net Assets: | ||||||||

| Beginning of Year | 17,201,622 | 17,206,081 | ||||||

| End of Year | $ | 22,697,448 | $ | 17,201,622 | ||||

| Undistributed Net Investment Income at End of Year | $ | 132,236 | $ | 208,684 | ||||

| Transactions in Shares: | ||||||||

| Sales | 260,791 | 22,181 | ||||||

| Reinvested Distributions | 84,370 | 64,077 | ||||||

| Redemptions | (81,466 | ) | (99,219 | ) | ||||

| Net Increase (Decrease) | 263,695 | (12,961 | ) | |||||

See notes to financial statements.

9

FINANCIAL HIGHLIGHTS

The following table shows per share operation performance data, total investment return, ratios and supplemental data for each of the years ended June 30:

2007 | 2006 | 2005 | 2004 | 2003 | ||||||||||||||||

The Primary Trend Fund | ||||||||||||||||||||

Per Share Operating Performance | ||||||||||||||||||||

| Net Asset Value, Beginning of Year | $ | 13.14 | $ | 13.01 | $ | 13.09 | $ | 11.30 | $ | 11.84 | ||||||||||

| Net Investment Income | 0.17 | 0.22 | 0.08 | 0.05 | 0.04 | |||||||||||||||

| Net Realized and Unrealized Gain (Loss) on Investments | 2.02 | 0.56 | 0.44 | 1.86 | (0.03 | ) | ||||||||||||||

| Total from Investment Operations | 2.19 | 0.78 | 0.52 | 1.91 | 0.01 | |||||||||||||||

| Less Distributions: | ||||||||||||||||||||

| From Net Investment Income | (0.25 | ) | (0.11 | ) | (0.06 | ) | (0.03 | ) | (0.05 | ) | ||||||||||

| From Net Realized Gains | (0.65 | ) | (0.54 | ) | (0.54 | ) | (0.09 | ) | (0.50 | ) | ||||||||||

| Total Distributions | (0.90 | ) | (0.65 | ) | (0.60 | ) | (0.12 | ) | (0.55 | ) | ||||||||||

| Net Increase (Decrease) | 1.29 | 0.13 | (0.08 | ) | 1.79 | (0.54 | ) | |||||||||||||

| Net Asset Value, End of Year | $ | 14.43 | $ | 13.14 | $ | 13.01 | $ | 13.09 | $ | 11.30 | ||||||||||

Total Investment Return | 17.56% | 6.26% | 4.27% | 17.05% | 0.34% | |||||||||||||||

Ratios and Supplemental Data | ||||||||||||||||||||

| Net Assets, End of Year (in thousands) | $ | 22,697 | $ | 17,202 | $ | 17,206 | $ | 16,714 | $ | 14,892 | ||||||||||

| Ratio of Net Expenses to Average Net Assets | 1.56% | 1.53% | 1.48% | 1.49% | 1.60% | |||||||||||||||

| Ratio of Net Investment Income to Average Net Assets | 1.33% | 1.74% | 0.67% | 0.39% | 0.41% | |||||||||||||||

| Portfolio Turnover | 41.5% | 28.9% | 37.5% | 31.7% | 27.5% | |||||||||||||||

See notes to financial statements.

10

NOTES TO FINANCIAL STATEMENTS

June 30, 2007

| 1. | Organization |

The Primary Trend Fund, Inc. (“Trend Fund”) began operations on September 15, 1986. The Trend Fund is registered under the Investment Company Act of 1940 as an open-end investment management company. |

| 2. | Significant Accounting Policies |

The following is a summary of significant accounting policies followed by the Fund. |

| a. | Securities listed on a national securities exchange are valued at the last sale price. Securities that are traded on the Nasdaq National Market or the Nasdaq Smallcap Market are valued at the Nasdaq Official Closing Price. If no sale is reported, the average of the last bid and asked prices is used. Other securities for which market quotations are readily available are valued at the average of the latest bid and asked prices. Debt securities (other than short-term instruments) are valued at prices furnished by a national pricing service, subject to review by the Adviser and determination of the appropriate price whenever a furnished price is significantly different from the previous day’s furnished price. Other assets and securities for which no quotations are readily available are valued at fair value as determined in good faith by the Board of Directors. Securities with maturities of 60 days or less are valued at amortized cost. |

| b. | Security transactions are recorded on the trade date. Dividend income is recorded on the ex-dividend date. Interest income is recorded as earned, and includes amortization of premiums and discounts. Securities gains and losses are determined on the basis of identified cost, which is the same basis used for federal income tax purposes. |

| c. | No provision for federal income taxes has been made since the Fund has elected to be taxed as a regulated investment company and intends to distribute its net investment income and net realized gains to shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. |

| d. | Dividends from net investment income are declared and paid at least annually by the Trend Fund. Distributions of net realized capital gains, if any, are declared and paid at least annually. Distributions to shareholders are recorded on the ex-dividend date. The character of distributions made during the year from net investment income or net realized gains may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain items for financial statement and tax purposes. |

The tax character of distributions paid during the fiscal years ended June 30, 2007 and 2006 were as follows: |

2007 | 2006 | |||||||

| Distributions paid from: | ||||||||

| Ordinary Income | $ | 477,184 | $ | 152,106 | ||||

| Net long term capital gains | 692,248 | 706,269 | ||||||

| Total taxable distributions | 1,169,432 | 858,375 | ||||||

| Total distributions paid | $ | 1,169,432 | $ | 858,375 | ||||

11

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2007

For the year ended June 30, 2007, the Fund designates $692,248 as long-term capital gain distributions for purposes of the dividends paid deduction. |

| e. | The preparation of financial statements in conformity with accounting principles generally accepted in the United States (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates. |

| 3. | Investment Advisory Fees and Management Agreements |

The Fund has an agreement with Arnold Investment Counsel, Inc. (the “Adviser”), with whom certain officers and directors of the Fund is affiliated, to serve as investment adviser. Under the terms of the agreement, the Adviser receives from the Trend Fund a monthly fee at an annual rate of 0.74% of its average daily net assets. The agreement further stipulates that the Adviser will reimburse the Fund for annual expenses exceeding certain specified levels. |

| 4. | Purchases and Sales of Securities |

Total purchases and sales of securities, other than short-term investments, for the Fund for the year ended June 30, 2007 were as follows: |

| Purchases | $ | 6,972,552 | ||

| Sales | 6,609,791 |

| 5. | Tax Information |

At June 30, 2007, gross unrealized appreciation and depreciation of investments, based on aggregate cost for federal income tax purposes of $18,764,711 for the Fund was as follows: |

| Unrealized appreciation | $ | 4,381,231 | ||

| Unrealized depreciation | (94,891 | ) | ||

| Net appreciation on investments | $ | 4,286,340 |

As of June 30, 2007, the components of accumulated earnings on a tax basis were as follows: |

| Undistributed ordinary income | $ | 251,107 | ||

| Undistributed long-term capital gains | 1,436,971 | |||

| Accumulated earnings | 1,688,078 | |||

| Accumulated capital and other losses | 0 | |||

| Unrealized appreciation | 4,286,340 | |||

| Total accumulated earnings | $ | 5,974,418 |

For the year ended June 30, 2007, 82.14% of the dividends paid from net investment income, including short-term gains (if any), for the Trend Fund is designated as qualified dividend income. |

For the year ended June 30, 2007, 75.13% of the dividends paid from net investment income, including short-term gains (if any), for the Trend Fund qualifies for the dividends received deduction available to corporate shareholders. |

12

NOTES TO FINANCIAL STATEMENTS (continued)

June 30, 2007

| 6. | New Accounting Pronouncements |

In June 2006, the Financial Accounting Standards Board (“FASB”) released FASB Interpretation No. 48 (FIN 48) “Accounting for Uncertainty in Income Taxes”. FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken in the course of preparing the fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. To the extent that a tax benefit of a position is not deemed to meet the “more-likely-than-not” threshold, the Fund would report an income tax expense in the Statement of Operations. Adoption of FIN 48 is required for fiscal years beginning after December 15, 2006. At this time, management is evaluating the implications of FIN 48, and the impact of this standard on the financial statements has not yet been determined. |

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157, “Fair Value Measurements” (“FAS 157”). The Statement defines fair value, establishes a framework for measuring fair value in GAAP, and expands disclosures about fair value measurements. The Statement establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (2) the reporting entity’s own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The statement is effective for financial statements issued for fiscal years beginning after November 15, 2007, and is to be applied prospectively as of the beginning of the fiscal year in which this Statement is initially applied. Management has recently begun to evaluate the application of the Statement to the Fund, and is not in a position at this time to evaluate the significance of its impact, if any, on the Funds’ financial statements. |

In addition, in February 2007, FASB issued “Statement of Financial Accounting Standard No. 159, The Fair Value Option for Financial Assets and Financial Liabilities” (“FAS 159”), which is effective for fiscal years beginning after November 15, 2007. Early adoption is permitted as of the beginning of a fiscal year that begins on or before November 15, 2007, provided the entity also elects to apply the provisions of FAS 157. FAS 159 permits entities to choose to measure many financial instruments and certain other items at fair value that are not currently required to be measured at fair value. FAS 159 also establishes presentation and disclosure requirements designed to facilitate comparisons between entities that choose different measurement attributes for similar types of assets and liabilities. Management has recently begun to evaluate the application of the Statement to the Fund, and is not in a position at this time to evaluate the significance of its impact, if any, on the Funds’ financial statements. |

13

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Audit Committee, Board of Directors

and Shareholders

The Primary Trend Fund, Inc.

Milwaukee, Wisconsin

We have audited the accompanying statement of assets and liabilities of The Primary Trend Fund, Inc. (the Fund), including the portfolio of investments, as of June 30, 2007, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended and the financial highlights for each of the four years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. The financial highlights of the Fund for the year ended June 30, 2003, were audited by other accountants whose report dated July 24, 2003, expressed an unqualified opinion on those financial highlights.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2007, by correspondence with the custodian and brokers. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The Primary Trend Fund, Inc., as of June 30, 2007, the results of its operations for the year then ended, the changes in its net assets for each of the two years then ended and the financial highlights for each of the four years then ended in conformity with accounting principles generally accepted in the United States of America.

BKD, LLP

Houston, Texas

August 16, 2007

14

Proxy Voting Policies and Procedures

For a description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, please call 1-800-443-6544 and request a Statement of Additional Information. One will be mailed to you free of charge. The Statement of Additional Information is also available on the website of the Securities and Exchange Commission at http://www.sec.gov. Information on how the Funds voted proxies relating to portfolio securities during the twelve month period ended June 30, 2007, will be available without charge, upon request, by calling 1-800-443-6544 or by accessing the website of Securities and Exchange Commission.

Disclosure of Portfolio Holdings

The Fund will file its complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The Form N-Q will be available on the website of the Securities and Exchange Commission at http://www.sec.gov.

15

DIRECTORS AND OFFICERS

Number of | |||||

Term of | Principal | Funds | Other | ||

Position(s) | Office and | Occupation(s) | in Complex | Directorships | |

Name, Address | Held with | Length of | During Past | Overseen | Held |

and Age | the Fund | Time Served | 5 Years | by Director | by Director |

Independent Directors: | |||||

| Clark Hillery | Director | Indefinite, until | Director of Team Services for | 1 | None |

| 700 N. Water Street | successor elected | the Milwaukee Bucks | |||

| Milwaukee, WI 53202 | |||||

| Age: 57 | 8 years | ||||

| William J. Rack | Director | Indefinite, until | Commercial Real Estate | 1 | None |

| 700 N. Water Street | successor elected | Development and Leasing | |||

| Milwaukee, WI 53202 | |||||

| Age: 61 | 4 Years | ||||

Interested Directors: | |||||

| Barry S. Arnold | Director, | Indefinite, until | Portfolio Manager | 1 | Arnold Investment |

| 700 N. Water Street | Vice President | successor elected | Counsel, Inc. | ||

| Milwaukee, WI 53202 | and Secretary | ||||

| Age: 42 | 9 years | ||||

Officer: | |||||

| Lilli Gust | President, | N/A | Investment Adviser | 1 | Arnold Investment |

| 700 N. Water Street | Treasurer | Counsel, Inc. | |||

| Milwaukee, WI 53202 | and Chief | ||||

| Age: 61 | Compliance | ||||

| Officer |

Certain officer and directors of the Trust are affiliated with the Adviser. None of these individuals receives a fee from the Trust for serving as an officer or director. The independent directors’ remuneration for the Fund totaled $2,500 for the period ended June 30, 2007.

Additional information about the Funds’ Directors is available in the Statement of Additional Information and is available, without charge, upon request, by calling 1-800-443-6544.

16

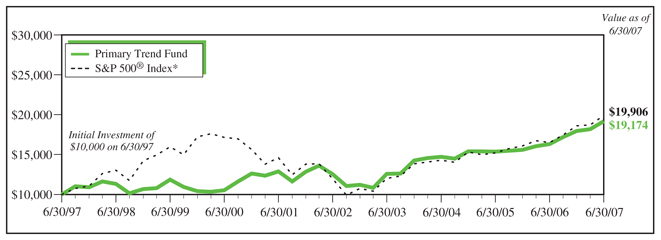

FUND PERFORMANCE COMPARISON

The performance data quoted is past performance and past performance is no guarantee of future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance quoted. To obtain performance current to the most recent month-end, please call 1-800-443-6544.

The performance included in the table and graph does not reflect the deduction of taxes on Fund distributions or the redemption of Fund shares. Total returns are based on net change in NAV, assuming reinvestment of distributions.

| * | The S&P 500® Index is an unmanaged but commonly used measure of common stock total return performance. The Fund’s total returns include operating expenses such as transaction costs and advisory fees which reduce total returns while the total returns of the Index do not. |

Average Annual Total Return | ||||||||

Fund Performance through June 30, 2007 | ||||||||

| Primary Trend Fund | S&P 500® | |||||||

| 2007 Year to Date | +6.81 | % | +6.96 | % | ||||

| One Year | +17.56 | % | +20.59 | % | ||||

| 5 Years | +8.88 | % | +10.70 | % | ||||

| 10 Years | +6.73 | % | +7.13 | % | ||||

| Since Inception (9/15/86) | +8.57 | % | +11.52 | % | ||||

17

(This Page Intentionally Left Blank.)

(This Page Intentionally Left Blank.)

www.primarytrendfunds.com

INVESTMENT ADVISER

Arnold Investment Counsel Incorporated

700 North Water Street

Milwaukee, Wisconsin 53202

1-800-443-6544

OFFICERS

Lilli Gust, President and Treasurer

Barry S. Arnold, Vice President and Secretary

DIRECTORS

Barry S. Arnold

Clark J. Hillery

William J. Rack

ADMINISTRATOR

UMB Fund Services, Inc.

803 West Michigan Street

Milwaukee, Wisconsin 53233

CUSTODIAN

U.S. Bank, N.A.

1555 North RiverCenter Drive

Milwaukee, Wisconsin 53212

TRANSFER AGENT AND

DIVIDEND DISBURSING AGENT

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, Wisconsin 53202

1-800-968-2122

INDEPENDENT AUDITORS

BKD, LLP

2800 Post Oak Boulevard, Suite 3200

Houston, Texas 77056

LEGAL COUNSEL

Foley & Lardner LLP

777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Founding member of | |

100% | NO-LOAD™ MUTUAL FUND COUNCIL |

Item 2. Code of Ethics

The Registrant has adopted a code of ethics (the “Code”) that applies to its principal executive officer and principal financial officer. A copy of the Code is filed as an exhibit to this Form N-CSR. During the period covered by this report, there were no amendments to the provisions of the Code, nor were there any implicit or explicit waivers to the provisions of the Code.

Item 3. Audit Committee Financial Expert

While The Primary Trend Fund, Inc. believes that each of the members of its audit committee has sufficient knowledge of accounting principles and financial statements to serve on the audit committee, none has the requisite experience to qualify as an “audit committee financial expert” as such term is defined by the Securities and Exchange Commission.

Item 4. Principal Accountant Fees and Services

The aggregate fees for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements are listed below.

(a) Audit Fees.

| Fiscal year ended June 30, 2007 | $30,500 |

| Fiscal year ended June 30, 2006 | $14,200 |

(b) Audit-Related Fees.

| Fiscal year ended June 30, 2007 | $2,160 |

| Fiscal year ended June 30, 2006 | $ 0 |

(c) Tax Fees.

| Fiscal year ended June 30, 2007 | $1,000 |

| Fiscal year ended June 30, 2006 | $ 500 |

(d) All Other Fees.

None.

(e)

(1) None.

(2) None.

(f) None.

(g) See item 4(c).

(h) Not applicable.

Item 5. Audit Committee of Listed Registrants

Not applicable.

Item 6. Schedule of Investments

Included as part of the report to shareholders filed under Item I of this Form N-CSR.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies

Not applicable.

Item 9. Purchase of Equity Securities of Closed-End Management Investment Company and Affiliated Purchasers

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders

Not applicable.

Item 11. Controls and Procedures

| (a) | The Principal Executive and Financial Officers concluded that the Registrant’s Disclosure Controls and Procedures are effective based on their evaluation of the Disclosure Controls and Procedures as of a date within 90 days of the filing date of this report. |

| (b) | There were no changes in Registrant’s internal control over financial reporting that occurred during the Registrant’s second fiscal quarter of the period covered by this report that materially affected or were reasonably likely to materially affect Registrant’s internal control over financial reporting. |

Item 12. Exhibits

| (a) | Code of Ethics. Filed as an attachment to this filing. |

| (b) | Certifications required pursuant to Sections 302 and 906 of the Sarbanes-Oxley Act of 2002 are filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

The Primary Trend Fund, Inc.

/s/Lilli Gust |

Lilli Gust

Principal Executive Officer

August 31, 2007

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

/s/Lilli Gust |

Lilli Gust

Principal Executive Officer

August 31, 2007

/s/Lilli Gust |

Lilli Gust

Principal Financial Officer

August 31, 2007