UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05084

MoA Funds Corporation

(Exact name of registrant as specified in charter)

320 Park Avenue, New York, N.Y. 10022

(Address of principal executive offices) (Zip code)

Chris W. Festog

Chairman of the Board, Chief Executive Officer and Principal Executive Officer

MoA Funds Corporation

320 Park Avenue

New York, NY 10022

(Name and address of agent for service)

Registrant’s telephone number, including area code:

(212) 224-1600

Date of fiscal year end: December 31

Date of reporting period: December 31, 2023

Explanatory Note:

The purpose of this amended filing is to correct a typographical error to the aggregate audit fees under Item 4(a). Other than the aforementioned revision, this amendment does not amend, update or change any other items or disclosures found in the original Form N-CSR filing.

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

The Annual Report to Shareholders follows:

DECEMBER 31, 2023

MoA Funds Annual Report

Equity Funds

| • | MoA Small Cap Value Fund (MAVKX) |

| • | MoA Mid Cap Value Fund (MAMVX) |

| • | MoA Small Cap Growth Fund (MAGKX) |

| • | MoA International Fund (MAIFX) |

| • | MoA Equity Index Fund (MAEIX) |

| • | MoA Mid Cap Equity Index Fund (MAMEX) |

| • | MoA Small Cap Equity Index Fund (MASOX) |

| • | MoA Catholic Values Index FundTM (MACCX) |

| • | MoA All America Fund (MAAKX) |

Fixed Income Funds

| • | MoA Intermediate Bond Fund (MAMBX) |

| • | MoA Core Bond FundTM (MABDX) |

| • | MoA Money Market Fund (MAAXX) |

Asset Allocation Funds

| • | MoA Conservative Allocation Fund (MACAX) |

| • | MoA Moderate Allocation Fund (MAMOX) |

| • | MoA Aggressive Allocation Fund (MAANX) |

| • | MoA Balanced Fund (MACHX) |

Target Date Funds

| • | MoA Retirement Income Fund (MARMX) |

| • | MoA Clear Passage 2015 FundTM (MURFX) |

| • | MoA Clear Passage 2020 FundTM (MURGX) |

| • | MoA Clear Passage 2025 FundTM (MURHX) |

| • | MoA Clear Passage 2030 FundTM (MURIX) |

| • | MoA Clear Passage 2035 FundTM (MURJX) |

| • | MoA Clear Passage 2040 FundTM (MURLX) |

| • | MoA Clear Passage 2045 FundTM (MURMX) |

| • | MoA Clear Passage 2050 FundTM (MURNX) |

| • | MoA Clear Passage 2055 FundTM (MUROX) |

| • | MoA Clear Passage 2060 FundTM (MURPX) |

| • | MoA Clear Passage 2065 FundTM (MURQX) |

|

On October 16, 2023, the Funds listed above were re-branded as the MoA Funds. Further details, including changes in individual fund names, can be found in Note 1 to the financial statements contained within this report. This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. The report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus. MoA Funds distributed by Foreside Fund Services, LLC. NOT FDIC INSURED ● MAY LOSE VALUE ● NO BANK GUARANTEE |

|

moafunds.com

CONTENTS

MOA FUNDS

We are pleased to present the MoA Funds Corporation (formerly, Mutual of America Investment Corporation; the “Investment Company”) Annual Report. This Report includes important information regarding the performance and financial position of the Investment Company’s Funds for the year ended December 31, 2023.

Economic and Market Perspective

Following unprecedented market turbulence in 2022, the conclusion of 2023 resulted in positive outcomes for both the stock and bond markets. Investors, initially bracing for a recession, were pleasantly surprised by a resilient economy, robust consumer spending, strong employment trends and favorable inflation data.

Despite low expectations by investors heading into 2023, stocks had an impressive year — the S&P 500® Index (S&P 500) gained 26.3%, the Dow Jones Industrial Average surpassed 37,000, and the Nasdaq Composite soared 44%, fueled by companies with exposure to artificial intelligence. The year-end rally, marking the S&P 500’s longest winning streak since January 2004, provided a welcome boost to various assets. Higher bond yields, which initially concerned money managers, didn’t dampen the rally. In October, the 10-year Treasury yield hit 5% for the first time in 16 years, before retreating to 3.88% by year-end.

Despite challenges such as the U.S. Federal Reserve (Fed) raising interest rates, a regional banking crisis and geopolitical tensions, the markets defied predictions, hinting that the worst of these challenges are behind us. As we step into 2024, the world’s financial markets will keenly observe how these narratives unfold amid the ever-changing global economics, geopolitics and the U.S. presidential election.

Equities Rock and Roll

From the end of July through late October, the U.S. stock market experienced a 10% correction, despite improving economic conditions. However, a robust rally ensued after softer inflation data in the October Consumer Price Index (CPI) and dovish remarks from the Fed fueled investor confidence in a potential soft landing of the economy. In the fourth quarter, the S&P 500 surged 11.7%, and the Russell 2000® Index gained a notable 14%, driven by a substantial 12.2% increase in December. Examining the Russell 1000® Growth and Russell 1000® Value Indexes, growth outperformed by 4% in the fourth quarter and by an impressive 31% for the year.

Equity investors navigated substantial volatility in the last two years, enduring a significant market selloff in 2022 followed by a robust yet turbulent rebound in 2023. Even with a strong 2023, the S&P 500 was up just 1.7%, and the Nasdaq was down 1.2% on an annualized basis for the combined last two years. It is worth noting, however, that the S&P 500 continued to shine in the first month of 2024, and on January 19, finished at 4,839.81 to set an all-time closing high, surpassing the previous mark of 4,796.56 from January 3, 2022.

A notable development in 2023 was the focus on the Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, NVIDIA, Tesla and Meta Platforms), which contributed approximately 62% to the S&P 500’s returns through December 31, 2023, a shift from nearly 100% in late October. In fact, the equally weighted S&P 500 was down through October, but a strong rally in November and December lifted the index so that it was up 13.8% for the year. This suggests a broadening of equity market performance.

Many investors anticipate this trend continuing into 2024, supported by compelling arguments. Notably, valuations for the equally weighted S&P 500 and S&P Small Cap 600 appear more attractive, with forward earnings multiples of 16.2x and 14.4x, respectively — both below their 10-year historical averages. In contrast, the S&P 500 currently trades at 19.7x, notably exceeding its 10-year historical average of 17.9x.

10-Year Treasury Yield Does a Round Trip

As the fourth quarter of 2023 approached, the Bloomberg U.S. Aggregate Index faced the prospect of marking its third consecutive negative year, an unprecedented occurrence. However, a “relief” rally in November and December propelled the index to a positive return of 6.8%, concluding the year 5.5% higher. Similar positive outcomes were observed in the Bloomberg U.S. Corporate Index, which returned 8.5% for the year.

By contrast, 2-year bond returns have less favorable results — the Bloomberg Aggregate Index and the Bloomberg Corporate Index declined by 8.2% and 8.5%, respectively. Despite a modest gain of 3% in long-term Treasuries in 2023, it remains one of the poorest-performing asset classes for the two-year period, during which it was down 26%. Notably, amid significant interest rate volatility, the 10-Year Treasury yield commenced and concluded the year nearly unchanged, at 3.875% and 3.879%, respectively, with the yield curve action concentrated at the short end. The only weakness that we spotted was in West Texas Intermediate Crude Oil futures, which fell 21.1% in the fourth quarter and 10.7% overall for the year.

1

Has the Fed Tamed Inflation without Hurting Employment?

Recently, economists have introduced the term “immaculate disinflation.” This unofficial term is used to depict a scenario where inflation subsides without triggering a surge in unemployment. It has also become synonymous with a soft landing.

Traditionally, accomplishing this has been challenging due to the well-studied “sacrifice ratio,” which suggests that reducing inflation incurs economic costs, typically seen as higher unemployment. In brief, the ratio is essentially the cost of combating inflation.

On the inflation front, utilizing the Fed’s preferred measure of core personal consumption expenditures (PCE), the annualized inflation rate dropped to 2.9% in December. Core PCE, which peaked 18 months ago, has declined as swiftly as it surged, challenging the notion of inflation being “sticky”—the idea that it falls more slowly than it rises. Non-core PCE and the CPI registered 2.6% and 3.4%, respectively, in December, rapidly approaching the Fed’s 2% target rate for inflation. This suggests that the Fed is making progress toward achieving its mandate of price stability in the coming months.

Turning to employment, the Fed’s secondary mandate, the unemployment rate, has consistently stayed below 4.0% since the initiation of interest rate hikes in March 2022. December’s unemployment rate held steady at 3.7%, resulting in an average rate of 3.6% for 2023, mirroring the 2022 average. This unprecedented 23-month streak below 4% indicates a persistently tight labor market. Some economists and investors speculate that the Fed has orchestrated a soft landing or immaculate disinflation by meeting both mandates. However, Fed officials exercise caution, awaiting inflation to sustain the central bank’s 2% target, recognizing that achieving this without a substantial rise in unemployment would be viewed as a near miracle by Fed Chair Jerome Powell and his colleagues.

Fed Officials and Investors Have Divergent Views on Rates

Anticipating a sustained easing in inflation, there’s a possibility that the Federal Open Market Committee (FOMC) will gradually start adjusting policy rates around mid-2024. The Fed’s current projection suggests three rate cuts for 2024, aiming for a year-end Federal Funds Rate ranging from 4.50% to 4.75%, down from the current target of 5.25% to 5.50%. Despite nearly two years of raising rates for price stability, the Fed seems to be signaling the end of that effort. Investors, however, anticipate a more aggressive approach, with six cuts totaling 1.25 percentage points, beginning as early as March 2024, creating a divergence from the Fed’s outlook. This disparity could introduce volatility to both equity and bond markets. Regardless, the Fed’s quantitative tightening, with a monthly removal of $95 billion, is expected to continue throughout 2024, withdrawing approximately $1 trillion from the economy in the next year.

Gross Domestic Product Is Resilient – No Recession Here

Following a robust 2.8% performance in 2023, including 3.3% growth in the fourth quarter, it is anticipated that the Gross Domestic Product (GDP) growth will ease to a 1.4% pace in 2024. The significant role of consumer spending, constituting 70% of GDP, adds importance to monitoring this indicator. Recent holiday shopping trends reflected modesty, with consumers displaying caution and actively seeking bargains. Several factors, such as reduced excess saving, stagnant wage growth, low saving rates and diminished pent-up demand, could contribute to a continued slowdown in consumer spending in 2024. Emerging indicators, including the resumption of student loan payments and a rise in subprime auto and credit card delinquencies, suggest potential stress for certain consumers. According to a Bloomberg economic forecast survey, the consensus points toward a lower GDP in 2024 compared to 2023, but this appears to be in no way recessionary.

Housing Continues to Be “Frozen”

With housing affordability metrics hitting a 40-year low in 2023 and 75% of mortgages secured at 4% or below, the U.S. housing market is essentially stagnant or frozen. Since 2020, housing affordability has plummeted by 47%, reaching levels near the lowest on record since 1986. Real residential investment experienced a notable 12% decline at a seasonally adjusted annual rate over the past six quarters. Despite a 6% rise in home values in 2023, resulting in nearly all-time highs due to tight supply and historically low vacancies, the market faces vulnerability in 2024 if mortgage rates, which dropped from above 8% to around 6% by year-end, don’t return to 3%.

Commercial Real Estate Troubles Loom

The office sector has transformed due to widespread work-from-home and hybrid office policies. Companies, reevaluating space needs, are downsizing, leading to reduced demand and lower rent rates. Concurrently, small and regional banks lending in commercial real estate are tightening standards amid rising interest rates. A substantial volume of commercial mortgages, with maturity approaching, will have to refinance at significantly higher rates. It is estimated that $1.2 trillion of commercial loans will need to be refinanced this year and next. This convergence presents a perfect storm, foreseeing lower valuations, increased loan defaults and potential foreclosures.

2

Supply Chains Continue to Adjust

In the last year, with the alleviation of inventory constraints and reduced shipping costs, supply-chain focus has transitioned from short-term tactics to long-term strategies emphasizing cost reduction and resilience. Legislation like the CHIPS and Science Act and the Inflation Reduction Act, both of which were enacted in 2022, incentivizes specific strategic industries — such as semiconductors and renewables — to bring production onshore. Consequently, there has been a noticeable increase in business investment in high-tech manufacturing structures over the past year. Looking ahead, global supply-chain adaptations are anticipated to proceed cautiously, especially now that companies have a better appreciation of how quickly supply-chain disruptions can squeeze their operating margins.

Geopolitics Are Plentiful

On the global front, persistent trade tensions with China, the ongoing Russia-Ukraine conflict and instability in the Middle East carried over from 2023 and are likely to contribute to ongoing uncertainties and risks in 2024. Although the direct impact on the U.S. economy has been limited, the overarching concern lies in the potential for a supply shock in essential commodities or goods — such as energy, food or semiconductors — leading to substantial market disruption. The upcoming U.S. presidential election in November may exert a more significant influence on geopolitics than recent cycles, given the current backdrop of heightened political tensions in the U.S.

Summary and Outlook

In 2023, the financial markets defied initial expectations, with both stock and bond markets experiencing positive outcomes by year-end. Despite concerns of a recession, a resilient economy, robust consumer spending and favorable inflation data led to impressive stock market gains, marked by the S&P 500’s longest winning streak since 2004. Equities faced challenges but navigated volatility, with a notable focus on the Magnificent Seven tech giants contributing to market performance. The 10-year Treasury yield ended where it started the year, with positive returns in the fourth quarter, but 2-year bond returns reflected less favorable results. Amid these developments, the Federal Reserve’s efforts to tame inflation without harming employment prompted discussions of a potential soft landing.

Looking ahead to 2024, there are diverging views between Fed officials and investors regarding policy rates. While the FOMC anticipates a gradual normalization with three rate cuts, investors are betting on a more aggressive approach, potentially adding volatility to both equity and bond markets. The GDP has been resilient, with a projected slowdown in 2024, but there appear to be no signs of a recession. However, challenges persisted in the housing market, characterized by affordability concerns and a “frozen” state. Commercial real estate faced troubles due to changes in the office sector and refinancing challenges. Meanwhile, supply chains continued to adjust, with a focus on long-term strategies, and geopolitics remained a source of uncertainty, particularly with trade tensions and conflicts influencing market dynamics as the world approached the 2024 U.S. presidential election.

With these key issues in mind, investors should continue to expect a sustained period of uncertainty in the financial markets and economy.

3

The total return performance (net of expenses) for each of the Funds is reflected below:

| | | | |

| Total Returns — Year Ended December 31, 2023 | |

| |

MoA Equity Index Fund | | | 26.12% | |

MoA All America Fund | | | 20.33% | |

MoA Small Cap Value Fund | | | 9.59% | |

MoA Small Cap Growth Fund | | | 15.63% | |

MoA Small Cap Equity Index Fund | | | 15.87% | |

MoA Mid Cap Value Fund | | | 6.96% | |

MoA Mid Cap Equity Index Fund | | | 16.25% | |

MoA Balanced Fund | | | 15.07% | |

MoA International Fund | | | 19.55% | |

MoA Catholic Values Index FundTM | | | 26.37% | |

MoA Retirement Income Fund | | | 9.91% | |

MoA Clear Passage 2015 FundTM | | | 10.55% | |

MoA Clear Passage 2020 FundTM | | | 11.83% | |

MoA Clear Passage 2025 FundTM | | | 13.59% | |

MoA Clear Passage 2030 FundTM | | | 15.25% | |

MoA Clear Passage 2035 FundTM | | | 17.26% | |

MoA Clear Passage 2040 FundTM | | | 18.87% | |

MoA Clear Passage 2045 FundTM | | | 19.64% | |

MoA Clear Passage 2050 FundTM | | | 19.94% | |

MoA Clear Passage 2055 FundTM | | | 19.98% | |

MoA Clear Passage 2060 FundTM | | | 20.19% | |

MoA Clear Passage 2065 FundTM | | | 20.50% | |

MoA Conservative Allocation Fund | | | 11.22% | |

MoA Moderate Allocation Fund | | | 15.34% | |

MoA Aggressive Allocation Fund | | | 17.52% | |

MoA Money Market Fund | | | 4.99% | |

MoA Intermediate Bond Fund | | | 4.62% | |

MoA Core Bond FundTM | | | 5.03% | |

For variable annuity owners or participants in a group variable annuity, the above performance figures do not reflect the deduction of respective Separate Account fees and expenses imposed by Mutual of America Life Insurance Company. All Fund performances presented throughout this report are historical, reflect the full reinvestment of dividends paid, and should not be considered indicative of future results.

The pages that immediately follow include brief discussions of each Fund’s performance for the year ended December 31, 2023, compared to its relevant index. Also presented are graphs and tables for each Fund (except for the Money Market Fund) which illustrate each Fund’s respective:

| | ● | | Historical total return achieved over specific periods and expressed as an average annual rate; |

| | ● | | Ending value in dollars of a $10,000 hypothetical investment at the beginning of each specified period; and |

| | ● | | Historical performance compared to an appropriate index. |

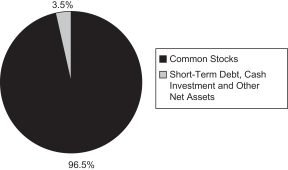

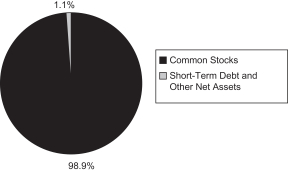

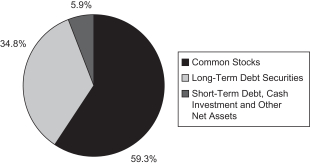

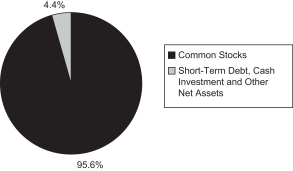

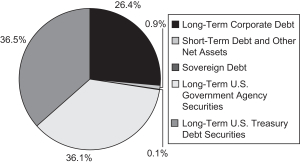

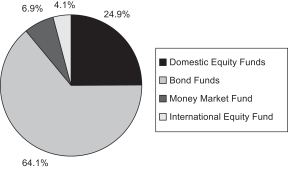

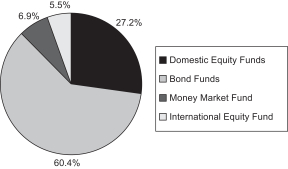

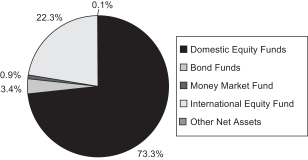

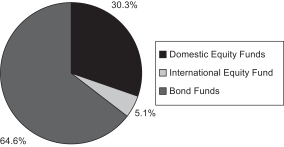

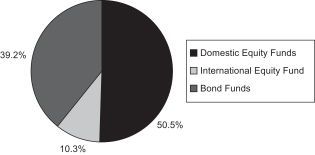

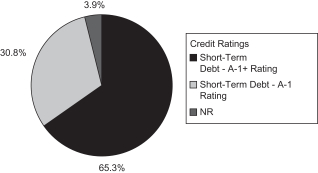

Following the discussions are the graphical representations of the asset allocations of each Fund and an illustration of each Fund’s operating expenses. The portfolios of each Fund and financial statements are presented in the pages that follow.

Thank you for your continued investment in our Funds.

Sincerely,

Chris W. Festog

Chairman of the Board,

Chief Executive Officer and Principal Executive Officer

MoA Funds Corporation

4

The views expressed in this Annual Report are subject to change at any time based on market and other conditions and should not be construed as a recommendation. This Report contains forward-looking statements which speak only as of the date they were made and involve a number of risks and uncertainties that could cause actual results to differ materially from those expressed herein. Readers are cautioned not to place undue reliance on our forward-looking statements, as we assume no obligation to update these forward-looking statements. Readers assume any and all responsibility for any investment decision made as a result of the views expressed herein.

S&P and S&P 500 are trademarks of Standard & Poor’s Financial Services LLC.

5

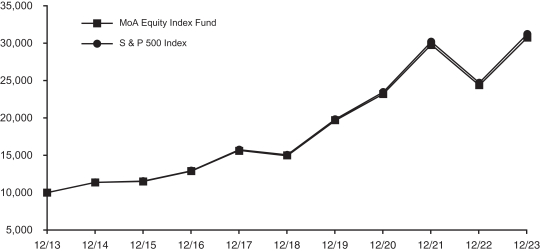

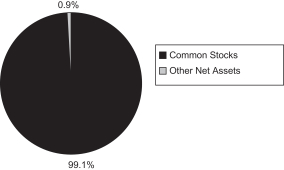

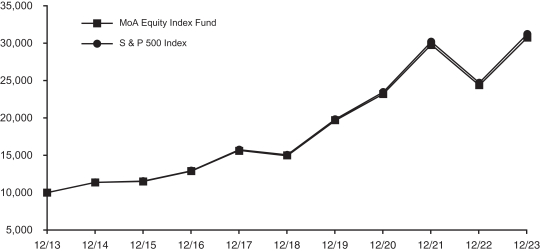

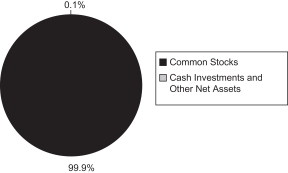

EQUITY INDEX FUND (Unaudited)

The Equity Index Fund’s objective is to seek investment results (before fees and expenses) that correspond to the investment performance of the S&P 500® Index (S&P 500), which consists of 500 stocks chosen by Standard & Poor’s for market size, liquidity and industry group representation. The S&P 500 is a market-weighted index of 500 stocks traded on the New York Stock Exchange, American Stock Exchange and NASDAQ, with each stock’s weight in the index proportionate to its market value. The weightings make each company’s influence on the S&P 500’s performance directly proportional to that company’s market value.

The Equity Index Fund’s performance for the year ended December 31, 2023, was 26.29% before expenses and 26.12% after expenses. The return of the S&P 500 was 26.29% over the same period.

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Equity Index Fund | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average Annual

Total Return | |

1 Year | | | $12,612 | | | | 26.12% | |

5 Years | | | $20,568 | | | | 15.52% | |

10 Years | | | $30,679 | | | | 11.86% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

The line representing the performance return of the MoA Equity Index Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not. Past performance is not indicative of future results.

6

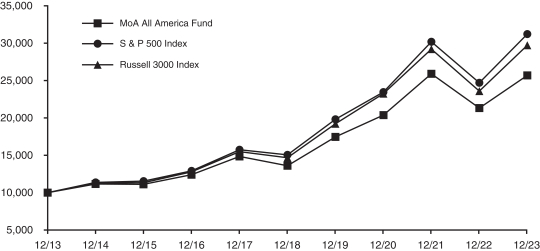

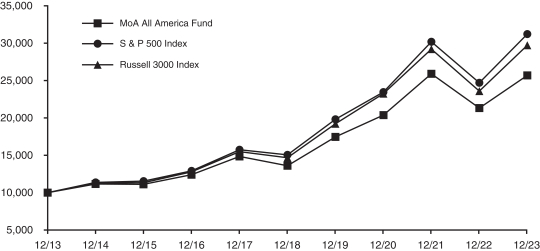

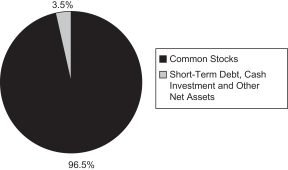

ALL AMERICA FUND (Unaudited)

The investment objective of the All America Fund is to outperform the Russell 3000® Index (Russell 3000) (before fees and expenses) by investing in a diversified portfolio of primarily common stocks. The All America Fund is approximately 60% passively invested in a selection of stocks from the 500 common stocks that comprise the S&P 500® Index, with the remaining 40% actively managed, comprised of approximately 20% mid cap and 20% small cap stocks, thus providing exposure to all levels of market capitalization among domestic stocks.

For the year ended December 31, 2023, the Russell 3000 increased by 25.96% on a total return basis, while the Russell® Midcap Core Index was up 17.23% and the Russell Midcap® Value Index was up 12.71%. The Russell 2000® Growth Index increased 18.66% and the Russell 2000® Value Index increased 14.65%.

The All America Fund’s return for the year ended December 31, 2023, was 20.96% before expenses and 20.33% after expenses. The return of its benchmark, the Russell 3000, was 25.96%. The underperformance of the Fund was driven by the higher weights in small and mid-size segments versus the Russell 3000.

Market leadership in 2023 was extremely narrow driven by a few mega-cap companies. Looking forward to 2024, we expect market breadth to broaden as the economy remains strong and interest rates come down.

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA All America Fund | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,033 | | | | 20.33% | |

5 Years | | | $18,863 | | | | 13.53% | |

10 Years | | | $25,608 | | | | 9.86% | |

| | | | | | | | |

Russell 3000 Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,596 | | | | 25.96% | |

5 Years | | | $20,254 | | | | 15.16% | |

10 Years | | | $29,641 | | | | 11.48% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

The line representing the performance return of the MoA All America Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Indices do not. Past performance is not indicative of future results.

7

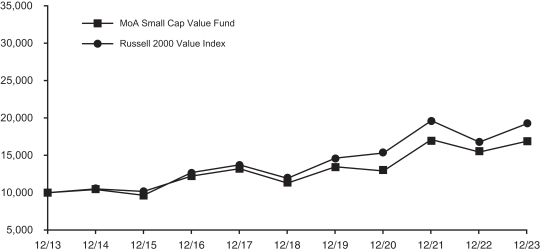

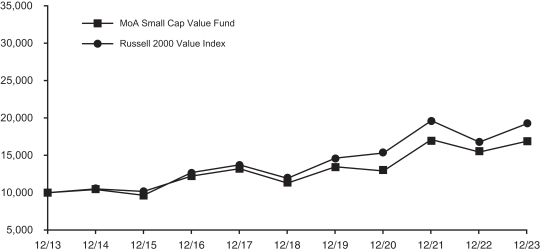

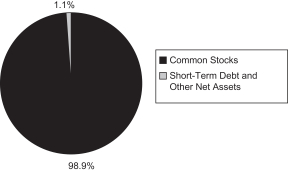

SMALL CAP VALUE FUND (Unaudited)

The Small Cap Value fund seeks strong risk-adjusted investment performance, in small capitalization companies with improving future investment prospects. The Fund approach is to invest in high quality companies with aligned management teams that can execute on their business plans and reinvest capital effectively. The Fund seeks to invest for the long term in companies with improving cash flows, low or improving financial leverage, where the investment team can develop a differentiated view of future returns. The strategy employs bottom-up disciplined fundamental research with proprietary risk models to identify future outperformers and to mitigate downside risk.

Small cap stocks as seen by the Russell 2000 Value Index, showed strong gains for the year ending December 2023. For the year ending December 31, 2023, the Russell 2000 Value Index returned 14.65% while the Small Cap Value Fund showed 10.50% before expenses and 9.59% after expenses for the same period.

From a sector perspective, stock selection within Financials and Consumer Discretionary sectors was the largest relative detractor to performance for the year, while stock selection within the Industrial and Healthcare sectors was the largest contributor to relative performance. Based on our bottom-up selection process, the portfolio is significantly overweight Industrials, with more moderate overweight to the Utility sector versus the Russell Small Cap Value benchmark. Conversely, the portfolio is currently significantly underweight in the Healthcare sector, with more moderate underweight to the Technology and Consumer Discretionary sectors.

Top contributors for the year were Mueller Industrials, Inc., Taylor Morrison Home Corporation and Miller Industrials, Inc. Top detractors for the year were Marriott Vacations Worldwide Corporation, Tegna, Inc. and Treehouse Foods, Inc. The largest new positions for the year were Ashland Inc, Fortrea Holdings Inc. and Northern Oil & Gas Inc.

Following a 2022 which was the worst year for markets over the last few decades, driven mainly by earnings multiple compression as the discount rate normalized from higher rates, 2023 marked a sharp reversal of these trends as rate expectations peaked out and investors began to discount a nearer end to the current interest rate cycle. The Fund continues to be overweight higher quality companies, as measured by return on assets and return on equity versus the benchmark, which presented a headwind to relative performance in particular during the fourth quarter of 2023.

We see multiple reasons to be bullish on small to mid-cap stocks over the next decade. Small capitalization US equities trade at an extreme discount to larger cap peers which is near multi-decade lows. In addition, smaller capitalization companies tend to outperform coming out of negative earnings revision cycles, which we have seen over the course of the last few quarters due to lower demand, higher interest rates and less benefits from pricing in 2023. Finally, the quality of market indices have declined dramatically over the last few years as non-profitable companies have become a greater percentage of the market. These factors create an increasingly attractive market opportunity for nimble, active investors.

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Small Cap Value Fund | |

Period Ended 12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,959 | | | | 9.59% | |

5 Years | | | $14,948 | | | | 8.37% | |

10 Years | | | $16,884 | | | | 5.38% | |

| | | | | | | | |

Russell 2000 Value Index | |

Period Ended 12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,465 | | | | 14.65% | |

5 Years | | | $16,105 | | | | 10.00% | |

10 Years | | | $19,226 | | | | 6.76% | |

The line representing the performance return of the MoA Small Cap Value Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not. Past performance is not indicative of future results.

8

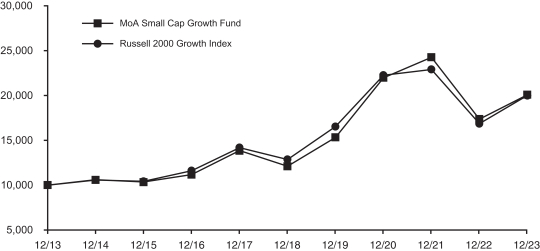

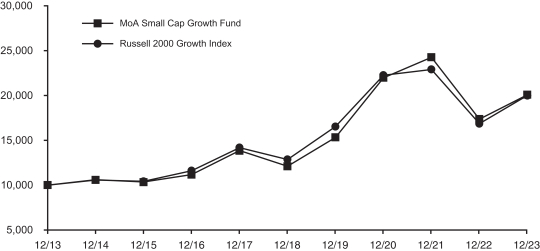

SMALL CAP GROWTH FUND (Unaudited)

The Fund seeks capital appreciation. That is, we invest for long-term growth of capital by investing in companies with small market capitalizations.

Our active small cap growth approach is to seek attractive returns without taking undue risk, which we seek to achieve by investment in companies that have strong fundamentals, a compelling and sustainable business model and are led by a proven management team that has demonstrated the ability to execute on a business plan. Successful investment of capital, we believe, is a significant determinant in a company’s prospects.

Small cap stocks, as represented by the Russell 2000® Growth Index, showed mid-teens results of 18.66%, with over half the return seen in the stellar fourth quarter performance. The Fund was competitive with its benchmark and its small cap growth peers. For 2023, the Small Cap Growth Fund showed a gross return of 16.59% and a net return of 15.63% after expenses.

Of the three traditional growth sectors, consumer discretionary and information technology returned above 20% while healthcare lagged the Index returning just under 11.5%. Our stock selection in the Industrials, Materials and Financials sectors contributed the most of any 3-sectors to the investment results of the Fund for 2023.

The machinery, pharmaceutical and professional services industries contributed the most to the return of the overall Fund relative to its index whereas the communications equipment, automobile components and electrical equipment industries detracted the most from the overall performance.

For the year, the Fund was underweight non-earning companies. We underperformed in this area given the 10-year Treasury yield fell from nearly 5% in mid-October to about 3.8% by the end of December. With interest rates declining, long duration assets, such as non-earning companies rallied in price.

Bottom-up, fundamental company research begins with ideas generation, which leverages the knowledge, depth, and scope of the investment professionals in our organization to identify candidates. We are long term investors with a 3- to 5- year time horizon. We employ a disciplined approach to portfolio construction through understanding and measuring risk.

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Small Cap Growth Fund | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,563 | | | | 15.63% | |

5 Years | | | $16,586 | | | | 10.65% | |

10 Years | | | $20,048 | | | | 7.20% | |

| | | | | | | | |

Russell 2000 Growth Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,866 | | | | 18.66% | |

5 Years | | | $15,544 | | | | 9.22% | |

10 Years | | | $19,966 | | | | 7.16% | |

The line representing the performance return of the MoA Small Cap Growth Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not. Past performance is not indicative of future results.

9

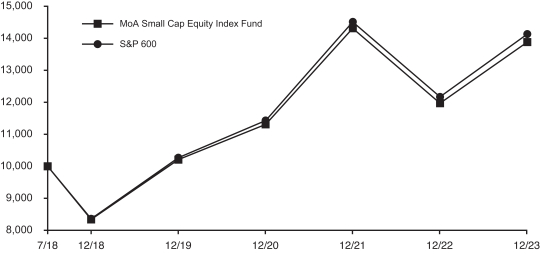

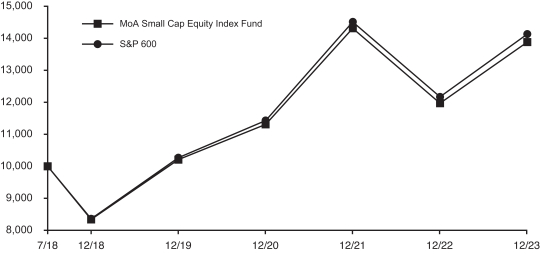

SMALL CAP EQUITY INDEX FUND (Unaudited)

The Small Cap Equity Index Fund invests in the stocks that comprise the S&P SmallCap 600® Index (S&P SmallCap 600). The S&P SmallCap 600 is a market-weighted index of 600 stocks traded on the New York Stock Exchange, American Stock Exchange and NASDAQ. The weightings make each company’s influence on the S&P SmallCap 600’s performance directly proportional to that company’s market value.

The Small Cap Equity Index Fund’s return for the year ended December 31, 2023 was 16.04% before expenses and 15.87% after expenses. The return of the S&P SmallCap 600 was 16.05%.

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Small Cap Equity Index Fund | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,587 | | | | 15.87% | |

5 Years | | | $16,617 | | | | 10.69% | |

Since 7/2/18 (Inception) | | | $13,866 | | | | 6.12% | |

| | | | | | | | |

S & P 600 Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,605 | | | | 16.05% | |

5 Years | | | $16,873 | | | | 11.03% | |

Since 7/2/18 (Inception) | | | $14,117 | | | | 6.47% | |

The line representing the performance return of the MoA Small Cap Equity Index Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not. Past performance is not indicative of future results.

10

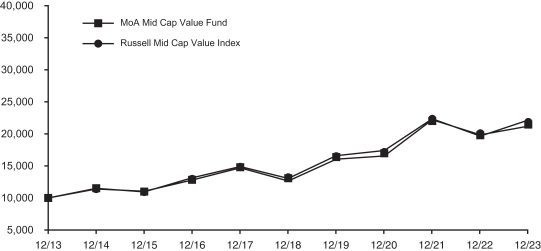

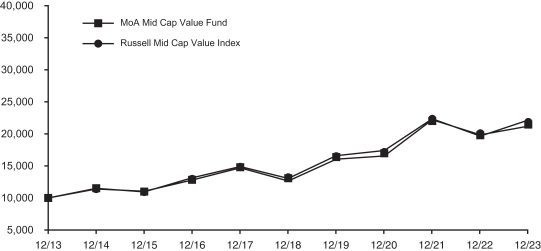

MID CAP VALUE FUND (Unaudited)

The Mid Cap Value fund seeks strong risk-adjusted investment performance in mid capitalization companies with improving future investment prospects. The Fund approach is to invest in high quality companies with aligned management teams that can execute on their business plans and reinvest capital effectively. The Fund seeks to invest for the long term in companies with improving cash flows, low or improving financial leverage, where the investment team can develop a differentiated view of future returns. The strategy employs bottom-up disciplined fundamental research with proprietary risk models to identify future outperformers and to mitigate downside risk.

Mid cap stocks as seen by the Russell Mid Value Index, showed strong gains for the year ending December 2023. For the year ending December 31, 2023, the Russell Mid Value Index returned 12.71% while the Mid Cap Value Fund returned 7.71% before expenses and 6.96% after expenses for the same period.

From a sector perspective, stock selection within Financials and Consumer Discretionary sectors was the largest relative detractor to performance for the year, while stock selection within the Industrial sector was the largest contributor to relative performance. Based on our bottom-up selection process, the portfolio is significantly overweight Materials, with more moderate overweight to the Utility and Energy sectors versus the Russell Mid Cap Value benchmark. Conversely, the portfolio is currently significantly underweight in the Consumer Discretionary sector, with more moderate underweight to the Financials and Technology sectors.

Top contributors for the year were Builders Firstsource, Inc., Mueller Industries, Inc. and Crane Company. Top detractors for the year were SVB Financial Group, Marriott Vacations Worldwide Corporation and Ashland Inc. The largest new positions for the year were Vontier Corp, Veralto Corp and Everest Group Ltd.

Following a 2022 which was one of the worst years for markets over the last few decades, driven mainly by earnings multiple compression as the discount rate normalized from higher rates, 2023 marked a sharp reversal of these trends as rate expectations peaked out and investors began to discount a nearer end to the current interest rate cycle. The Fund continues to be overweight higher quality companies, as measured by return on assets and return on equity versus the benchmark, which presented a headwind to relative performance in particular during the fourth quarter of 2023. The quality of market indices have declined dramatically over the last few years as non-profitable companies have become a greater percentage of the market. This dynamic creates an increasingly attractive market opportunity for nimble, active investors.

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Mid Cap Value Fund | |

Period Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,696 | | | | 6.96% | |

5 Years | | | $16,768 | | | | 10.89% | |

10 Years | | | $21,172 | | | | 7.79% | |

| | | | | | | | |

Russell Mid Cap Value Index | |

Period Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,271 | | | | 12.71% | |

5 Years | | | $16,971 | | | | 11.16% | |

10 Years | | | $22,122 | | | | 8.26% | |

The line representing the performance return of the MoA Mid Cap Value Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not. Past performance is not indicative of future results.

11

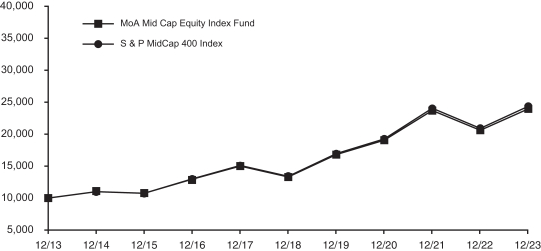

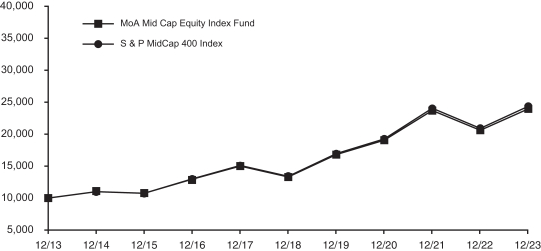

MID CAP EQUITY INDEX FUND (Unaudited)

The Mid Cap Equity Index Fund invests in stocks that comprise the S&P MidCap 400® Index (S&P MidCap 400). The S&P MidCap 400 is a market-weighted index of 400 stocks traded on the New York Stock Exchange, American Stock Exchange and NASDAQ. The weightings make each company’s influence on the S&P MidCap 400’s performance directly proportional to that company’s market value. The companies included in the S&P MidCap 400 tend to be typical of this asset class, the medium-capitalized sector of the U.S. securities market.

The Mid Cap Equity Index Fund’s performance for the year ended December 31, 2023, was 16.43% before expenses and 16.25% after expenses. The return of the S&P MidCap 400 was 16.44% over the same period.

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Mid Cap Equity Index Fund | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,625 | | | | 16.25% | |

5 Years | | | $17,969 | | | | 12.44% | |

10 Years | | | $23,879 | | | | 9.09% | |

| | | | | | | | |

S & P MidCap 400 Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,644 | | | | 16.44% | |

5 Years | | | $18,115 | | | | 12.62% | |

10 Years | | | $24,276 | | | | 9.27% | |

The line representing the performance return of the MoA Mid Cap Equity Index Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not. Past performance is not indicative of future results.

12

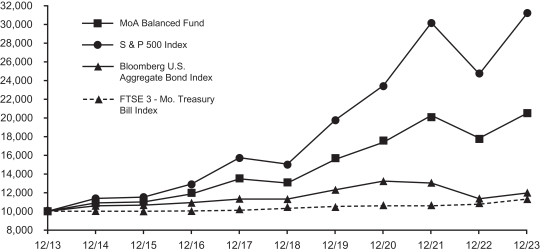

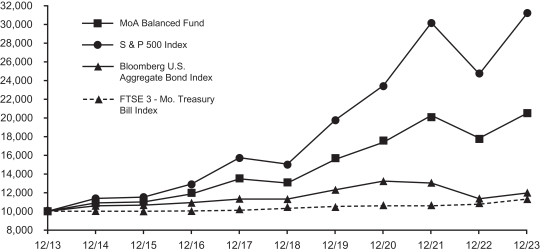

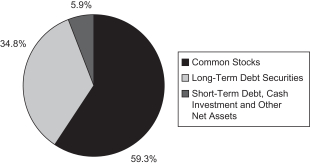

BALANCED FUND^ (Unaudited)

The Balanced Fund seeks capital appreciation and current income by investing in a diversified portfolio of common stocks, debt securities and money market instruments.

The fixed income portion of the Fund (i.e. the portion that invests in debt securities and money market instruments) invests primarily in investment grade publicly traded debt securities. The securities held include corporate, U.S. agency and mortgage-backed securities, all of which normally yield more than U.S. Treasury issues.

For the year ended December 31, 2023, the fixed income portion of the Fund had a total return of 5.46% before expenses. The Bloomberg U.S. Aggregate Bond Index returned 5.53% for the year ended December 31, 2023.

The equity portion of the Balanced Fund (i.e. the portion that invests in common stocks) provides exposure to a diversified portfolio of primarily large capitalization, domestic equity securities that have the potential to outperform their peer group over the medium to long term.

For the year ended December 31, 2023, the equity portion of the Fund had a total return of 22.19% (before expenses), underperforming the S&P 500® Index (S&P 500) which increased 26.29%.

The Fund’s aggregate performance for the year ended December 31, 2023 was 15.68% before expenses and 15.07% after expenses, versus a 17.71% return in the blended benchmark (60% weighting for the S&P 500 and 40% weighting for the Bloomberg U.S. Aggregate Index).

The underperformance of the fund was due to its emphasis on higher dividend yielding equities during a market that favored high growth, mega-cap companies. The fixed income portion contributed to the underperformance due to its more conservative positioning.

Looking forward to 2024, we expect market breadth to broaden, which should be constructive for equities. It is widely expected that the Federal Reserve will cut interest rates in 2024 which should benefit dividend payers.

| ^ | Formerly Composite Fund (Note 1). |

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Balanced Fund | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,507 | | | | 15.07% | |

5 Years | | | $15,734 | | | | 9.49% | |

10 Years | | | $20,493 | | | | 7.44% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

The line representing the performance return of the MoA Balanced Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Indices do not. Past performance is not indicative of future results.

13

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

10 Years | | | $11,964 | | | | 1.81% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

10 Years | | | $11,330 | | | | 1.26% | |

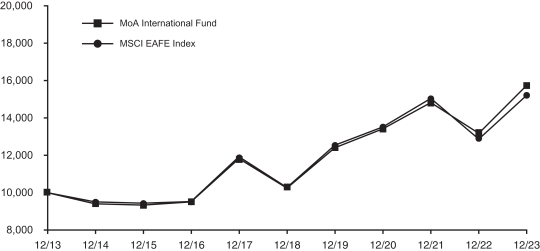

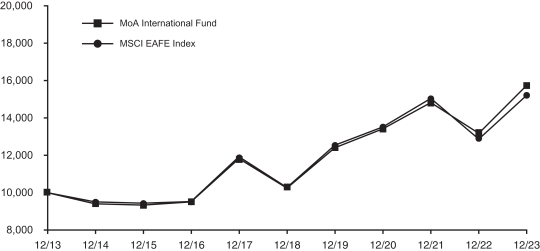

INTERNATIONAL FUND (Unaudited)

The International Fund seeks capital appreciation by investing primarily in stocks of large and mid-cap companies in developed market countries located outside of the United States and Canada that are reflected or contained in the Morgan Stanley Capital International, Inc. Europe, Australasia and Far East® Index (MSCI EAFE® Index). The Fund may also invest in exchange traded funds within the general limitations of the Investment Company Act of 1940.

For the year ended December 31, 2023, the International Fund returned 19.70% before expenses and 19.55% after expenses. The return of the MSCI EAFE benchmark was 18.24%.

We believe that successful long-term investing is a careful combination of seeking superior returns while maintaining a lower risk profile. Our investment approach emphasizes high-quality international companies that have attractive valuations, earnings, and strong free cash flow.

The Fund is a portfolio of primarily large-cap companies from around the world. Three regions comprise the primary areas where we find compelling investment opportunities: Europe, the UK, and Japan. In the current environment we have more favorable views toward investing in Japanese companies. From an economic perspective, Japan is still experiencing much-desired higher inflation after years of deflation. Younger Japanese consumers, compared to those in Europe, the UK, and the U.S., appear to be more willing to accept price increases. In addition, the Tokyo Stock Exchange has been a positive agent of change for the stock market and is emphasizing increased corporate governance. Recent regulations have emphasized shareholder-friendly practices such as returning capital to investors and increased independence for boards.

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA International Fund | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,955 | | | | 19.55% | |

5 Years | | | $15,360 | | | | 8.96% | |

10 Years | | | $15,729 | | | | 4.63% | |

| | | | | | | | |

MSCI EAFE Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,824 | | | | 18.24% | |

5 Years | | | $14,805 | | | | 8.16% | |

10 Years | | | $15,204 | | | | 4.28% | |

The line representing the performance return of the MoA International Fund includes expenses, such as direct management fees and expenses of the underlying ETFs in which the Fund invests that reduce returns, while the performance return line of the Index does not. Past performance is not indicative of future results.

14

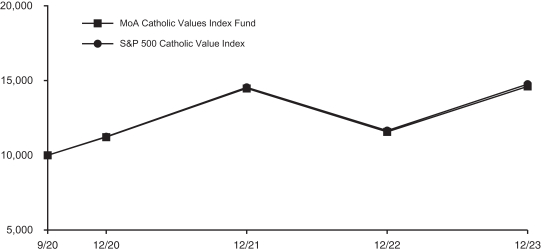

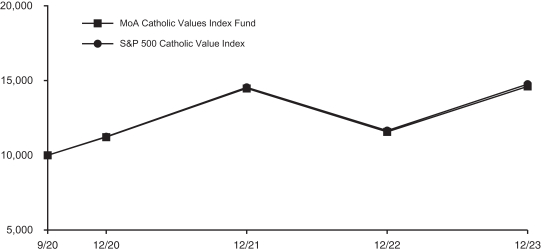

CATHOLIC VALUES INDEX FUND (Unaudited)

The Catholic Values Index Fund seeks investment results (before fees and expenses) that correspond to the investment performance of the S&P 500® Catholic Values Index (Catholic Values Index). The Catholic Values Index is designed to provide exposure to U.S. large capitalization stocks included in the S&P 500® Index (S&P 500) while maintaining alignment with the moral and social teachings of the Catholic Church. The Catholic Values Index is based on the S&P 500, and generally comprises approximately 500 or less U.S. listed common stocks. All index constituents are members of the S&P 500 and follow the eligibility criteria for that index. From this starting universe, constituents are screened to exclude companies involved in activities which are perceived to be inconsistent with Catholic values as outlined in the Socially Responsible Investment Guidelines of the United States Conference of Catholic Bishops, currently including the protection of human life, promotion of human dignity, reducing arms production, affordable housing and banking, protection of the environment and encouraging corporate responsibility. The Catholic Values Index then reweights the remaining constituents so that the Catholic Values Index’s sector exposures approximate the sector exposures on the S&P 500.

The Catholic Values Index Fund’s performance for the year ended December 31, 2023, was 26.65% before expenses and 26.37% after expenses. The benchmark returned 26.77%.

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Catholic Values Index Fund | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,637 | | | | 26.37% | |

Since 9/30/20 (Inception) | | | $14,603 | | | | 12.35% | |

| | | | | | | | |

S & P 500 Catholic Values Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,677 | | | | 26.77% | |

Since 9/30/20 (Inception) | | | $14,754 | | | | 12.70% | |

The line representing the performance return of the MoA Catholic Values Index Fund includes expenses, such as transaction costs and management fees that reduce returns, while the performance return line of the Index does not. Past performance is not indicative of future results.

15

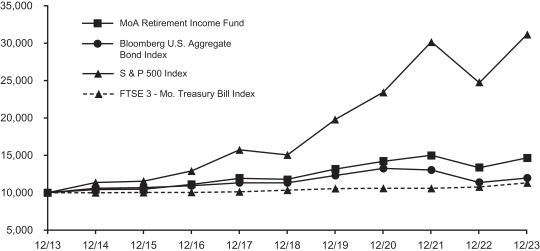

TARGET DATE SERIES (Unaudited)

All of the Funds in the Target Date Series had positive performance during the twelve-month period and exceeded the return of their corresponding Morningstar benchmark. For the year ended December 31, 2023, the return for the S&P 500® Index was 26.29%, for the Bloomberg U.S. Aggregate Bond Index was 5.53% and for the FTSE 3-Month Treasury Bill Index was 5.26%.

Compared to competitors, our relative underweight to International equities versus Domestic was a positive driver of performance, as U.S. equities outperformed. Our relative overweight to small and mid-capitalization equities relative to other providers was a headwind to performance, as these asset classes trailed large cap stocks.

The equity market had very strong returns, led by a small number of mega-cap companies, as investors bid up stocks in the face of declining inflation and a continued strong labor market. As breadth improves, we continue to believe that our Funds are well positioned to continue delivering attractive long-term returns.

16

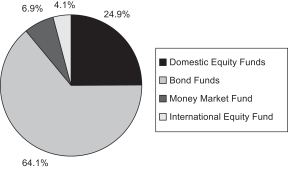

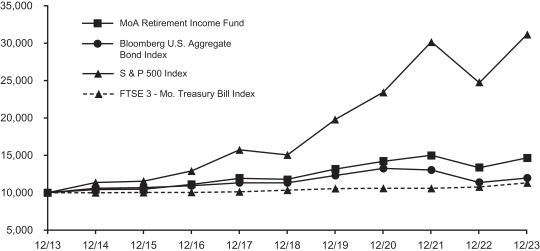

RETIREMENT INCOME FUND (Unaudited)

The objective of the Retirement Income Fund is current income consistent with the preservation of capital and, to a lesser extent, capital appreciation. The Retirement Income Fund invests in the equity and fixed-income Funds of the MoA Funds. The Fund’s current target allocation is approximately 70% of net assets in fixed-income and money market Funds and approximately 30% of net assets in equity Funds.

Performance for the Retirement Income Fund is compared to the Bloomberg U.S. Aggregate Bond Index, the FTSE 3-Month Treasury Bill Index and the S&P 500® Index. In addition, we compare the performance of our Fund to the Morningstar Lifetime Allocation Conservative Income Index. For the year ended December 31, 2023, the Fund returned 10.07% before expenses and 9.91% after expenses, versus a 8.16% return for the Morningstar benchmark.

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Retirement Income Fund | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,991 | | | | 9.91% | |

5 Years | | | $12,434 | | | | 4.45% | |

10 Years | | | $14,634 | | | | 3.88% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

10 Years | | | $11,964 | | | | 1.81% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

10 Years | | | $11,330 | | | | 1.26% | |

The line representing the performance return of the MoA Retirement Income Fund includes expenses, such as direct management fees and expenses of the underlying funds in which the Fund invests, that reduce returns while the performance return lines of the Indices do not. The Morningstar Lifetime Allocation Conservative Income Index measures the performance of a portfolio of global equities, bonds and traditional inflation hedges such as commodities and TIPS. Past performance is not indicative of future results.

17

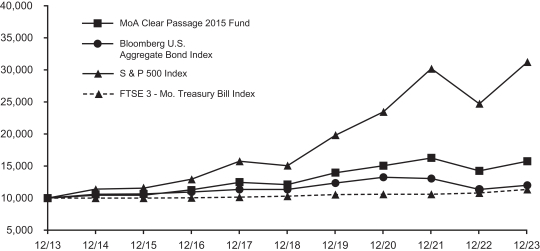

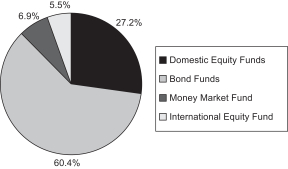

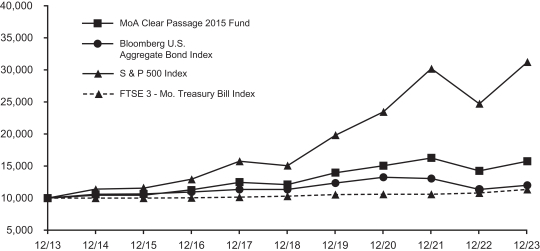

CLEAR PASSAGE 2015 FUND^ (Unaudited)

The objective of the Clear Passage 2015 Fund is current income and capital appreciation appropriate for the asset allocation associated with a retirement in 2015. The Clear Passage 2015 Fund invests in the equity and fixed-income funds of the MoA Funds. The Fund’s current target allocation is approximately 68% of net assets in fixed-income and money market Funds and approximately 32% of net assets in equity Funds.

Performance for the Clear Passage 2015 Fund is compared to the Bloomberg U.S. Aggregate Bond Index, the FTSE 3-Month Treasury Bill Index and the S&P 500® Index. In addition, we compare the performance of our Fund to the Morningstar Lifetime Allocation Conservative 2015 Index. For the year ended December 31, 2023, the Fund returned 10.77% before expenses and 10.55% after expenses, versus a 8.52% return for the Morningstar benchmark.

| ^ | Formerly Retirement 2015 Fund (Note 1). |

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Clear Passage 2015 Fund | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,055 | | | | 10.55% | |

5 Years | | | $13,004 | | | | 5.39% | |

10 Years | | | $15,704 | | | | 4.62% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

10 Years | | | $11,964 | | | | 1.81% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth of $10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

10 Years | | | $11,330 | | | | 1.26% | |

The line representing the performance return of the MoA Clear Passage 2015 Fund includes expenses, such as direct management fees and expenses of the underlying funds in which the Fund invests, that reduce returns while the performance return lines of the Indices do not. The Morningstar Lifetime Allocation Conservative 2015 Index measures the performance of a portfolio of global equities, bonds and traditional inflation hedges such as commodities and TIPS. This portfolio is held in proportions appropriate for a US investor who has a target maturity date of 2015. Past performance is not indicative of future results.

18

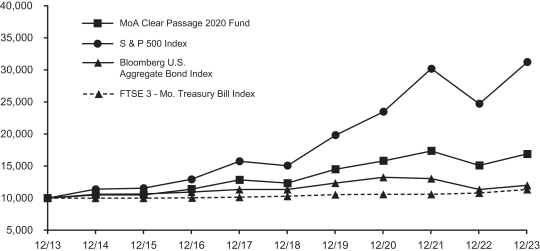

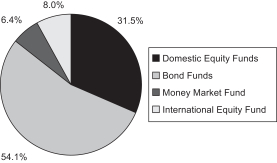

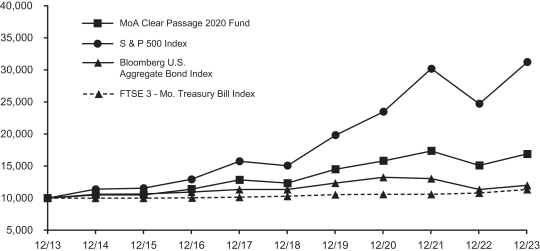

CLEAR PASSAGE 2020 FUND^ (Unaudited)

The objective of the Clear Passage 2020 Fund is current income and capital appreciation appropriate for the asset allocation associated with a retirement in 2020. The Clear Passage 2020 Fund invests in the equity and fixed-income funds of the MoA Funds. The Fund’s current target allocation is approximately 61% of net assets in fixed-income and money market Funds and approximately 39% of net assets in equity Funds.

Performance for the Clear Passage 2020 Fund is compared to the Bloomberg U.S. Aggregate Bond Index, the FTSE 3-Month Treasury Bill Index and the S&P 500® Index. In addition, we compare the performance of our Fund to the Morningstar Lifetime Allocation Moderate 2020 Index. For the year ended December 31, 2023, the Fund returned 11.95% before expenses and 11.83% after expenses, versus a 11.23% return for the Morningstar benchmark.

| ^ | Formerly Retirement 2020 Fund (Note 1). |

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Clear Passage 2020 Fund | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,183 | | | | 11.83% | |

5 Years | | | $13,691 | | | | 6.48% | |

10 Years | | | $16,855 | | | | 5.36% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

10 Years | | | $11,964 | | | | 1.81% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

10 Years | | | $11,330 | | | | 1.26% | |

The line representing the performance return of the MoA Clear Passage 2020 Fund includes expenses, such as direct management fees and expenses of the underlying funds in which the Fund invests, that reduce returns while the performance return lines of the Indices do not. The Morningstar Lifetime Allocation Moderate 2020 Index measures the performance of a portfolio of global equities, bonds and traditional inflation hedges such as commodities and TIPS. This portfolio is held in proportions appropriate for a US investor who has a target maturity date of 2020. Past performance is not indicative of future results.

19

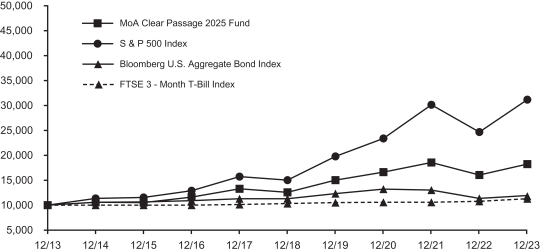

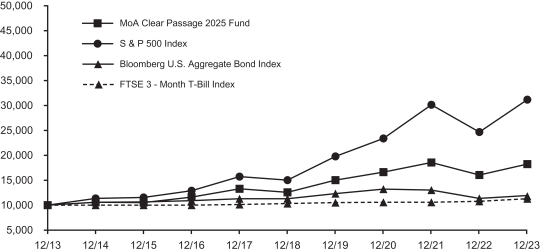

CLEAR PASSAGE 2025^ FUND (Unaudited)

The objective of the Clear Passage 2025 Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2025. The Clear Passage 2025 Fund invests in the equity and fixed-income funds of the MoA Funds. The Fund’s current target allocation is approximately 49% of net assets in equity Funds and approximately 51% of net assets in fixed-income and money market Funds.

Performance for the Clear Passage 2025 Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to the Morningstar Lifetime Allocation Moderate 2025 Index. For the year ended December 31, 2023, the Fund returned 13.70% before expenses and 13.59% after expenses, versus a 12.05% return for the Morningstar benchmark.

| ^ | Formerly Retirement 2025 Fund (Note 1). |

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Clear Passage 2025 Fund | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,359 | | | | 13.59% | |

5 Years | | | $14,522 | | | | 7.75% | |

10 Years | | | $18,250 | | | | 6.20% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

10 Years | | | $11,964 | | | | 1.81% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

10 Years | | | $11,330 | | | | 1.26% | |

The line representing the performance return of the MoA Clear Passage 2025 Fund includes expenses, such as direct management fees and expenses of the underlying funds in which the Fund invests, that reduce returns while the performance return lines of the Indices do not. The Morningstar Lifetime Allocation Moderate 2025 Index measures the performance of a portfolio of global equities, bonds and traditional inflation hedges such as commodities and TIPS. This portfolio is held in proportions appropriate for a US investor who has a target maturity date of 2025. Past performance is not indicative of future results.

20

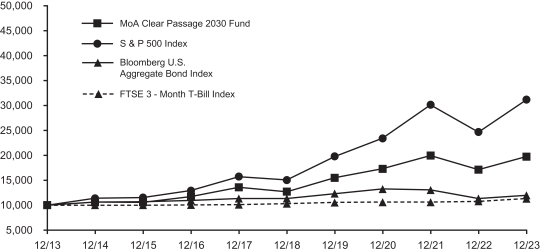

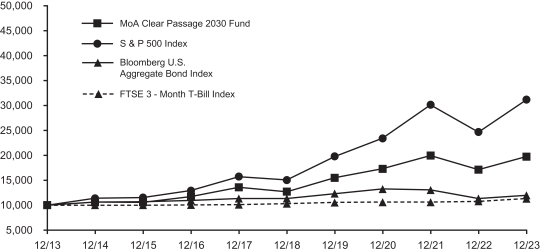

CLEAR PASSAGE 2030 FUND^ (Unaudited)

The objective of the Clear Passage 2030 Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2030. The Clear Passage 2030 Fund invests in the equity and fixed-income funds of the MoA. The Fund’s current target allocation is approximately 59% of net assets in equity Funds and approximately 41% of net assets in fixed-income and money market Funds.

Performance for the Clear Passage 2030 Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to the Morningstar Lifetime Allocation Moderate 2030 Index. For the year ended December 31, 2023, the Fund returned 15.35% before expenses and 15.25% after expenses, versus a 13.21% return for the Morningstar benchmark.

| ^ | Formerly Retirement 2030 Fund (Note 1). |

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Clear Passage 2030 Fund | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,525 | | | | 15.25% | |

5 Years | | | $15,534 | | | | 9.21% | |

10 Years | | | $19,726 | | | | 7.03% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

10 Years | | | $11,964 | | | | 1.81% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

10 Years | | | $11,330 | | | | 1.26% | |

The line representing the performance return of the MoA Clear Passage 2030 Fund includes expenses, such as direct management fees and expenses of the underlying funds in which the Fund invests, that reduce returns while the performance return lines of the Indices do not. The Morningstar Lifetime Allocation Moderate 2030 Index measures the performance of a portfolio of global equities, bonds and traditional inflation hedges such as commodities and TIPS. This portfolio is held in proportions appropriate for a US investor who has a target maturity date of 2030. Past performance is not indicative of future results.

21

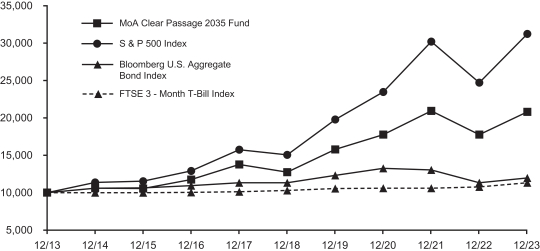

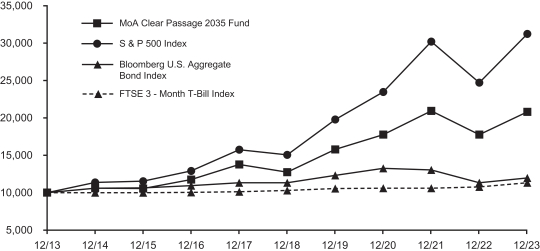

CLEAR PASSAGE 2035 FUND^ (Unaudited)

The objective of the Clear Passage 2035 Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2035. The Clear Passage 2035 Fund invests in the equity and fixed-income funds of the MoA Funds. The Fund’s current target allocation is approximately 71% of net assets in equity Funds and approximately 29% of net assets in the fixed-income and money market Funds.

Performance for the Clear Passage 2035 Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to the Morningstar Lifetime Allocation Moderate 2035 Index. For the year ended December 31, 2023, the Fund returned 17.36% before expenses and 17.26% after expenses, versus a 14.69% return for the Morningstar benchmark.

| ^ | Formerly Retirement 2035 Fund (Note 1). |

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Clear Passage 2035 Fund | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,726 | | | | 17.26% | |

5 Years | | | $16,311 | | | | 10.28% | |

10 Years | | | $20,792 | | | | 7.59% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

10 Years | | | $11,964 | | | | 1.81% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

10 Years | | | $11,330 | | | | 1.26% | |

The line representing the performance return of the MoA Clear Passage 2035 Fund includes expenses, such as direct management fees and expenses of the underlying funds in which the Fund invests, that reduce returns while the performance return lines of the Indices do not. The Morningstar Lifetime Allocation Moderate 2035 Index measures the performance of a portfolio of global equities, bonds and traditional inflation hedges such as commodities and TIPS. This portfolio is held in proportions appropriate for a US investor who has a target maturity date of 2035. Past performance is not indicative of future results.

22

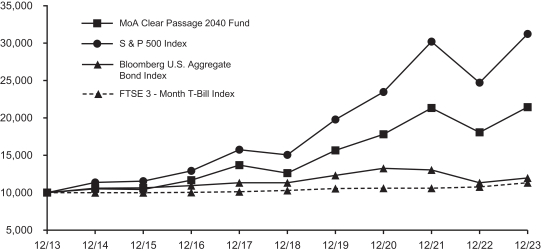

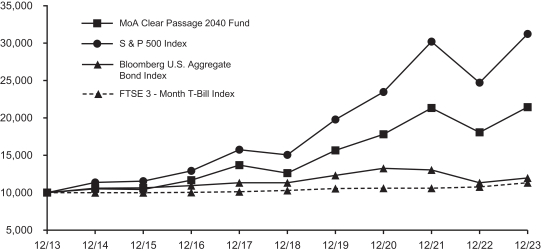

CLEAR PASSAGE 2040 FUND^ (Unaudited)

The objective of the Clear Passage 2040 Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2040. The Clear Passage 2040 Fund invests in the equity and fixed-income funds of the MoA Funds. The Fund’s current target allocation is approximately 81% of net assets in equity Funds and approximately 19% of net assets in the fixed-income and money market Funds.

Performance for the Clear Passage 2040 Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to the Morningstar Lifetime Allocation Moderate 2040 Index. For the year ended December 31, 2023, the Fund returned 18.97% before expenses and 18.87% after expenses, versus a 16.16% return for the Morningstar benchmark.

| ^ | Formerly Retirement 2040 Fund (Note 1). |

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Clear Passage 2040 Fund | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,887 | | | | 18.87% | |

5 Years | | | $16,998 | | | | 11.19% | |

10 Years | | | $21,425 | | | | 7.92% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

10 Years | | | $11,964 | | | | 1.81% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

10 Years | | | $11,330 | | | | 1.26% | |

The line representing the performance return of the MoA Clear Passage 2040 Fund includes expenses, such as direct management fees and expenses of the underlying funds in which the Fund invests, that reduce returns while the performance return lines of the Indices do not. The Morningstar Lifetime Allocation Moderate 2040 Index measures the performance of a portfolio of global equities, bonds and traditional inflation hedges such as commodities and TIPS. This portfolio is held in proportions appropriate for a US investor who has a target maturity date of 2040. Past performance is not indicative of future results.

23

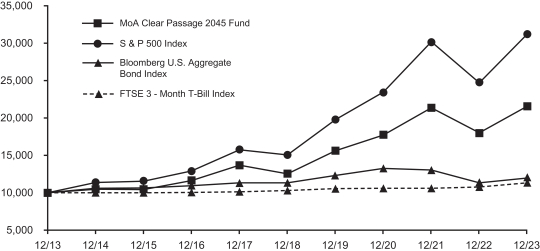

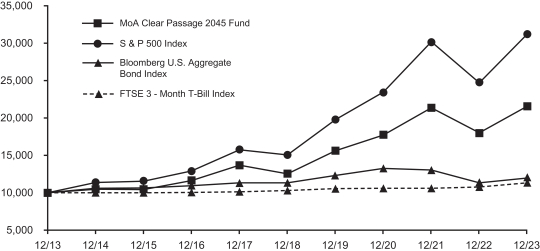

CLEAR PASSAGE 2045 FUND^ (Unaudited)

The objective of the Clear Passage 2045 Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2045. The Clear Passage 2045 Fund invests in the equity and fixed-income funds of the MoA Funds. The Fund’s current target allocation is approximately 86% of net assets in equity Funds and approximately 14% of net assets in the fixed-income and money market Funds.

Performance for the Clear Passage 2045 Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to the Morningstar Lifetime Allocation Moderate 2045 Index. For the year ended December 31, 2023, the Fund returned 19.74% before expenses and 19.64% after expenses, versus a 17.19% return for the Morningstar benchmark.

| ^ | Formerly Retirement 2045 Fund (Note 1). |

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Clear Passage 2045 Fund | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,964 | | | | 19.64% | |

5 Years | | | $17,182 | | | | 11.43% | |

10 Years | | | $21,542 | | | | 7.98% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

10 Years | | | $11,964 | | | | 1.81% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

10 Years | | | $11,330 | | | | 1.26% | |

The line representing the performance return of the MoA Clear Passage 2045 Fund includes expenses, such as direct management fees and expenses of the underlying funds in which the Fund invests, that reduce returns while the performance return lines of the Indices do not. The Morningstar Lifetime Allocation Moderate 2045 Index measures the performance of a portfolio of global equities, bonds and traditional inflation hedges such as commodities and TIPS. This portfolio is held in proportions appropriate for a US investor who has a target maturity date of 2045. Past performance is not indicative of future results.

24

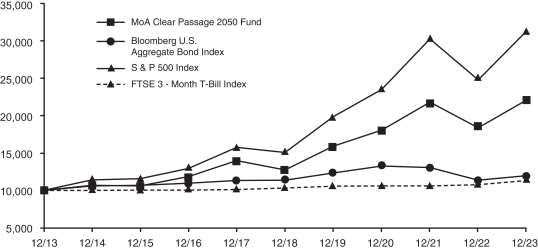

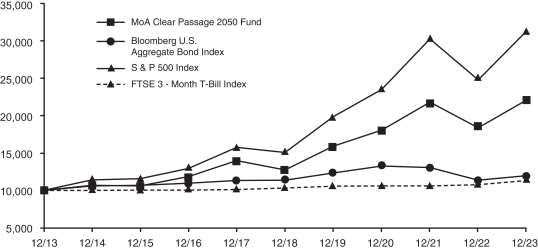

CLEAR PASSAGE 2050 FUND^ (Unaudited)

The objective of the Clear Passage 2050 Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2050. The Clear Passage 2050 Fund invests in the equity and fixed-income funds of the MoA Funds. The Fund’s current target allocation is approximately 88% of net assets in equity Funds and approximately 12% of net assets in the fixed-income and money market Funds.

Performance for the Clear Passage 2050 Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to the Morningstar Lifetime Allocation Moderate 2050 Index. For the year ended December 31, 2023, the Fund returned 20.04% before expenses and 19.94% after expenses, versus a 17.63% return for the Morningstar benchmark.

| ^ | Formerly Retirement 2050 Fund (Note 1). |

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Clear Passage 2050 Fund | |

Period

Ended

12/31/2023 | | Growth of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,994 | | | | 19.94% | |

5 Years | | | $17,275 | | | | 11.55% | |

10 Years | | | $21,971 | | | | 8.19% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

10 Years | | | $31,149 | | | | 12.03% | |

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

10 Years | | | $11,964 | | | | 1.81% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

10 Years | | | $11,330 | | | | 1.26% | |

The line representing the performance return of the MoA Clear Passage 2050 Fund includes expenses, such as direct management fees and expenses of the underlying funds in which the Fund invests, that reduce returns while the performance return lines of the Indices do not. The Morningstar Lifetime Allocation Moderate 2050 Index measures the performance of a portfolio of global equities, bonds and traditional inflation hedges such as commodities and TIPS. This portfolio is held in proportions appropriate for a US investor who has a target maturity date of 2050. Past performance is not indicative of future results.

25

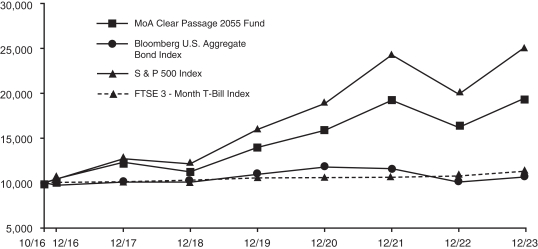

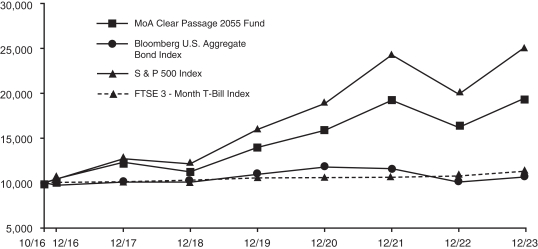

CLEAR PASSAGE 2055 FUND^ (Unaudited)

The objective of the Clear Passage 2055 Fund is current income and capital appreciation appropriate for the asset allocation associated with a target retirement in 2055. The Clear Passage 2055 Fund invests in the equity and fixed-income funds of the MoA Funds. The Fund’s current target allocation is approximately 91% of net assets in equity Funds and approximately 9% of net assets in the fixed-income and money market Funds.

Performance for the Clear Passage 2055 Fund is compared to the S&P 500® Index, the Bloomberg U.S. Aggregate Bond Index and the FTSE 3-Month Treasury Bill Index. In addition, we compare the performance of our Fund to the Morningstar Lifetime Allocation Moderate 2055 Index. For the year ended December 31, 2023, the Fund returned 20.11% before expenses and 19.98% after expenses, versus a 17.68% return for the Morningstar benchmark.

| ^ | Formerly Retirement 2055 Fund (Note 1). |

GROWTH OF A $10,000 INVESTMENT

| | | | | | | | |

MoA Clear Passage 2055 Fund | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $11,998 | | | | 19.98% | |

5 Years | | | $17,347 | | | | 11.65% | |

Since 10/1/16 (Inception) | | | $19,393 | | | | 9.57% | |

| | | | | | | | |

S & P 500 Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $12,629 | | | | 26.29% | |

5 Years | | | $20,721 | | | | 15.69% | |

Since 10/1/16 (Inception) | | | $25,061 | | | | 13.51% | |

| | | | | | | | |

Bloomberg U.S. Aggregate Bond Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,553 | | | | 5.53% | |

5 Years | | | $10,564 | | | | 1.10% | |

Since 10/1/16 (Inception) | | | $10,614 | | | | 0.83% | |

| | | | | | | | |

FTSE 3 - Month T-Bill Index | |

Period

Ended

12/31/2023 | | Growth

of

$10,000 | | | Average

Annual

Total Return | |

1 Year | | | $10,526 | | | | 5.26% | |

5 Years | | | $10,993 | | | | 1.91% | |

Since 10/1/16 (Inception) | | | $11,301 | | | | 1.70% | |

The line representing the performance return of the MoA Clear Passage 2055 Fund includes expenses, such as direct management fees and expenses of the underlying funds in which the Fund invests, that reduce returns while the performance return lines of the Indices do not. The Morningstar Lifetime Allocation Moderate 2055 Index measures the performance of a portfolio of global equities, bonds and traditional inflation hedges such as commodities and TIPS. This portfolio is held in proportions appropriate for a US investor who has a target maturity date of 2055. Past performance is not indicative of future results.

26

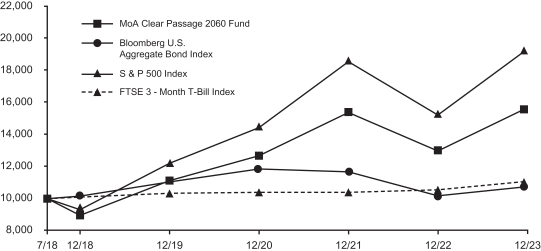

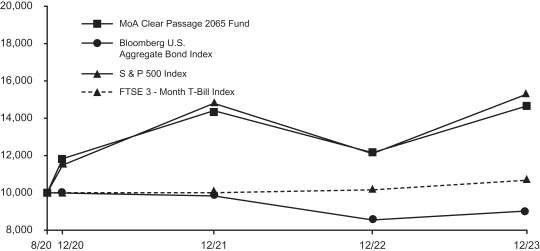

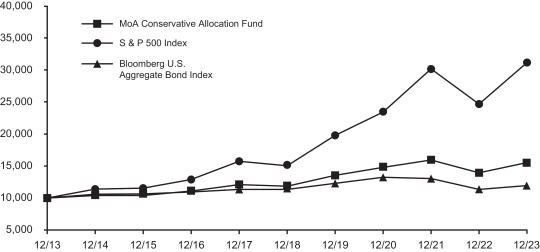

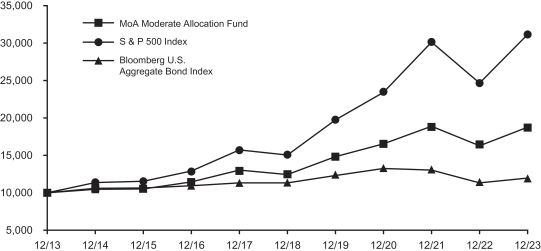

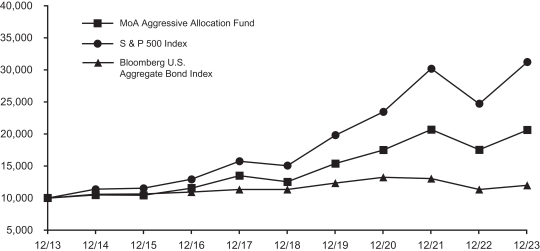

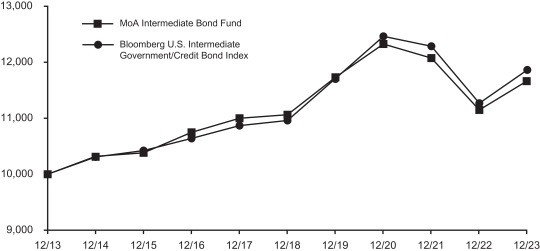

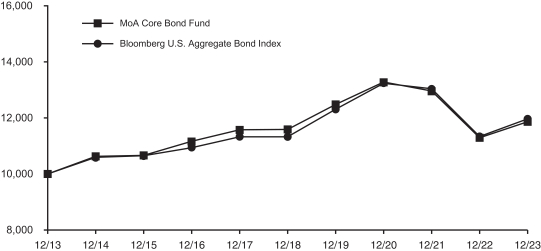

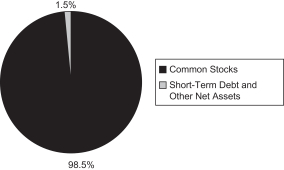

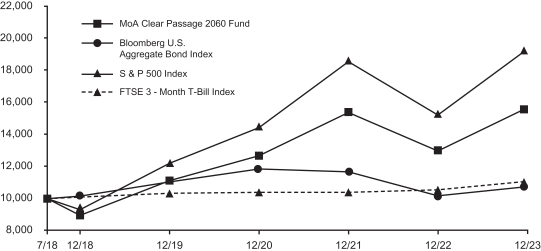

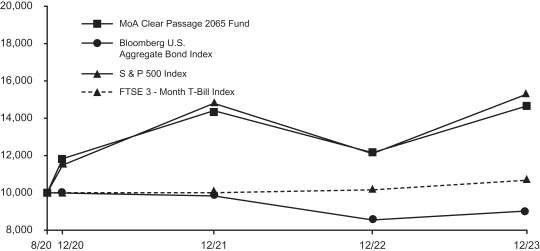

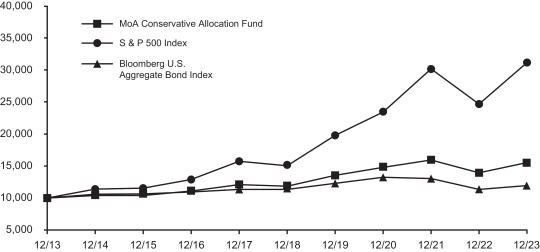

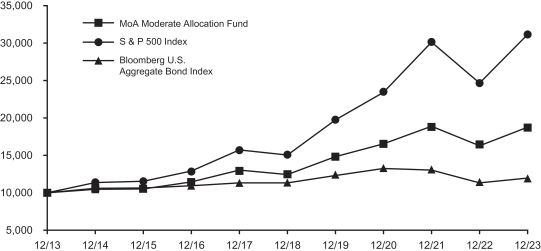

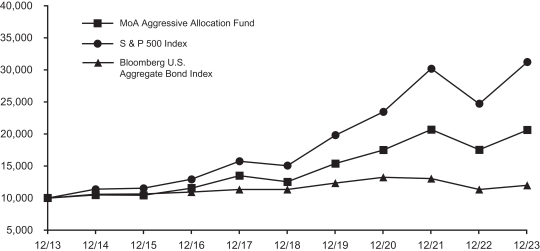

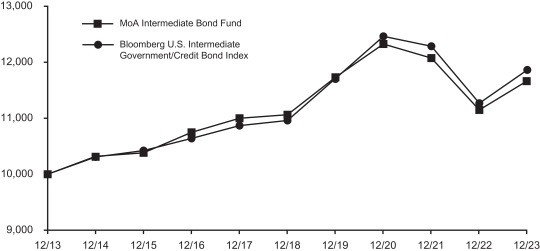

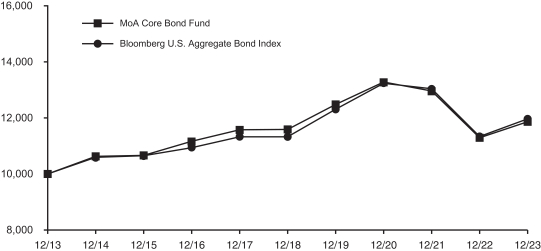

CLEAR PASSAGE 2060 FUND^ (Unaudited)