UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-4946

THOMPSON PLUMB FUNDS, INC.

(Exact name of registrant as specified in charter)

918 Deming Way

Madison, Wisconsin 53717

(Address of principal executive offices)--(Zip code)

John W. Thompson

Chief Executive Officer and President

Thompson Plumb Funds, Inc.

918 Deming Way

Madison, Wisconsin 53717

(Name and address of agent for service)

With a copy to:

Fredrick G. Lautz, Esq.

Quarles & Brady LLP

411 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Registrant's telephone number, including area code: (608) 827-5700

Date of fiscal year end: November 30, 2011

Date of reporting period: November 30, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, N.W., Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

THOMPSON PLUMB FUNDS, INC.

ANNUAL REPORT TO SHAREHOLDERS

NOTE ON FORWARD-LOOKING STATEMENTS

The matters discussed in this report may constitute forward-looking statements. These include any Advisor or portfolio manager predictions, assessments, analyses or outlooks for individual securities, industries, investment styles, market sectors, interest rates, economic trends and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each Fund in its current Prospectus, other factors bearing on these reports include the accuracy of the Advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the Advisor or portfolio manager and the ability of the Advisor or portfolio manager to implement its strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any Fund to differ materially as compared to its benchmarks.

2

THOMPSON PLUMB FUNDS, INC.

ANNUAL REPORT TO SHAREHOLDERS

November 30, 2011

CONTENTS

| | Page(s) |

| GROWTH FUND | | |

| Investment review | | 4-6 |

| Schedule of investments | | 7-8 |

| |

| MIDCAP FUND | | |

| Investment review | | 9-11 |

| Schedule of investments | | 12-13 |

| |

| BOND FUND | | |

| Investment review | | 14-16 |

| Schedule of investments | | 17-27 |

| |

| FUND EXPENSE EXAMPLES | | 28 |

| |

| FINANCIAL STATEMENTS | | |

| Statements of assets and liabilities | | 29 |

| Statements of operations | | 30 |

| Statements of changes in net assets | | 31 |

| Notes to financial statements | | 32-39 |

| Financial highlights | | 40-42 |

| |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | 43 |

| |

| DIRECTORS AND OFFICERS | | 44-45 |

| |

| ADDITIONAL INFORMATION | | 46-49 |

This report contains information for existing shareholders of Thompson Plumb Funds, Inc. It

does not constitute an offer to sell. This Annual Report is authorized for distribution to prospective investors

only when preceded or accompanied by a Fund Prospectus, which contains information about

the Funds’ objectives and policies, risks, management, expenses and other information.

A Prospectus can be obtained by calling 1-800-999-0887.

Please read your Prospectus carefully.

3

| GROWTH FUND INVESTMENT REVIEW (Unaudited) |

| November 30, 2011 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

John W. Thompson, CFA

Performance

The Growth Fund produced a total return of 3.02% for the fiscal year ended November 30, 2011, as compared to its benchmark, the S&P 500 Index, which returned 7.83%.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| Average Annual Total Returns |

| Through 11/30/11 |

| 1 Year | | 3 Year | | 5 Year | | 10 Year | |

| Thompson Plumb Growth Fund | 3.02% | | 15.67% | | -5.61% | | -0.59% | |

| S&P 500 Index | 7.83% | | 14.13% | | -0.18% | | 2.91% | |

Gross Expense Ratio as of 03/31/11 was 1.36%.*

* The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the Growth Fund through March 31, 2012 so that the annual operating expenses of the Fund do not exceed 1.40% of its average daily net assets.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonplumb.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot directly invest in an index.

See Notes to Financial Statements.

4

| GROWTH FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2011 |

Management Commentary

After roughly matching the performance of the S&P 500 from the beginning of the Fund’s fiscal year through July, the Fund underperformed for the fiscal year after global investors fled the equity markets in August and September. This retreat appears to have been caused by a combination of macroeconomic concerns, including the debate over the U.S. debt ceiling and continued worries over sovereign debt in Europe. In our view, the recency of the 2008 financial crisis exacerbated these concerns, as some investors who experienced sharp losses that “last time” sold aggressively in an effort to avoid what they perceived as a pending market calamity. The primary beneficiaries of this flight to safety were the 10- and 30-year Treasury bonds, which saw their yields decline 124 and 146 basis points, respectively, to levels well below their bottom in 2010.

In the equity market, sectors like Utilities, Consumer Staples and Telecom have, in the past, been treated as “bond substitutes” because of their higher dividend yields and more stable earnings. This means these sectors have generally performed their best in a declining interest rate environment. We had expected interest rates to remain flattish or even slightly increase over the next several years, and had deliberately underweighted these sectors while overweighting more cyclical sectors such as Technology and Industrials. The overweighted sectors, however, lagged their more defensive peers, which contributed to the Fund’s underperformance. With the unprecedented degree of stimulus by the Federal Reserve over the past several years we believe the risk of higher rates has actually increased, as that stimulus will presumably need to be withdrawn at the “right” time to avoid long-term inflationary pressures. In our opinion, the probability of a further drop in interest rates from here seems even less likely to occur. As a result, we believe that a continued underweight of the “bond substitute” sectors is even more compelling than it was before.

Whether the U.S. economy is destined for another recession is impossible to predict. Our bottom-up research on the Fund’s holdings suggests that while growth is slow, companies are not seeing the sharp declines in activity that usually coincide with the onset of a recession. This of course could change, but supports the notion that the sharp decline in equity markets since July is not a guarantee of a subsequent recession. Since 1950 there have been 12 instances when the market corrected between 12-18% downward from its high without a follow-on recession or full-blown “bear market” ensuing.1 The most recent example of such an instance was the summer dip in 2010. The market’s rally since September gives us hope that the current environment may turn out to be the 13th such instance.

Despite the uncertainty over future economic growth, we believe the market has not been waiting for clarity but rather is already pricing in a recession. Over the last 50 years the market as measured by the S&P 500 has traded at an average earnings multiple of 15x, with the lowest multiples coinciding with high interest rates in the late 1970s and early 1980s.2 With a 12 month forward P/E ratio of only 12.2x despite very low interest rates, we believe the market is already anticipating a substantial decline in earnings by discounting share price accordingly. But the profits of the S&P 500 are increasingly dependent on global growth, which per market consensus, should average 3.5-4%, instead of only U.S. growth, which will likely be slower. Margin compression associated with operating leverage usually accounts for the majority of cyclical earnings declines. To the extent companies never aggressively hired after the last recession there is less “fat” that would cause the kind of sharp drop the market seems to expect.

If we are right, as investors begin to gain clarity into the future path of macroeconomic activity and begin to rule out drastic earnings declines, the market should continue to recover. We are continuing to position for this scenario, while continuing to monitor holdings to make sure companies in which we have a position are posting solid earnings growth results. We believe this will lead to continued stock price appreciation and solid relative performance over the next fiscal year.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility.

Please refer to the Schedule of Investments on page 7 of this report for holdings information. The management commentary above as well as Fund holdings and asset/sector allocations should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings and asset/sector allocations are subject to change.

Basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument.

Earnings Growth is a measure of growth in a company’s net income over a specific period, often one year.

P/E Ratio is a valuation ratio of a company’s current share price compared to its per-share earnings. Divide market value of a share by the earnings per share.

Forward P/E is a price/earnings ratio, using earnings estimates for the next four quarters.

____________________

1 Source: The Leuthold Group. A “bear market” is defined as a decline of 20% or more from a prior market peak.

2 Source: Bloomberg

See Notes to Financial Statements.

5

| GROWTH FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2011 |

| Top 10 Equity Holdings at 11/30/11 |

| | % of Fund’s |

| Company | Industry | Net Assets |

| Exxon Mobil Corp. | Oil & Gas Producers | 3.62% | |

| Microsoft Corp. | Software & Computer Services | 2.86% | |

| General Electric Co. | General Industrials | 2.22% | |

| Medco Health Solutions, Inc. | Health Care Equipment & Services | 2.08% | |

| Intel Corp. | Technology Hardware & Equipment | 2.07% | |

| Chevron Corp. | Oil & Gas Producers | 2.05% | |

| Cisco Systems, Inc. | Technology Hardware & Equipment | 2.02% | |

| Qualcomm, Inc. | Technology Hardware & Equipment | 2.01% | |

| JPMorgan Chase & Co. | Banks | 1.93% | |

| Walgreen Co. | Food & Drug Retailers | 1.90% | |

As of November 30, 2011, 99.9% of the Fund’s net assets were in equity, cash and short-term instruments.

See Notes to Financial Statements.

6

| GROWTH FUND SCHEDULE OF INVESTMENTS |

| November 30, 2011 |

| Shares | | Value |

| COMMON STOCKS - 99.9% | | | | |

| Consumer Discretionary - 11.2% | | | | |

| Automobiles & Parts - 1.6% | | | | |

| Johnson Controls, Inc. | 34,300 | | $ | 1,079,764 |

| LKQ Corp. (a) | 18,525 | | | 565,568 |

| | | | 1,645,332 |

| General Retailers - 4.2% | | | | |

| Bed Bath & Beyond Inc. (a) | 12,525 | | | 757,888 |

| Best Buy Co., Inc. | 58,390 | | | 1,581,785 |

| Kohl’s Corp. | 14,460 | | | 777,948 |

| Target Corp. | 24,510 | | | 1,291,677 |

| | | | 4,409,298 |

| Household Products - 1.3% | | | | |

| D.R. Horton, Inc. | 49,650 | | | 591,332 |

| Jarden Corp. | 26,590 | | | 828,013 |

| | | | 1,419,345 |

| Leisure Goods - 0.6% | | | | |

| Brunswick Corp. | 32,750 | | | 609,805 |

| |

| Media - 2.8% | | | | |

| The Walt Disney Co. | 30,050 | | | 1,077,292 |

| Time Warner Inc. | 30,400 | | | 1,058,528 |

| Viacom Inc. Class B | 17,200 | | | 769,872 |

| | | | | 2,905,692 |

| Personal Goods - 0.7% | | | | |

| Hanesbrands, Inc. (a) | 28,750 | | | 708,113 |

| |

| Consumer Staples - 6.0% | | | | |

| Beverages - 1.2% | | | | |

| PepsiCo, Inc. | 19,500 | | | 1,248,000 |

| |

| Food & Drug Retailers - 3.9% | | | | |

| Sysco Corp. | 27,245 | | | 777,572 |

| Walgreen Co. | 58,775 | | | 1,981,893 |

| Wal-Mart Stores, Inc. | 21,775 | | | 1,282,547 |

| | | | | 4,042,012 |

| Household Goods & | | | | |

| Home Construction - 0.9% | | | | |

| The Procter & Gamble Co. | 14,550 | | | 939,494 |

| |

| Energy - 15.0% | | | | |

| Oil & Gas Producers - 10.1% | | | | |

| Anadarko Petroleum Corp. | 13,860 | | | 1,126,402 |

| Chevron Corp. | 20,795 | | | 2,138,142 |

| Devon Energy Corp. | 11,000 | | | 720,060 |

| Exxon Mobil Corp. | 46,795 | | | 3,764,190 |

| Forest Oil Corp. (a) | 72,400 | | | 1,161,296 |

| Hess Corp. | 26,270 | | | 1,581,979 |

| | | | | 10,492,069 |

| Oil Equipment, Services & | | | | |

| Distribution - 4.9% | | | | |

| Helmerich & Payne, Inc. | 14,075 | | | 801,712 |

| Schlumberger Ltd. | 21,969 | | | 1,654,925 |

| Seadrill Ltd. | 32,715 | | | 1,141,099 |

| Weatherford International Ltd. (a) | 102,275 | | | 1,550,489 |

| | | | | 5,148,225 |

| Financials - 16.2% | | | | |

| Banks - 8.6% | | | | |

| Associated Banc-Corp | 119,340 | | | 1,241,136 |

| Bank of America Corp. | 343,400 | | | 1,868,096 |

| Citigroup Inc. | 46,350 | | | 1,273,698 |

| First Horizon National Corp. | 151,710 | | | 1,168,167 |

| JPMorgan Chase & Co. | 65,000 | | | 2,013,050 |

| PNC Financial Services Group, Inc. | 16,330 | | | 885,249 |

| Zions Bancorporation | 31,900 | | | 513,271 |

| | | | | 8,962,667 |

| Financial Services - 5.4% | | | | |

| American Express Co. | 16,450 | | | 790,258 |

| Discover Financial Services | 42,795 | | | 1,019,377 |

| MSCI Inc. Class A (a) | 32,500 | | | 1,096,875 |

| Northern Trust Corp. | 34,220 | | | 1,287,699 |

| State Street Corp. | 35,225 | | | 1,396,671 |

| | | | 5,590,880 |

| Insurance - 1.0% | | | | |

| Aflac, Inc. | 25,160 | | | 1,092,950 |

| | | | | |

|

| Real Estate Investment | | | | |

| Trusts - 1.2% | | | | |

| DiamondRock Hospitality Co. | 67,000 | | | 588,260 |

| Host Hotels & Resorts Inc. | 44,100 | | | 624,015 |

| | | | 1,212,275 |

| |

| Health Care - 11.5% | | | | |

| Health Care Equipment & | | | | |

| Services - 7.6% | | | | |

| Baxter International Inc. | 13,150 | | | 679,329 |

| Henry Schein, Inc. (a) | 11,965 | | | 769,828 |

| Medco Health Solutions, Inc. (a) | 38,230 | | | 2,166,494 |

| Medtronic, Inc. | 22,450 | | | 817,854 |

| Patterson Cos., Inc. | 26,505 | | | 799,656 |

| ResMed Inc. (a) | 17,050 | | | 444,153 |

| St. Jude Medical, Inc. | 38,565 | | | 1,482,439 |

| Zimmer Holdings, Inc. (a) | 14,195 | | | 717,557 |

| | | | | 7,877,310 |

| Health Care Services - 1.1% | | | | |

| McKesson Corp. | 13,575 | | | 1,103,783 |

See Notes to Financial Statements.

7

| GROWTH FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2011 |

| | | Shares | | Value |

| COMMON STOCKS (continued) | | | | | |

| | Health Care (continued) | | | | | |

| | | Pharmaceuticals & | | | | | |

| | | Biotechnology - 2.8% | | | | | |

| | | Amgen Inc. | | 13,590 | | $ | 786,997 |

| | | Johnson & Johnson | | 22,610 | | | 1,463,319 |

| | | Novartis AG ADR | | 13,050 | | | 706,266 |

| | | | | | | | 2,956,582 |

| | Industrials - 15.2% | | | | | |

| | | Aerospace & Defense - 0.7% | | | | | |

| | | Lockheed Martin Corp. | | 10,050 | | | 785,408 |

| | | |

| | | Construction & Materials - 1.4% | | | | | |

| | | Masco Corp. | | 151,975 | | | 1,455,920 |

| | | |

| | | Electronic & Electrical | | | | | |

| | | Equipment - 1.1% | | | | | |

| | | Emerson Electric Co. | | 21,500 | | | 1,123,375 |

| | | |

| | | General Industrials - 3.7% | | | | | |

| | | General Electric Co. | | 145,250 | | | 2,310,927 |

| | | 3M Co. | | 19,320 | | | 1,565,693 |

| | | | | | | | 3,876,620 |

| | | Industrial Engineering - 4.1% | | | | | |

| | | ABB Ltd. ADR | | 77,675 | | | 1,473,495 |

| | | Illinois Tool Works Inc. | | 22,875 | | | 1,039,440 |

| | | Ingersoll-Rand PLC | | 17,000 | | | 563,040 |

| | | Rockwell Automation, Inc. | | 15,225 | | | 1,142,332 |

| | | | | | | | 4,218,307 |

| | | Industrial Transportation - 1.5% | | | | | |

| | | FedEx Corp. | | 19,425 | | | 1,613,829 |

| | | |

| | | Support Services - 2.7% | | | | | |

| | | EnergySolutions (a) | | 374,125 | | | 1,182,235 |

| | | Mobile Mini, Inc. (a) | | 42,775 | | | 771,233 |

| | | W.W. Grainger, Inc. | | 4,335 | | | 810,212 |

| | | | | | | | 2,763,680 |

| | | |

| | Information Technology - 23.4% | | | | | |

| | | Computer Programs - 1.3% | | | | | |

| | | Electronic Arts Inc. (a) | | 32,660 | | | 757,385 |

| | | Take-Two Interactive | | | | | |

| | | Software, Inc. (a) | | 40,175 | | | 560,441 |

| | | | | | | | 1,317,826 |

| | | Internet Programs & | | | | | |

| | | Services - 1.1% | | | | | |

| | | eBay Inc. (a) | | 38,555 | | | 1,140,842 |

| | | |

| | | IT Services - 1.8% | | | | | |

| | | Alliance Data Systems Corp. (a) | | 7,850 | | | 803,919 |

| | | Visa Inc. Class A | | 10,745 | | | 1,041,943 |

| | | | | | | | 1,845,862 |

| | | Software & Computer | | | | | |

| | | Services - 5.4% | | | | | |

| | | Adobe Systems Inc. (a) | | 46,625 | | | 1,278,457 |

| | | Google Inc. Class A (a) | | 2,260 | | | 1,354,621 |

| | | Microsoft Corp. | | 116,251 | | | 2,973,701 |

| | | | | | | | 5,606,779 |

| | | Technology Hardware & | | | | | |

| | | Equipment - 13.8% | | | | | |

| | | Altera Corp. | | 14,600 | | | 549,982 |

| | | Broadcom Corp. Class A (a) | | 36,840 | | | 1,117,910 |

| | | Cisco Systems, Inc. | | 112,635 | | | 2,099,516 |

| | | EMC Corp. (a) | | 46,325 | | | 1,065,938 |

| | | Hewlett-Packard Co. | | 39,875 | | | 1,114,506 |

| | | Intel Corp. | | 86,500 | | | 2,154,715 |

| | | JDS Uniphase Corp. (a) | | 140,610 | | | 1,543,898 |

| | | Linear Technology Corp. | | 25,370 | | | 777,083 |

| | | Maxim Integrated Products, Inc. | | 31,630 | | | 811,310 |

| | | Qualcomm, Inc. | | 38,180 | | | 2,092,264 |

| | | Xilinx, Inc. | | 33,700 | | | 1,102,327 |

| | | | | | | | 14,429,449 |

| | Materials - 1.4% | | | | | |

| | | Industrial Metals & Mining - 1.4% | | | | | |

| | | Freeport-McMoRan Copper | | | | | |

| | | & Gold Inc. | | 35,825 | | | 1,418,670 |

| | | |

| | | TOTAL COMMON STOCKS | | | | | |

| | | (COST $102,150,740) | | | | | 103,960,399 |

| | | |

| | | | Principal | | | |

| | | | Amount | | | |

| SHORT-TERM INVESTMENTS - 0.0% | | | | | |

| | Variable-Rate Demand Notes - 0.0% | | | | | |

| | | American Family Financial | | | | | |

| | | Services, 0.100% (b) | $ | 60,156 | | | 60,156 |

| | | |

| | | Total Variable-Rate Demand Notes | | | | | 60,156 |

| | | |

| | | TOTAL SHORT-TERM INVESTMENTS | | | |

| | | (COST $60,156) | | | | | 60,156 |

| | | |

| | | TOTAL INVESTMENTS - 99.9% | | | | | |

| | | (COST $102,210,896) | | | | | 104,020,555 |

| | | |

| | | NET OTHER ASSETS AND | | | | | |

| | | LIABILITIES - 0.1% | | | | | 65,587 |

| | | |

| | | NET ASSETS - 100.0% | | | | $ | 104,086,142 |

| | (a) | Non-income producing security. |

| | (b) | Interest rate shown represents the current coupon rate at November 30, 2011. |

ADR: American Depository Receipt

PLC: Public Limited Company

See Notes to Financial Statements.

8

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) |

| November 30, 2011 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

John W. Thompson, CFA

Performance

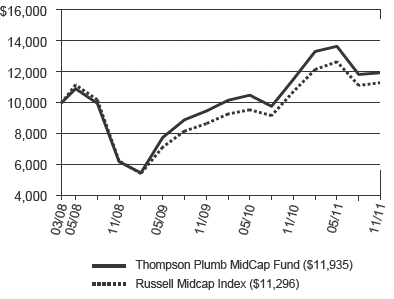

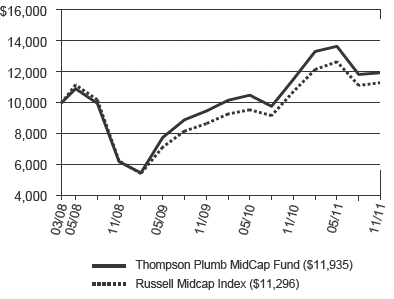

The MidCap Fund produced a total return of 3.69% for the fiscal year ended November 30, 2011, as compared to its benchmark, the Russell Midcap Index, which returned 5.39%.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| Average Annual Total Returns |

| Through 11/30/11 |

| | | | | Since | |

| | | | | Inception | |

| 1 Year | | 3 Year | | (03/31/08) | |

| Thompson Plumb MidCap Fund | 3.69% | | 24.53% | | 4.94% | |

| Russell Midcap Index | 5.39% | | 21.91% | | 3.38% | |

Gross Expense Ratio as of 03/31/11 was 2.34%.

Net Expense Ratio after reimbursement was 1.30%.*

* The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the MidCap Fund through March 31, 2012 so that the annual operating expenses of the Fund do not exceed 1.30% of its average daily net assets.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonplumb.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index based on total market capitalization. You cannot directly invest in an index.

See Notes to Financial Statements.

9

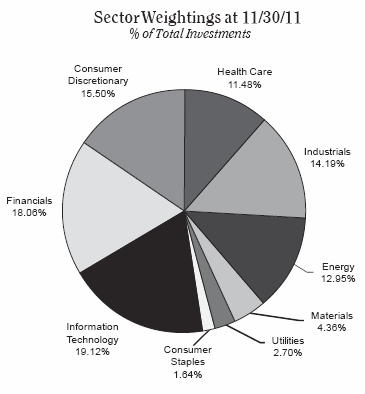

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2011 |

Management Commentary

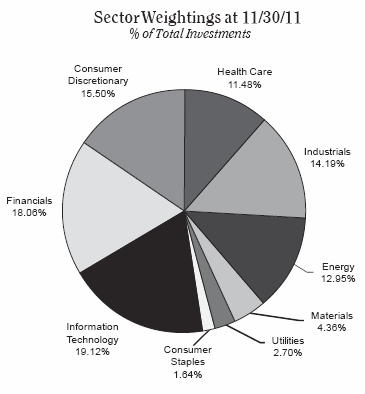

The relative performance of the Fund during the annual period was largely driven by individual stock selection. Stock selection in Information Technology and Consumer Discretionary sectors was strongest, together contributing 2.16% to performance. Electronic Arts and CBS Corp. were two of the major positive contributors to performance, but for different reasons. CBS Corp. has simply benefited from a steady improvement in its valuation over the last few years, as investors seem to have become more comfortable with exposure to certain types of advertising revenue. There was a significant concern regarding CBS’ reliance on auto advertising that we believe has waned to a large degree. We feel Electronic Arts is just beginning to see the benefits from changing the way it invests in and treats its designers and engineers, and its focusing more on quality. A key benchmark will be the success of its “Star Wars: the Old Republic” massively multiplayer online game, the release of which is imminent.

Stock selection in the Health Care and Financials sectors led to a lag of approximately 2.4% to performance on a combined basis. Custody banks like Northern Trust, for example, were hurt by the impact that continued low interest rates had on their money market fees. Investors do not have many opportunities to buy an apparently high-quality financial like Northern Trust at such a low valuation, so we believe that remaining patient should benefit shareholders.

There is always something to worry about in investing, and we have had no shortages of issues to ponder during the last fiscal year. From the downgrade of U.S. debt by Standard & Poor’s to fiscal and liquidity crises in Greece and Italy, each issue has been perceived by investors as the “next big shoe to drop.” We suspect that this is more indicative of the trauma caused to investors’ psyche by the U.S. liquidity freeze of 2008 than it is a thoughtful assessment of macroeconomic impacts on corporate earnings growth. The market declines of 2001 and 2008 were much worse than average because there were bubbles in the U.S. economy that needed to deflate. Specifically, technology stocks and real estate were overvalued. It appears that it was the ripple effects from their correction that caused the drop in equity markets at the beginning of the past decade and the financial crisis a few years ago. We do not see a similar bubble that needs deflating in the U.S. economy today given the lack of a major expansion from the last recession. In other words, there does not seem to have been the opportunity for a new bubble to develop.

In this environment of fear, it is important to maintain focus on the things that matter most – the potential for earnings growth of U.S. mid-cap companies into the future. We think that such potential in the market is great, and have populated the Fund portfolio with a group of companies that we believe have attractive valuations and the opportunity to grow their earnings at compelling rates. It is this strategy that we have sought to employ since the launch of the Fund on March 31, 2008, and which we will continue to embrace going forward. From inception through the end of the most recent fiscal year the Fund has produced an average annual return of 4.94% per year versus the 3.38% per year return of the Fund’s benchmark, the Russell Midcap Index.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Midcap companies tend to have limited liquidity and greater volatility than large-capitalization companies.

Please refer to the Schedule of Investments on page 12 of this report for holdings information. The management commentary above as well as Fund holdings and asset/sector allocations should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings and asset/sector allocations are subject to change.

Earnings Growth is a measure of growth in a company’s net income over a specific period, often one year.

See Notes to Financial Statements.

10

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2011 |

| Top 10 Equity Holdings at 11/30/11 |

| | % of Fund’s |

| Company | Industry | Net Assets |

| First Horizon National Corp. | Banks | 2.29% |

| JDS Uniphase Corp. | Technology Hardware & Equipment | 2.01% |

| Jarden Corp. | Household Products | 1.99% |

| Nalco Holding Co. | Industrial Materials | 1.99% |

| Associated Banc-Corp | Banks | 1.99% |

| EnergySolutions | Support Services | 1.87% |

| Hanesbrands, Inc. | Personal Goods | 1.78% |

| Weatherford International Ltd. | Oil Equipment, Services & Distribution | 1.77% |

| SPX Corp. | Industrial Engineering | 1.73% |

| Discover Financial Services | Financial Services | 1.72% |

As of November 30, 2011, 100.1% of the Fund’s net assets were in equity, cash and short-term instruments.

See Notes to Financial Statements.

11

| MIDCAP FUND SCHEDULE OF INVESTMENTS |

| November 30, 2011 |

| | Shares | | Value |

| COMMON STOCKS - 100.1% | | | | | |

| | | | | | |

| Consumer Discretionary - 15.5% | | | | | |

| Automobiles & Parts - 1.1% | | | | | |

| LKQ Corp. (a) | | 6,560 | | $ | 200,277 |

| |

| General Retailers - 4.9% | | | | | |

| Bed Bath & Beyond Inc. (a) | | 3,575 | | | 216,323 |

| Best Buy Co., Inc. | | 5,150 | | | 139,514 |

| Jos. A. Bank Clothiers, Inc. (a) | | 3,500 | | | 172,480 |

| Kohl's Corp. | | 2,500 | | | 134,500 |

| Nordstrom, Inc. | | 4,290 | | | 194,251 |

| | | | | 857,068 |

| Household Products - 2.6% | | | | | |

| D.R. Horton, Inc. | | 8,375 | | | 99,746 |

| Jarden Corp. | | 11,260 | | | 350,636 |

| | | | | 450,382 |

| Leisure Goods - 1.1% | | | | | |

| Brunswick Corp. | | 10,750 | | | 200,165 |

| |

| Media - 1.1% | | | | | |

| Lions Gate Entertainment Corp. (a) | | 21,821 | | | 191,807 |

| |

| Personal Goods - 3.0% | | | | | |

| Coach, Inc. | | 3,578 | | | 223,947 |

| Hanesbrands, Inc. (a) | | 12,708 | | | 312,998 |

| | | | | 536,945 |

| Travel & Leisure - 1.7% | | | | | |

| Darden Restaurants, Inc. | | 6,256 | | | 298,474 |

| |

| Consumer Staples - 1.6% | | | | | |

| Food Producers - 1.6% | | | | | |

| McCormick & Co., Inc. | | 3,413 | | | 166,213 |

| The J. M. Smucker Co. | | 1,612 | | | 122,480 |

| | | | | 288,693 |

| Energy - 13.0% | | | | | |

| Mining - 0.3% | | | | | |

| CONSOL Energy Inc. | | 1,200 | | | 49,968 |

| |

| Oil & Gas Producers - 8.6% | | | | | |

| ATP Oil & Gas Corp. (a) | | 10,885 | | | 79,896 |

| Bill Barrett Corp. (a) | | 3,215 | | | 125,385 |

| Chesapeake Energy Corp. | | 6,045 | | | 153,180 |

| Denbury Resources Inc. (a) | | 2,635 | | | 44,532 |

| Forest Oil Corp. (a) | | 10,400 | | | 166,816 |

| Lone Pine Resources Inc. (a) | | 5,542 | | | 41,510 |

| Murphy Oil Corp. | | 2,576 | | | 144,050 |

| Noble Energy, Inc. | | 2,973 | | | 292,513 |

| Quicksilver Resources Inc. (a) | | 10,430 | | | 84,483 |

| Range Resources Corp. | | 4,030 | | | 288,991 |

| Swift Energy Co. (a) | | 1,575 | | | 46,289 |

| Ultra Petroleum Corp. (a) | | 1,450 | | | 51,055 |

| | | | | 1,518,700 |

| Oil Equipment, Services & | | | | | |

| Distribution - 4.1% | | | | | |

| Helmerich & Payne, Inc. | | 3,670 | | | 209,043 |

| Seadrill Ltd. | | 5,585 | | | 194,805 |

| Weatherford International Ltd. (a) | | 20,605 | | | 312,372 |

| | | | | 716,220 |

| Financials - 18.1% | | | | | |

| Banks - 5.8% | | | | | |

| Associated Banc-Corp | | 33,634 | | | 349,794 |

| First Horizon National Corp. | | 52,420 | | | 403,634 |

| Regions Financial Corp. | | 23,435 | | | 96,318 |

| SunTrust Banks, Inc. | | 4,570 | | | 82,854 |

| Zions Bancorporation | | 5,280 | | | 84,955 |

| | | | | 1,017,555 |

| Financial Services - 6.8% | | | | | |

| Discover Financial Services | | 12,754 | | | 303,800 |

| Eaton Vance Corp. | | 7,420 | | | 178,303 |

| Investment Technology | | | | | |

| Group, Inc. (a) | | 22,730 | | | 242,075 |

| MSCI Inc. Class A (a) | | 5,400 | | | 182,250 |

| Northern Trust Corp. | | 7,875 | | | 296,336 |

| | | | | 1,202,764 |

| Insurance - 2.1% | | | | | |

| Cincinnati Financial Corp. | | 6,445 | | | 191,094 |

| Unum Group | | 7,560 | | | 170,176 |

| | | | | 361,270 |

| Real Estate Investment | | | | | |

| Trusts - 3.4% | | | | | |

| DiamondRock Hospitality Co. | | 22,200 | | | 194,916 |

| Host Hotels & Resorts Inc. | | 14,500 | | | 205,175 |

| LaSalle Hotel Properties | | 8,650 | | | 202,497 |

| | | | | | 602,588 |

| Health Care - 11.5% | | | | | |

| Health Care Equipment & | | | | | |

| Services - 10.5% | | | | | |

| Henry Schein, Inc. (a) | | 4,619 | | | 297,186 |

| Lincare Holdings Inc. | | 5,729 | | | 135,777 |

| MedAssets Inc. (a) | | 26,840 | | | 256,590 |

| Natus Medical Inc. (a) | | 25,175 | | | 210,715 |

| Patterson Cos., Inc. | | 10,055 | | | 303,359 |

| ResMed Inc. (a) | | 8,525 | | | 222,076 |

| St. Jude Medical, Inc. | | 3,275 | | | 125,891 |

| Waters Corp. (a) | | 1,689 | | | 135,120 |

| Zimmer Holdings, Inc. (a) | | 3,150 | | | 159,233 |

| | | | | | 1,845,947 |

| Health Care Services - 1.0% | | | | | |

| McKesson Corp. | | 2,205 | | | 179,289 |

| |

| Industrials - 14.2% | | | | | |

| Aerospace & Defense - 1.2% | | | | | |

| Alliant Techsystems Inc. | | 3,619 | | | 212,942 |

See Notes to Financial Statements.

12

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2011 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | | | | |

| | | | | | | | |

| Industrials (continued) | | | | | | | |

| Construction & | | | | | | | |

| Materials - 2.7% | | | | | | | |

| Masco Corp. | | | 31,500 | | $ | 301,770 | |

| Mueller Water Products, Inc. | | | | | | | |

| Class A | | | 35,400 | | | 79,296 | |

| USG Corp. (a) | | | 10,475 | | | 102,550 | |

| | | | | | 483,616 | |

| Industrial Engineering - 4.6% | | | | | | | |

| Ingersoll-Rand PLC | | | 8,600 | | | 284,832 | |

| Rockwell Automation, Inc. | | | 2,850 | | | 213,836 | |

| SPX Corp. | | | 4,800 | | | 304,320 | |

| | | | | | 802,988 | |

| Support Services - 5.7% | | | | | | | |

| Cintas Corp. | | | 5,745 | | | 174,648 | |

| EnergySolutions (a) | | | 104,035 | | | 328,751 | |

| Mobile Mini, Inc. (a) | | | 11,995 | | | 216,270 | |

| W.W. Grainger, Inc. | | | 1,518 | | | 283,714 | |

| | | | | | 1,003,383 | |

| Information Technology - 19.1% | | | | | | | |

| Computer Programs - 3.3% | | | | | | | |

| Activision Blizzard, Inc. | | | 10,220 | | | 126,932 | |

| Electronic Arts Inc. (a) | | | 7,595 | | | 176,128 | |

| Take-Two Interactive | | | | | | | |

| Software, Inc. (a) | | | 19,860 | | | 277,047 | |

| | | | | | 580,107 | |

| Electronic & Electrical | | | | | | | |

| Equipment - 3.3% | | | | | | | |

| Celestica Inc. (a) | | | 10,581 | | | 88,351 | |

| Flextronics International Ltd. (a) | | | 35,617 | | | 212,633 | |

| Molex Inc. Class A | | | 13,960 | | | 292,322 | |

| | | | | | 593,306 | |

| IT Services - 2.6% | | | | | | | |

| Alliance Data Systems Corp. (a) | | | 2,740 | | | 280,603 | |

| Fiserv, Inc. (a) | | | 3,122 | | | 180,015 | |

| | | | | | 460,618 | |

| Technology Hardware & | | | | | | | |

| Equipment - 9.9% | | | | | | | |

| Altera Corp. | | | 4,725 | | | 177,991 | |

| Broadcom Corp. Class A (a) | | | 9,975 | | | 302,691 | |

| Cavium Inc. (a) | | | 7,000 | | | 228,480 | |

| JDS Uniphase Corp. (a) | | | 32,181 | | | 353,347 | |

| Linear Technology Corp. | | | 7,422 | | | 227,336 | |

| Maxim Integrated Products, Inc. | | | 10,526 | | | 269,992 | |

| Xilinx, Inc. | | | 5,496 | | | 179,774 | |

| | | | | | 1,739,611 | |

| Materials - 4.4% | | | | | | | |

| Chemicals - 1.5% | | | | | | | |

| International Flavors & | | | | | | | |

| Fragrances Inc. | | | 4,763 | | | 258,440 | |

| | | | | | | | |

| Household Materials - 0.9% | | | | | | | |

| The Scotts Miracle-Gro Co. | | | | | | | |

| Class A | | | 3,636 | | | 160,311 | |

| |

| Industrial Materials - 2.0% | | | | | | | |

| Nalco Holding Co. | | | 9,043 | | | 350,416 | |

| |

| Utilities - 2.7% | | | | | | | |

| Electricity - 0.5% | | | | | | | |

| Pepco Holdings, Inc. | | | 4,210 | | | 83,274 | |

| |

| Gas, Water & Multiutilities - 2.2% | | | | |

| MDU Resources Group, Inc. | | | 12,247 | | | 262,943 | |

| SCANA Corp. | | | 2,964 | | | 129,290 | |

| | | | | | 392,233 | |

| |

| TOTAL COMMON STOCKS | | | | | | | |

| (COST $16,291,285) | | | | | | 17,639,357 | |

| |

| | | Principal | | | | |

| | Amount | | | | |

| SHORT-TERM INVESTMENTS - 0.0% | | | | | | | |

| Variable-Rate Demand Notes - 0.0% | | | | |

| American Family Financial | | | | | | | |

| Services, 0.100% (b) | | $ | 1,480 | | | 1,480 | |

| |

| Total Variable-Rate Demand Notes | | | | | | 1,480 | |

| |

| TOTAL SHORT-TERM INVESTMENTS | | | | |

| (COST $1,480) | | | | | | 1,480 | |

| |

| TOTAL INVESTMENTS - 100.1% | | | | | | | |

| (COST $16,292,765) | | | | | | 17,640,837 | |

| |

| NET OTHER ASSETS AND | | | | | | | |

| LIABILITIES - (0.1%) | | | | | | (20,687 | ) |

| |

| NET ASSETS - 100.0% | | | | | $ | 17,620,150 | |

| |

| | (a) Non-income producing security. |

| | (b) Interest rate shown represents the current coupon rate at November 30, 2011. |

| |

| | PLC: Public Limited Company |

See Notes to Financial Statements.

13

| BOND FUND INVESTMENT REVIEW (Unaudited) |

| November 30, 2011 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

John W. Thompson, CFA

Performance

The Bond Fund produced a total return of 2.16% for the fiscal year ended November 30, 2011, as compared to its benchmark, the Barclays Capital U.S. Government/Credit 1-5 Year Index, which returned 2.24%, and as compared to the Barclays Capital Intermediate U.S. Government/Credit 1-10 Year Index, which returned 3.67%.

Comparison of Change in Value of a Hypothetical $10,000 Investment

| Average Annual Total Returns |

| Through 11/30/11 |

| 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Thompson Plumb Bond Fund | 2.16% | | 12.56% | | 7.29% | | 5.92% |

| Barclays Capital U.S. Gov’t/Credit 1-5 Year Index | 2.24% | | 4.43% | | 4.75% | | 4.25% |

| Barclays Capital Intermediate U.S. Gov’t/Credit 1-10 Year Index | 3.67% | | 6.39% | | 5.63% | | 5.06% |

| Gross Expense Ratio as of 03/31/11 was 0.87%. | 30-Day SEC Yield as of 11/30/11 was 3.81%. |

| Net Expense Ratio after reimbursement was 0.80%.* | 30-Day SEC Yield (without reimbursement) as of 11/30/11 was 3.81%. |

* The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the Bond Fund through March 31, 2012 so that the annual operating expenses of the Fund do not exceed 0.80% of its average daily net assets.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonplumb.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The Barclays Capital U.S. Government/Credit 1-5 Year Index is a market-value-weighted index of all investment-grade bonds with maturities of more than one year and less than 5 years. The Barclays Capital Intermediate U.S. Government/Credit 1-10 Year Index is a market-value-weighted index of all investment-grade bonds with maturities of more than one year and less than 10 years. You cannot directly invest in an index.

The Funds determined to change the Bond Fund’s benchmark to the Barclays Capital U.S. Government/Credit 1-5 Year Index because they believe this index is generally composed of bonds that more closely resemble the typical range of maturities of bonds held in the Fund than did the Barclays Capital Intermediate U.S. Government/Credit 1-10 year Index.

See Notes to Financial Statements.

14

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2011 |

Management Commentary

The fiscal year was a tale of two halves for shareholders, as the Fund was solidly outperforming its benchmark at the end of the semi-annual period; then, in the second half of the fiscal year, a variety of macroeconomic concerns, including the U.S. debt ceiling debate and sovereign debt crisis in Europe, touched off a sharp “flight to quality” starting in August, leading to relative underperformance against the Fund’s benchmark for the fiscal year. Selling nearly every other asset class, investors piled into the U.S. Treasury market, driving the yield on the 10- and 30-year Treasury bonds down 99 and 116 basis points to 2.07% and 3.06%, respectively. There was compression on the short end of the yield curve as well, as yields on 5-year Treasuries came down 75 basis points to a shockingly low 0.95%. Agency debt followed Treasury bonds closely. With a near- 75% allocation to Treasuries and Agency debt, our benchmark benefited tremendously from price appreciation in these bonds. Unlike the Fund, many of our competitors also had healthy allocations to this debt. However, going forward, we believe the real return on 5-year Treasury bonds purchased today will actually turn out to be negative depending on the future path of inflation. As a result, we have reduced our already modest exposure to the sector to near zero.

Corporate bonds took a different track during the second half of the annual period. It appears the same concerns that caused a “flight to safety” resulted in investors demanding a higher spread with regard to corporate bonds. This was especially true in the 2014-16 maturity range. By the summer, many of the Fund’s holdings in bonds maturing in that period had seen price appreciation to the point where they were no longer the most attractive bonds to purchase with new money. The “hump” in corporate bond yields instead moved out to the 2017-18 timeframe, and as a result it was this maturity range where the majority of bonds purchased by the Fund since the end of semi-annual period lay. When spreads widened starting in August it was the 2014-16 bonds that were hit the hardest. Most bonds with these maturity dates in the Fund’s portfolio still show price appreciation from their original purchase price, and they just gave back some of the previously recorded capital appreciation during the flight to higher-quality bonds. The flip side is that the Fund has begun to find attractive bonds to purchase in this shorter maturity range again, as shareholders could potentially be rewarded with higher yields without having to take the extra interest rate risks associated with longer-maturity bonds. Additionally, if Treasury rates increase, we believe there should be cushion to absorb in current spreads. Thus a rising Treasury yield curve would probably not create equivalent declines in corporate bond prices.

Looking ahead, we believe the Fund is ideally positioned. The 30-day SEC yield at the end of the fiscal year was 3.81% and the duration was only 2.83 years. The yield to maturity was even higher. This is a higher yield and lower duration than the 5-year Treasury. In fact, the 30-day SEC yield of the Fund is higher than the yield on a 30-Year Treasury, despite the obvious difference in maturity and interest-rate risk. Shareholders have been rewarded richly for their willingness to tolerate credit risk and changes in corporate spreads. In any given period spreads can change quickly enough that Treasury bonds may outperform the Fund’s holdings. But absent actual defaults among the Fund’s holdings, their high current yields should be an advantage, based on the larger corporate bond allocation of the Fund. We believe it just takes the passage of time to “earn” this higher yield.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in bonds of foreign issuers involve greater volatility, political and economic risks and differences in accounting methods.

Please refer to the Schedule of Investments on page 17 of this report for holdings information. The management commentary above as well as Fund holdings should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings are subject to change.

The federal government guarantees interest payments from government securities while corporate bond interest payments carry no such guarantee. Government securities, if held to maturity, guarantee the timely payment of principal and interest.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

SEC Yield is a standardized yield computed by dividing the net investment income per share earned during the 30-day period prior to quarter-end and was created to allow for fairer comparisons among bond funds.

Basis point is a unit that is equal to 1/100th of 1%, and is used to denote the change in a financial instrument.

See Notes to Financial Statements.

15

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2011 |

| Portfolio Concentration at 11/30/11 |

| (Includes cash and cash equivalents) |

| % Total Investments |

| Quality |

| U.S. Government and Agency Issues | 0.77% | |

| AAA | 0.45% | |

| AA | 2.48% | |

| A | 15.97% | |

| BBB | 74.99% | |

| BB and Below | 4.82% | |

| Not Rated | 0.08% | |

| Short-Term Investments | 0.35% | |

| Common Stocks | 0.09% | |

| 100.00% | |

| | |

| Effective Maturity | |

| Under 1 year | 11.70% | |

| 1 to 3 years | 33.47% | |

| 3 to 5 years | 28.01% | |

| 5 to 10 years | 26.72% | |

| Over 10 years | 0.01% | |

| Common Stocks | 0.09% | |

| | 100.00% | |

| |

| Asset Allocation | |

| Corporate Bonds | 94.76% | |

| Asset-Backed Securities | 1.62% | |

| Convertible Bonds | 2.41% | |

| U.S. Government and Agency Issues | 0.47% | |

| Federal Agency Mortgage-Backed Securities | 0.30% | |

| Short-Term Investments | 0.35% | |

| Common Stocks | 0.09% | |

| 100.00% | |

| | | |

See Notes to Financial Statements.

16

| BOND FUND SCHEDULE OF INVESTMENTS |

| November 30, 2011 |

| | Shares or | | | |

| | Principal | | | |

| | Amount | | Value |

| COMMON STOCKS - 0.1% | | | | | | |

| | | | | | | |

| Financials - 0.1% | | | | | | |

| Financial Services - 0.1% | | | | | | |

| CIT Group Inc. (a) | | | 17,450 | | $ | 590,857 |

| |

| TOTAL COMMON STOCKS | | | | | | |

| (COST $501,587) | | | | | | 590,857 |

| |

| BONDS - 98.7% | | | | | | |

| | | | | | | |

| Asset-Backed Securities - 1.6% | | | | | | |

| Federal Express Corp. 1993 Trust | | | | | | |

| 7.150% due 9/28/2012 | | $ | 6,075 | | | 6,323 |

| |

| Federal Express Corp. 1997 Trust | | | | | | |

| 7.500% due 1/15/2018 | | | 3,446,144 | | | 3,476,298 |

| 7.520% due 1/15/2018 | | | 226,946 | | | 237,726 |

| |

| General American Railcar 1997-1 | | | | | | |

| 6.690% due 9/20/2016 (e) | | | 464,670 | | | 484,158 |

| |

| General American Railcar II | | | | | | |

| 6.210% due 9/20/2017 | | | 4,658,400 | | | 4,823,620 |

| |

| General American Railcar III | | | | | | |

| 7.760% due 8/20/2018 (e) | | | 1,437,475 | | | 1,530,580 |

| |

| Total Asset-Backed Securities | | | | | | 10,558,705 |

| |

| Convertible Bonds - 2.4% | | | | | | |

| Amgen Inc. | | | | | | |

| 0.375% due 2/1/2013 | | | 782,000 | | | 772,225 |

| |

| EMC Corp. | | | | | | |

| 1.750% due 12/1/2013 | | | 1,000,000 | | | 1,517,500 |

| |

| Medtronic, Inc. | | | | | | |

| 1.625% due 4/15/2013 | | | 4,073,000 | | | 4,073,000 |

| |

| Transocean Inc. | | | | | | |

| 1.500% due 12/15/2037 | | | 9,500,000 | | | 9,286,250 |

| |

| Total Convertible Bonds | | | | | | 15,648,975 |

| |

| Corporate Bonds - 93.9% | | | | | | |

| Allied Waste N.A., Inc. | | | | | | |

| 6.875% due 6/1/2017 | | | 2,146,000 | | | 2,288,173 |

| | | | | | | |

| American Express | | | | | | |

| 6.650% due 9/15/2015 | | | 90,000 | | | 97,772 |

| 6.900% due 9/15/2015 | | | 277,000 | | | 302,913 |

| |

| American General Finance | | | | | | |

| 6.000% due 10/15/2014 | | | 1,000,000 | | | 751,280 |

| 6.000% due 12/15/2014 | | | 1,000,000 | | | 740,323 |

| |

| American Standard Inc. | | | | | | |

| 5.500% due 4/1/2015 | | | 25,000 | | | 27,684 |

| |

| Amphenol Corp. | | | | | | |

| 4.750% due 11/15/2014 | | | 1,698,000 | | | 1,816,361 |

| |

| Anadarko Petroleum Corp. | | | | | | |

| 6.125% due 3/15/2012 | | | 26,000 | | | 26,315 |

| |

| Anheuser-Busch Cos., Inc. | | | | | | |

| 7.500% due 3/15/2012 | | | 119,000 | | | 121,055 |

| |

| Aquila, Inc. | | | | | | |

| 11.875% due 7/1/2012 | | | 1,926,000 | | | 2,038,174 |

| |

| Arden Realty LP | | | | | | |

| 5.250% due 3/1/2015 | | | 3,019,000 | | | 3,241,132 |

| |

| Aspen Insurance Holdings Ltd. | | | | | | |

| 6.000% due 8/15/2014 | | | 4,116,000 | | | 4,370,739 |

| |

| Avnet, Inc. | | | | | | |

| 6.625% due 9/15/2016 | | | 551,000 | | | 614,460 |

| |

| Axis Capital Holdings | | | | | | |

| 5.750% due 12/1/2014 | | | 5,622,000 | | | 5,898,490 |

| |

| Bank of America Corp. | | | | | | |

| 7.375% due 5/15/2014 | | | 866,000 | | | 872,396 |

| 5.375% due 6/15/2014 | | | 50,000 | | | 49,290 |

| 5.650% due 9/15/2014 | | | 25,000 | | | 24,282 |

| 5.000% due 5/15/2015 | | | 30,000 | | | 28,789 |

| 5.150% due 8/15/2015 | | | 60,000 | | | 57,062 |

| 5.350% due 9/15/2015 | | | 549,000 | | | 525,194 |

| 5.350% due 11/15/2015 | | | 35,000 | | | 33,409 |

| 5.250% due 12/1/2015 | | | 333,000 | | | 318,396 |

| 5.600% due 2/15/2016 | | | 25,000 | | | 24,082 |

| 5.625% due 10/14/2016 | | | 835,000 | | | 771,922 |

| 6.000% due 8/15/2017 | | | 65,000 | | | 63,274 |

See Notes to Financial Statements.

17

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2011 |

| | Principal | | | |

| | Amount | | Value |

| BONDS (continued) | | | | | | |

| | | | | | | |

| Corporate Bonds (continued) | | | | | | |

| Bank of America Corp. (continued) | | | | | | |

| 6.050% due 8/15/2017 | | $ | 948,000 | | $ | 925,046 |

| 5.750% due 12/1/2017 | | | 455,000 | | | 415,010 |

| 5.350% due 3/15/2018 | | | 81,000 | | | 73,772 |

| |

| BB&T Corp. | | | | | | |

| 5.200% due 12/23/2015 | | | 769,000 | | | 826,550 |

| |

| Bear Stearns Cos. LLC | | | | | | |

| 5.320% due 3/10/2014 (b) | | | 270,000 | | | 270,024 |

| 5.270% due 4/10/2014 (b) | | | 100,000 | | | 101,474 |

| |

| Best Buy Co., Inc. | | | | | | |

| 6.750% due 7/15/2013 | | | 570,000 | | | 604,703 |

| 3.750% due 3/15/2016 | | | 1,000,000 | | | 982,345 |

| |

| Bio-Rad Laboratories, Inc. | | | | | | |

| 8.000% due 9/15/2016 | | | 12,909,000 | | | 14,135,355 |

| |

| Black Hills Corp. | | | | | | |

| 9.000% due 5/15/2014 | | | 2,442,000 | | | 2,791,755 |

| |

| Boston Properties LP | | | | | | |

| 5.625% due 4/15/2015 | | | 331,000 | | | 362,858 |

| |

| Boston Scientific Corp. | | | | | | |

| 5.450% due 6/15/2014 | | | 1,392,000 | | | 1,488,862 |

| 4.500% due 1/15/2015 | | | 4,197,000 | | | 4,388,400 |

| 6.250% due 11/15/2015 | | | 3,358,000 | | | 3,707,890 |

| |

| Brinker International | | | | | | |

| 5.750% due 6/1/2014 | | | 7,967,000 | | | 8,471,295 |

| |

| Brocade Communications | | | | | | |

| Systems, Inc. | | | | | | |

| 6.625% due 1/15/2018 | | | 12,503,000 | | | 13,003,120 |

| |

| Brookfield Asset Management Inc. | | | | | | |

| 7.125% due 6/15/2012 | | | 1,306,000 | | | 1,341,472 |

| |

| Capital One Bank | | | | | | |

| 6.500% due 6/13/2013 | | | 423,000 | | | 445,034 |

| |

| Carpenter Technology Corp. | | | | | | |

| 7.030% due 5/22/2018 | | | 8,000 | | | 8,631 |

| | | | | | | |

| CBS Corp. | | | | | | |

| 8.200% due 5/15/2014 | | | 967,000 | | | 1,100,052 |

| |

| CenterPoint Energy, Inc. | | | | | | |

| 6.850% due 6/1/2015 | | | 192,000 | | | 218,676 |

| |

| Chesapeake & Potomac | | | | | | |

| Telephone Co. | | | | | | |

| 7.150% due 5/1/2023 | | | 158,000 | | | 169,095 |

| |

| CIT Group Inc. | | | | | | |

| 7.000% due 5/4/2015 (e) | | | 304,000 | | | 302,100 |

| 7.000% due 5/2/2016 (e) | | | 506,000 | | | 499,675 |

| 7.000% due 5/2/2017 (e) | | | 709,000 | | | 698,365 |

| |

| Citigroup, Inc. | | | | | | |

| 2.875% due 12/9/2011 | | | 45,000 | | | 45,014 |

| 5.250% due 2/27/2012 | | | 1,303,000 | | | 1,311,481 |

| 5.625% due 8/27/2012 | | | 10,883,000 | | | 11,005,303 |

| 5.300% due 10/17/2012 | | | 2,051,000 | | | 2,088,181 |

| 5.000% due 9/15/2014 | | | 3,085,000 | | | 3,086,506 |

| 4.875% due 5/7/2015 | | | 115,000 | | | 113,823 |

| 5.500% due 2/15/2017 | | | 180,000 | | | 180,354 |

| |

| CNA Financial Corp. | | | | | | |

| 5.850% due 12/15/2014 | | | 1,552,000 | | | 1,626,414 |

| 6.500% due 8/15/2016 | | | 1,250,000 | | | 1,340,213 |

| 6.950% due 1/15/2018 | | | 411,000 | | | 434,996 |

| |

| Commercial Net Lease Realty, Inc. | | | | | | |

| 6.250% due 6/15/2014 | | | 1,060,000 | | | 1,126,275 |

| 6.150% due 12/15/2015 | | | 443,000 | | | 474,630 |

| |

| Computer Sciences Corp. | | | | | | |

| 6.500% due 3/15/2018 | | | 12,673,000 | | | 13,153,041 |

| |

| Continental Corp. | | | | | | |

| 8.375% due 8/15/2012 | | | 411,000 | | | 426,253 |

| |

| Con-way Inc. | | | | | | |

| 7.250% due 1/15/2018 | | | 12,089,000 | | | 13,764,221 |

| |

| Countrywide Financial Corp. | | | | | | |

| 5.750% due 6/24/2015 (c) | | | 438,000 | | | 410,948 |

| 6.500% due 7/28/2015 (c) | | | 109,000 | | | 106,476 |

| 6.250% due 5/15/2016 | | | 927,000 | | | 862,228 |

See Notes to Financial Statements.

18

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2011 |

| | Principal | | | |

| | Amount | | Value |

| BONDS (continued) | | | | | | |

| | | | | | | |

| Corporate Bonds (continued) | | | | | | |

| Countrywide Home Loans, Inc. | | | | | | |

| 6.730% due 4/17/2013 | | $ | 93,000 | | $ | 91,611 |

| 6.000% due 1/24/2018 | | | 684,000 | | | 618,653 |

| 5.500% due 5/16/2018 | | | 25,000 | | | 21,862 |

| |

| Coventry Health Care, Inc. | | | | | | |

| 5.875% due 1/15/2012 | | | 380,000 | | | 381,575 |

| 6.300% due 8/15/2014 | | | 8,184,000 | | | 8,902,441 |

| 6.125% due 1/15/2015 | | | 1,136,000 | | | 1,242,283 |

| 5.950% due 3/15/2017 | | | 854,000 | | | 953,804 |

| |

| Darden Restaurants | | | | | | |

| 7.125% due 2/1/2016 | | | 75,000 | | | 86,729 |

| |

| Discover Financial Services | | | | | | |

| 6.450% due 6/12/2017 | | | 590,000 | | | 609,456 |

| |

| Domtar Corp. | | | | | | |

| 10.750% due 6/1/2017 | | | 3,605,000 | | | 4,533,288 |

| |

| Dow Chemical Co. | | | | | | |

| 6.000% due 10/1/2012 | | | 681,000 | | | 709,723 |

| 7.600% due 5/15/2014 | | | 1,688,000 | | | 1,908,578 |

| 5.900% due 2/15/2015 | | | 650,000 | | | 719,445 |

| |

| Duke Realty LP | | | | | | |

| 5.875% due 8/15/2012 | | | 200,000 | | | 204,814 |

| |

| Duquesne Light Holdings Inc. | | | | | | |

| 5.500% due 8/15/2015 | | | 6,782,000 | | | 7,044,131 |

| |

| Endurance Specialty Holdings Ltd. | | | | | | |

| 6.150% due 10/15/2015 | | | 5,990,000 | | | 6,344,165 |

| |

| Fairfax Financial Holdings Ltd. | | | | | | |

| 8.250% due 10/1/2015 | | | 1,904,000 | | | 2,122,688 |

| 7.750% due 6/15/2017 | | | 84,000 | | | 87,993 |

| 7.375% due 4/15/2018 | | | 3,414,000 | | | 3,640,297 |

| |

| Fidelity National Financial, Inc. | | | | | | |

| 5.250% due 3/15/2013 | | | 191,000 | | | 195,386 |

| 6.600% due 5/15/2017 | | | 7,268,000 | | | 7,665,988 |

| |

| Fifth Third Bancorp | | | | | | |

| 6.250% due 5/1/2013 | | | 1,356,000 | | | 1,425,686 |

| | | | | | | |

| First Horizon National Corp. | | | | | | |

| 5.375% due 12/15/2015 | | | 850,000 | | | 846,070 |

| |

| First Tennessee Bank | | | | | | |

| 4.500% due 5/15/2013 | | | 1,780,000 | | | 1,772,243 |

| 4.625% due 5/15/2013 | | | 4,501,000 | | | 4,507,797 |

| 5.050% due 1/15/2015 | | | 2,602,000 | | | 2,572,137 |

| 5.650% due 4/1/2016 | | | 2,941,000 | | | 2,940,288 |

| |

| Fortune Brands, Inc. | | | | | | |

| 6.375% due 6/15/2014 | | | 370,000 | | | 405,020 |

| 5.375% due 1/15/2016 | | | 10,000 | | | 10,870 |

| |

| Freeport-McMoRan Copper & | | | | | | |

| Gold Inc. | | | | | | |

| 8.375% due 4/1/2017 | | | 12,811,000 | | | 13,627,701 |

| |

| General Electric Capital Corp. | | | | | | |

| 4.000% due 2/15/2012 | | | 435,000 | | | 437,565 |

| 4.000% due 2/15/2012 | | | 66,000 | | | 66,284 |

| 4.150% due 5/15/2012 | | | 95,000 | | | 95,863 |

| 8.125% due 5/15/2012 | | | 423,000 | | | 435,528 |

| 4.750% due 6/15/2012 | | | 10,000 | | | 10,129 |

| 5.000% due 9/15/2012 | | | 79,000 | | | 80,815 |

| 6.000% due 10/15/2012 | | | 68,000 | | | 70,279 |

| 6.600% due 10/15/2012 | | | 148,000 | | | 153,714 |

| 6.700% due 10/15/2012 | | | 126,000 | | | 131,032 |

| 5.000% due 12/15/2012 | | | 12,000 | | | 12,368 |

| 5.000% due 12/15/2012 | | | 45,000 | | | 46,385 |

| 5.100% due 12/15/2012 | | | 55,000 | | | 56,742 |

| 5.900% due 5/13/2014 | | | 450,000 | | | 491,588 |

| 5.600% due 7/15/2014 | | | 500,000 | | | 529,195 |

| 4.500% due 5/15/2015 | | | 66,000 | | | 66,046 |

| 4.750% due 5/15/2015 | | | 80,000 | | | 80,026 |

| 4.125% due 6/15/2015 | | | 92,000 | | | 92,040 |

| 4.300% due 6/15/2015 | | | 103,000 | | | 103,040 |

| 5.250% due 6/15/2015 | | | 25,000 | | | 25,931 |

| 5.400% due 6/15/2015 | | | 59,000 | | | 61,375 |

| 5.500% due 8/15/2015 | | | 30,000 | | | 31,423 |

| 5.600% due 12/15/2015 | | | 159,000 | | | 160,012 |

| 5.250% due 1/15/2016 | | | 384,000 | | | 375,762 |

| 5.000% due 4/15/2016 | | | 220,000 | | | 216,892 |

| 5.000% due 4/15/2016 | | | 45,000 | | | 45,363 |

| 5.000% due 5/15/2016 | | | 45,000 | | | 44,358 |

| 4.750% due 3/15/2017 | | | 55,000 | | | 53,956 |

| 4.500% due 5/15/2017 | | | 56,000 | | | 55,613 |

| 4.500% due 7/15/2017 | | | 177,000 | | | 173,059 |

See Notes to Financial Statements.

19

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2011 |

| | Principal | | | |

| | Amount | | Value |

| BONDS (continued) | | | | | | |

| | | | | | | |

| Corporate Bonds (continued) | | | | | | |

| General Electric Capital Corp. (continued) | | | |

| 5.375% due 8/15/2017 | | $ | 28,000 | | $ | 28,011 |

| 5.500% due 10/6/2017 | | | 141,000 | | | 141,626 |

| 5.625% due 12/15/2017 | | | 586,000 | | | 576,247 |

| 5.625% due 12/15/2017 | | | 129,000 | | | 125,608 |

| 5.000% due 3/15/2018 | | | 38,000 | | | 37,224 |

| 5.000% due 3/15/2018 | | | 29,000 | | | 28,408 |

| 5.100% due 4/15/2018 | | | 37,000 | | | 35,849 |

| 5.250% due 4/15/2018 | | | 68,000 | | | 66,425 |

| 6.750% due 4/15/2018 | | | 373,000 | | | 408,307 |

| 4.750% due 5/15/2018 | | | 40,000 | | | 39,111 |

| 5.000% due 5/15/2018 | | | 55,000 | | | 54,533 |

| 6.300% due 5/15/2018 | | | 1,790,000 | | | 1,904,023 |

| 4.500% due 6/15/2018 | | | 83,000 | | | 81,526 |

| 4.500% due 6/15/2018 | | | 20,000 | | | 19,280 |

| 5.000% due 6/27/2018 (c) | | | 80,000 | | | 79,985 |

| 6.000% due 7/15/2018 | | | 57,000 | | | 59,388 |

| 6.000% due 7/15/2018 | | | 39,000 | | | 40,634 |

| 5.250% due 12/15/2021 | | | 30,000 | | | 28,726 |

| |

| Genworth Life Insurance Co. | | | | | | |

| 5.875% due 5/3/2013 (e) | | | 2,865,000 | | | 2,911,324 |

| |

| Georgia-Pacific LLC | | | | | | |

| 7.125% due 1/15/2017 (e) | | | 2,000,000 | | | 2,080,770 |

| |

| GMAC LLC | | | | | | |

| 7.250% due 8/15/2012 | | | 100,000 | | | 99,646 |

| 7.000% due 11/15/2012 | | | 50,000 | | | 49,659 |

| 7.100% due 1/15/2013 | | | 32,000 | | | 31,891 |

| 6.000% due 7/15/2013 | | | 60,000 | | | 58,728 |

| 0.000% due 6/15/2015 (d) | | | 1,250,000 | | | 881,250 |

| 6.350% due 2/15/2016 (c) | | | 75,000 | | | 69,090 |

| 6.500% due 2/15/2016 (c) | | | 100,000 | | | 92,639 |

| 6.500% due 9/15/2016 (c) | | | 87,000 | | | 80,164 |

| 7.250% due 9/15/2017 | | | 259,000 | | | 241,418 |

| |

| Golden West Financial Corp. | | | | | | |

| 4.750% due 10/1/2012 | | | 526,000 | | | 541,627 |

| |

| Goldman Sachs Group, Inc. | | | | | | |

| 3.625% due 8/1/2012 | | | 286,000 | | | 288,115 |

| 5.700% due 9/1/2012 | | | 526,000 | | | 537,559 |

| 5.450% due 11/1/2012 | | | 860,000 | | | 878,736 |

| 5.625% due 1/15/2017 | | | 565,000 | | | 548,414 |

| 5.950% due 1/18/2018 | | | 10,000 | | | 9,939 |

| | | | | | | |

| Great Plains Energy Inc. | | | | | | |

| 6.875% due 9/15/2017 | | | 30,000 | | | 35,418 |

| |

| Harley-Davidson | | | | | | |

| 5.250% due 12/15/2012 (e) | | | 1,675,000 | | | 1,727,422 |

| 15.000% due 2/1/2014 | | | 500,000 | | | 614,731 |

| 5.750% due 12/15/2014 (e) | | | 3,800,000 | | | 4,107,367 |

| |

| Harleysville Group Inc. | | | | | | |

| 5.750% due 7/15/2013 | | | 114,000 | | | 117,882 |

| |

| Hartford Financial Services | | | | | | |

| 4.625% due 7/15/2013 | | | 750,000 | | | 764,096 |

| 4.750% due 3/1/2014 | | | 825,000 | | | 842,549 |

| 6.300% due 3/15/2018 | | | 4,226,000 | | | 4,333,167 |

| |

| Hartford Life Insurance Co. | | | | | | |

| 5.400% due 6/15/2012 | | | 25,000 | | | 25,058 |

| 5.400% due 6/15/2012 | | | 55,000 | | | 55,127 |

| 5.050% due 7/15/2013 | | | 35,000 | | | 35,292 |

| |

| Hasbro, Inc. | | | | | | |

| 6.125% due 5/15/2014 | | | 1,000,000 | | | 1,093,300 |

| |

| HCP, Inc. | | | | | | |

| 5.650% due 12/15/2013 | | | 1,455,000 | | | 1,522,860 |

| 6.000% due 3/1/2015 | | | 5,879,000 | | | 6,298,167 |

| 7.072% due 6/8/2015 | | | 703,000 | | | 764,544 |

| |

| Hillenbrand Industries, Inc. | | | | | | |

| 8.500% due 12/1/2011 | | | 72,000 | | | 72,000 |

| |

| Horace Mann Educators Corp. | | | | | | |

| 6.850% due 4/15/2016 | | | 8,050,000 | | | 8,641,417 |

| |

| Hospitality Properties Trust | | | | | | |

| 6.750% due 2/15/2013 | | | 2,812,000 | | | 2,862,009 |

| 7.875% due 8/15/2014 | | | 4,804,000 | | | 5,218,508 |

| 5.125% due 2/15/2015 | | | 1,598,000 | | | 1,613,379 |

| 6.300% due 6/15/2016 | | | 261,000 | | | 272,509 |

| 5.625% due 3/15/2017 | | | 2,651,000 | | | 2,660,459 |

| |

| HRPT Properties Trust | | | | | | |

| 6.950% due 4/1/2012 | | | 2,704,000 | | | 2,728,125 |

| 5.750% due 11/1/2015 | | | 3,318,000 | | | 3,448,742 |

| 6.250% due 8/15/2016 | | | 2,520,000 | | | 2,671,306 |

See Notes to Financial Statements.

20

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2011 |

| | Principal | | | |

| | Amount | | Value |

| BONDS (continued) | | | | | | |

| | | | | | | |

| Corporate Bonds (continued) | | | | | | |

| HRPT Properties Trust (continued) | | | | | | |

| 6.250% due 6/15/2017 | | $ | 1,850,000 | | $ | 1,945,514 |

| 6.650% due 1/15/2018 | | | 100,000 | | | 106,479 |

| |

| HSBC Finance Corp. | | | | | | |

| 4.850% due 12/15/2011 | | | 20,000 | | | 20,010 |

| 5.000% due 12/15/2011 | | | 20,000 | | | 20,005 |

| 5.000% due 12/15/2011 | | | 456,000 | | | 456,112 |

| 5.250% due 12/15/2011 | | | 210,000 | | | 210,083 |

| 7.100% due 12/15/2011 | | | 173,000 | | | 173,140 |

| 4.500% due 2/15/2012 | | | 72,000 | | | 72,093 |

| 5.500% due 3/15/2012 | | | 31,000 | | | 31,122 |

| 6.000% due 4/15/2012 | | | 171,000 | | | 172,254 |

| 5.300% due 6/15/2012 | | | 160,000 | | | 160,812 |

| 5.350% due 6/15/2012 | | | 15,000 | | | 15,081 |

| 4.700% due 7/15/2012 | | | 698,000 | | | 699,682 |

| 5.700% due 7/15/2012 | | | 215,000 | | | 216,791 |

| 4.000% due 8/15/2012 | | | 151,000 | | | 150,683 |

| 5.750% due 8/15/2012 | | | 100,000 | | | 100,985 |

| 3.500% due 9/15/2012 | | | 350,000 | | | 347,841 |

| 3.750% due 9/15/2012 | | | 120,000 | | | 119,486 |

| 3.800% due 9/15/2012 | | | 201,000 | | | 200,352 |

| 3.850% due 9/15/2012 | | | 269,000 | | | 268,051 |

| 5.400% due 9/15/2012 | | | 337,000 | | | 339,759 |

| 5.600% due 9/15/2012 | | | 143,000 | | | 144,409 |

| 5.650% due 9/15/2012 | | | 173,000 | | | 174,743 |

| 5.350% due 10/15/2012 | | | 400,000 | | | 404,536 |

| 6.375% due 11/27/2012 | | | 767,000 | | | 787,582 |

| 5.350% due 12/15/2012 | | | 40,000 | | | 40,287 |

| 6.000% due 4/15/2013 | | | 621,000 | | | 639,533 |

| 6.080% due 9/15/2013 (b) | | | 366,000 | | | 372,830 |

| 6.210% due 10/10/2013 (b) | | | 331,000 | | | 334,423 |

| 5.990% due 1/10/2014 (b) | | | 335,000 | | | 340,762 |

| 5.600% due 4/15/2014 | | | 75,000 | | | 77,049 |

| 5.500% due 7/15/2014 | | | 30,000 | | | 30,739 |

| 6.000% due 8/15/2014 | | | 553,000 | | | 574,072 |

| 6.000% due 8/15/2014 | | | 67,000 | | | 69,526 |

| 5.800% due 9/15/2014 | | | 153,000 | | | 158,533 |

| 5.850% due 9/15/2014 | | | 325,000 | | | 337,049 |

| 5.650% due 10/15/2014 | | | 30,000 | | | 30,994 |

| 5.750% due 10/15/2014 | | | 274,000 | | | 283,806 |

| 5.350% due 11/15/2014 | | | 30,000 | | | 30,760 |

| |

| HSBC Holdings PLC | | | | | | |

| 5.250% due 12/12/2012 | | | 134,000 | | | 137,139 |

| | | | | | | |

| Hyatt Hotels Corp. | | | | | | |

| 5.750% due 8/15/2015 (e) | | | 100,000 | | | 106,820 |

| |

| Ingersoll-Rand | | | | | | |

| 9.500% due 4/15/2014 | | | 1,026,000 | | | 1,197,669 |

| |

| Ingram Micro Inc. | | | | | | |

| 5.250% due 9/1/2017 | | | 1,000,000 | | | 1,029,641 |

| |

| Int’l. Bank for Reconstruction | | | | | | |

| and Dev. (IBRD) | | | | | | |

| 0.000% due 2/15/2012 (d) | | | 59,000 | | | 58,934 |

| 0.000% due 2/15/2012 (d) | | | 297,000 | | | 296,669 |

| 0.000% due 8/15/2012 (d) | | | 131,000 | | | 130,421 |

| |

| Intuit Inc. | | | | | | |

| 5.400% due 3/15/2012 | | | 425,000 | | | 429,735 |

| |

| ITT Hartford Group | | | | | | |

| 7.300% due 11/1/2015 | | | 910,000 | | | 973,916 |

| |

| Jefferson-Pilot Corp. | | | | | | |

| 4.750% due 1/30/2014 | | | 3,739,000 | | | 3,892,235 |

| |

| John Hancock Life Ins. Co. | | | | | | |

| 4.000% due 11/15/2012 | | | 5,000 | | | 5,081 |

| 4.900% due 11/15/2012 | | | 65,000 | | | 66,457 |

| 5.450% due 9/15/2015 | | | 201,000 | | | 216,580 |

| 5.450% due 10/15/2015 | | | 29,000 | | | 30,837 |

| 5.500% due 11/15/2015 | | | 75,000 | | | 82,259 |

| 5.250% due 12/15/2015 | | | 25,000 | | | 27,039 |

| 5.500% due 12/15/2015 | | | 25,000 | | | 27,274 |

| 5.000% due 4/15/2016 | | | 60,000 | | | 65,130 |

| |

| JPMorgan Chase & Co. | | | | | | |

| 2.200% due 6/15/2012 | | | 104,000 | | | 105,206 |

| 2.125% due 6/22/2012 | | | 54,000 | | | 54,627 |

| 5.250% due 5/15/2018 | | | 55,000 | | | 55,085 |

| |

| Kemper Corp. | | | | | | |

| 6.000% due 11/30/2015 | | | 9,753,000 | | | 10,053,646 |

| 6.000% due 5/15/2017 | | | 3,095,000 | | | 3,211,876 |

| |

| LaSalle Funding LLC | | | | | | |

| 5.250% due 9/15/2017 | | | 25,000 | | | 23,540 |

See Notes to Financial Statements.

21

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2011 |

| | Principal | | | |

| | Amount | | Value |

| BONDS (continued) | | | | | | |

| | | | | | | |

| Corporate Bonds (continued) | | | | | | |

| Lexmark International, Inc. | | | | | | |

| 5.900% due 6/1/2013 | | $ | 2,556,000 | | $ | 2,697,868 |

| 6.650% due 6/1/2018 | | | 3,370,000 | | | 3,757,766 |

| |

| Liberty Property LP | | | | | | |

| 5.650% due 8/15/2014 | | | 36,000 | | | 38,413 |

| |

| Lincoln National Corp. | | | | | | |

| 4.750% due 2/15/2014 | | | 1,638,000 | | | 1,698,968 |

| |

| Macy’s Retail Holdings, Inc. | | | | | | |

| 8.000% due 7/15/2012 | | | 375,000 | | | 389,919 |

| |

| Manufacturers & Traders Trust Co. | | | | | | |

| 5.585% due 12/28/2020 (b) | | | 347,000 | | | 336,682 |

| |

| Marriott International, Inc. | | | | | | |

| 4.625% due 6/15/2012 | | | 371,000 | | | 376,877 |

| 5.810% due 11/10/2015 | | | 373,000 | | | 418,285 |

| |

| Marsh & McLennan Cos., Inc. | | | | | | |

| 6.250% due 3/15/2012 | | | 1,562,000 | | | 1,582,923 |

| |

| Marshall & Ilsley Bank | | | | | | |

| 5.150% due 2/22/2012 | | | 667,000 | | | 664,774 |

| 5.500% due 7/15/2012 | | | 10,000 | | | 9,973 |

| 5.250% due 9/4/2012 | | | 4,153,000 | | | 4,283,774 |

| |

| Masco Corp. | | | | | | |

| 7.125% due 8/15/2013 | | | 5,117,000 | | | 5,337,231 |

| 4.800% due 6/15/2015 | | | 1,456,000 | | | 1,432,646 |

| 6.125% due 10/3/2016 | | | 3,017,000 | | | 3,056,975 |

| 5.850% due 3/15/2017 | | | 1,318,000 | | | 1,302,944 |

| 6.625% due 4/15/2018 | | | 2,980,000 | | | 2,965,213 |

| |

| Maytag Corp. | | | | | | |

| 5.000% due 5/15/2015 | | | 50,000 | | | 51,505 |

| |

| MBNA America Bank | | | | | | |

| 6.625% due 6/15/2012 | | | 75,000 | | | 75,517 |

| |

| MBNA Corp. | | | | | | |

| 7.500% due 3/15/2012 | | | 115,000 | | | 115,752 |

| 5.000% due 6/15/2015 | | | 800,000 | | | 786,463 |

| | | | | | | |

| Merrill Lynch & Co. | | | | | | |

| 4.300% due 2/14/2012 | | | 23,000 | | | 22,898 |

| 5.450% due 2/5/2013 | | | 500,000 | | | 498,599 |

| 6.150% due 4/25/2013 | | | 455,000 | | | 455,839 |

| 0.000% due 8/30/2013 (d) | | | 65,000 | | | 60,664 |

| 5.000% due 2/3/2014 | | | 138,000 | | | 134,855 |

| 5.450% due 7/15/2014 | | | 1,082,000 | | | 1,069,325 |

| 5.000% due 1/15/2015 | | | 343,000 | | | 327,478 |

| 5.300% due 9/30/2015 | | | 1,712,000 | | | 1,577,298 |

| 6.050% due 5/16/2016 | | | 3,000,000 | | | 2,814,879 |

| 6.400% due 8/28/2017 | | | 2,538,000 | | | 2,431,754 |

| 6.500% due 7/15/2018 | | | 1,248,000 | | | 1,176,317 |

| 6.875% due 11/15/2018 | | | 375,000 | | | 352,448 |

| |

| MetLife, Inc. | | | | | | |

| 6.125% due 12/1/2011 | | | 41,000 | | | 41,000 |

| |

| Montpelier Re Holdings Ltd. | | | | | | |

| 6.125% due 8/15/2013 | | | 11,776,000 | | | 12,009,824 |

| |

| Morgan Stanley | | | | | | |

| 6.600% due 4/1/2012 | | | 123,000 | | | 123,798 |

| 4.750% due 4/1/2014 | | | 4,268,000 | | | 4,096,815 |

| 6.000% due 5/13/2014 | | | 695,000 | | | 691,029 |

| 6.000% due 4/28/2015 | | | 3,753,000 | | | 3,651,493 |

| 4.000% due 7/24/2015 | | | 200,000 | | | 183,091 |

| 5.375% due 10/15/2015 | | | 1,000,000 | | | 950,471 |

| 5.750% due 10/18/2016 | | | 2,178,000 | | | 2,015,970 |

| 5.550% due 4/27/2017 | | | 2,712,000 | | | 2,508,473 |

| 5.950% due 12/28/2017 | | | 2,683,000 | | | 2,517,373 |

| 6.625% due 4/1/2018 | | | 4,266,000 | | | 4,014,861 |

| |

| Motorola Solutions, Inc. | | | | | | |

| 5.375% due 11/15/2012 | | | 110,000 | | | 113,398 |

| |

| Nabisco, Inc. | | | | | | |

| 7.550% due 6/15/2015 | | | 50,000 | | | 59,155 |

| |

| National City Bank of Indiana | | | | | | |

| 4.250% due 7/1/2018 | | | 200,000 | | | 194,733 |

| |

| National City Preferred | | | | | | |

| Capital Trust I | | | | | | |

| 12.000% due 12/31/2049 (b) | | | 7,807,000 | | | 8,122,793 |

| |

| National Retail Properties Inc. | | | | | | |

| 6.875% due 10/15/2017 | | | 2,273,000 | | | 2,510,815 |

See Notes to Financial Statements.

22

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2011 |

| | Principal | | | |

| | Amount | | Value |

| BONDS (continued) | | | | | | |

| | | | | | | |

| Corporate Bonds (continued) | | | | | | |

| National Rural Utilities | | | | | | |

| 5.450% due 7/15/2012 | | $ | 29,000 | | $ | 29,607 |

| 5.500% due 7/15/2012 | | | 20,000 | | | 20,424 |

| 7.200% due 10/1/2015 | | | 30,000 | | | 35,343 |

| |

| National Semiconductor Corp. | | | | | | |

| 6.150% due 6/15/2012 | | | 196,000 | | | 201,666 |

| |

| NationsBank Corp. | | | | | | |

| 0.000% due 8/15/2013 (d) | | | 91,000 | | | 84,175 |

| 7.750% due 8/15/2015 | | | 2,251,000 | | | 2,242,478 |

| |

| Navigators Group, Inc. | | | | | | |

| 7.000% due 5/1/2016 | | | 11,287,000 | | | 11,601,625 |

| |

| NIPSCO Capital Markets, Inc. | | | | | | |

| 7.860% due 3/27/2017 | | | 38,000 | | | 44,647 |

| |

| NiSource Finance Corp. | | | | | | |

| 5.400% due 7/15/2014 | | | 215,000 | | | 232,999 |

| |

| Northern Indiana Public | | | | | | |

| Service Co. | | | | | | |

| 7.590% due 6/12/2017 | | | 182,000 | | | 218,015 |

| |

| Northern Rock Asset | | | | | | |

| Management PLC | | | | | | |

| 5.625% due 6/22/2017 (e) | | | 2,500,000 | | | 2,637,940 |

| |

| Ohio Casualty Corp. | | | | | | |

| 7.300% due 6/15/2014 | | | 351,000 | | | 375,545 |

| |

| Owens Corning | | | | | | |

| 6.500% due 12/1/2016 | | | 12,351,000 | | | 13,129,817 |

| |

| Paine Webber Group Inc. | | | | | | |

| 7.625% due 2/15/2014 | | | 50,000 | | | 54,844 |

| |

| Pitney Bowes Inc. | | | | | | |

| 4.625% due 10/1/2012 | | | 199,000 | | | 204,554 |

| |

| Platinum Underwriters | | | | | | |

| Finance, Inc. | | | | | | |

| 7.500% due 6/1/2017 | | | 9,548,000 | | | 10,393,189 |

| |