UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-4946

THOMPSON IM FUNDS, INC.

(Exact name of registrant as specified in charter)

918 Deming Way

Madison, Wisconsin 53717

(Address of principal executive offices)--(Zip code)

Jason L. Stephens

Chief Executive Officer

Thompson IM Funds, Inc.

918 Deming Way

Madison, Wisconsin 53717

(Name and address of agent for service)

With a copy to:

Matthew C. Vogel, Esq.

Quarles & Brady LLP

411 East Wisconsin Avenue

Milwaukee, Wisconsin 53202

Registrant's telephone number, including area code: (608) 827-5700

Date of fiscal year end: November 30, 2017

Date of reporting period: November 30, 2017

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, N.W., Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

THOMPSON IM FUNDS, INC.

ANNUAL REPORT TO SHAREHOLDERS

NOTE ON FORWARD-LOOKING STATEMENTS

The matters discussed in this report may constitute forward-looking statements. These include any Advisor or portfolio manager predictions, assessments, analyses or outlooks for individual securities, industries, investment styles, market sectors, interest rates, economic trends and/or markets. These statements involve risks and uncertainties. In addition to the general risks described for each Fund in its current Prospectus, other factors bearing on these reports include the accuracy of the Advisor’s or portfolio manager’s forecasts and predictions, the appropriateness of the investment strategies designed by the Advisor or portfolio manager and the ability of the Advisor or portfolio manager to implement its strategies efficiently and successfully. Any one or more of these factors, as well as other risks affecting the securities markets generally, could cause the actual results of any Fund to differ materially as compared to its benchmarks.

1

THOMPSON IM FUNDS, INC.

ANNUAL REPORT TO SHAREHOLDERS

November 30, 2017

CONTENTS

| | Page(s) |

| LargeCap Fund | | |

| Investment review | | 3-5 |

| Schedule of investments | | 6-9 |

| |

| MidCap Fund | | |

| Investment review | | 10-12 |

| Schedule of investments | | 13-16 |

| |

| Bond Fund | | |

| Investment review | | 17-19 |

| Schedule of investments | | 20-29 |

| |

| Fund Expense Examples | | 30 |

| |

| Financial Statements | | |

| Statements of assets and liabilities | | 31 |

| Statements of operations | | 32 |

| Statements of changes in net assets | | 33 |

| Notes to financial statements | | 34-40 |

| Financial highlights | | 41-43 |

| |

| Report of Independent Registered Public Accounting Firm | | 44 |

| |

| Directors and Officers | | 45-46 |

| |

| Additional Information | | 47-50 |

This report contains information for existing shareholders of Thompson IM Funds, Inc. It

does not constitute an offer to sell. This Annual Report is authorized for distribution to prospective investors

only when preceded or accompanied by a Fund Prospectus, which contains information about

the Funds’ objectives and policies, risks, management, expenses and other information.

A Prospectus can be obtained by calling 1-800-999-0887.

Please read your Prospectus carefully.

2

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) |

| November 30, 2017 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

Performance

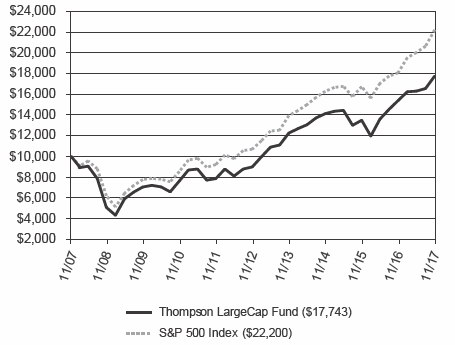

The LargeCap Fund produced a total return of 15.32% for the fiscal year ended November 30, 2017, as compared to its benchmark, the S&P 500 Index, which returned 22.87%.

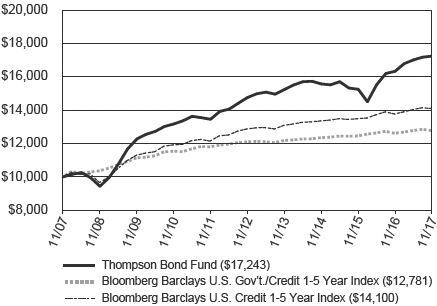

| Comparison of Change in Value of a Hypothetical $10,000 Investment |

|

| Average Annual Total Returns |

| Through 11/30/17 |

| | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Thompson LargeCap Fund | | | 15.32% | | | | 7.92% | | | | 14.60% | | | | 5.90% | |

| S&P 500 Index | | | 22.87% | | | | 10.91% | | | | 15.74% | | | | 8.30% | |

Gross Expense Ratio as of 03/31/17 was 1.25%.

Net Expense Ratio after reimbursement as of 12/01/17 was 1.05%.*

| * | The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the LargeCap Fund through March 31, 2019, so that the annual operating expenses of the Fund do not exceed 1.05% of its average daily net assets. Net expense ratios are current as of the most recent Prospectus and are applicable to investors. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks. You cannot directly invest in an index.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and has been licensed for use by Thompson Investment Management, Inc. S&P® and S&P 500® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”). The Thompson IM Funds are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P or their respective affiliates, and none of S&P Dow Jones Indices LLC, Dow Jones, S&P nor their respective affiliates makes any representation regarding the advisability of investing in such products.

See Notes to Financial Statements.

3

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2017 |

Management Commentary

We positioned the Fund at the outset of the fiscal year in a way that we anticipated would benefit from various changes we expected as a result of the election of Donald Trump and Republican governance in Washington, DC. These included owning companies that we felt would benefit from lower corporate taxes, repatriation of overseas cash, a lighter regulatory touch, and likely higher interest rates. While shareholders were rewarded for this positioning during the very beginning and end of the fiscal year, they were not during the vast majority of the period in between.

Throughout most of the fiscal year, performance was very narrowly concentrated in a handful of sectors and companies. In fact, only one sector, Technology, beat the performance of the overall S&P 500 by more than 2.5%. Conversely, six sectors—Consumer Discretionary, Staples, Industrials, Real Estate, Telecommunications and Energy—lagged the index by at least that margin. Performance was also concentrated in the very largest-capitalization companies in the market. The equally weighted version of the S&P 500 was up a more pedestrian 18.82% during the fiscal year, compared to the 22.87% return of the standard market-capitalization-weighted index. Mega cap technology stocks, which the market seemed to perceive could grow earnings with or without changes in government policy, generally performed the best. As we have written before, we are underweight these names not because they are poor companies, but rather because the elevated price/earnings (P/E) valuations of their stocks build in an expectation of a tremendous level of success. Instead, the expensive grew more so while many other stocks lagged, and shareholders’ relative returns suffered due to our underweight.

Going forward, we still like how we are positioned. The average P/E multiple of the stocks in the Fund has now consistently averaged less than its benchmark for several quarters. At the same time, average earnings growth is relatively similar to that of the Fund’s benchmark. While the catalysts we anticipated a year ago may or may not occur in the next year, if they do they could serve as a powerful tailwind for many of the Fund’s holdings. At the same time, we believe many of last year’s winners are so extended that the probability of them repeating as top performers in 2018 is low. A similar dynamic played out in 2015 and 2016. Performance of stocks in the benchmark in 2015 was similarly concentrated into fewer companies, and the Fund lagged its benchmark. It broadened out in 2016 and the Fund outperformed. We would be happy if a similar pattern plays out over the next year.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Investments in smaller companies involve additional risks such as limited liquidity and greater volatility. Investments in American Depositary Receipts (“ADRs”) are subject to some extent to the risks associated with directly investing in securities of foreign issuers, including the risk of changes in currency exchange rates, expropriation or nationalization of assets, and the impact of political, diplomatic, or social events. Investments in real estate securities may involve greater risk and volatility including greater exposure to economic downturns and changes in real estate values, rents, property taxes, tax, and other laws. A real estate investment trust’s (REITs) share price may decline because of adverse developments affecting the real estate industry.

Please refer to the Schedule of Investments on page 6 of this report for holdings information. The management commentary above as well as Fund holdings and asset/sector allocations should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings and asset/sector allocations are subject to change.

Price-To-Earnings (P/E) Ratio is a valuation ratio of a company’s current share price compared to its per-share earnings. Divide market value of a share by the earnings per share.

Earnings Growth is a measure of growth in a company’s net income over a specific period, often one year. It is not a prediction of the Fund’s future returns.

See Notes to Financial Statements.

4

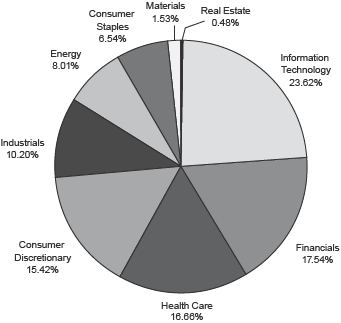

| LARGECAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2017 |

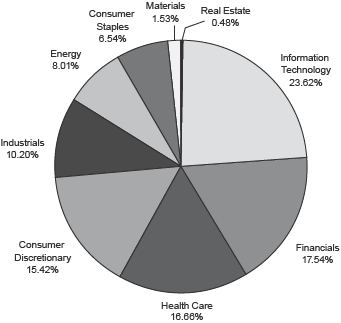

Sector Weightings at 11/30/17

% of Total Investments |

|

| Top 10 Equity Holdings at 11/30/17 |

| | % of Fund’s |

| Company | Industry | Net Assets |

| Alphabet, Inc. Class A | Internet Software & Services | 3.01% |

| Microsoft Corp. | Software | 2.63% |

| Bank of America Corp. | Banks | 2.54% |

| Qualcomm, Inc. | Semiconductors & Semiconductor Equipment | 2.53% |

| Exxon Mobil Corp. | Oil, Gas & Consumable Fuels | 2.53% |

| JPMorgan Chase & Co. | Banks | 2.33% |

| Citigroup Inc. | Banks | 2.30% |

| Viacom Inc. Class B | Media | 2.22% |

| Cisco Systems, Inc. | Communications Equipment | 2.22% |

| General Electric Co. | Industrial Conglomerates | 2.21% |

As of November 30, 2017, 99.8% of the Fund’s assets were in equity and short-term investments.

See Notes to Financial Statements.

5

| LARGECAP FUND SCHEDULE OF INVESTMENTS |

| November 30, 2017 |

| | Shares | | Value |

| COMMON STOCKS - 99.8% | | | | $ | 128,737,291 |

| (COST $134,748,769) | | | | | |

| |

| Consumer Discretionary - 15.4% | | | | | 19,851,852 |

| Automobiles - 1.0% | | | | | |

| Harley-Davidson, Inc. | | 26,125 | | | 1,311,475 |

| Distributors - 0.8% | | | | | |

| LKQ Corp. (a) | | 25,175 | | | 992,399 |

| Household Durables - 1.2% | | | | | |

| D.R. Horton, Inc. | | 15,150 | | | 772,650 |

| TopBuild Corp. (a) | | 11,702 | | | 795,619 |

| Leisure Products - 1.1% | | | | | |

| Brunswick Corp. | | 25,600 | | | 1,416,960 |

| Media - 5.6% | | | | | |

| CBS Corp. Class B | | 47,175 | | | 2,644,630 |

| The Walt Disney Co. | | 15,850 | | | 1,661,397 |

| Viacom Inc. Class B | | 101,100 | | | 2,863,152 |

| Multiline Retail - 3.4% | | | | | |

| Kohl’s Corp. | | 32,510 | | | 1,559,505 |

| Target Corp. | | 46,985 | | | 2,814,401 |

| Specialty Retail - 1.8% | | | | | |

| Bed Bath & Beyond Inc. | | 61,875 | | | 1,385,381 |

| Lumber Liquidators Holdings, Inc. (a) | | 33,275 | | | 943,346 |

| Textiles, Apparel & Luxury Goods - 0.5% | | | | | |

| Hanesbrands, Inc. | | 33,075 | | | 690,937 |

| |

| Consumer Staples - 6.5% | | | | | 8,422,627 |

| Food & Staples Retailing - 4.7% | | | | | |

| CVS Health Corp. | | 31,775 | | | 2,433,965 |

| Walgreens Boots Alliance, Inc. | | 37,075 | | | 2,697,577 |

| Wal-Mart Stores, Inc. | | 10,375 | | | 1,008,761 |

| Household Products - 1.8% | | | | | |

| Kimberly-Clark Corp. | | 11,393 | | | 1,364,426 |

| The Procter & Gamble Co. | | 10,200 | | | 917,898 |

| |

| Energy - 8.0% | | | | | 10,306,230 |

| Energy Equipment & Services - 1.1% | | | | | |

| Schlumberger Ltd. | | 23,144 | | | 1,454,600 |

| Oil, Gas & Consumable Fuels - 6.9% | | | | | |

| Anadarko Petroleum Corp. | | 5,000 | | | 240,450 |

| Chevron Corp. | | 10,920 | | | 1,299,371 |

| Devon Energy Corp. | | 44,325 | | | 1,707,842 |

| EOG Resources, Inc. | | 11,975 | | | 1,225,282 |

| Exxon Mobil Corp. | | 39,120 | | | 3,258,305 |

| Noble Energy, Inc. | | 42,600 | | | 1,120,380 |

See Notes to Financial Statements.

6

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | | |

| |

| Financials - 17.5% | | | | $ | 22,584,772 |

| Banks - 12.6% | | | | | |

| Associated Banc-Corp | | 52,827 | | | 1,347,089 |

| Bank of America Corp. | | 116,350 | | | 3,277,579 |

| CIT Group Inc. | | 34,700 | | | 1,729,448 |

| Citigroup Inc. | | 39,325 | | | 2,969,037 |

| First Horizon National Corp. | | 71,085 | | | 1,378,338 |

| JPMorgan Chase & Co. | | 28,725 | | | 3,002,337 |

| PNC Financial Services Group, Inc. | | 7,925 | | | 1,113,938 |

| SunTrust Banks, Inc. | | 11,300 | | | 696,419 |

| Zions Bancorporation | | 15,025 | | | 744,489 |

| Capital Markets - 3.2% | | | | | |

| Northern Trust Corp. | | 14,085 | | | 1,377,231 |

| State Street Corp. | | 28,550 | | | 2,722,243 |

| Consumer Finance - 0.6% | | | | | |

| Discover Financial Services | | 10,320 | | | 728,592 |

| Insurance - 1.1% | | | | | |

| FNF Group | | 37,025 | | | 1,498,032 |

| |

| Health Care - 16.6% | | | | | 21,444,608 |

| Biotechnology - 6.9% | | | | | |

| AbbVie Inc. | | 22,525 | | | 2,183,123 |

| Amgen Inc. | | 9,400 | | | 1,651,204 |

| Celgene Corp. (a) | | 24,875 | | | 2,508,146 |

| Exact Sciences Corp. (a) | | 31,125 | | | 1,851,315 |

| Shire PLC ADR | | 4,427 | | | 658,516 |

| Health Care Equipment & Supplies - 1.0% | | | | | |

| Zimmer Biomet Holdings, Inc. | | 11,550 | | | 1,352,505 |

| Health Care Providers & Services - 6.7% | | | | | |

| Express Scripts Holding Co. (a) | | 41,075 | | | 2,677,269 |

| Hanger, Inc. (a) | | 149,825 | | | 2,067,585 |

| HCA Healthcare, Inc. (a) | | 16,400 | | | 1,394,000 |

| McKesson Corp. | | 16,610 | | | 2,453,961 |

| Pharmaceuticals - 2.0% | | | | | |

| Johnson & Johnson | | 8,985 | | | 1,251,880 |

| Pfizer Inc. | | 38,475 | | | 1,395,104 |

| |

| Industrials - 10.2% | | | | | 13,127,027 |

| Air Freight & Logistics - 1.3% | | | | | |

| FedEx Corp. | | 7,375 | | | 1,707,018 |

| Airlines - 0.8% | | | | | |

| Delta Air Lines, Inc. | | 19,750 | | | 1,045,170 |

| Building Products - 3.1% | | | | | |

| Johnson Controls Int’l. PLC | | 50,941 | | | 1,917,419 |

| Masco Corp. | | 47,625 | | | 2,043,589 |

See Notes to Financial Statements.

7

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | | |

| |

| Industrials (continued) | | | | | |

| Electrical Equipment - 1.4% | | | | | |

| ABB Ltd. ADR | | 72,225 | | | $1,859,071 |

| Industrial Conglomerates - 2.2% | | | | | |

| General Electric Co. | | 156,200 | | | 2,856,898 |

| Machinery - 0.5% | | | | | |

| Ingersoll-Rand PLC | | 6,600 | | | 578,292 |

| Trading Companies & Distributors - 0.9% | | | | | |

| HD Supply Holdings, Inc. (a) | | 30,275 | | | 1,119,570 |

| |

| Information Technology - 23.6% | | | | | 30,412,657 |

| Communications Equipment - 3.0% | | | | | |

| Cisco Systems, Inc. | | 76,660 | | | 2,859,418 |

| Viavi Solutions Inc. (a) | | 109,910 | | | 1,029,857 |

| Electronic Equipment, Instruments & Components - 1.7% | | | | | |

| Corning Inc. | | 51,375 | | | 1,664,036 |

| Maxwell Technologies, Inc. (a) | | 93,997 | | | 522,623 |

| Internet Software & Services - 3.6% | | | | | |

| Alphabet, Inc. Class A (a) | | 3,745 | | | 3,880,457 |

| eBay Inc. (a) | | 20,270 | | | 702,761 |

| IT Services - 3.7% | | | | | |

| Alliance Data Systems Corp. | | 8,600 | | | 2,057,722 |

| Black Knight, Inc. (a) | | 15,006 | | | 673,769 |

| PayPal Holdings, Inc. (a) | | 19,070 | | | 1,444,171 |

| Visa Inc. Class A | | 5,600 | | | 630,504 |

| Semiconductors & Semiconductor Equipment - 5.3% | | | | | |

| Infineon Technologies A.G. ADR | | 40,775 | | | 1,128,856 |

| Intel Corp. | | 33,750 | | | 1,513,350 |

| Maxim Integrated Products, Inc. | | 17,355 | | | 908,187 |

| Qualcomm Inc. (a) | | 49,205 | | | 3,264,260 |

| Software - 4.2% | | | | | |

| Microsoft Corp. | | 40,351 | | | 3,396,344 |

| Oracle Corp. | | 42,475 | | | 2,083,824 |

| Technology Hardware, Storage & Peripherals - 2.1% | | | | | |

| Apple Inc. | | 8,525 | | | 1,465,021 |

| Hewlett Packard Enterprise Co. | | 35,575 | | | 496,271 |

| HP Inc. | | 32,225 | | | 691,226 |

| |

| Materials - 1.5% | | | | | 1,967,592 |

| Metals & Mining - 1.5% | | | | | |

| Freeport-McMoRan Inc. (a) | | 141,350 | | | 1,967,592 |

| |

| Real Estate - 0.5% | | | | | 619,926 |

| Real Estate Investment Trusts - 0.5% | | | | | |

| DiamondRock Hospitality Co. | | 55,400 | | | 619,926 |

See Notes to Financial Statements.

8

| LARGECAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | Shares | | Value |

| SHORT-TERM INVESTMENTS - 0.0%^ | | | | | $289 |

| (COST $289) | | | | | |

| | | | | | |

| Money Market Funds - 0.0%^ | | | | | 289 |

| Fidelity Inst’l. Government Portfolio Class I, 0.980% (b) | | 289 | | | 289 |

| | | | | | |

| TOTAL INVESTMENTS - 99.8% (COST $134,749,058) | | | | | 128,737,580 |

| | | | | | |

| NET OTHER ASSETS AND LIABILITIES - 0.2% | | | | | 267,679 |

| | | | | | |

| NET ASSETS - 100.0% | | | | $ | 129,005,259 |

| (a) | Non-income producing security. |

| (b) | Represents the 7-day yield at November 30, 2017. |

| ^ | Rounds to 0.0%. |

Abbreviations:

| ADR | | American Depositary Receipt |

| A.G. | | Aktiengesellschaft is the German term for a public limited liability corporation. |

| PLC | | Public Limited Company |

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”) and is licensed for use by Thompson Investment Management, Inc. Neither MSCI, S&P, nor any other party involved in making or compiling the GICS or any GICS classifications makes any warranties with respect thereto or the results to be obtained by the use thereof, and no such party shall have any liability whatsoever with respect thereto.

See Notes to Financial Statements.

9

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) |

| November 30, 2017 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

Performance

The MidCap Fund produced a total return of 14.78% for the fiscal year ended November 30, 2017, as compared to its benchmark, the Russell Midcap Index, which returned 18.76%.

| Comparison of Change in Value of a Hypothetical $10,000 Investment |

|

| Average Annual Total Returns |

| Through 11/30/17 |

| | | | | | | | Since |

| | | | | | | | Inception |

| | 1 Year | | 3 Year | | 5 Year | | (03/31/08) |

| Thompson MidCap Fund | | 14.78% | | 7.43% | | 13.46% | | 10.25% |

| Russell Midcap Index | | 18.76% | | 9.32% | | 15.26% | | 10.53% |

Gross Expense Ratio as of 03/31/17 was 1.50%.

Net Expense Ratio after reimbursement as of 12/01/17 was 1.15%.*

| * | The Advisor has contractually agreed to waive management fees and/or reimburse expenses incurred by the MidCap Fund through March 31, 2019, so that the annual operating expenses of the Fund do not exceed 1.15% of its average daily net assets. Net expense ratios are current as of the most recent Prospectus and are applicable to investors. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may be in effect. In the absence of such waivers, total return would be reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index based on total market capitalization. You cannot directly invest in an index.

FTSE Russell is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. “FTSE®” and “Russell®” are trademarks of the London Stock Exchange Group.

See Notes to Financial Statements.

10

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2017 |

Management Commentary

The Fund trailed its benchmark during the fiscal year based on several poor performers held by the Fund within the Technology, Consumer Staples and Utilities sectors. While the Fund’s holdings in the Health Care, Financials, Industrial and Consumer Discretionary sectors were enough to partially offset these disappointments, the drag of these underperforming stocks proved to be too great to fully counter. The only thing these disappointments had in common was that they generally came from the smaller-capitalization side of the midcap universe. In addition, a few high flyers that were not a part of the Fund’s holdings boosted index returns.

Similar to what we observed with large-capitalization stock indices such as the S&P 500, we noticed a distinct concentration of performance within a subset of the Fund’s benchmark during the fiscal year. The standard market-capitalization-weighted version of the Russell Midcap Index outperformed its equally weighted version by over 2.5%. In addition, the growth version of the index beat the value version by over 11%. These results match up with our anecdotal experiences, suggesting the market was focused on a handful of growth-oriented winners, while the majority of names either lagged modestly or much more severely in cases where company-specific news was disappointing.

We believe periods like this are often followed by a “reversion to the mean” where performance broadens out and favors more value-like strategies. There are several catalysts that may trigger such a reversal. Any corporate tax cut would tend to disproportionately favor smaller, more domestic-oriented firms that typically are currently paying closer to the statutory 35% (at the time of writing) tax rate. These characteristics more closely resemble those found in the bottom half of the Fund’s benchmark rather than its largest constituents. Rising interest rates often favor financial-sector stocks, which typically are classified on the value side of the growth/value spectrum. Finally, the strong performance of large-capitalization stocks leaves many of those names with a strong acquisition currency in the form of their own stock. Midcap companies are often attractive tuck-in acquisitions for these bigger firms, especially if the stock prices of these targets have not appreciated anywhere near to the same degree.

Thus we are optimistic regarding the future return potential of the Fund. While it is never fun to lag in performance, we feel the lag for the year was a result of broader market forces combined with a higher-than-average rate of company-specific disappointments. As the Fund approaches its 10-year anniversary in March 2018, we feel the longer-term record demonstrates these two factors have generally been transitory in the past. If they are again, 2018 could prove a favorable year for shareholders.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Midcap companies tend to have more limited liquidity and greater volatility than large-capitalization companies. Investments in American Depositary Receipts (“ADRs”) are subject to some extent to the risks associated with directly investing in securities of foreign issuers, including the risk of changes in currency exchange rates, expropriation or nationalization of assets, and the impact of political, diplomatic, or social events. Investments in real estate securities may involve greater risk and volatility including greater exposure to economic downturns and changes in real estate values, rents, property taxes, tax, and other laws. A real estate investment trust’s (REITs) share price may decline because of adverse developments affecting the real estate industry.

Please refer to the Schedule of Investments on page 13 of this report for holdings information. The management commentary above as well as Fund holdings and asset/sector allocations should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings and asset/sector allocations are subject to change.

Market Capitalization is the market price of an entire company, calculated by multiplying the number of shares outstanding by the price per share.

Price-To-Book (P/B) Ratio is a ratio used to compare a stock’s market value to its book value. It is calculated by dividing the current closing price of the stock by the latest quarter’s book value per share.

Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values.

Russell Midcap Value Index measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values.

The S&P 500 Index is an unmanaged index commonly used to measure the performance of U.S. stocks.

See Notes to Financial Statements.

11

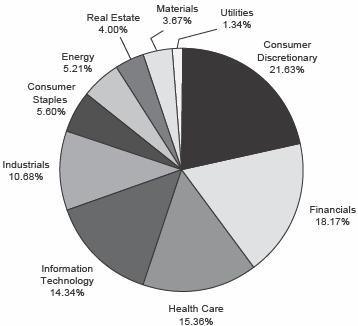

| MIDCAP FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2017 |

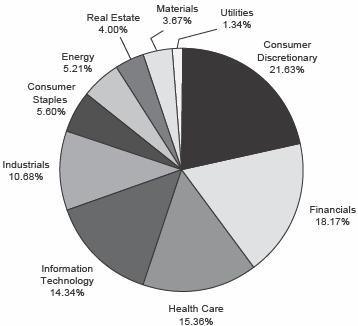

Sector Weightings at 11/30/17

% of Total Investments |

|

| Top 10 Equity Holdings at 11/30/17 |

| | % of Fund’s |

| Company | Industry | Net Assets |

| Hanger, Inc. | Health Care Providers & Services | 2.55% |

| CIT Group Inc. | Banks | 2.11% |

| Alliance Data Systems Corp. | IT Services | 2.10% |

| Associated Banc-Corp | Banks | 1.91% |

| Northern Trust Corp. | Capital Markets | 1.87% |

| First Horizon National Corp. | Banks | 1.85% |

| Kohl’s Corp. | Multiline Retail | 1.77% |

| SPX Flow, Inc. | Machinery | 1.71% |

| Bed Bath & Beyond Inc. | Specialty Retail | 1.69% |

| HD Supply Holdings, Inc. | Trading Companies & Distributors | 1.68% |

As of November 30, 2017, 100.0%, of the Fund’s net assets were in equity and short-term investments.

See Notes to Financial Statements.

12

| MIDCAP FUND SCHEDULE OF INVESTMENTS |

| November 30, 2017 |

| | | | Shares | | Value |

| COMMON STOCKS - 100.0% | | | | $ | 50,859,255 |

| (COST $42,865,918) | | | | | |

| |

| Consumer Discretionary - 21.6% | | | | | 11,001,787 |

| Automobiles - 1.0% | | | | | |

| Harley-Davidson, Inc. | | 10,625 | | | 533,375 |

| Distributors - 1.1% | | | | | |

| LKQ Corp. (a) | | 13,545 | | | 533,944 |

| Hotels, Restaurants & Leisure - 0.7% | | | | | |

| Extended Stay America, Inc. | | 21,700 | | | 379,099 |

| Household Durables - 4.7% | | | | | |

| D.R. Horton, Inc. | | 10,800 | | | 550,800 |

| Newell Brands, Inc. | | 21,631 | | | 669,912 |

| PulteGroup Inc. | | 15,950 | | | 544,373 |

| Toll Brothers, Inc. | | 5,050 | | | 254,167 |

| TopBuild Corp. (a) | | 5,625 | | | 382,444 |

| Leisure Products - 2.9% | | | | | |

| Brunswick Corp. | | 12,025 | | | 665,584 |

| Mattel, Inc. | | 43,650 | | | 796,612 |

| Multiline Retail - 1.8% | | | | | |

| Kohl’s Corp. | | 18,760 | | | 899,917 |

| Specialty Retail - 4.3% | | | | | |

| Bed Bath & Beyond Inc. | | 38,330 | | | 858,209 |

| Lumber Liquidators Holdings, Inc. (a) | | 23,975 | | | 679,691 |

| Urban Outfitters, Inc. (a) | | 20,575 | | | 640,294 |

| Textiles, Apparel & Luxury Goods - 5.1% | | | | | |

| Hanesbrands, Inc. | | 37,765 | | | 788,911 |

| Michael Kors Holdings Ltd. (a) | | 10,450 | | | 610,698 |

| Skechers U.S.A., Inc. Class A (a) | | 24,300 | | | 852,930 |

| Tapestry, Inc. | | 8,655 | | | 360,827 |

| |

| Consumer Staples - 5.6% | | | | | 2,850,502 |

| Food Products - 5.6% | | | | | |

| Amplify Snack Brands, Inc. (a) | | 96,950 | | | 562,310 |

| Inventure Foods, Inc. (a) | | 190,175 | | | 760,700 |

| Lamb Weston Holdings, Inc. | | 6,925 | | | 376,512 |

| The Hain Celestial Group, Inc. (a) | | 11,100 | | | 456,210 |

| The J. M. Smucker Co. | | 5,955 | | | 694,770 |

| |

| Energy - 5.2% | | | | | 2,650,729 |

| Energy Equipment & Services - 1.4% | | | | | |

| Helmerich & Payne, Inc. | | 3,410 | | | 199,758 |

| TechnipFMC PLC | | 17,125 | | | 490,460 |

| Oil, Gas & Consumable Fuels - 3.8% | | | | | |

| Cameco Corp. | | 19,750 | | | 185,255 |

| Devon Energy Corp. | | 10,250 | | | 394,933 |

| Noble Energy, Inc. | | 28,475 | | | 748,892 |

| Pioneer Natural Resources Co. | | 1,275 | | | 198,951 |

| Southwestern Energy Co. (a) | | 68,000 | | | 432,480 |

See Notes to Financial Statements.

13

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | | | Shares | | Value |

| COMMON STOCKS (continued) | | | | | |

| |

| Financials - 18.1% | | | | $ | 9,227,244 |

| Banks - 8.9% | | | | | |

| Associated Banc-Corp | | 38,043 | | | 970,096 |

| CIT Group Inc. | | 21,530 | | | 1,073,055 |

| First Horizon National Corp. | | 48,395 | | | 938,379 |

| Regions Financial Corp. | | 17,535 | | | 290,906 |

| SunTrust Banks, Inc. | | 8,820 | | | 543,577 |

| Zions Bancorporation | | 14,585 | | | 722,687 |

| Capital Markets - 3.4% | | | | | |

| Eaton Vance Corp. | | 9,770 | | | 540,086 |

| Northern Trust Corp. | | 9,730 | | | 951,399 |

| State Street Corp. | | 2,775 | | | 264,596 |

| Consumer Finance - 1.4% | | | | | |

| Discover Financial Services | | 10,079 | | | 711,577 |

| Insurance - 2.5% | | | | | |

| FNF Group | | 17,525 | | | 709,061 |

| Unum Group | | 9,580 | | | 542,420 |

| Mortgage Real Estate Investment Trusts - 0.7% | | | | | |

| Annaly Capital Management, Inc. | | 31,525 | | | 367,897 |

| Thrifts & Mortgage Finance - 1.2% | | | | | |

| Flagstar Bancorp, Inc. (a) | | 15,825 | | | 601,508 |

| |

| Health Care - 15.4% | | | | | 7,812,934 |

| Biotechnology - 2.6% | | | | | |

| Exact Sciences Corp. (a) | | 13,875 | | | 825,285 |

| MiMedx Group Inc. (a) | | 41,075 | | | 475,238 |

| Health Care Equipment & Supplies - 2.1% | | | | | |

| Hologic, Inc. (a) | | 10,150 | | | 423,458 |

| Zimmer Biomet Holdings, Inc. | | 5,500 | | | 644,050 |

| Health Care Providers & Services - 7.5% | | | | | |

| Acadia Healthcare Co., Inc. (a) | | 13,675 | | | 435,275 |

| Envision Healthcare Corp. (a) | | 20,955 | | | 669,093 |

| Hanger, Inc. (a) | | 94,044 | | | 1,297,807 |

| Henry Schein, Inc. (a) | | 2,700 | | | 192,915 |

| McKesson Corp. | | 2,415 | | | 356,792 |

| Patterson Cos., Inc. | | 10,630 | | | 388,527 |

| Premier, Inc. Class A (a) | | 15,875 | | | 460,692 |

| Life Sciences Tools & Services - 1.6% | | | | | |

| Accelerate Diagnostics, Inc. (a) | | 28,200 | | | 833,310 |

| Pharmaceuticals - 1.6% | | | | | |

| Jazz Pharmaceuticals PLC (a) | | 5,800 | | | 810,492 |

See Notes to Financial Statements.

14

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | |

| | | | |

| Industrials - 10.7% | | | | $5,432,208 |

| Building Products - 3.3% | | | | |

| A.O. Smith Corp. | | 6,250 | | 396,375 |

| Masco Corp. | | 19,775 | | 848,545 |

| USG Corp. (a) | | 10,625 | | 403,856 |

| Electrical Equipment - 0.9% | | | | |

| Regal Beloit Corp. | | 5,805 | | 446,695 |

| Machinery - 3.9% | | | | |

| Ingersoll-Rand PLC | | 5,275 | | 462,196 |

| Mueller Water Products, Inc. Class A | | 30,525 | | 381,257 |

| SPX Corp. (a) | | 8,950 | | 285,416 |

| SPX Flow, Inc. (a) | | 19,440 | | 870,329 |

| Trading Companies & Distributors - 2.6% | | | | |

| HD Supply Holdings, Inc. (a) | | 23,075 | | 853,313 |

| W.W. Grainger, Inc. | | 2,188 | | 484,226 |

| | | | | |

| Information Technology - 14.4% | | | | 7,297,949 |

| Communications Equipment - 1.3% | | | | |

| Viavi Solutions Inc. (a) | | 69,606 | | 652,208 |

| Electronic Equipment, Instruments & Components - 1.1% | | | | |

| FARO Technologies, Inc. (a) | | 5,250 | | 274,575 |

| Maxwell Technologies, Inc. (a) | | 49,997 | | 277,983 |

| Internet Software & Services - 0.7% | | | | |

| Liquidity Services, Inc. (a) | | 59,575 | | 342,556 |

| IT Services - 3.7% | | | | |

| Alliance Data Systems Corp. | | 4,470 | | 1,069,537 |

| Black Knight, Inc. (a) | | 8,735 | | 392,202 |

| Fiserv, Inc. (a) | | 3,194 | | 419,851 |

| Semiconductors & Semiconductor Equipment - 3.9% | | | | |

| Cavium Inc. (a) | | 8,825 | | 754,361 |

| Infineon Technologies A.G. ADR | | 18,450 | | 510,788 |

| Maxim Integrated Products, Inc. | | 13,591 | | 711,217 |

| Software - 0.6% | | | | |

| Take-Two Interactive Software, Inc. (a) | | 2,735 | | 305,089 |

| Technology Hardware, Storage & Peripherals - 3.1% | | | | |

| CPI Card Group Inc. | | 571,988 | | 503,464 |

| Electronics for Imaging, Inc. (a) | | 17,000 | | 522,920 |

| Pure Storage, Inc. Class A (a) | | 17,875 | | 330,330 |

| Stratasys Ltd. (a) | | 10,600 | | 230,868 |

See Notes to Financial Statements.

15

| MIDCAP FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | Shares | | Value |

| COMMON STOCKS (continued) | | | | | |

| | | | | |

| Materials - 3.7% | | | | $1,867,564 | |

| Chemicals - 1.4% | | | | | |

| Ecolab Inc. | | 2,581 | | 350,810 | |

| Int’l. Flavors & Fragrances Inc. | | 2,410 | | 374,610 | |

| Containers & Packaging - 0.5% | | | | | |

| AptarGroup, Inc. | | 2,650 | | 234,287 | |

| Metals & Mining - 1.8% | | | | | |

| Freeport-McMoRan Inc. (a) | | 54,400 | | 757,248 | |

| Lundin Mining Corp. | | 25,900 | | 150,609 | |

| | | | | | |

| Real Estate - 4.0% | | | | 2,034,471 | |

| Real Estate Investment Trusts - 3.0% | | | | | |

| DiamondRock Hospitality Co. | | 45,825 | | 512,782 | |

| Host Hotels & Resorts Inc. | | 26,235 | | 519,191 | |

| Kimco Realty Corp. | | 26,100 | | 483,372 | |

| Real Estate Management & Development - 1.0% | | | | | |

| Realogy Holdings Corp. | | 18,600 | | 519,126 | |

| | | | | | |

| Utilities - 1.3% | | | | 683,867 | |

| Multi-Utilities - 1.3% | | | | | |

| MDU Resources Group, Inc. | | 15,625 | | 436,719 | |

| SCANA Corp. | | 5,725 | | 247,148 | |

| | | | | | |

| SHORT-TERM INVESTMENTS - 0.0%^ | | | | 15,653 | |

| (COST $15,653) | | | | | |

| | | | | | |

| Money Market Funds - 0.0%^ | | | | 15,653 | |

| Fidelity Inst’l. Government Portfolio Class I, 0.980% (b) | | 15,653 | | 15,653 | |

| | | | | | |

| TOTAL INVESTMENTS - 100.0% (COST $42,881,571) | | | | 50,874,908 | |

| | | | | | |

| NET OTHER ASSETS AND LIABILITIES - 0.0%^ | | | | (22,519 | ) |

| | | | | | |

| NET ASSETS - 100.0% | | | | $50,852,389 | |

| (a) | Non-income producing security. |

| (b) | Represents the 7-day yield at November 30, 2017. |

| ^ | Rounds to 0.0%. |

| Abbreviations: |

| ADR | | American Depositary Receipt |

| A.G. | | Aktiengesellschaft is the German term for a public limited liability corporation. |

| PLC | | Public Limited Company |

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”) and is licensed for use by Thompson Investment Management, Inc. Neither MSCI, S&P, nor any other party involved in making or compiling the GICS or any GICS classifications makes any warranties with respect thereto or the results to be obtained by the use thereof, and no such party shall have any liability whatsoever with respect thereto.

See Notes to Financial Statements.

16

| BOND FUND INVESTMENT REVIEW (Unaudited) |

| November 30, 2017 |

Portfolio Managers

James T. Evans, CFA

Jason L. Stephens, CFA

John W. Thompson, CFA

Performance

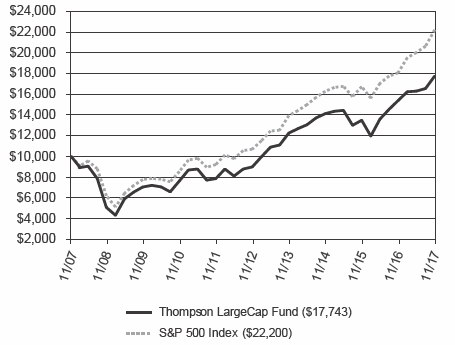

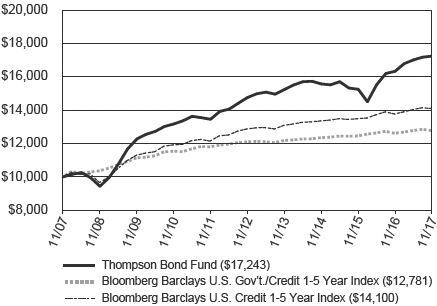

The Bond Fund produced a total return of 5.57% for the fiscal year ended November 30, 2017, as compared to its benchmark, the Bloomberg Barclays U.S. Government/Credit 1-5 Year Index, which returned 1.29%, and as compared to the Bloomberg Barclays U.S. Credit 1-5 Year Index, which returned 2.36%.

| Comparison of Change in Value of a Hypothetical $10,000 Investment |

| Average Annual Total Returns |

| Through 11/30/17 |

| | | | | | | | |

| | 1 Year | | 3 Year | | 5 Year | | 10 Year |

| Thompson Bond Fund | | 5.57% | | 3.45% | | 3.16% | | 5.60% |

| Bloomberg Barclays U.S. Gov’t./Credit 1-5 Year Index | | 1.29% | | 1.14% | | 1.10% | | 2.48% |

| Bloomberg Barclays U.S. Credit 1-5 Year Index | | 2.36% | | 1.81% | | 1.83% | | 3.50% |

| Gross Expense Ratio as of 03/31/17 was 0.72%. | 30-Day SEC Yield as of 11/30/17 was 2.67%. |

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-800-999-0887 or visiting www.thompsonim.com.

Results include the reinvestment of all dividends and capital gains distributions. Investment performance reflects all fee waivers that may have been in effect. In the absence of such waivers, total return would have been reduced. The performance information reflected in the graph and the table above does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares, nor does it imply future performance. The Bloomberg Barclays U.S. Government/Credit 1-5 Year Index is a market-value-weighted index of all investment-grade bonds with maturities of more than one year and less than 5 years. The Bloomberg Barclays U.S. Credit 1-5 Year Index is a market-value-weighted index which includes virtually every major investment-grade rated corporate bond with 1-5 years remaining until maturity that serves as a supplementary benchmark. You cannot directly invest in an index.

Bloomberg® is a trademark and service mark of Bloomberg Finance L.P. Barclays® is a trademark and service mark of Barclays Bank PLC.

See Notes to Financial Statements.

17

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2017 |

Management Commentary

During the fiscal year, U.S. Government Treasury yields increased anywhere from 0.5% to 0.8% on maturities of 5 years and shorter, while 10-year yields remained virtually unchanged. Yields on 30-year Treasuries actually declined by just over 0.2%, contributing to an overall flattening of the yield curve. Corporate spreads declined over the same period, to some degree counteracting the negative impact of overall rising interest rates on shorter-maturity bonds.

Much of the Fund’s positive relative performance over the last year resulted from decisions made during the previous fiscal year amidst significant market volatility and uncertainty. Since then, volatility has been minimal and the opportunities to take advantage of market dislocations have been fewer. With corporate spreads hovering at the low end of their historic range and interest rates likely to continue their rise, we have opted to remain patient. Consequently, issues with maturities of less than one year made up a higher percentage of new purchases than normal during the year.

We don’t know what the catalyst will be for volatility to return to the credit markets, but we do know that the current calm is unlikely to be sustainable. In a broad sense, current fixed-income markets likely do not fully reflect interest-rate and credit risk. If our choice to act more conservatively with regard to new purchases by weighting more heavily to shorter maturities is correct, the Fund could avoid negative volatility it otherwise might experience. When that volatility returns, we feel the Fund’s current positioning is likely to allow it to better take advantage of attractive opportunities, as it has during several past instances of increased volatility. While it’s unlikely that the Fund’s performance next year will match or exceed its recent history, its SEC yield of 2.67% as of the end of the fiscal year provides shareholders a competitive alternative to other short-term bond options while we wait for the next panic.

Opinions expressed are subject to change, are not guaranteed and should not be considered investment advice.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. The risk is usually greater for longer-term debt securities. Investments in bonds of foreign issuers involve greater volatility, political and economic risks, and differences in accounting methods. Investment by the Fund in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher-rated securities.

Please refer to the Schedule of Investments on page 20 of this report for holdings information. The management commentary above as well as Fund holdings should not be considered a recommendation to buy or sell any security. In addition, please note that Fund holdings are subject to change.

The federal government guarantees interest payments from government securities while dividend payments carry no such guarantee. Government securities, if held to maturity, guarantee the timely payment of principal and interest.

SEC Yield is a standardized yield computed by dividing the net investment income per share earned during the 30-day period prior to quarter-end and was created to allow for fairer comparisons among bond funds.

Spread is the percentage point difference between yields of various classes of bonds compared to treasury bonds.

Yield is the income earned from a bond, which takes into account the sum of the interest payment, the redemption value at the bond’s maturity, and the initial purchase price of the bond.

Yield Curve is a line that plots the interest rates, at a set point in time, of bonds having equal credit quality but differing maturity dates.

Credit Ratings are provided by Standard & Poor’s, who assign a rating based on their analysis of the issuer’s creditworthiness. The highest rating given is AAA and the lowest is C.

The purpose of Moody’s ratings is to provide investors with a simple system of gradation by which relative creditworthiness of securities may be noted. Gradations of creditworthiness are indicated by rating symbols, with each symbol representing a group in which the credit characteristics are broadly the same. The highest rating assigned by Moody’s is AAA and the lowest is C.

Although the makeup of the Bond Fund’s portfolio is constantly changing, as of November 30, 2017, 74.33% of the Fund’s portfolio was invested in corporate bonds. Due to prevailing market conditions, the composition of the Fund’s portfolio as of that date was consistent with the composition of the Fund’s portfolio over the past 5 years. In addition, as of that date 68.79% of the Fund’s portfolio was invested in securities rated BBB by Standard & Poor’s, while an additional 7.14% of the Fund’s portfolio was rated below investment-grade and 8.71% of the Fund’s portfolio was not rated by Standard & Poor’s. For portfolio information current as of the most recent quarter-end, please call 1-800-999-0887 or visit our website at www.thompsonim.com. Compared to a portfolio that is more evenly allocated between government and corporate bonds, a portfolio that is heavily allocated to corporate bonds may provide higher returns, but is also subject to greater levels of credit and liquidity risk and to greater price fluctuations. A portfolio that is significantly allocated to bonds having lower and below-investment-grade ratings may also be subject to greater levels of credit and liquidity risk and experience greater price fluctuations than a portfolio comprised of higher-rated investment-grade bonds.

See Notes to Financial Statements.

18

| BOND FUND INVESTMENT REVIEW (Unaudited) (Continued) |

| November 30, 2017 |

| | | |

| Asset Allocation at 11/30/17 |

| (Includes cash and cash equivalents) |

| % of Total Investments |

| Corporate Bonds | | 74.33% | |

| Asset-Backed Securities | | 15.62% | |

| Commercial Mortgage-Backed Securities | | 3.73% | |

| U.S. Government & Agency Issues | | 2.21% | |

| Taxable Municipal Bonds | | 2.08% | |

| Sovereign Bonds | | 1.28% | |

| Federal Agency Mortgage-Backed Securities | | 0.39% | |

| Tax-Exempt Municipal Bonds | | 0.25% | |

| Residential Mortgage-Backed Securities | | 0.11% | |

| | | 100.00% | |

| | |

| Quality Composition at 11/30/17^ |

| (Includes cash and cash equivalents) |

| % of Total Investments |

| U.S. Government & Agency Issues | | 2.60% | |

| AAA | | 0.46% | |

| AA | | 2.34% | |

| A | | 12.36% | |

| BBB | | 74.78% | |

| BB and Below | | 7.14% | |

| Not Rated | | 0.32% | |

| | 100.00% | |

| ^ | The Bond Fund’s quality composition is calculated using ratings from Standard & Poor’s. If Standard & Poor’s does not rate a holding then Moody’s is used. If Standard & Poor’s and Moody’s do not rate a holding then Fitch is used. For certain securities that are not rated by any of these three agencies, credit ratings from other Nationally Recognized Statistical Credit Rating Organization (NRSRO) agencies may be used. Not rated category includes holdings that are not rated by any NRSRO. All ratings are as of 11/30/17. |

| Top 10 Bond Holdings by Issuer at 11/30/17 |

| % of Fund’s Net Assets |

| XL Group PLC | | 2.91% | |

| MBIA Inc. | | 2.88% | |

| GFI Group Inc. | | 2.64% | |

| Citigroup, Inc. | | 2.17% | |

| Goldman Sachs Group, Inc. | | 2.05% | |

| Discover Financial Services | | 1.96% | |

| Ford Motor Credit Co. LLC | | 1.67% | |

| American Airlines Group Inc. | | 1.63% | |

| Lincoln National Corp. | | 1.59% | |

| Wells Fargo & Co. | | 1.57% | |

See Notes to Financial Statements.

19

| BOND FUND SCHEDULE OF INVESTMENTS |

| November 30, 2017 |

| | | | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS - 99.0% | | | | | | | | $ | 2,593,769,823 |

| (COST $2,643,218,175) | | | | | | | | | |

| | | | | | | | | | |

| Asset-Backed Securities - 15.8% | | | | | | | | | 412,789,306 |

| Air Canada, Series 2013-1B (e) | | 5.375 | | 11/15/22 | | 8,768,177 | | | 9,217,546 |

| Air Canada, Series 2015-2B (e) | | 5.000 | | 06/15/25 | | 5,204,252 | | | 5,444,949 |

| Airspeed Ltd., Series 2007-1A G1 | | | | | | | | | |

| (1 month LIBOR + 0.270%) (b) (e) | | 1.520 | | 06/15/32 | | 3,625,667 | | | 3,119,150 |

| America West Airlines, Series 1999-1 | | 7.930 | | 07/02/20 | | 4,328,982 | | | 4,448,029 |

| America West Airlines, Series 2000-1 | | 8.057 | | 01/02/22 | | 18,936 | | | 21,302 |

| America West Airlines, Series 2001-1 | | 7.100 | | 10/02/22 | | 3,841,739 | | | 4,187,496 |

| American Airlines, Series 2011-1 B (e) | | 7.000 | | 07/31/19 | | 14,546,690 | | | 14,699,430 |

| Applebee’s Funding LLC / IHOP Funding LLC, | | | | | | | | | |

| Series 2014-1 A2 (e) | | 4.277 | | 09/05/44 | | 40,059,000 | | | 39,070,448 |

| Basketball Properties Ltd. (e) | | 6.650 | | 03/01/25 | | 4,038,773 | | | 4,341,681 |

| British Airways PLC, Series 2013-1 B (e) | | 5.625 | | 12/20/21 | | 23,133,793 | | | 23,998,997 |

| British Airways PLC, Series 2013-1 B (e) | | 5.625 | | 12/20/21 | | 48,184 | | | 49,986 |

| Cajun Global LLC, Series 2017-1A A2 (e) | | 6.500 | | 08/20/47 | | 9,925,000 | | | 10,088,564 |

| CAL Funding II Ltd., Series 2012-1A A (e) | | 3.470 | | 10/25/27 | | 1,374,208 | | | 1,372,575 |

| CAL Funding II Ltd., Series 2013-1A A (e) | | 3.350 | | 03/27/28 | | 3,461,333 | | | 3,412,056 |

| Castle Aircraft Securitization Trust, | | | | | | | | | |

| Series 2015-1A A (e) | | 4.703 | | 12/15/40 | | 1,229,378 | | | 1,238,400 |

| Continental Airlines, Series 1997-4 A | | 6.900 | | 07/02/19 | | 32,818 | | | 32,858 |

| Continental Airlines, Series 1998-3 A-1 | | 6.820 | | 11/01/19 | | 27,975 | | | 28,254 |

| Continental Airlines, Series 1999-2 A-1 | | 7.256 | | 09/15/21 | | 19,055 | | | 20,127 |

| Continental Airlines, Series 2010-1 B | | 6.000 | | 07/12/20 | | 2,142,185 | | | 2,195,740 |

| Continental Airlines, Series 2012-1 B | | 6.250 | | 10/11/21 | | 5,447,286 | | | 5,737,082 |

| Continental Airlines, Series 2012-2 B | | 5.500 | | 04/29/22 | | 8,558,154 | | | 8,992,738 |

| Delta Air Lines, Series 2007-1 B | | 8.021 | | 02/10/24 | | 1,954,865 | | | 2,223,659 |

| Delta Air Lines, Series 2010-1 A | | 6.200 | | 01/02/20 | | 4,509,526 | | | 4,617,755 |

| Delta Air Lines, Series 2012-1B (e) | | 6.875 | | 05/07/19 | | 646,275 | | | 673,742 |

| Dong Fang Container Finance SPV Ltd., | | | | | | | | | |

| Series 2013-1 A (e) | | 3.960 | | 09/25/28 | | 3,263,178 | | | 3,215,491 |

| Dong Fang Container Finance SPV Ltd., | | | | | | | | | |

| Series 2014-1A A2 (e) | | 3.550 | | 11/25/39 | | 382,866 | | | 370,164 |

| Doric Nimrod Air Alpha, Series 2013-1 B (e) | | 6.125 | | 11/30/21 | | 18,129,110 | | | 18,696,551 |

| Doric Nimrod Air Alpha, Series 2013-1 B (e) | | 6.125 | | 11/30/21 | | 2,954,007 | | | 3,046,467 |

| Doric Nimrod Air Finance Alpha Ltd., | | | | | | | | | |

| Series 2012-1 B (e) | | 6.500 | | 05/30/21 | | 6,713,390 | | | 6,917,737 |

| ECAF I Ltd., Series 2015-1A A2 (e) | | 4.947 | | 06/15/40 | | 3,918,235 | | | 3,930,639 |

| ECAF I Ltd., Series 2015-1A B1 (e) | | 5.802 | | 06/15/40 | | 20,886,188 | | | 20,804,172 |

| Element Rail Leasing LLC, Series 2014-1A B1 (e) | | 4.406 | | 04/19/44 | | 10,158,750 | | | 10,084,612 |

| Element Rail Leasing LLC, Series 2015-1A B1 (e) | | 4.175 | | 02/19/45 | | 16,917,000 | | | 16,166,628 |

| EngenCap ABS Trust, Series 2016-1 A (e) | | 3.670 | | 12/21/26 | | 40,800,000 | | | 40,224,720 |

| Express Pipeline LP, Series (e) | | 7.390 | | 12/31/19 | | 123,000 | | | 124,887 |

| Federal Express Corp., Series 1996-B2 | | 7.840 | | 01/30/18 | | 83,279 | | | 84,196 |

| FPL Energy Caithness Funding Corp. (e) | | 7.645 | | 12/31/18 | | 1,856,880 | | | 1,921,871 |

| FRS LLC, Series 2013-1A B (e) | | 3.960 | | 04/15/43 | | 1,594,874 | | | 1,591,730 |

| Global Container Assets Ltd., Series 2015-1A A1 (e) | | 2.100 | | 02/05/30 | | 3,028,866 | | | 3,011,476 |

See Notes to Financial Statements.

20

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | | | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS (continued) | | | | | | | | |

| | | | | | | | | |

| Asset-Backed Securities (continued) | | | | | | | | |

| Global SC Finance II SRL (SEACO), | | | | | | | | |

| Series 2014-1A A1 (e) | | 3.190 | | 07/17/29 | | 2,533,333 | | $2,504,549 |

| HP Communities LLC (e) | | 5.320 | | 03/15/23 | | 323,221 | | 337,570 |

| Icon Brand Holdings LLC, Series 2012-1A A (e) | | 4.229 | | 01/25/43 | | 9,205,014 | | 8,475,113 |

| Landmark Leasing LLC, Series 2004A (e) | | 6.200 | | 10/01/22 | | 287,096 | | 289,944 |

| Latam Airlines Group, Series 2015-1 B | | 4.500 | | 08/15/25 | | 4,899,639 | | 4,853,705 |

| Merlin Aviation Holdings D.A.C., Series 2016-1 A (e) | | 4.500 | | 12/15/32 | | 14,167,737 | | 14,220,671 |

| Merlin Aviation Holdings D.A.C., Series 2016-1 B (e) | | 6.500 | | 12/15/32 | | 1,720,219 | | 1,757,405 |

| METAL LLC, Series 2017-1 A (e) | | 4.581 | | 10/15/42 | | 14,888,447 | | 14,895,891 |

| METAL LLC, Series 2017-1 B (e) | | 6.500 | | 10/15/42 | | 14,888,447 | | 14,582,748 |

| Northwest Airlines, Series 1999-2 A | | 7.575 | | 09/01/20 | | 437,663 | | 450,793 |

| Northwest Airlines, Series 2000-1 G (b) | | 7.150 | | 04/01/21 | | 11,966 | | 12,594 |

| Northwest Airlines, Series 2002-1 G-2 | | 6.264 | | 05/20/23 | | 1,124,644 | | 1,192,122 |

| Prudential Securities Structured Assets, Inc., | | | | | | | | |

| Series 1998-1 A (1 month LIBOR + 0.420%) (b) (e) | | 1.663 | | 03/02/25 | | 11,338,534 | | 10,431,452 |

| Spirit Master Funding, LLC, Series 2014-2A A (e) | | 5.760 | | 03/20/41 | | 3,887,317 | | 4,093,345 |

| Spirit Master Funding, LLC, Series 2014-4A A1 (e) | | 3.501 | | 01/20/45 | | 4,870,000 | | 4,893,542 |

| Textainer Marine Containers V Ltd., Series 2017-1A B (e) | | 4.850 | | 05/20/42 | | 1,798,621 | | 1,832,140 |

| TGIF Funding LLC, Series 2017-1A A2 (e) | | 6.202 | | 04/30/47 | | 26,730,000 | | 27,184,410 |

| United Air Lines, Series 2013-1 B | | 5.375 | | 02/15/23 | | 1,810,274 | | 1,903,050 |

| US Airways, Series 1999-1 A | | 8.360 | | 07/20/20 | | 19,705 | | 19,729 |

| US Airways, Series 2001-1 G | | 7.076 | | 09/20/22 | | 548,900 | | 585,951 |

| US Airways, Series 2012-1 B | | 8.000 | | 04/01/21 | | 17,283,970 | | 18,709,898 |

| Virgin Australia Trust, Series 2013-1 A (e) | | 5.000 | | 04/23/25 | | 133,352 | | 138,779 |

| |

| Commercial Mortgage-Backed Securities - 3.8% | | | | | | | | 98,662,026 |

| CG-CCRE Commercial Mortgage Trust, Series 2014-FL1 D | | | | | | | | |

| (1 month LIBOR + 2.750%) (b) (e) | | 4.000 | | 06/15/31 | | 12,000,000 | | 11,873,029 |

| COMM Mortgage Trust, Series 2012-CR3 E (b) (e) | | 4.755 | | 10/15/45 | | 5,000,000 | | 4,350,323 |

| COMM Mortgage Trust, Series 2013-CR9 D (b) (e) | | 4.254 | | 07/10/45 | | 4,898,000 | | 4,204,338 |

| GS Mortgage Securities Trust, Series 2010-C1 E (e) | | 4.000 | | 08/10/43 | | 17,741,000 | | 16,861,768 |

| Morgan Stanley Bank of America Merrill Lynch Trust, | | | | | | | | |

| Series 2014-C18 D (e) | | 3.389 | | 10/15/47 | | 5,000,000 | | 3,670,944 |

| SCG Trust, Series 2013-SRP1 C (1 month LIBOR + 3.250%) (b) (e) | | 4.750 | | 11/15/26 | | 18,940,000 | | 18,066,357 |

| TRU Trust, Series 2016-1 A (1 month LIBOR + 2.250%) (b) (e) | | 3.500 | | 11/15/30 | | 9,760,892 | | 9,670,687 |

| TRU Trust, Series 2016-1 B (1 month LIBOR + 3.150%) (b) (e) | | 4.400 | | 11/15/30 | | 14,600,000 | | 14,326,976 |

| TRU Trust, Series 2016-1 C (1 month LIBOR + 4.000%) (b) (e) | | 5.250 | | 11/15/30 | | 10,075,000 | | 9,717,484 |

| Wells Fargo Commercial Mortgage Trust, Series 2014-LC16 D (e) | | 3.938 | | 08/15/50 | | 7,072,000 | | 5,920,120 |

| |

| Corporate Bonds - 74.9% | | | | | | | | 1,963,859,694 |

| Actavis Funding SCS | | 2.350 | | 03/12/18 | | 4,705,000 | | 4,711,332 |

| Air Lease Corp. | | 2.125 | | 01/15/18 | | 457,000 | | 457,175 |

| American Electric Power Co., Inc. | | 1.650 | | 12/15/17 | | 629,000 | | 629,000 |

| Ameritech Capital Funding Corp. | | 6.450 | | 01/15/18 | | 803,000 | | 807,204 |

| AmTrust Financial Services, Inc. | | 6.125 | | 08/15/23 | | 18,000,000 | | 17,482,500 |

| Andeavor Logistics LP / Tesoro Logistics Finance Corp. | | 6.250 | | 10/15/22 | | 18,699,000 | | 19,863,948 |

| Apache Corp. | | 6.900 | | 09/15/18 | | 1,975,000 | | 2,047,700 |

| Arrow Electronics, Inc. | | 3.000 | | 03/01/18 | | 9,875,000 | | 9,898,901 |

See Notes to Financial Statements.

21

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | | | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS (continued) | | | | | | | | |

| |

| Corporate Bonds (continued) | | | | | | | | |

| Assurant, Inc. | | 2.500 | | 03/15/18 | | 971,000 | | $972,756 |

| Assured Guaranty US Holdings Inc. | | | | | | | | |

| (3 month LIBOR + 2.380%) (b) | | 3.700 | | 12/15/66 | | 20,601,000 | | 17,922,870 |

| AT&T Inc. | | 1.400 | | 12/01/17 | | 560,000 | | 560,000 |

| AutoNation, Inc. | | 6.750 | | 04/15/18 | | 7,103,000 | | 7,225,110 |

| Avon Products, Inc. (h) | | 6.600 | | 03/15/20 | | 500,000 | | 477,500 |

| Bank of America Corp. | | 5.750 | | 12/01/17 | | 2,995,000 | | 2,995,000 |

| Bank of America Corp. | | 2.000 | | 01/11/18 | | 10,000,000 | | 10,002,693 |

| Bank of America Corp. | | 5.650 | | 05/01/18 | | 7,425,000 | | 7,538,823 |

| Bank of New York Mellon Corp. | | 5.500 | | 12/01/17 | | 160,000 | | 160,000 |

| Barclays Bank PLC (e) | | 6.050 | | 12/04/17 | | 100,000 | | 100,000 |

| Barclays Bank PLC (c) | | 1.750 | | 09/13/19 | | 15,000,000 | | 14,706,195 |

| Barclays PLC | | 2.000 | | 03/16/18 | | 6,500,000 | | 6,499,902 |

| Becton Dickinson and Co. | | 4.900 | | 04/15/18 | | 3,362,000 | | 3,399,185 |

| BGC Partners Inc. | | 5.375 | | 12/09/19 | | 110,000 | | 114,968 |

| Brandywine Operating Partnership, L.P. | | 4.950 | | 04/15/18 | | 3,340,000 | | 3,368,184 |

| Brunswick Corp. (e) | | 4.625 | | 05/15/21 | | 9,828,000 | | 9,973,142 |

| Buckeye Partners, L.P. | | 6.050 | | 01/15/18 | | 9,924,000 | | 9,969,518 |

| Buckeye Partners, L.P. | | 2.650 | | 11/15/18 | | 821,000 | | 824,141 |

| CA, Inc. | | 2.875 | | 08/15/18 | | 8,357,000 | | 8,393,308 |

| Cabot Corp. | | 7.420 | | 12/11/18 | | 1,000,000 | | 1,049,641 |

| Cameron Int’l. Corp. | | 6.375 | | 07/15/18 | | 1,786,000 | | 1,835,152 |

| Capital One Bank USA N.A. | | 2.150 | | 11/21/18 | | 22,550,000 | | 22,578,208 |

| Capital One N.A. | | 1.650 | | 02/05/18 | | 8,025,000 | | 8,021,549 |

| Capital One N.A. | | 1.500 | | 03/22/18 | | 3,900,000 | | 3,896,777 |

| Capital One N.A. (3 month LIBOR + 1.150%) (b) | | 2.572 | | 08/17/18 | | 4,775,000 | | 4,800,499 |

| Carnival Corp. | | 1.875 | | 12/15/17 | | 1,408,000 | | 1,408,101 |

| Carpenter Technology Corp. | | 6.990 | | 04/20/18 | | 2,415,000 | | 2,433,721 |

| Carpenter Technology Corp. | | 7.060 | | 05/21/18 | | 500,000 | | 503,982 |

| Carpenter Technology Corp. | | 7.030 | | 05/22/18 | | 8,000 | | 8,061 |

| Catholic Health Initiatives | | 2.600 | | 08/01/18 | | 14,601,000 | | 14,665,426 |

| Citigroup, Inc. | | 1.800 | | 02/05/18 | | 12,965,000 | | 12,962,666 |

| Citigroup, Inc. | | 1.700 | | 04/27/18 | | 35,400,000 | | 35,378,947 |

| Citigroup, Inc. | | 2.500 | | 09/26/18 | | 8,489,000 | | 8,521,742 |

| Citizens Bank, N.A. | | 1.600 | | 12/04/17 | | 6,423,000 | | 6,423,000 |

| Cleveland Electric Illuminating Co. | | 8.875 | | 11/15/18 | | 900,000 | | 956,261 |

| CNA Financial Corp. | | 6.950 | | 01/15/18 | | 5,293,000 | | 5,321,661 |

| Credit Suisse A.G. New York | | 1.750 | | 01/29/18 | | 2,819,000 | | 2,819,226 |

| Credit Suisse A.G. New York | | 6.000 | | 02/15/18 | | 28,386,000 | | 28,618,183 |

| CRH America, Inc. | | 8.125 | | 07/15/18 | | 8,707,000 | | 9,028,352 |

| CVS Health Corp. | | 2.250 | | 12/05/18 | | 2,159,000 | | 2,162,560 |

| D.R. Horton, Inc. | | 3.625 | | 02/15/18 | | 2,492,000 | | 2,495,411 |

| D.R. Horton, Inc. | | 3.750 | | 03/01/19 | | 3,677,000 | | 3,724,291 |

| Deutsche Bank AG | | 1.875 | | 02/13/18 | | 12,704,000 | | 12,704,821 |

| Deutsche Bank AG (3 month LIBOR + 1.450%) (b) | | 2.804 | | 01/18/19 | | 184,000 | | 186,018 |

| Developers Diversified Realty Corp. | | 7.500 | | 07/15/18 | | 1,000,000 | | 1,032,264 |

| DIRECTV Holdings LLC / DIRECTV Financing Co., Inc. | | 1.750 | | 01/15/18 | | 613,000 | | 612,969 |

| Discover Bank | | 2.000 | | 02/21/18 | | 27,236,000 | | 27,242,769 |

See Notes to Financial Statements.

22

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | | | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS (continued) | | | | | | | | |

| |

| Corporate Bonds (continued) | | | | | | | | |

| Discover Bank | | 2.600 | | 11/13/18 | | 11,510,000 | | $11,562,748 |

| Discover Financial Services | | 10.250 | | 07/15/19 | | 11,304,000 | | 12,571,500 |

| Dun & Bradstreet Corp. (h) | | 3.500 | | 12/01/17 | | 7,694,000 | | 7,694,000 |

| eBay Inc. | | 2.500 | | 03/09/18 | | 8,393,000 | | 8,406,100 |

| El Paso Corp. | | 7.250 | | 06/01/18 | | 3,924,000 | | 4,023,444 |

| Ensco PLC | | 8.000 | | 01/31/24 | | 12,306,000 | | 12,059,880 |

| Enterprise Products Operating LLC | | | | | | | | |

| (3 month LIBOR + 2.7775%) (b) | | 4.093 | | 06/01/67 | | 8,538,000 | | 8,324,550 |

| Enterprise Products Operating LLC (7.034% to 01/15/18, | | | | | | | | |

| then 3 month LIBOR + 2.680%) (b) | | 7.034 | | 01/15/68 | | 2,020,000 | | 2,030,100 |

| Everest Reinsurance Holdings Inc. | | | | | | | | |

| (3 month LIBOR + 2.385%) (b) | | 3.801 | | 05/01/67 | | 13,386,000 | | 12,716,700 |

| Fairfax Financial Holdings Ltd. | | 7.375 | | 04/15/18 | | 25,645,500 | | 26,119,758 |

| Fifth Third Bancorp (4.900% to 09/30/19, | | | | | | | | |

| then 3 month LIBOR + 3.129%) (b) (d) | | 4.900 | | 09/30/19 | | 40,162,000 | | 40,814,632 |

| First Industrial, L.P. | | 7.500 | | 12/01/17 | | 1,539,000 | | 1,539,000 |

| Flagstar Bancorp, Inc. | | 6.125 | | 07/15/21 | | 12,300,000 | | 13,111,983 |

| FMG Resources August 2006 Pty. Ltd. (e) | | 9.750 | | 03/01/22 | | 26,175,000 | | 29,119,687 |

| Ford Motor Credit Co. LLC | | 1.724 | | 12/06/17 | | 35,041,000 | | 35,041,000 |

| Ford Motor Credit Co. LLC | | 2.145 | | 01/09/18 | | 600,000 | | 600,224 |

| Ford Motor Credit Co. LLC | | 5.000 | | 05/15/18 | | 1,742,000 | | 1,766,034 |

| Ford Motor Credit Co. LLC | | 2.240 | | 06/15/18 | | 6,450,000 | | 6,459,426 |

| Freeport-McMoRan Inc. | | 6.500 | | 11/15/20 | | 16,327,000 | | 16,650,275 |

| Freeport-McMoRan Inc. | | 6.750 | | 02/01/22 | | 7,970,000 | | 8,268,875 |

| General Electric Capital Corp. | | 5.250 | | 05/15/18 | | 55,000 | | 55,796 |

| General Electric Capital Corp. | | 6.300 | | 05/15/18 | | 118,000 | | 117,880 |

| General Electric Capital Corp. | | 6.000 | | 06/15/18 | | 220,000 | | 222,426 |

| General Electric Capital Corp. | | | | | | | | |

| (3 month LIBOR + 0.380%) (b) | | 1.771 | | 05/05/26 | | 906,000 | | 873,513 |

| General Electric Co. (5.000% to 01/21/21, | | | | | | | | |

| then 3 month LIBOR + 3.330%) (b) (d) | | 5.000 | | 01/21/21 | | 20,250,000 | | 21,009,375 |

| General Motors Financial Co., Inc. | | 3.250 | | 05/15/18 | | 2,105,000 | | 2,118,023 |

| General Motors Financial Co., Inc. | | 6.750 | | 06/01/18 | | 19,291,000 | | 19,744,099 |

| Genworth Financial Inc. | | 7.700 | | 06/15/20 | | 2,918,000 | | 2,947,180 |

| GFI Group Inc. (h) | | 8.375 | | 07/19/18 | | 66,627,000 | | 69,125,512 |

| Goldman Sachs Group, Inc. | | 5.950 | | 01/18/18 | | 7,437,000 | | 7,474,854 |

| Goldman Sachs Group, Inc. | | 6.150 | | 04/01/18 | | 20,803,000 | | 21,097,285 |

| Goldman Sachs Group, Inc. | | 2.625 | | 01/31/19 | | 25,000,000 | | 25,155,389 |

| Hartford Financial Services Group, Inc. | | 6.300 | | 03/15/18 | | 403,000 | | 408,000 |

| Hartford Financial Services Group, Inc. (8.125% to 06/15/18, | | | | | | | | |

| then 3 month LIBOR + 4.6025%) (b) | | 8.125 | | 06/15/68 | | 12,202,000 | | 12,537,555 |

| Hess Corp. | | 8.125 | | 02/15/19 | | 1,700,000 | | 1,808,779 |

| Hewlett Packard Enterprise Co. (c) | | 2.850 | | 10/05/18 | | 15,830,000 | | 15,926,309 |

| Highwoods Realty L.P. | | 7.500 | | 04/15/18 | | 3,803,000 | | 3,879,588 |

| Humana Inc. | | 7.200 | | 06/15/18 | | 725,000 | | 744,930 |

| Huntington Ingalls Industries, Inc. (e) | | 5.000 | | 12/15/21 | | 835,000 | | 856,710 |

| ING U.S., Inc. (h) | | 2.900 | | 02/15/18 | | 807,000 | | 808,336 |

See Notes to Financial Statements.

23

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | | | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS (continued) | | | | | | | | |

| | | | | | | | | |

| Corporate Bonds (continued) | | | | | | | | |

| International Lease Finance Corp. | | 3.875 | | 04/15/18 | | 1,510,000 | | $1,519,907 |

| INVISTA Finance LLC (e) | | 4.250 | | 10/15/19 | | 32,165,000 | | 32,848,506 |

| ITC Holdings Corp. (e) | | 6.050 | | 01/31/18 | | 3,746,000 | | 3,770,206 |

| Jabil Circuit, Inc. | | 8.250 | | 03/15/18 | | 39,316,000 | | 39,868,390 |

| Johnson Controls Int’l. plc | | 3.750 | | 01/15/18 | | 60,000 | | 60,082 |

| JPMorgan Chase & Co. (7.900% to 04/30/18, | | | | | | | | |

| then 3 month LIBOR + 3.470%) (b) (d) | | 7.900 | | 04/30/18 | | 30,491,000 | | 30,869,698 |

| JPMorgan Chase & Co. (5.000% to 07/01/19, | | | | | | | | |

| then 3 month LIBOR + 3.320%) (b) (d) | | 5.000 | | 07/01/19 | | 6,000,000 | | 6,157,500 |

| Kinder Morgan Energy Partners, L.P. | | 5.950 | | 02/15/18 | | 1,072,000 | | 1,080,594 |

| Kinder Morgan Inc. | | 2.000 | | 12/01/17 | | 969,000 | | 969,000 |

| Kinder Morgan Inc. | | 7.000 | | 02/01/18 | | 22,316,000 | | 22,496,463 |

| Kraft Heinz Foods Co. (e) | | 6.125 | | 08/23/18 | | 50,000 | | 51,464 |

| Kroger Co. | | 7.000 | | 05/01/18 | | 1,240,000 | | 1,265,698 |

| Lincoln National Corp. (3 month LIBOR + 2.3575%) (b) | | 3.779 | | 05/17/66 | | 25,985,000 | | 24,295,975 |

| Lincoln National Corp. (3 month LIBOR + 2.040%) (b) | | 3.403 | | 04/20/67 | | 19,155,000 | | 17,335,275 |

| Manufacturers & Traders Trust Co. | | 6.625 | | 12/04/17 | | 19,925,000 | | 19,925,000 |

| Manufacturers & Traders Trust Co. (1 month LIBOR + 1.215%) (b) | | 2.553 | | 12/28/20 | | 14,173,000 | | 14,173,131 |

| Manufacturers & Traders Trust Co. (3 month LIBOR + 0.640%) (b) | | 1.956 | | 12/01/21 | | 1,007,000 | | 999,344 |

| MarkWest Energy Partners, L.P. / MarkWest Energy Finance Corp. | | 5.500 | | 02/15/23 | | 1,118,000 | | 1,140,360 |

| Marriott Int’l., Inc. | | 6.750 | | 05/15/18 | | 1,364,000 | | 1,394,084 |

| Martin Marietta Materials, Inc. | | 6.600 | | 04/15/18 | | 12,873,000 | | 13,084,413 |

| Masco Corp. | | 6.625 | | 04/15/18 | | 14,525,000 | | 14,762,905 |

| Mattel, Inc. | | 1.700 | | 03/15/18 | | 2,336,000 | | 2,312,640 |

| MBIA Inc. | | 6.400 | | 08/15/22 | | 75,074,000 | | 75,355,528 |

| Medco Health Solutions, Inc. | | 7.125 | | 03/15/18 | | 1,780,000 | | 1,805,892 |

| Merrill Lynch & Co. (g) | | 0.000 | | 09/25/18 | | 100,000 | | 98,047 |

| MetLife, Inc. (c) | | 1.756 | | 12/15/17 | | 661,000 | | 661,049 |

| MetLife, Inc. (c) | | 1.903 | | 12/15/17 | | 1,182,000 | | 1,181,967 |

| Midcontinent Express Pipeline LLC (e) | | 6.700 | | 09/15/19 | | 22,665,000 | | 23,741,587 |

| Morgan Stanley | | 5.950 | | 12/28/17 | | 2,971,000 | | 2,979,479 |

| Morgan Stanley | | 1.875 | | 01/05/18 | | 5,100,000 | | 5,101,071 |

| Morgan Stanley | | 6.625 | | 04/01/18 | | 17,383,000 | | 17,646,114 |

| Morgan Stanley (CPI YOY + 2.000%) (b) | | 3.939 | | 04/01/21 | | 130,000 | | 132,113 |

| Morgan Stanley (CPI YOY + 2.000%) (b) | | 3.939 | | 06/09/23 | | 100,000 | | 100,750 |

| Mylan Inc. | | 2.600 | | 06/24/18 | | 7,875,000 | | 7,899,890 |

| Mylan N.V. (h) | | 3.000 | | 12/15/18 | | 14,440,000 | | 14,536,854 |

| National Bank of Canada | | 2.100 | | 12/14/18 | | 5,983,000 | | 5,984,315 |

| National Fuel Gas Co. | | 8.750 | | 05/01/19 | | 2,850,000 | | 3,093,970 |

| National Oilwell Varco, Inc. | | 1.350 | | 12/01/17 | | 3,073,000 | | 3,073,000 |

| Newell Brands, Inc. | | 2.150 | | 10/15/18 | | 3,205,000 | | 3,208,870 |

| NexBank Capital, Inc. (5.500% to 03/15/31, | | | | | | | | |

| then 3 month LIBOR + 4.355%) (b) (e) | | 5.500 | | 03/16/26 | | 4,500,000 | | 4,601,250 |

| NiSource Finance Corp. | | 6.400 | | 03/15/18 | | 559,000 | | 565,951 |

| Noble Drilling Corp. | | 7.500 | | 03/15/19 | | 19,381,000 | | 19,865,525 |

| Noble Energy, Inc. | | 5.625 | | 05/01/21 | | 25,280,000 | | 25,934,708 |

| Noble Holding Int’l. Ltd. | | 4.900 | | 08/01/20 | | 667,000 | | 640,320 |

| Noble Holding Int’l. Ltd. | | 4.625 | | 03/01/21 | | 7,949,000 | | 7,293,207 |

See Notes to Financial Statements.

24

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS (continued) | | | | | | | | |

| |

| Corporate Bonds (continued) | | | | | | | | |

| Nucor Corp. | | 5.750 | | 12/01/17 | | 4,212,000 | | $4,212,000 |

| NXP B.V. / NXP Funding LLC (e) | | 3.750 | | 06/01/18 | | 5,590,000 | | 5,616,552 |

| NXP B.V. / NXP Funding LLC (e) | | 5.750 | | 03/15/23 | | 25,541,000 | | 26,434,935 |

| Ohio Power Co. | | 6.050 | | 05/01/18 | | 75,000 | | 76,268 |

| Pacific Gas & Electric Co. | | 8.250 | | 10/15/18 | | 8,965,000 | | 9,435,060 |

| Packaging Corp. of America | | 6.500 | | 03/15/18 | | 46,000 | | 46,542 |

| Pemex Project Funding Master Trust | | 5.750 | | 03/01/18 | | 10,704,000 | | 10,794,984 |

| Pemex Project Funding Master Trust | | 9.250 | | 03/30/18 | | 162,000 | | 165,518 |

| Penske Truck Leasing Co., L.P. / PTL Finance Corp. (e) | | 3.375 | | 03/15/18 | | 309,000 | | 310,393 |

| Pershing Road Development Co., LLC | | | | | | | | |

| (3 month LIBOR + 0.400%) (b) (e) | | 1.716 | | 09/15/22 | | 1,238,000 | | 1,169,910 |

| Pershing Road Development Co., LLC | | | | | | | | |

| (3 month LIBOR + 0.400%) (b) (e) | | 1.716 | | 09/15/23 | | 3,791,000 | | 3,554,063 |

| Pershing Road Development Co., LLC | | | | | | | | |

| (3 month LIBOR + 0.400%) (b) (e) | | 1.716 | | 09/15/24 | | 1,000,000 | | 930,000 |

| Phillips 66 (3 month LIBOR + 0.750%) (b) (e) | | 2.109 | | 04/15/20 | | 17,975,000 | | 17,993,885 |

| Pitney Bowes Inc. | | 5.600 | | 03/15/18 | | 2,093,000 | | 2,100,326 |

| Plains All American Pipeline, L.P. / PAA Finance Corp. | | 6.500 | | 05/01/18 | | 15,085,000 | | 15,330,856 |

| PNC Bank, N.A. | | 6.000 | | 12/07/17 | | 2,015,000 | | 2,015,756 |

| PNC Bank, N.A. | | 6.875 | | 04/01/18 | | 11,725,000 | | 11,915,556 |

| Potash Corp. of Saskatchewan Inc. | | 3.250 | | 12/01/17 | | 2,199,000 | | 2,199,000 |

| Protective Life Corp. | | 6.400 | | 01/15/18 | | 1,882,000 | | 1,891,099 |

| Provident Cos., Inc. | | 7.000 | | 07/15/18 | | 153,000 | | 157,357 |

| Prudential Financial, Inc. (8.875% to 06/15/18, | | | | | | | | |

| then 3 month LIBOR + 5.000%) (b) | | 8.875 | | 06/15/68 | | 21,119,000 | | 21,858,165 |

| PSEG Power LLC | | 2.450 | | 11/15/18 | | 2,251,000 | | 2,259,611 |

| QBE Insurance Group Ltd. (e) | | 2.400 | | 05/01/18 | | 2,060,000 | | 2,058,183 |

| ReadyCap Holdings, LLC (e) | | 7.500 | | 02/15/22 | | 20,500,000 | | 20,971,500 |

| Realty Income Corp. | | 2.000 | | 01/31/18 | | 1,019,000 | | 1,019,112 |

| Regions Bank | | 7.500 | | 05/15/18 | | 5,141,000 | | 5,265,097 |

| Regions Bank | | 2.250 | | 09/14/18 | | 20,997,000 | | 21,025,138 |

| Reinsurance Group of America, Inc. | | | | | | | | |

| (3 month LIBOR + 2.665%) (b) | | 3.985 | | 12/15/65 | | 33,029,000 | | 31,542,695 |

| Roper Industries, Inc. | | 2.050 | | 10/01/18 | | 2,752,000 | | 2,752,077 |

| Royal Bank of Canada | | | | | | | | |

| (6.100% where USISDA10 is greater than or | | | | | | | | |

| equal to 1.784%) (b) | | 6.100 | | 08/15/19 | | 2,000,000 | | 1,977,600 |

| RPM Int’l., Inc. | | 6.500 | | 02/15/18 | | 274,000 | | 276,413 |

| S&P Global Inc. | | 2.500 | | 08/15/18 | | 750,000 | | 752,500 |

| Select Income REIT | | 2.850 | | 02/01/18 | | 26,721,000 | | 26,745,574 |

| Seminole Indian Tribe of Florida (e) | | 7.804 | | 10/01/20 | | 290,000 | | 292,900 |

| Seminole Indian Tribe of Florida (e) | | 8.030 | | 10/01/20 | | 18,600,000 | | 18,786,000 |

| Senior Housing Properties Trust | | 3.250 | | 05/01/19 | | 500,000 | | 503,426 |

| Senior Housing Properties Trust | | 6.750 | | 04/15/20 | | 4,104,000 | | 4,378,908 |

| SESI LLC | | 7.125 | | 12/15/21 | | 38,264,000 | | 39,077,110 |

| SLM Corp. | | 5.500 | | 03/15/19 | | 800,000 | | 788,347 |

| SLM Corp. (c) | | 6.000 | | 03/15/19 | | 140,000 | | 138,808 |

| SLM Corp. (c) | | 6.600 | | 03/15/19 | | 395,000 | | 394,133 |

See Notes to Financial Statements.

25

| BOND FUND SCHEDULE OF INVESTMENTS (Continued) |

| November 30, 2017 |

| | Rate (%) | | Maturity Date | | Principal Amount | | Value |

| BONDS (continued) | | | | | | | | |

| |

| Corporate Bonds (continued) | | | | | | | | |

| SLM Corp. | | 5.190 | | 04/24/19 | | 529,000 | | $529,000 |

| SLM Corp. (c) | | 6.250 | | 09/15/20 | | 172,000 | | 169,181 |

| SLM Corp. (c) | | 6.750 | | 12/15/20 | | 306,000 | | 304,857 |

| SLM Corp. (c) | | 6.750 | | 12/15/20 | | 95,000 | | 94,645 |

| SLM Corp. (c) | | 8.000 | | 12/15/20 | | 71,000 | | 71,048 |

| SLM Corp. | | 6.000 | | 06/15/21 | | 261,000 | | 252,999 |

| SLM Corp. | | 6.150 | | 06/15/21 | | 146,000 | | 142,209 |

| SLM Corp. | | 7.250 | | 01/25/22 | | 602,000 | | 648,655 |

| Spectra Energy Partners, L.P. | | 2.950 | | 09/25/18 | | 1,128,000 | | 1,135,940 |

| StanCorp Financial Group, Inc. (3 month LIBOR + 2.510%) (b) | | 3.826 | | 06/01/67 | | 38,809,000 | | 38,809,000 |

| Stanley Black & Decker Inc. | | 2.451 | | 11/17/18 | | 400,000 | | 401,827 |

| State Street Bank & Trust Co. | | 5.250 | | 10/15/18 | | 500,000 | | 514,512 |

| State Street Corp. (c) | | 4.956 | | 03/15/18 | | 750,000 | | 756,468 |