| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

FORM N-CSR |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

MANAGEMENT INVESTMENT COMPANIES |

| Investment Company Act File Number: 811-4521 |

| T. Rowe Price State Tax-Free Income Trust |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

| Registrant’s telephone number, including area code: (410) 345-2000 |

| Date of fiscal year end: February 28 |

| Date of reporting period: August 31, 2010 |

Item 1: Report to Shareholders

|

| New York Tax-Free Bond Fund | August 31, 2010 |

The views and opinions in this report were current as of August 31, 2010. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

New York tax-free municipal bonds produced strong returns in the six-month period ended August 31, 2010, mostly keeping up with taxable bonds and faring much better than equities in a challenging economic environment. In contrast, the nearly flat returns of New York tax-free money market securities reflected the Federal Reserve’s continued determination to keep short-term interest rates near 0%. Continuing recent trends, longer-term and lower-quality securities fared much better than shorter-term and higher-quality munis, as investors sought attractive yields from assets perceived to be relatively safe. Demand for municipal securities remained strong, as investors braced for higher federal tax rates, and possibly higher state and local income tax rates, in 2011. New York continues to face numerous headwinds, but the New York Tax-Free Bond Fund posted a solid return in this environment, while the New York Tax-Free Money Fund was roughly flat for the period.

MARKET ENVIRONMENT

The U.S. economic recovery, which started in the third quarter of 2009, has decelerated in recent months, and some fear that the economy is at risk of slipping into a new recession—a so-called “double dip.” Gross domestic product grew at a meager pace of 1.6% in the second quarter of 2010, according to the most recent estimates. While national unemployment remains stubbornly high, at well over 9%, and the housing recovery is far from robust, we currently believe the economy is likely to grow at a sluggish pace in the months ahead and not relapse into recession. Encouraging signs include continued growth in industrial production, modest expansion of payrolls, and rising capital goods shipments.

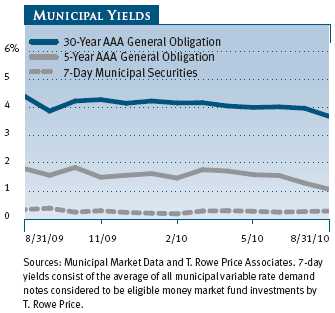

In the last six months, Fed officials consistently reassured investors that an increase in the fed funds target rate—which remained in the 0.00% to 0.25% range established in late 2008—was not imminent. Most recently, with economic growth weakening, the central bank acted to avoid a passive tightening of policy stemming from activities related to its balance sheet. On August 10, the Fed adopted a policy of reinvesting principal payments from other maturing securities into Treasury securities. As a result, longer-term Treasury yields tumbled to levels not seen since the depth of the financial crisis in late 2008. Intermediate- and longer-term municipal yields also declined but not as much as Treasury interest rates.

With municipal yields at reasonable levels relative to Treasury yields, tax-free securities are an attractive alternative to taxable bonds, particularly for investors in the highest tax brackets. For example, as of August 31, the 3.67% yield offered by a 30-year tax-free municipal bond rated AAA was 104% of the 3.52% pretax yield offered by a 30-year Treasury. An investor in the 28% federal tax bracket would need to invest in a taxable bond yielding about 5.10% in order to receive the same after-tax income from a 30-year AAA muni bond yielding 3.67%. Nonetheless, as in all other fixed income markets, municipal yields are at or near historic lows across the curve. (To calculate a municipal bond’s taxable-equivalent yield, divide the municipal bond’s yield by the quantity of 1.00 minus your federal tax bracket expressed as a decimal—in this case, 1.00 – 0.28, or 0.72.)

MUNICIPAL MARKET NEWS

Nationally, new municipal supply through the end of August totaled about $262 billion, according to The Bond Buyer. Tax-exempt supply this year reflects a steady pace of municipal borrowings for ongoing capital needs. Investor demand has remained strong, bolstered by concerns about higher federal, state, and local taxes. About one-fourth of this year’s new supply represented taxable municipal issuance under the Build America Bond program, which puts supply of new tax-exempt securities at constricted levels. While we expect this year’s overall issuance to be in line with that of recent years, we expect aggregate new issuance in 2010 to be a bit lower than it was in 2009.

New York and other states continue to face fiscal difficulties and have been forced to take drastic actions—including tax and fee increases and spending cuts—to close budget deficits. Despite the increasing negative press regarding their fiscal health, we do not see a near-term threat to the states’ ability to continue servicing their outstanding debts, though we have longer-term concerns about potentially onerous future pension obligations. In any event, the fiscal woes of state governments do not necessarily limit our tax-free investment opportunities. Many municipal market issuers continue to maintain good credit profiles.

NEW YORK MARKET NEWS

New York State continues to face economic and fiscal pressures, though it is showing some signs of improvement following the fallout of the credit crisis and national recession. The state benefits from a diverse economy. This has helped mitigate some of the economic shortfall on Wall Street, which has been responsible for as much as 20% of state revenues. Job losses have been less severe than in many parts of the country, with unemployment falling to 8.2% in July 2010 from 9.0% in December 2009. New York also has above-average wealth levels, with 2008 per capita personal income at 121% of the national average.

Last spring, Moody’s Investors Service and Fitch Ratings revised their municipal rating scales, resulting in changes to the state’s rating. However, these upward rating changes were due to a recalibration and not based on New York’s fundamental credit factors. The state’s general obligation debt has been rated at Aa2 by Moody’s, AA by Standard & Poor’s, and AA by Fitch. All three agencies maintain stable outlooks for the state.

In the current 2011 fiscal year, the state reported a significant budget gap of $9.2 billion. Passage of the budget was delayed by more than four months, which required the legislature to approve stop-gap measures until it was finalized. The $136 billion fiscal budget includes significant cuts and new taxes. It also contains substantial money from the federal government’s stimulus package. Coming into fiscal 2011, the state’s estimated $1.65 billion 2010 shortfall was rolled into the 2011 budget by delaying tax refunds and payments to school districts. New York still has $1.2 billion in its “rainy day” reserve fund, although the General Fund cash position is weak.

New York’s debt burden is among the highest in the nation, according to Moody’s. Unlike many other states, however, New York’s pension funds are well funded based on actuarial assumptions. The majority of New York’s debt is appropriation backed, which means that the legislature must approve debt service payments on these obligations annually, but it has no legal obligation to continue to consent to these expenses.

New York City is beginning to exhibit signs of economic recovery. The city has demonstrated strong fiscal management, including multiyear financial planning and a roll forward of its budget surplus from stronger years. The city passed its $63 billion fiscal 2011 budget on time, closing an estimated $5 billion gap, largely by rolling approximately $3 billion in surplus from fiscal 2010 into fiscal 2011. Property taxes are the city’s largest revenue source and act as a stabilizing factor given the city’s practice of phasing in tax assessments over five years. Still, the city faces outyear budget gaps of $3.3 billion in fiscal 2012, $4.1 billion in fiscal 2013, and $4.8 billion in fiscal 2014. Agency ratings for New York City are Aa2 from Moody’s, AA from S&P, and AA from Fitch, all with stable outlooks. As with ratings at the state level, the Moody’s and Fitch ratings moved upward in the spring due to recalibration.

PORTFOLIO STRATEGIES

New York Tax-Free Money Fund

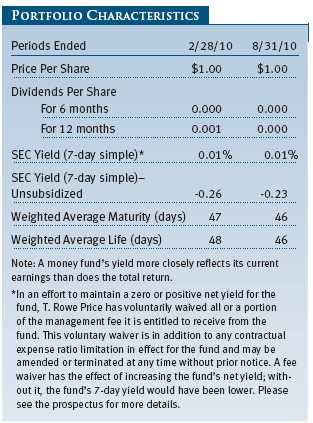

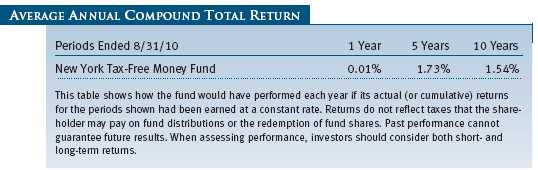

Your fund returned 0.01% for the six months ended August 31, 2010, versus 0.02% for its Lipper peer group average. As the Fed maintained short-term interest rates at historically low levels of 0.00% to 0.25%, the seven-day simple yield remained low and ended August at 0.01%.

An unchanged Federal Reserve policy, which has targeted a fed funds rate of 0.00% to 0.25% since late 2008, continues to compress all money market rates. All money market instruments—including Treasury, agency, corporate, and municipal—now trade in a very narrow range around the fed funds target rate. The result has been a continuation of meager yields for all money fund investors. Unfortunately, lenders—such as money market funds—have seen their interest income drop to nominal levels. T. Rowe Price, like many of its peers, is voluntarily waiving a portion of its management fee until such time as the level of income generated by the fund is sufficient to meet fund expenses. Until then, we shall continue to manage the fund with a focus on stability of principal and liquidity, while producing the highest level of income commensurate with those goals.

The municipal money market curve spent most of the past six months moving in a very narrow range. Yields have averaged around 0.18% in overnight investments, 0.28% for seven days, 0.33% for 90 days, and 0.36% for the one-year period. Thus, an investment anywhere along the municipal money market yield curve continues to generate income insufficient to meet fund expenses.

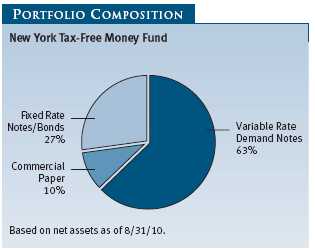

Interestingly, municipal rates have stayed low despite the fact that total money fund assets across the industry continue to fall—a technical factor that would normally push rates higher. A number of issues help explain these persistently low yields: a significant drop in short variable rate debt issuance; short-term bond funds dipping into the one-year part of the money fund curve; and the presence of crossover taxable money funds, which have become marginal buyers of short-dated municipals. With the Fed expected to maintain its low rate policy through most of 2011, we expect little change in our yield curve for some time.

Municipal money market supply is down sharply from years past for several reasons. As mentioned, short-dated variable rate demand note issuance is down year-to-date as issuers are opportunistically locking in low rates through longer-dated borrowing in the bond market. Credit quality concerns have also removed a number of names from our approved list. The slow economy and budget pressures have forced us to avoid some traditional borrowers among the state’s counties and school districts.

Despite low yields and the credit concerns permeating the municipal market, we are focused on the fund’s primary mandate, namely the stability of principal and liquidity. The money fund’s role within an investor’s portfolio is unchanged, and we remain committed to our consistent investment practices in fulfilling that role. We believe the low interest rate environment eventually will adjust to more normalized levels, and we look forward to a time when investors in the fund can feel more rewarded.

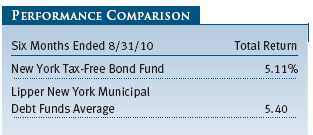

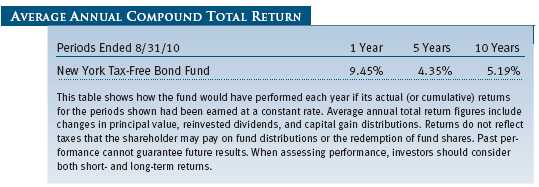

New York Tax-Free Bond Fund

Your fund returned 5.11% for the six-month period ended August 31. The gain modestly trailed that of our Lipper peer group average, but the fund’s long-term record relative to its competitors remains favorable. Based on cumulative total return, Lipper ranked the New York Tax-Free Bond Fund 65 out of 98, 34 out of 87, 24 out of 85, and 18 out of 73 New York State municipal debt funds for the 1-, 3-, 5-, and 10-year periods ended August 31, 2010, respectively. Returns will vary for other periods. Past performance cannot guarantee future results.

Our investment strategy has remained intact since February, with an overweight to longer-term maturities, as the steep yield curve made long-term rates much more compelling. Additionally, yields relative to taxable securities for longer-dated issues were much more attractive than for short- and intermediate-term securities. During the last six months, we continued to favor the long end, making new purchases in longer-dated issues. As a result, the fund’s weighted average maturity extended by a full year to 17 years. Relative to the Barclays Capital Municipal Bond Index, the fund is overweight in the 15- to 30-year maturity range and underweight in the 3- to 10-year range, a factor that aided our performance. Despite the longer maturity profile, the fund’s duration—a measure of its sensitivity to changes in interest rates—declined slightly from 5.5 to 5.1 years as interest rates declined and more holdings priced to their call dates. The fund’s duration, which measures sensitivity to changes in interest rates, was slightly shorter than that of the benchmark.

Fund holdings that underperformed were high-quality bonds with shorter maturities, including prerefunded issues. Lower-quality, longer-duration bonds, however, performed exceptionally well. Because the fund maintains high-quality characteristics, its smaller dedication to lower-quality issues relative to its Lipper peers hurt results. The fund’s 17% allocation to BBB rated holdings and nonrated holdings in high yield credits performed exceptionally well. Bonds in higher education and dedicated tax sectors as well as the health care sector also performed well.

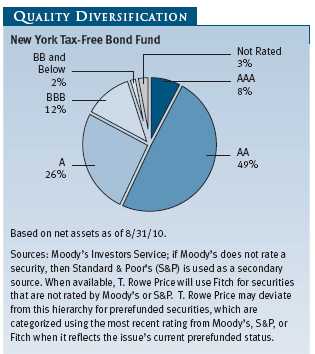

The fund experienced a notable shift in its quality diversification over the period. A good portion of the shift was due to Moody’s recalibration of municipal bond ratings in order to bring them in line with both the firm’s corporate ratings and its global scale rating system. The change caused many issuers to be upgraded. While most new additions to the fund during the past six months fell into the A rated category, exposure was unchanged at 26%, as upgrades caused bonds to move into the AA rated category and increase by 5% to 49% of the fund. AAA rated bonds decreased mostly due to a decline in the high-quality prerefunded sector as fund positions matured.

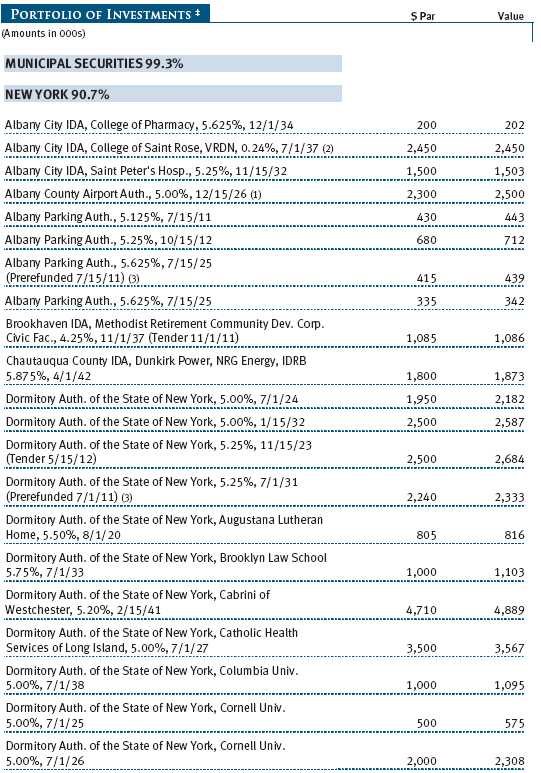

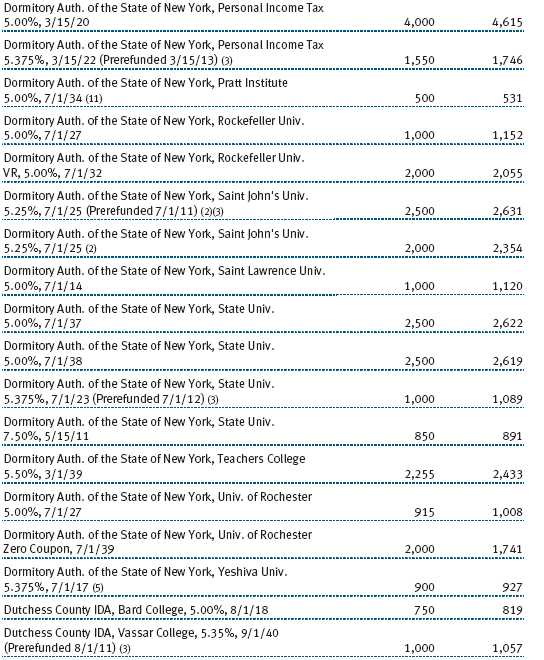

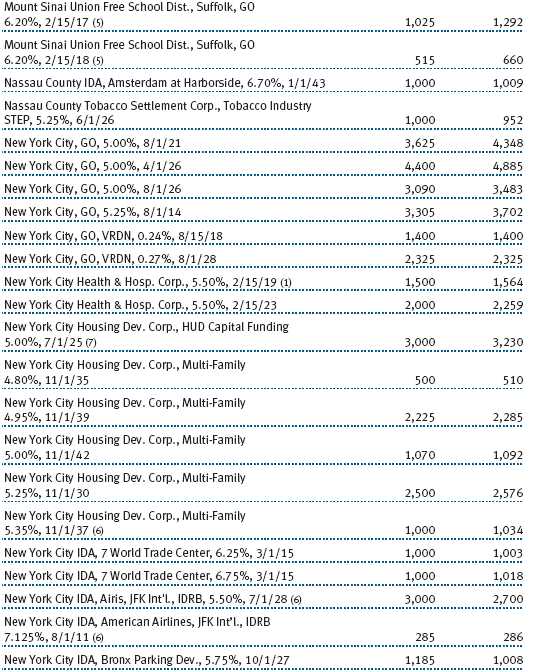

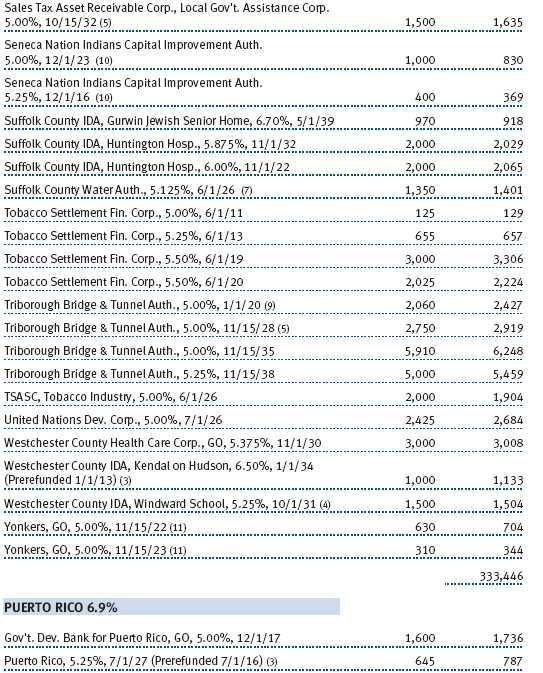

Trading activity was quite brisk as we sought to deploy our cash position to take advantage of new issuance. We added debt issued by the Albany County Airport and the Liberty Development Corporation for the Bank of America Tower. We also added to Puerto Rico sales tax-backed bonds, which are New York tax-exempt and provide attractive yields. (Please refer to the fund’s portfolio of investments for a complete listing of our holdings and the amount each represents in the portfolio.)

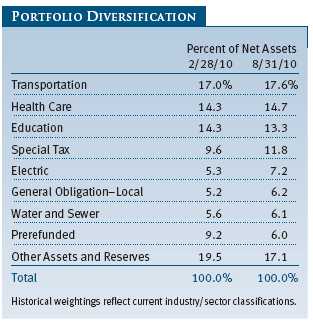

The fund’s structure reflects our bias for revenue bonds and continues to underweight the general obligation sector as the state and many local budgets face ongoing pressure. New York State’s budget was passed 125 days late in August, with an $8 billion shortfall projected in fiscal 2012. The transportation revenue sector remains the fund’s largest holding, at 17.6%, while exposure to both the electric revenue and special tax revenue sectors moved higher. The prerefunded sector declined by 3%, mostly due to bond maturities.

OUTLOOK

The credit environment for the municipal market could remain challenging for some time. Ongoing economic sluggishness, the housing market downturn, and high unemployment have reduced the tax revenues collected by state and local municipalities—a trend that could get worse over the next year—and municipal bond defaults, which historically have been rare, could increase moderately. Maintaining balanced budgets requires careful and dedicated work by state and local officials, and many issuers are trying to make the difficult but necessary fiscal decisions as they adjust to the sluggish economic recovery.

We continue to believe that the municipal market remains a high-quality market and that many municipal securities offer good long-term value, especially considering that tax rates are expected to rise in the next few years. Longer-term and lower-quality municipal bond valuations, though they have rebounded significantly, remain attractive and could improve further. In contrast, short- and intermediate-term securities appear to be fully valued and could be vulnerable if short-term interest rates increase, though that does not appear likely as long as the national unemployment rate remains high. We believe increased demand for munis due to higher anticipated tax rates and other factors, along with reduced tax-exempt issuance, will help cushion the effect of any rise in Treasury rates on the municipal market.

We believe T. Rowe Price’s strong credit research capabilities have been and will remain an asset for our investors. We continue to conduct our own thorough research and assign our own independent credit ratings before making investment decisions. As always, we are on the lookout for attractively valued bonds issued by municipalities with good fundamentals. We think such investments will continue to help us generate excellent long-term relative returns for our clients.

Respectfully submitted,

Joseph K. Lynagh

Chairman of the Investment Advisory Committee

New York Tax-Free Money Fund

Konstantine B. Mallas

Chairman of the Investment Advisory Committee

New York Tax-Free Bond Fund

September 15, 2010

The committee chairmen have day-to-day responsibility for managing the portfolios and work with committee members in developing and executing the funds’ investment programs.

RISKS OF FIXED INCOME INVESTING

Since money market funds are managed to maintain a constant $1.00 share price, there should be little risk of principal loss. However, there is no assurance the fund will avoid principal losses if fund holdings default or are downgraded or if interest rates rise sharply in an unusually short period. In addition, the fund’s yield will vary; it is not fixed for a specific period like the yield on a bank certificate of deposit. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. Although a money market fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in it. Bonds are subject to interest rate risk (the decline in bond prices that usually accompanies a rise in interest rates) and credit risk (the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default by failing to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. The New York Tax-Free Funds are less diversified than those investing nationally. Some income may be subject to state and local taxes and the federal alternative minimum tax.

GLOSSARY

30-day SEC yield: A method of calculating a fund’s yield that assumes all portfolio securities are held until maturity. Yield will vary and is not guaranteed.

Barclays Capital Municipal Bond Index: A broadly diversified index of tax-exempt bonds.

Basis points: One hundred basis points equal one percentage point.

Duration: A measure of a bond fund’s sensitivity to changes in interest rates. For example, a fund with a duration of six years would fall about 6% in price in response to a one-percentage-point rise in interest rates, and vice versa.

Escrowed-to-maturity bond: A bond that has the funds necessary for repayment at maturity, or a call date, set aside in a separate, or “escrow” account.

Fed funds target rate: An overnight lending rate set by the Federal Reserve and used by banks to meet reserve requirements. Banks also use the fed funds rate as a benchmark for their prime lending rates.

General obligation debt: A government’s strongest pledge that obligates its full faith and credit, including, if necessary, its ability to raise taxes.

Gross domestic product (GDP): The total market value of all goods and services produced in a country in a given year.

Libor: The London Interbank Offered Rate is a benchmark for short-term taxable rates.

Lipper averages: The averages of available mutual fund performance returns for specified time periods in defined categories as tracked by Lipper Inc.

Prerefunded bond: A bond that originally may have been issued as a general obligation or revenue bond but that is now secured by an escrow fund consisting entirely of direct U.S. government obligations that are sufficient for paying the bondholders.

SEC yield (7-day simple): A method of calculating a money fund’s yield by annualizing the fund’s net investment income for the last seven days of each period divided by the fund’s net asset value at the end of the period. Yield will vary and is not guaranteed.

Weighted average maturity: A measure of a fund’s interest rate sensitivity. In general, the longer the average maturity, the greater the fund’s sensitivity to interest rate changes. The weighted average maturity may take into account the interest rate readjustment dates for certain securities. Money funds must maintain a weighted average maturity of less than 60 days.

Weighted average life: The dollar-weighted average maturity of a portfolio’s securities without taking into account interest rate reset dates for certain adjustable rate securities. It is a measure that reflects how a fund may react in periods when credit spreads are widening or liquidity conditions are tightening. In general, the longer the fund’s average life, the greater its exposure to interest rate fluctuations. Money funds must maintain a weighted average life of less than 120 days.

Yield curve: A graphic depiction of the relationship among the yields for similar bonds with different maturities. A yield curve is positive when short-term yields are lower than long-term yields and negative when short-term yields are higher than long-term yields.

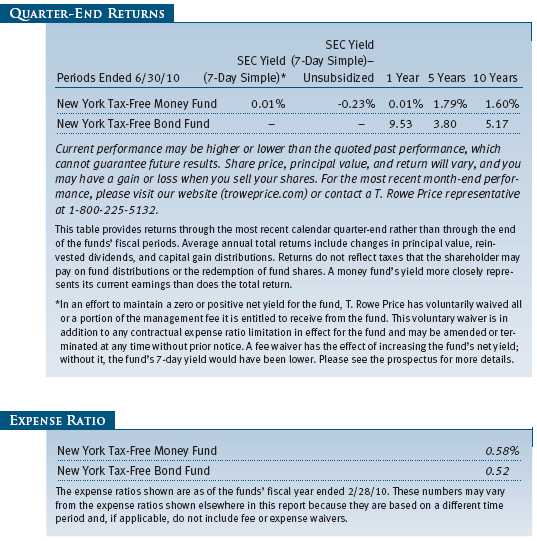

Performance and Expenses

| GROWTH OF $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| GROWTH OF $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| FUND EXPENSE EXAMPLE |

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Actual Expenses

The first line of the following table (“Actual”) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information in this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (“Hypothetical”) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual small-account maintenance fee of $10, generally for accounts with less than $2,000 ($500 for UGMA/UTMA). The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $25,000 or more, accounts employing automatic investing, and IRAs and other retirement plan accounts that utilize a prototype plan sponsored by T. Rowe Price (although a separate custodial or administrative fee may apply to such accounts). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

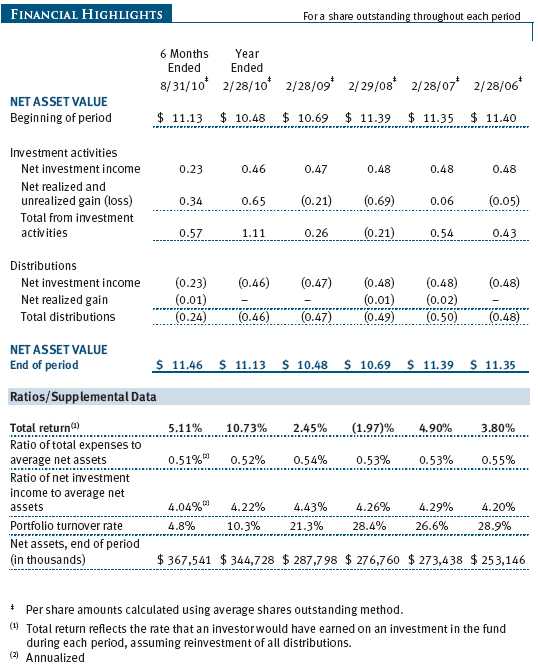

Unaudited

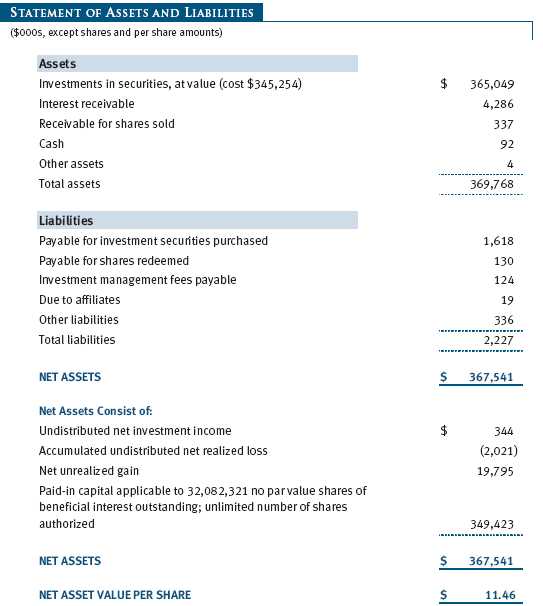

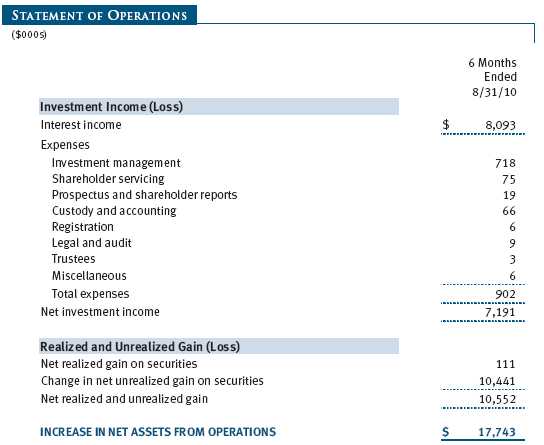

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

T. Rowe Price State Tax-Free Income Trust (the trust), is registered under the Investment Company Act of 1940 (the 1940 Act). The New York Tax-Free Bond Fund (the fund), a nondiversified, open-end management investment company, is one portfolio established by the trust. The fund commenced operations on August 28, 1986. The fund seeks to provide, consistent with prudent portfolio management, the highest level of income exempt from federal, New York state, and New York City income taxes by investing primarily in investment-grade New York municipal bonds.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by fund management. Fund management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale of securities.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared by daily and paid monthly. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Credits The fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits.

New Accounting Pronouncement On March 1, 2010, the fund adopted new accounting guidance that requires enhanced disclosures about fair value measurements in the financial statements. Adoption of this guidance had no impact on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s investments are reported at fair value as defined by GAAP. The fund determines the values of its assets and liabilities and computes its net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Debt securities are generally traded in the over-the-counter (OTC) market. Securities with remaining maturities of one year or more at the time of acquisition are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service, which considers the yield or price of bonds of comparable quality, coupon, maturity, and type, as well as prices quoted by dealers who make markets in such securities. Securities with remaining maturities of less than one year at the time of acquisition generally use amortized cost in local currency to approximate fair value. However, if amortized cost is deemed not to reflect fair value or the fund holds a significant amount of such securities with remaining maturities of more than 60 days, the securities are valued at prices furnished by dealers who make markets in such securities or by an independent pricing service.

Other investments, including restricted securities, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Trustees.

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. On August 31, 2010, all of the fund’s investments were classified as Level 2, based on the inputs used to determine their values.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $36,914,000 and $16,223,000, respectively, for the six months ended August 31, 2010.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. As of February 28, 2010, the fund had $2,073,000 of unused capital loss carryforwards, which expire: $87,000 in fiscal 2016, $1,538,000 in fiscal 2017, and $448,000 in fiscal 2018.

At August 31, 2010, the cost of investments for federal income tax purposes was $344,996,000. Net unrealized gain aggregated $20,053,000 at period-end, of which $23,061,000 related to appreciated investments and $3,008,000 related to depreciated investments.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (the manager of Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. The investment management agreement between the fund and the manager provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.10% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.285% for assets in excess of $220 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At August 31, 2010, the effective annual group fee rate was 0.30%.

In addition, the fund has entered into service agreements with Price Associates and a wholly owned subsidiary of Price Associates (collectively, Price). Price Associates computes the daily share price and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. For the six months ended August 31, 2010, expenses incurred pursuant to these service agreements were $44,000 for Price Associates and $48,000 for T. Rowe Price Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

| INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s website, www.sec.gov. The description of our proxy voting policies and procedures is also available on our website, www.troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (www.sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 450 Fifth St. N.W., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT |

On March 9, 2010, the fund’s Board of Directors (Board) unanimously approved the continuation of the investment advisory contract (Contract) between the fund and its investment manager, T. Rowe Price Associates, Inc. (Adviser). The Board considered a variety of factors in connection with its review of the Contract, also taking into account information provided by the Adviser during the course of the year, as discussed below:

Services Provided by the Adviser

The Board considered the nature, quality, and extent of the services provided to the fund by the Adviser. These services included, but were not limited to, management of the fund’s portfolio and a variety of related activities, as well as financial and administrative services, reporting, and communications. The Board also reviewed the background and experience of the Adviser’s senior management team and investment personnel involved in the management of the fund. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Adviser.

Investment Performance of the Fund

The Board reviewed the fund’s average annual total returns over the 1-, 3-, 5-, and 10-year periods, as well as the fund’s year-by-year returns, and compared these returns with a wide variety of previously agreed upon comparable performance measures and market data, including those supplied by Lipper and Morningstar, which are independent providers of mutual fund data. On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the severity of the market turmoil during 2008 and 2009, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Adviser under the Contract and other benefits that the Adviser (and its affiliates) may have realized from its relationship with the fund, including research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Adviser may receive some benefit from its soft-dollar arrangements pursuant to which it receives research from broker-dealers that execute the applicable fund’s portfolio transactions. The Board also received information on the estimated costs incurred and profits realized by the Adviser and its affiliates from advising T. Rowe Price mutual funds, as well as estimates of the gross profits realized from managing the fund in particular. The Board concluded that the Adviser’s profits were reasonable in light of the services provided to the fund. The Board also considered whether the fund or other funds benefit under the fee levels set forth in the Contract from any economies of scale realized by the Adviser. Under the Contract, the fund pays a fee to the Adviser composed of two components—a group fee rate based on the aggregate assets of certain T. Rowe Price mutual funds (including the fund) that declines at certain asset levels and an individual fund fee rate that is assessed on the assets of the fund. The Board concluded that the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees

The Board reviewed the fund’s management fee rate, operating expenses, and total expense ratio and compared them with fees and expenses of other comparable funds based on information and data supplied by Lipper. The information provided to the Board indicated that the fund’s management fee rate was above the median for certain groups of comparable funds but at or below the median for other groups of comparable funds. The information also indicated that the fund’s total expense ratio was above the median for certain groups of comparable funds but below the median for other groups of comparable funds. The Board also reviewed the fee schedules for institutional accounts of the Adviser and its affiliates with smaller mandates. Management informed the Board that the Adviser’s responsibilities for institutional accounts are more limited than its responsibilities for the fund and other T. Rowe Price mutual funds that it or its affiliates advise and that the Adviser performs significant additional services and assumes greater risk for the fund and other T. Rowe Price mutual funds that it advises than it does for institutional accounts. On the basis of the information provided, the Board concluded that the fees paid by the fund under the Contract were reasonable.

Approval of the Contract

As noted, the Board approved the continuation of the Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board was assisted by the advice of independent legal counsel and concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund to approve the continuation of the Contract, including the fees to be charged for services thereunder.

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES | |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the | |

| undersigned, thereunto duly authorized. | |

| T. Rowe Price State Tax-Free Income Trust | |

| By | /s/ Edward C. Bernard |

| Edward C. Bernard | |

| Principal Executive Officer | |

| Date | October 18, 2010 |

| Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment | |

| Company Act of 1940, this report has been signed below by the following persons on behalf of | |

| the registrant and in the capacities and on the dates indicated. | |

| By | /s/ Edward C. Bernard |

| Edward C. Bernard | |

| Principal Executive Officer | |

| Date | October 18, 2010 |

| By | /s/ Gregory K. Hinkle |

| Gregory K. Hinkle | |

| Principal Financial Officer | |

| Date | October 18, 2010 |