UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-04521

| T. Rowe Price State Tax-Free Funds, Inc. |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: February 28

Date of reporting period: August 31, 2018

|

| Maryland Tax-Free Money Fund | August 31, 2018 |

| T. ROWE PRICE MARYLAND TAX-FREE FUNDS |

HIGHLIGHTS

| ■ | Tax-free municipal bond returns were positive in the six-month period ended August 31, 2018, and munis generally outperformed taxable investment-grade bonds. |

| ■ | The Maryland Short-Term Tax-Free Bond Fund and Maryland Tax-Free Bond Fund generated positive returns but trailed their peer groups for the period, while the Maryland Tax-Free Money Fund performed roughly in line with its peer group average. |

| ■ | Maryland has a long history of responsible stewardship and prudent financial management, but we are closely monitoring the state’s progress in reducing its unfunded pension liabilities. |

| ■ | While the increased chance of rising yields represents a near-term headwind for broad muni market performance, we believe fundamentals are sound overall, and global economic uncertainties could spur demand for the asset class. |

Log in to your account at troweprice.com for more information.

*Certain mutual fund accounts that are assessed an annual account service fee can also save money by switching to e-delivery.

CIO Market Commentary

Dear Shareholder

Financial markets performed well overall in the first half of your fund’s fiscal year, the six months ended in August 2018. Investors had to endure periodic volatility, however, and returns varied considerably among asset classes.

U.S. equity returns were particularly strong, with most of the major benchmarks establishing new highs by August. Investors bid stocks up as profit growth surged in early 2018, with earnings for the S&P 500 Index in the first two quarters jumping by roughly 25% versus a year before—the biggest gain in nearly eight years. Revenue growth was also especially robust and reached multiyear highs.

Much of the topline and bottom-line growth remained concentrated in the largest technology and Internet firms, which continued to gain market share and disrupt a range of industries. Apple reached a market milestone in early August, when it became the first company with a market capitalization above $1 trillion—with Amazon.com and Alphabet (Google’s parent company) not far behind. However, public scrutiny of the power and reach of the tech giants reached new heights during the period. Most notably, Facebook founder Mark Zuckerberg was called before Congress to explain the unauthorized use of customer data.

Rising trade tensions were also front and center. On March 1, the first day of your fund’s fiscal year, President Donald Trump surprised markets by announcing new tariffs on metals imports. Tariff threats and counterthreats escalated in the following months, resulting in some unforeseen ripple effects for investors. In particular, shares in major U.S. industrial exporters lagged the market’s advance as the U.S. dollar strengthened and investors worried about retaliatory measures.

Comparatively, robust economic growth and rising interest rates drove the dollar higher against most foreign currencies. Slumping currencies converted modestly positive local equity returns in many countries into losses for U.S. investors. Non-U.S. bond returns were also broadly negative.

The strengthening dollar and trade worries took their heaviest toll on emerging markets. Chinese stocks fell sharply, while many other markets closely tied to global trade also declined. Past and present policy missteps combined with worrisome current account deficits threatened to lead to full-blown financial crises in Argentina and Turkey and caused a plunge in both nations’ currencies. The MSCI Emerging Markets Index entered bear market territory in mid-August after declining more than 20% from its January highs.

Longer-term Treasury yields ended flat to slightly lower over the period despite the accelerating economy and widening budget deficit. Stable yields supported bond prices generally, and most domestic bond segments recorded modest, positive total returns. Healthy corporate earnings and economic conditions supported demand for riskier assets, and high yield bonds offered the best returns. Meanwhile, the Federal Reserve continued to raise short-term interest rates, helping savers and income-seeking investors.

Investment-grade tax-free municipal bonds benefited from a supportive technical environment and outperformed Treasuries and the broader U.S. taxable investment-grade bond market for the six-month period. Investor demand for munis remained steady, while the supply of bonds shrank due to a steep drop in refundings. The new tax law enacted at the end of 2017 eliminated the tax benefits of advance refundings, which had allowed issuers to refinance existing debt with new bonds. Strong demand for higher-yielding securities helped lower-quality munis outperform. Puerto Rico bonds were the best performers in the muni market during the period. While many challenges remain for Puerto Rico, progress toward a resolution for bondholders extended the rally in these bonds.

In mid-August, the current bull market in U.S. stocks became the longest in modern history, according to one measure, and the current economic expansion may be poised to join the record books next summer. Understandably, many investors are beginning to wonder whether the economy and corporate earnings have reached a cycle peak, leading some to question how much longer the good times can last.

For now, fundamentals remain supportive, and we don’t see the classic signs of an impending recession on the horizon. That said, we will be monitoring global economic data and bond market signals for early signs of when this nine-year-plus bull market might be making its last charge. You can rest assured that your fund’s manager is drawing on the extensive resources of T. Rowe Price’s research platform in looking for both signs of trouble and new investment opportunities.

Thank you for your continued confidence in T. Rowe Price.

Sincerely,

Robert Sharps

Group Chief Investment Officer

Management’s Discussion of Fund Performance

MARYLAND TAX-FREE MONEY FUND

INVESTMENT OBJECTIVE

The fund seeks to provide preservation of capital, liquidity, and, consistent with these objectives, the highest level of income exempt from federal and Maryland state and local income taxes.

FUND COMMENTARY

How did the fund perform in the past six months?

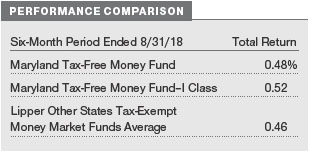

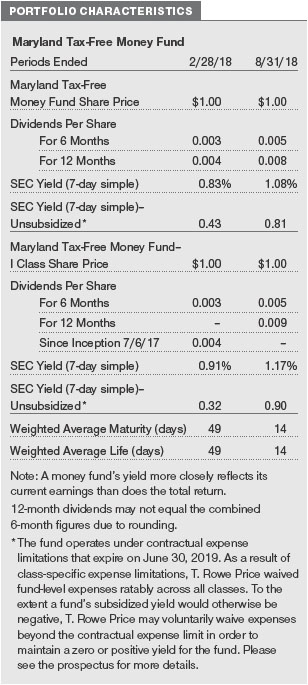

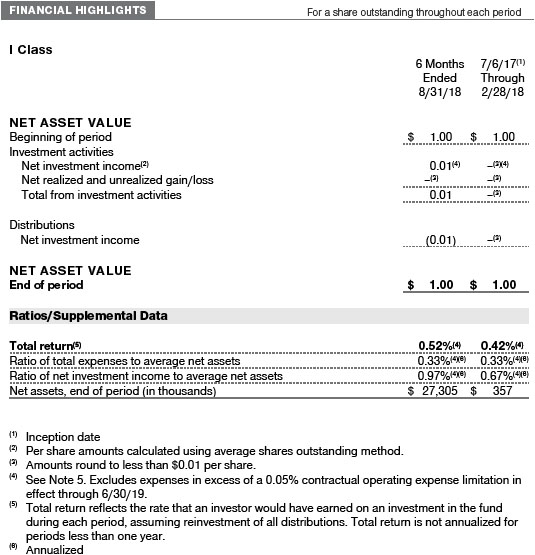

The Maryland Tax-Free Money Fund returned 0.48% in the six months ended August 31, 2018, while its peer group, the Lipper Other States Tax-Exempt Money Market Funds Average, returned 0.46%. (Returns for the I Class shares varied slightly, reflecting their different fee structure. Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

The Federal Reserve remained active during the reporting period and raised rates by 25 basis points in both March and June, which lifted the fed funds target rate to a range of 1.75% to 2.00% by the end of August (100 basis points equal one percentage point). Other short-term interest rates also rose in accordance with the Fed rate decisions.

Variable rate demand note (VRDN) yields averaged 1.37% since our last report, compared with a 1.04% average for the prior six months; still, supply constraints continued to limit how much rates rose. Longer tax-exempt money market rates increased, with one-year maturities trading with yields around 1.80% at the end of the period. The fund benefited from a strategy in which we underweighted VRDNs in favor of commercial paper and other fixed rate investments. Generally, this strategy resulted in a weighted average maturity somewhat longer than that of the peer group.

How is the fund positioned?

The fund’s weighted average maturity shortened during the six-month period as we increased our exposure to shorter-dated investments and VRDNs.

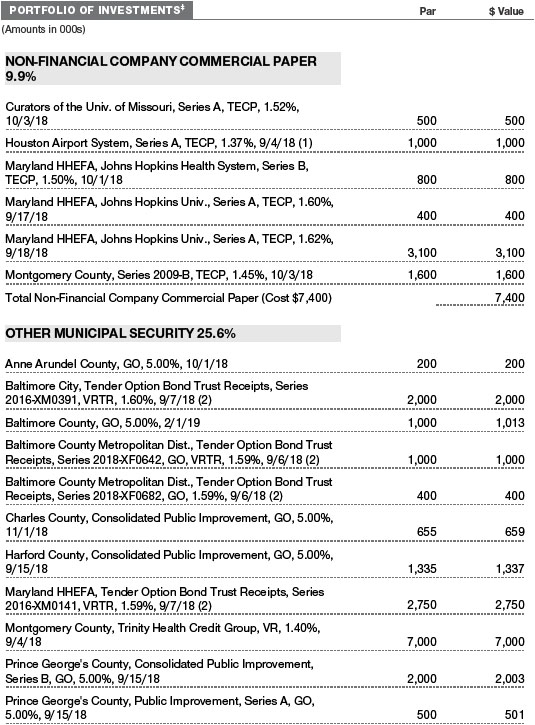

VRDNs, at 68% of net assets, represented the portfolio’s largest position in absolute terms at the end of the period, but we were underweight these securities compared with our peer group average and instead favored longer-maturity debt such as commercial paper. However, we expect to shift to a more neutral weighting in the coming months to reflect rising rates at the front end of the municipal money market yield curve.

Credit quality continues to play a significant part in our asset selection. At the end of the period, our largest sector allocations were to health care and housing revenue debt as well as local general obligation (GO) securities. Some prominent positions in the portfolio included Montgomery County, University of Maryland Medical System, Anne Arundel Health System, and Johns Hopkins Health System. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

What is portfolio management’s outlook?

By most measures, the economy continues to look strong. Employment remains robust, though wage growth and inflation have been restrained. As a result, we expect the Fed to continue its recent pace of interest rate increases and to lift its benchmark rate twice more in 2018—once in both September and December. This should lead to generally higher money market yields, but continued strong demand for Maryland tax-exempt issues will likely restrain yield levels in our market in the near term.

As always, we remain committed to managing a high-quality, diversified portfolio focused on liquidity and stability of principal, which we deem to be of utmost importance to our shareholders.

MARYLAND SHORT-TERM TAX-FREE BOND FUND

INVESTMENT OBJECTIVE

The fund seeks to provide the highest level of income exempt from federal and Maryland state and local income taxes consistent with modest fluctuation in principal value.

FUND COMMENTARY

How did the fund perform in the past six months?

The Maryland Short-Term Tax-Free Bond Fund returned 0.57% for the six months ended August 31, 2018, underperforming the Lipper Short Municipal Debt Funds Average. (Returns for I Class shares varied slightly, reflecting their different fee structure. Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

Shorter-maturity municipal bonds produced modestly positive returns for the six-month period but underperformed the broader muni market as investors sought out higher-yielding longer-maturity bonds. On a relative basis, the fund’s security selection in the health care sector detracted, while yield curve positioning and an underweight to prerefunded bonds contributed to results.

Our longer weighted average duration and our positioning in longer-maturity bonds were beneficial as the yield curve flattened. Specifically, our out-of-benchmark allocation to five-year maturities added value as longer-maturity bonds outperformed. As shown in the Portfolio Characteristics table, the fund’s weighted average maturity and duration were unchanged over the last six months. Our relatively large position in securities maturing in the next two years provides the fund with flexibility to invest in higher-yielding securities in a rising rate environment.

How is the fund positioned?

While our preference for revenue bonds over GOs remains intact, it has been challenging to find opportunities in revenue debt over the past couple of years in the short- to intermediate-term municipal market. As a result, local GO bonds continued to represent the fund’s largest allocation at the sector level at the end of the period. However, we were pleased that we were able to reduce this position somewhat while increasing our allocation to higher-yielding revenue sectors such as health care and water and sewer.

The portfolio’s allocation to prerefunded bonds increased from 6.0% to 7.2% over the six-month period. These bonds provide the fund another source of liquidity in addition to cash that can be used to purchase higher-yielding securities in a rising rate environment, but we expect this position to decline over time as a result of the tax reform package passed at the end of 2017, which severely restricted the ability of issuers to create new prerefunded bonds in the tax-exempt market.

The majority of the portfolio is allocated to AAA and AA rated bonds. However, during the six-month period, that allocation decreased from 58% to 52% as we were able to redeploy assets among lower-rated bonds that offered the potential for more attractive risk-adjusted returns.

What is portfolio management’s outlook?

We believe that the municipal bond market remains a high-quality market that offers good opportunities for long-term investors seeking tax-free income. While the uncertainty around the long-term impact of tax reform and the increased chance of rising yields represent near-term headwinds for broad muni market performance, we believe fundamentals are sound overall, and global economic uncertainties could spur demand for the asset class.

As the Fed continues on the path to interest rate normalization, muni bond yields are likely to increase along with Treasury yields—although probably not to the same extent. While higher yields pressure bond prices, munis should be less susceptible to slowly rising rates than Treasuries given their attractive tax-equivalent yields and the steady demand for tax-exempt income.

While we believe that many states deserve high credit ratings and will be able to continue servicing their debts, we have longer-term concerns about significant funding shortfalls for pensions and other post-employment benefit (OPEB) obligations in some jurisdictions. Although few large plans are at risk of insolvency in the near term, the magnitude of unfunded liabilities is becoming more conspicuous in a few states. Ultimately, we believe independent credit research is our greatest strength and will remain an asset for our investors as we navigate the current market environment.

MARYLAND TAX-FREE BOND FUND

INVESTMENT OBJECTIVE

The fund seeks to provide, consistent with prudent portfolio management, the highest level of income exempt from federal and Maryland state and local income taxes by investing primarily in investment-grade Maryland municipal bonds.

FUND COMMENTARY

How did the fund perform in the past six months?

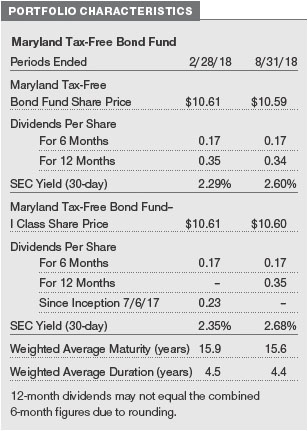

The Maryland Tax-Free Bond Fund returned 1.40% for the six months ended August 31, 2018, underperforming the Lipper Maryland Municipal Debt Funds Average. (Returns for I Class shares varied slightly, reflecting their different fee structure. Past performance cannot guarantee future results.)

What factors influenced the fund’s performance?

The fund’s total return was positive as dividends offset a small drop in net asset value. The fund trailed its peers slightly for the past six months, though its results compared favorably for longer periods. The overall environment for muni bonds was modestly positive during the reporting period. The muni yield curve flattened as yields of longer-maturity bonds declined, while shorter-maturity yields saw modest increases.

The fund’s concentration in revenue bonds was beneficial as revenue-backed debt outperformed GO bonds. Our overweight in health care, which was one of the strongest performing sectors, also contributed.

The fund’s cautious position on interest rate risk was a relative detractor, as demand for longer-term bonds kept rates from moving higher despite a pair of short-term rate hikes by the Federal Reserve during the period. The fund’s weighted average maturity, which was already low by historical standards, moved down about 0.3 years to 15.6 years, and the fund’s weighted average duration (a measure of interest rate sensitivity) ticked down to 4.4 years.

How is the fund positioned?

We maintained the fund’s long-term emphasis on revenue bonds, as lingering concerns about the ability of state and local governments to finance pensions and retiree health care benefits have steered us away from GO debt generally. Nonetheless, we did add some high-quality GO securities in the most recent six months, including bonds from Baltimore County, Anne Arundel County, Prince George’s County, and Montgomery County. As a result of these additions, our local GO debt total increased to 17.8% of the portfolio from 14.2% and our AAA allocation moved up two percentage points to 17%. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

From a sector perspective, we maintained our emphasis on health care, which offers higher risk-adjusted yields. The sector remains a core component of our strategy, although a few of our positions matured in the past six months, reducing our allocation to 26.3% from 27.1%. Prerefunded bonds still represent a decent concentration of the fund’s assets but dropped to 13.8% of the portfolio. This number should continue to decline over time as a result of the tax reform package passed at the end of 2017, which severely restricted the ability of issuers to create new prerefunded bonds in the tax-exempt market.

Though we are attempting to tamp down the interest rate risk in the portfolio, we continued to find value on the longer end of the yield curve. The majority of our portfolio additions during the six-month period were longer-dated maturities, although, as we noted earlier, the fund’s weighted average maturity declined.

Maryland’s credit rating was unchanged during the period. As of August 31, 2018, the state’s GO bonds were rated Aaa by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings. All three rating agencies maintain stable outlooks.

Maryland has a long history of responsible stewardship and prudent financial management, but, unfavorably, Maryland’s pension system was only funded at 69% on an actuarial basis as of June 30, 2017. Maryland’s practice of not fully funding its actuarial required contributions has led to a rise in its unfunded pension liability. As a result, Maryland faces heavy unfunded liabilities for its pension plans compared with other AAA rated states, at $20 billion as of June 30, 2017—a significant rise from $10 billion as of June 30, 2008. Various modifications to benefits under these programs as well as higher employee contributions have been imposed to reduce liabilities and improve funding, and we are closely monitoring Maryland’s progress in this regard.

What is portfolio management’s outlook?

We believe that the municipal bond market remains a high-quality market that offers good opportunities for long-term investors seeking tax-free income. While the uncertainty around the long-term impact of tax reform and the increased chance of rising yields represent near-term headwinds for broad muni market performance, we believe fundamentals are sound overall, and global economic uncertainties could spur demand for the asset class.

As the Fed continues on the path to interest rate normalization, muni bond yields are likely to increase along with Treasury yields—although probably not to the same extent. While higher yields pressure bond prices, munis should be less susceptible to slowly rising rates than Treasuries given their attractive tax-equivalent yields and the steady demand for tax-exempt income.

While we believe that many states deserve high credit ratings and will be able to continue servicing their debts, we have longer-term concerns about significant funding shortfalls for pensions and other post-employment benefit (OPEB) obligations in some jurisdictions. Although few large plans are at risk of insolvency in the near term, the magnitude of unfunded liabilities is becoming more conspicuous in a few states. Ultimately, we believe independent credit research is our greatest strength and will remain an asset for our investors as we navigate the current market environment.

The views expressed reflect the opinions of T. Rowe Price as of the date of this report and are subject to change based on changes in market, economic, or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

RISKS OF INVESTING IN A RETAIL MONEY MARKET FUND

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it cannot guarantee it will do so. The Fund may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time.

RISKS OF INVESTING IN FIXED INCOME SECURITIES

Bonds are subject to interest rate risk (the decline in bond prices that usually accompanies a rise in interest rates) and credit risk (the chance that any fund holding could have its credit rating downgraded or that a bond issuer will default by failing to make timely payments of interest or principal), potentially reducing the fund’s income level and share price. The fund is less diversified than one investing nationally. Some income may be subject to state and local taxes and the federal alternative minimum tax.

BENCHMARK INFORMATION

Note: Bloomberg Index Services Ltd. Copyright © 2018, Bloomberg Index Services Ltd. Used with permission.

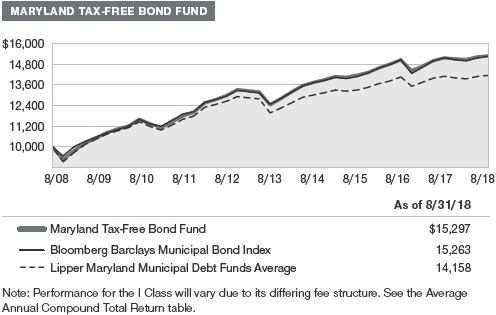

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

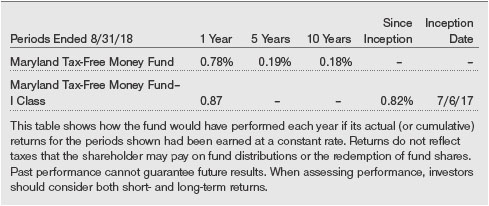

AVERAGE ANNUAL COMPOUND TOTAL RETURN

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

AVERAGE ANNUAL COMPOUND TOTAL RETURN

GROWTH OF $10,000

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which include a broad-based market index and may also include a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

AVERAGE ANNUAL COMPOUND TOTAL RETURN

EXPENSE RATIOS

FUND EXPENSE EXAMPLE

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

Please note that the fund has two share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, and the I Class shares are also available to institutionally oriented clients and impose no 12b-1 or administrative fee payment. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Personal Services or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $250,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

QUARTER-END RETURNS

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

The accompanying notes are an integral part of these financial statements.

Unaudited

| NOTES TO FINANCIAL STATEMENTS |

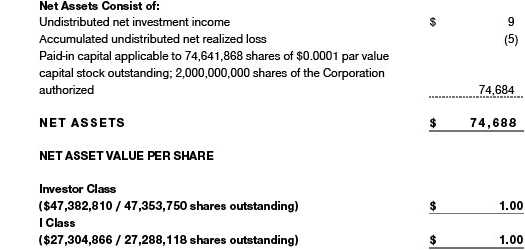

T. Rowe Price State Tax-Free Funds, Inc. (the corporation) is registered under the Investment Company Act of 1940 (the 1940 Act). The Maryland Tax-Free Money Fund (the fund) is a diversified, open-end management investment company established by the corporation. The fund seeks to provide preservation of capital, liquidity, and, consistent with these objectives, the highest level of income exempt from federal and Maryland state and local income taxes. The fund intends to operate as a retail money market fund and has the ability to impose liquidity fees on redemptions and/or temporarily suspend redemptions. The fund has two classes of shares: the Maryland Tax-Free Money Fund (Investor Class) and the Maryland Tax-Free Money Fund–I Class (I Class). I Class shares generally are available only to investors meeting a $1,000,000 minimum investment or certain other criteria. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to both classes; and, in all other respects, the same rights and obligations as the other class.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The fund is an investment company and follows accounting and reporting guidance in the Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 946 (ASC 946). The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), including, but not limited to, ASC 946. GAAP requires the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Investment transactions are accounted for on the trade date basis. Income and expenses are recorded on the accrual basis. Realized gains and losses are reported on the identified cost basis. Premiums and discounts on debt securities are amortized for financial reporting purposes. Income tax-related interest and penalties, if incurred, are recorded as income tax expense. Income distributions are declared by each class daily and paid monthly. Distributions to shareholders are recorded on the ex-dividend date. A capital gain distribution may also be declared and paid by the fund annually.

Class Accounting Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to both classes and investment income are allocated to the classes based upon the relative daily net assets of each class’s settled shares; realized and unrealized gains and losses are allocated based upon the relative daily net assets of each class’s outstanding shares. To the extent any expenses are waived or reimbursed in accordance with an expense limitation (see Note 5), the waiver or reimbursement is charged to the applicable class or allocated across the classes in the same manner as the related expense.

New Accounting Guidance In March 2017, the FASB issued amended guidance to shorten the amortization period for certain callable debt securities held at a premium. The guidance is effective for fiscal years and interim periods beginning after December 15, 2018. Adoption will have no effect on the fund’s net assets or results of operations.

Indemnification In the normal course of business, the fund may provide indemnification in connection with its officers and directors, service providers, and/or private company investments. The fund’s maximum exposure under these arrangements is unknown; however, the risk of material loss is currently considered to be remote.

NOTE 2 - VALUATION

The fund’s financial instruments are valued and each class’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business. However, the NAV per share may be calculated at a time other than the normal close of the NYSE if trading on the NYSE is restricted, if the NYSE closes earlier, or as may be permitted by the SEC. The fund’s financial instruments are reported at fair value, which GAAP defines as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Assets and liabilities other than financial instruments, including short-term receivables and payables, are carried at cost, or estimated realizable value, if less, which approximates fair value. The T. Rowe Price Valuation Committee (the Valuation Committee) is an internal committee that has been delegated certain responsibilities by the fund’s Board of Directors (the Board) to ensure that financial instruments are appropriately priced at fair value in accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the Valuation Committee develops and oversees pricing-related policies and procedures, including the comparison of amortized cost to market-based value, and approves all fair value determinations.

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values. For example, securities held by a money market fund are generally high quality and liquid; however, they are reflected as Level 2 because the inputs used to determine fair value are not quoted prices in an active market.

In accordance with Rule 2a-7 under the 1940 Act, the fund values its securities at amortized cost, which approximates fair value. Securities for which amortized cost is deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. On August 31, 2018, all of the fund’s financial instruments were classified as Level 2 in the fair value hierarchy.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

Restricted Securities The fund may invest in securities that are subject to legal or contractual restrictions on resale. Prompt sale of such securities at an acceptable price may be difficult and may involve substantial delays and additional costs.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences. The amount and character of tax-basis distributions and composition of net assets are finalized at fiscal year-end; accordingly, tax-basis balances have not been determined as of the date of this report.

The fund intends to retain realized gains to the extent of available capital loss carryforwards. Net realized capital losses may be carried forward indefinitely to offset future realized capital gains. As of February 28, 2018, the fund had $3,000 of available capital loss carryforwards.

At August 31, 2018, the cost of investments for federal income tax purposes was $77,257,000.

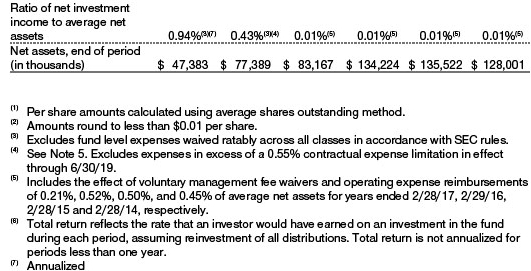

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee, equal to 0.10% of the fund’s average daily net assets, and a group fee. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.265% for assets in excess of $650 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At August 31, 2018, the effective annual group fee rate was 0.29%. Price Associates agreed to reduce the fund’s annual investment management fee to 0.28% through June 30, 2019. This contractual arrangement will renew automatically for one-year terms thereafter and may be revised, revoked, or terminated only with approval of the fund’s Board. The fund has no obligation to repay fees reduced under this arrangement.

The Investor Class is subject to a contractual expense limitation through June 30, 2019. During the limitation period, Price Associates is required to waive its management fee or pay any expenses (excluding interest, expenses related to borrowings, taxes, brokerage, and other non-recurring expenses permitted by the investment management agreement) that would otherwise cause the class’s ratio of annualized total expenses to average net assets (expense ratio) to exceed its expense limitation of 0.55%. The class is required to repay Price Associates for expenses previously waived/paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s expense ratio (after the repayment is taken into account) to exceed both: (1) the expense limitation in place at the time such amounts were waived; and (2) the class’s current expense limitation. However, no repayment will be made more than three years after the date of a payment or waiver.

The I Class is also subject to an operating expense limitation (I Class limit) pursuant to which Price Associates is contractually required to pay all operating expenses of the I Class, excluding management fees, interest, expenses related to borrowings, taxes, brokerage, and other non-recurring expenses permitted by the investment management agreement, to the extent such operating expenses, on an annualized basis, exceed 0.05% of average net assets. This agreement will continue until June 30, 2019, and may be renewed, revised, or revoked only with approval of the fund’s Board. The I Class is required to repay Price Associates for expenses previously paid to the extent the class’s net assets grow or expenses decline sufficiently to allow repayment without causing the class’s operating expenses (after the repayment is taken into account) to exceed both: (1) the expense limitation in place at the time such amounts were paid; and (2) the class’s current expense limitation. However, no repayment will be made more than three years after the date of a payment or waiver.

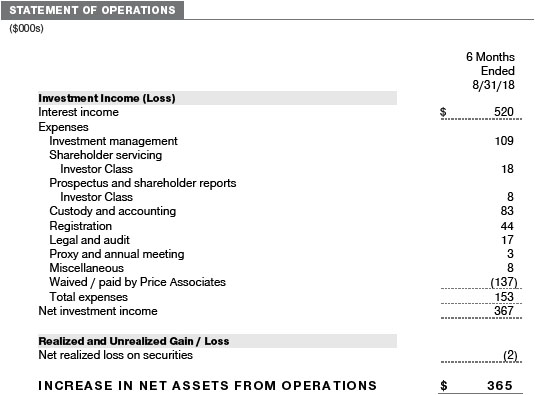

Pursuant to these agreements, $137,000 of expenses were waived/paid by Price Associates during the six months ended August 31, 2018. Including this amount, expenses previously waived/paid by Price Associates in the amount of $342,000 remain subject to repayment by the fund at August 31, 2018.

In addition, the fund has entered into service agreements with Price Associates and a wholly owned subsidiary of Price Associates, each an affiliate of the fund (collectively, Price). Price Associates provides certain accounting and administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend-disbursing agent. For the six months ended August 31, 2018, expenses incurred pursuant to these service agreements were $45,000 for Price Associates and $14,000 for T. Rowe Price Services, Inc. All amounts due to and due from Price, exclusive of investment management fees payable, are presented net on the accompanying Statement of Assets and Liabilities.

As of August 31, 2018, T. Rowe Price Group, Inc., or its wholly owned subsidiaries owned 250,000 shares of the I Class, representing 1% of the I Class’s net assets.

The fund may participate in securities purchase and sale transactions with other funds or accounts advised by Price Associates (cross trades), in accordance with procedures adopted by the fund’s Board and Securities and Exchange Commission rules, which require, among other things, that such purchase and sale cross trades be effected at the independent current market price of the security. Purchases and sales cross trades aggregated $4,286,000 and $0, respectively, with net realized gain of $0 for the six months ended August 31, 2018.

INFORMATION ON PROXY VOTING POLICIES, PROCEDURES, AND RECORDS

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information. You may request this document by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov.

The description of our proxy voting policies and procedures is also available on our corporate website. To access it, please visit the following Web page:

https://www3.troweprice.com/usis/corporate/en/utility/policies.html

Scroll down to the section near the bottom of the page that says, “Proxy Voting Policies.” Click on the Proxy Voting Policies link in the shaded box.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through T. Rowe Price, visit the website location shown above, and scroll down to the section near the bottom of the page that says, “Proxy Voting Records.” Click on the Proxy Voting Records link in the shaded box.

HOW TO OBTAIN QUARTERLY PORTFOLIO HOLDINGS

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT

Each year, the fund’s Board of Directors (Board) considers the continuation of the investment management agreement (Advisory Contract) between the fund and its investment advisor, T. Rowe Price Associates, Inc. (Advisor), on behalf of the fund. In that regard, at an in-person meeting held on March 5–6, 2018 (Meeting), the Board, including a majority of the fund’s independent directors, approved the continuation of the fund’s Advisory Contract. The Board noted that, effective October 30, 2017, the fund entered into a new Advisory Contract as a result of the fund being reorganized and redomiciled from a Massachusetts business trust to a Maryland corporation and that there were no material changes from the previous investment management agreement that was in place with the Advisor. At the Meeting, the Board considered the factors and reached the conclusions described below relating to the selection of the Advisor and the approval of the Advisory Contract. The independent directors were assisted in their evaluation of the Advisory Contract by independent legal counsel from whom they received separate legal advice and with whom they met separately.

In providing information to the Board, the Advisor was guided by a detailed set of requests for information submitted by independent legal counsel on behalf of the independent directors. In considering and approving the Advisory Contract, the Board considered the information it believed was relevant, including, but not limited to, the information discussed below. The Board considered not only the specific information presented in connection with the Meeting but also the knowledge gained over time through interaction with the Advisor about various topics. The Board meets regularly and, at each of its meetings, covers an extensive agenda of topics and materials and considers factors that are relevant to its annual consideration of the renewal of the T. Rowe Price funds’ advisory contracts, including performance and the services and support provided to the funds and their shareholders.

Services Provided by the Advisor

The Board considered the nature, quality, and extent of the services provided to the fund by the Advisor. These services included, but were not limited to, directing the fund’s investments in accordance with its investment program and the overall management of the fund’s portfolio, as well as a variety of related activities such as financial, investment operations, and administrative services; compliance; maintaining the fund’s records and registrations; and shareholder communications. The Board also reviewed the background and experience of the Advisor’s senior management team and investment personnel involved in the management of the fund, as well as the Advisor’s compliance record. The Board concluded that it was satisfied with the nature, quality, and extent of the services provided by the Advisor.

Investment Performance of the Fund

The Board took into account discussions with the Advisor and reports that it receives throughout the year relating to fund performance. In connection with the Meeting, the Board reviewed the fund’s net annualized total returns for the 1-, 2-, 3-, 4-, 5-, and 10-year periods as of September 30, 2017, and compared these returns with the performance of a peer group of funds with similar investment programs and a wide variety of other previously agreed-upon comparable performance measures and market data, including those supplied by Broadridge, which is an independent provider of mutual fund data.

On the basis of this evaluation and the Board’s ongoing review of investment results, and factoring in the relative market conditions during certain of the performance periods, the Board concluded that the fund’s performance was satisfactory.

Costs, Benefits, Profits, and Economies of Scale

The Board reviewed detailed information regarding the revenues received by the Advisor under the Advisory Contract and other benefits that the Advisor (and its affiliates) may have realized from its relationship with the fund, including any research received under “soft dollar” agreements and commission-sharing arrangements with broker-dealers. The Board considered that the Advisor may receive some benefit from soft-dollar arrangements pursuant to which research is received from broker-dealers that execute the fund’s portfolio transactions. The Board received information on the estimated costs incurred and profits realized by the Advisor from managing the T. Rowe Price funds. While the Board did not review information regarding profits realized from managing the fund in particular because the fund had either not achieved sufficient portfolio asset size or not recognized sufficient revenues to produce meaningful profit margin percentages, the Board concluded that the Advisor’s profits were reasonable in light of the services provided to the T. Rowe Price funds.

The Board also considered whether the fund benefits under the fee levels set forth in the Advisory Contract from any economies of scale realized by the Advisor. Under the Advisory Contract, the fund pays a fee to the Advisor for investment management services composed of two components—a group fee rate based on the combined average net assets of most of the T. Rowe Price funds (including the fund) that declines at certain asset levels and an individual fund fee rate based on the fund’s average daily net assets—and the fund pays its own expenses of operations (subject to a contractual expense limitation on total expense ratio with respect to the Investor Class and a contractual expense limitation on operating expenses with respect to the I Class). In addition, the fund has a contractual limitation in place whereby the Advisor has agreed to waive a portion of the management fee it is entitled to receive from the fund in order to limit the fund’s overall management fee rate to 0.28% of the fund’s average daily net assets. Any fees waived under this management fee waiver agreement are not subject to reimbursement to the Advisor by the fund. The Board concluded that the advisory fee structure for the fund continued to provide for a reasonable sharing of benefits from any economies of scale with the fund’s investors.

Fees and Expenses

The Board was provided with information regarding industry trends in management fees and expenses. Among other things, the Board reviewed data for peer groups that were compiled by Broadridge, which compared: (i) contractual management fees, total expenses, actual management fees, and nonmanagement expenses of the Investor Class of the fund with a group of competitor funds selected by Broadridge (Expense Group) and (ii) total expenses, actual management fees, and nonmanagement expenses of the Investor Class of the fund with a broader set of funds within the Lipper investment classification (Expense Universe). The Board considered the fund’s contractual management fee rate, actual management fee rate (which reflects the management fees actually received from the fund by the Advisor after any applicable waivers, reductions, or reimbursements), operating expenses, and total expenses (which reflect the net total expense ratio of the fund after any waivers, reductions, or reimbursements) in comparison with the information for the Broadridge peer groups. Broadridge generally constructed the peer groups by seeking the most comparable funds based on similar investment classifications and objectives, expense structure, asset size, and operating components and attributes and ranked funds into quintiles, with the first quintile representing the funds with the lowest relative expenses and the fifth quintile representing the funds with the highest relative expenses. The information provided to the Board indicated that the fund’s contractual management fee ranked in the third quintile (Expense Group), the fund’s actual management fee rate ranked in the fifth quintile (Expense Group and Expense Universe), and the fund’s total expenses ranked in the fifth quintile (Expense Group and Expense Universe).

The Board requested additional information from management with respect to the fund’s relative actual management fee and total expenses ranking in the fifth quintile and reviewed and considered the information provided relating to the fund, other funds in the peer groups, and other factors that the Board determined to be relevant.

The Board also reviewed the fee schedules for institutional accounts and private accounts with similar mandates that are advised or subadvised by the Advisor and its affiliates. Management provided the Board with information about the Advisor’s responsibilities and services provided to subadvisory and other institutional account clients, including information about how the requirements and economics of the institutional business are fundamentally different from those of the mutual fund business. The Board considered information showing that the Advisor’s mutual fund business is generally more complex from a business and compliance perspective than its institutional account business and considered various relevant factors, such as the broader scope of operations and oversight, more extensive shareholder communication infrastructure, greater asset flows, heightened business risks, and differences in applicable laws and regulations associated with the Advisor’s proprietary mutual fund business. In assessing the reasonableness of the fund’s management fee rate, the Board considered the differences in the nature of the services required for the Advisor to manage its mutual fund business versus managing a discrete pool of assets as a subadvisor to another institution’s mutual fund or for an institutional account and that the Advisor generally performs significant additional services and assumes greater risk in managing the fund and other T. Rowe Price funds than it does for institutional account clients.

On the basis of the information provided and the factors considered, the Board concluded that the fees paid by the fund under the Advisory Contract are reasonable.

Approval of the Advisory Contract

As noted, the Board approved the continuation of the Advisory Contract. No single factor was considered in isolation or to be determinative to the decision. Rather, the Board concluded, in light of a weighting and balancing of all factors considered, that it was in the best interests of the fund and its shareholders for the Board to approve the continuation of the Advisory Contract (including the fees to be charged for services thereunder).

Item 2. Code of Ethics.

A code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions is filed as an exhibit to the registrant’s annual Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the registrant’s most recent fiscal half-year.

Item 3. Audit Committee Financial Expert.

Disclosure required in registrant’s annual Form N-CSR.

Item 4. Principal Accountant Fees and Services.

Disclosure required in registrant’s annual Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is filed with the registrant’s annual Form N-CSR.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price State Tax-Free Funds, Inc.

| By | /s/ David Oestreicher | |||||

| David Oestreicher | ||||||

| Principal Executive Officer | ||||||

| Date | October 17, 2018 | |||||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ David Oestreicher | |||||

| David Oestreicher | ||||||

| Principal Executive Officer | ||||||

| Date | October 17, 2018 | |||||

| By | /s/ Catherine D. Mathews | |||||

| Catherine D. Mathews | ||||||

| Principal Financial Officer | ||||||

| Date | October 17, 2018 | |||||